Corporate Update October 2, 2019 Exhibit 99.2

Forward-Looking Statements This presentation contains "forward-looking statements" as defined by the Private Securities Litigation Reform Act of 1995. We caution investors that forward-looking statements are based on management’s expectations and assumptions as of the date of this presentation, and involve substantial risks and uncertainties that could cause our clinical development programs, future results, performance or achievements to differ significantly from those expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, those associated with: the full-year 2019 net product sales guidance for the CINV franchise; whether the FDA approves the NDA for HTX-011; the timing of the FDA’s review process for HTX-011; the timing of the commercial launch of HTX-011; the timing of the CHMP’s review process for HTX-011; whether the European Commission authorizes the MAA for HTX-011; the potential market opportunity for SUSTOL, CINVANTI and HTX-011; the timing and results of the studies in the HTX-011 and HTX-034 development programs; the expected future balances of Heron’s cash, cash equivalents and short-term investments; the expected duration over which Heron’s cash, cash equivalents and short-term investments balances will fund its operations; and other risks and uncertainties identified in Heron's filings with the Securities and Exchange Commission. Forward-looking statements reflect our analysis only on their stated date, and we take no obligation to update or revise these statements except as may be required by law.

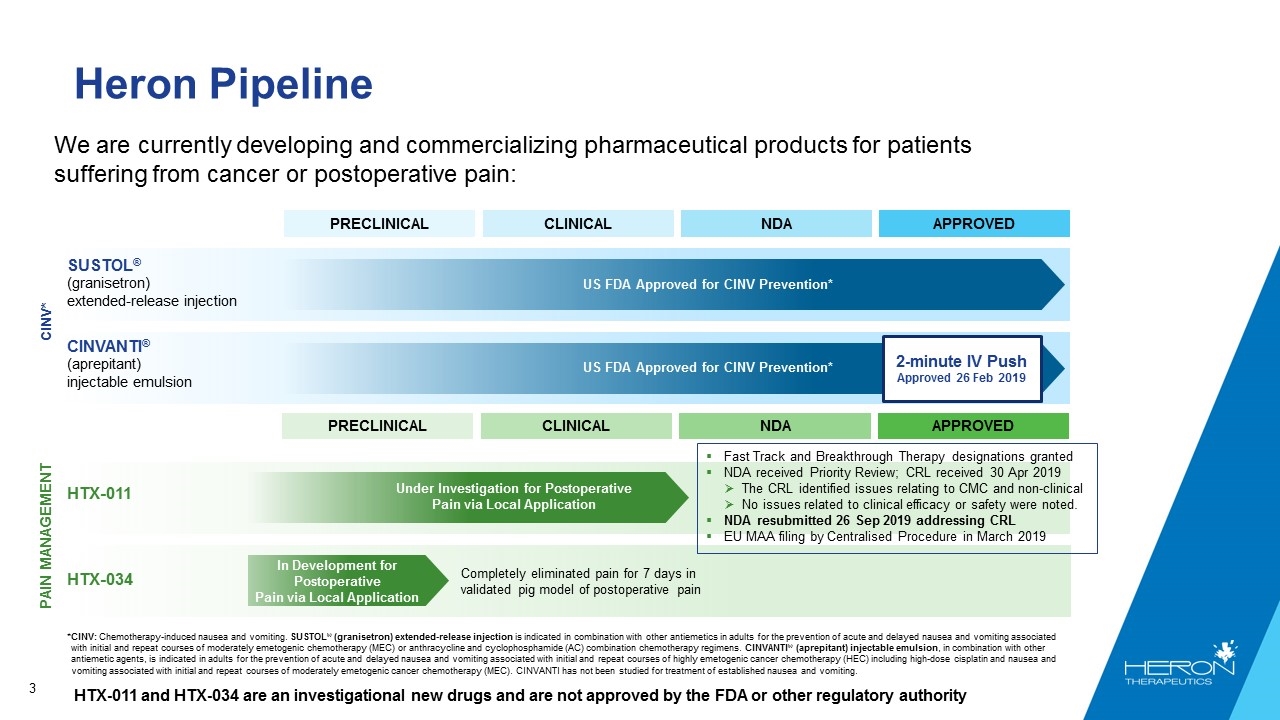

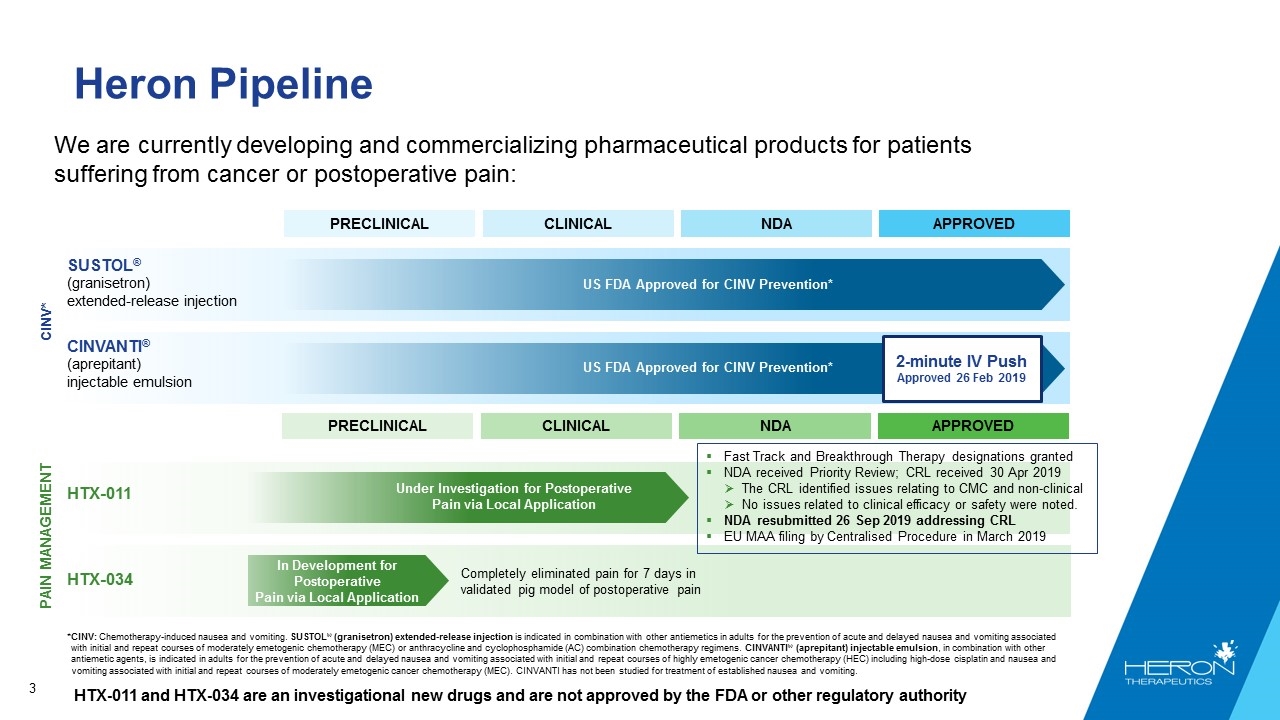

Heron Pipeline We are currently developing and commercializing pharmaceutical products for patients suffering from cancer or postoperative pain: SUSTOL® (granisetron) extended-release injection Fast Track and Breakthrough Therapy designations granted NDA received Priority Review; CRL received 30 Apr 2019 The CRL identified issues relating to CMC and non-clinical No issues related to clinical efficacy or safety were noted. NDA resubmitted 26 Sep 2019 addressing CRL EU MAA filing by Centralised Procedure in March 2019 CINV* US FDA Approved for CINV Prevention* Under Investigation for Postoperative Pain via Local Application CINVANTI® (aprepitant) injectable emulsion US FDA Approved for CINV Prevention* HTX-011 PAIN MANAGEMENT CLINICAL NDA APPROVED PRECLINICAL CLINICAL NDA APPROVED PRECLINICAL *CINV: Chemotherapy-induced nausea and vomiting. SUSTOL® (granisetron) extended-release injection is indicated in combination with other antiemetics in adults for the prevention of acute and delayed nausea and vomiting associated with initial and repeat courses of moderately emetogenic chemotherapy (MEC) or anthracycline and cyclophosphamide (AC) combination chemotherapy regimens. CINVANTI® (aprepitant) injectable emulsion, in combination with other antiemetic agents, is indicated in adults for the prevention of acute and delayed nausea and vomiting associated with initial and repeat courses of highly emetogenic cancer chemotherapy (HEC) including high-dose cisplatin and nausea and vomiting associated with initial and repeat courses of moderately emetogenic cancer chemotherapy (MEC). CINVANTI has not been studied for treatment of established nausea and vomiting. Completely eliminated pain for 7 days in validated pig model of postoperative pain In Development for Postoperative Pain via Local Application HTX-034 HTX-011 and HTX-034 are an investigational new drugs and are not approved by the FDA or other regulatory authority 2-minute IV Push Approved 26 Feb 2019

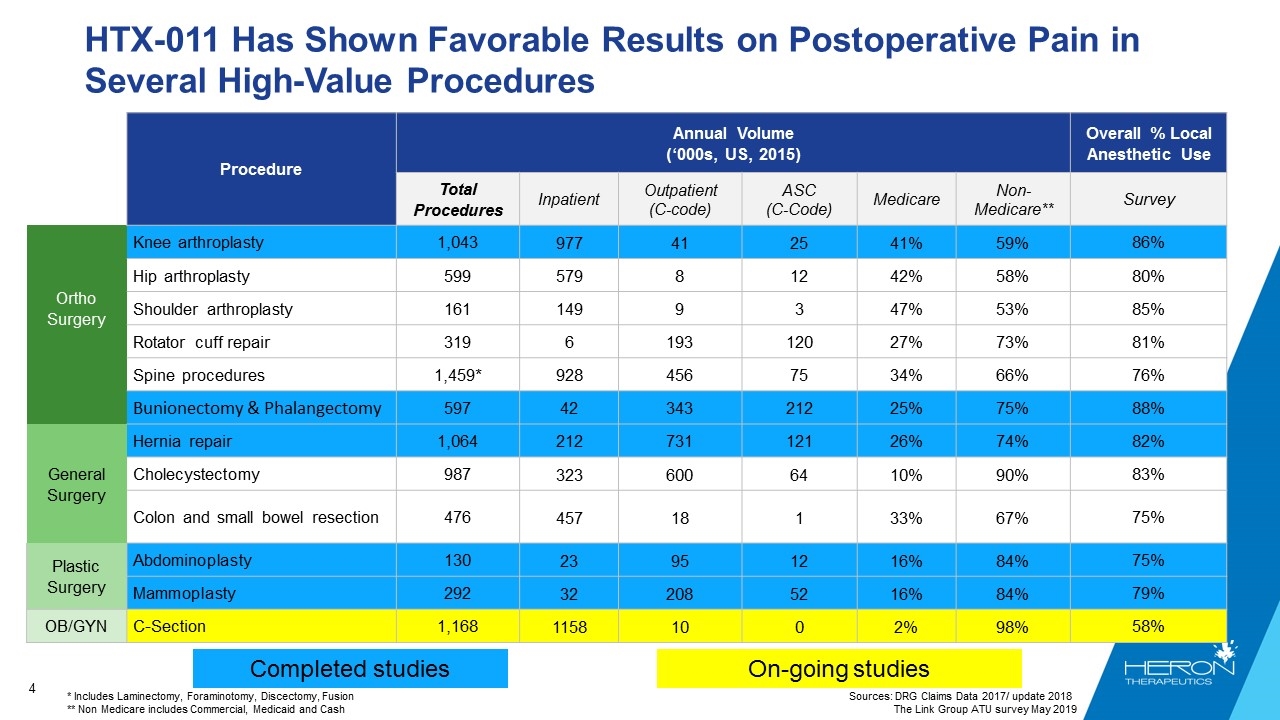

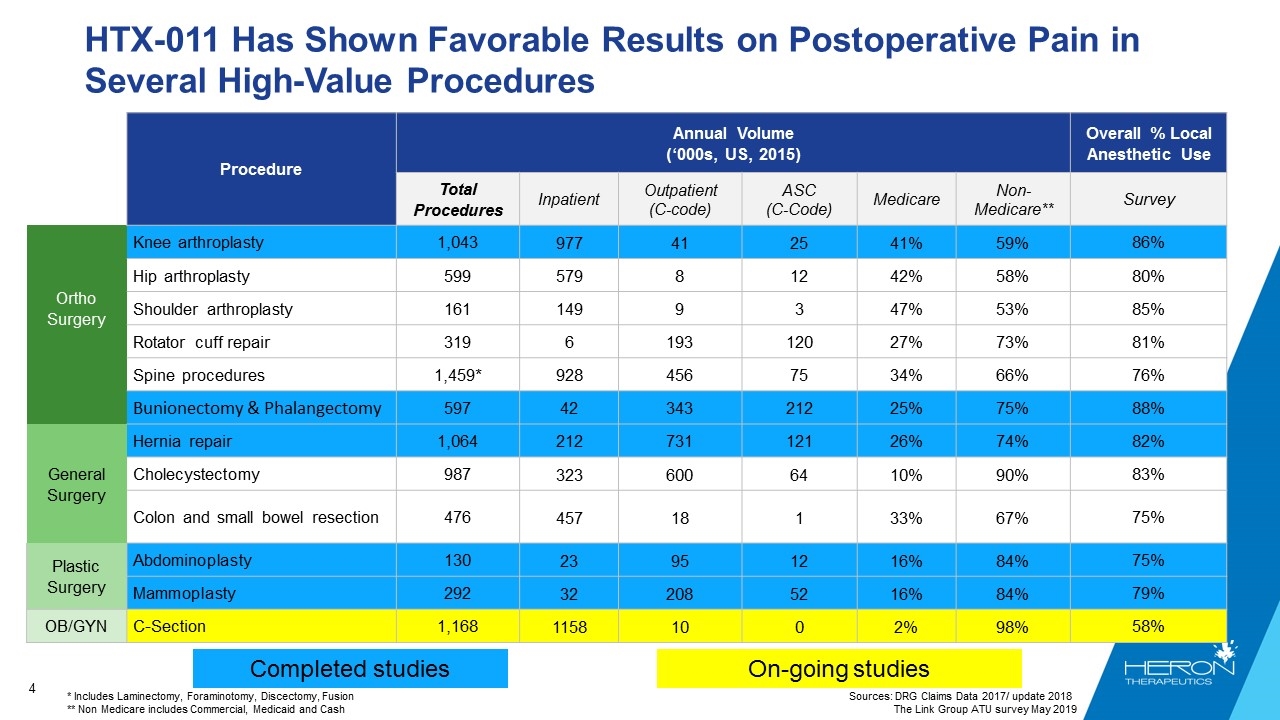

HTX-011 Has Shown Favorable Results on Postoperative Pain in Several High-Value Procedures Procedure Annual Volume (‘000s, US, 2015) Overall % Local Anesthetic Use Total Procedures Inpatient Outpatient (C-code) ASC (C-Code) Medicare Non-Medicare** Survey Ortho Surgery Knee arthroplasty 1,043 977 41 25 41% 59% 86% Hip arthroplasty 599 579 8 12 42% 58% 80% Shoulder arthroplasty 161 149 9 3 47% 53% 85% Rotator cuff repair 319 6 193 120 27% 73% 81% Spine procedures 1,459* 928 456 75 34% 66% 76% Bunionectomy & Phalangectomy 597 42 343 212 25% 75% 88% General Surgery Hernia repair 1,064 212 731 121 26% 74% 82% Cholecystectomy 987 323 600 64 10% 90% 83% Colon and small bowel resection 476 457 18 1 33% 67% 75% Plastic Surgery Abdominoplasty 130 23 95 12 16% 84% 75% Mammoplasty 292 32 208 52 16% 84% 79% OB/GYN C-Section 1,168 1158 10 0 2% 98% 58% Completed studies On-going studies * Includes Laminectomy, Foraminotomy, Discectomy, Fusion ** Non Medicare includes Commercial, Medicaid and Cash Sources: DRG Claims Data 2017/ update 2018 The Link Group ATU survey May 2019

Phase 2b Total Knee Arthroplasty (TKA) (Study 209) Study 209 Follow-on: HTX-011 + MMA in TKA* (Study 306) *The multimodal analgesic (MMA) regimen used in this study was identical to the PILLAR Study of liposomal bupivacaine

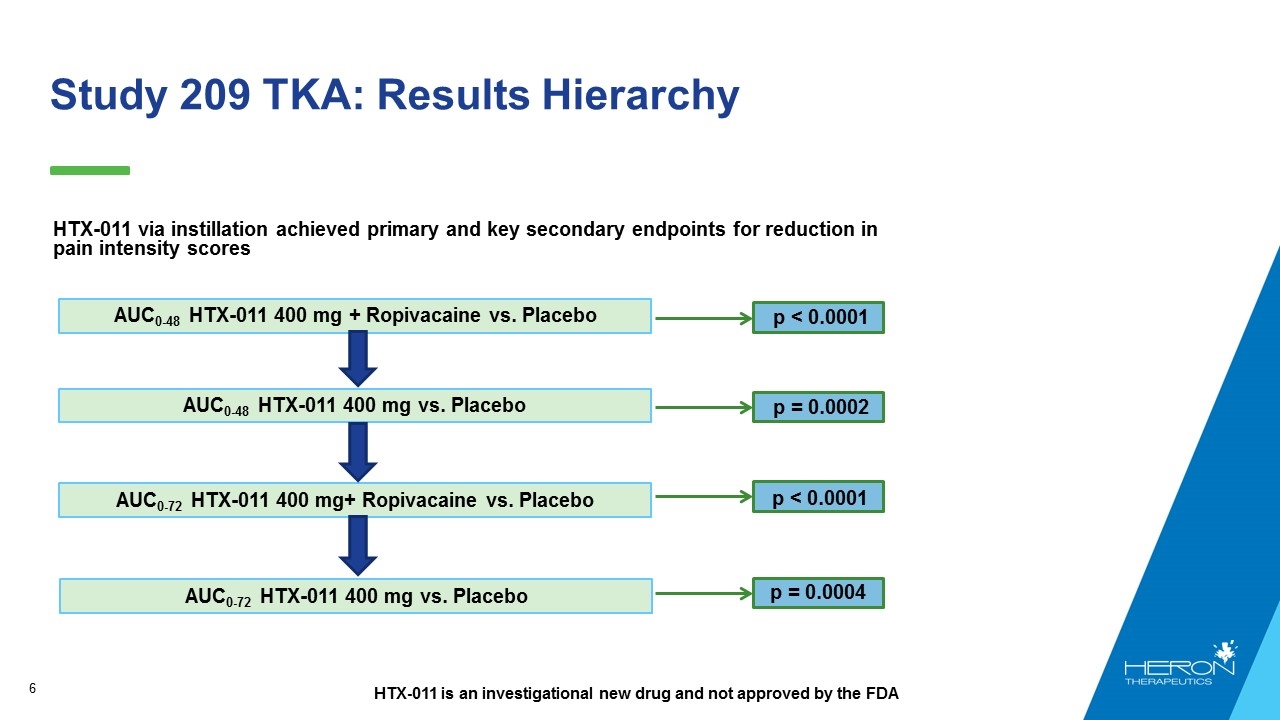

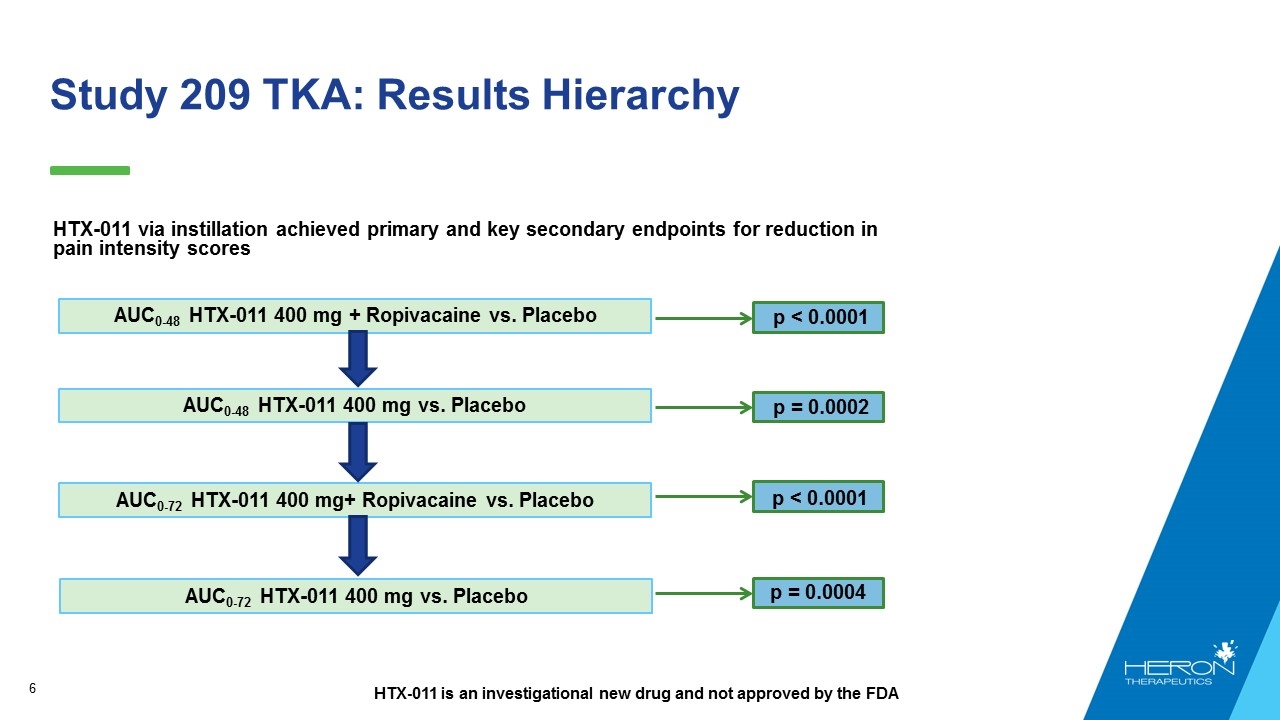

Study 209 TKA: Results Hierarchy AUC0-48 HTX-011 400 mg vs. Placebo AUC0-72 HTX-011 400 mg+ Ropivacaine vs. Placebo AUC0-48 HTX-011 400 mg + Ropivacaine vs. Placebo p < 0.0001 AUC0-72 HTX-011 400 mg vs. Placebo p = 0.0002 p < 0.0001 p = 0.0004 HTX-011 via instillation achieved primary and key secondary endpoints for reduction in pain intensity scores HTX-011 is an investigational new drug and not approved by the FDA

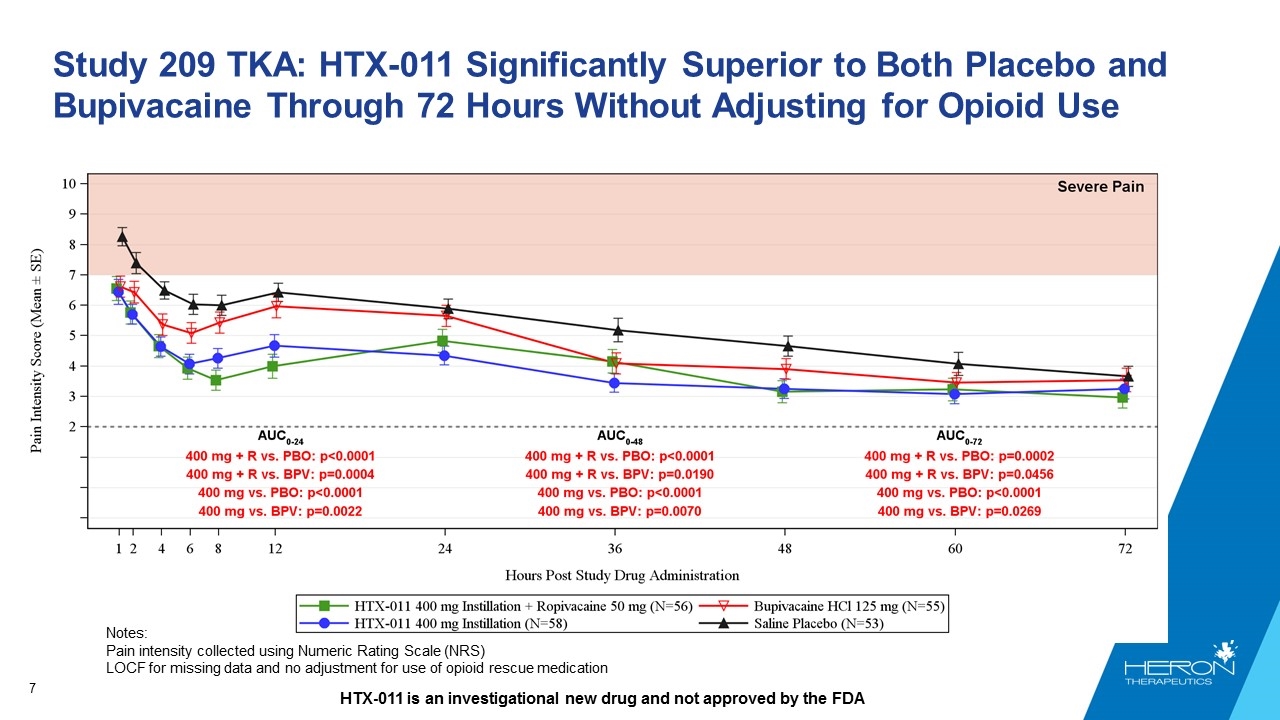

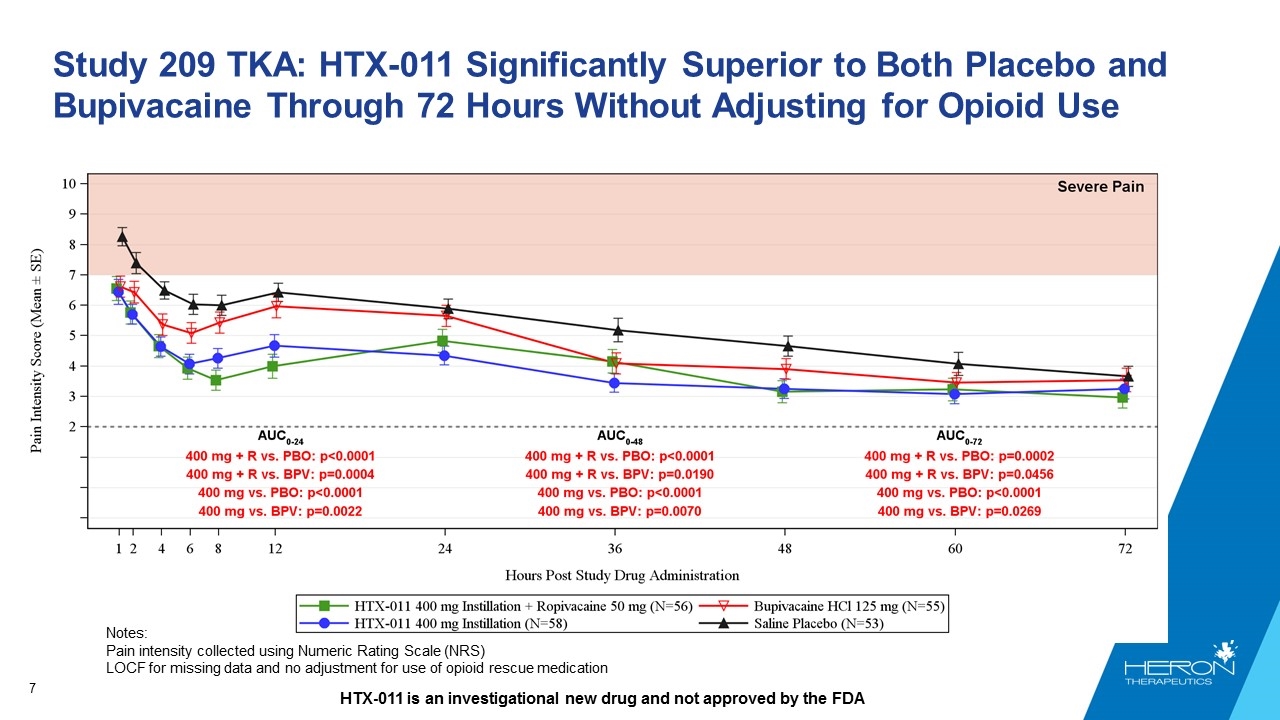

Study 209 TKA: HTX-011 Significantly Superior to Both Placebo and Bupivacaine Through 72 Hours Without Adjusting for Opioid Use Notes: Pain intensity collected using Numeric Rating Scale (NRS) LOCF for missing data and no adjustment for use of opioid rescue medication HTX-011 is an investigational new drug and not approved by the FDA [LINE CHART]

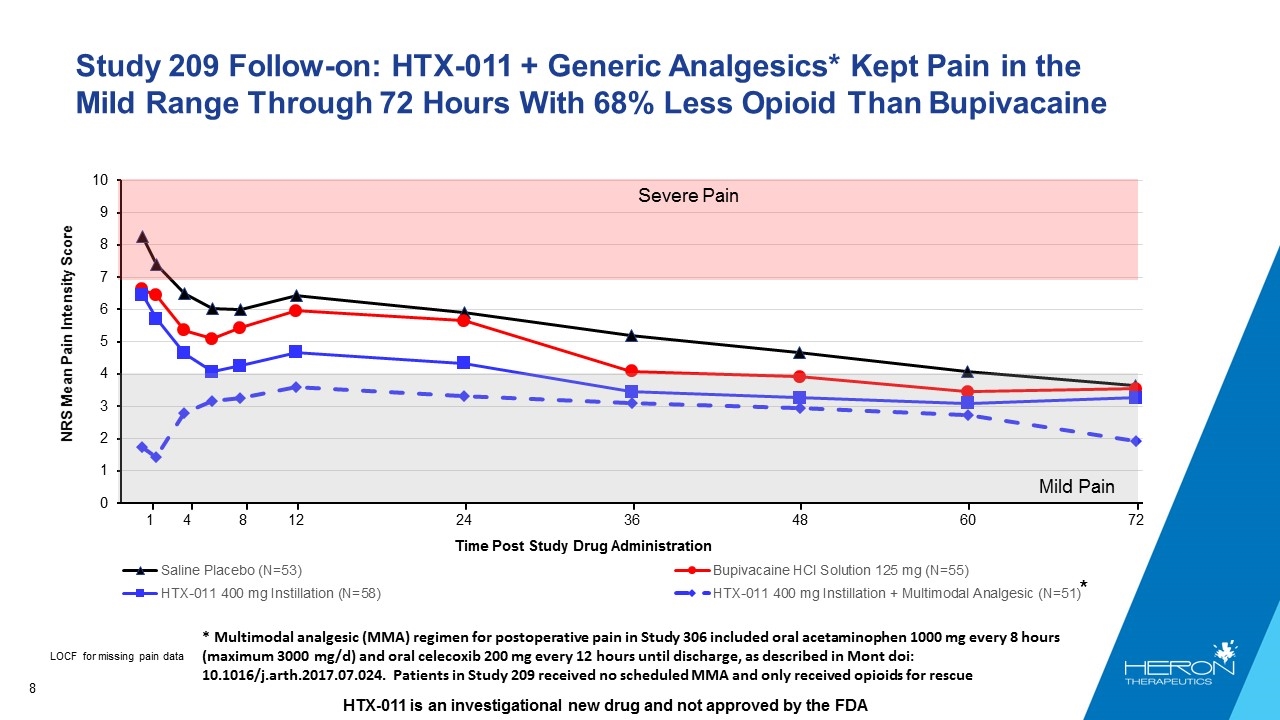

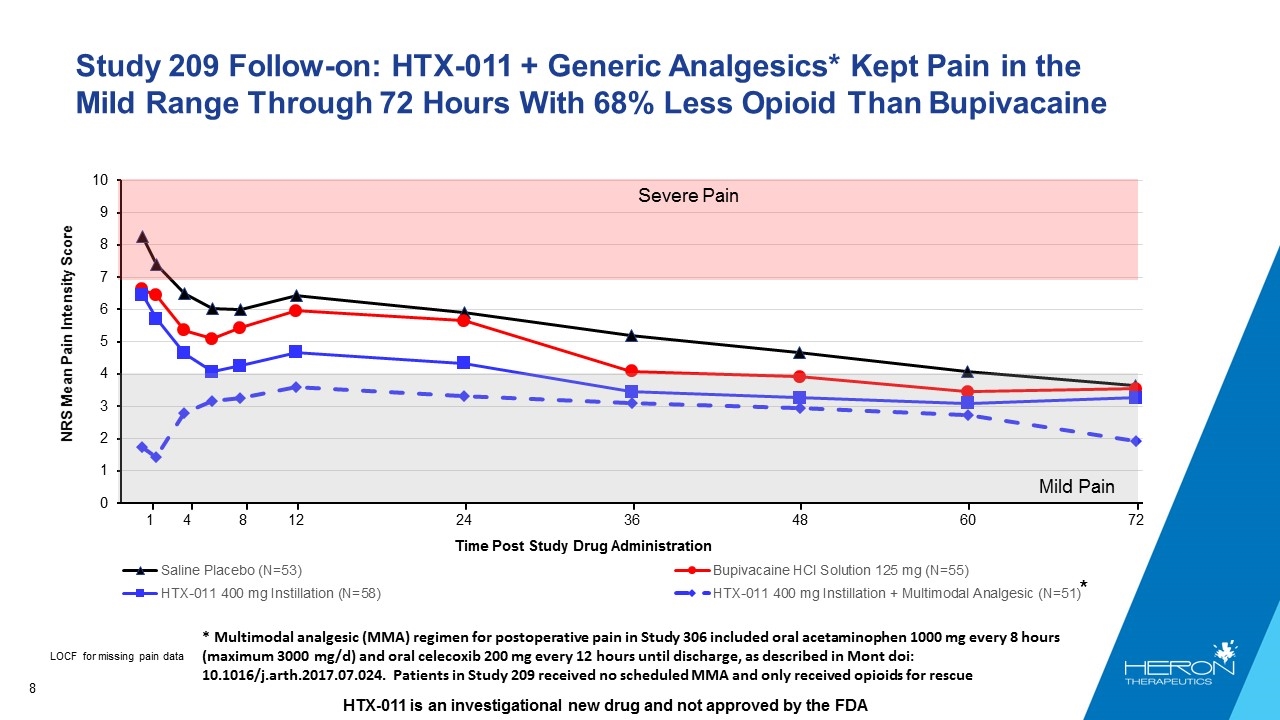

Study 209 Follow-on: HTX-011 + Generic Analgesics* Kept Pain in the MiId Range Through 72 Hours With 68% Less Opioid Than Bupivacaine HTX-011 is an investigational new drug and not approved by the FDA LOCF for missing pain data 1 4 8 * Multimodal analgesic (MMA) regimen for postoperative pain in Study 306 included oral acetaminophen 1000 mg every 8 hours (maximum 3000 mg/d) and oral celecoxib 200 mg every 12 hours until discharge, as described in Mont doi: 10.1016/j.arth.2017.07.024. Patients in Study 209 received no scheduled MMA and only received opioids for rescue Severe Pain Mild Pain * [LINE CHART]

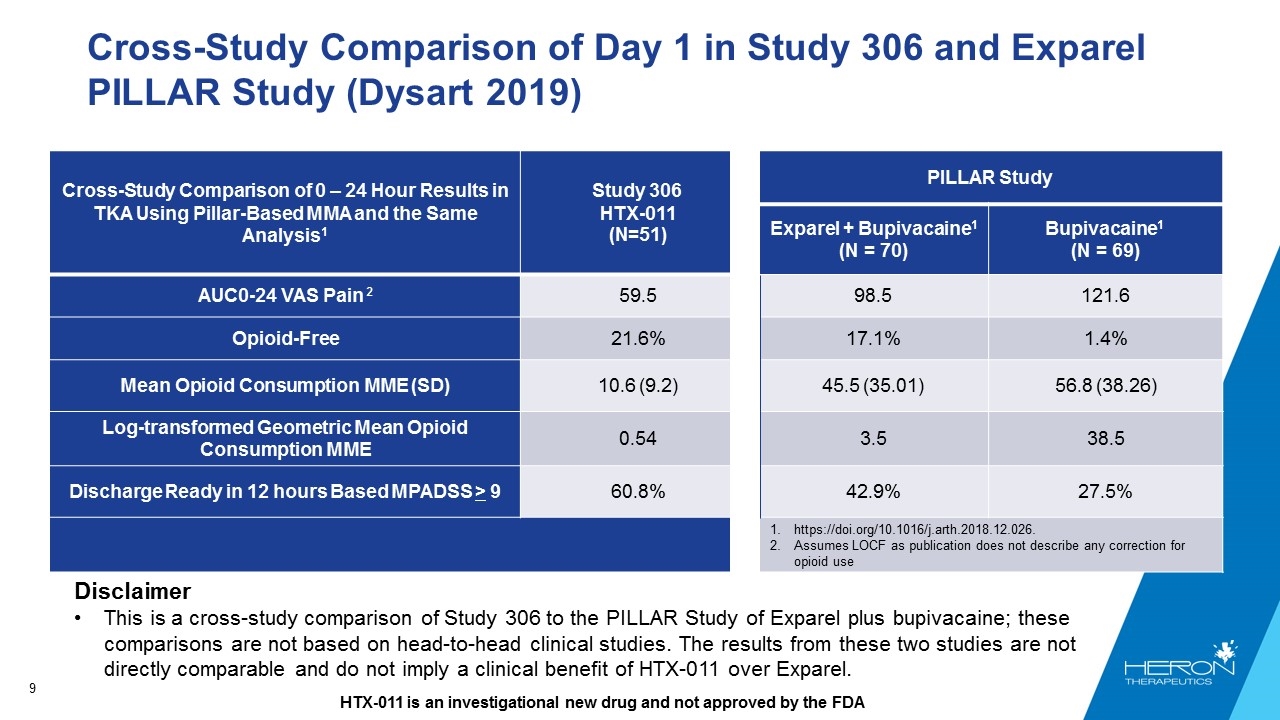

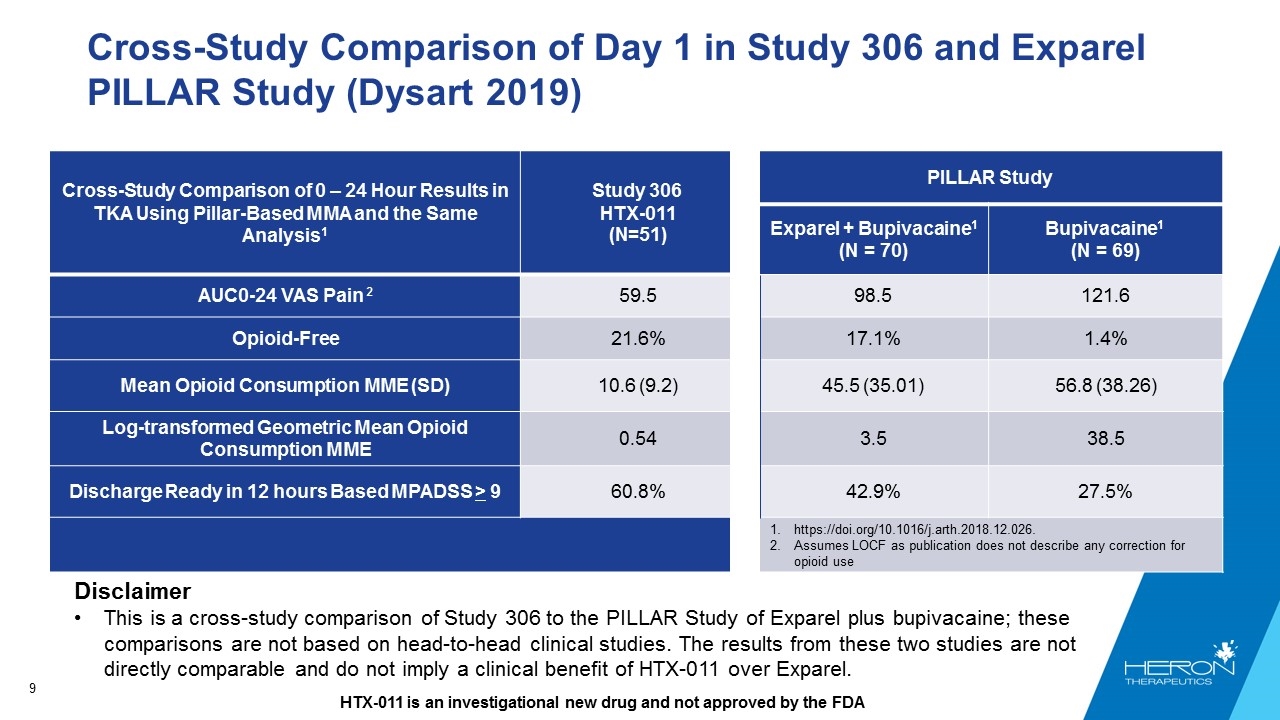

Cross-Study Comparison of Day 1 in Study 306 and Exparel PILLAR Study (Dysart 2019) Cross-Study Comparison of 0 – 24 Hour Results in TKA Using Pillar-Based MMA and the Same Analysis1 Study 306 HTX-011 (N=51) PILLAR Study Exparel + Bupivacaine1 (N = 70) Bupivacaine1 (N = 69) AUC0-24 VAS Pain 2 59.5 98.5 121.6 Opioid-Free 21.6% 17.1% 1.4% Mean Opioid Consumption MME (SD) 10.6 (9.2) 45.5 (35.01) 56.8 (38.26) Log-transformed Geometric Mean Opioid Consumption MME 0.54 3.5 38.5 Discharge Ready in 12 hours Based MPADSS > 9 60.8% 42.9% 27.5% https://doi.org/10.1016/j.arth.2018.12.026. Assumes LOCF as publication does not describe any correction for opioid use Disclaimer This is a cross-study comparison of Study 306 to the PILLAR Study of Exparel plus bupivacaine; these comparisons are not based on head-to-head clinical studies. The results from these two studies are not directly comparable and do not imply a clinical benefit of HTX-011 over Exparel. HTX-011 is an investigational new drug and not approved by the FDA

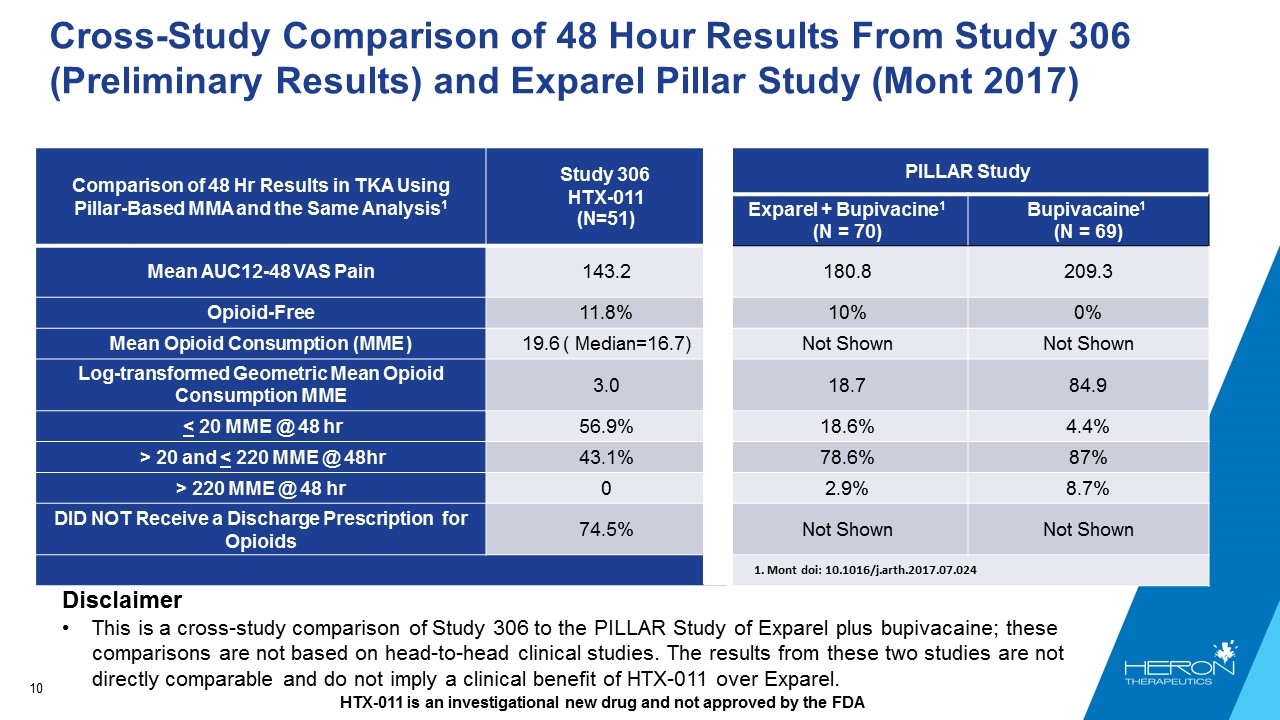

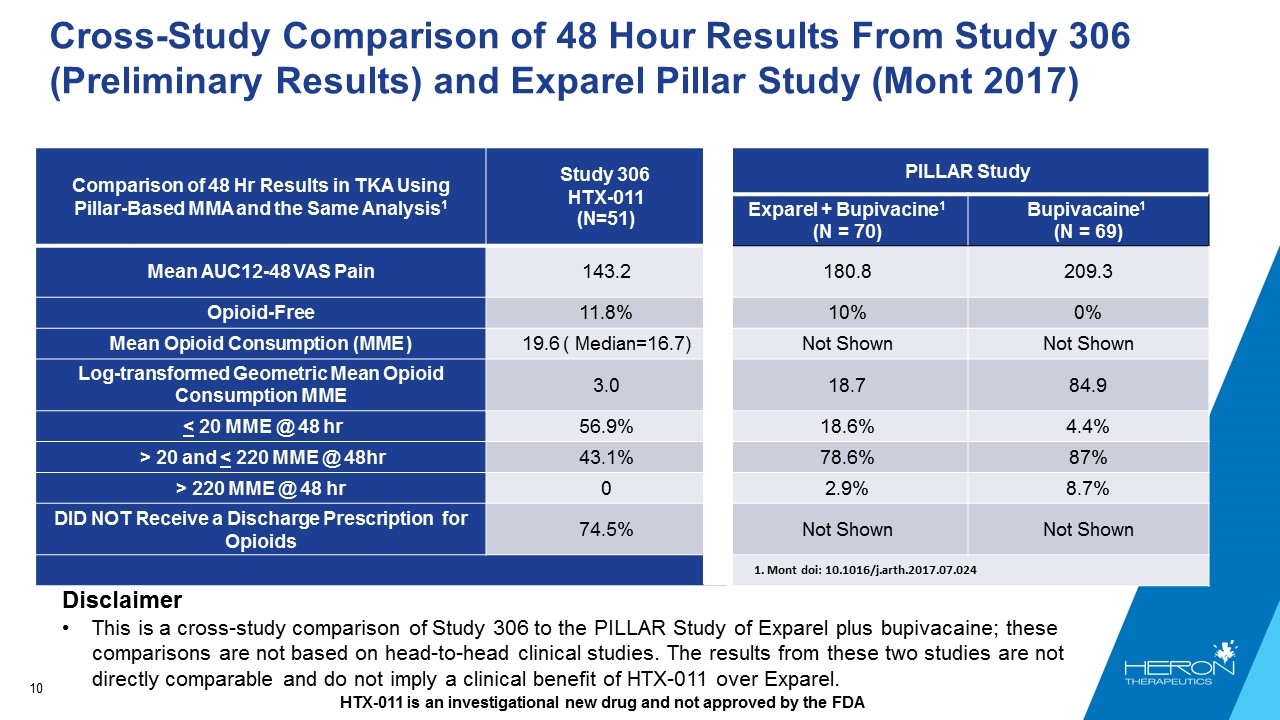

Cross-Study Comparison of 48 Hour Results From Study 306 (Preliminary Results) and Exparel Pillar Study (Mont 2017) Comparison of 48 Hr Results in TKA Using Pillar-Based MMA and the Same Analysis1 Study 306 HTX-011 (N=51) PILLAR Study Exparel + Bupivacine1 (N = 70) Bupivacaine1 (N = 69) Mean AUC12-48 VAS Pain 143.2 180.8 209.3 Opioid-Free 11.8% 10% 0% Mean Opioid Consumption (MME ) 19.6 ( Median=16.7) Not Shown Not Shown Log-transformed Geometric Mean Opioid Consumption MME 3.0 18.7 84.9 < 20 MME @ 48 hr 56.9% 18.6% 4.4% > 20 and < 220 MME @ 48hr 43.1% 78.6% 87% > 220 MME @ 48 hr 0 2.9% 8.7% DID NOT Receive a Discharge Prescription for Opioids 74.5% Not Shown Not Shown 1. Mont doi: 10.1016/j.arth.2017.07.024 Disclaimer This is a cross-study comparison of Study 306 to the PILLAR Study of Exparel plus bupivacaine; these comparisons are not based on head-to-head clinical studies. The results from these two studies are not directly comparable and do not imply a clinical benefit of HTX-011 over Exparel. HTX-011 is an investigational new drug and not approved by the FDA

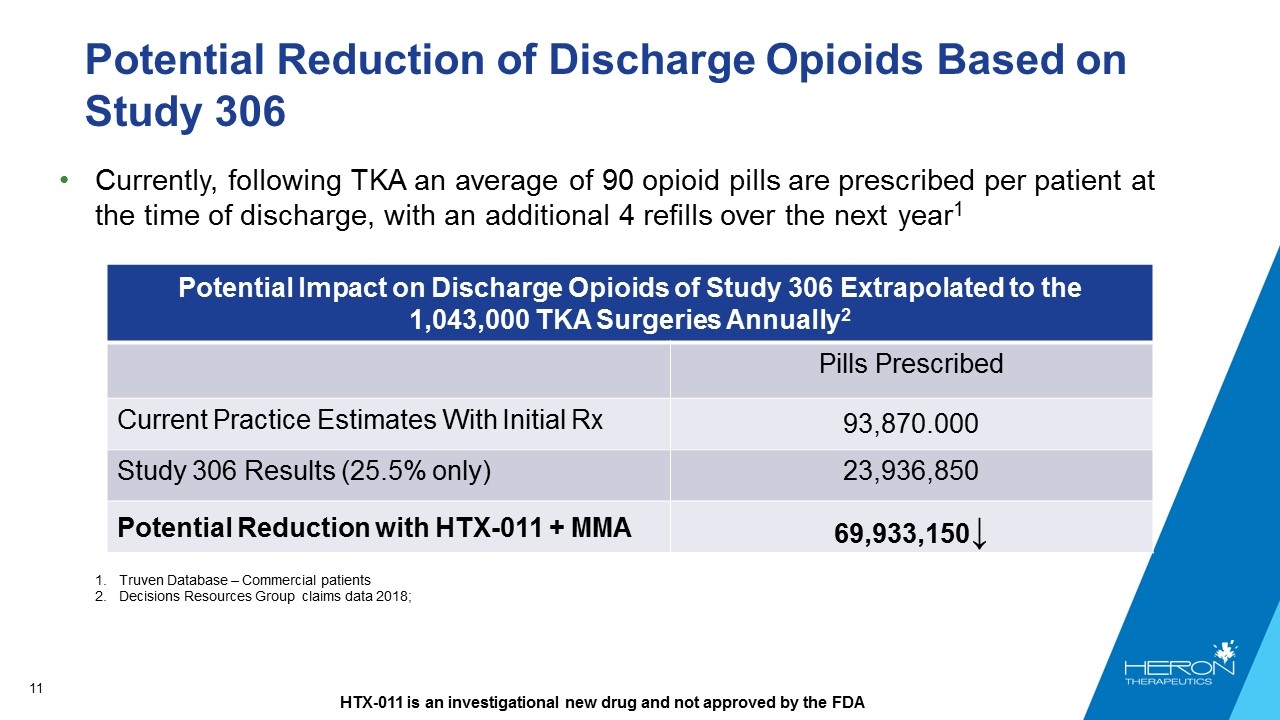

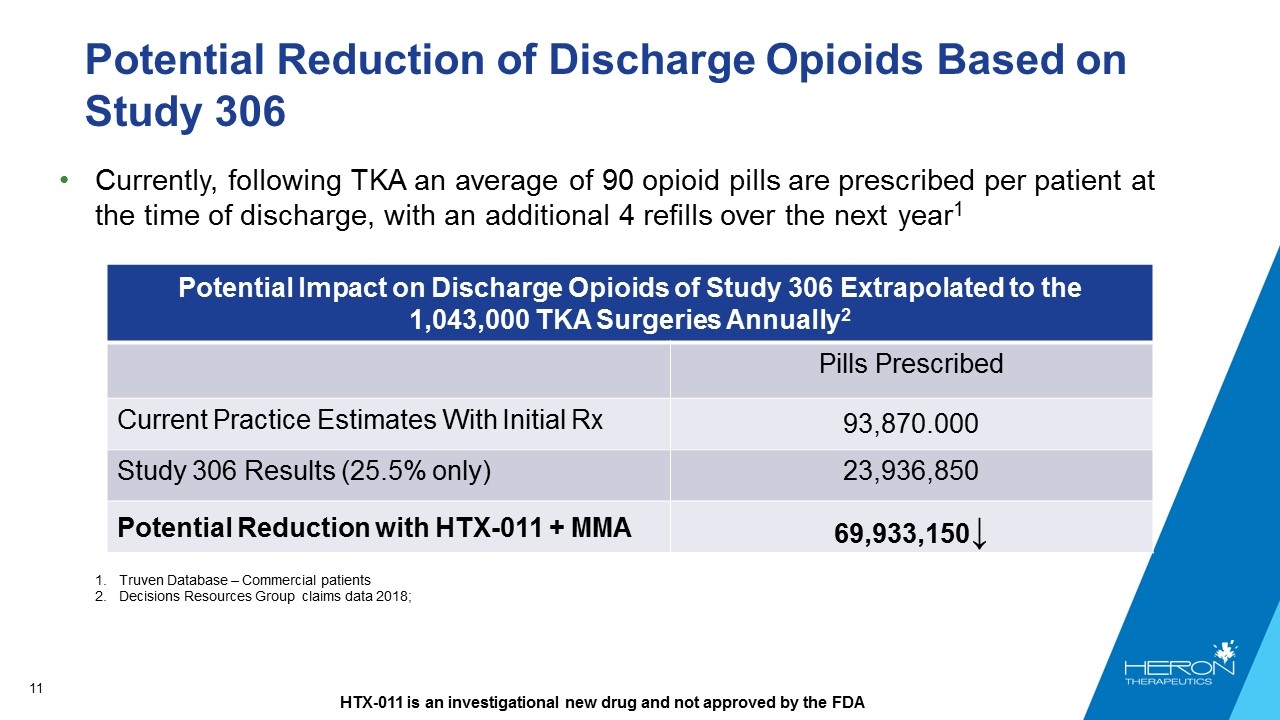

Potential Reduction of Discharge Opioids Based on Study 306 Currently, following TKA an average of 90 opioid pills are prescribed per patient at the time of discharge, with an additional 4 refills over the next year1 Potential Impact on Discharge Opioids of Study 306 Extrapolated to the 1,043,000 TKA Surgeries Annually2 Pills Prescribed Current Practice Estimates With Initial Rx 93,870.000 Study 306 Results (25.5% only) 23,936,850 Potential Reduction with HTX-011 + MMA 69,933,150↓ Truven Database – Commercial patients Decisions Resources Group claims data 2018; HTX-011 is an investigational new drug and not approved by the FDA

EPOCH 1: Bunionectomy Results (Study 301) EPOCH 1 Follow-on: Opioid Elimination Study in Bunionectomy

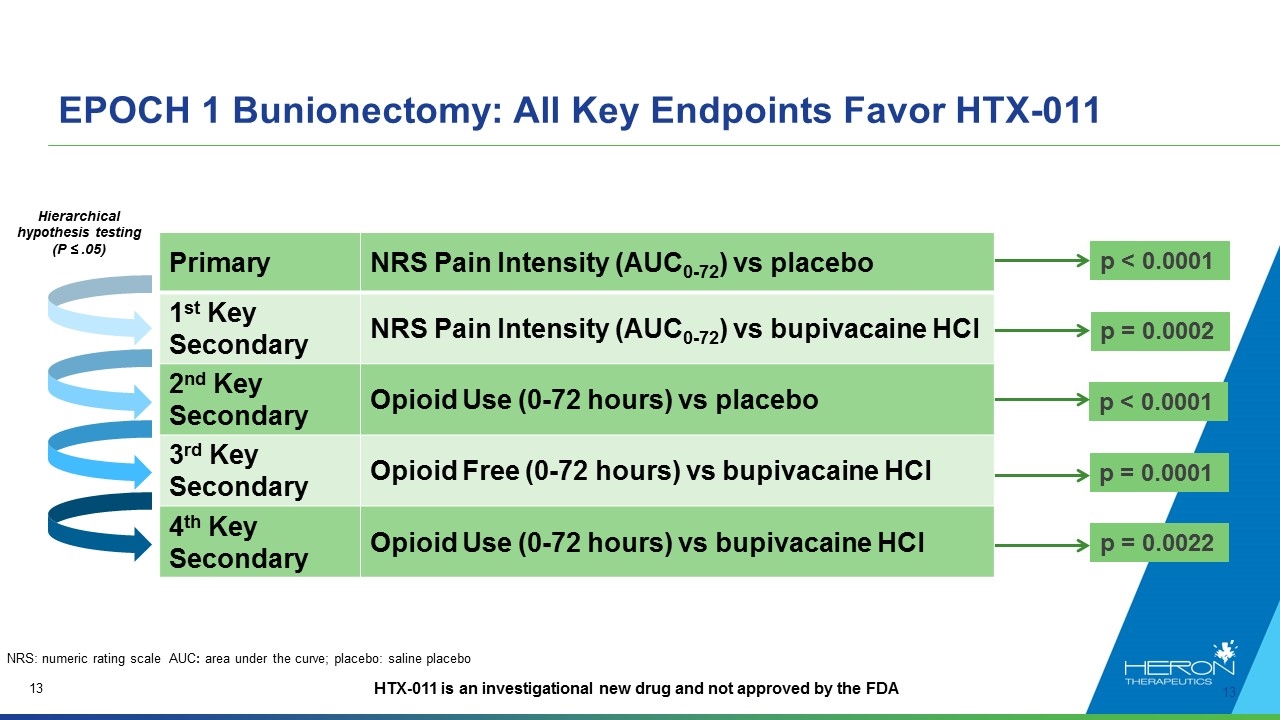

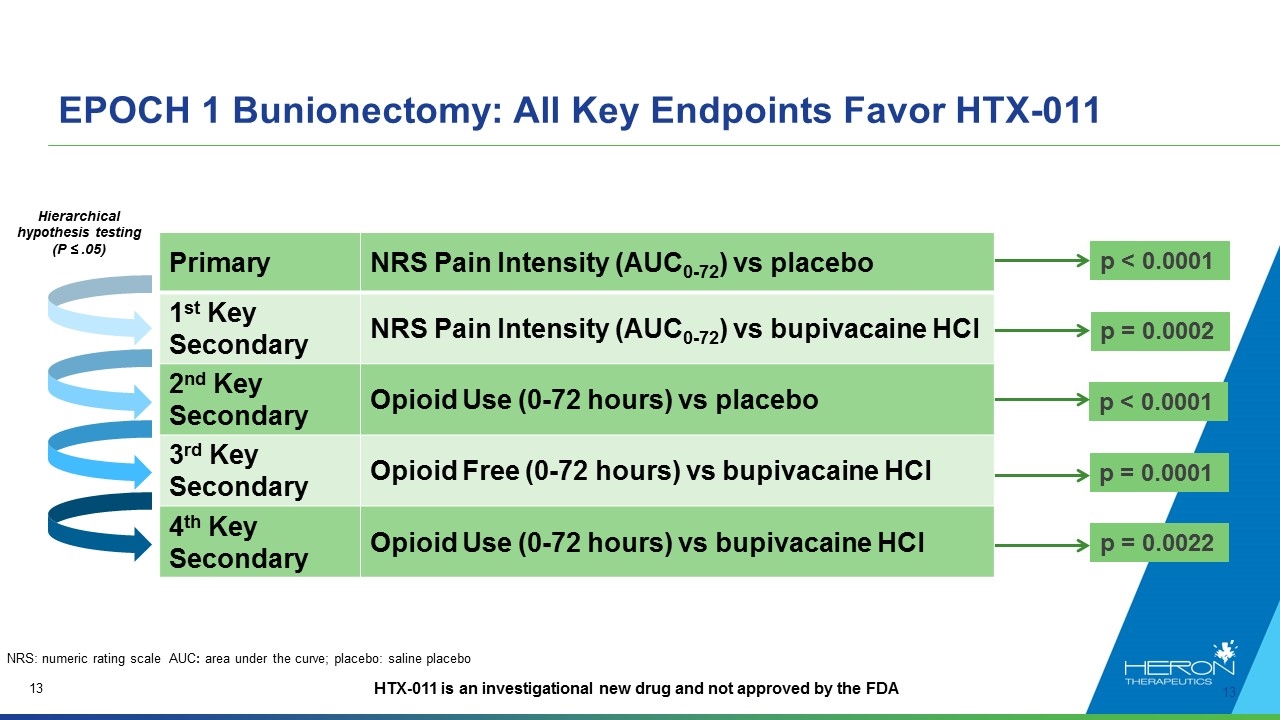

EPOCH 1 Bunionectomy: All Key Endpoints Favor HTX-011 Hierarchical hypothesis testing (P ≤ .05) NRS: numeric rating scale AUC: area under the curve; placebo: saline placebo p < 0.0001 p = 0.0002 p < 0.0001 p = 0.0001 p = 0.0022 Primary NRS Pain Intensity (AUC0-72) vs placebo 1st Key Secondary NRS Pain Intensity (AUC0-72) vs bupivacaine HCl 2nd Key Secondary Opioid Use (0-72 hours) vs placebo 3rd Key Secondary Opioid Free (0-72 hours) vs bupivacaine HCl 4th Key Secondary Opioid Use (0-72 hours) vs bupivacaine HCl HTX-011 is an investigational new drug and not approved by the FDA

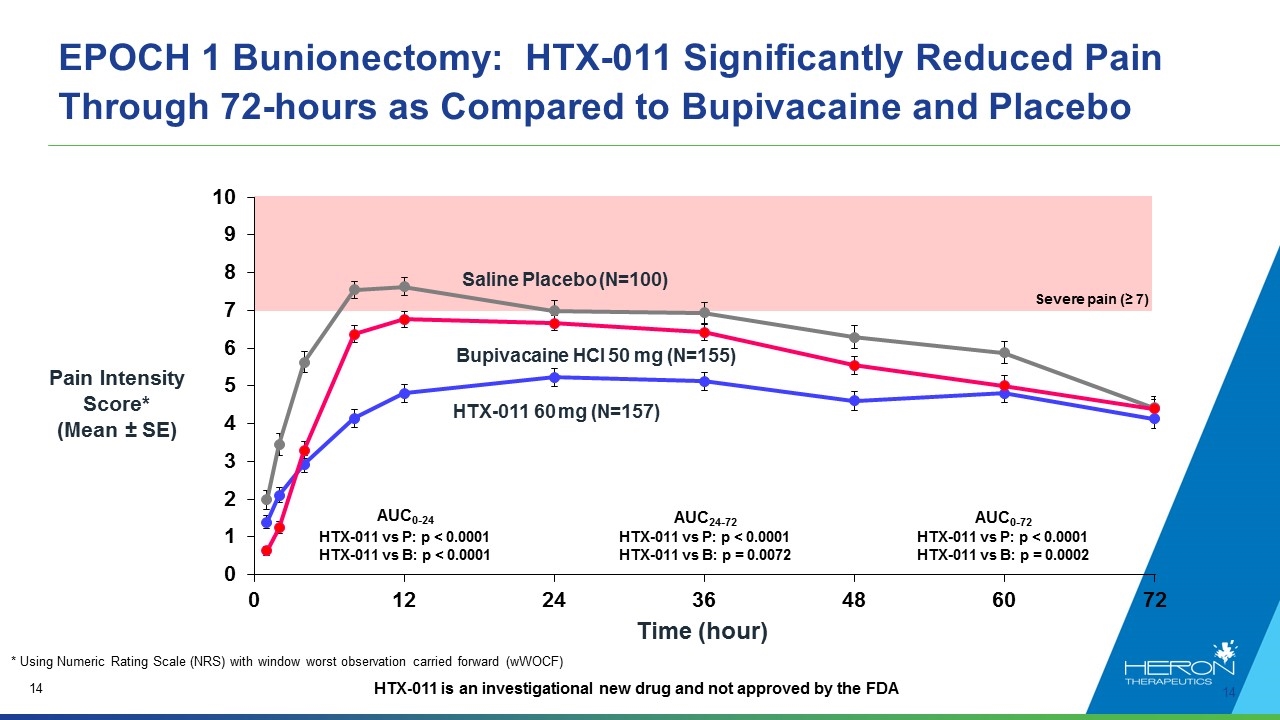

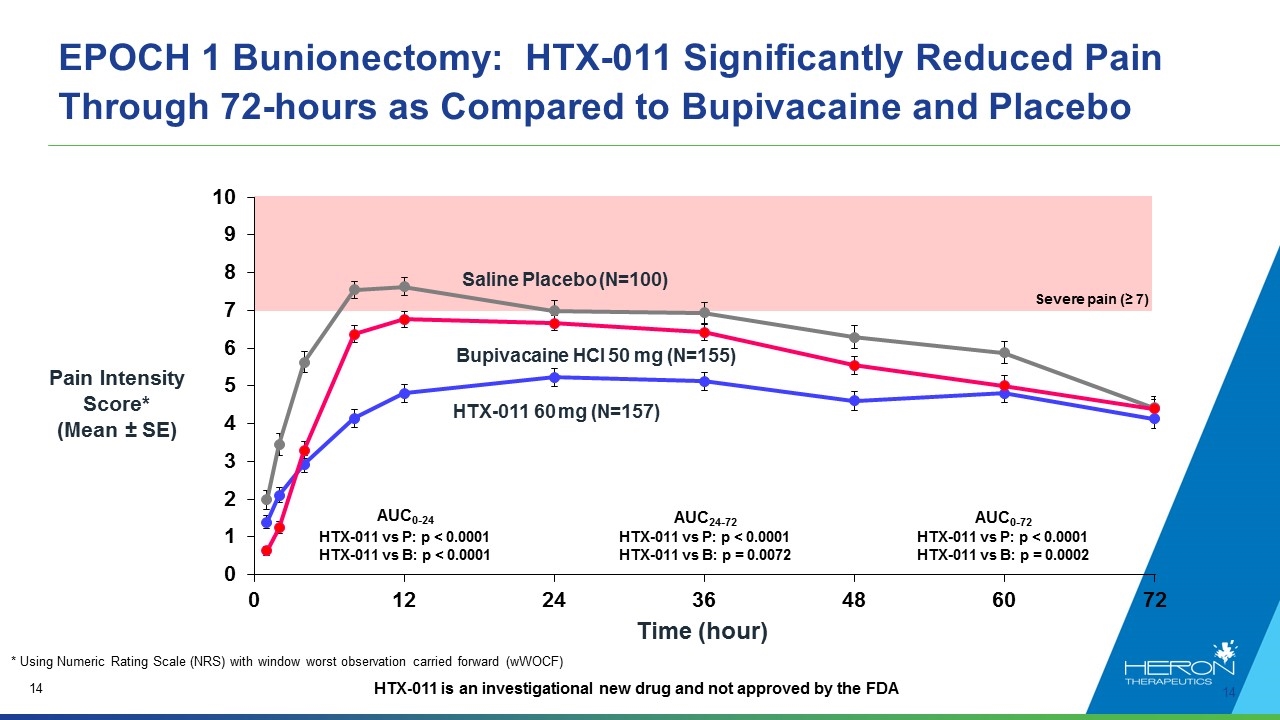

EPOCH 1 Bunionectomy: HTX-011 Significantly Reduced Pain Through 72-hours as Compared to Bupivacaine and Placebo * Using Numeric Rating Scale (NRS) with window worst observation carried forward (wWOCF) Time (hour) Pain Intensity Score* (Mean ± SE) AUC0-24 HTX-011 vs P: p < 0.0001 HTX-011 vs B: p < 0.0001 AUC24-72 HTX-011 vs P: p < 0.0001 HTX-011 vs B: p = 0.0072 AUC0-72 HTX-011 vs P: p < 0.0001 HTX-011 vs B: p = 0.0002 HTX-011 60 mg (N=157) Saline Placebo (N=100) Bupivacaine HCI 50 mg (N=155) Severe pain (≥ 7) HTX-011 is an investigational new drug and not approved by the FDA

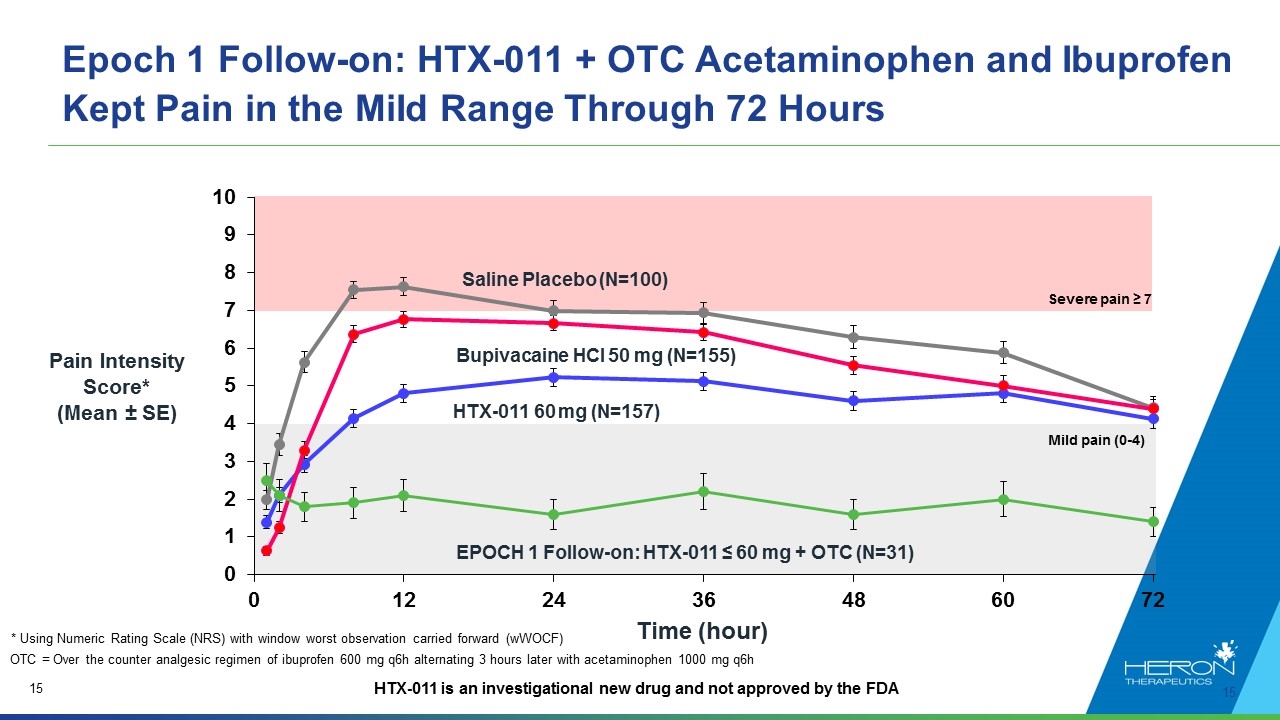

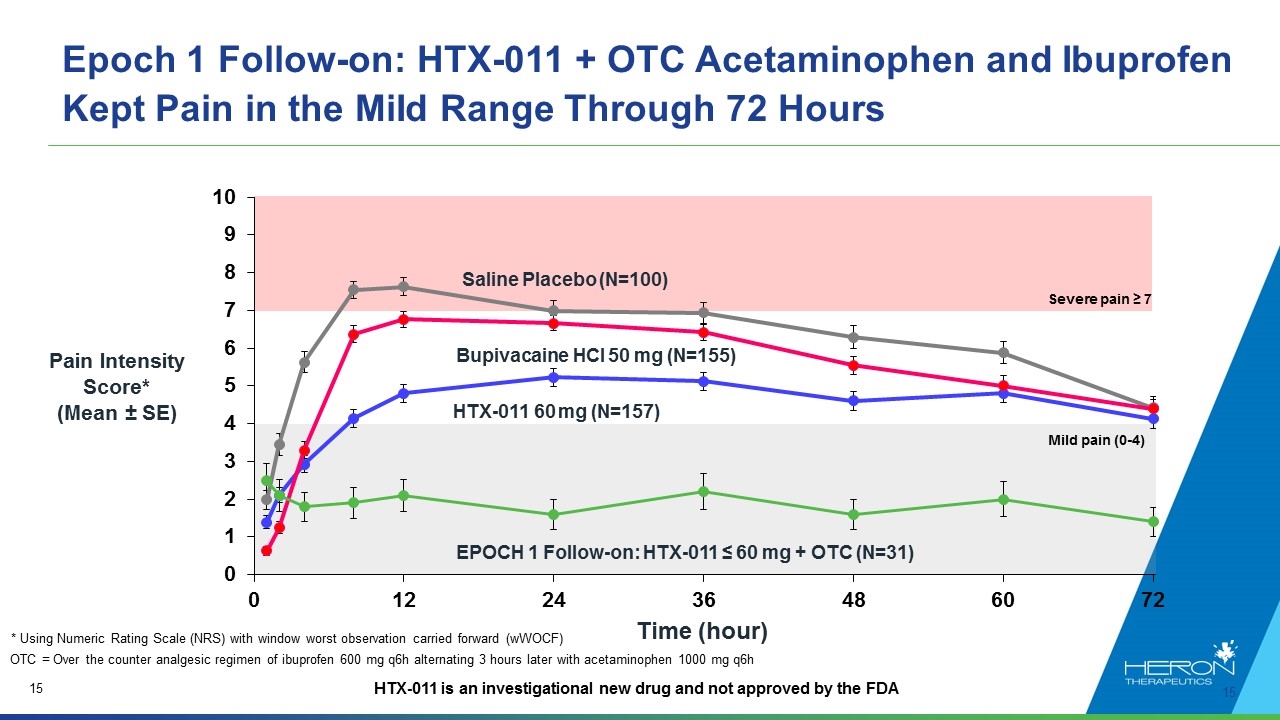

Epoch 1 Follow-on: HTX-011 + OTC Acetaminophen and Ibuprofen Kept Pain in the MiId Range Through 72 Hours HTX-011 60 mg (N=157) Saline Placebo (N=100) Bupivacaine HCI 50 mg (N=155) Severe pain ≥ 7 Mild pain (0-4) Time (hour) EPOCH 1 Follow-on: HTX-011 ≤ 60 mg + OTC (N=31) OTC = Over the counter analgesic regimen of ibuprofen 600 mg q6h alternating 3 hours later with acetaminophen 1000 mg q6h * Using Numeric Rating Scale (NRS) with window worst observation carried forward (wWOCF) Pain Intensity Score* (Mean ± SE) HTX-011 is an investigational new drug and not approved by the FDA [LINE CHART]

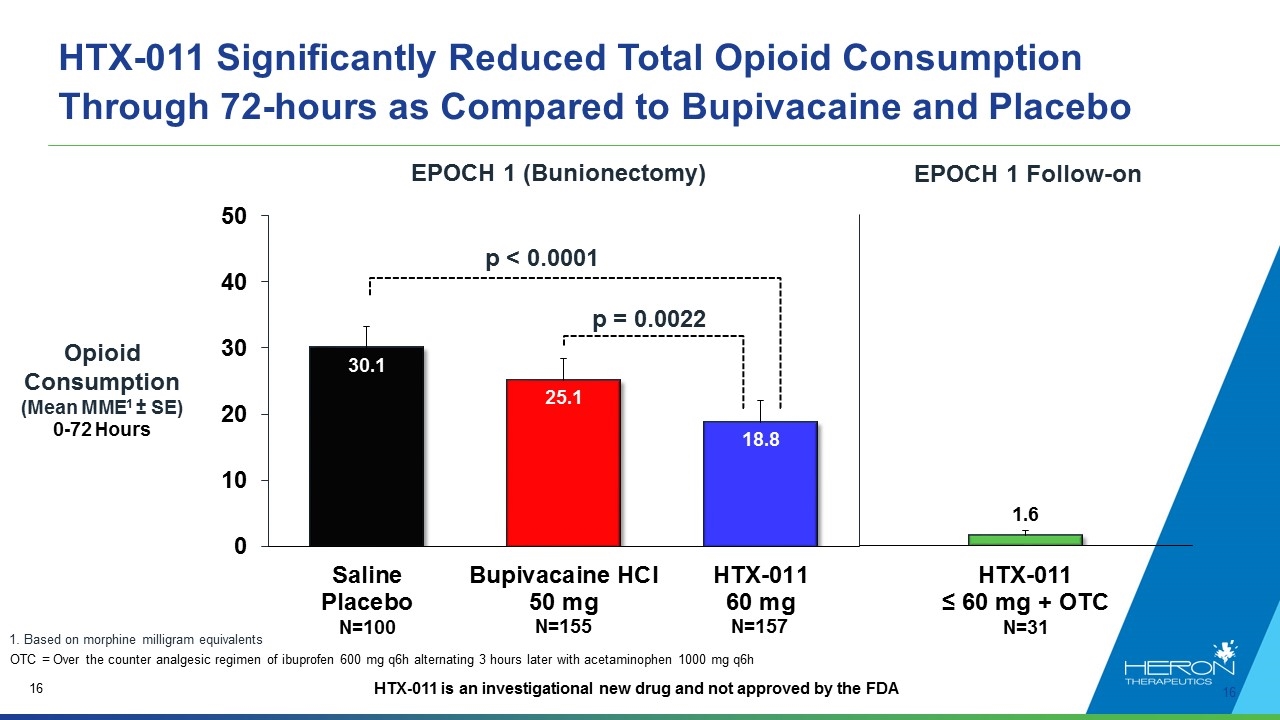

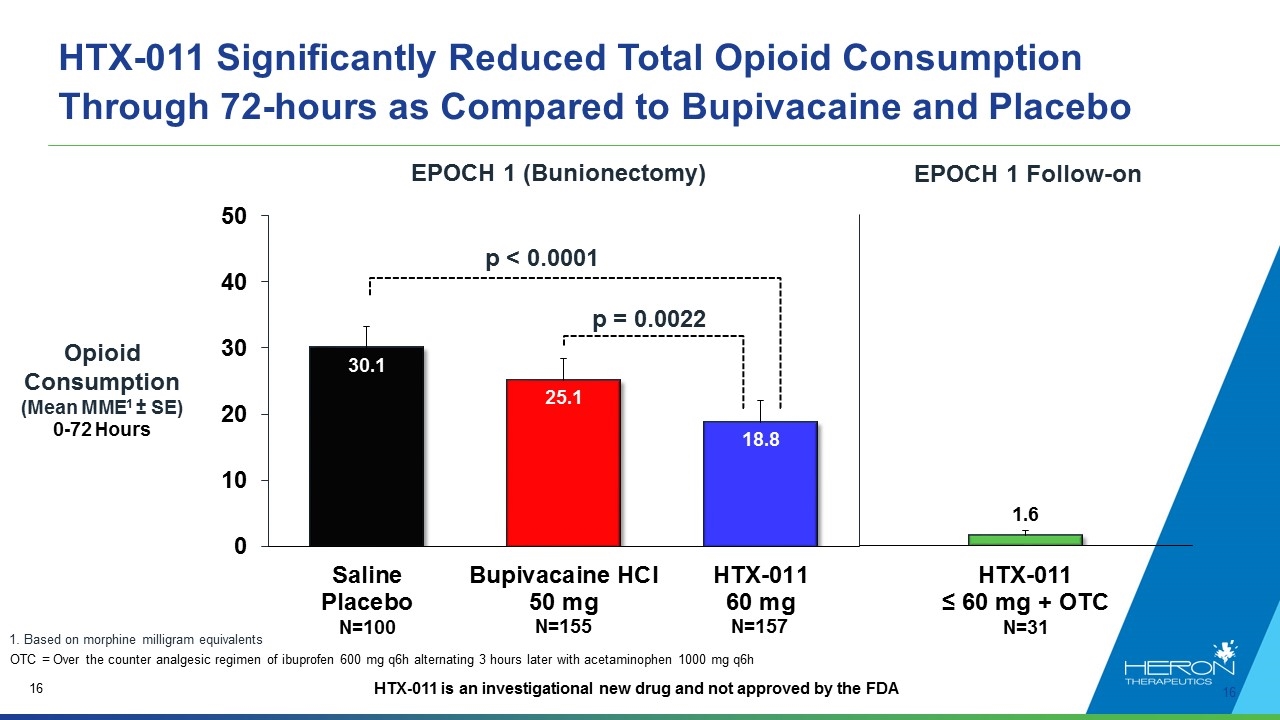

HTX-011 Significantly Reduced Total Opioid Consumption Through 72-hours as Compared to Bupivacaine and Placebo 1. Based on morphine milligram equivalents p = 0.0022 p < 0.0001 Opioid Consumption (Mean MME1 ± SE) 0-72 Hours N=31 EPOCH 1 Follow-on N=100 N=155 N=157 OTC = Over the counter analgesic regimen of ibuprofen 600 mg q6h alternating 3 hours later with acetaminophen 1000 mg q6h EPOCH 1 (Bunionectomy) HTX-011 is an investigational new drug and not approved by the FDA [BAR CHART]

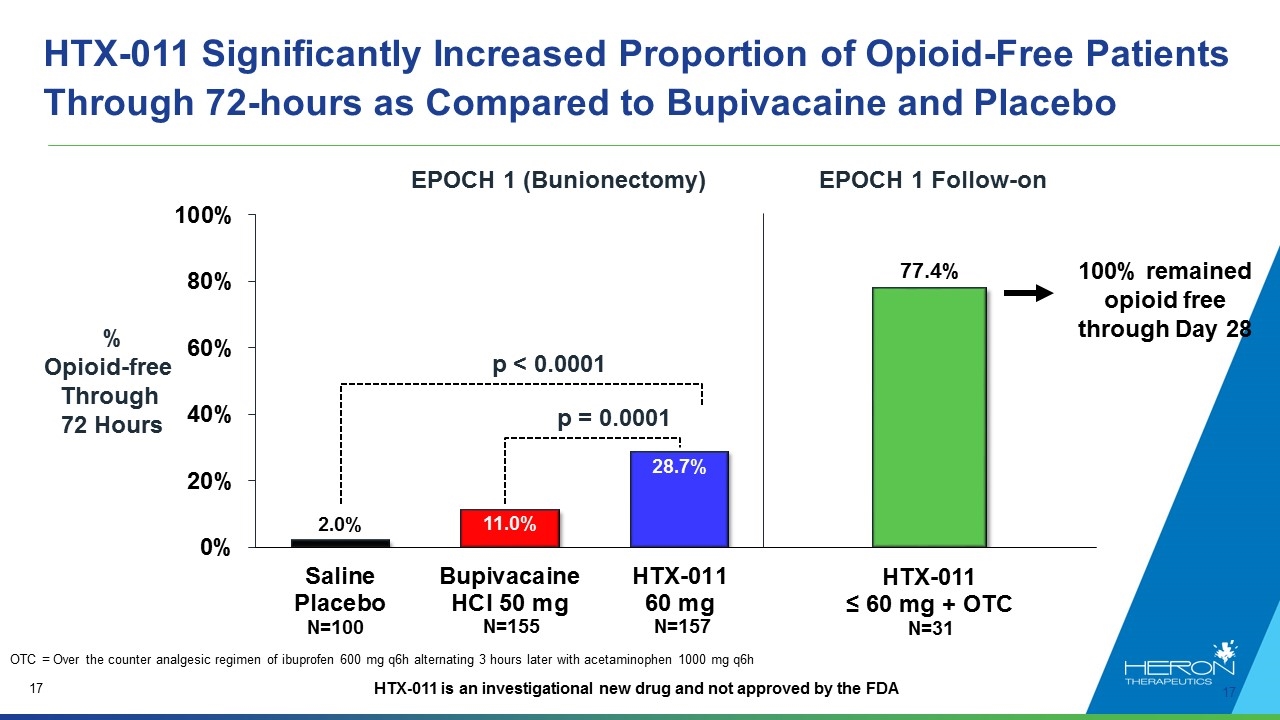

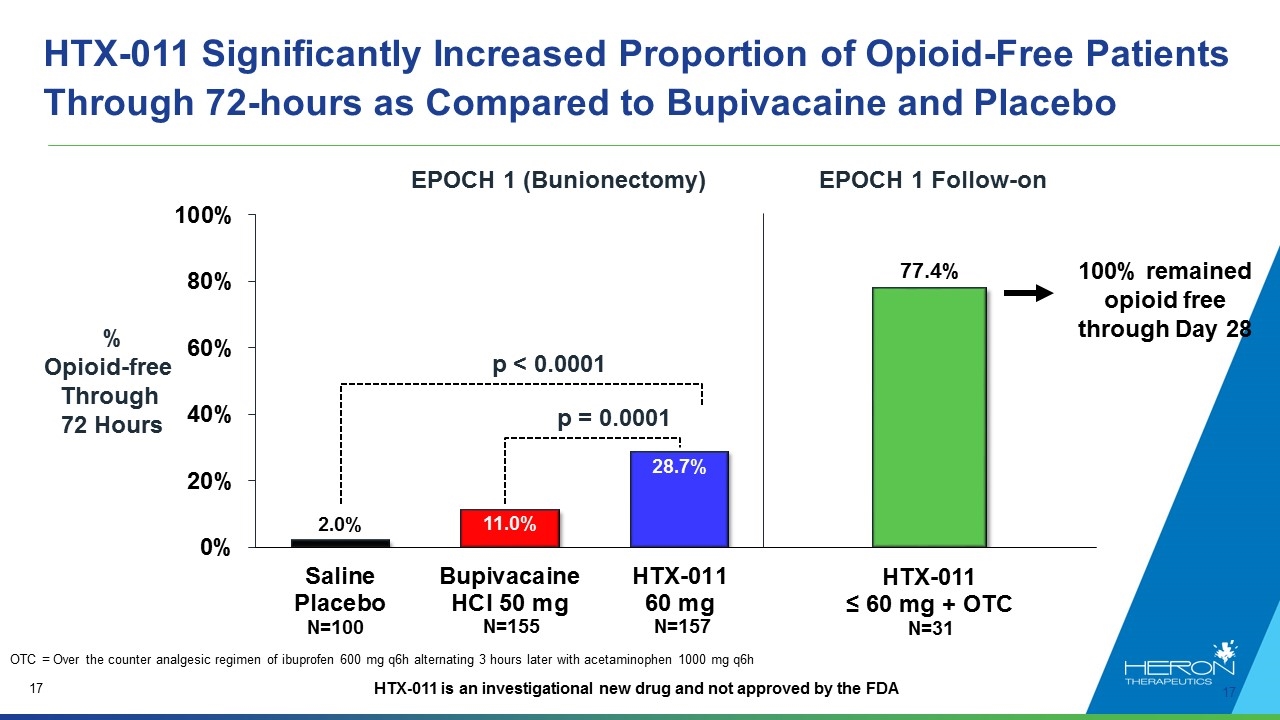

HTX-011 Significantly Increased Proportion of Opioid-Free Patients Through 72-hours as Compared to Bupivacaine and Placebo p = 0.0001 p < 0.0001 % Opioid-free Through 72 Hours EPOCH 1 Follow-on N=31 EPOCH 1 (Bunionectomy) N=100 N=155 N=157 OTC = Over the counter analgesic regimen of ibuprofen 600 mg q6h alternating 3 hours later with acetaminophen 1000 mg q6h Slide 9, please mirror EPOCH 2 with an arrow and text that says 100% remained Opioid free at Day 28 100% remained opioid free through Day 28 HTX-011 is an investigational new drug and not approved by the FDA [BAR CHART]

EPOCH 2: Herniorrhaphy Results (Study 302) EPOCH 2 Follow-on: Opioid Elimination Study in Herniorrhaphy

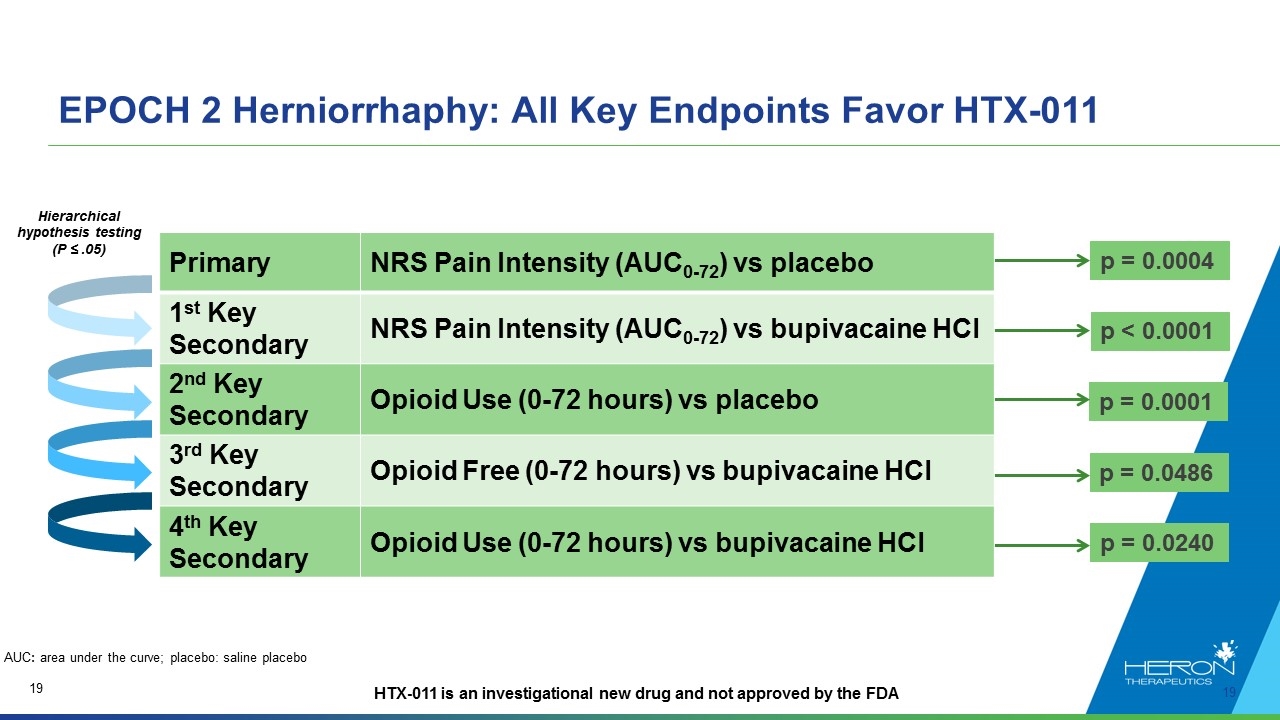

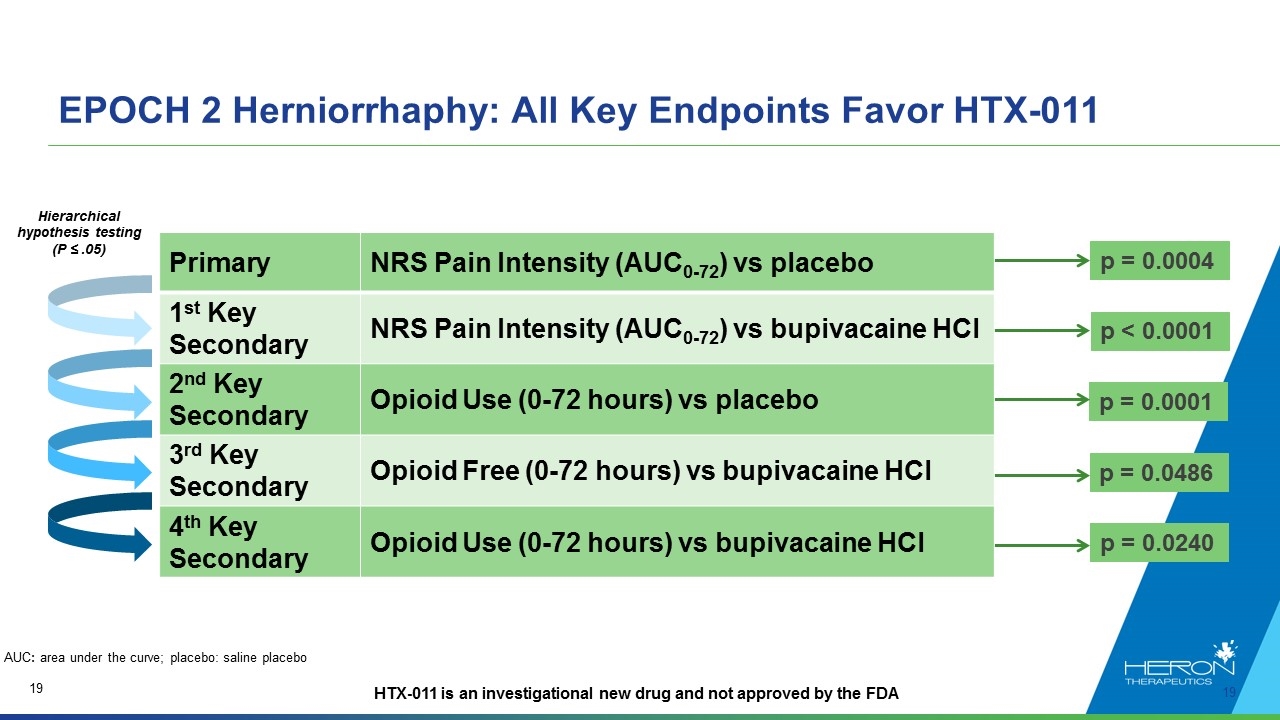

EPOCH 2 Herniorrhaphy: All Key Endpoints Favor HTX-011 Hierarchical hypothesis testing (P ≤ .05) AUC: area under the curve; placebo: saline placebo p = 0.0004 p < 0.0001 p = 0.0001 p = 0.0486 p = 0.0240 Primary NRS Pain Intensity (AUC0-72) vs placebo 1st Key Secondary NRS Pain Intensity (AUC0-72) vs bupivacaine HCl 2nd Key Secondary Opioid Use (0-72 hours) vs placebo 3rd Key Secondary Opioid Free (0-72 hours) vs bupivacaine HCl 4th Key Secondary Opioid Use (0-72 hours) vs bupivacaine HCl HTX-011 is an investigational new drug and not approved by the FDA

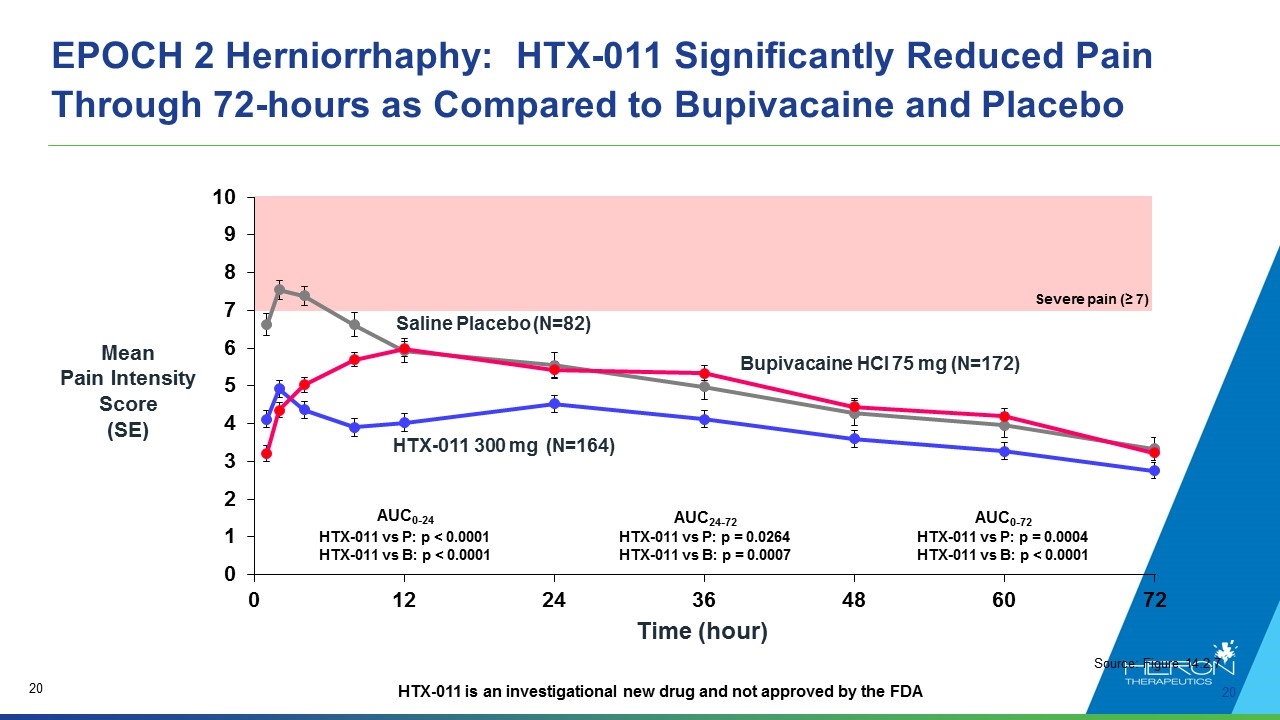

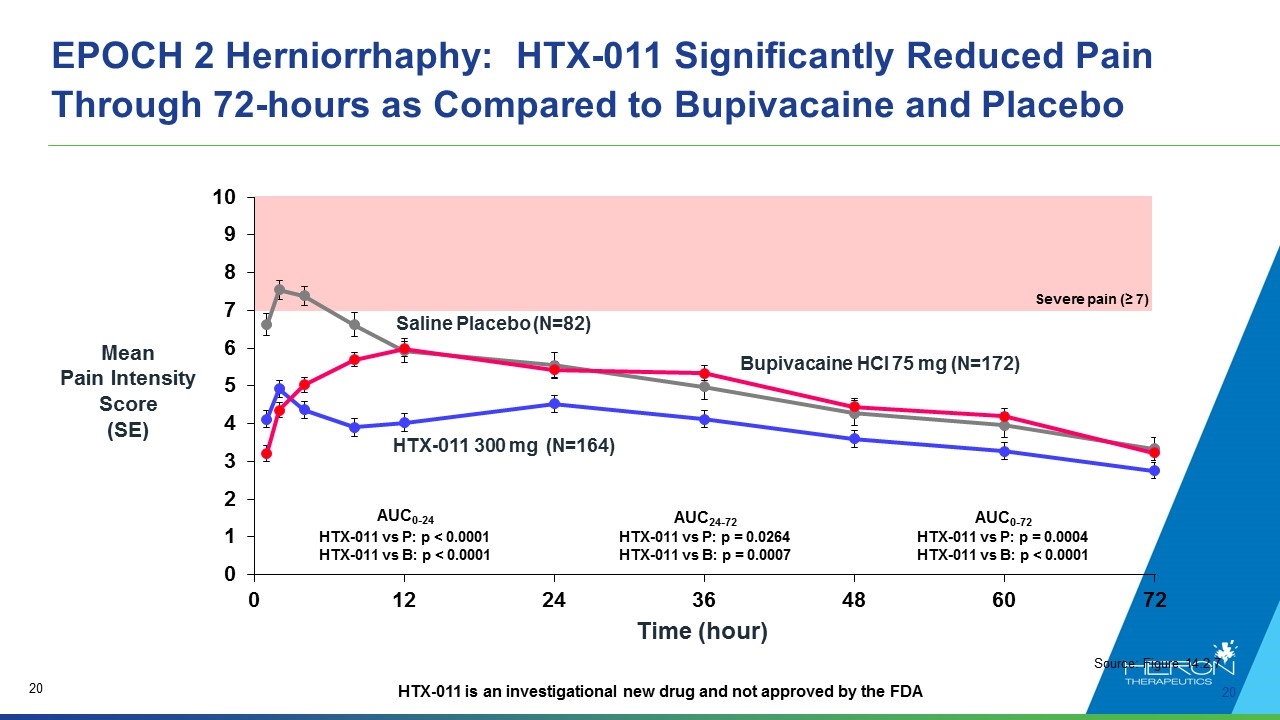

EPOCH 2 Herniorrhaphy: HTX-011 Significantly Reduced Pain Through 72-hours as Compared to Bupivacaine and Placebo Time (hour) Mean Pain Intensity Score (SE) AUC0-24 HTX-011 vs P: p < 0.0001 HTX-011 vs B: p < 0.0001 AUC24-72 HTX-011 vs P: p = 0.0264 HTX-011 vs B: p = 0.0007 AUC0-72 HTX-011 vs P: p = 0.0004 HTX-011 vs B: p < 0.0001 Severe pain (≥ 7) HTX-011 300 mg (N=164) Saline Placebo (N=82) Bupivacaine HCI 75 mg (N=172) Source: Figure 14.2.7 HTX-011 is an investigational new drug and not approved by the FDA [LINE CHART]

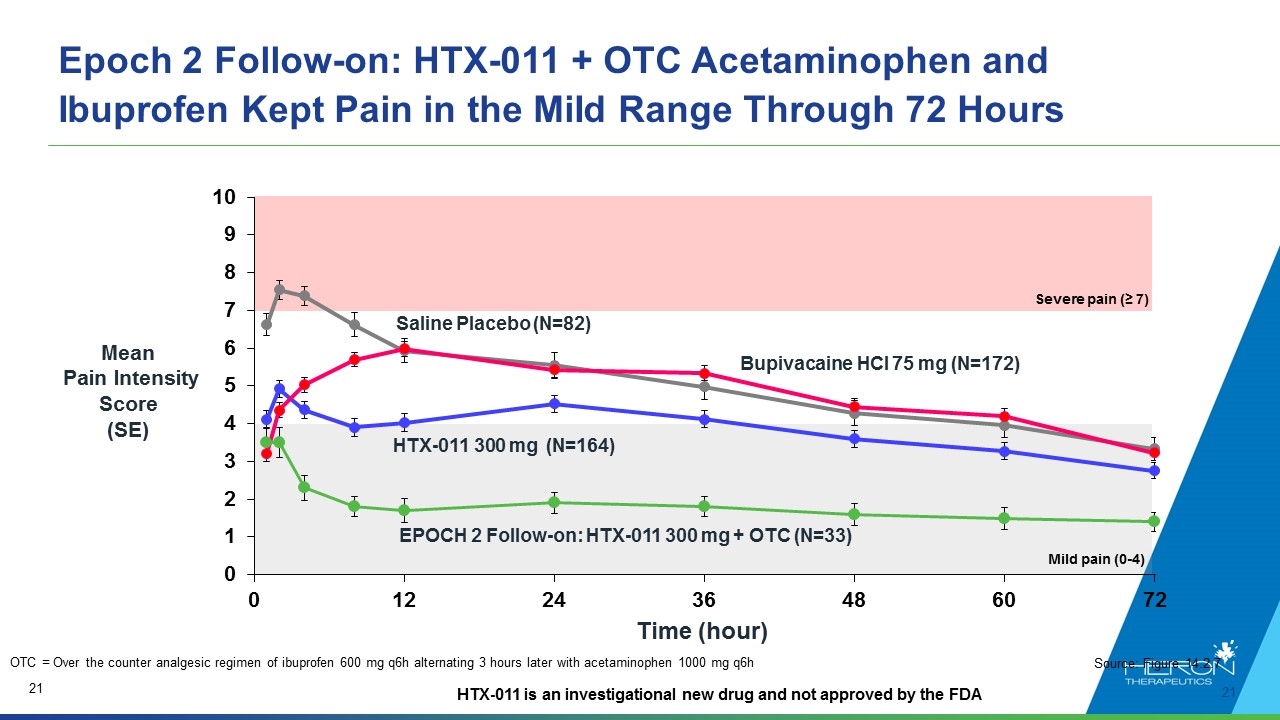

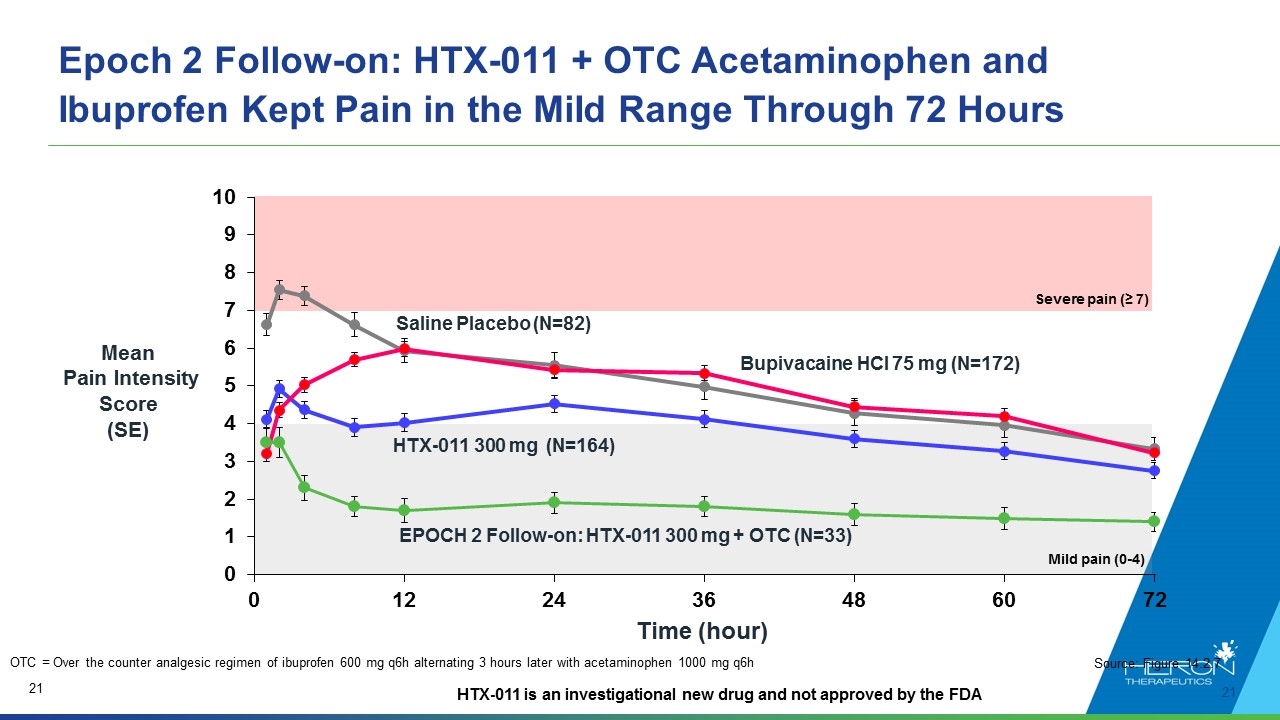

Epoch 2 Follow-on: HTX-011 + OTC Acetaminophen and Ibuprofen Kept Pain in the MiId Range Through 72 Hours Time (hour) Mean Pain Intensity Score (SE) HTX-011 300 mg (N=164) Saline Placebo (N=82) Bupivacaine HCI 75 mg (N=172) Source: Figure 14.2.7 HTX-011 is an investigational new drug and not approved by the FDA Mild pain (0-4) EPOCH 2 Follow-on: HTX-011 300 mg + OTC (N=33) Severe pain (≥ 7) OTC = Over the counter analgesic regimen of ibuprofen 600 mg q6h alternating 3 hours later with acetaminophen 1000 mg q6h [LINE CHART]

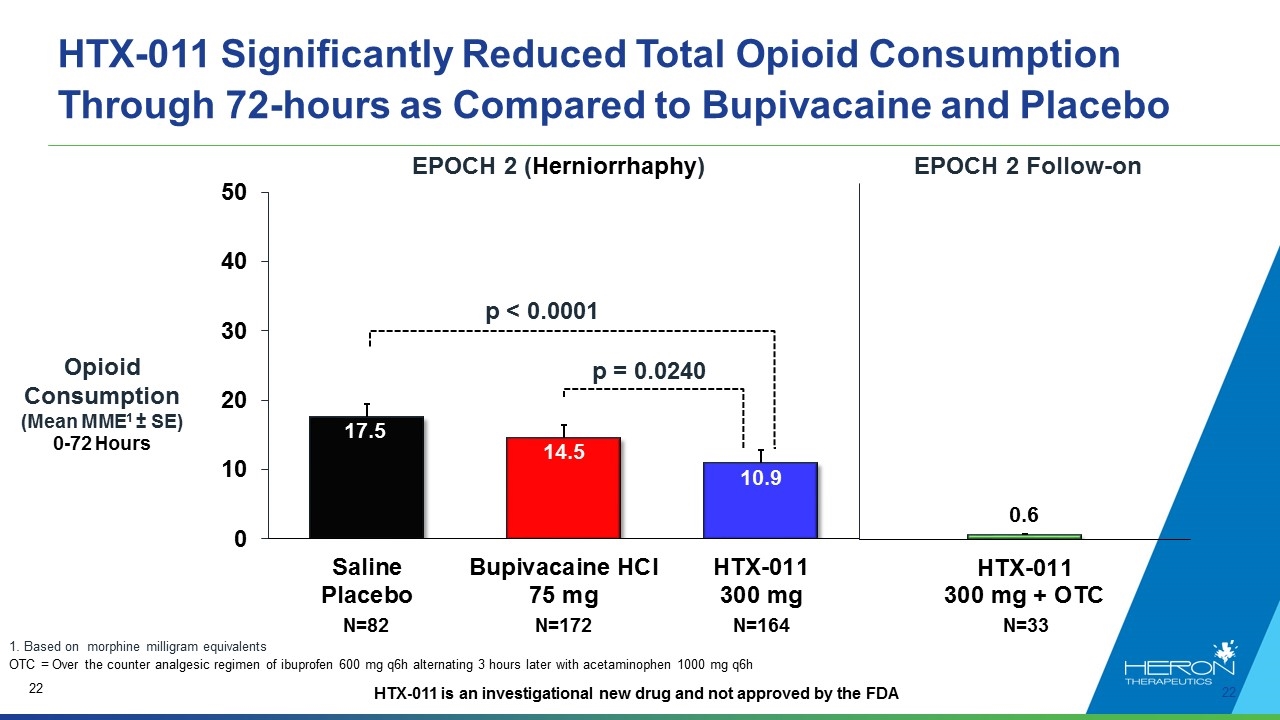

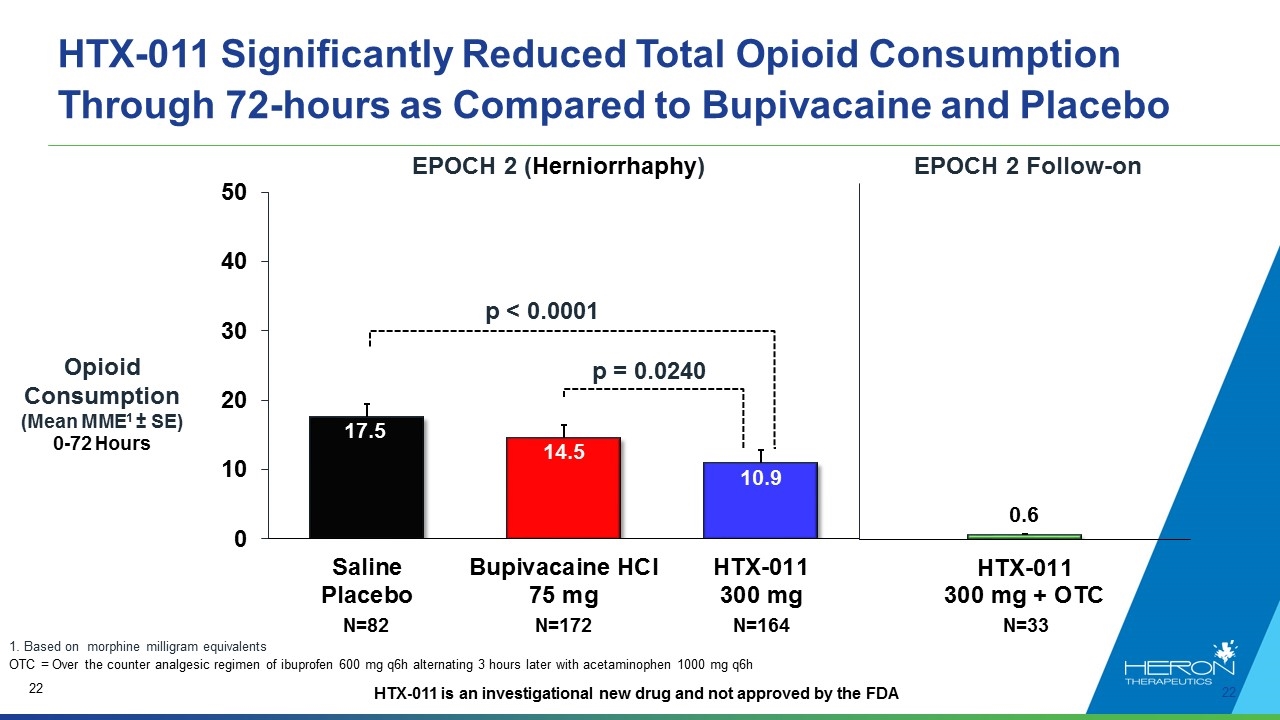

HTX-011 Significantly Reduced Total Opioid Consumption Through 72-hours as Compared to Bupivacaine and Placebo 1. Based on morphine milligram equivalents N=82 N=172 N=164 p = 0.0240 p < 0.0001 EPOCH 2 (Herniorrhaphy) N=33 EPOCH 2 Follow-on OTC = Over the counter analgesic regimen of ibuprofen 600 mg q6h alternating 3 hours later with acetaminophen 1000 mg q6h Opioid Consumption (Mean MME1 ± SE) 0-72 Hours HTX-011 is an investigational new drug and not approved by the FDA [BAR CHART]

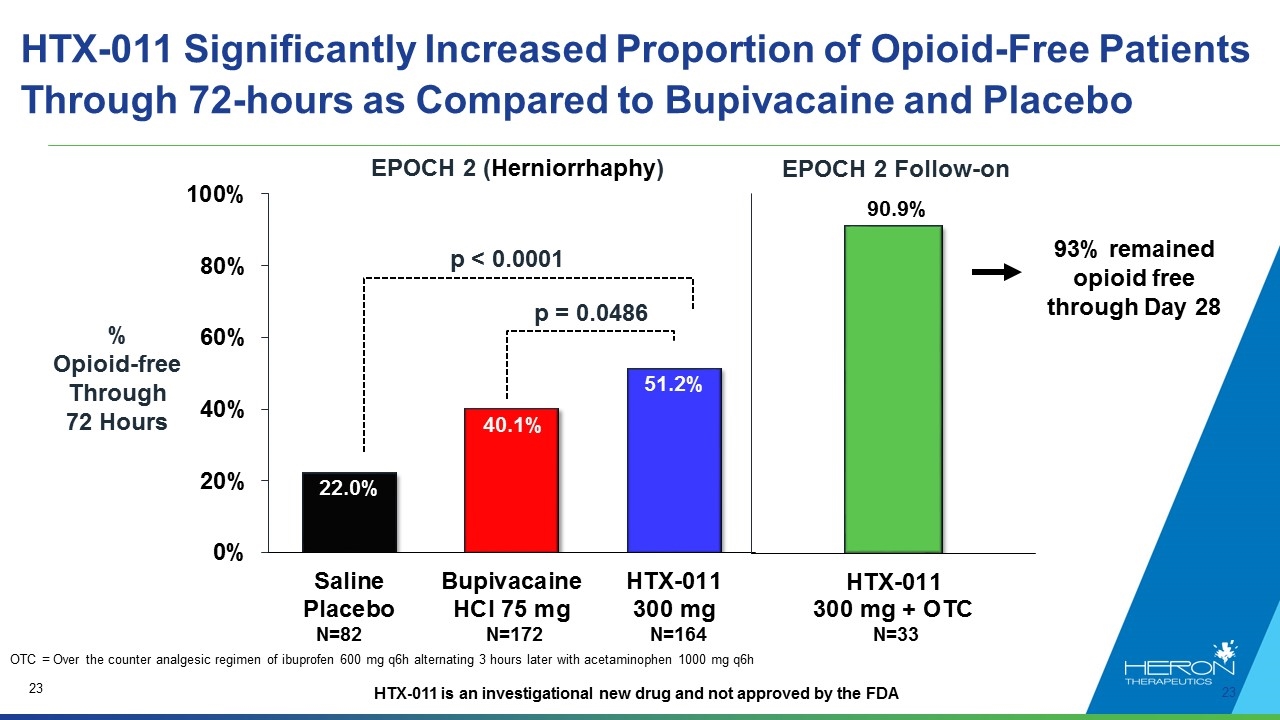

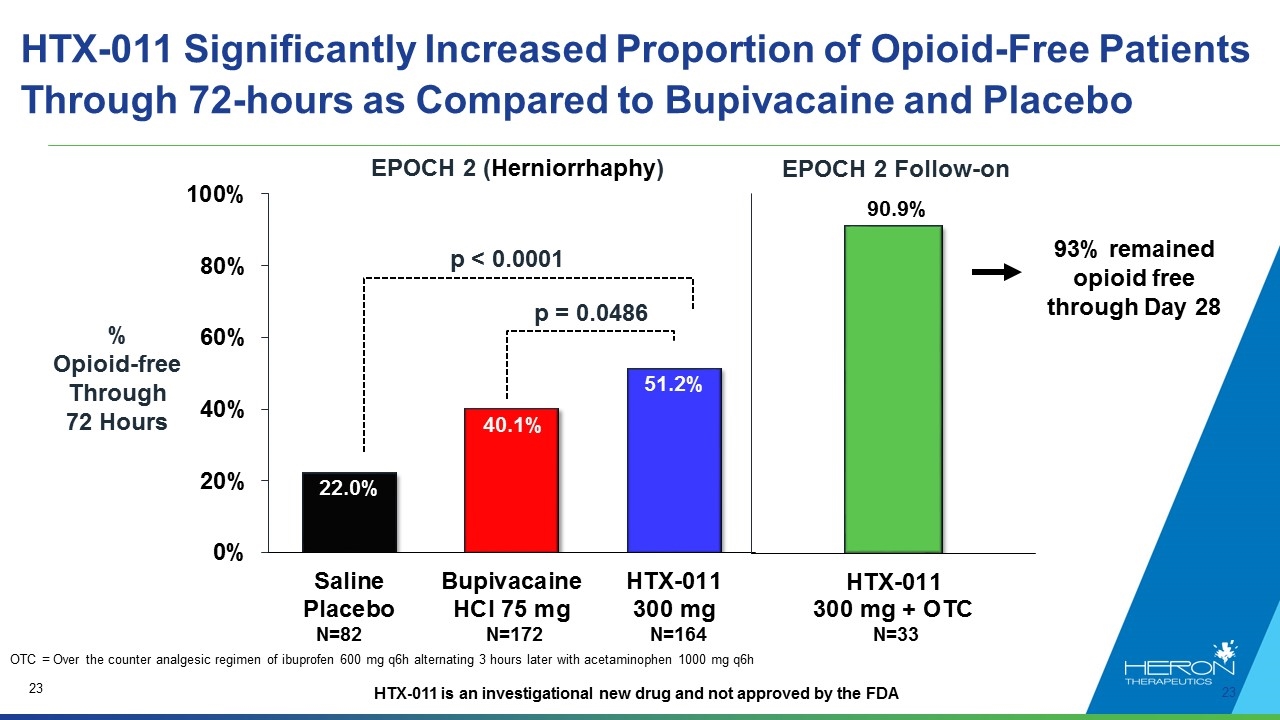

HTX-011 Significantly Increased Proportion of Opioid-Free Patients Through 72-hours as Compared to Bupivacaine and Placebo p = 0.0486 p < 0.0001 EPOCH 2 Follow-on EPOCH 2 (Herniorrhaphy) % Opioid-free Through 72 Hours N=82 N=172 N=164 N=33 40.1% OTC = Over the counter analgesic regimen of ibuprofen 600 mg q6h alternating 3 hours later with acetaminophen 1000 mg q6h 93% remained opioid free through Day 28 90.9% HTX-011 is an investigational new drug and not approved by the FDA [BAR CHART]

HOPE-1: Real World Evidence of Opioid-Free Recovery Post Inguinal Herniorrhaphy with HTX-011 + OTC Analgesics

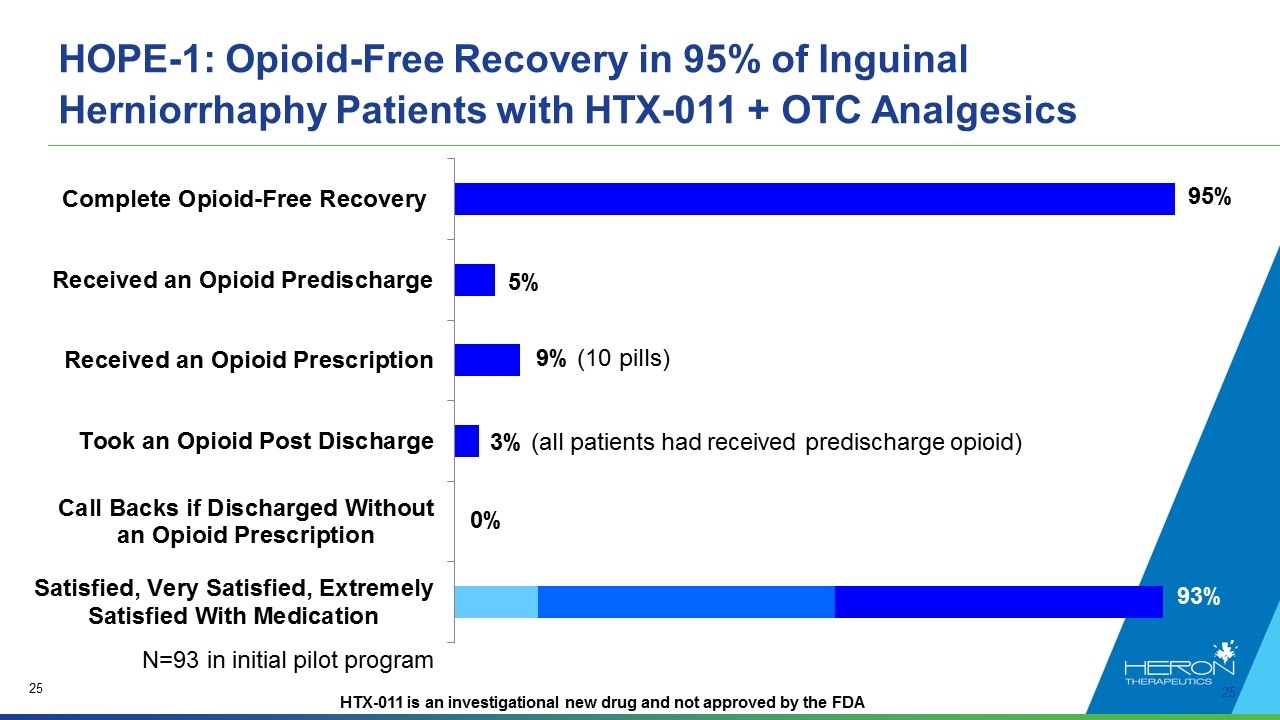

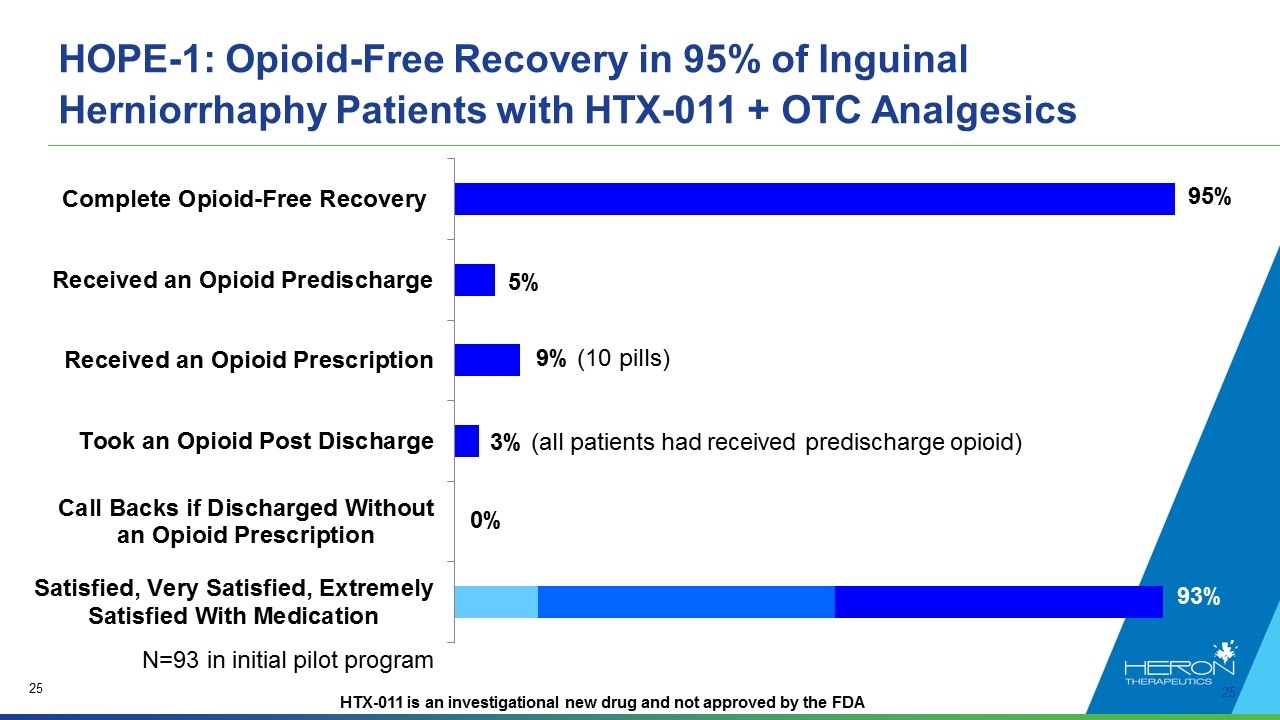

HOPE-1: Opioid-Free Recovery in 95% of Inguinal Herniorrhaphy Patients with HTX-011 + OTC Analgesics 5% N=93 in initial pilot program 93% HTX-011 is an investigational new drug and not approved by the FDA [BAR CHART]

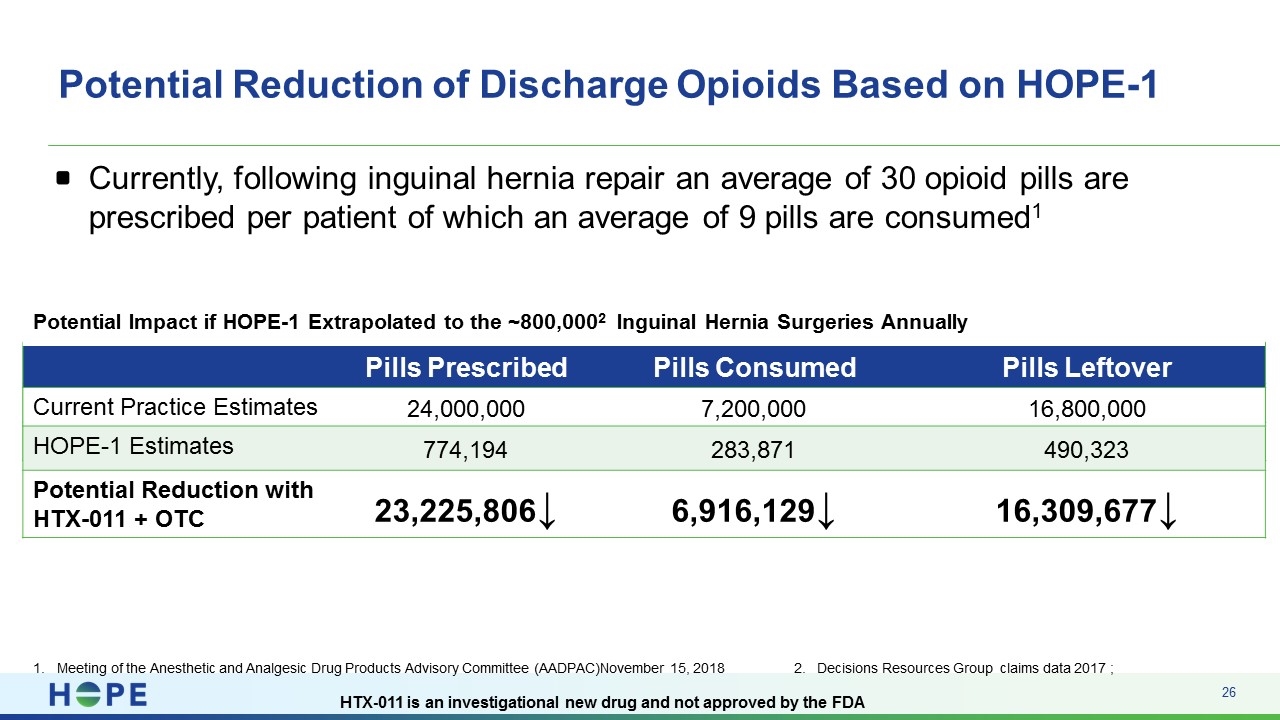

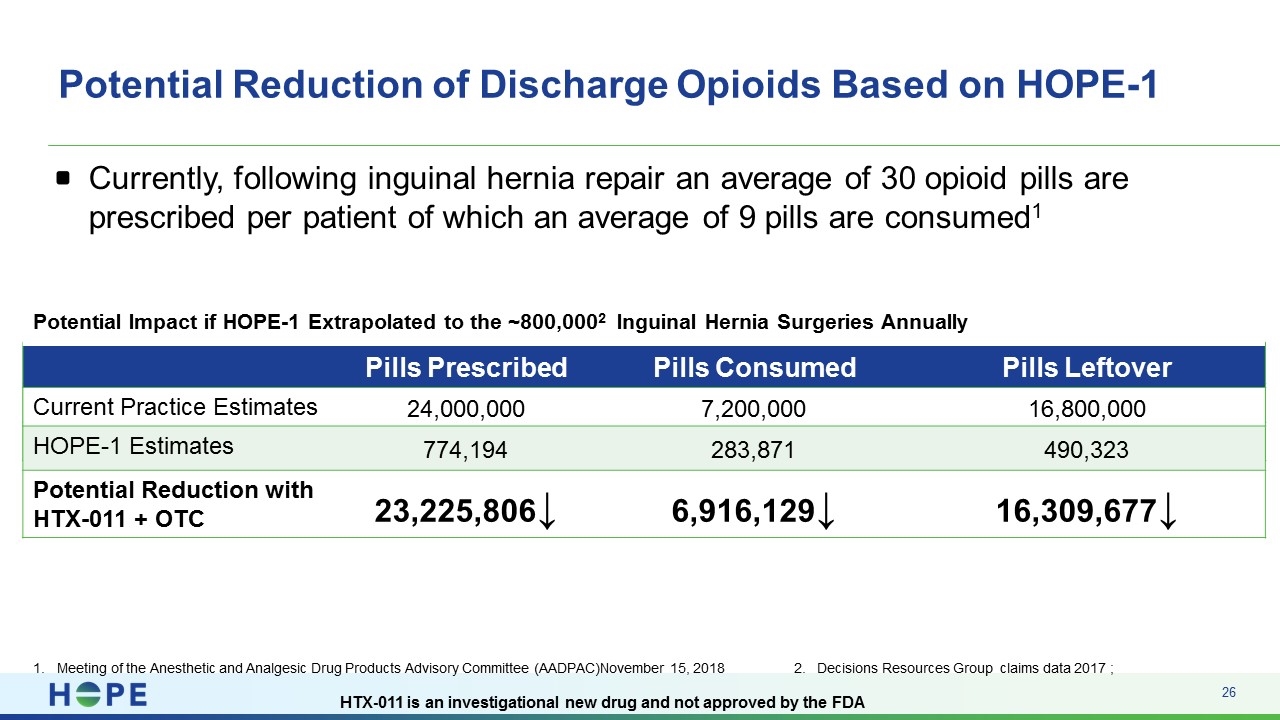

Potential Reduction of Discharge Opioids Based on HOPE-1 Currently, following inguinal hernia repair an average of 30 opioid pills are prescribed per patient of which an average of 9 pills are consumed1 HOPE-1 Study vs Estimated Opioid Usage With Current Practice Assumptions (n=93) Pills Prescribed Pills Consumed Pills Leftover Current practice estimates 2790 837 1953 HOPE-1 results 90 33 57 Meeting of the Anesthetic and Analgesic Drug Products Advisory Committee (AADPAC)November 15, 2018 Potential Impact if HOPE-1 Extrapolated to the ~800,0002 Inguinal Hernia Surgeries Annually Pills Prescribed Pills Consumed Pills Leftover Current Practice Estimates 24,000,000 7,200,000 16,800,000 HOPE-1 Estimates 774,194 283,871 490,323 Potential Reduction with HTX-011 + OTC 23,225,806↓ 6,916,129↓ 16,309,677↓ 2. Decisions Resources Group claims data 2017 ; HTX-011 is an investigational new drug and not approved by the FDA

Safety Summary HTX-011 was generally well tolerated across all Phase 2 and Phase 3 studies with no clinically meaningful differences from placebo and bupivacaine in: Overall adverse events The incidence of serious adverse events Premature discontinuations due to adverse events Potential local anesthetic systemic toxicity (LAST) adverse events Potential wound healing related adverse events Deaths (none on HTX-011; one on bupivacaine) HTX-011 is an investigational new drug and not approved by the FDA

The Commercialization of HTX-011 Advancing Pain Management HTX-011 is an investigational new drug and not approved by the FDA

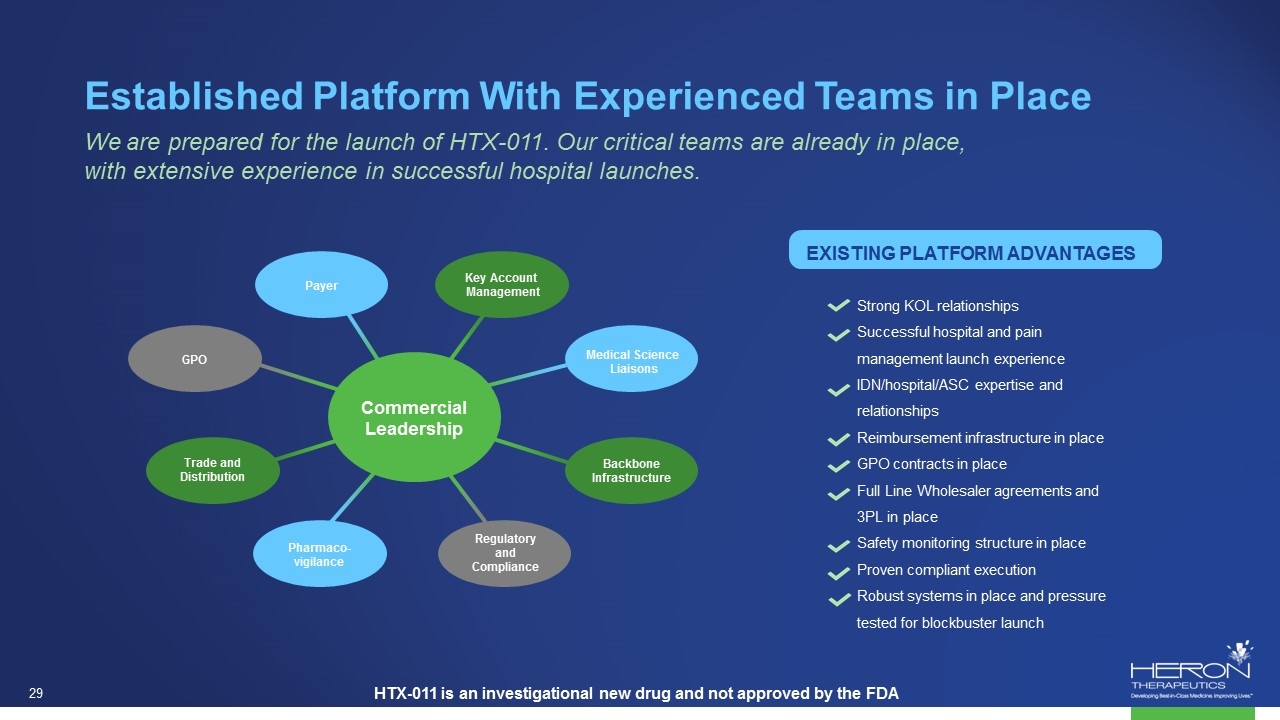

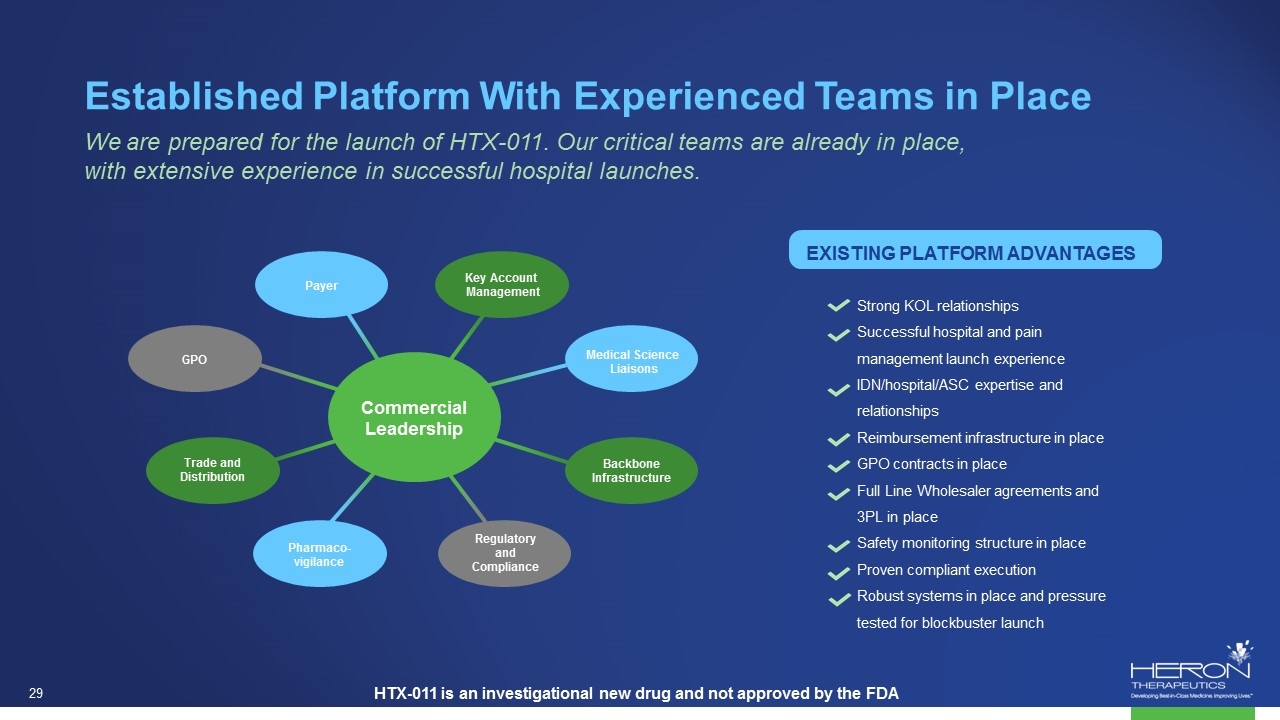

EXISTING PLATFORM ADVANTAGES Established Platform With Experienced Teams in Place We are prepared for the launch of HTX-011. Our critical teams are already in place, with extensive experience in successful hospital launches. Strong KOL relationships Successful hospital and pain management launch experience IDN/hospital/ASC expertise and relationships Reimbursement infrastructure in place GPO contracts in place Full Line Wholesaler agreements and 3PL in place Safety monitoring structure in place Proven compliant execution Robust systems in place and pressure tested for blockbuster launch Commercial Leadership Key Account Management Payer GPO Trade and Distribution Pharmaco- vigilance Regulatory and Compliance Backbone Infrastructure Medical Science Liaisons HTX-011 is an investigational new drug and not approved by the FDA

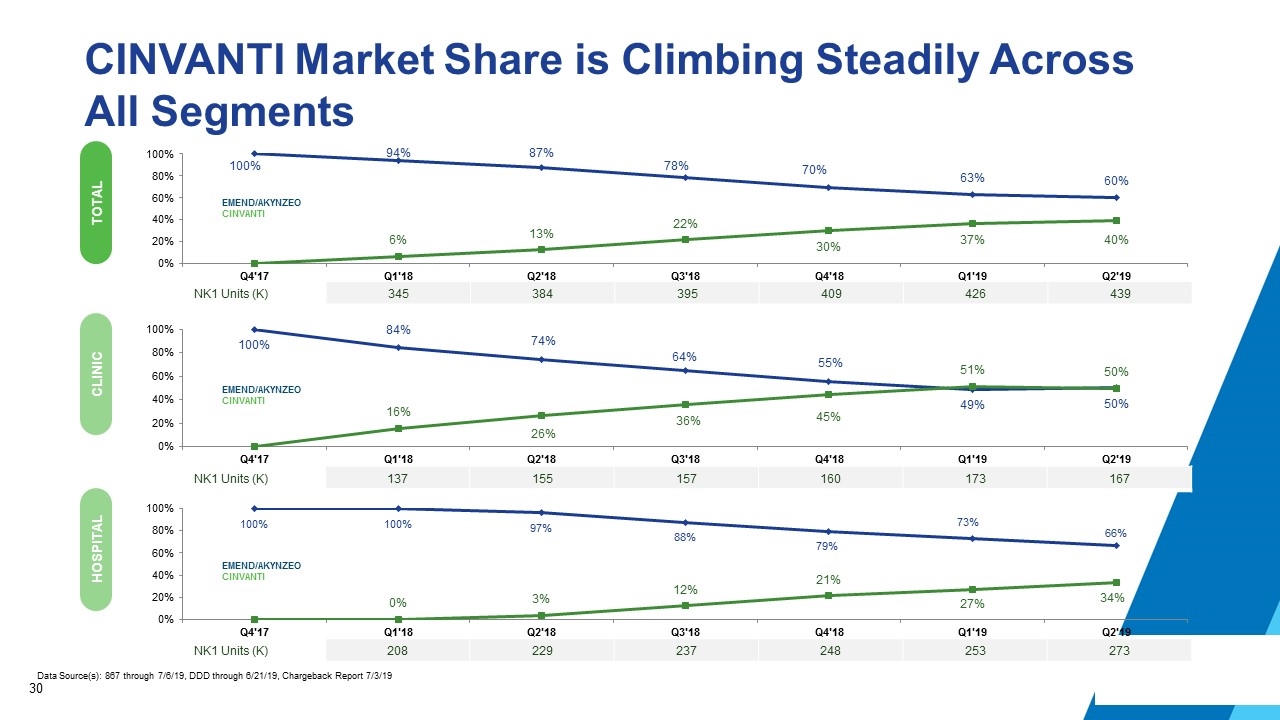

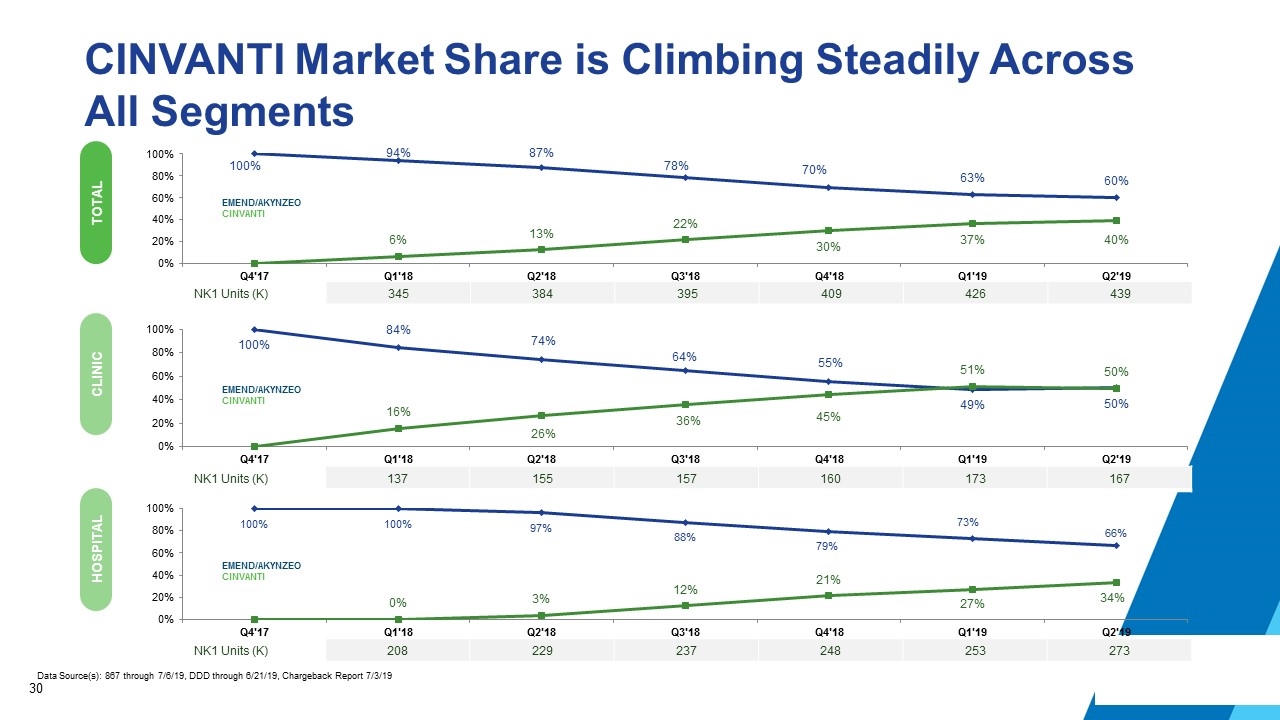

TOTAL CLINIC HOSPITAL CINVANTI Market Share is Climbing Steadily Across All Segments NK1 Units (K) 345 384 395 409 426 439 NK1 Units (K) 137 155 157 160 173 167 NK1 Units (K) 208 229 237 248 253 273 EMEND/AKYNZEO CINVANTI EMEND/AKYNZEO CINVANTI EMEND/AKYNZEO CINVANTI Data Source(s): 867 through 7/6/19, DDD through 6/21/19, Chargeback Report 7/3/19

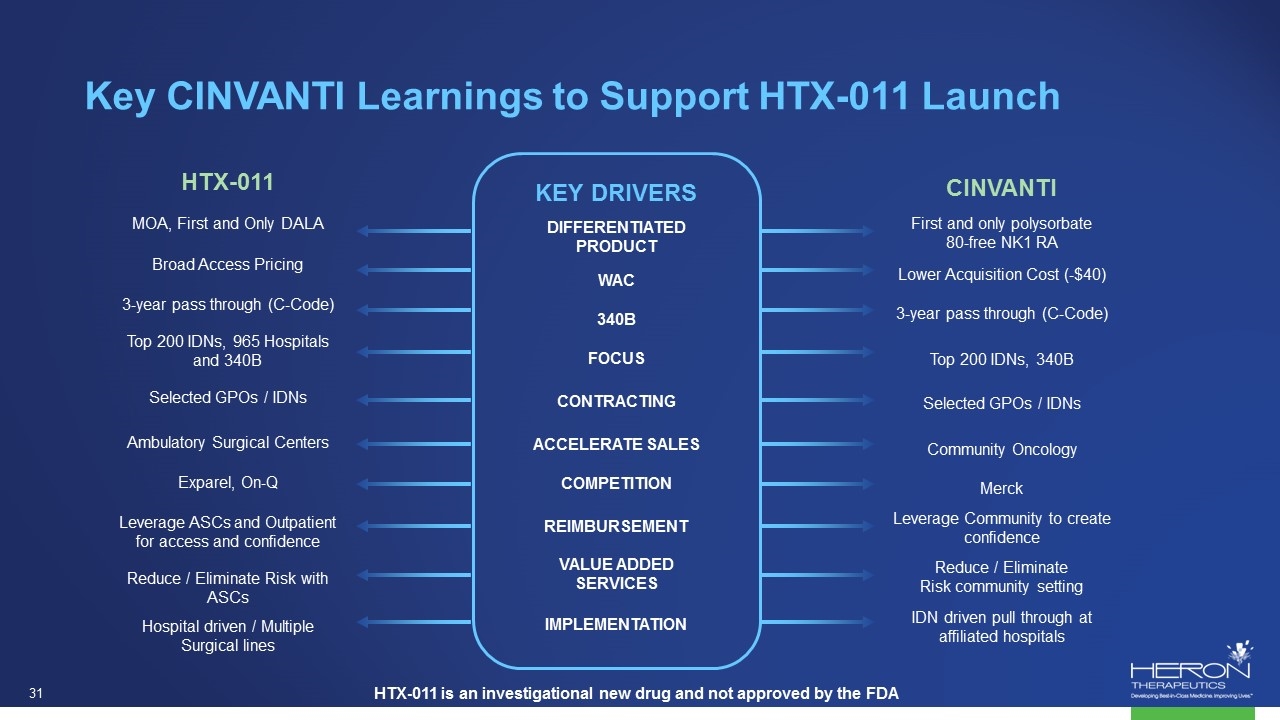

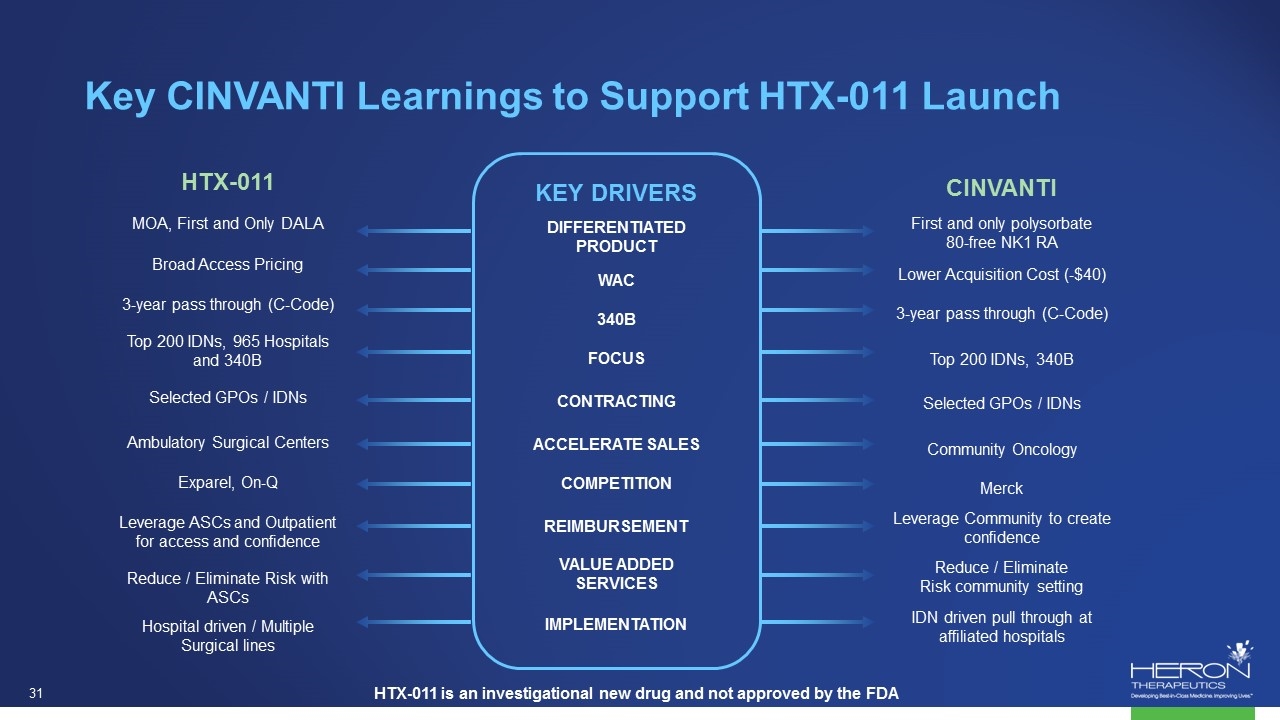

Key CINVANTI Learnings to Support HTX-011 Launch HTX-011 MOA, First and Only DALA Broad Access Pricing 3-year pass through (C-Code) Top 200 IDNs, 965 Hospitals and 340B Selected GPOs / IDNs Ambulatory Surgical Centers Exparel, On-Q Leverage ASCs and Outpatient for access and confidence Reduce / Eliminate Risk with ASCs Hospital driven / Multiple Surgical lines CINVANTI First and only polysorbate 80-free NK1 RA Lower Acquisition Cost (-$40) 3-year pass through (C-Code) Top 200 IDNs, 340B Selected GPOs / IDNs Community Oncology Merck Leverage Community to create confidence Reduce / Eliminate Risk community setting IDN driven pull through at affiliated hospitals KEY DRIVERS DIFFERENTIATED PRODUCT WAC 340B FOCUS CONTRACTING ACCELERATE SALES COMPETITION REIMBURSEMENT VALUE ADDED SERVICES IMPLEMENTATION HTX-011 is an investigational new drug and not approved by the FDA

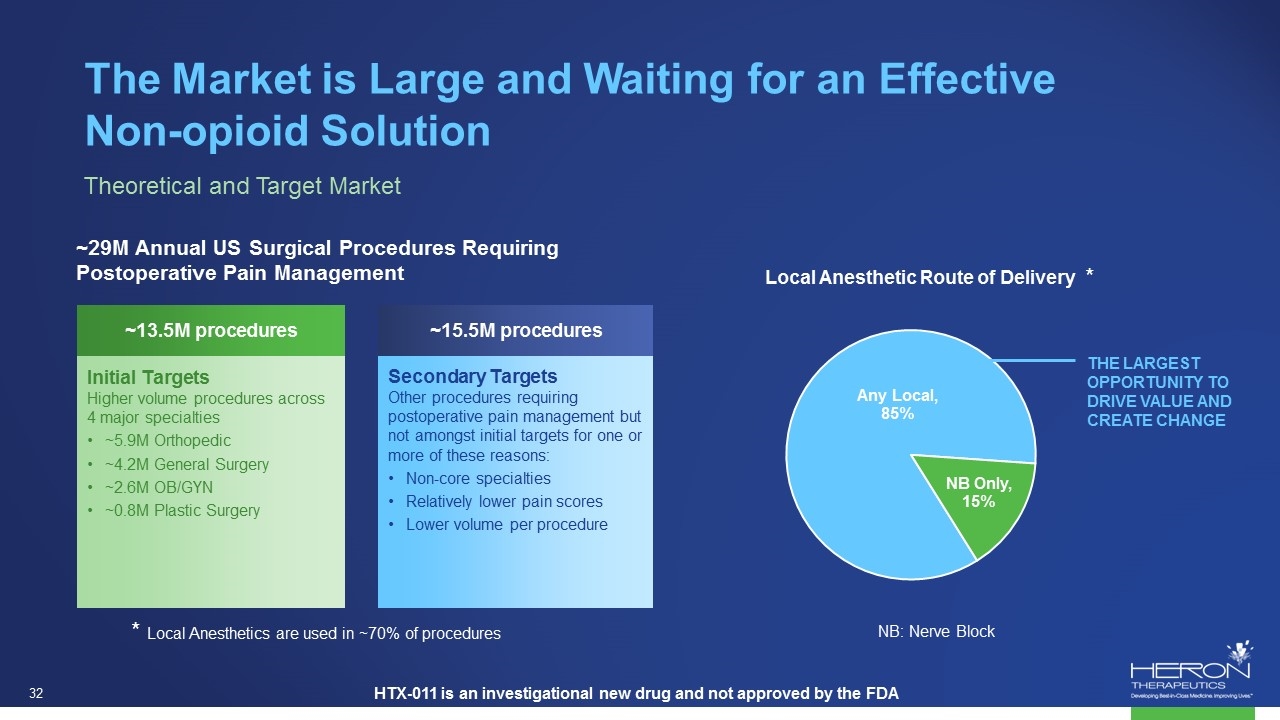

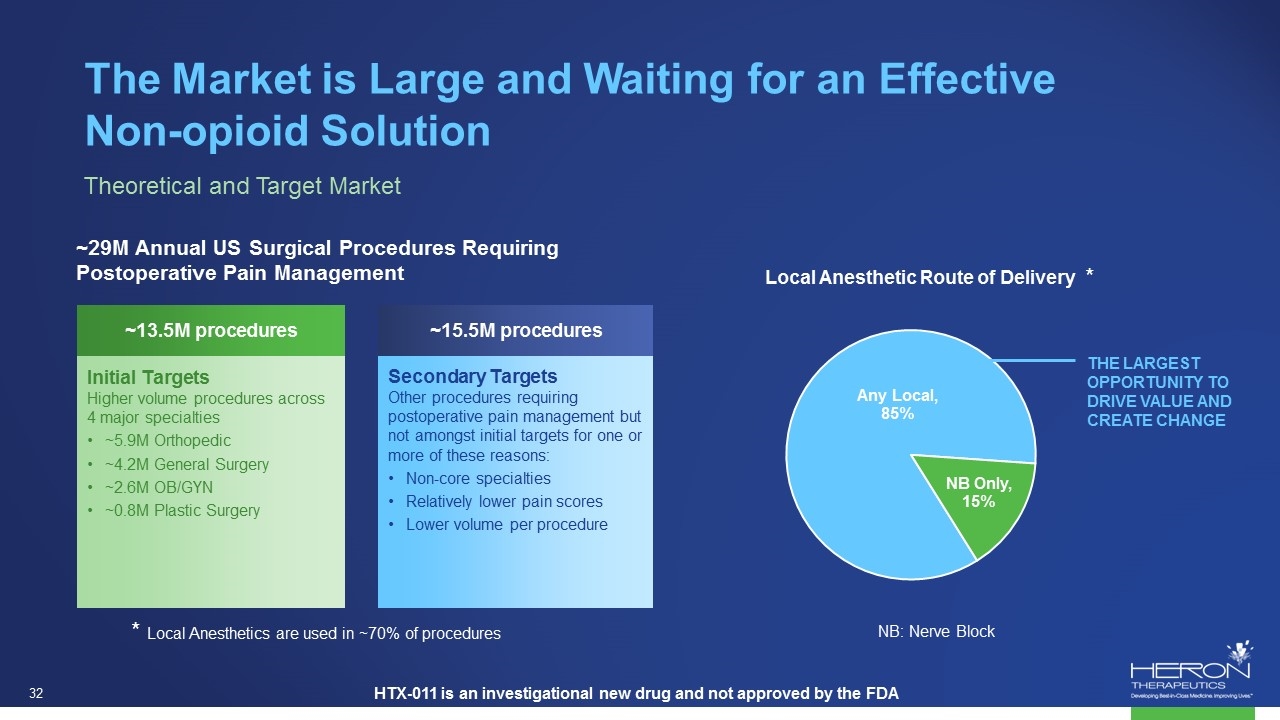

The Market is Large and Waiting for an Effective Non-opioid Solution Theoretical and Target Market ~29M Annual US Surgical Procedures Requiring Postoperative Pain Management Initial Targets Higher volume procedures across 4 major specialties ~5.9M Orthopedic ~4.2M General Surgery ~2.6M OB/GYN ~0.8M Plastic Surgery Secondary Targets Other procedures requiring postoperative pain management but not amongst initial targets for one or more of these reasons: Non-core specialties Relatively lower pain scores Lower volume per procedure ~13.5M procedures ~15.5M procedures THE LARGEST OPPORTUNITY TO DRIVE VALUE AND CREATE CHANGE NB: Nerve Block * * Local Anesthetics are used in ~70% of procedures HTX-011 is an investigational new drug and not approved by the FDA

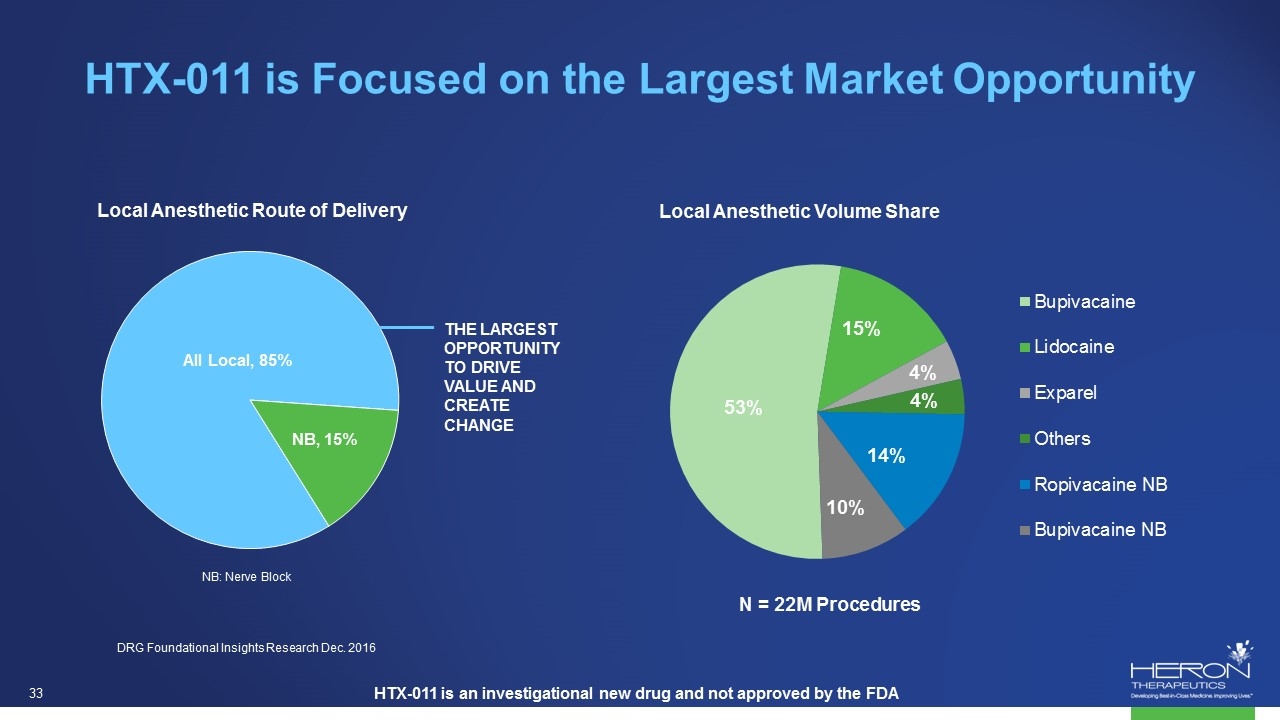

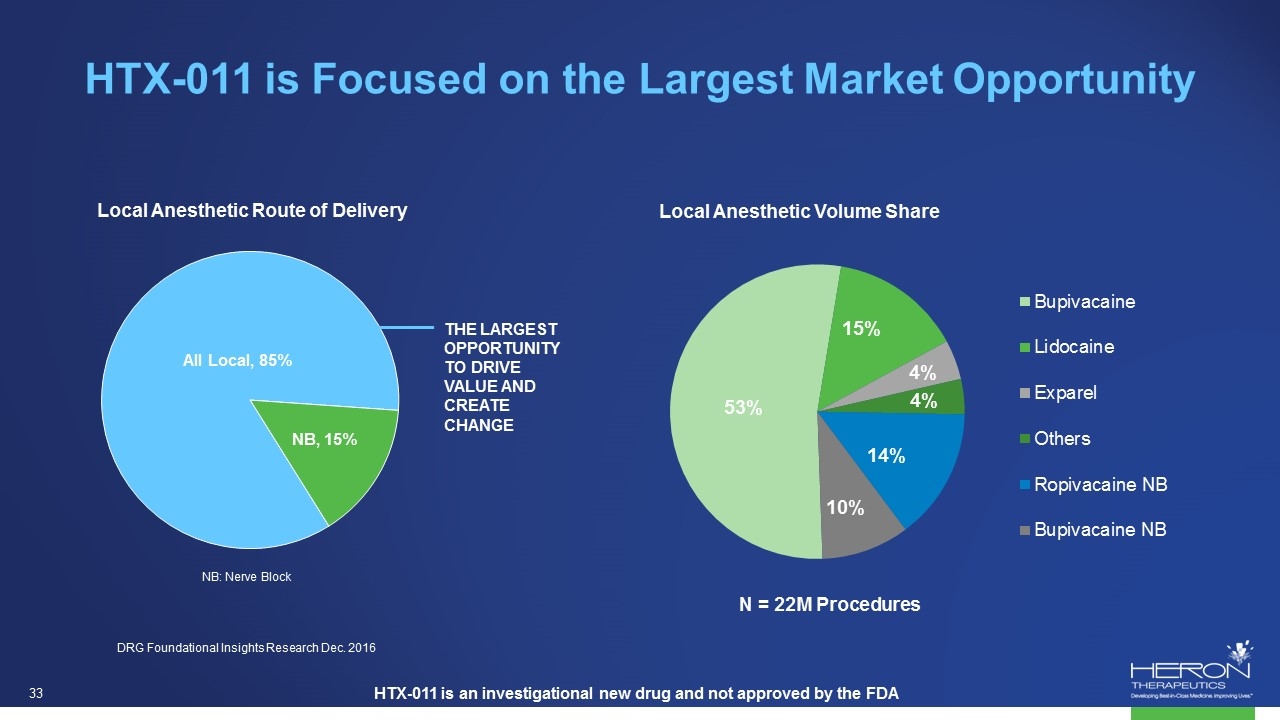

HTX-011 is Focused on the Largest Market Opportunity THE LARGEST OPPORTUNITY TO DRIVE VALUE AND CREATE CHANGE NB: Nerve Block N = 22M Procedures DRG Foundational Insights Research Dec. 2016 HTX-011 is an investigational new drug and not approved by the FDA [PIE CHART]

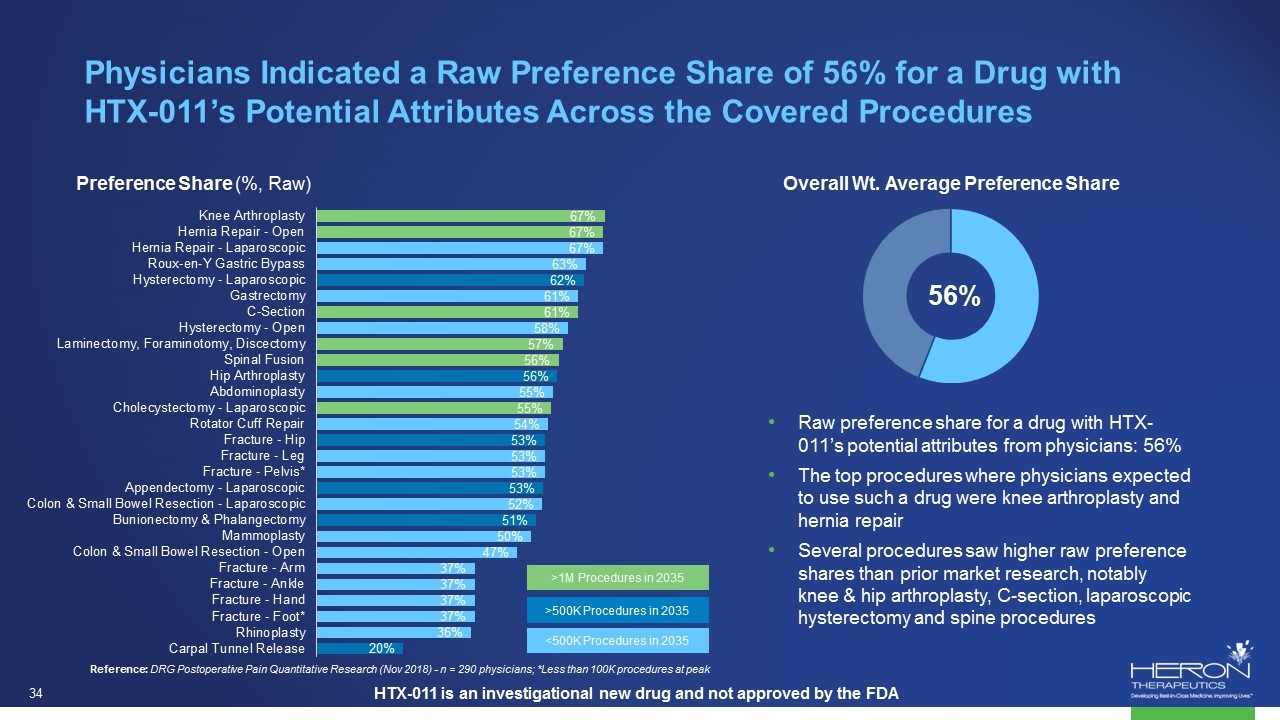

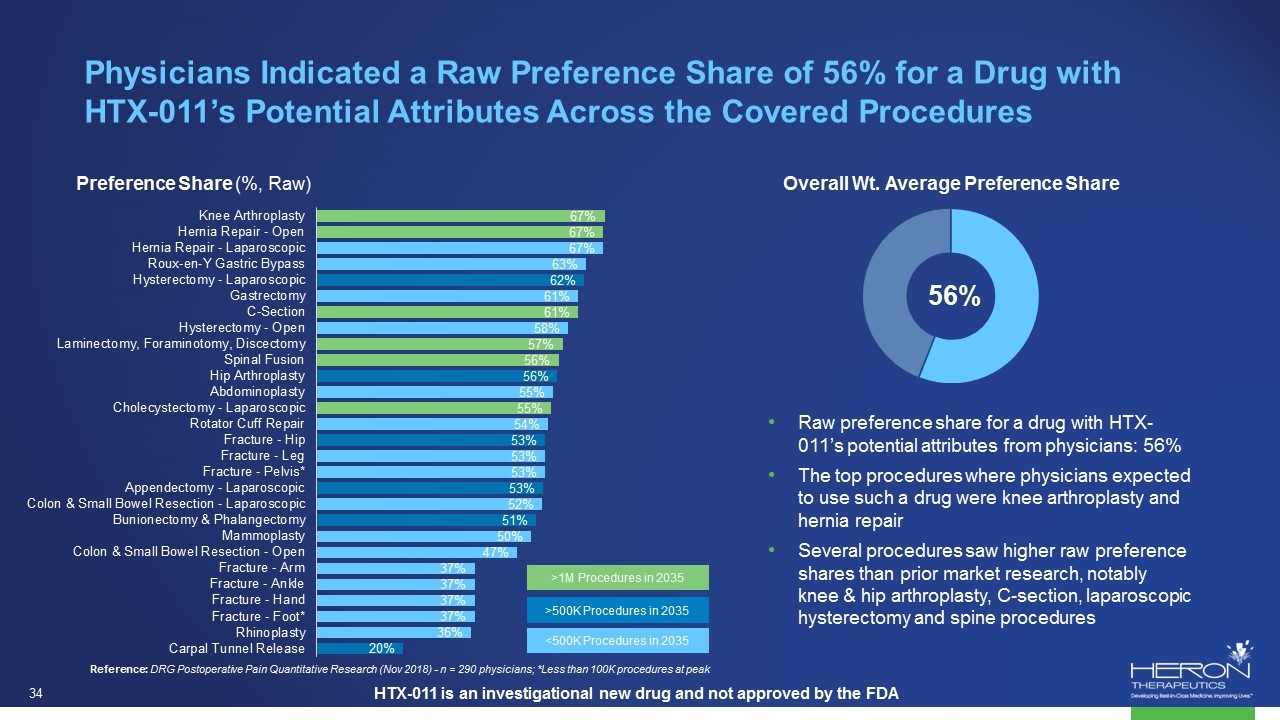

Physicians Indicated a Raw Preference Share of 56% for a Drug with HTX-011’s Potential Attributes Across the Covered Procedures Overall Wt. Average Preference Share Preference Share (%, Raw) 56% Raw preference share for a drug with HTX-011’s potential attributes from physicians: 56% The top procedures where physicians expected to use such a drug were knee arthroplasty and hernia repair Several procedures saw higher raw preference shares than prior market research, notably knee & hip arthroplasty, C-section, laparoscopic hysterectomy and spine procedures >1M Procedures in 2035 >500K Procedures in 2035 <500K Procedures in 2035 Reference: DRG Postoperative Pain Quantitative Research (Nov 2018) - n = 290 physicians; *Less than 100K procedures at peak HTX-011 is an investigational new drug and not approved by the FDA [BAR CHART]

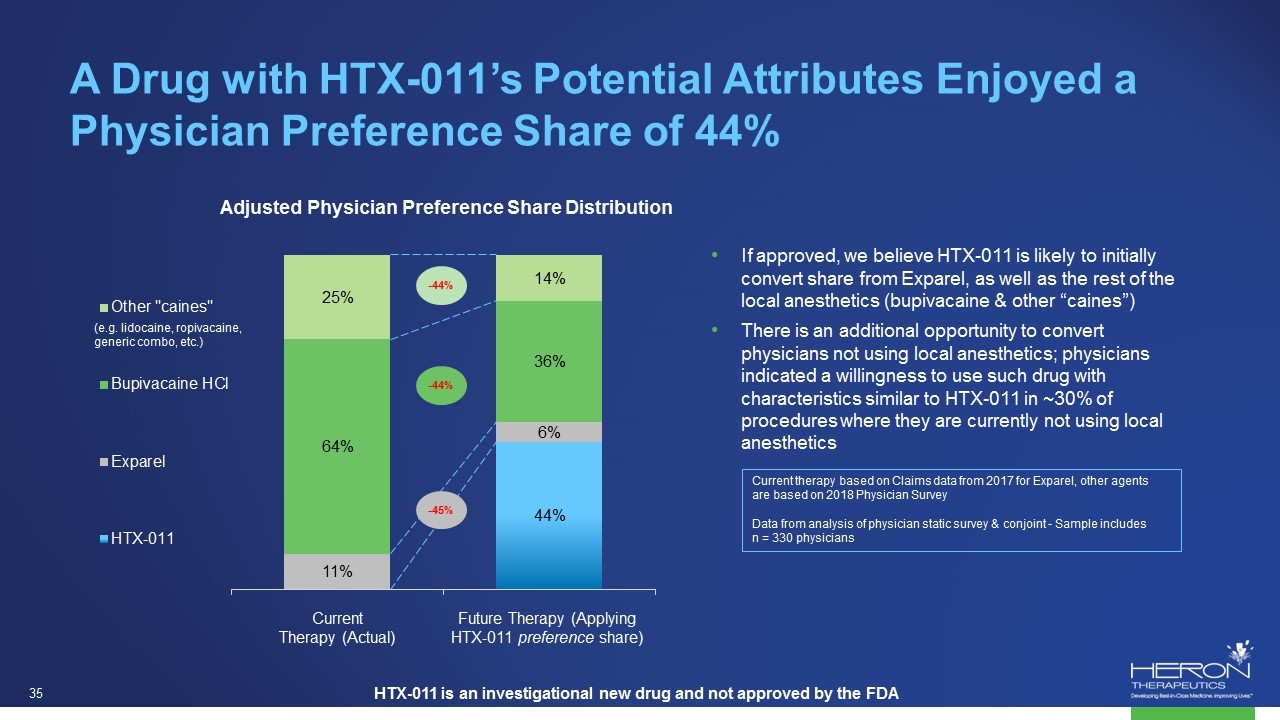

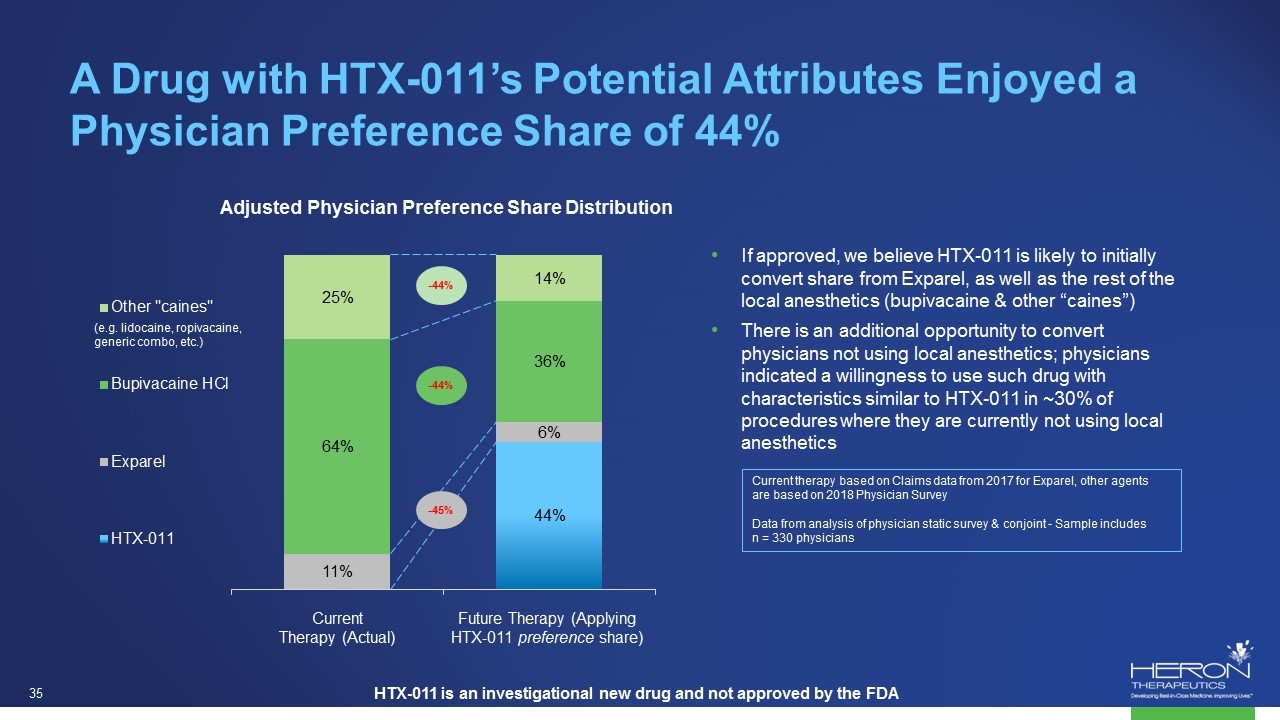

Adjusted Physician Preference Share Distribution -44% -44% -45% Future Therapy (Applying HTX-011 preference share) Current Therapy (Actual) (e.g. lidocaine, ropivacaine, generic combo, etc.) Current therapy based on Claims data from 2017 for Exparel, other agents are based on 2018 Physician Survey Data from analysis of physician static survey & conjoint - Sample includes n = 330 physicians A Drug with HTX-011’s Potential Attributes Enjoyed a Physician Preference Share of 44% If approved, we believe HTX-011 is likely to initially convert share from Exparel, as well as the rest of the local anesthetics (bupivacaine & other “caines”) There is an additional opportunity to convert physicians not using local anesthetics; physicians indicated a willingness to use such drug with characteristics similar to HTX-011 in ~30% of procedures where they are currently not using local anesthetics HTX-011 is an investigational new drug and not approved by the FDA

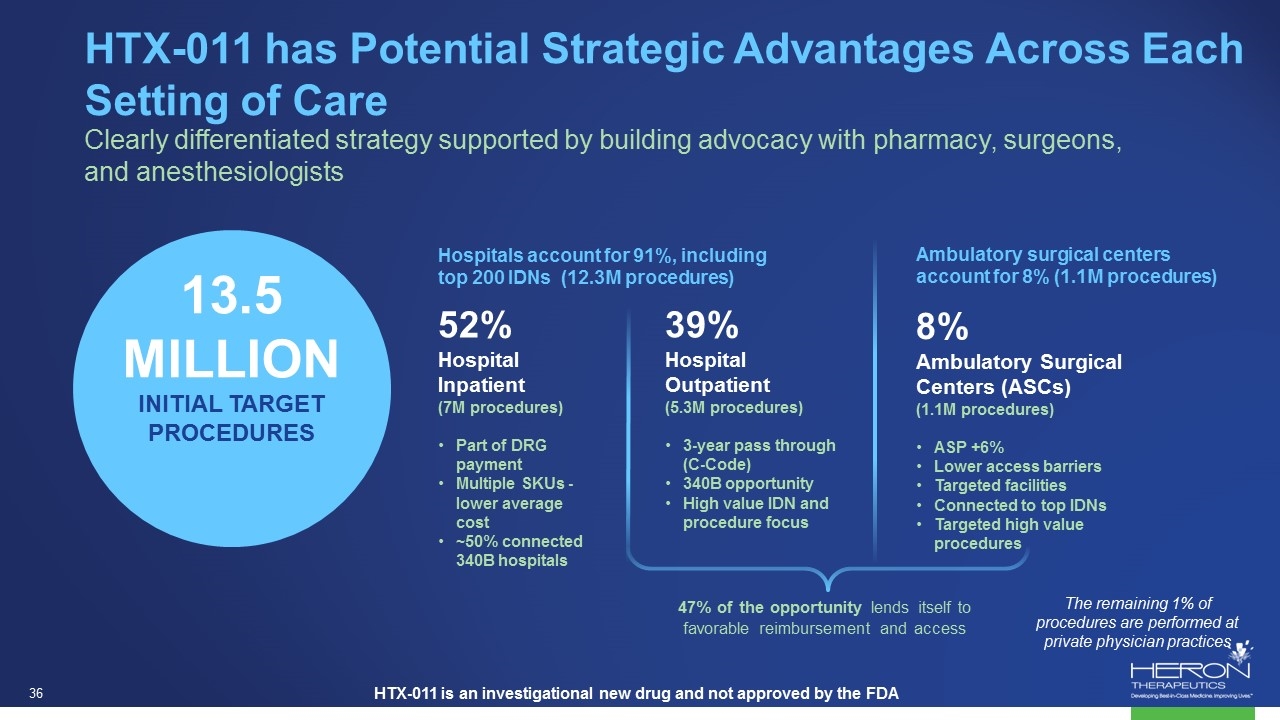

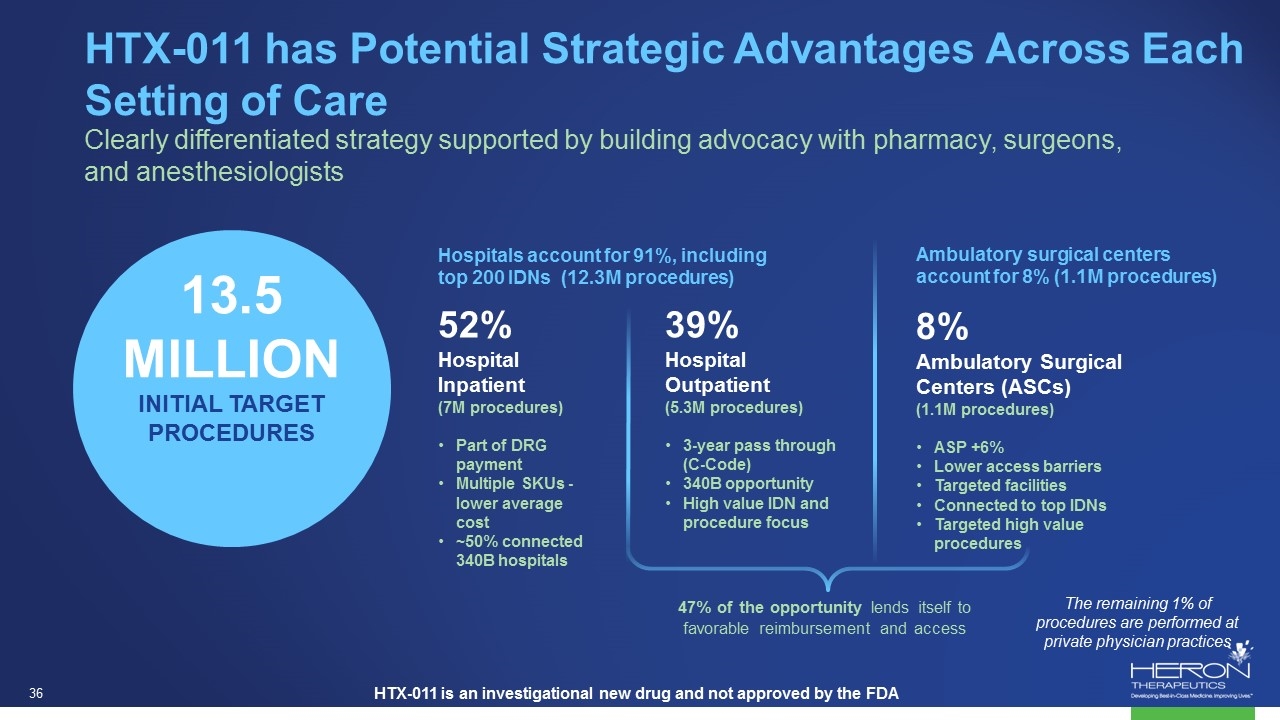

HTX-011 has Potential Strategic Advantages Across Each Setting of Care Clearly differentiated strategy supported by building advocacy with pharmacy, surgeons, and anesthesiologists 52% Hospital Inpatient (7M procedures) Part of DRG payment Multiple SKUs - lower average cost ~50% connected 340B hospitals 39% Hospital Outpatient (5.3M procedures) 3-year pass through (C-Code) 340B opportunity High value IDN and procedure focus Hospitals account for 91%, including top 200 IDNs (12.3M procedures) 8% Ambulatory Surgical Centers (ASCs) (1.1M procedures) ASP +6% Lower access barriers Targeted facilities Connected to top IDNs Targeted high value procedures Ambulatory surgical centers account for 8% (1.1M procedures) The remaining 1% of procedures are performed at private physician practices 13.5 MILLION INITIAL TARGET PROCEDURES 47% of the opportunity lends itself to favorable reimbursement and access HTX-011 is an investigational new drug and not approved by the FDA

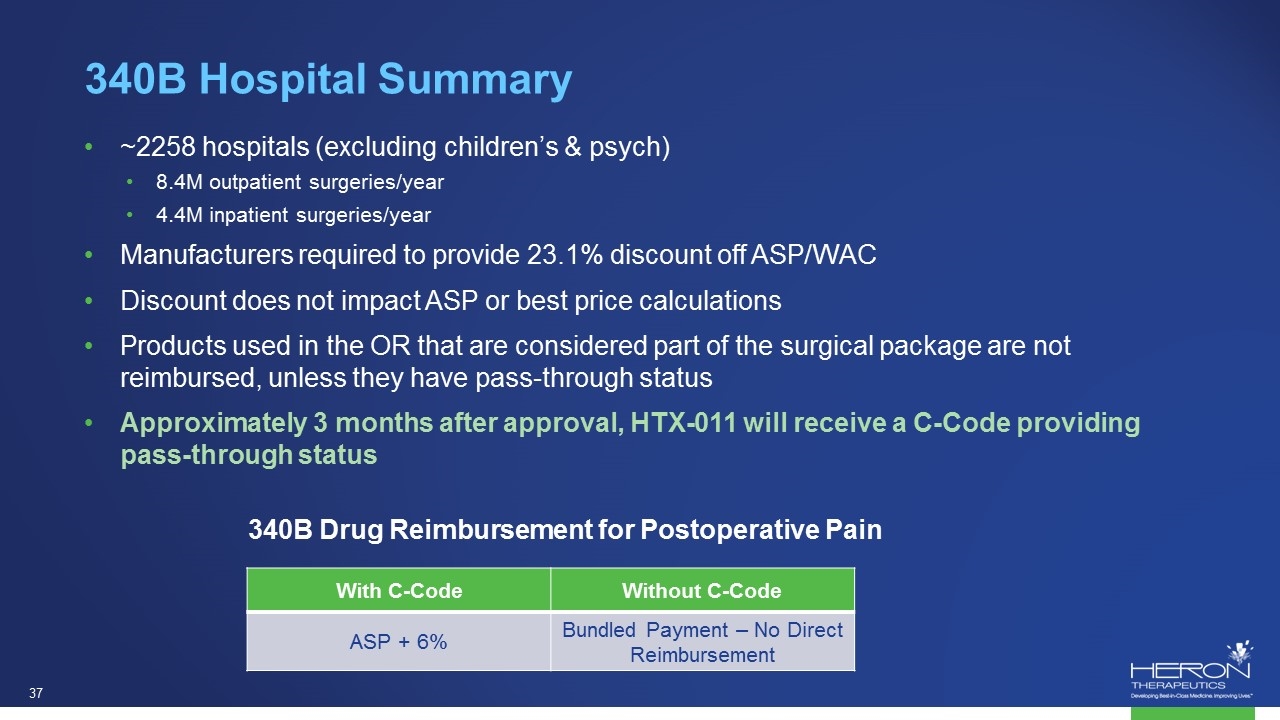

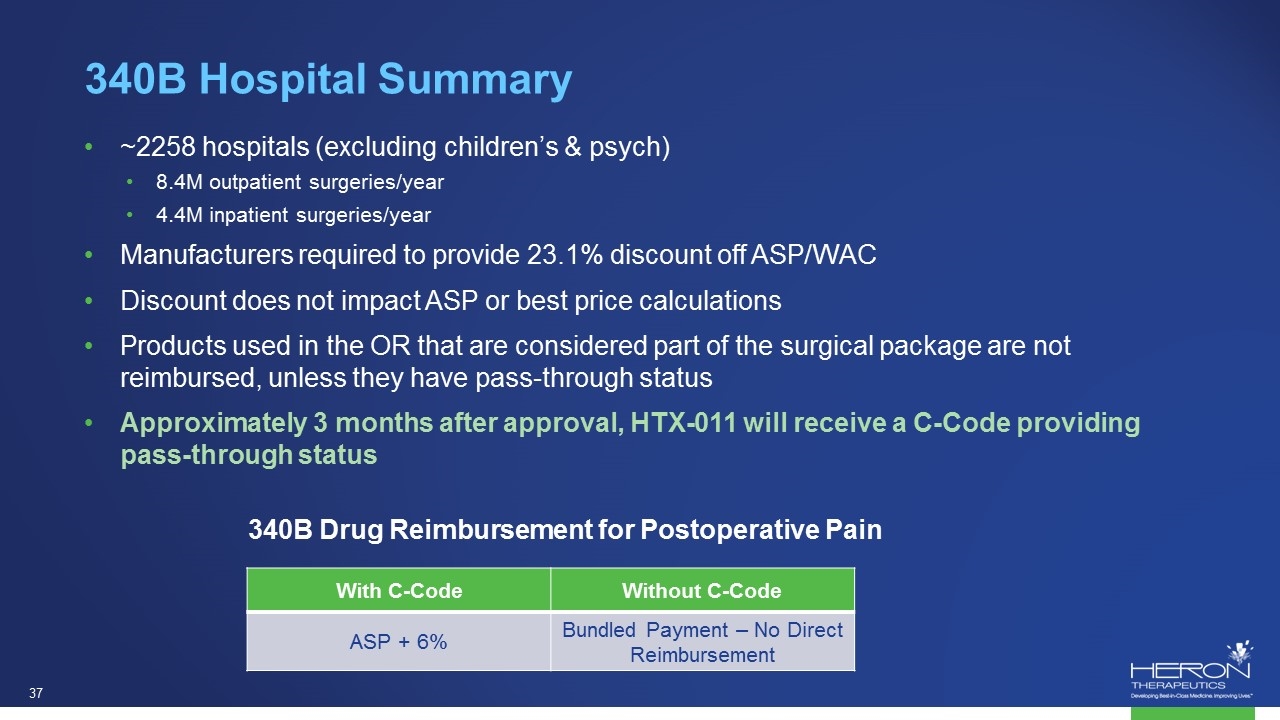

~2258 hospitals (excluding children’s & psych) 8.4M outpatient surgeries/year 4.4M inpatient surgeries/year Manufacturers required to provide 23.1% discount off ASP/WAC Discount does not impact ASP or best price calculations Products used in the OR that are considered part of the surgical package are not reimbursed, unless they have pass-through status Approximately 3 months after approval, HTX-011 will receive a C-Code providing pass-through status 340B Hospital Summary With C-Code Without C-Code ASP + 6% Bundled Payment – No Direct Reimbursement 340B Drug Reimbursement for Postoperative Pain

Heron is Well Positioned to Execute a Blockbuster Launch for HTX-011 Proven track record with hospital launch success Existing robust platform and structure to support launch Significant unmet need and market opportunity Highly focused launch strategy to accelerate sales Unprecedented value proposition HTX-011 is an investigational new drug and not approved by the FDA

CINV Commercial Products

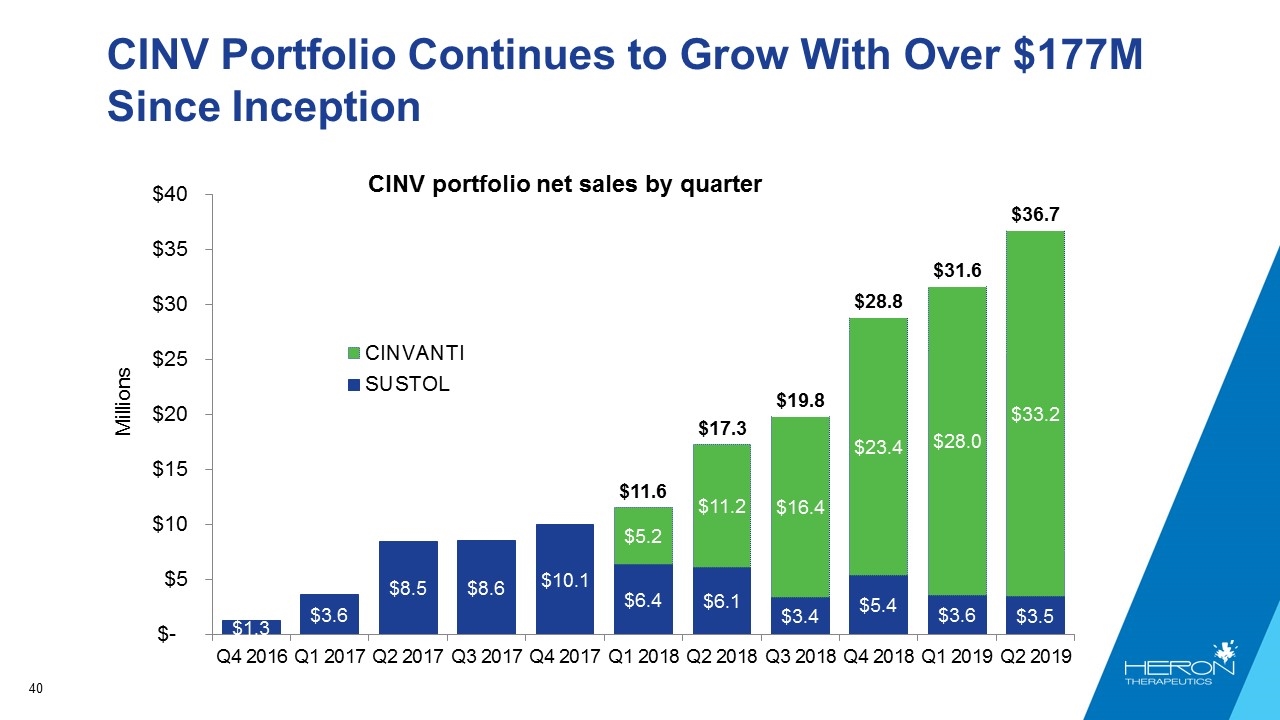

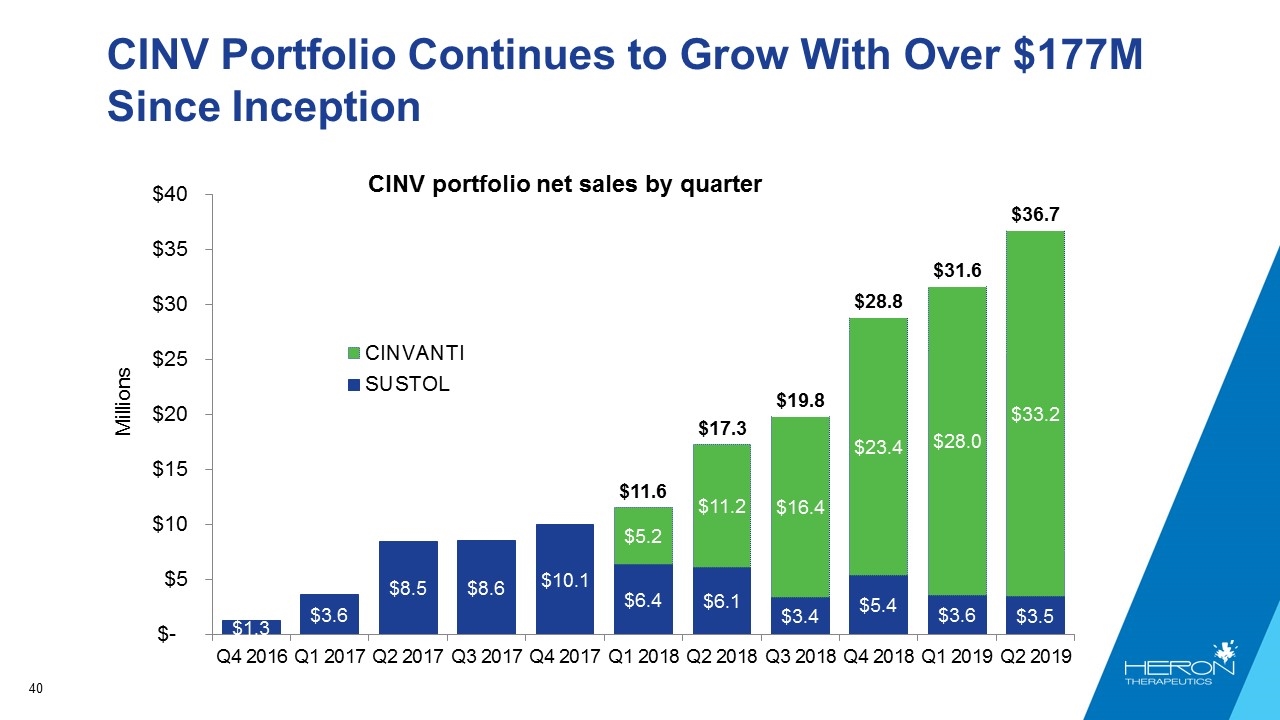

CINV Portfolio Continues to Grow With Over $177M Since Inception CINV portfolio net sales by quarter [BAR CHART]

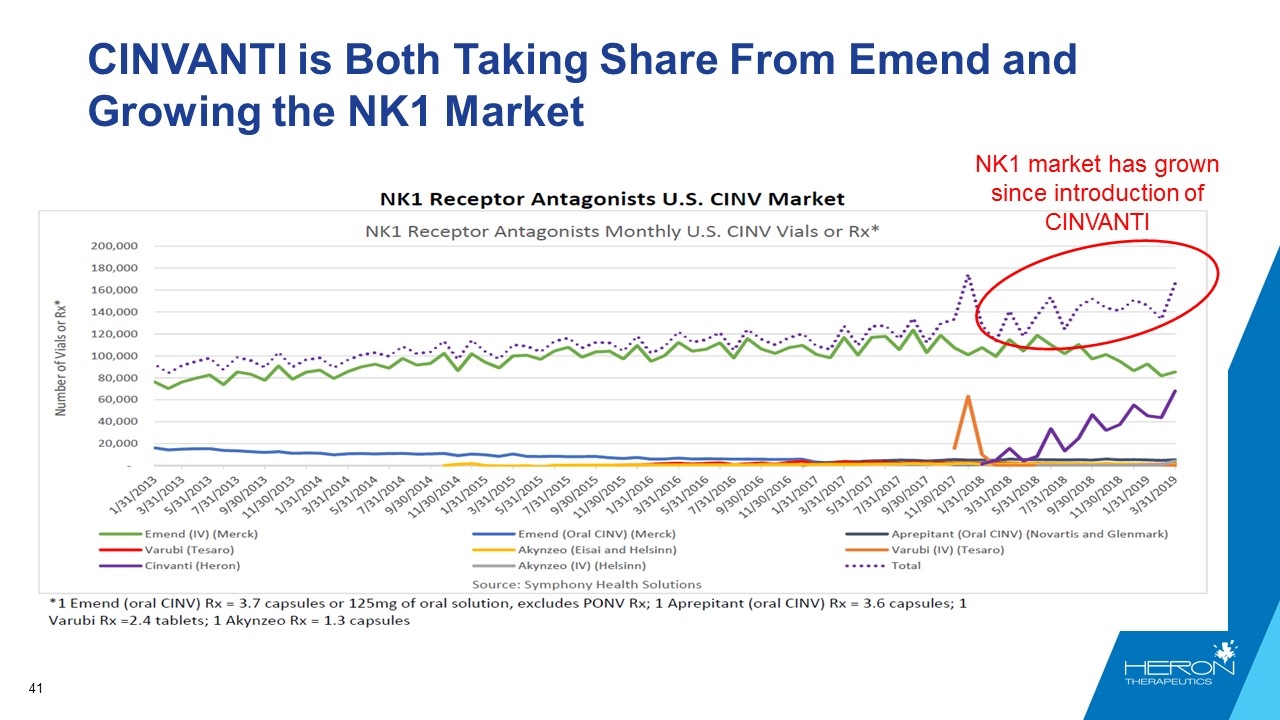

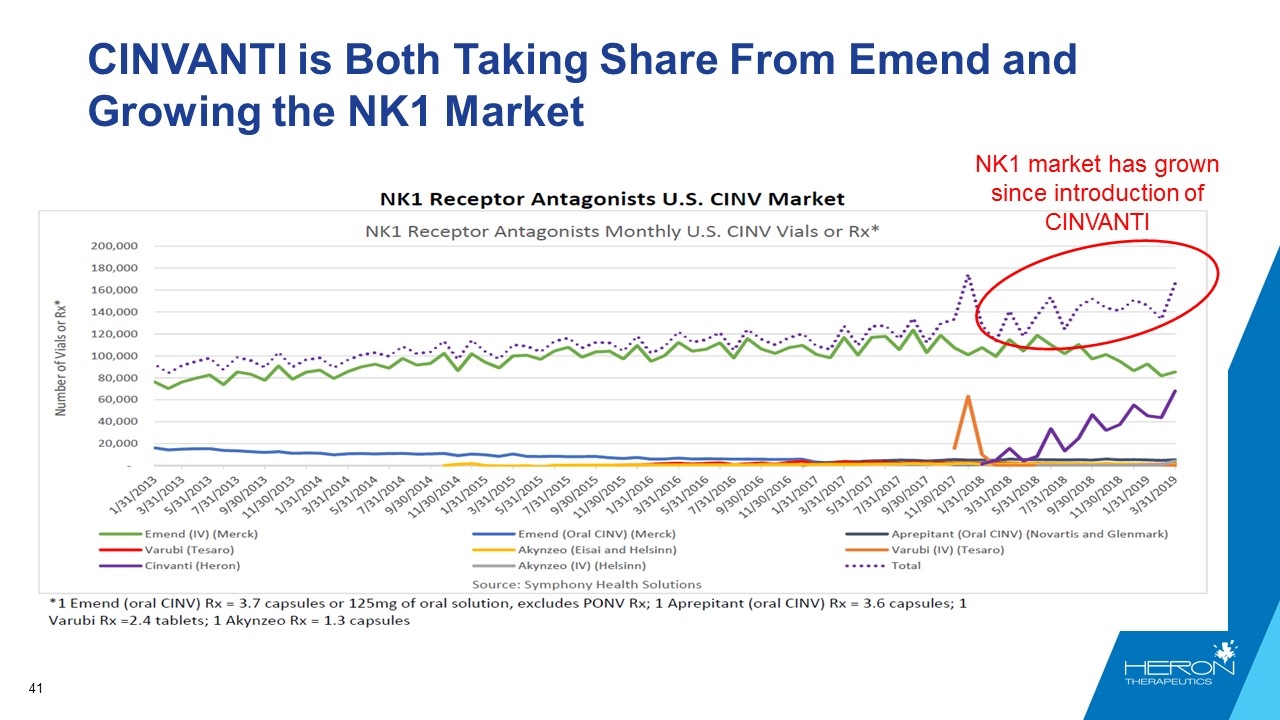

CINVANTI is Both Taking Share From Emend and Growing the NK1 Market NK1 market has grown since introduction of CINVANTI [LINE CHART]

Strategy to Preserve CINVANTI Through Generic Arbitrage Leverage favorable 340B pass through status, ASP+ 6% through 2020 IV push sNDA approved further differentiating CINVANTI from Emend and generics Long-term contracting CINVANTI has become an established brand across both clinics and hospital capturing 40% of the market in Q2 2019

Branded ALOXI/Palonosetron Arbitrage Lasted Much Longer Than Projected, Resulting in an Accelerated Decline in Sustol ASP Even with multiple generics on the market, the price of palonosetron did not drop as quickly as in past arbitrage periods Slow decline in prices resulted in a very long arbitrage, which also resulted in an accelerated decline in the Sustol ASP The only way to rebuild value in the brand is to implement an innovative strategy: Starting October 1, all discounting of Sustol was discontinued, which will result in lower sales In approximately 5 quarters the ASP of Sustol will reset to approximately the WAC Sustol will be re-launched with enhanced value for practices and Heron

2019 CINV Franchise Outlook SUSTOL®: To recover from the protracted palonosetron arbitrage, Heron has implemented an innovative strategy to refresh the ASP This will result in greatly reduced sales for approximately 5 quarters, followed by a significant rebound in units and revenue CINVANTI® Cinvanti continues to have the best overall profile compared to the other available NK1 antagonists and is completely differentiated from generic fosaprepitant with the 2-min IV Push administration CINVANTI (aprepitant) injectable emulsion received unique J-Code J0185 effective January 1, 2019, so generic pricing does not effect Cinvanti reimbursement Generic fosaprepitant IV entered the market in September 2019 Due to significant sales in 340b hospitals, IV push label and other factors, we do not expect this arbitrage to have the same magnitude as the Aloxi arbitrage Based on early price reductions within weeks of the first generic entry, the duration of the arbitrage should also be shorter than with Aloxi CINV Franchise 2019 guidance: $115M - $120M

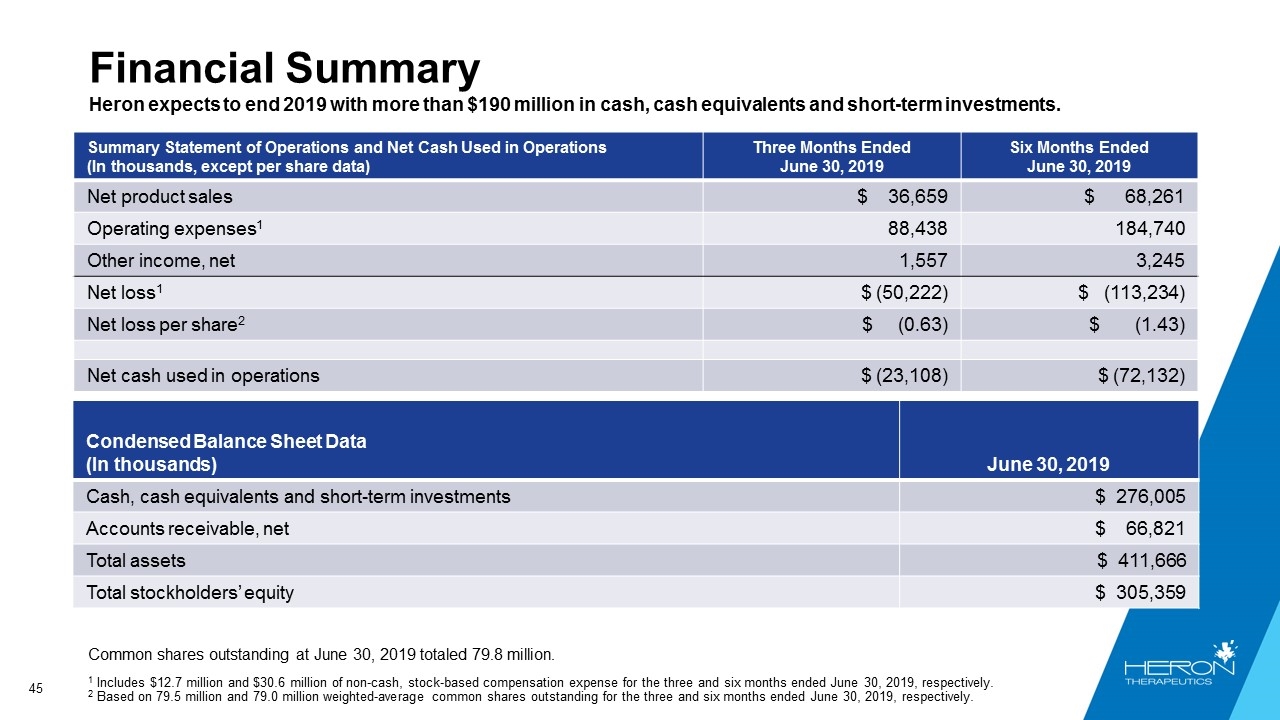

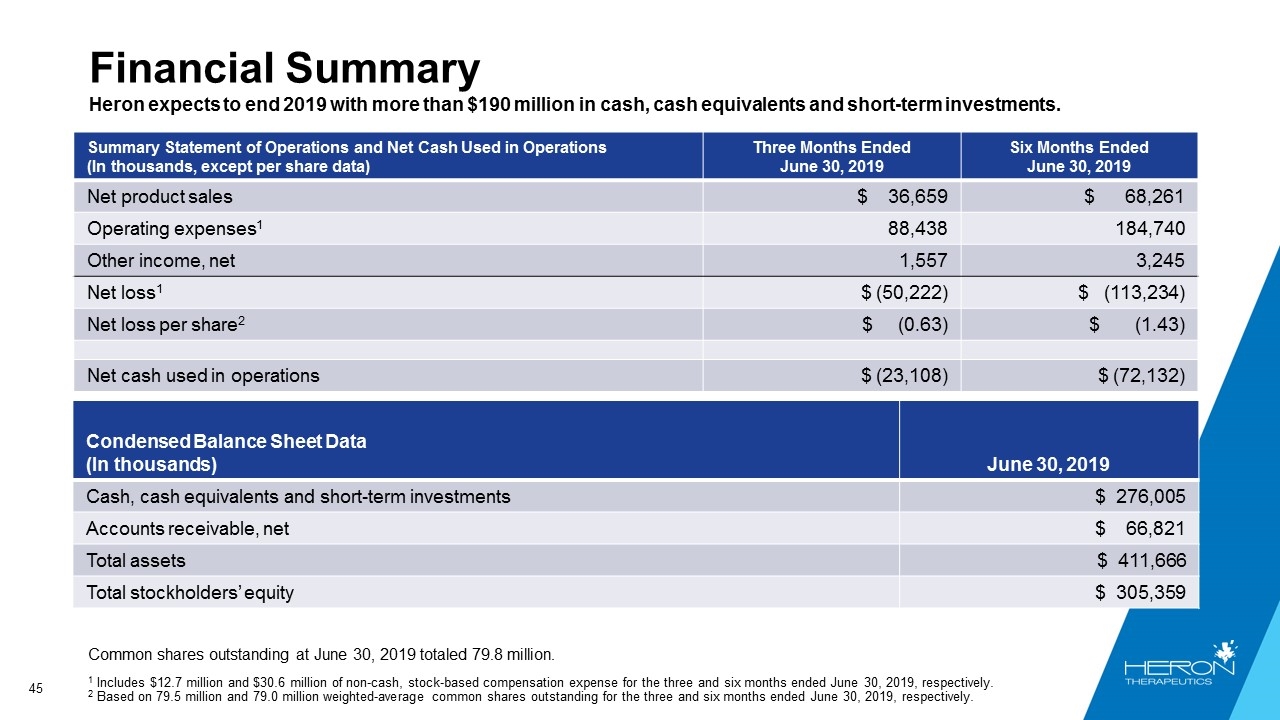

Financial Summary Heron expects to end 2019 with more than $190 million in cash, cash equivalents and short-term investments. Summary Statement of Operations and Net Cash Used in Operations (In thousands, except per share data) Three Months Ended June 30, 2019 Six Months Ended June 30, 2019 Net product sales $ 36,659 $ 68,261 Operating expenses1 88,438 184,740 Other income, net 1,557 3,245 Net loss1 $ (50,222) $ (113,234) Net loss per share2 $ (0.63) $ (1.43) Net cash used in operations $ (23,108) $ (72,132) Condensed Balance Sheet Data (In thousands) June 30, 2019 Cash, cash equivalents and short-term investments $ 276,005 Accounts receivable, net $ 66,821 Total assets $ 411,666 Total stockholders’ equity $ 305,359 Common shares outstanding at June 30, 2019 totaled 79.8 million. 1 Includes $12.7 million and $30.6 million of non-cash, stock-based compensation expense for the three and six months ended June 30, 2019, respectively. 2 Based on 79.5 million and 79.0 million weighted-average common shares outstanding for the three and six months ended June 30, 2019, respectively.

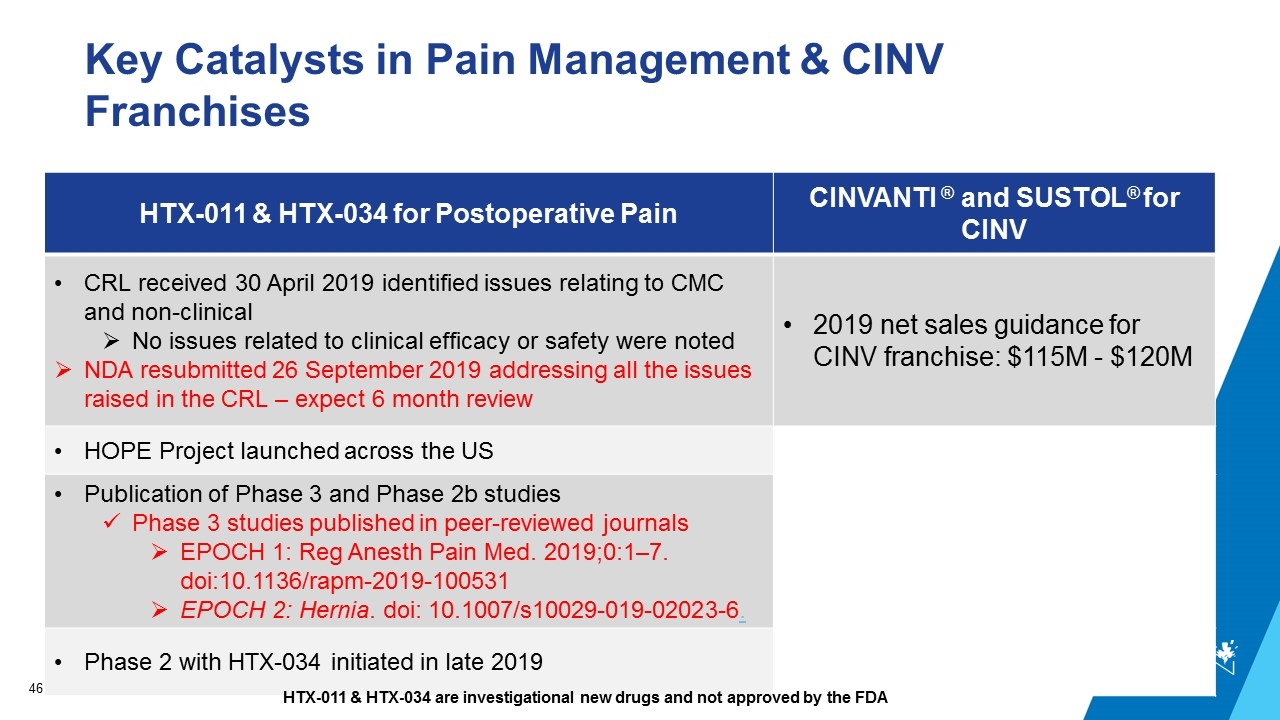

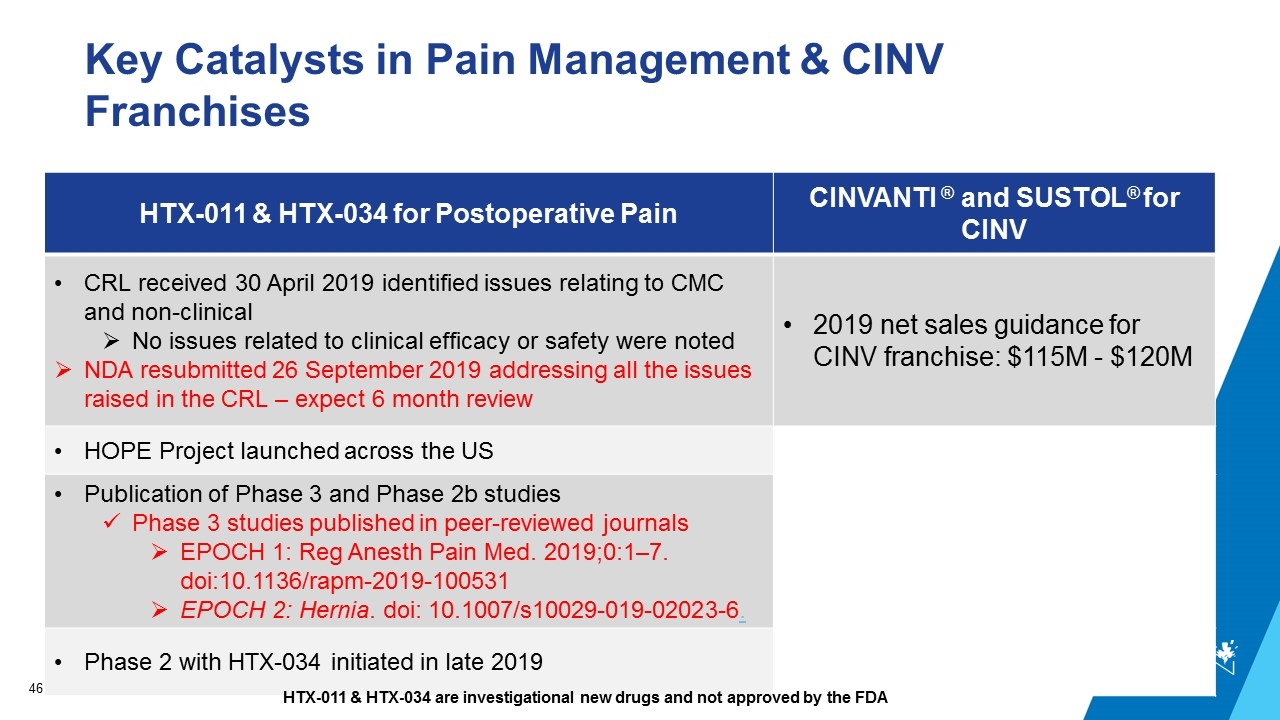

Key Catalysts in Pain Management & CINV Franchises HTX-011 & HTX-034 for Postoperative Pain CINVANTI ® and SUSTOL® for CINV CRL received 30 April 2019 identified issues relating to CMC and non-clinical No issues related to clinical efficacy or safety were noted NDA resubmitted 26 September 2019 addressing all the issues raised in the CRL – expect 6 month review 2019 net sales guidance for CINV franchise: $115M - $120M HOPE Project launched across the US Publication of Phase 3 and Phase 2b studies Phase 3 studies published in peer-reviewed journals EPOCH 1: Reg Anesth Pain Med. 2019;0:1–7. doi:10.1136/rapm-2019-100531 EPOCH 2: Hernia. doi: 10.1007/s10029-019-02023-6. Phase 2 with HTX-034 initiated in late 2019 HTX-011 & HTX-034 are investigational new drugs and not approved by the FDA