Project Fusion Special Committee Discussion Materials 10 April 2017 CONFIDENTIAL F:\Alliance Healthcare Services\Presentation\SC Prez\Presentation\Selected Valuation Materials\Project Fusion - Draft Selected Valuation Materials v51.pptx Time Stamp Exhibit (c)(2)

The information herein has been prepared by Lazard based upon information supplied by Alliance HealthCare Services (“the Company”) or publicly available information and portions of the information herein may be based upon certain statements, estimates and forecasts provided by the Company with respect to the anticipated future performance of the Company. We have relied upon the accuracy and completeness of the foregoing information and have not assumed any responsibility for any independent verification of such information or any independent valuation or appraisal of any of the assets or liabilities of the Company or any other entity, or concerning solvency or fair value of the Company or any other entity. With respect to financial forecasts, we have assumed that they have been reasonably prepared in good faith on bases reflecting the best currently available estimates and judgments of management of the Company as to the future financial performance of the Company. We assume no responsibility for and express no view as to such forecasts or the assumptions on which they are based. The information set forth herein is based upon economic, monetary, market and other conditions as in effect on and the information made available to us as of, the date hereof, unless indicated otherwise. These materials and the information contained herein are confidential and may not be disclosed publicly or made available to third parties without the prior written consent of Lazard. Lazard is acting as investment banker to the Special Committee of the Board of Directors of the Company and will not be responsible for and will not provide any tax, accounting, actuarial, legal or other specialist advice. Disclaimer Project Fusion CONFIDENTIAL 1

Table of Contents Project Fusion CONFIDENTIAL ISITUATION OVERVIEW 2 IIFINANCIAL ANALYSIS 10 APPENDIX

Confidential ISituation Overview Project Fusion

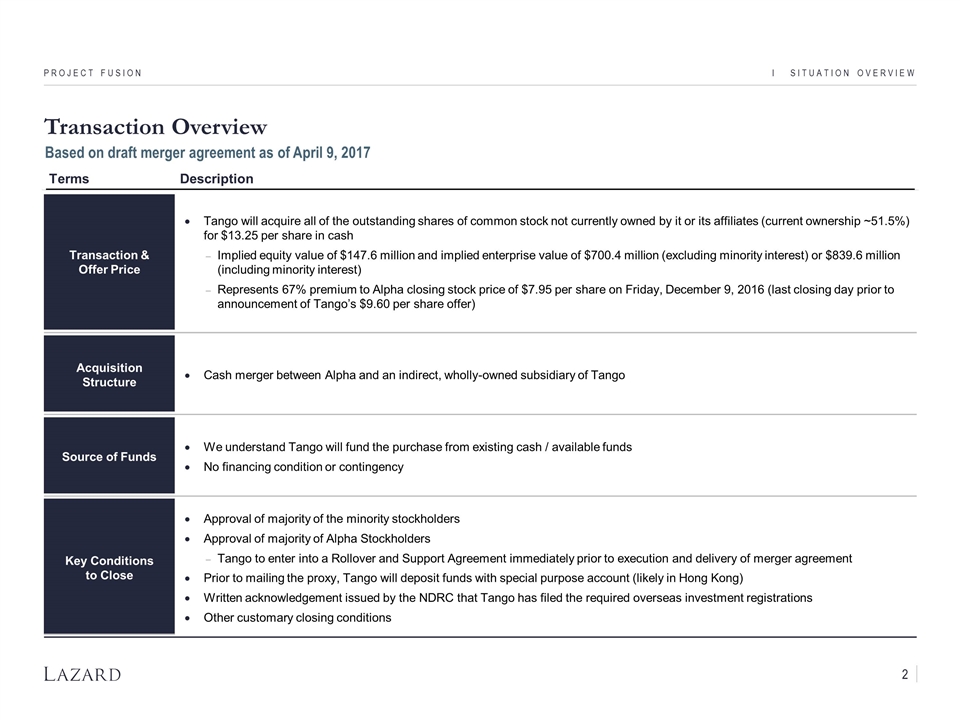

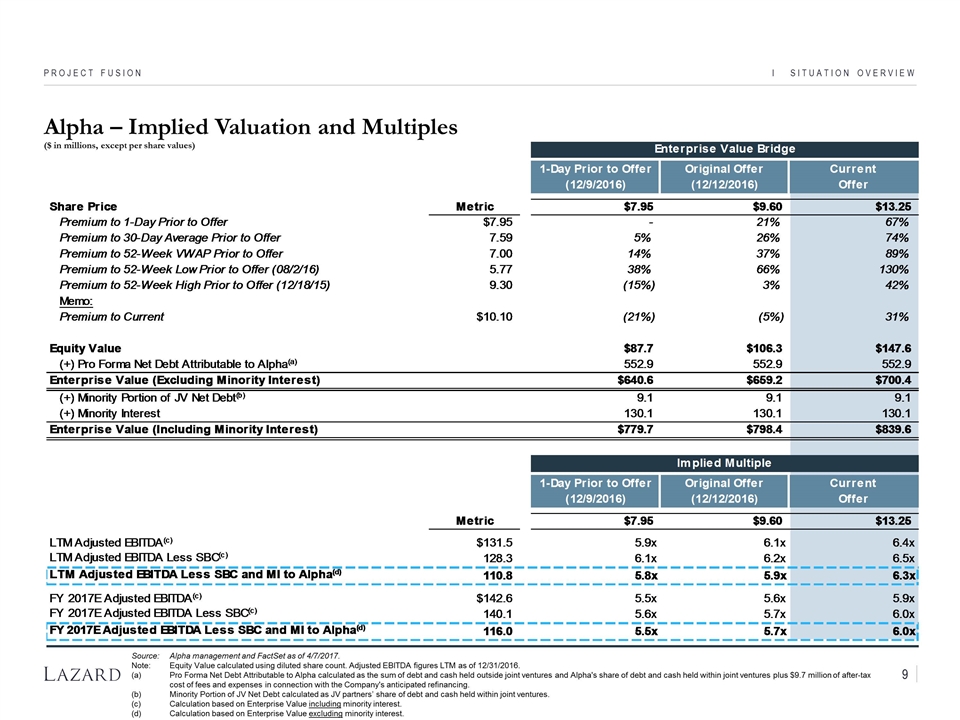

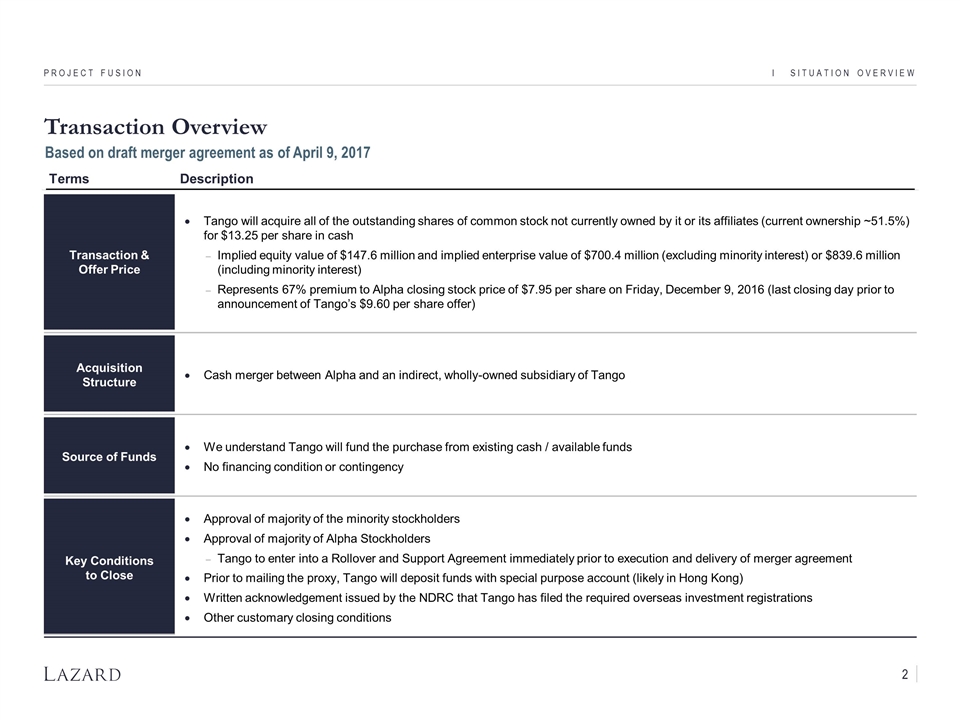

Transaction Overview I Situation Overview Project Fusion 2 Terms Description Transaction & Offer Price Tango will acquire all of the outstanding shares of common stock not currently owned by it or its affiliates (current ownership ~51.5%) for $13.25 per share in cash Implied equity value of $147.6 million and implied enterprise value of $700.4 million (excluding minority interest) or $839.6 million (including minority interest) Represents 67% premium to Alpha closing stock price of $7.95 per share on Friday, December 9, 2016 (last closing day prior to announcement of Tango’s $9.60 per share offer) Acquisition Structure Cash merger between Alpha and an indirect, wholly-owned subsidiary of Tango Source of Funds We understand Tango will fund the purchase from existing cash / available funds No financing condition or contingency Key Conditions to Close Approval of majority of the minority stockholders Approval of majority of Alpha Stockholders Tango to enter into a Rollover and Support Agreement immediately prior to execution and delivery of merger agreement Prior to mailing the proxy, Tango will deposit funds with special purpose account (likely in Hong Kong) Written acknowledgement issued by the NDRC that Tango has filed the required overseas investment registrations Other customary closing conditions Based on draft merger agreement as of April 9, 2017

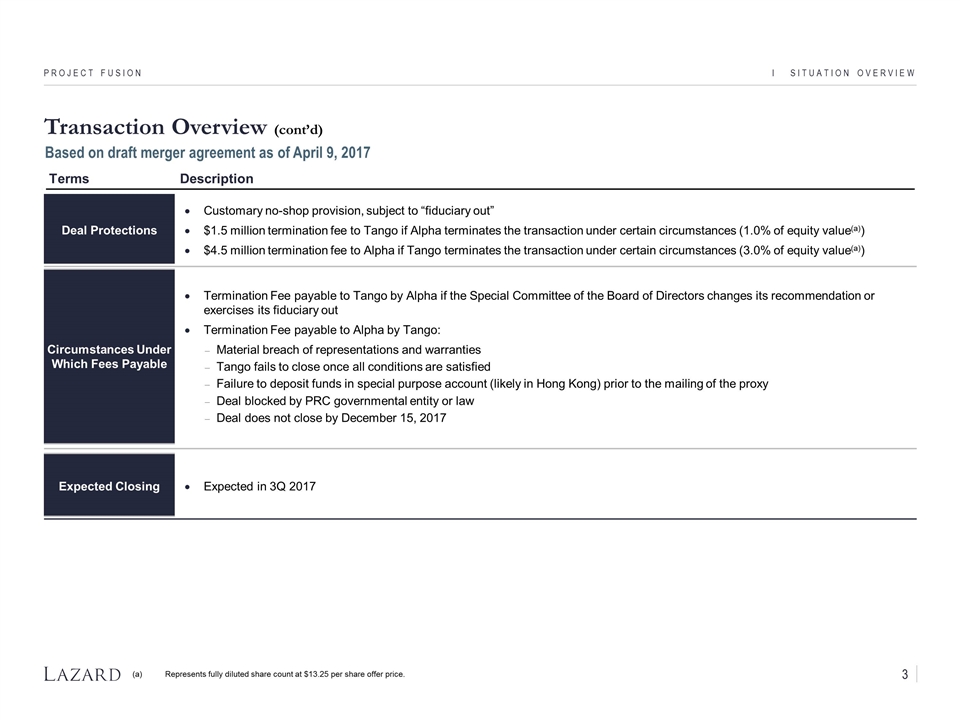

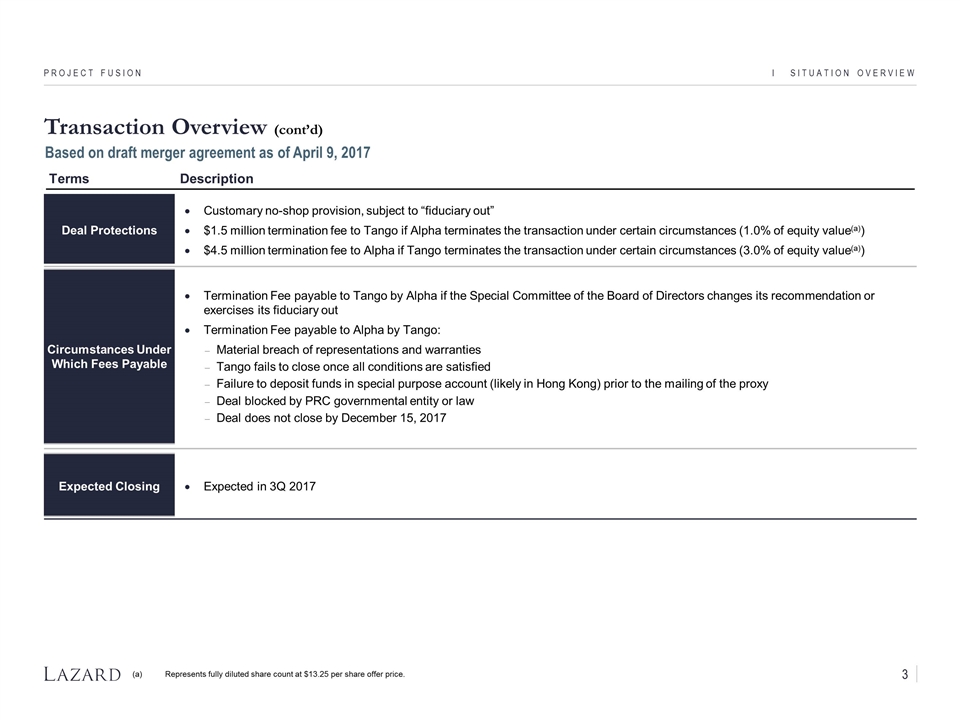

I Situation Overview Project Fusion Transaction Overview (cont’d) Terms Description Deal Protections Customary no-shop provision, subject to “fiduciary out” $1.5 million termination fee to Tango if Alpha terminates the transaction under certain circumstances (1.0% of equity value(a)) $4.5 million termination fee to Alpha if Tango terminates the transaction under certain circumstances (3.0% of equity value(a)) Circumstances Under Which Fees Payable Termination Fee payable to Tango by Alpha if the Special Committee of the Board of Directors changes its recommendation or exercises its fiduciary out Termination Fee payable to Alpha by Tango: Material breach of representations and warranties Tango fails to close once all conditions are satisfied Failure to deposit funds in special purpose account (likely in Hong Kong) prior to the mailing of the proxy Deal blocked by PRC governmental entity or law Deal does not close by December 15, 2017 Expected Closing Expected in 3Q 2017 3 Based on draft merger agreement as of April 9, 2017 (a)Represents fully diluted share count at $13.25 per share offer price.

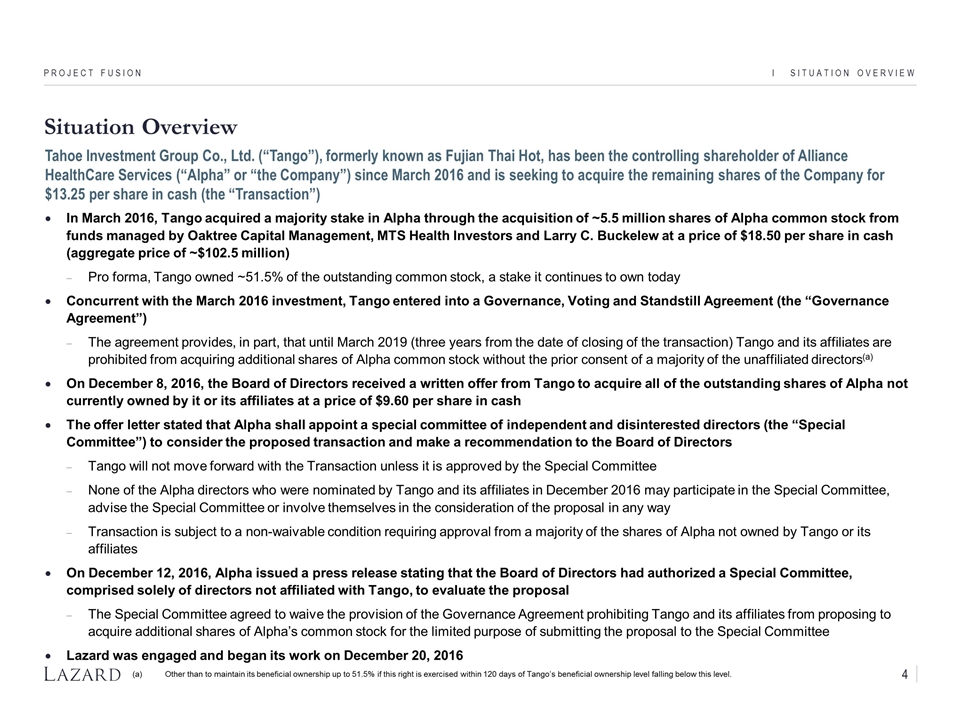

Situation Overview 4 Project Fusion I Situation Overview (a)Other than to maintain its beneficial ownership up to 51.5% if this right is exercised within 120 days of Tango’s beneficial ownership level falling below this level. Tahoe Investment Group Co., Ltd. (“Tango”), formerly known as Fujian Thai Hot, has been the controlling shareholder of Alliance HealthCare Services (“Alpha” or “the Company”) since March 2016 and is seeking to acquire the remaining shares of the Company for $13.25 per share in cash (the “Transaction”) In March 2016, Tango acquired a majority stake in Alpha through the acquisition of ~5.5 million shares of Alpha common stock from funds managed by Oaktree Capital Management, MTS Health Investors and Larry C. Buckelew at a price of $18.50 per share in cash (aggregate price of ~$102.5 million) Pro forma, Tango owned ~51.5% of the outstanding common stock, a stake it continues to own today Concurrent with the March 2016 investment, Tango entered into a Governance, Voting and Standstill Agreement (the “Governance Agreement”) The agreement provides, in part, that until March 2019 (three years from the date of closing of the transaction) Tango and its affiliates are prohibited from acquiring additional shares of Alpha common stock without the prior consent of a majority of the unaffiliated directors(a) On December 8, 2016, the Board of Directors received a written offer from Tango to acquire all of the outstanding shares of Alpha not currently owned by it or its affiliates at a price of $9.60 per share in cash The offer letter stated that Alpha shall appoint a special committee of independent and disinterested directors (the “Special Committee”) to consider the proposed transaction and make a recommendation to the Board of Directors Tango will not move forward with the Transaction unless it is approved by the Special Committee None of the Alpha directors who were nominated by Tango and its affiliates in December 2016 may participate in the Special Committee, advise the Special Committee or involve themselves in the consideration of the proposal in any way Transaction is subject to a non-waivable condition requiring approval from a majority of the shares of Alpha not owned by Tango or its affiliates On December 12, 2016, Alpha issued a press release stating that the Board of Directors had authorized a Special Committee, comprised solely of directors not affiliated with Tango, to evaluate the proposal The Special Committee agreed to waive the provision of the Governance Agreement prohibiting Tango and its affiliates from proposing to acquire additional shares of Alpha’s common stock for the limited purpose of submitting the proposal to the Special Committee Lazard was engaged and began its work on December 20, 2016

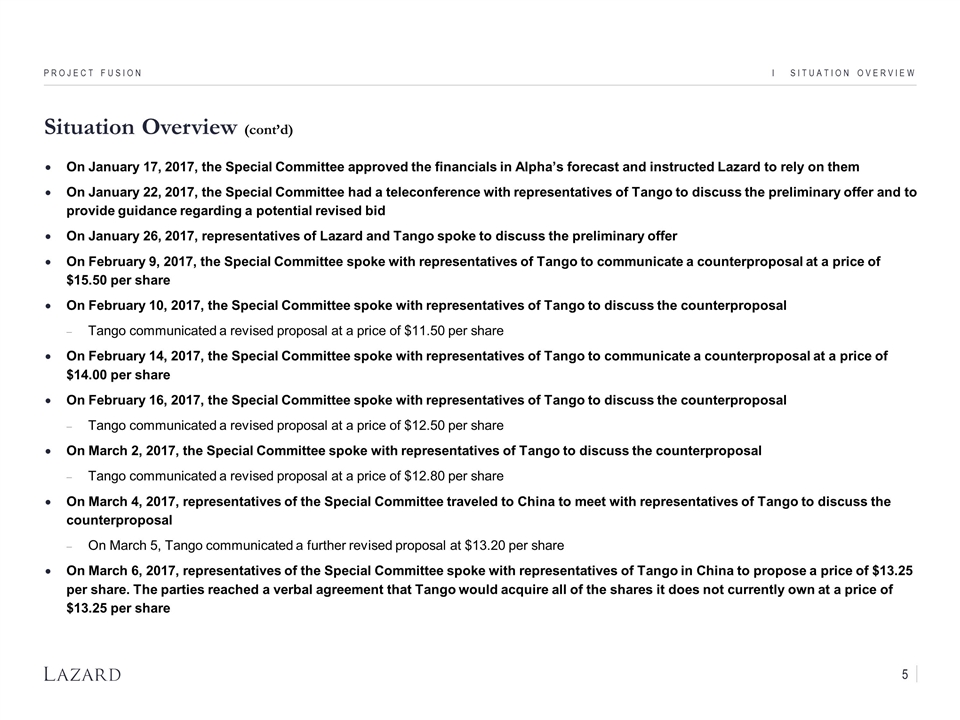

Situation Overview (cont’d) I Situation Overview Project Fusion 5 On January 17, 2017, the Special Committee approved the financials in Alpha’s forecast and instructed Lazard to rely on them On January 22, 2017, the Special Committee had a teleconference with representatives of Tango to discuss the preliminary offer and to provide guidance regarding a potential revised bid On January 26, 2017, representatives of Lazard and Tango spoke to discuss the preliminary offer On February 9, 2017, the Special Committee spoke with representatives of Tango to communicate a counterproposal at a price of $15.50 per share On February 10, 2017, the Special Committee spoke with representatives of Tango to discuss the counterproposal Tango communicated a revised proposal at a price of $11.50 per share On February 14, 2017, the Special Committee spoke with representatives of Tango to communicate a counterproposal at a price of $14.00 per share On February 16, 2017, the Special Committee spoke with representatives of Tango to discuss the counterproposal Tango communicated a revised proposal at a price of $12.50 per share On March 2, 2017, the Special Committee spoke with representatives of Tango to discuss the counterproposal Tango communicated a revised proposal at a price of $12.80 per share On March 4, 2017, representatives of the Special Committee traveled to China to meet with representatives of Tango to discuss the counterproposal On March 5, Tango communicated a further revised proposal at $13.20 per share On March 6, 2017, representatives of the Special Committee spoke with representatives of Tango in China to propose a price of $13.25 per share. The parties reached a verbal agreement that Tango would acquire all of the shares it does not currently own at a price of $13.25 per share

Situation Overview (cont’d) I Situation Overview Project Fusion 6 Lazard has been asked to render a written opinion to the Special Committee, as to the fairness, from a financial point of view, to the shareholders of Alpha (excluding Tango and its affiliates) (the “Unaffiliated Shareholders”) of the consideration to be paid to the Unaffiliated Shareholders by Tango in the proposed Transaction Lazard also understands that the Company is in discussions with lenders to refinance its existing debt The Company’s revolver ($21.5 million outstanding as of December 31, 2016) and term loan ($497.7 million outstanding as of December 31, 2016) mature in June 2018 and June 2019, respectively In connection with the potential refinancing, Alpha expects to incur significant financing fees and other upfront expenses. Per Alpha management, the refinancing is also projected to materially increase Alpha’s annual interest expense The anticipated refinancing has been reflected in the financial forecast provided by the Company

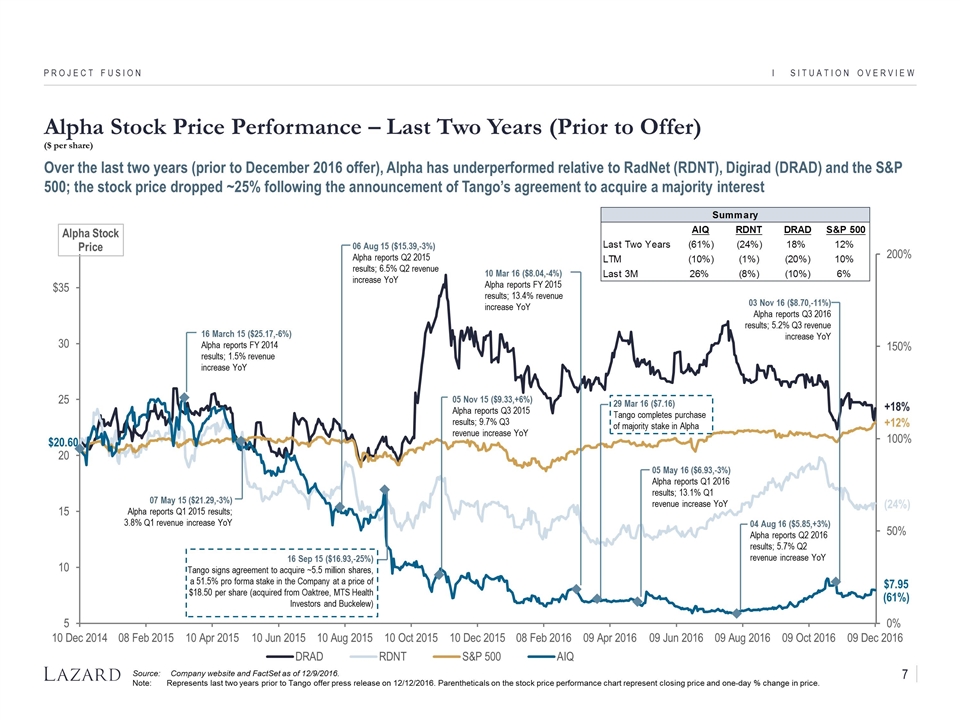

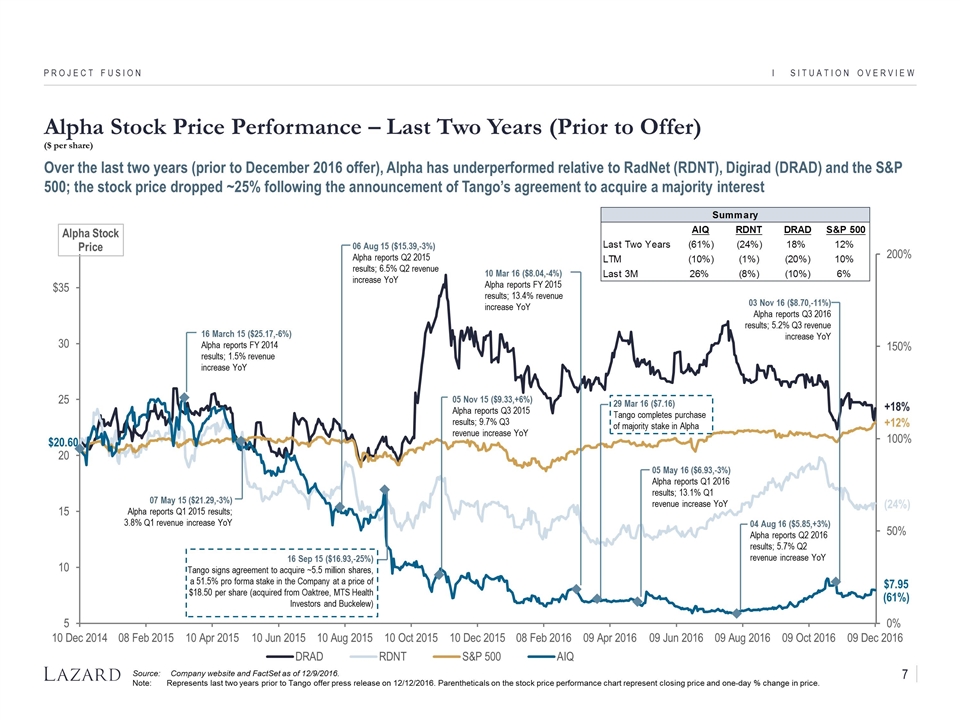

Alpha Stock Price Performance – Last Two Years (Prior to Offer) ($ per share) I Situation Overview 7 Project Fusion Over the last two years (prior to December 2016 offer), Alpha has underperformed relative to RadNet (RDNT), Digirad (DRAD) and the S&P 500; the stock price dropped ~25% following the announcement of Tango’s agreement to acquire a majority interest 29 Mar 16 ($7.16) Tango completes purchase of majority stake in Alpha +12% (24%) $7.95 (61%) 03 Nov 16 ($8.70,-11%) Alpha reports Q3 2016 results; 5.2% Q3 revenue increase YoY 04 Aug 16 ($5.85,+3%) Alpha reports Q2 2016 results; 5.7% Q2 revenue increase YoY 05 May 16 ($6.93,-3%) Alpha reports Q1 2016 results; 13.1% Q1 revenue increase YoY 10 Mar 16 ($8.04,-4%) Alpha reports FY 2015 results; 13.4% revenue increase YoY 05 Nov 15 ($9.33,+6%) Alpha reports Q3 2015 results; 9.7% Q3 revenue increase YoY 06 Aug 15 ($15.39,-3%) Alpha reports Q2 2015 results; 6.5% Q2 revenue increase YoY 07 May 15 ($21.29,-3%) Alpha reports Q1 2015 results; 3.8% Q1 revenue increase YoY 16 March 15 ($25.17,-6%) Alpha reports FY 2014 results; 1.5% revenue increase YoY 16 Sep 15 ($16.93,-25%) Tango signs agreement to acquire ~5.5 million shares, a 51.5% pro forma stake in the Company at a price of $18.50 per share (acquired from Oaktree, MTS Health Investors and Buckelew) $20.60 +18% Source:Company website and FactSet as of 12/9/2016. Note: Represents last two years prior to Tango offer press release on 12/12/2016. Parentheticals on the stock price performance chart represent closing price and one-day % change in price.

Alpha Stock Price Performance – Last Two Years (Prior to Offer) (cont’d) I Situation Overview Project Fusion 8 Source:Company website and FactSet as of 12/9/2016. Note: Represents last two years prior to Tango offer press release on 12/12/2016. S&P 500 +12% RDNT (24%) AIQ $7.95 (61%) DRAD +18%

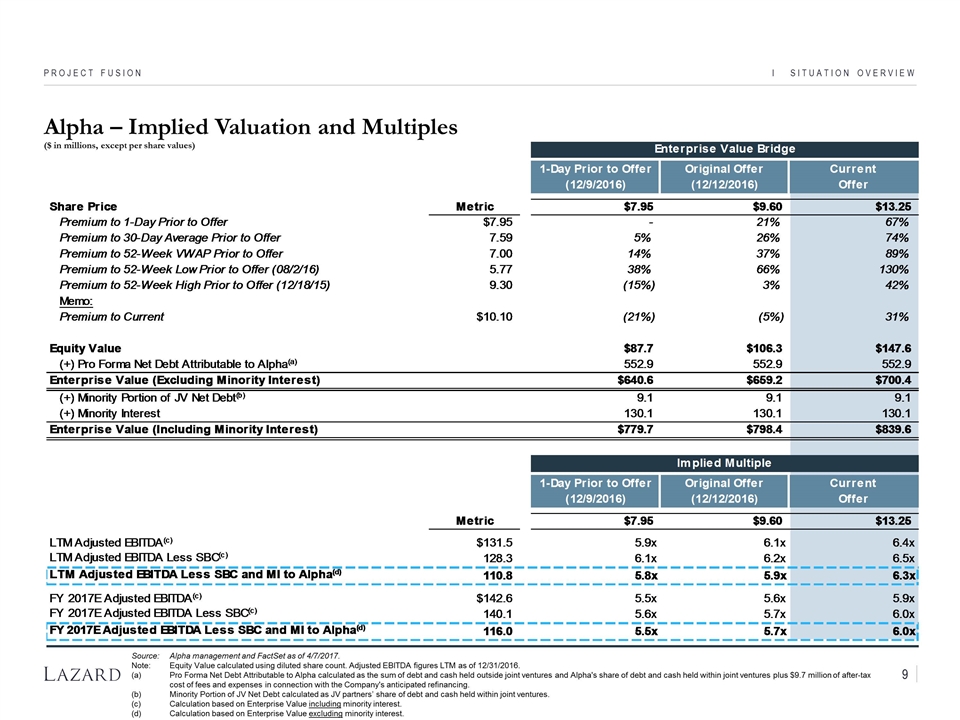

I Situation Overview 9 Project Fusion Source:Alpha management and FactSet as of 4/7/2017. Note:Equity Value calculated using diluted share count. Adjusted EBITDA figures LTM as of 12/31/2016. Pro Forma Net Debt Attributable to Alpha calculated as the sum of debt and cash held outside joint ventures and Alpha's share of debt and cash held within joint ventures plus $9.7 million of after-tax cost of fees and expenses in connection with the Company's anticipated refinancing. Minority Portion of JV Net Debt calculated as JV partners’ share of debt and cash held within joint ventures. Calculation based on Enterprise Value including minority interest. Calculation based on Enterprise Value excluding minority interest. Alpha – Implied Valuation and Multiples ($ in millions, except per share values)

Confidential IIFinancial Analysis Project Fusion

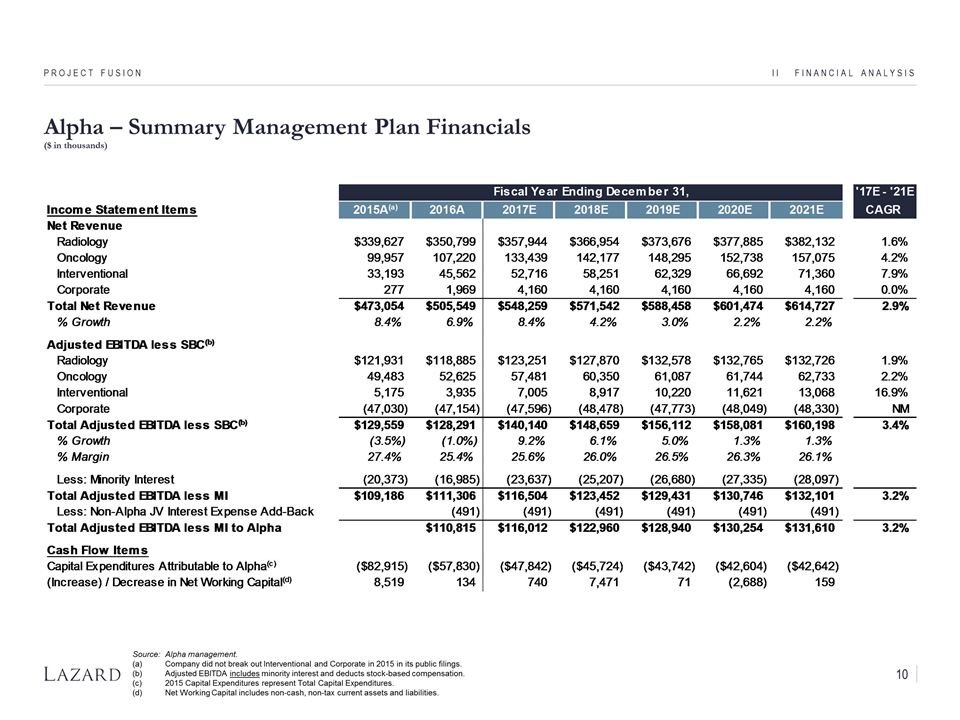

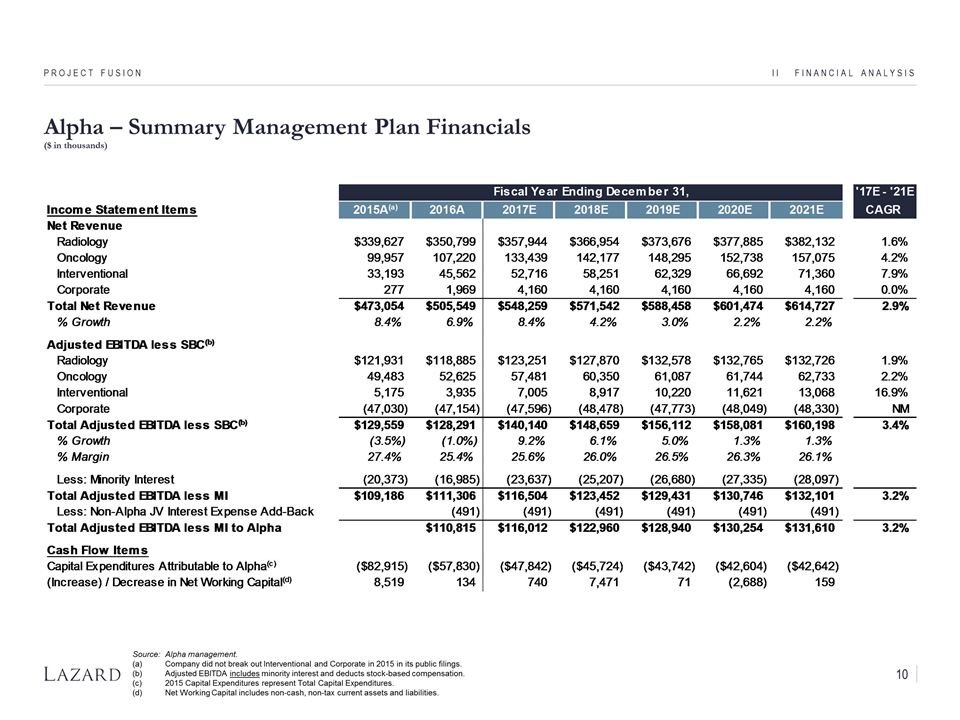

Alpha – Summary Management Plan Financials ($ in thousands) II Financial Analysis Project Fusion 10 Source:Alpha management. Company did not break out Interventional and Corporate in 2015 in its public filings. Adjusted EBITDA includes minority interest and deducts stock-based compensation. 2015 Capital Expenditures represent Total Capital Expenditures. Net Working Capital includes non-cash, non-tax current assets and liabilities.

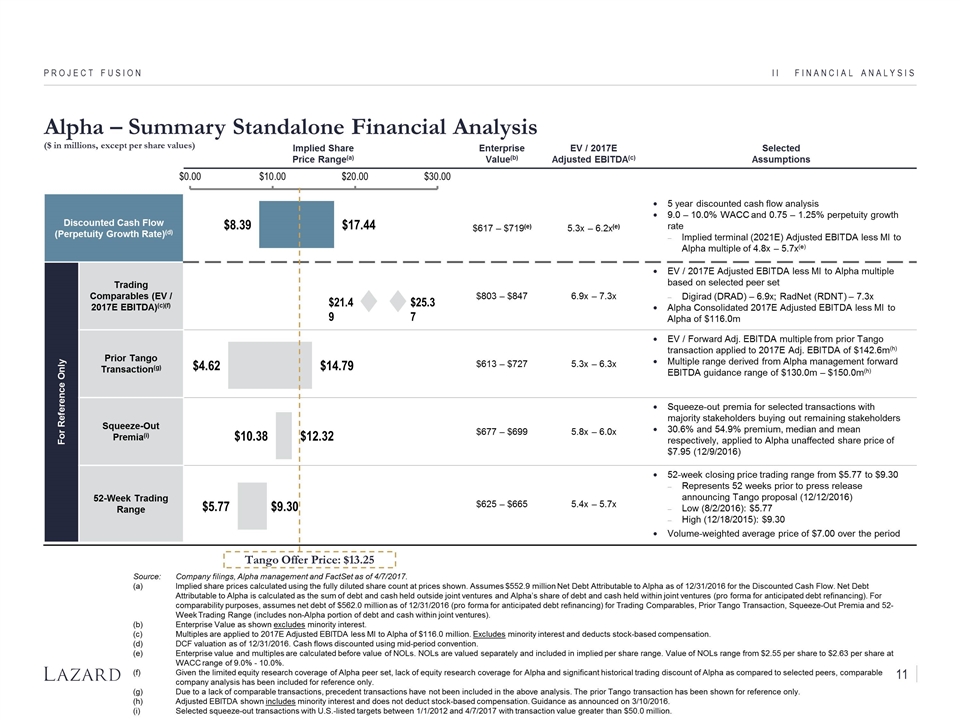

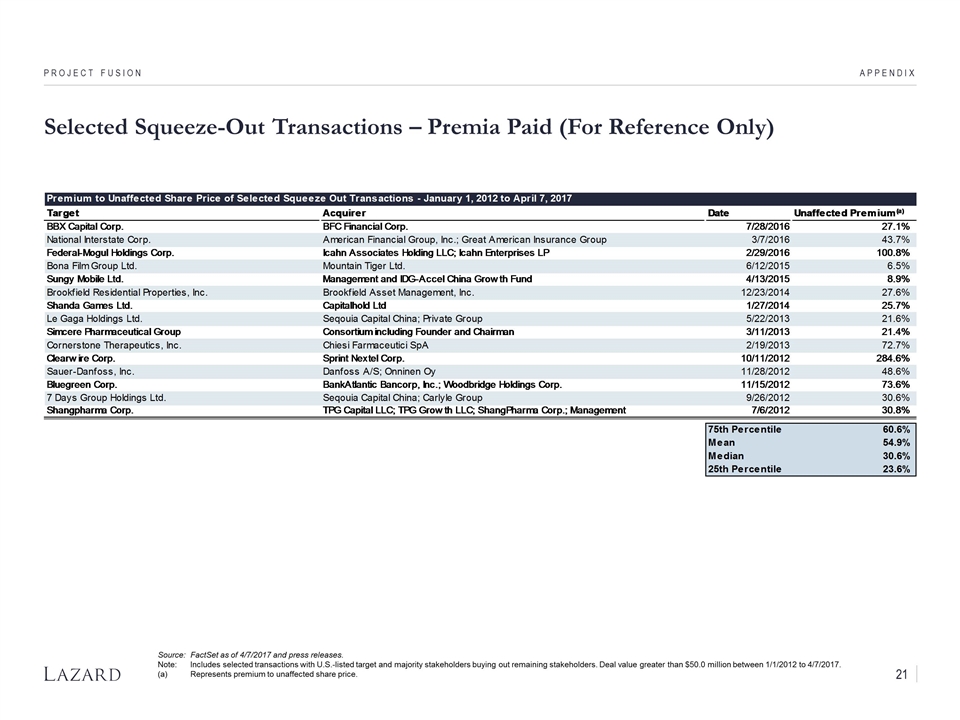

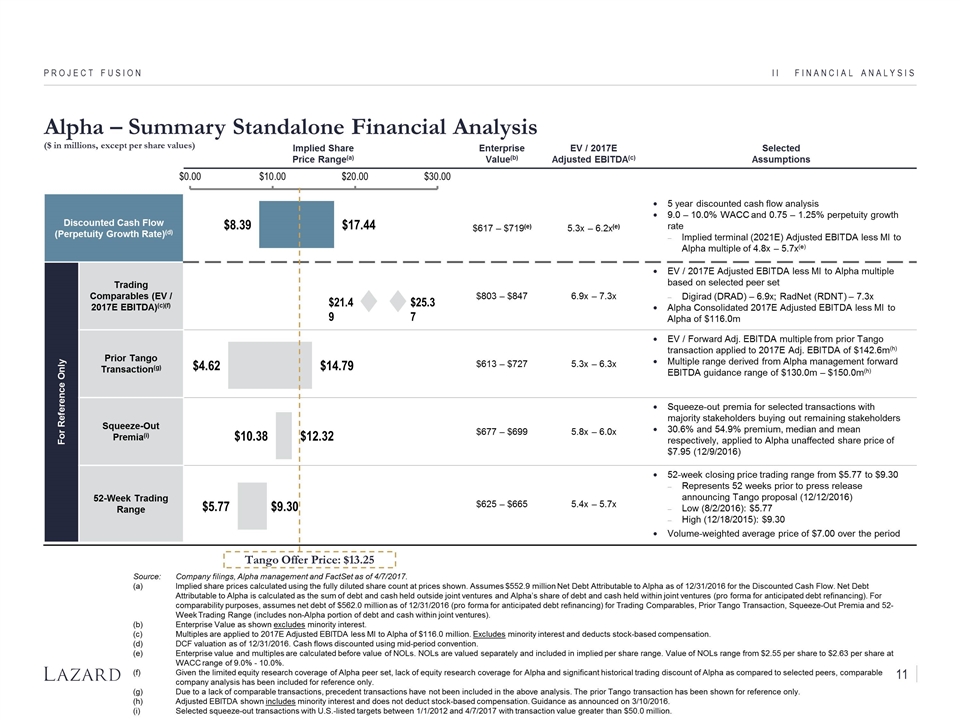

II Financial Analysis Project Fusion Source:Company filings, Alpha management and FactSet as of 4/7/2017. Implied share prices calculated using the fully diluted share count at prices shown. Assumes $552.9 million Net Debt Attributable to Alpha as of 12/31/2016 for the Discounted Cash Flow. Net Debt Attributable to Alpha is calculated as the sum of debt and cash held outside joint ventures and Alpha’s share of debt and cash held within joint ventures (pro forma for anticipated debt refinancing). For comparability purposes, assumes net debt of $562.0 million as of 12/31/2016 (pro forma for anticipated debt refinancing) for Trading Comparables, Prior Tango Transaction, Squeeze-Out Premia and 52-Week Trading Range (includes non-Alpha portion of debt and cash within joint ventures). Enterprise Value as shown excludes minority interest. Multiples are applied to 2017E Adjusted EBITDA less MI to Alpha of $116.0 million. Excludes minority interest and deducts stock-based compensation. DCF valuation as of 12/31/2016. Cash flows discounted using mid-period convention. Enterprise value and multiples are calculated before value of NOLs. NOLs are valued separately and included in implied per share range. Value of NOLs range from $2.55 per share to $2.63 per share at WACC range of 9.0% - 10.0%. Given the limited equity research coverage of Alpha peer set, lack of equity research coverage for Alpha and significant historical trading discount of Alpha as compared to selected peers, comparable company analysis has been included for reference only. Due to a lack of comparable transactions, precedent transactions have not been included in the above analysis. The prior Tango transaction has been shown for reference only. Adjusted EBITDA shown includes minority interest and does not deduct stock-based compensation. Guidance as announced on 3/10/2016. Selected squeeze-out transactions with U.S.-listed targets between 1/1/2012 and 4/7/2017 with transaction value greater than $50.0 million. Implied Share Price Range(a) Enterprise Value(b) EV / 2017E Adjusted EBITDA(c) Selected Assumptions Discounted Cash Flow (Perpetuity Growth Rate)(d) $617 – $719(e) 5.3x – 6.2x(e) 5 year discounted cash flow analysis 9.0 – 10.0% WACC and 0.75 – 1.25% perpetuity growth rate Implied terminal (2021E) Adjusted EBITDA less MI to Alpha multiple of 4.8x – 5.7x(e) For Reference Only Trading Comparables (EV / 2017E EBITDA)(c)(f) $803 – $847 6.9x – 7.3x EV / 2017E Adjusted EBITDA less MI to Alpha multiple based on selected peer set Digirad (DRAD) – 6.9x; RadNet (RDNT) – 7.3x Alpha Consolidated 2017E Adjusted EBITDA less MI to Alpha of $116.0m Prior Tango Transaction(g) $613 – $727 5.3x – 6.3x EV / Forward Adj. EBITDA multiple from prior Tango transaction applied to 2017E Adj. EBITDA of $142.6m(h) Multiple range derived from Alpha management forward EBITDA guidance range of $130.0m – $150.0m(h) Squeeze-Out Premia(i) $677 – $699 5.8x – 6.0x Squeeze-out premia for selected transactions with majority stakeholders buying out remaining stakeholders 30.6% and 54.9% premium, median and mean respectively, applied to Alpha unaffected share price of $7.95 (12/9/2016) 52-Week Trading Range $625 – $665 5.4x – 5.7x 52-week closing price trading range from $5.77 to $9.30 Represents 52 weeks prior to press release announcing Tango proposal (12/12/2016) Low (8/2/2016): $5.77 High (12/18/2015): $9.30 Volume-weighted average price of $7.00 over the period Alpha – Summary Standalone Financial Analysis ($ in millions, except per share values) $21.49 $25.37 11 Tango Offer Price: $13.25

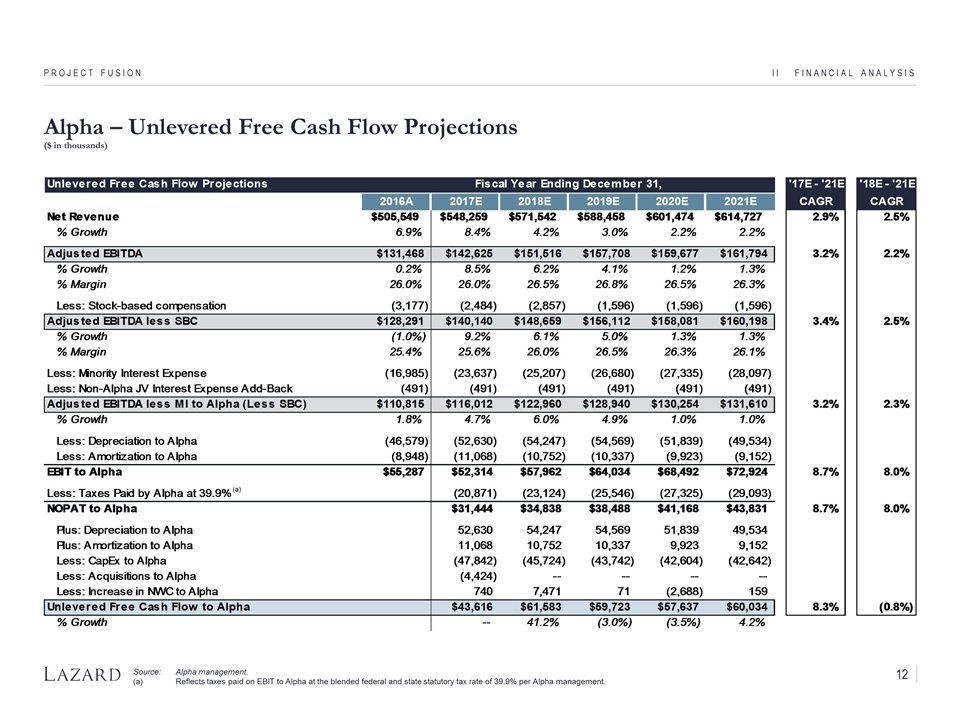

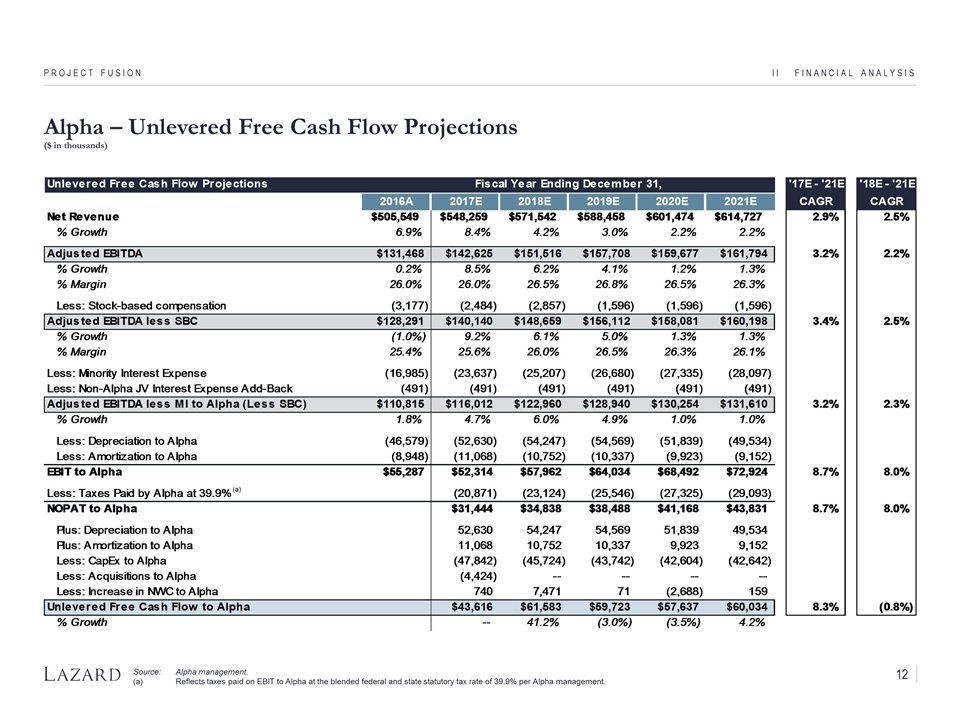

II Financial Analysis Project Fusion Alpha – Unlevered Free Cash Flow Projections ($ in thousands) Source:Alpha management. Reflects taxes paid on EBIT to Alpha at the blended federal and state statutory tax rate of 39.9% per Alpha management. 12 (a)

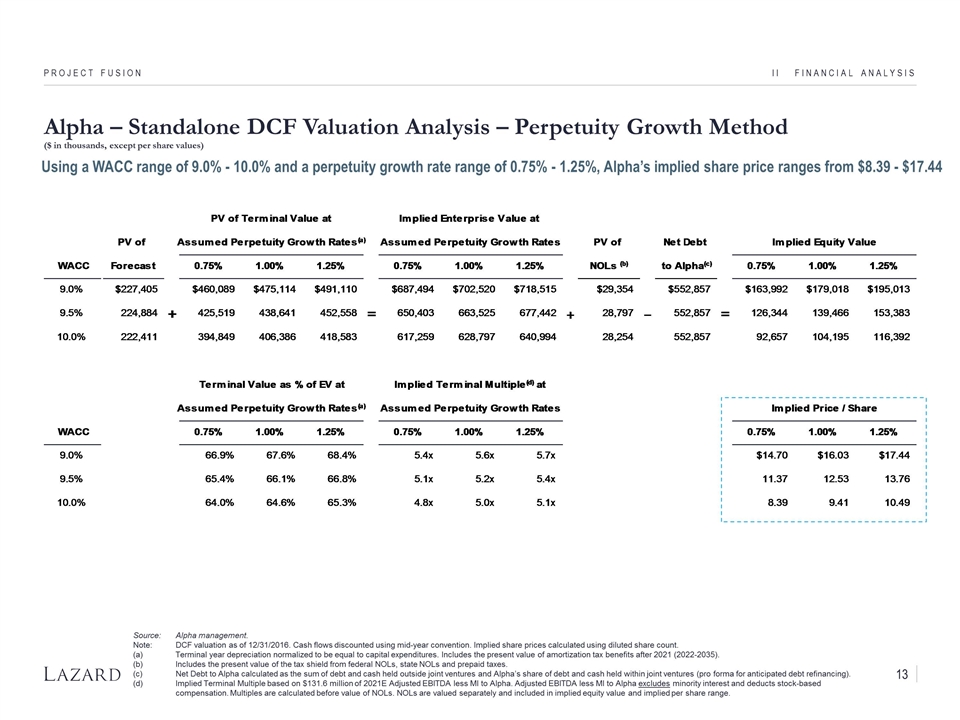

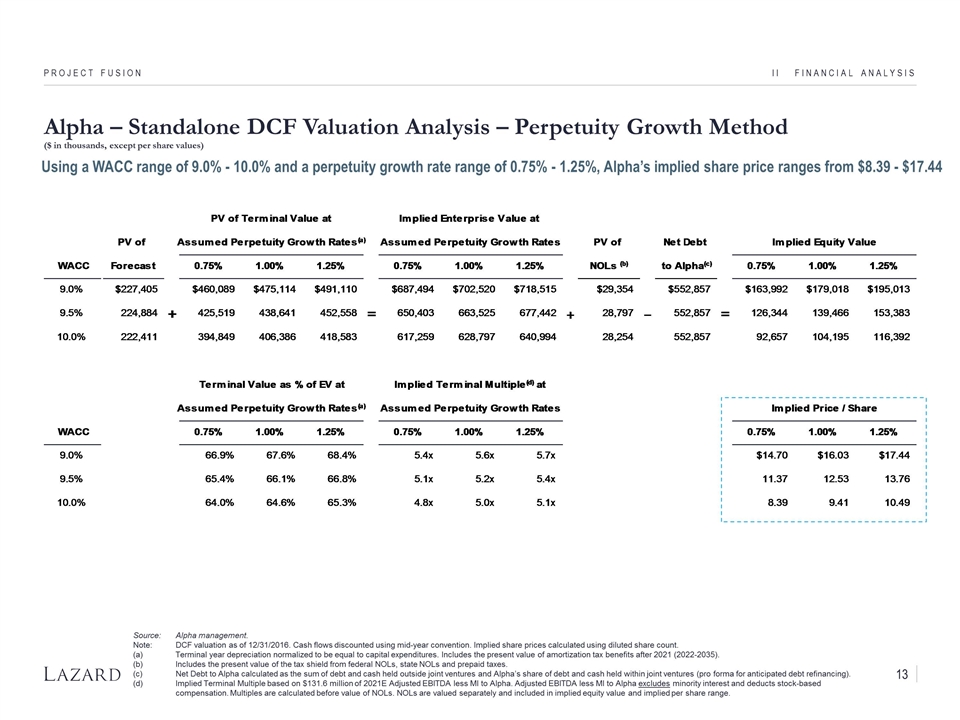

II Financial Analysis Project Fusion 13 Alpha – Standalone DCF Valuation Analysis – Perpetuity Growth Method ($ in thousands, except per share values) Using a WACC range of 9.0% - 10.0% and a perpetuity growth rate range of 0.75% - 1.25%, Alpha’s implied share price ranges from $8.39 - $17.44 Source:Alpha management. Note:DCF valuation as of 12/31/2016. Cash flows discounted using mid-year convention. Implied share prices calculated using diluted share count. Terminal year depreciation normalized to be equal to capital expenditures. Includes the present value of amortization tax benefits after 2021 (2022-2035). Includes the present value of the tax shield from federal NOLs, state NOLs and prepaid taxes. Net Debt to Alpha calculated as the sum of debt and cash held outside joint ventures and Alpha’s share of debt and cash held within joint ventures (pro forma for anticipated debt refinancing). Implied Terminal Multiple based on $131.6 million of 2021E Adjusted EBITDA less MI to Alpha. Adjusted EBITDA less MI to Alpha excludes minority interest and deducts stock-based compensation. Multiples are calculated before value of NOLs. NOLs are valued separately and included in implied equity value and implied per share range.

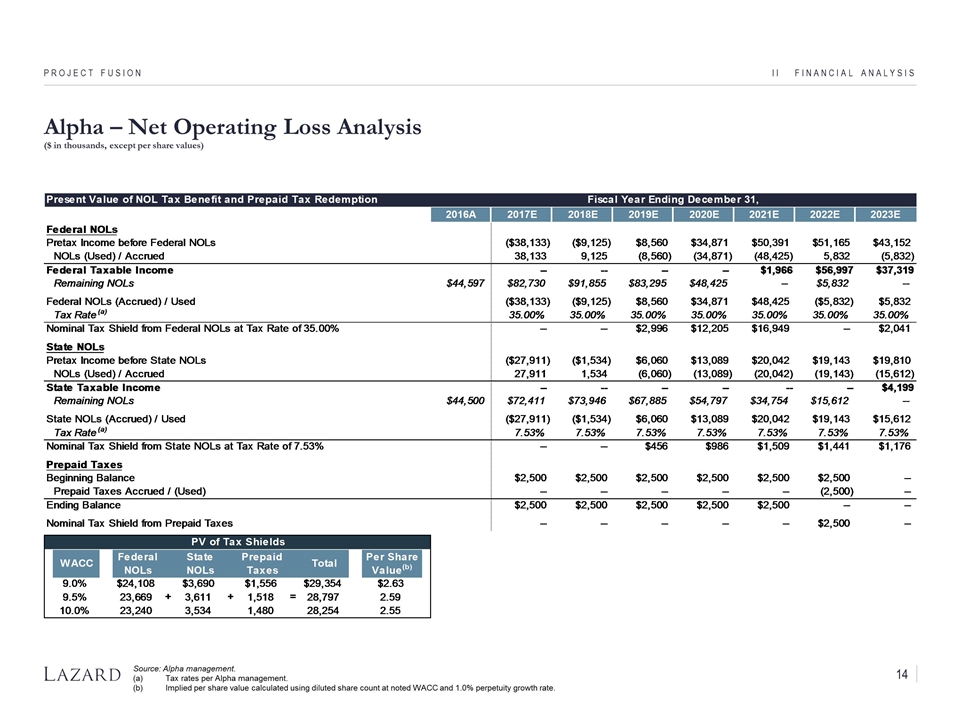

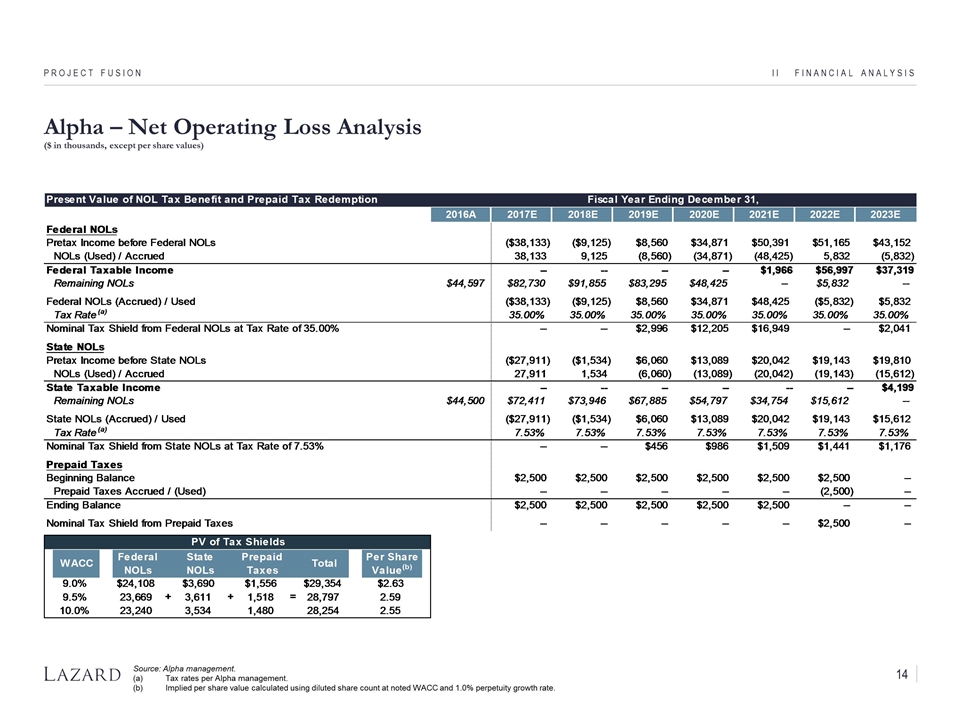

II Financial Analysis Project Fusion 14 Alpha – Net Operating Loss Analysis ($ in thousands, except per share values) Source: Alpha management. Tax rates per Alpha management. Implied per share value calculated using diluted share count at noted WACC and 1.0% perpetuity growth rate.

Confidential Appendix Project Fusion

Appendix Project Fusion 15 Alpha – Trading Comparables (For Reference Only) ($ in millions, except per share values) Source:Company filings, Alpha management, FactSet as of 4/7/2017 and Wall Street research. Note:For comparability purposes, assumes Alpha net debt of $562.0 million as of 12/31/2016 (pro forma for anticipated debt refinancing and includes non-Alpha portion of debt and cash within joint ventures). Enterprise Value excludes minority interest. Adjusted EBITDA excludes minority interest and deducts stock-based compensation. Adjusted EBITDA includes minority interest and deducts stock-based compensation.

Alpha – Historical EV/LTM EBITDA Trading Multiples (Prior to Offer) Appendix Project Fusion Source: FactSet as of 12/9/2016. Note:EV / LTM multiples calculated using Enterprise Value including minority interest. LTM EBITDA before deduction for minority interest expense and does not deduct stock-based compensation. DRAD had negative EBITDA prior to January 2014 8.7x 9.1x 5.9x Over the 2-3 year period prior to the offer date, Alpha has consistently traded at a significant EBITDA multiple discount relative to RadNet and Digirad 16

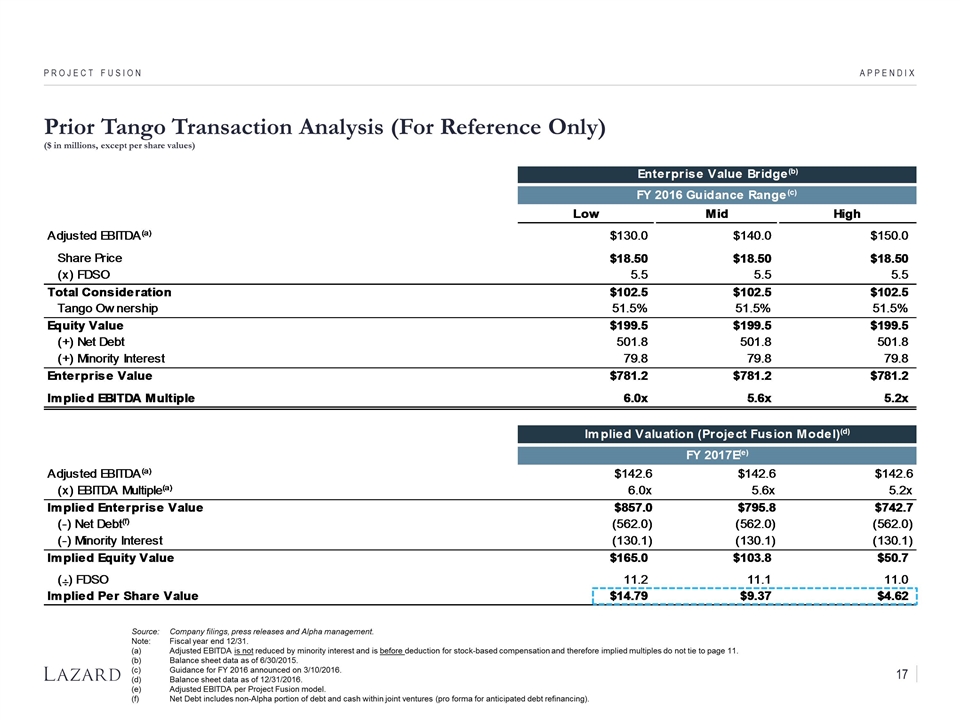

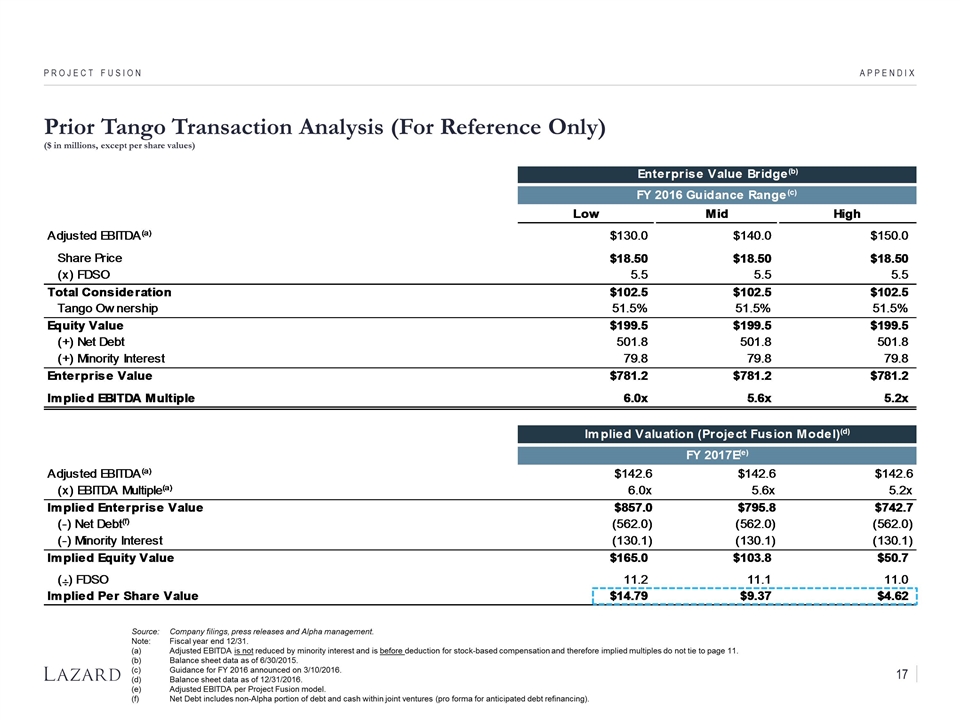

Prior Tango Transaction Analysis (For Reference Only) ($ in millions, except per share values) Appendix Project Fusion 17 Source:Company filings, press releases and Alpha management. Note:Fiscal year end 12/31. Adjusted EBITDA is not reduced by minority interest and is before deduction for stock-based compensation and therefore implied multiples do not tie to page 11. Balance sheet data as of 6/30/2015. Guidance for FY 2016 announced on 3/10/2016. Balance sheet data as of 12/31/2016. Adjusted EBITDA per Project Fusion model. Net Debt includes non-Alpha portion of debt and cash within joint ventures (pro forma for anticipated debt refinancing).

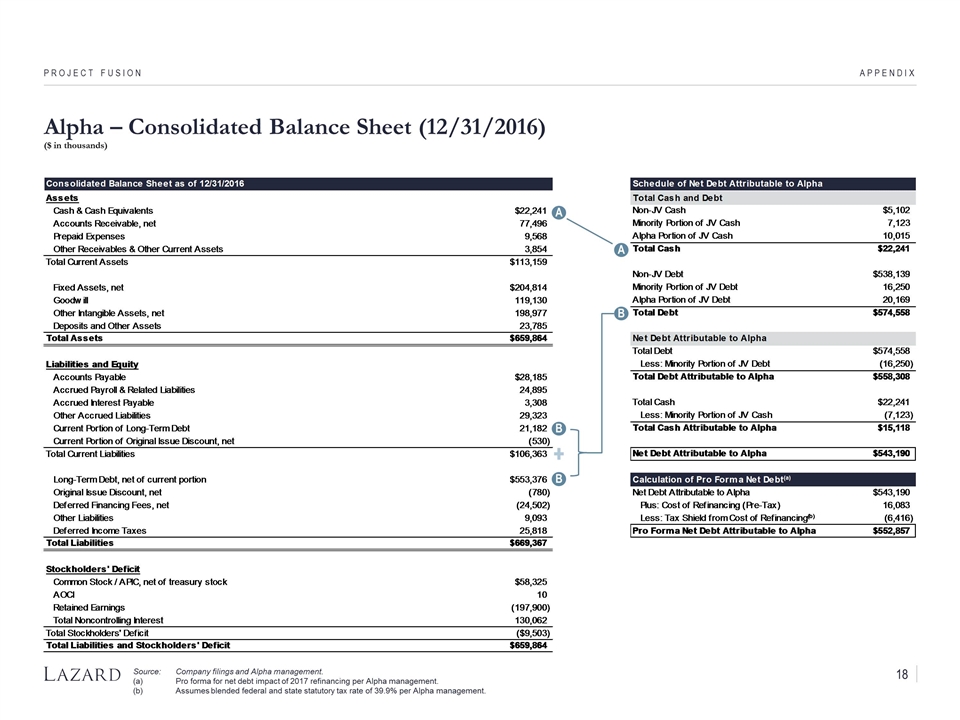

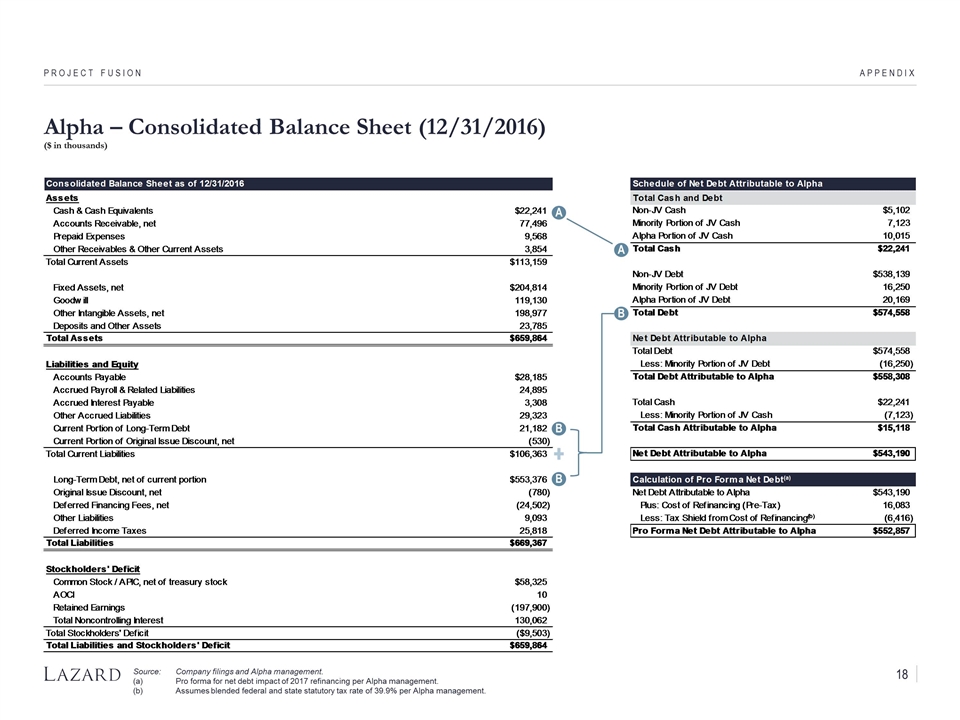

Appendix Project Fusion Alpha – Consolidated Balance Sheet (12/31/2016) ($ in thousands) Source:Company filings and Alpha management. Pro forma for net debt impact of 2017 refinancing per Alpha management. Assumes blended federal and state statutory tax rate of 39.9% per Alpha management. 18 A A B B B

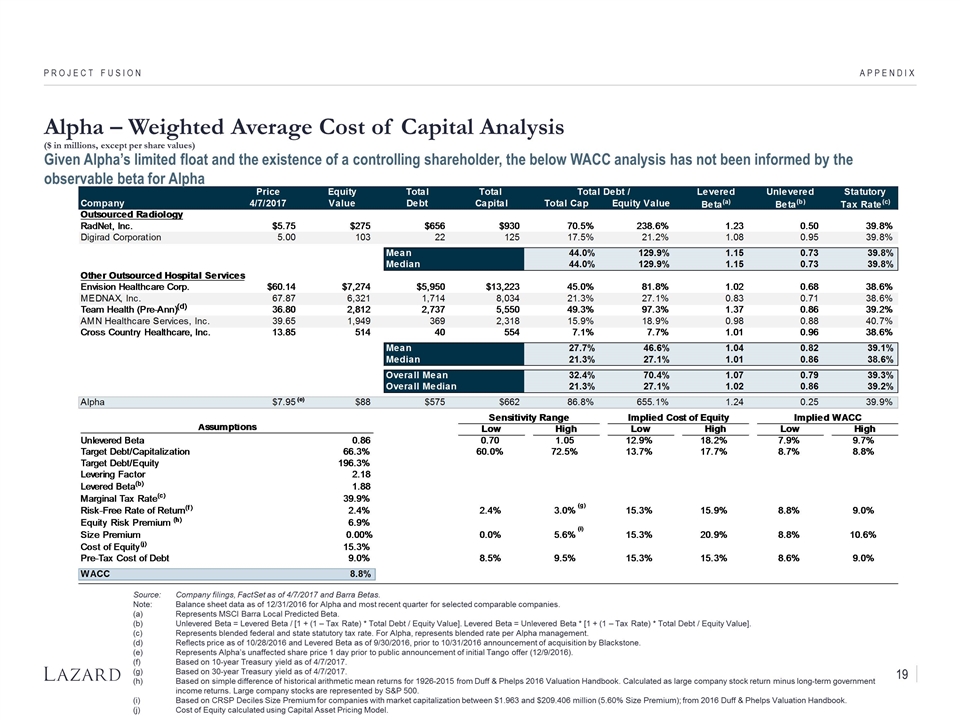

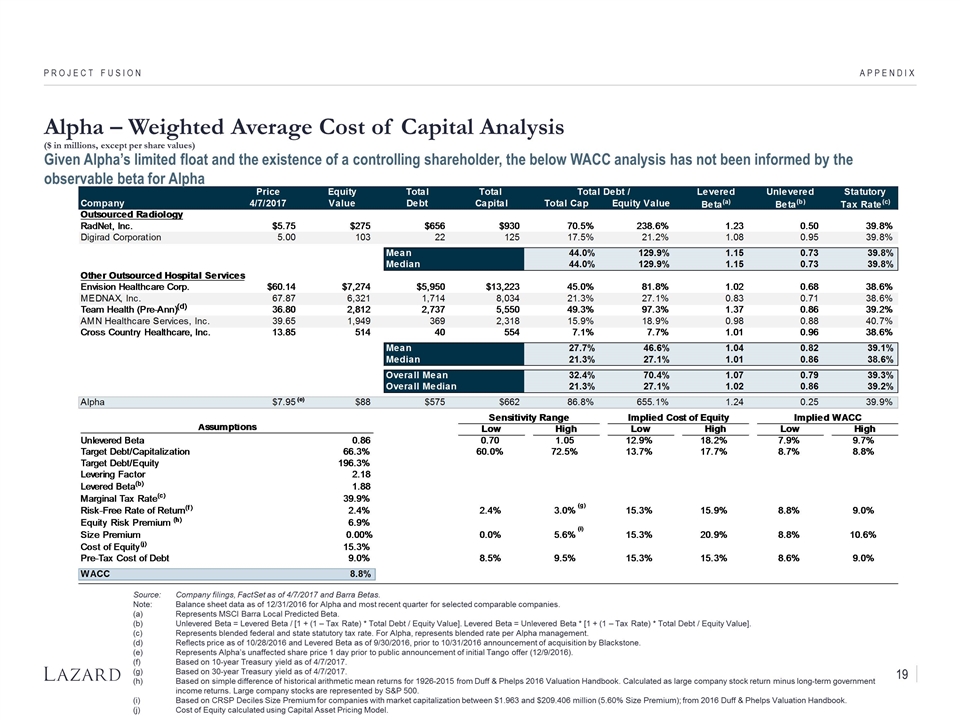

Appendix Project Fusion 19 Alpha – Weighted Average Cost of Capital Analysis ($ in millions, except per share values) Source:Company filings, FactSet as of 4/7/2017 and Barra Betas. Note:Balance sheet data as of 12/31/2016 for Alpha and most recent quarter for selected comparable companies. Represents MSCI Barra Local Predicted Beta. Unlevered Beta = Levered Beta / [1 + (1 – Tax Rate) * Total Debt / Equity Value]. Levered Beta = Unlevered Beta * [1 + (1 – Tax Rate) * Total Debt / Equity Value]. Represents blended federal and state statutory tax rate. For Alpha, represents blended rate per Alpha management. Reflects price as of 10/28/2016 and Levered Beta as of 9/30/2016, prior to 10/31/2016 announcement of acquisition by Blackstone. Represents Alpha’s unaffected share price 1 day prior to public announcement of initial Tango offer (12/9/2016). Based on 10-year Treasury yield as of 4/7/2017. Based on 30-year Treasury yield as of 4/7/2017. Based on simple difference of historical arithmetic mean returns for 1926-2015 from Duff & Phelps 2016 Valuation Handbook. Calculated as large company stock return minus long-term government income returns. Large company stocks are represented by S&P 500. Based on CRSP Deciles Size Premium for companies with market capitalization between $1.963 and $209.406 million (5.60% Size Premium); from 2016 Duff & Phelps Valuation Handbook. Cost of Equity calculated using Capital Asset Pricing Model. Given Alpha’s limited float and the existence of a controlling shareholder, the below WACC analysis has not been informed by the observable beta for Alpha

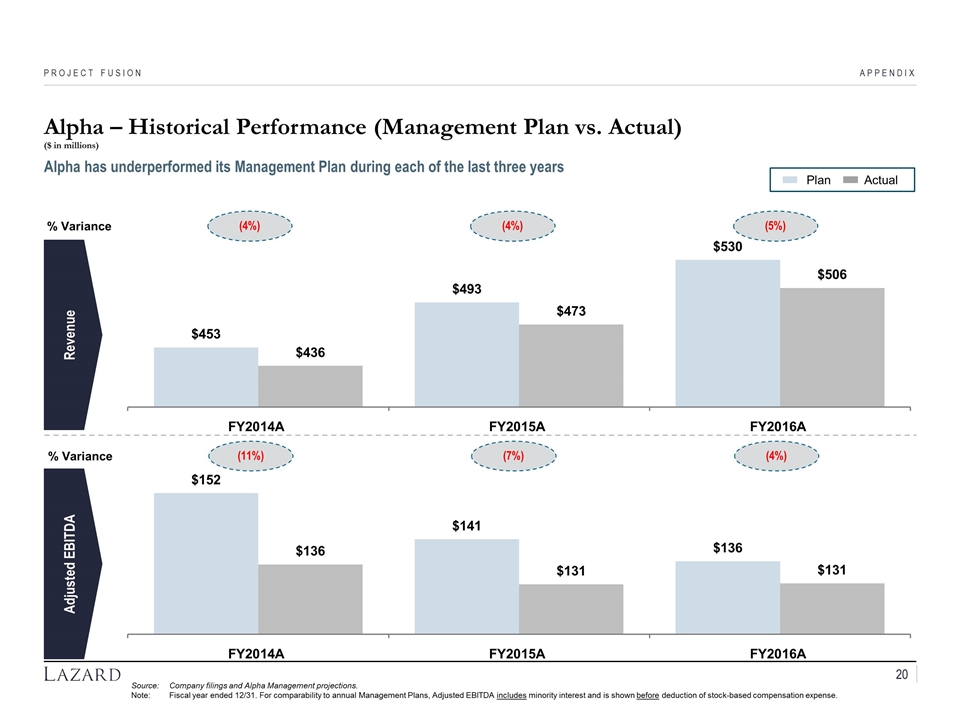

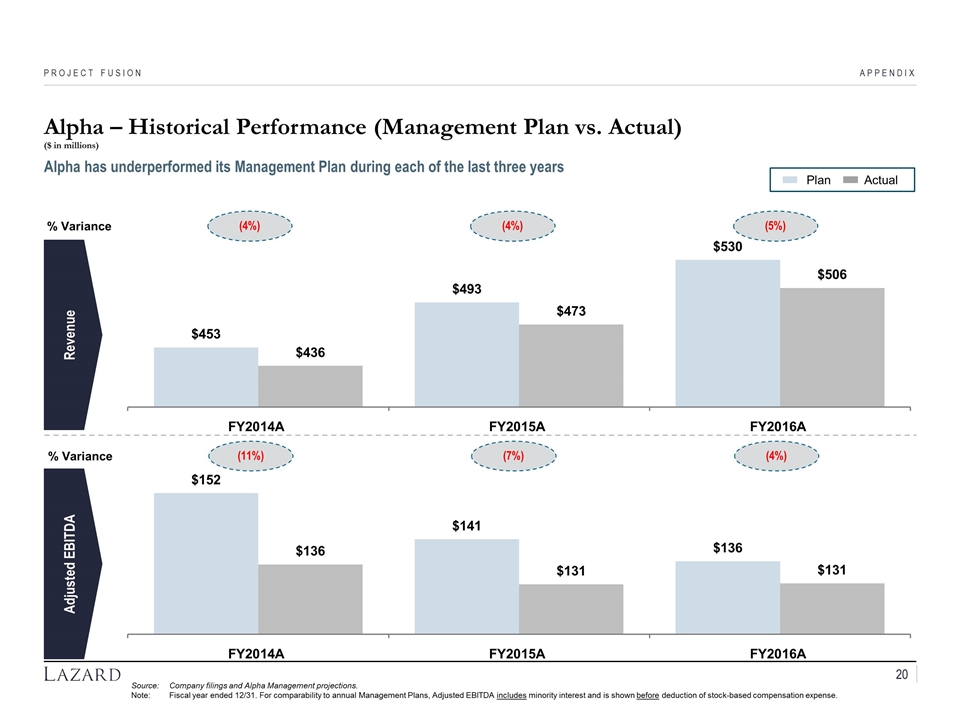

Appendix 20 Project Fusion Revenue Adjusted EBITDA Source:Company filings and Alpha Management projections. Note:Fiscal year ended 12/31. For comparability to annual Management Plans, Adjusted EBITDA includes minority interest and is shown before deduction of stock-based compensation expense. % Variance % Variance Plan Actual (4%) (4%) (5%) (11%) (7%) (4%) Alpha has underperformed its Management Plan during each of the last three years Alpha – Historical Performance (Management Plan vs. Actual) ($ in millions)

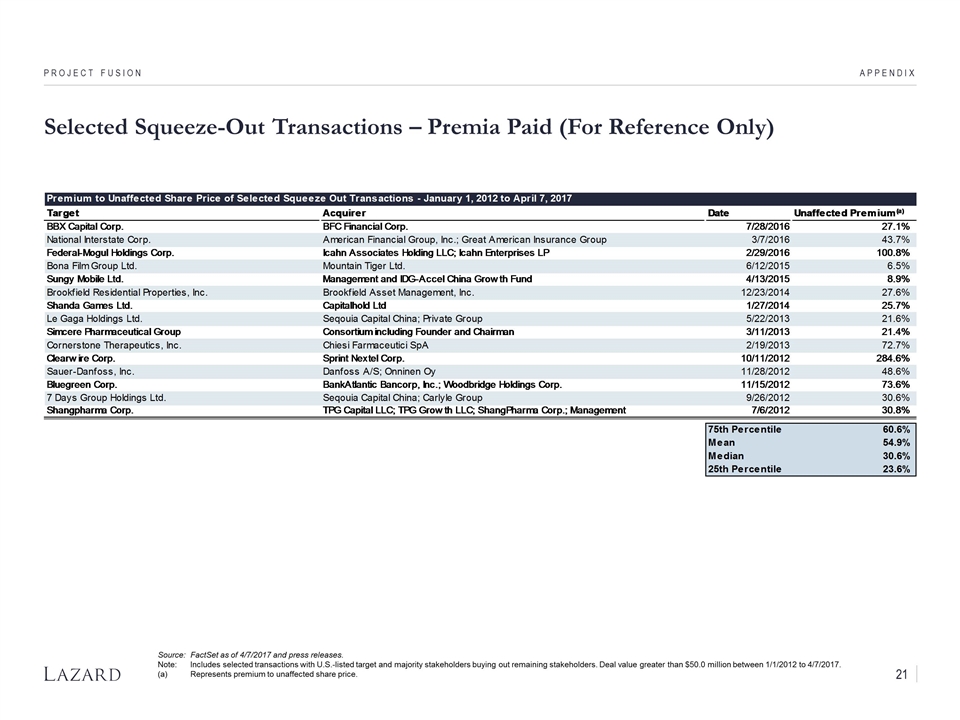

Selected Squeeze-Out Transactions – Premia Paid (For Reference Only) Appendix Project Fusion 21 Source:FactSet as of 4/7/2017 and press releases. Note:Includes selected transactions with U.S.-listed target and majority stakeholders buying out remaining stakeholders. Deal value greater than $50.0 million between 1/1/2012 to 4/7/2017. (a)Represents premium to unaffected share price.