|

Company Overview OTCQB: APPA.PK September 2011 Exhibit 99.1 |

|

Legal Disclaimer September 2011 © 2011. A.P. Pharma, Inc. All rights reserved. 2 This presentation contains "forward-looking statements" as defined by the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve risks and uncertainties, including uncertainties associated with timely development, approval, launch and acceptance of new products, satisfactory completion of clinical studies, establishment of new corporate alliances, progress in research and development programs and other risks and uncertainties identified in the Company's filings with the Securities and Exchange Commission. Actual results may differ materially from the results expected in our forward looking statements. We caution investors that forward-looking statements reflect our analysis only on their stated date. We do not intend to update them except as required by law. |

|

Company: A.P. Pharma, Inc. Ticker: OTCQB: APPA.PK Stock Price: $0.25 (9/16/11) Market Capitalization: $98.1 million 1 Cash: $23.6 million 2 Debt: $1.5 million 3 Stock Summary September 2011 © 2011. A.P. Pharma, Inc. All rights reserved. 3 1 Based on 392.5 million as-converted common shares assuming the full conversion of convertible debt outstanding or subject to purchase rights, and 80 million warrants; not including options and 4M warrants with an exercise price of $0.88/share 2 Pro forma as of June 30, 2011 including net proceeds from July 1, 2011 PIPE funding 3 As of June 30, 2011 |

|

John B. Whelan President, CEO & CFO Raven Biotechnologies Eos Biotechnology Hewlett Packard/Agilent Michael A. Adam, Ph.D. Senior Vice President & Chief Operating Officer Spectrum Pharmaceuticals Pfizer Bristol-Myers Squibb John Barr, Ph.D. Senior Vice President, Research and Development Cortech Kristin Ficks Head of Commercial Operations Gemini Healthcare Celgene Eisai/MGI Pharma Management September 2011 © 2011. A.P. Pharma, Inc. All rights reserved. 4 |

|

A.P. Pharma Highlights © 2011. A.P. Pharma, Inc. All rights reserved. 5 Lead product candidate, APF530, is long-acting, injectable product for chemotherapy-induced nausea and vomiting (CINV) Incorporates widely used 5HT3 anatgonist - granisetron (Kytril ® ) 5-day delivery profile Reduces both acute- and delayed-onset CINV with single injection APF530 shown to be non-inferior to market leader Aloxi ® 1,341-patient, randomized, controlled, Phase 3 study Presented at ASCO 2009 Company is addressing issues raised in Complete Response Letter End-of-review meetings held in 1Q 2011 Resubmission planned for 1H 2012 APF530 targets a $900 million market opportunity in US alone Could be second, long-acting, injectable product on market A.P. Pharma has pipeline of additional products based on its Biochronomer™ drug delivery technology September 2011 |

|

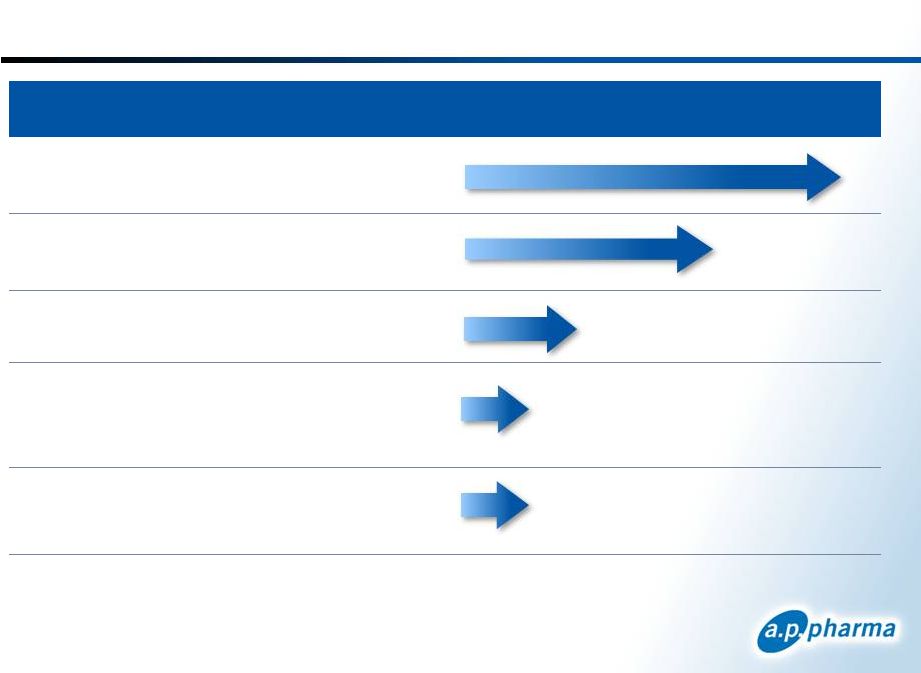

Product Pipeline Product Candidate Potential Indication Drug Target Duration Preclinical Phase 1 Phase 2 Phase 3 NDA APF530 Chemotherapy- induced nausea and vomiting Granisetron 5 days APF112 Post-surgical pain relief (opiate-sparing) Mepivacaine 3 days APF580 Sustained pain relief Buprenorphine 7 days APF328 Post-surgical pain and inflammation (orthopedic surgery) Meloxicam Up to two weeks APF505 Chronic pain and inflammation (osteoarthritis) Meloxicam Up to six weeks All leverage same polymer technology used in APF530 6 © 2011. A.P. Pharma, Inc. All rights reserved. September 2011 |

|

APF530 Milestones 2011 - 2012 1Q 2012 2Q 2012 2H 2012 7 © 2011. A.P. Pharma, Inc. All rights reserved. September 2011 Complete validation activities FDA approval decision Complete thorough QT and metabolism study Complete human factors study Complete CMC activities Resubmit APF530 NDA |

|

Clinical Summary 8 © 2011. A.P. Pharma, Inc. All rights reserved. September 2011 |

|

APF530 Pivotal Phase 3 Study Overview Randomized, controlled, multi-center study 1,341 patients in primary efficacy population Two doses of APF530 (5 mg and 10 mg granisetron) compared to the approved dose of Aloxi Patients stratified by type of chemotherapy regimen (moderately or highly emetogenic) Primary end point compared complete response between groups in both the acute (day 1) and delayed (days 2-5) phase Complete response defined as no emesis and no rescue medications A ±15% margin was used to establish non-inferiority 9 © 2011. A.P. Pharma, Inc. All rights reserved. September 2011 |

|

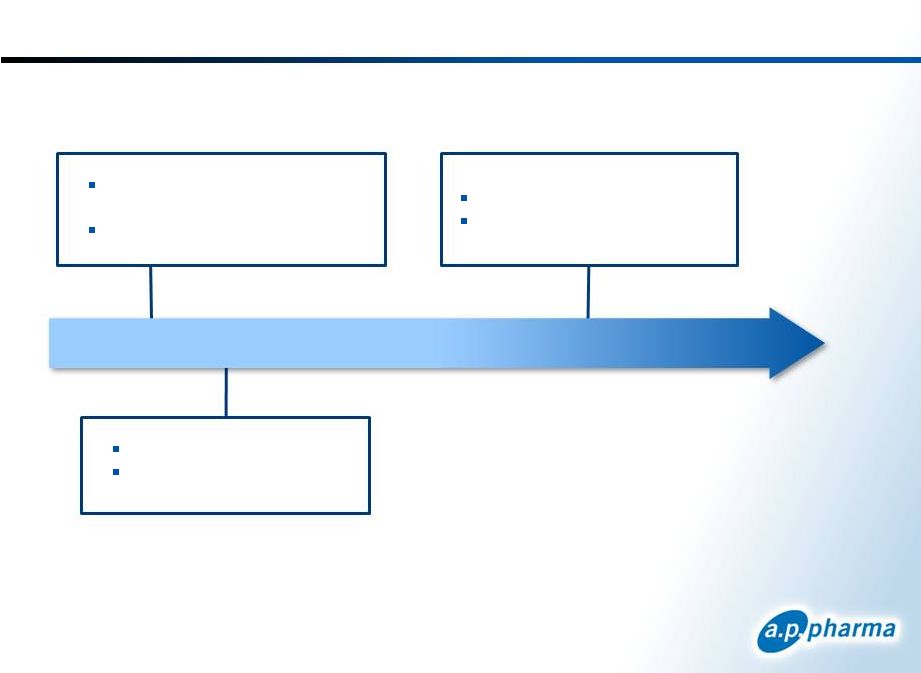

APF530 Phase 3 Study Design Cycle 1 Cycles 2 to 4 Patient Stratification (n = 1,341) Moderately Emetogenic (n = 634) Highly Emetogenic (n = 707) 10 © 2011. A.P. Pharma, Inc. All rights reserved. September 2011 Aloxi APF530 (5mg) APF530 (10mg) Aloxi APF530 (5mg) APF530 (10mg) APF530 (5mg) APF530 (10mg) APF530 (5mg) APF530 (10mg) |

|

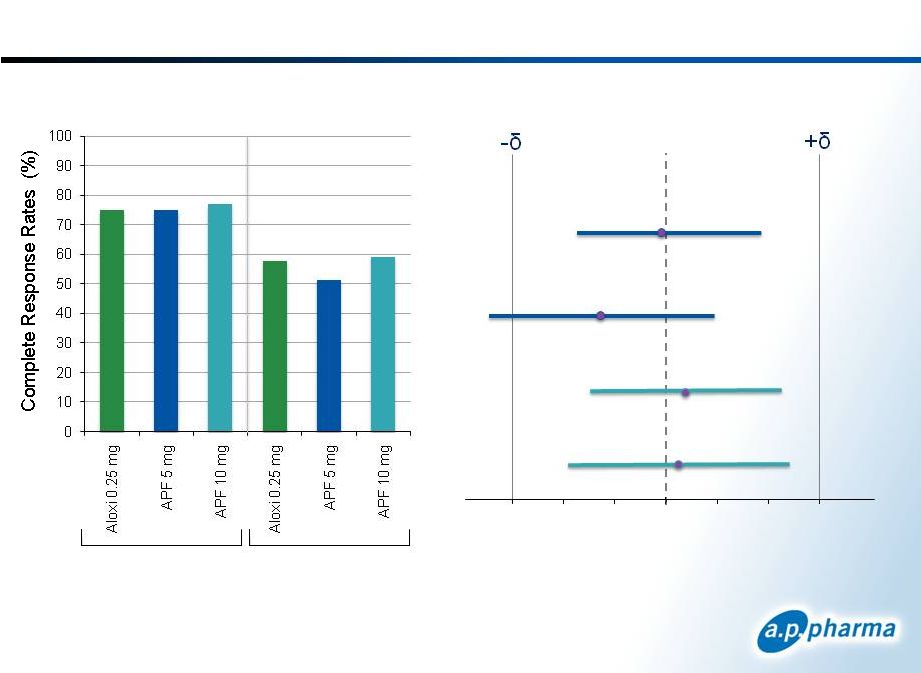

Primary Efficacy Results: Complete Response Patients Receiving Moderately Emetogenic Chemotherapy 11 © 2011. A.P. Pharma, Inc. All rights reserved. Acute Delayed APF530 5mg APF530 10mg Acute Delayed Acute Delayed Difference in Complete Response APF530-Aloxi (97.5% CI) -15 -10 -5 0 5 10 15 September 2011 75 74.8 76.9 57.7 51.4 59.0 |

|

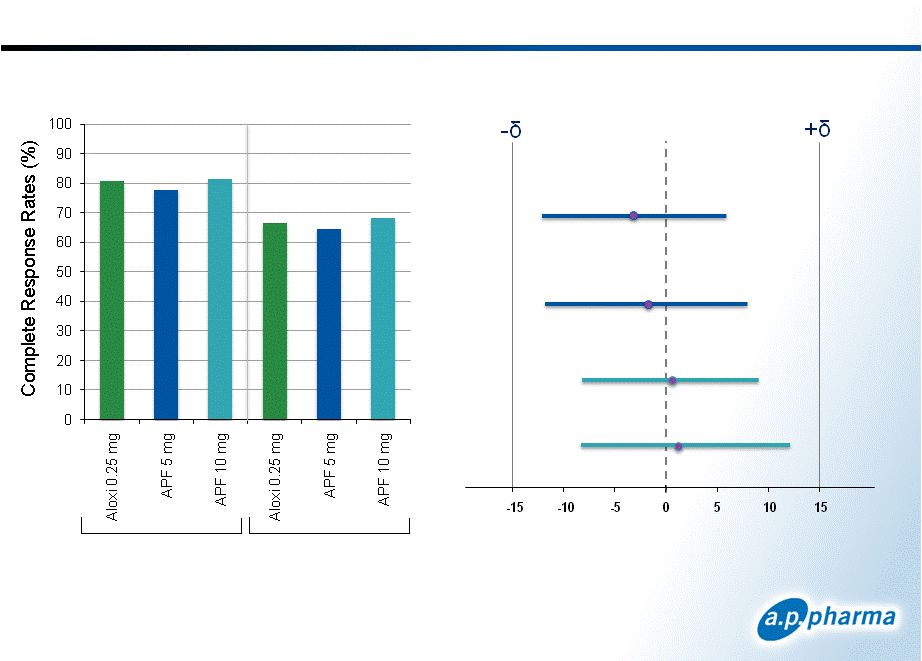

Primary Efficacy Results: Complete Response Difference in Complete Response APF530-Aloxi (98.33% CI) Acute Acute Delayed Delayed APF530 5mg APF530 10mg Patients Receiving Highly Emetogenic Chemotherapy 12 © 2011. A.P. Pharma, Inc. All rights reserved. Acute Delayed September 2011 80.7 77.7 81.3 66.4 64.6 68.3 |

|

Safety Summary * >90% of injection site reactions were reported as mild; one patient discontinued due to injection site reaction Reported in Cycle 1 13 © 2011. A.P. Pharma, Inc. All rights reserved. September 2011 Nervous System Bruising Erythema (redness) Nodule (lump) Pain Injection Site* Headache Serious Adverse Events Discontinued Due to Adverse Event Frequent Adverse Events Constipation Nausea Diarrhea Abdominal pain Gastrointestinal disorders APF530 5 mg APF530 10 mg N % N % N % 1 1 0.2 0.2 0 1 0 0 0 0 0 0.2 62 56 49 21 13.4 12.1 10.6 4.5 72 60 44 13 15.4 12.8 9.4 2.8 62 41 39 28 13.4 8.9 8.4 6.0 31 6.7 47 10.0 45 9.7 78 33 22 16 16.8 7.1 4.7 3.4 93 51 50 33 19.9 10.9 10.7 7.1 41 14 3 5 8.9 3.0 0.6 1.1 Placebo (NaCl) Aloxi 0.25 mg |

|

APF530’s Efficacy with Difficult Chemo Regimens 14 © 2011. A.P. Pharma, Inc. All rights reserved. Treatment Chemotherapeutic Regimen APF530 10 mg Aloxi 0.25 mg Moderately Emetogenic Acute Cyclophosphamide/Doxorubicin 70.7% 65.7% All other regimens 84.4% 85.0% Delayed Cyclophosphamide/Doxorubicin 47.4% 46.3% All other regimens 72.9% 70.0% Highly Emetogenic Acute Cisplatin regimens 81.1% 75.5% Carboplatin/Paclitaxel 85.4% 89.8% All other regimens 75.4% 67.6% Delayed Cisplatin regimens 66.0% 60.4% Carboplatin/Paclitaxel 70.8% 71.4% All other regimens 65.2% 57.4% September 2011 |

|

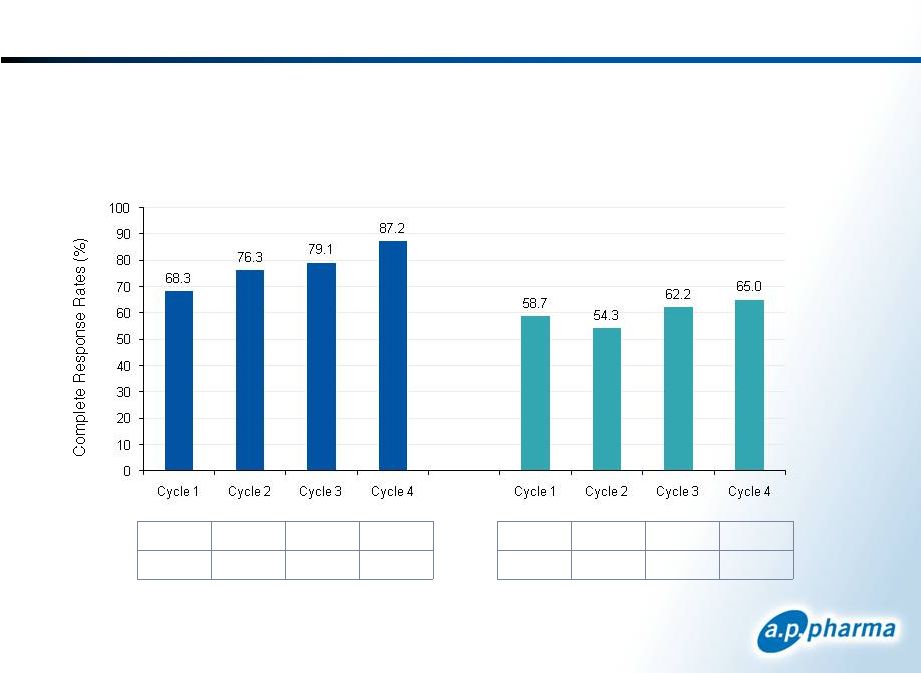

APF530’s Sustained Efficacy in Cycles 2-4 © 2011. A.P. Pharma, Inc. All rights reserved. 15 * Sakai et al (Annals of Oncology, Vol. 19 Sept. 2008) Complete Response Rates for Delayed-onset CINV in Patients Receiving Highly Emetogenic Chemotherapy 351 315 254 117 100% 90% 72% 33% 240 169 129 94 100% 70% 54% 39% N = % of Cycle 1 APF530 10mg Aloxi 0.75mg* September 2011 |

|

Summary of APF530 Phase 3 Results Non-inferiority to Aloxi was demonstrated For both acute- and delayed-onset CINV With both moderately and highly emetogenic chemotherapy APF530 was safe and well-tolerated Incidence of adverse events comparable to Aloxi High response rates were observed in difficult chemotherapy regimens A high level of efficacy was maintained through multiple cycles of chemotherapy 16 © 2011. A.P. Pharma, Inc. All rights reserved. September 2011 |

|

Regulatory Status and Strategy 17 © 2011. A.P. Pharma, Inc. All rights reserved. September 2011 |

|

APF530 NDA Status Submitted NDA in May 2009 Received Complete Response Letter in March 2010 FDA raised issues in three main areas: Dosing system Two-syringe system Chemistry, Manufacturing, and Controls (CMC) Sterilization Characterization Clinical/statistical Specific studies Presentation of data Held end-of-review meetings with FDA in 1Q 2011 Implementing plan to resubmit NDA in 1H 2012 18 © 2011. A.P. Pharma, Inc. All rights reserved. September 2011 |

|

Outcome of FDA Meetings Dosing System Changed to single-syringe system Single glass syringe for storage and administration Smaller needle: switch from 1” x 16 gauge to 5/8” x 18 gauge thin-wall Enhanced dosing instructions Overall, simpler and more convenient Non-clinical human factors study planned Chemistry, Manufacturing, and Controls Changed from bulk to terminal irradiation Additional specifications and assays for raw materials, polymer and drug product Clinical/Statistical Thorough QT study – Initiated in August 2011 Metabolism study Revised presentation format for Phase 3 data No additional clinical efficacy studies requested 19 © 2011. A.P. Pharma, Inc. All rights reserved. September 2011 |

|

Commercial Opportunity 20 © 2011. A.P. Pharma, Inc. All rights reserved. September 2011 |

|

U.S. Market Opportunity for APF530 More than 7 million cycles of chemotherapy administered each year ~27% are highly emetogenic ~46% are moderately emetogenic Significant unmet medical need for additional therapies to address delayed-onset CINV 5HT3 antagonists are standard-of-care for CINV Recommended in treatment guidelines – NCCN, ASCO, ONS An injectable 5HT3 antagonist is co-administered with more than 90% of moderately and highly emetogenic regimens APF530 targets a $900 million market opportunity in the US alone In 2010, there were 5.14 million vials of injectable 5HT3 antagonists administered for CINV The average selling price for market leader Aloxi is $179 Sources: Company-sponsored survey and analysis and Wolters Kluwer 21 © 2011. A.P. Pharma, Inc. All rights reserved. September 2011 |

|

1 Generation 5HT3 Antagonists Study Results © 2011. A.P. Pharma, Inc. All rights reserved. 22 Moderately Emetogenic Chemotherapy - Ondansetron Gralla Eisenberg 50% 34% Highly Emetogenic Chemotherapy Ondansetron Granisetron Aapro Emend Label Studies Emend Label Saito 25% 43% 52% 43% 33% 40% Average Overall Complete Response* rates *Overall Complete Response defined as no emesis and no rescue medications during 0 to 120 hours following chemotherapy September 2011 st Moderately Emetogenic Chemotherapy ~ 42% Highly Emetogenic Chemotherapy ~ 39% Overall Complete Response rates by study: |

|

Aloxi Study Results © 2011. A.P. Pharma, Inc. All rights reserved. 23 Moderately Emetogenic Chemotherapy Eisenberg Gralla Grunberg Hajdenberg APPA Ph 3 46% 69% 59% 59% 52% Highly Emetogenic Chemotherapy Aapro APPA Ph 3 41% 62% Average Overall Complete Response rates Moderately Emetogenic Chemotherapy ~ 57% Highly Emetogenic Chemotherapy ~ 51% Overall Complete Response rates by study: September 2011 |

|

Antiemetic Treatment Patterns September 2011 © 2011. A.P. Pharma, Inc. All rights reserved. 24 Most chemotherapy patients will undergo 4 to 15 cycles of chemotherapy Doctors prefer to administer antiemetics on-site for moderately and highly emetogenic chemotherapy Patient compliance is a significant concern Average cost per CINV event ranges from $4,000 to $5,300 Issues controlling CINV typically appear during the first few cycles If the initial prevention regimen is not effective, drugs are added and/or changed to address CINV in subsequent cycles No long-acting injectable alternative to Aloxi is available to prevent delayed-onset CINV |

CINV Market Dynamics

Injectable Drugs for the Prevention of CINV

Number of Package Units Sold by Quarter

800,000

700,000

600,000

500,000

400,000

300,000

200,000

100,000

0

Q2’06 Q3’06 Q4’06 Q1’07 Q2’07 Q3’07 Q4’07 Q1’08 Q2’08 Q3’08 Q4’08 Q1’09 Q2’09 Q3’09 Q4’09 Q1’10 Q2’10 Q3’10 Q4’10 Q1’11 Q2’11

ALOXI ANZEMET KYTRIL KYTRIL Generic (GRANISETRON) ZOFRAN ZOFRAN Generic (ONDANSETRON) EMEND

* US Oncology data added starting Q1’09.

Source: Wolters Kluwer

Usage in CINV estimated based on vial size

September 2011 © 2011. A.P. Pharma, Inc. All rights reserved.

a.p.pharma

25

|

Aloxi Market Performance September 2011 © 2011. A.P. Pharma, Inc. All rights reserved. 26 Zofran went generic Pricing Average Selling Price = $179 Medicare Reimbursement = $189 Wholesale Acquisition Cost ~ $300 - $330 Orange Book Patent Exclusivity One patent expires April 2015 Three patents expire January 2024 |

|

CINV Market Dynamics: Conclusions Aloxi has gained market share over last 3 years despite availability of generics for acute-onset CINV From 48% in 2008 to 56% in 2Q 2011 Kytril was widely used prior to Zofran ® going generic High physician acceptance of granisetron Aloxi dipped 30% when Zofran went generic but then regained 100% of its lost share two quarters later NK1 antagonists typically are only used as an adjunct to 5HT3 antatgonists Injectable Emend ® units sold less than 10% of injectable units sold for CINV prevention 27 © 2011. A.P. Pharma, Inc. All rights reserved. September 2011 |

|

Competitive Landscape September 2011 © 2011. A.P. Pharma, Inc. All rights reserved. 28 APF530 would be one of two injectable products approved for preventing delayed-onset CINV 5HT3 antagonists are standard-of-care 1 generation products have limited effectiveness in preventing delayed- onset CINV Patients continue to experience CINV despite currently available products Most chemotherapy patients will undergo 4 to 15 cycles of chemotherapy Large Phase III study supporting APF530’s use Non-inferior efficacy to Aloxi Similar safety profile to granisetron and Aloxi High response rates were observed in difficult chemotherapy regimens A high level of efficacy was maintained through multiple cycles of chemotherapy st |

|

APF530 Commercialization Strategy A.P. Pharma owns worldwide rights to APF530 APF530 can be commercialized with a compact commercial infrastructure targeting oncologists Company to evaluate partnering opportunities before and after FDA approval 29 © 2011. A.P. Pharma, Inc. All rights reserved. September 2011 |

|

Financial Summary September 2011 © 2011. A.P. Pharma, Inc. All rights reserved. 30 Completed $24MM PIPE in July 2011 Current resources expected to fund company into 2013 Summary Statement of Operations (In thousands, except per share data) Six Months Ended June 30, 2011 Revenue $ 646 Operating expenses 3,501 Other income (expenses) 1 (496) Net loss $ (3,351) Net loss per share 2 $ (0.08) Condensed Balance Sheet Data (In thousands) June 30, 2011 Dec 31, 2010 Cash and cash equivalents $ 21,331 3 $ 2,109 Working capital $ 18,626 $ 941 Total assets $ 22,121 $ 2,911 Total stockholders’ equity $ 18,892 $ 1,316 1 Includes discontinued operations 2 Based on 40.1 million weighted average common shares outstanding 3 Includes $20.3 million in advance proceeds received in June 2011 |

|

A.P. Pharma Highlights © 2011. A.P. Pharma, Inc. All rights reserved. 31 Lead product candidate, APF530, is long-acting, injectable product for chemotherapy-induced nausea and vomiting (CINV) Incorporates widely used 5HT3 antagonist - granisetron (Kytril ® ) 5-day delivery profile Reduces both acute- and delayed-onset CINV with single injection APF530 shown to be non-inferior to market leader Aloxi ® 1,341-patient, randomized, controlled, Phase 3 study Presented at ASCO 2009 Company is addressing issues raised in Complete Response Letter End-of-review meetings held in 1Q 2011 Resubmission planned for 1H 2012 APF530 targets a $900 million market opportunity in US alone Could be second, long-acting, injectable product on market A.P. Pharma has pipeline of additional products based on its Biochronomer™ drug delivery technology |

|

Thank You A.P. Pharma, Inc. OTCQB: APPA.PK September 2011 © 2011. A.P. Pharma, Inc. All rights reserved. 32 |