UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| | þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009

OR

| | ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 814-00149

AMERICAN CAPITAL, LTD.

| | |

| Delaware | | 52-1451377 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

2 Bethesda Metro Center

14th Floor

Bethesda, Maryland 20814

(Address of principal executive offices)

(301) 951-6122

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

| Title of each class | | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | | The NASDAQ Stock Market LLC |

| | (NASDAQ Global Select Market) |

Securities registered pursuant to section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨. No þ.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨. No þ.

Indicate by check mark whether the registrant (1) has filed all reports to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter earlier period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ. No ¨.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Act.

| | |

Large accelerated filer þ | | Accelerated filer ¨ |

Non-accelerated filer ¨ (Do not check if a smaller reporting company) | | Smaller Reporting Company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No. þ

As of June 30, 2009, the aggregate market value of the Registrant’s common stock held by non-affiliates of the Registrant was approximately $682 million based upon a closing price of the Registrant’s common stock of $3.21 per share as reported on The NASDAQ Global Select Market on that date. (For this computation, the registrant has excluded the market value of all shares of its common stock reported as beneficially owned by executive officers and directors of the registrant and certain other shareholders; such an exclusion shall not be deemed to constitute an admission that any such person is an “affiliate” of the registrant.)

As of February 1, 2010, there were 281,153,012 shares of the Registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE. The Registrant’s definitive proxy statement for the 2010 Annual Meeting of Stockholders is incorporated by reference into certain sections of Part III herein.

Certain exhibits previously filed with the Securities and Exchange Commission are incorporated by reference into Part IV of this report.

AMERICAN CAPITAL, LTD.

TABLE OF CONTENTS

2

PART I

Item 1.Business

General

American Capital, Ltd. (formerly known as American Capital Strategies, Ltd, and is referred to throughout this report as “American Capital”, “we” and “us”) is a publicly traded private equity firm and global asset manager. We invest in private equity, private debt, private real estate investments, early and late stage technology investments, special situation investments, alternative asset funds managed by us and structured finance investments. These investments constitute, in part, what are considered alternative assets. We provide investors the opportunity to participate in the private equity and alternative asset management industry through an investment in our publicly traded stock.

On August 29, 1997, we completed an initial public offering (“IPO”) and became a non-diversified closed end investment company that has elected to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940, as amended (“1940 Act”). As a BDC, we primarily invest in senior debt, subordinated debt and equity in the buyouts of private companies sponsored by us, the buyouts of private companies sponsored by other private equity firms and provide capital directly to early stage and mature private and small public companies. We refer to our investments in these companies as our private finance portfolio. We also invest in structured financial product investments (“Structured Products”) including commercial mortgage backed securities (“CMBS”), commercial collateralized loan obligation (“CLO”) securities and collateralized debt obligation (“CDO”) securities and invest in alternative asset funds managed by us. We are also an alternative asset manager with $12.7 billion of capital resources under management as of December 31, 2009, including $6.0 billion of third-party assets. Our third-party alternative asset fund management services are conducted through our wholly-owned portfolio company, American Capital, LLC. Our primary business objectives are to increase our taxable income, net realized earnings and net asset value (“NAV”) by making investments with attractive current yields and/or potential for equity appreciation and realized gains.

We also operate so as to qualify to be taxed as a regulated investment company (“RIC”) as defined in Subtitle A, Chapter 1, under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). As a RIC, we are not subject to federal income tax on the portion of our taxable income and capital gains we distribute to our shareholders.

In addition to managing American Capital’s assets and providing management services to portfolio companies of American Capital, we, through our ownership of American Capital, LLC, also manage the following alternative asset funds: European Capital Limited (“European Capital”), American Capital Agency Corp. (“AGNC”), American Capital Equity I, LLC (“ACE I”), American Capital Equity II, LP (“ACE II”), ACAS CLO 2007-1, Ltd. (“ACAS CLO-1”) and ACAS CRE CDO 2007-1, Ltd. (“ACAS CRE CDO”).

Significant Developments in our Business in 2009

Unsecured Debt Default and Restructuring Efforts

Since December 31, 2008, we have been in breach of financial covenants under our primary unsecured debt arrangements totaling $2.4 billion as of December 31, 2009. Through the course of 2009, we have had active discussions with the creditors under these arrangements to negotiate a comprehensive restructuring of our unsecured debt. In November 2009, we reached an agreement in principle with a steering committee of the lenders under our unsecured revolving credit facility (the “Credit Facility”) with respect to the material terms of a proposed restructuring of the Credit Facility (the “Restructuring”), which also required that our other primary unsecured debt arrangements be restructured on generally similar terms. Representatives of the holders of our private unsecured notes and public unsecured notes and their advisors participated with the bank steering committee in various parts of the negotiations. We subsequently entered into a lock up agreement with all of the lenders under the Credit Facility to further our efforts to restructure all of our primary unsecured debt

3

arrangements based on the proposed Restructuring. Under the current terms of the proposed Restructuring, the loans outstanding under the Credit Facility and our private unsecured notes and public unsecured notes would be exchanged for term debt secured by a pledge of substantially all of our unencumbered assets. Key terms of the proposed Restructuring include (i) an aggregate $450 million principal payment at closing, (ii) scheduled aggregate principal amortization of $250 million in 2010, $300 million in 2011, $350 million in 2012, and $300 million in 2013 with any remaining unpaid principal due at maturity on December 31, 2013, (iii) deferral through 2013 of up to $200 million in the aggregate of annual scheduled principal amortization, which is limited to $100 million in 2010, (iv) an interest rate of the greater of 2.00% or LIBOR, plus a spread based on the aggregate outstanding principal balance of (a) 9.50% if the outstanding obligations are greater than or equal to $1.7 billion, (b) 8.50% if the outstanding obligations are less than $1.7 billion but greater than or equal to $1.4 billion, (c) 6.50% if the outstanding obligations are less than $1.4 billion but greater than or equal to $1.0 billion, or (d) 5.50% if the outstanding obligations are less than $1.0 billion, (v) an additional interest spread of 0.50% each time that certain additional principal amortizations, which are greater than the scheduled principal amortizations noted above, are not met, (vi) an additional 1.00% if we defer any portion of the scheduled principal amortization due in 2010, and (vii) the payment of fees equal to 2.00% of the aggregate principal balance at closing, and 1.00% at both December 31, 2011 and 2012.

The proposed Restructuring contemplates that there will be a voluntary amendment and restatement of the Credit Facility and an exchange of the unsecured private notes and unsecured public notes for new securities (collectively, the “Exchange Transaction”). In the event that fewer than 100% of the lenders under our Credit Facility, fewer than 100% of the holders of our private unsecured notes and holders of less than 85% of the principal amount of our public unsecured notes agree to enter the Exchange Transaction, we intend to implement the proposed Restructuring by soliciting votes for a prepackaged reorganization under Title eleven of the United States Code (the “Plan”) and commence a voluntary reorganization case under Title eleven of the United States Code (a “Restructuring Case”). We plan to commence the Exchange Transaction and solicitation of votes for the Plan simultaneously in March 2010.

The lock up agreement generally requires all of the lenders under the Credit Facility to agree to the proposed Restructuring assuming specified conditions are met. However, the lock up agreement may be terminated if various stages of the proposed Restructuring are not completed by certain dates. These deadlines were extended twice in January 2010. Currently, the lock up agreement may be terminated (i) upon consummation of the Exchange Transaction and the effective date of the Plan or a written agreement to terminate the lock up agreement, (ii) if the Exchange Transaction is not consummated in accordance with the proposed Restructuring and we have not commenced a Restructuring Case by March 15, 2010 (unless the administrative agent under the Credit Facility agrees to an extension of not later than March 31, 2010) or (iii) if we commence a Restructuring Case and (1) any material order is entered that is inconsistent with the lock up agreement or the proposed Restructuring, which is objected to by a majority of the lenders, (2) an order finding that the solicitation complying with applicable law and confirming the Plan has not been entered on or before May 15, 2010 (unless the administrative agent under the Credit Facility agrees to an extension of not later than May 31, 2010) or (3) the Plan is not consummated by May 31, 2010, or the Restructuring Case is dismissed or converted to a case under Chapter seven of Title eleven of the United States Code (the “Accelerated Case”) or a trustee or examiner shall have been appointed in the Restructuring Case. In addition, either party may terminate the lock up agreement upon a breach of material obligations by the other party. Because we have not launched the Exchange Transaction as of the date of this filing and the tender offer rules under the Securities Exchange Act of 1934, as amended, require that such offers generally remain open for 20 business days, it is likely that we will be unable to complete the Exchange Transaction by the above deadlines. We may seek an amendment to the lock up agreement to further extend the deadlines for consummating the Exchange Transaction or we may proceed with the proposed Restructuring without a lock up agreement with the lenders under the Credit Facility. We do not have a lock up agreement with our other unsecured creditors. As noted above, if the requisite lenders and noteholders do not agree to the Exchange Transaction, we intend to implement the proposed Restructuring by soliciting votes for a Plan. We expect that we will ultimately be successful in completing the proposed Restructuring.

4

Portfolio Liquidity through Realizations

As part of our overall debt restructuring efforts, we developed a plan at the beginning of 2009 to reduce the risk within our capital structure by delevering our balance sheet. To further those efforts during 2009, we evaluated each of our portfolio investments to determine if a current sale would yield attractive investment returns. As a result, we proactively exited select investments, realizing $1.1 billion of cash proceeds from exits during 2009 through the sale or repayment of debt and equity investments. We exited both performing and non-performing assets during 2009 at approximately fair value, evidenced by the realized proceeds from fully exited investments being within 1% of the prior quarter’s valuation. To the extent that any realized proceeds were not required to pay down principal balances in our asset securitizations or to fund our ongoing operations, including providing capital to our existing portfolio investments to maintain or improve those investments, we held the cash proceeds in anticipation of completing a restructuring of our debt obligations in 2010. Our cash and cash equivalents increased $626 million during the year to an ending balance of $835 million as of December 31, 2009.

Strategic Restructurings

To better align our organization and cost structure with current economic conditions, we performed strategic reviews of our business in 2009 and 2008 which resulted in the closing of several offices and the elimination of certain functions at other offices. During 2009, we recorded an aggregate restructuring charge of $25 million, including $9 million for severance and related costs associated with 72 employees and $16 million of costs related to excess facilities. During 2008, we recorded an aggregate restructuring charge of $19 million, including $10 million for severance and related costs associated with 160 employees and $9 million of costs related to excess facilities. In total, our restructuring efforts and attrition have decreased our employee headcount by more than 380 employees, or 55%, and we have reduced our number of offices by 50% since the peak in the first quarter of 2008.

Acquisition of European Capital

On November 10, 2008, American Capital and European Capital entered into an implementation agreement regarding our proposal to acquire all of the ordinary shares of European Capital held by other investors, representing 32.3% of European Capital’s outstanding ordinary shares, by means of a “scheme of arrangement” under Guernsey company law. Under the terms of the agreement, each European Capital shareholder other than us would receive 0.333 shares of our common stock for every one ordinary share that they owned of European Capital. On February 19, 2009, our shareholders approved a proposal authorizing us to sell shares of our common stock below NAV per share in certain instances, including in connection with the proposed acquisition of European Capital. On March 19, 2009, the proposed transaction was approved by a special majority of the shareholders of European Capital, not including us. The acquisition became effective as of March 26, 2009, following approval of the Royal Court of Guernsey. In connection with the transaction, we issued 11.5 million shares of our common stock with a value of $25 million as of March 26, 2009 in exchange for the outstanding European Capital ordinary shares. As of December 31, 2009, our investment in European Capital had a fair value of $269 million.

American Capital Investment Portfolio

We provide investment capital to middle market companies, which we generally consider to be companies with sales between $10 million and $750 million. We primarily invest in senior debt, subordinated debt and equity in the buyouts of private companies sponsored by us, the buyouts of private companies sponsored by other private equity firms and provide capital directly to early stage and mature private and small public companies. Currently, we will invest up to $100 million in a single middle market transaction in North America. We also invest in Structured Products and alternative asset funds managed by us. For summary financial information by geographic area, see Note 4 to our consolidated financial statements in this Annual Report on Form 10-K.

5

Since our IPO through December 31, 2009, we invested committed capital of over $5.7 billion in equity securities and over $16.8 billion in debt securities of middle market companies and also invested $1.7 billion in Structured Products. We have had 282 exits and repayments of over $13.1 billion of our originally invested committed capital, representing 54% of our total capital committed since our IPO, earning a 14% compounded annual return on these investments, including the interest, dividends, fees and net realized gains over the life of the investments. We have earned a 29% compounded annual return on the exit of our equity securities, including dividends, fees and net realized gains. Since our IPO through December 31, 2009, we have realized $1.4 billion in gross portfolio realized gains and $1.6 billion in gross portfolio realized losses resulting in $170 million in cumulative portfolio net realized losses, excluding net gains and losses attributable to interest rate swap agreements, foreign currency and taxes on net realized gains.

As of December 31, 2009, we had investments in 187 portfolio companies with an average investment size, at fair value, of $30 million, or 0.4% of total assets. As of December 31, 2009, our ten largest investments at fair value were as follows (in millions):

| | | | | |

Company | | Industry | | Fair Value |

Mirion Technologies | | Electrical Equipment | | $ | 322 |

European Capital | | Diversified Financial Services | | | 269 |

WIS Holding Company, Inc. | | Commercial Services & Supplies | | | 276 |

SMG Holdings, Inc. | | Hotels, Restaurants & Leisure | | | 236 |

Affordable Care Holding Corp. | | Health Care Providers & Services | | | 186 |

Orchard Brands Corporation | | Internet & Catalog Retail | | | 172 |

WRH, Inc. | | Life Sciences Tools & Services | | | 170 |

RDR Holdings, Inc. | | Household Durables | | | 155 |

SPL Acquisition Corp. | | Pharmaceuticals | | | 141 |

CIBT Travel Solutions, Inc | | Commercial Services & Supplies | | | 136 |

| | | | | |

Total | | | | $ | 2,063 |

| | | | | |

Business

Private Finance Investments Overview

Historically, a majority of our investment financings have been to assist in the funding of change of control management buyouts of privately held middle market companies, and we expect that trend to continue. A change of control transaction could be the result of a sale of a portfolio company by another private equity firm, a corporate divestiture, a sale of a family-owned or closely-held business, a going private transaction or an ownership transition. Our financing of a change of control management buyout could either be for a buyout sponsored by us or for a buyout sponsored by another private equity firm. As an investor in the buyouts of other private equity firms, we support other private equity sponsors with subordinated debt, senior debt and minority equity investments in order to allow them to leverage their capital base. Since our IPO, we have partnered with approximately 150 equity sponsors. We expect that in the future a majority of any investments in new portfolio companies would be to provide senior and subordinated debt to portfolio companies of other private equity firms and that equity for buyouts sponsored by us in new portfolio companies will be done through funds that we manage.

Our loans typically range from $5 million to $100 million, mature in five to ten years, and require monthly or quarterly interest payments at fixed rates or variable rates generally based on LIBOR, plus a margin. We price our debt and equity investments based on our analysis of each transaction. As of December 31, 2009, the weighted average effective interest rate on our private finance debt investments was 9.9%, which includes the impact of non-accruing loans. As of December 31, 2009, we had a fully-diluted weighted average ownership interest of 45% in our private finance portfolio companies with a total equity investment at fair value of over $1.6 billion.

6

Our private finance portfolio investments consist of loans and equity securities primarily to privately-held middle market companies. There is generally no publicly available information about these companies and a primary or secondary market for the trading of these privately issued loans and equity securities generally does not exist. These investments have been historically exited through normal repayment or a change in control transaction such as a sale or recapitalization of the portfolio company. The opportunity to be repaid or exit our investments may occur if a portfolio company repays our loans out of cash flows, refinances our loans, is sold in a change of control transaction, or sells its equity in a public offering, or if we exercise any put rights or sell our privately-held debt or equity investments in a secondary market. As a public company, we can invest with a long-term horizon compared to a limited partnership, which typically has a finite life and must sell investments in order to return capital to investors in a short time horizon.

Our ability to fund the entire capital structure is a competitive advantage in completing many middle market transactions. We often sponsor One-Stop Buyouts™ in which we provide most, if not all, of the senior debt, subordinated debt and equity financing in the transaction. We may initially fund all of the senior debt at closing and syndicate it to third-party lenders post closing. We have a loan syndications group that arranges to have all or part of the senior loans syndicated to third-party lenders. In the future, we expect that we will fund the equity for our One-Stop Buyouts™ from funds that we manage.

As a BDC, we are required by law to make significant managerial assistance available to most of our portfolio companies. Such assistance typically involves providing guidance and counsel concerning the management, operations and business objectives and policies of the portfolio company to its management and board of directors, including participating on the company’s board of directors. As of December 31, 2009, we had board seats at 78 out of 142 of our private finance and managed fund portfolio companies and had board observation rights on 22 of our remaining private finance portfolio companies. We also have an operations team, including ex-CEOs with significant turnaround and bankruptcy experience, which provides intensive operational and managerial assistance. Providing assistance to our portfolio companies serves as an opportunity for us to maximize their value.

Structured Product Investments

Our Structured Product investments are generally in non-investment grade tranches, which means that major rating agencies rate them below the top four investment-grade rating categories (i.e., “AAA” through “BBB”). Non-investment grade tranches have a higher risk of loss but are expected to provide a higher yield than investment grade securities. We may also make select investments in investment grade tranches if the expected returns meet our overall portfolio targeted returns. We invest in Structured Products with the intention of holding them until maturity. An active market for most of the non-investment grade tranches of Structured Products in which we invest generally does not exist.

Our investments in CMBS bonds are secured by diverse pools of commercial mortgage loans. We also have an investment in ACAS CRE CDO, which is a commercial real estate CDO secured by CMBS bonds. Since our IPO through December 31, 2009, we have made $1.3 billion of investments in CMBS bonds. As of December 31, 2009, our total investment in CMBS bonds and ACAS CRE CDO was $645 million at cost and $52 million at fair value, or only 1% of our total investments. Since we invested in the CMBS bonds, the overall commercial real estate market has experienced a significant decline in value. The current macroeconomic factors have resulted in a higher rate of default and likely higher future loss rate of the loan collateral compared to what we originally expected when we underwrote the investments. We do not expect to make significant new investments in CMBS in the near future.

Our investments in CLO securities are generally secured by diverse pools of commercial corporate loans and have minimal exposure to residential mortgage loans. Our investments are in 26 CLO funds managed by 19 separate portfolio managers. We also have investments in CDO securities that are generally secured by diverse pools of bonds of other securitizations including commercial loans, CMBS and residential mortgage backed

7

securities. Certain of our commercial CLO investments are in a joint venture portfolio company. Since our IPO through December 31, 2009, we have made $308 million of investments in commercial CLO and CDO securities. As of December 31, 2009, our investment in commercial CLO and CDO securities was $248 million at cost and $115 million at fair value, or only 2% of our total investments. Our investments in these securities have generally performed in accordance with our original underwriting assumptions.

Lending and Investment Decision Criteria

We review certain criteria in order to make investment decisions. The list below represents a general overview of the criteria we use in making our lending and investment decisions. Not all criteria are required to be favorable in order for us to make an investment. Add-on investments for growth, acquisitions or recapitalizations are based on the same general criteria. Add-on investments in distressed situations are based on the same general criteria, but are also evaluated on the potential to preserve prior investments.

Operating History. We generally focus on middle market companies that have been in business over ten years and have an attractive operating history, including generating positive cash flow. We generally target companies with significant market share in their products or services relative to their competitors. In addition, we consider factors such as customer concentration, performance during recessionary periods, competitive environment and ability to sustain margins. As of December 31, 2009, our current private finance portfolio companies had an average age of 32 years with 2009 average sales of $159 million and 2009 average adjusted earnings before interest, taxes, depreciation and amortization (“EBITDA”) of $32 million and an EBITDA margin of 20%.

Growth. We consider a target company’s ability to increase its cash flow. Anticipated growth is a key factor in determining the ability of the company to repay its debt and the value ascribed to any warrants and equity interests acquired by us.

Liquidation Value of Assets. Although we do not operate as an asset-based lender, liquidation value of the assets collateralizing our loans is a factor in many credit decisions. Emphasis is placed both on tangible assets such as accounts receivable, inventory, plant, property and equipment as well as intangible assets such as brand recognition, market reputation, customer lists, networks, databases and recurring revenue streams.

Experienced Management Team. We consider the quality of senior management to be extremely important to the long-term performance of most companies. Therefore, we consider it important that senior management be experienced and properly incentivized through meaningful ownership interest in the company.

Exit Strategy. Almost all of our investments consist of securities acquired directly from their issuers in private transactions. These securities are rarely traded in public markets, thus limiting their liquidity. Therefore, we consider it important that a prospective portfolio company have a number of methods by which our financing can be repaid and our equity investment sold or redeemed. These methods would typically include the sale or refinancing of the business or the ability to generate sufficient cash flow to repurchase our equity securities and repay our loans.

Structured Products Criteria.We receive extensive information from the issuer regarding the mortgage loans, commercial loans and other securities that are the underlying collateral for a CMBS, CLO or CDO pool. We underwrite the collateral securing our investment as appropriate.

8

Portfolio Composition

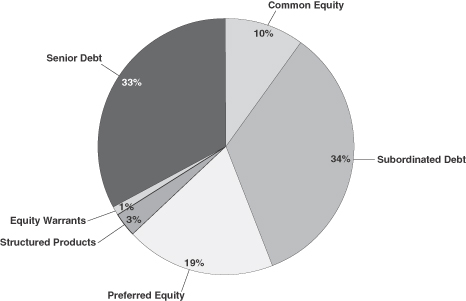

We primarily invest in senior debt, subordinated debt, preferred and common equity and Structured Products. The composition summary of our investment portfolio as of December 31, 2009 at fair value as a percentage of total investments, excluding derivative agreements, is shown below:

We have a diversified investment portfolio and do not concentrate in any one or two industry sectors. We use the Global Industry Classification Standards for classifying the industry groupings of our portfolio companies. The following chart shows the portfolio composition by industry grouping at fair value as a percentage of total investments as of December 31, 2009. Our investments in derivative agreements, European Capital and CLO and CDO securities are excluded from the table below. Our investments in ACAS CRE CDO and CMBS are classified in the Real Estate and Real Estate Investment Trusts category.

9

Alternative Asset Management Business Overview

As of December 31, 2009, our assets under management totaled $12.5 billion, including $5.8 billion of assets under management in our alternative asset funds. Our third-party alternative asset management business is conducted through our wholly-owned portfolio company, American Capital, LLC. In general, wholly-owned subsidiaries of American Capital, LLC enter into management agreements with each of its managed alternative asset funds. The discussion of the operations of American Capital, LLC in this Annual Report on Form 10-K includes its wholly-owned consolidated subsidiaries.

American Capital, LLC had over 55 employees as of December 31, 2009, including seven investment teams with over 20 investment professionals located in three offices in Bethesda, London and Paris. We enter into service agreements with American Capital, LLC to provide asset management services. Through these agreements, we provide investment advisory and oversight services to American Capital, LLC as well as access to our employees, infrastructure, business relationships, management expertise and capital raising capabilities. We charge American Capital, LLC an asset management fee for the use of these services. American Capital, LLC generally earns base management fees based on the size of the managed alternative asset funds and may earn incentive income, or a carried interest, based on the performance of the alternative asset funds. In addition, we may invest directly into our alternative asset funds and earn investment income from our investments in those funds.

10

The following table sets forth certain information with respect to our alternative asset funds under management as of December 31, 2009.

| | | | | | | | | | | | | | |

| | | American Capital | | European Capital | | AGNC | | ACE I | | ACE II | | ACAS CLO-1 | | ACAS CRE CDO |

Fund type | | Public

Alternative

Asset Manager

& Fund | | Private Fund | | Public REIT Fund

- The NASDAQ

Global Market | | Private Fund | | Private Fund

| | Private Fund | | Private Fund |

Established | | 1986 | | 2005 | | 2008 | | 2006 | | 2007 | | 2006 | | 2007 |

Assets under management | | $6.7 Billion(1) | | $1.9 Billion(2) | | $4.6 Billion | | $0.6 Billion | | $0.2 Billion | | $0.4 Billion | | $0.0 Billion |

Investment types | | Senior &

Subordinated

Debt, Equity,

Structured

Products | | Senior & Subordinated

Debt, Equity,

Structured Products | | Agency Securities

| | Equity | | Equity | | Senior Debt | | CMBS |

Capital type | | Permanent | | Permanent | | Permanent | | Finite Life | | Finite Life | | Finite Life | | Finite Life |

| (1) | Includes our investment in third-party funds that we manage. |

| (2) | Excluded from our third-party funds under management as we own 100% of European Capital. |

European Capital invests in and sponsors management and employee buyouts, invests in private equity buyouts and provides capital directly to private and mid-sized public companies primarily in Europe. As of December 31, 2009, European Capital is a wholly-owned portfolio company of ours. American Capital, LLC receives an annual management fee equal to 2% of the weighted average monthly consolidated gross asset value of all the investments of European Capital, an incentive fee equal to 100% of the net earnings in excess of a return of 8% but less than a return of 10% and 20% of the net earnings thereafter. During 2009, the investment management agreement with European Capital was amended to reduce the annual management fee to 1.5% effective from July 1, 2009 to December 31, 2010.

AGNC is a publicly traded mortgage real estate investment trust, or REIT, that invests exclusively in residential mortgage pass-through securities and collateralized mortgage obligations on a leveraged basis. These investments consist of securities for which the principal and interest payments are guaranteed by U.S. Government-sponsored entities such as the Federal National Mortgage Association, or Fannie Mae, and the Federal Home Loan Mortgage Corporation, or Freddie Mac, or by a U.S. Government agency such as the Government National Mortgage Association, or Ginnie Mae. On May 20, 2008, AGNC successfully completed its IPO of ten million shares of common stock for proceeds, net of the underwriters’ discount and estimated expenses, of $186 million. In a private placement concurrent with the AGNC IPO, we purchased five million shares of AGNC common stock at the IPO price of $20.00 per share, for a purchase price of $100 million. AGNC’s net proceeds from the IPO and the concurrent private placement were $286 million. In July 2009, through a public secondary offering, we sold 2.5 million shares of our common stock that we purchased in the private placement. The shares are traded on The NASDAQ Global Select Market under the symbol “AGNC.” American Capital, LLC earns a base management fee of 1.25% of AGNC’s stockholders’ equity.

ACE I is a private equity fund established in 2006 with $1 billion of equity commitments from third-party investors. ACE I purchased 30% of our equity investments in 96 portfolio companies for an aggregate purchase price of $671 million. Also, ACE I co-invested with American Capital in an amount equal to 30% of equity investments made by American Capital between October 2006 and November 2007 until the $329 million remaining equity commitment was exhausted. In addition, 10%, or $100 million, of the $1 billion of equity commitments are recallable by American Capital, LLC for add-on investments with American Capital once they have been distributed to the third-party ACE I investors. As of December 31, 2009, there were $75 million of recallable distributions available for add-on investments. American Capital, LLC manages ACE I in exchange for a 2% base management fee on the net cost basis of ACE I’s assets and 10% to 30% of the net profits of ACE I, subject to certain hurdles.

ACE II is a private equity fund established in 2007 with $585 million of equity commitments from third-party investors. ACE II purchased 17% of our equity investments in 80 portfolio companies for an aggregate purchase price of $488 million.

11

The remaining $97 million commitments will be used to fund add-on investments in the 80 portfolio companies. In addition, 10%, or $59 million, of the $585 million of equity commitments are recallable by American Capital, LLC for add-on investments with American Capital once they have been distributed to the third-party ACE II investors. As of December 31, 2009, ACE II had $85 million and $59 million of unfunded equity commitments and recallable distributions outstanding, respectively. American Capital, LLC manages ACE II in exchange for a 2% base management fee on the net cost basis of ACE II’s assets and 10% to 30% of the net profits of ACE II, subject to certain hurdles.

In April 2007, ACAS CLO-1 completed a $400 million securitization that invests in broadly syndicated and middle market senior loans. We purchased 55% of the BB rated notes and 70% of the non-rated subordinated notes in ACAS CLO-1 for a total purchase price of $33 million. American Capital, LLC earns a base management fee of 0.68% of ACAS CLO-1’s assets and receives 20% of the net profits of ACAS CLO-1, subject to certain hurdles.

ACAS CRE CDO was established in 2007 as a commercial real estate collateralized debt obligation trust that holds investments in subordinated tranches of CMBS trusts. We own notes that were rated either investment grade or non-investment grade at origination and preferred shares of ACAS CRE CDO. American Capital, LLC serves as the collateral manager for ACAS CRE CDO in exchange for an annual senior management fee of 7.5 basis points and a subordinate management fee of 7.5 basis points.

Private Finance Deal Stream and Market Share

We have established an extensive referral network comprised of investment bankers, private equity firms, subordinated funds, trade organizations, commercial bankers, attorneys and business and financial brokers. We have developed an extensive proprietary database of reported middle market transactions. We have also developed an internet website that provides an efficient tool to businesses for learning about American Capital and our capabilities.

Institutional Approach to Investing

We have built an institution with a leading capability to originate, underwrite, finance, syndicate, monitor and exit investments that generate attractive returns. Our dedicated teams of investment professionals are the cornerstone of our institution. We have also created an extensive support structure that provides in-house due diligence, operational, legal and human resources support to our investment professionals and to our portfolio company, American Capital, LLC. The following are the key functional teams that execute our alternative asset management business including the internal management of American Capital and its portfolio.

Investment Teams: As of December 31, 2009, we had 25 Investment Teams with over 70 professionals located in our five offices in the United States. The Investment Teams originate, review and screen investment opportunities, conduct business, management and operations due diligence, prepare investment committee reports and models, make recommendations to the investment committee, execute investments, represent us on the boards of directors of portfolio companies, assist in monitoring and valuing of investments and manage acquisitions, divestures and exiting of investments. Our Investment Teams are organized so that each team focuses on a specific investment strategy. Our Investment Teams include:

| | • | | American Capital Buyout: A 20-person team that leads our American Capital One-Stop Buyouts™ of middle market companies including corporate divestitures, acquisitions of portfolio companies from private equity firms, acquisition of family-owned or closely held businesses, going private transactions and ownership transitions. They originate senior debt, subordinated debt and equity in American Capital controlled buyouts. |

| | • | | Sponsor Finance: A 14-person team that provides private equity sponsors with senior debt, subordinated debt and equity co-investments in support of their buyouts of middle market companies. In addition, they will also target investments directly to privately and publicly-held middle market companies. |

12

| | • | | Energy Investment: A 3-person team that leads our American Capital One-Stop Buyouts™, direct investments and sponsored finance investments in the entire chain of energy exploration, production and distribution, and services, manufacturing, power and utility services. They will also invest in alternative energy, including wind power, solar energy and biofuels. They originate senior debt, subordinated debt and equity investments. |

| | • | | Special Situations: A 5-person team that leads our American Capital One-Stop Buyouts™, direct investments and sponsored finance investments in distressed companies, companies undergoing turnarounds, bankruptcy auctions, debtor-in-possession, exit financing and other special situations in middle market companies. They originate senior debt, subordinated debt and equity investments. |

| | • | | Technology Investment: A 3-person team leads our American Capital One-Stop Buyouts™, direct investments and sponsored finance investments in early, middle and late stage technology companies. They will invest in various technology sectors including networking, software, communications, enterprise data, new media, consumer technologies and industrial technology. They originate senior debt, subordinated debt and equity investments. |

| | • | | Commercial Mortgage Asset Management: A 5-person team that invests in commercial mortgages and related assets directly or by investing in debt and equity tranches of CMBS and CRE CDOs. The team also participates in underwriting, due diligence and financing of real estate owned by our portfolio companies. |

| | • | | Collateralized Loan Obligation: A 6-person team that invests in and manages senior loan collateral for third-party investors through structured finance products such as a CLO. The team sources middle market senior loans originated through our various Investment Teams and also by purchasing rated, broadly syndicated senior debt. They also invest in non-rated tranches of CLOs and CDOs managed by other third-party fund managers. |

Operations Team: A 19-person team with expertise in manufacturing services, consumer products, financial services, energy services, supply chain management, outsourcing and technology. The Operations Team is led by a managing director and includes seasoned former presidents, CEOs (7), COOs (2), CFOs (2) and supply chain and outsourcing specialists (4). The Operations Team conducts operational due diligence on prospective portfolio companies and reports and makes recommendations to our investment committee. The team will also assist portfolio companies post close with operational improvement plans. If we have a portfolio company that is underperforming, the Operations Team will work closely with the portfolio company to improve performance by providing interim leadership at the portfolio company and to identify business actions to help improve performance. The team will provide hands-on assistance to reduce costs, systemize sales and marketing, develop and align business plans, grow the business and strengthen management talent at the portfolio company.

Investment Committee Support Team: A 5-person team that assists our investment committee (the “Investment Committee”) in establishing procedures and controls, establishing due diligence protocol and working with Investment Teams to establish due diligence plans for each prospective investment, developing standard investment committee reports and models, organizing investment committee meetings, monitoring and reporting investment committee results and tracking subsequent developments.

Financial Accounting and Compliance Team (“FACT”): A 32-person team of certified public accountants, chartered accountants and valuation and audit professionals. FACT is responsible for providing pre- and post-investment financial due diligence, portfolio monitoring and quarterly valuations of portfolio assets. FACT assists our Investment Teams in conducting extensive financial, accounting, tax and information technology due diligence of each target investment company, which includes one or more on-site visits, a review of the portfolio company’s historical and prospective financial information, and identifying and confirming pro forma financial adjustments. FACT also monitors the existing portfolio investments by gathering, inputting into an automated database, analyzing and regularly reviewing monthly financial information and other materials to assess financial performance as well as to ensure compliance with loan covenants. Also, FACT, with the assistance of our Investment Teams and subject to the oversight of senior management and the Audit and Compliance Committee, prepares a quarterly valuation of each portfolio company investment.

13

Syndications Team: A 4-person team that is responsible for arranging syndications of all or part of the senior debt of our portfolio companies either at closing or subsequent to the closing of a senior financing transaction. They perform a variety of functions relating to the marketing and completing of such transactions.

Capital Markets, Finance and Treasury Team: A 27-person team that is responsible for raising equity and debt capital, investor relations, financial budgeting and forecasting and daily liquidity and cash management. Through its debt capital raising activities, the team is responsible for structuring, selling and administering on-balance sheet term debt securitizations of debt investments, unsecured bonds and various other revolving facilities and term debt facilities for American Capital and its alternative asset funds under management. Through its equity capital raising activities, the team is responsible for structuring and selling equity for American Capital and our public and private funds. The team is also responsible for monitoring and reporting on capital market conditions and researching, developing and raising private and public capital for new third-party funds for our alternative asset management business. The team is also responsible for arranging syndications of all or part of the equity of our portfolio companies either at closing or subsequent to the closing of an equity financing transaction.

Accounting and Reporting Team: A 39-person team that is responsible for the accounting of our financial results as well as that of our managed funds, including financial reporting and communications to our shareholders, partners and regulatory bodies. Among its tasks are preparing financial statements, investment accounting, analysis of investment performance, loan servicing, billing, accounts receivable and payable, tax compliance, external audit coordination and developing and monitoring our internal controls.

Legal and Compliance Team: A 24-person team that provides legal support on corporate, capital raising and investing matters, is involved in regular reporting and special communications with our shareholder and regulatory bodies and manages the outside law firms that provide transactional, litigation and regulatory services to us. In addition, as required by the SEC, we have appointed a Chief Compliance Officer, who is responsible for administering our code of ethics and conduct and our legal compliance activities.

Internal Audit Team: A 3-person team that reports directly to the Audit and Compliance Committee of our Board of Directors. The team performs operational audits and tests our internal controls over financial reporting to assist management’s assessment of the effectiveness of our internal controls over financial reporting under the Sarbanes-Oxley Act of 2002.

Human Resources Team: An 8-person team that assists in recruiting, hiring, reviewing and establishing and administering compensation programs for our employees. In addition, the team is available to the Investment Teams and the Operations Team to assist with executive management and other human resources issues at portfolio companies.

Information Technology Team: A 20-person team that assists all departments in researching, developing, implementing and maintaining communication and technological resources for our multi-office operations including highly specialized systems for the input, processing and reporting of data.

Investment Process

Investment Sourcing and Screening: We have a multi-disciplined approach to reach diverse channels of deal sources. Our Investment Teams target a referral network comprised of investment bankers, private equity firms, subordinated funds, trade organizations, commercial bankers, attorneys and business and financial brokers. We developed and maintain a proprietary industry-wide database of reported middle market transactions, which enables us to monitor and evaluate the middle market investing environment. This database is used to help us assess whether we are penetrating our target markets and to track terms and pricing. Our financial professionals review financing memorandums and private placement memorandums sourced from this referral network in search of potential buyout or financing opportunities. Our Investment Teams undertake a preliminary evaluation

14

and analysis of potential investment opportunities to determine whether or not they meet our criteria based upon the limited information received in these early stages of the investment process. For investment opportunities that pass an initial screen, our Investment Teams prepare an initial investment thesis and analysis that is presented to an internal Investment Committee, which includes representatives of our senior officers depending on the nature of the proposed investment, for approval to proceed further.

Due Diligence:In our private finance investments, our investment professionals along with our FACT and Operations Team conduct due diligence of each target company that passes the initial screening process. This includes one or more on-site visits, a review of the target company’s historical and prospective financial information, identifying and confirming pro-forma financial adjustments, interviews with and assessments of management, employees, customers and vendors, review of the adequacy of the target company’s systems, background investigations of senior management and research on the target company’s products, services and industry. We often engage professionals such as environmental consulting firms, accounting firms, law firms, risk management companies and management consulting firms with relevant industry expertise to perform elements of the due diligence.

In our Structured Products investments, we receive information regarding the mortgage loans, commercial loans and other securities that are the underlying collateral for a CMBS, CLO or CDO pool from the issuer and we underwrite the collateral securing our investment as appropriate.

Investment Approval: Upon completion of our due diligence, our Investment Teams, FACT and Operations Team as well as any consulting firms that we have engaged, prepare and present a report containing the due diligence information for review to our Investment Committee. Our Board of Directors has delegated authority to the Investment Committee to conduct the initial review and approval of our investments. Our Investment Committee generally must approve each investment. Investments exceeding a certain size or meeting certain other criteria must also be approved by our Board of Directors. Our Investment Committee is supported by a dedicated staff that focuses on the due diligence and other research done with regard to each proposed investment.

Documentation and Negotiations: Documentation for the legal agreements for a transaction is completed either by our in-house legal team or through the retention of outside legal counsel. We maintain custody of our investment securities and the original related investment documentation in custodial accounts with qualified banks and members of national securities exchanges in accordance with applicable regulatory and financing requirements.

Investment Funding:Prior to the release of any investment funds, our treasury department prepares a summary of the investment terms, the funding amounts approved by our Investment Committee and wiring instructions. Our treasury department performs various procedures to confirm any wiring instructions. A senior executive officer must approve this summary of terms and funding amounts prior to the disbursement of the funds.

Portfolio Monitoring: In addition to the due diligence at the time of the original investment decision, we seek to preserve and enhance the performance of our portfolio companies under management through our active involvement with the portfolio companies. As a BDC, we are required by law to make significant managerial assistance available to most of our portfolio companies. This generally includes providing guidance and counsel concerning the management, operations and business objectives and policies of the portfolio company to the portfolio company’s management and board of directors, including participating on the company’s board of directors. The respective FACT and Investment Teams regularly review each portfolio company’s monthly financial statements to assess performance and trends, periodically conduct on-site financial and operational reviews and evaluate industry and economic issues that may affect the portfolio company.

Investment Exits: We regularly evaluate each investment to determine the appropriate time to exit an investment. For investments that we control, we will typically sell the portfolio company through an auction process although an exit may also occur through an initial public offering or a privately negotiated transaction.

15

With the approval of our Investment Committee, our Investment Teams will typically engage an investment bank. If an offered sales price yields the desired return, our Investment Team would recommend the sale of the company to our Investment Committee for approval. For performing investments that we do not control, the exit typically occurs when the sponsor, or other party, in control of the portfolio company decides to recapitalize or sell the business. In both instances, our debt investment is typically paid in full and any equity investment would realize a value consistent with the controlling parties. For non-performing investments that we do not control, we may determine that based on the facts and circumstances relating to the investment, to accept an amount less than what we are legally owed with any such decision requiring approval by our Investment Committee.

Portfolio Valuation

FACT, with the assistance of our Investment Teams, and subject to the oversight of senior management and the Audit and Compliance Committee, prepares a quarterly valuation of each of our portfolio company investments. Our Board of Directors approves our portfolio valuations as required by the 1940 Act. In connection with our valuation process to determine the fair value of investments, we may work with third-party consultants to obtain assistance and advice as additional support in the preparation of our internal valuation analysis for our portfolio.

Competition

We compete with hundreds of private equity and subordinated funds and other financing sources, including traditional financial services companies such as finance companies, commercial banks, investment banks and other equity and non-equity based investment funds. Some of our competitors are substantially larger and have considerably greater financial resources than we do. Competitors may have a lower cost of funds and many have access to funding sources that are not available to us. In addition, certain of our competitors may have higher risk tolerances or different risk assessments, which could allow them to consider a wider variety of investments and establish more relationships and build their market shares. There is no assurance that the competitive pressures we face will not have a material adverse effect on our business, financial condition and results of operations. In addition, as a result of this competition, we may not be able to take advantage of attractive investment opportunities from time to time and there can be no assurance that we will be able to identify and make investments that satisfy our investment objectives or that we will be able to meet our investment goals.

Corporate Information

Our executive offices are located at 2 Bethesda Metro Center, 14th Floor, Bethesda, Maryland 20814 and our telephone number is (301) 951-6122. In addition to our executive offices, we, or our portfolio company American Capital, LLC, maintain offices in New York, Chicago, Dallas, Boston, London, Paris and Hong Kong.

We make available all of our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to such reports free of charge on our internet website atwww.americancapital.com as soon as reasonably practical after such material is electronically filed with or furnished to the Securities and Exchange Commission (“SEC”). These reports are also available on the SEC’s internet website atwww.sec.gov. The public may also read and copy paper filings that we have made with the SEC at the SEC’s Public Reference Room, located at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330.

Employees

As of December 31, 2009, we employed 264 full-time employees compared to 384 and 580 full-time employees as of December 31, 2008 and 2007, respectively. We believe that we have excellent relations with our employees.

16

Business Development Company Requirements

We are a closed-end, non-diversified, management investment company that has elected to be regulated as a BDC under the 1940 Act, and, as such, are subject to regulation under that act.

Qualifying Assets

As a BDC, we may not acquire any asset other than “qualifying assets”, as defined by the 1940 Act, unless, at the time the acquisition is made, the value of our qualifying assets represent at least 70% of the value of our total assets. The principal categories of qualifying assets relevant to our business include the following:

| | • | | securities purchased in transactions not involving any public offering from: |

| | a) | an issuer that (i) is organized and has its principal place of business in the United States, (ii) is neither an investment company other than a wholly-owned small business investment company nor an entity that would be an investment company but for certain statutory exemptions, and (iii) does not have any class of securities listed on a national securities exchange with a market capitalization in excess of $250 million; or |

| | b) | an issuer that satisfies the criteria set forth in clauses (a) (i) and (ii) above but not clause (a)(iii), so long as, at the time of purchase, we own at least 50% of (i) the greatest amount of equity securities of the issuer, including securities convertible into such securities and (ii) the greatest amount of certain debt securities of such issuer, held by us at any point in time during the period when such issuer was an eligible portfolio company, except that options, warrants, and similar securities which have by their terms expired and debt securities which have been converted, or repaid or prepaid in the ordinary course of business or incident to a public offering of securities of such issuer, shall not be considered to have been held by us, and we are one of the 20 largest holders of record of such issuer’s outstanding voting securities; |

| | • | | securities of an issuer described in clauses (a)(i) and (ii) above with respect to which we control (alone or together as a part of a group), we in fact exercise a controlling influence over such issuer’s management or policies and a person affiliated with us is on the issuer’s board of directors; |

| | • | | securities received in exchange for or distributed with respect to securities described above, or pursuant to the exercise of options, warrants or rights relating to such securities; and |

| | • | | cash, cash items, government securities, or high quality debt securities maturing in one year or less from the time of investment. |

Under the 1940 Act, we may not change the nature of our business so as to cease to be, or withdraw our election as, a BDC without consent of the holders of a majority of our outstanding voting securities. Since we made our BDC election, we have not made any substantial change in our structure or in the nature of our business.

To include certain securities above as qualifying assets for the purpose of the 70% test, a BDC must either control the issuer of the securities or offer to make significant managerial assistance available to the issuer of those securities, such as providing significant guidance and counsel concerning the management, operations, or business objectives and policies of a portfolio company or making loans to a portfolio company. We make significant managerial assistance available to each of our portfolio companies.

Leverage

The 1940 Act permits us, as a BDC, to issue senior debt securities and preferred stock (collectively, “Senior Securities”) in amounts such that our asset coverage is at least 200% after each issuance of Senior Securities. Asset coverage is defined in the 1940 Act as the ratio which the value of the total assets, less all liabilities and indebtedness not represented by Senior Securities, bears to the aggregate amount of Senior Securities

17

representing indebtedness. Such indebtedness may also be incurred for the purpose of effecting share repurchases. As a result, we are exposed to the risks of leverage. Although we have no current intention to do so, we have retained the right to issue preferred stock. As permitted by the 1940 Act, we may, in addition, borrow amounts up to 5% of our total assets for temporary purposes. As of December 31, 2009, our asset coverage was 156%. Accordingly, we are generally prohibited from issuing any additional Senior Securities until our asset coverage exceeds 200%.

Under the 1940 Act, if a BDC has any senior debt securities outstanding that were publicly issued, the BDC must make provision to prohibit the declaration of any dividend (except a dividend payable in the stock of the BDC) if its asset coverage is below certain thresholds at the time of the distribution after deducting the amount of such dividend. However, we have received guidance from the staff of the SEC that notwithstanding this provision of the 1940 Act, we are able to declare and pay dividends pursuant to the revenue procedure issued by the Internal Revenue Service (“IRS”). (See Item 1. Business—Regulated Investment Company Requirements)

Issuance of Stock

We are generally not able to issue and sell our common stock at a price below our NAV per share, exclusive of any distributing commission or discount. We may, however, sell our common stock at a price below the current NAV per share of our common stock, or sell warrants options or rights to acquire our common stock at a price below the current NAV per share of our common stock if our Board of Directors determines that such a sale is in our best interests and our shareholders approve our policy and practice of making such sales. In any such case, the price at which our securities are to be issued and sold may not be less than a price that, in the determination of our Board of Directors and the underwriters on an offering, closely approximates the market value of such securities (exclusive of any distributing commission or discount).

On February 19, 2009, our shareholders approved a proposal to authorize us to sell shares of our common stock at prices below the NAV per share in one or more offerings subject to certain limitations, including the prior approval of our Board of Directors. The authorization was effective for the twelve month period that expired on February 19, 2010 and the number of shares that could be issued below the NAV per share was limited to (i) the number of shares of our common stock issued for the acquisition of the ordinary shares of European Capital and (ii) a maximum of an additional 42.8 million shares of common stock, which was 20% of the number of shares outstanding as of the record date for shareholder vote of the proposal, subject to adjustment for shares issued following the occurrence of events such as stock splits, stock dividends, distributions and recapitalizations. As a result of the shareholder distribution on August 7, 2009, which consisted of $24 million in cash and 67 million shares of common stock, the number of shares of common stock that could be issued below NAV per share was increased to approximately 55.6 million shares. On February 12, 2010, our shareholders approved an additional proposal to authorize us to sell shares of our common stock at prices below the NAV per share in one or more offerings subject to certain limitations, including the prior approval of our Board of Directors. The authorization is effective for the twelve month period expiring on February 12, 2011 and the number of shares that may be issued below NAV per share is limited to 58.3 million shares of common stock, which was 20% of the number of shares outstanding as of the record date for shareholder vote of the proposal, subject to adjustment for shares issued following the occurrence of events such as stock splits, stock dividends, distributions and recapitalizations.

Regulated Investment Company Requirements

We operate so as to qualify as a RIC under Subchapter M of the Code. If we qualify as a RIC and annually distribute to our shareholders in a timely manner at least 90% of our investment company taxable ordinary income, we will not be subject to federal income tax on the portion of our taxable ordinary income and long-term capital gains we distribute to our shareholders. Taxable income generally differs from net income as defined by accounting principles generally accepted in the United States (“GAAP”) due to temporary and permanent timing differences in the recognition of income and expenses, returns of capital and net unrealized appreciation or depreciation of investments.

18

Generally, in order to maintain our status as a RIC, we must: a) continue to qualify as a BDC; b) distribute to our shareholders in a timely manner, at least 90% of our investment company taxable ordinary income, as defined by the Code; c) derive in each taxable year at least 90% of our gross investment company income from dividends, interest, payments with respect to securities loans, gains from the sale of stock or other securities or other income derived with respect to our business of investing in such stock or securities as defined by the Code; and d) meet investment diversification requirements. The diversification requirements generally require us at the end of each quarter of the taxable year to have (i) at least 50% of the value of our assets consist of cash, cash items, government securities, securities of other regulated investment companies and other securities if such other securities of any one issuer do not represent more than 5% of our assets and 10% of the outstanding voting securities of the issuer; and (ii) no more than 25% of the value of our assets invested in the securities of one issuer (other than U.S. government securities and securities of other RICs), or of two or more issuers that are controlled by us and are engaged in the same or similar or related trades or businesses.

If we fail to satisfy the 90% distribution requirement or otherwise fail to qualify as a RIC in any taxable year, we will be subject to tax in such year on all of our taxable income, regardless of whether we make any distribution to our shareholders. In addition, in that case, all of our distributions to our shareholders will be characterized as ordinary income (to the extent of our current and accumulated earnings and profits). We have distributed and currently intend to distribute sufficient dividends to eliminate our investment company taxable income.

On January 7, 2009, the IRS issued Revenue Procedure 2009-15, which temporarily allows a RIC to distribute its own stock as a dividend for the purpose of fulfilling its distribution requirements. Pursuant to this revenue procedure, a RIC may treat a distribution of its own stock as a dividend if (i) the stock is publicly traded on an established securities market, (ii) the distribution is declared with respect to a taxable year ending on or before December 31, 2009 and (iii) each shareholder may elect to receive his entire distribution in either cash or stock of the RIC subject to a limitation on the aggregate amount of cash to be distributed to all shareholders, which must be at least 10% of the aggregate declared distribution. If too many shareholders elect to receive cash, each shareholder electing to receive cash will receive a pro rata amount of cash (with the balance of the distribution paid in stock). In no event will any shareholder electing to receive cash receive less than 10% of his or her entire distribution in cash. On December 23, 2009, the IRS issued Revenue Procedure 2010-12, which extends under similar terms the temporary guidance provided by Revenue Procedure 2009-15. This new guidance applies to distributions by a RIC of its own stock declared by December 31, 2012 with respect to RIC distribution requirements for taxable years ending on or before December 31, 2011.

In addition, with respect to each calendar year, if we distribute or have treated as having distributed (including amounts retained but designated as deemed distributed) in a timely manner 98% of our capital gain income for each one-year period ending on October 31, and distribute 98% of our investment company ordinary income for such calendar year (as well as any ordinary income not distributed in prior years), we will not be subject to the 4% nondeductible federal excise tax imposed with respect to certain undistributed income of RICs. We may elect to not distribute all of our investment company taxable income and pay the excise tax on the undistributed amount. Any such undistributed income is carried over into the next year as taxable income subject to the minimum distribution requirements for that year.

Our wholly-owned consolidated subsidiary, American Capital Financial Services, Inc. (“ACFS”), is a corporation subject to corporate level federal, state or other local income tax.

19

Investment Objectives

Our primary business objectives are to increase our taxable income, net realized earnings and NAV by investing in senior debt, subordinated debt and equity securities of private companies, early and late stage technology companies, companies in special situations, alternative asset funds managed by us and Structured Products with attractive current yields and/or potential for equity appreciation and realized gains. Our investment objectives provide that:

| | • | | We will at all times conduct our business so as to retain our status as a BDC. In order to retain that status, we may not acquire any assets (other than non-investment assets necessary and appropriate to our operations as a BDC) if after giving effect to such acquisition the value of our qualifying assets amounts to less than 70% of the value of our total assets. For a summary definition of qualifying assets, see “Business Development Company Requirements.” We believe most of the securities we will acquire (provided that we control, or through our officers or other participants in the financing transaction, make significant managerial assistance available to the issuers of these securities), as well as temporary investments, will generally be qualifying assets. Securities of public companies with a market capitalization in excess of $250 million, on the other hand, are generally not qualifying assets unless they were acquired in a distribution, in exchange for or upon the exercise of a right relating to securities that were qualifying assets. |

| | • | | We may invest up to 100% of our assets in securities acquired directly from issuers in privately-negotiated transactions. With respect to such securities, we may, for the purpose of public resale, be deemed an “underwriter” as that term is defined in the Securities Act. We may invest up to 50% of our assets to acquire securities of issuers for the purpose of acquiring control (up to 100% of the voting securities) of such issuers. We will not concentrate our investments in any particular industry or group of industries. Therefore, we will not acquire any securities (except upon the exercise of a right related to previously acquired securities) if, as a result, 25% or more of the value of our total assets consists of securities of companies in the same industry. |

| | • | | We may issue senior securities to the extent permitted by the 1940 Act for the purpose of making investments, to fund share repurchases, or for temporary or emergency purposes. As a BDC, we may issue senior securities up to an amount so that the asset coverage, as defined in the 1940 Act, is at least 200% immediately after each issuance of senior securities. |

| | • | | We generally will not (a) act as an underwriter of securities of other issuers (except to the extent that we may (i) be deemed an “underwriter” of securities purchased by us that must be registered under the Securities Act before they may be offered or sold to the public or (ii) underwrite securities to be distributed to or purchased by our shareholders in connection with offerings of securities by companies in which we are a shareholder); (b) sell securities short (except with regard to managing risks associated with publicly traded securities issued by portfolio companies); (c) purchase securities on margin (except to the extent that we may purchase securities with borrowed money); (d) write or buy put or call options (except (i) to the extent of warrants or conversion privileges in connection with our acquisition financing or other investments, and rights to require the issuers of such investments or their affiliates to repurchase them under certain circumstances, or (ii) with regard to managing risks associated with publicly traded securities issued by portfolio companies); (e) engage in the purchase or sale of commodities or commodity contracts, including futures contracts (except where necessary in working out distressed loan or investment situations); or (f) acquire more than 3% of the voting stock of, or invest more than 5% of our total assets in any securities issued by, any other investment company (as defined in the 1940 Act), except as they may be acquired as part of a merger, consolidation or acquisition of assets. With regard to that portion of our investments in securities issued by other investment companies it should be noted that such investments may subject our shareholders to additional expenses. |

The percentage restrictions set forth above, other than the restriction pertaining to the issuance of senior securities, as well as those contained elsewhere herein, apply at the time a transaction is effected, and a

20

subsequent change in a percentage resulting from market fluctuations or any cause other than an action by us will not require us to dispose of portfolio securities or to take other action to satisfy the percentage restriction.

The above investment objectives have been set by our Board of Directors and do not require shareholder consent to be changed.

Investment Advisor

We have no investment advisor and are internally managed by our executive officers under the supervision of our Board of Directors.

Item 1A. Risk Factors

You should carefully consider the risks described below and all other information contained in this annual report on Form 10-K, including our consolidated financial statements and the related notes thereto before making a decision to purchase our securities. The risks and uncertainties described below are not the only ones facing us. Additional risks and uncertainties not presently known to us, or not presently deemed material by us, may also impair our operations and performance.

If any of the following risks actually occur, our business, financial condition or results of operations could be materially adversely affected. If that happens, the trading price of our securities could decline, and you may lose all or part of your investment.

Risks Related to Our Business and Structure

Our primary unsecured creditors can or have accelerated the maturity of the amounts outstanding under our unsecured debt agreements with them due to certain financial covenant breaches by us