UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05251

Fidelity Concord Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Margaret Carey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | April 30 |

|

|

Date of reporting period: | April 30, 2023 |

Item 1.

Reports to Stockholders

Fidelity® Mid-Cap Stock K6 Fund

Annual Report

April 30, 2023

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-835-5092 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2023 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

| Average Annual Total Returns |

| | | | |

Periods ended April 30, 2023 | Past 1 year | Life of Fund A |

| Fidelity® Mid-Cap Stock K6 Fund | 1.82% | 10.62% |

A From June 13, 2019

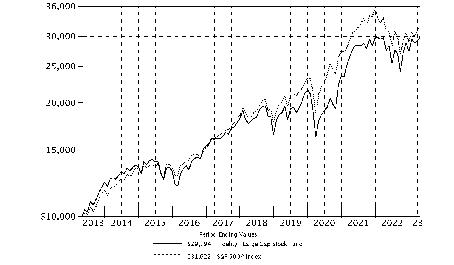

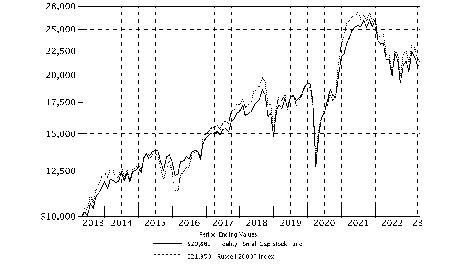

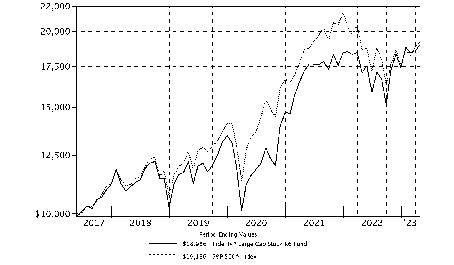

| $10,000 Over Life of Fund |

| |

Let's say hypothetically that $10,000 was invested in Fidelity® Mid-Cap Stock K6 Fund, on June 13, 2019, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the S&P MidCap 400® Index performed over the same period. |

|

|

Market Recap:

U.S. equities gained 2.66% for the 12 months ending April 30, 2023, according to the S&P 500 ® index, as markets digested multiple crosscurrents and sustained year-to-date momentum. The upturn followed a year in which the S&P 500 ® returned -18.11% amid a multitude of risk factors. Record inflation prompted the Federal Reserve to aggressively tighten monetary policy, and market interest rates eclipsed their highest level in a decade, stoking recession fears and sending stocks into bear market territory. Since March 2022, the Fed has raised its benchmark rate nine times, by 4.75 percentage points, while also shrinking its massive asset portfolio. Against this backdrop, stocks struggled to gain traction until a rally in late 2022, as risky assets regained favor. The S&P 500 ® continued to advance in 2023, gaining 7.50% in the first quarter and adding 1.56% in April, supported by moderating inflation data, a resilient labor market, earnings that continued to exceed lowered expectations and indications from the Fed it was nearing the end of its interest rate hiking regime. Indeed, the central bank stepped down to hikes of 25 basis points (0.25 percentage points) in February and March, as stress in the financial system started to show, with two regional banks failing in March. For the full 12 months, value stocks handily outpaced growth. By sector, energy (+19%) led the way, followed by information technology (+9%) and industrials (+7%). In contrast, real estate (-16%), consumer discretionary (-8%) and materials (-3%) lagged most.

Comments from Portfolio Manager Nicola Stafford:

For the fiscal year ending April 30, 2023, the fund gained 1.82%, outperforming the 1.33% result of the benchmark S&P MidCap 400 Index. Versus the benchmark, security selection was the primary contributor, led by the energy sector. Arch Capital, the fund's biggest individual contributor, gained 64% this period. This was among the fund's biggest holdings. Our second-largest contributor was Brunello Cucinelli Spa, which gained about 85% the past year. This was among the largest holdings as of April 30. Another contributor this period was Hess. The stock gained 42% the past 12 months. This was among our biggest holdings. All of these contributors were non-benchmark positions. In contrast, the largest detractor from performance versus the benchmark was our stock selection in information technology. Weak picks in the industrials sector, especially within the capital goods industry, also hampered relative performance. Also hampering the fund's relative performance was security selection in consumer staples. The biggest individual relative detractor was an overweight position in EQT (-11%). EQT was among our largest holdings this period. The fund's position in Comerica returned approximately -46%. We reduced our non-benchmark investment in the company the past 12 months. Avoiding First Solar, a benchmark component that gained roughly 112%, also hurt relative performance. Notable changes in positioning include decreased exposure to the real estate sector and a higher allocation to information technology.

Note to shareholders:

John Roth retired from Fidelity at the end of 2022, leaving Nicola Stafford with sole management responsibilities for the fund.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Top Holdings (% of Fund's net assets) |

| |

| Arch Capital Group Ltd. | 2.1 | |

| Hess Corp. | 1.9 | |

| Molina Healthcare, Inc. | 1.7 | |

| WNS Holdings Ltd. sponsored ADR | 1.5 | |

| AECOM | 1.4 | |

| Brunello Cucinelli SpA | 1.4 | |

| Cheniere Energy, Inc. | 1.4 | |

| American Financial Group, Inc. | 1.3 | |

| Performance Food Group Co. | 1.3 | |

| Imperial Oil Ltd. | 1.3 | |

| | 15.3 | |

| |

| Market Sectors (% of Fund's net assets) |

| |

| Industrials | 22.4 | |

| Financials | 16.5 | |

| Consumer Discretionary | 11.7 | |

| Energy | 9.2 | |

| Materials | 7.9 | |

| Health Care | 6.7 | |

| Real Estate | 5.7 | |

| Utilities | 4.8 | |

| Information Technology | 4.8 | |

| Consumer Staples | 4.8 | |

| Communication Services | 3.1 | |

| |

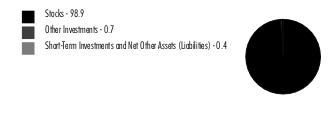

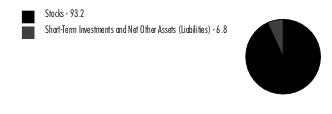

Asset Allocation (% of Fund's net assets) |

|

|

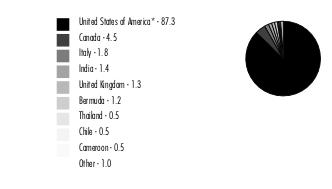

Geographic Diversification (% of Fund's net assets) |

|

* Includes Short-Term investments and Net Other Assets (Liabilities). Percentages are adjusted for the effect of derivatives, if applicable. |

| |

Showing Percentage of Net Assets

| Common Stocks - 97.3% |

| | | Shares | Value ($) |

| COMMUNICATION SERVICES - 3.1% | | | |

| Entertainment - 1.6% | | | |

| Endeavor Group Holdings, Inc. (a)(b) | | 265,445 | 6,843,172 |

| Liberty Media Corp. Liberty Formula One Class A (a) | | 35,025 | 2,268,920 |

| Warner Music Group Corp. Class A | | 135,334 | 4,123,627 |

| | | | 13,235,719 |

| Interactive Media & Services - 0.4% | | | |

| Ziff Davis, Inc. (a) | | 41,039 | 3,001,592 |

| Media - 1.1% | | | |

| Cable One, Inc. (b) | | 4,559 | 3,457,591 |

| Interpublic Group of Companies, Inc. | | 162,243 | 5,796,942 |

| | | | 9,254,533 |

TOTAL COMMUNICATION SERVICES | | | 25,491,844 |

| CONSUMER DISCRETIONARY - 11.7% | | | |

| Automobile Components - 1.1% | | | |

| American Axle & Manufacturing Holdings, Inc. (a) | | 431,328 | 3,083,995 |

| Aptiv PLC (a) | | 59,406 | 6,110,501 |

| | | | 9,194,496 |

| Diversified Consumer Services - 1.0% | | | |

| Duolingo, Inc. (a) | | 24,285 | 3,306,646 |

| H&R Block, Inc. | | 156,642 | 5,311,730 |

| | | | 8,618,376 |

| Hotels, Restaurants & Leisure - 4.3% | | | |

| ARAMARK Holdings Corp. | | 180,473 | 6,262,413 |

| Caesars Entertainment, Inc. (a) | | 63,995 | 2,898,334 |

| Churchill Downs, Inc. | | 32,076 | 9,383,192 |

| Domino's Pizza, Inc. | | 13,570 | 4,308,068 |

| Vail Resorts, Inc. (b) | | 16,538 | 3,977,720 |

| Wyndham Hotels & Resorts, Inc. | | 127,008 | 8,664,486 |

| | | | 35,494,213 |

| Household Durables - 1.7% | | | |

| D.R. Horton, Inc. | | 53,680 | 5,895,138 |

| Mohawk Industries, Inc. (a) | | 24,429 | 2,587,031 |

| NVR, Inc. (a) | | 908 | 5,302,720 |

| | | | 13,784,889 |

| Specialty Retail - 0.7% | | | |

| Best Buy Co., Inc. | | 26,702 | 1,989,833 |

| Foot Locker, Inc. | | 84,400 | 3,543,956 |

| | | | 5,533,789 |

| Textiles, Apparel & Luxury Goods - 2.9% | | | |

| Brunello Cucinelli SpA | | 123,952 | 11,841,721 |

| PVH Corp. | | 78,390 | 6,726,646 |

| Tapestry, Inc. | | 126,362 | 5,156,833 |

| | | | 23,725,200 |

TOTAL CONSUMER DISCRETIONARY | | | 96,350,963 |

| CONSUMER STAPLES - 4.7% | | | |

| Beverages - 0.4% | | | |

| Boston Beer Co., Inc. Class A (a) | | 11,215 | 3,560,875 |

| Consumer Staples Distribution & Retail - 2.2% | | | |

| Albertsons Companies, Inc. | | 149,307 | 3,120,516 |

| Grocery Outlet Holding Corp. (a)(b) | | 142,659 | 4,248,385 |

| Performance Food Group Co. (a) | | 170,195 | 10,669,525 |

| | | | 18,038,426 |

| Food Products - 1.3% | | | |

| Bunge Ltd. | | 41,808 | 3,913,229 |

| Freshpet, Inc. (a)(b) | | 46,243 | 3,189,380 |

| Nomad Foods Ltd. (a) | | 206,388 | 3,880,094 |

| | | | 10,982,703 |

| Household Products - 0.6% | | | |

| Energizer Holdings, Inc. | | 74,767 | 2,499,461 |

| Reynolds Consumer Products, Inc. | | 74,550 | 2,089,637 |

| | | | 4,589,098 |

| Personal Care Products - 0.2% | | | |

| Olaplex Holdings, Inc. (a)(b) | | 332,164 | 1,229,007 |

TOTAL CONSUMER STAPLES | | | 38,400,109 |

| ENERGY - 9.2% | | | |

| Energy Equipment & Services - 0.5% | | | |

| Expro Group Holdings NV (a) | | 209,851 | 4,173,936 |

| Oil, Gas & Consumable Fuels - 8.7% | | | |

| Canadian Natural Resources Ltd. | | 141,021 | 8,593,345 |

| Cheniere Energy, Inc. | | 75,744 | 11,588,832 |

| Energy Transfer LP | | 675,228 | 8,696,937 |

| EQT Corp. | | 185,673 | 6,468,847 |

| Golar LNG Ltd. (a) | | 182,943 | 4,152,806 |

| Hess Corp. | | 109,924 | 15,945,575 |

| Imperial Oil Ltd. | | 208,649 | 10,635,347 |

| Range Resources Corp. | | 202,387 | 5,353,136 |

| | | | 71,434,825 |

TOTAL ENERGY | | | 75,608,761 |

| FINANCIALS - 16.5% | | | |

| Banks - 4.8% | | | |

| BOK Financial Corp. | | 81,510 | 6,836,244 |

| Comerica, Inc. | | 29,242 | 1,268,226 |

| First Horizon National Corp. | | 530,847 | 9,316,365 |

| Huntington Bancshares, Inc. | | 414,758 | 4,645,290 |

| M&T Bank Corp. | | 50,121 | 6,305,222 |

| U.S. Bancorp | | 139,200 | 4,771,776 |

| Wintrust Financial Corp. | | 98,567 | 6,739,026 |

| | | | 39,882,149 |

| Capital Markets - 1.8% | | | |

| Cboe Global Markets, Inc. | | 20,501 | 2,863,990 |

| Lazard Ltd. Class A | | 76,405 | 2,391,477 |

| Northern Trust Corp. | | 35,923 | 2,807,742 |

| Raymond James Financial, Inc. | | 40,410 | 3,658,317 |

| TPG, Inc. (b) | | 108,196 | 3,134,438 |

| | | | 14,855,964 |

| Financial Services - 1.9% | | | |

| Equitable Holdings, Inc. | | 73,859 | 1,919,595 |

| Euronet Worldwide, Inc. (a) | | 35,720 | 3,955,633 |

| Radian Group, Inc. (b) | | 353,575 | 8,581,265 |

| Shift4 Payments, Inc. (a) | | 19,195 | 1,300,845 |

| | | | 15,757,338 |

| Insurance - 8.0% | | | |

| American Financial Group, Inc. | | 86,946 | 10,670,883 |

| Arch Capital Group Ltd. (a) | | 232,753 | 17,472,762 |

| Assurant, Inc. | | 23,046 | 2,837,654 |

| Beazley PLC | | 438,493 | 3,281,658 |

| First American Financial Corp. | | 129,083 | 7,436,472 |

| Hartford Financial Services Group, Inc. | | 68,444 | 4,858,840 |

| Hiscox Ltd. | | 289,655 | 4,302,763 |

| RenaissanceRe Holdings Ltd. | | 49,114 | 10,579,647 |

| The Travelers Companies, Inc. | | 23,934 | 4,335,405 |

| | | | 65,776,084 |

TOTAL FINANCIALS | | | 136,271,535 |

| HEALTH CARE - 6.6% | | | |

| Biotechnology - 0.1% | | | |

| Day One Biopharmaceuticals, Inc. (a) | | 47,700 | 591,480 |

| Health Care Equipment & Supplies - 2.1% | | | |

| Hologic, Inc. (a) | | 92,626 | 7,966,762 |

| Masimo Corp. (a) | | 35,424 | 6,700,095 |

| Tandem Diabetes Care, Inc. (a) | | 61,368 | 2,428,945 |

| | | | 17,095,802 |

| Health Care Providers & Services - 3.2% | | | |

| Centene Corp. (a) | | 104,745 | 7,220,073 |

| Henry Schein, Inc. (a) | | 44,968 | 3,633,864 |

| LifeStance Health Group, Inc. (a) | | 160,787 | 1,310,414 |

| Molina Healthcare, Inc. (a) | | 47,547 | 14,163,776 |

| | | | 26,328,127 |

| Health Care Technology - 0.2% | | | |

| Evolent Health, Inc. (c) | | 63,000 | 2,179,139 |

| Life Sciences Tools & Services - 0.2% | | | |

| 10X Genomics, Inc. (a)(b) | | 27,936 | 1,464,684 |

| Pharmaceuticals - 0.8% | | | |

| Recordati SpA | | 67,781 | 3,116,725 |

| UCB SA | | 20,603 | 1,916,540 |

| Viatris, Inc. | | 157,532 | 1,469,774 |

| | | | 6,503,039 |

TOTAL HEALTH CARE | | | 54,162,271 |

| INDUSTRIALS - 22.3% | | | |

| Aerospace & Defense - 1.7% | | | |

| BWX Technologies, Inc. | | 73,138 | 4,723,252 |

| Huntington Ingalls Industries, Inc. | | 25,725 | 5,187,704 |

| Woodward, Inc. | | 46,239 | 4,439,869 |

| | | | 14,350,825 |

| Air Freight & Logistics - 0.4% | | | |

| GXO Logistics, Inc. (a) | | 63,780 | 3,388,631 |

| Building Products - 2.4% | | | |

| Builders FirstSource, Inc. (a) | | 82,330 | 7,802,414 |

| Fortune Brands Home & Security, Inc. | | 32,413 | 2,096,797 |

| Johnson Controls International PLC | | 50,299 | 3,009,892 |

| Owens Corning | | 64,339 | 6,872,049 |

| | | | 19,781,152 |

| Commercial Services & Supplies - 1.3% | | | |

| CoreCivic, Inc. (a) | | 212,685 | 1,869,501 |

| GFL Environmental, Inc. | | 248,207 | 9,015,217 |

| | | | 10,884,718 |

| Construction & Engineering - 1.8% | | | |

| AECOM | | 142,590 | 11,842,100 |

| Willscot Mobile Mini Holdings (a) | | 63,200 | 2,869,280 |

| | | | 14,711,380 |

| Electrical Equipment - 2.7% | | | |

| Acuity Brands, Inc. | | 36,571 | 5,755,544 |

| Generac Holdings, Inc. (a) | | 37,292 | 3,811,988 |

| Regal Rexnord Corp. | | 61,658 | 8,025,405 |

| Sensata Technologies, Inc. PLC | | 100,839 | 4,381,455 |

| | | | 21,974,392 |

| Ground Transportation - 1.4% | | | |

| Knight-Swift Transportation Holdings, Inc. Class A | | 138,784 | 7,816,315 |

| RXO, Inc. | | 195,029 | 3,528,075 |

| | | | 11,344,390 |

| Machinery - 5.5% | | | |

| Allison Transmission Holdings, Inc. | | 131,133 | 6,397,979 |

| Chart Industries, Inc. (a)(b) | | 44,422 | 5,912,568 |

| Crane Co. | | 59,346 | 4,277,066 |

| Crane Nxt Co. | | 98,046 | 4,643,459 |

| Donaldson Co., Inc. | | 129,312 | 8,217,778 |

| Fortive Corp. | | 97,163 | 6,130,014 |

| Oshkosh Corp. | | 68,242 | 5,221,878 |

| PACCAR, Inc. | | 58,887 | 4,398,270 |

| | | | 45,199,012 |

| Marine Transportation - 0.4% | | | |

| Kirby Corp. (a) | | 47,982 | 3,447,027 |

| Professional Services - 4.2% | | | |

| ASGN, Inc. (a) | | 14,591 | 1,044,570 |

| Concentrix Corp. | | 30,319 | 2,926,087 |

| Leidos Holdings, Inc. | | 46,590 | 4,344,983 |

| Science Applications International Corp. | | 51,512 | 5,255,769 |

| SS&C Technologies Holdings, Inc. | | 64,805 | 3,793,685 |

| TransUnion Holding Co., Inc. | | 73,729 | 5,073,292 |

| WNS Holdings Ltd. sponsored ADR (a) | | 131,836 | 11,887,652 |

| | | | 34,326,038 |

| Trading Companies & Distributors - 0.5% | | | |

| Beacon Roofing Supply, Inc. (a) | | 68,066 | 4,096,212 |

TOTAL INDUSTRIALS | | | 183,503,777 |

| INFORMATION TECHNOLOGY - 4.8% | | | |

| Communications Equipment - 0.4% | | | |

| Lumentum Holdings, Inc. (a) | | 60,652 | 2,926,459 |

| Electronic Equipment, Instruments & Components - 1.2% | | | |

| Fabrinet (a) | | 46,010 | 4,368,650 |

| Flex Ltd. (a) | | 145,007 | 2,982,794 |

| Keysight Technologies, Inc. (a) | | 15,189 | 2,196,937 |

| | | | 9,548,381 |

| IT Services - 1.4% | | | |

| Akamai Technologies, Inc. (a) | | 30,223 | 2,477,379 |

| Amdocs Ltd. | | 57,252 | 5,224,245 |

| MongoDB, Inc. Class A (a) | | 14,674 | 3,521,173 |

| | | | 11,222,797 |

| Semiconductors & Semiconductor Equipment - 0.3% | | | |

| Skyworks Solutions, Inc. | | 26,074 | 2,761,237 |

| Software - 1.5% | | | |

| Aspen Technology, Inc. | | 17,076 | 3,022,452 |

| Black Knight, Inc. (a) | | 60,516 | 3,306,594 |

| Dynatrace, Inc. (a) | | 152,637 | 6,453,492 |

| | | | 12,782,538 |

TOTAL INFORMATION TECHNOLOGY | | | 39,241,412 |

| MATERIALS - 7.9% | | | |

| Chemicals - 2.7% | | | |

| Cabot Corp. | | 55,398 | 3,975,360 |

| Celanese Corp. Class A | | 24,817 | 2,636,558 |

| CF Industries Holdings, Inc. | | 53,353 | 3,819,008 |

| LG Chemical Ltd. | | 6,956 | 3,865,474 |

| Nutrien Ltd. | | 45,728 | 3,172,288 |

| Westlake Corp. | | 39,523 | 4,496,927 |

| | | | 21,965,615 |

| Containers & Packaging - 1.4% | | | |

| Avery Dennison Corp. | | 15,645 | 2,729,740 |

| O-I Glass, Inc. (a) | | 408,804 | 9,185,826 |

| | | | 11,915,566 |

| Metals & Mining - 3.8% | | | |

| Commercial Metals Co. | | 142,811 | 6,667,846 |

| Franco-Nevada Corp. | | 34,537 | 5,240,518 |

| Freeport-McMoRan, Inc. | | 125,529 | 4,758,804 |

| Lundin Mining Corp. | | 549,464 | 4,197,478 |

| Newcrest Mining Ltd. | | 125,563 | 2,397,609 |

| Novagold Resources, Inc. (a) | | 398,813 | 2,160,599 |

| Steel Dynamics, Inc. | | 55,375 | 5,756,231 |

| | | | 31,179,085 |

TOTAL MATERIALS | | | 65,060,266 |

| REAL ESTATE - 5.7% | | | |

| Equity Real Estate Investment Trusts (REITs) - 5.2% | | | |

| Cousins Properties, Inc. | | 129,803 | 2,831,003 |

| Essex Property Trust, Inc. | | 9,697 | 2,130,722 |

| Gaming & Leisure Properties | | 131,476 | 6,836,752 |

| Healthcare Trust of America, Inc. | | 327,667 | 6,481,253 |

| National Retail Properties, Inc. | | 135,649 | 5,900,732 |

| Realty Income Corp. | | 82,765 | 5,200,953 |

| Spirit Realty Capital, Inc. | | 115,414 | 4,438,822 |

| VICI Properties, Inc. | | 204,671 | 6,946,534 |

| Welltower, Inc. | | 25,825 | 2,045,857 |

| | | | 42,812,628 |

| Real Estate Management & Development - 0.5% | | | |

| Jones Lang LaSalle, Inc. (a) | | 29,070 | 4,041,893 |

TOTAL REAL ESTATE | | | 46,854,521 |

| UTILITIES - 4.8% | | | |

| Electric Utilities - 2.9% | | | |

| Alliant Energy Corp. | | 117,500 | 6,478,950 |

| FirstEnergy Corp. | | 104,997 | 4,178,881 |

| IDACORP, Inc. | | 52,153 | 5,795,241 |

| OGE Energy Corp. | | 200,252 | 7,517,460 |

| | | | 23,970,532 |

| Gas Utilities - 0.6% | | | |

| Atmos Energy Corp. | | 44,865 | 5,120,891 |

| Independent Power and Renewable Electricity Producers - 0.9% | | | |

| The AES Corp. | | 143,943 | 3,405,691 |

| Vistra Corp. | | 161,689 | 3,857,900 |

| | | | 7,263,591 |

| Multi-Utilities - 0.4% | | | |

| NiSource, Inc. | | 124,373 | 3,539,656 |

TOTAL UTILITIES | | | 39,894,670 |

| TOTAL COMMON STOCKS (Cost $730,394,794) | | | 800,840,129 |

| | | | |

| Convertible Preferred Stocks - 0.3% |

| | | Shares | Value ($) |

| CONSUMER STAPLES - 0.1% | | | |

| Food Products - 0.1% | | | |

| Bowery Farming, Inc. Series C1 (a)(c)(d) | | 19,457 | 181,339 |

| HEALTH CARE - 0.1% | | | |

| Biotechnology - 0.1% | | | |

| National Resilience, Inc. Series B (a)(c)(d) | | 15,539 | 943,683 |

| INDUSTRIALS - 0.1% | | | |

| Construction & Engineering - 0.1% | | | |

| Beta Technologies, Inc. Series B, 6.00% (c)(d) | | 11,901 | 876,271 |

| TOTAL CONVERTIBLE PREFERRED STOCKS (Cost $2,612,360) | | | 2,001,293 |

| | | | |

| Money Market Funds - 5.2% |

| | | Shares | Value ($) |

| Fidelity Cash Central Fund 4.88% (e) | | 19,533,992 | 19,537,899 |

| Fidelity Securities Lending Cash Central Fund 4.88% (e)(f) | | 23,294,096 | 23,296,425 |

| TOTAL MONEY MARKET FUNDS (Cost $42,834,324) | | | 42,834,324 |

| | | | |

| TOTAL INVESTMENT IN SECURITIES - 102.8% (Cost $775,841,478) | 845,675,746 |

NET OTHER ASSETS (LIABILITIES) - (2.8)% | (22,707,534) |

| NET ASSETS - 100.0% | 822,968,212 |

| | |

Legend

| (b) | Security or a portion of the security is on loan at period end. |

| (c) | Restricted securities (including private placements) - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $4,180,432 or 0.5% of net assets. |

| (e) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

| (f) | Investment made with cash collateral received from securities on loan. |

| Additional information on each restricted holding is as follows: |

| Security | Acquisition Date | Acquisition Cost ($) |

| Beta Technologies, Inc. Series B, 6.00% | 4/04/22 | 1,227,826 |

| | | |

| Bowery Farming, Inc. Series C1 | 5/18/21 | 1,172,271 |

| | | |

| Evolent Health, Inc. | 3/28/23 | 1,827,000 |

| | | |

| National Resilience, Inc. Series B | 12/01/20 | 212,263 |

| | | |

Affiliated Central Funds

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 4.88% | 21,371,002 | 195,790,902 | 197,624,005 | 913,666 | - | - | 19,537,899 | 0.0% |

| Fidelity Securities Lending Cash Central Fund 4.88% | 15,217,524 | 163,412,160 | 155,333,259 | 55,196 | - | - | 23,296,425 | 0.1% |

| Total | 36,588,526 | 359,203,062 | 352,957,264 | 968,862 | - | - | 42,834,324 | |

| | | | | | | | | |

Amounts in the dividend income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line item in the Statement of Operations, if applicable.

Amounts in the dividend income column for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Amounts included in the purchases and sales proceeds columns may include in-kind transactions, if applicable.

Investment Valuation

The following is a summary of the inputs used, as of April 30, 2023, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: |

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | | | | |

|

| Equities: | | | | |

Communication Services | 25,491,844 | 25,491,844 | - | - |

Consumer Discretionary | 96,350,963 | 96,350,963 | - | - |

Consumer Staples | 38,581,448 | 38,400,109 | - | 181,339 |

Energy | 75,608,761 | 75,608,761 | - | - |

Financials | 136,271,535 | 136,271,535 | - | - |

Health Care | 55,105,954 | 51,983,132 | 2,179,139 | 943,683 |

Industrials | 184,380,048 | 183,503,777 | - | 876,271 |

Information Technology | 39,241,412 | 39,241,412 | - | - |

Materials | 65,060,266 | 58,797,183 | 6,263,083 | - |

Real Estate | 46,854,521 | 46,854,521 | - | - |

Utilities | 39,894,670 | 39,894,670 | - | - |

|

| Money Market Funds | 42,834,324 | 42,834,324 | - | - |

| Total Investments in Securities: | 845,675,746 | 835,232,231 | 8,442,222 | 2,001,293 |

| Statement of Assets and Liabilities |

| | | | April 30, 2023 |

| | | | | |

| Assets | | | | |

| Investment in securities, at value (including securities loaned of $23,150,752) - See accompanying schedule: | | | | |

Unaffiliated issuers (cost $733,007,154) | $ | 802,841,422 | | |

Fidelity Central Funds (cost $42,834,324) | | 42,834,324 | | |

| | | | | |

| | | | | |

| Total Investment in Securities (cost $775,841,478) | | | $ | 845,675,746 |

| Cash | | | | 2,742 |

| Foreign currency held at value (cost $59,468) | | | | 59,468 |

| Receivable for investments sold | | | | 1,833,024 |

| Receivable for fund shares sold | | | | 723,548 |

| Dividends receivable | | | | 308,953 |

| Distributions receivable from Fidelity Central Funds | | | | 92,292 |

Total assets | | | | 848,695,773 |

| Liabilities | | | | |

| Payable for investments purchased | $ | 1,597,923 | | |

| Payable for fund shares redeemed | | 529,013 | | |

| Accrued management fee | | 304,604 | | |

| Other payables and accrued expenses | | 30 | | |

| Collateral on securities loaned | | 23,295,991 | | |

| Total Liabilities | | | | 25,727,561 |

| Net Assets | | | $ | 822,968,212 |

| Net Assets consist of: | | | | |

| Paid in capital | | | $ | 785,550,310 |

| Total accumulated earnings (loss) | | | | 37,417,902 |

| Net Assets | | | $ | 822,968,212 |

Net Asset Value , offering price and redemption price per share ($822,968,212 ÷ 60,865,505 shares) | | | $ | 13.52 |

| Statement of Operations |

| | | | Year ended April 30, 2023 |

| Investment Income | | | | |

| Dividends | | | $ | 11,726,347 |

| Interest | | | | 68 |

| Income from Fidelity Central Funds (including $55,196 from security lending) | | | | 968,862 |

| Total Income | | | | 12,695,277 |

| Expenses | | | | |

| Management fee | $ | 2,812,906 | | |

| Independent trustees' fees and expenses | | 2,944 | | |

| Total expenses before reductions | | 2,815,850 | | |

| Expense reductions | | (369) | | |

| Total expenses after reductions | | | | 2,815,481 |

| Net Investment income (loss) | | | | 9,879,796 |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | (32,316,920) | | |

| Redemptions in-kind | | 16,581,447 | | |

| Foreign currency transactions | | (1,659) | | |

| Total net realized gain (loss) | | | | (15,737,132) |

| Change in net unrealized appreciation (depreciation) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | 25,485,796 | | |

| Assets and liabilities in foreign currencies | | 2,797 | | |

| Total change in net unrealized appreciation (depreciation) | | | | 25,488,593 |

| Net gain (loss) | | | | 9,751,461 |

| Net increase (decrease) in net assets resulting from operations | | | $ | 19,631,257 |

| Statement of Changes in Net Assets |

| |

| | Year ended April 30, 2023 | | Year ended April 30, 2022 |

| Increase (Decrease) in Net Assets | | | | |

| Operations | | | | |

| Net investment income (loss) | $ | 9,879,796 | $ | 6,629,271 |

| Net realized gain (loss) | | (15,737,132) | | 9,367,287 |

| Change in net unrealized appreciation (depreciation) | | 25,488,593 | | (14,219,391) |

| Net increase (decrease) in net assets resulting from operations | | 19,631,257 | | 1,777,167 |

| Distributions to shareholders | | (16,927,430) | | (17,547,894) |

| Share transactions | | | | |

| Proceeds from sales of shares | | 410,750,484 | | 380,459,853 |

| Reinvestment of distributions | | 16,927,430 | | 17,547,894 |

| Cost of shares redeemed | | (183,950,405) | | (125,624,170) |

Net increase (decrease) in net assets resulting from share transactions | | 243,727,509 | | 272,383,577 |

| Total increase (decrease) in net assets | | 246,431,336 | | 256,612,850 |

| | | | | |

| Net Assets | | | | |

| Beginning of period | | 576,536,876 | | 319,924,026 |

| End of period | $ | 822,968,212 | $ | 576,536,876 |

| | | | | |

| Other Information | | | | |

| Shares | | | | |

| Sold | | 31,165,672 | | 27,206,050 |

| Issued in reinvestment of distributions | | 1,289,203 | | 1,240,806 |

| Redeemed | | (13,767,167) | | (8,904,637) |

| Net increase (decrease) | | 18,687,708 | | 19,542,219 |

| | | | | |

Financial Highlights

| Fidelity® Mid-Cap Stock K6 Fund |

| |

| Years ended April 30, | | 2023 | | 2022 | | 2021 | | 2020 A |

Selected Per-Share Data | | | | | | | | |

| Net asset value, beginning of period | $ | 13.67 | $ | 14.13 | $ | 8.78 | $ | 10.00 |

| Income from Investment Operations | | | | | | | | |

Net investment income (loss) B,C | | .21 | | .19 | | .15 | | .11 |

| Net realized and unrealized gain (loss) | | .03 | | (.07) | | 5.37 | | (1.27) |

| Total from investment operations | | .24 | | .12 | | 5.52 | | (1.16) |

| Distributions from net investment income | | (.17) | | (.13) | | (.17) | | (.06) |

| Distributions from net realized gain | | (.21) | | (.45) | | - | | - |

| Total distributions | | (.39) D | | (.58) | | (.17) | | (.06) |

| Net asset value, end of period | $ | 13.52 | $ | 13.67 | $ | 14.13 | $ | 8.78 |

Total Return E,F | | 1.82% | | .78% | | 63.39% | | (11.74)% |

Ratios to Average Net Assets C,G,H | | | | | | | | |

| Expenses before reductions | | .45% | | .45% | | .45% | | .45% I |

| Expenses net of fee waivers, if any | | .45% | | .45% | | .45% | | .45% I |

| Expenses net of all reductions | | .45% | | .45% | | .44% | | .45% I |

| Net investment income (loss) | | 1.58% | | 1.35% | | 1.35% | | 1.29% I |

| Supplemental Data | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 822,968 | $ | 576,537 | $ | 319,924 | $ | 108,435 |

Portfolio turnover rate J | | 34% K | | 40% K | | 61% K | | 52% I,K |

A For the period June 13, 2019 (commencement of operations) through April 30, 2020.

B Calculated based on average shares outstanding during the period.

C Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

D Total distributions per share do not sum due to rounding.

E Total returns for periods of less than one year are not annualized.

F Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

G Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

I Annualized.

J Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

K Portfolio turnover rate excludes securities received or delivered in-kind.

For the period ended April 30, 2023

1. Organization.

Fidelity Mid-Cap Stock K6 Fund (the Fund) is a fund of Fidelity Concord Street Trust (the Trust) and is authorized to issue an unlimited number of shares. Share transactions on the Statement of Changes in Net Assets may contain exchanges between affiliated funds. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. Shares generally are available only to employer-sponsored retirement plans that are recordkept by Fidelity, or to certain employer-sponsored retirement plans that are not recordkept by Fidelity.

2. Investments in Fidelity Central Funds.

Funds may invest in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Schedule of Investments lists any Fidelity Central Funds held as an investment as of period end, but does not include the underlying holdings of each Fidelity Central Fund. An investing fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

Based on its investment objective, each Fidelity Central Fund may invest or participate in various investment vehicles or strategies that are similar to those of the investing fund. These strategies are consistent with the investment objectives of the investing fund and may involve certain economic risks which may cause a decline in value of each of the Fidelity Central Funds and thus a decline in the value of the investing fund.

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense Ratio A |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

A Expenses expressed as a percentage of average net assets and are as of each underlying Central Fund's most recent annual or semi-annual shareholder report.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds which contain the significant accounting policies (including investment valuation policies) of those funds, and are not covered by the Report of Independent Registered Public Accounting Firm, are available on the Securities and Exchange Commission website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services - Investment Companies . The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The Fund's Schedule of Investments lists any underlying mutual funds or exchange-traded funds (ETFs) but does not include the underlying holdings of these funds. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has designated the Fund's investment adviser as the valuation designee responsible for the fair valuation function and performing fair value determinations as needed. The investment adviser has established a Fair Value Committee (the Committee) to carry out the day-to-day fair valuation responsibilities and has adopted policies and procedures to govern the fair valuation process and the activities of the Committee. In accordance with these fair valuation policies and procedures, which have been approved by the Board, the Fund attempts to obtain prices from one or more third party pricing services or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with the policies and procedures. Factors used in determining fair value vary by investment type and may include market or investment specific events, transaction data, estimated cash flows, and market observations of comparable investments. The frequency that the fair valuation procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee manages the Fund's fair valuation practices and maintains the fair valuation policies and procedures. The Fund's investment adviser reports to the Board information regarding the fair valuation process and related material matters.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Level 1 - unadjusted quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing service on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of April 30, 2023 is included at the end of the Fund's Schedule of Investments.

Foreign Currency. Certain Funds may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received, and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost. Commissions paid to certain brokers with whom the investment adviser, or its affiliates, places trades on behalf of a fund include an amount in addition to trade execution, which may be rebated back to a fund. Any such rebates are included in net realized gain (loss) on investments in the Statement of Operations. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Certain distributions received by the Fund represent a return of capital or capital gain. The Fund determines the components of these distributions subsequent to the ex-dividend date, based upon receipt of tax filings or other correspondence relating to the underlying investment. These distributions are recorded as a reduction of cost of investments and/or as a realized gain. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain. Funds may file withholding tax reclaims in certain jurisdictions to recover a portion of amounts previously withheld. Any withholding tax reclaims income is included in the Statement of Operations in dividends. Any receivables for withholding tax reclaims are included in the Statement of Assets and Liabilities in dividends receivable.

Expenses. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expenses included in the accompanying financial statements reflect the expenses of that fund and do not include any expenses associated with any underlying mutual funds or exchange-traded funds. Although not included in a fund's expenses, a fund indirectly bears its proportionate share of these expenses through the net asset value of each underlying mutual fund or exchange-traded fund. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. As of April 30, 2023, the Fund did not have any unrecognized tax benefits in the financial statements; nor is the Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are declared and recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, passive foreign investment companies (PFIC), redemptions in-kind, partnerships, capital loss carryforwards and losses deferred due to wash sales.

As of period end, the cost and unrealized appreciation (depreciation) in securities, and derivatives if applicable, for federal income tax purposes were as follows:

| Gross unrealized appreciation | $109,289,797 |

| Gross unrealized depreciation | (43,277,961) |

| Net unrealized appreciation (depreciation) | $66,011,836 |

| Tax Cost | $779,663,910 |

The tax-based components of distributable earnings as of period end were as follows:

| Undistributed ordinary income | $3,349,484 |

| Capital loss carryforward | $(31,554,388) |

| Net unrealized appreciation (depreciation) on securities and other investments | $65,622,804 |

Capital loss carryforwards are only available to offset future capital gains of the Fund to the extent provided by regulations and may be limited. The capital loss carryforward information presented below, including any applicable limitation, is estimated as of fiscal period end and is subject to adjustment.

Short-term | $(15,032,339) |

Long-term | (16,522,049) |

| Total capital loss carryforward | $(31,554,388) |

The tax character of distributions paid was as follows:

| | April 30, 2023 | April 30, 2022 |

| Ordinary Income | $7,865,886 | $7,952,847 |

| Long-term Capital Gains | 9,061,544 | 9,595,047 |

| Total | $16,927,430 | $17,547,894 |

Restricted Securities (including Private Placements). Funds may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities held at period end is included at the end of the Schedule of Investments, if applicable.

4. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities and in-kind transactions, as applicable, are noted in the table below.

| | Purchases ($) | Sales ($) |

| Fidelity Mid-Cap Stock K6 Fund | 267,687,757 | 199,223,646 |

Unaffiliated Redemptions In-Kind. Shares that were redeemed in-kind for investments, including accrued interest and cash, if any, are shown in the table below. The net realized gain or loss on investments delivered through in-kind redemptions is included in the "Net realized gain (loss) on: Redemptions in-kind" line in the accompanying Statement of Operations. The amount of the in-kind redemptions is included in share transactions in the accompanying Statement of Changes in Net Assets. There was no gain or loss for federal income tax purposes.

| | Shares | Total net realized gain or loss($) | Total Proceeds($) |

| Fidelity Mid-Cap Stock K6 Fund | 4,189,666 | 16,581,447 | 56,686,184 |

Unaffiliated Exchanges In-Kind. Shares that were exchanged for investments, including accrued interest and cash, if any, are shown in the table below. The amount of in-kind exchanges is included in share transactions in the accompanying Statement of Changes in Net Assets.

| | Shares | Total Proceeds($) |

| Fidelity Mid-Cap Stock K6 Fund | 18,276,381 | 237,757,517 |

Prior Year Unaffiliated Exchanges In-Kind. Shares that were exchanged for investments, including accrued interest and cash, if any, are shown in the table below. The amount of in-kind exchanges is included in share transactions in the accompanying Statement of Changes in Net Assets.

| | Shares | Total Proceeds($) |

| Fidelity Mid-Cap Stock K6 Fund | 16,479,320 | 227,539,776 |

5. Fees and Other Transactions with Affiliates.

Management Fee. Fidelity Management & Research Company LLC (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee that is based on an annual rate of .45% of average net assets. Under the management contract, the investment adviser or an affiliate pays all other expenses of the Fund, excluding fees and expenses of the independent Trustees, and certain miscellaneous expenses such as proxy and shareholder meeting expenses.

Brokerage Commissions. A portion of portfolio transactions were placed with brokerage firms which are affiliates of the investment adviser. Brokerage commissions are included in net realized gain (loss) and change in net unrealized appreciation (depreciation) in the Statement of Operations. The commissions paid to these affiliated firms were as follows:

| | Amount |

| Fidelity Mid-Cap Stock K6 Fund | $5,381 |

Interfund Trades. Funds may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act. Any interfund trades are included within the respective purchases and sales amounts shown in the Purchases and Sales of Investments note. Interfund trades during the period are noted in the table below.

| | Purchases ($) | Sales ($) | Realized Gain (Loss) ($) |

| Fidelity Mid-Cap Stock K6 Fund | 13,439,980 | 8,730,233 | (955,805) |

6. Committed Line of Credit.

Certain Funds participate with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The commitment fees on the pro-rata portion of the line of credit are borne by the investment adviser. During the period, there were no borrowings on this line of credit.

7. Security Lending.

Funds lend portfolio securities from time to time in order to earn additional income. Lending agents are used, including National Financial Services (NFS), an affiliate of the investment adviser. Pursuant to a securities lending agreement, NFS will receive a fee, which is capped at 9.9% of a fund's daily lending revenue, for its services as lending agent. A fund may lend securities to certain qualified borrowers, including NFS. On the settlement date of the loan, a fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of a fund and any additional required collateral is delivered to a fund on the next business day. A fund or borrower may terminate the loan at any time, and if the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, a fund may apply collateral received from the borrower against the obligation. A fund may experience delays and costs in recovering the securities loaned. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. Any loaned securities are identified as such in the Schedule of Investments, and the value of loaned securities and cash collateral at period end, as applicable, are presented in the Statement of Assets and Liabilities. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds. Affiliated security lending activity, if any, was as follows:

| | Total Security Lending Fees Paid to NFS | Security Lending Income From Securities Loaned to NFS | Value of Securities Loaned to NFS at Period End |

| Fidelity Mid-Cap Stock K6 Fund | $5,791 | $690 | $- |

8. Expense Reductions.

Through arrangements with the Fund's custodian, credits realized as a result of certain uninvested cash balances were used to reduce the Fund's expenses by $369.

9. Other.

A fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the fund. In the normal course of business, a fund may also enter into contracts that provide general indemnifications. A fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against a fund. The risk of material loss from such claims is considered remote.

10. Risk and Uncertainties.

Many factors affect a fund's performance. Developments that disrupt global economies and financial markets, such as pandemics, epidemics, outbreaks of infectious diseases, war, terrorism, and environmental disasters, may significantly affect a fund's investment performance. The effects of these developments to a fund will be impacted by the types of securities in which a fund invests, the financial condition, industry, economic sector, and geographic location of an issuer, and a fund's level of investment in the securities of that issuer. Significant concentrations in security types, issuers, industries, sectors, and geographic locations may magnify the factors that affect a fund's performance.

To the Board of Trustees of Fidelity Concord Street Trust and Shareholders of Fidelity Mid-Cap Stock K6 Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Fidelity Mid-Cap Stock K6 Fund (one of the funds constituting Fidelity Concord Street Trust, referred to hereafter as the "Fund") as of April 30, 2023, the related statement of operations for the year ended April 30, 2023, the statement of changes in net assets for each of the two years in the period ended April 30, 2023, including the related notes, and the financial highlights for each of the three years in the period ended April 30, 2023 and for the period June 13, 2019 (commencement of operations) through April 30, 2020 (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of April 30, 2023, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended April 30, 2023 and the financial highlights for each of the three years in the period ended April 30, 2023 and for the period June 13, 2019 (commencement of operations) through April 30, 2020 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund's management. Our responsibility is to express an opinion on the Fund's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of April 30, 2023 by correspondence with the custodian, issuers of privately offered securities and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

Boston, Massachusetts

June 13, 2023

We have served as the auditor of one or more investment companies in the Fidelity group of funds since 1932.

The Trustees, Members of the Advisory Board (if any), and officers of the trust and fund, as applicable, are listed below. The Board of Trustees governs the fund and is responsible for protecting the interests of shareholders. The Trustees are experienced executives who meet periodically throughout the year to oversee the fund's activities, review contractual arrangements with companies that provide services to the fund, oversee management of the risks associated with such activities and contractual arrangements, and review the fund's performance. Except for Jonathan Chiel, each of the Trustees oversees 318 funds. Mr. Chiel oversees 188 funds.

The Trustees hold office without limit in time except that (a) any Trustee may resign; (b) any Trustee may be removed by written instrument, signed by at least two-thirds of the number of Trustees prior to such removal; (c) any Trustee who requests to be retired or who has become incapacitated by illness or injury may be retired by written instrument signed by a majority of the other Trustees; and (d) any Trustee may be removed at any special meeting of shareholders by a two-thirds vote of the outstanding voting securities of the trust. Each Trustee who is not an interested person (as defined in the 1940 Act) of the trust and the fund is referred to herein as an Independent Trustee. Each Independent Trustee shall retire not later than the last day of the calendar year in which his or her 75th birthday occurs. The Independent Trustees may waive this mandatory retirement age policy with respect to individual Trustees. Officers and Advisory Board Members hold office without limit in time, except that any officer or Advisory Board Member may resign or may be removed by a vote of a majority of the Trustees at any regular meeting or any special meeting of the Trustees. Except as indicated, each individual has held the office shown or other offices in the same company for the past five years.

The fund's Statement of Additional Information (SAI) includes more information about the Trustees. To request a free copy, call Fidelity at 1-800-835-5092.

Experience, Skills, Attributes, and Qualifications of the Trustees. The Governance and Nominating Committee has adopted a statement of policy that describes the experience, qualifications, attributes, and skills that are necessary and desirable for potential Independent Trustee candidates (Statement of Policy). The Board believes that each Trustee satisfied at the time he or she was initially elected or appointed a Trustee, and continues to satisfy, the standards contemplated by the Statement of Policy. The Governance and Nominating Committee also engages professional search firms to help identify potential Independent Trustee candidates who have the experience, qualifications, attributes, and skills consistent with the Statement of Policy. From time to time, additional criteria based on the composition and skills of the current Independent Trustees, as well as experience or skills that may be appropriate in light of future changes to board composition, business conditions, and regulatory or other developments, have also been considered by the professional search firms and the Governance and Nominating Committee. In addition, the Board takes into account the Trustees' commitment and participation in Board and committee meetings, as well as their leadership of standing and ad hoc committees throughout their tenure.

In determining that a particular Trustee was and continues to be qualified to serve as a Trustee, the Board has considered a variety of criteria, none of which, in isolation, was controlling. The Board believes that, collectively, the Trustees have balanced and diverse experience, qualifications, attributes, and skills, which allow the Board to operate effectively in governing the fund and protecting the interests of shareholders. Information about the specific experience, skills, attributes, and qualifications of each Trustee, which in each case led to the Board's conclusion that the Trustee should serve (or continue to serve) as a trustee of the fund, is provided below.

Board Structure and Oversight Function. Robert A. Lawrence is an interested person and currently serves as Chair. The Trustees have determined that an interested Chair is appropriate and benefits shareholders because an interested Chair has a personal and professional stake in the quality and continuity of services provided to the fund. Independent Trustees exercise their informed business judgment to appoint an individual of their choosing to serve as Chair, regardless of whether the Trustee happens to be independent or a member of management. The Independent Trustees have determined that they can act independently and effectively without having an Independent Trustee serve as Chair and that a key structural component for assuring that they are in a position to do so is for the Independent Trustees to constitute a substantial majority for the Board. The Independent Trustees also regularly meet in executive session. David M. Thomas serves as Lead Independent Trustee and as such (i) acts as a liaison between the Independent Trustees and management with respect to matters important to the Independent Trustees and (ii) with management prepares agendas for Board meetings.

Fidelity ® funds are overseen by different Boards of Trustees. The fund's Board oversees Fidelity's high income and certain equity funds, and other Boards oversee Fidelity's alternative investment, investment-grade bond, money market, asset allocation, and other equity funds. The asset allocation funds may invest in Fidelity ® funds overseen by the fund's Board. The use of separate Boards, each with its own committee structure, allows the Trustees of each group of Fidelity ® funds to focus on the unique issues of the funds they oversee, including common research, investment, and operational issues. On occasion, the separate Boards establish joint committees to address issues of overlapping consequences for the Fidelity ® funds overseen by each Board.

The Trustees operate using a system of committees to facilitate the timely and efficient consideration of all matters of importance to the Trustees, the fund, and fund shareholders and to facilitate compliance with legal and regulatory requirements and oversight of the fund's activities and associated risks. The Board, acting through its committees, has charged FMR and its affiliates with (i) identifying events or circumstances the occurrence of which could have demonstrably adverse effects on the fund's business and/or reputation; (ii) implementing processes and controls to lessen the possibility that such events or circumstances occur or to mitigate the effects of such events or circumstances if they do occur; and (iii) creating and maintaining a system designed to evaluate continuously business and market conditions in order to facilitate the identification and implementation processes described in (i) and (ii) above. Because the day-to-day operations and activities of the fund are carried out by or through FMR, its affiliates, and other service providers, the fund's exposure to risks is mitigated but not eliminated by the processes overseen by the Trustees. While each of the Board's committees has responsibility for overseeing different aspects of the fund's activities, oversight is exercised primarily through the Operations, Audit, and Compliance Committees. Appropriate personnel, including but not limited to the fund's Chief Compliance Officer (CCO), FMR's internal auditor, the independent accountants, the fund's Treasurer and portfolio management personnel, make periodic reports to the Board's committees, as appropriate, including an annual review of Fidelity's risk management program for the Fidelity ® funds. The responsibilities of each standing committee, including their oversight responsibilities, are described further under "Standing Committees of the Trustees."

Interested Trustees*:

Correspondence intended for a Trustee who is an interested person may be sent to Fidelity Investments, 245 Summer Street, Boston, Massachusetts 02210.

Name, Year of Birth; Principal Occupations and Other Relevant Experience+

Jonathan Chiel (1957)

Year of Election or Appointment: 2016

Trustee

Mr. Chiel also serves as Trustee of other Fidelity ® funds. Mr. Chiel is Executive Vice President and General Counsel for FMR LLC (diversified financial services company, 2012-present). Previously, Mr. Chiel served as general counsel (2004-2012) and senior vice president and deputy general counsel (2000-2004) for John Hancock Financial Services; a partner with Choate, Hall & Stewart (1996-2000) (law firm); and an Assistant United States Attorney for the United States Attorney's Office of the District of Massachusetts (1986-95), including Chief of the Criminal Division (1993-1995). Mr. Chiel is a director on the boards of the Boston Bar Foundation and the Maimonides School.

Bettina Doulton (1964)

Year of Election or Appointment: 2021

Trustee

Ms. Doulton also serves as Trustee of other Fidelity ® funds. Prior to her retirement, Ms. Doulton served in a variety of positions at Fidelity Investments, including as a managing director of research (2006-2007), portfolio manager to certain Fidelity ® funds (1993-2005), equity analyst and portfolio assistant (1990-1993), and research assistant (1987-1990). Ms. Doulton currently owns and operates Phi Builders + Architects and Cellardoor Winery. Previously, Ms. Doulton served as a member of the Board of Brown Capital Management, LLC (2014-2018).

Robert A. Lawrence (1952)

Year of Election or Appointment: 2020

Trustee

Chair of the Board of Trustees

Mr. Lawrence also serves as Trustee of other funds. Previously, Mr. Lawrence served as a Trustee and Member of the Advisory Board of certain funds. Prior to his retirement in 2008, Mr. Lawrence served as Vice President of certain Fidelity ® funds (2006-2008), Senior Vice President, Head of High Income Division of Fidelity Management & Research Company (investment adviser firm, 2006-2008), and President of Fidelity Strategic Investments (investment adviser firm, 2002-2005).

* Determined to be an "Interested Trustee" by virtue of, among other things, his or her affiliation with the trust or various entities under common control with FMR.

+ The information includes the Trustee's principal occupation during the last five years and other information relating to the experience, attributes, and skills relevant to the Trustee's qualifications to serve as a Trustee, which led to the conclusion that the Trustee should serve as a Trustee for the fund.

Independent Trustees:

Correspondence intended for an Independent Trustee may be sent to Fidelity Investments, P.O. Box 55235, Boston, Massachusetts 02205-5235.

Name, Year of Birth; Principal Occupations and Other Relevant Experience+

Thomas P. Bostick (1956)

Year of Election or Appointment: 2021

Trustee

Lieutenant General Bostick also serves as Trustee of other Fidelity ® funds. Prior to his retirement, General Bostick (United States Army, Retired) held a variety of positions within the U.S. Army, including Commanding General and Chief of Engineers, U.S. Army Corps of Engineers (2012-2016) and Deputy Chief of Staff and Director of Human Resources, U.S. Army (2009-2012). General Bostick currently serves as a member of the Board and Finance and Governance & Sustainability Committees of CSX Corporation (transportation, 2020-present) and a member of the Board and Corporate Governance and Nominating Committee of Perma-Fix Environmental Services, Inc. (nuclear waste management, 2020-present). General Bostick serves as Chief Executive Officer of Bostick Global Strategies, LLC (consulting, 2016-present), as a member of the Board of HireVue, Inc. (video interview and assessment, 2020-present), as a member of the Board of Allonnia (biotechnology and engineering solutions, 2022-present) and on the Advisory Board of Solugen, Inc. (specialty bio-based chemicals manufacturer, 2022-present). Previously, General Bostick served as a Member of the Advisory Board of certain Fidelity ® funds (2021), President, Intrexon Bioengineering (2018-2020) and Chief Operating Officer (2017-2020) and Senior Vice President of the Environment Sector (2016-2017) of Intrexon Corporation (biopharmaceutical company).

Dennis J. Dirks (1948)

Year of Election or Appointment: 2005

Trustee

Mr. Dirks also serves as Trustee of other Fidelity ® funds. Prior to his retirement in May 2003, Mr. Dirks served as Chief Operating Officer and as a member of the Board of The Depository Trust & Clearing Corporation (financial markets infrastructure), President, Chief Operating Officer and a member of the Board of The Depository Trust Company (DTC), President and a member of the Board of the National Securities Clearing Corporation (NSCC), Chief Executive Officer and a member of the Board of the Government Securities Clearing Corporation and Chief Executive Officer and a member of the Board of the Mortgage-Backed Securities Clearing Corporation. Mr. Dirks currently serves as a member of the Finance Committee (2016-present) and Board (2017-present) and is Treasurer (2018-present) of the Asolo Repertory Theatre.

Donald F. Donahue (1950)

Year of Election or Appointment: 2018

Trustee

Mr. Donahue also serves as Trustee of other Fidelity ® funds. Mr. Donahue serves as President and Chief Executive Officer of Miranda Partners, LLC (risk consulting for the financial services industry, 2012-present). Previously, Mr. Donahue served as Chief Executive Officer (2006-2012), Chief Operating Officer (2003-2006) and Managing Director, Customer Marketing and Development (1999-2003) of The Depository Trust & Clearing Corporation (financial markets infrastructure). Mr. Donahue currently serves as a member (2007-present) and Co-Chairman (2016-present) of the Board of United Way of New York. Mr. Donahue previously served as a member of the Advisory Board of certain Fidelity ® funds (2015-2018) and as a member of the Board of The Leadership Academy (previously NYC Leadership Academy) (2012-2022).

Vicki L. Fuller (1957)

Year of Election or Appointment: 2020

Trustee

Ms. Fuller also serves as Trustee of other Fidelity ® funds. Previously, Ms. Fuller served as a member of the Advisory Board of certain Fidelity ® funds (2018-2020), Chief Investment Officer of the New York State Common Retirement Fund (2012-2018) and held a variety of positions at AllianceBernstein L.P. (global asset management, 1985-2012), including Managing Director (2006-2012) and Senior Vice President and Senior Portfolio Manager (2001-2006). Ms. Fuller currently serves as a member of the Board, Audit Committee and Nominating and Governance Committee of two Blackstone business development companies (2020-present), as a member of the Board of Treliant, LLC (consulting, 2019-present), as a member of the Board of Ariel Alternatives, LLC (private equity, 2022-present) and as a member of the Board and Chair of the Audit Committee of Gusto, Inc. (software, 2021-present). In addition, Ms. Fuller currently serves as a member of the Board of Roosevelt University (2019-present) and as a member of the Executive Board of New York University's Stern School of Business. Ms. Fuller previously served as a member of the Board, Audit Committee and Nominating and Governance Committee of The Williams Companies, Inc. (natural gas infrastructure, 2018-2021).

Patricia L. Kampling (1959)

Year of Election or Appointment: 2020

Trustee

Ms. Kampling also serves as Trustee of other Fidelity ® funds. Prior to her retirement, Ms. Kampling served as Chairman of the Board and Chief Executive Officer (2012-2019), President and Chief Operating Officer (2011-2012) and Executive Vice President and Chief Financial Officer (2010-2011) of Alliant Energy Corporation. Ms. Kampling currently serves as a member of the Board, Finance Committee and Governance, Compensation and Nominating Committee of Xcel Energy Inc. (utilities company, 2020-present) and as a member of the Board, Audit, Finance and Risk Committee and Safety, Environmental, Technology and Operations Committee and Chair of the Executive Development and Compensation Committee of American Water Works Company, Inc. (utilities company, 2019-present). In addition, Ms. Kampling currently serves as a member of the Board of the Nature Conservancy, Wisconsin Chapter (2019-present). Previously, Ms. Kampling served as a Member of the Advisory Board of certain Fidelity® funds (2020), a member of the Board, Compensation Committee and Executive Committee and Chair of the Audit Committee of Briggs & Stratton Corporation (manufacturing, 2011-2021), a member of the Board of Interstate Power and Light Company (2012-2019) and Wisconsin Power and Light Company (2012-2019) (each a subsidiary of Alliant Energy Corporation) and as a member of the Board and Workforce Development Committee of the Business Roundtable (2018-2019).

Thomas A. Kennedy (1955)

Year of Election or Appointment: 2021

Trustee