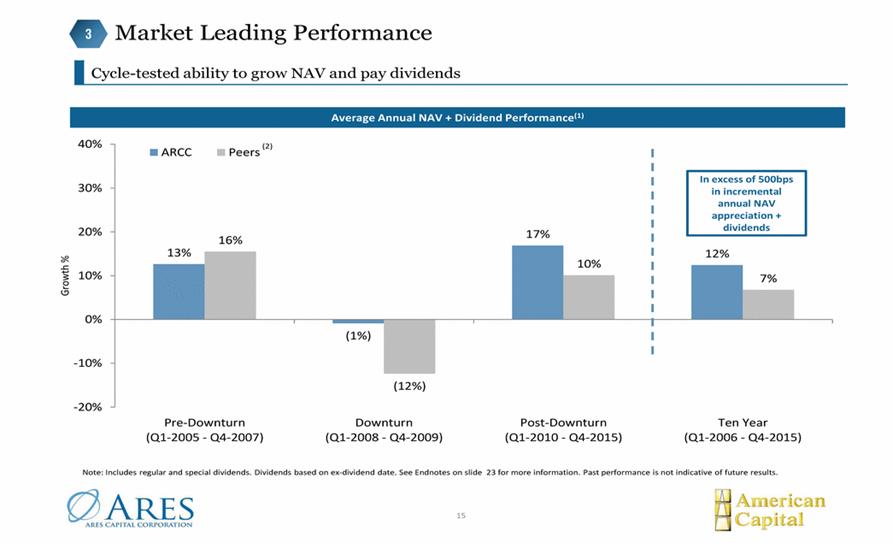

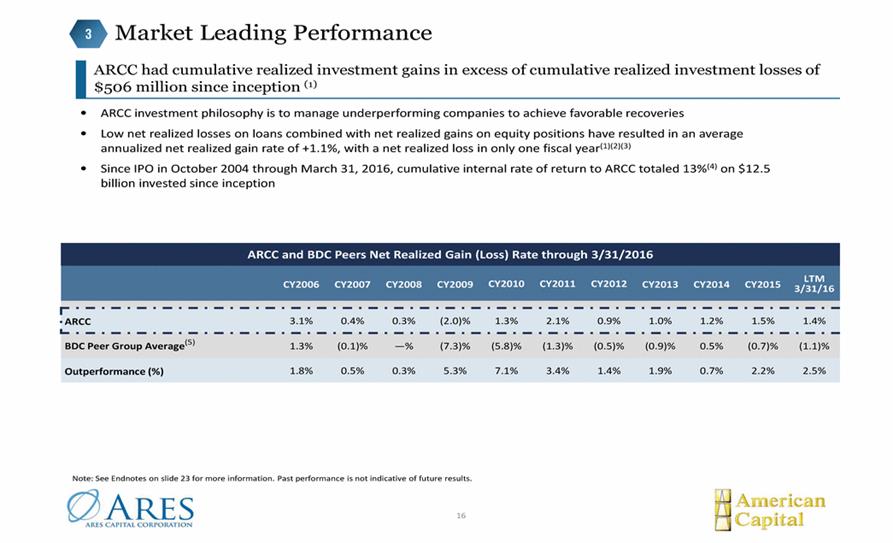

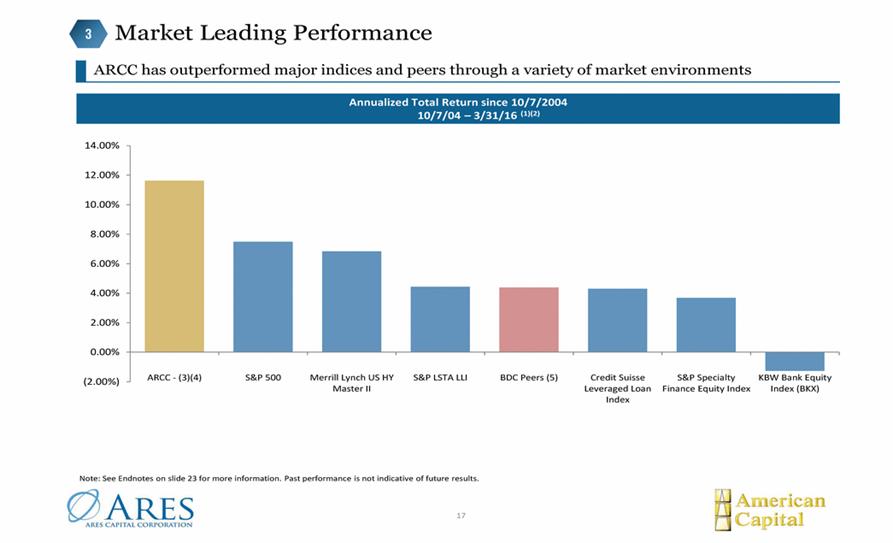

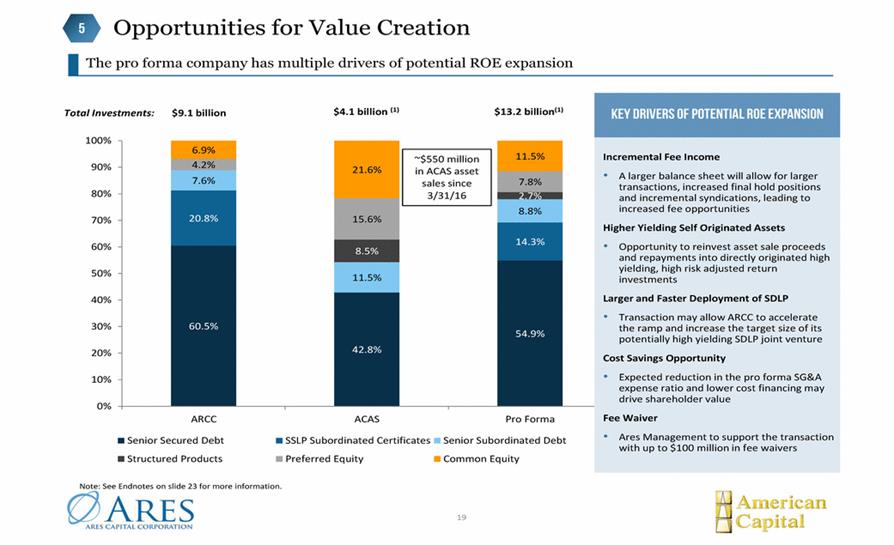

Endnotes Slide 15 Represents the average of annualized NAV plus dividends for the relevant periods. Peers include BDCs that began trading publicly before and within one year after ARCC’s initial public offering on October 5, 2004 and with market capitalization or an investment portfolio fair value of $500 million or greater as of March 31, 2016 or who are under common management with a BDC that meets these criteria (ACAS, AINV, HTGC, PSEC and TICC). Slide 16 From inception through March 31, 2016, excludes $196 million one-time gain on the acquisition of Allied Capital in Q2-10 and gains/losses from extinguishment of debt and sale of other assets. Calculated as an average of the historical annual net realized gain/loss rates (where annual net realized gain/loss rate is calculated as the amount of net realized gains/losses for a particular period from ARCC IPO in October 2004 to December 31, 2015 divided by the average quarterly investments at amortized cost in such period). For purposes of this calculation, SSLP sub certs are considered debt investments. Based on original cash invested, net of syndications, of approximately $12.5 billion and total proceeds from such exited investments of approximately $15.3 billion. Internal rate of return ("IRR") is the discount rate that makes the net present value of all cash flows related to a particular investment equal to zero. Internal rate of return is gross of management fees and expenses related to investments as these fees and expenses are not allocable to specific investments. The effect of such management and other expenses may reduce, maybe materially, the IRR’s shown herein. Investments are considered to be exited when the original investment objective has been achieved through the receipt of cash and/or non-cash consideration upon the repayment of ARCC’s debt investment or sale of an investment, or through the determination that no further consideration was collectible and, thus, a loss may have been realized. These IRR results are historical results relating to ARCC’s past performance and are not necessarily indicative of future results, the achievement of which cannot be assured. BDC peer group consists of BDCs with market capitalization or an investment portfolio fair value of $500 million or greater as of March 31, 2016 or who are under common management with a BDC that meets these criteria. Peers include ACAS, AINV, BKCC, CPTA, FSC, FSFR, FSIC, GBDC, GSBD, HTGC, MAIN, MCC, NMFC, PFLT, PNNT, PSEC, SLRC, SUNS, TCAP, TCPC, TCRD, TICC and TSLX. Slide 17 The benchmarks included represent investments in either the U.S. non-investment grade credit or equity market. The Merrill Lynch US HY Master II is a broad index tracking high-yield corporate bonds, the S&P 500 Index is a broad index tracking the U.S. equity markets, the S&P LSTA LLI is a broad index tracking the U.S. loan market and the Credit Suisse Leveraged Loan Index is a broad index tracking the non-investment grade bank loans. Time period selected to include ARCC IPO in October 2004. Ares Capital's stock price-based total return is calculated assuming dividends are reinvested at the end of day stock price on the relevant quarterly ex-dividend dates. Total return is calculated assuming investors did not participate in Ares Capital's rights offering issuance as of March 20, 2008. Peers include BDCs that began trading publicly before and within one year after ARCC’s initial public offering on October 5, 2004 and with market capitalization or an investment portfolio fair value of $500 million or greater as of March 31, 2016 or who are under common management with a BDC that meets these criteria (ACAS, AINV, HTGC, PSEC and TICC). Slide 19 Total pro forma investments as of March 31, 2016, excluding fair value related to American Capital Mortgage Management, LLC and does not reflect any asset sales prior to closing. The weighted average yield on the total investment portfolio at amortized cost is computed as (a) annual stated interest rate or yield earned divided by (b) total investments at amortized cost.