SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| | |

| Filed by the Registrant x | | Filed by a Party other than the Registrant ¨ |

Check the appropriate box:

| | |

| x | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

American Capital, Ltd.

(Name of Registrant as Specified in its Charter)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| x | | No fee required |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| ¨ | | Fee paid previously with preliminary materials |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

AMERICAN CAPITAL, LTD.

NOTICE OF SPECIAL MEETING OF

STOCKHOLDERS TO BE HELD ON , 20

DATE AND TIME: | , 20 ; : .m. |

PLACE: | Hyatt Regency Bethesda, 7400 Wisconsin Avenue, Bethesda, Maryland 20814 |

ITEMS OF BUSINESS: | To approve the following matters and other actions generally related to American Capital Ltd.’s strategy to focus primarily on the growth of our asset management business by transferring most of our existing investment assets to American Capital Income, Ltd. (“ACAP”) and distributing as a special dividend, all of the outstanding shares of common stock of ACAP to our stockholders: |

| | 1) | | To approve the withdrawal of our election to be regulated as a business development company under the Investment Company Act of 1940 following the spin-off of American Capital Income, Ltd.; |

| | 2) | | To approve the management agreement with American Capital Income, Ltd.; |

| | 3) | | To approve an amendment to our certificate of incorporation to effect a reverse stock split, subject to certain limitations; |

| | 4) | | To ratify the appointment of the directors of American Capital Income, Ltd.; |

| | 5) | | To approve the adoption of our 2016 equity incentive plan; |

| | 6) | | To authorize us, under limited circumstances, to sell shares of common stock below the net asset value per share; |

| | 7) | | To authorize the chairman of the Special Meeting to adjourn the Special Meeting if necessary or appropriate, in the discretion of the chairman, to obtain a quorum or to permit further solicitation of proxies if there are not sufficient votes at the time of the Special Meeting to approve any of the foregoing matters; and |

| | 8) | | To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

WHO CAN VOTE: | You are entitled to notice of, and to vote at, the Special Meeting and any adjournments or postponements of the meeting if you were a stockholder of record at the close of business on , 20 . |

VOTING: | Your vote is important and we urge you to vote. You may vote in person at the Special Meeting, or you may cause your shares to be voted by submitting a proxy by telephone, through the internet or by mailing your completed proxy card (or voting instruction form, if you hold your shares through a broker, bank or other nominee). See Question 9 of “Questions and Answers About the Special Meeting and Voting” in the accompanying Proxy Statement for additional information regarding voting. |

MEETING ADMISSION: | If you wish to attend the Special Meeting in person, we request that you register in advance with our Investor Relations department by following the instructions set forth in response to Question 17 of “Questions and Answers About the Special Meeting and Voting” in the accompanying Proxy Statement. |

DATE OF DISTRIBUTION: | This notice, the Proxy Statement and the accompanying proxy card are first being sent to our common stockholders on or about , 20 . |

| | | | |

| | | | By Order of the Board of Directors, |

| | |

| | | | Samuel A. Flax |

| | | | Executive Vice President, General Counsel, |

| | | | Chief Compliance Officer and Secretary |

, 20

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON , 20

This Proxy Statement is available free of charge on the internet at http://www.ACAS.com/specialproxymaterials.

This Proxy Statement contains information about the Special Meeting of Stockholders (the “Special Meeting”) of American Capital, Ltd. (“American Capital,” “ACAS,” the “Company,” “we,” “our” and “us”).

Forward-Looking Statements

All statements contained herein that are not historical facts including, but not limited to, statements regarding anticipated activity are forward looking in nature and involve a number of risks and uncertainties. Actual results may differ materially. Among the factors that could cause actual results to differ materially are the following: (i) changes in the economic conditions in which we operate negatively impacting our financial resources; (ii) certain of our competitors have greater financial resources than us, reducing the number of suitable investment opportunities offered to us or reducing the yield necessary to consummate the investment; (iii) there is uncertainty regarding the fair value of our privately-held securities that require our good faith estimate of fair value, and a change in estimate could affect our net asset value (“NAV”); (iv) our and our funds’ investments in securities of privately-held companies may be illiquid, which could affect our ability to realize the investment; (v) we use external financing to fund our business, which may not always be available; (vi) our ability to retain key management personnel; (vii) an economic downturn or recession could impair our and our funds’ portfolio companies and investments and therefore harm our operating results; (viii) our borrowing arrangements impose certain restrictions; (ix) changes in interest rates may affect our cost of capital and net operating income (“NOI”); (x) the Spin-Off discussed herein may not be completed, and even if it is completed, may not have the benefits we anticipate; (xi) our common stock price may be volatile; and (xii) general business and economic conditions and other risk factors described in our reports filed from time to time with the Securities and Exchange Commission (“SEC”). We caution you that forward-looking statements are not guarantees. Although we believe that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, our actual results could differ materially from those set forth in the forward-looking statements. We undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time unless otherwise required by law. You are advised to consult any additional disclosures that we may make directly to you or through reports that we file with the SEC in the future, including annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. The forward-looking statements and projections contained in this Proxy Statement or in periodic reports we file under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) are excluded from the safe harbor protection provided by Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act.

AMERICAN CAPITAL, LTD. – Proxy Statement i

ii AMERICAN CAPITAL, LTD. – Proxy Statement

AMERICAN CAPITAL, LTD. – Proxy Statement iii

iv AMERICAN CAPITAL, LTD. – Proxy Statement

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING AND VOTING

QUESTIONS AND ANSWERS

ABOUT THE SPECIAL MEETING AND VOTING

| 1. | WHY DID I RECEIVE THESE PROXY MATERIALS? |

We announced on November 5, 2014, and updated the announcement on May 6, 2015, that our Board of Directors had approved a plan to transfer most of our existing investment assets to a newly-formed subsidiary, American Capital Income, Ltd. (“American Capital Income” or “ACAP”), and distribute as a special dividend, all of the outstanding shares of common stock of ACAP to our stockholders (the “Spin-Off”), for the reasons discussed in Question 4, below.

Following the Spin-Off, (a) ACAP will be a publicly-traded company and will (i) elect to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940, as amended (the “1940 Act”), (ii) elect to be taxed as a regulated investment company (“RIC”), as defined in Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”) and (iii) distribute annually at least 90% of its taxable income as dividends to its stockholders and (b) American Capital will no longer be an investment company and will focus primarily on operating as a leading, global alternative asset manager. Thus, in connection with the Spin-Off, American Capital is proposing that its stockholders approve the withdrawal of its election to be regulated as a BDC under the 1940 Act. In addition, we are seeking your approval or ratification, as applicable, of the management agreement with ACAP, an amendment to our certificate of incorporation to effect a for reverse stock split of our outstanding common stock, par value $0.01 per share (the “Common Stock”), the appointment of ACAP’s directors, an equity incentive plan for our employees and directors and the issuance of shares of our Common Stock below the NAV per share, under limited circumstances, each as discussed further in this Proxy Statement.

Our Board of Directors is furnishing this Proxy Statement to you to solicit proxies on its behalf to be voted on these matters at the Special Meeting on at .m., Eastern Time, at the Hyatt Regency Bethesda, 7400 Wisconsin Avenue, Bethesda, Maryland 20814. The proxies also may be voted at any adjournments or postponements of the meeting.

American Capital is not required to obtain, and it is not seeking, approval of the Spin-Off. However, the Spin-Off will not take place as contemplated in this Proxy Statement unless stockholders approve each of proposals 1, 2, 3 and 4 at the Special Meeting, in addition to certain other conditions as set forth in ACAP’s Preliminary Information Statement attached as Exhibit I to this Proxy Statement.

| 2. | WHAT INFORMATION IS INCLUDED IN THIS PROXY STATEMENT? |

This Proxy Statement contains important information about the Special Meeting and the proposals to be voted on at the Special Meeting. It also includes (a) a preliminary version of the ACAP Information Statement as Exhibit I, which provides additional information about ACAP and the Spin-Off, (b) pro forma financial information for American Capital after giving effect to the Spin-Off and (c) a summary of certain risks involved in holding American Capital common stock following the Spin-Off. Assuming stockholder approval of proposals 1, 2, 3 and 4 is obtained at the Special Meeting and certain other conditions to the Spin-Off are satisfied, the final version of the ACAP Information Statement will be distributed to American Capital stockholders who hold Common Stock as of the record date for the Spin-Off.

You should read this Proxy Statement and the exhibits hereto carefully and in their entirety. By submitting a proxy, the enclosed voting materials allow you to have your shares voted at the Special Meeting without attending in person.

All properly executed written proxies, and all properly completed proxies submitted by telephone, by the internet or by mail that are delivered pursuant to this solicitation will be voted at the Special Meeting in accordance with the directions given in the proxy, unless the proxy is revoked before the completion of voting at the Special Meeting.

| 3. | HOW DOES ACAS PLAN TO EFECT THE SPIN-OFF? |

American Capital plans to effect the Spin-Off through a distribution to American Capital stockholders of all of the outstanding shares of common stock of ACAP, followed by a for reverse stock split of American Capital Common Stock. On the planned distribution date, each American Capital stockholder will receive share of ACAP common stock for every shares of ACAS Common Stock held as of the record date. The outstanding shares of American Capital Common Stock will then be combined in a for reverse stock split so that each American Capital stockholder will own share of American Capital Common Stock for every shares previously owned. Fractional shares resulting from the reverse stock split will not be issued and stockholders will be paid cash in respect of such fractional interests. Thus, immediately following the two transactions, American Capital’s stockholders will effectively own share of common stock of ACAP and share of ACAS

AMERICAN CAPITAL, LTD. – Proxy Statement 1

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING AND VOTING

Common Stock for every shares of ACAS Common Stock held prior to the Spin-Off, and American Capital’s stockholders will own all of the outstanding shares of common stock of ACAP.

| 4. | WHAT ARE THE REASONS FOR THE SPIN-OFF? |

Our Board of Directors has determined that the Spin-Off is in the best interests of American Capital and its stockholders because it will provide the following key benefits:

| | • | | With two separate public companies having distinct business models and investment characteristics, investors will have the opportunity to value each against distinct sets of peers and investment metrics. This has the potential to increase the overall valuation of the companies, thus unlocking stockholder value; |

| | • | | Separating the businesses should allow increased transparency for stockholders and other constituents, such as creditors and rating agencies, regarding each company’s assets, growth profile, operating performance and profitability; |

| | • | | Immediately after the Spin-off, only American Capital, and not ACAP will have net operating loss (“NOL”) carryforwards. As a RIC, ACAP will generally not have NOL carryforwards. Limiting the applicability of NOL carryforwards to American Capital’s asset management business should allow more efficient use of tax attributes such as NOLs; |

| | • | | Because ACAP will generally not have NOL carryforwards, it can be expected to have taxable income, at least 90% of which it will generally be required to distribute annually to its stockholders in accordance with Subchapter M of the Code, so long as it is a RIC; |

| | • | | By separating American Capital’s asset management business from its investment business, American Capital’s assets under management will now include the ACAP assets. Also, the Company should have the opportunity to expand more easily its operations and assets under management through the organic growth of assets under management and the acquisition of third-party asset management contracts and businesses; and |

| | • | | It will enable us and our affiliates to align better our recruiting, retention and equity-based incentive plans with the respective operating and stock price performance of us and our managed funds, such as ACAP, and provide us with additional flexibility to implement performance measurement metrics and incentive structures. |

| 5. | WHAT ITEMS WILL BE VOTED ON AT THE SPECIAL MEETING? |

| | | | | | |

| Proposal | | Board

Recommendations | | See Proxy Page | |

1) Approval of the Withdrawal of our Election to be Regulated as a Business Development Company under the Investment Company Act of 1940 | | FOR | | | 31 | |

2) Approval of the Management Agreement with American Capital Income, Ltd. | | FOR | | | 36 | |

3) Approval of an Amendment to our Certificate of Incorporation to Effect a Reverse Stock Split, Subject to Certain Limitations | | FOR | | | 41 | |

4) Ratification of the Appointment of the Directors of American Capital Income, Ltd. | | FOR | | | 46 | |

5) Approval of the American Capital, Ltd. 2016 Equity Incentive Plan | | FOR | | | 51 | |

6) Authorization, under Limited Circumstances, to Sell Shares of our Common Stock Below the Net Asset Value Per Share | | FOR | | | 55 | |

7) Approval of the Adjournment Proposal | | FOR | | | 59 | |

Our Board of Directors does not intend to bring other matters before the Special Meeting except items incidental to the conduct of the meeting. However, on all other matters properly brought before the meeting, or any adjournments or postponements thereof, by our Board of Directors or others, the persons named as proxies in the accompanying proxy, or their substitutes, will vote in their discretion.

It is your legal designation of another person to vote the stock you own. That other person is called a proxy. If you designate someone as your proxy in a written document, that document also is called a proxy or a proxy card. Samuel A. Flax and John R. Erickson have been designated as proxies by the Board of Directors for the Special Meeting.

2 AMERICAN CAPITAL, LTD. – Proxy Statement

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING AND VOTING

| 7. | WHAT IS THE RECORD DATE AND WHAT DOES IT MEAN? |

The record date for the Special Meeting is (the “record date”). The record date is established by the Board of Directors and only stockholders of record at the close of business on the record date are entitled to:

| a. | receive notice of the meeting; and |

| b. | vote at the meeting and any adjournments or postponements of the meeting. |

Each stockholder of record on the record date is entitled to one vote for each share of our Common Stock held. On the record date, there were shares of our Common Stock issued and legally outstanding.

| 8. | WHAT IS THE DIFFERENCE BETWEEN A STOCKHOLDER OF RECORD AND A STOCKHOLDER WHO HOLDS STOCK IN STREET NAME? |

If your shares of stock are registered in your name on the books and records of our transfer agent, you are a stockholder of record. If you are a stockholder of record you may provide a proxy to vote your shares and may attend the Special Meeting in person and vote your shares at the Special Meeting.

If your shares of stock are held for you through an intermediary in the name of your broker, bank or other nominee, your shares are held in street name and you are a beneficial owner, not a stockholder of record. Shares beneficially owned through an intermediary in the name of your broker, bank or other nominee may be voted only by the record holder, so you will need to provide voting instructions to the record holder as to how your shares are to be voted at the Special Meeting. While the holders of shares in street name can attend the Special Meeting with proper identification as described below, such holders may not vote at the Special Meeting unless they have a proxy from the record holder to vote at the Special Meeting.

It is important that you vote your shares or submit a proxy if you are a stockholder of record and, if you hold shares in street name, that you provide appropriate voting instructions to your broker, bank or other nominee as discussed in the answer to Question 13 below.

| 9. | WHAT ARE THE DIFFERENT METHODS THAT I CAN USE TO VOTE MY SHARES OF COMMON STOCK? |

You may submit your proxy or vote your shares of our Common Stock by any of the following methods:

By Telephone or the Internet—Stockholders can have their shares voted by submitting a proxy via telephone or the internet. The telephone and internet procedures are designed to authenticate a stockholder’s identity, to allow stockholders to vote their shares and to confirm that their instructions have been properly recorded.

By Mail—A stockholder who receives a paper proxy card or voting instruction form or requests a paper proxy card or voting instruction form by telephone or internet may elect to submit a proxy by mail and should complete, sign and date the proxy card or voting instruction form and mail it in the pre-addressed envelope that accompanies the delivery of the proxy card or voting instruction form. For stockholders of record, proxy cards submitted by mail must be received by the date and time of the Special Meeting. For stockholders who hold their shares through an intermediary, such as a broker, bank or other nominee, the voting instruction form submitted by mail must be mailed by the deadline imposed by your broker, bank or other nominee for your shares to be voted.

In Person—Shares held in your name as the stockholder of record on the record date may be voted by you in person at the Special Meeting. Shares held beneficially by you in street name on the record date may be voted by you in person at the Special Meeting only if you obtain a legal proxy from the broker, bank or other nominee that holds your shares giving you the right to vote the shares and bring that proxy to the meeting.

We will retain an independent tabulator to receive and tabulate the proxies and independent inspectors of election to certify the results.

| 11. | WHAT IF A STOCKHOLDER DOES NOT SPECIFY A CHOICE FOR A MATTER WHEN RETURNING A PROXY? |

Stockholders should specify their voting choice for each matter on the accompanying proxy. If no specific choice is made for one or more matters, proxies that are signed and returned will be voted “FOR” each of the proposals that are not marked.

AMERICAN CAPITAL, LTD. – Proxy Statement 3

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING AND VOTING

| 12. | WHAT DOES IT MEAN IF I RECEIVE MORE THAN ONE PROXY CARD? |

It means that you have multiple accounts with brokers and/or our transfer agent.Please submit proxies with respect to all of these shares.

We recommend that you contact your broker and/or our transfer agent to consolidate as many accounts as possible under the same name and address. Our transfer agent is Computershare Investor Services. Computershare’s address is P.O. Box 30170 College Station, TX 77842-3170; you can reach Computershare at 1-800-733-5001 (from within the United States or Canada) or 781-575-3400 (from outside the United States or Canada).

| 13. | WILL MY SHARES BE VOTED IF I DO NOT PROVIDE MY PROXY? |

Stockholders of Record: If you are a stockholder of record (see Question 8 above), your shares of Common Stock will not be voted if you do not provide your proxy unless you vote in person at the meeting.It is important that your shares are voted in person or by proxy.

Street Name Holders: If your shares are held in street name (see Question 8 above) and you do not provide your signed and dated voting instruction form to your broker, bank or other nominee, your shares of Common Stock may not be voted by your broker, bank or other nominee because none of the proposals to be voted upon at the Special Meeting is considered “routine” under applicable rules.It is, therefore, important that you vote your shares.

| 14. | ARE ABSTENTIONS AND BROKER NON-VOTES COUNTED? |

Abstentions are not treated as votes cast and therefore will not be included in vote totals and will not affect the outcome of the vote for proposals 4, 5 and 7, but will have the same effect as a vote against proposals 1, 2, 3 and 6 at the Special Meeting. Because none of the proposals to be voted on at the Special Meeting are considered “routine” matters for which brokers, banks or other nominees may vote uninstructed shares, there will be no broker non-votes.

| 15. | HOW CAN I REVOKE A PROXY? |

The enclosed proxy is solicited on behalf of the Board of Directors and is revocable at any time prior to the voting of the proxy at the Special Meeting, by the filing of an instrument revoking it, or a duly executed proxy bearing a later date, with our Secretary, addressed to our principal executive offices at 2 Bethesda Metro Center, 14th Floor, Bethesda, Maryland 20814. If you are a holder of record, in the event that you attend the Special Meeting, you may

revoke your proxy and cast your vote personally. Simply attending the Special Meeting will not revoke a prior proxy.

| 16. | WHO WILL PAY THE COST OF THIS PROXY SOLICITATION? |

The cost of this solicitation of proxies will be paid by American Capital. In addition to the use of mail, our officers and employees may solicit proxies by telephone or facsimile. Upon request, we will reimburse brokers, dealers, banks, and trustees, or their nominees, for reasonable expenses incurred by them in forwarding our proxy materials to beneficial owners of our Common Stock. It is contemplated that additional solicitation of proxies will be made in the same manner under the engagement and direction of Georgeson Inc., 480 Washington Blvd. 26th Floor, Jersey City, NJ 07310, at an anticipated cost of $ , plus reimbursement of out-of-pocket expenses.

| 17. | HOW DO I OBTAIN ADMISSION TO THE SPECIAL MEETING? |

If you wish to attend the Special Meeting in person, we request that you register in advance with our Investor Relations department either by email atIR@AmericanCapital.com or by telephone at (301) 951-5917.Attendance at the Special Meeting will be limited to persons presenting proof of stock ownership on the record date and picture identification. If you hold shares directly in your name as the stockholder of record, proof of ownership could include a copy of your account statement or a copy of your stock certificate(s). If you hold shares through an intermediary, such as a broker, bank or other nominee, proof of stock ownership could include a proxy from your broker, bank or other nominee or a copy of your brokerage or bank account statement.

| 18. | HOW MANY VOTES MUST BE PRESENT TO HOLD THE SPECIAL MEETING? |

In order for us to conduct the Special Meeting, holders representing a majority of our outstanding shares of Common Stock entitled to vote as of , must be present in person or by proxy at the Special Meeting. This is referred to as a quorum. Your shares are counted as present at the meeting if you attend the meeting in person or if you properly return a proxy by internet, telephone or mail.

Abstentions and shares of record held by a broker, bank or other nominee that are instructed to be voted on any matter are included in determining the number of shares present. However, because no routine discretionary matters for which broker non-votes may be submitted will be considered at the Special Meeting, broker non-votes, if any, will not be treated as present at the Special Meeting or entitled to vote and will not be included in determining whether a quorum is present.

4 �� AMERICAN CAPITAL, LTD. – Proxy Statement

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING AND VOTING

| 19. | WHAT IS THE REQUIRED VOTE FOR EACH PROPOSAL TO BE APPROVED? |

| | |

| Proposal | | Required Vote |

| |

| 1) Approval of the Withdrawal of our Election to be Regulated as a Business Development Company under the Investment Company Act of 1940 | | Approval of the withdrawal of our election to be regulated as a BDC requires an affirmative vote of a majority of our outstanding voting securities.* Abstentions will not count as affirmative votes and will therefore count against the proposal. |

| |

| 2) Approval of the Management Agreement with American Capital Income, Ltd. | | Approval of the Management Agreement requires an affirmative vote of a majority of our outstanding voting securities.* Abstentions will not count as affirmative votes and will therefore count against the proposal. |

| |

| 3) Approval of an Amendment to our Certificate of Incorporation to Effect a Reverse Stock Split, Subject to Certain Limitations | | The affirmative vote by the holders of a majority of the votes of all outstanding shares of our Common Stock as of the record date is necessary for approval of this proposal. Abstentions will not count as affirmative votes and will therefore count against the proposal. |

| |

| 4) Ratification of the Appointment of the Directors of American Capital Income, Ltd. | | The affirmative vote of a majority of the votes cast by the holders of our Common Stock present or represented and entitled to vote at the Special Meeting is required to ratify the appointment of the directors of ACAP. Abstentions will have no effect on the outcome of the proposal. |

| |

| 5) Approval of the American Capital, Ltd. 2016 Equity Incentive Plan | | The affirmative vote by the holders of a majority of the votes cast by the holders of our Common Stock present or represented and entitled to vote at the Special Meeting is necessary for approval of this proposal. Abstentions will have no effect on the outcome of the proposal. |

| |

| 6) Authorization, under Limited Circumstances, to Sell Shares of our Common Stock Below the Net Asset Value per Share | | The approval of this proposal requires the affirmative vote of (1) a majority of our outstanding voting securities; and (2) a majority of our outstanding voting securities that are not held by affiliated persons of us, which includes directors, officers, employees and 5% stockholders.* Abstentions will not count as affirmative votes and will therefore count against the proposal. |

| |

| 7) Approval of the Adjournment Proposal | | The affirmative vote by the holders of a majority of the votes cast by the holders of our Common Stock present or represented and entitled to vote at the Special Meeting is necessary for approval of this proposal. Abstentions will have no effect on the outcome of the proposal. |

| * | For purposes of this proposal, a “majority” of the outstanding voting securities, as defined in the 1940 Act, means the vote of (i) 67% or more of the shares of our Common Stock present at the Special Meeting, if the holders of 50% or more of our outstanding shares of Common Stock are present or represented by proxy, or (ii) more than 50% of the outstanding shares of our Common Stock, whichever is the less. |

AMERICAN CAPITAL, LTD. – Proxy Statement 5

BACKGROUND

Set forth below is a summary of certain information regarding the Spin-Off, including a description of American Capital and ACAP following the transaction. It may not contain all of the information that is important to you. Certain additional information regarding the Spin-Off and ACAP is set forth in the ACAP’s Preliminary Information Statement, attached hereto as Exhibit I. To obtain a more complete description of the Spin-Off and the transactions contemplated by it, you should carefully read all of the information contained herein, including Exhibit I.

The Spin-Off

We announced on November 5, 2014, and updated the announcement on May 6, 2015, that our Board of Directors had approved a plan to transfer most of our existing investment assets to ACAP, a newly-formed subsidiary, and to distribute as a special dividend all of the outstanding shares of ACAP’s common stock to the holders of American Capital’s Common Stock. ACAP will elect to be regulated as a BDC under the 1940 Act, to elect to be taxed as a RIC, as defined in Subchapter M of the Code, and to distribute annually at least 90% of its investment company taxable income to its stockholders. ACAP will be externally managed by American Capital ACAP Management, LLC (the “Manager,” or “ACAP Manager”), which is indirectly, wholly-owned by American Capital. Following the Spin-Off, ACAP will invest primarily in U.S. companies in the middle-market (which we consider to be companies with annual sales between $10 million and $750 million) and large-market (which we consider to be companies with annual EBITDA greater than $50 million). American Capital will withdraw its election to be regulated as a BDC and will no longer be an investment company and will focus primarily on operating as a leading, global alternative asset manager.

American Capital plans to effect the Spin-Off through a distribution to American Capital stockholders of all of the outstanding shares of common stock of ACAP, followed by a for reverse stock split of American Capital Common Stock. On the planned distribution date, each American Capital stockholder will receive share of ACAP common stock for every shares of ACAS Common Stock held as of the record date. Immediately following the distribution, American Capital’s stockholders will own all of the outstanding shares of common stock of ACAP. After the Spin-Off, ACAP will be a separate, publicly-traded company (NASDAQ: ACAP) and will be externally managed by ACAP Manager. In connection with the Spin-Off, American Capital expects to effect a for reverse stock split so that each American Capital stockholder will own share of ACAS Common Stock for every shares previously owned. Thus, immediately following the Spin-Off and the reverse stock split, American Capital’s stockholders will own share of common stock of ACAP and share of common stock of ACAS for every shares of ACAS Common Stock held prior to the Spin-Off, and American Capital’s stockholders will own all of the outstanding shares of common stock of ACAP. No fractional shares of American Capital or ACAP common stock will be issued in the reverse stock split or the special dividend. Holders of American Capital common stock that would otherwise be entitled to fractional shares as a result of the reverse stock split or the distribution will receive the cash value thereof, which cash payment will generally be taxable.

Pre- and Post-Spin-Off Structures

The Spin-Off is structured as a tax-free spin-off for American Capital stockholders. Our Board expects to provide final approval of the Spin-Off following the receipt of (1) a private letter ruling from the Internal Revenue Service confirming that certain discrete substantive items are consistent with tax-free spin-off treatment, (2) an opinion from our outside tax adviser concluding that the transaction as a whole should be treated as a tax free spin-off to American Capital and our stockholders and (3) the satisfaction of other conditions set forth in ACAP’s Preliminary Information Statement attached hereto as Exhibit I. There can be no assurances that any such conditions will be satisfied.

Prior to the Spin-Off, American Capital plans to transfer certain investment assets listed under “Portfolio Companies” in ACAP’s Preliminary Information Statement attached hereto as Exhibit I, $ in outstanding borrowings, certain other liabilities and $ in cash and cash equivalents to one or more wholly-owned subsidiaries of American Capital. Immediately prior to the Spin-Off, such subsidiaries and ACAS Funding I, LLC and ACAS Funding II, LLC, which are wholly-owned financing subsidiaries of American Capital that invest in leveraged loans, will be contributed by American Capital to ACAP. ACAS Funding I, LLC is the borrower under a $1.25 billion secured revolving credit facility (the “$1.25 Billion Revolving Credit Facility”) and ACAS Funding II, LLC is the borrower under a $500 million revolving credit facility (the

6 AMERICAN CAPITAL, LTD. – Proxy Statement

BACKGROUND

“$500 Million Revolving Credit Facility”). Under such facilities, ACAP will have the ability to borrow, prepay and reborrow loans at any time prior to the commitment termination dates of February 6, 2017 and October 30, 2016, respectively, subject to certain terms and conditions. Any outstanding balance on the $1.25 Billion Revolving Credit Facility and the $500 Million Revolving Credit Facility as of the commitment termination date is repayable on the maturity date of March 6, 2017 and October 31, 2016, respectively.

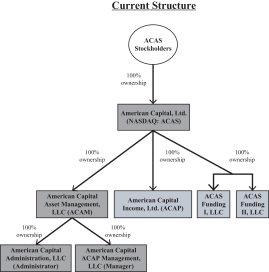

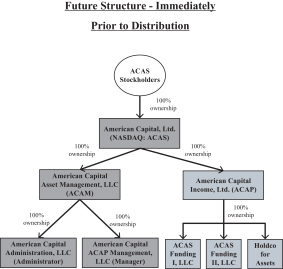

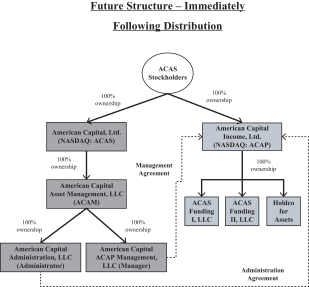

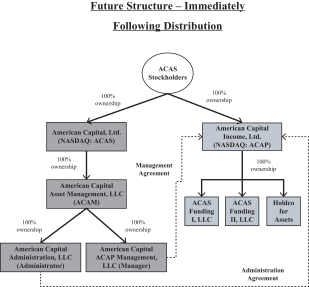

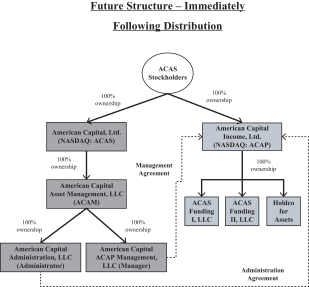

The charts below illustrate the current organizational structure of the two companies and the structure immediately before and after the Spin-Off:

AMERICAN CAPITAL, LTD. – Proxy Statement 7

BACKGROUND

Description of the Companies Post Spin-Off

The following discussion describes the business and operations of American Capital and ACAP as they are expected to be conducted after giving effect to the Spin-Off, assuming that certain of the proposals are approved by our stockholders. Information about American Capital’s business and operations as they are currently conducted is available in our Annual Report on Form 10-K for the year ended December 31, 2014 and our Quarterly Report on Form 10-Q for the period ended June 30, 2015 and certain other documents incorporated by reference into this Proxy Statement. See Question 5 of “Questions and Answers About Stockholder Communications and Proposals” for instructions to obtain those documents.

American Capital, Ltd.

Following the Spin-Off, American Capital, Ltd. (NASDAQ: ACAS) will focus primarily on operating as a leading, global alternative asset manager with approximately $ billion of fee earning assets under management and $ billion of total assets under management by affiliated managers, including investments in middle-market private debt and equity, leveraged finance, real estate, energy and structured products. American Capital’s asset management business will continue to be conducted through American Capital Asset Management, LLC (“ACAM”), a wholly-owned investment adviser registered under the Investment Advisers Act of 1940, as amended, and ACAM’s subsidiaries. Upon completion of the Spin-Off, American Capital expects to be managing four publicly traded permanent capital vehicles (ACAP, American Capital Senior Floating, Ltd. (NASDAQ: ACSF), American Capital Mortgage Investment Corp. (NASDAQ: MTGE) and American Capital Agency Corp. (NASDAQ: AGNC)) and 14 private funds with investments in the United States, Europe, Africa and Asia. It will also have a broad and scalable asset management platform, with approximately 90 investment professionals in eight offices in the United States, Europe and Asia. American Capital will seek to deliver industry leading performance to its stockholders by using its extensive investment and asset management experience and utilizing its capital and other resources to grow organically by increasing the size of existing funds, raising new funds to manage across a variety of asset classes, capital structures and fund strategies, and acquiring other asset management contracts or businesses.

Specifically, American Capital expects to continue to “incubate” new investment funds on its balance sheet by utilizing experienced investment and asset management teams to originate investments in particular asset classes, with the purpose of selling or contributing the assets to investment vehicles in conjunction with raising third-party capital. Consistent with past practices, American Capital may also maintain significant co-investments initially in new managed funds to align better American Capital’s interest with that of other fund investors. American Capital believes that its ability to incubate investment vehicles on its balance sheet is a significant competitive advantage to attract new investment and asset management teams and in growing its assets under management. These incubation assets will generally be held in various wholly-owned subsidiaries based on asset class, which will be consolidated by American Capital. In addition, American Capital expects to retain investment company accounting on the consolidation of the wholly-owned subsidiaries, which means that “controlled” fund incubation assets (i.e., controlled investments held in a consolidated fund incubation entity) will be accounted for at fair value in American Capital’s financial statements rather than consolidated.

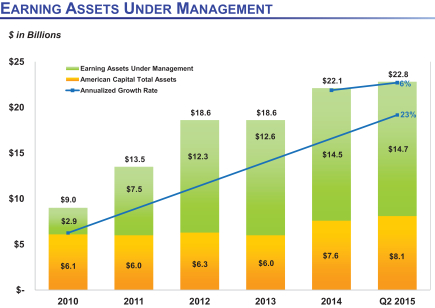

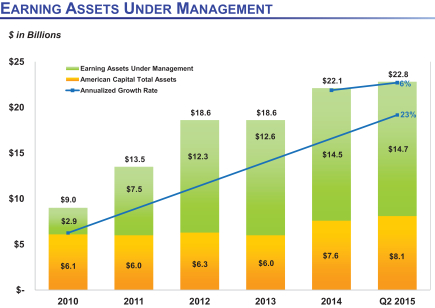

American Capital’s assets under management grew significantly since 2010 driven by its ability to incubate and grow new funds. The following tables reflect assets under management and earning assets under management by business line as of June 30, 2015 and December 31, 2014, 2013, 2012, 2011 and 2010 (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | |

| Assets Under Management | | June 30,

2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| Publicly Traded BDCs | | $ | 8,365 | | | $ | 7,922 | | | $ | 6,009 | | | $ | 6,319 | | | $ | 5,961 | | | $ | 6,084 | |

| Publicly Traded REITs | | | 69,105 | | | | 74,797 | | | | 84,632 | | | | 108,149 | | | | 60,107 | | | | 14,476 | |

| CLO Funds | | | 2,805 | | | | 2,359 | | | | 1,465 | | | | 682 | | | | 365 | | | | 388 | |

| Private Funds | | | 1,199 | | | | 1,344 | | | | 1,104 | | | | 1,650 | | | | 1,673 | | | | 1,697 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Assets Under Management(1) | | $ | 81,474 | | | $ | 86,422 | | | $ | 93,210 | | | $ | 116,800 | | | $ | 68,106 | | | $ | 22,645 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Assets under management are as of the end of the period presented and include both (i) the total assets of American Capital and (ii) the total assets of the funds under management by ACAM, excluding any direct investment American Capital has in those funds. |

8 AMERICAN CAPITAL, LTD. – Proxy Statement

BACKGROUND

| | | | | | | | | | | | | | | | | | | | | | | | |

| Earning Assets Under Management | | June 30,

2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| Publicly Traded BDCs | | $ | 8,367 | | | $ | 7,926 | | | $ | 6,009 | | | $ | 6,319 | | | $ | 5,961 | | | $ | 6,084 | |

| Publicly Traded REITs | | | 10,449 | | | | 10,546 | | | | 10,419 | | | | 10,852 | | | | 6,288 | | | | 1,616 | |

| CLO Funds | | | 2,805 | | | | 2,359 | | | | 1,465 | | | | 682 | | | | 365 | | | | 364 | |

| Private Funds | | | 1,131 | | | | 1,276 | | | | 710 | | | | 789 | | | | 882 | | | | 925 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Earning Assets Under Management(2) | | $ | 22,752 | | | $ | 22,107 | | | $ | 18,603 | | | $ | 18,642 | | | $ | 13,496 | | | $ | 8,989 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (2) | Earning assets under management are as of the end of the period presented and include both (i) the total assets of American Capital and (ii) the total third-party earning assets under management by ACAM from which the associated base management fees are calculated, excluding any direct investment American Capital has in those funds. |

Competitive Strengths Post Spin-Off

American Capital believes that its track record as an asset manager with a proven capability of raising and managing publicly-traded permanent capital vehicles, as well as its demonstrated ability to incubate new fund platforms, will enable it to continue to grow its asset management business. American Capital will utilize its experienced personnel and resources to continue to manage the daily operations for its managed funds. American Capital’s corporate, investment and operating platforms are well established, allowing it to realize economies of scale and other strengths, including the following:

Time-tested Management Expertise. American Capital has a highly-experienced team of investment and asset management professionals who possess significant investment, operational and management experience in numerous industries. We believe the accumulated experience of our management team allows us to identify opportunities and deploy capital of our managed funds across a broad spectrum of potential investments fluidly in response to changes in market and economic conditions in the U.S. and abroad.

Investment and Asset Management Experience. American Capital has developed a reputation as a leading asset manager because of its strong performance record in managing $ billion in assets under management as of for it and its managed funds making investments in the U.S., Europe, Africa and Asia. American Capital is also a diversified asset manager with multiple investment funds, both private and public, across a variety of asset classes and industries. American Capital believes that it can leverage its investment experience and asset management skills to structure and manage the investments of ACAP and its other managed funds effectively and efficiently.

AMERICAN CAPITAL, LTD. – Proxy Statement 9

BACKGROUND

Capital Markets Experience. American Capital has a proven track record of accessing the public and private capital markets in the U.S. and abroad, on behalf of American Capital and its managed funds, demonstrating its experience and ability to structure and finance assets efficiently. American Capital and its managed funds have raised more than $ billion of public equity capital in more than transactions and $ billion of private equity capital in more than transactions over the past 18 years in the U.S. and abroad. In addition, they have raised more than $ billion in public and private debt capital over the same time. American Capital expects to continue to access a wide range of secured, unsecured and structured debt and public and private equity capital sources for its managed funds to finance their investment activities and grow their assets.

Public Company Reporting, Investment Company, REIT and CLO Experience. American Capital has extensive experience managing publicly traded companies, including investment companies and REITs, in the U.S. and abroad, as well as managing and investing in multiple CLOs. Its management team is skilled in public company investor relations, reporting and compliance with the requirements of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), as well as the 1940 Act and stock exchange regulations, and is skilled in complying with the requirements under the Code to obtain RIC or REIT status and to maintain the ability to be taxed as a RIC or REIT for U.S. federal income tax purposes, as well as experienced in managing European Alternative Investment Funds under the regulatory framework of the Alternative Investment Fund Managers directive. American Capital believes its existing infrastructure is a competitive advantage in recruiting investment and asset management teams to incubate new fund platforms.

Flexibility to Sponsor Additional Vehicles and Assist with Growth. American Capital expects its balance sheet scale and flexibility will aid its growth initiatives, including the further build-out of American Capital’s existing investment management strategies, accelerated growth of new vehicles and strategies and the pursuit of acquisition opportunities.

Regulatory and Compliance Matters

Our operations are subject to regulation and supervision in several jurisdictions. The level of regulation and supervision to which we are subject varies from jurisdiction to jurisdiction and is based on the type of business activity involved. The regulatory and legal requirements that apply to our activities are subject to change from time to time and may become more restrictive. The SEC, the U.S. Commodity Futures Trading Commission (“CFTC”) and various other regulatory and self-regulatory organizations have in recent years increased their regulatory activities, including regulation, examination and enforcement in respect of asset management firms. Our businesses have operated for many years within a legal framework that requires our being able to monitor and comply with a broad range of legal and regulatory developments that affect our activities. Rigorous legal and compliance analysis of our businesses and investments is important to our culture. We strive to maintain a culture of compliance through the use of policies and procedures, such as codes of conduct, compliance systems, communication of compliance guidance and employee education and training. Employees in our legal and compliance departments monitor our compliance with all of the regulatory requirements to which we are subject and manage our compliance policies and procedures. Our compliance policies and procedures address a variety of regulatory and compliance risks including, but not limited to, the handling of material non-public information, position reporting, personal securities trading, valuation of investments on a vehicle-specific basis, document retention, potential conflicts of interest and the allocation of investment opportunities in the U.S. and abroad. See also the discussion of our regulation as a BDC under “Proposal 1: Approval of the Withdrawal of our Election to be Regulated as a Business Development Company under the Investment Company Act of 1940” on page .

Financing Strategy

Prior to the Spin-Off, American Capital plans to refinance or pay off certain of its existing indebtedness. We expect to use any additional proceeds from new indebtedness for general corporate purposes. In addition, immediately prior to the Spin-Off, American Capital will contribute ACAS Funding I, LLC and ACAS Funding II, LLC, which are wholly-owned financing subsidiaries of American Capital that invest in leveraged loans, to ACAP. ACAS Funding I, LLC is the borrower under a $1.25 billion secured revolving credit facility and ACAS Funding II, LLC is the borrower under a $500 million revolving credit facility. American Capital also plans to capitalize ACAP with certain of the assets it will own prior to the Spin-Off and to assist ACAP with obtaining appropriate term and/or revolving loan financing for its current and future assets.

Following the Spin-Off, American Capital will no longer be an investment company and subject to the asset coverage limitations under the 1940 Act. Thus, there will not be a regulatory limit on American Capital’s capacity to use leverage. American Capital’s financing objective following the Spin-Off will be to manage its capital structure effectively in order to provide sufficient capital to execute its business strategy for the benefit of its stockholders.

10 AMERICAN CAPITAL, LTD. – Proxy Statement

BACKGROUND

Risk Management

Risk management includes the ability to manage assets of our managed funds in a manner that is appropriate for the specific fund strategy. American Capital maintains a comprehensive fund management process, which generally includes investment and operating guidelines for the fund manager, daily oversight, periodic management meetings and a quarterly performance review process designed to enable it to evaluate and proactively manage fund performance.

Employees

As of , American Capital and ACAM, its wholly-owned asset management company, had employees operating out of six offices in the U.S. and two offices outside the U.S. American Capital believes that one of its major strengths is the quality and dedication of its people.

American Capital Income, Ltd.

American Capital Income, Ltd., a newly-organized Maryland corporation, intends to operate as a non-diversified closed-end management investment company and to elect to be regulated as a BDC under the 1940 Act, to elect to be taxed as a RIC, as defined in Subchapter M of the Code, and to distribute annually at least 90% of its investment company taxable income to its stockholders.

American Capital Income’s investment objective will be to provide investors with attractive, risk-adjusted total returns over the long-term primarily through current income while also seeking to preserve its capital, by owning and managing a portfolio composed primarily of diversified investments in (a) first and second lien senior, unitranche and mezzanine debt and minority equity co-investments in middle-market and large-market private companies sponsored by private equity funds (“Sponsor Finance Investments”), (b) first and second lien senior floating rate loans to large-market U.S. based companies (“Senior Floating Rate Loans” or “SFRL”), (c) structured finance investments (“Structured Products”), including the equity tranches of collateralized loan obligation (“CLO”) securities and collateralized debt obligation securities and (d) first and second lien senior and mezzanine debt and minority and controlling equity investments in middle-market companies with attractive franchise values that have experienced periods of excess leverage, operational and/or financial underperformance or other special circumstances (“Special Situations Investments”). In addition to these assets, American Capital Income’s initial portfolio will include first and second lien senior, unitranche and mezzanine debt and controlling equity in buyouts of private companies previously sponsored by American Capital (“American Capital One Stop Buyouts®”). ACAP intends to utilize leverage (limited to no more than one-to-one debt to equity) to enhance stockholder returns, and believes that, when properly financed, its investment strategy can produce attractive risk-adjusted returns. ACAP intends to apply to have its common stock listed on The NASDAQ Global Select Market under the trading symbol “ACAP.”

Competitive Strengths Post-Spin-Off

We expect ACAP will have competitive advantages over other entities investing in sponsor finance, leveraged loan, structured finance and special situations investments in the U.S. middle-market and large-market. We expect that these advantages will assist ACAP in seeking to provide attractive risk-adjusted returns to its stockholders. ACAP’s advantages include the following characteristics:

Proven and Experienced Senior Management. ACAP’s senior management is led by Malon Wilkus, who is the Chief Executive Officer of ACAP and ACAP Manager. ACAP’s other executive officers include (a) Brian Graff, President of ACAP and ACAP Manager, (b) John R. Erickson, ACAP’s Executive Vice President, Chief Financial Officer and Assistant Secretary and Executive Vice President and Treasurer of ACAP Manager, (c) Samuel A. Flax, Executive Vice President, Chief Compliance Officer and Secretary of ACAP and ACAP Manager and (d) Gordon O’Brien, Executive Vice President of ACAP and ACAP Manager.

In addition to ACAP’s executive officers, the other members of ACAP Manager’s senior management include Ryan Brauns, Senior Vice President and Managing Director, Sponsor Finance, Mark Pelletier, Senior Vice President and Managing Director, Leveraged Finance, Myung Yi, Senior Vice President and Managing Director, Special Situations, Jeff Schumacher, Senior Vice President and Managing Director, Syndications, Thomas McHale, Senior Vice President, Finance, and Roland Cline, Senior Vice President and Managing Director. ACAP Manager’s senior management team has an average of years

AMERICAN CAPITAL, LTD. – Proxy Statement 11

BACKGROUND

of collective experience in underwriting, investing in and managing Sponsor Finance Investments, Senior Floating Rate Loans, Structured Products, Special Situations Investments and American Capital One Stop Buyouts® and has managed portfolios of these assets through various credit cycles and market disruptions. As of , 2015, ACAP Manager’s senior management team managed approximately $ billion of investments on behalf of American Capital and its affiliates, including $ billion of Sponsor Finance Investments, $ billion of Senior Floating Rate Loans, $ billion of Structured Products, $ billion of Special Situations Investments and $ billion of American Capital One Stop Buyouts®.

We expect the extensive experience of ACAP Manager’s senior management team in identifying and investing in middle-market and large-market U.S. companies and structured finance investments to be a competitive advantage relative to ACAP’s competitors.

Established Platform. Through the Management Agreement (defined below) with the ACAP Manager and the Administration Agreement (defined below) with a subsidiary of American Capital as administrator, ACAP will have access not only to our employees, including senior management, investment professionals and operations, compliance, legal, capital markets, accounting, treasury, tax, investor relations and information technology staffs, who are experienced in sourcing, structuring, analyzing, executing and monitoring a broad range of private investments, but also to our infrastructure, operations, business relationships and management expertise. We expect that the American Capital investment platform will provide a competitive advantage to ACAP and will assist it in delivering value to its stockholders.

Large Capital Base. We expect ACAP to have a large capital base with approximately $ billion in equity as of , 2015, which will permit it to underwrite and hold generally up to $ million and $ million, respectively, in a single Sponsor Finance Investment or Special Situation Investment and to invest up to $ million in a single Structured Products Investment. We expect that at the time of the Spin-Off, ACAP will be one of the largest BDCs, which will differentiate it in the marketplace and make it a more desirable and flexible capital provider, particularly since it will have the ability to syndicate and/or hold larger investments than many of its competitors. We expect that ACAP will be flexible with the types of investments it makes and the terms associated with those investments. We believe that this approach and experience will provide ACAP a competitive advantage in identifying attractive investment opportunities throughout economic and capital market cycles and across a company’s life cycle and capital structure so it can make investments consistent with its stated investment objective and preserve principal while seeking appropriate risk adjusted returns. Additionally, we believe that ACAP’s ability to provide capital at both the senior and subordinated levels of the balance sheet will provide a strong value proposition to middle-market and large-market borrowers, and that its senior debt capabilities will provide superior deal origination and relative value analysis capabilities compared to traditional “mezzanine only” lenders.

Broad Syndications Capability. The senior members who will be on ACAP administrator’s syndications team have an average of years of collective experience, and have underwritten and distributed $ billion in first and second lien senior, unitranche and mezzanine debt and minority equity co-investments in middle-market and large-market private companies. We believe that the syndications capability provides a competitive advantage by potentially increasing net income and earnings through syndication, increasing originated deal flow flexibility, broadening market relationships and investment opportunities and allowing it to optimize its portfolio composition.

Disciplined Approach to Portfolio Management. ACAP Manager will manage ACAP’s portfolio through a well-defined underwriting and portfolio management process that will leverage the established platform of American Capital and its affiliates. We believes this will reduce the downside risk to ACAP’s stockholders and provides a scalable framework for investing in the future.

Extensive Experience Investing in Middle-Market and Large-Market U.S. Companies. We expect ACAP will benefit from American Capital’s historical focus on, and the extensive experience of ACAP Manager’s senior management team in, evaluating and investing in middle-market and large-market companies. This team has an extensive network of relationships with private equity firms, investment banks, commercial banks, financial services firms, mezzanine debt funds, trade organizations, attorneys and business and financial brokers focused on middle-market and large-market companies, which will be extremely useful in sourcing prospective portfolio company investments that have the potential to generate attractive returns. They have also developed and maintain a proprietary industry-wide database of reported middle-market and large-market transactions, which will enable ACAP to monitor the middle-market and large-market investing environment and to assess the degree to which ACAP is covering its target markets.

12 AMERICAN CAPITAL, LTD. – Proxy Statement

BACKGROUND

Financing Strategy

American Capital Income’s primary sources of liquidity will be its investment portfolio, cash and cash equivalents and the available capacity under the revolving credit facilities to be transferred to ACAP prior to the Spin-Off. In addition, ACAP may seek to finance certain of its assets, subject to market conditions, through other debt arrangements, including warehouse and revolving credit facilities, term loans and other asset-backed securitizations, and the additional issuance of equity securities. ACAP’s financing alternatives will be restricted in that it may not enter into debt transactions that would cause its asset coverage ratio to fall below 200%, as defined in the 1940 Act, and its ability to issue stock is limited if it is trading below NAV per share.

Immediately following the Spin-Off, ACAP is expected to have $ million of cash and cash equivalents, $ million of restricted cash and cash equivalents, $ million of outstanding indebtedness and $ million of available capacity under new credit facilities. ACAP believes that it will generate sufficient cash flow through the receipt of interest, dividend and fee payments from its investment portfolio, as well as cash proceeds from the realization of select portfolio investments, to allow it to service its debt, pay its operating costs and expenses, fund capital to its portfolio companies and originate new investments.

Portfolio Management

Following stockholder approval of the Management Agreement, the ACAP Manager will establish an investment committee (the “Investment Committee”), consisting of at least four members of ACAP Manager’s senior management team, depending on asset class. The Investment Committee will review and generally approve all of ACAP’s investments or investment strategies. The Investment Committee intends to meet on a regular basis as frequently as it believes is required to maintain prudent oversight of ACAP’s investment activities. The Investment Committee expects to set and monitor ACAP’s investment policies and guidelines and to receive notification in the event that ACAP may operate outside of such policies or guidelines. The Investment Committee and/or ACAP’s Board of Directors may change these policies or guidelines at any time without approval from ACAP’s stockholders.

Employees

Subject to stockholder approval of the Management Agreement, each of ACAP’s and ACAP Manager’s officers will be an employee of American Capital or one of its affiliates and none of them will be required to devote his or her time to ACAP exclusively. Each of ACAP’s and ACAP Manager’s officers will have significant responsibilities to American Capital and certain of its affiliated entities or managed funds. Each of ACAP’s and ACAP Manager’s senior management team will provide services to ACAP and may provide services to other investment vehicles that have been or may be sponsored by American Capital in the future and may have similar investment strategies. As such, conflicts may arise as employees of American Capital and any such affiliates may have conflicts between their duties to ACAP and their duties to, and interest in, other funds or entities to which they provide services. Our policy is to resolve any such conflicts in good faith.

Reasons for the Spin-Off

The American Capital Board of Directors, including a majority of the directors who are not “interested persons” of American Capital, as such term is defined in the 1940 Act, has determined that the Spin-Off is in the best interests of American Capital and its stockholders, and that separating most of American Capital’s investment assets from its asset management business will provide benefits to both American Capital and ACAP that could not be achieved as a combined company, including the ability to: (a) unlock stockholder value; (b) offer greater investor choice and transparency through separate entities; (c) provide greater tax efficiency; (d) expand American Capital’s asset management business; and (e) enhance strategic alignment of compensation structures.

Unlock stockholder value.American Capital’s Board of Directors believes that, following the Spin-Off, the combined value of American Capital’s common stock and ACAP’s common stock could, over time and assuming similar market conditions, be greater than the value of American Capital’s common stock had the Spin-Off not occurred, resulting in greater long-term value to American Capital stockholders and greater flexibility for each of American Capital and ACAP to make new investments to advance their business plans. As a combined company, American Capital has no exact peers, which we believe

AMERICAN CAPITAL, LTD. – Proxy Statement 13

BACKGROUND

causes the market to undervalue the combined company. With two separate public companies having distinct business models and investment characteristics, investors will have the opportunity to value each against distinct sets of peers and investment metrics. This has the potential to increase the overall valuation of the companies, thus unlocking stockholder value. The increased market value of the common stock of each company should provide additional flexibility for each company to pursue its business strategy.

Offer greater investor choice and transparency through separate entities.The Spin-Off will separate most of American Capital’s investment assets from its asset management business. American Capital’s Board of Directors believes this will increase transparency for stockholders and other constituents, such as creditors and rating agencies, regarding each company’s assets, growth profile, operating performance and profitability, facilitating the creation of a more natural and interested investor base for each company. The Spin-Off will provide investors with two individual investment options that may be more attractive to them than an investment in the combined company. The Spin-Off will allow investors to make independent decisions with respect to each of American Capital and ACAP based on, among other actors, their desired investment strategy, return profile and risk tolerance.

Provide greater tax efficiency. From the date of its initial public offering in August 1997 through October 2008, American Capital paid quarterly dividends to the holders of its common stock. Beginning with American Capital’s tax year ended September 30, 2011, American Capital’s status changed from a RIC subject to taxation under Subchapter M of the Code to a corporation subject to taxation under Subchapter C of the Code. Thus, American Capital is now subject to federal and applicable state corporate income taxes on its taxable ordinary income and capital gains and is no longer subject to the annual distribution requirements under Subchapter M of the Code. However, under Subchapter C of the Code, American Capital is able to carry forward any NOLs historically incurred to succeeding years, which it would not be able to do if it were subject to taxation as a RIC under Subchapter M of the Code. By separating American Capital’s existing NOLs from its investment assets in the Spin-Off, American Capital will have greater tax efficiency by preserving the use of its NOLs and tax attributes while allowing ACAP to immediately have taxable income that it can distribute to stockholders. Because ACAP will generally not have NOL carryforwards, it can be expected to have taxable income, at least 90% of which it will generally be required to distribute annually to its stockholders in accordance with Subchapter M of the Code, so long as it is a RIC.

Expand American Capital’s asset management business. By separating American Capital’s asset management business from its investment business, American Capital’s assets under management will now include the ACAP assets. Also, the Company should have the opportunity to expand more easily its operations and assets under management through the organic growth of assets under management and the acquisition of third-party asset management contracts and businesses. American Capital’s Board of Directors believes this is possible due to American Capital’s proposed structure being better aligned with the business and regulatory environment for asset managers coupled with the ability to retain earnings and issue multiple forms of capital to finance new and existing business opportunities.

Enhance strategic alignment of compensation structures.The Spin-Off is expected to enable American Capital and its affiliates to align better their recruiting, retention and equity-based incentive plans with the respective operating and stock price performances of American Capital and its managed funds, such as ACAP. After the Spin-Off, American Capital will have additional flexibility to implement different performance measurement metrics and incentive structures to compensate employees in accordance with American Capital’s and its managed funds’ respective strategic and financial plans.

14 AMERICAN CAPITAL, LTD. – Proxy Statement

BACKGROUND

American Capital, Ltd. Selected Historical Consolidated Financial Information

The selected consolidated financial information as of and for the years ended December 31, 2014, 2013, 2012, 2011 and 2010 has been derived from American Capital’s consolidated financial statements which were audited by Ernst & Young LLP and with respect to the years ended December 31, 2014, 2013 and 2012 are incorporated herein. The interim selected historical consolidated financial information as of and for the six months ended June 30, 2015 and 2014 has been derived from American Capital’s unaudited consolidated financial statements, which are incorporated herein. The interim selected historical consolidated financial information, in the opinion of American Capital’s management, reflects all adjustments (consisting only of normal recurring adjustments) that are necessary to present fairly the results for such interim periods. Interim results as of and for the six months ended June 30, 2015 are not necessarily indicative of the results that may be expected for American Capital for the year ended December 31, 2015.

The selected historical consolidated financial information presented below should be read in conjunction with the consolidated financial statements of American Capital and the accompanying notes to those financial statements and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” which may be found in American Capital’s Annual Report on Form 10-K for the year ended December 31, 2014 and American Capital’s Quarterly Report on Form 10-Q for the period ended June 30, 2015, which are incorporated herein by reference. The selected historical consolidated financial information below does not include all of the revenues, expenses, expense reductions and expense reimbursements that would have impacted us had we been two separate independent companies. As a result, the selected historical consolidated financial information is not indicative of our future performance and does not reflect what our leverage, financial condition, revenue, costs and results of operations would have been had we operated as independent, publicly-traded companies during the periods presented, including changes that will occur in our operations as a result of the Spin-Off.

AMERICAN CAPITAL, LTD. – Proxy Statement 15

BACKGROUND

AMERICAN CAPITAL, LTD.

SELECTED HISTORICAL FINANCIAL INFORMATION

(dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended

June 30, | | | Year Ended December 31, | |

| | | 2015 | | | 2014 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

| Total operating revenue | | $ | 322 | | | $ | 184 | | | $ | 471 | | | $ | 487 | | | $ | 646 | | | $ | 591 | | | $ | 600 | |

| Total operating expenses | | | 147 | | | | 127 | | | | 288 | | | | 255 | | | | 263 | | | | 288 | | | | 396 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net operating income before income taxes | | | 175 | | | | 57 | | | | 183 | | | | 232 | | | | 383 | | | | 303 | | | | 204 | |

| Tax (provision) benefit(1) | | | (58 | ) | | | (26 | ) | | | (66 | ) | | | (76 | ) | | | 14 | | | | 145 | | | | – | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net operating income (“NOI”) | | | 117 | | | | 31 | | | | 117 | | | | 156 | | | | 397 | | | | 448 | | | | 204 | |

| Loss on extinguishment of debt, net of tax | | | – | | | | – | | | | – | | | | – | | | | (3 | ) | | | – | | | | – | |

| Net realized (loss) gain, net of tax(1) | | | (436 | ) | | | 14 | | | | 152 | | | | (55 | ) | | | (270 | ) | | | (310 | ) | | | (576 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net realized (loss) earnings | | | (319 | ) | | | 45 | | | | 269 | | | | 101 | | | | 124 | | | | 138 | | | | (372 | ) |

| Net unrealized appreciation, net of tax(1) | | | 396 | | | | 237 | | | | 165 | | | | 83 | | | | 1,012 | | | | 836 | | | | 1,370 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net increase in net assets resulting from operations (“Net earnings”) | | $ | 77 | | | $ | 282 | | | $ | 434 | | | $ | 184 | | | $ | 1,136 | | | $ | 974 | | | $ | 998 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Per share data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

NOI: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | 0.43 | | | $ | 0.12 | | | $ | 0.44 | | | $ | 0.53 | | | $ | 1.24 | | | $ | 1.30 | | | $ | 0.63 | |

Diluted | | $ | 0.41 | | | $ | 0.11 | | | $ | 0.42 | | | $ | 0.51 | | | $ | 1.20 | | | $ | 1.26 | | | $ | 0.62 | |

Net earnings: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | 0.28 | | | $ | 1.05 | | | $ | 1.62 | | | $ | 0.63 | | | $ | 3.55 | | | $ | 2.83 | | | $ | 3.06 | |

Diluted | | $ | 0.27 | | | $ | 1.00 | | | $ | 1.55 | | | $ | 0.61 | | | $ | 3.44 | | | $ | 2.74 | | | $ | 3.02 | |

| Balance sheet data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 8,085 | | | $ | 6,394 | | | $ | 7,640 | | | $ | 6,009 | | | $ | 6,319 | | | $ | 5,961 | | | $ | 6,084 | |

Total debt | | $ | 2,107 | | | $ | 791 | | | $ | 1,703 | | | $ | 791 | | | $ | 775 | | | $ | 1,251 | | | $ | 2,259 | |

Total shareholders’ equity | | $ | 5,456 | | | $ | 5,305 | | | $ | 5,472 | | | $ | 5,126 | | | $ | 5,429 | | | $ | 4,563 | | | $ | 3,668 | |

NAV per share | | $ | 20.35 | | | $ | 20.12 | | | $ | 20.50 | | | $ | 18.97 | | | $ | 17.84 | | | $ | 13.87 | | | $ | 10.71 | |

| Other data (unaudited): | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Number of portfolio companies at period end | | | 439 | | | | 267 | | | | 402 | | | | 132 | | | | 139 | | | | 152 | | | | 160 | |

New investments(2) | | $ | 1,928 | | | $ | 1,134 | | | $ | 3,610 | | | $ | 1,107 | | | $ | 719 | | | $ | 317 | | | $ | 234 | |

Realizations(3) | | $ | 819 | | | $ | 850 | | | $ | 2,765 | | | $ | 1,208 | | | $ | 1,498 | | | $ | 1,066 | | | $ | 1,293 | |

Weighted average effective interest rate on debt investments, excluding SFRLs, at period end(4) | | | 8.8 | % | | | 9.3 | % | | | 8.2 | % | | | 10.0 | % | | | 11.4 | % | | | 10.7 | % | | | 10.2 | % |

Weighted average effective interest rate on debt investments at period end(4) | | | 6.4 | % | | | 7.8 | % | | | 6.6 | % | | | 10.0 | % | | | 11.4 | % | | | 10.7 | % | | | 10.2 | % |

LTM NOI before income taxes return on average shareholders’ equity(5) | | | 5.6 | % | | | 2.9 | % | | | 3.5 | % | | | 4.3 | % | | | 7.4 | % | | | 7.2 | % | | | 6.9 | % |

LTM NOI return on average shareholders’ equity(5) | | | 3.7 | % | | | 1.7 | % | | | 2.2 | % | | | 2.9 | % | | | 7.7 | % | | | 10.7 | % | | | 6.8 | % |

LTM net earnings return on average shareholders’ equity(5) | | | 4.2 | % | | | 1.9 | % | | | 8.2 | % | | | 3.4 | % | | | 22.1 | % | | | 23.3 | % | | | 33.5 | % |

Assets under management(6) | | $ | 81,474 | | | $ | 82,904 | | | $ | 86,422 | | | $ | 93,210 | | | $ | 116,800 | | | $ | 68,106 | | | $ | 22,645 | |

Earning assets under management(7) | | $ | 22,752 | | | $ | 19,450 | | | $ | 21,807 | | | $ | 18,603 | | | $ | 18,642 | | | $ | 13,496 | | | $ | 8,989 | |

| (1) | Beginning in 2011, we were no longer taxed as a RIC under Subchapter M of the Code and instead became subject to taxation as a corporation under Subchapter C of the Code. As a result, we recorded a net deferred tax asset of $428 million in 2011 recorded as a deferred tax benefit of $145 million in NOI, $75 million in net realized (loss) gain and $208 million in net unrealized appreciation. |

| (2) | New investments include amounts as of the investment dates that are committed. |

| (3) | Realizations represent cash proceeds received upon the exit of investments including payment of scheduled principal amortization, debt prepayments, proceeds from loan syndications and sales, payment of accrued PIK notes, and dividends and payments associated with accreted original issue discounts (“OID”) and sale of equity and other securities. |

| (4) | Weighted average effective interest rate on debt investments as of period end is computed as (a) annual stated interest rate or yield earned plus the net annual amortization of OID and market discount earned on accruing debt investments, divided by (b) total debt investments at amortized cost. |

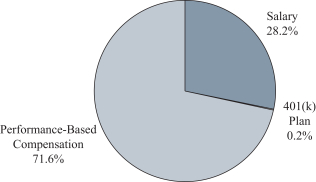

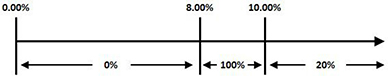

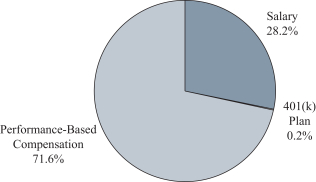

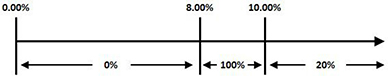

| (5) | Return represents net increase or decrease in net assets resulting from operations. Average equity is calculated based on the quarterly shareholders’ equity balances. For the 2015 and 2014 interim periods, LTM represents the twelve month period from July 1, 2014 to June 30, 2015 and July 1, 2013 to June 30, 2014, respectively. |