UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

| | |

| | x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

OR

|

| | |

| | o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 814-00149

AMERICAN CAPITAL, LTD.

(Exact name of registrant as specified in its charter)

|

| | |

| Delaware | | 52-1451377 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

2 Bethesda Metro Center

14th Floor

Bethesda, Maryland 20814

(Address of principal executive offices)

(301) 951-6122

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| Title of each class | | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | | The NASDAQ Stock Market LLC (NASDAQ Global Select Market) |

Securities registered pursuant to section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No x.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Act.

|

| | | | |

Large accelerated filer x | | | | Accelerated filer o |

Non-accelerated filer o | | (Do not check if a smaller reporting company) | | Smaller Reporting Company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No. x

As of June 30, 2013, the aggregate market value of the Registrant’s common stock held by non-affiliates of the Registrant was approximately $3.6 billion based upon a closing price of the Registrant’s common stock of $12.67 per share as reported on The NASDAQ Global Select Market on that date. (For this computation, the registrant has excluded the market value of all shares of its common stock reported as beneficially owned by executive officers and directors of the registrant and certain other shareholders; such an exclusion shall not be deemed to constitute an admission that any such person is an “affiliate” of the registrant.)

As of February 3, 2014, there were 275,656,005 shares of the Registrant’s common stock legally outstanding.

DOCUMENTS INCORPORATED BY REFERENCE. The Registrant’s definitive proxy statement for the 2014 Annual Meeting of Stockholders is incorporated by reference into certain sections of Part III herein.

Certain exhibits previously filed with the Securities and Exchange Commission are incorporated by reference into Part IV of this report.

________________________________________________________________________________________________________________________

AMERICAN CAPITAL, LTD. TABLE OF CONTENTS

|

| | |

| PART I. FINANCIAL INFORMATION | |

| | | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | | |

| PART II. | |

| | | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| | | |

| PART III. | |

| | | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | | |

| PART IV. | |

| | | |

| Item 15. | | |

| |

| | | |

PART I.

General

American Capital, Ltd. (which is referred to throughout this report as “American Capital”, “we”, “our” and “us”) is a publicly traded global asset manager and private equity firm. American Capital, both directly and through its asset management business, originates, underwrites and manages investments in middle market private equity, leveraged finance, real estate, energy and structured products. It is our practice to sell into funds that we manage some of the assets that we originate as an investor. We primarily invest in senior and mezzanine debt and equity in buyouts of private companies sponsored by us (“American Capital One Stop Buyouts®”) or sponsored by other private equity funds (“Sponsor Finance Investments”) and provide capital directly to early stage and mature private and small public companies. We refer to our investments in these companies as our private finance portfolio. We manage $19 billion of assets, including assets on our balance sheet and fee earning assets under management by affiliated managers, with $93 billion of total assets under management (including levered assets). Our asset management is conducted through our wholly-owned portfolio company, American Capital Asset Management, LLC (“ACAM”). ACAM manages the following funds: American Capital Senior Floating, Ltd. (“ACSF”), European Capital Limited (“European Capital”), American Capital Agency Corp. (“AGNC”), American Capital Mortgage Investment Corp. (“MTGE”), American Capital Equity I, LLC (“ACE I”), American Capital Equity II, LP (“ACE II”), ACAS CLO 2007-1, Ltd. (“ACAS CLO 2007-1”), ACAS CLO 2012-1, Ltd. (“ACAS CLO 2012-1”), ACAS CLO 2013-1, Ltd. (“ACAS CLO 2013-1”) and ACAS CLO 2013-2, Ltd. (“ACAS CLO 2013-2”).

On August 29, 1997, we completed an initial public offering (“IPO”) and became a non-diversified closed end investment company that has elected to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940, as amended (“1940 Act”). Our primary business objectives are to increase our net earnings and net asset value (“NAV”) by making investments with attractive current yields and/or potential for equity appreciation and realized gains.

We are taxed as a corporation and pay federal and applicable state corporate taxes on our taxable income. From 1997 through the tax ended September 30, 2010, we were taxed as a regulated investment company (“RIC”) as defined in Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). As a RIC, we were not subject to federal income tax on the portion of our taxable income and capital gains we distributed to our shareholders, but we were also not able to carry forward net operating losses (“NOL”) from year to year. Beginning with our tax year ended September 30, 2011, our status changed from a RIC subject to taxation under Subchapter M to a corporation subject to taxation under Subchapter C. Under Subchapter C, we are able to carry forward any NOLs historically incurred to succeeding years, which we would not be able to do if we were subject to taxation as a RIC under Subchapter M. This change in tax status does not affect our status as a BDC under the 1940 Act or our compliance with the portfolio composition requirements of that statute.

American Capital Investment Portfolio

As an investor, we primarily invest in senior and mezzanine debt and equity of middle market companies, which we generally consider to be companies with revenue between $10 million and $750 million. We and ACAM also invest in assets that could be sold or contributed to public or private funds that ACAM could manage, as a means of “incubating” such funds. We also have investments in structured finance investments (“Structured Products”), including collateralized loan obligation (“CLO”) securities, collateralized debt obligation (“CDO”) and commercial mortgage backed securities (“CMBS”) and in funds managed by us.

Over the last three years, we have committed $2,143 million of capital to new investments, composed of $1,328 million of debt securities, $673 million of equity securities and $142 million of Structured Products investments. Of the $2,143 million of new investment commitments over the last three years, $274 million was committed to new Sponsor Finance, Direct and Other Investments, $329 million was committed to new American Capital One Stop Buyouts®, $79 million was committed to new Structured Products, $871 million was committed to add-on investments in our existing portfolio companies, $147 million was committed to European Capital and $443 million was committed to ACAM, primarily for fund development. Over the last three years, we received $3.8 billion of cash realizations, composed of $2.6 billion of debt realizations and $1.2 billion of equity realizations. In addition, over the last three years, our investment portfolio has generated operating revenue, net operating income before income taxes and net earnings of $1.7 billion, $918 million and $2.3 billion, respectively. Over the last three years, our weighted average net earnings return on shareholders’ equity was 15.6%.

Since our IPO, we have committed capital of $6.4 billion in equity securities, $18.4 billion in debt securities and $1.8 billion in Structured Products. Since our IPO, we have had over 370 exits and repayments of $19.7 billion, representing 74% of our total capital committed since our IPO, earning a 10% compounded annual return on these investments. Since our IPO, our weighted average net earnings return on shareholders’ equity was 4.3%.

Portfolio Composition

As of December 31, 2013, we had investments in 132 portfolio companies totaling $5.1 billion and $5.5 billion at fair value and cost basis, respectively. As of December 31, 2013, our ten largest investments had a fair value and cost basis of $3.3 billion and $3.1 billion, respectively, or 55% of total assets at fair value, and are as follows (in millions):

|

| | | | | | | | | | | | |

| Company | | Business Line | | Industry | | Fair Value | | Cost Basis |

| American Capital Asset Management, LLC | | Asset Management | | Capital Markets | | $ | 870 |

| | $ | 356 |

|

| European Capital Limited | | European Capital | | Diversified Financial Services | | 841 |

| | 1,093 |

|

| CML Pharmaceuticals, Inc. | | American Capital One Stop Buyouts® | | Life Sciences Tools & Services | | 393 |

| | 430 |

|

| SPL Acquisition Corp. | | American Capital One Stop Buyouts® | | Pharmaceuticals | | 223 |

| | 176 |

|

| SMG Holdings, Inc. | | American Capital One Stop Buyouts® | | Hotels, Restaurants & Leisure | | 195 |

| | 208 |

|

| The Tensar Corporation | | Sponsor Finance Investments | | Construction & Engineering | | 185 |

| | 172 |

|

| Mirion Technologies, Inc. | | American Capital One Stop Buyouts® | | Electrical Equipment | | 172 |

| | 89 |

|

| Affordable Care Holding Corp. | | American Capital One Stop Buyouts® | | Health Care Providers & Services | | 171 |

| | 86 |

|

| Soil Safe Holdings, LLC | | Sponsor Finance Investments | | Professional Services | | 125 |

| | 128 |

|

| WRH, Inc. | | American Capital One Stop Buyouts® | | Life Sciences Tools & Services | | 118 |

| | 341 |

|

| Total | | | | | | $ | 3,293 |

| | $ | 3,079 |

|

| | | | | | | | | |

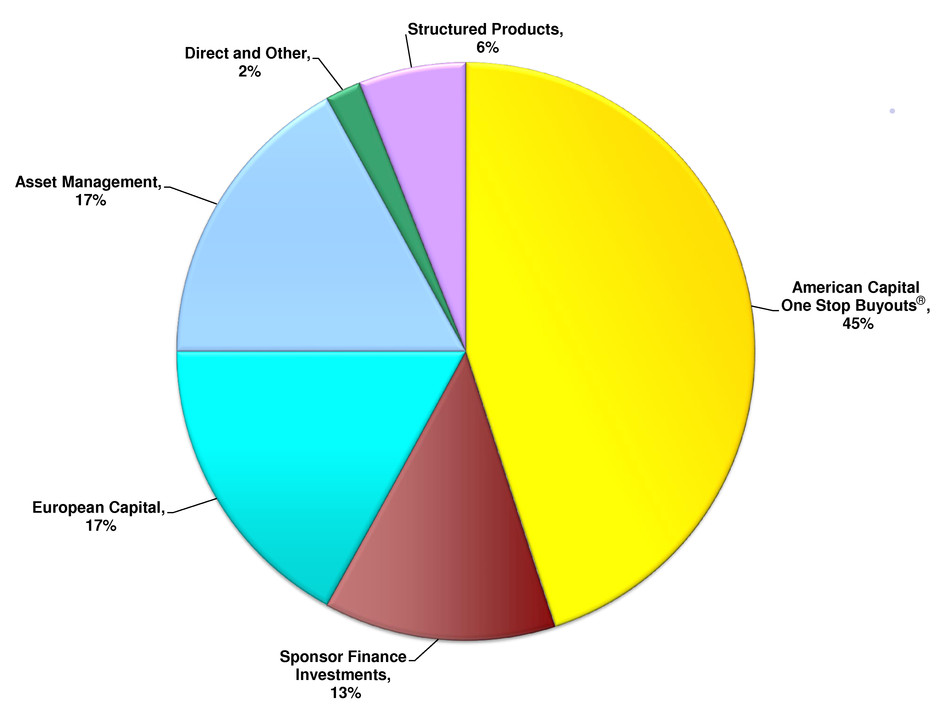

Our investments can be divided into the following six business lines: (i) American Capital One Stop Buyouts®, (ii) Sponsor Finance Investments, (iii) Direct and Other Investments, (iv) European Capital, (v) Asset Management and (vi) Structured Products.

The composition of our investment portfolio as of December 31, 2013, at fair value, as a percentage of total investments based on these different business lines, is shown below:

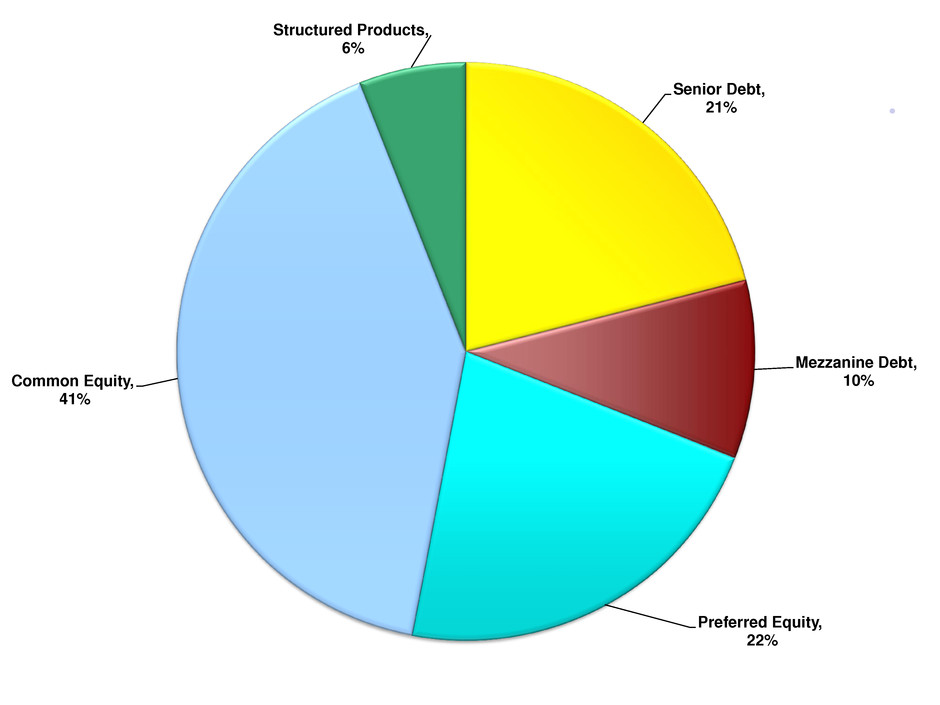

The composition of our investment portfolio as of December 31, 2013, at fair value, as a percentage of total investments by security type, is shown below:

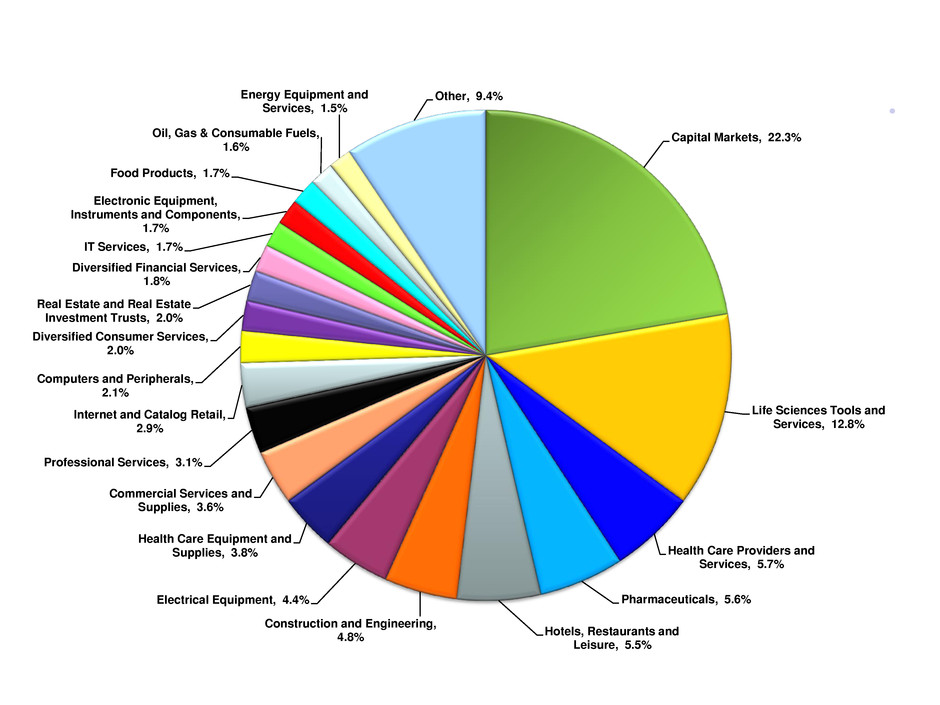

Other than our investment in European Capital, our investments are primarily in portfolio companies located in the United States. For summary financial information by geographic area, see Note 3 to our audited consolidated financial statements included in this Annual Report on Form 10-K. We have a diversified investment portfolio and do not concentrate in any one or two industry sectors, apart from Asset Management. We use the Global Industry Classification Standards for classifying the industry groupings of our portfolio companies. The following chart shows the portfolio composition by industry grouping at fair value as a percentage of total investments as of December 31, 2013. Our investments in European Capital, CLO and CDO securities and derivative agreements are excluded from the table below. Our investments in CMBS are classified in the Real Estate and Real Estate Investment Trusts category.

Private Finance Investments

The majority of our private finance investments have been either to assist in the funding of change of control buyouts of privately held middle market companies or to support the growth or recapitalization of an existing portfolio company. A change of control transaction could be the result of a corporate divestiture, a sale of a family-owned or closely-held business, a going private transaction, the sale by a private equity fund of a portfolio company or an ownership transition. Our financing of a change of control transaction could either be for an American Capital One Stop Buyout® or for a Sponsor Finance Investment. In an American Capital One Stop Buyout®, we lend senior and mezzanine debt and make majority equity investments. As an investor in Sponsor Finance Investments, we lend senior and mezzanine debt and make minority equity co-investments.

Our private finance portfolio investments consist of loans and equity securities primarily to privately-held middle market companies. Our private finance loans consist of first lien secured revolving credit facilities, first lien secured loans, second lien secured loans and secured and unsecured mezzanine loans. Our loans typically mature in five to ten years and require monthly or quarterly interest payments at fixed rates or variable rates generally based on LIBOR, plus a margin. Certain of our loans permit the interest to be paid-in-kind by adding it to the outstanding loan balance and paid at maturity. We price our debt and equity investments based on our analysis of each transaction. As of December 31, 2013, the weighted average effective interest rate on our private finance debt investments was 10.1%, which includes the impact of non-accruing loans. As of December 31, 2013, our fully-diluted weighted average ownership interest in our private finance portfolio companies, which excludes our 100% investments in European Capital and ACAM, was 72%, with a total equity investment at fair value of $1.5 billion.

There is generally no publicly available information about these companies and a primary or secondary market for the trading of these privately issued loans and equity securities generally does not exist. These investments have been historically exited through normal repayment, a change in control transaction or recapitalization of the portfolio company. However, we may also sell our loans or equity investments in non-change of control transactions.

Our ability to fund the entire capital structure is a competitive advantage in completing many middle market transactions. We sponsor American Capital One Stop Buyouts® in which we provide most, if not all, of the senior and mezzanine debt and equity financing in the transaction. For our American Capital One Stop Buyouts®, we would historically fund all of the senior debt at closing and then syndicate it to third-party lenders post-closing. In general, third-party senior debt agreements limit the ability of our portfolio companies to pay cash dividends to their shareholders, including us. Going forward, in general, we intend to hold the senior debt of these controlled portfolio companies. In addition to providing us with interest income from the senior debt investments, it will also allow these controlled portfolio companies to pay cash dividends to their shareholders, including us.

As a BDC, we are required by law to make significant managerial assistance available to most of our portfolio companies. Such assistance typically involves providing guidance and counsel concerning the management, operations and business objectives and policies of the portfolio company to its management and board of directors, including participating on the company’s board of directors. We have an operations team with significant turnaround and bankruptcy experience that assists our investment professionals in providing intensive operational and managerial assistance to our portfolio companies. As of December 31, 2013, we had board seats at 48 out of 82 of our private finance companies and had board observation rights at certain other private finance portfolio companies. Providing assistance to our portfolio companies serves as an opportunity for us to maximize their value.

American Capital Asset Management Investment

Our fund management business is conducted through our wholly-owned portfolio company, ACAM. In general, subsidiaries of ACAM enter into management agreements with each of its managed funds. As of December 31, 2013, our investment in ACAM was $356 million at cost and $870 million at fair value, or 17% of our total investments at fair value. The discussion of the operations of ACAM includes its consolidated subsidiaries. As of December 31, 2013, ACAM’s earning assets under management totaled $13 billion. As of December 31, 2013, ACAM had $87 billion of total assets under management (including levered assets), including $76 billion of total assets under management for American Capital Agency Corp. (NASDAQ: AGNC) and $8 billion of total assets under management for American Capital Mortgage Investment Corp. (NASDAQ: MTGE), which are publicly traded mortgage real estate investment trusts (“REITs”). We believe that having capital to incubate new funds to be managed by ACAM is a competitive advantage for our asset management business.

ACAM had over 100 employees as of December 31, 2013, including three Investment Teams with over 40 investment professionals located in Bethesda (Maryland), New York, Annapolis (Maryland), London and Paris. We have entered into service agreements with ACAM to provide it with additional asset management and administrative services support. Through these agreements, we provide investment advisory and oversight services to ACAM, as well as access to our employees, infrastructure, business relationships, management expertise and capital raising capabilities. During the year ended December 31, 2013, American Capital earned $26 million from ACAM for these services. ACAM generally earns base management fees based on the shareholders’ equity or the net cost basis of the assets of the funds under management and may earn incentive income, or a carried interest, based on the performance of the funds. In addition, American Capital or ACAM may invest directly into these funds and earn investment income from its investments in those funds.

The following table sets forth certain information with respect to ACAM’s funds under management as of December 31, 2013:

|

| | | | | | | | | | |

| Fund | | Fund type | | Established | | Assets under management | | Investment types | | Capital type |

| European Capital | | Private Equity Fund | | 2005 | | $1.2 Billion | | Senior and Mezzanine Debt, Equity,

Structured Products | | Permanent |

| AGNC | | Publicly Traded REIT - NASDAQ (AGNC) | | 2008 | | $76.2 Billion | | Agency Securities | | Permanent |

| MTGE | | Publicly Traded REIT - NASDAQ (MTGE) | | 2011 | | $8.4 Billion | | Mortgage Investments | | Permanent |

| ACE I | | Private Equity Fund | | 2006 | | $0.5 Billion | | Equity | | Finite Life |

| ACE II | | Private Equity Fund | | 2007 | | $0.2 Billion | | Equity | | Finite Life |

| ACAS CLO 2007-1 | | CLO | | 2006 | | $0.4 Billion | | Senior Debt | | Finite Life |

| ACAS CLO 2012-1 | | CLO | | 2012 | | $0.4 Billion | | Senior Debt | | Finite Life |

| ACAS CLO 2013-1 | | CLO | | 2013 | | $0.4 Billion | | Senior Debt | | Finite Life |

| ACAS CLO 2013-2 | | CLO | | 2013 | | $0.4 Billion | | Senior Debt | | Finite Life |

ACSF is an investment management company that invests primarily in first lien and second lien floating rate loans to large market, U.S. based companies (“Leveraged Loans”) and invests opportunistically in equity tranches of CLOs collateralized primarily by Leveraged Loans. On January 15, 2014, ACSF successfully completed its IPO of ten million shares of common stock

for proceeds of $150 million. Its shares are traded on The NASDAQ Global Select Market under the symbol “ACSF.” ACAM earns a base management fee of 0.80% of ACSF’s assets, as defined in ACSF’s management agreement. In addition, ACAM also purchased 3% of the common stock of ACSF for $4.5 million.

Under its investment management agreement with European Capital, ACAM is entitled to receive an annual management fee of 2% of the weighted average monthly consolidated gross asset value of all the investments at fair value of European Capital, an incentive fee equal to 100% of the net earnings in excess of a return of 8% but less than a return of 10%, and 20% of the net earnings thereafter. The investment management agreement with European Capital was amended to waive the incentive fee for 2011, 2012 and 2013.

AGNC is a publicly traded REIT, which invests on a leveraged basis primarily in residential mortgage pass-through securities and collateralized mortgage obligations, for which the interest and principal payments are guaranteed by a U.S. government agency or U.S. government-sponsored entity. Its shares are traded on The NASDAQ Global Select Market under the symbol “AGNC.” ACAM earns a base management fee of 1.25% of AGNC’s shareholders’ equity, as defined in the management agreement. The management contract is renewable annually and if AGNC were not to renew the management agreement without cause, it would have to pay a termination fee equal to three times the average annual management fee earned by ACAM during the 24-month period immediately preceding the most recently completed month prior to the effective date of termination. If the termination fee were calculated for the period ending December 31, 2013, it would have been $374 million. As of December 31, 2013, AGNC’s total shareholders’ equity was $8.7 billion.

MTGE is also a publicly traded REIT, which invests in and manages a leveraged portfolio of agency mortgage investments, non-agency mortgage investments and other mortgage-related investments. Its shares are traded on The NASDAQ Global Select Market under the symbol “MTGE.” ACAM earns a base management fee of 1.50% of MTGE’s shareholders’ equity, as defined in the management agreement. The management agreement has a current term through August 9, 2014 and is renewable annually thereafter. If MTGE were not to renew the management agreement without cause, it would have to pay a termination fee equal to three times the average annual management fee earned by ACAM during the 24-month period immediately preceding the most recently completed month prior to the effective date of termination. If the termination fee were calculated for the period ending December 31, 2013, it would have been $42 million. As of December 31, 2013, MTGE’s total shareholders’ equity was $1.1 billion.

ACE I is a private equity fund, which was established in 2006 with $1 billion of equity commitments from third-party investors. At the closing of the fund, ACE I used the majority of its committed capital to purchase 30% of our equity investments in 96 portfolio companies for an aggregate purchase price of $671 million. Also, ACE I co-invested with American Capital in an amount equal to 30% of equity investments made by us between October 2006 and November 2007 until the $329 million remaining equity commitment was exhausted. In addition, 10%, or $100 million, of the $1 billion of distributions to the ACE I investors is recallable for add-on investments. As of December 31, 2013, ACE I investors had invested $1,057 million, received distributions of $1,008 million, had $506 million in total investments at fair value and had $43 million of recallable distributions available for add-on investments. ACAM manages ACE I in exchange for a 2% base management fee on the net cost basis of ACE I’s assets (as of December 31, 2013 the cost basis of ACE I’s assets was $467 million) and 10% to 30% of the net profits of ACE I, subject to certain hurdles (“Carried Interest”). As of December 31, 2013, the Carried Interest allocation to ACAM was $40 million. Due to certain clawback obligations, as defined in ACE I’s operating agreement, as of December 31, 2013, ACAM has not recorded an accrual related to its Carried Interest in ACE I.

ACE II is a private equity fund, which was established in 2007 with $585 million of equity commitments from third-party investors. At the closing of the fund, ACE II used the majority of its committed capital to purchase 17% of our equity investments in 80 portfolio companies for an aggregate purchase price of $488 million. The remaining $97 million equity commitment is being used to fund add-on investments in the 80 portfolio companies. As of December 31, 2013, ACE II investors had invested $513 million, received distributions of $375 million, had $207 million in total investments at fair value and had $72 million of remaining equity commitments available for future add-on investments or cost contributions. ACAM manages ACE II in exchange for a 2% base management fee on the net cost basis of ACE II’s assets (as of December 31, 2013, the cost basis of ACE II’s assets was $243 million) and a 10% to 35% Carried Interest, subject to certain hurdles. As of December 31, 2013, ACAM has not recorded an accrual related to its Carried Interest in ACE II.

In April 2007, ACAS CLO 2007-1 completed a $400 million securitization that invests in broadly syndicated and middle market commercial senior loans. ACAM manages ACAS CLO 2007-1 in exchange for a base management fee of 0.68% of ACAS CLO 2007-1’s assets and a 20% carried interest, subject to certain hurdles.

In September 2012, ACAS CLO 2012-1 completed a $362 million securitization that invests in broadly syndicated commercial senior loans. ACAM manages ACAS CLO 2012-1 in exchange for a base management fee of 0.42% of ACAS CLO

2012-1’s total assets and a 20% carried interest, subject to certain hurdles. A subsidiary of ACAM also purchased 70% of the non-rated equity tranche of subordinated notes in ACAS CLO 2012-1 for $30 million.

In April 2013, ACAS CLO 2013-1 completed a $414 million securitization that invests in broadly syndicated commercial senior secured loans purchased in the primary and secondary markets. ACAM manages ACAS CLO 2013-1 in exchange for a base management fee of 0.50% of ACAS CLO 2013-1’s assets and a 20% carried interest, subject to certain hurdles. A subsidiary of ACAM also purchased 70% of the non-rated equity tranche of subordinated notes in ACAS CLO 2013-1 for $25 million.

In September 2013, ACAS CLO 2013-2 completed a $414 million securitization that invests in broadly syndicated commercial senior secured loans purchased in the primary and secondary markets. ACAM manages ACAS CLO 2013-2 in exchange for a base management fee of 0.50% of ACAS CLO 2013-2’s assets and a 20% carried interest, subject to certain hurdles. American Capital purchased 21% of the non-rated equity tranche of subordinated notes in ACAS CLO 2013-2 for $8 million.

In addition to managing ACAS CLO 2012-1 and ACAS CLO 2013-1, ACAM, through a wholly-owned subsidiary, also holds a direct investment in these funds consisting of 70% of the non-rated equity tranche of subordinated notes with a total fair value of $50 million as of December 31, 2013.

European Capital Investment

European Capital is a wholly-owned investment fund incorporated in Guernsey and is managed by ACAM, through a wholly-owned subsidiary. European Capital invests in senior and mezzanine debt and equity in buyouts of private companies sponsored by European Capital (“European Capital One Stop Buyouts®”), Sponsor Finance Investments and provides capital directly to early stage and mature private and small public companies primarily in Europe. It primarily invests in senior and mezzanine debt and equity.

As of December 31, 2013, European Capital had investments in 33 portfolio companies totaling $1.1 billion at fair value, with an average investment size of $32 million, or 2.6% of its total assets. As of December 31, 2013, European Capital’s five largest investments at fair value were $616 million, or 51% of its total assets.

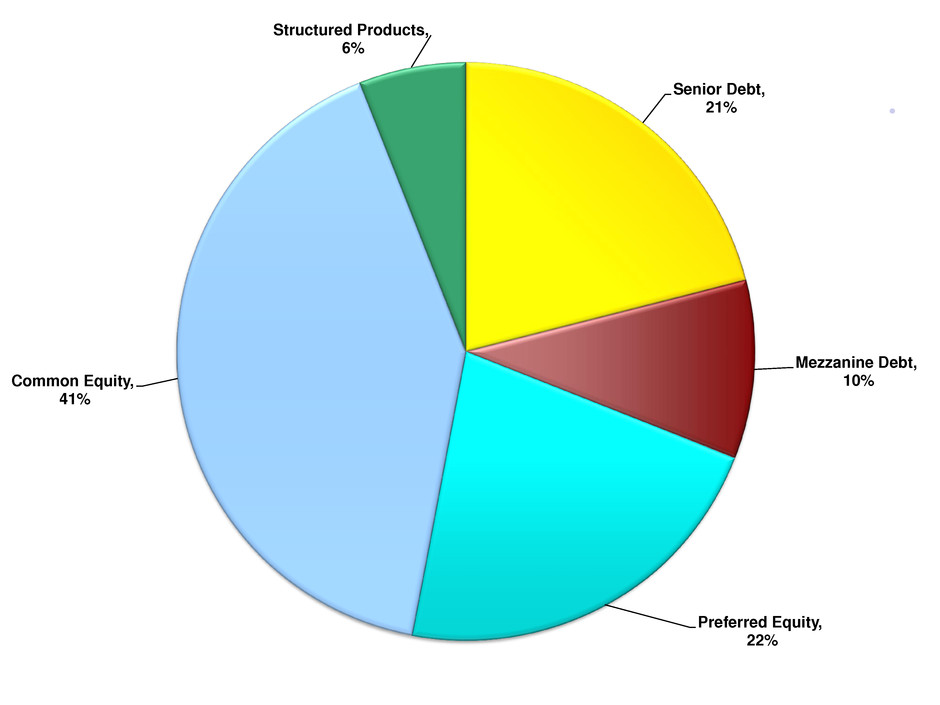

The composition of European Capital’s investment portfolio by business line as of December 31, 2013, at fair value, as a percentage of its total investments, is shown below:

As of December 31, 2013, all of European Capital’s assets are invested in portfolio companies headquartered in countries with AA rating or better based on Standard & Poor’s ratings. As of December 31, 2013, European Capital’s NAV at fair value was $992 million and our investment in European Capital consisted of an equity investment with a cost basis and fair value of $1,093 million and $841 million, respectively. We valued our equity investment in European Capital below its NAV as a result of applying several discounts to its NAV in computing the fair value. See Note 2 to our audited consolidated financial statements included in this Annual Report on Form 10-K for further discussion of our valuation of European Capital.

Structured Products Investments

Our Structured Products investments consist of investments in CLO, CDO and CMBS securities. Our Structured Products investments are generally in non-investment grade securities. Non-investment grade tranches have a higher risk of loss, but are expected to provide a higher yield than investment grade securities. We may also make select investments in investment grade tranches if the expected returns meet our overall portfolio targeted returns. We invest in Structured Products with the intention of holding them until maturity. An active market generally does not exist for most of the non-investment grade tranches of Structured Products in which we invest.

Our investments in CLO securities are generally secured by diverse pools of commercial corporate loans. Our investments are in 31 CLO funds managed by 17 separate portfolio managers. We also invest in CDO securities, which are generally secured by diverse pools of bonds of other securitizations including commercial loans, CMBS and residential mortgage backed securities. Certain of our commercial CLO investments are in a joint venture portfolio company. As of December 31, 2013, our investment in CLO and CDO securities was $278 million at cost and $255 million at fair value, or 5% of our total investments at fair value. This includes our investment in ACAS CLO 2007-1 and ACAS CLO 2013-2, which represents $25 million and $8 million at fair value, respectively.

Our investments in CMBS bonds are secured by diverse pools of commercial mortgage loans. As of December 31, 2013, our total investment in CMBS bonds was $76 million at cost and $21 million at fair value, or less than 1% of our total investments at fair value.

Business Actions and Strategy

During the ten years following our 1997 IPO, our common stock generally traded at a premium to our NAV. However, since 2009, our common stock has traded at a discount to our NAV. This low stock valuation has had an adverse impact on our shareholders and our ability to raise equity capital at an attractive cost, among other consequences. There are a number of actions that we have taken and plan to take that are intended to improve our business, deliver attractive returns to our shareholders and improve our stock valuation. These actions include working to increase the value of our private finance equity investments and our equity investment in European Capital, generating earnings that utilize our deferred tax assets, making appropriate investments in existing portfolio companies, funding all of the capital of new American Capital One Stop Buyouts® so as to permit our equity investments to generate cash yields, making investments in attractive new portfolio companies, growing our asset management business and repurchasing shares of our common stock when they trade below NAV and paying a dividend when we trade above NAV.

In addition to these actions, we have undertaken a process to evaluate our corporate structure and the various legal, regulatory, tax and accounting regimes under which we operate for the purpose of determining whether they are the optimum means for the operation and capitalization of our business. Our change in 2011 from a RIC to a taxable company, which has allowed us to retain our earnings, carry forward NOLs from past periods and to shelter a significant amount of future income from taxation, which we could not do if we were a RIC, is an illustration of how we can be affected by these regimes in ways that may or may not be in the interests of our shareholders. As a result of these evaluations, we may decide to make no change at all, proceed with structural and organizational changes (certain of which may require the approval of our shareholders), which could result in the establishment of externally managed BDCs that may focus on particular investment classes such as mezzanine debt or American Capital One Stop Buyouts®, changes in our corporate form, termination of our election to be regulated as a BDC, or conversion from an investment company to an operating company or other fundamental changes. We may conclude, for example, that it would be preferable to separate our asset management and investment businesses, with the investment businesses managed by the asset management business. Any such changes would be made with the primary intention of promoting shareholder value. Such changes could result in a change in how we account for our investments and our assets, including the consolidation of certain majority owned companies with which we do not now consolidate as an investment company.

Our evaluation process has been lengthy and will likely take significant additional time. In completing the evaluation process, we may incur various costs for which we will not receive any benefit and take certain exploratory actions that may not be indicative of any eventual decisions. We may not necessarily make further announcements about the progress or results of this evaluation process.

Lending and Investment Decision Criteria

We generally review certain criteria in order to make investment decisions. The list below represents a general overview of the criteria we use in making our lending and investment decisions in our private finance business. Not all criteria are required to be favorable in order for us to make an investment. Add-on investments for growth, acquisitions or recapitalizations are based on the same general criteria. Add-on investments in distressed situations are based on the same general criteria, but are also evaluated on the potential to preserve prior investments.

Operating History. We generally focus on middle market companies that have been in business over ten years and have an attractive operating history, including generating positive cash flow. We generally target companies with significant market share in their products or services relative to their competitors. In addition, we consider factors such as customer concentration, performance during recessionary periods, competitive environment and ability to sustain margins. As of December 31, 2013, our current private finance portfolio companies had an average age of 25 years with average revenue and average adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”) for the latest available twelve month period of $178 million, and $49 million, respectively. Adjusted EBITDA may reflect certain adjustments to the reported EBITDA of a portfolio company for non-recurring, unusual or infrequent items or other pro-forma items or events to normalize current earnings which a buyer may consider in a change in control transaction.

Growth. We consider a target company’s ability to increase its cash flow. Anticipated growth is a key factor in determining the ability of the company to repay its debt and the value ascribed to any warrants and equity interests acquired by us.

Liquidation Value of Assets. Although we do not operate as an asset-based lender, liquidation value of the assets collateralizing our loans is a factor in many credit decisions. Emphasis is placed both on tangible assets such as accounts receivable, inventory, plant, property and equipment as well as intangible assets such as brand recognition, market reputation, customer lists, networks, databases and recurring revenue streams.

Experienced Management Team. We consider the quality of senior management to be extremely important to the long-term performance of most companies. Therefore, we consider it important that senior management be experienced and properly incentivized through meaningful ownership interest in the company.

Exit Strategy. Almost all of our investments consist of securities acquired directly from their issuers in private transactions. These securities are rarely traded in public markets, thus limiting their liquidity. Therefore, we consider it important that a prospective portfolio company have a number of methods by which our financing can be repaid and our equity investment sold or redeemed. These methods would typically include the sale or refinancing of the business, the ability to generate sufficient cash flow to repurchase our equity securities and repay our loans or the ability to contribute the security to a fund that we manage.

Structured Products Criteria. We receive extensive information from the issuer regarding their track record and the collateral pool. We underwrite the manager and the collateral securing our investment as appropriate.

Fund Investment Criteria. We receive extensive information from the manager regarding their track record and the investment thesis. We assess the ability to raise capital with the manager and underwrite the manager and the investment strategy as appropriate.

Institutional Approach to Investing

We have built an institution with a leading capability to originate, underwrite, finance, syndicate, monitor and exit investments that generate attractive returns. Our dedicated teams of investment professionals are the cornerstone of our institution. We have also created an extensive support structure that provides in-house due diligence, operational, legal and human resources support to our investment professionals and to our portfolio company, ACAM. The following are our key functional teams.

Investment Teams: As of December 31, 2013, we had 31 Investment Teams with over 90 professionals located in our six offices in the United States, including Investment Teams and professionals of ACAM, but excluding Investment Teams and professionals dedicated to European Capital, AGNC and MTGE. The Investment Teams originate, review and screen investment opportunities, conduct business, management and operations due diligence, prepare investment committee reports and models, make recommendations to the investment committee, execute investments, represent us on the boards of directors of portfolio companies, assist in monitoring and valuing of investments and manage acquisitions, divestitures and exiting of investments. Our Investment Teams are organized so that each team focuses on a specific investment strategy and work cooperatively to share expertise. Our Investment Teams include:

| |

| • | American Capital Buyout: A 27-person team that implements American Capital One Stop Buyouts® of middle market companies including corporate divestitures, acquisitions of portfolio companies from private equity funds, acquisitions of family-owned or closely held businesses, going private transactions and ownership transitions. They originate senior and mezzanine debt and equity in American Capital controlled buyouts. |

| |

| • | Sponsor Finance: A 14-person team that makes senior and mezzanine debt investments and equity co-investments in Sponsor Finance Investments. In addition, they make senior and mezzanine debt and equity investments in privately and publicly-held middle market companies. |

| |

| • | Special Situations: A 6-person team that implements American Capital One Stop Buyouts®, Sponsor Finance Investments and other direct investments in distressed companies, companies undergoing turnarounds, bankruptcy auctions, debtor-in-possession, exit financing and other special situations in middle market companies. They make senior and mezzanine debt and equity investments. |

| |

| • | Technology Investment: A 6-person team that implements our American Capital One Stop Buyouts®, Sponsor Finance Investments and other direct investments in technology companies. They will invest in various technology sectors including networking, software, communications, enterprise data, new media, consumer technologies and industrial technology. They make senior and mezzanine debt and equity investments. |

| |

| • | Commercial Mortgage Asset Management: A 5-person team that invests in commercial mortgages and related assets. The team also participates in underwriting, due diligence and financing of real estate owned by our portfolio companies. |

| |

| • | Leverage Finance: A 17-person team that has responsibility for our investments in and manages senior loan collateral for third-party investors through structured finance products such as a CLO. The team invests in middle market senior loans originated through our various Investment Teams and also by purchasing rated, broadly syndicated commercial senior debt. They also invest in non-rated tranches of CLOs managed by other third-party fund managers. |

| |

| • | Energy and Infrastructure: A 7-person team that invests in energy infrastructure assets in high-growth and developed markets, including power generation facilities, gas and power distribution and transmission networks, energy transportation assets, fuel production opportunities and product and service companies focused on the power and energy sector. |

Operations Team: A 16-person team with expertise in manufacturing services, consumer products, financial services, energy services, supply chain management, outsourcing and technology. The Operations Team includes nine former CEOs and presidents, one former COO, three lean champions, five financial VPs and associates and four supply chain and outsourcing specialists. The Operations Team conducts operational due diligence on prospective portfolio companies and reports and makes recommendations to our investment committee. The team will also assist portfolio companies post close with operational improvement. If we have a portfolio company that is underperforming, the Operations Team will work closely with the portfolio company to improve performance by providing interim leadership at the portfolio company and to identify business actions to help improve performance. The team will provide hands-on assistance to reduce costs, systemize sales and marketing, develop and align business plans, grow the business and strengthen management talent at the portfolio company.

Investment Committee Support Team: A 3-person team that assists our investment committee (the “Investment Committee”) in establishing procedures and controls, establishing due diligence protocol and working with Investment Teams to establish due diligence plans for each prospective investment, developing standard investment committee reports and models, organizing investment committee meetings, monitoring and reporting investment committee results and tracking subsequent developments.

Financial Advisory and Consulting Team (“FACT”): A 29-person team of valuation and audit professionals. FACT is responsible for providing pre- and post-investment financial due diligence, portfolio monitoring and quarterly valuations of portfolio company investments. FACT assists our Investment Teams in conducting extensive financial, accounting and information technology due diligence of each target investment company, which includes one or more on-site visits, a review of the portfolio company’s historical and prospective financial information, and identifying and confirming pro-forma financial adjustments. FACT also monitors the existing portfolio investments by gathering, inputting into an automated database, analyzing and regularly reviewing monthly financial information and other materials to assess financial performance as well as to ensure compliance with loan covenants. Also, FACT, with the assistance of our Investment Teams and subject to the oversight of the Audit and Compliance Committee, prepares a quarterly valuation of each portfolio company investment.

Syndications Team: A 5-person team that is responsible for arranging syndications of all or part of the senior debt of our portfolio companies either at closing or subsequent to the closing of a senior financing transaction. They perform a variety of functions relating to the marketing and completing of such transactions.

Capital Markets, Finance and Treasury Team: A 27-person team that is responsible for raising equity and debt capital, investor relations, financial budgeting and forecasting and daily liquidity and cash management. Through its debt capital raising activities, the team is responsible for structuring, selling and administering on-balance sheet term debt securitizations of debt investments, secured and unsecured bonds and various other revolving facilities and term debt facilities for us and our funds under management. Through its equity capital raising activities, the team is responsible for structuring and selling equity for us and our

public and private funds. The team is also responsible for monitoring and reporting on capital market conditions and researching, developing and raising private and public capital for new third-party funds for our asset management business. The team is also responsible for arranging syndications of all or part of the equity of our portfolio companies either at closing or subsequent to the closing of an equity financing transaction.

Accounting, Tax and Reporting Team: A 40-person team that is responsible for the accounting of our financial results as well as that of our managed funds, including financial reporting and communications to our shareholders, partners and regulatory bodies. Among its tasks are preparing financial statements, investment accounting, analysis of investment performance, loan servicing, billing, accounts receivable and payable, tax compliance, external audit coordination and developing and monitoring our internal controls.

Legal and Compliance Team: A 22-person team that provides legal support on corporate, capital raising and investing matters, is involved in regular reporting and special communications with our shareholders and regulatory bodies and manages the outside law firms that provide transactional, litigation and regulatory services to us. In addition, as required by the Securities and Exchange Commission (“SEC”), we have appointed a Chief Compliance Officer, who is responsible for administering our code of ethics and conduct and our legal compliance activities.

Internal Audit Team: An 8-person team that reports directly to the Audit and Compliance Committee of our Board of Directors. The team tests our internal controls over financial reporting to assist management’s assessment of the effectiveness of our internal controls over financial reporting under the Sarbanes-Oxley Act of 2002.

Human Resources Team: A 7-person team that assists in recruiting and hiring as well as reviewing, establishing and administering compensation programs and benefit plans for our employees. In addition, the team is available to the Investment Teams and the Operations Team to assist with executive management and other human resources issues at portfolio companies.

Information Technology Team: A 30-person team that assists all departments in researching, developing, implementing and maintaining communication and technological resources for our multi-office operations, including highly specialized systems for the input, processing and reporting of data.

Investment Process

Investment Sourcing and Screening: We have a multi-disciplined approach to reach diverse channels of deal sources. Our Investment Teams target a referral network composed of investment bankers, private equity firms, mezzanine debt funds, trade organizations, commercial bankers, attorneys and business and financial brokers. We developed and maintain a proprietary industry-wide database of reported middle market transactions, which enables us to monitor and evaluate the middle market investing environment. This database is used to help us assess whether we are penetrating our target markets and to track terms and pricing. Our financial professionals review financing memorandums and private placement memorandums sourced from this referral network in search of potential buyout or financing opportunities. Our Investment Teams undertake a preliminary evaluation and analysis of potential investment opportunities to determine whether or not they meet our criteria based upon the limited information received in these early stages of the investment process. For investment opportunities that pass an initial screening process, our Investment Teams prepare an initial investment thesis and analysis that is presented to an internal Investment Committee, which includes representatives of our senior officers depending on the nature of the proposed investment, for approval to proceed further.

Due Diligence: In our private finance investments, our investment professionals along with FACT and our Operations Team conduct due diligence of each target company that passes the initial screening process. This includes one or more on-site visits, a review of the target company’s historical and prospective financial information, identifying and confirming pro-forma financial adjustments, interviews with and assessments of management, employees, customers and vendors, review of the adequacy of the target company’s systems, background investigations of senior management and research on the target company’s products, services and industry. We often engage professionals such as environmental consulting firms, accounting firms, law firms, risk management companies and management consulting firms with relevant industry expertise to perform elements of the due diligence.

Investment Approval: Upon completion of our due diligence, our Investment Teams, FACT and our Operations Team, as well as any consulting firms that we have engaged, prepare and present a report containing the due diligence information for review by our Investment Committee. Our Board of Directors has delegated authority to the Investment Committee to conduct the initial review and approval of our investments. Our Investment Committee generally must approve each investment. Investments exceeding a certain size or meeting certain other criteria must also be approved by our Board of Directors. Our Investment Committee is supported by a dedicated staff that focuses on the due diligence and other research done with regard to each proposed investment.

Documentation and Negotiations: Documentation for the legal agreements for a transaction is completed either by our in-house legal team or through the retention of outside legal counsel. We maintain custody of our investment securities and the original

related investment documentation in custodial accounts with qualified banks and members of national securities exchanges in accordance with applicable regulatory and financing requirements.

Investment Funding: Prior to the release of any funding for investments, our treasury department prepares a summary of the investment terms, the funding amounts approved by our Investment Committee and wiring instructions. Our treasury department performs various procedures to confirm any wiring instructions. A senior executive officer must approve this summary of terms and funding amounts prior to the disbursement of the funds.

Portfolio Monitoring: In addition to the due diligence at the time of the original investment decision, we seek to preserve and enhance the performance of our portfolio companies under management through our active involvement with the portfolio companies. As a BDC, we are required by law to make significant managerial assistance available to most of our eligible portfolio companies. This generally includes providing guidance and counsel concerning the management, operations and business objectives and policies of the portfolio company to the portfolio company’s management and board of directors, including participating on the company’s board of directors. The respective Investment Teams, FACT, Operations Teams and accounting teams regularly review each portfolio company’s monthly financial statements to assess performance and trends, periodically conduct on-site financial and operational reviews and evaluate industry and economic issues that may affect the portfolio company.

Investment Exits: We regularly evaluate each investment to determine the appropriate time to exit an investment. For investments that we control, portfolio companies are usually sold through an auction process, following the engagement of an investment bank. For performing investments that we do not control, the exit typically occurs when the sponsor or other party in control of the portfolio company decides to recapitalize or sell the business. In both instances, our debt investment is typically paid in full and any equity investment we own realizes a value consistent with the value realized by the controlling parties. For non-performing investments that we do not control, we may determine that based on the facts and circumstances relating to the investment, to accept an amount less than what we are legally owed with any such decision requiring approval by our Investment Committee.

Portfolio Valuation

FACT, with the assistance of our Investment Teams and subject to the oversight of the Audit and Compliance Committee, prepares a quarterly valuation of each of our portfolio company investments. Our Board of Directors approves our portfolio valuations as required by the 1940 Act.

Competition

We compete with strategic buyers, private equity funds, mezzanine debt funds and other buyers and financing sources, including traditional financial services companies such as finance companies, commercial banks, investment banks and other equity and non-equity based investment funds. Some of our competitors are substantially larger and have considerably greater financial resources than we do. Competitors may have a lower cost of funds and many have access to funding sources that are not available to us. In addition, certain of our competitors may have higher risk tolerances or different risk assessments, which could allow them to consider a wider variety of investments and establish more relationships and build their market shares. There is no assurance that the competitive pressures we face will not have a material adverse effect on our business, financial condition and results of operations. In addition, as a result of this competition, we may not be able to take advantage of attractive investment opportunities from time to time and there can be no assurance that we will be able to identify and make investments that satisfy our investment objectives or that we will be able to meet our investment goals.

Corporate Information

Our executive offices are located at 2 Bethesda Metro Center, 14th Floor, Bethesda, Maryland 20814, and our telephone number is (301) 951-6122. In addition to our executive offices, we, or subsidiaries of our wholly-owned portfolio company ACAM, maintain offices in New York, Chicago, Dallas, Boston, Annapolis (Maryland), London and Paris.

We make available all of our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to such reports free of charge on our internet website at www.AmericanCapital.com as soon as reasonably practical after such material is electronically filed with or furnished to the SEC. These reports are also available on the SEC’s internet website at www.sec.gov. The public may also read and copy paper filings that we have made with the SEC at the SEC’s Public Reference Room, located at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330.

Employees

As of December 31, 2013, we employed 291 full-time employees compared to 256 and 249 full-time employees as of December 31, 2012 and 2011, respectively. We believe that we have excellent relations with our employees.

Business Development Company Requirements

We are a closed-end, non-diversified, management investment company that has elected to be regulated as a BDC under the 1940 Act, and, as such, are subject to regulation under that act.

Qualifying Assets

As a BDC, we may not acquire any asset other than certain qualifying assets described in the 1940 Act, unless, at the time the acquisition is made, the value of such qualifying assets represent at least 70% of the value of our total assets. The principal categories of qualifying assets relevant to our business include the following:

| |

| • | securities purchased in transactions not involving any public offering from: |

| |

| a) | an issuer that (i) is organized and has its principal place of business in the United States, (ii) is neither an investment company other than a wholly-owned small business investment company nor an entity that would be an investment company but for certain statutory exemptions, and (iii) does not have any class of securities listed on a national securities exchange with a market capitalization in excess of $250 million; or |

| |

| b) | an issuer that satisfies the criteria set forth in clauses (a) (i) and (ii) above but not clause (a)(iii), so long as, at the time of purchase, we own at least 50% of (i) the greatest amount of equity securities of the issuer, including securities convertible into such securities and (ii) the greatest amount of certain debt securities of such issuer, held by us at any point in time during the period when such issuer was an eligible portfolio company, except that options, warrants, and similar securities which have by their terms expired and debt securities which have been converted, or repaid or prepaid in the ordinary course of business or incident to a public offering of securities of such issuer, shall not be considered to have been held by us, and we are one of the 20 largest holders of record of such issuer's outstanding voting securities; |

| |

| • | securities of an issuer described in clauses (a)(i) and (ii) above with respect to which we control (alone or together as a part of a group), we in fact exercise a controlling influence over such issuer’s management or policies and a person affiliated with us is on the issuer’s board of directors; |

| |

| • | securities received in exchange for or distributed with respect to securities described above, or pursuant to the exercise of options, warrants or rights relating to such securities; and |

| |

| • | cash, cash items, U.S. government securities, or high quality debt securities maturing in one year or less from the time of investment. |

To include certain securities above as qualifying assets for the purpose of the 70% test, a BDC must either control the issuer of the securities or offer to make significant managerial assistance available to the issuer of those securities, such as providing significant guidance and counsel concerning the management, operations, or business objectives and policies of a portfolio company or making loans to a portfolio company. We make significant managerial assistance available to most of our eligible portfolio companies.

Under the 1940 Act, we may not change the nature of our business so as to cease to be, or withdraw our election as, a BDC without consent of the holders of a majority of our outstanding voting securities. Since we made our BDC election, we have not made any substantial change in our structure or in the nature of our business.

Temporary Investments

Pending investment in other types of qualifying assets described in the 1940 Act, we may invest our funds in cash items, government securities, agency paper or high quality debt securities maturing in one year or less from the time of investment in such high quality debt investments. We refer to such assets and cash herein as temporary investments.

Leverage

The 1940 Act permits us, as a BDC, to issue senior debt securities and preferred stock (collectively, “Senior Securities”) in amounts such that our asset coverage is at least 200% after each issuance of Senior Securities. Asset coverage is defined in the 1940 Act as the ratio which the value of the total assets, less all liabilities and indebtedness not represented by Senior Securities, bears to the aggregate amount of Senior Securities representing indebtedness. Such indebtedness may also be incurred for the purpose of effecting share repurchases. As a result, we are exposed to the risks of leverage. Although we have no current intention to do so, we have retained the right to issue preferred stock, subject to certain limitations under the 1940 Act. As permitted by the

1940 Act, we may, in addition, borrow amounts up to 5% of our total assets for temporary purposes. As of December 31, 2013, our asset coverage was 588%.

Under the 1940 Act, if a BDC has any senior debt securities outstanding that were publicly issued, the BDC must make provision to prohibit the declaration of any dividend (except a dividend payable in the stock of the BDC) if its asset coverage is below 200% at the time of the distribution after deducting the amount of such dividend.

Issuance of Stock

As a BDC, we are generally not able to issue and sell our common stock at a price below our NAV per share, exclusive of any distributing commission or discount, except (i) with the prior approval of a majority of our shareholders, (ii) in connection with a rights offering to our existing shareholders, or (iii) under such other circumstances as the SEC may permit. As of December 31, 2013, our NAV was $18.97 per share and our closing market price was $15.64 per share. As of the date of this filing, we do not have any authorization to issue shares of our common stock below our NAV per share.

Investment Objectives

Our primary business objectives are to increase our net earnings and NAV by investing in senior and mezzanine debt and equity securities of private companies and funds managed by ACAM with attractive current yields and/or potential for equity appreciation and realized gains. Our investment objectives provide that:

| |

| • | We will at all times conduct our business so as to retain our status as a BDC. In order to retain that status, we may not acquire any assets (other than non-investment assets necessary and appropriate to our operations as a BDC) if after giving effect to the acquisition the value of our qualifying assets under the 1940 Act amounts to less than 70% of the value of our total assets. See “Business Development Company Requirements” for a discussion of certain qualifying assets described in the 1940 Act. We believe that most of the securities we will acquire (provided that we control, or through our officers or other participants in the financing transaction, make significant managerial assistance available to the issuers of these securities), as well as temporary investments, will generally be qualifying assets. Securities of public companies with a market capitalization in excess of $250 million, on the other hand, are generally not qualifying assets unless they were acquired in a distribution, in exchange for or upon the exercise of a right relating to securities that were qualifying assets. |

| |

| • | We may invest up to 100% of our assets in securities acquired directly from issuers in privately-negotiated transactions. With respect to such securities, we may, for the purpose of public resale, be deemed an “underwriter” as that term is defined in the Securities Act of 1933. |

| |

| • | We may issue Senior Securities to the extent permitted by the 1940 Act for the purpose of making investments, to fund share repurchases, or for temporary or emergency purposes. As a BDC, we may issue Senior Securities up to an amount so that the asset coverage, as defined in the 1940 Act, is at least 200% immediately after each issuance of Senior Securities. |

| |

| • | We generally will not (a) act as an underwriter of securities of other issuers (except to the extent that we may (i) be deemed an “underwriter” of securities purchased by us that must be registered under the Securities Act of 1933 before they may be offered or sold to the public or (ii) underwrite securities to be distributed to or purchased by our shareholders in connection with offerings of securities by companies in which we are a shareholder); (b) sell securities short (except with regard to managing risks associated with publicly traded securities issued by portfolio companies); (c) purchase securities on margin (except to the extent that we may purchase securities with borrowed money); (d) write or buy put or call options (except (i) to the extent of warrants or conversion privileges in connection with our acquisition financing or other investments, and rights to require the issuers of such investments or their affiliates to repurchase them under certain circumstances, or (ii) with regard to managing risks associated with publicly traded securities issued by portfolio companies); (e) engage in the purchase or sale of commodities or commodity contracts, including futures contracts (except where necessary in working out distressed loan or investment situations); or (f) acquire more than 3% of the voting stock of, or invest more than 5% of our total assets in any securities issued by, any other investment company (as defined in the 1940 Act), except as they may be acquired as part of a merger, consolidation or acquisition of assets or as otherwise permitted by the staff of the SEC. With regard to that portion of our investments in securities issued by other investment companies it should be noted that such investments may subject our shareholders to additional expenses. |

The percentage restrictions set forth above, other than the restriction pertaining to the issuance of Senior Securities, as well as those contained elsewhere herein, apply at the time a transaction is effected, and a subsequent change in a percentage resulting from market fluctuations or any cause other than an action by us will not require us to dispose of portfolio securities or to take other action to satisfy the percentage restriction.

The above investment objectives have been set by our Board of Directors and do not require shareholder consent to be changed.

Investment Advisor

We have no investment advisor and are internally managed by our executive officers under the supervision of our Board of Directors.

You should carefully consider the risks described below, as well as other information contained in this Annual Report on Form 10-K, including our consolidated financial statements and the related notes thereto before making an investment decision. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect us in the future. Any of the following risks could materially adversely affect our business, financial condition, results of operations or cash flows. In such case, you may lose all or part of your original investment. The risks discussed below also include forward-looking statements, and our actual results may differ substantially from those discussed in these forward-looking statements. See “Forward-Looking Statements” in this Annual Report on Form 10-K.

Risks Related to Our Business and Structure

Future adverse market and economic conditions could cause harm to our operating results

Past recessions have had a significant negative impact on the operating performance and fair value of our portfolio investments. Many of our portfolio companies could be adversely impacted again by any future economic downturn or recession and may be unable to repay our debt investments, may be unable to be sold at a price that would allow us to recover our investment, or may be unable to operate during such recession. Such portfolio company performance could have a material adverse effect on our business, financial condition and results of operations.

We have loans to and investments in middle market borrowers who may default on their loans and we may lose our investment

We have invested in and made loans to privately-held, middle market businesses and plan to continue to do so. There is generally a limited amount of publicly available information about these businesses. Therefore, we rely on our principals, associates, analysts, other employees and consultants to investigate and monitor these businesses. The portfolio companies in which we have invested may have significant variations in operating results, may from time to time be parties to litigation, may be engaged in rapidly changing businesses with products subject to a substantial risk of obsolescence, may require substantial additional capital to support their operations, to finance expansion or to maintain their competitive position, may otherwise have a weak financial position or may be adversely affected by changes in the business cycle. Our portfolio companies may not meet net income, cash flow and other coverage tests typically imposed by senior lenders. Numerous factors may affect a portfolio company’s ability to repay its loans, including the failure to meet its business plan, a downturn in its industry or negative economic conditions. Deterioration in a portfolio company’s financial condition and prospects may be accompanied by deterioration in the collateral for the loan. We have also made unsecured and mezzanine loans and invested in equity securities, which involve a higher degree of risk than senior secured loans. In certain cases, our involvement in the management of our portfolio companies may subject us to additional defenses and claims from borrowers and third-parties. These conditions may make it difficult for us to obtain repayment of our investments.

Middle market businesses typically have narrower business lines and smaller market shares than large businesses. They tend to be more vulnerable to competitors’ actions and market conditions, as well as general economic downturns. In addition, these companies may face intense competition, including competition from companies with greater financial resources, more extensive development, manufacturing, marketing, and other capabilities, and a larger number of qualified managerial and technical personnel.

These businesses may also experience substantial variations in operating results. Typically, the success of a middle market business also depends on the management talents and efforts of one or two persons or a small group of persons. The death, disability or resignation of one or more of these persons could have a material adverse impact on us. In addition, middle market businesses often need substantial additional capital to expand or compete and may have borrowed money from other lenders with claims that are senior to our claims.

Our senior loans generally are secured by the assets of our borrowers; however, certain of our senior loans may have a second priority lien and thus, our security interest may be subordinated to the payment rights and security interest of the first lien senior lender. Additionally, our mezzanine loans may or may not be secured by the assets of the borrower; however, if a mezzanine loan is secured, our rights to payment and our security interest are usually subordinated to the payment rights and security interests of the first and second lien senior lenders. Therefore, we may be limited in our ability to enforce our rights to collect our second lien senior loans or mezzanine loans and to recover any of the loan balance through a foreclosure of collateral.

Non-accruing loans adversely affect our results of operations and financial condition and could result in further losses in the future

As of December 31, 2013 and 2012, our non-accruing loans at cost totaled $287 million and $260 million, or 17.0% and 12.9% of our total loans at cost, respectively. Non-accruing loans adversely affect net income in various ways. Upon becoming non-accruing, we reverse prior PIK income from a non-accruing loan, and no interest income is recorded on non-accruing loans, thereby, in both cases, adversely affecting income and returns on assets and equity. There is no assurance that we will not experience further increases in non-accruing loans in the future, or that non-accruing loans will not result in further losses to come.

There is uncertainty regarding the value of our portfolio investments

Virtually none of our portfolio investments are publicly traded. As required by law, we fair value these investments in accordance with the 1940 Act and Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 820, Fair Value Measurements and Disclosures (“ASC 820”) based on a determination made in good faith by our Board of Directors. Due to the uncertainty inherent in valuing investments that are not publicly traded, as set forth in our audited consolidated financial statements included in this Annual Report on Form 10-K, our determinations of fair value may differ materially from the values that would exist if a ready market for these investments existed. Our determinations of the fair value of our investments have a material impact on our net earnings through the recording of unrealized appreciation or depreciation of investments as well as our assessment of income recognition. Thus, our NAV could be materially affected in the event of any changes in applicable law or accounting pronouncements governing how we currently fair value assets, or if our determinations regarding the fair value of our investments are materially different from the values that would exist if a ready market existed for these securities.

Our business has significant capital requirements and may be adversely affected by a prolonged inability to access the capital markets or to sell assets

Our business requires a substantial amount of capital to operate. We historically have financed our operations, including the funding of new investments, through cash generated by our operating activities, the repayment of debt investments, the sale of equity investments, the issuance of debt by special purpose affiliates to which we have contributed loan assets, the sale of our stock and through secured and unsecured borrowings. Our ability to continue to rely on such sources or other sources of capital is affected by restrictions in both the 1940 Act and in certain of our debt agreements relating to the incurrence of additional indebtedness as well as changes in the capital markets from the recent economic recession. It is also affected by legal, structural and other factors. There can be no assurance that we will be able to earn or access the funds necessary for our liquidity requirements.

Our ability to recognize the benefits of our deferred tax asset is dependent on future taxable income and could be substantially limited if we experience an “ownership change” within the meaning of Section 382 of the Code

We recognize the expected future tax benefit from a deferred tax asset when the tax benefit is considered more likely than not to be realized. Otherwise, a valuation allowance is applied against the deferred tax asset. Assessing the recoverability of a deferred tax asset requires management to make significant estimates related to expectations of future taxable income. Estimates of future taxable income are based on forecasted cash flows from investments and operations, the character of expected income or loss as either capital or ordinary and the application of existing tax laws in each jurisdiction. To the extent that future cash flows and the amount or character of taxable income differ significantly from estimates, our ability to realize the deferred tax asset could be impacted. See Note 11 to our audited consolidated financial statements included in this Annual Report on Form 10-K.