Exhibit 99.1

PROVIDENT BANKSHARES

CORPORATION

FORWARD-LOOKING STATEMENTS AND RISK FACTORS

This presentation, as well as other written communications made from time to time by Provident Bankshares Corporation and its subsidiaries (the “Corporation”) (including, without limitation, the Corporation’s 2004 Annual Report to Stockholders) and oral communications made from time to time by authorized officers of the Corporation, may contain statements relating to the future results of the Corporation (including certain projections and business trends) that are considered “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995 (the “PSLRA”). Such forward-looking statements may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “intend” and “potential.” Examples of forward-looking statements include, but are not limited to, possible or assumed estimates with respect to the financial condition, expected or anticipated revenue, and results of operations and business of the Corporation, including earnings growth determined using U.S. generally accepted accounting principles (“GAAP”); revenue growth in retail banking, lending and other areas; origination volume in the Corporation’s consumer, commercial and other lending businesses; asset quality and levels of non-performing assets; current and future capital management programs; non-interest income levels, including fees from services and product sales; tangible capital generation; market share; expense levels; and other business operations and strategies. For these statements, the Corporation claims the protection of the safe harbor for forward-looking statements contained in the PSLRA.

The Corporation cautions you that a number of important factors could cause actual results to differ materially from those currently anticipated in any forward-looking statement. Such factors include, but are not limited to: the factors identified in the Corporation’s Form 10-K for the fiscal year ended December 31, 2004 under the headings “Forward-Looking Statements” and “Risk Factors,” prevailing economic conditions, either nationally or locally in some or all areas in which the Corporation conducts business or conditions in the securities markets or the banking industry; changes in interest rates, deposit flows, loan demand, real estate values and competition, which can materially affect, among other things, consumer banking revenues, revenues from sales on non-deposit investment products, origination levels in the Corporation’s lending businesses and the level of defaults, losses and prepayments on loans made by the Corporation, whether held in portfolio or sold in the secondary markets; changes in the quality or composition of the loan or investment portfolios; the Corporation’s ability to successfully integrate any assets, liabilities, customers, systems and management personnel the Corporation may acquire into its operations and its ability to realize related revenue synergies and cost savings within expected time frames; the Corporation’s timely development of new and competitive products or services in a changing environment, and the acceptance of such products or services by customers; operational issues and/or capital spending necessitated by the potential need to adapt to industry changes in information technology systems, on which it is highly dependent; changes in accounting principles, policies, and guidelines; changes in any applicable law, rule, regulation or practice with respect to tax or legal issues; risks and uncertainties related to mergers and related integration and restructuring activities; and other economic, competitive, governmental, regulatory and technological factors affecting the Corporation’s operations, pricing, products and services. Readers are cautioned not to place undue reliance on these forward-looking statements which are made as of the date of this presentation, and, except as may be required by applicable law or regulation, the Corporation assumes no obligation to update the forward-looking statements or to update the reasons why actual results could differ from those projected in the forward-looking statements.

ANALYST / INVESTOR DAY

PRESENTATION

September 9, 2005

Welcome

Gary N. Geisel

Chairman and Chief Executive Officer

Introduction

Provident Bank History

1886 Founded as a Mutual Thrift

1987 Converted to Commercial Bank

1993 Retail Banking Expansion

1997 Citizen’s Savings Bank Merger

2004 Southern Financial Merger

Introduction

Provident Bank Mission

Provident Bank’s mission is to exceed customer expectations by delivering superior service, products and banking convenience. Every employee’s commitment to serve our customers in this fashion will establish Provident Bank as the primary bank of choice of individuals, families, small businesses and mid-sized companies throughout our chosen markets.

Introduction

Provident Bank Vision

Provident Bank’s vision is to be chosen as our customers’ primary bank because we consistently execute our business as The Right Size Bank.

Introduction

Provident Bank Core Values

Integrity

Excellence

Caring

Partnership

Results Driven

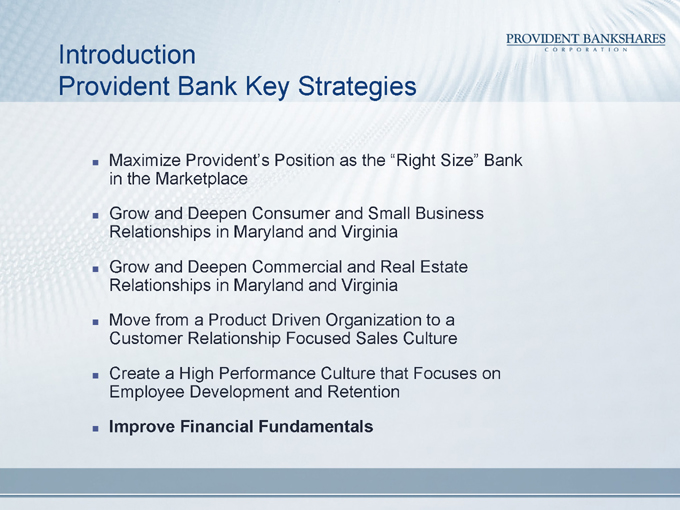

Introduction

Provident Bank Key Strategies

Maximize Provident’s Position as the “Right Size” Bank in the Marketplace

Grow and Deepen Consumer and Small Business Relationships in Maryland and Virginia

Grow and Deepen Commercial and Real Estate Relationships in Maryland and Virginia

Move from a Product Driven Organization to a Customer Relationship Focused Sales Culture

Create a High Performance Culture that Focuses on Employee Development and Retention

Improve Financial Fundamentals

Introduction Peer Group

Commerce Bancshares Inc. (MO)

First Midwest Bancorp, Inc.

Fulton Financial Corporation

Mercantile Bankshares Corporation

Sky Financial Group, Inc.

Susquehanna Bancshares, Inc.

TCF Financial Corporation

United Bankshares, Inc.

Valley National Bancorp

Introduction Mid Cap Group

Am South Bancorporation

TD Banknorth Inc.

Commerce Bancorp Inc.

Compass Bancshares, Inc.

Comerica Incorporated

Colonial BancGroup Inc.

First Horizon National Corp.

FirstMerit Corporation

Fulton Financial Corporation

Huntington Bancshares Inc.

Hibernia Corporation

Mercantile Bankshares Corp.

M&T Bank Corporation

North Fork Bancorporation, Inc.

South Financial Group, Inc

Synovus Financial Corp

Susquehanna Bancshares Inc.

TCF Financial Corporation

United Bankshares, Inc.

Zions Bancorporation

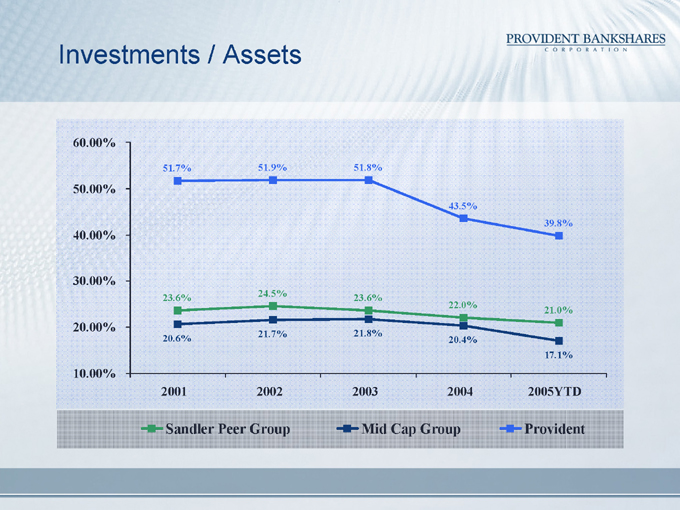

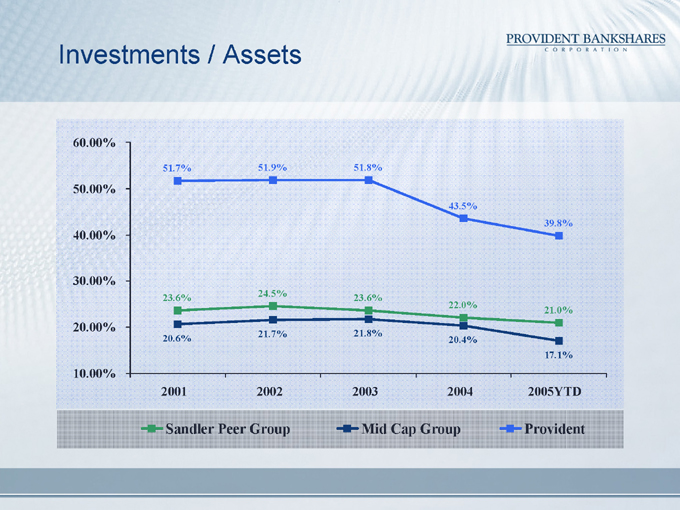

Investments / Assets

60.00% 50.00% 40.00% 30.00% 20.00% 10.00%

2001 2002 2003 2004 2005YTD

51.7%

51.9%

51.8%

43.5%

39.8%

23.6%

24.5%

23.6%

22.0%

21.0%

20.6%

21.7%

21.8%

20.4%

17.1%

Sandler Peer Group

Mid Cap Group

Provident

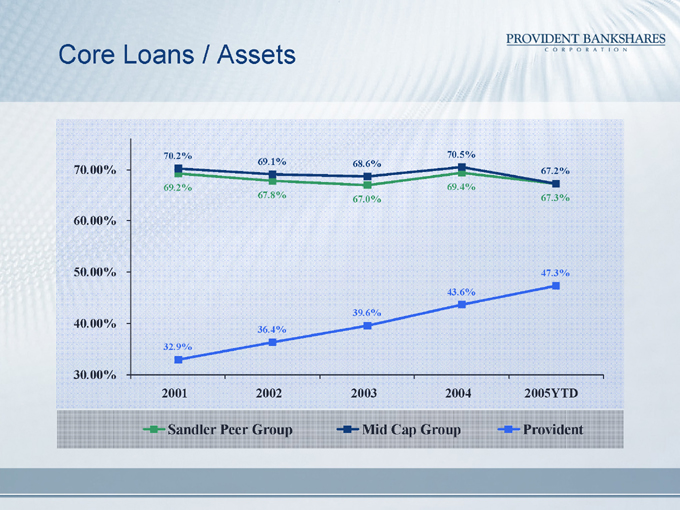

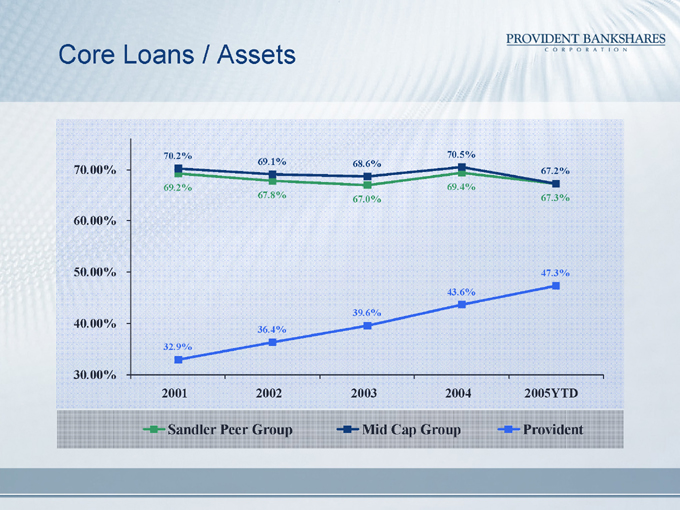

Core Loans / Assets

70.00% 60.00% 50.00% 40.00% 30.00%

2001 2002 2003 2004 2005YTD

70.2%

69.1%

68.6%

70.5%

67.2%

69.2%

67.8%

67.0%

69.4%

67.3%

32.9%

36.4%

39.6%

43.6%

47.3%

Sandler Peer Group

Mid Cap Group

Provident

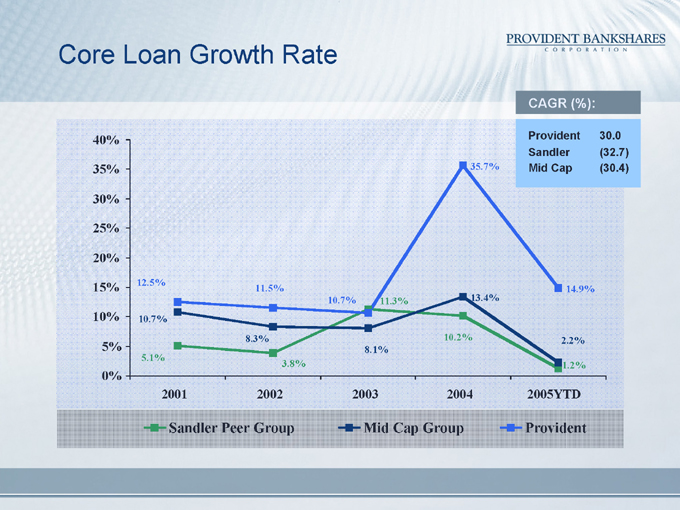

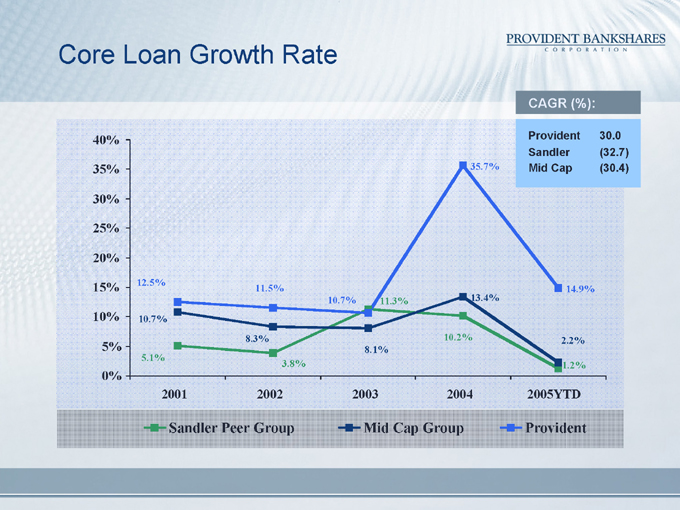

Core Loan Growth Rate

40% 35% 30% 25% 20% 15% 10% 5% 0%

2001 2002 2003 2004 2005YTD

12.5%

11.5%

10.7%

35.7%

14.9%

10.7%

8.3%

8.1%

13.4%

2.2%

5.1%

3.8%

11.3%

10.2%

1.2%

Sandler Peer Group

Mid Cap Group

Provident

CAGR (%):

Provident 30.0 Sandler (32.7) Mid Cap (30.4)

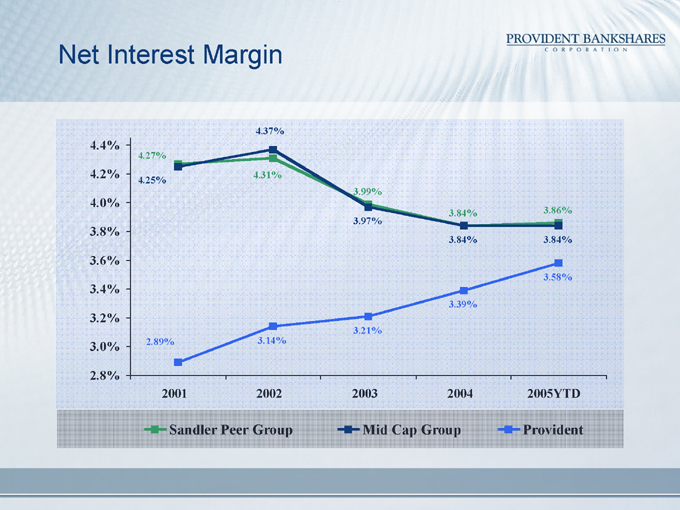

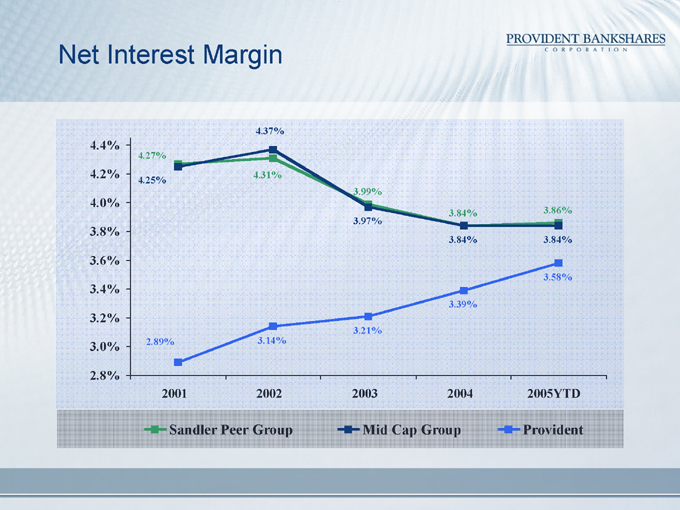

Net Interest Margin

4.4% 4.2% 4.0% 3.8% 3.6% 3.4% 3.2% 3.0% 2.8%

2001 2002 2003 2004 2005YTD

4.27%

4.25%

2.89%

4.37%

4.31%

3.14%

3.99%

3.97%

3.21%

3.84%

3.84%

3.39%

3.86%

3.84%

3.58%

Sandler Peer Group

Mid Cap Group

Provident

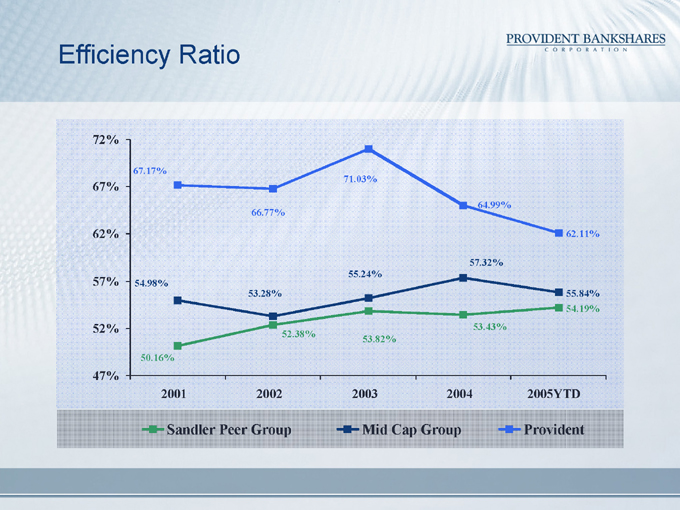

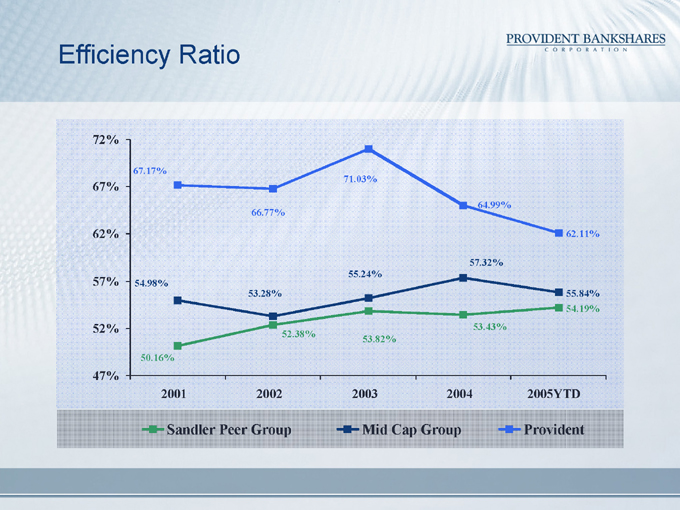

Efficiency Ratio

72% 67% 62% 57% 52% 47%

2001 2002 2003 2004 2005YTD

67.17%

54.98%

50.16%

66.77%

53.28%

52.38%

71.03%

55.24%

53.82%

64.99%

57.32%

53.43%

62.11%

55.84%

54.19%

Sandler Peer Group

Mid Cap Group

Provident

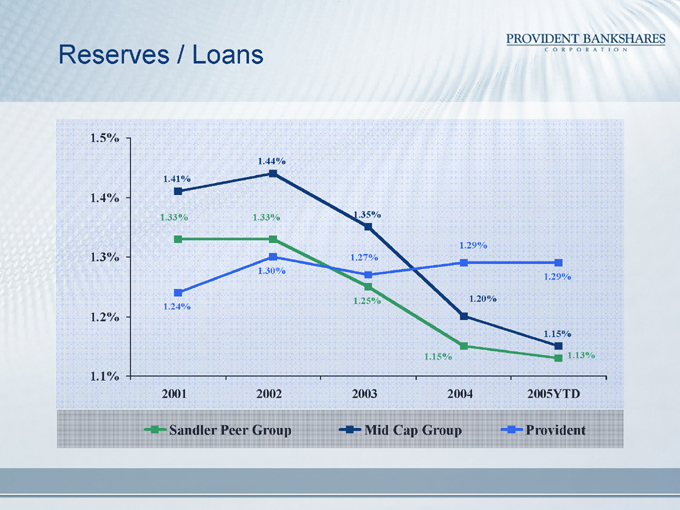

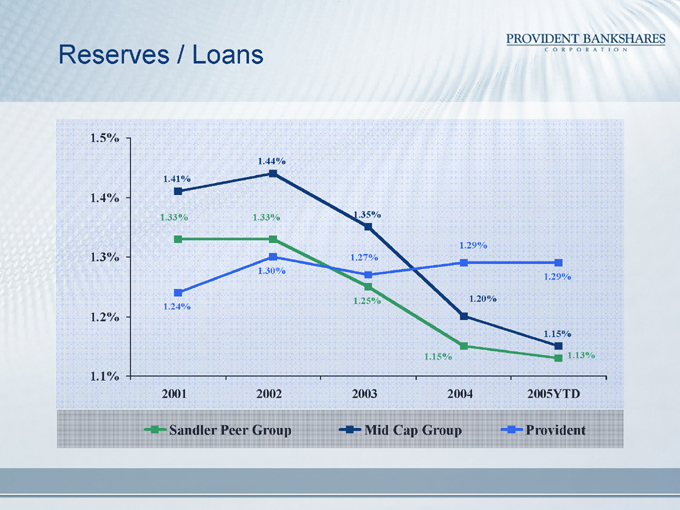

Reserves / Loans

1.5% 1.4% 1.3% 1.2% 1.1%

2001 2002 2003 2004 2005YTD

1.41%

1.33%

1.24%

1.44%

1.33%

1.30%

1.35%

1.27%

1.25%

1.29%

1.20%

1.15%

1.29%

1.15%

1.13%

Sandler Peer Group

Mid Cap Group

Provident

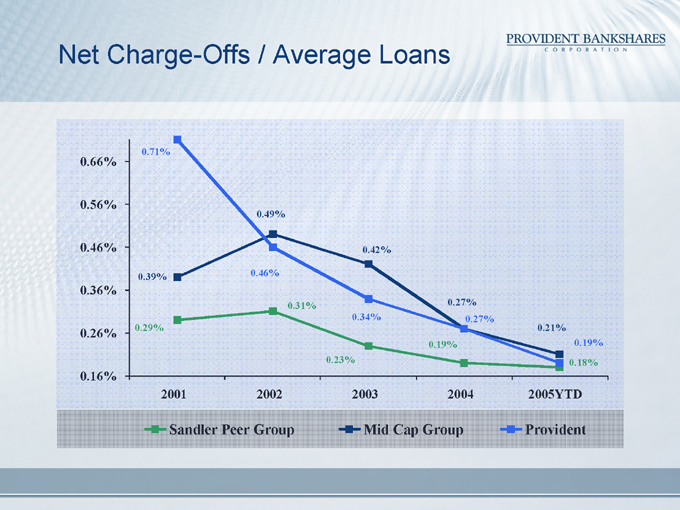

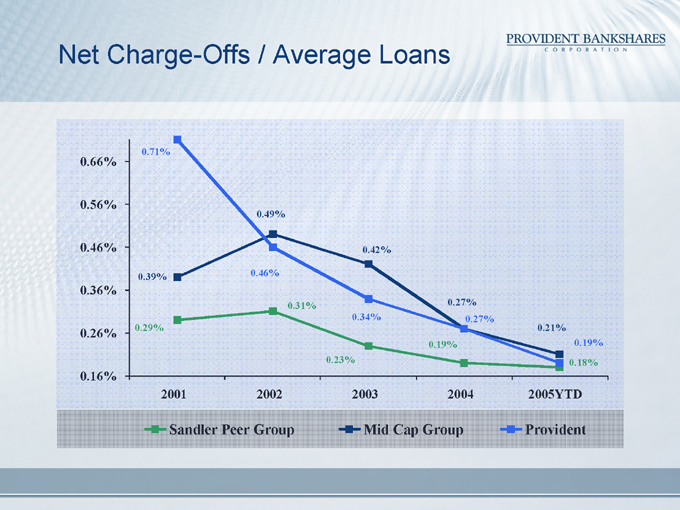

Net Charge-Offs / Average Loans

0.66% 0.56% 0.46% 0.36% 0.26% 0.16%

2001 2002 2003 2004 2005YTD

0.71%

0.39%

0.29%

0.49%

0.46%

0.31%

0.23%

0.42%

0.34%

0.19%

0.27%

0.27%

0.21%

0.19%

0.18%

Sandler Peer Group

Mid Cap Group

Provident

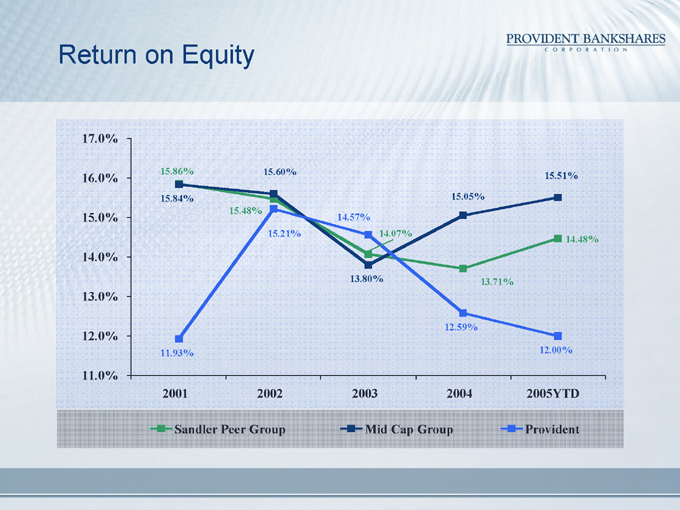

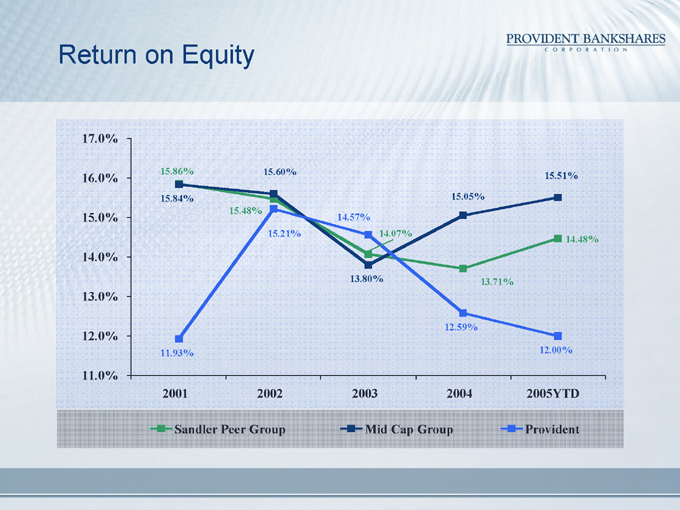

Return on Equity

17.0% 16.0% 15.0% 14.0% 13.0% 12.0% 11.0%

2001 2002 2003 2004 2005YTD

15.86%

15.84%

11.93%

15.60%

15.48%

15.21%

14.57%

14.07%

13.80%

15.05%

13.71%

12.59%

15.51%

14.48%

12.00%

Sandler Peer Group

Mid Cap Group

Provident

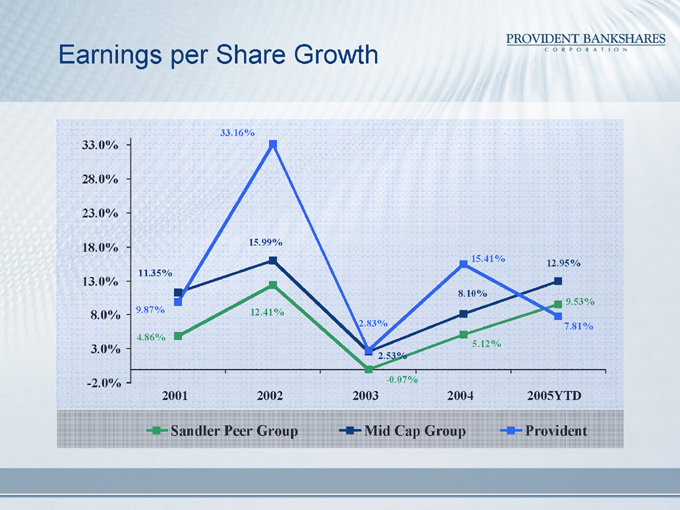

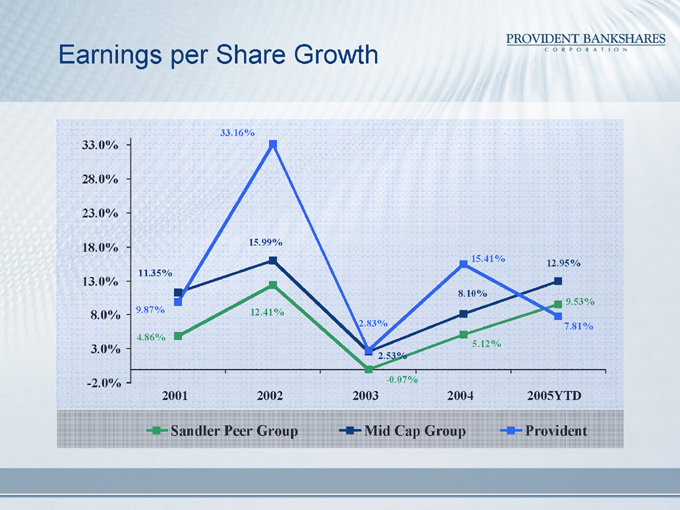

Earnings per Share Growth

33.0% 28.0% 23.0% 18.0% 13.0% 8.0% 3.0% -2.0%

2001 2002 2003 2004 2005YTD

11.35%

9.87%

4.86%

33.16%

15.99%

12.41%

2.83%

2.53%

-0.07%

15.41%

8.10%

5.12%

12.95%

9.53%

7.81%

Sandler Peer Group

Mid Cap Group

Provident

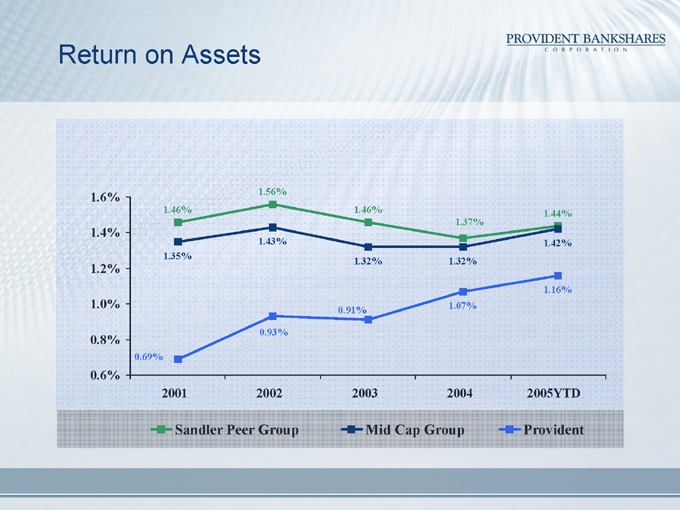

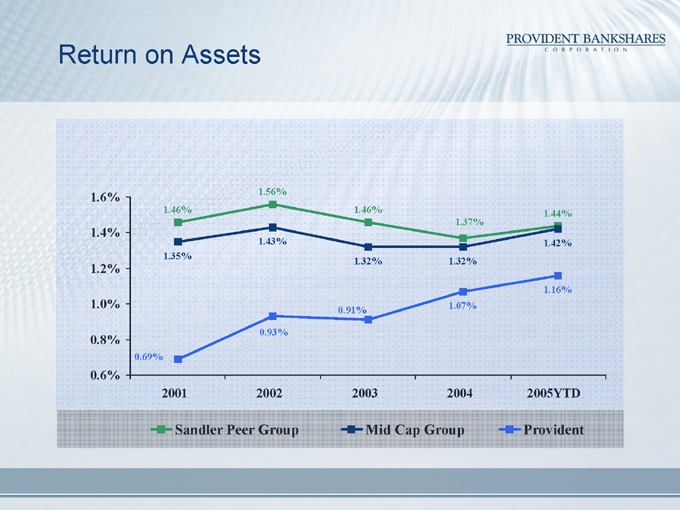

Return on Assets

1.6% 1.4% 1.2% 1.0% 0.8% 0.6%

2001 2002 2003 2004 2005YTD

1.46%

1.35%

0.69%

1.56%

1.43%

0.93%

1.46%

1.32%

0.91%

1.37%

1.32%

1.07%

1.44%

1.42%

1.16%

Sandler Peer Group

Mid Cap Group

Provident

PROGRAM OVERVIEW

Kevin Byrnes

President and Chief Operating Officer

CONVENIENT BANKING

Ann Clair

Managing Director, Sales Management

Convenient Banking

Banking Channels

In Store Banking

Products

Future Opportunities

Attractive and Easy to Use Channel Options

Provident provides more 7-day-a-week banking options than any other bank in Maryland and Virginia.

Non-branch banking options provide added convenience

Provident Direct opens retail and small business deposit accounts and takes loan applications—all by phone

Internet and Online Banking give customer 24-7 account access

ATM network extends from Virginia to New Jersey

Telephone Banking helps customers 7-days-a-week

In Store Network Why We Are Successful

We have the right store Partners

Our Program supports success

We hire and train the right People

EDLP Product line

We Have the Right Store Partners

Store partnerships primarily with Superfresh, Shoppers Food Warehouse, Wal-Mart and BJ’s Wholesale Club

Target similar customer segments

Employ complementary pricing methods

Select stores where we will be successful

Our Program Supports Success

Independent In-store network structure

Value In-store branch contribution

Capitalize on 65,000 sq. ft. In-store lobbies

Market to 15,000 customers who visit our stores each week

Provide attractive variable compensation

We Hire and Train the

Right People

One banker does it all!

Hire sales people and teach them banking

Extensive training program

Competitive Product Line

Employ Every Day Low Pricing product pricing methodology

Product line appeals to shared customer segments

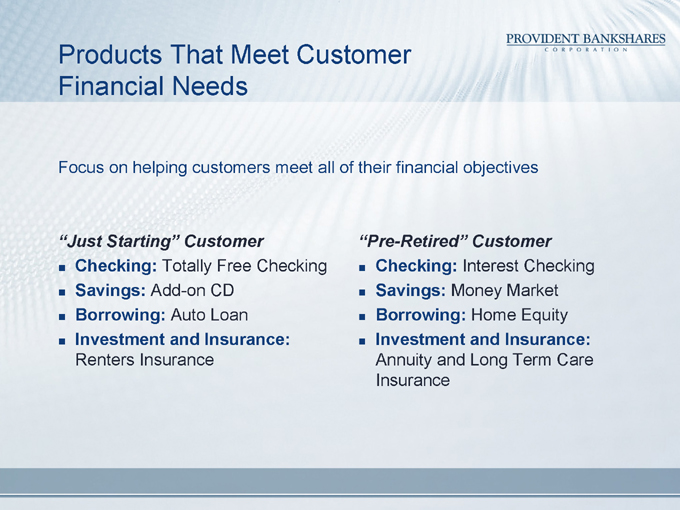

Products That Meet Customer Financial Needs

Focus on helping customers meet all of their financial objectives

“Just Starting” Customer

Checking: Totally Free Checking

Savings: Add-on CD

Borrowing: Auto Loan

Investment and Insurance: Renters Insurance

“Pre-Retired” Customer

Checking: Interest Checking

Savings: Money Market

Borrowing: Home Equity

Investment and Insurance: Annuity and Long Term Care Insurance

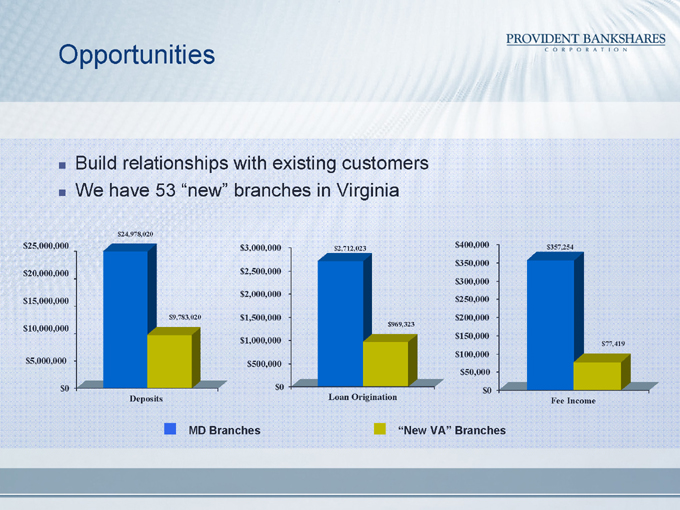

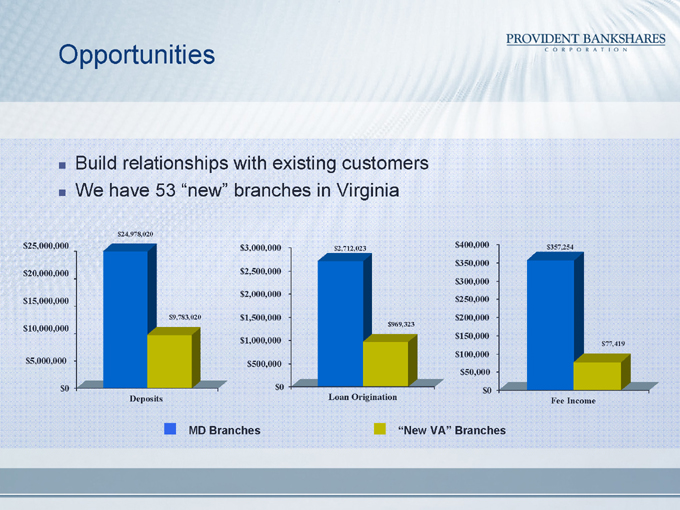

Opportunities

Build relationships with existing customers

We have 53 “new” branches in Virginia

$25,000,000 $20,000,000 $15,000,000 $10,000,000 $5,000,000 $0 $24,978,020 $9,783,020

Deposits $3,000,000 $2,500,000 $2,000,000 $1,500,000 $1,000,000 $500,000 $0 $2,712,023 $969,323

Loan Origination $400,000 $350,000 $300,000 $250,000 $200,000 $150,000 $100,000 $50,000 $0 $357,254 $77,419

Fee Income

MD Branches

“New VA” Branches

Branch Network

Our branch network is well positioned in the Greater Baltimore, Suburban Washington and Richmond market areas

CONSUMER LENDING

Eric Dawes

Managing Director, Consumer Lending Division

Core Competency

Quality products with very competitive pricing.

Streamlined home equity approval to closing process.

Effective delivery channels with home equity expertise.

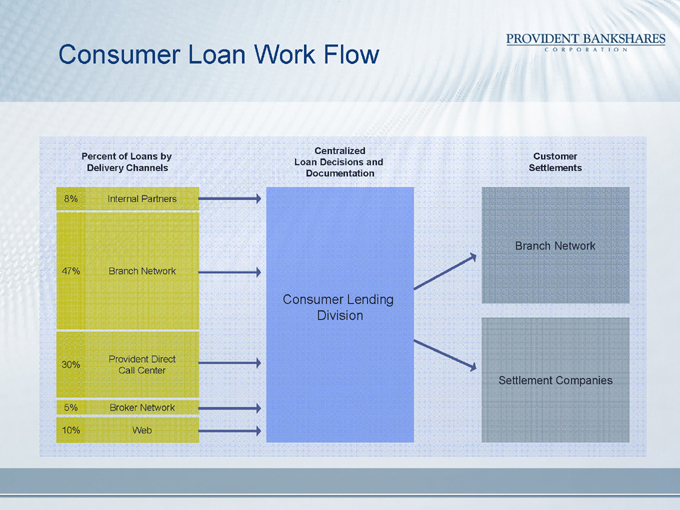

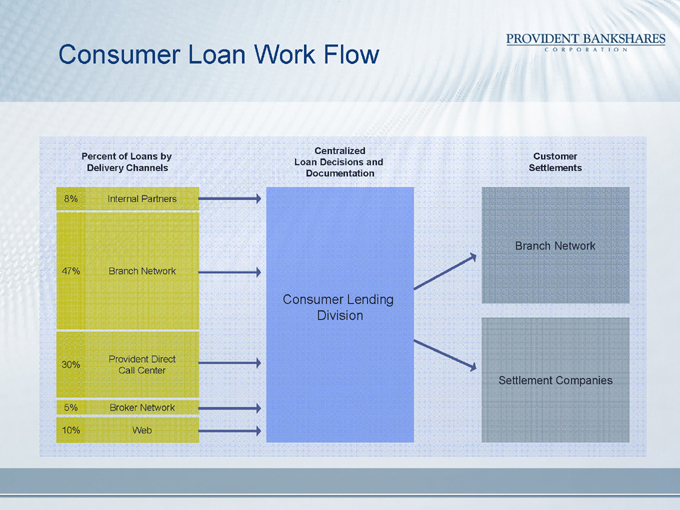

Consumer Loan Work Flow

Percent of Loans by Delivery Channels

8% Internal Partners

47% Branch Network

Provident Direct

30%

Call Center

5% Broker Network

10% Web

Centralized Loan Decisions and Documentation

Consumer Lending Division

Customer Settlements

Branch Network

Settlement Companies

Core Competency

Loan Field Specialist

Ability to quickly respond to changing market conditions

Real estate market knowledge

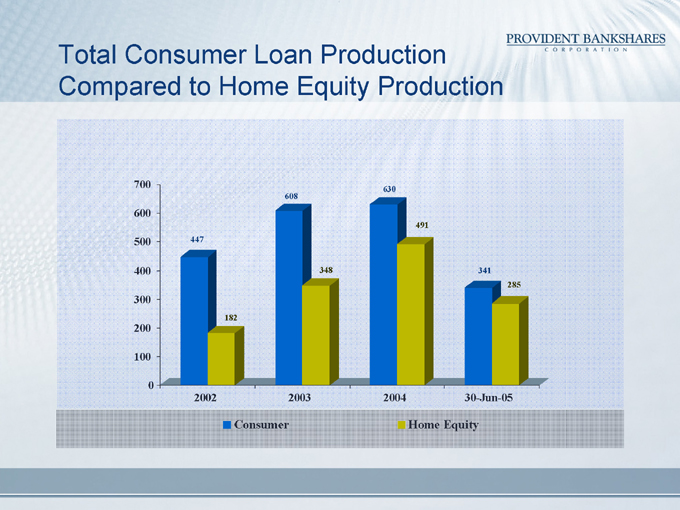

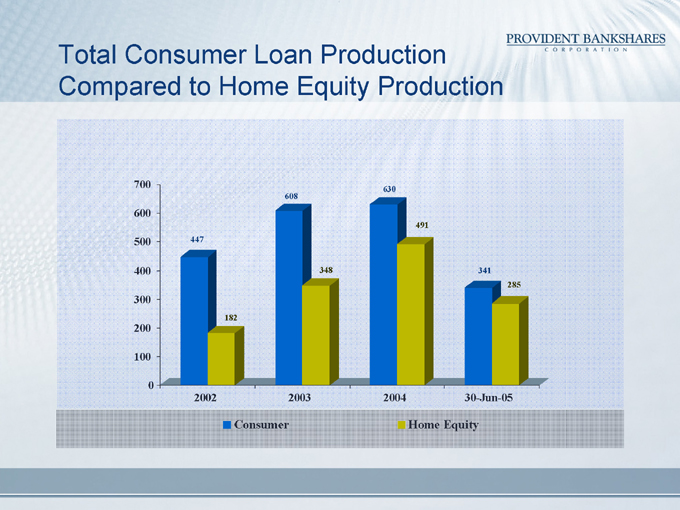

Total Consumer Loan Production Compared to Home Equity Production

700 600 500 400 300 200 100 0

2002 2003 2004 30-Jun-05

447

182

608

348

630

491

341

285

Consumer

Home Equity

Market Opportunities

Housing market growth

Introduction of new home equity products and services

Total Home Equity (fixed line/loan) Home Equity Retention Program

Virginia Market Opportunities

Northern VA focus.

PNC has entered the D.C. metro market with acquisition of Riggs.

Track 10 bank competitors with branch offices that we compete with for home equity loans.

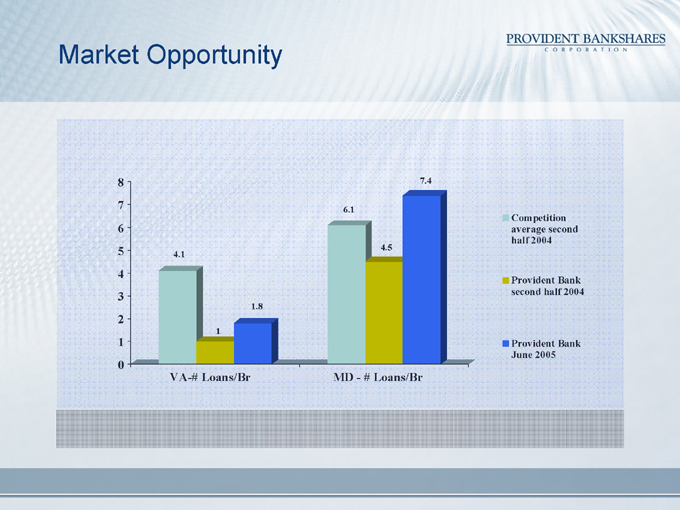

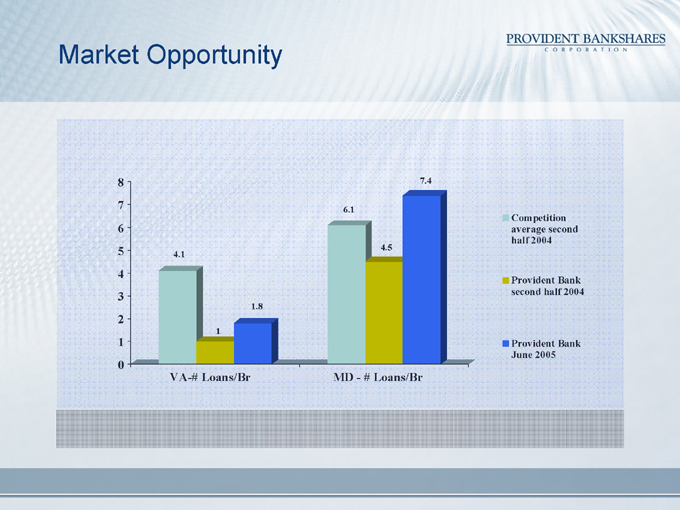

Market Opportunity

8 7 6 5 4 3 2 1 0

4.1

1

1.8

VA-# Loans/Br

6.1

4.5

7.4

MD - # Loans/Br

Competition average second half 2004

Provident Bank second half 2004

Provident Bank June 2005

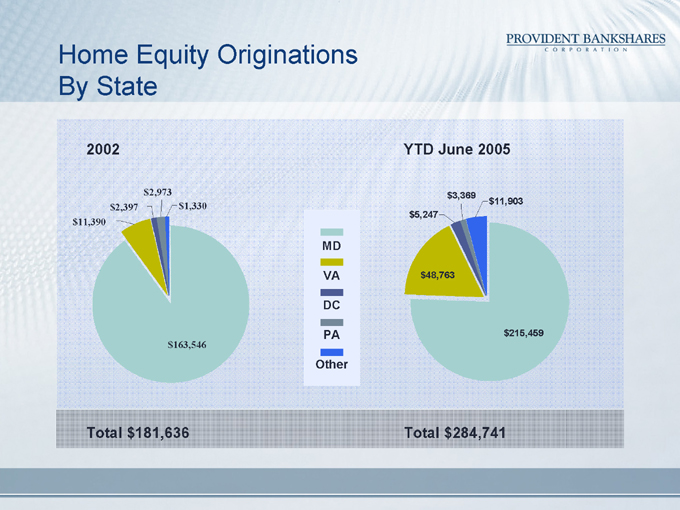

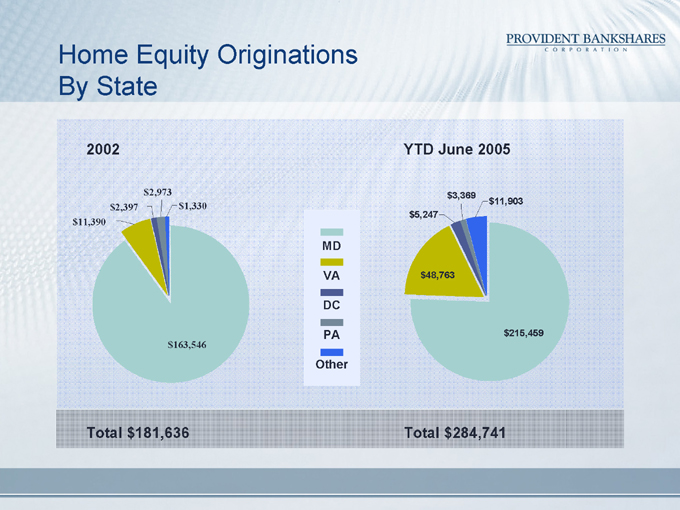

Home Equity Originations By State

2002 $11,390 $2,397 $2,973 $1,330 $163,546

MD

VA

DC

PA

Other

YTD June 2005 $5,247 $3,369 $11,903 $48,763 $215,459

Total $181,636

Total $284,741

Competitive Advantage

Excellent branch distribution Best home equity rate guidelines

89% loan to value ratio

45% debit to income ratio

$25,000 minimum loan approval

660> FICO score

An outstanding portfolio management practice

Portfolio Highlights

Average combined loan, line size = $86,000

Average booked LTV = 71%

Average booked debt to income ratio = 32%

Average FICO migration on existing portfolio = 736

Home equity dollar delinquencies = 38 BP

YTD 2005 net charge-offs are a net recovery

How We Will Better Execute Our Plan

Increase promotional spend

Improve technology

Increase branch support

Implement new product line

Second looks at all declined loans

CASH MANAGEMENT

John Goedeke

Senior Vice President / Division Head Commercial Services Division

Cash Management

History

Product offerings

Outsourcing

Cash Management

Sales Strategy

Customer service

Time sensitive services

Implementation team

Product Strategy

Reliable products

Moderately priced

Sweep accounts

Cash Management

Target Markets

Neglected relationships

Time sensitive services

Success story

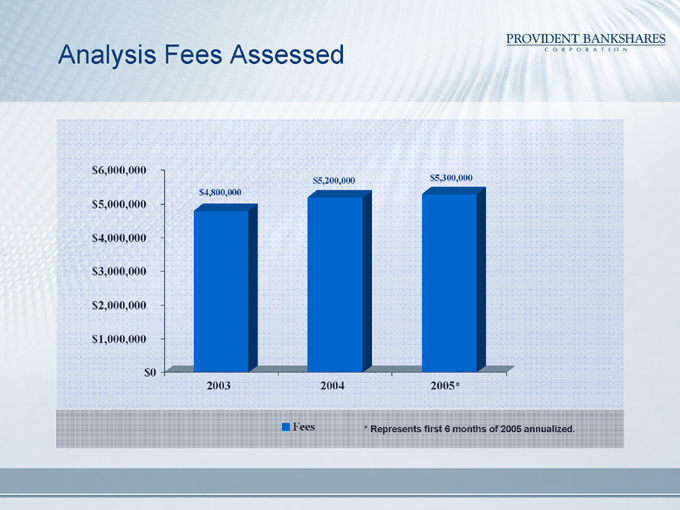

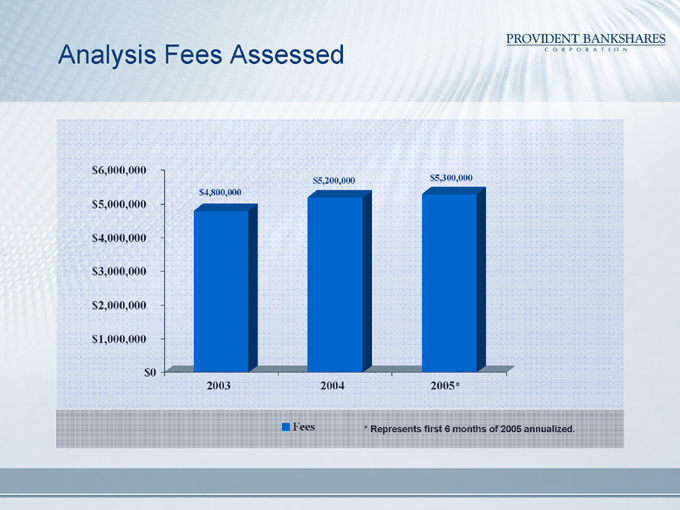

Analysis Fees Assessed

$6,000,000 $5,000,000 $4,000,000 $3,000,000 $2,000,000 $1,000,000 $0

2003 2004 2005* $4,800,000 $5,200,000 $5,300,000

Fees

* Represents first 6 months of 2005 annualized.

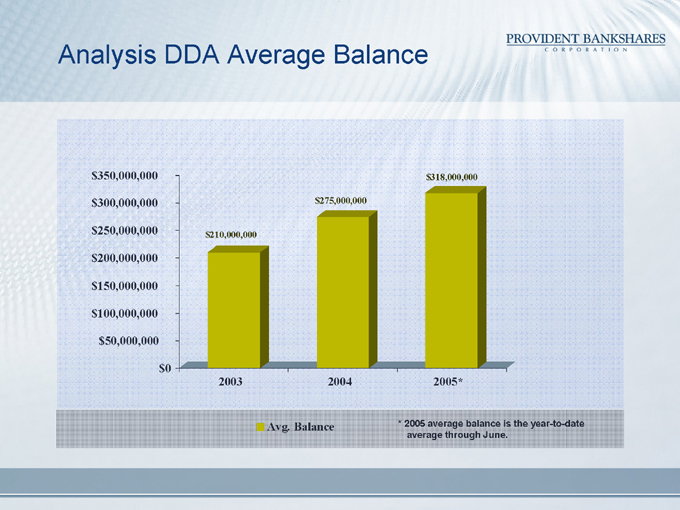

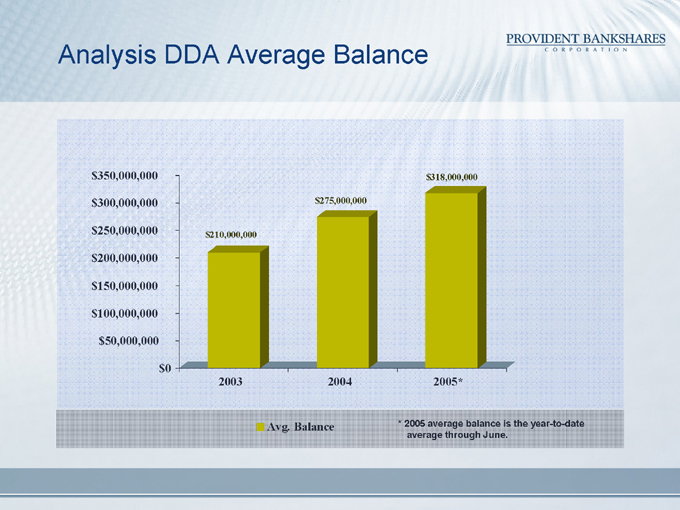

Analysis DDA Average Balance

$350,000,000 $300,000,000 $250,000,000 $200,000,000 $150,000,000 $100,000,000 $50,000,000 $0

2003 2004 2005* $210,000,000 $275,000,000 $318,000,000

Avg. Balance

* 2005 average balance is the year-to-date average through June.

Cash Management

New Initiatives

Product management

ARTS

Payroll processing strategic alliance

Rate strategies

Cash Management

New Initiatives

Sales

Management

Telephone sales

Automated Client Review

Sales training and proposal software

Virginia market potential

DEVELOPMENT OF REAL ESTATE

LENDING INTO NEW MARKETS

Cecilia Hodges

Managing Director

George Decker

Senior Vice President

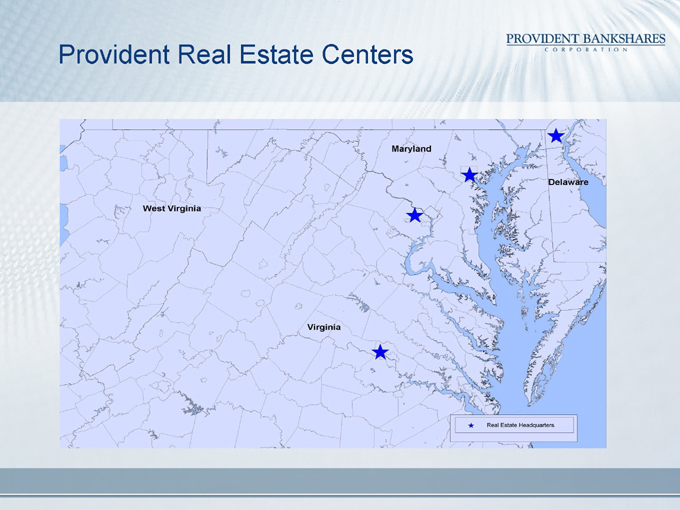

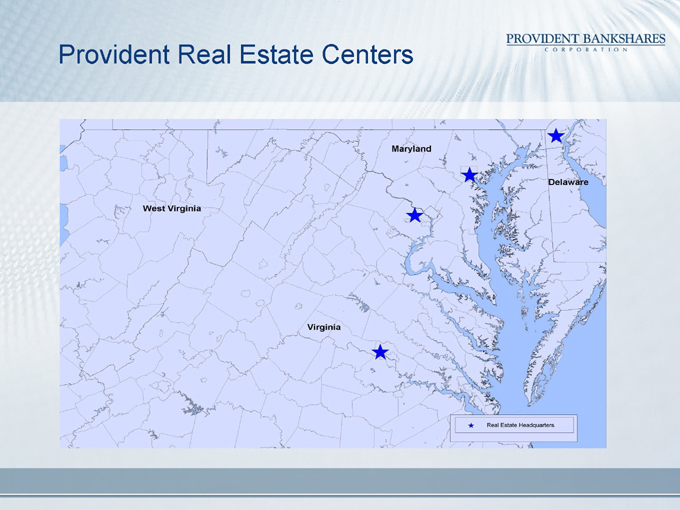

Provident Real Estate Centers

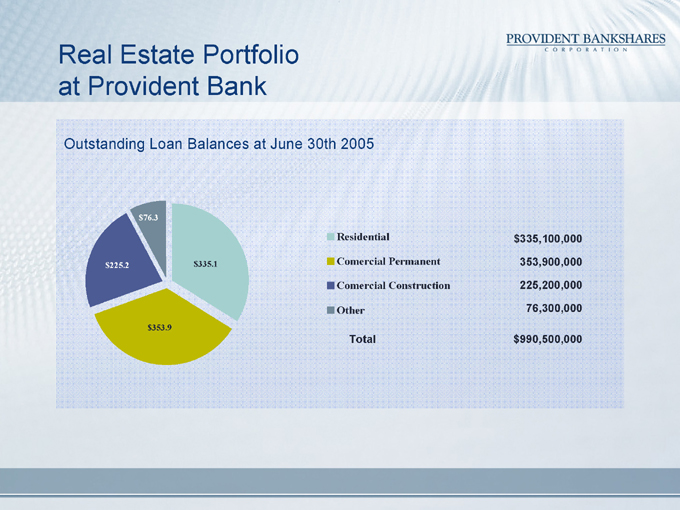

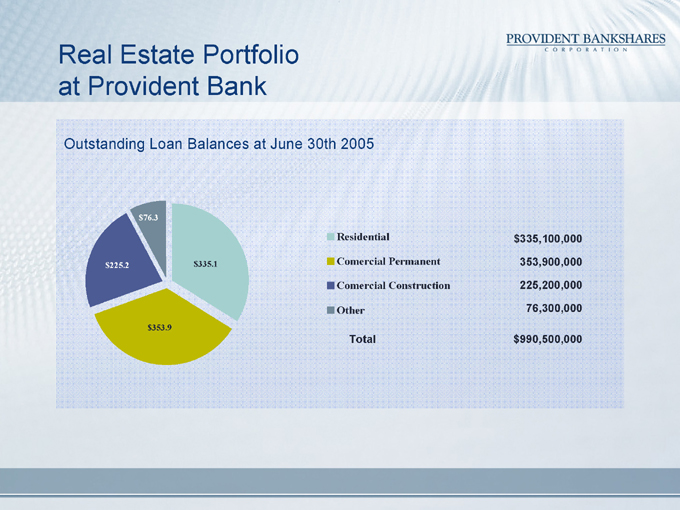

Real Estate Portfolio at Provident Bank

Outstanding Loan Balances at June 30th 2005 $225.2 $76.3 $335.1 $353.9

Residential $ 335,100,000

Comercial Permanent 353,900,000

Comercial Construction 225,200,000

Other 76,300,000

Total $ 990,500,000

Loan Outstandings

All Real Estate Lending Regions $1,000,000,000 $800,000,000 $600,000,000 $400,000,000 $200,000,000 $0

2002 2003 2004* 2005 YTD 6/30/05 $515,644,000 $616,900,000 $901,600,000 $990,500,000

* $ 109MM attributed to Southern Financial acquisition.

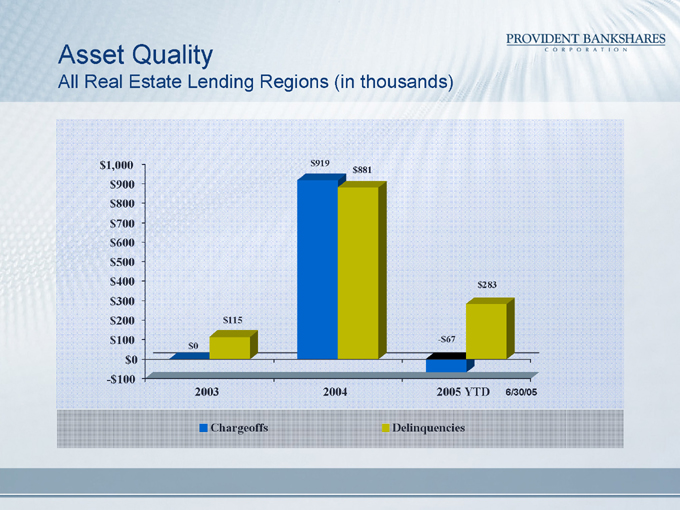

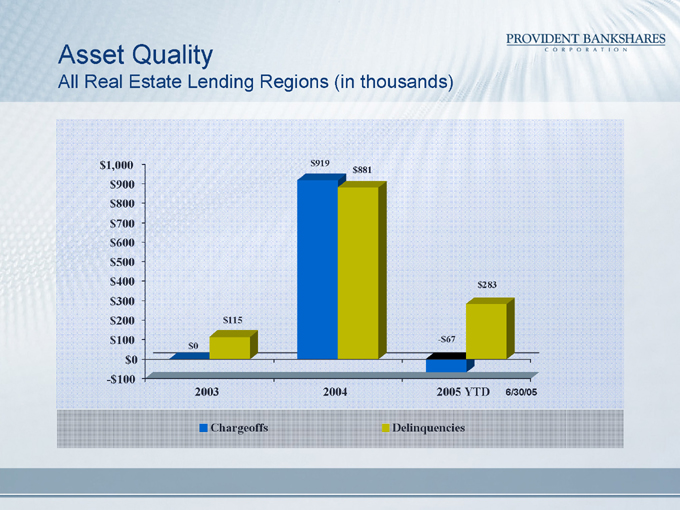

Asset Quality

All Real Estate Lending Regions (in thousands) $1,000 $900 $800 $700 $600 $500 $400 $300 $200 $100 $0

-$100

2003 2004 2005 YTD 6/30/05 $0 $115 $919 $881

-$67 $283

Chargeoffs

Delinquencies

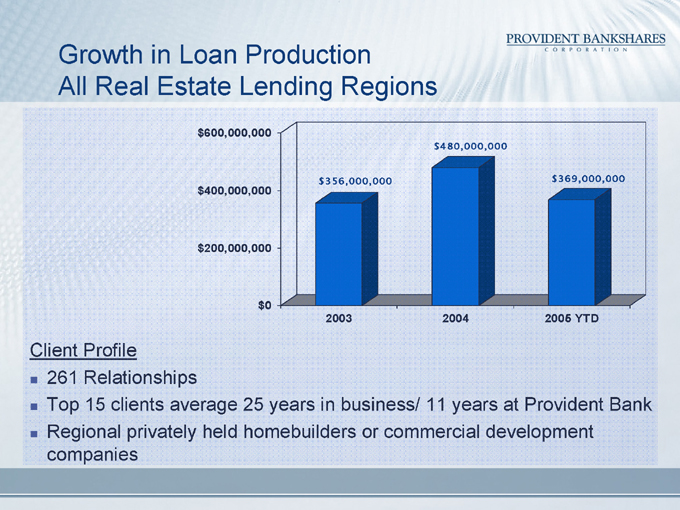

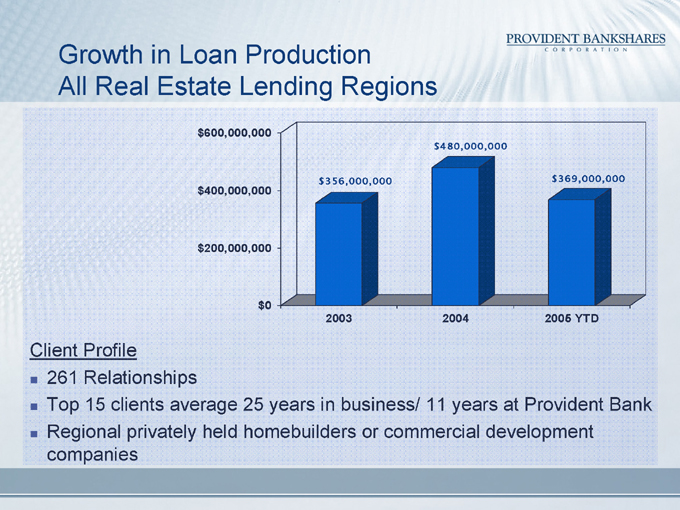

Growth in Loan Production All Real Estate Lending Regions $600,000,000 $400,000,000 $200,000,000 $0

2003 2004 2005 YTD $356,000,000 $480,000,000 $369,000,000

Client Profile

261 Relationships

Top 15 clients average 25 years in business/ 11 years at Provident Bank

Regional privately held homebuilders or commercial development companies

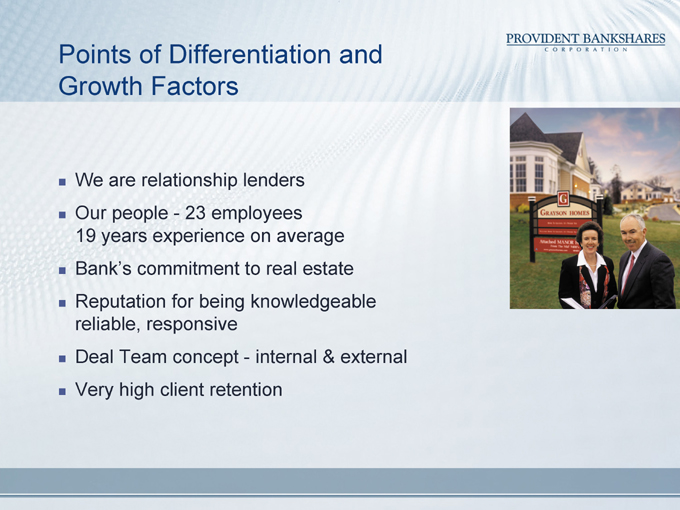

Points of Differentiation and Growth Factors

We are relationship lenders

Our people - 23 employees 19 years experience on average

Bank’s commitment to real estate

Reputation for being knowledgeable reliable, responsive

Deal Team concept - internal & external

Very high client retention

Cross Sell Deposit Growth

All Real Estate Lending Regions (in millions) $300 $250 $200 $150 $100 $50 $0

2003 2004 2005 YTD

6/30/05 $149.2 $226.0 $255.6

Virginia

Opportunities for Expansion

Additional opportunities in Washington Metro/DC Market

Central Virginia

Custom Homebuilder

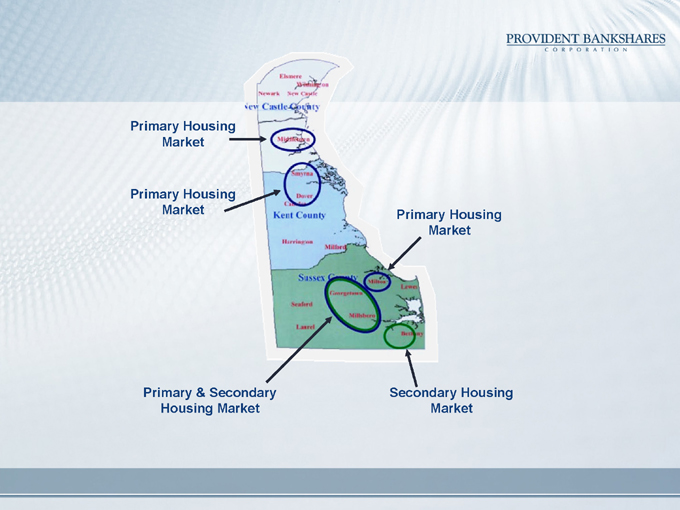

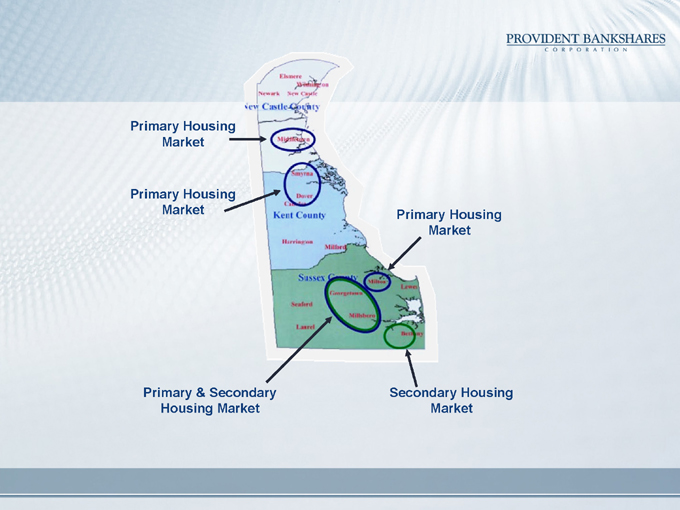

Primary Housing Market

Primary Housing Market

Primary & Secondary Housing Market

Secondary Housing Market

Primary Housing Market

Reasons to Lend in Delaware

Maryland homebuilder clients are active in Delaware

Delaware housing market is active

Delaware builders meet Provident client profile

Provident real estate lending success

Expected Results of Lending in Delaware

Ongoing/expansion source of real estate loans

Opportunity to increase loans with Maryland builders

Opportunity to bring new clients to Provident

RELATIONSHIP SALES CULTURE

John King

Group Manager Consumer Banking

Relationship Sales Culture

Why the change?

What is it?

Where are we?

Relationship Sales Culture

1993 Crossroads

Stagnant Growth

Savings Bank Carry Over

Relationship Sales Culture

1993 Evolution

HPC

In-Store

Exception Decisioning

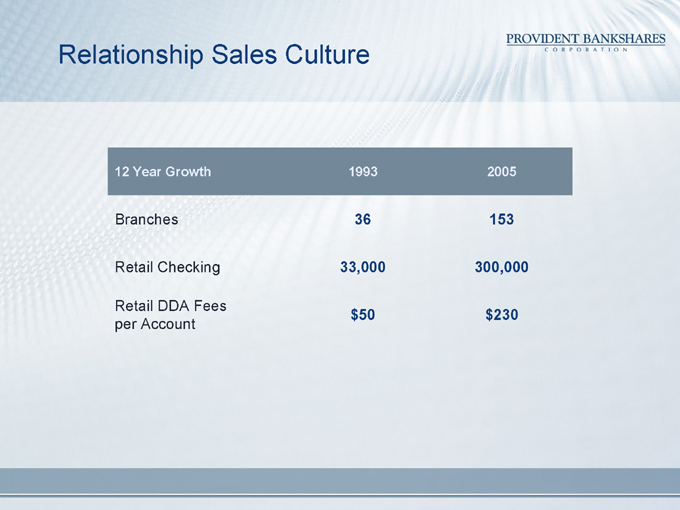

Relationship Sales Culture

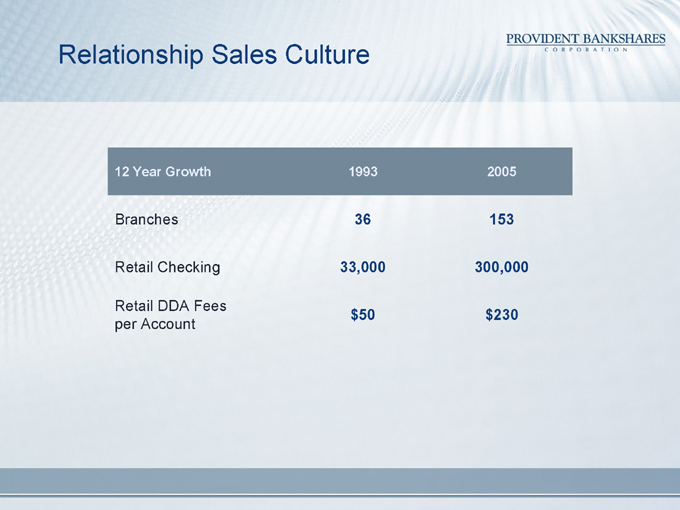

12 Year Growth 1993 2005

Branches 36 153

Retail Checking 33,000 300,000

Retail DDA Fees

$50 $230

per Account

Relationship Sales Culture

Today’s Crossroads

Free checking competition

Customer behavior changes

Efficiency needs

Product driven

Relationship Sales Culture

Households Provident Cross Sell

Retail 267,102 2.77

Small Business 23,773 2.23

Commercial 796 2.99

Real Estate 304 2.82

Relationship Sales Culture

How Do We Get There?

Spring 2004

Hired consultant to assess our environment by seeking employee input on issues

Summer 2004

40 Employees - Cross Divisional - 3 day offsite

Define how to achieve a Relationship Sales Culture

Fall-Winter 2004

6 Project Teams pursued ways to move toward a Relationship Sales Culture

Identified 60+ recommendations

Relationship Sales Culture

How Do We Get There?

Spring 2005

6 new teams were formed to evaluate and implement the recommendations

Every area of the bank is represented

A member of executive management is assigned to champion each team

Relationship Sales Culture

Teams

The Provident Way

Technology/Systems/Online Resources

Goals and Compensation

Staffing and Training

Policy and Procedure

Employee Resources

Relationship Sales Culture

Initiatives Completed

Relationship exception decision making

Prize patrols

Ads/commercials on intranet

Branch segmentation on intranet

Product representative at orientation

Communication/customer/service standards

Increased debit card limits

Relationship building incentives

Relationship Sales Culture

Initiatives In Process

Branch greeters

One-view screen

Sales referral card

Cultural training

‘Living the Provident Way’ video

Institutionalize success stories

Monthly mystery shops

Relationship Sales Culture

Defining Success

Short Term

Interdepartmental referrals

Recommendation implementation

Early trends on cross-sell, customer retention

Long Term

Interdepartmental referral goals and performance

Cross-sell goals

Customer retention goals

New customer attrition

Provident employee “poll”

Revenue growth

Relationship Sales Culture

Success Story

Relationship Sales Culture

Selling one additional product to a household with 1 product increases their retention from 83% to 92%

1 more to 400,000

SMALL BUSINESS

Rich Hunt

SVP / Division Head, Small Business

Jim Prusak

SVP, Consumer Banking Division

Strategy

To be the “Unparalleled Leader” in establishing and maintaining value-added relationships with the small business owners in our footprint, now and in the future

Definition of Small Business

Provident defines a Small Business as a company with revenues up to $5 million and credit requirements up to $1 million.

Opportunity

There are over 383,000 Small Businesses located in our Maryland and Virginia marketplace. Currently, Provident has relationships with only 7.8% of these businesses.

We have a huge opportunity to exploit.

Challenges

Focusing on cross sell, not just being a lender

Increased competition

Establishing effective partnerships both internally and externally

Centralized support and continued product enhancement

Effective delivery channels

Sales Philosophy

A business loan is not enough. Our sales force will go after the company’s entire banking relationship: business, owner and employees.

Developing relationships through persistent cross-selling is our standard for excellence.

Delivery Channels

How it all fits together

Relationship Managers

Commercial Branch Managers

Small Business Financial Consultants (Provident Direct Call Center Team)

Branch Managers

Right Size Bank - Providing the small business customer with choices

Partnerships

Small Business Division H/R TRAINING

COLLECTIONS

MARKETING

CREDIT

CASH MANAGEMENT

CONSUMER

LENDING

COMMUNITY

BANKING

Branches

PIC

COURT SQUARE LEASING

COMMERCIAL

MIDDLE MARKET

COMMERCIAL

BRANCHES

PROVIDENT

DIRECT

LEGEND

SMALL BUSINESS SUPPORT

SMALL BUSINESS PARTNER

Branch Banking’s Small

Business Focus… Why are we having one

30,000 Small Business Customers

Importance of deepening these relationships:

The average small business customer life span with a bank is 7 years.

Increase customer loyalty by focusing on life cycle of business owner (it’s not just about commercial).

Capitalize on our branch network to deliver small business products to customer.

Small Business Focus

Commercial Branches

12 Commercial Branches in the Network

What is a Commercial Manager?

What is a Commercial Branch?

Small Business 2005

InitiativesWhat we have done to date

HUGS Phase 1

Commercial Call Training

Branch Network Referral Program

Business Plus Line

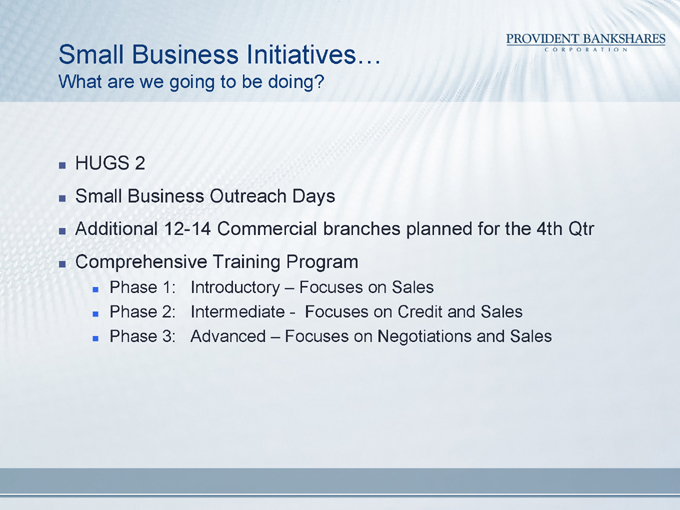

Small Business Initiatives…

What are we going to be doing?

HUGS 2

Small Business Outreach Days

Additional 12-14 Commercial branches planned for the 4th Qtr

Comprehensive Training Program

Phase 1: Introductory – Focuses on Sales

Phase 2: Intermediate - Focuses on Credit and Sales

Phase 3: Advanced – Focuses on Negotiations and Sales

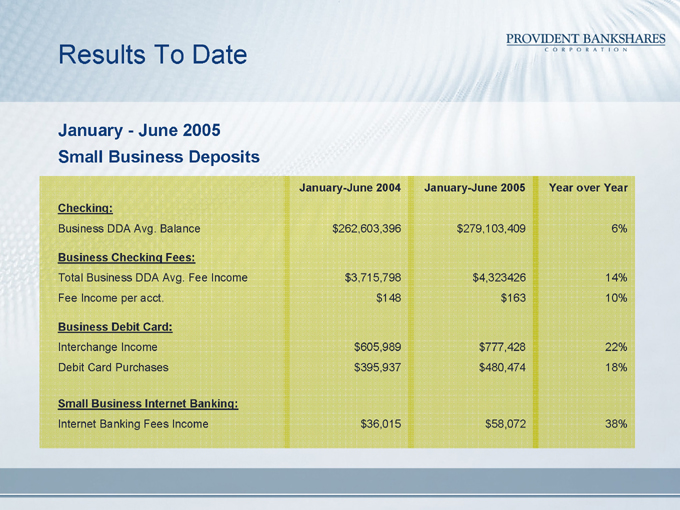

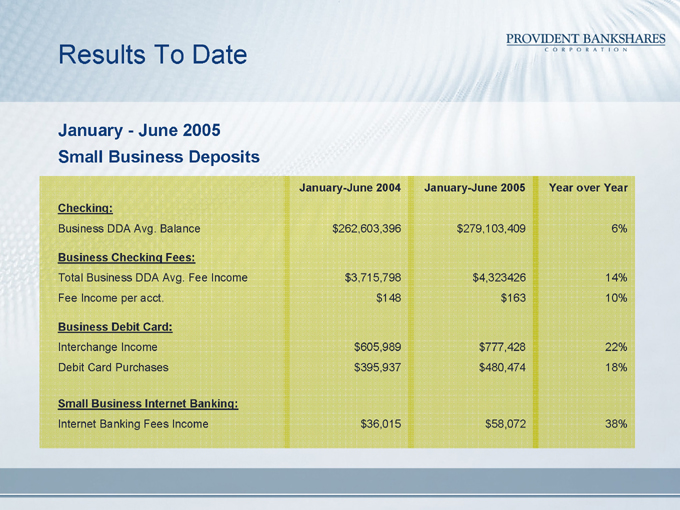

Results To Date

January - June 2005 Small Business Deposits

January-June 2004 January-June 2005 Year over Year

Checking:

Business DDA Avg. Balance $262,603,396 $279,103,409 6%

Business Checking Fees:

Total Business DDA Avg. Fee Income $3,715,798 $4,323426 14%

Fee Income per acct. $148 $163 10%

Business Debit Card:

Interchange Income $605,989 $777,428 22%

Debit Card Purchases $395,937 $480,474 18%

Small Business Internet Banking:

Internet Banking Fees Income $36,015 $58,072 38%

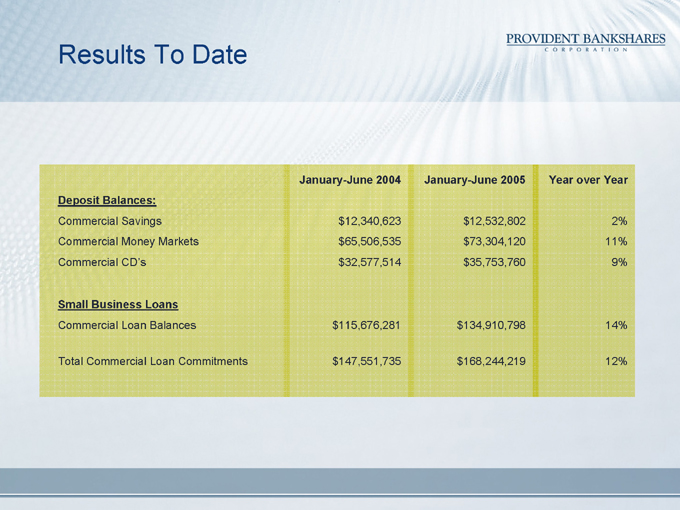

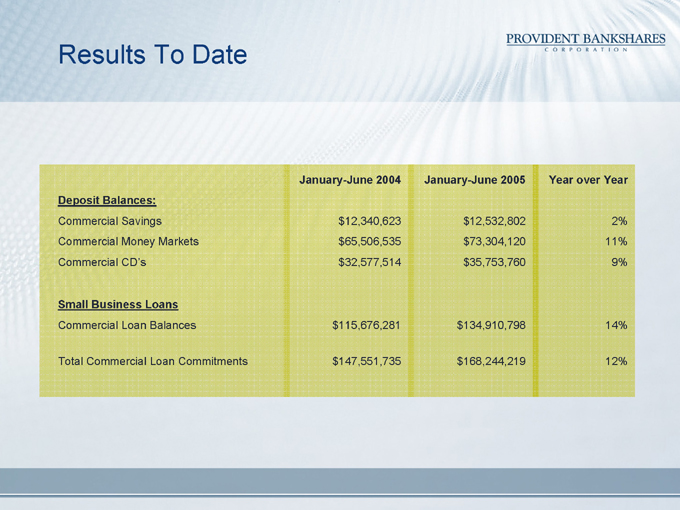

Results To Date

January-June 2004 January-June 2005 Year over Year

Deposit Balances:

Commercial Savings $12,340,623 $12,532,802 2%

Commercial Money Markets $65,506,535 $73,304,120 11%

Commercial CD’s $32,577,514 $35,753,760 9%

Small Business Loans

Commercial Loan Balances $115,676,281 $134,910,798 14%

Total Commercial Loan Commitments $147,551,735 $168,244,219 12%

NEW PRODUCTS/SERVICES AND

ADVERTISING STRATEGIES

Lillian Suffolk Kilroy

Chief Marketing Officer & Managing Director, Consumer Products

New Products 2005 / 2006

Total Home Equity

Direct Deposit Payroll Partnership

ARTS

Business Plus Credit Products

Health Savings Accounts

Benefit Banking Relationship Pricing

Health Savings Accounts

Product Definition

H.S.A. Accounts

Individually owned tax-favored account

Funds pay for current medical expenses

Provident H.S.A.

Interest checking, competitive rates and online access

Debit card access for purchases and ATM

Health Savings Accounts

Product Definition

H.S.A. Accounts

Provident H.S.A.

Funds saved for future qualified expenses

Works with High Deductible Health Plan

Competitive interest rates, brokerage option

Available through Provident Insurance Network

Health Savings Accounts

Target Market

Small businesses <25 employees

Professional firms

Partnerships

Individuals

Forrester Research estimates H.S.A. plans will attract 22 million workers — 12% of commercially insured market — by 2008

Health Savings Accounts

Market Opportunity

Direct Sales

30,000 Provident Small Business customers

Focused calling program

Joint HDHC/H.S.A. sales opportunity

Broker Sales

Negotiations with Maryland/Virginia TPAs

Product line extensions

Benefit Banking

Overall Strategy

Relationship pricing program that rewards customers who have their primary banking relationship at Provident with the best rates on products and services.

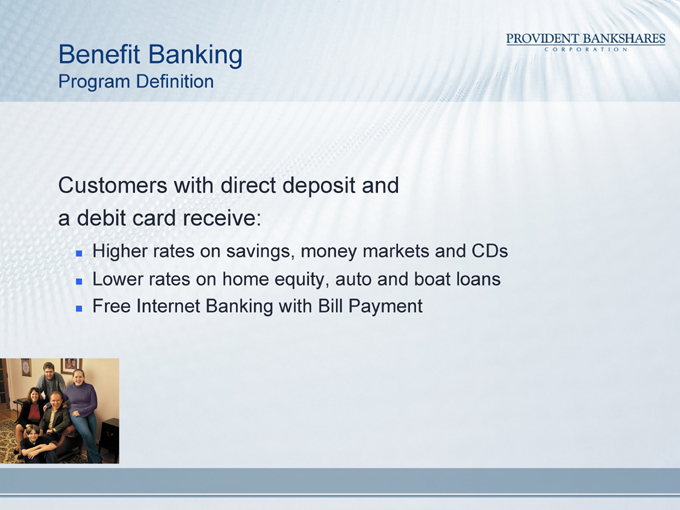

Benefit Banking

Program Definition

Customers with direct deposit and a debit card receive:

Higher rates on savings, money markets and CDs

Lower rates on home equity, auto and boat loans

Free Internet Banking with Bill Payment

Benefit Banking

Program Objectives

Make Provident the primary bank for more customers

Increase customer profitability

Grow customer wallet share

Increase customer retention

Benefit Banking

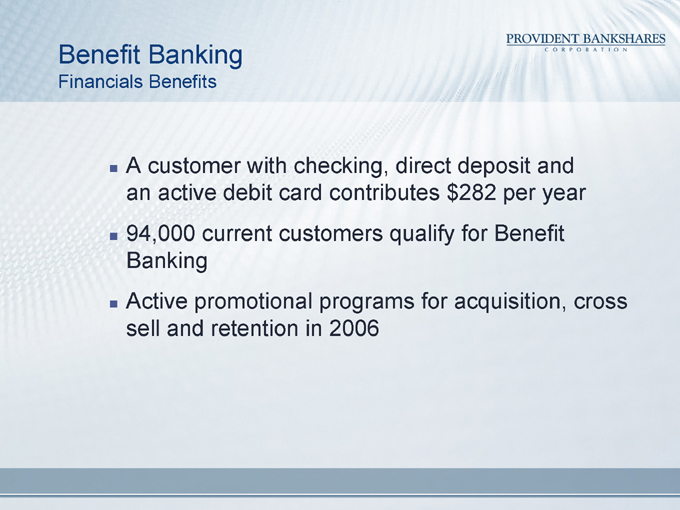

Financials Benefits

A customer with checking, direct deposit and an active debit card contributes $282 per year

94,000 current customers qualify for Benefit Banking

Active promotional programs for acquisition, cross sell and retention in 2006

Provident Bank

Just the Right Size for You

Brand Position

Conveniently deliver the product/service depth and breath of big banks

With personal attention, market expertise and attention to detail provided by only the best community banks

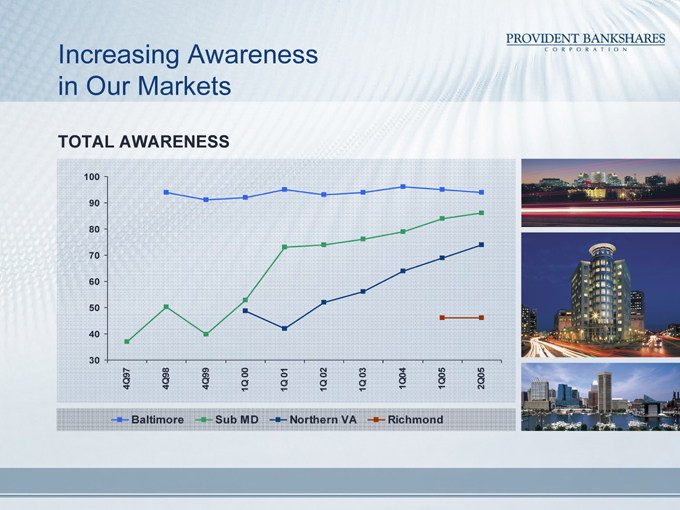

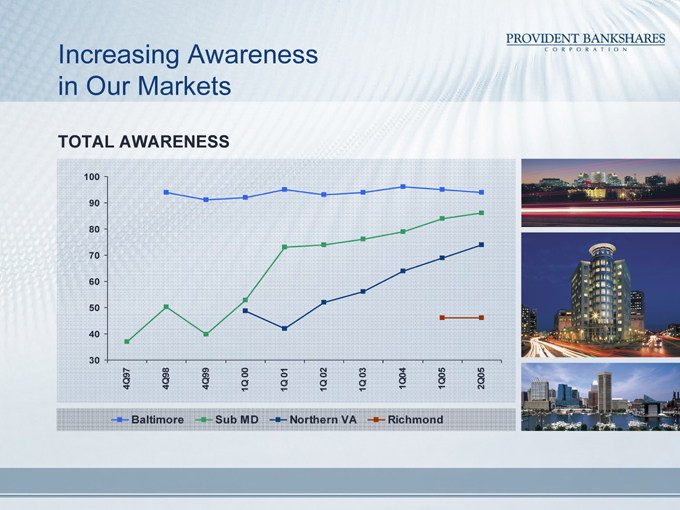

Increasing Awareness in Our Markets

TOTAL AWARENESS

100 90 80 70 60 50 40 30

4Q97 4Q98 4Q99 1Q 00 1Q 01 1Q 02 1Q 03 1Q04 1Q05 2Q05

Baltimore

Sub MD

Northern VA

Richmond

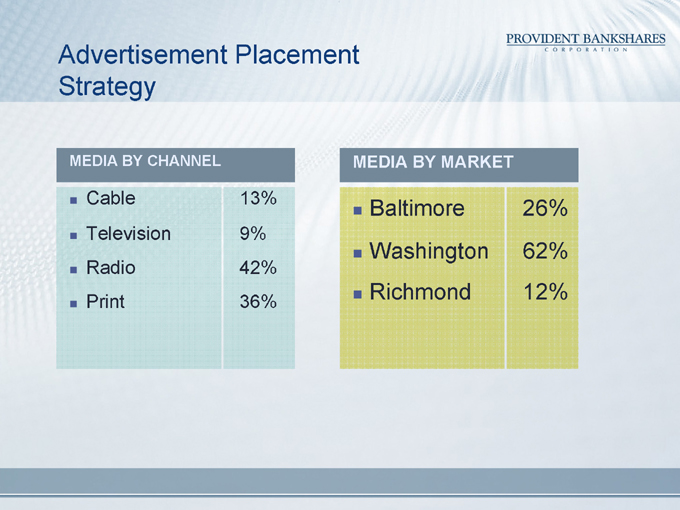

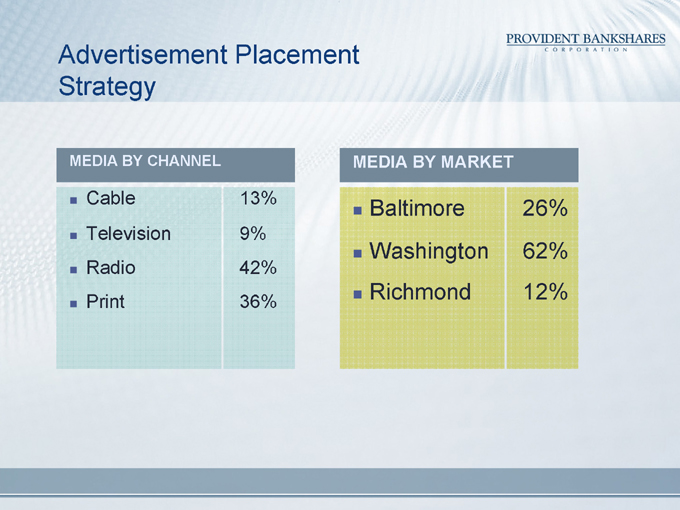

Advertisement Placement Strategy

MEDIA BY CHANNEL

MEDIA BY MARKET

Cable 13%

Television 9%

Radio 42%

Print 36%

Baltimore 26%

Washington 62%

Richmond 12%

It All Works In Concert

PROVIDENT BANKSHARES CORPORATION

www.provbank.com

Contact

Media: Lillian Kilroy (410) 277-2833

Investment Community: Melissa Kelly (410) 277-2080