UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 0-16211

DENTSPLY SIRONA Inc.

(Exact name of registrant as specified in its charter) | | | | | |

| Delaware | 39-1434669 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

| 13320 Ballantyne Corporate Place, Charlotte, North Carolina | 28277-3607 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (844) 848-0137

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, par value $.01 per share | XRAY | The Nasdaq Stock Market LLC |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | | | | |

| Large Accelerated Filer | x | Accelerated Filer o | Non-Accelerated Filer o | Smaller Reporting Company ☐ |

Emerging Growth Company ☐ | If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o |

|

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes ☐ No x

The aggregate market value of the voting common stock held by non-affiliates of the registrant computed by reference to the closing price as of the last business day of the registrant’s most recently completed second quarter ended June 30, 2024, was $5,036,994,579. For purpose of this calculation only, without determining whether the following are affiliates of the registrant, the registrant has assumed that (i) its directors and executive officers are affiliates, and (ii) no party who has filed a Schedule 13D or 13G is an affiliate.

The number of shares of the registrant’s common stock outstanding as of the close of business on February 14, 2025 was 198,991,963.

DOCUMENTS INCORPORATED BY REFERENCE

Certain portions of the definitive Proxy Statement of DENTSPLY SIRONA Inc. (the “Proxy Statement”) to be used in connection with the 2025 Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K to the extent provided herein. Except as specifically incorporated by reference herein the Proxy Statement is not deemed to be filed as part of this Form 10-K.

| | | | | | | | | | | |

| DENTSPLY SIRONA Inc. |

| Table of Contents |

| | | |

|

| | | Page |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

|

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

|

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

|

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

PART I

FORWARD-LOOKING STATEMENTS AND ASSOCIATED RISKS

All statements included or incorporated by reference in this Form 10-K and other filings with the U.S. Securities and Exchange Commission (the “SEC”) that do not directly and exclusively relate to historical facts constitute “forward-looking statements.” These statements represent current expectations and beliefs, and no assurance can be given that the results described in such statements will be achieved. Such statements are subject to numerous assumptions, risks, uncertainties and other factors that could cause actual results to differ materially from those described in such statements, many of which are outside of our control. No assurance can be given that any expectation, belief, goal or plan set forth in any forward-looking statement can or will be achieved, and readers are cautioned not to place undue reliance on such statements which speak only as of the date they are made. We do not undertake any obligation to update or release any revisions to any forward-looking statement or to report any events or circumstances after the date of this Form 10-K or to reflect the occurrence of unanticipated events.

You should carefully consider these and other relevant factors, including those risk factors in Item 1A, “Risk Factors” of this Form 10-K and any other information included or incorporated by reference in this report, and information which may be contained in the Company’s other filings with the SEC, when reviewing any forward-looking statement. Investors should understand it is impossible to predict or identify all such factors or risks. As such, you should not consider either the foregoing lists, or the risks identified in the Company’s SEC filings, to be a complete discussion of all potential risks or uncertainties associated with an investment in the Company.

GENERAL

Unless otherwise stated herein or the context otherwise indicates, references throughout this Form 10-K to “Dentsply Sirona,” or the “Company,” “we,” “us” or “our” refer to DENTSPLY SIRONA Inc., together with its subsidiaries on a consolidated basis.

Item 1. Business

Overview

DENTSPLY SIRONA Inc. (“Dentsply Sirona” or the “Company”) is the world’s largest diversified manufacturer of professional dental products and technologies, with a 138-year history of innovation and service to the dental industry, and a vision of improving oral health and continence care globally. Dentsply Sirona develops, manufactures, and markets comprehensive solutions, including technologically advanced dental equipment supported by cloud-enabled solutions, dental products, and healthcare consumable products in urology and enterology under a strong portfolio of world-class brands. Dentsply Sirona’s innovative products provide high-quality, effective, and connected solutions to advance patient care and deliver better, safer and faster dentistry. The Company introduced the first dental electric drill approximately 133 years ago, the first dental X-ray unit approximately 100 years ago, the first hydrophilic catheter and the first dental computer-aided design/computer-aided manufacturing (“CAD/CAM”) system approximately 40 years ago, and numerous other significant innovations, including pioneering ultrasonic scaling to increase the speed, effectiveness and comfort of cleaning and revolutionizing both file and apex locater technology to make root canal procedures easier and safer. Dentsply Sirona continues to make significant investments in research and development (“R&D”), and its track record of innovative and profitable new products continues today. Dentsply Sirona’s worldwide headquarters is located in Charlotte, North Carolina and its shares of common stock are listed in the United States on Nasdaq under the symbol XRAY.

Dentsply Sirona’s headquarters and principal operations are located in the United States of America (“U.S.” or “United States”) and the Company sells products globally through its foreign subsidiaries to customers in approximately 150 countries. Dentsply Sirona has a long-established presence in the European market, particularly in Germany, Sweden, France, the United Kingdom (“UK”), Italy, and Switzerland. The Company also has a significant market presence in the Asia-Pacific region, Central and South America, the Middle East region, and Canada.

Our Company’s mission is to transform oral health and continence care with innovative products, solutions and services through an engaged workforce. We conduct our business in accordance with that goal using the following core operating principles:

•Approach customers as one: The Company has an integrated approach to customer service, direct and indirect selling, and clinical education to strengthen relationships with customers and better serve customers’ needs.

•Create innovative solutions that customers love to use: We manage a comprehensive R&D program that prioritizes strategic spending, builds the next generation of digital workflow technologies and service offerings, and results in impactful innovations that grow our business.

•Think and act with positive intent and the highest integrity: We execute our business in a way that empowers our people, respects the communities in which we do business, and establishes trust with our partners and stakeholders.

•Use size and global breadth to our advantage: We are focused on integrating our dental product portfolios to unlock operational efficiencies, and on enhancing our healthcare consumables product portfolio, with an emphasis on performance improvements in procurement, logistics, manufacturing, sales force and marketing programs, while at the same time simplifying our business on a worldwide scale. In combination, these initiatives will improve organizational efficiency and better leverage our selling, general and administrative infrastructure.

•Operate sustainably in everything we do: We take a thoughtful, proactive approach to creating a sustainable company through investments in our employees, customers, and the environment.

Principal Products and Product Categories

The professional dental industry encompasses the diagnosis, treatment and prevention of disease and ailments of the teeth, gums and supporting bone. The Company offers a broad suite of dental products which together provide digital workflows for dental practitioners to make the highest use of technological advancements throughout each stage of patient care. Dentsply Sirona’s principal dental product categories are dental technology and equipment products, dental implants, clear aligners, and dental consumable products. Additionally, the Company manufactures and sells healthcare consumable products for urological and enterological applications. As part of its dental technology and equipment solutions, the Company also offers an open, cloud-based platform for digital services, DS Core. These products and solutions are produced by the Company globally and are distributed throughout the world under some of the most well-established brand names and trademarks in these industries, including but not limited to: AH PLUS, ANKYLOS, AQUASIL ULTRA, ARTICADENT, ASTRA TECH, ATLANTIS, AXANO, AXEOS, BYTE, CALIBRA, CAULK, CAVITRON, CELTRA, CERAMCO, CERCON, CEREC, CITANEST, CONFORM FIT, DAC, DELTON, DENTSPLY, DETREY, DS CORE, DYRACT, ENERGO, ESTHET.X, FRIOS, HELIODENT, EV, INLAB, INTEGO, IPN, LOFRIC, LUCITONE, MAILLEFER, MIDWEST, MIS, NAVINA, NUPRO, OMNITAPER, ORAQIX, ORIGO, ORTHOPHOS, OSSEOSPEED, OSSIX, PALODENT, PRIME & BOND, PROFILE, PRIMEMILL, PRIMEPRINT, PRIMESCAN, PRIMESCAN CONNECT, PRIMETAPER, PROGLIDER, PROTAPER, RECIPROC, PUREVAC, SCHICK, SDR FLOW+, SIDEXIS, SIMPLANT, SINIUS, SIROLASER, SIRONA, SLIMLINE, SMARTLITE, SPECTRA ST, STYLUS, SULTAN, SURESMILE, SYMBIOS, T1, T2, T3, T4, THERMAFIL, TRIODENT, TRUBYTE, TRUNATOMY, VDW, VIPI, WAVEONE, WELLSPECT, XENO, XIOS, X SMART, XYLOCAINE and ZHERMACK.

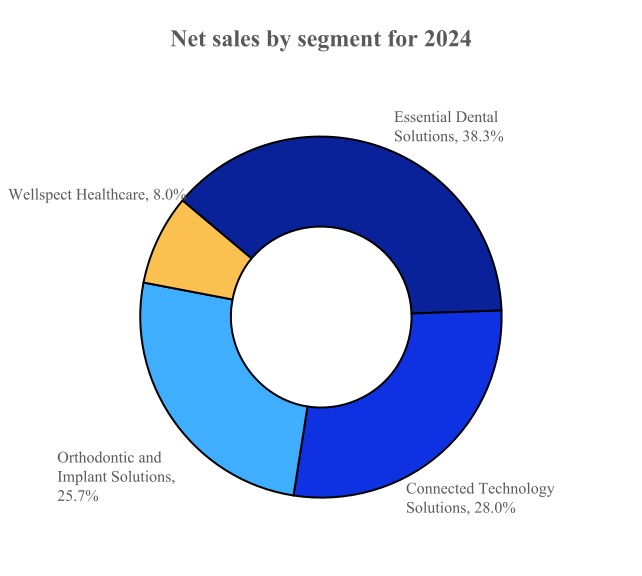

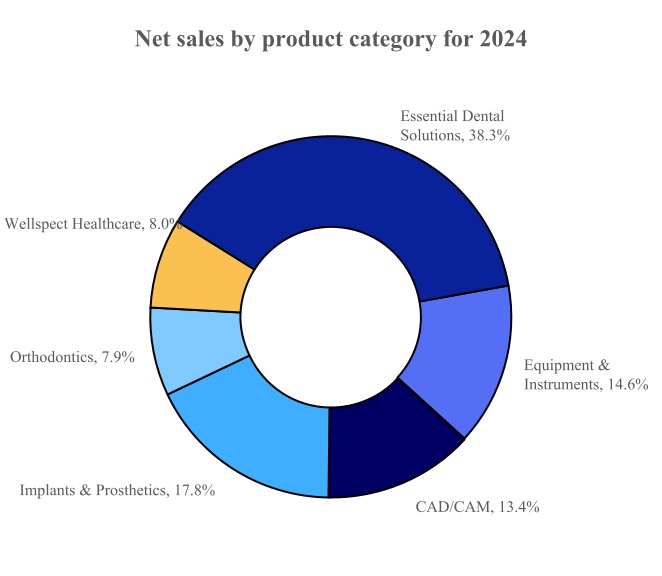

The Company conducts business through four reportable segments: (1) Connected Technology Solutions, (2) Essential Dental Solutions, (3) Orthodontic and Implant Solutions, and (4) Wellspect Healthcare. For the year ended December 31, 2024, the Company’s net sales of each reportable segments and the product categories of these reportable segments as a percent of total net sales were as follows:

Connected Technology Solutions

This segment includes the design, manufacture and sales of the Company’s dental technology and equipment products. These products include the Equipment & Instruments and CAD/CAM product categories.

Equipment & Instruments

The Equipment & Instruments product category consists of basic and high-tech dental equipment such as imaging equipment, motorized dental handpieces, treatment centers, and other instruments for dental practitioners and specialists. Imaging equipment serves as a key point of entry to the Company’s digital workflow offerings and consists of a broad range of diagnostic imaging systems for 2D or 3D, panoramic, and intraoral applications, as well as cone-beam computed tomography systems (“CBCT”). Treatment centers comprise a broad range of products from basic dental chairs to sophisticated chair-based units with integrated diagnostic, hygienic and ergonomic functionalities, as well as specialist centers used in preventive treatment and for training purposes. This product group also includes other lab equipment, such as amalgamators, mixing machines and porcelain furnaces.

CAD/CAM

Dental CAD/CAM technologies are products designed for dental professionals to support numerous digital workflows for procedures such as dental restorations through integrations with DS Core, our cloud-based platform. This product category includes intraoral scanners, 3-D printers, mills, and certain software and services, as well as a full-chairside economical restoration of esthetic ceramic dentistry offering called CEREC, which enables dentists to practice same-day or single visit dentistry.

Essential Dental Solutions

This segment includes the development, manufacture and sales of the Company’s value-added endodontic, restorative, and preventive consumable products and small equipment used by dental professionals for the treatment of patients. Offerings in this segment also include specialized treatment products including products used in the creation of dental appliances.

Essential Dental Solutions products are designed to operate in an integrated system to provide solutions for high-tech dental procedures. The endodontic products include motorized endodontic handpieces, files, sealers, irrigation needles and other tools or single-use solutions which support root canal procedures. The restorative products include dental ceramics and other materials used in prosthetic restorations including crowns and veneers.

The preventive products include small equipment products such as curing light systems, dental diagnostic systems and ultrasonic scalers and polishers, as well as other dental supplies including dental anesthetics, prophylaxis paste, dental sealants and impression materials.

Orthodontic and Implant Solutions

This segment includes the design, manufacture, and sales of the Company’s various digital implant systems and innovative dental implant products, digital dentures and dental professional-directed aligner solutions. Offerings in this segment also include application of our digital services and technology, including those provided by DS Core, our cloud-based platform.

Orthodontics

The Orthodontics product category includes SureSmile, a clear aligner solution provided through clinician offices and Byte, a direct-to-consumer clear aligner solution. The Orthodontics product category includes a High Frequency Vibration technology device known as VPro, as well as the SureSmile Simulator which uses intraoral scanners and our DS Core platform to create a 3D visualization of patient outcomes, and SureSmile aligner solutions, which include whitening kits and retainers. The aligner offerings also include software technology that enables aligner treatment planning and the seamless connectivity of a digital workflow from diagnostics through treatment delivery. Byte operations were significantly reduced after October 24, 2024 and limited to supporting patients already undergoing treatment, following a decision to voluntarily suspend sales and marketing of Byte aligners and impression kits. In January 2025, the Company subsequently announced it will no longer offer the Byte direct-to-consumer clear aligner solution to new patients, and it has decided to leverage technologies developed by Byte elsewhere in the aligners portfolio to create orthodontic demand, support a digital clinical workflow, enhance the customer experience, and improve patient monitoring.

Implants & Prosthetics

The Implants & Prosthetics product category includes technology to support the Company’s digital workflows for implant systems, a portfolio of innovative dental implant products, digital dentures, crown and bridge porcelain products, bone regenerative and restorative solutions, treatment planning software and educational programs. The Implants & Prosthetics product category is supported by key technologies including custom abutments, advanced tapered immediate load screws and regenerative bone growth factor. Offerings in this category also include dental prosthetics such as artificial teeth and precious metal dental alloys.

Wellspect Healthcare

This segment includes the design, manufacture, and sales of the Company’s innovative continence care solutions for both urinary and bowel management. Wellspect Healthcare is a leading global provider of innovative medical devices that help people suffering from urinary retention or chronic constipation. Wellspect is one of the world’s leading manufacturers of intermittent urinary catheters, with LoFric as the most known brand. To help those with chronic or severe constipation, Wellspect also offers an advanced irrigation system, Navina, which combines a high degree of user convenience, clinical effectiveness and connectivity into one smart system.

Industry Growth Drivers

The Company believes that the dental industry is attractive and will grow over the long-term based on the following factors:

•Increasing worldwide population, including a shift toward aging demographics, which will require greater dental care.

•Natural teeth are being retained longer - individuals with natural teeth are much more likely to visit a dentist than those without any natural teeth.

•Increasing demand for aesthetic dentistry and the use of clear aligners as an orthodontic treatment.

•Continued opportunities in emerging markets related to the rise in discretionary incomes making dental services an increasing priority.

•Growing preference for single visit dentistry versus historical multi-visit procedure requirements, and for higher quality of patient care in terms of comfort and ease of product use and handling.

•Increasing demand for earlier preventive care - dentistry has evolved from a profession primarily dealing with pain, infections, and tooth decay to one with increased emphasis on earlier diagnosis, preventive care, and the role oral health plays in overall health.

•Increasing opportunity for digital collaboration between General Practitioners (“GPs”), specialists, labs, and patients is creating widening demand for fully integrated solutions such as cloud-based platforms and services facilitated by GPs.

•Increasing demand for more efficiency and better workflow in the dental office, including digital tools such as diagnostic equipment enhanced through the power of 3D imaging. The rapid pace of digital technology adoption, including the digitization of clinical workflows, is becoming a category standard versus traditional manual processes.

•An accelerating trend, predominately in the United States, toward consolidation of dental practices into group affiliations, often called Dental Support Organizations (“DSOs”), which may expand access for underserved patient populations, remove administrative and capital burdens on providers, and allow more opportunities for investment in dental technology and patient care.

Similarly, we believe that the healthcare consumables market for urology and enterology products will grow over the long-term based on the following:

•Aging demographics, together with an increasing incidence of chronic diseases such as diabetes, requiring greater continence care.

•An expansion of the population covered by medical insurance and the trend toward more supportive reimbursement policies by governments and insurers encouraging the use of continence care products and related therapies.

•The growth in specialized care facilities, technical advancements pertaining to the identification and treatment of chronic renal ailments, and the increasing awareness of incontinence diseases.

Sales and Distribution

As of December 31, 2024, Dentsply Sirona employed approximately 4,600 highly trained, sales and technical staff specialized in each of our various products and solutions to provide comprehensive marketing, sales, and technical support services to meet the needs of our distributors and end-users.

The Company remains focused on its strategy of enabling dentists to utilize superior integrated workflows through our robust market offerings in all key areas of dental procedures (implants, endodontic, restorative and aligners) as well as digital infrastructure (CAD/CAM and imaging) utilized in dental practices around the globe. In 2024, the Company continued a rigorous portfolio management process to simplify and optimize our suite of product offerings, gain efficiencies through optimized product life-cycle management, and improve overall customer experience. The program, which has the potential to be expanded in future years, had an initial focus on endodontic and restorative consumable products, including a goal of achieving additional efficiency from optimizing our geographic footprint.

Dentsply Sirona distributes approximately two-thirds of its dental consumable and technology and equipment products through third-party distributors. Certain products such as endodontic instruments and materials, dental implants and orthodontic aligners and appliances are often sold directly to dental laboratories or dental professionals in some markets. Our continence care products are primarily sold to distributors of medical supplies, with the remaining sales being made directly to patients and medical providers.

For the year ended December 31, 2024, no customer accounted for 10% or more of consolidated net sales or consolidated accounts receivable.

Customers that accounted for 10% or more of net sales or accounts receivable for the years ended December 31, 2023 and 2022 were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 2023 | | 2022 | | | |

| | | | | | % of net sales | | % of accounts receivable | | % of net sales | | % of accounts receivable | | | | | |

| | | | | | | | | | | | | | | | | |

| Henry Schein, Inc. | | | | | | 14 | % | | 11 | % | | 11 | % | | 15 | % | | | | | |

| Patterson Companies, Inc. | | | | | | N/A | | 10 | % | | N/A | | 12 | % | | | | | |

Although a significant portion of the Company’s sales are made to distributors, Dentsply Sirona focuses much of its marketing efforts on the orthodontists, dentists, dental specialists, dental hygienists, dental assistants, dental laboratories and dental schools which are the end-users of its products. As part of this end-user “pull through” marketing strategy, the Company conducts extensive marketing programs with a combined approach that also engages DSOs and distributors.

Product Development

While the Company enjoys market leadership in several of its product categories, continuous innovation and product development are critical for it to continue to grow its share in markets it serves. We continue to focus efforts on successfully launching innovative products that have a significant impact on how dental and clinical professionals treat their patients. The Company’s plans for investment in product development include maintaining a level of R&D spending that is at approximately 4% of annual net sales, with a focus on innovation in and expansion of digital workflow solutions and other platform offerings. In particular, the Company has continued to prioritize investments supporting digitally connected solutions and enhanced workflows through each stage of patient care, including software for improved collaboration and treatment planning, imaging and scanning technologies used in diagnosis, and products which are customizable and scalable.

During 2022, the Company unveiled its cloud solution, DS Core, an open platform developed in collaboration with Google Cloud that integrates digital dentistry workflows across its devices, services, and technologies. DS Core supports access of end users to case files, orders, and messages through a web browser without any software licenses. The DS Core digital platform is designed to enable simplified cloud storage, optimize diagnostic capabilities, and streamline existing workflows with laboratory partners. Innovations include: the Company’s Primeprint Solution, which provides medical-grade 3D printing; Primescan Connect, which offers a laptop-based version of Primescan; the SmartLite Pro EndoActivator which serves as a new irrigation solution for root canal procedures; and the Axano treatment center combining smart design with efficient workflows. During 2022, the Company also introduced its premium EV Implants System for providing implants that are simplified and digitally enabled and introduced SureSmile Solutions, an enhanced orthodontic offering that includes a whitening kit, retainers, and the VPro orthodontic device.

During 2023, the Company launched key digital dentistry offerings within the DS Core platform including the SureSmile Simulator and several updates to DS Core. The SureSmile Simulator creates a 3D visualization of patients’ potential new smile to be achieved in clear aligner treatment using uploads from a Primescan intraoral scanner. The DS Core Communication Canvas allows for communication with patients through images and scans along with annotations by the dentist. DS Core’s lab connectivity features enable digital collaboration between dentists and their preferred lab. Also in 2023, the Company released expanded milling and printing materials to enhance the Primeprint and Primemill Solutions and workflows for patient-specific nightguards and splints. The Company continued to expand its innovative endodontic solutions with the X-Smart Pro+ motor, the Midwest Energo series of electric handpiece instruments, and the Ossix Agile, an innovative, pericardium-based membrane for periodontic procedures.

During 2024, the Company introduced additional key offerings in digital dentistry with Primescan 2 and further updates to DS Core. Primsescan 2 is the next generation of intraoral scanners and features a cloud-native and wireless design. The new technology performs scans, which are then captured directly on the DS Core cloud platform, enabling dental professionals additional mobility when treating patients. The newly launched DS Core Enterprise provides DSOs a cloud-based platform for digital workflows to centralize management and monitoring of equipment, giving DSOs transparency over all equipment connected to DS Core across their practices. The Company also introduced the Axano Pure treatment center, which incorporates an enhanced touch display screen, allowing dental professionals to integrate DS Core directly for processing and displaying patient scans and patient communication. In 2024, the Company also expanded its implant business with the MiS Lynx implant, a new, conical connection implant technology, the PrimerTaper Guided Surgery and Atlantis for BLX and Neodent. The Company also added a multi-layer abutment block to the CEREC Zirconia offering within the restorative business and the Oryx product within the endodontic business.

Research and Development (“R&D”) investments include activities to accelerate product and clinical innovation and discipline and to develop potential improvements to the manufacturing process. These investments also support engineering efforts that incorporate customer feedback into continuous improvement for current and next-generation products, with the objective to achieve more frequent development and release cycles. The Company also undertakes pre-commercialization trials and testing of technological improvements prior to inception of the manufacturing process. As is true across its other functions, the Company regularly enhances how R&D is conducted by identifying best practices, driving efficiencies, and optimizing cost structure to enable a more effective development process with a strategic focus on innovation process discipline. We are also looking to increasingly utilize an enterprise approach to funding that employs a returns-based mindset with the goal of allocating R&D spending to those areas with the highest return. In addition to internal product development, the Company also pursues external R&D opportunities, including acquisitions, licensing, or other arrangements with third parties.

Clinical Education

In 2024, the Company continued its investments in clinical education as a key value driver to leverage its global footprint, enhance digital content, and strengthen its clinical network. As part of this objective, the Company remains committed to participation in clinical research demonstrating the efficacy of its products prior to market introduction, and in supporting the clinical education and technical training of dental professionals. Dentsply Sirona has 57 academies and education centers in 35 countries worldwide that are home to state-of-the-art training facilities which provide training both directly and through third-party content for dental professionals seeking clinical and technical continuing education. The academies offer hands-on teaching, live lectures, and on-demand webinars and courses which are taught by a diverse range of internationally recognized experts in all fields of dentistry. In 2024, we partnered in the delivery of thousands of training courses to dental professionals through in-person, online, and hybrid formats. As part of these courses, the Company trains laboratory technicians, dental hygienists, dental assistants and dentists in the proper use of its products and introduces them to the latest technological developments. Additionally, we maintain ongoing consulting and educational relationships with various dental associations and recognized worldwide opinion leaders in the dental field. Initiatives to support clinical education also include partnerships with research institutions and dental and medical schools. The Company offers education tracks at its premier DS World trade and professional education events, which hosted over 7,000 participants at six DS World events across the globe in 2024. These investments in clinical education allow us to reinforce and develop relationships with dental professionals. We also annually support the achievements of dental students conducting innovative research through our Student Competition for Advancing Dental Research and its Application Awards program.

Through our internal research centers as well as through our collaborations with external research institutions, dental and medical schools, the Company directly invests in the development of new products, the improvement of existing products, and advancements in technology. These investments include an emphasis on research in digital data sharing technology, including the incorporation of long-term artificial intelligence and machine learning. The continued development of these areas is a critical step in meeting the Company’s strategic goal to be a leader in defining the future of dentistry and preparing the next generation of dental practitioners.

Competition

The Company conducts its global operations under highly competitive market conditions. Competition in the industries for dental technology and equipment, dental consumables, orthodontics and continence care products is based primarily upon product performance, quality, safety and ease of use, as well as price, customer service, innovation and acceptance by clinicians, technicians and patients. Dentsply Sirona believes that its principal strengths include its well-established brand names, its end-to-end dental portfolio, its reputation for high quality and innovative products, its leadership in product development and manufacturing, its global sales force, the breadth of its distribution network, its commitment to customer satisfaction and the support of the Company’s products by dental and medical professionals.

The size and number of the Company’s competitors vary by product line and from region to region. There are many companies that produce some of the same types of products as those produced by the Company, but no single competitor produces the breadth of products that are produced by the Company.

Regulation

The development, manufacture, sales and distribution of the Company’s products are subject to comprehensive governmental regulation within the United States and internationally. The following sections describe some, but not all, of the significant regulations that apply to the Company. For a description of the risks related to the regulations that the Company is subject to, please refer to Item 1A, “Risk Factors,” of this Form 10-K.

The majority of the Company’s products are classified as medical devices and are subject to restrictions under domestic and foreign laws, rules, regulations, self-regulatory codes, circulars and orders, including, but not limited to, the U.S. Food, Drug, and Cosmetic Act (the “FDCA”), Council Directive 93/42/EEC on Medical Devices (“MDD”) in the European Union (“EU”), which was updated to the EU Medical Device Regulation (“MDR”), and similar international laws and regulations. The FDCA requires these products, when sold in the United States, to be safe and effective for their intended use and to comply with the regulations administered by the U.S. Food and Drug Administration (“FDA”). Certain medical device products are also regulated by comparable agencies in non-U.S. countries in which they are produced or sold.

Dental and medical devices sold by the Company in the United States are generally classified by the FDA into a category that renders them subject to the same controls that apply to all medical devices, including regulations regarding alteration,

misbranding, notification, record-keeping and good manufacturing practices. In the EU, the Company’s products are subject to the medical device laws of the various member states, which are based on a Directive of the European Commission. Such laws generally regulate the safety of the products in a similar way to the FDA regulations. The Company’s products in Europe bear the CE mark showing that such products comply with European regulations. The Company’s products classified by the EU MDD were mandated to be certified under the MDR. These regulations also applied to all medical device manufacturers who market their medical devices in the EU and all such manufacturers had to perform significant upgrades to quality systems and processes including technical documentation and subject them to certification under the EU MDR in order to continue to sell those products in the EU. Although all medical device manufacturers were required to certify their Class I products by May 2021, on March 15, 2023, the EU extended the MDR transition periods to December 31, 2027 for Class III and implantable Class IIb devices and December 31, 2028 for non-implantable Class IIb and lower risk devices and for Class I devices (each such Class as defined in the EU MDR regulations) that are a higher class under the MDR. The Company completed required certifications of its quality management systems in 2024. The Company remains focused on ensuring that all its products that are considered to be medical devices will be fully certified as required by the EU MDR dates and timelines.

Beginning in late 2022, the Chinese government launched a national program for volume-based, centralized medical device and consumables procurement with minimum quantity commitments in an attempt to negotiate lower prices from drug manufacturers and reduce the price of medical devices and other products. Under the program, the government will award contracts to the lowest bidders who are able to satisfy the quality and quantity requirements. The successful bidders will be guaranteed a sales volume for at least a year, giving the winner an opportunity to gain or increase market share. The volume guarantee is intended to make manufacturers more willing to cut their prices in order to win a bid and may also enable successful bidders to lower their distribution and commercial costs. The program, which took effect in the first half of 2023, resulted in a temporary reduction in net sales of our implants products during that period due to reduced prices, which was offset by higher volume of net sales in the second half of 2023. In 2024, the program resulted in increased volumes for implants products, particularly during the first half of the year, with a decline in the second half of the year due to current macroeconomic conditions. Although significant changes to the program were not made in 2024, China’s volume-based procurement strategy is expected to evolve further in future years, including a formal updated program policy expected in 2026, which may include expansion to new categories, new incentives for innovation, changes to the bidding process which could increase price competition, and possible implementation of stricter quality standards. It is expected that the government may also move to prioritize domestic production and the purchase of products from domestic companies in certain categories, aligning with the country’s “Made in China 2025” initiative, which may result in additional competitive pressures from the sale of implants made locally. Future expansion of the program by the Chinese government could also result in reduced margins on covered devices and products, required renegotiation of distributor arrangements, and incurrence of inventory-related charges.

The Company is also subject to domestic and foreign laws, rules, regulations, self-regulatory codes, circulars and orders regarding anti-bribery and anti-corruption, including, but not limited to, the U.S. Foreign Corrupt Practices Act (“FCPA”), the U.S. Federal Anti-Kickback Statute (“AKS”), the UK’s Bribery Act 2010 (c.23), Brazil’s Clean Company Act 2014 (Law No. 12,846) China’s National Health and Family Planning Commission (“NHFPC”) circulars No. 40 and No. 50, and similar international laws and regulations. The FCPA and similar anti-bribery and anti-corruption laws applicable in non-U.S. jurisdictions generally prohibit companies and their intermediaries from improperly offering or paying anything of value to foreign government officials for the purpose of obtaining or retaining business. Some of the Company’s customer relationships are with governmental entities and therefore may be subject to such anti-bribery laws. The AKS and similar fraud and abuse laws applicable in non-U.S. jurisdictions prohibit persons from knowingly and willfully soliciting, offering, receiving or providing remuneration, directly or indirectly, in exchange for or to induce either the referral of an individual, or the furnishing or arranging for a good or service, for which payment may be made under a health care program, such as, in the United States, Medicare or Medicaid.

The Company’s production and sales of products are further subject to regulations concerning the use of conflict minerals, various environmental regulations such as the Federal Water Pollution Control Act (the “Clean Water Act”) and others enforced by the Environmental Protection Agency (“EPA”) or equivalent state agencies, and the Patient Protection and Affordable Care Act as amended by the Health Care and Education Reconciliation Act (the “Health Care Reform Law”). In the manufacture, sale, delivery and servicing of the Company’s products internationally, the Company must also comply with various domestic and foreign import and export control and economic sanctions, laws, and regulations, including those administered by the Department of Treasury’s Office of Foreign Assets Control (“OFAC”), the Department of Commerce’s Bureau of Industry and Security (“BIS”) and similar foreign governmental agencies, which may require licenses or other authorizations for transactions relating to certain products, certain countries and regions, and/or with certain individuals and entities identified by the respective government. Despite the Company’s internal compliance program, policies and procedures may not always protect it from negligent, reckless, or criminal acts committed by its employees or agents. Violations of these requirements are punishable by criminal and civil sanctions, including substantial fines and imprisonment. The Company’s Byte aligner business in the United States is subject to various state laws, rules and policies which govern the practice of dentistry within such states, particularly based on the direct-to-consumer model that leverages teledentistry, which is no longer a model applicable to products offered to new patients as of October 24, 2024. Byte has historically contracted with an expansive nationwide network of independent licensed dentists and orthodontists for the provision of clinical services, including the oversight and control of each customer’s clinical treatment in order to comply with these regulations and to ensure that the business does not violate rules pertaining to the corporate practice of dentistry.

The Company is subject to domestic and foreign laws, rules, regulations, self-regulatory codes, circulars and orders governing data privacy and transparency, including, but not limited to, the Health Insurance Portability and Accountability Act of 1996 (“HIPAA”) as amended by the Health Information Technology for Economic and Clinical Health Act of 2009 (the “HITECH Act”), the California Consumer Privacy Act, the California Privacy Rights Act, the European General Data Protection Regulation (“GDPR”), China’s Personal Information Protection Law (“PIPL”), Brazil’s Lei Geral de Protecäo de Dados (“LPGD”), the Physician Payments Sunshine Provisions of the Patient Protection and Affordable Care Act, EU Directive 2002/58/EC (and implementing and local measures adopted thereunder), France’s Data Protection Act of 1978 (rev. 2004) and France’s Loi Bertrand, certain rules issued by Denmark’s Health and Medicines Authority, and similar international laws and regulations. Applicable privacy laws around the world restrict the use and disclosure of personal information, and mandate the adoption of standards relating to the privacy and security of individually identifiable information such as data minimization, access control, providing transparent notice of our privacy practices, and respecting data subject rights. Privacy laws also require the reporting of certain breaches of individually identifiable information. The Physician Payments Sunshine Provisions of the Patient Protection and Affordable Care Act require the Company to record all transfers of value to physicians and teaching hospitals and to report this data to the Centers for Medicare and Medicaid Services for public disclosure. Similar reporting requirements have also been enacted in several states, and an increasing number of countries worldwide either have adopted or are considering similar laws requiring transparency of interactions with health care professionals.

The Company believes it is in substantial compliance with the laws and regulations that regulate its business. There are, however, significant uncertainties involving the application of various legal requirements, the violation of which could result in, among other things, sanctions. See Item 1A, “Risk Factors,” of this Form 10-K for additional detail.

Sources and Supply of Raw Materials and Finished Goods

The Company manufactures the majority of the products that it sells. The Company sources the necessary raw materials from various suppliers, and no single supplier accounts for more than 10% of our supply requirements.

Intellectual Property

Products manufactured by Dentsply Sirona are sold primarily under its own trade names and trademarks. Dentsply Sirona also owns and maintains more than 5,000 patents throughout the world and has also licensed a number of patents owned by others.

Our policy is to protect the Company’s products and technology through patents and trademark registrations in the United States and in significant international markets. The Company monitors trademark use worldwide and promotes enforcement of its patents and trademarks in a manner that is designed to balance the cost of such protection against obtaining the greatest value for the Company. Dentsply Sirona believes its patents and trademark properties are important and contribute to the Company’s marketing position but it does not consider its overall business to be materially dependent upon any individual patent or trademark. Additional information regarding certain risks related to our intellectual property is included in Item 1A, “Risk Factors” of this Form 10-K and is incorporated herein by reference.

Human Capital

Every day, our people create innovative solutions that transform lives. Our inclusive, agile & high-performance culture equips us to build, grow, and win as one. Together, we are shaping the future and delivering value to customers and patients. As of December 31, 2024, our organization and its subsidiaries employed approximately 14,000 employees globally. Of these employees, approximately 3,000 were employed in the United States. Employees outside of the United States, particularly in Europe, may be covered by collective bargaining agreements, union contracts, worker councils or other similar programs. At Dentsply Sirona, we believe our global talent strategy enables our employees to reach their highest performance.

High-Performance Culture

We deliver a consistent, high-quality talent selection process in alignment with our desired culture. We offer Emerging Talent programs focused on attracting early-career employees through university relationships, including partnerships with Historically Black Colleges and Universities and local trade schools. These programs provide options for apprenticeships, rotational assignments, on-the-job experiences, networking, development, and executive interactions. New employees participate in our custom Enterprise Orientation module that introduces our culture and instills pride in what we do.

Our Performance Feedback Process includes performance and development goal-setting and regular reviews between the employee and manager. Every employee has access to our Own Your Journey career development pathing toolkit to explore their career aspirations. We offer access to an OnDemand learning library available in multiple languages to develop skills and capabilities through our partnership with LinkedIn Learning, and we also provide an additional eLearning training program through Cornell University. All employees globally can utilize our automated matching system for internal mentoring and coaching. To ensure employees know what development resources are available, we offer live sessions on self-development at our organization.

In 2024, we began a partnership with Prosci, the industry leader in Change Management methodology and research, to provide a consistent set of tools and processes for leading the people side of change. Our Change Management training strategy focuses on building our internal change capabilities to support our business priorities. We internally deliver courses to project teams, front-line employees, and managers.

We prioritize preparing our internal talent for available opportunities. All aspiring and existing managers have access to participate in our Manager Fundamentals course options to develop leadership skills. We utilize regular talent reviews to identify successors and high-potential employees to participate in our nomination-based Leadership Development program, delivered in partnership with Cornell University. Our executives each commit to sponsoring high potential employees to accelerate their growth and visibility.

Compensation and Benefits

As part of our total rewards strategy, we offer competitive compensation and benefit programs designed to attract, retain, and reward top talent. We are committed to providing and administering these programs in a way that treats our employees at all levels fairly and equitably. Our total rewards offerings vary by country and include an array of programs that support our employees’ financial, physical, and mental well-being, including annual performance incentive opportunities, pension and retirement savings programs, health and welfare benefits, paid time off (including for charitable actions), leave programs, flexible work schedules, and employee assistance programs.

Inclusion & Engagement

One of our greatest strengths and competitive advantages as an organization is our global diversity. To further build on this strength, we are concentrating our diversity, equity, and inclusion efforts to focus on inclusion and engagement. This shift reflects the deep significance we place on creating a workplace where every employee feels valued, heard, and empowered to contribute. By integrating inclusion and engagement more closely, we aim to enhance the experience of our employees and ensure meaningful progress toward our desired culture.

Diversity, Equity & Inclusion Council

Our Diversity, Equity & Inclusion Council is a group of diverse employees in terms of perspectives, experience, background, geography, and function within the organization dedicated to championing an environment where all employees can reach their highest performance.

Employee Resource Groups

Our Employee Resource Groups (“ERGs”) encourage an inclusive work environment, cultivate collaboration, and offer development opportunities. As of December 31, 2024, we have nine established ERGs consisting of approximately 3,800 members globally.

Training and Awareness

We offer a catalog of optional training courses aimed at strengthening our inclusive work environment. Our ongoing “Conversations of Understanding” sessions are a standout offering. Employees can choose to participate in group discussions where internal volunteers share experiences on varying topics to generate awareness.

We keep employees connected, engaged, and informed through regular town hall meetings and live video chats. These events provide multiple opportunities for our global workforce to submit questions and interact with our executive leadership team. We deploy an annual global engagement survey to all employees, share the results internally and commit to prioritizing actions and communicating progress throughout the year. We also monitor multiple stages of the employee experience through lifecycle and pulse surveys.

Employee Health & Safety Matters

The health and safety of our employees are of utmost importance to us. We have a dedicated Employee Health & Safety (“EHS”) program that provides global processes and trainings and monitors our progress against set goals. Our actions are in line with EHS frameworks and certifications such as OHSAS 1800 and ISO 45001. We also have a corporate Crisis Management Team and a newly implemented crisis response platform which prepare us to respond in a prompt and efficient manner to crisis situations which we may face on a local or global scale.

Other Factors Affecting the Business

The Company’s business is subject to quarterly fluctuations in demand due to price changes, marketing and promotional programs, management of inventory levels by distributors, and implementation of strategic initiatives which may impact sales levels in any given period. More broadly, our business is impacted by macroeconomic conditions including changes in global supply chain constraints, growth rates, interest rate variability, labor and energy costs, and geopolitical conflicts, which can impact manufacturing costs as well as demand for our products. Demand can also fluctuate based on the timing of dental trade shows where promotions are offered, major new product introductions, and variability in dental patient traffic, which can be exacerbated by seasonal or severe weather patterns, or other disruptions such as global pandemics. Some dental practices in certain countries may also delay purchasing equipment and restocking consumables until year-end due to tax planning which can impact the timing of our consolidated net sales, net income and cash flows. Sales for the industry and the Company are generally strongest in the second and fourth quarters and weaker in the first and third quarters, due to the effects of the items noted above and due to the impact of holidays and vacations, particularly throughout Europe.

Although the backlog on products is generally not material to the Company’s financial statements due in part to the Company’s efforts to maintain short lead times within its manufacturing, levels can fluctuate and affect sales in certain periods due to supply chain disruption and unavailability of required inputs.

Available Information

Dentsply Sirona maintains a primary website, www.dentsplysirona.com, and makes available free of charge through the investor section of its website the Company’s annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) as soon as reasonably practicable after such materials are filed with or furnished to the SEC. The information contained on, or that may be accessed through, the Company’s website is not incorporated by reference into, and is not a part of, this report. All filings with the Securities and Exchange Commission (“SEC”) are also available at the SEC’s website, www.sec.gov.

Item 1A. Risk Factors

Summary

The following is a summary of the significant risk factors that could materially impact our business, financial condition or future results, including risks related to our businesses, our international operations, our regulatory environments, ownership of our common stock, and other general risks:

•We rely heavily on information and technology to operate our businesses and product portfolios, and any cyber incidents could harm our operations and have a material impact on our business and financial results.

•Evolving governmental oversight of the use of personal information, cross-border data transfer restrictions and the use of emerging technologies, including AI, as well as other technology regulations, may adversely affect our business.

•We may be unable to develop innovative products and solutions to stimulate customer demand.

•Damage to our reputation or brand could negatively impact our business, financial condition or results of operations.

•Our ongoing business operations may be disrupted for a significant period of time, resulting in material operating costs and financial losses.

•We may be unable to execute key strategic initiatives due to competing priorities and strategies of our distribution partners and other factors, which may result in financial losses and operational inefficiencies.

•Our acquisitions, exiting of businesses, divestitures or strategic investments may result in financial results that are different than expected and create certain risks for our business and operations.

•We may fail to realize the expected benefits of our strategic initiatives, including executed, announced, or potential future restructuring and other business transformation efforts.

•We have recognized substantial goodwill and indefinite-lived intangible asset impairment charges and may be required to recognize additional goodwill and indefinite-lived intangible asset impairment charges in the future.

•Our failure to protect our proprietary technology could have an adverse impact on our competitive position.

•Our financial results may be adversely impacted if our products or services are found to infringe upon the intellectual property rights of others.

•Changes in our credit ratings or macroeconomic impacts on credit markets may increase our cost of capital and limit financing options.

•Our indebtedness could adversely affect our financial condition and prevent us from fulfilling our debt or contractual obligations.

•Our foreign currency hedging and cash management transactions may be ineffective or only partially mitigate the impact of exchange rate fluctuations, exposing us to unexpected volatility.

•Due to the global nature of our business, including increasing exposure to markets outside of the United States, political or economic changes or other factors could harm our business and financial performance.

•Management previously identified material weaknesses in our internal control over financial reporting, some of which resulted in errors in previously issued financial statements. These material weaknesses were all remediated as of December 31, 2023. If we experience additional material weaknesses in the future, we may be unable to accurately and timely report financial results or comply with the requirements for public companies, which could cause the price of our common stock to decline or limit our access to the capital markets.

•Lack of global standardized processes could result in control deficiencies and adversely impact management’s assertions and financial reporting.

•We may be subject to additional litigation and regulatory examinations, investigations, proceedings or court orders relating to the completed 2022 internal investigation regarding certain financial reporting matters. If any of these items are resolved adversely to us, it could harm our business, financial condition and results of operations.

•We may be unable to obtain necessary product approvals and marketing clearances.

•Changes in tax rules or interpretations of tax rules, operating structures, transfer pricing regulations, country profitability mix and regulations and tax investigations, audits, or other proceedings that we are subject to may harm our business, financial condition and results of operations, including by adversely affecting our effective tax rate.

•We voluntarily suspended the sale and marketing of our direct-to-consumer Byte aligner systems and impression kits, and subsequently determined to cease offering these aligners to new patients while repurposing Byte technologies and capabilities to support other products within our aligner portfolio. As a result, we have experienced a material impact on our results of operations, and we may be required to take additional significant impairment charges if we are unsuccessful in our efforts to reposition Byte.

•Inadequate levels of reimbursement from governmental or other third-party payors for procedures using our products may cause our revenue to decline.

•Challenges may be asserted against our products due to real or perceived quality, health or environmental issues.

•If we fail to comply with laws and regulations relating to health care fraud, we could suffer penalties or be required to make significant changes to our operations, which could adversely affect our business.

•Our business is subject to extensive, complex and changing domestic and foreign laws, rules, regulations, self-regulatory codes, directives, circulars and orders which, if not complied with, subject us to civil or criminal penalties or other liabilities.

•The market price for our common stock may continue to be volatile as a result of a number of factors, including our quarterly operating results.

•Certain provisions in our governing documents, and of Delaware law, may make it more difficult for a third party to acquire us.

•Our business may be adversely affected by changes in global economic conditions, including inflation, rising interest rates, and supply chain shortages.

•Talent gaps and failure to manage and retain top talent may impact our ability to manage our operations, execute strategic initiatives and grow our business.

•We face the inherent risk of legal actions, including litigation, product liability claims, and other regulatory or compliance matters.

•Climate change and related natural disasters could negatively impact our business and financial results.

•Expectations relating to environmental, social and governance considerations may expose us to potential liabilities, increased costs, reputational harm, and other adverse effects on our business.

Below is a full description of each of such significant risk factors.

RISKS RELATED TO OUR BUSINESSES

We rely heavily on information technology to operate our businesses and product portfolios, and any cyber incidents could harm our operations and have a material impact on our business and financial results.

We are exposed to the risk of cyber incidents, which can result from deliberate attacks or unintentional events, in the normal course of business. We use integrated information and technology systems to manage our business and deliver products and services to customers. In particular, the 2022 launch of DS Core, our cloud platform that integrates digital dentistry workflows across devices, and the 2024 launch of Primescan 2, a cloud-native intraoral scanner, have introduced new potential vulnerabilities to cyber attacks. The breadth and complexity of our information and technology systems have increased and we expect that they will continue to increase as we expand the services enabled by DS Core and further develop our ERP systems and product offerings to utilize artificial intelligence (“AI”) and analytics. As a result, we will increasingly be exposed to risks inherent in the development, integration and operation of the evolving information and technology supporting our product platforms, as well as our own internal infrastructure, including:

• security breaches, viruses, cyberattacks, ransomware or other malware or other failures, cyber incidents or malfunctions;

• disruption, impairment or failure of data centers or hardware, telecommunications facilities or other infrastructure, including due to natural disasters;

• failures during the process of upgrading or replacing software, databases or components;

• the compromise or unauthorized disclosure of sensitive, personal, proprietary or intellectual property information related to our business and customers;

• excessive costs, excessive delays or other deficiencies in systems development and deployment; and

• an unintentional event that involves a third party gaining unauthorized access to our systems or proprietary information.

We also utilize systems, applications and data storage provided and maintained by third parties, including those delivered through cloud-based solutions. Any disruptions to or deterioration of our distribution partners’ or service providers’ information and technology infrastructures could pose a threat to our operations and harm our business.

Like other large, global companies, during the normal course of business, we have experienced and expect to continue to experience cyber threats, attacks and other attempts to compromise our information systems, with such attacks and threats rapidly increasing in both sophistication and frequency. However, none, to our knowledge, have had a material adverse effect on our business, financial condition or results of operations to date. Our policies, required employee training (including that which relates to phishing prevention), procedures and technical safeguards may be insufficient to prevent or detect improper access to confidential, proprietary or sensitive data, including personal data. Cyberattacks could also cause us to incur significant costs, disrupt key business operations and divert attention of management and key information technology resources. We also face the ongoing challenge of controlling access to our information and technology infrastructure. We have experienced various cyber incidents in the past and have implemented new controls, governance, protections and procedures as a result. If we do not successfully manage these access controls, it could expose us to the risk of security breaches or disruptions. Although past cybersecurity incidents have not had a material effect on our business or operations, and although we and our service providers take efforts to ensure the integrity of our systems and anticipate, detect, avoid or mitigate such threats, we cannot provide assurances that a future cyberattack would not result in material harm to our business and results of operations. Disaster recovery plans, where in place, might not adequately protect us in the event of a system failure. Further, we currently do not have excess or standby computer processing or network capacity everywhere in the world to avoid disruption in the event of a system failure. Despite any precautions we take, damage from natural disasters, telecommunications failures, computer viruses, break-ins, human error or similar events at our computer facilities could result in interruptions in the flow of data to our servers, although we have not yet experienced such an interruption. While we have invested and continue to invest in information technology risk management and disaster recovery plans, these measures cannot fully insulate us from cyber incidents, technology disruptions or data loss and the resulting adverse effect on our operations and financial results. If our information systems are breached again, sensitive and proprietary data is compromised, surreptitiously modified, rendered inaccessible for any period of time or made public, or if we fail to make adequate or timely disclosures to affected individuals, appropriate state and federal regulatory authorities or law enforcement agencies, it could result in significant fines, penalties, court orders, sanctions and proceedings or actions against us by governmental or other regulatory authorities, customers or third parties. We may incur substantial costs and suffer other negative consequences such as liability, reputational harm and significant remediation costs and experience material harm to our business and financial results if we experience cyber incidents in the future.

AI-based platforms and tools are increasingly being used in the consumer health industries, and our use of this technology, as well as its use by our business partners, may continue to increase and could lead to the unintentional release of our confidential information, which could negatively impact us, including our ability to realize the benefits of our intellectual property. Additionally, the advancement of AI and large language models has given rise to additional vulnerabilities and potential entry points for cyber threats; threat actors may have additional tools to automate breaches or persistent attacks, evade detection, generate sophisticated phishing emails, or impersonate employees or senior management. Our use of AI in our products and processes and the use of AI by our business partners may lead to novel cybersecurity, legal and regulatory risks, which could have a material adverse effect on our operations and reputation as well as the operations of our business partners.

Additionally, we seek to maintain insurance coverage for cybersecurity risks, but such insurance has become increasingly difficult to secure and, in some cases, policies may not provide adequate coverage for possible losses. Further, as cybersecurity risks evolve, such insurance may not be available to us on commercially reasonable terms, or at all. Uninsured losses or operational losses that result from large deductible payments under commercial insurance coverage might have an adverse impact on our business operations, financial position or results of operations.

Evolving governmental oversight of the use of personal information, cross-border data transfer restrictions and the use of emerging technologies, including AI, as well as other technology regulations, may adversely affect our business.

We collect and process personally identifiable information (“PII”) and other data as part of our business processes and activities. This data is subject to an increasing number of U.S. and foreign laws and regulations, including oversight by regulatory or governmental bodies. The EU General Data Protection Regulation (“GDPR”), for example, imposes stringent data protection requirements and provides significant penalties for noncompliance. Fines for noncompliance can amount to up to €20 million or 4% of the total worldwide annual sales from the preceding financial year (whichever is higher) and may be imposed in conjunction with the exercise of the authority’s investigatory and corrective powers. The GDPR’s extraterritorial scope makes it applicable to our U.S.-based legal entities whenever our business activities process the personal data of EU residents. Privacy laws, rules and regulations are also rapidly developing in other regions, including China, Brazil and South Korea, and the United States.

In the United States, the federal Health Insurance Portability and Accountability Act of 1996, as amended, and its implementing regulations (collectively, “HIPAA”) impose certain requirements on covered entities and their business associates

to protect the privacy and security of protected health information (“PHI”) and to provide notification in the event of a breach of PHI. The U.S. Department of Health and Human Services Office for Civil Rights (“OCR”), which is responsible for enforcing HIPAA, also may enter into resolution agreements requiring the payment of civil money penalties and/or the establishment of corrective action plans to address violations of HIPAA. Pursuant to HIPAA, OCR has adopted privacy regulations to govern the use and disclosure of PHI and data security regulations that require the implementation of safeguards to protect electronic PHI.

Our Company, through its various subsidiaries, functions as both a covered entity and a business associate under HIPAA. Where necessary, we have segregated our data to ensure that PHI is handled in accordance with HIPAA requirements. We believe that we have implemented appropriate policies and procedures and security measures necessary to comply with HIPAA. However, despite our compliance efforts, we may suffer a serious breach of PHI or be subject to a cyberattack that compromises the PHI that we maintain.

Additionally, federal and state privacy and security-related laws may be more restrictive than HIPAA and could impose additional penalties. For example, the Federal Trade Commission uses its consumer protection authority to initiate enforcement actions in response to alleged privacy violations and data breaches. The California Consumer Privacy Act (“CCPA”) created additional data privacy obligations for covered companies and a private right of action with statutory damages for certain data breaches. In addition, the California Privacy Rights Act further expanded the CCPA to provide even greater rights to California consumers with respect to their data. Other states have followed California by implementing data privacy laws, including, but not limited to, Colorado, Connecticut, Utah, Virginia, and Washington. If we suffer a serious breach of personal data, we may be subject to breach notification requirements, government investigations, media inquiries, civil and criminal fines and penalties, litigation, and negative public perception, and we may be required to expend substantial financial and personnel resources. Any liability from failing to comply with applicable privacy and data protection laws could adversely affect our operations and our financial condition.

These varying laws, rules, regulations and industry standards impact our businesses to the extent we rely on the use of personal data, including PHI, and create significant compliance challenges. In addition, certain privacy and data protection laws may apply to us indirectly through our customers, manufacturers, suppliers or other third-party partners. For example, non-compliance with applicable laws or regulations by a third-party partner that is processing personal data on our behalf may be deemed to be non-compliance or a failure to conduct proper due diligence. Any inability, or perceived inability, to adequately address privacy and data protection concerns or to comply with applicable laws, regulations, policies, industry standards, contractual obligations, or other legal obligations (including at newly acquired companies) could result in additional cost and liability to us or our officers, damage our reputation, inhibit sales, and otherwise adversely affect our business.

Moreover, global regulation related to the provision of services on the Internet is increasing, as governments continue to adopt new laws and regulations addressing data privacy and the collection, processing, storage and use of personal information. Such laws and regulations are subject to new and differing interpretations and may be inconsistent among jurisdictions. These and other requirements could restrict our ability to store and process data or impact our ability to offer future digital dentistry products and services in certain locations. The costs of compliance with and other burdens imposed by these types of laws, regulations and standards may limit the adoption of our products or services or lead to significant fines, penalties or liabilities for noncompliance, any of which could harm our business.

In addition, the legal and regulatory landscape surrounding AI technologies is rapidly evolving and uncertain, especially in the areas of intellectual property, cybersecurity, and privacy and data protection. For example, there is uncertainty around the validity and enforceability of intellectual property rights related to the use, development, and deployment of AI. Compliance with new or changing laws, regulations or industry standards relating to AI may impose significant operational costs and may limit the ability of the Company and our business partners to develop, deploy or use AI technologies. Failure to appropriately respond to this evolving landscape may result in legal liability, regulatory action, or brand and reputational harm.

New and more stringent multinational, national and state technology legislation and regulations may be adopted in 2025 and beyond. We cannot predict the scope of new legislation, regulation or enforcement, the jurisdictions that may be involved, or impact. Failure to comply with technology laws and regulations could result in enforcement actions (which could include substantial penalties), private litigation and/or adverse publicity and could have a material adverse impact on our business, financial condition or results of operations.

Although we currently maintain liability insurance intended to cover cyber and certain other privacy and security breach-related claims, we cannot ensure that our insurance coverage will be adequate to cover liabilities arising out of claims asserted against us in the future if the outcomes of such claims are unfavorable to us. Liabilities in excess of our insurance coverage,

including coverage for cyber liability and certain other privacy and security breach-related claims, could have a material adverse effect on our business, financial condition, results of operations, cash flows and the trading price of our securities.

We may be unable to develop innovative products and solutions to stimulate customer demand.

The worldwide markets for dental and continence care products are highly competitive and are subject to rapid and significant technological disruption. There can be no assurance that our products will not lose their competitive advantage or become obsolete as a result of such factors, or that we will be able to generate any economic return on our investment in product development. If product demand or sales effectiveness decreases, or if our newly introduced products are not accepted by our customers, our revenue and profit could be negatively impacted. Important factors that could cause demand for our products to decrease include changes in:

•business conditions, including downturns in the dental industry, regional economies, and the overall economy;

•the level of customers’ inventories;

•evolving industry practices;