Exhibit 5.1

July 21, 2016

Teva Pharmaceutical Industries Limited

5 Basel Street

Petach Tikvah 4951033

Israel

Teva Pharmaceutical Finance Netherlands III B.V.

Piet Heinkade 107, 1019 GM Amsterdam,

Netherlands

Ladies and Gentlemen:

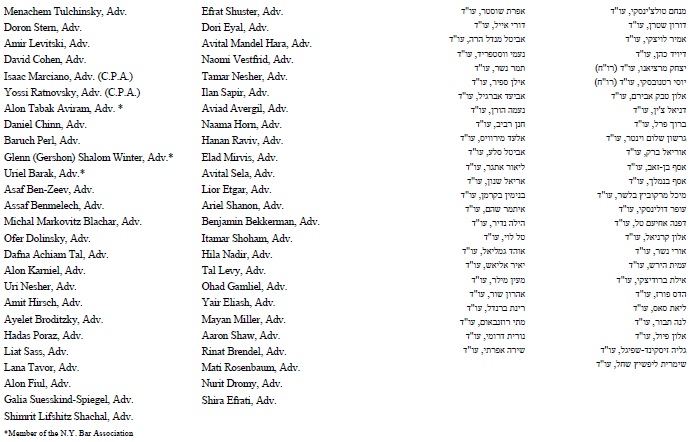

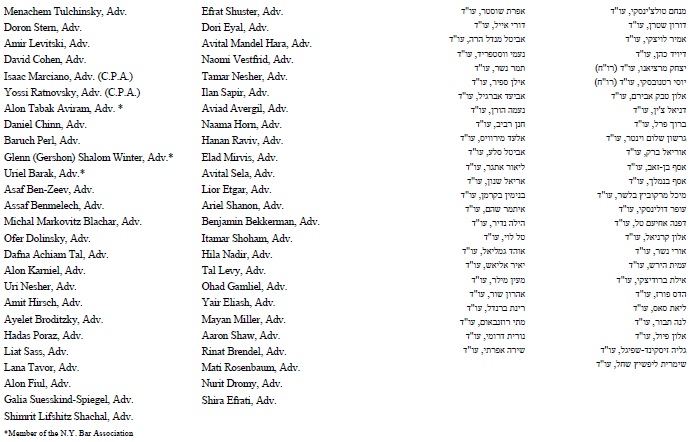

TULCHINSKYSTERNMARCIANOCOHENLEVITSKI& CO.

| | | | |

| | LAW OFFICES |  | | |

www.tslaw.co.il

We have acted as Israeli counsel for Teva Pharmaceutical Industries Limited, an Israeli corporation (the “Guarantor”) with respect to (i) the issuance and sale by Teva Pharmaceutical Finance Netherlands III B.V., a private limited liability company organized under the laws of the Netherlands (the “Company”) of: (a) $1,500,000,000 aggregate principal amount of the 1.400% Senior Notes due 2018 (the “2018 notes”); (b) $ 2,000,000,000 aggregate principal amount of the 1.700% Senior Notes due 2019 (the “2019 notes”); (c) $3,000,000,000 aggregate principal amount of the 2.200% Senior Notes due 2021 (the “2021 notes”); (d) $3,000,000,000 aggregate principal amount of the 2.800% Senior Notes due 2023 (the “2023 notes”); (e) $3,500,000,000 aggregate principal amount of the 3.150% Senior Notes due 2026 (the “2026 notes”); and (f) $2,000,000,000 aggregate principal amount of the 4.100% Senior Notes due 2046 (the “2046 notes” and, collectively with the 2018 notes, the 2019 notes, the 2021 notes, the 2023 notes and 2026 notes, the “Notes”); and (ii) the Guarantor’s unconditional guarantees of the Notes (the “Guarantees”). The Notes are being issued pursuant to an indenture, dated as of July 21, 2016, as supplemented by a supplemental indenture, dated as of July 21, 2016, by and among the Company, the Guarantor and The Bank of New York Mellon, as Trustee (the “Indentures”).

For purposes of the opinions hereinafter expressed, we have reviewed (i) the Registration Statement on Form F-3 (File No. 333-201984) filed by the Guarantor, the Company and other related issuers with the United States Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Securities Act”), on February 9, 2015, which became effective on February 9, 2015, as amended (as so amended, the “Registration Statement”), (ii) the prospectus of the Guarantor, the Company and other related issuers dated July 13, 2016, as supplemented by a prospectus supplement, dated July 19, 2016 relating to the Notes, as filed in final form with the Commission on July 21, 2016 pursuant to Rule 424(b) under the Securities Act (the “Prospectus”) (iii) the Indenture, (iv) the memorandum of association and the articles of association of the Guarantor, (v) copies of the resolutions of the board of directors of the Guarantor, and (vi) such other corporate records, as well as such other material, as we have deemed necessary as a basis for the opinions expressed herein.

In our examination, we have assumed the genuineness of all signatures, the legal capacity of natural persons, the authenticity of all documents submitted to us as originals, the conformity to original documents of all documents submitted to us as certified, photostatic or facsimile copies and the authenticity of the originals of such copies.

Our opinions set forth herein are based upon our consideration of only these statutes, rules and regulations of the State of Israel which, in our experience, are normally applicable to guarantors or issuers of securities of the nature of the Notes.

Based on and subject to the foregoing, we are of the opinion that:

| | 1. | The Indentures have been duly authorized by the Guarantor. |

| | 2. | The Guarantees have been duly authorized by the Guarantor. |

| | 3. | Under the choice of law or conflicts of law doctrines of Israel, a court, tribunal or other competent authority sitting in Israel has discretion but should apply to any claim or controversy arising under the Indentures, the Notes, the Guarantees the law of the State of New York, which is the local law governing the Indentures and the Guarantees designated therein by the parties thereto, provided there are no reasons for declaring such designation void on the grounds of public policy or as being contrary to Israeli law. |

2

TULCHINSKYSTERNMARCIANOCOHENLEVITSKI& CO.

| | | | |

| | LAW OFFICES |  | | |

www.tslaw.co.il

We do not purport to be an expert on the laws of any jurisdiction other than the laws of the State of Israel, and we express no opinion herein as to the effect of any other laws.

This opinion is being rendered solely in connection with the registration of the offering and sale of the Notes, pursuant to the registration requirements of the Securities Act. We hereby consent to the filing of this opinion as an exhibit to the Guarantor’s Current Report on Form 6-K, which is incorporated by reference into the Registration Statement and the Prospectus. By giving our consent, we do not admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations issued or promulgated thereunder.

Very truly yours,

/s/ Tulchinsky Stern Marciano Cohen Levitski & Co., Law Offices

Tulchinsky Stern Marciano Cohen Levitski & Co.,

Law Offices

3