Fidelity Concord Street Trust

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05251

Fidelity Concord Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | April 30 |

|

|

Date of reporting period: | October 31, 2019 |

Item 1.

Reports to Stockholders

Fidelity® Mid-Cap Stock Fund

Semi-Annual Report

October 31, 2019

See the inside front cover for important information about access to your fund’s shareholder reports.

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of a fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the fund or from your financial intermediary, such as a financial advisor, broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a fund electronically, by contacting your financial intermediary. For Fidelity customers, visit Fidelity's web site or call Fidelity using the contact information listed below.

You may elect to receive all future reports in paper free of charge. If you wish to continue receiving paper copies of your shareholder reports, you may contact your financial intermediary or, if you are a Fidelity customer, visit Fidelity’s website, or call Fidelity at the applicable toll-free number listed below. Your election to receive reports in paper will apply to all funds held with the fund complex/your financial intermediary.

| Account Type | Website | Phone Number |

| Brokerage, Mutual Fund, or Annuity Contracts: | fidelity.com/mailpreferences | 1-800-343-3548 |

| Employer Provided Retirement Accounts: | netbenefits.fidelity.com/preferences (choose 'no' under Required Disclosures to continue to print) | 1-800-343-0860 |

| Advisor Sold Accounts Serviced Through Your Financial Intermediary: | Contact Your Financial Intermediary | Your Financial Intermediary's phone number |

| Advisor Sold Accounts Serviced by Fidelity: | institutional.fidelity.com | 1-877-208-0098 |

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 if you’re an individual investing directly with Fidelity, call 1-800-835-5092 if you’re a plan sponsor or participant with Fidelity as your recordkeeper or call 1-877-208-0098 on institutional accounts or if you’re an advisor or invest through one to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2019 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Investment Summary (Unaudited)

Top Ten Stocks as of October 31, 2019

| | % of fund's net assets |

| NVR, Inc. | 1.9 |

| Amphenol Corp. Class A | 1.5 |

| Radian Group, Inc. | 1.5 |

| WNS Holdings Ltd. sponsored ADR | 1.4 |

| M&T Bank Corp. | 1.3 |

| Huntington Bancshares, Inc. | 1.3 |

| Reinsurance Group of America, Inc. | 1.3 |

| OGE Energy Corp. | 1.3 |

| VICI Properties, Inc. | 1.3 |

| Huntington Ingalls Industries, Inc. | 1.1 |

| | 13.9 |

Top Five Market Sectors as of October 31, 2019

| | % of fund's net assets |

| Financials | 21.2 |

| Consumer Discretionary | 14.5 |

| Industrials | 11.8 |

| Information Technology | 9.6 |

| Health Care | 8.5 |

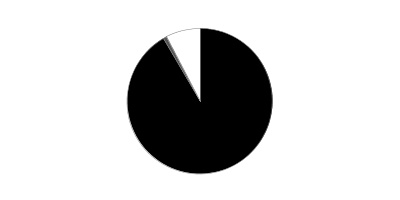

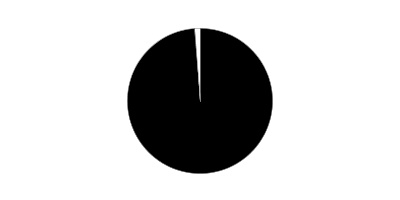

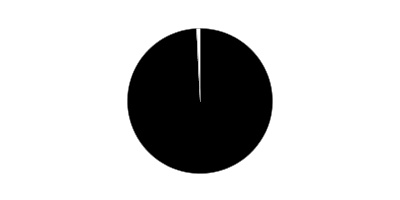

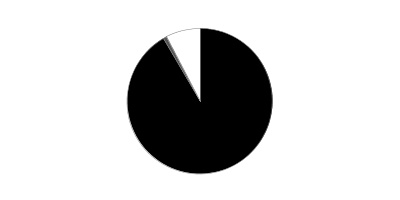

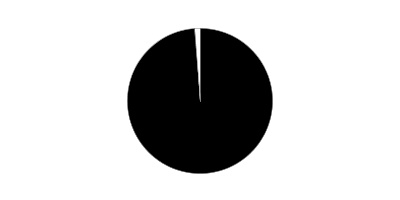

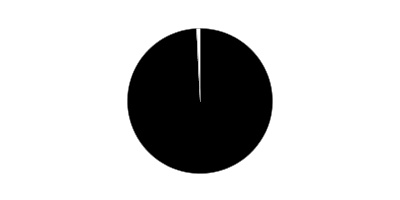

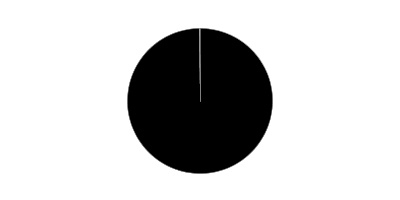

Asset Allocation (% of fund's net assets)

| As of October 31, 2019 * |

| | Stocks | 91.6% |

| | Convertible Securities | 0.7% |

| | Other Investments | 0.1% |

| | Short-Term Investments and Net Other Assets (Liabilities) | 7.6% |

* Foreign investments - 14.6%

Schedule of Investments October 31, 2019 (Unaudited)

Showing Percentage of Net Assets

| Common Stocks - 91.6% | | | |

| | | Shares | Value (000s) |

| COMMUNICATION SERVICES - 2.1% | | | |

| Diversified Telecommunication Services - 0.6% | | | |

| Cogent Communications Group, Inc. | | 373,600 | $21,908 |

| Iridium Communications, Inc. (a) | | 677,400 | 16,576 |

| | | | 38,484 |

| Entertainment - 0.3% | | | |

| WME Entertainment Parent, LLC Class A (a)(b)(c)(d) | | 8,815,374 | 20,892 |

| Media - 0.6% | | | |

| Nexstar Broadcasting Group, Inc. Class A | | 229,100 | 22,289 |

| Sinclair Broadcast Group, Inc. Class A | | 566,700 | 22,577 |

| | | | 44,866 |

| Wireless Telecommunication Services - 0.6% | | | |

| Sprint Corp. (a) | | 7,283,341 | 45,230 |

|

| TOTAL COMMUNICATION SERVICES | | | 149,472 |

|

| CONSUMER DISCRETIONARY - 14.3% | | | |

| Automobiles - 1.0% | | | |

| Aston Martin Lagonda Global Holdings PLC (a)(e) | | 2,994,600 | 15,489 |

| Fiat Chrysler Automobiles NV | | 3,748,712 | 57,430 |

| | | | 72,919 |

| Hotels, Restaurants & Leisure - 2.7% | | | |

| ARAMARK Holdings Corp. | | 1,200,727 | 52,544 |

| Drive Shack, Inc. (a) | | 3,204,790 | 12,787 |

| Dunkin' Brands Group, Inc. | | 391,000 | 30,740 |

| Wyndham Hotels & Resorts, Inc. (f) | | 1,131,856 | 61,086 |

| Wynn Resorts Ltd. | | 293,800 | 35,650 |

| | | | 192,807 |

| Household Durables - 3.5% | | | |

| D.R. Horton, Inc. | | 1,177,243 | 61,652 |

| Lennar Corp. Class A | | 569,724 | 33,956 |

| Mohawk Industries, Inc. (a) | | 115,745 | 16,596 |

| NVR, Inc. (a) | | 38,351 | 139,469 |

| | | | 251,673 |

| Leisure Products - 0.9% | | | |

| New Academy Holding Co. LLC unit (a)(c)(d)(g) | | 294,000 | 8,796 |

| Peloton Interactive, Inc. | | 2,507,776 | 53,875 |

| Peloton Interactive, Inc. Class A (a)(f) | | 179,600 | 4,287 |

| | | | 66,958 |

| Multiline Retail - 1.5% | | | |

| Dollar General Corp. | | 433,962 | 69,581 |

| Dollar Tree, Inc. (a) | | 311,400 | 34,379 |

| | | | 103,960 |

| Specialty Retail - 2.7% | | | |

| AutoZone, Inc. (a) | | 33,966 | 38,870 |

| Best Buy Co., Inc. | | 287,878 | 20,678 |

| National Vision Holdings, Inc. (a) | | 1,653,067 | 39,343 |

| Ross Stores, Inc. | | 466,900 | 51,205 |

| Tiffany & Co., Inc. (f) | | 329,767 | 41,059 |

| | | | 191,155 |

| Textiles, Apparel & Luxury Goods - 2.0% | | | |

| Allbirds, Inc. (a)(c)(d) | | 10,775 | 534 |

| Brunello Cucinelli SpA | | 2,069,700 | 64,818 |

| PVH Corp. | | 304,193 | 26,513 |

| Tapestry, Inc. | | 1,092,896 | 28,262 |

| Under Armour, Inc. Class A (sub. vtg.) (a)(f) | | 1,092,296 | 22,556 |

| | | | 142,683 |

|

| TOTAL CONSUMER DISCRETIONARY | | | 1,022,155 |

|

| CONSUMER STAPLES - 4.0% | | | |

| Food & Staples Retailing - 1.7% | | | |

| Kroger Co. | | 1,128,640 | 27,810 |

| Performance Food Group Co. (a) | | 973,117 | 41,465 |

| U.S. Foods Holding Corp. (a) | | 1,280,606 | 50,802 |

| | | | 120,077 |

| Food Products - 1.5% | | | |

| Bunge Ltd. | | 458,237 | 24,745 |

| Conagra Brands, Inc. | | 1,197,190 | 32,384 |

| Greencore Group PLC | | 15,752,484 | 47,421 |

| | | | 104,550 |

| Personal Products - 0.8% | | | |

| Coty, Inc. Class A | | 1,440,939 | 16,845 |

| Edgewell Personal Care Co. (a) | | 1,194,493 | 41,807 |

| | | | 58,652 |

|

| TOTAL CONSUMER STAPLES | | | 283,279 |

|

| ENERGY - 4.9% | | | |

| Energy Equipment & Services - 0.8% | | | |

| Borr Drilling Ltd. (a)(f) | | 2,125,200 | 14,312 |

| Oceaneering International, Inc. (a) | | 1,967,882 | 27,865 |

| Pacific Drilling SA (a) | | 916,714 | 2,292 |

| TechnipFMC PLC | | 657,835 | 12,979 |

| | | | 57,448 |

| Oil, Gas & Consumable Fuels - 4.1% | | | |

| Cabot Oil & Gas Corp. | | 1,472,113 | 27,440 |

| Cheniere Energy, Inc. (a) | | 728,000 | 44,808 |

| GasLog Ltd. | | 1,150,614 | 15,775 |

| Golar LNG Ltd. | | 1,952,745 | 26,889 |

| Hess Corp. | | 982,807 | 64,620 |

| Kosmos Energy Ltd. | | 7,082,468 | 43,911 |

| New Fortress Energy LLC | | 1,276,100 | 22,000 |

| The Williams Companies, Inc. | | 2,215,458 | 49,427 |

| | | | 294,870 |

|

| TOTAL ENERGY | | | 352,318 |

|

| FINANCIALS - 21.2% | | | |

| Banks - 8.7% | | | |

| Bank of Hawaii Corp. | | 462,433 | 40,375 |

| Cullen/Frost Bankers, Inc. | | 682,810 | 61,508 |

| First Horizon National Corp. | | 3,375,789 | 53,911 |

| Huntington Bancshares, Inc. | | 6,845,400 | 96,726 |

| M&T Bank Corp. | | 620,073 | 97,060 |

| Prosperity Bancshares, Inc. (f) | | 914,176 | 63,096 |

| Signature Bank | | 604,100 | 71,477 |

| SunTrust Banks, Inc. | | 615,578 | 42,069 |

| UMB Financial Corp. | | 616,000 | 40,200 |

| Wintrust Financial Corp. | | 854,700 | 54,547 |

| | | | 620,969 |

| Capital Markets - 3.0% | | | |

| Cboe Global Markets, Inc. | | 212,700 | 24,492 |

| Lazard Ltd. Class A | | 852,838 | 31,836 |

| Northern Trust Corp. | | 510,200 | 50,857 |

| Raymond James Financial, Inc. | | 295,701 | 24,688 |

| The NASDAQ OMX Group, Inc. | | 457,500 | 45,645 |

| TPG Specialty Lending, Inc. | | 1,921,028 | 40,918 |

| | | | 218,436 |

| Consumer Finance - 0.3% | | | |

| Shriram Transport Finance Co. Ltd. | | 1,222,100 | 19,575 |

| Insurance - 7.7% | | | |

| American Financial Group, Inc. | | 573,021 | 59,617 |

| Arch Capital Group Ltd. (a) | | 1,787,300 | 74,638 |

| Axis Capital Holdings Ltd. | | 640,653 | 38,074 |

| Beazley PLC | | 2,871,400 | 21,815 |

| First American Financial Corp. | | 1,025,193 | 63,336 |

| FNF Group | | 1,218,112 | 55,838 |

| Globe Life, Inc. | | 488,207 | 47,517 |

| Hartford Financial Services Group, Inc. | | 823,568 | 47,009 |

| Hiscox Ltd. | | 957,407 | 18,466 |

| Principal Financial Group, Inc. | | 556,700 | 29,717 |

| Reinsurance Group of America, Inc. | | 578,116 | 93,927 |

| | | | 549,954 |

| Thrifts & Mortgage Finance - 1.5% | | | |

| Radian Group, Inc. | | 4,275,424 | 107,313 |

|

| TOTAL FINANCIALS | | | 1,516,247 |

|

| HEALTH CARE - 8.1% | | | |

| Health Care Equipment & Supplies - 2.0% | | | |

| Boston Scientific Corp. (a) | | 1,051,338 | 43,841 |

| Hologic, Inc. (a) | | 717,430 | 34,659 |

| ResMed, Inc. | | 259,038 | 38,317 |

| Wright Medical Group NV (a) | | 1,127,723 | 23,457 |

| | | | 140,274 |

| Health Care Providers & Services - 2.8% | | | |

| Centene Corp. (a) | | 410,385 | 21,783 |

| Henry Schein, Inc. (a) | | 629,600 | 39,404 |

| Molina Healthcare, Inc. (a) | | 582,811 | 68,562 |

| Universal Health Services, Inc. Class B | | 486,808 | 66,917 |

| | | | 196,666 |

| Life Sciences Tools & Services - 1.3% | | | |

| Bruker Corp. | | 966,595 | 43,013 |

| Lonza Group AG | | 135,524 | 48,769 |

| | | | 91,782 |

| Pharmaceuticals - 2.0% | | | |

| Catalent, Inc. (a) | | 1,183,454 | 57,575 |

| Perrigo Co. PLC | | 706,686 | 37,468 |

| Recordati SpA | | 686,500 | 28,842 |

| Zogenix, Inc. (a) | | 503,100 | 22,463 |

| | | | 146,348 |

|

| TOTAL HEALTH CARE | | | 575,070 |

|

| INDUSTRIALS - 11.7% | | | |

| Aerospace & Defense - 2.1% | | | |

| Huntington Ingalls Industries, Inc. | | 360,735 | 81,403 |

| Kratos Defense & Security Solutions, Inc. (a) | | 2,201,500 | 41,564 |

| Space Exploration Technologies Corp.: | | | |

| Class A (a)(c)(d) | | 139,629 | 29,881 |

| Class C (a)(c)(d) | | 2,034 | 435 |

| | | | 153,283 |

| Air Freight & Logistics - 0.9% | | | |

| C.H. Robinson Worldwide, Inc. | | 119,347 | 9,027 |

| XPO Logistics, Inc. (a)(f) | | 682,011 | 52,106 |

| | | | 61,133 |

| Commercial Services & Supplies - 1.3% | | | |

| IAA Spinco, Inc. (a) | | 620,573 | 23,675 |

| KAR Auction Services, Inc. (f) | | 616,277 | 15,321 |

| Stericycle, Inc. (a)(f) | | 588,700 | 33,909 |

| U.S. Ecology, Inc. | | 366,781 | 22,825 |

| | | | 95,730 |

| Electrical Equipment - 3.2% | | | |

| AMETEK, Inc. | | 803,180 | 73,611 |

| Generac Holdings, Inc. (a) | | 797,894 | 77,061 |

| Melrose Industries PLC | | 17,717,841 | 48,908 |

| Regal Beloit Corp. | | 370,126 | 27,408 |

| | | | 226,988 |

| Machinery - 2.1% | | | |

| Donaldson Co., Inc. (f) | | 1,463,222 | 77,170 |

| Gardner Denver Holdings, Inc. (a) | | 1,033,200 | 32,887 |

| Pentair PLC | | 888,802 | 36,859 |

| | | | 146,916 |

| Marine - 0.3% | | | |

| Goodbulk Ltd. (a)(d) | | 1,493,822 | 19,959 |

| Professional Services - 0.7% | | | |

| Equifax, Inc. | | 351,445 | 48,046 |

| Road & Rail - 1.1% | | | |

| Knight-Swift Transportation Holdings, Inc. Class A | | 1,336,350 | 48,723 |

| Lyft, Inc. (f) | | 780,089 | 32,327 |

| | | | 81,050 |

|

| TOTAL INDUSTRIALS | | | 833,105 |

|

| INFORMATION TECHNOLOGY - 9.6% | | | |

| Communications Equipment - 0.2% | | | |

| Ericsson (B Shares) | | 1,992,600 | 17,413 |

| Electronic Equipment & Components - 3.0% | | | |

| Amphenol Corp. Class A | | 1,094,994 | 109,861 |

| Fabrinet (a) | | 1,090,129 | 61,298 |

| Keysight Technologies, Inc. (a) | | 418,277 | 42,208 |

| | | | 213,367 |

| IT Services - 5.7% | | | |

| Akamai Technologies, Inc. (a) | | 546,100 | 47,238 |

| Black Knight, Inc. (a) | | 1,181,275 | 75,838 |

| Euronet Worldwide, Inc. (a) | | 146,100 | 20,464 |

| Fiserv, Inc. (a) | | 598,000 | 63,472 |

| FleetCor Technologies, Inc. (a) | | 60,639 | 17,841 |

| Leidos Holdings, Inc. | | 630,676 | 54,383 |

| Verra Mobility Corp. (a) | | 1,920,700 | 27,562 |

| WNS Holdings Ltd. sponsored ADR (a) | | 1,572,811 | 97,263 |

| | | | 404,061 |

| Software - 0.7% | | | |

| Citrix Systems, Inc. | | 445,400 | 48,486 |

|

| TOTAL INFORMATION TECHNOLOGY | | | 683,327 |

|

| MATERIALS - 2.9% | | | |

| Chemicals - 1.4% | | | |

| International Flavors & Fragrances, Inc. (f) | | 321,475 | 39,223 |

| LG Chemical Ltd. | | 62,300 | 16,370 |

| Nutrien Ltd. | | 481,500 | 23,035 |

| Olin Corp. | | 1,329,109 | 24,376 |

| | | | 103,004 |

| Containers & Packaging - 0.1% | | | |

| Avery Dennison Corp. | | 43,844 | 5,606 |

| Metals & Mining - 1.4% | | | |

| Franco-Nevada Corp. | | 334,300 | 32,438 |

| Newcrest Mining Ltd. | | 1,263,079 | 27,571 |

| Novagold Resources, Inc. (a) | | 5,111,776 | 37,181 |

| | | | 97,190 |

|

| TOTAL MATERIALS | | | 205,800 |

|

| REAL ESTATE - 8.0% | | | |

| Equity Real Estate Investment Trusts (REITs) - 8.0% | | | |

| Apartment Investment & Management Co. Class A | | 890,756 | 48,885 |

| Cousins Properties, Inc. | | 1,279,005 | 51,326 |

| Gaming & Leisure Properties | | 967,100 | 39,032 |

| Healthcare Realty Trust, Inc. | | 1,678,804 | 58,372 |

| Healthcare Trust of America, Inc. | | 1,611,871 | 49,968 |

| National Retail Properties, Inc. | | 1,025,664 | 60,422 |

| SBA Communications Corp. Class A | | 172,500 | 41,512 |

| Spirit Realty Capital, Inc. | | 774,198 | 38,586 |

| Taubman Centers, Inc. | | 906,184 | 32,423 |

| VEREIT, Inc. | | 5,983,354 | 58,876 |

| VICI Properties, Inc. | | 3,790,070 | 89,256 |

| | | | 568,658 |

| UTILITIES - 4.8% | | | |

| Electric Utilities - 3.3% | | | |

| Alliant Energy Corp. | | 1,500,400 | 80,031 |

| IDACORP, Inc. | | 586,241 | 63,091 |

| OGE Energy Corp. | | 2,118,959 | 91,242 |

| | | | 234,364 |

| Gas Utilities - 1.5% | | | |

| Atmos Energy Corp. | | 708,281 | 79,667 |

| Spire, Inc. | | 324,972 | 27,317 |

| | | | 106,984 |

|

| TOTAL UTILITIES | | | 341,348 |

|

| TOTAL COMMON STOCKS | | | |

| (Cost $5,018,580) | | | 6,530,779 |

|

| Preferred Stocks - 0.7% | | | |

| Convertible Preferred Stocks - 0.7% | | | |

| CONSUMER DISCRETIONARY - 0.2% | | | |

| Textiles, Apparel & Luxury Goods - 0.2% | | | |

| Allbirds, Inc.: | | | |

| Series A (c)(d) | | 4,253 | 211 |

| Series B (c)(d) | | 747 | 37 |

| Series C (c)(d) | | 7,140 | 354 |

| Bolt Threads, Inc. Series D (a)(c)(d) | | 976,285 | 13,024 |

| | | | 13,626 |

| CONSUMER STAPLES - 0.0% | | | |

| Food & Staples Retailing - 0.0% | | | |

| Sweetgreen, Inc.: | | | |

| Series C (c)(d) | | 3,889 | 67 |

| Series D (c)(d) | | 62,561 | 1,070 |

| Series I (c)(d) | | 147,450 | 2,521 |

| | | | 3,658 |

| HEALTH CARE - 0.4% | | | |

| Health Care Equipment & Supplies - 0.4% | | | |

| Butterfly Network, Inc. Series D (a)(c)(d) | | 1,647,945 | 25,230 |

| INDUSTRIALS - 0.1% | | | |

| Aerospace & Defense - 0.1% | | | |

| Space Exploration Technologies Corp. Series H (a)(c)(d) | | 18,837 | 4,031 |

|

| TOTAL CONVERTIBLE PREFERRED STOCKS | | | 46,545 |

|

| Nonconvertible Preferred Stocks - 0.0% | | | |

| CONSUMER DISCRETIONARY - 0.0% | | | |

| Textiles, Apparel & Luxury Goods - 0.0% | | | |

| Allbirds, Inc. (c)(d) | | 2,285 | 113 |

| TOTAL PREFERRED STOCKS | | | |

| (Cost $39,575) | | | 46,658 |

| | | Principal Amount (000s) | Value (000s) |

|

| Nonconvertible Bonds - 0.0% | | | |

| ENERGY - 0.0% | | | |

| Energy Equipment & Services - 0.0% | | | |

| Pacific Drilling SA 12% 4/1/24 pay-in-kind(e)(h) | | | |

| (Cost $445) | | 437 | 181 |

| | | Shares | Value (000s) |

|

| Other - 0.1% | | | |

| ENERGY - 0.1% | | | |

| Oil, Gas & Consumable Fuels – 0.1% | | | |

| Utica Shale Drilling Program (non-operating revenue interest) (b)(c)(d) | | | |

| (Cost $20,398) | | 20,397,834 | 9,424 |

|

| Money Market Funds - 10.2% | | | |

| Fidelity Cash Central Fund 1.83% (i) | | 508,035,818 | 508,137 |

| Fidelity Securities Lending Cash Central Fund 1.84% (i)(j) | | 219,789,545 | 219,812 |

| TOTAL MONEY MARKET FUNDS | | | |

| (Cost $727,902) | | | 727,949 |

| TOTAL INVESTMENT IN SECURITIES - 102.6% | | | |

| (Cost $5,806,900) | | | 7,314,991 |

| NET OTHER ASSETS (LIABILITIES) - (2.6)% | | | (183,426) |

| NET ASSETS - 100% | | | $7,131,565 |

Legend

(a) Non-income producing

(b) Investment is owned by a wholly-owned subsidiary (Subsidiary) that is treated as a corporation for U.S. tax purposes.

(c) Restricted securities - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $116,620,000 or 1.6% of net assets.

(d) Level 3 security

(e) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $15,670,000 or 0.2% of net assets.

(f) Security or a portion of the security is on loan at period end.

(g) Investment is owned by an entity that is treated as a U.S. Corporation for tax purposes in which the Fund holds a percentage ownership.

(h) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

(i) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(j) Investment made with cash collateral received from securities on loan.

Additional information on each restricted holding is as follows:

| Security | Acquisition Date | Acquisition Cost (000s) |

| Allbirds, Inc. | 10/9/18 | $591 |

| Allbirds, Inc. | 10/9/18 | $125 |

| Allbirds, Inc. Series A | 10/9/18 | $233 |

| Allbirds, Inc. Series B | 10/9/18 | $41 |

| Allbirds, Inc. Series C | 10/9/18 | $392 |

| Bolt Threads, Inc. Series D | 12/13/17 | $15,659 |

| Butterfly Network, Inc. Series D | 5/4/18 | $16,924 |

| New Academy Holding Co. LLC unit | 8/1/11 | $30,988 |

| Space Exploration Technologies Corp. Class A | 4/8/16 - 9/11/17 | $14,283 |

| Space Exploration Technologies Corp. Class C | 9/11/17 | $275 |

| Space Exploration Technologies Corp. Series H | 8/4/17 | $2,543 |

| Sweetgreen, Inc. Series C | 9/13/19 | $67 |

| Sweetgreen, Inc. Series D | 9/13/19 | $1,070 |

| Sweetgreen, Inc. Series I | 9/13/19 | $2,521 |

| Utica Shale Drilling Program (non-operating revenue interest) | 10/5/16 - 9/1/17 | $20,398 |

| WME Entertainment Parent, LLC Class A | 8/16/16 | $16,835 |

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| | (Amounts in thousands) |

| Fidelity Cash Central Fund | $5,966 |

| Fidelity Securities Lending Cash Central Fund | 793 |

| Total | $6,759 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable. Amount for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Other Affiliated Issuers

An affiliated company is a company in which the Fund has ownership of at least 5% of the voting securities. Fiscal year to date transactions with companies which are or were affiliates are as follows:

| Affiliate (Amounts in thousands) | Value, beginning of period | Purchases | Sales Proceeds(a) | Dividend Income | Realized Gain (loss) | Change in Unrealized appreciation (depreciation) | Value, end of period |

| Goodbulk Ltd. | $25,046 | $-- | $156 | $1,140 | $24 | $(4,955) | $-- |

| Total | $25,046 | $-- | $156 | $1,140 | $24 | $(4,955) | $-- |

(a) Includes the value of securities delivered through in-kind transactions, if applicable.

Investment Valuation

The following is a summary of the inputs used, as of October 31, 2019, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| (Amounts in thousands) | | | | |

| Investments in Securities: | | | | |

| Equities: | | | | |

| Communication Services | $149,472 | $128,580 | $-- | $20,892 |

| Consumer Discretionary | 1,035,894 | 958,950 | 53,875 | 23,069 |

| Consumer Staples | 286,937 | 283,279 | -- | 3,658 |

| Energy | 352,318 | 352,318 | -- | -- |

| Financials | 1,516,247 | 1,496,672 | 19,575 | -- |

| Health Care | 600,300 | 575,070 | -- | 25,230 |

| Industrials | 837,136 | 782,830 | -- | 54,306 |

| Information Technology | 683,327 | 665,914 | 17,413 | -- |

| Materials | 205,800 | 178,229 | 27,571 | -- |

| Real Estate | 568,658 | 568,658 | -- | -- |

| Utilities | 341,348 | 341,348 | -- | -- |

| Corporate Bonds | 181 | -- | 181 | -- |

| Other | 9,424 | -- | -- | 9,424 |

| Money Market Funds | 727,949 | 727,949 | -- | -- |

| Total Investments in Securities: | $7,314,991 | $7,059,797 | $118,615 | $136,579 |

The following is a reconciliation of Investments in Securities for which Level 3 inputs were used in determining value:

| (Amounts in thousands) | |

| Investments in Securities: | |

| Beginning Balance | $183,894 |

| Net Realized Gain (Loss) on Investment Securities | 24 |

| Net Unrealized Gain (Loss) on Investment Securities | (30,300) |

| Cost of Purchases | 3,658 |

| Proceeds of Sales | (20,697) |

| Amortization/Accretion | -- |

| Transfers into Level 3 | -- |

| Transfers out of Level 3 | -- |

| Ending Balance | $136,579 |

| The change in unrealized gain (loss) for the period attributable to Level 3 securities held at October 31, 2019 | $292 |

The information used in the above reconciliation represents fiscal year to date activity for any Investments in Securities and Other Financial Instruments identified as using Level 3 inputs at either the beginning or the end of the current fiscal period. Transfers in or out of Level 3 represent the beginning value of any Security or Instrument where a change in the pricing level occurred from the beginning to the end of the period. The cost of purchases and the proceeds of sales may include securities received or delivered through corporate actions or exchanges. Realized and unrealized gains (losses) disclosed in the reconciliation are included in Net Gain (Loss) on the Fund's Statement of Operations.

Other Information

Distribution of investments by country or territory of incorporation, as a percentage of Total Net Assets, is as follows (Unaudited):

| United States of America | 85.4% |

| Bermuda | 3.7% |

| Ireland | 1.7% |

| United Kingdom | 1.4% |

| Bailiwick of Jersey | 1.4% |

| Italy | 1.3% |

| Canada | 1.3% |

| Netherlands | 1.1% |

| Others (Individually Less Than 1%) | 2.7% |

| | 100.0% |

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| Amounts in thousands (except per-share amounts) | | October 31, 2019 (Unaudited) |

| Assets | | |

Investment in securities, at value (including securities loaned of $213,574) — See accompanying schedule:

Unaffiliated issuers (cost $5,078,998) | $6,587,042 | |

| Fidelity Central Funds (cost $727,902) | 727,949 | |

| Total Investment in Securities (cost $5,806,900) | | $7,314,991 |

| Restricted cash | | 1,087 |

| Receivable for investments sold | | 56,486 |

| Receivable for fund shares sold | | 1,890 |

| Dividends receivable | | 2,360 |

| Interest receivable | | 4 |

| Distributions receivable from Fidelity Central Funds | | 873 |

| Prepaid expenses | | 14 |

| Other receivables | | 633 |

| Total assets | | 7,378,338 |

| Liabilities | | |

| Payable for investments purchased | $18,408 | |

| Payable for fund shares redeemed | 3,625 | |

| Accrued management fee | 3,591 | |

| Other affiliated payables | 808 | |

| Other payables and accrued expenses | 552 | |

| Collateral on securities loaned | 219,789 | |

| Total liabilities | | 246,773 |

| Net Assets | | $7,131,565 |

| Net Assets consist of: | | |

| Paid in capital | | $5,234,315 |

| Total accumulated earnings (loss) | | 1,897,250 |

| Net Assets | | $7,131,565 |

| Net Asset Value and Maximum Offering Price | | |

| Mid-Cap Stock: | | |

| Net Asset Value, offering price and redemption price per share ($5,290,925 ÷ 147,710 shares) | | $35.82 |

| Class K: | | |

| Net Asset Value, offering price and redemption price per share ($1,840,640 ÷ 51,350 shares) | | $35.84 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Amounts in thousands | | Six months ended October 31, 2019 (Unaudited) |

| Investment Income | | |

| Dividends (including $1,140 earned from other affiliated issuers) | | $60,515 |

| Interest | | 27 |

| Income from Fidelity Central Funds (including $793 from security lending) | | 6,759 |

| Total income | | 67,301 |

| Expenses | | |

| Management fee | | |

| Basic fee | $19,685 | |

| Performance adjustment | 4,362 | |

| Transfer agent fees | 4,358 | |

| Accounting fees | 589 | |

| Custodian fees and expenses | 71 | |

| Independent trustees' fees and expenses | 21 | |

| Registration fees | 35 | |

| Audit | 35 | |

| Legal | 9 | |

| Miscellaneous | 28 | |

| Total expenses before reductions | 29,193 | |

| Expense reductions | (284) | |

| Total expenses after reductions | | 28,909 |

| Net investment income (loss) | | 38,392 |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | 330,636 | |

| Redemptions in-kind with affiliated entities | 31,103 | |

| Fidelity Central Funds | (3) | |

| Other affiliated issuers | 24 | |

| Foreign currency transactions | 302 | |

| Total net realized gain (loss) | | 362,062 |

| Change in net unrealized appreciation (depreciation) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | (165,918) | |

| Fidelity Central Funds | 1 | |

| Other affiliated issuers | (4,955) | |

| Assets and liabilities in foreign currencies | (4) | |

| Total change in net unrealized appreciation (depreciation) | | (170,876) |

| Net gain (loss) | | 191,186 |

| Net increase (decrease) in net assets resulting from operations | | $229,578 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Amounts in thousands | Six months ended October 31, 2019 (Unaudited) | Year ended April 30, 2019 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $38,392 | $76,180 |

| Net realized gain (loss) | 362,062 | 964,362 |

| Change in net unrealized appreciation (depreciation) | (170,876) | (439,242) |

| Net increase (decrease) in net assets resulting from operations | 229,578 | 601,300 |

| Distributions to shareholders | (127,421) | (1,189,126) |

| Share transactions - net increase (decrease) | (691,652) | 325,889 |

| Total increase (decrease) in net assets | (589,495) | (261,937) |

| Net Assets | | |

| Beginning of period | 7,721,060 | 7,982,997 |

| End of period | $7,131,565 | $7,721,060 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Fidelity Mid-Cap Stock Fund

| | Six months ended (Unaudited) October 31, | Years endedApril 30, | | | | |

| | 2019 | 2019 | 2018 | 2017 | 2016 | 2015 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $35.31 | $38.38 | $36.62 | $34.07 | $40.11 | $40.26 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | .18 | .34 | .22 | .22 | .21 | .18 |

| Net realized and unrealized gain (loss) | .92 | 2.26 | 4.30 | 5.19 | (1.54) | 3.52 |

| Total from investment operations | 1.10 | 2.60 | 4.52 | 5.41 | (1.33) | 3.70 |

| Distributions from net investment income | (.08) | (.29) | (.22) | (.27) | (.22) | (.09) |

| Distributions from net realized gain | (.51) | (5.38) | (2.55) | (2.59) | (4.49) | (3.76) |

| Total distributions | (.59) | (5.67) | (2.76)B | (2.86) | (4.71) | (3.85) |

| Redemption fees added to paid in capitalA | – | – | – | –C | –C | –C |

| Net asset value, end of period | $35.82 | $35.31 | $38.38 | $36.62 | $34.07 | $40.11 |

| Total ReturnD,E | 3.16% | 7.90% | 12.66% | 16.80% | (3.44)% | 9.83% |

| Ratios to Average Net AssetsF,G | | | | | | |

| Expenses before reductions | .82%H | .68% | .61% | .58% | .72% | .73% |

| Expenses net of fee waivers, if any | .82%H | .67% | .61% | .58% | .72% | .72% |

| Expenses net of all reductions | .82%H | .67% | .61% | .58% | .72% | .72% |

| Net investment income (loss) | 1.02%H | .93% | .58% | .64% | .59% | .46% |

| Supplemental Data | | | | | | |

| Net assets, end of period (in millions) | $5,291 | $5,373 | $5,629 | $5,622 | $5,136 | $5,874 |

| Portfolio turnover rateI | 32%H,J | 29% | 22% | 27%J | 23%J | 29% |

A Calculated based on average shares outstanding during the period.

B Total distributions of $2.76 per share is comprised of distributions from net investment income of $.217 and distributions from net realized gain of $2.545 per share.

C Amount represents less than $.005 per share.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Annualized

I Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

J Portfolio turnover rate excludes securities received or delivered in-kind.

See accompanying notes which are an integral part of the financial statements.

Fidelity Mid-Cap Stock Fund Class K

| | Six months ended (Unaudited) October 31, | Years endedApril 30, | | | | |

| | 2019 | 2019 | 2018 | 2017 | 2016 | 2015 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $35.32 | $38.40 | $36.64 | $34.08 | $40.12 | $40.27 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | .20 | .37 | .26 | .26 | .25 | .22 |

| Net realized and unrealized gain (loss) | .92 | 2.26 | 4.30 | 5.20 | (1.54) | 3.51 |

| Total from investment operations | 1.12 | 2.63 | 4.56 | 5.46 | (1.29) | 3.73 |

| Distributions from net investment income | (.09) | (.33) | (.26) | (.31) | (.26) | (.13) |

| Distributions from net realized gain | (.51) | (5.38) | (2.55) | (2.59) | (4.49) | (3.76) |

| Total distributions | (.60) | (5.71) | (2.80)B | (2.90) | (4.75) | (3.88)C |

| Redemption fees added to paid in capitalA | – | – | – | –D | –D | –D |

| Net asset value, end of period | $35.84 | $35.32 | $38.40 | $36.64 | $34.08 | $40.12 |

| Total ReturnE,F | 3.23% | 7.99% | 12.78% | 16.96% | (3.33)% | 9.92% |

| Ratios to Average Net AssetsG,H | | | | | | |

| Expenses before reductions | .72%I | .57% | .51% | .46% | .60% | .61% |

| Expenses net of fee waivers, if any | .72%I | .57% | .51% | .46% | .60% | .61% |

| Expenses net of all reductions | .71%I | .57% | .50% | .46% | .60% | .61% |

| Net investment income (loss) | 1.12%I | 1.03% | .69% | .76% | .71% | .57% |

| Supplemental Data | | | | | | |

| Net assets, end of period (in millions) | $1,841 | $2,348 | $2,354 | $2,213 | $1,988 | $2,588 |

| Portfolio turnover rateJ | 32%I,K | 29% | 22% | 27%K | 23%K | 29% |

A Calculated based on average shares outstanding during the period.

B Total distributions of $2.80 per share is comprised of distributions from net investment income of $.259 and distributions from net realized gain of $2.545 per share.

C Total distributions of $3.88 per share is comprised of distributions from net investment income of $.127 and distributions from net realized gain of $3.757 per share.

D Amount represents less than $.005 per share.

E Total returns for periods of less than one year are not annualized.

F Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

G Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Annualized

J Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

K Portfolio turnover rate excludes securities received or delivered in-kind.

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements (Unaudited)

For the period ended October 31, 2019

(Amounts in thousands except percentages)

1. Organization.

Fidelity Mid-Cap Stock Fund (the Fund) is a fund of Fidelity Concord Street Trust (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Mid-Cap Stock and Class K shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date ranged from less than .005% to .01%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds are available on the SEC website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investments Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fair Value Committee (the Committee) established by the Fund's investment adviser. In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events, changes in interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy. Equity securities, including restricted securities, for which observable inputs are not available are valued using alternate valuation approaches, including the market approach and the income approach and are categorized as Level 3 in the hierarchy. The market approach generally consists of using comparable market transactions while the income approach generally consists of using the net present value of estimated future cash flows, adjusted as appropriate for liquidity, credit, market and/or other risk factors.

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing vendors or from brokers who make markets in such securities. Corporate bonds are valued by pricing vendors who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing vendors. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

The following provides information on Level 3 securities held by the Fund that were valued at period end based on unobservable inputs. These amounts exclude valuations provided by a broker.

| Asset Type | Fair Value | Valuation Technique(s) | Unobservable Input | Amount or Range/Weighted Average | Impact to Valuation from an Increase in Input(a) |

| Equities | $127,155 | Market comparable | Enterprise value/Sales multiple (EV/S) | 3.9 - 11.0 / 10.0 | Increase |

| | | | Discount for lack of marketability | 10.0% | Decrease |

| | | | Premium rate | 15.5% - 94.7% / 47.7% | Increase |

| | | | Enterprise value/EBITA (EV/EBITDA) | 11.6 | Increase |

| | | Market approach | Transaction price | $13.36- $214.00 / $132.49 | Increase |

| | | Discount cash flow | Growth rate | 1.0% | Increase |

| | | | Weigted average cost of capital (WACC) | 12.0% | Decrease |

| Other | $9,424 | Discount cash flow | Discount rate | 16.7% | Decrease |

(a) Represents the directional change in the fair value of the Level 3 investments that could have resulted from an increase in the corresponding input as of period end. A decrease to the unobservable input would have had the opposite effect. Significant changes in these inputs may have resulted in a significantly higher or lower fair value measurement at period end.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of October 31, 2019, as well as a roll forward of Level 3 investments, is included at the end of the Fund's Schedule of Investments.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Certain distributions received by the Fund represent a return of capital or capital gain. The Fund determines the components of these distributions subsequent to the ex-dividend date, based upon receipt of tax filings or other correspondence relating to the underlying investment. These distributions are recorded as a reduction of cost of investments and/or as a realized gain. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Paid in Kind (PIK) income is recorded at the fair market value of the securities received. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent fees incurred. Certain expense reductions may also differ by class. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Deferred Trustee Compensation. Under a Deferred Compensation Plan (the Plan) for the Fund, certain independent Trustees have elected to defer receipt of a portion of their annual compensation. Deferred amounts are invested in a cross-section of Fidelity funds, are marked-to-market and remain in the Fund until distributed in accordance with the Plan. The investment of deferred amounts and the offsetting payable to the Trustees of $441 are included in the accompanying Statement of Assets and Liabilities in other receivables and other payables and accrued expenses, respectively.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are declared and recorded on the ex-dividend date. Income and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to foreign transactions, partnerships, and passive foreign investment companies (PFIC), defaulted bonds, deferred trustees compensations, and losses deferred due to wash sales.

As of period end, the cost and unrealized appreciation (depreciation) in securities, and derivatives if applicable, for federal income tax purposes were as follows:

| Gross unrealized appreciation | $1,886,218 |

| Gross unrealized depreciation | (384,836) |

| Net unrealized appreciation (depreciation) | $1,501,382 |

| Tax cost | $5,813,609 |

Restricted Securities. The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Fund's Schedule of Investments.

Consolidated Subsidiary. The Fund invests in certain investments through a wholly-owned subsidiary ("Subsidiary"), which may be subject to federal and state taxes upon disposition.

As of period end, the Fund held an investment of $31,403 in these Subsidiaries, representing .44% of the Fund's net assets. The financial statements have been consolidated and include accounts of the Fund and each Subsidiary. Accordingly, all inter-company transactions and balances have been eliminated.

Any cash held by the Subsidiaries is restricted as to its use and is presented as Restricted cash in the Statement of Assets and Liabilities.

4. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities and in-kind transactions, aggregated $1,079,118 and $1,566,510, respectively.

Unaffiliated Redemptions In-Kind. During the period, 1,658 shares of the Fund were redeemed in-kind for investments and cash with a value of $58,396. The net realized gain of $18,326 on investments delivered through in-kind redemptions is included in the accompanying Statement of Operations. The amount of the in-kind redemptions is included in share transactions in the accompanying Statement of Changes in Net Assets as well as the Notes to Financial Statements. The Fund recognized no gain or loss for federal income tax purposes.

5. Fees and Other Transactions with Affiliates.

Management Fee. Fidelity Management & Research Company (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .30% of the Fund's average net assets and an annualized group fee rate that averaged .24% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by the investment adviser, including any mutual funds previously advised by the investment adviser that are currently advised by Fidelity SelectCo, LLC, an affiliate of the investment adviser. The group fee rate decreases as assets under management increase and increases as assets under management decrease. In addition, the management fee is subject to a performance adjustment (up to a maximum of +/- .20% of the Fund's average net assets over a 36 month performance period). The upward or downward adjustment to the management fee is based on the relative investment performance of Mid-Cap Stock as compared to its benchmark index, the S&P MidCap 400 Index, over the same 36 month performance period. For the reporting period, the total annualized management fee rate, including the performance adjustment, was .65% of the Fund's average net assets. The performance adjustment included in the management fee rate may be higher or lower than the maximum performance adjustment rate due to the difference between the average net assets for the reporting and performance periods.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc., (FIIOC), an affiliate of the investment adviser, is the transfer, dividend disbursing and shareholder servicing agent for each class of the Fund. FIIOC receives account fees and asset-based fees that vary according to the account size and type of account of the shareholders of Mid-Cap Stock, except for Class K. FIIOC receives an asset-based fee of Class K's average net assets. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements.

For the period, transfer agent fees for each class were as follows:

| | Amount | % of Class-Level Average Net Assets(a) |

| Mid-Cap Stock | $3,884 | .15 |

| Class K | 474 | .05 |

| | $4,358 | |

(a) Annualized

Accounting Fees. Fidelity Service Company, Inc. (FSC), an affiliate of the investment adviser, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for each month. For the period, the fees were equivalent to an annualized rate of .02%.

Brokerage Commissions. The Fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. Brokerage commissions are included in net realized gain (loss) and change in net unrealized appreciation (depreciation) in the Statement of Operations. The commissions paid to these affiliated firms were $39 for the period.

Interfund Trades. The Fund may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act. Interfund trades are included within the respective purchases and sales amounts shown in the Purchases and Sales of Investments note.

Affiliated Redemptions In-Kind. During the period, 3,271 shares of the Fund were redeemed in-kind for investments and cash with a value of $112,604. The net realized gain of $31,103 on investments delivered through in-kind redemptions is included in the accompanying Statement of Operations. The amount of the in-kind redemptions is included in share transactions in the accompanying Statement of Changes in Net Assets as well as the Notes to Financial Statements. The Fund recognized no gain or loss for federal income tax purposes.

6. Committed Line of Credit.

The Fund participates with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The Fund has agreed to pay commitment fees on its pro-rata portion of the line of credit, which amounted to $9 and is reflected in Miscellaneous expenses on the Statement of Operations. During the period, the Fund did not borrow on this line of credit.

7. Security Lending.

The Fund lends portfolio securities from time to time in order to earn additional income. For equity securities, lending agents are used, including National Financial Services (NFS), an affiliate of the Fund. Pursuant to a securities lending agreement, NFS will receive a fee, which is capped at 9.9% of daily lending revenue, for its services as lending agent. The Fund may lend securities to certain qualified borrowers, including NFS. On the settlement date of the loan, the Fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. The Fund or borrower may terminate the loan at any time, and if the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, the Fund may apply collateral received from the borrower against the obligation. The Fund may experience delays and costs in recovering the securities loaned. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. The value of loaned securities and cash collateral at period end are disclosed on the Fund's Statement of Assets and Liabilities. At period end, there were no security loans outstanding with NFS, as affiliated borrower. Total fees paid by the Fund to NFS, as lending agent, amounted to $13. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds, and includes amount less than five hundred dollar from securities loaned to NFS, as affiliated borrower.

8. Expense Reductions.

Commissions paid to certain brokers with whom the investment adviser, or its affiliates, places trades on behalf of the Fund include an amount in addition to trade execution, which may be rebated back to the Fund to offset certain expenses. This amount totaled $255 for the period.

In addition, during the period the investment adviser reimbursed and/or waived a portion of fund-level operating expenses in the amount of $29.

9. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

| | Six months ended

October 31, 2019 | Year ended

April 30, 2019 |

| Distributions to shareholders | | |

| Mid-Cap Stock | $88,136 | $805,928 |

| Class K | 39,285 | 383,198 |

| Total | $127,421 | $1,189,126 |

10. Share Transactions.

Share transactions for each class were as follows and may contain automatic conversions between classes or exchanges between affiliated funds:

| | Shares | Shares | Dollars | Dollars |

| | Six months ended October 31, 2019 | Year ended April 30, 2019 | Six months ended October 31, 2019 | Year ended April 30, 2019 |

| Mid-Cap Stock | | | | |

| Shares sold | 5,184 | 9,727 | $181,677 | $346,378 |

| Reinvestment of distributions | 2,415 | 22,487 | 83,495 | 761,032 |

| Shares redeemed | (12,073) | (26,697) | (422,784) | (975,536) |

| Net increase (decrease) | (4,474) | 5,517 | $(157,612) | $131,874 |

| Class K | | | | |

| Shares sold | 2,741 | 18,446 | $96,080 | $677,575 |

| Reinvestment of distributions | 1,136 | 11,384 | 39,285 | 383,198 |

| Shares redeemed | (19,000)(a),(b) | (24,667) | (669,405)(a),(b) | (866,758) |

| Net increase (decrease) | (15,123) | 5,163 | $(534,040) | $194,015 |

(a) Amount includes in-kind redemptions (see the Unaffiliated Redemptions In-Kind note for additional details).

(b) Amount includes in-kind redemptions (see the Affiliated Redemptions In-Kind note for additional details).

11. Other.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (May 1, 2019 to October 31, 2019).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | Annualized Expense Ratio-A | Beginning

Account Value

May 1, 2019 | Ending

Account Value

October 31, 2019 | Expenses Paid

During Period-B

May 1, 2019

to October 31, 2019 |

| Mid-Cap Stock | .82% | | | |

| Actual | | $1,000.00 | $1,031.60 | $4.19 |

| Hypothetical-C | | $1,000.00 | $1,021.01 | $4.17 |

| Class K | .72% | | | |

| Actual | | $1,000.00 | $1,032.30 | $3.68 |

| Hypothetical-C | | $1,000.00 | $1,021.52 | $3.66 |

A Annualized expense ratio reflects expenses net of applicable fee waivers.

B Expenses are equal to each Class' annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

C 5% return per year before expenses

MCS-SANN-1219

1.538556.122

Fidelity® Large Cap Stock Fund

Semi-Annual Report

October 31, 2019

See the inside front cover for important information about access to your fund’s shareholder reports.

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of a fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the fund or from your financial intermediary, such as a financial advisor, broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a fund electronically, by contacting your financial intermediary. For Fidelity customers, visit Fidelity's web site or call Fidelity using the contact information listed below.

You may elect to receive all future reports in paper free of charge. If you wish to continue receiving paper copies of your shareholder reports, you may contact your financial intermediary or, if you are a Fidelity customer, visit Fidelity’s website, or call Fidelity at the applicable toll-free number listed below. Your election to receive reports in paper will apply to all funds held with the fund complex/your financial intermediary.

| Account Type | Website | Phone Number |

| Brokerage, Mutual Fund, or Annuity Contracts: | fidelity.com/mailpreferences | 1-800-343-3548 |

| Employer Provided Retirement Accounts: | netbenefits.fidelity.com/preferences (choose 'no' under Required Disclosures to continue to print) | 1-800-343-0860 |

| Advisor Sold Accounts Serviced Through Your Financial Intermediary: | Contact Your Financial Intermediary | Your Financial Intermediary's phone number |

| Advisor Sold Accounts Serviced by Fidelity: | institutional.fidelity.com | 1-877-208-0098 |

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2019 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Investment Summary (Unaudited)

Top Ten Stocks as of October 31, 2019

| | % of fund's net assets |

| General Electric Co. | 6.0 |

| Microsoft Corp. | 5.1 |

| Exxon Mobil Corp. | 4.5 |

| Comcast Corp. Class A | 3.9 |

| Altria Group, Inc. | 3.4 |

| Bank of America Corp. | 3.1 |

| Wells Fargo & Co. | 2.9 |

| Bristol-Myers Squibb Co. | 2.5 |

| Qualcomm, Inc. | 2.3 |

| Apple, Inc. | 2.3 |

| | 36.0 |

Top Five Market Sectors as of October 31, 2019

| | % of fund's net assets |

| Health Care | 18.6 |

| Financials | 18.3 |

| Information Technology | 15.0 |

| Industrials | 13.8 |

| Energy | 9.2 |

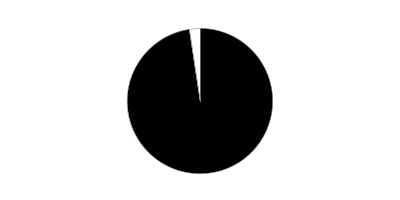

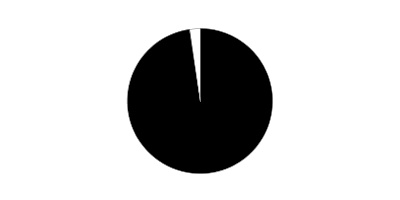

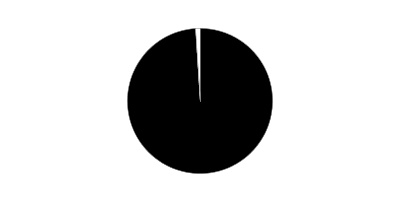

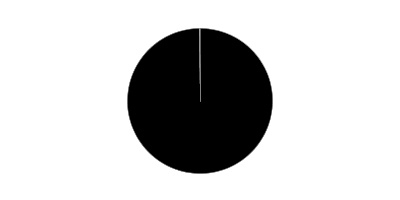

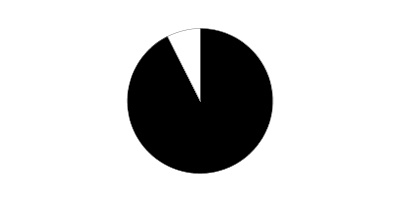

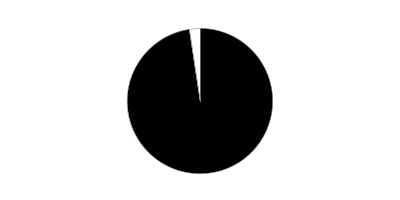

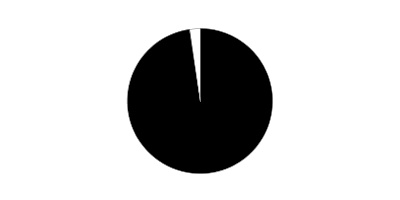

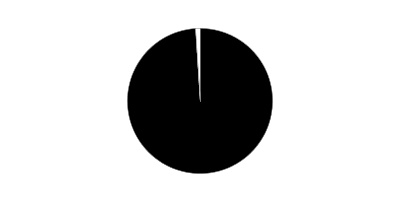

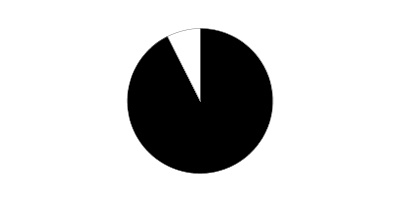

Asset Allocation (% of fund's net assets)

| As of October 31, 2019 * |

| | Stocks | 97.6% |

| | Other Investments | 0.1% |

| | Short-Term Investments and Net Other Assets (Liabilities) | 2.3% |

* Foreign investments - 10.4%

Schedule of Investments October 31, 2019 (Unaudited)

Showing Percentage of Net Assets

| Common Stocks - 97.6% | | | |

| | | Shares | Value (000s) |

| COMMUNICATION SERVICES - 8.5% | | | |

| Diversified Telecommunication Services - 1.2% | | | |

| Verizon Communications, Inc. | | 473,206 | $28,615 |

| Entertainment - 1.9% | | | |

| Activision Blizzard, Inc. | | 145,132 | 8,132 |

| Electronic Arts, Inc. (a) | | 114,817 | 11,068 |

| The Walt Disney Co. | | 51,604 | 6,704 |

| Vivendi SA | | 697,620 | 19,420 |

| | | | 45,324 |

| Interactive Media & Services - 0.7% | | | |

| Alphabet, Inc.: | | | |

| Class A (a) | | 6,914 | 8,703 |

| Class C (a) | | 7,116 | 8,967 |

| | | | 17,670 |

| Media - 4.7% | | | |

| Comcast Corp. Class A | | 2,076,542 | 93,071 |

| Discovery Communications, Inc. Class A (a) | | 95,303 | 2,569 |

| Interpublic Group of Companies, Inc. | | 364,216 | 7,922 |

| Omnicom Group, Inc. | | 20,682 | 1,596 |

| Sinclair Broadcast Group, Inc. Class A | | 171,631 | 6,838 |

| | | | 111,996 |

|

| TOTAL COMMUNICATION SERVICES | | | 203,605 |

|

| CONSUMER DISCRETIONARY - 3.8% | | | |

| Distributors - 0.3% | | | |

| LKQ Corp. (a) | | 200,063 | 6,800 |

| Hotels, Restaurants & Leisure - 0.0% | | | |

| Drive Shack, Inc. (a) | | 153,381 | 612 |

| Household Durables - 1.0% | | | |

| Mohawk Industries, Inc. (a) | | 110,741 | 15,878 |

| Whirlpool Corp. | | 53,575 | 8,150 |

| | | | 24,028 |

| Internet & Direct Marketing Retail - 1.2% | | | |

| The Booking Holdings, Inc. (a) | | 13,788 | 28,248 |

| Leisure Products - 0.2% | | | |

| Brunswick Corp. | | 78,574 | 4,576 |

| Specialty Retail - 0.9% | | | |

| Lowe's Companies, Inc. | | 166,553 | 18,589 |

| TJX Companies, Inc. | | 64,719 | 3,731 |

| | | | 22,320 |

| Textiles, Apparel & Luxury Goods - 0.2% | | | |

| Capri Holdings Ltd. (a) | | 22,845 | 710 |

| PVH Corp. | | 42,914 | 3,740 |

| Tapestry, Inc. | | 28,489 | 737 |

| | | | 5,187 |

|

| TOTAL CONSUMER DISCRETIONARY | | | 91,771 |

|

| CONSUMER STAPLES - 8.8% | | | |

| Beverages - 1.1% | | | |

| The Coca-Cola Co. | | 470,272 | 25,597 |

| Food & Staples Retailing - 2.0% | | | |

| Walgreens Boots Alliance, Inc. | | 142,384 | 7,800 |

| Walmart, Inc. | | 342,498 | 40,161 |

| | | | 47,961 |

| Food Products - 0.3% | | | |

| Nestle SA sponsored ADR | | 70,331 | 7,537 |

| Household Products - 1.1% | | | |

| Procter & Gamble Co. | | 170,122 | 21,182 |

| Spectrum Brands Holdings, Inc. | | 88,598 | 4,449 |

| | | | 25,631 |

| Personal Products - 0.0% | | | |

| Edgewell Personal Care Co. (a) | | 16,306 | 571 |

| Tobacco - 4.3% | | | |

| Altria Group, Inc. | | 1,827,815 | 81,868 |

| British American Tobacco PLC sponsored ADR | | 425,788 | 14,886 |

| Philip Morris International, Inc. | | 92,909 | 7,567 |

| | | | 104,321 |

|

| TOTAL CONSUMER STAPLES | | | 211,618 |

|

| ENERGY - 9.1% | | | |

| Energy Equipment & Services - 0.1% | | | |

| Schlumberger Ltd. | | 50,300 | 1,644 |

| Oil, Gas & Consumable Fuels - 9.0% | | | |

| BP PLC sponsored ADR (b) | | 319,553 | 12,114 |

| Cenovus Energy, Inc. (Canada) | | 4,154,041 | 35,387 |

| Equinor ASA sponsored ADR | | 1,250,184 | 23,141 |

| Exxon Mobil Corp. | | 1,603,600 | 108,355 |

| Hess Corp. | | 389,347 | 25,600 |