UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05207

ALLIANCEBERNSTEIN INCOME FUND, INC.

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Joseph J. Mantineo

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: December 31, 2015

Date of reporting period: June 30, 2015

ITEM 1. REPORTS TO STOCKHOLDERS.

JUN 06.30.15

SEMI-ANNUAL REPORT

ALLIANCEBERNSTEIN INCOME FUND

(NYSE: ACG)

Investment Products Offered

|

• Are Not FDIC Insured • May Lose Value • Are Not Bank Guaranteed |

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit AB’s website at www.abglobal.com, or go to the Securities and Exchange Commission’s (the “Commission”) website at www.sec.gov, or call AB at (800) 227-4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commission’s website at www.sec.gov. The Fund’s Forms N-Q may also be reviewed and copied at the Commission’s Public Reference Room in Washington, DC; information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330.

AllianceBernstein Investments, Inc. (ABI) is the distributor of the AB family of mutual funds. ABI is a member of FINRA and is an affiliate of AllianceBernstein L.P., the Adviser of the funds.

The [A/B] logo is a service mark of AllianceBernstein and AllianceBernstein® is a registered trademark used by permission of the owner, AllianceBernstein L.P.

August 14, 2015

Semi-Annual Report

This report provides management’s discussion of fund performance for AllianceBernstein Income Fund (the “Fund”) for the semi-annual reporting period ended June 30, 2015. The Fund is a closed-end fund that trades on the New York Stock Exchange.

Investment Objectives and Policies

The investment objective of the Fund is high current income consistent with preservation of capital.

The Fund normally invests at least 80% of its net assets in income-producing securities. The Fund normally invests at least 65% of its total assets in securities issued or guaranteed by the U.S. government, its agencies or instrumentalities, and repurchase agreements pertaining to U.S. government securities. The Fund may also invest up to 35% of its assets in other fixed-income securities, including those issued by nongovernmental issuers in the U.S. and those issued by foreign governments. The Fund may invest up to 35% of its net assets in below investment-grade securities. Additionally, the Fund may utilize other investment instruments, including options, swaps, forwards and futures, and may employ leverage. For more information regarding the Fund’s risks, please see “A Word About Risk” on pages 4-5 and “Note E—Risks Involved in Investing in the Fund” of the Notes to Financial Statements on pages 64-66.

Proposed Acquisition of Assets of the Fund by AB Income Fund, a New Series of AB Bond Fund, Inc.

On August 6, 2015, the Fund announced that its Board of Directors had approved a proposed acquisition of its assets, and the assumption of its liabilities, by AB Income Fund (“Income Fund”), a newly-formed series of AB Bond Fund, Inc., an open-end registered investment company (the “Acquisition”). The Acquisition requires the approval of the Fund’s shareholders and a Special Meeting of Shareholders of the Fund (the “Special Meeting”) is scheduled to be held on February 1, 2016 to solicit the vote of shareholders on the Acquisition. The close of business on October 28, 2015 has been fixed as the record date for the Special Meeting or any adjournment or postponement thereof.

Each of the Fund and Income Fund is advised by AllianceBernstein L.P. (the “Adviser”). Income Fund will have the same investment objective as the Fund. Like the Fund, Income Fund will normally invest at least 80% of its net assets in income-producing securities. The most significant difference between the Fund and Income Fund is that while the Fund invests at least 65% of its assets in securities issued by the U.S. government, Income Fund will invest at least 65% of its assets in securities of U.S. and foreign governments. The broader investment policy of the Income Fund should provide the investment flexibility to better manage duration and credit risk. To limit the risk of this broader investment policy, the Income Fund

| | | | |

| ALLIANCEBERNSTEIN INCOME FUND • | | | 1 | |

will have an additional policy to invest at least 65% of its assets in securities denominated in U.S. dollars. Income Fund will be managed by the same portfolio managers as the Fund.

If the Acquisition is approved by the Fund’s shareholders, the Fund’s assets will be acquired, and its liabilities will be assumed, by Income Fund, and shareholders will receive Advisor Class shares of Income Fund which will have an aggregate net asset value equal to the aggregate net asset value of the shareholder’s holding in the Fund. A redemption fee of 0.75% will be imposed on redemptions of Advisor Class shares for three months after the Acquisition to defray the costs of increased redemptions expected to occur after the Acquisition. The Fund would then be de-registered as a registered investment company, dissolved, and its shares delisted from the New York Stock Exchange. If approved by the Fund’s shareholders, the Acquisition is expected to be completed in the first quarter of 2016.

Investment Results

The table on page 6 provides performance data for the Fund and its benchmark, the Barclays U.S. Aggregate Bond Index, for the six- and 12-month periods ended June 30, 2015.

The Fund outperformed its benchmark for both periods. Sector selection contributed positively for both periods, relative to the benchmark. For the six-month period, an overweight to commercial mortgage obligations and non-investment grade corporates con-

tributed to returns; during the 12-month period, an overweight to non-investment grade corporates and emerging market corporates detracted from performance. Security selection contributed for the six-month period, yet detracted for the 12-month period. Currency positioning contributed to returns for the 12-month period yet detracted for the six-month period, mainly from a long U.S. dollar position against a short Australian dollar, euro and New Zealand dollar. Yield curve positioning contributed to performance for both periods, specifically an underweight to the 20-year part of the yield curve paired with a slight overweight to the 10-year part of the curve.

The Fund utilized derivatives including Treasury futures and purchased options for hedging purposes, which added to returns for the six-month period and detracted for the 12-month period, in absolute terms; credit default swaps and interest rate swaps for hedging and investment purposes had an immaterial impact during the six-month period and detracted for the 12-month period; currency forwards for hedging and investment purposes detracted during the six-month period and added for the 12-month period; and written options for hedging purposes had an immaterial impact for the six-month period and added for the 12-month period. The Fund utilized leverage through reverse repurchase agreements at favorable rates, and was able to reinvest the proceeds into higher-yielding securities; leverage contributed positively for both periods.

| | |

| 2 | | • ALLIANCEBERNSTEIN INCOME FUND |

Market Review and Investment Strategy

Bond markets were volatile for both periods, as growth trends and monetary policies in the world’s biggest economies headed in different directions. In the fourth quarter of 2014, a sharp decline in oil prices put pressure on credit and emerging market debt, and complicated efforts to boost inflation in Europe and Japan. Oil prices stabilized later in the first quarter of 2015 but remained well below where they were in 2014. Economic fundamentals remained challenging in many emerging market countries. China’s central bank, faced with a slowing economy and volatile domestic markets, cut interest rates in June for the fourth time in several months.

Developed-market government bond yields were near multiyear lows in April. The yield on the benchmark 10-year German Bund was just slightly above zero and appeared headed for negative territory. Over the next two months, prices plunged and yields increased. In late June, they retraced some of that ground as Greece’s debt crisis worsened and the prospect of default added a new dose of volatility to financial markets.

Credit fundamentals remained generally solid, and the Fund’s Investment Management Team continues to look for opportunities in periods of volatility, while emphasizing the importance of security selection. The team cautions against the reach for yield, and remains selective in the Fund’s exposure to CCC-rated bonds. The Fund’s high yield holdings are well diversified at the country, sector and issuer levels.

Share Repurchase Program

On June 25, 2014, the Fund announced that its Board of Directors had authorized the Fund’s discretionary repurchase of up to 15% of its then outstanding shares of common stock (valued at up to approximately $306 million as of June 24, 2014 based on Fund total net assets of approximately $2.04 billion) in open market transactions over a one-year period.

Through June 25, 2015, the Fund had repurchased 27,076,089 of its shares of common stock in open market transactions (approximately 11.15% of its outstanding shares as of June 25, 2014). The share repurchase program expired on June 25, 2015.

| | | | |

| ALLIANCEBERNSTEIN INCOME FUND • | | | 3 | |

DISCLOSURES AND RISKS

AllianceBernstein Income Fund Shareholder Information

Weekly comparative net asset value (“NAV”) and market price information about the Fund is published each Saturday in Barron’s and in other newspapers in a table called “Closed End Funds”. Daily NAV and market price information, and additional information regarding the Fund, is available at www.abglobal.com and www.nyse.com. For additional shareholder information regarding this Fund, please see pages 71-72.

Benchmark Disclosure

The unmanaged Barclays U.S. Aggregate Bond Index does not reflect fees and expenses associated with the active management of a mutual fund portfolio. The Barclays U.S. Aggregate Bond Index represents the performance of securities within the U.S. investment grade fixed-rate bond market, with index components for government and corporate securities, mortgage pass-through securities, asset-backed securities, and commercial mortgage backed securities. The Index is not leveraged, whereas the Fund utilizes leverage. An investor cannot invest directly in an index, and its results are not indicative of the performance for any specific investment, including the Fund.

A Word About Risk

Until May 22, 2009, the Fund participated in a credit facility for the purpose of utilizing investment leverage. The Fund continues to utilize leverage through engaging in reverse repurchase agreements and may also utilize other techniques such as dollar rolls. In addition, the Fund may borrow money in the future through participation in credit facilities, direct bank borrowings, or otherwise. Reverse repurchase agreements involve sales by the Fund of portfolio assets concurrently with an agreement by the Fund to repurchase the same assets at a later date at a fixed price. Generally, the effect of such a transaction is that the Fund can recover all or most of the cash invested in the portfolio securities involved during the term of the reverse repurchase agreement, while it will be able to keep the interest income associated with those portfolio securities. Such transactions are only advantageous if the interest cost to the Fund of the reverse repurchase agreement transaction is less than the return on the leveraged portion of the Fund’s investment portfolio. The Fund may enter into dollar rolls in which the Fund sells securities for delivery in the current month and simultaneously contracts to repurchase substantially similar (same type and coupon) securities on a specified future date. During the roll period, the Fund forgoes principal and interest paid on the securities. The Fund is compensated by the difference between the current sales price and the lower forward price for the future purchase (often referred to as the “drop”) as well as the interest earned on the cash proceeds of the initial sale. Reverse repurchase agreements and dollar rolls are speculative techniques and are considered borrowings by the Fund.

Leverage may result in higher returns to the Fund than if the Fund were not leveraged, but may also adversely affect returns, particularly if the market is declining. The risks of leverage also include potentially a higher volatility of the NAV of the Fund’s shares, potentially more volatility in the market value of the Fund’s shares, and the relatively greater effect on the NAV of the Fund’s shares caused by favorable or adverse changes in portfolio security values or currency exchange rates. In addition, changes in the interest rate environment can increase or decrease shareholder returns. The Fund maintains asset coverage of at least 300% with respect to borrowings.

To the extent that the current interest rate on the Fund’s indebtedness approaches the net return on the leveraged portion of the Fund’s investment portfolio, then the benefit to the shareholders will be reduced. If the rate payable by the Fund on indebtedness were to exceed the net return on the same portion of the portfolio, then this would result in a lower rate of return for the shareholders. Similarly, the use of

(Disclosures, Risks and Note about Historical Performance continued on next page)

| | |

| 4 | | • ALLIANCEBERNSTEIN INCOME FUND |

Disclosures and Risks

DISCLOSURES AND RISKS

(continued from previous page)

leverage in a declining market can advance the decrease of the Fund’s NAV more so than if the Fund were not leveraged, which would likely be reflected in a greater decline in the market price for shares of the Fund than if the Fund were not leveraged. In extreme cases, if the Fund’s current investment income were not sufficient to meet interest payments on indebtedness or if the Fund failed to maintain the asset coverage required by the 1940 Act, then it could be necessary for the Fund to liquidate certain investments at a time when it may be disadvantageous to do so.

Part of the Fund’s assets will be invested in foreign securities. A significant portion of the Fund’s investments in foreign securities is in emerging markets. Since the Fund invests in foreign currency denominated securities, fluctuations in NAV may be magnified by changes in foreign exchange rates. The Fund also may seek investment opportunities by taking long or short positions in currencies through the use of currency-related derivatives, including forward currency exchange contracts, futures and options on futures, swaps and options. Foreign markets can be more volatile than the U.S. market due to increased risks of adverse issuer, political, regulatory, market or economic developments. The Fund may invest in high yield bonds or below investment-grade securities (“junk bonds”). High yield bonds involve a greater risk of default and price volatility than other bonds. While the Fund invests principally in fixed-income securities, in order to achieve its investment objectives, the Fund may at times use certain types of investment derivatives, such as options, futures, forwards and swaps. These instruments involve risks different from, and in certain cases, greater than, the risks presented by more traditional investments. These risks include the risk that the value of a derivative instrument may not correlate perfectly, or at all, with the value of the assets, reference rates or indices that they are designed to track. Other risks include: the possible absence of a liquid secondary market for a particular instrument and possible exchange-imposed price fluctuation limits, either of which may make it difficult or impossible to close out a position when desired, and the risk that the counterparty will not perform its obligation. Certain derivatives may have a leverage component and involve leverage risk. Adverse price movements in an instrument can result in a loss substantially greater than the Fund’s initial investment in that instrument (in some cases, the potential loss is unlimited).

The Fund may invest in mortgage-backed and/or other asset-backed securities, including securities backed by mortgages and assets with an international or emerging markets origination and securities backed by non-performing loans at the time of investment. Investments in mortgage-backed and other asset-backed securities are subject to certain additional risks. The value of these securities may be particularly sensitive to changes in interest rates. These risks include “extension risk”, which is the risk that, in periods of rising interest rates, issuers may delay the payment of principal, and “prepayment risk”, which is the risk that, in periods of falling interest rates, issuers may pay principal sooner than expected, exposing the Fund to a lower rate of return upon reinvestment of principal. Mortgage-backed securities offered by nongovernmental issuers and other asset-backed securities may be subject to other risks, such as higher rates of default in the mortgages or assets backing the securities or risks associated with the nature and servicing of mortgages or assets backing the securities.

An Important Note About Historical Performance

The performance on the following page represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. All fees and expenses related to the operation of the Fund have been deducted. Performance assumes reinvestment of distributions and does not account for taxes.

| | | | |

| ALLIANCEBERNSTEIN INCOME FUND • | | | 5 | |

Disclosures and Risks

HISTORICAL PERFORMANCE

| | | | | | | | | | |

| | | | | | | | | | |

THE FUND VS. ITS BENCHMARK

PERIODS ENDED JUNE 30, 2015 (unaudited) | | Returns | | | |

| | 6 Months | | | 12 Months | | | |

| AllianceBernstein Income Fund (NAV) | | | 2.04% | | | | 4.40% | | | |

|

| Barclays U.S. Aggregate Bond Index | | | -0.10% | | | | 1.86% | | | |

|

| The Fund’s market price per share on June 30, 2015 was $7.44. The Fund’s NAV price per share on June 30, 2015 was $8.32. For additional Financial Highlights, please see pages 69-70. |

| | | | | | | | | | |

See Disclosures, Risks and Note about Historical Performance on pages 4-5.

| | |

| 6 | | • ALLIANCEBERNSTEIN INCOME FUND |

Historical Performance

PORTFOLIO SUMMARY

June 30, 2015 (unaudited)

PORTFOLIO STATISTICS

Net Assets ($mil): $1,796.7

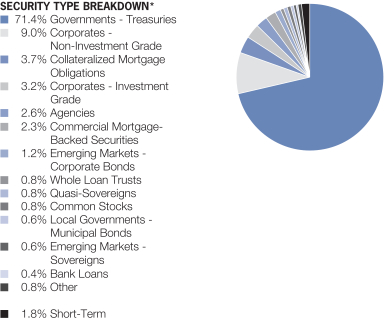

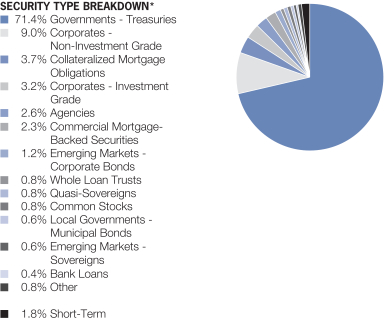

| * | | All data are as of June 30, 2015. The Fund’s security type breakdown is expressed as a percentage of total investments and may vary over time. The Fund also enters into derivative transactions, which may be used for hedging or investment purposes (see “Portfolio of Investments” section of the report for additional details). “Other” security type weightings represents 0.4% or less in the following types: Asset-Backed Securities, Governments—Sovereign Agencies, Governments—Soverign Bonds, Investment Companies, Mortgage Pass-Throughs and Preferred Stocks. |

| | | | |

| ALLIANCEBERNSTEIN INCOME FUND • | | | 7 | |

Portfolio Summary

PORTFOLIO SUMMARY

June 30, 2015 (unaudited)

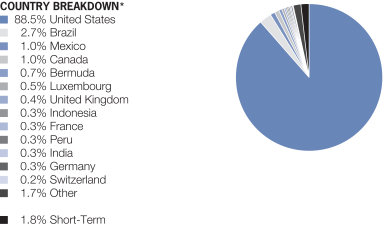

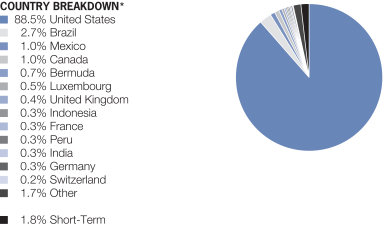

| * | | All data are as of June 30, 2015. The Fund’s country breakdown is expressed as a percentage of total investments and may vary over time. The Fund also enters into derivative transactions, which may be used for hedging or investment purposes (see “Portfolio of Investments” section of the report for additional details). “Other” country weightings represent 0.2% or less in the following countries: Australia, Barbados, Belgium, Dominican Republic, El Salvador, Guatemala, Italy, Ivory Coast, Jamaica, Morocco, Netherlands, Norway, Pakistan, South Africa, Spain, Sri Lanka, Sweden, Venezuela and Zambia. |

| | |

| 8 | | • ALLIANCEBERNSTEIN INCOME FUND |

Portfolio Summary

PORTFOLIO OF INVESTMENTS

June 30, 2015 (unaudited)

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

| | | | | | | | | | |

GOVERNMENTS –

TREASURIES – 105.6% | | | | | | | | | | |

Brazil – 2.5% | | | | | | | | | | |

Brazil Notas do Tesouro Nacional

Series F

10.00%, 1/01/17-1/01/25 | | BRL | | | 148,570 | | | $ | 44,428,292 | |

| | | | | | | | | | |

| | | |

United States – 103.1% | | | | | | | | | | |

U.S. Treasury Bonds

3.125%, 8/15/44 | | U.S.$ | | | 76,388 | | | | 76,513,353 | |

5.375%, 2/15/31 | | | | | 1,961 | | | | 2,636,166 | |

6.25%, 5/15/30(a) | | | | | 250,000 | | | | 360,742,250 | |

6.375%, 8/15/27(a) | | | | | 260,000 | | | | 366,376,660 | |

6.50%, 11/15/26(a) | | | | | 183,000 | | | | 257,400,846 | |

8.00%, 11/15/21 | | | | | 27,000 | | | | 36,855,000 | |

8.75%, 8/15/20 | | | | | 39,500 | | | | 53,275,625 | |

U.S. Treasury Notes

1.125%, 3/31/20 | | | | | 13,000 | | | | 12,717,653 | |

1.25%, 1/31/20 | | | | | 33,000 | | | | 32,556,546 | |

2.125%, 8/31/20(a) | | | | | 150,000 | | | | 153,199,200 | |

2.125%, 8/15/21 | | | | | 21,000 | | | | 21,236,250 | |

2.375%, 12/31/20 | | | | | 23,080 | | | | 23,792,226 | |

3.125%, 5/15/21(a) | | | | | 95,000 | | | | 101,612,855 | |

3.50%, 5/15/20 | | | | | 27,608 | | | | 30,025,853 | |

3.625%, 2/15/21(a)(b) | | | | | 295,000 | | | | 323,647,155 | |

| | | | | | | | | | |

| | | | | | | | | 1,852,587,638 | |

| | | | | | | | | | |

Total Governments – Treasuries

(cost $1,850,691,254) | | | | | | | | | 1,897,015,930 | |

| | | | | | | | | | |

| | | | | | | | | | |

CORPORATES – NON-INVESTMENT GRADE – 13.3% | | | | | | | | | | |

Industrial – 11.0% | | | | | | | | | | |

Basic – 1.0% | | | | | | | | | | |

ArcelorMittal

7.50%, 3/01/41 | | | | | 676 | | | | 662,480 | |

7.75%, 10/15/39 | | | | | 1,846 | | | | 1,836,770 | |

Arch Coal, Inc.

7.00%, 6/15/19 | | | | | 2,100 | | | | 304,500 | |

Cliffs Natural Resources, Inc.

8.25%, 3/31/20(c) | | | | | 1,759 | | | | 1,662,255 | |

Commercial Metals Co.

7.35%, 8/15/18 | | | | | 2,644 | | | | 2,862,130 | |

Lundin Mining Corp.

7.50%, 11/01/20(c) | | | | | 1,138 | | | | 1,226,195 | |

7.875%, 11/01/22(c) | | | | | 1,500 | | | | 1,605,000 | |

Magnetation LLC/Mag Finance Corp.

11.00%, 5/15/28(c)(d) | | | | | 2,121 | | | | 890,820 | |

Novelis, Inc.

8.75%, 12/15/20 | | | | | 837 | | | | 885,127 | |

| | | | |

| ALLIANCEBERNSTEIN INCOME FUND • | | | 9 | |

Portfolio of Investments

| | | | | | | | | | |

| | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

| | | | | | | | | | |

Thompson Creek Metals Co., Inc.

7.375%, 6/01/18(a) | | U.S.$ | | | 4,398 | | | $ | 3,606,360 | |

TPC Group, Inc.

8.75%, 12/15/20(c) | | | | | 827 | | | | 764,975 | |

Univar, Inc.

6.75%, 7/15/23(c) | | | | | 1,666 | | | | 1,682,660 | |

| | | | | | | | | | |

| | | | | | | | | 17,989,272 | |

| | | | | | | | | | |

Capital Goods – 0.7% | | | | | | | | | | |

Apex Tool Group LLC

7.00%, 2/01/21(c) | | | | | 1,955 | | | | 1,739,950 | |

Berry Plastics Corp.

5.125%, 7/15/23 | | | | | 1,536 | | | | 1,497,600 | |

Bombardier, Inc.

4.75%, 4/15/19(c) | | | | | 3,450 | | | | 3,355,125 | |

7.50%, 3/15/25(c) | | | | | 2,438 | | | | 2,212,485 | |

Huntington Ingalls Industries, Inc.

7.125%, 3/15/21 | | | | | 690 | | | | 731,400 | |

Sealed Air Corp.

6.875%, 7/15/33(c) | | | | | 1,486 | | | | 1,500,860 | |

Summit Materials LLC/Summit Materials

Finance Corp.

10.50%, 1/31/20 | | | | | 862 | | | | 940,657 | |

| | | | | | | | | | |

| | | | | | | | | 11,978,077 | |

| | | | | | | | | | |

Communications - Media – 1.8% | | | | | | | | | | |

CCO Holdings LLC/CCO Holdings Capital Corp.

5.25%, 9/30/22 | | | | | 2,079 | | | | 2,047,815 | |

Cumulus Media Holdings, Inc.

7.75%, 5/01/19(a) | | | | | 678 | | | | 622,065 | |

DISH DBS Corp.

5.875%, 11/15/24 | | | | | 3,303 | | | | 3,172,944 | |

Hughes Satellite Systems Corp.

7.625%, 6/15/21 | | | | | 3,111 | | | | 3,422,722 | |

Intelsat Jackson Holdings SA

7.25%, 4/01/19 | | | | | 4,231 | | | | 4,294,465 | |

Nielsen Co. Luxembourg SARL (The)

5.50%, 10/01/21(c) | | | | | 3,243 | | | | 3,275,430 | |

Quebecor Media, Inc.

5.75%, 1/15/23 | | | | | 2,145 | | | | 2,139,638 | |

Time, Inc.

5.75%, 4/15/22(c) | | | | | 2,285 | | | | 2,210,738 | |

Unitymedia GmbH

6.125%, 1/15/25(c) | | | | | 2,749 | | | | 2,872,705 | |

Univision Communications, Inc.

5.125%, 5/15/23(c) | | | | | 3,295 | | | | 3,196,150 | |

UPCB Finance IV Ltd.

5.375%, 1/15/25(c) | | | | | 2,700 | | | | 2,577,150 | |

| | |

| 10 | | • ALLIANCEBERNSTEIN INCOME FUND |

Portfolio of Investments

| | | | | | | | | | |

| | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

| | | | | | | | | | |

Virgin Media Finance PLC

5.25%, 2/15/22 | | U.S.$ | | | 2,246 | | | $ | 2,144,930 | |

| | | | | | | | | | |

| | | | | | | | | 31,976,752 | |

| | | | | | | | | | |

Communications - Telecommunications – 0.8% | | | | | | | | | | |

Altice SA

7.75%, 5/15/22(c) | | | | | 1,342 | | | | 1,298,385 | |

Columbus International, Inc.

7.375%, 3/30/21(c) | | | | | 3,872 | | | | 4,157,560 | |

Frontier Communications Corp.

6.25%, 9/15/21 | | | | | 3,000 | | | | 2,730,000 | |

Numericable-SFR SAS

6.25%, 5/15/24(c) | | | | | 766 | | | | 753,553 | |

Sprint Corp.

7.625%, 2/15/25 | | | | | 2,635 | | | | 2,483,487 | |

Windstream Services LLC

7.50%, 4/01/23(a) | | | | | 2,000 | | | | 1,745,000 | |

7.75%, 10/01/21 | | | | | 1,070 | | | | 979,050 | |

| | | | | | | | | | |

| | | | | | | | | 14,147,035 | |

| | | | | | | | | | |

Consumer Cyclical - Automotive – 0.4% | | | | | | | | | | |

Affinia Group, Inc.

7.75%, 5/01/21 | | | | | 238 | | | | 248,710 | |

Exide Technologies

Series AI

7.00%, 4/30/25(e)(f)(g) | | | | | 2,249 | | | | 1,922,695 | |

11.00%, 4/30/20(h) | | | | | 5,143 | | | | 4,333,079 | |

| | | | | | | | | | |

| | | | | | | | | 6,504,484 | |

| | | | | | | | | | |

Consumer Cyclical - Entertainment – 0.1% | | | | | | | | | | |

AMC Entertainment, Inc.

5.75%, 6/15/25(c) | | | | | 1,692 | | | | 1,658,160 | |

| | | | | | | | | | |

| | | |

Consumer Cyclical - Other – 0.4% | | | | | | | | | | |

International Game Technology PLC

6.25%, 2/15/22(c) | | | | | 2,605 | | | | 2,487,775 | |

6.50%, 2/15/25(c) | | | | | 350 | | | | 323,750 | |

MGM Resorts International

6.625%, 12/15/21 | | | | | 744 | | | | 777,480 | |

6.75%, 10/01/20 | | | | | 1,700 | | | | 1,802,000 | |

Shea Homes LP/Shea Homes Funding Corp.

6.125%, 4/01/25(c) | | | | | 697 | | | | 702,228 | |

Taylor Morrison Communities, Inc./Monarch Communities, Inc.

5.875%, 4/15/23(c) | | | | | 2,018 | | | | 1,997,820 | |

| | | | | | | | | | |

| | | | | | | | | 8,091,053 | |

| | | | | | | | | | |

| | | | |

| ALLIANCEBERNSTEIN INCOME FUND • | | | 11 | |

Portfolio of Investments

| | | | | | | | | | |

| | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

| | | | | | | | | | |

Consumer Cyclical - Retailers – 0.6% | | | | | | | | | | |

American Tire Distributors, Inc.

10.25%, 3/01/22(c) | | U.S.$ | | | 3,855 | | | $ | 4,115,213 | |

Chinos Intermediate Holdings A, Inc.

7.75% (7.75% Cash or 8.50% PIK),

5/01/19(c)(g) | | | | | 1,973 | | | | 1,588,265 | |

Family Tree Escrow LLC

5.75%, 3/01/23(c) | | | | | 2,475 | | | | 2,586,375 | |

Men’s Wearhouse, Inc. (The)

7.00%, 7/01/22 | | | | | 1,870 | | | | 2,000,900 | |

| | | | | | | | | | |

| | | | | | | | | 10,290,753 | |

| | | | | | | | | | |

Consumer Non-Cyclical – 1.9% | | | | | | | | | | |

Air Medical Merger Sub Corp.

6.375%, 5/15/23(c) | | | | | 2,407 | | | | 2,262,580 | |

CHS/Community Health Systems, Inc.

6.875%, 2/01/22 | | | | | 3,286 | | | | 3,466,730 | |

ConvaTec Finance International SA

8.25% (8.25% Cash or 9.00% PIK),

1/15/19(c)(g) | | | | | 3,860 | | | | 3,792,450 | |

Endo Finance LLC/Endo Ltd./Endo Finco, Inc.

6.00%, 7/15/23(c) | | | | | 1,434 | | | | 1,466,265 | |

Holding Medi-Partenaires SAS

7.00%, 5/15/20(c) | | EUR | | | 1,750 | | | | 2,067,031 | |

Jaguar Holding Co. II/Jaguar Merger Sub, Inc.

9.50%, 12/01/19(c) | | U.S.$ | | | 2,000 | | | | 2,130,000 | |

Kinetic Concepts, Inc./KCI USA, Inc.

10.50%, 11/01/18 | | | | | 4,000 | | | | 4,270,080 | |

Mallinckrodt International Finance SA/Mallinckrodt CB LLC

5.50%, 4/15/25(c) | | | | | 653 | | | | 633,410 | |

Post Holdings, Inc.

6.00%, 12/15/22(c) | | | | | 869 | | | | 836,413 | |

7.375%, 2/15/22 | | | | | 705 | | | | 717,338 | |

PRA Holdings, Inc.

9.50%, 10/01/23(c) | | | | | 2,231 | | | | 2,493,142 | |

Smithfield Foods, Inc.

5.875%, 8/01/21(c) | | | | | 2,597 | | | | 2,681,402 | |

Spectrum Brands, Inc.

5.75%, 7/15/25(c) | | | | | 2,897 | | | | 2,940,455 | |

Sterigenics-Nordion Holdings LLC

6.50%, 5/15/23(c) | | | | | 384 | | | | 389,760 | |

Valeant Pharmaceuticals International, Inc.

5.875%, 5/15/23(c) | | | | | 1,130 | | | | 1,158,250 | |

6.125%, 4/15/25(c) | | | | | 3,277 | | | | 3,375,310 | |

| | | | | | | | | | |

| | | | | | | | | 34,680,616 | |

| | | | | | | | | | |

| | |

| 12 | | • ALLIANCEBERNSTEIN INCOME FUND |

Portfolio of Investments

| | | | | | | | | | |

| | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

| | | | | | | | | | |

Energy – 2.2% | | | | | | | | | | |

Antero Resources Corp.

5.375%, 11/01/21 | | U.S.$ | | | 792 | | | $ | 760,320 | |

Berry Petroleum Co. LLC

6.375%, 9/15/22 | | | | | 3,107 | | | | 2,423,460 | |

Bonanza Creek Energy, Inc.

6.75%, 4/15/21 | | | | | 640 | | | | 606,400 | |

BreitBurn Energy Partners LP/BreitBurn Finance Corp.

7.875%, 4/15/22 | | | | | 1,374 | | | | 1,140,420 | |

Denbury Resources, Inc.

4.625%, 7/15/23 | | | | | 2,591 | | | | 2,176,440 | |

5.50%, 5/01/22 | | | | | 2,257 | | | | 2,014,373 | |

Energy XXI Gulf Coast, Inc.

11.00%, 3/15/20(c) | | | | | 2,102 | | | | 1,839,250 | |

Golden Energy Offshore Services AS

8.74%, 5/28/17(e)(i) | | NOK | | | 7,624 | | | | 529,920 | |

Holly Energy Partners LP/Holly Energy Finance Corp.

6.50%, 3/01/20 | | U.S.$ | | | 2,196 | | | | 2,190,510 | |

Hornbeck Offshore Services, Inc.

5.875%, 4/01/20 | | | | | 2,737 | | | | 2,483,827 | |

Legacy Reserves LP/Legacy Reserves Finance Corp.

6.625%, 12/01/21 | | | | | 3,090 | | | | 2,502,900 | |

Northern Blizzard Resources, Inc.

7.25%, 2/01/22(c) | | | | | 1,300 | | | | 1,241,500 | |

Offshore Group Investment Ltd.

7.125%, 4/01/23 | | | | | 3,068 | | | | 1,871,480 | |

Paragon Offshore PLC

6.75%, 7/15/22(c) | | | | | 849 | | | | 280,170 | |

7.25%, 8/15/24(c) | | | | | 3,230 | | | | 1,049,750 | |

Rosetta Resources, Inc.

5.875%, 6/01/24 | | | | | 1,322 | | | | 1,424,455 | |

Sabine Pass Liquefaction LLC

5.625%, 3/01/25(c) | | | | | 2,036 | | | | 2,015,640 | |

SandRidge Energy, Inc.

7.50%, 2/15/23 | | | | | 1,259 | | | | 532,179 | |

SM Energy Co.

5.625%, 6/01/25 | | | | | 946 | | | | 936,351 | |

Southern Star Central Corp.

5.125%, 7/15/22(c) | | | | | 2,000 | | | | 2,030,000 | |

Tervita Corp.

8.00%, 11/15/18(c) | | | | | 3,547 | | | | 3,227,770 | |

Transocean, Inc.

6.50%, 11/15/20(a) | | | | | 2,700 | | | | 2,500,875 | |

7.50%, 4/15/31 | | | | | 2,200 | | | | 1,760,000 | |

| | | | |

| ALLIANCEBERNSTEIN INCOME FUND • | | | 13 | |

Portfolio of Investments

| | | | | | | | | | |

| | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

| | | | | | | | | | |

Whiting Petroleum Corp.

6.25%, 4/01/23(c) | | U.S.$ | | | 2,789 | | | $ | 2,795,972 | |

| | | | | | | | | | |

| | | | | | | | | 40,333,962 | |

| | | | | | | | | | |

Other Industrial – 0.2% | | | | | | | | | | |

Safway Group Holding LLC/Safway Finance Corp.

7.00%, 5/15/18(c) | | | | | 3,300 | | | | 3,373,557 | |

| | | | | | | | | | |

| | | |

Services – 0.2% | | | | | | | | | | |

Service Corp. International/US

7.50%, 4/01/27 | | | | | 3,300 | | | | 3,795,000 | |

| | | | | | | | | | |

| | | |

Technology – 0.4% | | | | | | | | | | |

Avaya, Inc.

10.50%, 3/01/21(c) | | | | | 1,196 | | | | 986,700 | |

Brightstar Corp.

9.50%, 12/01/16(c) | | | | | 1,600 | | | | 1,644,000 | |

Energizer SpinCo., Inc.

5.50%, 6/15/25(c) | | | | | 1,163 | | | | 1,148,463 | |

Infor Software Parent LLC/Infor Software Parent, Inc.

7.125% (7.125% Cash or 7.875% PIK),

5/01/21(c)(g) | | | | | 3,278 | | | | 3,286,195 | |

| | | | | | | | | | |

| | | | | | | | | 7,065,358 | |

| | | | | | | | | | |

Transportation - Services – 0.3% | | | | | | | | | | |

Hertz Corp. (The)

5.875%, 10/15/20 | | | | | 2,710 | | | | 2,743,875 | |

LBC Tank Terminals Holding Netherlands BV

6.875%, 5/15/23(c) | | | | | 1,789 | | | | 1,847,143 | |

XPO Logistics, Inc.

6.50%, 6/15/22(c) | | | | | 1,815 | | | | 1,776,431 | |

| | | | | | | | | | |

| | | | | | | | | 6,367,449 | |

| | | | | | | | | | |

| | | | | | | | | 198,251,528 | |

| | | | | | | | | | |

Financial Institutions – 1.5% | | | | | | | | | | |

Banking – 1.1% | | | | | | | | | | |

Barclays Bank PLC

6.86%, 6/15/32(c)(j) | | | | | 656 | | | | 736,360 | |

7.625%, 11/21/22 | | | | | 654 | | | | 744,775 | |

Citigroup, Inc.

5.95%, 1/30/23(j) | | | | | 2,055 | | | | 2,024,175 | |

Series P

5.95%, 5/15/25(j) | | | | | 1,850 | | | | 1,780,625 | |

Commerzbank AG

8.125%, 9/19/23(c) | | | | | 3,610 | | | | 4,210,487 | |

Credit Agricole SA

7.589%, 1/30/20(j) | | GBP | | | 1,150 | | | | 1,992,148 | |

7.875%, 1/23/24(a)(c)(j) | | U.S.$ | | | 549 | | | | 562,039 | |

| | |

| 14 | | • ALLIANCEBERNSTEIN INCOME FUND |

Portfolio of Investments

| | | | | | | | | | |

| | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

| | | | | | | | | | |

Credit Suisse Group AG

7.50%, 12/11/23(c)(j) | | U.S.$ | | | 2,066 | | | $ | 2,158,970 | |

Intesa Sanpaolo SpA

5.017%, 6/26/24(c) | | | | | 2,922 | | | | 2,838,852 | |

Royal Bank of Scotland PLC (The)

9.50%, 3/16/22(c) | | | | | 2,106 | | | | 2,323,211 | |

| | | | | | | | | | |

| | | | | | | | | 19,371,642 | |

| | | | | | | | | | |

Finance – 0.1% | | | | | | | | | | |

Creditcorp

12.00%, 7/15/18(c) | | | | | 2,000 | | | | 1,675,000 | |

| | | | | | | | | | |

| | | |

Insurance – 0.1% | | | | | | | | | | |

American Equity Investment Life Holding Co.

6.625%, 7/15/21 | | | | | 2,432 | | | | 2,571,840 | |

| | | | | | | | | | |

| | | |

Other Finance – 0.1% | | | | | | | | | | |

ACE Cash Express, Inc.

11.00%, 2/01/19(c) | | | | | 779 | | | | 432,345 | |

iPayment, Inc.

9.50%, 12/15/19(c) | | | | | 88 | | | | 83,668 | |

Series AI

9.50%, 12/15/19 | | | | | 1,763 | | | | 1,675,265 | |

| | | | | | | | | | |

| | | | | | | | | 2,191,278 | |

| | | | | | | | | | |

REITS – 0.1% | | | | | | | | | | |

Felcor Lodging LP

6.00%, 6/01/25(c) | | | | | 1,018 | | | | 1,033,270 | |

| | | | | | | | | | |

| | | | | | | | | 26,843,030 | |

| | | | | | | | | | |

Utility – 0.8% | | | | | | | | | | |

Electric – 0.8% | | | | | | | | | | |

Calpine Corp.

7.875%, 1/15/23(c) | | | | | 2,187 | | | | 2,361,960 | |

Dynegy, Inc.

7.375%, 11/01/22(c) | | | | | 2,895 | | | | 3,032,512 | |

7.625%, 11/01/24(c) | | | | | 1,915 | | | | 2,025,113 | |

FirstEnergy Corp.

Series C

7.375%, 11/15/31 | | | | | 1,552 | | | | 1,890,961 | |

GenOn Energy, Inc.

7.875%, 6/15/17 | | | | | 2,100 | | | | 2,126,250 | |

9.50%, 10/15/18 | | | | | 2,087 | | | | 2,128,740 | |

Talen Energy Supply LLC

4.60%, 12/15/21 | | | | | 965 | | | | 885,388 | |

| | | | | | | | | | |

| | | | | | | | | 14,450,924 | |

| | | | | | | | | | |

Total Corporates – Non-Investment Grade

(cost $250,095,053) | | | | | | | | | 239,545,482 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | |

| ALLIANCEBERNSTEIN INCOME FUND • | | | 15 | |

Portfolio of Investments

| | | | | | | | | | |

| | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

| | | | | | | | | | |

COLLATERALIZED MORTGAGE OBLIGATIONS – 5.4% | | | | | | | | | | |

GSE Risk Share Floating Rate – 2.7% | | | | | | | | | | |

Federal Home Loan Mortgage Corp. Structured Agency Credit Risk Debt Notes

Series 2013-DN1, Class M2

7.337%, 7/25/23(i) | | U.S.$ | | | 3,250 | | | $ | 3,851,558 | |

Series 2013-DN2, Class M2

4.437%, 11/25/23(i) | | | | | 5,605 | | | | 5,672,247 | |

Series 2014-DN1, Class M2

2.387%, 2/25/24(i) | | | | | 4,085 | | | | 4,061,878 | |

Series 2014-DN1, Class M3

4.687%, 2/25/24(i) | | | | | 4,665 | | | | 4,785,551 | |

Series 2014-DN2, Class M3

3.787%, 4/25/24(i) | | | | | 4,565 | | | | 4,411,657 | |

Series 2014-DN3, Class M3

4.187%, 8/25/24(i) | | | | | 5,065 | | | | 5,000,242 | |

Series 2014-DN4, Class M3

4.737%, 10/25/24(i) | | | | | 700 | | | | 716,145 | |

Series 2014-HQ2, Class M3

3.937%, 9/25/24(i) | | | | | 1,010 | | | | 972,289 | |

Series 2015-DNA1, Class M3

3.487%, 10/25/27(i) | | | | | 505 | | | | 492,590 | |

Series 2015-DNA2, Class M2

2.787%, 12/25/27(i) | | | | | 5,920 | | | | 5,932,478 | |

Federal National Mortgage Association Connecticut Avenue Securities

Series 2014-C01, Class M2

4.587%, 1/25/24(i) | | | | | 1,606 | | | | 1,645,051 | |

Series 2014-C04, Class 1M2

5.087%, 11/25/24(i) | | | | | 6,100 | | | | 6,274,941 | |

Series 2015-C01, Class 1M2

4.487%, 2/25/25(i) | | | | | 4,520 | | | | 4,480,231 | |

| | | | | | | | | | |

| | | | | | | | | 48,296,858 | |

| | | | | | | | | | |

Non-Agency Fixed Rate – 1.9% | | | | | | | | | | |

Alternative Loan Trust

Series 2006-19CB, Class A24

6.00%, 8/25/36 | | | | | 164 | | | | 152,141 | |

BCAP LLC Trust

Series 2009-RR13, Class 17A3

6.082%, 4/26/37(c) | | | | | 812 | | | | 663,986 | |

BNPP Mortgage Securities LLC Trust

Series 2009-1, Class B1

6.00%, 8/27/37(c) | | | | | 1,219 | | | | 1,007,841 | |

CHL Mortgage Pass-Through Trust

Series 2007-16, Class A1

6.50%, 10/25/37 | | | | | 1,603 | | | | 1,496,507 | |

| | |

| 16 | | • ALLIANCEBERNSTEIN INCOME FUND |

Portfolio of Investments

| | | | | | | | | | |

| | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

| | | | | | | | | | |

Series 2007-3, Class A30

5.75%, 4/25/37 | | U.S.$ | | | 1,670 | | | $ | 1,523,881 | |

Series 2007-HY4, Class 1A1

2.554%, 9/25/47 | | | | | 896 | | | | 797,613 | |

Citigroup Mortgage Loan Trust

Series 2006-4, Class 2A1A

6.00%, 12/25/35 | | | | | 4,422 | | | | 4,089,747 | |

Series 2007-AR4, Class 1A1A

5.387%, 3/25/37 | | | | | 674 | | | | 641,112 | |

Series 2010-3, Class 2A2

7.063%, 8/25/37(c) | | | | | 739 | | | | 638,477 | |

Countrywide Alternative Loan Trust

Series 2006-19CB, Class A15

6.00%, 8/25/36 | | | | | 257 | | | | 234,640 | |

Series 2006-24CB, Class A15

5.75%, 6/25/36 | | | | | 2,409 | | | | 2,156,453 | |

Series 2006-41CB, Class 2A13

5.75%, 1/25/37 | | | | | 1,974 | | | | 1,781,857 | |

Series 2007-13, Class A2

6.00%, 6/25/47 | | | | | 2,932 | | | | 2,482,145 | |

Credit Suisse Mortgage Trust

Series 2009-8R, Class 6A2

6.00%, 1/26/38(c) | | | | | 176 | | | | 131,966 | |

Series 2010-13R, Class 1A2

5.50%, 12/26/35(c) | | | | | 67 | | | | 63,126 | |

Series 2010-9R, Class 1A5

4.00%, 8/27/37(c) | | | | | 938 | | | | 919,332 | |

CSMC Mortgage-Backed Trust

Series 2006-7, Class 3A12

6.25%, 8/25/36 | | | | | 1,682 | | | | 1,468,986 | |

First Horizon Alternative Mortgage Securities Trust

Series 2006-AA5, Class A1

2.236%, 9/25/36 | | | | | 2,319 | | | | 1,820,508 | |

Morgan Stanley Mortgage Loan Trust

Series 2005-10, Class 4A1

5.50%, 12/25/35 | | | | | 1,058 | | | | 974,053 | |

Series 2007-10XS, Class A2

6.25%, 7/25/47 | | | | | 1,242 | | | | 931,873 | |

Nomura Resecuritization Trust

Series 2010-5RA, Class 1A7

6.50%, 10/26/37(c) | | | | | 1,916 | | | | 1,640,890 | |

Wells Fargo Mortgage Backed Securities Trust

Series 2006-AR7, Class 2A1

2.733%, 5/25/36 | | | | | 2,375 | | | | 2,254,320 | |

Series 2007-AR7, Class A1

2.58%, 12/28/37 | | | | | 4,377 | | | | 4,039,238 | |

| | | | |

| ALLIANCEBERNSTEIN INCOME FUND • | | | 17 | |

Portfolio of Investments

| | | | | | | | | | |

| | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

| | | | | | | | | | |

Series 2007-AR8, Class A1

2.614%, 11/25/37 | | U.S.$ | | | 1,737 | | | $ | 1,521,426 | |

| | | | | | | | | | |

| | | | | | | | | 33,432,118 | |

| | | | | | | | | | |

Non-Agency Floating Rate – 0.6% | | | | | | | | | | |

First Horizon Alternative Mortgage Securities Trust

Series 2007-FA2, Class 1A10

0.437%, 4/25/37(i) | | | | | 945 | | | | 509,534 | |

Series 2007-FA2, Class 1A5

0.487%, 4/25/37(i) | | | | | 1,070 | | | | 581,062 | |

Lehman XS Trust

Series 2007-10H, Class 2AIO

6.82%, 7/25/37(i)(k) | | | | | 1,184 | | | | 308,152 | |

Residential Accredit Loans, Inc. Trust

Series 2006-QA4, Class A

0.367%, 5/25/36(i) | | | | | 3,476 | | | | 2,815,222 | |

Washington Mutual Mortgage Pass-Through Certificates Trust

Series 2007-OA1, Class A1A

0.858%, 2/25/47(i) | | | | | 4,469 | | | | 3,575,181 | |

Series 2007-OA4, Class A1A

0.918%, 4/25/47(i) | | | | | 5,283 | | | | 3,867,250 | |

| | | | | | | | | | |

| | | | | | | | | 11,656,401 | |

| | | | | | | | | | |

Agency Fixed Rate – 0.2% | | | | | | | | | | |

Federal National Mortgage Association REMICs

Series 2013-87, Class KI

3.00%, 12/25/37(k) | | | | | 14,295 | | | | 1,408,613 | |

Government National Mortgage Association

Series 2013-170, Class MI

4.50%, 11/20/43(k) | | | | | 10,251 | | | | 2,105,726 | |

| | | | | | | | | | |

| | | | | | | | | 3,514,339 | |

| | | | | | | | | | |

Total Collateralized Mortgage Obligations

(cost $95,166,925) | | | | | | | | | 96,899,716 | |

| | | | | | | | | | |

| | | | | | | | | | |

CORPORATES – INVESTMENT GRADE – 4.8% | | | | | | | | | | |

Industrial – 2.6% | | | | | | | | | | |

Basic – 0.7% | | | | | | | | | | |

Braskem Finance Ltd.

6.45%, 2/03/24 | | | | | 1,204 | | | | 1,137,780 | |

GTL Trade Finance, Inc.

5.893%, 4/29/24(c) | | | | | 2,711 | | | | 2,644,580 | |

7.25%, 4/16/44(c) | | | | | 274 | | | | 254,478 | |

Minsur SA

6.25%, 2/07/24(c) | | | | | 1,764 | | | | 1,932,944 | |

| | |

| 18 | | • ALLIANCEBERNSTEIN INCOME FUND |

Portfolio of Investments

| | | | | | | | | | |

| | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

| | | | | | | | | | |

Southern Copper Corp.

7.50%, 7/27/35 | | U.S.$ | | | 5,107 | | | $ | 5,719,534 | |

Teck Resources Ltd.

4.50%, 1/15/21 | | | | | 2,206 | | | | 2,117,636 | |

| | | | | | | | | | |

| | | | | | | | | 13,806,952 | |

| | | | | | | | | | |

Capital Goods – 0.4% | | | | | | | | | | |

Odebrecht Finance Ltd. | | | | | | | | | | |

4.375%, 4/25/25(c) | | | | | 6,760 | | | | 5,171,400 | |

5.25%, 6/27/29(c) | | | | | 2,103 | | | | 1,577,671 | |

| | | | | | | | | | |

| | | | | | | | | 6,749,071 | |

| | | | | | | | | | |

Communications - Telecommunications – 0.7% | | | | | | | | | | |

Qwest Corp.

6.875%, 9/15/33 | | | | | 1,500 | | | | 1,483,185 | |

Telefonica Emisiones SAU

7.045%, 6/20/36 | | | | | 5,000 | | | | 6,140,710 | |

Verizon Communications, Inc.

4.522%, 9/15/48(c) | | | | | 6,159 | | | | 5,410,786 | |

| | | | | | | | | | |

| | | | | | | | | 13,034,681 | |

| | | | | | | | | | |

Consumer Non-Cyclical – 0.3% | | | | | | | | | | |

HJ Heinz Co. | | | | | | | | | | |

2.80%, 7/02/20(c) | | | | | 2,700 | | | | 2,702,101 | |

3.50%, 7/15/22(c) | | | | | 2,294 | | | | 2,299,382 | |

Reynolds American, Inc.

5.70%, 8/15/35 | | | | | 650 | | | | 673,963 | |

| | | | | | | | | | |

| | | | | | | | | 5,675,446 | |

| | | | | | | | | | |

Energy – 0.4% | | | | | | | | | | |

Reliance Holding USA, Inc.

5.40%, 2/14/22(c) | | | | | 3,568 | | | | 3,850,307 | |

Weatherford International Ltd./Bermuda

7.00%, 3/15/38 | | | | | 2,900 | | | | 2,771,904 | |

| | | | | | | | | | |

| | | | | | | | | 6,622,211 | |

| | | | | | | | | | |

Transportation - Airlines – 0.1% | | | | | | | | | | |

Delta Air Lines Pass-Through Trust

Series 2007-1A

6.821%, 8/10/22 | | | | | 1,337 | | | | 1,533,884 | |

| | | | | | | | | | |

| | | | | | | | | 47,422,245 | |

| | | | | | | | | | |

Financial Institutions – 2.0% | | | | | | | | | | |

Banking – 0.5% | | | | | | | | | | |

Credit Suisse AG

6.50%, 8/08/23(c) | | | | | 3,900 | | | | 4,257,100 | |

HSBC Capital Funding LP/Jersey

10.176%, 6/30/30(c)(j) | | | | | 884 | | | | 1,348,100 | |

JPMorgan Chase & Co.

Series S

6.75%, 2/01/24(j) | | | | | 2,998 | | | | 3,185,375 | |

| | | | |

| ALLIANCEBERNSTEIN INCOME FUND • | | | 19 | |

Portfolio of Investments

| | | | | | | | | | |

| | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

| | | | | | | | | | |

Nordea Bank AB

6.125%, 9/23/24(c)(j) | | U.S.$ | | | 596 | | | $ | 587,618 | |

| | | | | | | | | | |

| | | | | | | | | 9,378,193 | |

| | | | | | | | | | |

Insurance – 1.5% | | | | | | | | | | |

AIG Life Holdings, Inc

8.125%, 3/15/46(c) | | | | | 509 | | | | 703,693 | |

American International Group, Inc.

8.175%, 5/15/58 | | | | | 2,525 | | | | 3,343,100 | |

Fairfax Financial Holdings Ltd.

8.30%, 4/15/26 | | | | | 5,000 | | | | 6,066,215 | |

Great-West Life & Annuity Insurance Capital LP II

7.153%, 5/16/46(c) | | | | | 2,707 | | | | 2,761,140 | |

Humana, Inc.

8.15%, 6/15/38 | | | | | 1,650 | | | | 2,292,543 | |

MetLife, Inc. | | | | | | | | | | |

6.40%, 12/15/36 | | | | | 3,345 | | | | 3,671,137 | |

Series C | | | | | | | | | | |

5.25%, 6/15/20(j) | | | | | 1,799 | | | | 1,783,259 | |

Pacific Life Insurance Co.

9.25%, 6/15/39(c) | | | | | 1,500 | | | | 2,240,034 | |

Transatlantic Holdings, Inc.

8.00%, 11/30/39 | | | | | 2,122 | | | | 2,746,142 | |

| | | | | | | | | | |

| | | | | | | | | 25,607,263 | |

| | | | | | | | | | |

| | | | | | | | | 34,985,456 | |

| | | | | | | | | | |

Utility – 0.2% | | | | | | | | | | |

Electric – 0.2% | | | | | | | | | | |

ComEd Financing III

6.35%, 3/15/33 | | | | | 3,462 | | | | 3,548,574 | |

| | | | | | | | | | |

| | | |

Total Corporates – Investment Grade

(cost $81,241,953) | | | | | | | | | 85,956,275 | |

| | | | | | | | | | |

| | | | | | | | | | |

AGENCIES – 3.9% | | | | | | | | | | |

Agency Debentures – 3.9% | | | | | | | | | | |

Residual Funding Corp. Principal Strip

Zero Coupon, 7/15/20 | | | | | 42,045 | | | | 38,053,079 | |

Federal Home Loan Mortgage Corp.

6.25%, 7/15/32 | | | | | 15,000 | | | | 20,844,435 | |

Federal Home Loan Banks

5.50%, 7/15/36 | | | | | 8,695 | | | | 11,249,052 | |

| | | | | | | | | | |

| | | |

Total Agencies

(cost $68,087,544) | | | | | | | | | 70,146,566 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | |

| 20 | | • ALLIANCEBERNSTEIN INCOME FUND |

Portfolio of Investments

| | | | | | | | | | |

| | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

| | | | | | | | | | |

COMMERCIAL MORTGAGE-BACKED SECURITIES – 3.3% | | | | | | | | | | |

Non-Agency Fixed Rate CMBS – 3.1% | | | | | | | | | | |

Banc of America Commercial Mortgage Trust

Series 2007-3, Class AJ

5.749%, 6/10/49 | | U.S.$ | | | 1,517 | | | $ | 1,572,509 | |

Citigroup Commercial Mortgage Trust

Series 2013-GC17, Class D

5.261%, 11/10/46(c) | | | | | 6,525 | | | | 6,342,770 | |

Series 2014-GC21, Class D

4.997%, 5/10/47(c) | | | | | 6,052 | | | | 5,628,688 | |

Series 2014-GC23, Class D

4.658%, 7/10/47(c) | | | | | 1,323 | | | | 1,197,891 | |

Commercial Mortgage Trust

Series 2014-LC17, Class D

3.687%, 10/10/47(c) | | | | | 3,549 | | | | 2,942,844 | |

Series 2014-UBS5, Class D

3.495%, 9/10/47(c) | | | | | 1,041 | | | | 834,573 | |

Series 2015-DC1, Class D

4.499%, 2/10/48(c) | | | | | 2,730 | | | | 2,378,593 | |

CSAIL 2015-C1 Commercial Mortgage Trust

Series 2015-C2, Class D

4.354%, 6/15/57 | | | | | 4,091 | | | | 3,661,324 | |

GS Mortgage Securities Trust

Series 2013-GC13, Class D

4.206%, 7/10/46(c) | | | | | 9,440 | | | | 8,617,370 | |

LB-UBS Commercial Mortgage Trust

Series 2007-C7, Class AJ

6.455%, 9/15/45 | | | | | 1,750 | | | | 1,850,168 | |

ML-CFC Commercial Mortgage Trust

Series 2006-4, Class AJ

5.239%, 12/12/49 | | | | | 6,667 | | | | 6,744,454 | |

Morgan Stanley Bank of America Merrill Lynch Trust

Series 2014-C19, Class D

3.25%, 12/15/47(c) | | | | | 1,194 | | | | 994,492 | |

Wells Fargo Commercial Mortgage Trust

Series 2014-LC18, Class D

3.957%, 12/15/47(c) | | | | | 3,781 | | | | 3,208,858 | |

Series 2015-LC20, Class D

4.511%, 4/15/50(c) | | | | | 4,000 | | | | 3,431,924 | |

WF-RBS Commercial Mortgage Trust

Series 2012-C8, Class E

5.038%, 8/15/45(c) | | | | | 4,000 | | | | 4,021,664 | |

Series 2014-C23, Class D

4.138%, 10/15/57(c) | | | | | 2,699 | | | | 2,352,101 | |

| | | | | | | | | | |

| | | | | | | | | 55,780,223 | |

| | | | | | | | | | |

| | | | |

| ALLIANCEBERNSTEIN INCOME FUND • | | | 21 | |

Portfolio of Investments

| | | | | | | | | | |

| | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

| | | | | | | | | | |

Non-Agency Floating Rate CMBS – 0.2% | | | | | | | | | | |

Great Wolf Trust

Series 2015-WOLF, Class A

1.637%, 5/15/34(c)(i) | | U.S.$ | | | 4,138 | | | $ | 4,130,518 | |

Indus Eclipse PLC

Series 2007-1X, Class B

0.821%, 1/25/20(c)(i) | | GBP | | | 59 | | | | 89,096 | |

| | | | | | | | | | |

| | | | | | | | | 4,219,614 | |

| | | | | | | | | | |

Agency CMBS – 0.0% | | | | | | | | | | |

Government National Mortgage Association

Series 2006-32, Class XM

0.018%, 11/16/45(k) | | U.S.$ | | | 558 | | | | 696 | |

| | | | | |

| | | |

Total Commercial Mortgage-Backed Securities

(cost $59,671,805) | | | | | | | | | 60,000,533 | |

| | | | | |

| | | | | | | | | | |

EMERGING MARKETS – CORPORATE BONDS – 1.8% | | | | | | | | | | |

Industrial – 1.8% | | | | | | | | | | |

Basic – 0.3% | | | | | | | | | | |

Elementia SAB de CV

5.50%, 1/15/25(c) | | | | | 1,039 | | | | 1,051,987 | |

Vedanta Resources PLC

6.00%, 1/31/19(c) | | | | | 855 | | | | 827,213 | |

8.25%, 6/07/21(a)(c) | | | | | 1,943 | | | | 1,978,353 | |

9.50%, 7/18/18(c) | | | | | 610 | | | | 651,175 | |

| | | | | | | | | | |

| | | | | | | | | 4,508,728 | |

| | | | | | | | | | |

Capital Goods – 0.4% | | | | | | | | | | |

Cemex SAB de CV

7.25%, 1/15/21(c) | | | | | 2,376 | | | | 2,503,710 | |

Grupo Cementos de Chihuahua SAB de CV

8.125%, 2/08/20(c) | | | | | 1,954 | | | | 2,096,642 | |

Servicios Corporativos Javer SAPI de CV

9.875%, 4/06/21(c) | | | | | 2,185 | | | | 2,332,487 | |

| | | | | | | | | | |

| | | | | | | | | 6,932,839 | |

| | | | | | | | | | |

Communications - Telecommunications – 0.2% | | | | | | | | | | |

Comcel Trust via Comunicaciones Celulares SA

6.875%, 2/06/24(c) | | | | | 2,016 | | | | 2,121,840 | |

Digicel Ltd.

6.00%, 4/15/21(c) | | | | | 1,500 | | | | 1,446,180 | |

6.75%, 3/01/23(c) | | | | | 385 | | | | 377,416 | |

| | | | | | | | | | |

| | | | | | | | | 3,945,436 | |

| | | | | | | | | | |

| | |

| 22 | | • ALLIANCEBERNSTEIN INCOME FUND |

Portfolio of Investments

| | | | | | | | | | |

| | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

| | | | | | | | | | |

Consumer Cyclical - Retailers – 0.2% | | | | | | | | | | |

Office Depot de Mexico SA de CV

6.875%, 9/20/20(c) | | U.S.$ | | | 4,000 | | | $ | 4,295,000 | |

| | | | | | | | | | |

| | | |

Consumer Non-Cyclical – 0.5% | | | | | | | | | | |

Cosan Luxembourg SA

5.00%, 3/14/23(c) | | | | | 1,361 | | | | 1,258,925 | |

9.50%, 3/14/18(c) | | BRL | | | 3,117 | | | | 874,717 | |

Marfrig Holding Europe BV

8.375%, 5/09/18(c) | | U.S.$ | | | 900 | | | | 906,480 | |

Marfrig Overseas Ltd.

9.50%, 5/04/20(c) | | | | | 4,151 | | | | 4,241,077 | |

Minerva Luxembourg SA

7.75%, 1/31/23(c) | | | | | 877 | | | | 883,577 | |

Tonon Bioenergia SA

9.25%, 1/24/20(c) | | | | | 2,272 | | | | 760,461 | |

Virgolino de Oliveira Finance SA

10.50%, 1/28/18(d)(e) | | | | | 4,738 | | | | 47,380 | |

10.875%, 1/13/20(d)(e) | | | | | 750 | | | | 127,500 | |

11.75%, 2/09/22(d)(e) | | | | | 1,690 | | | | 16,900 | |

| | | | | | | | | | |

| | | | | | | | | 9,117,017 | |

| | | | | | | | | | |

Transportation - Airlines – 0.2% | | | | | | | | | | |

TAM Capital 3, Inc.

8.375%, 6/03/21(c) | | | | | 2,843 | | | | 2,956,720 | |

| | | | | | | | | | |

| | | |

Total Emerging Markets – Corporate Bonds

(cost $37,916,043) | | | | | | | | | 31,755,740 | |

| | | | | | | | | | |

| | | | | | | | | | |

WHOLE LOAN TRUSTS – 1.2% | | | | | | | | | | |

Performing Asset – 1.2% | | | | | | | | | | |

Alpha Credit Debt Fund LLC

15.00%, 1/15/18(f)(l) | | | | | 1,740 | | | | 1,739,773 | |

Cara Aircraft Leasing 28548, Inc.

8.00%, 11/26/19(f)(l) | | | | | 374 | | | | 374,412 | |

Cara Aircraft Leasing 28563, Inc.

8.00%, 6/09/19(f)(l) | | | | | 253 | | | | 252,744 | |

Cara Aircraft Leasing 28868, Inc.

8.00%, 11/26/19(f)(l) | | | | | 434 | | | | 434,353 | |

Deutsche Bank Mexico SA

8.00%, 10/31/34(f)(l) | | MXN | | | 30,052 | | | | 1,421,391 | |

Deutsche Bank Mexico SA

8.00%, 10/31/34(f)(l)(m) | | | | | 48,053 | | | | 2,272,815 | |

Ede Del Este SA (DPP)

12.00%, 3/31/16(f)(l) | | U.S.$ | | | 707 | | | | 719,320 | |

Ede Del Este SA (ITABO)

12.00%, 3/31/16(f)(l) | | | | | 684 | | | | 696,031 | |

Finalam SA de C.V.

17.25%, 8/06/19(f)(l) | | MXN | | | 15,616 | | | | 993,547 | |

| | | | |

| ALLIANCEBERNSTEIN INCOME FUND • | | | 23 | |

Portfolio of Investments

| | | | | | | | | | |

| | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

| | | | | | | | | | |

Recife Funding Ltd.

Zero Coupon, 11/05/29(f)(l) | | U.S.$ | | | 2,884 | | | $ | 2,859,726 | |

Sheridan Auto Loan Holdings I LLC

10.00%, 12/31/20(f)(l) | | | | | 1,369 | | | | 1,368,608 | |

Sheridan Consumer Finance Trust

10.86%, 4/01/20(f)(i)(l) | | | | | 8,611 | | | | 8,654,419 | |

| | | | | | | | | | |

| | | |

Total Whole Loan Trusts

(cost $22,449,143) | | | | | | | | | 21,787,139 | |

| | | | | | | | | | |

| | | | | | | | | | |

QUASI-SOVEREIGNS – 1.2% | | | | | | | | | | |

Quasi-Sovereign Bonds – 1.2% | | | | | | | | | | |

Indonesia – 0.4% | | | | | | | | | | |

Majapahit Holding BV

7.875%, 6/29/37(c) | | | | | 6,188 | | | | 7,131,670 | |

| | | | | | | | | | |

| | | |

Mexico – 0.5% | | | | | | | | | | |

Petroleos Mexicanos

5.625%, 1/23/46(c) | | | | | 4,710 | | | | 4,386,894 | |

6.50%, 6/02/41 | | | | | 4,900 | | | | 5,096,000 | |

| | | | | | | | | | |

| | | | | | | | | 9,482,894 | |

| | | | | | | | | | |

South Africa – 0.1% | | | | | | | | | | |

Eskom Holdings SOC Ltd.

7.125%, 2/11/25(c) | | | | | 1,070 | | | | 1,082,605 | |

| | | | | | | | | | |

| | | |

Venezuela – 0.2% | | | | | | | | | | |

Petroleos de Venezuela SA

5.25%, 4/12/17(c) | | | | | 7,500 | | | | 3,734,625 | |

| | | | | | | | | | |

| | | |

Total Quasi-Sovereigns

(cost $23,041,092) | | | | | | | | | 21,431,794 | |

| | | | | | | | | | |

| | | |

| | | | | Shares | | | | |

COMMON STOCKS – 1.2% | | | | | | | | | | |

Exide Technologies(f)(h)(n) | | | | | 45,970 | | | | 185,719 | |

Ion Media Networks, Inc. Class A(f)(l)(n) | | | | | 2,512 | | | | 969,104 | |

iPayment, Inc.(n) | | | | | 110,385 | | | | 391,867 | |

Mt Logan Re Ltd. (Preference Shares)(h)(n)(o) | | | | | 4,476 | | | | 4,556,125 | |

Mt Logan Re Ltd.(n)(o) | | | | | 15,000 | | | | 15,127,170 | |

| | | | | | | | | | |

| | | |

Total Common Stocks

(cost $20,685,633) | | | | | | | | | 21,229,985 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | |

| 24 | | • ALLIANCEBERNSTEIN INCOME FUND |

Portfolio of Investments

| | | | | | | | | | |

| | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

| | | | | | | | | | |

LOCAL GOVERNMENTS – MUNICIPAL BONDS – 0.9% | | | | | | | | | | |

United States – 0.9% | | | | | | | | | | |

Buckeye Tobacco Settlement Financing Authority

Series 2007A-2

5.875%, 6/01/47 | | U.S.$ | | | 1,950 | | | $ | 1,506,784 | |

Iowa Tobacco Settlement Authority

Series 2005C

5.625%, 6/01/46 | | | | | 1,575 | | | | 1,353,334 | |

Michigan Tobacco Settlement Finance Authority

Series 2007A

6.00%, 6/01/48 | | | | | 5,915 | | | | 4,717,272 | |

State of Illinois

Series 2010

7.35%, 7/01/35 | | | | | 3,330 | | | | 3,686,077 | |

Texas Transportation Commission State Highway Fund

Series 2010B

5.178%, 4/01/30 | | | | | 2,560 | | | | 2,954,010 | |

Tobacco Settlement Financing Corp./VA

Series 2007B1

5.00%, 6/01/47 | | | | | 1,850 | | | | 1,287,082 | |

| | | | | | | | | | |

| | | |

Total Local Governments – Municipal Bonds

(cost $15,881,771) | | | | | | | | | 15,504,559 | |

| | | | | | | | | | |

| | | | | | | | | | |

EMERGING MARKETS –

SOVEREIGNS – 0.8% | | | | | | | | | | |

Dominican Republic – 0.1% | | | | | | | | | | |

Dominican Republic International Bond

7.45%, 4/30/44(c) | | | | | 1,873 | | | | 2,046,252 | |

| | | | | | | | | | |

| | | |

El Salvador – 0.3% | | | | | | | | | | |

El Salvador Government International Bond

7.65%, 6/15/35(c) | | | | | 5,957 | | | | 5,986,785 | |

| | | | | | | | | | |

| | | |

Ivory Coast – 0.1% | | | | | | | | | | |

Ivory Coast Government International Bond 6.375%, 3/03/28(c) | | | | | 2,440 | | | | 2,385,100 | |

| | | | | | | | | | |

| | | |

Pakistan – 0.1% | | | | | | | | | | |

Pakistan Government International Bond

7.25%, 4/15/19(c) | | | | | 1,700 | | | | 1,781,830 | |

| | | | | | | | | | |

| | | |

Sri Lanka – 0.1% | | | | | | | | | | |

Sri Lanka Government International Bond

6.00%, 1/14/19(c) | | | | | 1,236 | | | | 1,262,265 | |

| | | | | | | | | | |

| | | | |

| ALLIANCEBERNSTEIN INCOME FUND • | | | 25 | |

Portfolio of Investments

| | | | | | | | | | |

| | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

| | | | | | | | | | |

Zambia – 0.1% | | | | | | | | | | |

Zambia Government International Bond

8.50%, 4/14/24(c) | | U.S.$ | | | 1,553 | | | $ | 1,560,765 | |

| | | | | | | | | | |

| | | |

Total Emerging Markets – Sovereigns

(cost $13,325,180) | | | | | | | | | 15,022,997 | |

| | | | | | | | | | |

| | | | | | | | | | |

BANK LOANS – 0.6% | | | | | | | | | | |

Industrial – 0.6% | | | | | | | | | | |

Basic – 0.1% | | | | | | | | | | |

FMG Resources (August 2006) Pty Ltd. (FMG America Finance, Inc.)

3.75%, 6/30/19(i) | | | | | 924 | | | | 818,618 | |

Magnetation LLC

12.00% 11/11/15(g) | | | | | 774 | | | | 746,286 | |

| | | | | | | | | | |

| | | | | | | | | 1,564,904 | |

| | | | | | | | | | |

Communications - Media – 0.1% | | | | | | | | | | |

TWCC Holding Corp.

7.00%, 6/26/20(i) | | | | | 1,550 | | | | 1,441,500 | |

| | | | | | | | | | |

| | | |

Consumer Cyclical - Other – 0.1% | | | | | | | | | | |

New HB Acquisition LLC

6.75%, 4/09/20(i) | | | | | 1,100 | | | | 1,113,750 | |

| | | | | | | | | | |

| | | |

Consumer Non-Cyclical – 0.1% | | | | | | | | | | |

Par Pharmaceutical Companies, Inc. (Par Pharmaceutical, Inc.)

4.00%, 9/30/19(i) | | | | | 545 | | | | 544,226 | |

Pharmedium Healthcare Corp.

7.75%, 1/28/22(i) | | | | | 1,902 | | | | 1,901,604 | |

| | | | | | | | | | |

| | | | | | | | | 2,445,830 | |

| | | | | | | | | | |

Energy – 0.1% | | | | | | | | | | |

Atlas 2014 1 Ltd.

6.875%, 1/15/21 | | | | | 1,896 | | | | 1,900,540 | |

| | | | | | | | | | |

| | | |

Other Industrial – 0.1% | | | | | | | | | | |

Accudyne Industries Borrower S.C.A./Accudyne Industries LLC (fka Silver II US Holdings LLC)

4.00%, 12/13/19(i) | | | | | 1,144 | | | | 1,102,452 | |

Unifrax Holding Co.

4.50%, 11/28/18(i) | | EUR | | | 751 | | | | 838,226 | |

| | | | | | | | | | |

| | | | | | | | | 1,940,678 | |

| | | | | | | | | | |

Technology – 0.0% | | | | | | | | | | |

Avaya, Inc.

4.69%, 10/26/17(i) | | U.S.$ | | | 154 | | | | 152,876 | |

| | | | | | | | | | |

| | | |

Total Bank Loans

(cost $10,983,970) | | | | | | | | | 10,560,078 | |

| | | | | | | | | | |

| | |

| 26 | | • ALLIANCEBERNSTEIN INCOME FUND |

Portfolio of Investments

| | | | | | | | | | |

| | | |

| Company | | | | Shares | | | U.S. $ Value | |

| |

| | | | | | | | | | |

PREFERRED STOCKS – 0.5% | | | | | | | | | | |

Financial Institutions – 0.3% | | | | | | | | | | |

Banking – 0.2% | | | | | | | | | | |

US Bancorp/MN

Series F

6.50% | | | | | 180,000 | | | $ | 5,079,600 | |

| | | | | | | | | | |

| | | |

REITS – 0.1% | | | | | | | | | | |

National Retail Properties, Inc.

Series E

5.70% | | | | | 26,000 | | | | 629,720 | |

Public Storage

Series W

5.20% | | | | | 28,475 | | | | 663,183 | |

Public Storage

Series X

5.20% | | | | | 2,000 | | | | 46,840 | |

| | | | | | | | | | |

| | | | | | | | | 1,339,743 | |

| | | | | | | | | | |

| | | | | | | | | 6,419,343 | |

| | | | | | | | | | |

Industrial – 0.2% | | | | | | | | | | |

Ventas Realty LP/Ventas Capital Corp.

5.45% | | | | | 139,500 | | | | 3,363,345 | |

| | | | | | | | | | |

| | | |

Total Preferred Stocks

(cost $9,127,365) | | | | | | | | | 9,782,688 | |

| | | | | | | | | | |

| | | |

| | | | | Principal

Amount

(000) | | | | |

GOVERNMENTS – SOVEREIGN AGENCIES – 0.3% | | | | | | | | | | |

Governments - Sovereign Agencies – 0.3% | | | | | | | | | | |

OCP SA

5.625%, 4/25/24(c) | | U.S.$ | | | 1,148 | | | | 1,196,928 | |

Petrobras Global Finance BV

5.375%, 1/27/21 | | | | | 5,000 | | | | 4,809,000 | |

| | | | | | | | | | |

| | | |

Total Governments – Sovereign Agencies

(cost $6,284,155) | | | | | | | | | 6,005,928 | |

| | | | | | | | | | |

| | | |

| | | | | Shares | | | | |

INVESTMENT COMPANIES – 0.2% | | | | | | | | | | |

Funds and Investment Trusts – 0.2% | | | | | | | | | | |

OCL Opportunities Fund I(f)(l) | | | | | 16,259 | | | | 1,801,571 | |

OCL Opportunities Fund II(f)(l) | | | | | 6,916 | | | | 903,242 | |

| | | | | | | | | | |

| | | |

Total Investment Companies

(cost $2,981,056) | | | | | | | | | 2,704,813 | |

| | | | | | | | | | |

| | | | |

| ALLIANCEBERNSTEIN INCOME FUND • | | | 27 | |

Portfolio of Investments

| | | | | | | | | | |

| | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

| | | | | | | | | | |

ASSET-BACKED SECURITIES – 0.1% | | | | | | | | | | |

Autos - Fixed Rate – 0.1% | | | | | | | | | | |

Hertz Vehicle Financing LLC

Series 2013-1A, Class B2

2.48%, 8/25/19(c)

(cost $2,124,499) | | U.S.$ | | | 2,169 | | | $ | 2,124,804 | |

| | | | | | | | | | |

| | | | | | | | | | |

GOVERNMENTS – SOVEREIGN BONDS – 0.1% | | | | | | | | | | |

Indonesia – 0.1% | | | | | | | | | | |

Indonesia Government International Bond

8.50%, 10/12/35(c)

(cost $907,894) | | | | | 801 | | | | 1,081,350 | |

| | | | | | | | | | |

| | | | | | | | | | |

MORTGAGE PASS-THROUGHS – 0.0% | | | | | | | | | | |

Agency Fixed Rate 30-Year – 0.0% | | | | | | | | | | |

Federal National Mortgage Association

Series 1999

7.50%, 11/01/29 | | | | | 27 | | | | 32,431 | |

Series 1998

8.00%, 6/01/28 | | | | | 20 | | | | 23,578 | |

| | | | | | | | | | |

| | | |

Total Mortgage Pass-Throughs

(cost $47,926) | | | | | | | | | 56,009 | |

| | | | | | | | | | |

| | | |

| | | | | Shares | | | | |

SHORT-TERM INVESTMENTS – 2.7% | | | | | | | | | | |

Investment Companies – 2.5% | | | | | | | | | | |

AB Fixed Income Shares, Inc. – Government STIF Portfolio, 0.10%(p)(q)

(cost $43,936,524) | | | | | 43,936,524 | | | | 43,936,524 | |

| | | | | | | | | | |

| | | |

| | | | | Principal

Amount

(000) | | | | |

GOVERNMENTS – TREASURIES – 0.2% | | | | | | | | | | |

Uruguay – 0.2% | | | | | | | | | | |

Uruguay Treasury Bills

Series 0001

Zero Coupon, 8/20/15

(cost $4,116,646) | | UYU | | | 111,491 | | | | 4,052,900 | |

| | | | | | | | | | |

| | | |

Total Short-Term Investments

(cost $48,053,170) | | | | | | | | | 47,989,424 | |

| | | | | | | | | | |

| | | |

Total Investments – 147.9%

(cost $2,618,763,431) | | | | | | | | | 2,656,601,810 | |

Other assets less liabilities – (47.9)% | | | | | | | | | (859,912,321 | ) |

| | | | | | | | | | |

| | | |

Net Assets – 100.0% | | | | | | | | $ | 1,796,689,489 | |

| | | | | | | | | | |

| | |

| 28 | | • ALLIANCEBERNSTEIN INCOME FUND |

Portfolio of Investments

FUTURES (see Note C)

| | | | | | | | | | | | | | | | | | | | |

| Type | | Number of Contracts | | | Expiration Month | | | Original Value | | | Value at June 30, 2015 | | | Unrealized Appreciation/ (Depreciation) | |

Sold Contracts | | | | | | | | | | | | | | | | | | | | |

Euro-BOBL Futures | | | 212 | | | | September 2015 | | | $ | 30,630,019 | | | $ | 30,625,988 | | | $ | 4,031 | |

U.S. Long Bond (CBT) Futures | | | 2,316 | | | | September 2015 | | | | 350,103,403 | | | | 349,354,125 | | | | 749,278 | |

U.S. T-Note 5 Yr (CBT) Futures | | | 103 | | | | September 2015 | | | | 12,290,640 | | | | 12,283,555 | | | | 7,085 | |

U.S. T-Note 10 Yr (CBT) Futures | | | 3,234 | | | | September 2015 | | | | 409,298,209 | | | | 408,039,844 | | | | 1,258,365 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | $ | 2,018,759 | |

| | | | | | | | | | | | | | | | | | | | |

FORWARD CURRENCY EXCHANGE CONTRACTS (see Note C)

| | | | | | | | | | | | | | | | |

| Counterparty | | Contracts to

Deliver

(000) | | | In Exchange

For

(000) | | | Settlement Date | | | Unrealized

Appreciation/

(Depreciation) | |

Barclays Bank PLC | | USD | 11,259 | | | IDR | 150,368,723 | | | | 7/10/15 | | | $ | (9,502 | ) |

Barclays Bank PLC | | TWD | 280,634 | | | USD | 9,047 | | | | 8/14/15 | | | | (42,267 | ) |

BNP Paribas SA | | USD | 13,852 | | | GBP | 8,887 | | | | 7/10/15 | | | | 109,981 | |

BNP Paribas SA | | USD | 9,451 | | | SGD | 12,836 | | | | 7/24/15 | | | | 76,187 | |

BNP Paribas SA | | USD | 13,750 | | | TRY | 38,553 | | | | 7/27/15 | | | | 527,509 | |

Credit Suisse International | | BRL | 147,297 | | | USD | 47,475 | | | | 7/02/15 | | | | 99,254 | |

Credit Suisse International | | TRY | 43,594 | | | USD | 15,698 | | | | 7/02/15 | | | | (562,985 | ) |

Credit Suisse International | | USD | 47,515 | | | BRL | 147,297 | | | | 7/02/15 | | | | (139,072 | ) |

Credit Suisse International | | USD | 13,884 | | | GBP | 8,887 | | | | 7/10/15 | | | | 78,040 | |

Credit Suisse International | | MXN | 282,801 | | | USD | 18,383 | | | | 7/16/15 | | | | 408,297 | |

Credit Suisse International | | BRL | 147,297 | | | USD | 46,985 | | | | 8/04/15 | | | | 154,185 | |

Deutsche Bank AG | | TRY | 38,553 | | | USD | 13,750 | | | | 7/27/15 | | | | (527,483 | ) |

Deutsche Bank AG | | USD | 17,031 | | | TRY | 45,140 | | | | 7/27/15 | | | | (313,906 | ) |

Goldman Sachs Bank USA | | BRL | 13,169 | | | USD | 4,299 | | | | 7/02/15 | | | | 63,887 | |

Goldman Sachs Bank USA | | USD | 4,244 | | | BRL | 13,169 | | | | 7/02/15 | | | | (8,873 | ) |

Goldman Sachs Bank USA | | NOK | 7,213 | | | USD | 911 | | | | 7/29/15 | | | | (8,083 | ) |

Goldman Sachs Bank USA | | TRY | 44,126 | | | USD | 16,325 | | | | 8/06/15 | | | | 29,951 | |

HSBC Bank USA | | BRL | 71,388 | | | USD | 23,161 | | | | 7/02/15 | | | | 198,947 | |

HSBC Bank USA | | USD | 8,535 | | | BRL | 27,189 | | | | 7/02/15 | | | | 210,219 | |

HSBC Bank USA | | USD | 14,246 | | | BRL | 44,200 | | | | 7/02/15 | | | | (29,783 | ) |

HSBC Bank USA | | USD | 13,714 | | | MXN | 210,583 | | | | 7/16/15 | | | | (329,505 | ) |

HSBC Bank USA | | USD | 8,268 | | | BRL | 26,261 | | | | 8/04/15 | | | | 81,421 | |

HSBC Bank USA | | NZD | 25,905 | | | USD | 17,708 | | | | 8/14/15 | | | | 218,943 | |

Royal Bank of Scotland PLC | | TRY | 25,918 | | | USD | 9,400 | | | | 7/02/15 | | | | (267,743 | ) |

Royal Bank of Scotland PLC | | USD | 9,692 | | | TRY | 25,387 | | | | 7/02/15 | | | | (222,462 | ) |

Royal Bank of Scotland PLC | | KRW | 40,401,707 | | | USD | 36,069 | | | | 8/07/15 | | | | 23,385 | |

Royal Bank of Scotland PLC | | USD | 59 | | | TWD | 1,830 | | | | 8/14/15 | | | | 279 | |

Societe Generale | | EUR | 5,885 | | | USD | 6,616 | | | | 7/30/15 | | | | 52,696 | |

Standard Chartered Bank | | CAD | 33,648 | | | USD | 27,283 | | | | 7/23/15 | | | | 350,628 | |

Standard Chartered Bank | | AUD | 35,948 | | | USD | 27,472 | | | | 8/07/15 | | | | (209,796 | ) |

State Street Bank & Trust Co. | | GBP | 19,547 | | | USD | 29,959 | | | | 7/10/15 | | | | (751,714 | ) |

State Street Bank & Trust Co. | | SGD | 12,853 | | | USD | 9,527 | | | | 7/24/15 | | | | (13,350 | ) |

UBS AG | | BRL | 117,118 | | | USD | 36,768 | | | | 7/02/15 | | | | (901,723 | ) |

UBS AG | | USD | 37,748 | | | BRL | 117,118 | | | | 7/02/15 | | | | (78,918 | ) |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | $ | (1,733,356 | ) |

| | | | | | | | | | | | | | | | |

| | | | |

| ALLIANCEBERNSTEIN INCOME FUND • | | | 29 | |

Portfolio of Investments

CURRENCY OPTIONS WRITTEN (see Note C)

| | | | | | | | | | | | | | | | | | | | |

| Description | | Exercise

Price | | | Expiration

Date | | | Contracts

(000) | | | Premiums

Received | | | U.S. $ Value | |

Put – USD vs. TRY | | TRY | 3.01 | | | | 7/24/15 | | | TRY | 82,775 | | | $ | 443,575 | | | $ | (10,316 | ) |

CENTRALLY CLEARED CREDIT DEFAULT SWAPS (see Note C)

| | | | | | | | | | | | | | | | | | | | |

Clearing Broker/ (Exchange) & Referenced Obligation | | Fixed

Rate

(Pay)

Receive | | | Implied

Credit

Spread at

June 30,

2015 | | | Notional

Amount

(000) | | | Market

Value | | | Unrealized

Appreciation/

(Depreciation) | |

Sale Contracts | | | | | | | | | | | | | | | | | | | | |

Morgan Stanley & Co., LLC/(INTRCONX): | | | | | | | | | | | | | | | | | | | | |

CDX-NAHY Series 21,

5 Year Index, 12/20/18* | | | 5.00 | % | | | 2.53 | % | | $ | 12,323 | | | $ | 994,581 | | | $ | 304,250 | |

CDX-NAHY Series 24,

5 Year Index, 6/20/20* | | | 5.00 | | | | 3.53 | | | | 708 | | | | 44,922 | | | | (6,469 | ) |

CDX-NAHY Series 24,

5 Year Index, 6/20/20* | | | 5.00 | | | | 3.53 | | | | 709 | | | | 44,985 | | | | (4,545 | ) |

CDX-NAHY Series 24,

5 Year Index, 6/20/20* | | | 5.00 | | | | 3.53 | | | | 4,605 | | | | 292,278 | | | | (17,077 | ) |

CDX-NAHY Series 24,

5 Year Index, 6/20/20* | | | 5.00 | | | | 3.53 | | | | 1,632 | | | | 103,541 | | | | (8,382 | ) |

CDX-NAHY Series 24,

5 Year Index, 6/20/20* | | | 5.00 | | | | 3.53 | | | | 1,142 | | | | 72,504 | | | | (1,321 | ) |

CDX-NAHY Series 24,

5 Year Index, 6/20/20* | | | 5.00 | | | | 3.53 | | | | 1,040 | | | | 66,033 | | | | (709 | ) |

CDX-NAHY Series 24,

5 Year Index, 6/20/20* | | | 5.00 | | | | 3.53 | | | | 708 | | | | 44,922 | | | | (482 | ) |

CDX-NAHY Series 24,

5 Year Index, 6/20/20* | | | 5.00 | | | | 3.53 | | | | 708 | | | | 44,922 | | | | (958 | ) |

CDX-NAHY Series 24,

5 Year Index, 6/20/20* | | | 5.00 | | | | 3.53 | | | | 708 | | | | 44,922 | | | | (2,508 | ) |

CDX-NAHY Series 24,

5 Year Index, 6/20/20* | | | 5.00 | | | | 3.53 | | | | 708 | | | | 44,922 | | | | (3,164 | ) |

CDX-NAHY Series 24,

5 Year Index, 6/20/20* | | | 5.00 | | | | 3.53 | | | | 1,005 | | | | 63,771 | | | | (6,923 | ) |

CDX-NAHY Series 24,

5 Year Index, 6/20/20* | | | 5.00 | | | | 3.53 | | | | 709 | | | | 44,985 | | | | (4,447 | ) |

CDX-NAHY Series 24,

5 Year Index, 6/20/20* | | | 5.00 | | | | 3.53 | | | | 708 | | | | 44,922 | | | | (8,101 | ) |

CDX-NAHY Series 24,

5 Year Index, 6/20/20* | | | 5.00 | | | | 3.53 | | | | 708 | | | | 44,922 | | | | (7,335 | ) |

CDX-NAHY Series 24,

5 Year Index, 6/20/20* | | | 5.00 | | | | 3.53 | | | | 495 | | | | 31,415 | | | | (4,656 | ) |

CDX-NAHY Series 24,

5 Year Index, 6/20/20* | | | 5.00 | | | | 3.53 | | | | 708 | | | | 44,922 | | | | (6,861 | ) |

CDX-NAHY Series 24,

5 Year Index, 6/20/20* | | | 5.00 | | | | 3.53 | | | | 708 | | | | 44,922 | | | | (8,136 | ) |

CDX-NAHY Series 24,

5 Year Index, 6/20/20* | | | 5.00 | | | | 3.53 | | | | 2,683 | | | | 170,265 | | | | (2,475 | ) |

CDX-NAHY Series 24,