institutional venture capital partnerships, and has served as Chairman of the AB Funds since January 2014 and the Chairman of the Independent Directors Committees of such Funds since February 2014; and Mr. Weiner has experience as a securities lawyer whose practice includes registered investment companies and as director or trustee of various non-profit organizations and Chairman of a number of them, and served as Chairman of the Governance and Nominating Committees of the AB Funds from 2007 until August 2014. The disclosure herein of a director’s experience, qualifications, attributes and skills does not impose on such director any duties, obligations, or liability that are greater than the duties, obligations and liability imposed on such director as a member of the Board and any committee thereof in the absence of such experience, qualifications, attributes and skills.

Board Structure and Oversight Function. The Board is responsible for oversight of the Fund. The Fund has engaged the Adviser to manage the Fund on a day-to-day basis. The Board is responsible for overseeing the Adviser and the Fund’s other service providers in the operations of the Fund in accordance with its investment objective and policies, and otherwise in accordance with the Fund’s prospectus, the requirements of the 1940 Act and other applicable Federal laws, applicable state laws and the Fund’s charter and bylaws. The Board meets in-person at regularly scheduled meetings eight times throughout the year. In addition, the Directors may meet in-person or by telephone at special meetings or on an informal basis at other times. The Independent Directors also regularly meet without the presence of any representatives of management. As described below, the Board has established three standing committees—the Audit Committee, the Governance and Nominating Committee, and the Independent Directors Committee—and may establish ad hoc committees or working groups from time to time to assist the Board in fulfilling its oversight responsibilities. Each committee is composed exclusively of Independent Directors. The responsibilities of each committee, including its oversight responsibilities, are described further below. The Independent Directors have also engaged independent legal counsel, and may from time to time engage consultants and other advisors, to assist them in performing their oversight responsibilities.

An Independent Director serves as Chairman of the Board. The Chairman’s duties include setting the agenda for each Board meeting in consultation with management, presiding at each Board meeting, meeting with management between Board meetings and facilitating communication and coordination between the Independent Directors and management. The Directors have determined that the Board’s leadership by an Independent Director and its committees composed exclusively of Independent Directors is appropriate because they believe this structure sets the proper tone for the relationships between the Fund, on the one hand, and the Adviser and other service providers, on the other, and facilitates the exercise of the Board’s independent judgment in evaluating and managing such relationships. In addition, the Fund is required to have an Independent Director as Chairman pursuant to certain 2003 regulatory settlements involving the Adviser.

Risk Oversight. The Fund is subject to a number of risks, including investment, compliance and operational risks, including cyber risks. Day-to-day risk management of

the Fund resides with the Adviser or other service providers (depending on the nature of the risk), subject to supervision by the Adviser. The Board has charged the Adviser and its affiliates with (i) identifying events or circumstances, the occurrence of which could have demonstrable and material adverse effects on the Fund; (ii) to the extent appropriate, reasonable or practicable, implementing processes and controls reasonably designed to lessen the possibility that such events or circumstances will occur or to mitigate the effects of such events or circumstances if they do occur; and (iii) creating and maintaining a system designed to evaluate continuously, and to revise as appropriate, the processes and controls described in (i) and (ii) above.

Risk oversight forms part of the Board’s general oversight of the Fund’s investment program and operations, and is addressed as part of various regular Board and committee activities. The Fund’s investment management and business affairs are carried out by or through the Adviser and other service providers. Each of these persons has an independent interest in ensuring effective risk management, but the policies and the methods by which one or more risk management functions are carried out may differ from the Fund’s and each other’s in the setting of priorities, resource availability and/or the effectiveness of relevant controls. Oversight of risk management is provided by the Board and the Audit Committee. The Directors regularly receive reports from, among others, management (including the Chief Risk Officer and the Global Heads of Investment Risk and Trading Risk of the Adviser), the Fund’s Senior Officer (who is also the Fund’s Independent Compliance Officer), the Fund’s Chief Compliance Officer, the Fund’s independent registered public accounting firm and counsel, the Adviser’s Chief Compliance Officer and internal auditors for the Adviser, as appropriate, regarding risks faced by the Fund and the Adviser’s risk management programs. In addition, the Directors receive regular updates on cyber security matters.

Not all risks that may affect the Fund can be identified, nor can controls be developed to eliminate or mitigate their occurrence or effects. It may not be practical or cost-effective to eliminate or mitigate certain risks. Processes and controls employed to address certain risks may be limited in their effectiveness, and some risks are simply beyond the reasonable control of the Fund or the Adviser, its affiliates or other service providers. Moreover, it is necessary for the Fund to bear certain risks (such as investment-related risks) to achieve the Fund’s goals. As a result of the foregoing and other factors, the Fund’s ability to manage risk is subject to substantial limitations.

During the Fund’s fiscal year ended 2014, the Board met nine times. The Fund does not have a policy that requires a Director to attend annual meetings of stockholders.

Board Committees. The Board has three standing committees: the Audit Committee, the Governance and Nominating Committee and the Independent Directors Committee. The members of the Committees are identified above in the table listing the Directors.

The function of the Audit Committee is to assist the Board in its oversight of the Fund’s accounting and financial reporting policies and practices. The members of the

Audit Committee are “independent” as required by applicable listing standards of the New York Stock Exchange. During the Fund’s fiscal year ended 2014, the Audit Committee met three times.

The Board has adopted a charter for its Governance and Nominating Committee, a current copy of which is available at www.abglobal.com (under “Menu,” click on “Americas,” then “Individual Investors,” then “United States (US Citizens),” then “Investments,” then “Closed-End Funds,” then the name of the Fund (“AllianceBernstein Income Fund”), then “Governance and Nominating Committee Charter”). Pursuant to the charter of the Governance and Nominating Committee, the Committee assists the Board in carrying out its responsibilities with respect to Fund governance and identifies, evaluates and selects and nominates candidates for the Board. The Committee may also set standards or qualifications for Directors and reviews at least annually the performance of each Director, taking into account factors such as attendance at meetings, adherence to Board policies, preparation for and participation at meetings, commitment and contribution to the overall work of the Board and its committees, and whether there are health or other reasons that might affect a Director’s ability to perform his or her duties. The Committee may consider candidates as Directors submitted by the Fund’s current Board members, officers, the Adviser, stockholders (subject to the following paragraph), and other appropriate sources.

Pursuant to the charter, the Governance and Nominating Committee will consider candidates submitted by a stockholder or group of stockholders who have beneficially owned at least 5% of the Fund’s outstanding common stock for at least two years prior to the time of submission and who timely provide specified information about the candidates, and the nominating stockholder or group. To be timely for consideration by the Committee, the submission, including all required information, must be submitted in writing to the attention of the Secretary at the principal executive office of the Fund not less than 120 days before the date of the proxy statement for the previous year’s annual meeting of stockholders. The Committee will consider only one candidate submitted by such a stockholder or group of stockholders for nomination for election at an annual meeting of stockholders. The Committee will not consider self-nominated candidates.

The Governance and Nominating Committee will consider and evaluate candidates submitted by stockholders on the basis of the same criteria as those used to consider and evaluate candidates submitted from other sources. These criteria include the candidate’s relevant knowledge, experience and expertise, the candidate’s ability to carry out his or her duties in the best interests of the Fund, and the candidate’s ability to qualify as an Independent Director. When assessing a candidate for nomination, the Committee considers whether the individual’s background, skills, and experience will complement the background, skills and experience of other nominees and will contribute to the diversity of the Board. During the Fund’s fiscal year ended 2014, the Governance and Nominating Committee met three times.

The function of the Independent Directors Committee is to consider and take action on matters that the Committee or the Board believes should be addressed in executive

session of the Independent Directors, such as review and approval of the Advisory and Shareholder Inquiry Agency Agreements. During the Fund’s fiscal year ended 2014, the Independent Directors Committee met eight times. The Independent Directors meet in executive session without representation of management present at every Board meeting. In the fiscal year ended 2014, the approval of the Advisory and Shareholder Inquiry Agreement was considered at the September 24 and November 4-6, 2014 meetings of the Independent Directors Committee.

The Board has adopted a process for stockholders to send communications to the Board. To communicate with the Board or an individual Director of the Fund, a stockholder must send a written communication to the Fund’s principal office at the address listed in the Notice of Annual Meeting of Stockholders accompanying this Proxy Statement, addressed to the Board or the individual Director. All stockholder communications received in accordance with this process will be forwarded to the Board or the individual Director to whom or to which the communication is addressed.

Board Compensation. The Fund does not pay any fees to, or reimburse expenses of, any Director during a time when the Director is considered an “interested person” of the Fund. Information concerning the aggregate compensation paid by the Fund to the Directors during the Fund’s fiscal year ended 2014; the aggregate compensation paid to the Directors during calendar year 2014 by all of the investment companies overseen by the Director within the AB Fund Complex; the total number of investment companies in the AB Fund Complex for which each Director serves as a director or trustee; and the number of investment portfolios for which each Director serves as a director or trustee, is set forth below. Neither the Fund nor any other investment company in the AB Fund Complex provides compensation in the form of pension or retirement benefits to any of its directors or trustees.

| | | | | | | | | | | | | | | | |

Name of Director | | Compensation

from the

Fund during

its Fiscal Year

ended 2014 | | | Compensation

from the AB

Fund Complex,

including the

Fund, during

2014 | | | Number of

Investment

Companies in the

AB Fund Complex,

including the

Fund, as to

which the

Director is a

Director or

Trustee | | | Number of

Investment

Portfolios

within the

AB Fund

Complex,

including the

Fund, as to

which the

Director is a

Director or

Trustee | |

| | | | | | | | | | | | | | | | |

Independent Directors | | | | | | | | | | | | | | | | |

John H. Dobkin | | $ | 6,550 | | | $ | 262,000 | | | | 31 | | | | 116 | |

Michael J. Downey | | $ | 6,550 | | | $ | 262,000 | | | | 31 | | | | 116 | |

William H. Foulk, Jr. | | $ | 6,550 | | | $ | 262,000 | | | | 31 | | | | 116 | |

D. James Guzy | | $ | 6,550 | | | $ | 262,000 | | | | 31 | | | | 116 | |

Nancy P. Jacklin | | $ | 6,738 | | | $ | 269,500 | | | | 31 | | | | 116 | |

Garry L. Moody | | $ | 7,425 | | | $ | 297,000 | | | | 31 | | | | 116 | |

Marshall C. Turner, Jr. | | $ | 10,206 | | | $ | 457,000 | | | | 31 | | | | 116 | |

Earl D. Weiner | | $ | 6,813 | | | $ | 272,500 | | | | 31 | | | | 116 | |

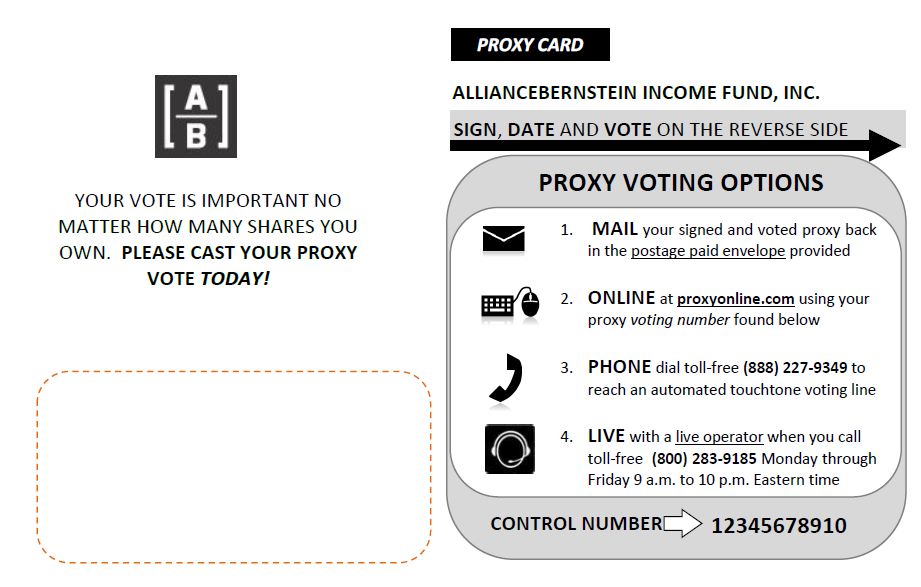

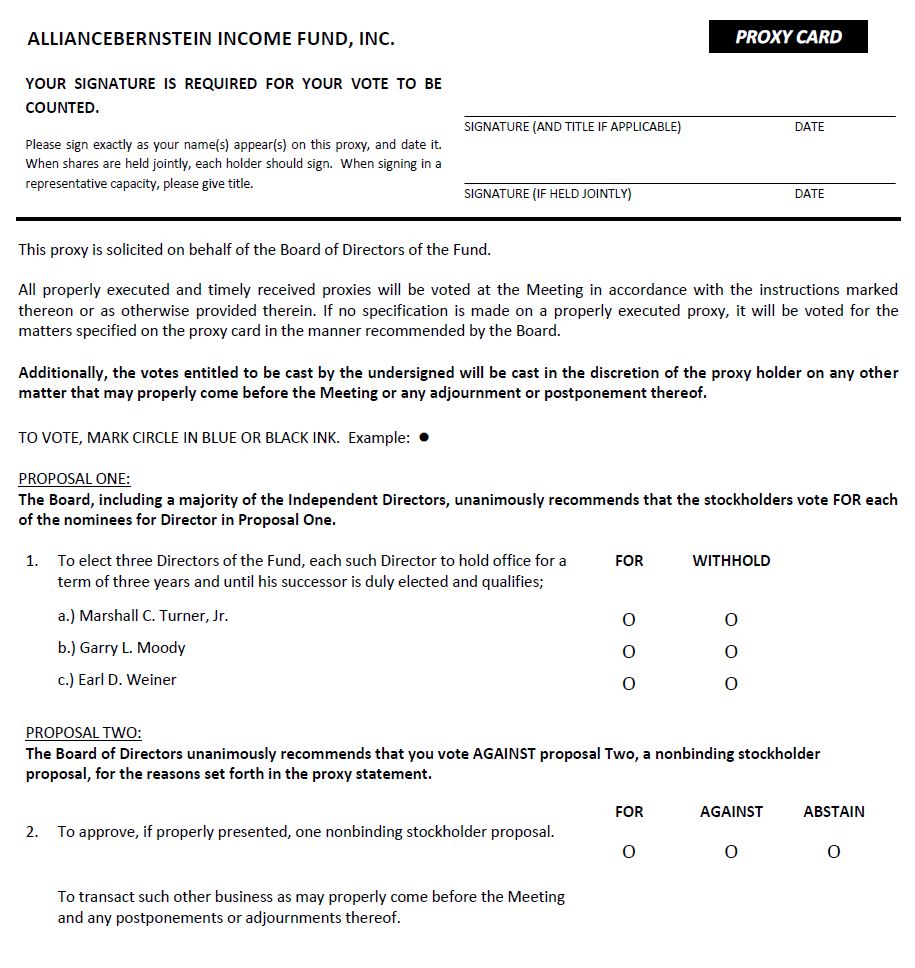

The election of each nominee as a Director in Proposal One requires the affirmative vote of a majority of the votes entitled to be cast.

The Board, including a majority of the Independent Directors, unanimously recommends that the stockholders vote FOR each of the nominees for Director in Proposal One.

PROPOSAL TWO

STOCKHOLDER PROPOSAL

A stockholder (the “Proponent”) has informed the Fund that it intends to submit a nonbinding proposal at the Meeting and has requested that the Fund include the nonbinding proposal in this year’s proxy material. The Board, including the Independent Directors, unanimously recommends that stockholders of the Fund vote AGAINST the nonbinding stockholder proposal. The nonbinding proposal and the supporting statement for it, exactly as received by the Fund, are set forth below and are followed by the Board’s explanation of its reasons for opposing the nonbinding proposal. The Fund will provide promptly to any stockholder, upon receipt of an oral or written request, the name and address of the stockholder that has submitted the nonbinding proposal and the number of shares of the Fund’s common stock held by the stockholder.

Proposal:

BE IT RESOLVED, the shareholders of the AllianceBernstein Income Fund (“ACG” or the “Fund”) request the Board of Directors promptly consider authorizing a self-tender offer for all outstanding common shares of the Fund at or close to net asset value (“NAV”). If more than 50% of the Fund’s outstanding common shares are tendered, the tender offer should be cancelled and the Board should take the steps necessary to liquidate, merge or convert the Fund to an open-end mutual fund.

Proponent’s Supporting Statement:

Pursuant to the Fund’s prospectus, in 2013 [the Proponent] (as well as at least 10% of the Fund’s outstanding shares) submitted a written request to have the Fund submit a proposal to Fund shareholders to convert the Fund from a closed-end to an open-end investment company. Against shareholders’ best interests, our Board unanimously recommended shareholders vote against this proposal.

At the close of last year’s meeting on March 27, 2014, this means that shareholders could’ve received an additional 10.83% or $0.90 for each share if the open-ending would’ve occurred.

Because the discount of the Fund has remained virtually unchanged, shareholders could receive a similar amount (10.70% or $0.90) through the date we’ve submitted this proposal.

Not only did the Board unanimously recommend against the open-ending proposal, but its “solution” to the Fund’s discount was to ask shareholders to change the Fund’s fundamental investment objectives. Shareholders responded strongly, and the measure did not pass. As we said at the time, if the Board was having difficulty managing the Fund’s discount, we didn’t believe the answer was to ask shareholders to assume more risk in a search for yield. Shareholders were right.

Presumably, the Fund included the original language in its prospectus because it saw the possibility for the Fund to trade a persistent discount. While the Fund has conducted open market share repurchases, the Fund’s persistently wide discount to net asset value shows that the Board’s actions have not proven effective. This is why we believe our proposal should be implemented and the Board should authorize a self-tender offer for the Fund’s common shares at or close to net asset value. Should a majority of outstanding shares be tendered, this would indicate that shareholders do not support the Fund continuing in its closed-end format.

The Fund and Board are likely to come up with a litany of arguments against our Proposal but the simple fact of the matter is that the Board has not been able to effectively manage the Fund’s discount.

Tell the Board that you want it to take more effective action to narrow the discount. Vote FOR [the Proponent’s] Proposal to tell the Board you want it to adhere to the spirit and intent of the prospectus’ lifeboat provision to enhance shareholder value. (Emphasis original.)

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE AGAINST THIS NONBINDING STOCKHOLDER PROPOSAL FOR THE REASONS SET FORTH BELOW

The Board’s Statement of Opposition

The Fund has been structured as a closed-end fund since it commenced operations in 1987. The stable asset base and relatively low costs associated with the closed-end fund structure have been instrumental in the Fund’s excellent record of investment and income producing success—including its achievement of above-benchmark returns in 18 of the 27 full fiscal years of the Fund including the last full fiscal year. A $10,000 investment in the Fund at inception through December 31, 2014 would now be worth approximately $77,657.75, assuming reinvestment of dividends and capital gains distributions. A similar investment in the Barclays US Aggregate Index would be worth approximately $59,760.52. The Fund notes that it is not possible to directly invest in an index.

The current yield of the Fund is 5.91% based on market price, and 5.29% based on NAV, as of the close of business on December 31, 2014. This compares to the yield of the Barclays US Aggregate Index of 2.25% on such date. Since its inception through December 31, 2014, the Fund has distributed over $2.9 billion to its stock-

holders, equating to more than $24 per share. During the period from January 1, 2005 through December 31, 2014, the Fund has distributed over $1.3 billion to its stockholders, equating to more than $5.45 per share.

Despite the Fund’s 28 year record of success, the Proponent, in pursuit of a potential onetime gain, asks stockholders to urge drastic fundamental changes to the Fund to the detriment of long-term stockholders by recommending a tender offer for all of the Fund’s outstanding shares at a price at or close to NAV per share, with the offer to be canceled and steps taken to liquidate or open-end the Fund in the event more than 50% of the Fund’s shares are tendered. If such an offer were to be made, there are two potential likely outcomes, each of which is contrary to the interests of the Fund’s long-term stockholders.

Even if less than 50% of the Fund’s shares are tendered, the Fund expects that a significant percentage would be tendered due to arbitrageurs buying shares at a discount in the market for the sole purpose of tendering into the offer “at or close to NAV” with no risk of pro-ration, which would, among other things:

| | • | | result in a significant reduction in the Fund’s size, |

| | • | | force the Fund to liquidate a large portion of its portfolio securities regardless of whether there are adverse market conditions and prices at the time the Fund is required to take up and pay for tendered shares, |

| | • | | potentially result in adverse tax consequences including the realization of gains that would not otherwise be realized, and |

| | • | | lead to a material increase in the Fund’s expense ratio as fixed costs are spread over a much smaller asset base. |

The non-binding proposal would urge the liquidation or open-ending of the Fund if more than 50% of the Fund’s shares are tendered. This would either:

| | A. | result in liquidation of the Fund, ending the Fund’s record of excellent investment performance and consistent payout of attractive dividends to stockholders; or |

| | B. | make the Fund a much less desirable investment for long term stockholders because the change to open-end status would lead to: |

| | • | | a significant reduction in the Fund’s leverage, |

| | • | | a substantial increase in its expense ratio since open-end funds have much higher transfer agency and shareholder servicing costs than closed-end funds, |

| | • | | the Fund holding significantly higher cash balances than closed-end funds to deal with possible redemptions, |

| | • | | the Fund operating much differently as a result, and |

| | • | | as noted above, the Fund’s use of substantial leverage and relatively low expense ratio have been key to its long-term investment success; open-ending would result in reduced leverage and higher expenses. |

As a result of the foregoing, the Fund would pay lower dividends as an open-end fund.

The Proponent asks stockholders through the nonbinding proposal to effectively urge abandonment of the Fund’s current structure and strategies, an approach that has served stockholders well for over 25 years, in order to permit the realization of a short term benefit. The Proponent has acknowledged publicly that “closed-end funds, over longer periods, outperform traditional open-end funds with similar objectives” and that “shareholder activism is often used to close… discounts.” The Proponent advises its advisory clients and potential clients that “there is no assurance that in purchasing shares of a closed-end fund that the discount to NAV may not widen due to market events, investor sentiment, or movement in the underlying securities.” The trading price of a closed-end fund’s shares is determined by market forces (a fact acknowledged by the Proponent) and will almost never be equal to or close to the fund’s NAV per share. While liquidation or open-ending would by definition result in elimination of a trading market discount, either action would also eliminate the substantial benefits of the closed-end fund structure, acknowledged by the Proponent to result in outperformance over time, which are discussed below.

The Board believes that the Fund’s excellent historical performance and distribution history merit the continuance of the Fund under its current closed-end fund structure and the rejection by stockholders of the proposal. The Board is firmly of the view that the stable asset base and other characteristics of the closed-end fund structure permit the Fund to invest for the long-term and to achieve demonstrated beneficial investment returns for the Fund’s stockholders. The Board believes that any of the outcomes put forth by the Proponent would have materially adverse consequences for the Fund, and as a practical matter would result in the elimination of the Fund as it currently operates as an investment opportunity for you and other stockholders.

The following addresses the drawbacks of the nonbinding proposal and its likely detrimental consequences to stockholders, if approved, and then the Proponent’s assertions regarding the Fund’s discount.

Proponent’s Solutions Lead to Adverse Consequences and Termination of the Fund as it is Currently Constituted

The Board has carefully considered the likely impact of the proposed tender offer on the Fund and its stockholders and believes that a tender offer for all outstanding

common shares of the Fund is not in the best interests of the Fund and its stockholders. The Board believes that such a tender offer would result in a drastic reduction in the size of the Fund, which would result in increased costs and potential adverse tax consequences for long-term stockholders who do not tender. In addition, the Board believes that the announcement of an intention to conduct an “any and all” tender offer would attract arbitrageurs who would purchase shares of the Fund’s common stock for the sole purpose of tendering those shares and realizing a short-term trading profit.

Reduction in Fund Size and Increase in Expenses. In order to finance the type of substantial tender offer sought by the Proponent, the Fund would likely be required to liquidate a significant portion of its portfolio holdings in a relatively short time to raise cash to meet tender requests. The Fund’s sale of portfolio securities for this purpose may exert downward pressure on the prices of certain portfolio securities, thereby increasing the amount of such securities that the Fund would be required to sell. The sale of a significant portion of the Fund’s portfolio and the subsequent distribution of cash to satisfy tender requests would reduce the Fund’s total assets significantly. Such a reduction would likely cause the Fund’s expense ratio to increase because the fixed costs of operating the Fund would not decrease as assets decrease. Remaining stockholders would bear their allocable portion of these expenses.

Transaction Costs and Tax Consequences to Remaining Shareholders. The Fund would incur transaction costs in selling portfolio holdings to meet tender requests, and remaining stockholders would incur the tax burden related to any capital gains distribution resulting from the sales. Furthermore, the amount of the Fund’s assets available for future investment would decline, making it more difficult to achieve the Fund’s investment goals. Each of these results could adversely affect the Fund’s long-term performance.

The Board believes that liquidating the Fund if more than 50% of the Fund’s outstanding common shares are tendered would not be in the best interests of the Fund and its stockholders. A liquidation of the Fund would eliminate the Fund as an investment option for all stockholders and would necessarily involve the sale of all of the Fund’s assets, which is governed by Maryland General Corporation Law (“Maryland law”). The Fund would be required to obtain approval of both the Board and the Fund’s stockholders before it could sell all of its assets and dissolve the Fund. A liquidation of the Fund could also have adverse tax consequences for stockholders.

| • | | Conversion/Merger into an Open-End Mutual Fund |

The Board believes that converting or merging the Fund into an open-end mutual fund would not be in the best interests of the Fund and its stockholders. A proposal to open-end the Fund was submitted to stockholders at the 2014 Annual Meeting of Stockholders. Stockholders at the 2014 Annual Meeting rejected that proposal. The Board unanimously believes that the current nonbinding proposal is not in the best

interests of the Fund or its stockholders and urges that stockholders similarly reject the Proponent’s nonbinding proposal, at the 2015 Annual Meeting.

The Board strongly believes that open-ending the Fund would deprive the Fund’s stockholders of the following benefits of the closed-end structure:

| | • | | more favorable long-term investment returns than would be achieved if the Fund were an open-end fund pursuing a similar strategy; |

| | • | | a stable asset base that can be invested for the long-term, unconstrained by the unpredictable near-term liquidity requirements associated with an open-end fund; |

| | • | | an operating structure that is more cost-effective than that of many open-end funds; and |

| | • | | a structure that allows for more tax-efficient management of the portfolio than would be possible if the Fund were operated as an open-end fund. |

Adverse Effect on Portfolio Management. Converting the Fund to an open-end fund would have an adverse effect on the Adviser’s ability to effectively manage the Fund in accordance with its investment strategies. The Fund’s current and historical use of leverage, which has been highly accretive to the Fund’s net income per share, could be adversely affected if the Fund were to become an open-end fund, because, among other things, the Fund would no longer have a stable asset base. Reducing leverage to levels that are more typical in open-end funds could materially adversely affect the Fund’s current yield. Conversion to an open-end fund would also cause the Fund to lose its ability to issue preferred stock or debt securities, as such sources of leverage are not permitted for open-end funds under the 1940 Act. Such forms of leverage could be advantageous to the Fund from time to time.

Adverse Effects of Daily Redemptions. Because open-end funds are required to meet redemption requests on a daily basis, and to redeem shares from stockholders requesting redemptions at the shares’ then-current NAV, the portfolio liquidations and reconfigurations necessary to accommodate such redemptions—and to otherwise operate the Fund as an open-end fund—could have a significant adverse effect on the Fund by impeding the Fund’s ability to adhere to its investment strategies and generate income. In fact, the Adviser expects that the Fund, like most open-end funds, would be required to maintain a much larger cash position than it does at present to meet potential redemptions. Although the Fund’s positions in U.S. government securities are liquid, liquidating certain of the Fund’s non-government positions within a short period of time could pose challenges. Liquidating portfolio positions, particularly less liquid securities, at inopportune times could have significant market impact, depressing the prices received by the Fund and the value of its remaining positions to the detriment of the Fund’s stockholders.

Following a conversion to an open-end fund, the Fund may be required to sell portfolio securities and incur increased transaction costs in order to satisfy redemption requests. Any sale of portfolio securities that is effected for purposes of meeting a

redemption obligation would be a taxable transaction and could result in unfavorable capital gains treatment for non-redeeming stockholders. Any capital gains would be distributed to stockholders and would be taxable to the stockholders receiving them.

Increase in Expense Ratio. It is likely that the Fund’s expense ratio would substantially increase as a result of a conversion to an open-end fund. Among other factors, the Adviser expects that substantial redemptions of Fund shares would occur, as arbitrageurs typically buy up closed-end fund shares in advance of an open-ending in order to promptly redeem them upon the fund’s conversion to open-end status. A reduction in the size of the Fund would result in the Fund’s fixed expenses being spread over a smaller asset base, thereby proportionally increasing the effect of such expenses on a per-share basis. These expenses would include legal, administrative and accounting, audit and custody expenses. In addition, the Fund would incur new ongoing operating expenses associated with an open-end fund, such as the cost of annual registration statement updates, significantly higher transfer agent fees due to higher costs of servicing open-end fund stockholders and Securities and Exchange Commission (“SEC”) and state blue sky registration fees.

It is likely that the Fund’s expenses would also increase because, for the Fund to have any chance of realizing significant sales of shares over the longer term as an open-end fund, the Fund would need to adopt and implement a distribution and pricing structure that is the same as that which is currently utilized by the open-end investment companies in the AB Fund Complex. Under a “multi-class” pricing structure, stockholders may pay sales charges and/or distribution fees that differ depending on the class of shares. The Fund’s stockholders would likely receive Class A shares upon conversion of the Fund to an open-end fund without imposition of a sales charge. Class A shares are generally subject to an annual distribution fee (“Rule 12b-1 fee”) of up to 0.25%.

By way of example of these increased costs, the Adviser estimates that, in the event of a 40% decrease in assets caused by outflows resulting from redemptions, the Fund’s per-share expense ratio for Class A shares, including a Rule 12b-1 fee of 0.25% and other recurring costs (but excluding interest expense), would almost double—increasing from its current level of 61 basis points to approximately 109 basis points. Obviously, higher levels of redemptions would be accompanied by greater increases in the Fund’s expense ratio.

Redemption Fee. As noted above, converting the Fund to an open-end fund would likely lead to substantial redemptions at NAV of Fund shares and temporary redemption fees may be imposed in situations where large redemptions are anticipated in connection with a closed-end fund’s conversion to an open-end fund. The Board may determine to impose a redemption fee of up to 2% of the NAV of the shares redeemed or exchanged for a temporary period following the conversion. A redemption fee would serve to, among other things, offset some of the direct and indirect costs associated with the conversion, including the costs of liquidating portfolio positions, and as an anti-dilution measure to remaining stockholders.

Process and Timing. Any conversion or merger of the Fund to effect open-ending would be a lengthy process and involve substantial costs to the Fund. To effect any conversion, the Fund would be required to either (i) amend the Fund’s Charter, change its classification and file a registration statement with the SEC, or (ii) enter into a consolidation, merger, share exchange, transfer or sale of assets with, or a conversion into, another business entity. Under Maryland law, each of these actions would require the Board to, first, consider and adopt a resolution setting forth the proposed action, and then declare the advisability of the action and direct that the proposed action be submitted for consideration at either an annual or special meeting of the Fund’s stockholders. The Fund’s stockholders would then be required to vote to approve the proposed action. The Charter requires stockholder approval by the affirmative vote of at least two-thirds of the Fund’s outstanding shares to convert/merge the Fund from a closed-end fund into an open-end fund.

The process of converting the Fund to an open-end fund would involve additional printing, legal, other professional costs and other expenses of establishing a new structure. These costs and expenses include the costs of preparing a registration statement, including a prospectus, for the Fund, as required by federal securities laws, and the fees associated with notice filings under state securities laws. The Fund estimates that these costs, which would be incurred by the Fund, would be at least $250,000. The Fund believes that the entire process could take at least 4 months.

Discount Assertions in the Proposal

The Board strongly disagrees with many of the discount assertions contained in the Proponent’s statement supporting its nonbinding proposal.

| | • | | The Proponent asserts that “the Board has not been able to manage the Fund’s discount.” The Board regularly monitors trading in the Fund’s shares and considers whether it would be in the best interests of the Fund and its stockholders for it to undertake discount-reduction mechanisms, such as open market purchases of shares or tender offers. In 2014, the Board approved, and the Fund commenced, a share repurchase program for up to 15% of its shares. A number of stockholders, including the Proponent, had urged that such repurchases be made. Through February 20, 2015, the Fund has repurchased 19,559,365 shares and the Board continues to closely monitor the implementation of the program and intends to assess its efficacy after it has been in place for a year. The Board has also considered alternate measures, such as converting the Fund to an interval fund structure or establishing a managed distribution plan. In doing so, the Board is aware that these and other discount-reduction measures may benefit professional arbitrageurs more than—and often to the detriment of—long-term stockholders. |

| | • | | The Proponent asserts that the Fund has traded at “a persistently wide discount.” The Fund’s shares traded at a premium or single digit discount from 2002 through 2010. The Fund has traded at higher discounts in recent years (its three year average discount is 10.52%), which the Adviser believes is largely attribut- |

| | able to low interest rates and the Fund’s large investments in U.S. Treasuries in accordance with its strategies. |

A discount provides a closed-end fund’s stockholders with the opportunity to obtain exposure to the fund’s underlying assets at a price that is below the market price for those assets, and investors who reinvest their dividends and capital gains distributions at a discount may receive greater returns over the long term. Stockholders who sell their shares at a discount will not receive the NAV of their shares, even if such stockholders paid less than NAV for such shares. In addition, a discount can attract the attention of opportunistic short-term traders seeking to exploit the discount for their own purposes, often adversely affecting the closed-end fund and its long-term shareholders.

| | • | | Referring to the open-ending proposal that was rejected by the Fund’s stockholders at the 2014 Annual Meeting of Stockholders, the Proponent asserts that “[a]t the close of last year’s meeting on March 27, 2014…shareholders could’ve received an additional 10.83% or $0.90 for each share if the open-ending would’ve occurred.” This assertion is inaccurate for a number of reasons. First, even if the Fund’s stockholders had approved the open-ending proposal at the 2014 Annual Meeting (instead of rejecting it), the open-ending could not have occurred immediately. A number of actions require completion prior to the Fund converting to an open-end investment company, including filing a registration statement with the SEC. The conversion process would take several months following any vote to approve open-ending the Fund. Consequently, no stockholder could have received $0.90 per share on March 27, 2014 as the proposal suggests. |

In addition, the quantification of the amount stockholders would have received upon open-ending fails to take into account a redemption fee of up to 2% that the Board may determine to impose for a temporary period following the conversion. Temporary redemption fees are typically imposed, for the benefit of long-term stockholders, in situations where large redemptions are anticipated in connection with the conversion of a closed-end fund to an open-end fund.

| | • | | The Proponent characterizes the Fund’s discount over a period of eight months through to the October 23, 2014 date of the proposal as “virtually unchanged.” In fact, the discount fluctuated materially over that period (13.09% or $1.09 per share on April 16, 2014 and 9.83% or $0.82 per share on September 19, 2014). Since then (through February 20, 2015) the discount has continued to fluctuate, ranging between 11.75% on January 28, 2015 and 9.06% on November 4, 2014. In addition, the Proponent asserts that shareholders could have received “10.70% or $0.90” for each share from March 27, 2014 through the date that the proposal was submitted (October 23, 2014). This is inaccurate because, for the reasons discussed above, the implementation of the proposal by the Fund would require actions under the 1940 Act, the Securities Act of 1933 and Maryland state law. |

| | The amount of any discount would not be known until those actions were taken, although the discount generally narrows temporarily if a Fund undertakes a tender offer, and more sustainability if it announces conversion to an open-end fund. |

The Board, including the Independent Directors, unanimously recommends that stockholders vote AGAINST the proposal.

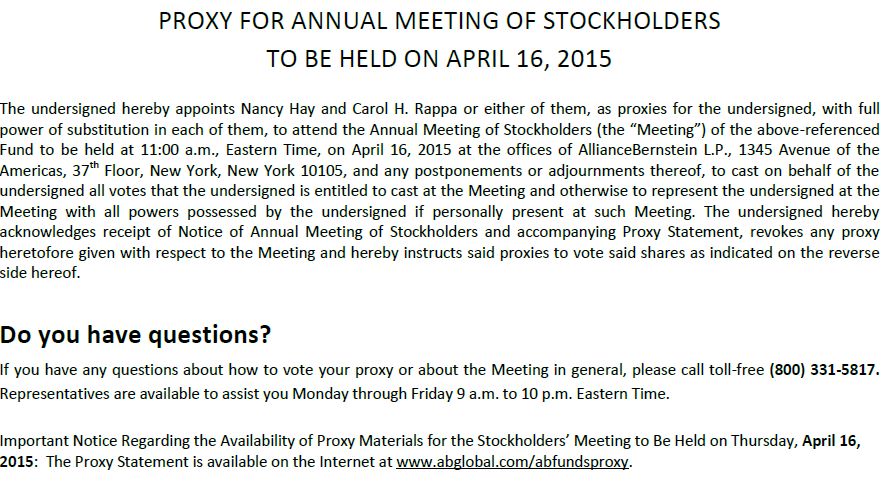

PROXY VOTING AND STOCKHOLDER MEETING

All properly executed and timely received proxies will be voted at the Meeting in accordance with the instructions marked thereon or as otherwise provided therein. Accordingly, unless instructions to the contrary are marked on the proxies, for Proposal One, the votes will be cast FOR the election of the nominees as Directors for the Fund, and the votes will be cast AGAINST the nonbinding stockholder proposal. If no specification is made on a properly executed proxy, it will be voted for the matters specified on the Proxy Card in the manner recommended by the Board. Any stockholder may revoke that stockholder’s proxy at any time prior to exercise thereof by (i) giving written notice to the Secretary of the Fund at 1345 Avenue of the Americas, New York, New York 10105, (ii) signing and delivering to the Secretary of the Fund another proxy of a later date, or (iii) voting in person at the Meeting.

The election of the nominees as Directors in Proposal One requires an affirmative vote of the holders of a majority of the votes entitled to be cast. The approval of Proposal Two requires the affirmative vote of a majority of the votes cast at a meeting at which a quorum is present. Properly executed proxies may be returned with instructions to abstain from voting or to withhold authority to vote (an “abstention”) or may represent a broker “non-vote” (which is a proxy from a broker or nominee indicating that the broker or nominee has not received instructions from the beneficial owner or other person entitled to vote shares on a particular matter with respect to which the broker or nominee does not have discretionary power to vote). An abstention or broker non-vote will be considered present for purposes of determining the existence of a quorum for the meeting, but will have the effect of a vote against the election of the nominees in Proposal One, and no effect on the result of the vote in Proposal Two. If any proposal, other than Proposal One or Proposal Two properly comes before the Meeting, shares represented by proxies will be voted on all such proposals in the discretion of the person or persons holding the proxies. The Fund has not received notice of, and is not otherwise aware of, any other matter to be presented at the Meeting.

A quorum for the Meeting will consist of the presence in person or by proxy of the holders of a majority of the total outstanding shares of common stock of the Fund. In the event that (i) a quorum is not present at the Meeting; or (ii) a quorum is present but sufficient votes in favor of the position recommended by the Board for a Proposal (as each is described in the Proxy Statement) have not been timely received, the Chairman of the Meeting may authorize, or the persons named as proxies may propose and vote for, one or more adjournments of the Meeting up to 120 days after the Record Date, with no other notice than an announcement at the Meeting, in order to permit further solicitation of proxies. Shares represented by proxies indicating a vote contrary to the position recommended by the Board for a Proposal will be voted against adjournment of the Meeting.

The Fund has engaged AST Fund Solutions LLC (“AST”) to assist in soliciting proxies for the Meeting. AST will receive a total fee of approximately $125,000 for its services.

OTHER INFORMATION

Officers of the Fund

Certain information concerning the Fund’s officers is set forth below. Each officer is elected annually by the Board and serves a one-year term until his or her successor is duly elected and qualifies.

| | | | |

Name, Address* and Age | | Position(s) (Month and Year

First Elected) | | Principal Occupation During Past 5 Years (or Longer) |

| | |

Robert M. Keith 54 | | President and Chief Executive Officer (09/08) | | See biography above. |

| | |

Philip L. Kirstein 69 | | Senior Vice President and Independent Compliance Officer (10/04) | | Senior Vice President and Independent Compliance Officer of the AB Fund Complex, with which he has been associated since October 2004. Prior thereto, he was Of Counsel to Kirkpatrick & Lockhart, LLP from October 2003-October 2004, and General Counsel of Merrill Lynch Investment Managers, L.P. since prior to March 2003. |

| | |

Douglas J. Peebles 49 | | Vice President (8/02) | | Senior Vice President of the Adviser**, with which he has been associated since prior to 2010. |

| | |

Paul J. DeNoon 52 | | Vice President (3/93) | | Senior Vice President of the Adviser**, with which he has been associated since prior to 2010. |

| | |

Gershon M. Distenfeld 39 | | Vice President (3/06) | | Senior Vice President of the Adviser**, with which he has been associated since prior to 2010. |

| | |

Michael L. Mon 46 | | Vice President (4/00) | | Senior Vice President of the Adviser**, with which he has been associated since prior to 2010. |

| | |

Matthew S. Sheridan 39 | | Vice President (11/08) | | Senior Vice President of the Adviser**, with which he has been associated since prior to 2010. |

| | |

Joseph J. Mantineo 55 | | Treasurer and Chief Financial Officer (8/06) | | Senior Vice President of AllianceBernstein Investor Services, Inc. (“ABIS”)**, with which he has been associated since prior to 2010. |

| | | | |

Name, Address* and Age | | Position(s) (Month and Year

First Elected) | | Principal Occupation During Past 5 Years (or Longer) |

| | |

Phyllis J. Clarke 54 | | Controller (11/08) | | Vice President of ABIS**, with which she has been associated since prior to 2010. |

| | |

Vincent S. Noto 50 | | Chief Compliance Officer (1/14) | | Vice President and Mutual Fund Chief Compliance Officer of the Adviser** since 2014. Prior thereto, he was Vice President and Director of Mutual Fund Compliance of the Adviser** since prior to 2010. |

| | |

Emilie D. Wrapp 59 | | Secretary (10/05) | | Senior Vice President, Assistant General Counsel and Assistant Secretary of ABI**, with which she has been associated since prior to 2010. |

| * | The address for the Fund’s officers is 1345 Avenue of the Americas, New York, New York 10105. |

| ** | An affiliate of the Fund. |

Stock Ownership

There are 242,911,697 shares of common stock outstanding of the Fund.

As of February 20, 2015, the Directors and officers of the Fund, both individually and as a group, owned less than 1% of the Fund’s shares. During the Fund’s most recently completed fiscal year, the Fund’s Directors as a group did not engage in the purchase or sale of more than 1% of any class of securities of the Adviser or of any of its parents or subsidiaries.

Audit Committee Report

The following Audit Committee Report was adopted by the Audit Committee.

The Audit Committee operates pursuant to a written charter, a copy of which may be found on the Adviser’s website at www.abglobal.com (under “Menu,” click on “Americas,” then “Individual Investors,” then “United States (US Citizens),” then “Investments,” then “Closed-End Funds,” then the name of the Fund (“AllianceBernstein Income Fund”), then “Closed-End Funds Audit Committee Charter”). The purposes of the Audit Committee are to (1) assist the Board in its oversight of the accounting and financial reporting policies and practices of the Fund, including (i) the quality and integrity of the Fund’s financial statements and the independent audit thereof; (ii) the Fund’s compliance with legal and regulatory requirements, particularly those that relate to the Fund’s accounting, financial reporting, internal controls over financial reporting, and independent audits; (iii) the retention, independence, qualifications and performance of the independent registered public accounting firm; (iv) meeting with representatives of the internal audit department of the Adviser regarding such department’s activities relating to the Fund; and (v) the Fund’s compliance with applicable laws by receiving reports from counsel

who believe they have credible evidence of a material violation of law by the Fund or by someone owing a fiduciary or other duty to the Fund; and (2) to prepare this report. As set forth in the Audit Committee Charter, management of the Fund is responsible for the preparation, presentation and integrity of the Fund’s financial statements, the Fund’s accounting and financial reporting principles and policies and internal control over financial reporting and other procedures that provide for compliance with accounting standards and applicable laws and regulations. The independent registered public accounting firm is responsible for auditing the Fund’s financial statements and expressing an opinion as to their conformity with U.S. generally accepted accounting principles.

In the performance of its oversight function, the Audit Committee has considered and discussed the audited financial statements with management and the independent registered public accounting firm of the Fund. The Audit Committee has also discussed with the independent registered public accounting firm the matters required to be discussed by Statement on Auditing Standards No. 114, Auditors Communication with those Charged with Governance, and other professional standards, as currently in effect. The Audit Committee has also considered whether the provision of any non-audit services not pre-approved by the Audit Committee provided by the Fund’s independent registered public accounting firm to the Adviser and to any entity controlling, controlled by or under common control with the Adviser that provides ongoing services to the Fund is compatible with maintaining the independent registered public accounting firm’s independence. Finally, the Audit Committee has received the written disclosures and the letter from the independent registered public accounting firm required by Public Company Accounting Oversight Board Rule 3526, Communication with Audit Committees Concerning Independence, as currently in effect, and has discussed the independent registered public accounting firm’s independence with such firm.

The members of the Fund’s Audit Committee are not full-time employees of the Fund and are not performing the functions of auditors or accountants. As such, it is not the duty or responsibility of the Audit Committee or its members to conduct “field work” or other types of auditing or accounting reviews or procedures or to set auditor independence standards. Members of the Audit Committee necessarily rely on the information provided to them by management and the independent registered public accounting firm. Accordingly, the Audit Committee’s considerations and discussions referred to above do not assure that the audit of the Fund’s financial statements has been carried out in accordance with generally accepted auditing standards, that the financial statements are presented in accordance with U.S. generally accepted accounting principles or that the Fund’s independent registered public accounting firm is in fact “independent”.

Based upon the reports and discussions described in this report, and subject to the limitations on the role and responsibilities of the Audit Committee referred to above and in the Audit Committee Charter, the Audit Committee recommended to the Board that the audited financial statements of the Fund be included in the Fund’s annual report to stockholders for the most recent fiscal year.

Submitted by the Audit Committee of the Fund’s Board of Directors:

| | |

| John H. Dobkin | | Nancy P. Jacklin |

| Michael J. Downey | | Garry L. Moody |

| William H. Foulk, Jr. | | Marshall C. Turner, Jr. |

| D. James Guzy | | Earl D. Weiner |

Approval of Independent Registered Public Accounting Firm by the Board

The Audit Committee is responsible for the appointment, compensation, retention and oversight of the work of the Fund’s independent registered public accounting firm. In addition, the Board approved the selection of the Fund’s independent registered public accounting firm as required by, and in accordance with, the 1940 Act. At a meeting held on November 4-6, 2014, the Board approved by the vote, cast in person, of a majority of the Directors, including a majority of the Directors who are not “interested persons” of the Fund, the selection of Ernst & Young LLP as the independent registered public accounting firm to audit the accounts of the Fund for its fiscal year ending December 31, 2015.

Ernst & Young LLP has audited the accounts of the Fund since the date of the commencement of the Fund’s operations, and has represented that it does not have any direct financial interest or any material indirect financial interest in the Fund. Representatives of Ernst & Young LLP are expected to attend the Meeting, to have the opportunity to make a statement and to respond to appropriate questions from the stockholders.

Independent Registered Public Accounting Firm’s Fees

The following table sets forth the aggregate fees billed by the independent registered public accounting firm for the Fund’s last two fiscal years for professional services rendered for: (i) the audit of the Fund’s annual financial statements included in the Fund’s annual report to stockholders; (ii) assurance and related services that are reasonably related to the performance of the audit of the Fund’s financial statements and are not reported under (i), which include advice and education on accounting and auditing issues and quarterly press release reviews; (iii) tax compliance, tax advice and tax return preparation; and (iv) aggregate non-audit services provided to the Fund, the Adviser and entities that control, are controlled by or under common control with the Adviser that provide ongoing services to the Fund (“Service Affiliates”). No other services were provided by the independent registered public accounting firm to the Fund during this period.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Audit Fees | | | Audit

Related Fees | | | Tax Fees | | | All Other Fees for

Services Provided

to the Fund | | | All Fees for Non-Audit

Services Provided to

the Fund, the Adviser

and Service Affiliates* | |

. | | | | | | | | | | | | | | | | | | | | | | | | |

AllianceBernstein Income Fund, Inc. | | | 2013 | | | $ | 57,500 | | | $ | 8,000 | | | $ | 10,917 | | | $ | 0 | | | $ | 311,188 | |

| | | 2014 | | | $ | 102,946 | | | $ | 8,000 | | | $ | 30,899 | | | $ | 0 | | | $ | 444,504 | |

| * | The fees vary because they are presented based on the Fund’s last two fiscal years and reflect fees for non-audit services for different periods. |

Beginning with audit and non-audit service contracts entered into on or after May 6, 2003, the Fund’s Audit Committee policies and procedures require the pre-approval of all audit and non-audit services provided to the Fund by the Fund’s independent registered public accounting firm. The Fund’s Audit Committee policies and procedures also require pre-approval of all audit and non-audit services provided to the Adviser and any Service Affiliates to the extent that these services are directly related to the operations or financial reporting of the Fund. Accordingly, all of the amounts in the table for Audit Fees, Audit-Related Fees and Tax Fees for 2014 are for services pre-approved by the Fund’s Audit Committee. The amounts of the Fees for Non-Audit Services provided to the Fund, the Adviser and Service Affiliates in the table for the Fund that were subject to pre-approval by the Audit Committee for 2014 were $38,899 (comprising $8,000 of audit related fees and $30,899 of tax fees). The Audit Committee has considered whether the provision, to the Adviser and/or any Service Affiliate by the Fund’s independent registered public accounting firm, of any non-audit services that were not pre-approved by the Audit Committee is compatible with maintaining the independent registered public accounting firm’s independence.

INFORMATION AS TO THE INVESTMENT ADVISER AND THE ADMINISTRATOR OF THE FUND

The Fund’s investment adviser is AllianceBernstein L.P., 1345 Avenue of the Americas, New York, New York 10105. The Adviser also functions as the administrator for the Fund.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

The Fund is not aware of an untimely filing of a statement of initial beneficial ownership interest by any person subject to Section 16 under the Securities Exchange Act of 1934 during the Fund’s fiscal year ended 2014.

OTHER MATTERS

Management of the Fund does not know of any matters properly to be presented at the Meeting other than those mentioned in this Proxy Statement. If any other matters properly come before the Meeting, the shares represented by proxies will be voted with respect thereto in the discretion of the person or persons voting the proxies. As of February 20, 2015, the following stockholders beneficially owned more than 5% of the Fund’s shares.

| | | | | | |

Beneficial Owners (address) | | Class of Shares | | Number of Shares | | Percentage |

| Karpus Management, Inc., d/b/a/ Karpus Investment Management (183 Sully’s Trail, Pittsford, New York 14534) | | Common Stock | | 12,352,332 | | 5.09% |

SUBMISSION OF PROPOSALS FOR THE NEXT ANNUAL MEETING OF STOCKHOLDERS

Proposals of stockholders intended to be presented at the next annual meeting of stockholders of the Fund must be received by the Fund by November 3, 2015 for inclusion in the Fund’s proxy statement and proxy card relating to that meeting. The submission by a stockholder of a proposal for inclusion in the proxy statement does not guarantee that it will be included. In addition, stockholder proposals are subject to certain requirements under the federal securities laws and the Maryland General Corporation Law and must be submitted in accordance with the Fund’s Bylaws. To be presented at the 2016 Annual Meeting of Stockholders, a stockholder proposal that is not otherwise includable in the proxy statement for the 2015 Annual Meeting must be delivered by a stockholder of record to the Fund no sooner than October 4, 2015 and no later than November 3, 2015.

The persons named as proxies for the 2016 Annual Meeting of Stockholders will, regarding the proxies in effect at the meeting, have discretionary authority to vote on any matter presented by a stockholder for action at that meeting unless the Fund receives notice of the matter no sooner than October 4, 2015 and no later than November 3, 2015. If the Fund receives such timely notice, these persons will not have this authority except as provided in the applicable rules of the SEC.

REPORTS TO STOCKHOLDERS

The Fund will furnish each person to whom this Proxy Statement is delivered with a copy of its latest annual report to stockholders and its subsequent semi-annual report to stockholders, if any, upon request and without charge. To request a copy, please call AllianceBernstein Investments, Inc. at (800) 227-4618 or contact Carol Rappa at AllianceBernstein L.P., 1345 Avenue of the Americas, New York, New York 10105.

By Order of the Board of Directors,

Emilie D. Wrapp

Secretary

March 2, 2015

New York, New York

| | | | |

TABLE OF CONTENTS | | Page | |

Introduction | | | 3 | |

Proposal One: Election of Directors | | | 4 | |

Proposal Two: Stockholder Proposal | | | 16 | |

Proxy Voting and Stockholder Meeting | | | 25 | |

Information as to the Investment Adviser and the Administrator of the Fund | | | 30 | |

Section 16(a) Beneficial Ownership Reporting Compliance | | | 30 | |

Other Matters | | | 30 | |

Submission of Proposals for the Next Annual Meeting of Stockholders | | | 31 | |

Reports to Stockholders | | | 31 | |

AllianceBernstein Income Fund, Inc.