SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

¨ | | Preliminary Proxy Statement |

¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement |

¨ | | Definitive Additional Materials |

¨ | | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

MULTI-COLOR CORPORATION

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: N/A |

| | (2) | Aggregate number of securities to which transaction applies: N/A |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): N/A |

| | (4) | Proposed maximum aggregate value of transaction: N/A |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: N/A |

| | (2) | Form, Schedule or Registration Statement No.: N/A |

MULTI-COLOR CORPORATION

425 WALNUT STREET, SUITE 1300

CINCINNATI, OHIO 45202

Dear Shareholder:

We invite you to attend our annual meeting of shareholders at 10:30 a.m. on Thursday, August 18, 2005 at the Queen City Club, 331 East Fourth Street, Cincinnati, Ohio 45202. After the meeting, you will hear a report on our operations and have a chance to meet your directors and executives.

This booklet includes the formal notice of the meeting and the proxy statement. The proxy statement tells you more about the agenda and procedures for the meeting. It also describes how the Board operates and provides information about our director candidates.

Your vote is important. Whether or not you plan to attend, please complete, sign, date and return your proxy card promptly in the enclosed envelope. If you do attend the meeting, you may vote your shares in person.

|

| Sincerely yours, |

|

/s/ Lorrence T. Kellar |

Lorrence T. Kellar Chairman of the Board |

July 12, 2005

NOTICE OF ANNUAL MEETING

OF

SHAREHOLDERS OF MULTI-COLOR CORPORATION

TIME:

10:30 a.m., Eastern Time

DATE:

Thursday, August 18, 2005

PLACE:

The Queen City Club

331 East Fourth Street

Cincinnati, Ohio 45202

PURPOSE:

1. Election of directors.

2. Ratification of the appointment of Grant Thornton LLP as Multi-Color’s independent public accountants for the fiscal year ending March 31, 2006.

3. Conduct other business, if properly raised.

Only shareholders of record on July 1, 2005 may vote at the meeting. The approximate mailing date of this proxy statement and accompanying proxy card is July 12, 2005.

YOUR VOTE IS IMPORTANT. PLEASE COMPLETE, SIGN, DATEAND RETURN YOUR PROXY CARD PROMPTLY IN THE ENCLOSED ENVELOPE.

|

| |

|

/s/ Dawn H. Bertsche |

Dawn H. Bertsche Senior Vice President, Chief Financial Officer and Secretary |

July 12, 2005

MULTI-COLOR CORPORATION

425 WALNUT STREET, SUITE 1300

CINCINNATI, OHIO 45202

PROXY STATEMENT

GENERAL INFORMATION

Time and Place of Annual Meeting

The annual meeting will be held on Thursday, August 18, 2005 at 10:30 a.m. at the Queen City Club, 331 East Fourth Street, Cincinnati, Ohio 45202.

Record Date

Record holders of Common Stock of Multi-Color, as shown on our stock register on July 1, 2005, may vote at the meeting. As of that date, Multi-Color had 6,505,193 shares of Common Stock issued and outstanding.

First Mailing Date

This Proxy Statement, the Notice of the Annual Meeting of Shareholders and the accompanying proxy card are being mailed to shareholders on or about July 12, 2005.

Information About Voting

You may vote in person at the meeting or by proxy. We recommend you vote by proxy even if you plan to attend the meeting. You can always change your vote at the meeting.

All proxies will be voted in accordance with the instructions specified. If you sign and return the enclosed proxy card but do not specify how to vote, we will vote your shares in favor of (1) the election of all nominees for director proposed by the Board, and (2) the ratification of the appointment of Grant ThorntonLLP as independent public accountants for the fiscal year ending March 31, 2006. Management does not know of any other matters to be presented for action at the Annual Meeting. If any other matters properly come before the Annual Meeting, however, the proxies will vote such matters in their discretion.

You may receive more than one proxy or voting card depending on how you hold your shares. Please sign and return all proxies. If you hold shares through someone else, such as a stockbroker, you may get material from them asking how you want to vote.

Revoking a Proxy

You may revoke your proxy before it is voted by submitting a new proxy with a later date, by voting in person at the meeting, or by notifying Multi-Color’s Secretary in writing at the address under “Questions” on page 17.

Solicitation

The proxies are being solicited by Multi-Color’s Board of Directors. All expenses of Multi-Color in connection with this solicitation will be borne by Multi-Color. Solicitation will be made principally by mail, but officers and regular employees may solicit proxies by telephone or personal contact with nominal expense to Multi-Color. Multi-Color will request brokers and other nominees who hold Common Stock in their names to solicit proxies from the beneficial owners and will pay the standard charges and expenses associated with that solicitation.

Quorum

In order to carry on the business of the meeting, we must have a quorum. This means at least a majority of the outstanding shares eligible to vote must be represented at the meeting, either by proxy or in person. Shares owned by Multi-Color are not voted and do not count for this purpose.

Votes Needed

Nominees for director receiving the highest number of votes cast will be elected to fill the seats on the Board. Ratification of the appointment of Grant ThorntonLLP requires the favorable vote of a majority of the votes cast. Only votes for or against a proposal count. Abstentions and broker non-votes count for quorum purposes but not for voting purposes. Broker non-votes occur when a broker returns a proxy but does not have authority to vote on a particular proposal.

ELECTION OF DIRECTORS

(ITEM 1 ON THE PROXY CARD)

General Information about the Board of Directors

The Board of Directors oversees the management of Multi-Color on your behalf. The Board reviews Multi-Color’s long-term strategic plans and exercises direct decision-making authority in key areas such as choosing the Chief Executive Officer, setting the scope of his authority to manage Multi-Color’s business day to day, and evaluating his performance. The Board also reviews development and succession plans for Multi-Color’s top executives.

Multi-Color’s Code of Regulations requires that the Board consist of at least three members with the exact number to be established by shareholders or the Board. The Board has established a board consisting of seven directors.

The Board met four times last year. All of Multi-Color’s directors who served during the 2005 fiscal year attended at least 75% of Board and committee meetings. In addition, all directors of Multi-Color who served during the 2005 fiscal year attended the annual meeting of shareholders

2

held on August 19, 2004. Multi-Color expects each of its directors to attend each annual meeting of shareholders absent a significant personal or business conflict.

The Board convened four executive sessions last year. Executive sessions may be scheduled in conjunction with regular Board meetings.

Director Independence

The Board of Directors has determined that the following six of Multi-Color’s seven directors are “independent” as defined by federal securities laws and NASDAQ listing standards: David L. Abbott, Robert R. Buck, Charles B. Connolly, Lorrence T. Kellar, Roger A. Keller and David H. Pease, Jr.

Director Compensation

Non-employee directors receive annually a non-qualified stock option to purchase 4,500 shares of Multi-Color Common Stock and a $15,000 retainer, payable quarterly. They also receive $1,500 for each board or committee meeting attended in person and $500 for each telephonic board meeting and committee meeting. Committee Chairs receive an additional $2,000 annually and the Chairman receives an additional $3,000 annually. Directors who are employees of Multi-Color are not separately compensated for serving as directors.

Board Committees

The Board appoints committees in order to perform its duties more effectively. Board committees are able to consider key issues in greater detail than would be possible at full Board meetings. Each committee reviews the results of its meetings with the full Board. The Board has established the Audit and Finance Committee (“Audit Committee”), Nominating and Corporate Governance Committee (“Nominating Committee”) and Compensation and Organization Development Committee (“Compensation Committee”). David L. Abbott became a director of Multi-Color on June 30, 2005. The Board will determine the committees to which Mr. Abbott will be appointed at the Board meeting to be convened immediately following the annual meeting of shareholders.

The charters of the Audit Committee, Nominating Committee and Compensation Committee are available in the Investor Relations section of Multi-Color’s website (www.multicolorcorp.com).

The Audit Committee assists the Board in fulfilling its responsibilities relating to corporate accounting, reporting practices, compliance with legal and regulatory requirements, and the quality and integrity of Multi-Color’s financial reports. The Audit Committee oversees the accounting and financial reporting processes of Multi-Color and the audit of Multi-Color’s financial statements. It reviews the scope and adequacy of Multi-Color’s internal accounting and financial controls, reviews the scope and results of the audit plan of Multi-Color’s independent auditors and reviews Multi-Color’s financial reporting activities and the accounting standards and principles followed. The Audit Committee oversees the procedures for the receipt, retention and treatment of any complaints received regarding accounting, internal accounting controls or auditing matters and the confidential, anonymous submission by employees of any concerns

3

regarding questionable accounting or auditing matters. The Audit Committee also selects, for shareholder ratification, and engages Multi-Color’s independent auditors and approves their fees.

The Board has determined that all members of the Audit Committee, Robert R. Buck (Chairman), Lorrence T. Kellar and David H. Pease, Jr., satisfy the standards of “independence” required of audit committee members under applicable federal securities laws and NASDAQ listing standards. In addition, the Board has concluded that each of the three members of the Audit Committee is a “financial expert” within the meaning of applicable federal securities laws and NASDAQ listing standards. The Audit Committee met five times during the fiscal year ended March 31, 2005.

The Nominating Committee assists the Board in identifying qualified individuals to become Board members, in determining the composition of the Board of Directors and its committees, in monitoring a process to assess Board effectiveness and in developing, implementing and monitoring the effectiveness of Multi-Color’s corporate governance guidelines. A copy of Multi-Color’s corporate governance guidelines is available in the Investor Relations section of Multi-Color’s website (www.multicolorcorp.com).

The Nominating Committee is comprised entirely of directors who satisfy the standards of “independence” under applicable federal securities laws and NASDAQ listing standards. The Nominating Committee members are Roger A. Keller (Chairman), Charles B. Connolly and Lorrence T. Kellar. The Nominating Committee met two times last year.

The Compensation Committee is responsible for establishing Multi-Color’s compensation philosophy and assuring that directors, executives and key management personnel are effectively compensated in terms that are motivating, internally equitable, externally competitive and aligned with the short-term and long-term interests of shareholders. The Compensation Committee approves all compensation of key management personnel, administers Multi-Color’s incentive compensation plans, sets the criteria for awards under incentive compensation plans and determines whether such criteria have been met. The Compensation Committee also oversees the policies and practices of Multi-Color that advance its organizational development, including those designed to achieve the most productive engagement of Multi-Color’s workforce and the attainment of greater diversity.

The Compensation Committee is comprised entirely of directors who satisfy the standards of “independence” under applicable federal securities laws and NASDAQ listing standards. The Compensation Committee members are Lorrence T. Kellar (Chairman), Robert R. Buck, Charles B. Connolly, Roger A. Keller and David H. Pease, Jr. The Compensation Committee met once last year.

Nomination Process

Directors are elected each year by shareholders at the annual meeting. The Nominating Committee leads the search for individuals qualified to become members of the Board and selects director nominees to be presented for approval by the Board and shareholders at the annual meeting of shareholders.

4

The Nominating Committee selects nominees who have high personal and professional integrity, have demonstrated exceptional ability and judgment and who are effective, in conjunction with the other nominees and members of the Board, in collectively serving the interests of shareholders.

Shareholders may propose nominees for election as directors. The Nominating Committee will evaluate director nominee candidates based on the same criteria regardless of whether they are recommended by Committee members or by a shareholder. Shareholders should submit the following information (“Nomination Information”) in writing to the Secretary of Multi-Color at 425 Walnut Street, Suite 1300, Cincinnati, Ohio 45202: (a) the shareholder’s name and address; (b) number of shares of Multi-Color’s stock held by the shareholder; and (c) the following Nomination Information: (i) name, age, business address and residence address; (ii) principal occupation or employment; (iii) number of shares of Multi-Color’s stock held by the nominee; and (iv) the reason the shareholder believes the nominee is qualified to serve as a director. Upon request, the shareholder must submit additional information reasonably requested by the Nominating Committee, including information that would be required to be disclosed about a director nominee pursuant to federal proxy disclosure requirements. If a shareholder wishes to submit a name for consideration by the Nominating Committee for director nomination at the 2006 annual meeting of shareholders, the Nomination Information must be received by Multi-Color no later than March 15, 2006.

The Nominees

The Board is nominating for election each of the following persons: David L. Abbott, Robert R. Buck, Charles B. Connolly, Francis D. Gerace, Lorrence T. Kellar, Roger A. Keller and David H. Pease, Jr. Proxies solicited by the Board will be voted for the election of these nominees. All directors elected at the meeting will be elected to hold office until the next annual meeting. In voting to elect directors, shareholders are not entitled to cumulate their votes.

If a director nominee becomes unavailable before the election, your proxy card authorizes us to vote for a replacement nominee if the Board names one.

Nominees receiving the highest number of votes cast for the positions to be filled will be elected.

Six of the seven Multi-Color directors are “independent” within the meaning of applicable federal securities laws and NASDAQ listing standards. Information on each of our nominees is given below.

The Board Recommends You Vote FOR Each of the Following Nominees:

| | |

David L. Abbott Age 54 Director since June 2005 | | Mr. Abbott became a director of Multi-Color on June 30, 2005, upon appointment by the

Board of Directors. Mr. Abbott is currently serving as Chairman of the Board of E-Markets,

Inc., an Internet solutions provider, and Chairman of the Board and a member of the Executive

Committee of Exopack, LLC, a flexible packaging manufacturer. He served as Interim

President and Chief Executive Officer of Exopack, LLC in 2004 and as |

5

| | |

| | | President and Chief Executive Officer of E-Markets, Inc. from 2000 to 2003. Mr. Abbott is a member of the Dean’s Advisory Board for the College of Agriculture and Life Sciences at the University of Vermont. |

| |

Robert R. Buck Age 57 Director since 2003 | | Mr. Buck became a director on July 1, 2003. Mr. Buck is currently the Chief Executive Officer of Beacon Roofing Supply. Mr. Buck previously served as Senior Vice President and President — Uniform Rental Division of Cintas Corporation (primarily a corporate identity uniform company) from 1997 to 2003. Prior to that time, he served Cintas Corporation as Senior Vice President — Midwest Region (1991-1997) and Senior Vice President - Finance and Chief Financial Officer (1982-1991). Mr. Buck serves as a director of Kendle International and the National Coalition of Children and Families, is a trustee of the Fellowship of Christian Athletes, and is a member of the Dean’s Advisory Council for the College of Business Administration at the University of Cincinnati. |

| |

Charles B. Connolly Age 48 Director since 1998 | | Mr. Connolly was elected a director of Multi-Color in October 1998. Mr. Connolly has over 20 years of experience in the converting, coating and packaging industries. He has served as General Manager of Connemara Converting,LLC, a Chicago-based converter of specialty paper and plastic substrates, since April 1996. From March 1994 to April 1996 he served as Vice President, Sales and Marketing for Lawson Mardon Packaging. Prior to joining Lawson Mardon Packaging, Mr. Connolly was Vice President and General Manager of Camvac America, a subsidiary of RexamP.L.C. that produces vacuum metallized papers and films. |

| |

Francis D. Gerace Age 52 Director since 1999 | | Mr. Gerace was promoted to President of Multi-Color and appointed a director in May 1999 and was elected Chief Executive Officer in August 1999. Mr. Gerace served as Multi-Color’s Vice-President of Operations from April 1998 through May 1999. Prior to joining Multi-Color, Mr. Gerace was Director of Strategic Business Systems for Fort James Corporation’s Packaging Business from 1993 to 1998. From 1974 to 1993, Mr. Gerace held various general management positions with Conagra, Inc. and Beatrice Foods Company. |

| |

Lorrence T. Kellar Age 67 Director since 1988 | | Mr. Kellar was elected a director of Multi-Color in January 1988. Since October 2002, Mr. Kellar has served as Vice President of Continental Properties, Inc., a developer. Mr. Kellar served as Vice President, Real Estate of Kmart Corporation from May 1996 to September 2002. Prior to that time, he served as Group Vice President of The Kroger Co. (a grocery retailer), having joined The Kroger Co. in 1965. His prior positions with The Kroger Co. included Vice President of Corporate |

6

| | |

| | | Development and Vice President-Treasurer. Mr. Kellar also serves as a director of Frisch’s Restaurants, Spar Group, Inc. and Acadia Realty Trust. |

| |

Roger A. Keller Age 60 Director since 2000 | | Mr. Keller was elected a director of Multi-Color in August 2000. Mr. Keller is a private investor. From July 1993 to November 2000, Mr. Keller served as Vice President, General Counsel and Secretary of Mallinckrodt, Inc., a health-care company. |

| |

David H. Pease, Jr. Age 76 Director March 1987 - August 1999; October 1999 – Present | | Mr. Pease served as a director of Multi-Color from March 1987 to August 1999 and from October 1999 to the present. He was Chairman and Chief Executive Officer of Pease Industries, Inc., a Cincinnati-based manufacturer of residential building products, from 1980 until his retirement in 2000. |

RATIFICATION OF THE APPOINTMENT OF GRANT THORNTON LLP AS INDEPENDENT PUBLIC ACCOUNTANTS FOR FISCAL YEAR ENDING MARCH 31, 2006 (ITEM 2 ON THE PROXY CARD)

The Board is seeking shareholder ratification of its appointment of Grant ThorntonLLP as independent public accountants for the fiscal year ending March 31, 2006. Although action by the shareholders in this matter is not required, the Board believes that it is appropriate to seek shareholder ratification of this appointment in light of the critical role played by independent auditors in maintaining the integrity of Multi-Color’s financial controls and reporting. An affirmative vote of a majority of votes cast at the meeting is required for ratification. Representatives of Grant ThorntonLLP are expected to be present at the Annual Meeting and will be given an opportunity to comment, if they so desire, and to respond to appropriate questions that may be asked by shareholders.

Audit Fees

Grant Thornton LLP’s fees for audit and review of the Annual Report on Form 10-K for the fiscal year ended March 31, 2005 and the Quarterly Reports on Form 10-Q for the first three quarters of the fiscal year ended March 31, 2005 and for services provided in the 2005 fiscal year related to compliance with the requirements of the Sarbanes-Oxley Act of 2002 were $179,075. Grant Thornton LLP’s fees for audit and review of the Form 10-K for the fiscal year ended March 31, 2004 and Quarterly Reports on Form 10-Q for the first three quarters of the fiscal year ended March 31, 2004 and for services provided in the 2004 fiscal year related to Sarbanes-Oxley Act compliance were $106,000.

Audit-Related Fees

The total fees paid to Grant Thornton LLP by Multi-Color for the fiscal years ended March 31, 2005 and 2004, for services provided in connection with the audits of Multi-Color’s 401(k) plan, for acquisition-related services and various accounting consultations were $273,109 and $28,010, respectively.

7

Tax Fees

The total amount of fees paid by Multi-Color to Grant Thornton LLP for tax compliance, tax advice and tax planning services for the fiscal year ended March 31, 2004 was $16,400. Grant Thornton LLP did not provide tax compliance, tax advice or tax planning services to Multi-Color during the fiscal year ended March 31, 2005.

All Other Fees

None

All audit-related and other services for the fiscal year ended March 31, 2005 were pre-approved by the Audit Committee, which concluded that the provision of those services by Grant Thornton LLP was compatible with the maintenance of the auditors’ independence in the conduct of the auditing functions. The Audit Committee requires pre-approval of the audit and nonaudit services performed by the independent accountants in order to assure that the provision of such services does not impair the auditor’s independence. Unless a type of service has received general pre-approval, it requires specific pre-approval by the Audit Committee. Any proposed services exceeding pre-approved cost levels require specific pre-approval by the Audit Committee. To ensure prompt handling of unexpected matters, the Audit Committee has delegated pre-approval authority to the Chairman of the Audit Committee. However, the Chairman must report any such pre-approval decisions to the Audit Committee at the next scheduled meeting following such pre-approval.

DIRECTORS, EXECUTIVE OFFICERS AND PRINCIPAL SHAREHOLDERS

The following table sets forth the share ownership of directors, executive officers and shareholders known by Multi-Color to own beneficially five percent (5%) or more of its outstanding Common Stock as of May 31, 2005. David L. Abbott, who became a director of Multi-Color on June 30, 2005, beneficially owns no shares of Multi-Color Common Stock.

| | | | | | | |

| | | | | Common Stock Beneficially Owned(1)

| |

Name

| | Position

| | Amount

| | Percentage

| |

Margaret Clark Morgan Foundation(2) | | Principal Shareholder | | 530,665 | | 8.4 | % |

Burton D. Morgan Foundation(3) | | Principal Shareholder | | 469,665 | | 7.4 | % |

John C. Court(4) | | Principal Shareholder | | 528,920 | | 8.3 | % |

Ashford Capital Management, Inc.(5) | | Principal Shareholder | | 748,511 | | 11.8 | % |

Wellington Management Company, LLP(6) | | Principal Shareholder | | 379,150 | | 6.0 | % |

UBS AG(7) | | Principal Shareholder | | 340,498 | | 5.4 | % |

Lorrence T. Kellar(8) | | Chairman of the Board of Directors | | 301,792 | | 4.8 | % |

Roger A. Keller (9) | | Director | | 260,450 | | 4.1 | % |

David H. Pease, Jr. | | Director | | 135,042 | | 2.1 | % |

Charles B. Connolly | | Director | | 100,755 | | 1.6 | % |

8

| | | | | | | |

| | | | | Common Stock Beneficially Owned(1)

| |

Name

| | Position

| | Amount

| | Percentage

| |

Robert R. Buck(10) | | Director | | 10,500 | | * | |

Francis D. Gerace(11) | | Chief Executive Officer, President, Director | | 240,176 | | 3.8 | % |

Dawn H. Bertsche(12) | | Senior Vice President, Chief Financial Officer, Secretary | | 98,694 | | 1.6 | % |

Donald E. Kneir(13) | | President, Decorating Solutions Division | | 7,601 | | * | |

Edward V. Allen(14) | | President, Packaging Services Division | | 261 | | * | |

Executive Officers and Directors serving as of 5/31/05 as a group, including the above (9 persons) | | | | 1,155,271 | | 18.2 | % |

| * | Indicates less than one percent. |

| 1. | Included in the amount of Common Stock beneficially owned are the following shares of Common Stock subject to exercisable options or options exercisable within 60 days of May 31, 2005; Ms. Bertsche – 11,850 shares, Mr. Buck — 9,000 shares, Mr. Connolly – 40,500 shares, Mr. Gerace – 14,125 shares, Mr. Kellar – 9,000 shares, Mr. Keller – 31,500 shares, Mr. Pease – 31,500 shares, and Mr. Kneir – 7,500 shares. All officers, directors and principal stockholders have sole investment and voting power unless otherwise indicated. |

| 2. | Based on a Schedule 13G dated December 27, 2004 filed with the Securities and Exchange Commission by the Margaret Clark Morgan Foundation. The business address of the Margaret Clark Morgan Foundation is 1521 Georgetown Road, Suite 205, Hudson, Ohio 44236. |

| 3. | Based on a Schedule 13G dated December 28, 2004 and filed by the Burton D. Morgan Foundation with the Securities and Exchange Commission. The business address of the Burton D. Morgan Foundation is P.O. Box 1500, Akron, Ohio 44309. |

| 4. | Includes 4,204 shares held by Mr. Court’s son. Mr. Court’s address is 2145 East Hill Avenue, Cincinnati Ohio 45208. |

| 5. | Based on a Schedule 13G dated February 24, 2005 filed by Ashford Capital Management, Inc. with the Securities and Exchange Commission for the year ended December 31, 2004. The address of Ashford Capital Management, a registered investment advisor, is P. O. Box 4172, Wilmington, Delaware 19807. |

| 6. | Based on a Schedule 13G dated February 14, 2005 and filed by Wellington Management Company, LLP with the Securities and Exchange Commission for the year ended December 31, 2004. The Schedule 13G reported shared voting power with respect to 271,000 shares and shared dispositive power with respect to 379,150 shares. The business address of Wellington Management Company, LLP is 75 State Street, Boston, Massachusetts 02109. |

| 7. | Based on a Schedule 13G dated February 18, 2004 and filed by UBS AG and its subsidiary, UBS Americas Inc., with the Securities and Exchange Commission for the year ended December 31, 2003, for shares acquired by their subsidiary, UBS Financial Services Inc. The business address of UBS AG is Bahnhofstrasse 45, P. O. Box 8021 Zurich, Switzerland. The business address of UBS Americas Inc. is 677 Washington Boulevard, Stamford, CT 06901. |

| 8. | Excludes 26,550 shares held by his wife. Mr. Kellar disclaims beneficial ownership of these shares. |

| 9. | Includes 228,950 shares held jointly with right of survivorship. |

| 10. | Includes 1,500 shares held by his wife. |

| 11. | Includes 11,309 shares held in Mr. Gerace’s 401k plan. |

| 12. | Includes 6,638 shares held in Ms. Bertsche’s 401k plan and 80,206 shares held jointly with right of survivorship. |

| 13. | Includes 101 shares held in Mr. Kneir’s 401k plan. |

| 14. | Includes 261 shares held in Mr. Allen’s 401k plan. |

9

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16 of the Securities Exchange Act of 1934 requires Multi-Color’s executive officers, directors and persons who own more than 10% of a registered class of Multi-Color’s equity securities to file reports of ownership and changes in ownership. Based on a review of such forms, Multi-Color believes that during the last fiscal year, except for one Form 4 filed late with respect to the exercise of an option by Mr. Pease, all of its executive officers, directors and ten percent shareholders complied with the Section 16 reporting requirements.

SUMMARY COMPENSATION TABLE

The following table sets forth the cash and non-cash compensation for Multi-Color’s Chief Executive Officer and the three other most highly compensated executive officers (whose salary and bonus exceeded $100,000) for the fiscal years ended March 31, 2005, 2004 and 2003, respectively. At March 31, 2005, Multi-Color had four executive officers: Francis D. Gerace, Dawn H. Bertsche, Donald E. Kneir and Edward V. Allen. Mr. Kneir joined Multi-Color in February 2004 as President, Decorating Solutions Division. Mr. Allen joined Multi-Color in August 2004 as President, Packaging Services Division.

| | | | | | | | | | | | | | | | |

| | | | | Annual Compensation

| | Long Term

Compensation

Awards

| | |

Name and Principal Position

| | Fiscal Year Ended March 31,

| | Salary

| | Bonus

| | Other Annual Compensation(1)

| | Securities Underlying Options

| | All Other Compensation (2)

|

Francis D. Gerace President and Chief Executive Officer | | 2005

2004

2003 | | $

$

$ | 310,500

300,000

280,000 | | $

$

$ | 115,732

65,794

263,997 | | $

$

$ | 32,783

30,429

27,455 | | 5,000

22,500

16,875 | | $

$

$ | 6,579

6,150

5,800 |

| | | | | | |

Dawn H. Bertsche Senior Vice President, Chief Financial Officer and Secretary | | 2005

2004

2003 | | $

$

$ | 194,100

187,500

174,720 | | $

$

$ | 72,346

41,121

164,734 | | $

$

$ | 18,484

18,484

16,599 | | 3,000

22,500

11,250 | | $

$

$ | 6,551

6,096

5,550 |

| | | | | | |

Donald E. Kneir President Decorating Solutions Division | | 2005

2004 | | $

$ | 205,000

21,342 | | $

$ | 76,409

4,681 | | $

$ | 16,505

1,707 | | 0

37,500 | | $

$ | 1,319

0 |

| | | | | | |

Edward V. Allen President Packaging Services Division | | 2005 | | $ | 118,068 | | $ | 35,773 | | $ | 9,445 | | 37,500 | | $ | 2,010 |

| 1. | Multi-Color has established a deferred compensation program for key executives based on 8% of the executive’s salary; the amounts listed represent the percentage of salary plus accrued interest under this plan. |

| 2. | The amounts listed reflect Multi-Color’s contributions under the Multi-Color Corporation 401(k) plan, but exclude the $600 per month car allowance provided to Mr. Gerace, the $500 per month car allowance provided to Ms. Bertsche, Mr. Kneir and Mr. Allen, and $50 per month related to the non-election of medical insurance by Ms. Bertsche. |

10

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR AND

FISCAL YEAR-END OPTION VALUES

| | | | | | | | | |

| | | Shares Acquired on Exercise

| | Value Realized(1)

| | Number of Securities Underlying Unexercised Options at Fiscal Year End Exercisable/Unexercisable

| | Value of Unexercised In-the-Money Options at Fiscal Year End Exercisable/Unexercisable (2)

|

Francis D. Gerace | | 86,250 | | $ | 1,215,675 | | 0/25,625 | | $0/$178,113 |

| | | | |

Dawn H. Bertsche | | 54,375 | | $ | 734,569 | | 0/21,750 | | $0/$159,535 |

| | | | |

Donald E. Kneir | | 0 | | | — | | 7,500/30,000 | | $19,050/$76,200 |

| | | | |

Edward V. Allen | | 0 | | | — | | 0/37,500 | | $0/$150,000 |

| 1. | Based on the difference between the closing price of the stock on the date(s) of exercise and the option exercise price. |

| 2. | Based on a fair market value of $19.54 on March 31, 2005 (closing price of the stock on this date). |

Employment Agreements

Multi-Color and Mr. Gerace are parties to an Employment Agreement dated as of March 16, 1998, as amended on May 18, 1999. The initial term of employment extended through June 30, 2000. The term automatically renews for successive one year periods until either party gives the other at least three (3) months written notice. The Board sets Mr. Gerace’s salary annually based on performance. Mr. Gerace is also entitled to a bonus pursuant to the Executive Incentive Compensation Plan, as amended from time to time. If Mr. Gerace terminates his employment for any reason within one year of a Change in Control (as defined in his agreement), he is entitled to: (i) his annual salary through the date of termination, (ii) a bonus of 50% of his annual salary prorated through the date of termination, (iii) any deferred compensation and other non-qualified benefit plan balances and (iv) an amount equal to his annual salary paid over a two year period in monthly installments. If Mr. Gerace’s position is eliminated upon a Change in Control or if Mr. Gerace is terminated by Multi-Color for any reason other than Cause (as defined in his agreement), he will receive the same severance compensation as stated above except that the compensation provided in item (iv) above will be paid in a lump sum.

Upon termination of employment by Multi-Color, other than for cause, Ms. Bertsche is entitled to payments equal to one year’s salary paid over a one-year period. Mr. Kneir and Mr. Allen are entitled to payments upon termination of employment by Multi-Color, other than for cause, in an amount equal to six months’ salary.

Multi-Color maintains stock option plans which authorize the issuance of incentive and non-qualified stock options. Options granted under the plans contain such terms and conditions as are established by the Board at the time of the grant. Options currently granted to employees generally have ten year terms and vest ratably over three to five years. The options fully vest upon a change in control.

11

OPTION GRANTS IN LAST FISCAL YEAR

| | | | | | | | | | | | | | | | |

Individual Grants

| | Options Granted (1)

| | % of Total Options Granted for Employees in Fiscal Year

| | | Exercise Price ($/Per Share)

| | Expiration Date

| | Potential Realized Value of Assumed Annual Rates of Price Appreciation for Option Term(2)

|

| | | | | | 5%

| | 10%

|

Francis D. Gerace | | 5,000 | | 5.4 | % | | $ | 18.82 | | 4/15/14 | | $ | 30,593 | | $ | 63,247 |

| | | | | | |

Dawn H. Bertsche | | 3,000 | | 3.2 | % | | $ | 18.82 | | 4/15/14 | | $ | 18,356 | | $ | 37,948 |

| | | | | | |

Donald E. Kneir | | 0 | | — | | | | — | | — | | | — | | | — |

Edward V. Allen | | 37,500 | | 40.5 | % | | $ | 15.54 | | 8/22/14 | | $ | 352,445 | | $ | 597,351 |

| 1. | All options are non-qualified options, granted at fair market value, and vest ratably over five years. |

| 2. | The dollar amounts under these columns are the result of calculations at the 5% and 10% rates required by the applicable regulations of the Securities and Exchange Commission and therefore are not intended to forecast possible future appreciation, if any, of the Common Stock price. |

SUMMARY OF EQUITY COMPENSATION PLANS

The following table provides information about the options outstanding under Multi-Color’s existing equity compensation plans as of the end of the 2005 fiscal year. Multi-Color does not have any equity compensation plans which have not been approved by shareholders.

| | | | | | | |

Plan Category

| | No. of Shares to be Issued

Upon Exercise of

Outstanding Options

| | Weighted-Average Exercise Price of Outstanding Options

| | Number of Shares Remaining Available for

Future Issuance Under

These Plans

|

Plans approved by shareholders | | 439,875 | | $ | 11.86 | | 527,625 |

12

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

Executive Compensation Policies

Multi-Color’s policies on executive compensation are designed to encourage and motivate its executive officers to achieve both short-term and long-term operating, financial and strategic goals, and thereby build shareholder value on a steady but aggressive basis. To that end, senior executive compensation packages are increasingly weighted towards incentive plans that emphasize stock ownership and bonus compensation arrangements which serve to align more closely the interests of management with shareholders. It is also the policy of the Committee to reward superior corporate performance, recognize individual initiative and achievement, and assist Multi-Color in attracting and retaining qualified executives.

The Omnibus Budget Reconciliation Act of 1993 provides that compensation in excess of $1,000,000 per year paid to the Chief Executive Officer of a public company as well as the other executive officers listed in the compensation table is not deductible unless the compensation is “performance-based” and approved by the shareholders. The Committee’s general policy is to preserve the deductibility of most compensation paid to its executive officers to the extent appropriate and possible.

Salaries

The Committee believes it is important to maintain executive salaries at competitive levels, and relies heavily on comparisons with other regional companies of similar size. In determining salary adjustments for executive officers, the Committee takes into account, among other things, the salaries paid by comparable regional companies as reported in a study commissioned by Multi-Color from a reputable third party. The Committee believes these materials provide a broad representation of salaries paid in the region, which gives the Committee a reasonable basis for establishing salary levels and adjustments.

Salary levels and adjustments targeted are the average of the reported ranges. In establishing salaries for the executive officers, the Committee took into account Multi-Color’s recent performance based on certain general financial and operational criteria. The Committee did not, however, base its decisions on salary levels or adjustments on specific quantifiable performance goals or targets, but attempted to maintain salaries at a level which will allow Multi-Color to compete in the marketplace for executive talent. In addition, the Committee did not compare Multi-Color’s executive compensation with the levels of compensation paid by companies in the NASDAQ Market Index or the Hemscott Industry Group-Packaging and Containers, nor did the Committee attempt to correlate executive compensation levels with Multi-Color’s relative performance as shown in the financial performance graph contained in this Proxy Statement.

13

With respect to the salary paid to Mr. Gerace, Multi-Color’s President and Chief Executive Officer, the Committee utilized the salary data, company performance and other factors described above. The Committee also evaluated the ability of Mr. Gerace to develop and implement strategic plans for company growth and profitability. The Committee determined Mr. Gerace’s salary was appropriate in light of these factors.

Annual Bonuses

In determining annual bonus awards, including Mr. Gerace’s annual bonus, the Committee utilized the compensation survey mentioned above, but relied on such data to a lesser extent than in its review of the salary component. The Committee also considered Company and individual performance.

Stock Options and Restricted Stock

Multi-Color’s 1997 Stock Option Plan, 1999 Long Term Incentive Plan and 2003 Stock Incentive Plan are the principal means by which long-term incentive compensation is provided for key officers and employees of Multi-Color and the interests of these persons are brought more closely into tandem with the interests of shareholders. The plans are administered by the Compensation Committee. Multi-Color’s policies on executive compensation described above are applicable to all decisions regarding the number, pricing, timing and the recipients of stock option grants and restricted stock awards. The Committee determined that in connection with the hiring of Edward V. Allen as President of the Packaging Services Division, it was appropriate to make a grant of options to purchase 37,500 shares of Multi-Color’s Common Stock to provide significant long-term incentive to Mr. Allen. No restricted stock awards were made in the 2005 fiscal year.

RESPECTFULLY SUBMITTED BY THE MEMBERS OF THE COMPENSATION COMMITTEE, LORRENCE T. KELLAR (CHAIRMAN), ROBERT R. BUCK, CHARLES B. CONNOLLY, ROGER A. KELLER AND DAVID H. PEASE, JR.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

None of the members of the Compensation Committee is an officer or employee, or former officer or employee of Multi-Color. No interlocking relationship exists between the members of Multi-Color’s Board or Compensation Committee and the board of directors or compensation committee of any other company.

CODE OF ETHICS

Multi-Color has Standards of Business Conduct and a Code of Ethics applicable to all associates, officers, directors and agents of Multi-Color and its subsidiaries, including the chief executive officer and chief financial officer. A copy of the Standards of Business Conduct and Code of Ethics is available in the Investor Relations section of Multi-Color’s website (www.multicolorcorp.com). Multi-Color will post any amendments to and any waivers from the Standards of Business Conduct and Code of Ethics, as required by applicable federal securities laws and NASDAQ listing standards at the same location on its website.

14

AUDIT COMMITTEE REPORT

The Audit Committee assists the Board in fulfilling its responsibilities relating to corporate accounting, reporting practices, compliance with legal and regulatory requirements, and the quality and integrity of Multi-Color’s financial reports. The Audit Committee oversees the accounting and financial reporting processes of Multi-Color and the audit of Multi-Color’s financial statements. It reviews the scope and adequacy of Multi-Color’s internal accounting and financial controls, reviews the scope and results of the audit plan of Multi-Color’s independent auditors and reviews Multi-Color’s financial reporting activities and the accounting standards and principles followed. The Audit Committee oversees the procedures for the receipt, retention and treatment of any complaints received regarding accounting, internal accounting controls or auditing matters and the confidential, anonymous submission by employees of any concerns regarding questionable accounting or auditing matters. The Audit Committee also selects, for shareholder ratification, and engages Multi-Color’s independent auditors and approves their fees.

A copy of the Audit Committee’s Charter, which was revised in November 2004, is attached to this proxy statement as Appendix A and is available in the Investor Relations section of Multi-Color’s website (www.multicolorcorp.com).

The Board has determined that all members of the Audit Committee, Robert R. Buck (Chairman), Lorrence T. Kellar and David H. Pease, Jr., satisfy the standards of “independence” required of audit committee members under applicable federal securities laws and NASDAQ listing standards. In addition, the Board has concluded that each of the three members of the Audit Committee is a “financial expert” within the meaning of applicable federal securities laws and NASDAQ listing standards.

In connection with the March 31, 2005 financial statements, the Audit Committee reviewed and discussed the audited financial statements with management and the independent auditors; discussed with the auditors the matters required by Statement on Auditing Standards No. 61; and received and discussed with the auditors the matters required by Independent Standards Board Statement No. 1 and considered the compatibility of non-audit services with the auditor’s independence. Based on these reviews and discussions, the Audit Committee recommended to the Board that Multi-Color’s audited financial statements be included in its Annual Report on Form 10-K for the year ended March 31, 2005.

RESPECTFULLY SUBMITTED BY THE MEMBERS OF THE AUDIT COMMITTEE, ROBERT R. BUCK (CHAIRMAN), LORRENCE T. KELLAR AND DAVID H. PEASE, JR.

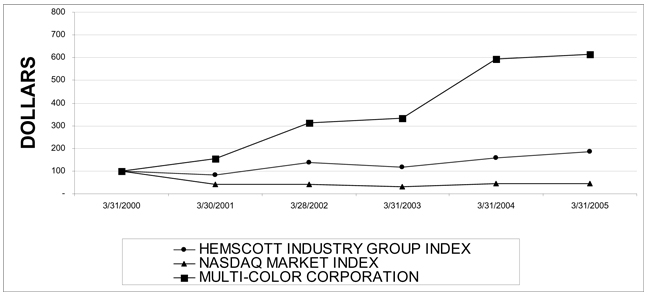

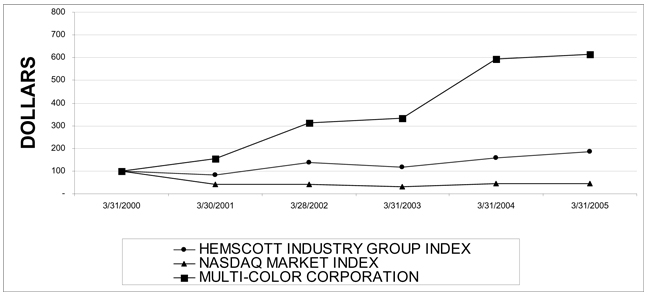

PERFORMANCE GRAPH

The following performance graph compares Multi-Color’s cumulative total shareholder return from April 1, 2000 through March 31, 2005, to that of the NASDAQ Market Index, a broad market index, and the Hemscott (formerly known as CoreData) Group Index – Packaging and Containers, an index of printing and packaging industry peer companies. The graph assumes that the value of the investment in the Common Stock and each index was $100 on April 1, 2000, and that all dividends were reinvested. Stock price performances shown in the graph are not indicative of future price performances. This data was furnished by Hemscott, Inc.

15

COMPARISON OF 5-YEAR CUMULATIVE TOTAL RETURN

AMONG MULTI-COLOR CORPORATION,

NASDAQ MARKET INDEX AND PACKAGING & CONTAINERS INDEX

| | | | | | | | | | | | | | | | | | |

| | | 2000

| | 2001

| | 2002

| | 2003

| | 2004

| | 2005

|

Pkg/Cont. Index | | $ | 100 | | $ | 84 | | $ | 136 | | $ | 116 | | $ | 158 | | $ | 186 |

NASDAQ | | | 100 | | | 41 | | | 42 | | | 31 | | | 46 | | | 46 |

Multi-Color Corporation | | | 100 | | | 153 | | | 313 | | | 334 | | | 593 | | | 613 |

16

PROPOSALS OF SHAREHOLDERS FOR 2006 ANNUAL MEETING

In order for a shareholder proposal to be included in Multi-Color’s proxy statement for presentation at next year’s annual meeting, it must be received, in writing, by the Secretary of Multi-Color at its principal executive offices, 425 Walnut Street, Suite 1300, Cincinnati, Ohio 45202, not later than March 15, 2006. For any proposal not submitted for inclusion in the proxy statement, but sought to be presented directly at next year’s meeting, SEC rules permit management to vote proxies in its discretion if Multi-Color: (1) receives notice of the proposal by May 31, 2006 and advises shareholders in the 2006 proxy statement about the nature of the matter and how management intends to vote on such matter; or (2) does not receive notice of the proposal prior to May 31, 2006. If there is a change in the anticipated date of next year’s annual meeting (or this deadline) by more than 30 days, we will notify you of this change through our Form 10-Q filings or by any other practicable means.

Shareholders may submit proposed nominees for director to the Nominating Committee for consideration. See “Election of Directors – Nomination Process.”

ANNUAL REPORT

The Annual Report for the fiscal year ended March 31, 2005 accompanies this Proxy Statement.

SHAREHOLDER COMMUNICATION WITH THE BOARD

Shareholders may communicate directly with the Board. Communications should be sent in writing addressed to the Chairman of the Board, Multi-Color Corporation, 425 Walnut Street, Suite 1300, Cincinnati, Ohio 45202.

QUESTIONS?

If you have questions or need more information about the annual meeting, write to:

Dawn H. Bertsche

Senior Vice President, Chief Financial Officer

and Secretary

Multi-Color Corporation

425 Walnut Street, Suite 1300

Cincinnati, Ohio 45202

or call us at (513) 381-1480.

For information about your record holdings, please call Computershare Investor Services at 1-888-294-8217. We also invite you to visit Multi-Color’s website at www.multicolorcorp.com.Information contained on this website is not part of this proxy solicitation.

17

Appendix A

AUDIT AND FINANCE COMMITTEE CHARTER

Organization

The Audit and Finance Committee of the Board of Directors shall be composed of a minimum of three directors. All members of the Audit and Finance Committee shall be: (i) “independent” under securities laws and regulations and satisfy the criteria for audit committee membership of the NASDAQ National Market System or such other exchange or trading system on which the Corporation’s securities are traded (“Applicable Listing Standards”); and (ii) free from any relationship that, in the opinion of the Board of Directors, would interfere with their exercise of independent judgment as an Audit and Finance Committee member. All members shall have sufficient financial experience and ability to enable them to discharge their responsibilities. At least one member shall be a “financial expert” as defined under securities laws and regulations and at least one member (who may also be the audit committee financial expert) shall have the requisite accounting or related financial experience or expertise under Applicable Listing Standards.

Members of the Audit and Finance Committee shall be appointed by the Board of Directors upon the recommendation of the Nominating and Corporate Governance Committee and may be removed by the Board of Directors in its discretion.

Purpose

The Audit and Finance Committee shall assist the Board in fulfilling its responsibilities to shareholders, potential shareholders and the investment community relating to corporate accounting, reporting practices of the Corporation, the Corporation’s compliance with legal and regulatory requirements, and the quality and integrity of the financial reports of the Corporation. The Audit and Finance Committee shall oversee the accounting and financial reporting processes of the Corporation and the audit of the Corporation’s financial statements. In fulfilling these duties, it is the responsibility of the Audit and Finance Committee to maintain free and open means of communication among the directors, the independent auditors, the internal auditors and the financial management of the Corporation.

Responsibilities

The Audit and Finance Committee’s policies and procedures will be designed to ensure that corporate accounting and reporting practices of the Corporation comply with all applicable legal and regulatory requirements and are of high quality. The Audit and Finance Committee further believes that its policies and procedures should remain flexible to allow the Corporation to react to changing conditions, laws and regulations.

In furtherance of its purpose, the Audit and Finance Committee shall have the following authority and responsibilities:

| 1. | To select, for shareholder ratification, the independent auditors to audit the financial statements of the Corporation and its divisions and subsidiaries. The Audit and Finance |

| | Committee shall have the sole authority and responsibility for the appointment, compensation, retention and oversight of the work of the independent auditors (including resolution of disagreements between management and the auditor). |

| 2. | The Audit and Finance Committee must review and approve the pre-approval policy for any non-audit service provided to the Corporation by the independent auditors. |

| 3. | To meet with the independent auditors and financial management of the Corporation to review the scope of the proposed audit for the current year and the audit procedures to be utilized. |

| 4. | To review such audit at its conclusion, including any comments or recommendations of the independent auditors. The Audit and Finance Committee shall discuss with management and the independent auditors, as appropriate, any audit problems or difficulties and management’s response. |

| 5. | The Audit and Finance Committee shall have the sole authority and responsibility for the appointment, compensation, retention and oversight of the work of the internal auditor. On an annual basis, the Audit and Finance committee will review and approve the Multi-Color Corporation Internal Audit plan. In addition, the Audit and Finance Committee will provide sufficient opportunity for the internal auditor to meet with members of the Audit and Finance Committee without members of management being present. |

| 6. | To review and discuss the Corporation’s risk assessment and risk management policies, including the Corporation’s major financial risk exposure, and steps taken by management to monitor and control such exposure. |

| 7. | To review with the independent auditors and financial, accounting and internal audit personnel the adequacy and effectiveness of the accounting and financial controls of the Corporation. The Audit and Finance Committee shall ensure that the Corporation complies with all the requirements of the Sarbanes Oxley Act. |

| 8. | To review and approve for filing the annual audited financial statements and Form 10-Q quarterly financial statements, including matters required to be reviewed under applicable legal, regulatory or Applicable Listing Standards. |

| 9. | To discuss with management and the independent auditors, as appropriate, earnings press releases, financial information, and earnings guidance provided to analysts. |

| 10. | To review the Corporation’s financial reporting and accounting standards and principles, significant changes in such standards and principles or in their application and the key accounting decisions affecting the Corporation’s financial statements. |

| 11. | To provide sufficient opportunity for the independent auditors to meet with the members of the Audit and Finance Committee without members of management being present. Among the items to be discussed in such meetings are the independent auditors’ |

ii

| | evaluation of the Corporation’s financial and accounting personnel and the cooperation that the independent auditors received during the course of the audit. |

| 12. | To review accounting and financial human resources and succession planning within the Corporation, if not accomplished at regular Board meetings. |

| 13. | To obtain and review at least annually a formal written report from the independent auditor delineating: the auditing firm’s internal quality-control procedures; any material issues raised within the preceding five years by the auditing firm’s internal quality-control reviews, by peer reviews of the firm, or by any governmental or other inquiry or investigation relating to any audit conducted by the firm. The Audit and Finance Committee shall review the steps taken by the auditing firm to address any findings in any of the foregoing reviews. In addition, the Audit and Finance Committee shall review at least annually all relationships between the independent auditor and the Corporation in order to assess auditor independence. |

| 14. | To prepare and publish an annual committee report in the Corporation’s proxy statement. |

| 15. | To review and investigate, as appropriate, any matters pertaining to the integrity of officers, directors and employees, including conflicts of interest, or adherence to standards of business conduct as required in the policies of the Corporation, including the Corporation’s Standards of Business Conduct and Code of Ethics. The Audit and Finance Committee shall review the Corporation’s compliance process on a regular basis. |

| 16. | To establish and maintain procedures for: (i) the receipt, retention and treatment of complaints received regarding accounting, internal accounting controls or auditing matters and for: (ii) confidential anonymous submission by employees of concerns regarding questionable accounting, or auditing matters. |

| 17. | To perform such other activities as the Audit and Finance Committee deems appropriate, or as are requested by the Board, consistent with this Charter, the Corporation’s Code of Regulations and applicable law. |

The Audit and Finance Committee shall have the authority to retain outside counsel and other advisors as the Audit and Finance Committee deems appropriate in its sole discretion. The Audit and Finance Committee shall have the sole authority to approve related fees and retention terms. The Corporation will provide appropriate funding, as determined by the Audit and Finance Committee, for payment of: (i) compensation of any accounting firm engaged for the purpose of preparing or issuing an audit report or performing any audit, review or attest services for the Corporation; (ii) compensation of any advisors employed by the Audit and Finance Committee; and (iii) ordinary administrative expenses of the Audit and Finance Committee that are necessary or appropriate in carrying out its duties.

The Audit and Finance Committee shall report its actions and recommendations to the Board after each Audit and Finance Committee meeting and shall conduct and present to the Board an annual performance evaluation of the Audit and Finance Committee. The Audit and Finance Committee shall review at least annually the adequacy of this Charter and recommend any necessary or desirable changes to the Board for approval.

iii

| | | | | | |

| | | | | MMMMMMMMMMMM |

| | | Multi-Color Corporation | | |

| | |

| | MR A SAMPLE DESIGNATION (IF ANY) ADD 1 ADD 2 ADD 3 ADD 4 ADD 5 ADD 6 !123456564525! | | 000000000.000 ext 000000000.000 ext 000000000.000 ext 000000000.000 ext 000000000.000 ext 000000000.000 ext 000000000.000 ext C 1234567890 J N T |

| | |

| | | | |  |

| | | |

| | | | | ¨ | | Mark this box with an X if you have made changes to your name or address details above. |

Annual Meeting Proxy Card - Meeting Date: Thursday, August 18, 2005

The Board of Directors recommends a vote FOR the listed nominees.

1. Authority to elect as directors the seven (7) nominees listed below:

| | | | | | |

| | | For | | Withhold | | |

01 - David L. Abbott | | ¨ | | ¨ | | |

| | | |

02 - Robert R. Buck | | ¨ | | ¨ | | |

| | | |

03 - Charles B. Connolly | | ¨ | | ¨ | | |

| | | |

04 - Francis D. Gerace | | ¨ | | ¨ | | |

| | | |

05 - Lorrence T. Kellar | | ¨ | | ¨ | | |

| | | |

06 - Roger A. Keller | | ¨ | | ¨ | | |

| | | |

07 - David H. Pease, Jr. | | ¨ | | ¨ | | |

The Board of Directors recommends a vote FOR the following proposal.

| | | | | | | | |

| | | For | | Against | | Abstain | | |

2. Ratification of the appointment of Grant Thornton LLP as independent public accountants for the fiscal year ending March 31, 2006. | | ¨ | | ¨ | | ¨ | | |

C Authorized Signatures - Sign Here - - This section must be completed for your instructions to be executed.

IMPORTANT: Please sign exactly as name appears hereon indicating, where proper, official position or representative capacity. In the case of joint holders, all should sign.

| | | | | | | | |

| Signature 1 - Please keep signature within the box | | | | Signature 2 - Please keep signature within the box | | | | Date (mm/dd/yyyy) |

| | | | | |

| | | | | | | | | / / |

| | |

| | | | | 1 U P X H H H P P P P 006032 |

Proxy - Multi-Color Corporation

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby appoints Francis D. Gerace and Dawn H. Bertsche, or either of them, proxies of the undersigned, each with the power of substitution, to vote all shares of Common Stock which the undersigned would be entitled to vote at the Annual Meeting of Shareholders of Multi-Color Corporation to be held on Thursday, August 18, 2005, at 10:30 a.m. Eastern Time at Queen City Club, 331 East Fourth Street, Cincinnati, Ohio 45202, and any adjournment of such meeting on the matters specified on the reverse side and in their discretion with respect to such other business as may properly come before the meeting or any adjournment thereof.

THIS PROXY WILL BE VOTED AS RECOMMENDED BY THE BOARD OF DIRECTORS UNLESS A CONTRARY CHOICE IS SPECIFIED.