SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

American Capital, Ltd.

(Name of Registrant as Specified in its Charter)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

AMERICAN CAPITAL, LTD.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON SEPTEMBER 15, 2010

To the stockholders:

On behalf of the Board of Directors, it is my pleasure to invite you to our 2010 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at [ ], on September 15, 2010, at 10:00 a.m. (ET), for the purposes set forth below.

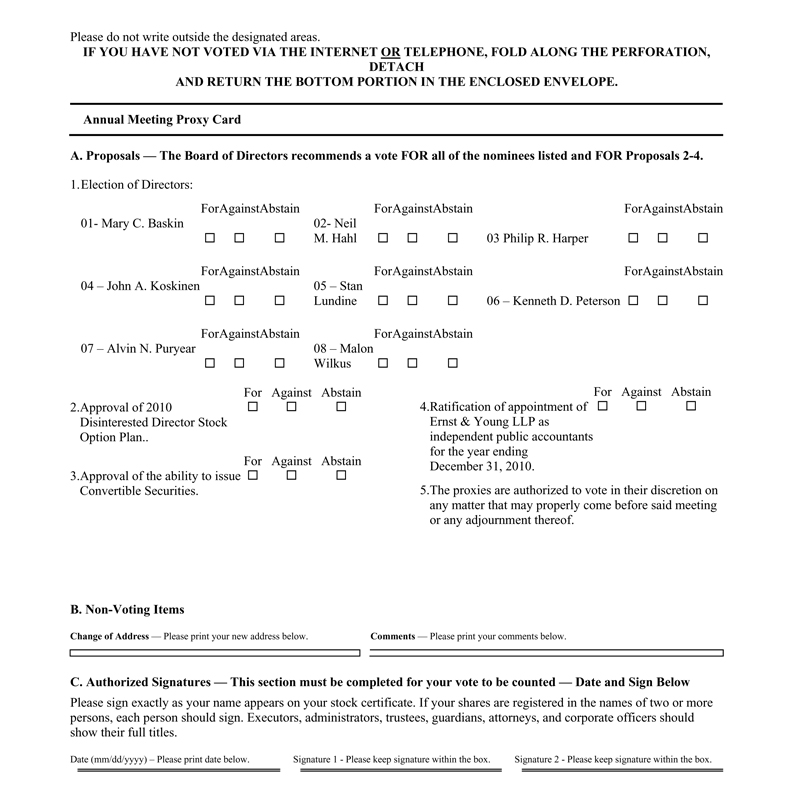

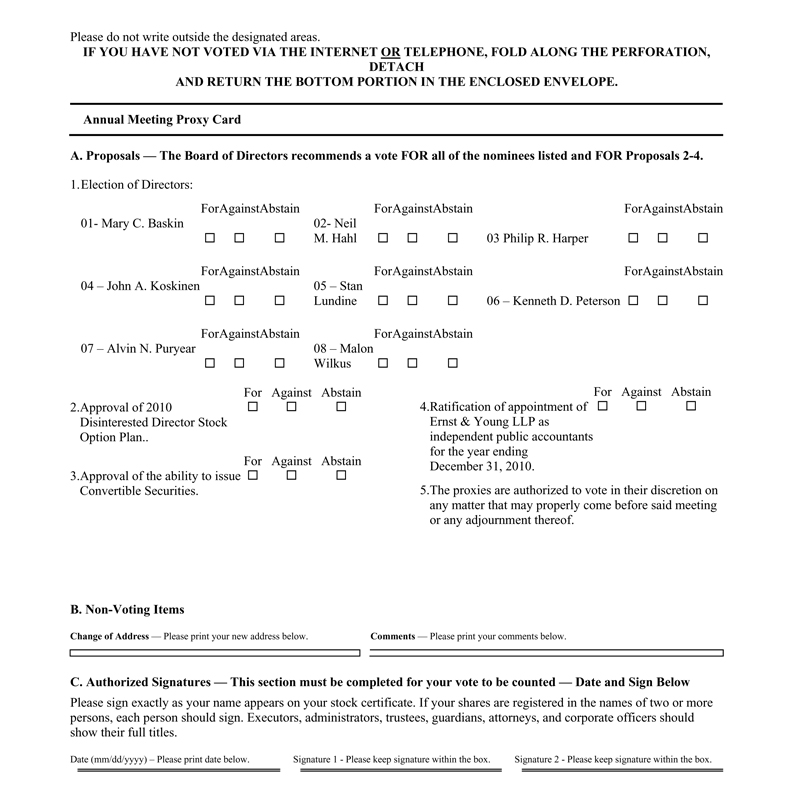

| | 1. | To elect eight directors, each to serve a one-year term; |

| | 2. | To approve the adoption of our 2010 Disinterested Director Stock Option Plan; |

| | 3. | To approve our ability to issue preferred stock or debt securities convertible into shares of our common stock (“Convertible Securities”); |

| | 4. | To ratify the appointment of Ernst & Young LLP to serve as our independent public accountants for the year ending December 31, 2010; and |

| | 5. | To transact such other business as may properly come before the meeting or any adjournment thereof. |

Stockholders of record at the close of business on July 22, 2010, are entitled to notice of, and to vote at, the Annual Meeting and any adjournment of the meeting. If you wish to vote shares held in your name and attend the Annual Meeting in person, we request that you register in advance with our Investor Relations department either by email atIR@americancapital.com or by telephone at (301) 951-5917.Attendance at the Annual Meeting will be limited to persons presenting proof of stock ownership on the record date and picture identification.If you hold shares directly in your name as the stockholder of record, proof of ownership could include a copy of your account statement or a copy of your stock certificate(s). If you hold shares through an intermediary, such as a broker, bank or other nominee, proof of stock ownership could include a proxy from your broker, bank or other nominee or a copy of your brokerage or bank account statement. Additionally, if you intend to vote your shares at the meeting, you must request a “legal proxy” from your broker, bank or other nominee and bring this legal proxy to the meeting.

If you have received or requested a printed copy of the proxy materials from us by mail, you may vote by completing, signing and promptly returning the enclosed proxy card promptly in the envelope provided, which requires no postage if mailed in the United States. Internet and telephone voting procedures are described in the General Information section beginning on page 1 of the Proxy Statement and on the proxy card. For shares held through a benefit or compensation plan or a bank, broker or other nominee, you may vote by submitting voting instructions to your plan trustee, bank, broker or nominee. If you attend the meeting, you may withdraw your proxy and vote in person.

|

BY ORDER OF THE BOARD OF DIRECTORS, |

|

| Samuel A. Flax |

Executive Vice President, General Counsel, Chief Compliance Officer and Secretary |

[ ], 2010

Enclosures

TABLE OF CONTENTS

AMERICAN CAPITAL, LTD.

PROXY STATEMENT

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board of Directors”) of American Capital, Ltd. (“American Capital,” “we” and “us”), for use at our 2010 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on September 15, 2010, at 10:00 a.m. (ET), at [ ], and for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders, and at any adjournments to the meeting. This proxy statement, the accompanying proxy card and our annual report to stockholders, which includes our annual report on Form 10-K with audited financial statements for the year ended December 31, 2009, are first being sent to our stockholders on or about [ ], 2010.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on September 15, 2010: This proxy statement and our annual report on Form 10-K are available on the internet athttp:// . On this site, you will be able to access our 2010 proxy statement, our annual report to stockholders, which includes our annual report on Form 10-K for the fiscal year ended December 31, 2009, and any amendments or supplements to the foregoing materials that are required to be furnished to stockholders.

GENERAL

The enclosed proxy is solicited on behalf of the Board of Directors and is revocable at any time prior to the voting of the proxy, by the filing of an instrument revoking it, or a duly executed proxy bearing a later date, with our Secretary. In the event that you attend the Annual Meeting, you may revoke your proxy and cast your vote personally at the meeting. Shares represented by valid proxies will be voted in accordance with instructions contained therein. If no specification is made, such shares will be voted FOR the election of the eight director nominees; FOR approval of the 2010 Disinterested Director Stock Option Plan; FOR approval of the ability to issue convertible securities; and FOR the ratification of the appointment of Ernst & Young LLP as our independent public accountants for the year ending December 31, 2010.

The Board of Directors is not aware of any matter to be presented for action at the Annual Meeting other than the matters set forth herein. Should any other matter requiring a vote of stockholders arise, it is the intention of the persons named in the proxies to vote in accordance with their best judgment on such matters.

We will bear the cost of soliciting proxies on the accompanying form. In addition to the use of mail, our officers and employees may solicit proxies by telephone or facsimile. Upon request, we will reimburse brokers, dealers, banks, and trustees, or their nominees, for reasonable expenses incurred by them in forwarding our proxy materials to beneficial owners of our common stock, $0.01 par value per share.

The Board of Directors has fixed the close of business on July 22, 2010, as the record date for determining the holders of our common stock entitled to receive notice of and to vote at the Annual Meeting and any adjournments thereof. On the record date, there were [ ] shares of our common stock outstanding. Only stockholders on the record date are entitled to vote at the Annual Meeting and such stockholders will be entitled to one vote for each share of our common stock held, which may be given in person or by proxy duly authorized in writing. The presence in person or by proxy of a majority of shares of our common stock entitled to vote will constitute a quorum for the transaction of business at the Annual Meeting. Shares represented by proxies received but marked as abstentions will be included in the calculation of the number of shares considered to be present at the meeting. Shares held in a brokerage account that are voted by the broker or other nominee on some but not all matters will be treated as shares present for purposes of determining the presence of a quorum. However, if you hold your shares in street name and do not provide voting instructions to your broker, your shares will not be voted on any proposal on which your broker does not have discretionary authority to vote (a “broker non-vote”). Under current rules, your broker will not have discretionary authority to vote your shares at the Annual Meeting on the proposals relating to the election of directors, the issuance of convertible securities or the director option plan. We encourage you to provide instructions to your bank, broker or nominee by carefully following the instructions provided. This will ensure that your shares are voted at the Annual Meeting as you direct.

1

You may submit your proxy or vote your shares of our common stock by any of the following methods:

By Telephone or the Internet — Stockholders can vote their shares via telephone or the internet as instructed in the Notice of Internet Availability of Proxy Materials, the proxy card or the voting instruction form. The telephone and internet procedures are designed to authenticate a stockholder’s identity, to allow stockholders to vote their shares and to confirm that their instructions have been properly recorded.

By Mail — A stockholder who receives a paper proxy card or voting instruction form or requests a paper proxy card or voting instruction form by telephone or internet may elect to vote by mail and should complete, sign and date the proxy card or voting instruction form and mail it in the pre-addressed envelope that accompanies the delivery of the proxy card or voting instruction form. For stockholders of record, proxy cards submitted by mail must be received by the date and time of the Annual Meeting. For stockholders that hold their shares through an intermediary, such as a broker, bank or other nominee, the voting instruction form submitted by mail must be mailed by the deadline imposed by your bank, broker or other agent for your shares to be voted.

In Person — Shares held in your name as the stockholder of record may be voted by you in person at the Annual Meeting. Shares held beneficially in street name may be voted by you in person at the Annual Meeting only if you obtain a legal proxy from the broker or other agent that holds your shares giving you the right to vote the shares and bring that proxy to the meeting.

Our principal executive offices are located at 2 Bethesda Metro Center, 14th floor, Bethesda, Maryland 20814. Notices of revocation of proxies should be sent to that address, attention Secretary.

PROPOSAL 1: ELECTION OF DIRECTORS

Pursuant to our Third Amended and Restated Certificate of Incorporation (our “Certificate of Incorporation”), stockholders elect each of the members of the Board of Directors annually. The term of each director will expire at the Annual Meeting. Each director has been nominated by the Compensation and Corporate Governance Committee of the Board of Directors, in accordance with our Second Amended and Restated Bylaws, as amended (“Bylaws”), to stand for re-election at the Annual Meeting and to hold office until the annual meeting to be held in 2011. It is expected that each of the nominees will be able to serve, but if any such nominee is unable to serve for any reason, the proxies reserve discretion to vote or refrain from voting for a substitute nominee or nominees. A stockholder using the enclosed form of proxy can vote for or against any or all of the nominees or may abstain from voting for any or all of the nominees.

We believe that all of our directors, each of whom is standing for re-election, possess the personal and professional qualifications necessary to serve as a member of our Board of Directors. Our directors have been evaluated by the Compensation and Corporate Governance Committee pursuant to the guidelines described below under “Compensation and Corporate Governance Committee” and the determination was made that each of them fulfills and exceeds the qualities that we look for in members of our Board of Directors. Other than Mr. Wilkus, each of the nominees is independent as defined in the NASDAQ listing standards and is not an “Interested Person” as defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended (the “1940 Act”).

The information set forth below is as of [ ], 2010, with respect to each of our directors, each a nominee for election at the Annual Meeting. The business address of each nominee is American Capital, Ltd., 2 Bethesda Metro Center, 14th floor, Bethesda, Maryland 20814. We have highlighted specific attributes for each Board member below.

2

NOMINEES FOR DIRECTOR

| | | | |

Name and Year First Elected Director | | Age | | Qualifications and Experience |

| Mary C. Baskin (2000) | | 59 | | Ms. Baskin has been Managing Director of the Ansley Consulting Group, a retained executive search firm, since 1999. From 1997 to 1999, Ms. Baskin served as Partner of Quayle Partners, a start-up consulting firm that she helped found. From 1996 to 1997, Ms. Baskin served as Vice President and Senior Relationship Manager for Harris Trust and Savings Bank. From 1990 to 1996, Ms. Baskin served as Director, Real Estate Division and Account Officer, Special Accounts Management Unit, for the Bank of Montreal. The Board has determined that Ms. Baskin is an “audit committee financial expert” (as defined in Item 401 of Regulation S-K under the Securities Act of 1933, as amended (the “Securities Act”)). Ms. Baskin’s experience in finance, accounting, risk management and executive compensation matters strengthens our Board’s collective qualifications, skills, experience and viewpoints. |

| | |

| Neil M. Hahl (1997) | | 62 | | Mr. Hahl is a general business consultant. He was President of The Weitling Group, a business consulting firm, from 1996 to 2001. From 1995 to 1996, Mr. Hahl served as Senior Vice President of the American Financial Group. From 1982 to 1995, Mr. Hahl served as Senior Vice President and Chief Financial Officer and a Director of The Penn Central Corporation. The Board has also determined that Mr. Hahl is an “audit committee financial expert” (as defined in Item 401 of Regulation S-K under the Securities Act). Mr. Hahl’s public company accounting, finance and risk management expertise, including his extensive experience as a senior executive responsible for the preparation of financial statements, strengthens our Board’s collective qualifications, skills, experience and viewpoints. |

| | |

| Philip R. Harper (1997) | | 66 | | Mr. Harper is the retired Chairman of US Investigations Services, Inc. (“USIS”) (k/n/a Altegrity Risk International), a company that provides business intelligence and risk management solutions, security and related services and expert staffing solutions for businesses and federal agencies. He served as Chairman from 1996 to 2007. From 1996 to 2005, he was also the Chief Executive Officer and President of USIS. From 1991 to 1994, Mr. Harper served as President of Wells Fargo Alarm Services. From 1988 to 1991, Mr. Harper served as President of Burns International Security Services—Western Business Unit. Mr. Harper served in the U.S. Army from 1961 to 1982, where he commanded airborne infantry and intelligence units. Mr. Harper’s extensive senior executive officer and board service and his experience with executive compensation and corporate governance matters strengthen our Board’s collective qualifications, skills, experience and viewpoints. |

| | |

| John A. Koskinen (2007) | | 71 | | Mr. Koskinen has served as the Non-Executive Chairman of Freddie Mac since September 2008 and also served as the interim CEO and the person performing the function of Principal Financial Officer of Freddie Mac for six months during 2009. Prior to that he was President of the United States Soccer Foundation and a member of its Board from 2004 to 2008. He has also been a member of the Board of Directors of AES Corporation since 2004. From 2000 to 2003, Mr. Koskinen served as Deputy Mayor and City Administrator of the District of Columbia. From 1994 to 2000, Mr. Koskinen served in the White House as Deputy Director for Management |

3

| | | | |

Name and Year First Elected Director | | Age | | Qualifications and Experience |

| | | | | of the Office of Management and Budget and Assistant to the President and Chair of the

President’s Council on Year 2000 Conversion. Prior to his service with the U.S.

Government, Mr. Koskinen served as the Vice President and later the President and

Chief Executive Officer of The Palmieri Company, a company which restructured large,

troubled operating companies. He was also a member of the Board of Trustees of Duke

University from 1985 to 1997, serving as Chairman of the Board from 1994 to 1997.

The Board has also determined that Mr. Koskinen is an “audit committee financial

expert” (as defined in Item 401 of Regulation S-K under the Securities Act). Mr. Koskinen’s extensive board, government and senior executive experience managing

a wide range of companies and divisions engaged in a variety of activities and his

finance and risk management expertise strengthen our Board’s collective qualifications,

skills, experience and viewpoints. |

| | |

| Stan Lundine (1997) | | 72 | | Mr. Lundine is currently retired. From 1995 to 2008 he served as Of Counsel to the law firm of Sotir and Goldman and as Executive Director of the Chautauqua County Health Network, a consortium of four hospitals. He was also President of the Chautauqua Integrated Delivery System, Inc., a for-profit Physician/Hospital organization. From 1987 to 1994, Mr. Lundine served as Lieutenant Governor of New York and chaired several boards and councils in addition to assisting the Governor on a variety of tasks. From 1976 until 1987, Lundine was a Member of Congress serving on the Banking Committee and the Committee on Science and Technology. From 1970 until his election to Congress, Lundine was Mayor of Jamestown, NY and an executive or board member of various governmental entities and institutions. Mr. Lundine is a Director of John G. Ullman and Associates, Inc. and serves on the Advisory Board of M&T Bank. He also serves on the Board of Directors of Chautauqua Institution and the Robert H. Jackson Center. Previously he was also on the Board of Directors of U.S. Investigations, Inc. and National Forge Co. Mr. Lundine’s extensive legal, board and government service and his experience with corporate governance and executive compensation matters strengthen our Board’s collective qualifications, skills, experience and viewpoints. |

| | |

| Kenneth D. Peterson, Jr. (2001) | | 57 | | Mr. Peterson has been Chief Executive Officer of Columbia Ventures Corporation, a private equity firm holding interests in domestic and international telecommunications specialty chemicals, energy, medical and other industries, since 1988. He is also a member of the Board of Directors of Metro One Telecommunications, Inc., Pac-West Telcom, Inc., Washington Policy Center and One Communications Corp. Mr. Peterson’s extensive board, senior executive and private equity experience strengthens our Board’s collective qualifications, skills, experience and viewpoints. |

| | |

| Alvin N. Puryear (1998) | | 74 | | Dr. Puryear is a management consultant who specializes in advising businesses with high-growth potential. From 1970 to 2007, Dr. Puryear was on the faculty of Baruch College of the City University of New York where he was the Lawrence N. Field Professor of Entrepreneurship and Professor of Management. Prior to 1970, Dr. Puryear held executive positions in finance and information technology with the Mobil Corporation and Allied Chemical Corporation, respectively. He is also a member of the Board of Directors of the Bank of Tokyo-Mitsubishi UFG |

4

| | | | |

Name and Year First Elected Director | | Age | | Qualifications and Experience |

| | | | Trust Company and American Capital Agency Corp. In the past five years Dr. Puryear has also served as a director of Green Point Financial Corp., Green Point Bank, North Fork Bancorporation and North Fork Bank. Dr. Puryear’s extensive academic and board service and his experience in finance, corporate governance and executive compensation matters strengthen our Board’s collective qualifications, skills, experience and viewpoints. |

| | |

| Malon Wilkus* (1986) | | 58 | | Mr. Wilkus founded American Capital in 1986 and has served as our Chief Executive Officer and Chairman of the Board of Directors since that time, except for the period from 1997 to 1998 during which he served as Chief Executive Officer and Vice Chairman of the Board of Directors. He also served as our President from 2001 to 2008 and from 1986 to 1999. In addition, Mr. Wilkus is the President of American Capital, LLC, our fund management portfolio company. He is also Chief Executive Officer, President and Chairman of the Board of Directors of American Capital Agency Corp. Mr. Wilkus’ extensive board and senior executive experience investing in and managing private and public investment vehicles and his financial expertise and deep knowledge of our business as our founder and Chief Executive Officer strengthen our Board’s collective qualifications, skills, experience and viewpoints. |

| * | Director who is an “Interested Person” as defined in Section 2(a)(19) of the 1940 Act. Mr. Wilkus is an Interested Person because he is our employee and officer. |

Director Resignation Policy

Our Bylaws require a candidate in an uncontested election for director to receive a majority of the votes cast in order to be elected as a director. Under this provision, each vote is specifically counted “for” or “against” the director’s election, unless a stockholder abstains from voting with respect to the matter. Thus, a director nominee is required to receive more votes “for” than “against” to be elected. Pursuant to Delaware law, a director shall remain in office until his or her successor is elected, even if the director has not received a vote sufficient for re-election. Thus, a company could have a “holdover” director. However, pursuant to our Board-approved director resignation policy, an incumbent director must tender his or her resignation to the Board of Directors if the director is nominated but not re-elected. The policy also requires the Compensation and Corporate Governance Committee to make a recommendation to the full Board of Directors on whether to accept or reject the resignation, and the full Board of Directors to make that determination. The Board of Directors will publicly disclose its decision within 90 days after receipt of the tendered resignation.

Any director who tenders his or her resignation pursuant to this policy may not participate in the Compensation and Corporate Governance Committee recommendation or Board of Directors action regarding whether to accept the resignation offer. If each member of the Compensation and Corporate Governance Committee does not receive a vote sufficient for re-election, then the independent directors who did not fail to receive a sufficient vote shall appoint a committee amongst themselves to consider the resignation offers and recommend to the Board of Directors whether to accept them. If the only directors who did not fail to receive a sufficient vote for re-election constitute three or fewer directors, all directors may participate in the action regarding whether to accept the resignation offers.

Conclusion and Recommendation; Vote Required

The election of directors nominated in Proposal 1 requires the vote of a majority of the votes of all shares of common stock present or represented and entitled to vote at the Annual Meeting. A “majority” of the votes cast means that the number of votes cast “for” a director nominee must exceed the votes cast “against” that nominee. In the context of the election of eight directors at the Annual Meeting, it will mean that each of the eight director nominees will be required to receive more votes “for” than “against” to be elected. Abstentions and broker non-votes will have no effect on the outcome of the proposal. THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR THE ELECTION OF ALL THE NOMINEES NAMED ABOVE.

5

DIRECTOR COMPENSATION AND STOCK OWNERSHIP GUIDELINES

The elements of compensation for our non-employee directors include a retainer, fees for attending meetings and, if applicable, for serving on the boards of directors of our portfolio companies, stock options and compensation under our disinterested director retention plan. The retainer and fee rates noted below for 2009 did not increase from 2008. The 2010 rates were also set at the same level.

For 2009, non-employee directors were paid a retainer for service on the Board of Directors at the rate of $100,000 per year, with the lead director and members chairing a committee receiving an additional retainer at the rate of $10,000 per year. In addition, non-employee directors received a fee of $3,000 for attending Board or committee meetings and certain other meetings, with approval of the Chairman of our Board of Directors. Non-employee directors received a fee from us for each American Capital portfolio company board of directors on which they served, in lieu of any payment by the portfolio company. For such companies that are not public, that fee is set at the rate of $30,000 per year. For such companies that are public that fee is based on the fee payable by the company to its other directors. Directors are reimbursed for travel, lodging and other out-of-pocket expenses incurred in connection with the Board of Directors and committee meetings. Directors who are our employees do not receive additional compensation for service as a member of the Board of Directors.

The following table sets forth the compensation received by each non-employee director during 2009:

| | | | | | | | | | | | | | |

Name | | Fees Earned

or Paid in

Cash ($)(1) | | Stock

Awards

($) | | Option

Awards

($)(2) | | Non-Equity

Incentive Plan

Compensation

($) | | Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings | | All Other

Compensation

($) | | Total

($) |

Mary C. Baskin (2000) | | 325,000 | | — | | 88,605 | | — | | — | | — | | 413,605 |

Neil M. Hahl (1997) | | 347,000 | | — | | 88,605 | | — | | — | | — | | 435,605 |

Philip R. Harper (1997) | | 308,000 | | — | | 88,605 | | — | | — | | — | | 396,605 |

John A. Koskinen (2007) | | 256,000 | | — | | 88,605 | | — | | — | | — | | 344,605 |

Stan Lundine (1997) | | 244,000 | | — | | 88,605 | | — | | — | | — | | 332,605 |

Kenneth D. Peterson, Jr. (2001) | | 187,000 | | — | | 88,605 | | — | | — | | — | | 275,605 |

Alvin N. Puryear (1998) | | 392,000 | | — | | 88,605 | | — | | — | | — | | 480,605 |

| (1) | The column “Fees Earned or Paid in Cash” includes the following payments by us to directors in 2009 for serving on certain boards of directors of our portfolio companies in the following amounts: Ms. Baskin—$30,000 for Core Business Credit, LLC and $30,000 for eLynx Holdings, Inc.; Mr. Hahl—$30,000 for WIS Holdings Company Inc. and $30,000 for The Meadows of Wickenburg, L.P.; Mr. Harper—$30,000 for SMG Holdings Inc.; Dr. Puryear—$30,000 for each of CIBT Travel Solutions, Inc. and Financial Asset Management Systems, Inc., and $61,000 for American Capital Agency Corp. |

| (2) | Amounts under the column “Option Awards” represent the fair value of stock option awards granted in 2009 based on the fair value per share that we recognize for financial statement reporting purposes in accordance with Financial Accounting Standards Board ASC Topic 718,Compensation-Stock Compensation(“ASC 718”) using certain assumptions that we explain under the heading “Stock Based Compensation” in Item 7 of Management’s Discussion and Analysis in our Annual Report on Form 10-K for the year ended December 31, 2009. On December 31, 2009, Ms. Baskin, Messrs. Hahl, Harper, Lundine, Peterson, Koskinen and Dr. Puryear had the following aggregate option awards outstanding: 223,750; 208,750; 208,750; 208,750; 183,750; 203,750; and 208,750, respectively. |

We have established a series of option plans for our non-employee directors, each of which must be approved by the Securities and Exchange Commission (the “SEC”) under the 1940 Act to become effective (the “existing director option plans”). The first was the 1997 Disinterested Director Stock Option Plan, which was approved by the SEC on May 14, 1999, and which provided for the issuance to participants of options to purchase an aggregate of 150,000 shares of our common stock. Messrs. Hahl, Harper and Lundine and Dr. Puryear each received automatic grants of options to purchase 15,000 shares of our common stock when the plan was approved by the SEC. In addition, as of May 15, 2000, Messrs. Hahl, Harper and Lundine and Dr. Puryear each received grants of options to purchase an additional 5,000 shares of our common stock. Ms. Baskin and Mr. Peterson were granted options to purchase 15,000 shares of our common stock each on June 15, 2000 and January 23, 2001, respectively, and Mr. Koskinen was granted options to purchase 20,000 shares of our common stock on February 2, 2007. All such options have vested and are fully exercisable except for the options that were granted on May 15, 2000 and June 15, 2000, which have all expired. All unexercised options expire ten years from the date of grant except that the initial grants to Messrs. Hahl, Harper and Lundine expired on November 6, 2007, and Dr. Puryear’s initial grant expired on September 15, 2008.

The second plan was the 2000 Disinterested Director Stock Option Plan, which provides for the issuance of options to purchase up to 150,000 shares of our common stock, and which became effective on February 28, 2006, when the SEC issued an order authorizing the plan. Ms. Baskin, Messrs. Hahl, Harper, Lundine and Peterson, and Dr. Puryear, who were our directors on the date of the order, each received an automatic grant of options to purchase 25,000 shares of our common stock. All such options have now vested. These options expire on October 30, 2013.

6

The third plan was the 2006 Stock Option Plan, which provides for the issuance to non-employee directors of options to purchase up to 320,000 shares of our common stock, and which became effective on February 16, 2007, when the SEC issued an order authorizing the plan. Each of the non-employee directors received an automatic grant of options to purchase 40,000 shares of our common stock on February 16, 2007. All such options have now vested. These options expire on May 11, 2016, except for Mr. Koskinen’s options, which will expire on February 1, 2017.

The fourth plan was the 2007 Stock Option Plan, which provides for the issuance of options to purchase up to 400,000 shares of our common stock, and which became effective on October 24, 2007, when the SEC issued an order authorizing the plan. Each of the non-employee directors received an automatic grant of options to purchase 50,000 shares of our common stock. All such options will vest over the first three anniversaries of May 4, 2007, and expire on May 4, 2017. Vesting of these options will be automatically accelerated upon the occurrence of death or disability of the director.

The fifth plan was the 2008 Stock Option Plan, which provides for the issuance of options to purchase up to 750,000 shares of our common stock, and which became effective on September 30, 2009, when the SEC issued an order authorizing the plan. Each of the non-employee directors received an automatic grant of options to purchase 93,750 shares of our common stock. All such options will vest over the first three anniversaries of May 19, 2008, and expire on May 19, 2018. Vesting of these options will be automatically accelerated upon the occurrence of death or disability of the director.

The sixth plan was the 2009 Stock Option Plan, which provides for the issuance of options to purchase up to 750,000 shares of our common stock. We have filed an application for such an order with the SEC but have not yet received an order. No options will be issued to non-employee directors under the 2009 Stock Option Plan until the SEC issues such an order (an “SEC Approval Order”). The 2009 Stock Option Plan is designed such that all grants to non-employee directors will be automatic and nondiscretionary. Each person who was a non-employee director during the entire period from June 11, 2009, to the date of the SEC Approval Order, will automatically be granted an option to purchase 93,750 shares of our common stock on the date of the SEC Approval Order. Such an option will be deemed to vest over a three-year period commencing on June 11, 2009. Each person who becomes a non-employee director after June 11, 2009, will (assuming that there are a sufficient number of shares available for issuance under the 2009 Stock Option Plan) automatically be granted an option to purchase 93,750 shares of our common stock as of the later of the date of the SEC Approval Order and the date the person becomes a non-employee director. Such an option will be deemed to vest over a three-year period commencing on the date the person becomes a non-employee director, or, if the date of the SEC Approval Order is after any such anniversary, the options that would have vested on any such anniversary date shall vest on the date of the SEC Approval Order. Vested options may be exercised no later than June 11, 2019 (or the ten-year anniversary of the date the person becomes a non-employee director if the person becomes a non-employee director after June 11, 2009), or, if later, the three-year anniversary of the date of the SEC Approval Order.

On July 27, 2006, the Board of Directors approved the American Capital Strategies, Ltd. Disinterested Director Retention Plan (the “Retention Plan”) for the purposes of attracting and retaining non-employee directors of outstanding competence. All of our directors who are not “interested” and have completed at least one year of service on the Board of Directors are eligible to participate in the Retention Plan. The Retention Plan is a nonqualified deferred compensation plan, which provides a lump sum payment in cash shortly following a director’s termination of service. However, no payment is made if there is a unanimous vote not to make the payment by the remaining directors.

On December 11, 2008, the Board of Directors amended the Retention Plan to suspend further accruals, and set the benefit that would be paid under the Retention Plan as each director’s number of full and fractional years of service as of December 11, 2008, multiplied by the current $100,000 director retainer. The suspension of further accruals resulted in $700,000 of savings to us in 2009. The participants individually do not have access to or control of the payment until separation from the Board of Directors, although the Board of Directors has the authority to make further amendments to the Retention Plan. Each director has fully vested in his or her account.

Stock Ownership Guidelines

Our Board of Directors believes that directors more effectively represent the best interests of the company if they are stockholders themselves. Thus, non-employee directors are encouraged to own shares of our common stock equal in value to the lesser of two times the annual cash Board retainer (which was $100,000 for 2009) or 5,000 shares within five years of joining the Board (of which 1,000 shares should be owned within the first year of joining the Board). The minimum number of shares to be held by the directors will be calculated on the first trading day of each calendar year based on their fair market value. In the event the cash retainer increases, the directors will have five years from the time of the increase to acquire any additional shares needed to meet these guidelines.

7

PROPOSAL 2:

APPROVAL OF 2010 DISINTERESTED DIRECTOR STOCK OPTION PLAN

General Information

The Board reviewed the existing director option plans and concluded that the number of shares authorized and available for grant under the existing director option plans is now insufficient to provide flexibility with respect to stock-based compensation for the directors who are not employees. The Executive Committee and the Board of Directors believe that stock-based incentive compensation, particularly through the award of stock options, is a key element of non-employee director compensation. Thus, the Executive Committee recommended and the Board of Directors approved, and subject to stockholder approval and the issuance of an exemptive order by the SEC under the 1940 Act (an “SEC Approval Order”), the 2010 Disinterested Director Stock Option Plan (the “2010 Director Option Plan”).

Summary of Material Provisions of the 2010 Director Option Plan

The following is a summary of certain provisions of the 2010 Director Option Plan. The complete text of the 2010 Director Option Plan is attached as Appendix I to this Proxy Statement and is incorporated herein by reference.

The 2010 Director Option Plan provides for the issuance of options to purchase a maximum of 1,250,000 shares of Common Stock or [ ]% of the [ ] shares of Common Stock outstanding on the Record Date, to non-employee directors of the Company. Options granted under the 2010 Director Option Plan may be exercised for a period of no more than ten years from the date of grant. Unless sooner terminated by the Company’s Board of Directors, the 2010 Director Option Plan will terminate on [ ], and no additional awards may be made under the 2010 Director Option Plan after that date. The maximum number of shares that may be covered by options granted under the Plan for a single participant is [ ].

Options granted under the 2010 Director Option Plan will be non-qualified stock options under the Code and entitle the optionee, upon exercise, to purchase shares of Common Stock from the Company at a specified exercise price per share. Stock options granted under the 2010 Director Option Plan must have a per share exercise price of no less than the fair market value of a share of Common Stock on the date of the grant. Options will not transferable other than by laws of descent and distribution and will generally be exercisable during an optionee’s lifetime only by the optionee.

The Executive Committee will administer the 2010 Director Option Plan. The committee has the authority to adjust the number of shares available for options, the number of shares subject to outstanding options and the exercise price for options following the occurrence of events such as stock splits, dividends, distributions and recapitalizations. However, without the approval of the our stockholders, and except in connection with a stock split, stock dividend or similar event, the committee will not lower the exercise price for any outstanding options or issue any replacement options for options previously granted at a higher exercise price.

The committee may provide that the exercise price of an option may be paid in Common Stock. The committee may also permit a “cashless exercise” arrangement whereby an optionee, without payment of the exercise price, receives upon exercise, shares having an aggregate fair market value equal to the product of (i) the excess of the fair market value of a share on the exercise date over the exercise price and (ii) the number of shares covered by the option.

The 1940 Act imposes certain requirements on options granted under the 2010 Director Option Plan including that the options must expire no later than ten years from grant, that the options not be separately transferable other than by gift, will or intestacy, that the exercise price must not be less than the current market price for the Common Stock at the time of grant, that the plan must be approved by the stockholders, and the Corporation not have a profit-sharing plan as described in the 1940 Act. In addition, the proposal to issue options under the 2010 Director Option Plan must be approved and an executive order issued by the SEC on the basis that the proposal is fair and reasonable and does not involve overreaching of the Company or its stockholders. We expect to file an application for such an order shortly after the issuance of this proxy statement. No options will be issued to non-employee directors under the 2010 Director Option Plan until we receive the SEC Approval Order.

The 2010 Director Option Plan is designed such that all grants will be automatic and nondiscretionary.

8

Each person who was a non-employee director during the entire period from September 15, 2010, to the date of the SEC Approval Order will automatically be granted an option to purchase [ ] shares of our common stock on the date of the SEC Approval Order. Such an option will be deemed to vest over a three-year period commencing on September 15, 2010, the date of the Annual Meeting. Vested options may not be exercised after [ ], or, if later, the three-year anniversary of the date of the SEC Approval Order.

Each person who becomes a non-employee director after September 15, 2010, will (assuming that there are a sufficient number of shares available for issuance under the 2010 Director Option Plan) automatically be granted an option to purchase [ ] shares of our common stock as of the later of the date of the SEC Approval Order and the date the person becomes a non-employee director. Such an option will be deemed to vest over a three-year period commencing on the date the person becomes a non-employee director. Vested options may not be exercised after the ten-year anniversary of the date the person becomes a non-employee director, or, if later, the three-year anniversary of the date of the SEC Approval Order.

In the event of death or the disability (as defined in the 2010 Director Option Plan) of a participant during his or her service as a director, all of his unexercised options will immediately become exercisable and may be exercised for a period of three years following the date of death or one year following the date of Disability (but no later than the expiration date of the option). In the event of termination of a participant’s service as a director for cause (as defined in the 2010 Director Option Plan), all of his or her unexercised options terminate immediately upon such termination, unless otherwise determined by the committee. If a person ceases to be a non-employee director for any reason other than death, disability or termination by the Company for cause, his or her options generally will be exercisable for a period of one year thereafter (but not later than the expiration date of the option). The 2010 Director Option Plan may be amended by the Board of Directors, except that the Board may not (i) change any option previously made under the 2010 Director Option Plan in a manner which would impair the recipients’ rights without their consent, or (ii) amend the 2010 Director Option Plan without approval of our stockholders, if required by law.

New Plan Benefits

The following table sets forth the number of options that have been committed to be granted to individuals in the following groups under the 2010 Director Option Plan as of [ ], 2010, subject to stockholder approval of the 2010 Director Option Plan:

| | | | | |

| | | 2010 Disinterested Director Stock Option Plan |

Name and Position | | Number of Shares of American

Capital Common Stock

Underlying Option Grant(1) | | Market Value of

Underlying Shares of

Common Stock(2) |

All Non-Employee Directors as a Group | | | | $ | |

Total | | | | $ | |

| (1) | Amounts represent options approved for grant by the Compensation and Corporate Governance Committee as of [ ], 2010. We may grant additional options under the 2010 Director Option Plan to such person(s) or group(s) of persons at future times. |

| (2) | The market value of underlying shares of common stock is calculated by multiplying the closing price of our common stock as reported on The NASDAQ Global Select Market as of [ ], 2010, times the number of options committed to be granted. No deduction is made for the strike price of the option that would have to be paid by the option holder to us in the event of an exercise of such option. |

Except as set forth above, we cannot determine at this time what benefits or amounts, if any, will be received by or allocated to any other person or group of persons under the 2010 Director Option Plan if the 2010 Director Option Plan is approved by the stockholders, or what amounts would have been received by any person or group of persons for the last fiscal year if the 2010 Director Option Plan had been in effect.

Summary of Certain Federal Income Tax Consequences

The following discussion briefly summarizes certain United States federal income tax aspects of options granted pursuant to the 2010 Director Option Plan. State, local and foreign tax consequences may differ.

Non-qualified Stock Options. All options under the 2010 Director Option Plan will be non-qualified stock options. A participant generally is not required to recognize income on the grant of a non-qualified stock option. Instead, ordinary income generally is required to be recognized on the date the non-qualified stock option is exercised. In general, the amount of ordinary income required to be recognized is an amount equal to the excess, if any, of the fair market value of the shares on the date of exercise over the exercise price.

9

Gain or Loss on Sale or Exchange of Shares. In general, gain or loss from the sale or exchange of shares granted under the 2010 Director Option Plan will be treated as capital gain or loss, provided that the shares are held as capital assets at the time of the sale or exchange.

Withholding. Our obligation to issue or deliver shares is subject to the satisfaction of applicable tax withholding. The respective committees may provide that a participant can satisfy tax withholding by (a) making a cash payment, (b) authorizing us to withhold shares that would otherwise be issued upon the exercise of the option, or (c) delivering to us already owned and unencumbered shares of our common stock.

Deductibility by Company. In general, in the case of a non-qualified stock option, we will be allowed a deduction in an amount equal to the amount of ordinary income recognized by the participant.

Tax Rules Affecting Nonqualified Deferred Compensation Plans. Options under the 2010 Director Option Plan may be subject to federal income tax rules that apply to “nonqualified deferred compensation plans” that were enacted as part of the American Jobs Creation Act of 2004 and which became effective on January 1, 2005. Failure to comply with these rules or qualify for an exemption in respect of an option could result in significant adverse tax results to the grantee of such option, including immediate taxation of the option upon vesting (and immediate taxation upon vesting of the grantee’s awards under certain other plans), a penalty tax of 20 percent of the amount of income so recognized, plus a special interest payment. The 2010 Director Option Plan has been designed to allow, but not require, the grant of options that are intended to comply with these deferred compensation rules or qualify for an exemption.

Conclusion and Recommendation; Vote Required

The Board of Directors believes that it is in our best interests and the best interests of the stockholders to adopt the 2010 Disinterested Director Stock Option Plan, to help attract and retain key persons of outstanding competence and to further align their interests with those of the stockholders. The approval of the 2010 Disinterested Director Stock Option Plan requires the vote of a majority of the votes of all shares of common stock present or represented and entitled to vote at the Annual Meeting. Abstentions and broker non-votes will have no effect on the outcome of the proposal. THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR APPROVAL OF THE 2010 DISINTERESTED DIRECTOR STOCK OPTION PLAN.

PROPOSAL 3:

APPROVAL OF CONVERTIBLE SECURITIES PROPOSAL

General Information

Sections 18(d) and 61(a) of the 1940 Act restrict the ability of a BDC such as us to issue warrants, options or rights to subscribe or to convert to voting securities of the company. If such securities are to be issued, the proposal must be approved by the stockholders of the BDC. In 2008, our stockholders approved a proposal for the company to issue shares of preferred stock or debt securities convertible into up to 20,000,000 shares of common stock (“convertible securities”). While we have not issued any such convertible securities, the Board of Directors believes it would be in our best interests to have flexibility to issue additional convertible securities under appropriate circumstances in connection with the capital raising and financing activities of the company. Thus, our Board of Directors has approved and recommends to the stockholders for their approval a proposal for the company to issue shares of preferred stock or debt securities convertible into up to 50,000,000 shares of our common stock, subject to adjustment for shares issued following the occurrence of events such as stock splits, stock dividends, distributions and recapitalizations (the “Convertible Securities Proposal”). The authority to issue convertible securities issuable pursuant to the Convertible Securities Proposal would be in addition to the convertible securities issuable pursuant to the 2008 authorization to issue convertible securities referenced above. Our Certificate of Incorporation currently authorizes 5,000,000 shares of preferred stock.

Background and Reasons

Our management and the Board of Directors have determined that it would be advantageous to the company to have flexibility to issue additional preferred stock or debt securities convertible into shares of our common stock in connection with the financing and capital raising activities of the company because it may be a cost-effective way for the company to raise capital. The issuance of convertible securities is a common practice in connection with the sale of securities through private placements or obtaining debt financing and approval of this proposal would place us in substantially the same position as corporations that are not BDCs. Such convertible securities, which may be issued in the form of preferred stock or debt securities, typically allow the purchaser of the securities to participate in any increase in the value of the issuer’s or borrower’s common stock. By allowing purchasers of the other securities to share in increases in the value of the common stock, such purchasers typically are willing to accept a lower specified return on the other securities than they would without such conversion feature. However, Section 61(a) of the 1940 Act sets forth certain requirements with regard to warrants, options, or rights to subscribe or convert to voting securities of a company that are not issued to directors, officers or

10

employees of a BDC. Specifically, (i) such warrants, options or rights must expire within 10 years of issuance, (ii) the conversion price for the securities must not be less than the current market value of the common stock at the date of issuance and (iii) the proposal to issue such securities must be authorized by the stockholders of the BDC and the individual issuances must be approved by a majority of the BDC directors who are not Interested Persons on the basis that such issuance is in the best interest of the BDC and its stockholders. In addition, if the warrants, options or rights are accompanied by other securities when issued, such warrants, options or rights cannot be separately transferable unless no class of such warrants, options, or rights and the securities that accompany them has been publicly distributed.

We have no immediate plans to issue any such convertible securities. However, in order to provide more flexibility for future issuances, which typically must be undertaken quickly, the Board of Directors has approved and is seeking stockholder approval of the Convertible Securities Proposal to issue shares of preferred stock or debt securities convertible into up to 50,000,000 shares of our common stock, subject to adjustment for shares issued following the occurrence of events such as stock splits, stock dividends, distributions and recapitalizations. The final terms of any convertible securities (subject to the requirements noted in Section 61 of the 1940 Act noted above), including conversion price, term and vesting requirements as well as any interest or dividends that such securities may pay prior to conversion, will be determined by the Board of Directors at the time of issuance. Also, the nature and amount of consideration that would be received by the company at the time of issuance and the use of any such consideration will be considered and approved by the Board of Directors at the time of issuance. No further authorization from the stockholders will be solicited prior to any such issuance. If such convertible securities are issued and if they are subsequently converted, it would increase the number of outstanding shares of our common stock by up to 50,000,000 shares, subject to adjustment for shares issued following the occurrence of events such as stock splits, stock dividends, distributions and recapitalizations. The number of warrants, options or rights that we may have outstanding at any time (including options held by our employees and non-employee directors) is limited by Section 61 of the 1940 Act to no more than 25% of the outstanding shares of our common stock. Any such conversion would be dilutive on the voting power of existing stockholders and could be dilutive with regard to dividends and other economic aspects of the common stock. Because the timing of any issuance is not currently known, the actual dilutive effects cannot be predicted.

Conclusion and Recommendation; Vote Required

The Board of Directors believes that it is in our best interests and in the best interests of the stockholders to adopt the Convertible Securities Proposal. The affirmative vote by the holders of a majority of the votes of all shares of our common stock present or represented and entitled to vote is necessary for approval of this proposal. Abstentions and broker non-votes will have no effect on the outcome of the proposal. THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR APPROVAL OF THE CONVERTIBLE SECURITIES PROPOSAL.

PROPOSAL 4:

RATIFICATION OF APPOINTMENT OF INDEPENDENT PUBLIC ACCOUNTANTS FOR 2010

Ernst & Young LLP has served as our independent registered public accounting firm since 1993 and, at a meeting on February 24, 2010, the Audit and Compliance Committee approved the appointment of Ernst & Young LLP to audit our consolidated financial statements for the year ending December 31, 2010. This appointment is subject to ratification or rejection by the stockholders. Ernst & Young LLP has no financial interest in American Capital. A representative of Ernst & Young LLP is expected to be present at the Annual Meeting, will have an opportunity to make a statement if he or she so desires and is expected to be available to respond to appropriate questions.

Ernst & Young LLP performed various audit and other services for us during 2009. The following presents a summary of the 2009 and 2008 fees billed by Ernst & Young LLP:

| | | | | | |

| | | 2009 | | 2008 |

Audit Fees | | $ | 3,711,985 | | $ | 4,185,019 |

Audit-Related Fees | | | 384,740 | | | 389,856 |

Tax Fees | | | — | | | 24,170 |

All Other Fees | | | 34,649 | | | 25,037 |

| | | | | | |

Total Fees | | $ | 4,131,374 | | $ | 4,624,082 |

| | | | | | |

Audit Fees

“Audit Fees” relate to fees and expenses billed by Ernst & Young LLP for the annual audit, including the audit of our annual financial statements, audit of internal control over financial reporting, review of our quarterly financial statements, comfort letters and consents related to debt and stock issuances and security custody examinations.

11

Audit-Related Fees

“Audit-Related Fees” relate to fees billed for required agreed upon procedures related to our debt securitization transactions and accounting consultation.

Tax Fees

“Tax Fees” relate to fees billed for professional services for tax compliance.

All Other Fees

“All Other Fees” relate to fees billed for required agreed upon procedures related to funds managed by one of our portfolio companies.

All services rendered by Ernst & Young LLP were permissible under applicable laws and regulations, and were pre-approved by the Audit and Compliance Committee for 2009 in accordance with its pre-approval policy. The Audit and Compliance Committee has established a policy regarding the pre-approval of all audit and permissible non-audit services provided by our independent auditors. The policy requires the Audit and Compliance Committee to approve each audit or non-audit engagement or accounting project involving the independent auditors, and the related fees, prior to commencement of the engagement or project to make certain that the provision of such services does not impair the firm’s independence. Approval of such engagements may be provided in person at regularly scheduled meetings or, for certain services, by email upon the affirmative assent thereto by at least two members of the Audit and Compliance Committee so long as no member objects thereto. In the case of an objection, approval must then be obtained at an in person meeting of the Audit and Compliance Committee. Pre-approval is not required for audit or non-audit services that result in ade minimis amount of $10,000 or less, although such services are reported to the Audit and Compliance Committee promptly thereafter. In addition, pursuant to the policy, pre-approval is not required for additional non-audit services if such services result in ade minimis amount of less than 5% of the total annual fees paid by us to the independent auditor during the fiscal year in which the non-audit services are provided, were not recognized by us at the time of engagement to be non-audit services and are reported to the Audit and Compliance Committee promptly thereafter and approved prior to the completion of the audit.

Our portfolio companies may engage Ernst & Young LLP to perform audit and other services. We do not participate in the selection or appointment of Ernst & Young LLP by our portfolio companies.

Conclusion and Recommendation; Vote Required

The affirmative vote of a majority of the votes cast by the holders of our common stock present or represented and entitled to vote at the Annual Meeting is required to ratify the appointment of our independent auditors. Abstentions and broker non-votes will have no effect on the outcome of the proposal. THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS OUR INDEPENDENT PUBLIC ACCOUNTANTS FOR 2010.

REPORT OF THE AUDIT AND COMPLIANCE COMMITTEE

The Board of Directors has appointed an Audit and Compliance Committee presently composed of three directors, Ms. Baskin and Messrs. Hahl and Koskinen. Each of the directors is independent as defined in the NASDAQ listing standards. The Board of Directors has determined that Ms. Baskin and Messrs. Hahl and Koskinen are all “audit committee financial experts” (as defined in Item 401 of Regulation S-K under the Securities Act).

The Audit and Compliance Committee’s responsibility is one of oversight as set forth in its charter, which is available on our web site atwww.AmericanCapital.com. It is not the duty of the Audit and Compliance Committee to prepare our financial statements, to plan or conduct audits or to determine that our financial statements are complete and accurate and are in accordance with generally accepted accounting principles. Our management is responsible for preparing our financial statements and for maintaining internal controls. The independent auditors are responsible for auditing the financial statements and for expressing an opinion as to whether those audited financial statements fairly present our financial position, results of operations and cash flows in conformity with generally accepted accounting principles.

The Audit and Compliance Committee has reviewed and discussed our audited financial statements with management and with Ernst & Young LLP, our independent auditors for 2009.

The Audit and Compliance Committee has discussed with Ernst & Young LLP the matters required to be discussed by Statement on Auditing Standards No. 61, as amended.

12

The Audit and Compliance Committee has received from Ernst & Young LLP the written statements required by PCAOB Rule No. 3526,“Communications with Audit Committees Concerning Independence,” and has discussed Ernst & Young’s independence with Ernst & Young LLP, and has considered the compatibility of non-audit services with the auditor’s independence.

Based on the review and discussions referred to above, the Audit and Compliance Committee recommended to the Board of Directors that the audited consolidated financial statements for the year ended December 31, 2009, be included in our Annual Report on Form 10-K for the year ended December 31, 2009, for filing with the Securities and Exchange Commission.

The Audit and Compliance Committee also recommends the selection of Ernst & Young LLP to serve as independent public accountants for the year ending December 31, 2010.

|

| By the Audit and Compliance Committee: |

| Neil M. Hahl, Chairman |

| Mary C. Baskin |

| John A. Koskinen |

Use of Report of the Audit and Compliance Committee

In accordance with and to the extent permitted by applicable law or regulation, the information contained in the foregoing Report of the Audit and Compliance Committee is not “soliciting material” and is not to be incorporated by reference into any future filing under the Securities Act or the Exchange Act.

EXECUTIVE OFFICERS

The Board of Directors elects executive officers annually following our annual meeting of stockholders to serve until the meeting of the Board following the next annual meeting. Set forth below is certain information about each executive officer as of [ ], 2010. The business address of each executive officer is American Capital, Ltd., 2 Bethesda Metro Center, 14th floor, Bethesda, Maryland 20814.

| | | | |

Name | | Age | | Information about Executive Officers |

| Malon Wilkus | | 58 | | Chief Executive Officer (“CEO”) and Chairman of the Board of Directors. Further information about Mr. Wilkus may be found on page 3 of this proxy statement. |

| | |

| John R. Erickson | | 50 | | Mr. Erickson has served as the President, Structured Finance since 2008 and as our Chief Financial Officer (“CFO”) since 1998. He also served as our Secretary from 1999 to 2005 and an Executive Vice President from 2001 to 2008. From 1998 to 2001, Mr. Erickson was a Vice President. |

| | |

| Samuel A. Flax | | 54 | | Mr. Flax has served as an Executive Vice President and our General Counsel (“GC”), Chief Compliance Officer and Secretary since 2005. From 1990 to 2005, he was a partner in the Washington, D.C. law firm of Arnold & Porter LLP, where he served as our principal external counsel. Mr. Flax also served as Of Counsel to Arnold & Porter LLP in 2005. |

| | |

| Gordon J. O’Brien | | 45 | | Mr. O’Brien has served as the President, Specialty Finance and Operations since 2008. From 2001 to 2008 he served as a Senior Vice President and Managing Director. Prior to his election as a Senior Vice President, he served as a Vice President in 2001. From 1998 to 2001, he was a Principal. Mr. O’Brien was a Vice President at Pennington Partners & Company, a private equity fund from 1995 to 1998. |

| | |

| Ira J. Wagner | | 57 | | Mr. Wagner has served as the President, European Private Finance since 2008. He previously served as our Chief Operating Officer from 2001 to 2008 and as a Senior Vice President in 2001, prior to becoming an Executive Vice President from 2001 to 2008. He has been an employee since 1997 and has also held the positions of Principal and Senior Investment Officer. From 1993 to 1997, Mr. Wagner was a self-employed consultant and financial advisor. |

| | |

| Brian S. Graff | | 44 | | Mr. Graff has served as a Senior Vice President since 2004 and as a Senior Managing Director since 2008. From 2005 to 2008 he served as a Regional Managing Director and from 2004 to 2005 he served as a Managing Director. Mr. Graff also served as a Vice President and Principal from 2001 to 2004. From 2000 to 2001, he was a Principal of Odyssey Investments Partners, a private equity fund. |

13

| | | | |

Name | | Age | | Information about Executive Officers |

| Darin R. Winn | | 45 | | Mr. Winn has served as a Senior Vice President since 2002 and as a Senior Managing Director since 2008. From 2005 to 2008 he served as a Regional Managing Director and from 2002 to 2005 he served as a Managing Director. Mr. Winn also served as a Vice President from 2001 to 2002. From 1998 to 2001, he was a Principal. Prior to joining the Company, he worked at Stratford Equity Partners, a mezzanine and equity fund, from 1995 to 1998. |

| | |

| Roland H. Cline | | 63 | | Mr. Cline has served as a Senior Vice President and Managing Director since 2001. From 1998 to 2001, he was a Vice President. |

COMPENSATION DISCUSSION AND ANALYSIS

The following is a discussion of certain aspects of our compensation program and practices as they relate to our principal executive officer, our principal financial officer and our three other most highly-paid executive officers for 2009, whom we refer to below collectively as our “named executive officers,” or “NEOs.” We also refer to our CEO, Presidents, CFO and GC as our “senior management.”

Executive Compensation Philosophy and Objectives in the Current Economic Environment

There have been material developments in the financial markets worldwide over the past two years, which have led to a recession in the U.S. and other countries. We have been adversely affected by these developments, as has virtually every financial institution in the world. We believe that our ability to weather these challenging economic times and continue our success as a leading private equity firm and alternative asset manager depends on our ability to motivate and retain outstanding executive officers through the use of both current and long-term incentive compensation programs, which are competitive in a global market. We also believe that as a public company, elements of our executive compensation program should be designed to align employee interests with those of the stockholders and to reward performance above established goals, which is why we implemented our long-term incentive compensation programs. We establish compensation levels for our named executive officers based on current competitive market conditions and individual and company performance, each in the context of the economic climate, the relative values of different compensation programs and the widespread concern over executive pay. Our executive compensation programs and related data are reviewed throughout the year and on an annual basis by the Compensation and Corporate Governance Committee (the “Compensation Committee”) to determine if our executive officers are meeting their stated objectives and the programs are providing their intended results.

Decision-Making Process; Role of Executive Officers

The Compensation Committee performs an extensive review of each element of compensation of our executive officers at least once a year and makes a final determination regarding any adjustments to current compensation structure and levels after considering a number of factors. The Compensation Committee generally takes into account the scope of an officer’s responsibilities, performance and experience and balances these factors with competitive compensation levels, our performance and current market conditions. During the annual review process, the Compensation Committee reviews our full-year financial results against financial performance in prior periods with members of senior management and considers research conducted by our senior vice president – human resources (“SVP HR”) and her staff on compensation structure and levels at similar firms (“Industry Data”). Even during this turbulent financial crisis, we believe that we compete with private and public management companies of private equity, mezzanine, hedge funds and other types of funds to retain our executive talent. The Compensation Committee also considers recommendations made by our CEO and SVP HR and compensation consultants, if any, with regard to compensation for each of the other NEOs, based on the Industry Data, the performance of each executive officer and our performance over the past year.

Compensation Consultants

Under its charter, the Compensation Committee has the authority to select, retain and terminate compensation consultants. In 2009, the Compensation Committee did not retain any compensation consultants.

Elements of Compensation

We pay our named executive officers a combination of base salary, cash incentive payments and long-term incentive compensation, in addition to providing health, retirement and other benefits. In addition, we have entered into employment agreements with each of the NEOs. In accordance with applicable law and the Compensation Committee’s charter, the

14

Compensation Committee is required to approve any changes in the compensation of our executive officers. We have not adopted any formal policies or guidelines for allocating compensation between long-term compensation and regularly-paid income or between cash and non-cash compensation. We strive to achieve an appropriate mix between equity incentive awards and cash compensation in order to meet our objectives, as set forth above. For our NEOs, annual salary constituted 20.1% to 28.3% of total compensation, cash incentive payments under our Performance Incentive Plan (“PIP”) for each quarter constituted 34.6% to 40.3% of total compensation and long-term incentive compensation constituted the remaining 36.9% to 39.6% of total compensation in 2009. Thus, we believe that our NEOs remain closely aligned with our stockholders during this economic crisis. Each element of compensation is discussed briefly below.

Base Salary

Base salary is one component of each named executive officer’s cash compensation. We establish base salary after considering a variety of factors, including the current economic conditions and competitive market for executive officers, the scope of each officer’s responsibilities, the performance of the executive officer and our performance and if requested, recommendations from a retained compensation consultant. Base salaries are used to attract, motivate and retain outstanding employees.

Base salaries for our executive officers are reviewed annually by the Compensation Committee and at the time of a promotion or other change in responsibility of an executive officer and may be adjusted after considering the above factors. Each named executive officer’s employment agreement sets a minimum base salary, as described below under “Employment Agreements.” While the Compensation Committee believes that the named executive officers performed well in 2009 in an extraordinarily tough business environment, they determined not to increase the salaries of the NEOs for 2010, which have not been increased since 2007, except for Mr. O’Brien. The current base salaries for the NEOs are $1,495,000 for Mr. Wilkus, $1,085,000 for Mr. Erickson, and $1,020,000 for each of Messrs. Flax, O’Brien and Wagner.

Short-Term Incentive Payments

Each named executive officer is entitled to participate in a performance-based target incentive payment program under which he may receive a cash incentive payment based on a target amount. The target amount for each NEO is generally determined by the Compensation Committee each year prior to or shortly after the beginning of the year. The Compensation Committee then makes a quarterly determination regarding the amount, if any, of the target incentive payment that should be paid to each named executive officer for that quarter. Typically, only a portion of the incentive payment, if any, will be paid after the end of each of the first three quarters of the year and the majority of the incentive payment is considered for payment after the year has concluded and the Compensation Committee has reviewed our performance and the NEO’s performance for the entire year. Payment of the quarterly and year-end target incentive payments in 2009 was contingent on our achievement of certain performance goals set by the Committee and intended to qualify under Section 162(m) of the Code (the “Section 162(m) Criteria”). For 2010, we have again established Section 162(m) Criteria each quarter, as well as the full year. The portion of each executive officer’s target incentive payment that is contingent on achievement of Section 162(m) Criteria is paid as part of our Performance Incentive Plan and is described further below.

The quarterly payout of a target incentive payment, if any, is intended to motivate our NEOs throughout the year and to match rewards with actual performance when value is added, with a larger amount typically paid at the end of the year. After the conclusion of each year, the Compensation Committee meets to review each executive officer’s performance and our overall performance for the year, including the achievement of the Section 162(m) Criteria, as discussed below.

Each named executive officer’s employment agreement sets a minimum target incentive payment amount, which is described below. Any amount above the minimum target incentive payment amount set forth in each employment agreement is at the discretion of the Compensation Committee. For 2010, the Compensation Committee determined not to increase the target incentive payment amount of the NEOs from the following amounts set for 2009, which was also the same as for 2008: Mr. Wilkus at $6,000,000, Mr. Erickson at $3,000,000, and $2,500,000 for each of Messrs. Flax, O’Brien and Wagner. The NEOs were awarded half of their target incentive payment amount under the Performance Incentive Plan for 2009 under the retention agreements described below. After considering market data, the Compensation Committee concluded that the 2010 target incentive payment amounts were consistent with market practices and sufficient to meet our objectives as described above. As discussed further below, we entered in agreements with each of the NEOs under which we guaranteed, under certain circumstances, that each NEO will receive at least a portion of the 2009 target incentive payment amount

Long-Term Incentive Compensation Plans

Each NEO participates in long-term incentive compensation plans as do virtually all of our employees. The Compensation Committee and our Board of Directors believe that stock-based incentive compensation is necessary to help attract, motivate and retain outstanding officers, employees and directors and to align further their interests with those of our

15

stockholders. As discussed above, long-term incentive compensation comprised 36.9% to 39.6% of the NEOs’ total compensation for 2009, which we believe helps to ensure that our NEOs are focused on rebuilding stockholder value during this unprecedented economic period.

Stock-based compensation advances the interests of our company, but as a business development company we are restricted under the 1940 Act in the forms of incentive compensation that we can provide to our employees. For instance, we cannot compensate employees with stock appreciation rights. However, we compete with numerous private equity, mezzanine and hedge funds for our investment professionals. Such funds commonly pay to their partners and employees 20% of the profits (including capital gains), or carried interest, of each newly-raised fund under management. We have established three long-term equity based incentive plans based on these considerations.

Employee Stock Ownership and 401(k) Plans

We have established the American Capital, Ltd. Employee Stock Ownership Plan (the “ESOP”) as an “employee stock ownership plan” within the meaning of Section 4975(e)(7) of the Code, and the American Capital, Ltd. 401(k) Plan (the “401(k) Plan”) with a cash or deferred arrangement intended to qualify under Section 401(k) of the Code. We maintain the ESOP and 401(k) Plan for the benefit of our employees to enable them to share in our growth and supplement their personal savings and social security. The ESOP provided that for plan years prior to January 1, 2010, participants would receive allocations of our common stock at least equal to 3% of their annual compensation, up to certain statutory maximums. We will not be making a contribution to the ESOP for the 2010 plan year. The 401(k) Plan allows participants to make elective deferrals of a portion of their income as contribution to a Section 401(k) profit sharing plan. Beginning with the 2010 plan year, the 401(k) Plan provides that we may make discretionary matching contributions to the 401(k) Plan. We have determined that for 2010 we will match 100% of an employee’s 401(k) contributions, up to the first 3% of his or her compensation, subject to statutory maximums. The statutory maximum matching contribution for 2010 is $7,350. The NEOs participate in the ESOP and 401(k) Plan on the same basis as all of our other employees.

Employee Stock Option Plans