PROVIDENT BANKSHARES

C O R P O R A T I O N

Sandler O’Neill & Partners, L.P.

Financial Services Conference

November 13, 2003

Filed by Provident Bankshares Corporation

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Southern Financial Bancorp, Inc.

Commission File No. 0-22836

The following is the presentation of Provident Bankshares Corporation at the Sandler O’Neill & Partners, L.P. Financial Services Conference hosted on November 13, 2003:

Provident Bankshares Corporation and Southern Financial Bancorp, Inc. will be filing a joint proxy statement/prospectus and other relevant documents concerning the merger with the

United States Securities and Exchange Commission (the "SEC").

WE URGE INVESTORS TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC, BECAUSE THEY

CONTAIN IMPORTANT INFORMATION.

Investors will be able to obtain these documents free of charge at the SEC's web site (www.sec.gov). In addition, documents filed with the SEC by Provident Bankshares Corporation will be

available free of charge from the Investor Relations Department at Provident Bankshares Corporation, 114 East Lexington Street, Baltimore, Maryland 21202. Documents filed with the

SEC by Southern Financial Bancorp, Inc. will be available free of charge from the Investor Relations Department at Southern Financial Bancorp, Inc., 37 East Main Street, Warrenton,

Virginia 20186.

The directors, executive officers, and certain other members of management of Provident Bankshares Corporation and Southern Financial Bancorp, Inc. may be soliciting proxies in favor of

the merger from the companies' respective shareholders. For information about these directors, executive officers, and members of management, shareholders are asked to refer to the most

recent proxy statements issued by the respective companies, which are available on their web sites and at the addresses provided in the preceding paragraph.

FORWARD-LOOKING STATEMENTS AND ASSOCIATED RISK FACTORS

This release, and the associated conference call, web cast, other written materials, and statements management may make, may contain certain forward-looking statements regarding the

Company's prospective performance and strategies within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation

Reform Act of 1995, and is including this statement for purposes of said safe harbor provisions.

Forward-looking statements, which are based on certain assumptions and describe future plans, strategies, and expectations of the Company, are generally identified by use of the words

"plan," "believe," "expect," "intend," "anticipate," "estimate," "project," or other similar expressions. The Company's ability to predict results or the actual effects of its plans and strategies

is inherently uncertain. Accordingly, actual results may differ materially from anticipated results.

The following factors, among others, could cause the actual results of the merger to differ materially from the expectations stated in this release and the associated conference call and web

cast: the ability of the companies to obtain the required shareholder or regulatory approvals of the merger; the ability of the companies to consummate the merger; the ability of Southern

Financial to timely complete its acquisition of Essex Bancorp, Inc.; the ability to successfully integrate the companies following the merger; a materially adverse change in the financial

condition of either company; the ability to fully realize the expected cost savings and revenues; and the ability to realize the expected cost savings and revenues on a timely basis.

Other factors that could cause the actual results of the merger to differ materially from current expectations include a change in economic conditions; changes in interest rates, deposit

flows, loan demand, real estate values, and competition; changes in accounting principles, policies, or guidelines; changes in legislation and regulation; and other economic, competitive,

governmental, regulatory, geopolitical, and technological factors affecting the companies' operations, pricing, and services.

The Company undertakes no obligation to update these forward-looking statements to reflect events or circumstances that occur after the date on which such statements were made.

###

HISTORY

THE PROVIDENT DISTINCTION

KEY STRATEGIES

SOUTHERN FINANCIAL

MERGER

AGENDA

PROVIDENT BANKSHARES

C O R P O R A T I O N

HISTORY

1886 - Founded

1987 - Converted to Commercial Bank

1993 - Totally Free Checking/In-Store

Branches

1997 - CSB Acquisition

2003 - Strategic Merger with SFFB announced

November 3

PROVIDENT BANKSHARES

C O R P O R A T I O N

THE PROVIDENT

DISTINCTION

UNIQUE BY WHAT WE ARE

$5 Billion in Assets

“Right size bank” to know and serve our primary region

Access to Executive Management

Targeted to specific customers

“Middle America” Consumer customer

Small Business and Middle Market

Sophisticated niche businesses (RE & Marine)

Value-oriented products and delivery

Convenient access

Depth and breadth of products and services

PROVIDENT BANKSHARES

C O R P O R A T I O N

KEY STRATEGIES

Build market share and expand branch network

in Washington Metro

Grow commercial banking market share in the

Baltimore-Washington corridor

Grow core banking business

Improve financial fundamentals

PROVIDENT BANKSHARES

C O R P O R A T I O N

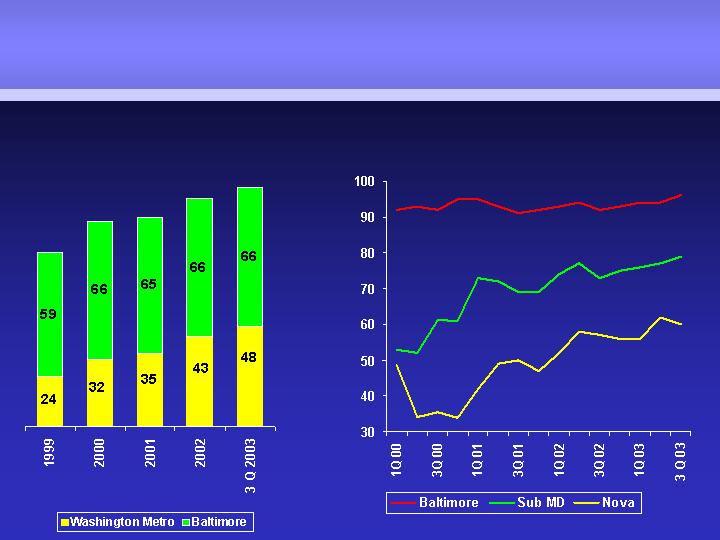

GROW MARKET SHARE AND

EXPAND IN

WASHINGTON METRO

PROVIDENT BANKSHARES

C O R P O R A T I O N

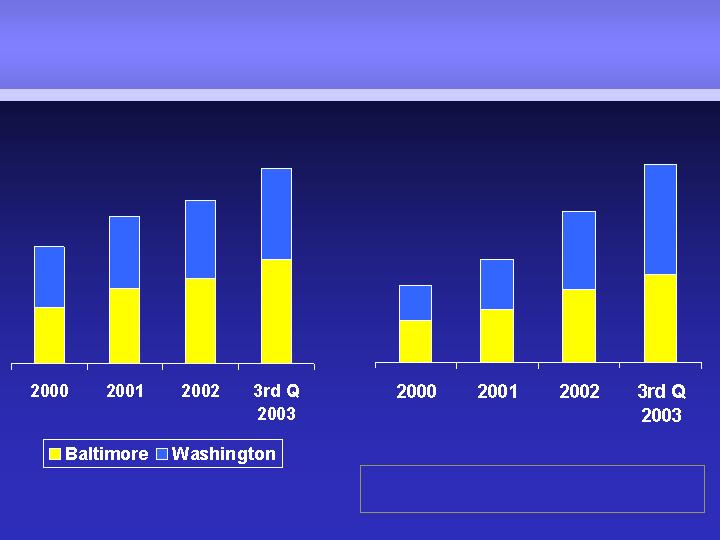

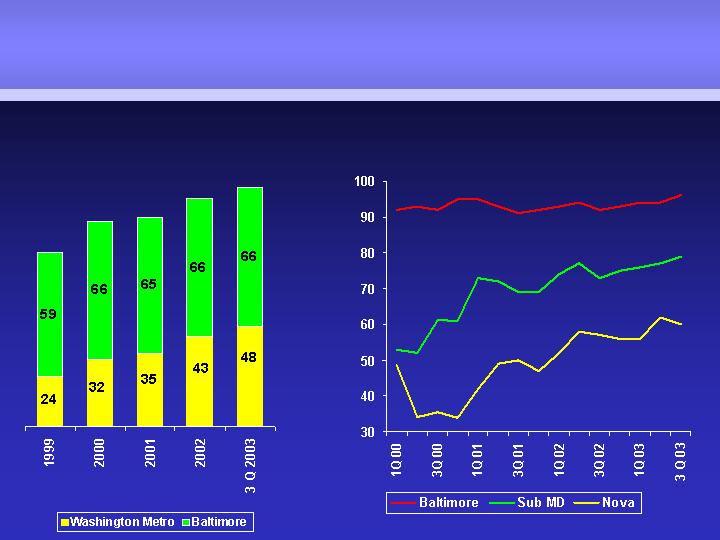

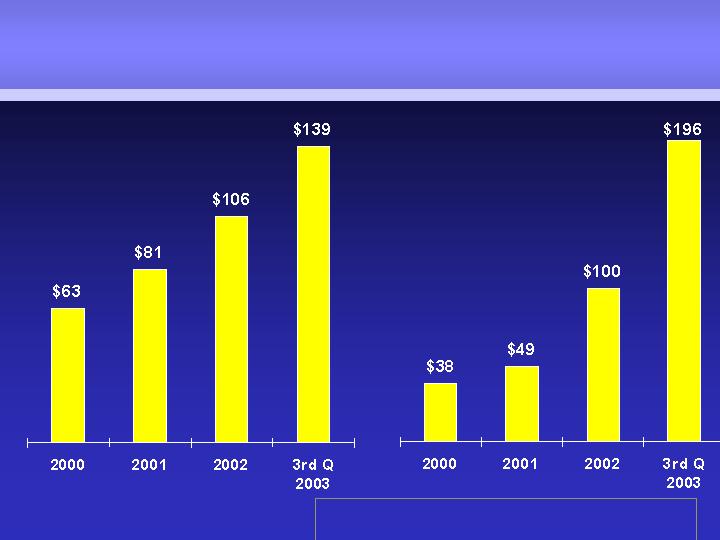

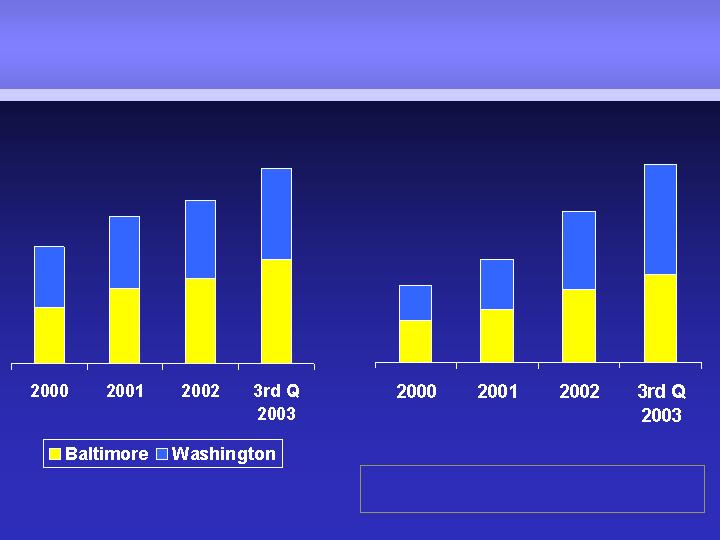

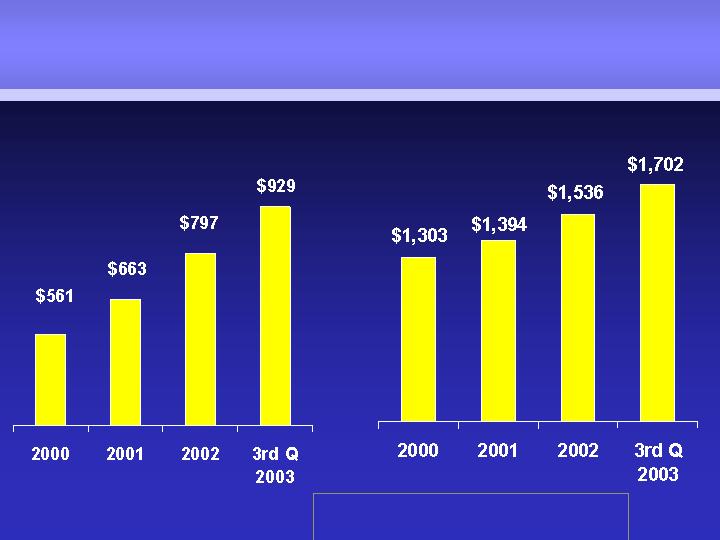

GROW MARKET SHARE AND EXPAND

IN WASHINGTON METRO

TOTAL AWARENESS

BRANCH NETWORK

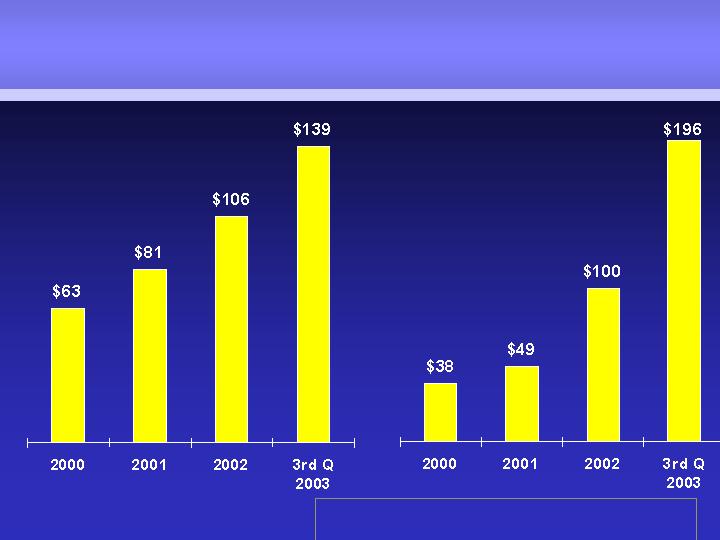

CHECKING BALANCE GROWTH

WASHINGTON METRO

CONSUMER

COMMERCIAL

Average Balances - Millions

CAGR Consumer 2000-2002 29.44%

CAGR Commercial 2000-2002 61.36%

GROW COMMERCIAL BANKING

MARKET SHARE IN THE

BALTIMORE-WASHINGTON

CORRIDOR

PROVIDENT BANKSHARES

C O R P O R A T I O N

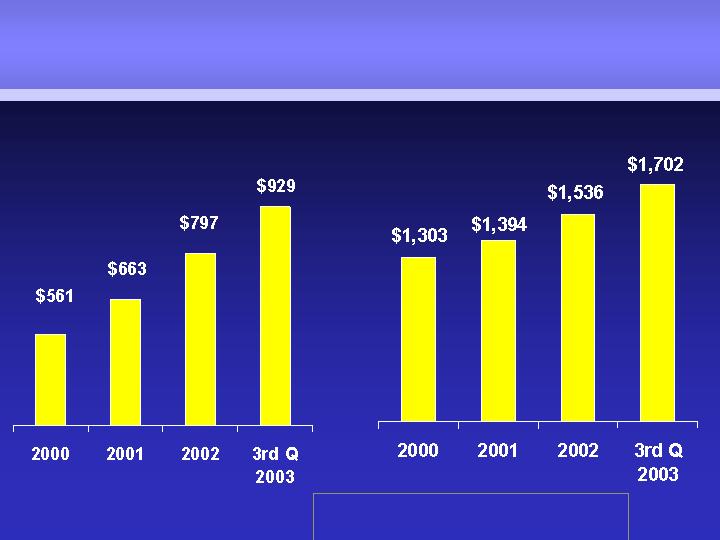

CORE COMMERCIAL LOAN AND

DEPOSIT/REPO GROWTH

Average Balances ($ millions)

$670

$791

$856

$985

LOANS

$346

$426

$579

$727

DEPOSIT/REPO

CAGR Loans 2000-2002 13.04%

CAGR Dep/Repo 2000-2002 29.37%

GROW CORE

BANKING BUSINESS

PROVIDENT BANKSHARES

C O R P O R A T I O N

DEFINITIONS

Core Loans

Originated by Provident; participations in our defined

market area

Core Consumer includes home equity loans and

lines, marine, other installment loans

Core Commercial includes real estate, commercial

loans and lines and leases

Non-Core Loans

Purchased loans; participations outside our defined

market area; discontinued product lines

Core Deposits

All deposits except brokered deposits

CORE CONSUMER LOAN AND

DEPOSIT GROWTH

Average Balances ($ millions)

LOANS

DEPOSITS

(excluding CD/IRA’s)

CAGR 2000-2002 Loans 19.15%

CAGR 2000-2002 Deposits 8.57%

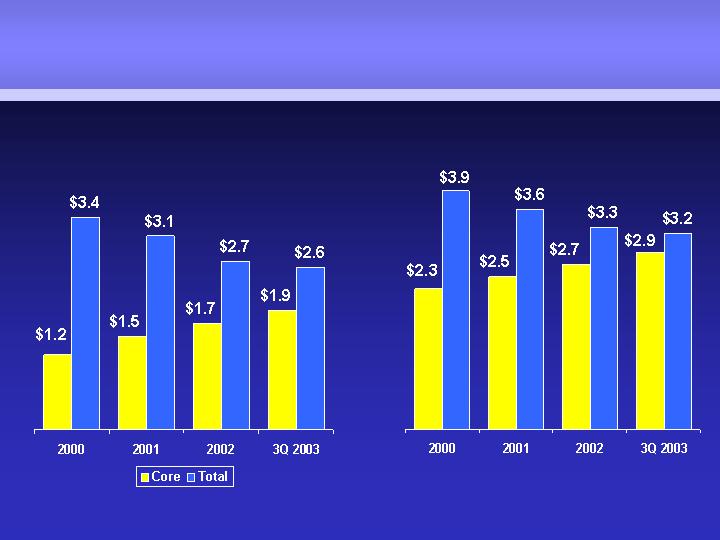

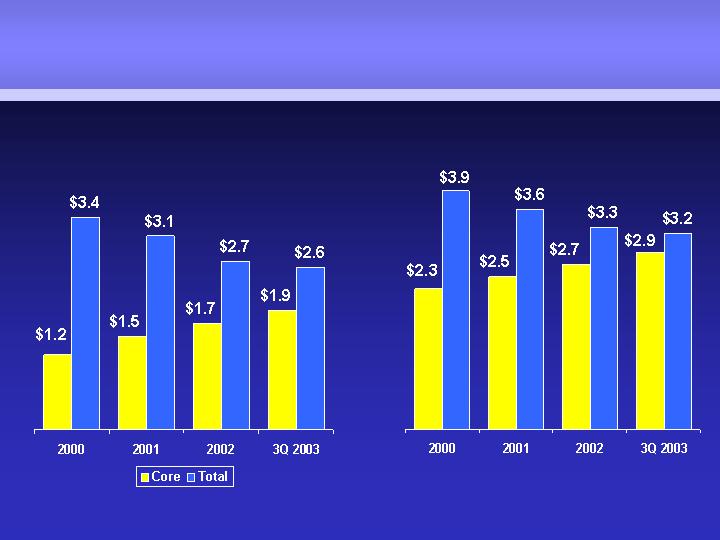

GROW CORE BANKING

Average Balances ( $ Billions)

CORE LOANS VS

TOTAL LOANS

CORE DEPOSITS VS

TOTAL DEPOSITS

CAGR Total Loans 2000-2002 (11.47%)

CAGR Core Loans 2000-2002 15.88%

CAGR Total Deposits 2000-2002 (8.06%)

CAGR Core Deposits 2000-2002 7.53%

STRATEGIC MERGER

Southern

Financial

Bank

SOUTHERN FINANCIAL

BANCORP, INC

Founded in 1986

Headquartered in Warrenton, Virginia

$1.5 Billion Assets*

33 Branches*

Middle Market and Small Business focus;

Leading SBA lender

*Upon completion of Essex acquisition

TRANSACTION STRENGTHS

Strategic Fit

Cultural Compatibility

Financial Opportunity

STRATEGIC FIT

Continues Provident’s market

share expansion in the high

growth markets of Northern

Virginia

VIRGINIA:

STRONG BANKING MARKET

Population:

7.4 million

(12th largest state)

Projected Population Growth:

6.5% (14th highest growth rate in the nation)

(‘03-’08)

Median Household Income:

$51,923 (13th highest in the nation and 10% above the national average)

Median Household Income Growth:

14.4% (11th highest growth rate in the nation)

(‘03-’08)

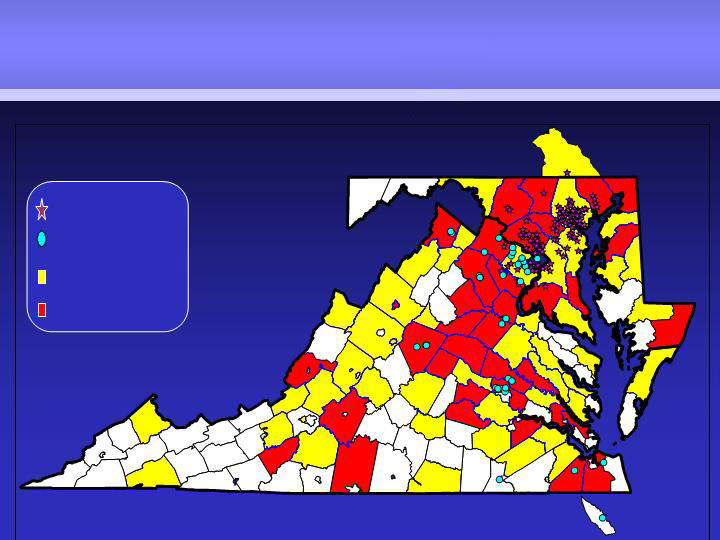

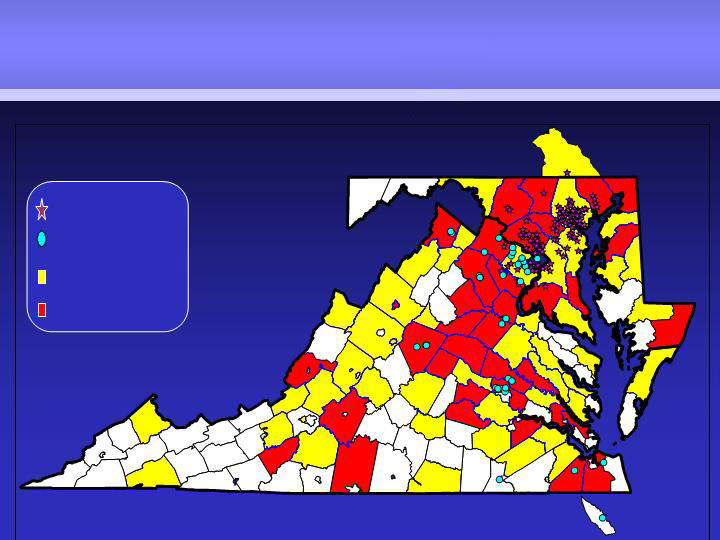

PRO FORMA FRANCHISE

County Demographics

PBKS Branches

SFFB Branches*

4 - 8% Projected

Growth

+8% Projected

Growth

Branches located in Maryland and

Virginia’s best markets

* Southern Financial Bancorp, Inc. is pro forma for the pending

acquisition of Essex Bancorp

STRATEGIC FIT

Adds significant competitive

advantage for business banking

companies with a powerful

integrated suite of online

banking services

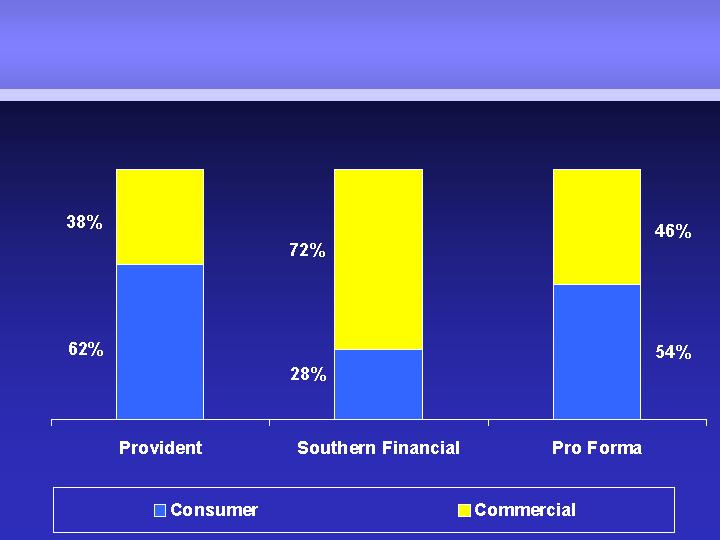

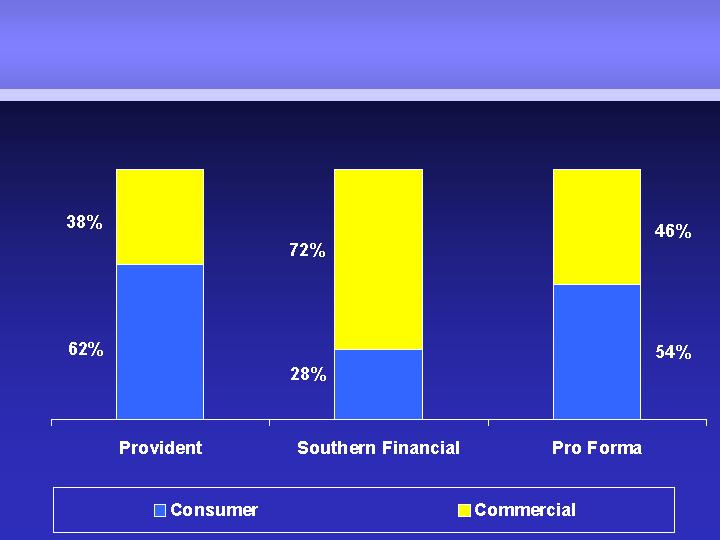

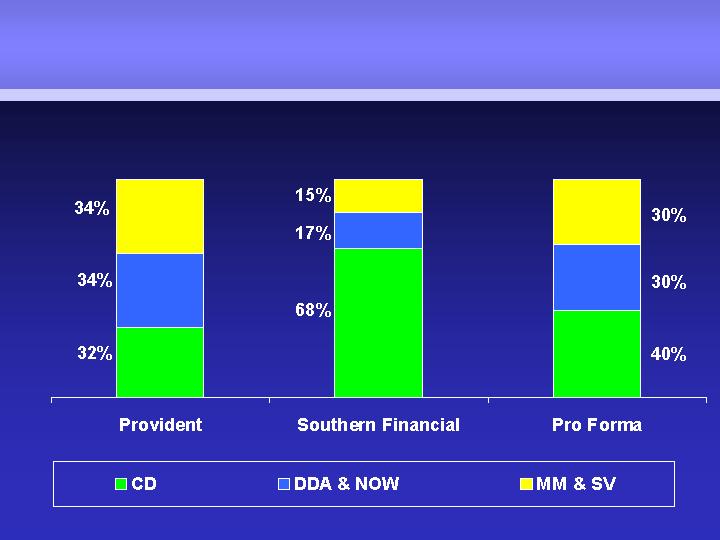

Pro Forma Financial Impact

Loan Mix

$2.6 Billion

$0.6 Billion

$3.2 Billion

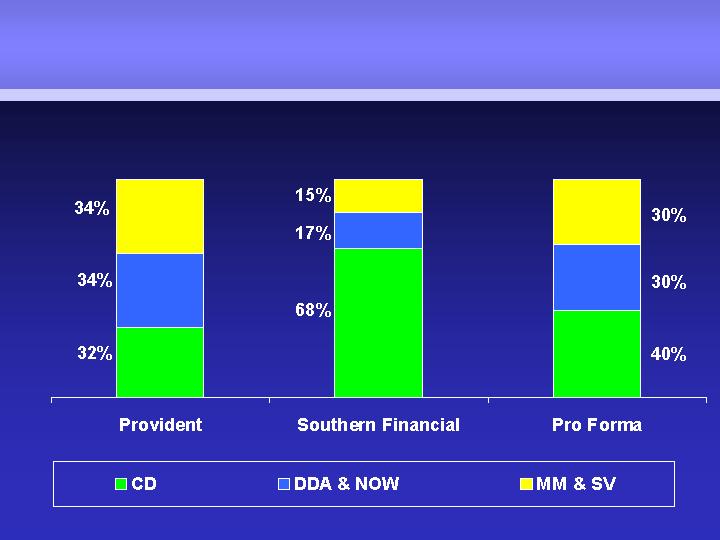

Pro Forma Financial Impact

Deposit Mix

$3.3 Billion

$0.9 Billion

$4.2 Billion

CULTURAL COMPATABILITY

Customer oriented

Employee focused

Community supporter

Excellent credit quality

FINANCIAL OPPORTUNITY

Accretive to GAAP and cash EPS in first full

year of combined operations

Identified, achievable cost savings

Combined loan composition well-balanced

Significant potential for retail loan and

deposit growth

DEAL STRUCTURE

Shares Issued: 8,065,000

Seller Ownership: 29.9%

Goodwill: $261 Million

Cost Savings: 24.6%

DEAL STRUCTURE

Price / LTM Reported EPS:

Premium to Market:

Price / Estimated EPS:

Price / Book Value:

Price / Tangible Book Value:

19.4%

22.9x

19.0x

2.72x

3.40x

37.3%

20.4x

19.0x

2.88x

3.04x

PBKS/ SFFB

Mid-Atlantic Comps

(2)

(1)

Source: SNL Financial, Company Filings, Press Releases & KBW

Comparable Transactions include bank transactions greater than $50 million since 1/1/2002

(1) Includes selling companies headquartered in MD, NC, NJ, PA, SC or VA

(2) Southern Financial Bancorp, Inc. is pro forma for the pending acquisition of Essex Bancorp

PRO FORMA RESULTS

At Closing

At First Year

Assets

$6.7 Billion

$6.7 Billion

Deposits

$4.5 Billion

$4.9 Billion

Core Loans

$2.6 Billion

$2.9 Billion

Tangible Capital

5.19%

6.23%

Leverage Ratio

7.34%

8.39%

Provident

Transaction Integration Experience

Three prior acquisitions

At the time of acquisition, First Citizens Financial

represented 25% of Provident assets; Southern Financial

Bancorp represents 29% of Provident assets today

Company

Employees

Accounts

First Citizens Financial

188

56,400

Southern Financial Bancorp

216

47,414

Provident has more than sufficient systems capacity to

accommodate Southern Financial’s customers

(1) Southern Financial Bancorp, Inc. is pro forma for the pending acquisition of Essex Bancorp

IMPROVE FINANCIAL

FUNDAMENTALS

PROVIDENT BANKSHARES

C O R P O R A T I O N

BACK TO PROVIDENT….

IMPROVE FINANCIAL

FUNDAMENTALS

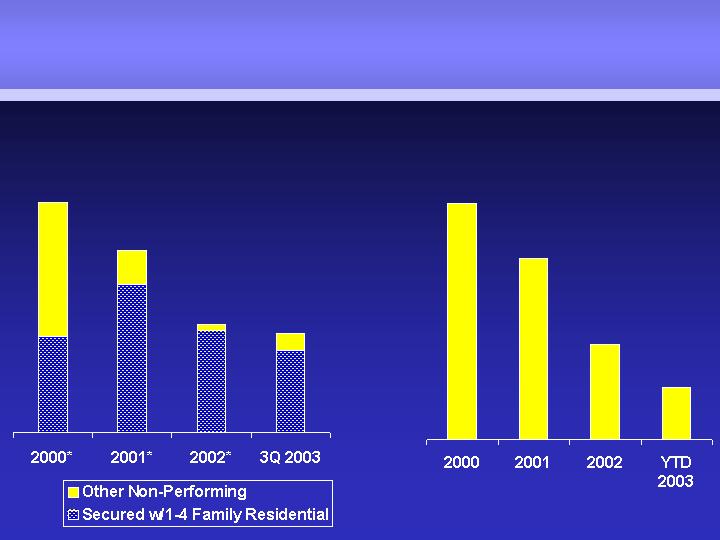

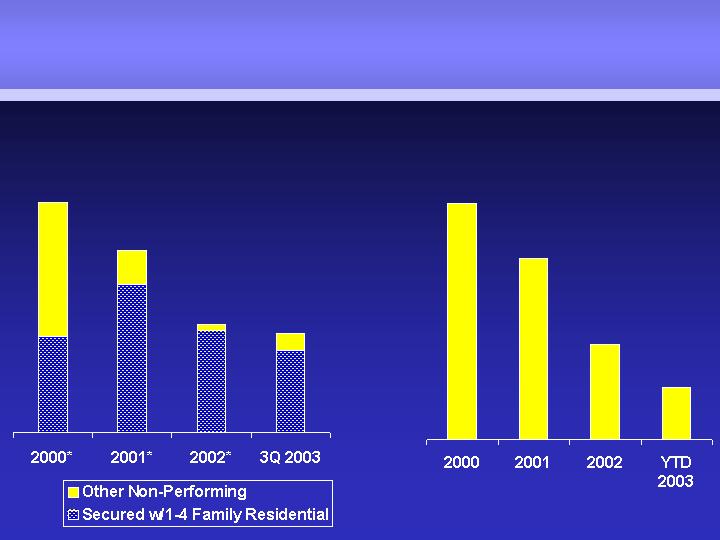

NET CHARGE OFFS

NON PERFORMING LOANS

(Period End)

0.81%

$27.4

0.68%

$21.0

0.41%

$11.0

0.32%

$6.1

% of loans; $Millions

1.01%

$33.8

1.04%

$28.8

0.83%

$21.1

0.75%

$20.3

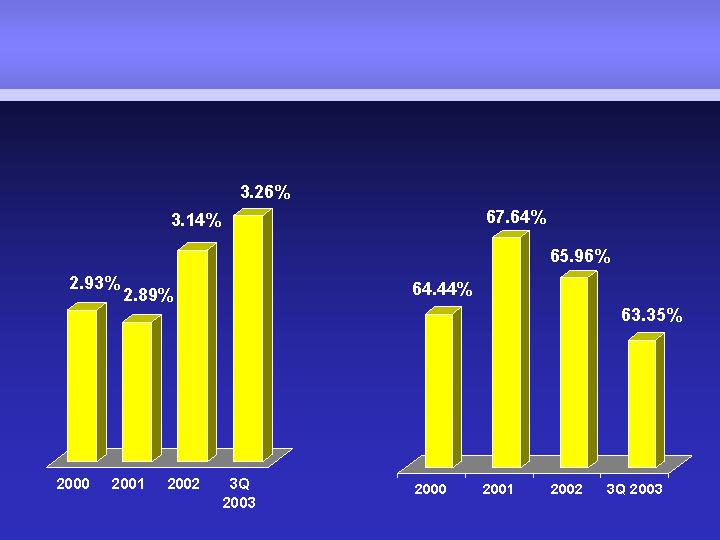

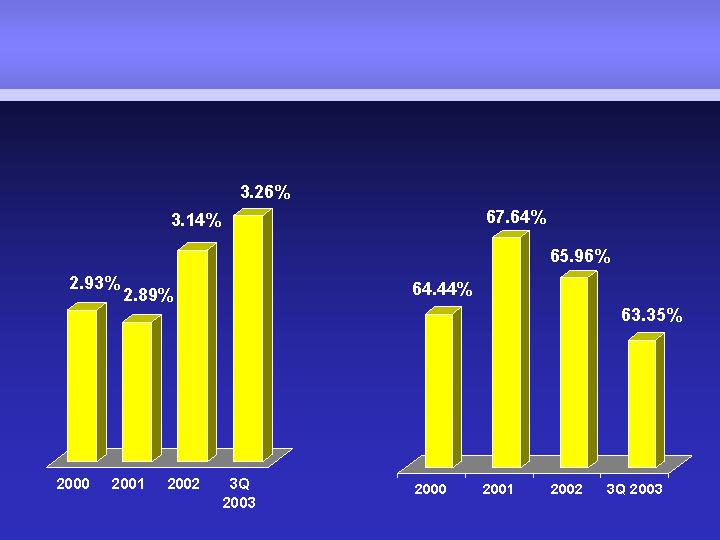

IMPROVE FINANCIAL

FUNDAMENTALS

NET INTEREST MARGIN

EFFICIENCY RATIO

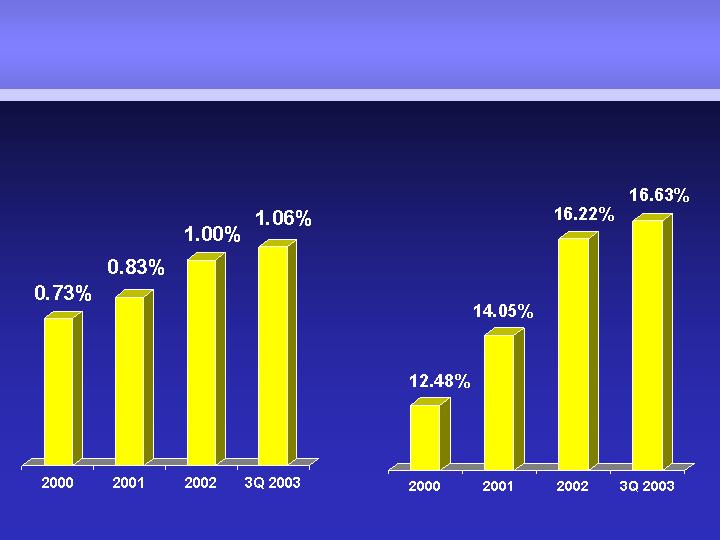

IMPROVE FINANCIAL

FUNDAMENTALS

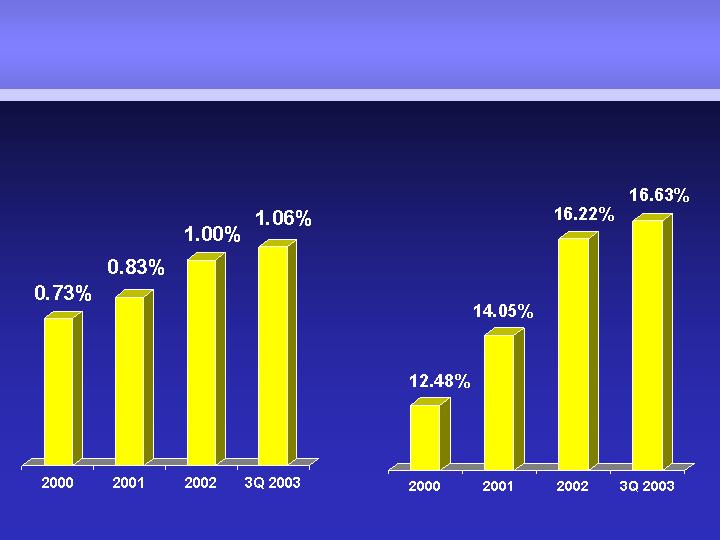

00-02 Compound Annual Growth Rate 17%

RETURN ON AVERAGE

ASSETS

RETURN ON AVERAGE

COMMON EQUITY

PROVIDENT BANKSHARES

CORPORATION

(www.provbank.com)

Contact:

Media: Lillian Kilroy: (410) 277-2833

Investment Community: Josie Porterfield: (410) 277-

2889

PROVIDENT BANKSHARES

C O R P O R A T I O N