Investor Presentation Curt R. Hartman Chair of the Board, President, and Chief Executive Officer Todd W. Garner Executive Vice President and Chief Financial Officer November 15, 2022 Exhibit 99.2

Forward-Looking Information This presentation contains forward-looking statements based on certain assumptions and contingencies that involve risks and uncertainties. The forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and relate to the Company's performance on a going-forward basis. The forward-looking statements in this presentation involve risks and uncertainties which could cause actual results, performance or trends, to differ materially from those expressed in the forward-looking statements herein or in previous disclosures. For example, in addition to general industry and economic conditions, factors that could cause actual results to differ materially from those discussed in the forward-looking statements in this presentation include, but are not limited to, the risks posed to the Company’s business, financial condition, and results of operations by the COVID-19 global pandemic and the various government responses to the pandemic, including deferral of surgeries, reductions in hospital and ambulatory surgery center operating volumes, disruption to potential supply chain reliability; any assumptions underlying any of the foregoing, as well as the risk factors discussed in the Company's Annual Report on Form 10-K for the full year ended December 31, 2021 and other risks and uncertainties which may be detailed from time to time in reports filed by CONMED with the SEC, including the risks associated with the timing and costs related to the software implementation as further described in the risk factors listed in the Current Report filed on Form 8-K on November 15, 2022. Management has disclosed adjusted financial measurements in this presentation that present financial information that is not in accordance with generally accepted accounting principles in the United States (GAAP). The Company analyzes net sales on a constant currency basis to better measure the comparability of results between periods. To measure earnings performance on a consistent and comparable basis, the Company excludes certain items that affect the comparability of operating results and the trend of earnings. These adjustments are irregular in timing, may not be indicative of past and future performance and are therefore excluded to allow investors to better understand underlying operating trends. These measurements are not a substitute for GAAP measurements. Investors should consider adjusted measures in addition to, and not as a substitute for, or superior to, financial performance measures prepared in accordance with GAAP.

CONMED Vision Empower healthcare providers worldwide to deliver exceptional outcomes for patients. Focus behind the Vision People, Products, Profitability

Objectives for Our Shareholders Aggregate growth and profitability over the long term to significantly increase the valuation of the company Increase our market share in large and attractive markets Deliver above-market revenue and profitability growth over the long term

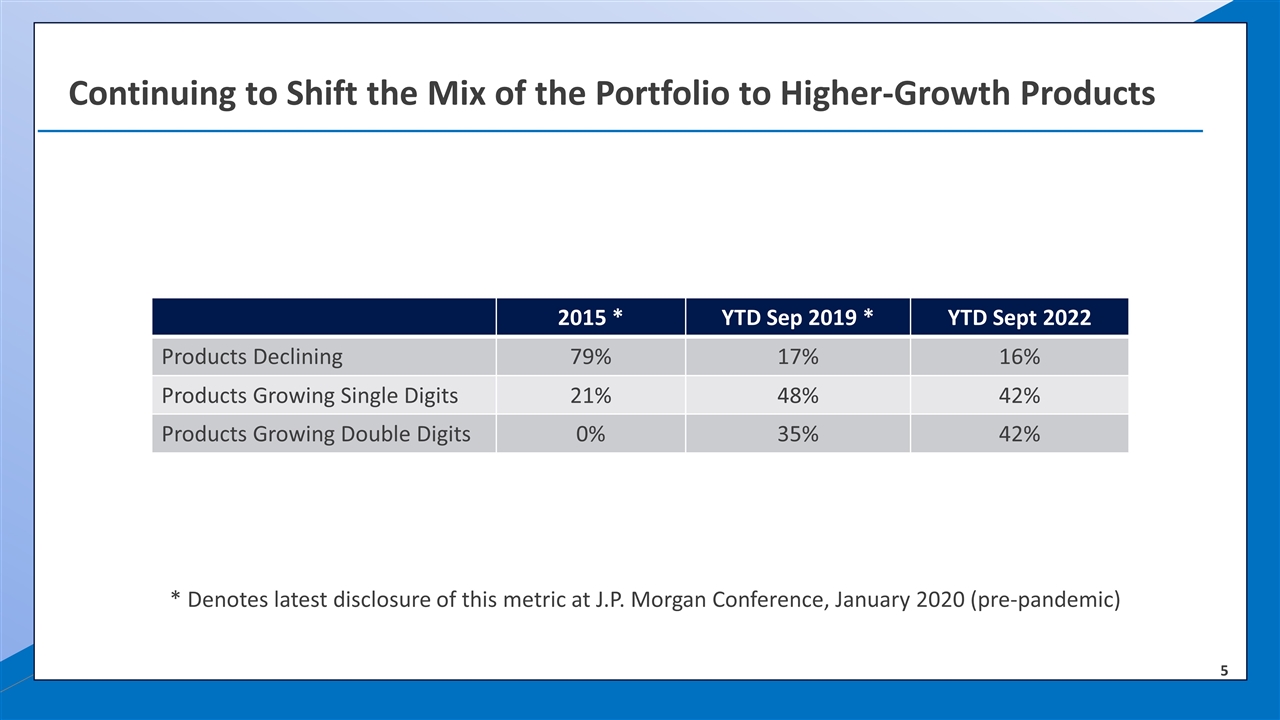

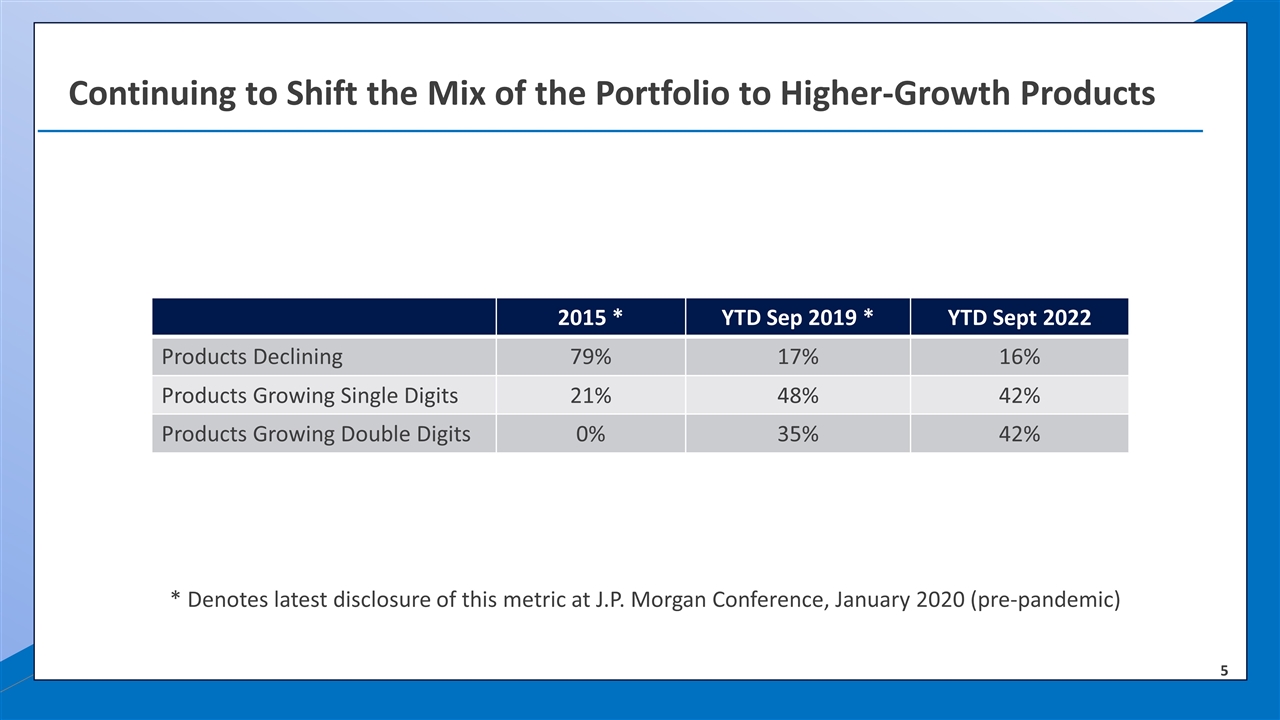

Higher-Growth Products Continuing to Shift the Mix of the Portfolio to Higher-Growth Products 2015 * YTD Sep 2019 * YTD Sept 2022 Products Declining 79% 17% 16% Products Growing Single Digits 21% 48% 42% Products Growing Double Digits 0% 35% 42% * Denotes latest disclosure of this metric at J.P. Morgan Conference, January 2020 (pre-pandemic)

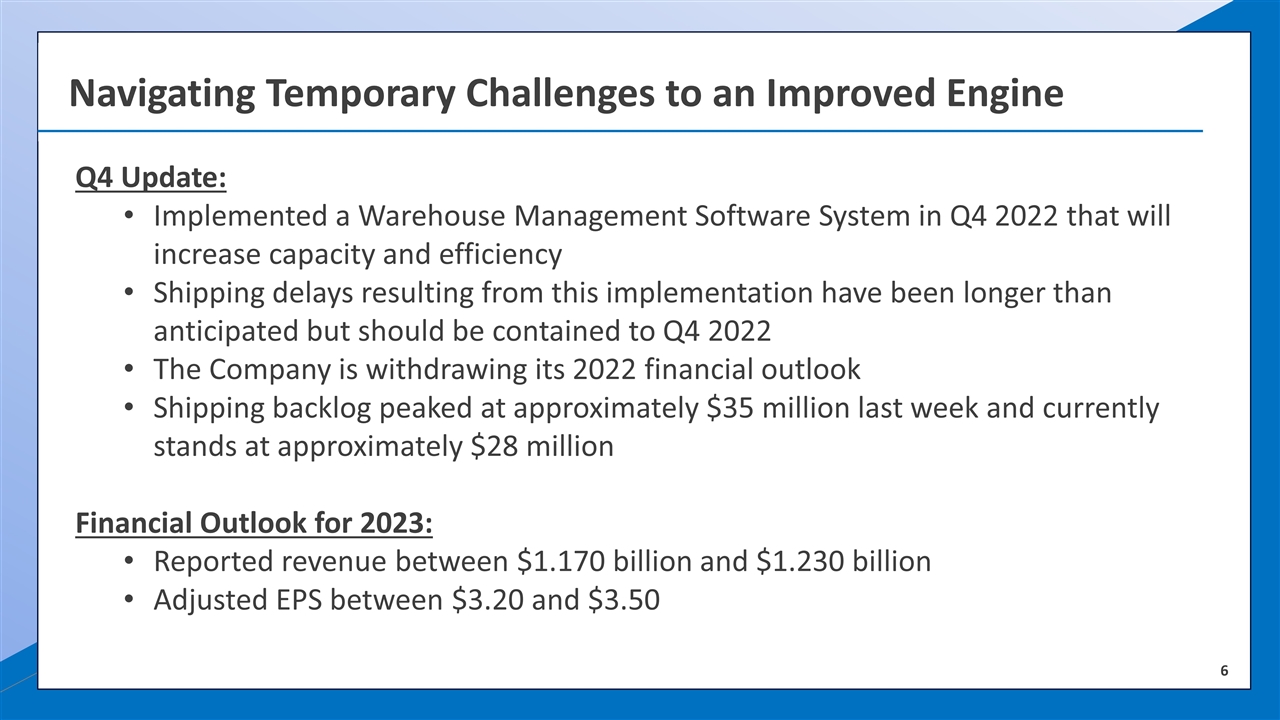

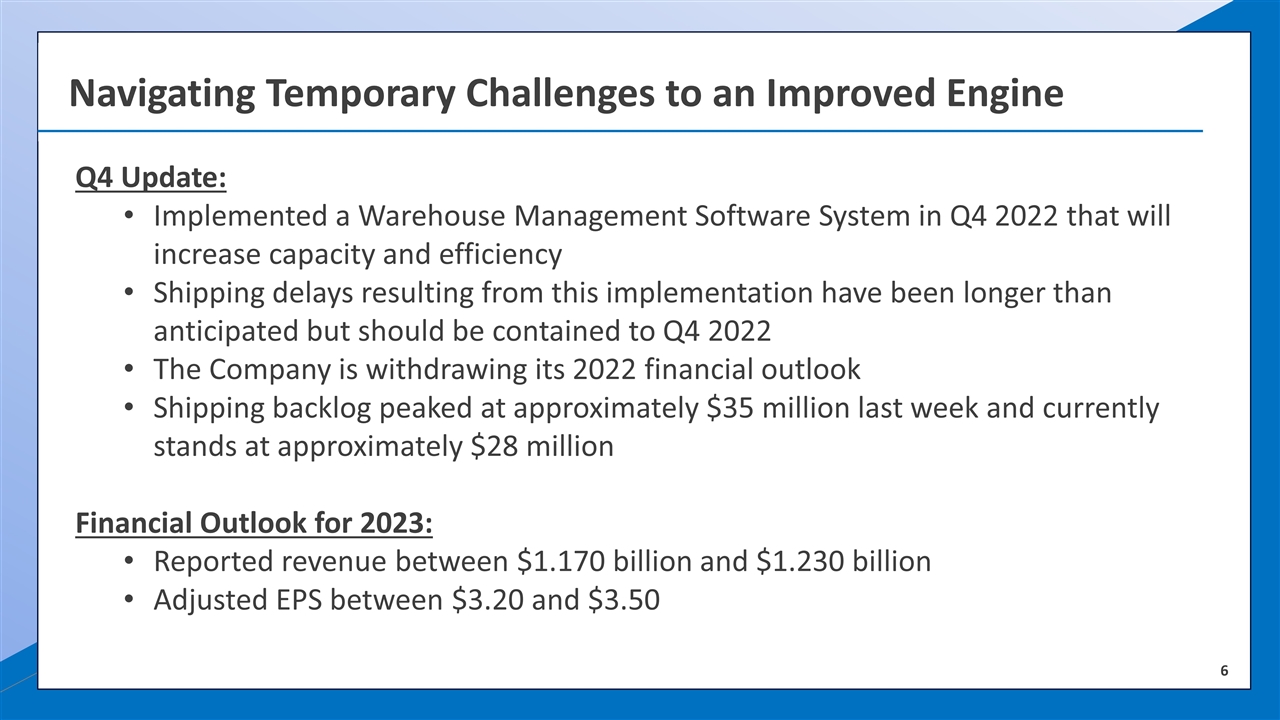

Navigating Temporary Challenges to an Improved Engine Q4 Update: Implemented a Warehouse Management Software System in Q4 2022 that will increase capacity and efficiency Shipping delays resulting from this implementation have been longer than anticipated but should be contained to Q4 2022 The Company is withdrawing its 2022 financial outlook Shipping backlog peaked at approximately $35 million last week and currently stands at approximately $28 million Financial Outlook for 2023: Reported revenue between $1.170 billion and $1.230 billion Adjusted EPS between $3.20 and $3.50

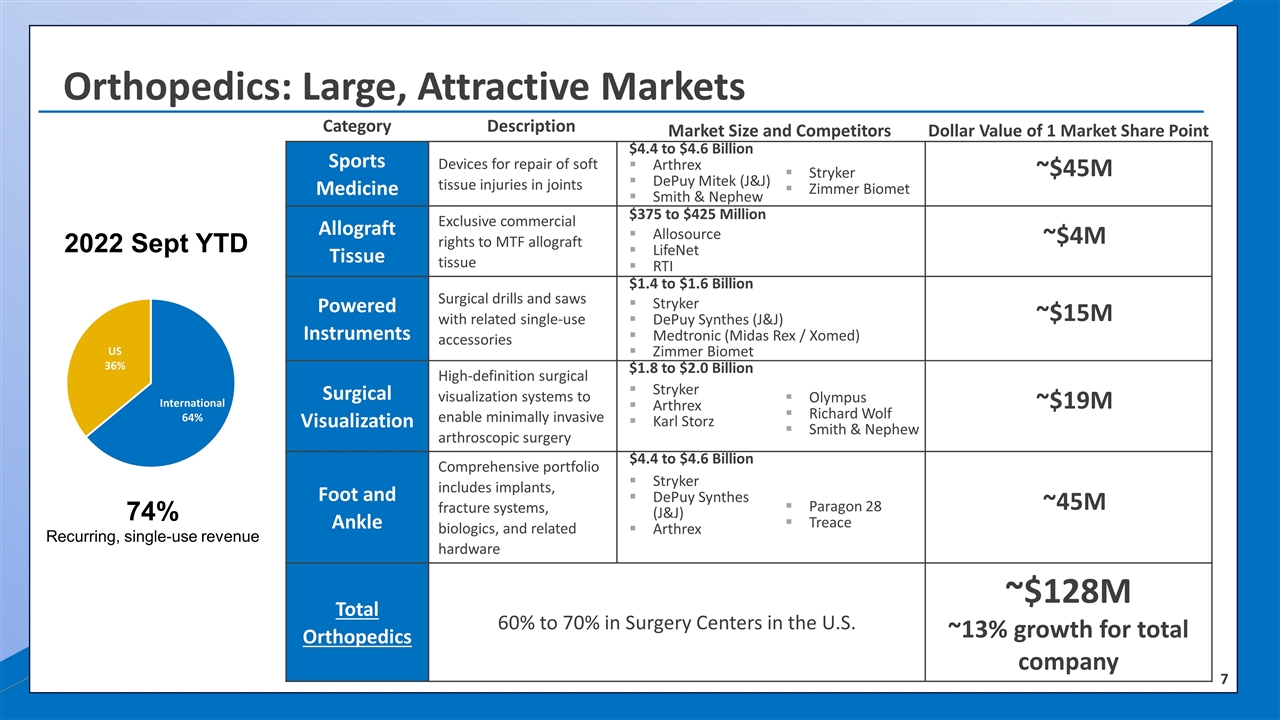

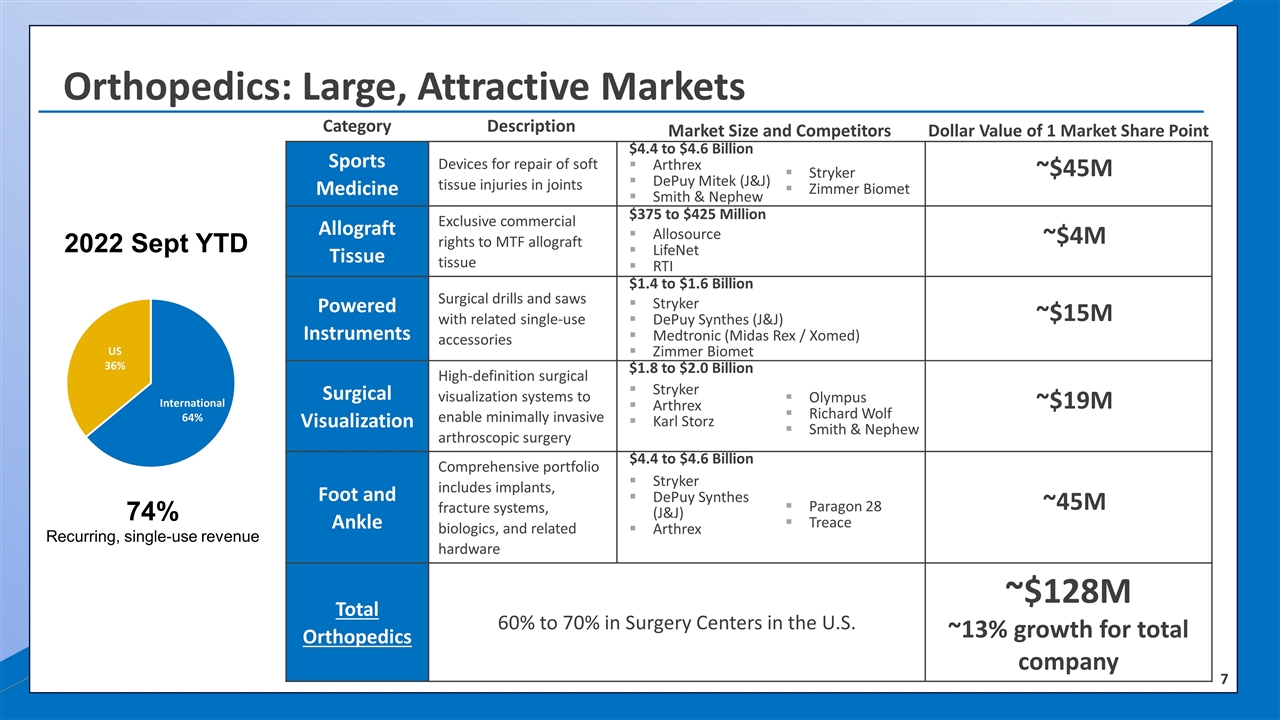

Orthopedics: Large, Attractive Markets Category Description Market Size and Competitors Dollar Value of 1 Market Share Point Sports Medicine Devices for repair of soft tissue injuries in joints $4.4 to $4.6 Billion ~$45M Arthrex DePuy Mitek (J&J) Smith & Nephew Stryker Zimmer Biomet Allograft Tissue Exclusive commercial rights to MTF allograft tissue $375 to $425 Million Allosource LifeNet RTI ~$4M Powered Instruments Surgical drills and saws with related single-use accessories $1.4 to $1.6 Billion Stryker DePuy Synthes (J&J) Medtronic (Midas Rex / Xomed) Zimmer Biomet ~$15M Surgical Visualization High-definition surgical visualization systems to enable minimally invasive arthroscopic surgery $1.8 to $2.0 Billion ~$19M Stryker Arthrex Karl Storz Olympus Richard Wolf Smith & Nephew Foot and Ankle Comprehensive portfolio includes implants, fracture systems, biologics, and related hardware $4.4 to $4.6 Billion ~45M Stryker DePuy Synthes (J&J) Arthrex Paragon 28 Treace Total Orthopedics 60% to 70% in Surgery Centers in the U.S. ~$128M ~13% growth for total company 2022 Sept YTD 74% Recurring, single-use revenue

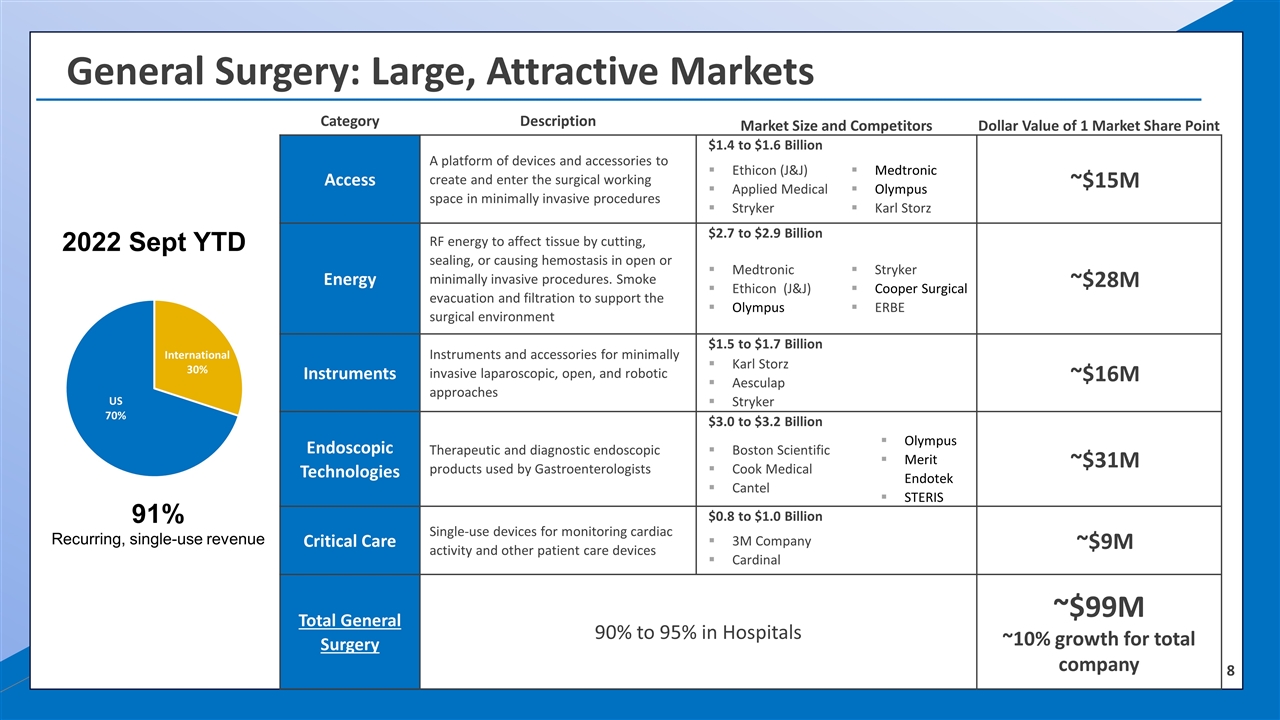

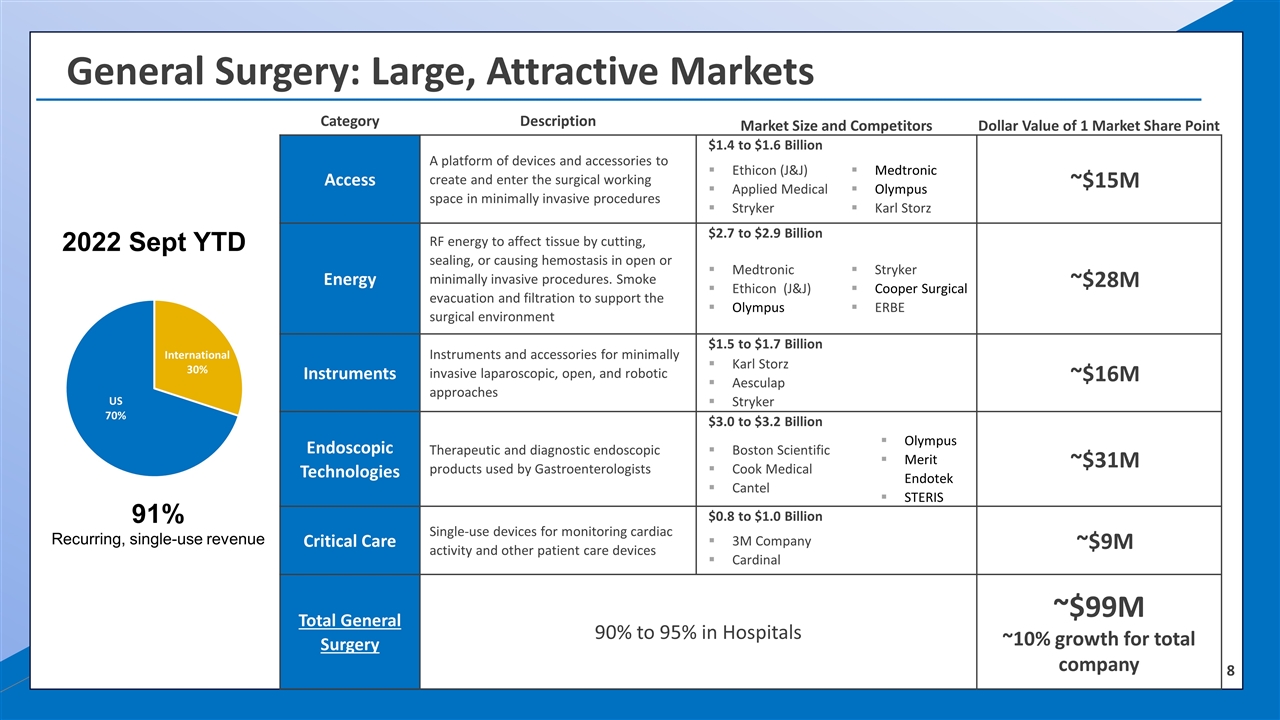

General Surgery: Large, Attractive Markets Category Description Market Size and Competitors Dollar Value of 1 Market Share Point Access A platform of devices and accessories to create and enter the surgical working space in minimally invasive procedures $1.4 to $1.6 Billion ~$15M Ethicon (J&J) Applied Medical Stryker Medtronic Olympus Karl Storz Medtronic Olympus Karl Storz Energy RF energy to affect tissue by cutting, sealing, or causing hemostasis in open or minimally invasive procedures. Smoke evacuation and filtration to support the surgical environment $2.7 to $2.9 Billion ~$28M Medtronic Ethicon (J&J) Olympus Stryker Cooper Surgical ERBE Stryker Cooper Surgical Ethicon (J&J) Instruments Instruments and accessories for minimally invasive laparoscopic, open, and robotic approaches $1.5 to $1.7 Billion ~$16M Karl Storz Aesculap Stryker Endoscopic Technologies Therapeutic and diagnostic endoscopic products used by Gastroenterologists $3.0 to $3.2 Billion ~$31M Boston Scientific Cook Medical Cantel Olympus Merit Endotek STERIS Olympus Merit Endotek STERIS Critical Care Single-use devices for monitoring cardiac activity and other patient care devices $0.8 to $1.0 Billion ~$9M 3M Company Cardinal Total General Surgery 90% to 95% in Hospitals ~$99M ~10% growth for total company 2022 Sept YTD 91% Recurring, single-use revenue

Environmental, Social and Governance (ESG) Together We Are Making A Difference for a Better Tomorrow Environmental Chihuahua, Mexico plant has held the Clean Industry Certification since 2015 Utica, New York plant is ISO 14001 certified 100% LED lighting at Utica and Chihuahua plants Social Partners with United Way and TEAMFund to serve communities globally where we do business Over 90% of employees participated in the Gallup Q12 Employee Engagement Survey Women make up 51% of our global workforce Governance 33% gender diversity on Board of Directors Committee Chair rotation every five years 100% Independent Standing Board Committee Report posted on October 7, 2022. View the report now on: CONMED.com

Closing Thoughts Intense focus on solving unmet needs for healthcare customers drives increased market share Large and attractive markets provide CONMED with ample opportunities for above-average revenue and profitability growth Aggregating growth over the long term can drive meaningful shareholder value At CONMED, we are focused on doing things the right way and being good corporate citizens