Exhibit 99.2

PROVIDENT BANKSHARES CORPORATION

November 2006

FORWARD-LOOKING STATEMENTS AND RISK FACTORS

This presentation contains “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties, which may cause results to differ materially from those set forth in the statements. The forward-looking statements may include statements regarding business strategies, intended results and future performance. Forward-looking statements are preceded by such terms as “expects,” “believes,” “anticipates,” “intends,” and similar expressions. No forward-looking statement can be guaranteed, and actual results may differ materially from those projected. The Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise. Forward-looking statements in this presentation should be evaluated together with the uncertainties that affect the Company’s business, particularly those mentioned under the headings “Forward-looking Statements” and “Item 1A. Risk Factors” in the Company’s Form 10-K for the year ended December 31, 2005, and in its reports on Form 10-Q and Form 8-K, which the Company incorporates by reference.

In the event that any non-GAAP financial information is described in any communication, including this presentation, please refer to the supplemental financial tables included on our website for the GAAP reconciliation of this information.

Agenda

Introduction Regional Overview Key Strategies Financial Performance

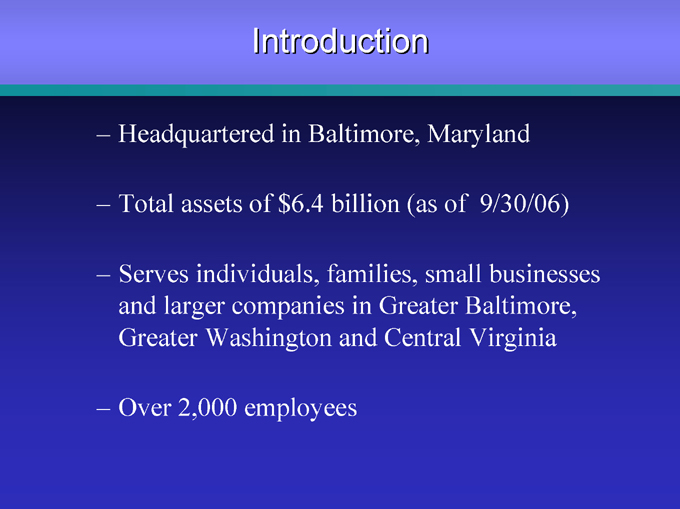

Introduction

Headquartered in Baltimore, Maryland

Total assets of $6.4 billion (as of 9/30/06)

Serves individuals, families, small businesses and larger companies in Greater Baltimore, Greater Washington and Central Virginia

Over 2,000 employees

Introduction

Provident Bank History

1886 Founded as a Mutual Thrift 1987 Converted to Commercial Bank 1993 Retail Banking Expansion 1997 Citizen’s Savings Bank Merger 2004 Southern Financial Merger

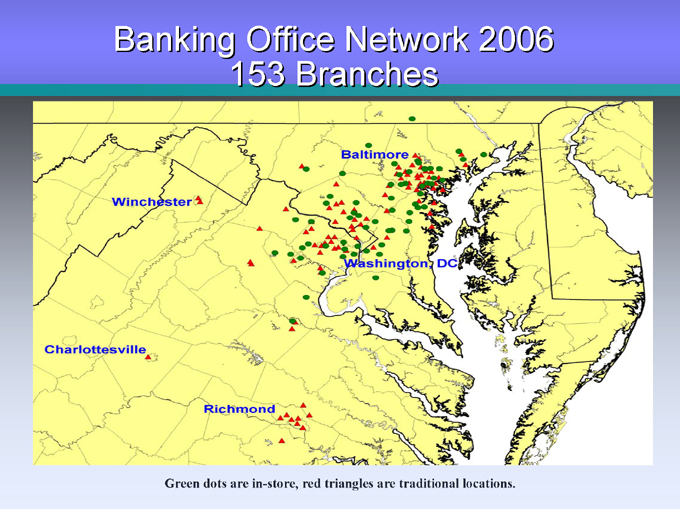

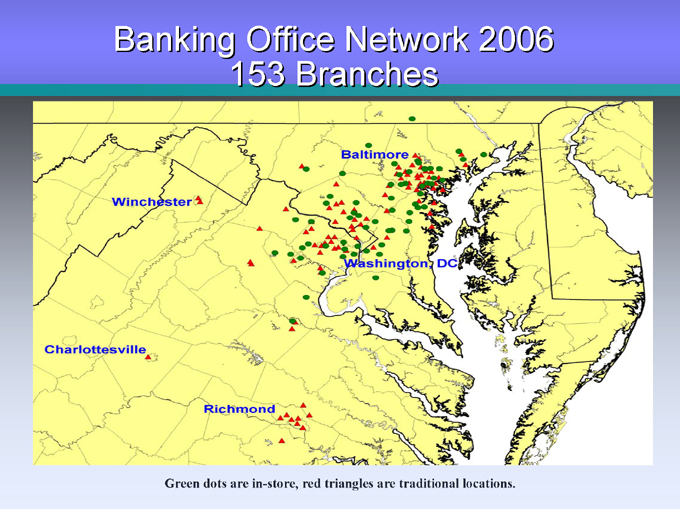

Banking Office Network 2006 153 Branches

Winchester

Baltimore

Richmond

Charlotteville

Washington DC

Green dots are in-store, red triangles are traditional locations.

Regional Overview

National Growth Markets

Seattle (6.32%)

Portland (8.68%)

Reno (14.55%)

San Francisco (4.33%)

Los Angeles (5.28%)

Phoenix (16.27%)

Boise (15.42%)

Salt Lake City (8.62%) Denver (10.32%)

Minneapolis (8.86%)

Columbus (10.80%)

Concord (8.38%)

Washington D.C. (10.83%)

Nashville (10.38%)

Atlanta (16.61%)

Orlando (18.58%)

Miami (9.24%)

Dallas (13.86%)

Houston (14.96%)

San Antonio (9.96%)

Top Quartile Growth Markets

Provident Bankshares

NY002HT3_1.wor

Source: SNL Financial. Shaded counties represent top quartile markets based on projected population growth.

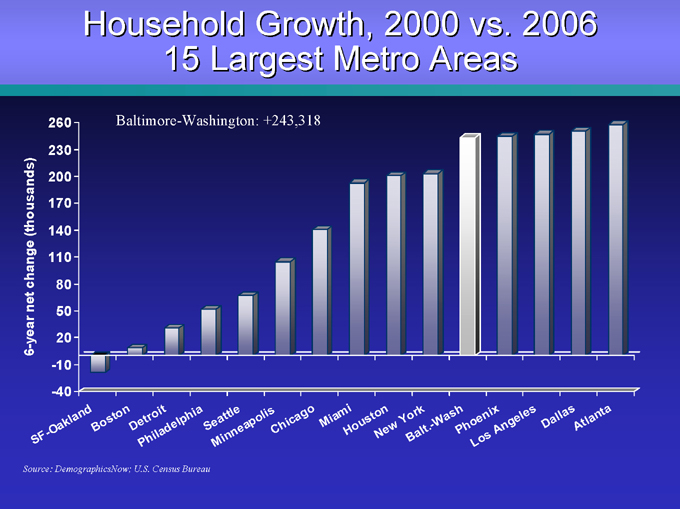

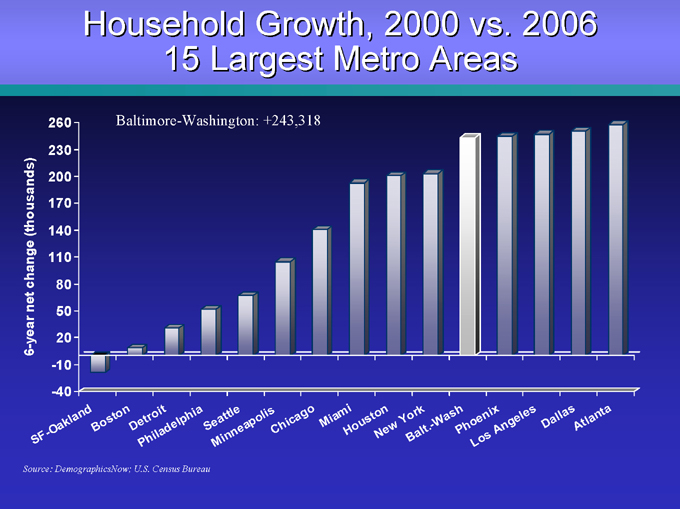

Household Growth, 2000 vs. 2006 15 Largest Metro Areas

Baltimore-Washington: +243,318

260 230 200 170 140 110 80 50 20 -10 -40

SF-Oakland

Boston

Detroit

Philadelphia

Seattle

Minneapolis

Chicago

Miami

Houston

New York

Balt.-Wash

Phoenix

Los Angeles

Dallas

Atlanta

Baltimore-Washington: +243,318

6-year net change (thousands)

Source: DemographicsNow; U.S. Census Bureau

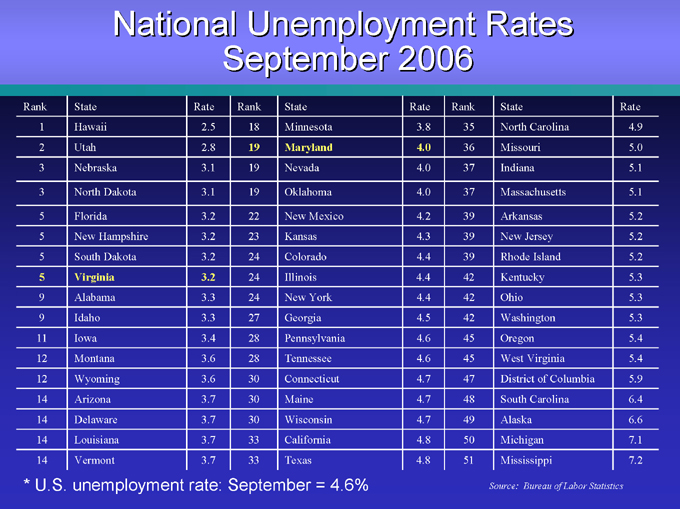

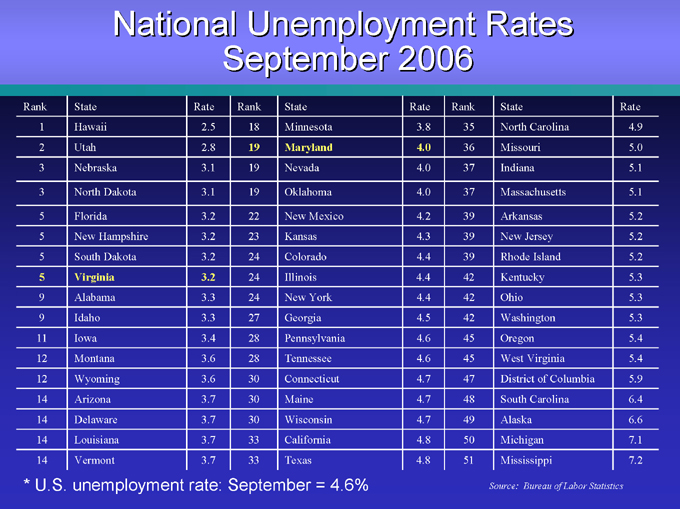

National Unemployment Rates September 2006

Rank State Rate Rank State Rate Rank State Rate

1 | | Hawaii 2.5 18 Minnesota 3.8 35 North Carolina 4.9 |

2 | | Utah 2.8 19 Maryland 4.0 36 Missouri 5.0 |

3 | | Nebraska 3.1 19 Nevada 4.0 37 Indiana 5.1 |

3 | | North Dakota 3.1 19 Oklahoma 4.0 37 Massachusetts 5.1 |

5 | | Florida 3.2 22 New Mexico 4.2 39 Arkansas 5.2 |

5 | | New Hampshire 3.2 23 Kansas 4.3 39 New Jersey 5.2 |

5 | | South Dakota 3.2 24 Colorado 4.4 39 Rhode Island 5.2 |

5 | | Virginia 3.2 24 Illinois 4.4 42 Kentucky 5.3 |

9 Alabama 3.3 24 New York 4.4 42 Ohio 5.3

9 Idaho 3.3 27 Georgia 4.5 42 Washington 5.3

11 Iowa 3.4 28 Pennsylvania 4.6 45 Oregon 5.4

12 Montana 3.6 28 Tennessee 4.6 45 West Virginia 5.4

12 Wyoming 3.6 30 Connecticut 4.7 47 District of Columbia 5.9

14 Arizona 3.7 30 Maine 4.7 48 South Carolina 6.4

14 Delaware 3.7 30 Wisconsin 4.7 49 Alaska 6.6

14 Louisiana 3.7 33 California 4.8 50 Michigan 7.1

14 Vermont 3.7 33 Texas 4.8 51 Mississippi 7.2

* | | U.S. unemployment rate: September = 4.6% |

Source: Bureau of Labor Statistics

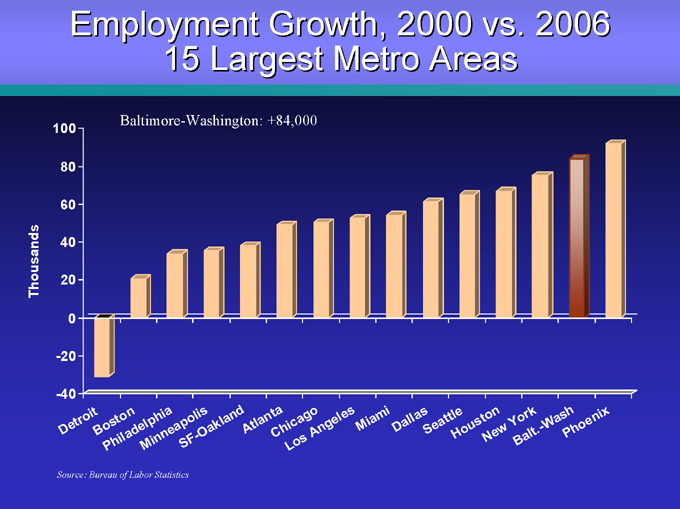

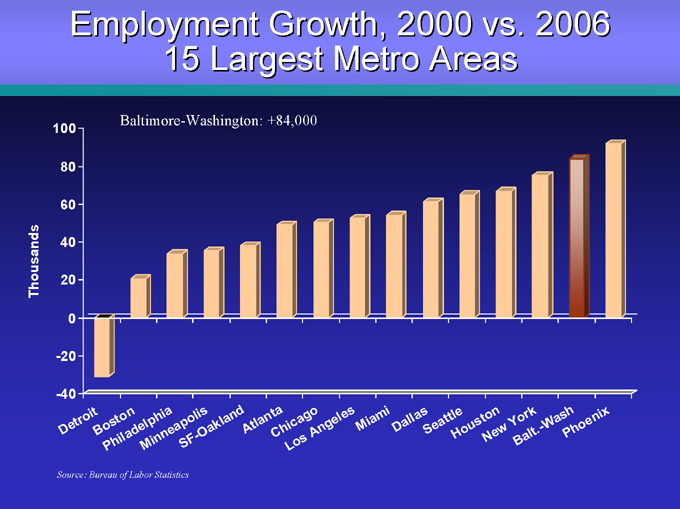

Employment Growth, 2000 vs. 2006 15 Largest Metro Areas

Baltimore-Washington: +84,000

100 80 60 40 20 0 -20 -40

Detroit

Boston

Philadelphia

Minneapolis

SF-Oakland

Atlanta

Chicago

Los Angeles Miami Dallas Seattle Houston New York Balt.-Wash Phoenix

Thousands

Source: Bureau of Labor Statistics

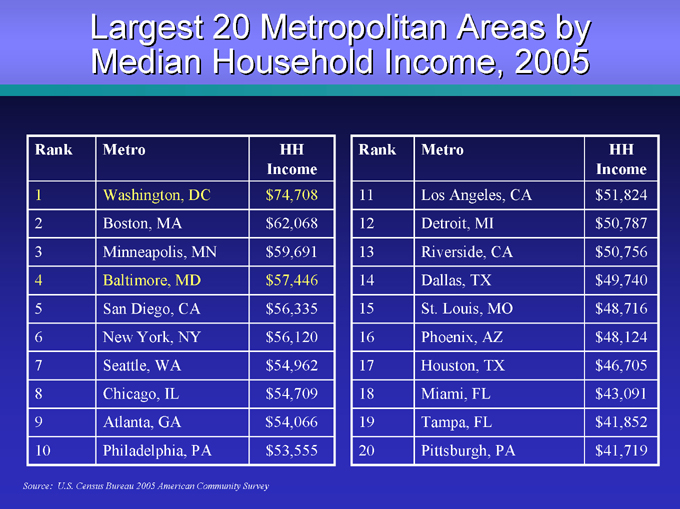

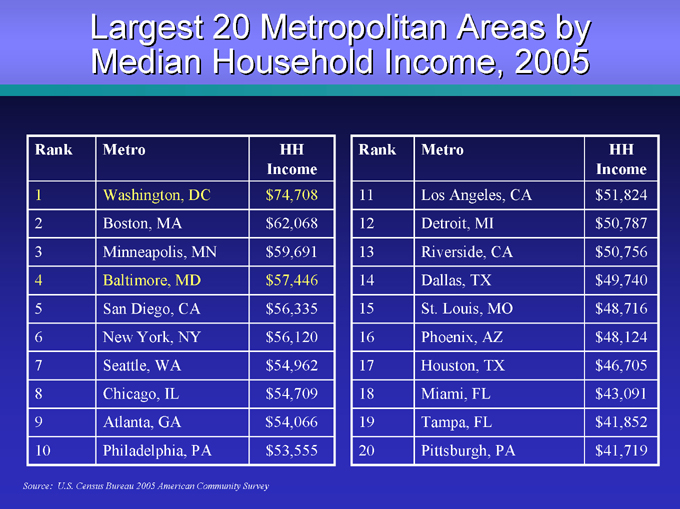

Largest 20 Metropolitan Areas by Median Household Income, 2005

Rank Metro HH

Income

1 | | Washington, DC $ 74,708 |

3 | | Minneapolis, MN $ 59,691 |

9 Atlanta, GA $ 54,066

10 Philadelphia, PA $ 53,555

Rank Metro HH

Income

11 Los Angeles, CA $ 51,824

12 Detroit, MI $ 50,787

13 Riverside, CA $ 50,756

14 Dallas, TX $ 49,740

15 St. Louis, MO $ 48,716

16 Phoenix, AZ $ 48,124

17 Houston, TX $ 46,705

18 Miami, FL $ 43,091

19 Tampa, FL $ 41,852

20 Pittsburgh, PA $ 41,719

Source: U.S. Census Bureau 2005 American Community Survey

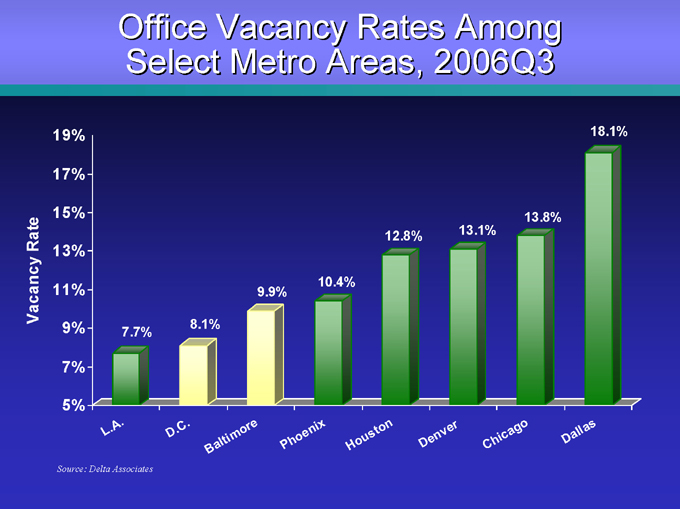

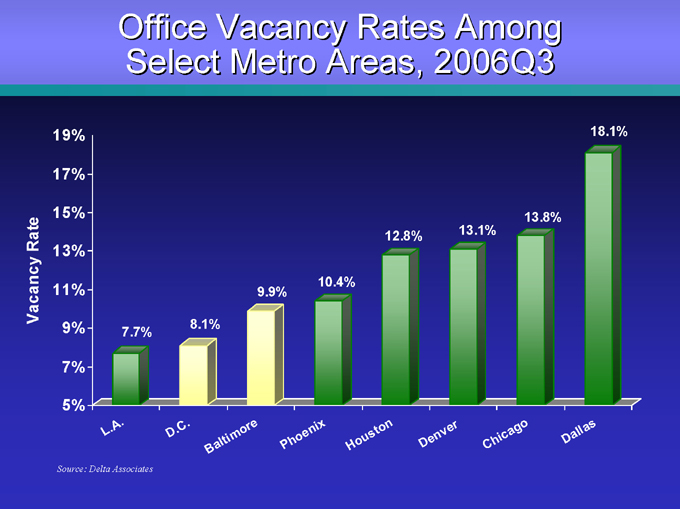

Office Vacancy Rates Among Select Metro Areas, 2006Q3

18.1%

13.8%

12.8% 13.1%

10.4% 9.9%

8.1% 7.7%

19% 17% 15% 13% 11% 9% 7% 5%

Vacancy Rate

Source: Delta Associates

L.A.D.C.BaltimorePhoenixHoustonDenverChicagoDallas

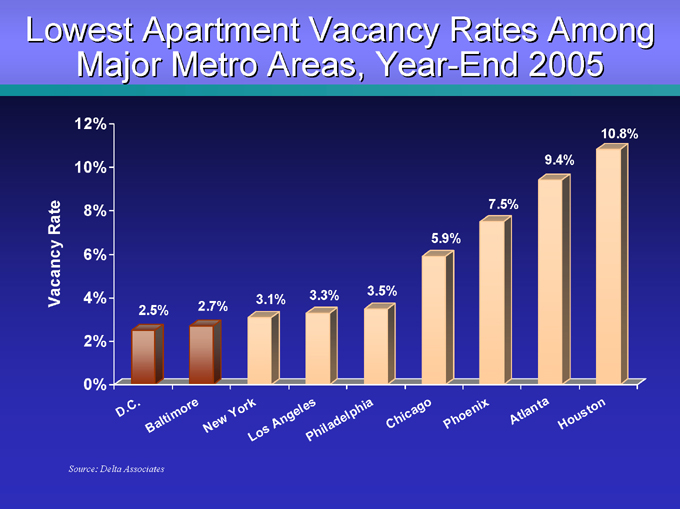

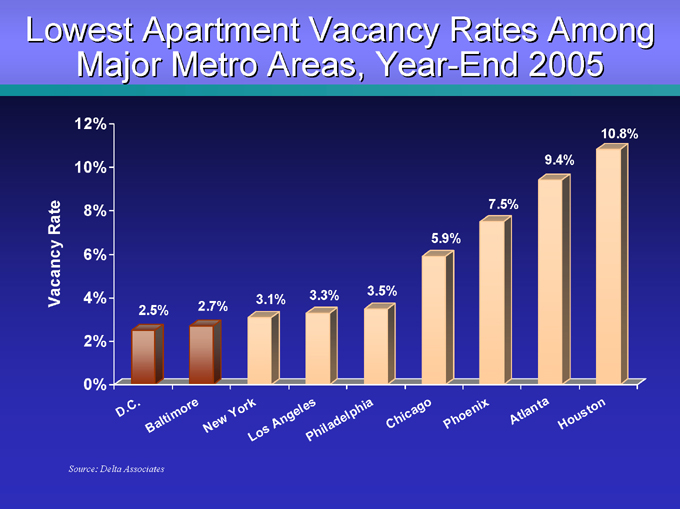

Lowest Apartment Vacancy Rates Among Major Metro Areas, Year-End 2005

12% 10% 8%

6% 4% 2% 0%

Vacancy Rate

10.8% 9.4%

7.5%

5.9%

3.3% 3.5% 3.1% 2.5% 2.7%

D.C.

Baltimore

New York Los Angeles Philadelphia Chicago Phoenix Atlanta Houston

Source: Delta Associates

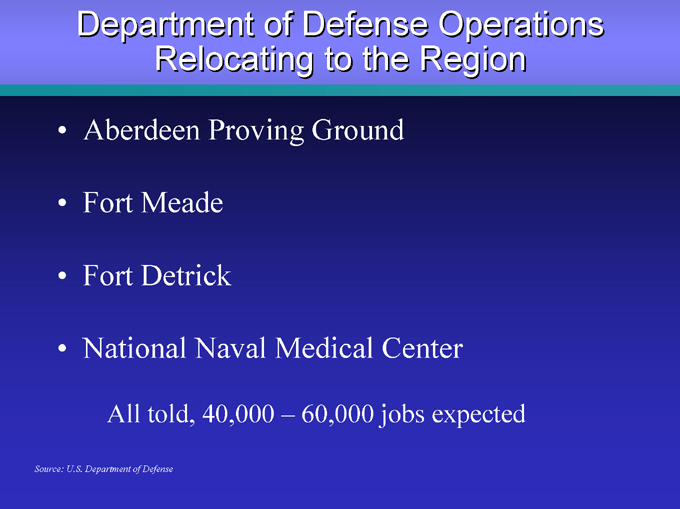

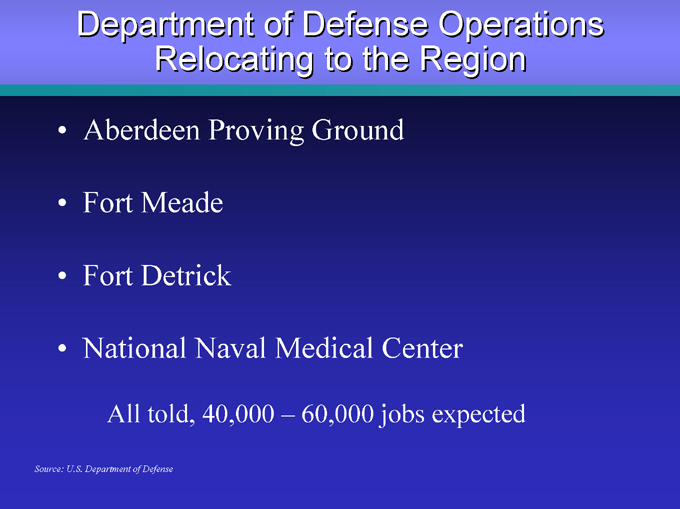

Department of Defense Operations Relocating to the Region

Aberdeen Proving Ground Fort Meade Fort Detrick National Naval Medical Center

All told, 40,000 – 60,000 jobs expected

Source: U.S. Department of Defense

Introduction Provident Bank Mission

Provident Bank’s mission is to exceed customer expectations by delivering superior service, products and banking convenience. Every employee’s commitment to serve our customers in this fashion will establish Provident Bank as the primary bank of choice of individuals, families, small businesses and mid-sized companies throughout our chosen markets.

Introduction Provident Bank Core Values

Integrity Excellence Caring Partnership Results Driven

Strategic Priorities

Maximize Provident’s position as the ‘right size’ bank

Consistently execute a high performance, customer relationship focused sales culture

Sustain a culture that attracts and retains employees who provide the differentiating ‘Provident Way’ customer experience

Profitably grow and deepen customer relationships in all four key market segments: commercial, commercial real estate, small business and consumer

Expand delivery (branch and non-branch) within the footprint

Improve financial fundamentals

Provident Bank Positioning Strategy

We will continue to provide the products and services of our largest competitors, while delivering the level of service found in only the best community banks.

Strategic Priorities

Consistently execute a high performance customer relationship focused sales culture

Customer Relationship Strategy

Provident Bank’s vision is to be chosen as our customers’ primary bank because we consistently execute our business as The Right Size Bank.

Customer Relationship Strategy

Executing our Vision

Acquire Enhance Retain

Acquire Customer Relationships

Acquire different customers and acquire customers differently

Success Factors:

Right size bank positioning Unparalleled convenience Value-oriented product line Reputation for superior service

Success Metric: Growth in Primary Bank Relationships

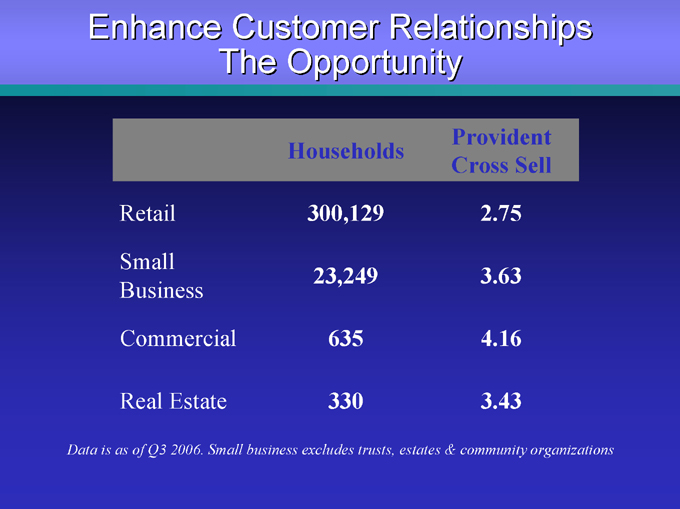

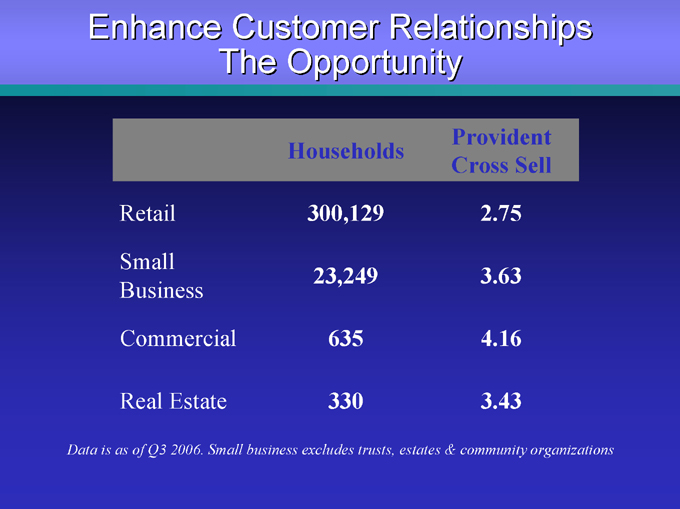

Enhance Customer Relationships The Opportunity

Households

Provident Cross Sell

Retail 300,129 2.75

Small Business

23,249 3.63

Commercial 635 4.16

Real Estate 330 3.43

Data is as of Q3 2006. Small business excludes trusts, estates & community organizations

Enhance Customer Relationships

Leverage customer segmentation methodology Build a relationship sales culture Roll-out sales and leadership training Achieve CSBI relationship

Success Metric: 1 More to 400,000

Retain Customer Relationships

One additional product to a household with one product increases their retention from 83% to 92%

Utilize on-boarding program for all customers Survey customers’ satisfaction quarterly Build specific retention plans based on customer segmentation data

Success Metric: Level of Customer Engagement

Strategic Priorities

Sustain a culture that attracts and retains employees who provide the differentiating ‘Provident Way’ customer experience

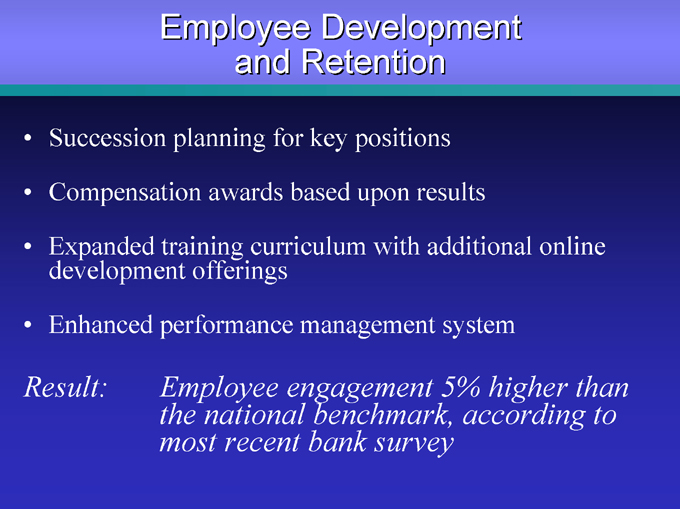

Employee Development and Retention

Succession planning for key positions

Compensation awards based upon results

Expanded training curriculum with additional online development offerings

Enhanced performance management system

Result:

Employee engagement 5% higher than the national benchmark, according to most recent bank survey

Strategic Priorities

Profitably grow and deepen customer relationships in all four key market segments:

commercial real estate small business consumer

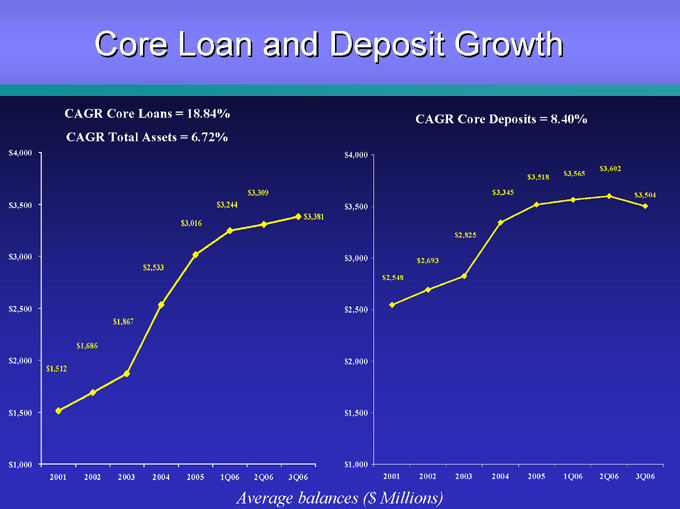

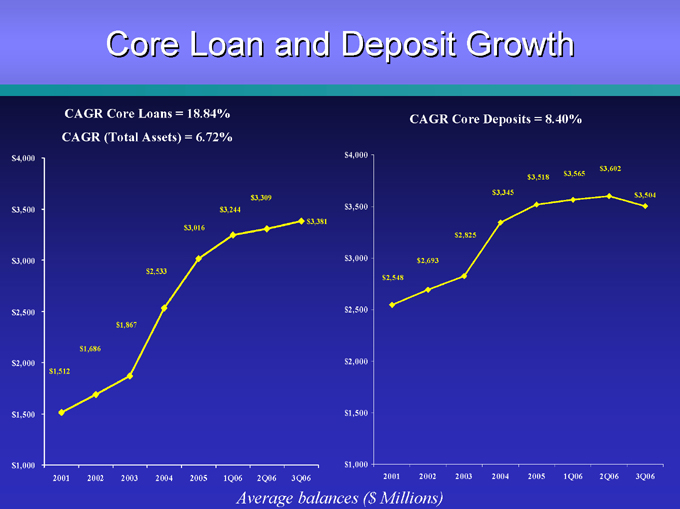

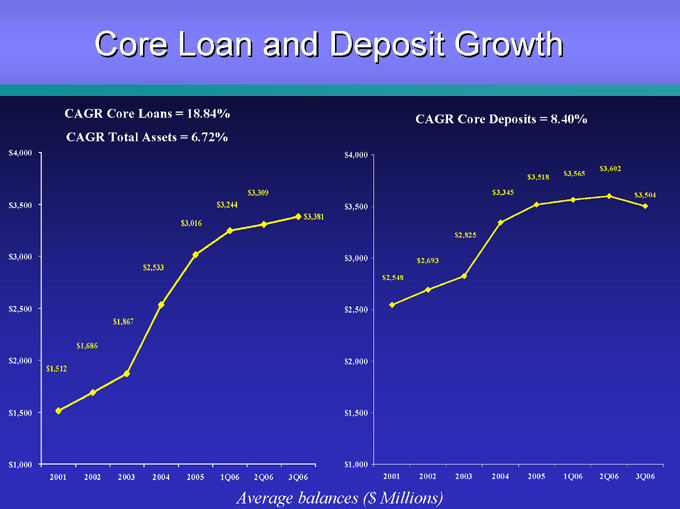

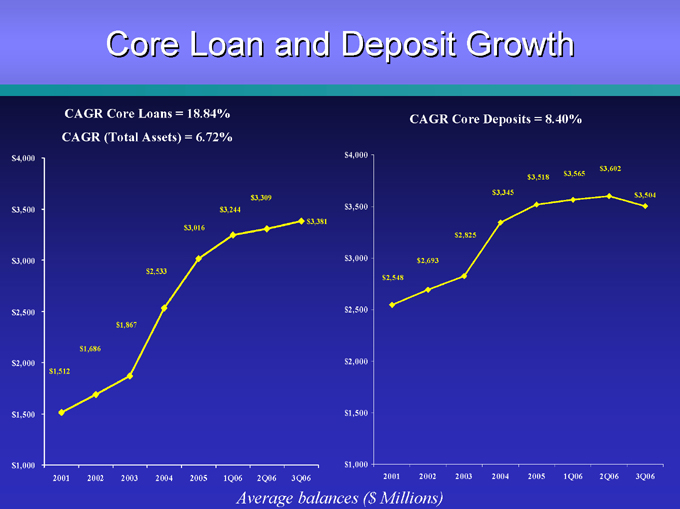

Core Loan and Deposit Growth

CAGR Core Loans = 18.84% CAGR Total Assets = 6.72% $4,000 $3,500 $3,000 $2,500 $2,000 $1,500 $1,000 $3,309 $3,244 $3,381 $3,016

$2,533

$1,867 $1,686 $1,512

2001 2002 2003 2004 2005 1Q06 2Q06 3Q06

CAGR Core Deposits = 8.40% $4,000 $3,500 $3,000 $2,500 $2,000 $1,500 $1,000 $3,602 $3,565 $3,518 $3,345 $3,504

$2,825

$2,693

$2,548

2001 2002 2003 2004 2005 1Q06 2Q06 3Q06

Average balances ($ Millions)

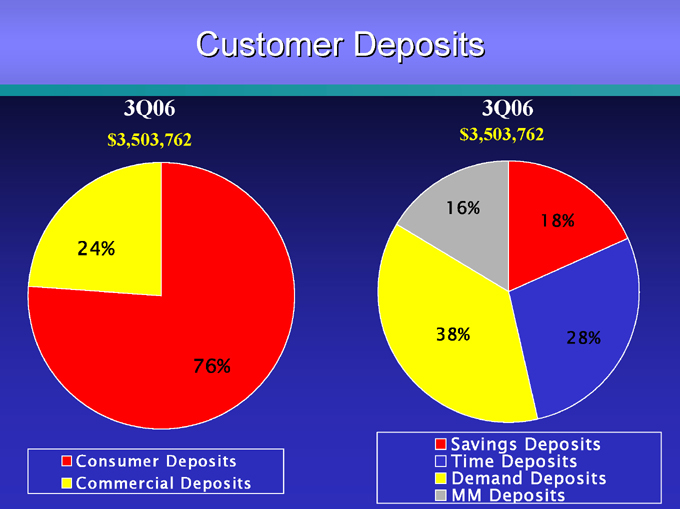

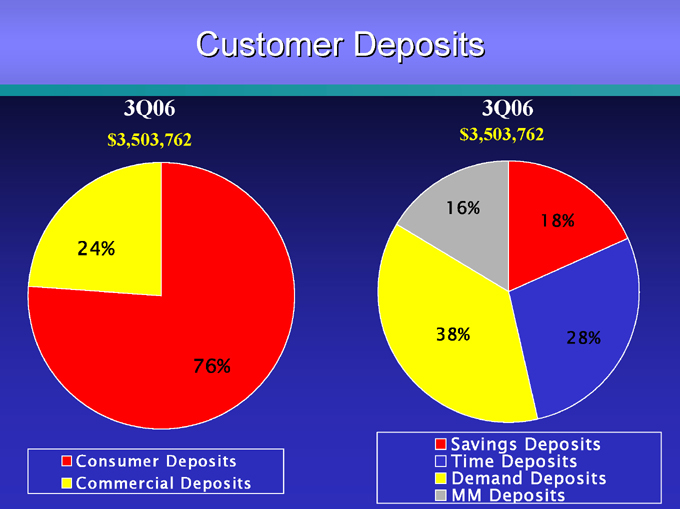

Customer Deposits

3Q06

$3,503,762

24%

76%

Consumer Deposits Commercial Deposits

3Q06

$3,503,762

16%

38%

18%

28%

Savings Deposits Time Deposits Demand Deposits MM Deposits

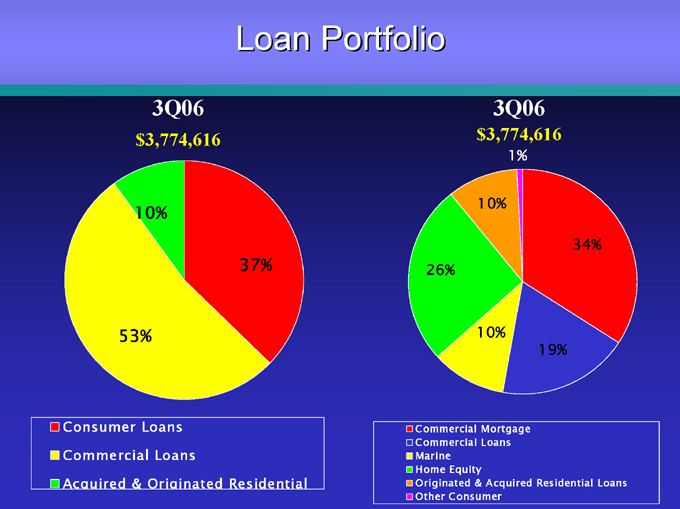

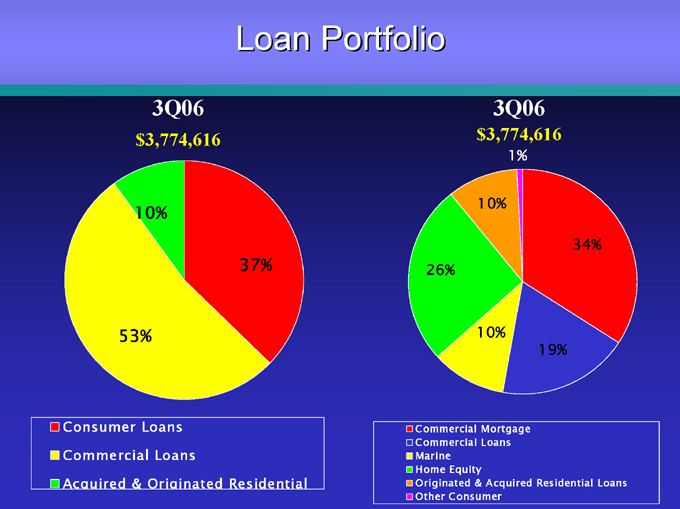

Loan Portfolio

3Q06

$3,774,616

10%

37%

53%

Consumer Loans Commercial Loans

Acquired & Originated Residential

3Q06

$3,774,616

1%

10%

34%

19%

10%

26%

Commercial Mortgage Commercial Loans Marine Home Equity

Originated & Acquired Residential Loans Other Consumer

Strategic Priorities

Expand delivery via de novo branches and select acquisitions within the footprint

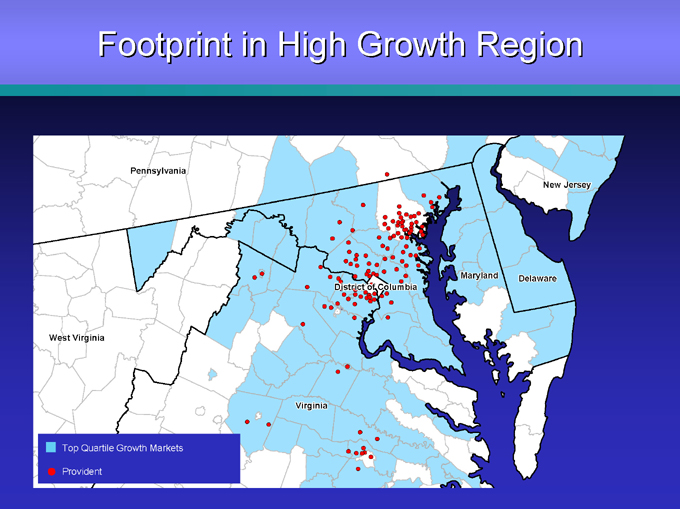

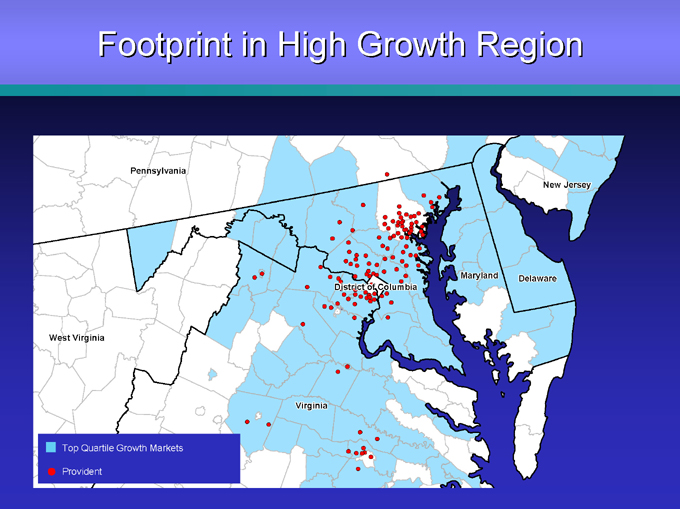

Footprint in High Growth Region

Pennsylvania

West Virginia

Virginia

District of Columbia

Maryland Delaware

New Jersey

Top Quartile Growth Markets

Provident

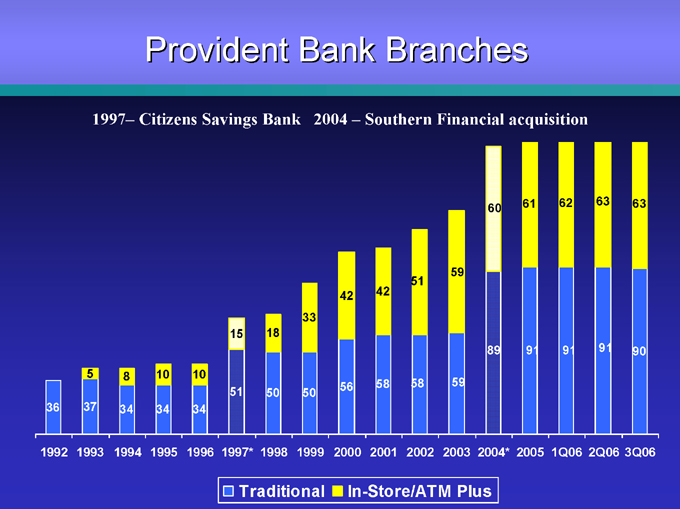

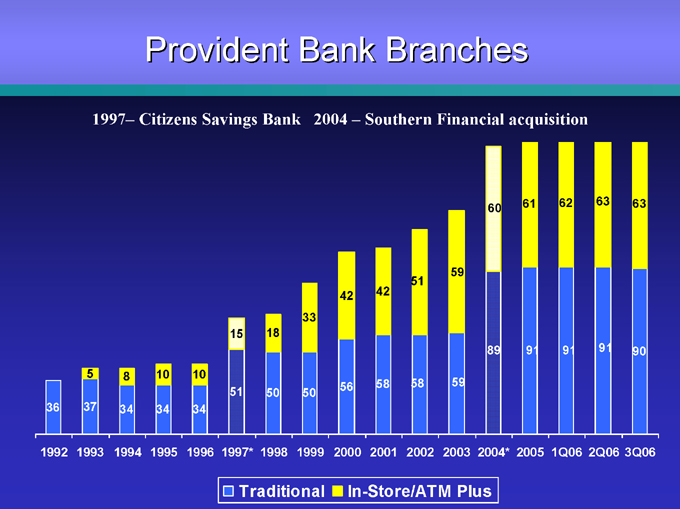

Provident Bank Branches

1997– Citizens Savings Bank 2004 – Southern Financial acquisition

61 62 63 63 60

59 51

42 42 33

15 18

89 91 91 91 90

56 58 58 59

51 50 50

36 37 34 34 34

1992 1993 1994 1995 1996 1997* 1998 1999 2000 2001 2002 2003 2004* 2005 1Q06 2Q06 3Q06

Traditional

In-Store/ATM Plus

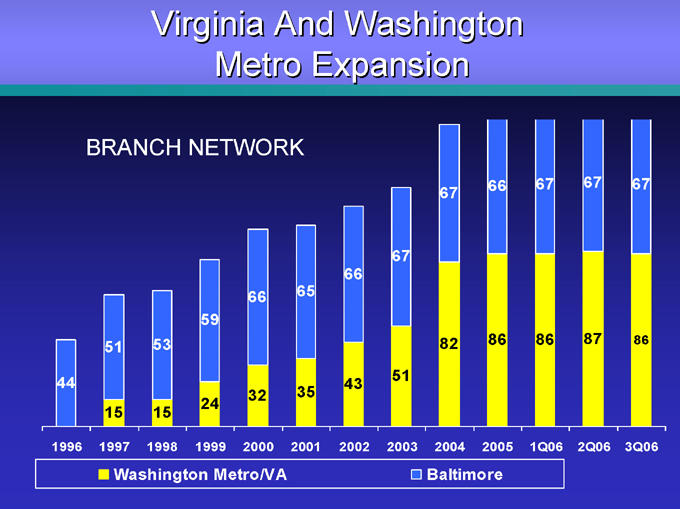

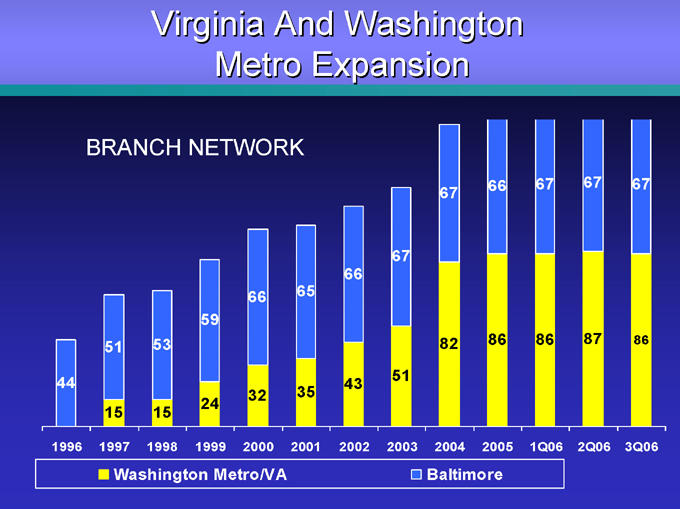

Virginia And Washington Metro Expansion

BRANCH NETWORK

66 67 67 67 67

67 66

66 65 59

53 82 86 86 87 86 51 51

44 43

32 35 24

15 15

1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 1Q06 2Q06 3Q06

Washington Metro/VA

Baltimore

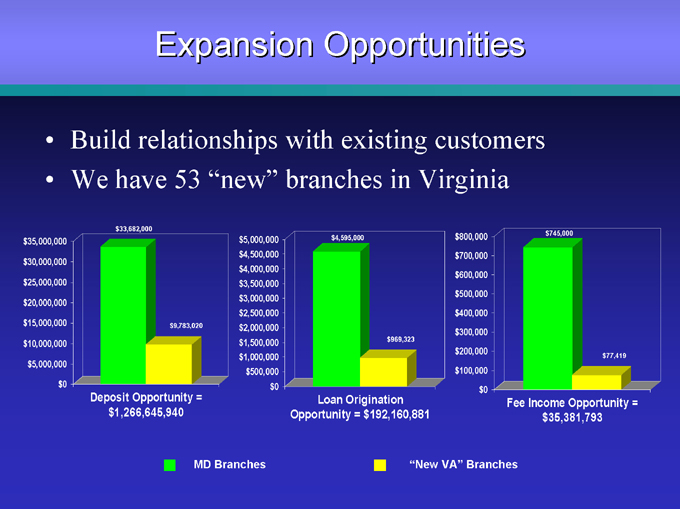

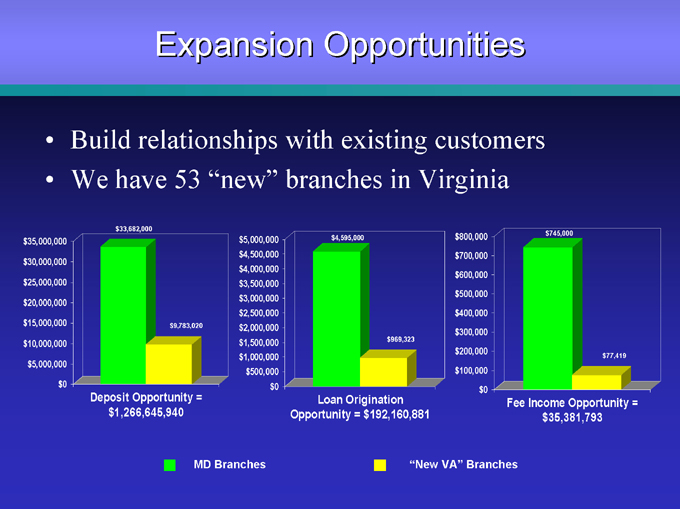

Expansion Opportunities

Build relationships with existing customers We have 53 “new” branches in Virginia $33,682,000 $35,000,000 $30,000,000 $25,000,000 $20,000,000 $15,000,000 $10,000,000 $5,000,000 $0

Deposit Opportunity = $1,266,645,940 $9,783,020 $4,595,000

$969,323 $5,000,000 $4,500,000 $4,000,000 $3,500,000 $3,000,000 $2,500,000 $2,000,000 $1,500,000 $1,000,000 $500,000 $0

Loan Origination Opportunity = $192,160,881 $745,000

$77,419 $800,000 $700,000 $600,000 $500,000 $400,000 $300,000 $200,000 $100,000 $0

Fee Income Opportunity = $35,381,793

MD Branches

“New VA” Branches

Strategic Priorities Improve Financial Fundamentals

I. Continued transformation of the balance sheet II. Strong growth in core loans and deposits III. Solid fee income growth IV. Improved asset quality

V. Higher capital levels

VI. Growth in earnings with improved quality of earnings

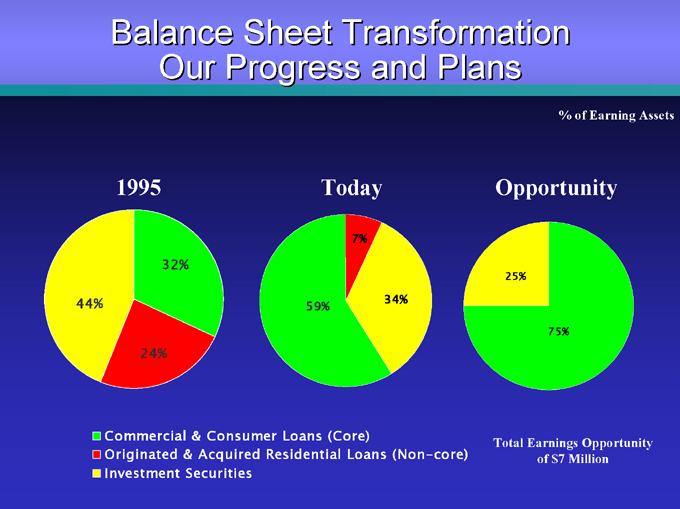

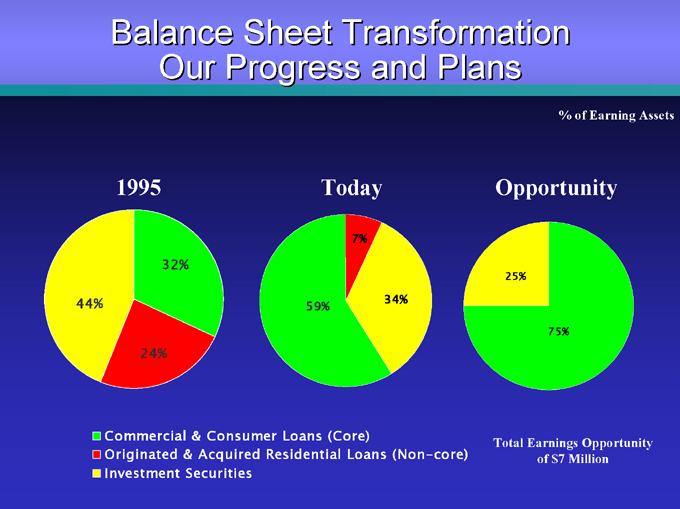

Balance Sheet Transformation Our Progress and Plans

% of Earning Assets

1995

32%

24%

44%

Today

7%

34%

59%

Opportunity

25%

75%

Commercial & Consumer Loans (Core)

Originated & Acquired Residential Loans (Non-core) Investment Securities

Total Earnings Opportunity of $7 Million

Core Loan and Deposit Growth

CAGR Core Loans = 18.84% CAGR (Total Assets) = 6.72% $4,000 $3,500 $3,000 $2,500 $2,000 $1,500 $1,000 $3,309 $3,244 $3,381 $3,016

$2,533

$1,867 $1,686 $1,512

2001 2002 2003 2004 2005 1Q06 2Q06 3Q06

CAGR Core Deposits = 8.40% $4,000 $3,500 $3,000 $2,500 $2,000 $1,500 $1,000 $3,602 $3,565 $3,518 $3,345 $3,504

$2,825

$2,693

$2,548

2001 2002 2003 2004 2005 1Q06 2Q06 3Q06

Average balances ($ Millions)

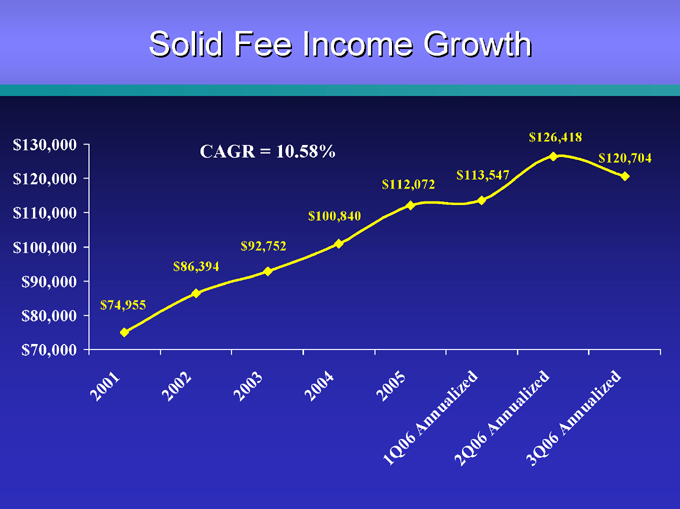

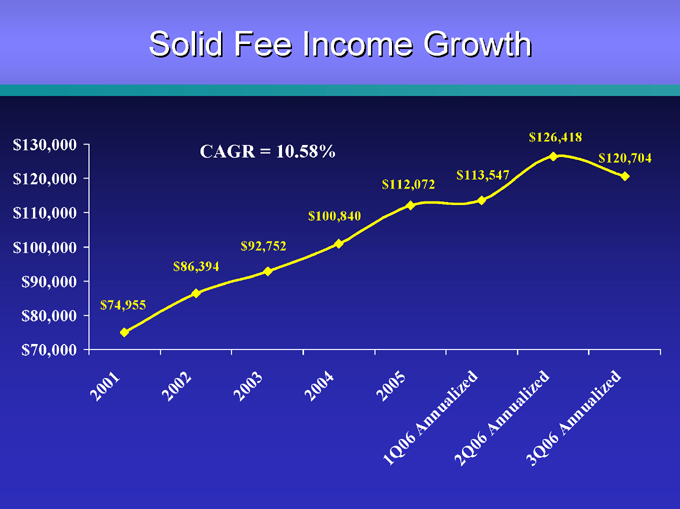

Solid Fee Income Growth

CAGR = 10.58% $130,000 $120,000 $110,000

$100,000 $90,000 $80,000 $70,000 $74,955 $86,394 $92,752 $100,840 $112,072 $113,547 $126,418 $120,704

2001 2002 2003 2004

2005

1Q06 Annualized2Q06 Annualized3Q06 Annualized

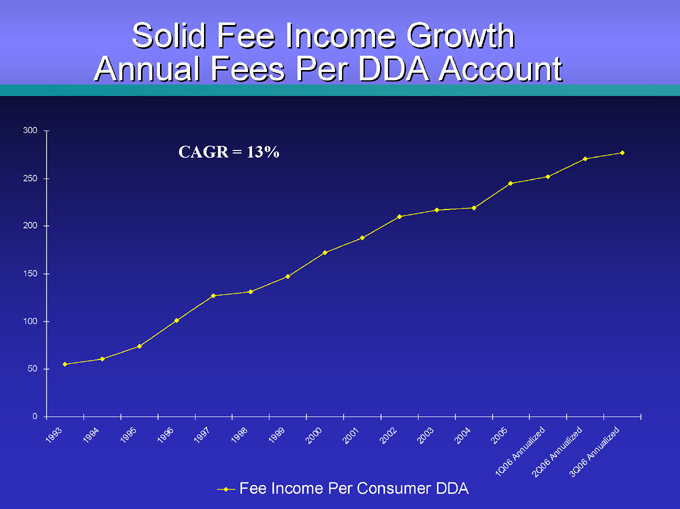

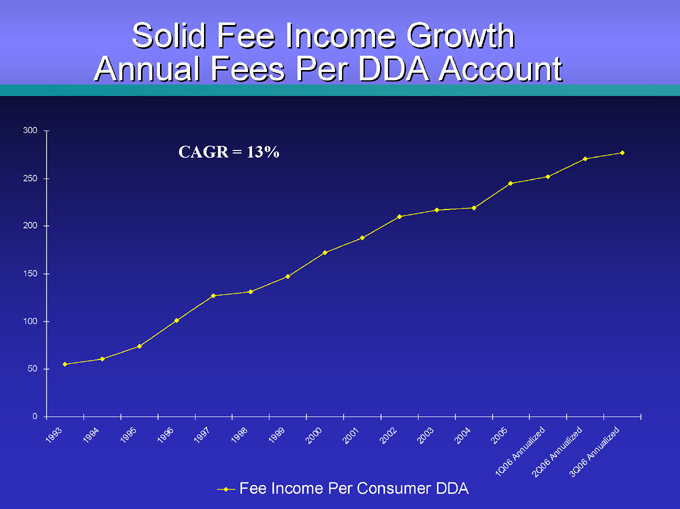

Solid Fee Income Growth Annual Fees Per DDA Account

CAGR = 13%

300 250 200 150 100 50 0

Fee Income Per Consumer DDA

19931994199519961997199819992000200120022003

2004

2005

1Q06 Annualized2Q06 Annualized3Q06 Annualized

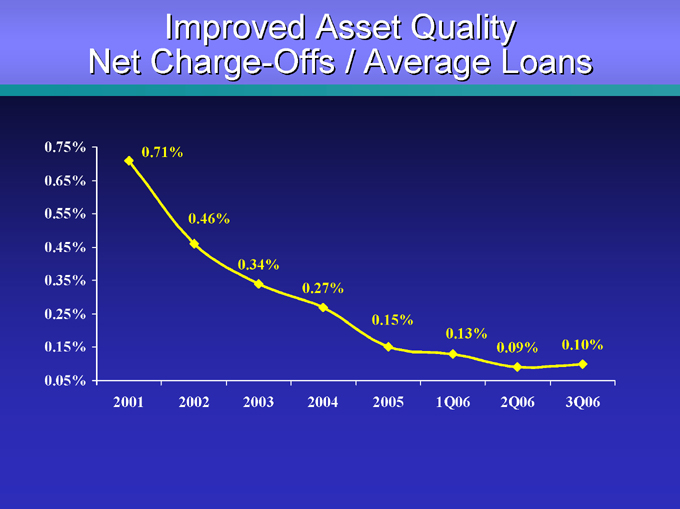

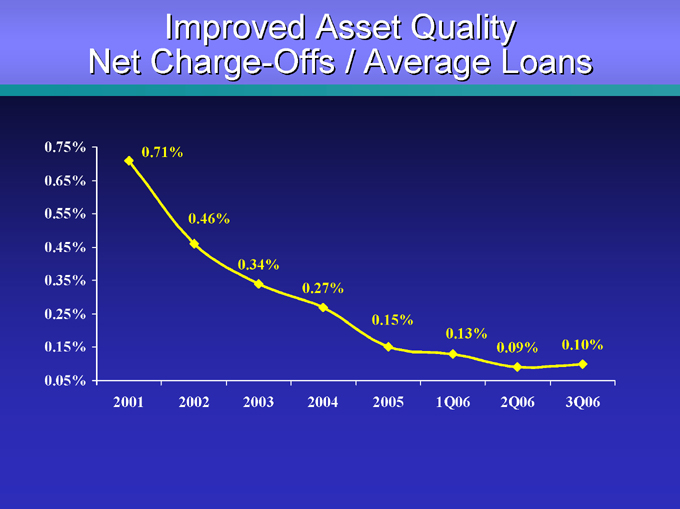

Improved Asset Quality Net Charge-Offs / Average Loans

0.71%

0.46%

0.34%

0.27%

0.15%

0.13%

0.09% 0.10%

0.75% 0.65% 0.55% 0.45% 0.35% 0.25% 0.15% 0.05%

2001 2002 2003 2004 2005 1Q06 2Q06 3Q06

Improved Asset Quality Reserves / Loans

1.5% 1.4% 1.3% 1.2% 1.1%

1.30% 1.29% 1.27%

1.24% 1.24%

1.21%

1.19% 1.19%

2001 2002 2003 2004 2005 1Q06 2Q06 3Q06

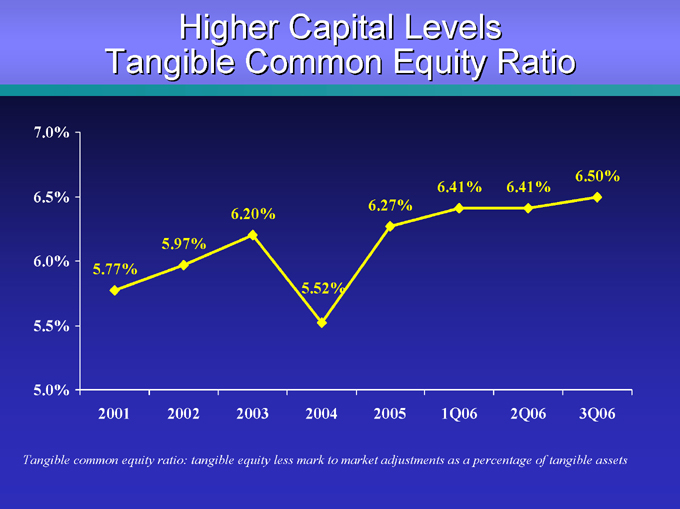

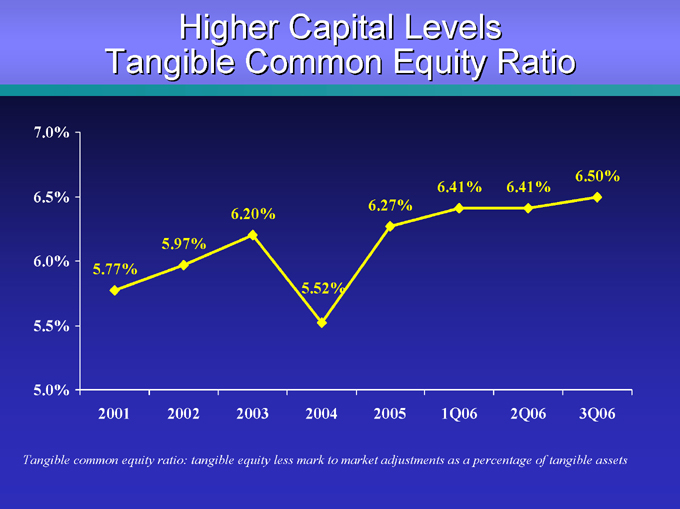

Higher Capital Levels Tangible Common Equity Ratio

6.50% 6.41% 6.41% 6.27% 6.20% 5.97% 5.77% 5.52%

7.0% 6.5% 6.0% 5.5% 5.0%

2001 2002 2003 2004 2005 1Q06 2Q06 3Q06

Tangible common equity ratio: tangible equity less mark to market adjustments as a percentage of tangible assets

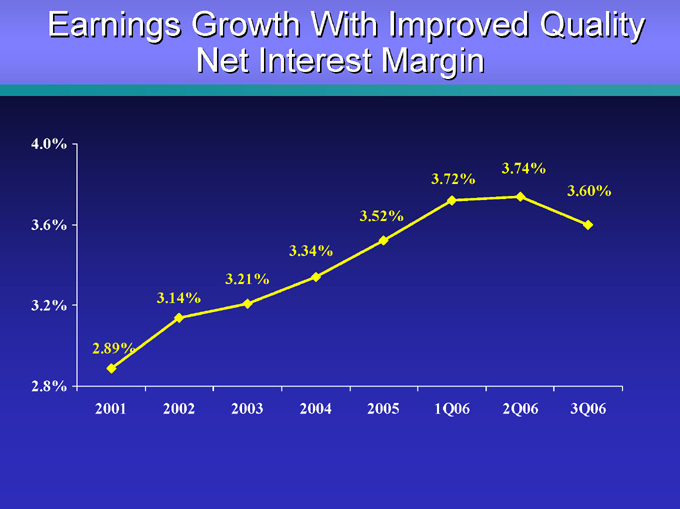

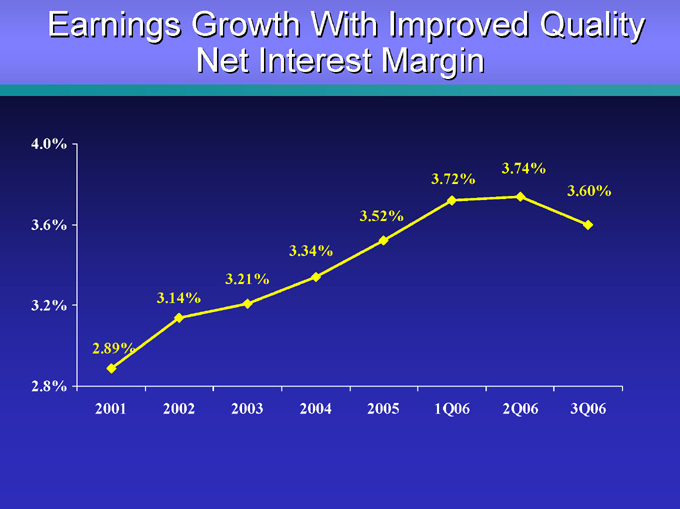

Earnings Growth With Improved Quality Net Interest Margin

3.74% 3.72%

3.60% 3.52%

3.34% 3.21% 3.14%

2.89%

4.0% 3.6% 3.2% 2.8%

2001 2002 2003 2004 2005 1Q06 2Q06 3Q06

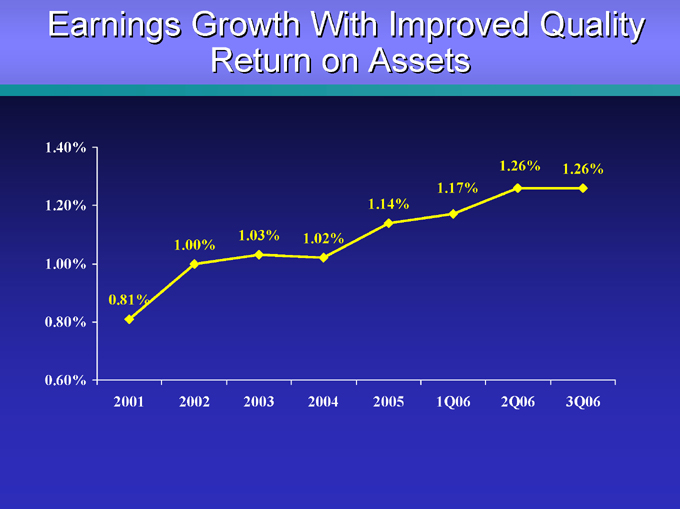

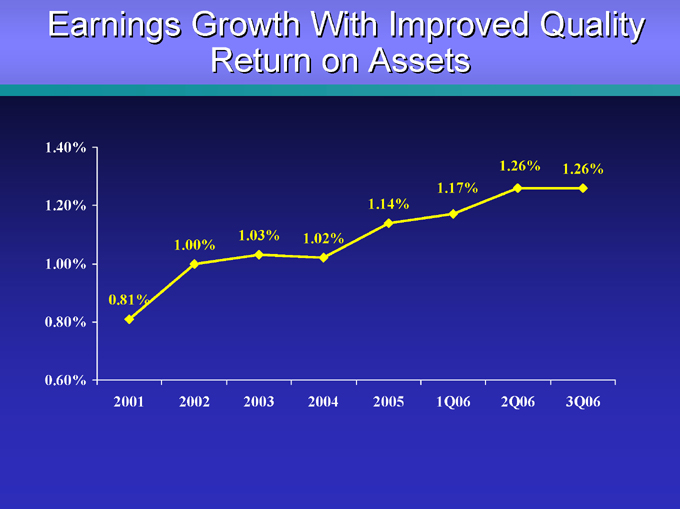

Earnings Growth With Improved Quality Return on Assets

1.26% 1.26% 1.17% 1.14%

1.03% 1.02% 1.00%

0.81%

1.40% 1.20% 1.00% 0.80% 0.60%

2001 2002 2003 2004 2005 1Q06 2Q06 3Q06

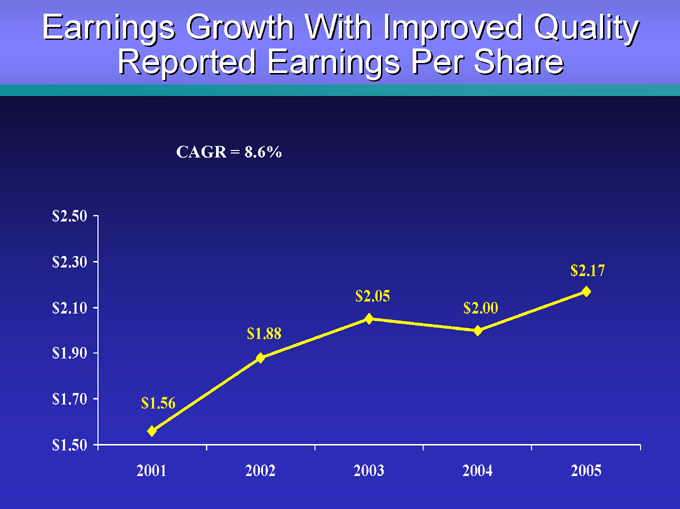

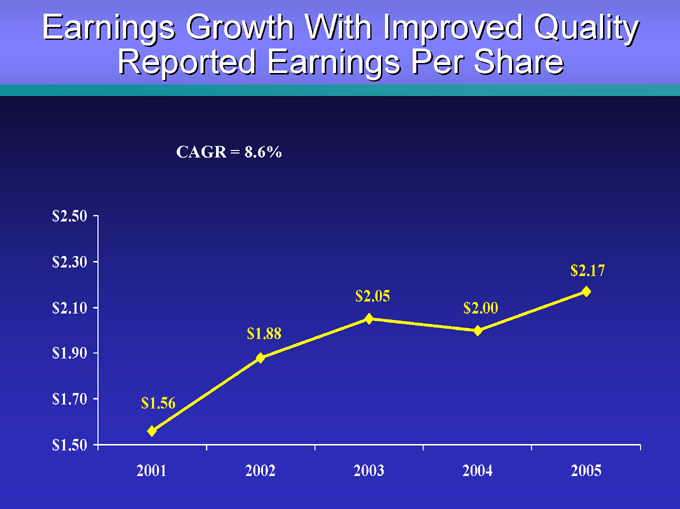

Earnings Growth With Improved Quality Reported Earnings Per Share

CAGR = 8.6% $2.50 $2.30 $2.10 $1.90 $1.70 $1.50 $2.17 $2.05 $2.00 $1.88

$1.56

2001 2002 2003 2004 2005

PROVIDENT BANKSHARES

CORPORATION

www.provbank.com

Contact

Media: Lillian Kilroy (410) 277-2833

Investment Community: Melissa Kelly (410) 277-2080