UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 31, 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 0-16148

MULTI-COLOR CORPORATION

| | |

Incorporated in the State of Ohio | | IRS Employer Identification Number 31-1125853 |

4053 Clough Woods Dr.

Batavia, OH 45103

(Address of principal executive offices)

(513) 381-1480

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, no par value

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K x.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | x |

| | | |

| Non-accelerated filer | | ¨ | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates was approximately $116,089,000 based upon the closing price of $15.43 per share of Common Stock on the NASDAQ Global Select Market as of September 30, 2009, the last business day of the registrant’s most recently completed second fiscal quarter.

As of May 28, 2010, 12,279,947 shares of no par value Common Stock were issued and 12,236,963 shares of no par value Common Stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement to be filed pursuant to Regulation 14A of the Exchange Act for its 2010 Annual Meeting of Shareholders to be held on August 11, 2010 are incorporated by reference into Parts II and III of Form 10-K.

Table of Contents

FORWARD-LOOKING STATEMENTS

The Company believes certain statements contained in this report that are not historical facts constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, and are intended to be covered by the safe harbors created by that Act. Reliance should not be placed on forward-looking statements because they involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to differ materially from those expressed or implied. Any forward-looking statement speaks only as of the date made. The Company undertakes no obligation to publically update or revise any forward-looking statements whether as a result of new information, future events or otherwise.

Statements concerning expected financial performance, on-going business strategies, and possible future actions which the Company intends to pursue in order to achieve strategic objectives constitute forward-looking information. Implementation of these strategies and the achievement of such financial performance are each subject to numerous conditions, uncertainties and risk factors. Factors which could cause actual performance by the Company to differ materially from these forward-looking statements include, without limitation, factors discussed in conjunction with a forward-looking statement; changes in general economic and business conditions in the U.S. and abroad; the ability to consummate and successfully integrate acquisitions; the ability to manage foreign operations; currency exchange rate fluctuations; the retention, success and financial condition of the Company’s significant customers; competition; acceptance of new product offerings; changes in business strategy or plans; quality of management; the Company’s ability to maintain an effective system of internal control; availability, terms and development of capital and credit; cost and price changes; raw material cost pressures; availability of raw materials; ability to pass raw material cost increases to its customers; business abilities and judgment of personnel; changes in, or the failure to comply with, government regulations, legal proceedings and developments; risk associated with significant leverage; increases in general interest rate levels affecting the Company’s interest costs; ability to manage global political uncertainty; and terrorism and political unrest.

2

PART I

OVERVIEW

Multi-Color Corporation (“Multi-Color,” “MCC,” “We,” “Us,” “Our” or “the Company”), established in 1916, is a leader in global label solutions supporting a number of the world’s most prominent brands including leading producers of home and personal care, wine and spirit, food and beverage and specialty consumer products. MCC serves international brand owners in North, Central and South America, Australia, New Zealand and South Africa via a comprehensive range of the latest Label Technologies in Pressure Sensitive, Cut and Stack, In-Mold, Shrink Sleeve and Heat Transfer. MCC employs approximately 1,100 associates at 12 facilities globally and is a public company trading on the NASDAQ Global Select Market (company symbol: LABL).

Prior to June 2007, the Company was organized into two business segments: Decorating Solutions and Packaging Services. The Decorating Solutions segment’s primary operations consisted of the design and printing of labels, while the Packaging Services segment provided promotional packaging, assembly and fulfillment services. On July 2, 2007, the Company completed the sale of Quick Pak, whose operating results were reported as the Packaging Services segment. Accordingly, the results of Quick Pak are now presented as discontinued operations for all periods and the Company no longer reports any segment results.

The Company is an Ohio-based corporation that was incorporated in 1985, succeeding the predecessor business. Our corporate offices are located at 4053 Clough Woods Drive, Batavia, Ohio 45103 and our telephone number is (513) 381-1480.

Our common stock, no par value, is listed on the NASDAQ Global Select Market under the symbol “LABL”. See “Item 5 – Market for the Registrant’s Common Stock, Related Stockholder Matters and Issuer Purchases of Equity Securities.” We maintain a website (www.multicolorcorp.com) which includes additional information about the Company. The website includes corporate governance information for our shareholders and our Code of Ethics can be found under the corporate governance section. Shareholders can also obtain, free of charge, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after the Company electronically files such materials with or furnishes such materials to the Securities and Exchange Commission (SEC).

PRODUCTS AND SERVICES

The Company provides a wide range of products for the packaging needs of our customers and is one of the world’s largest producers of high quality pressure sensitive, in-mold and heat transfer labels, and a major manufacturer of glue-applied and shrink sleeve labels. The Company also provides a full complement of print methods including flexographic, lithographic, rotogravure and digital, plus in-house pre-press services.

Pressure Sensitive Labels:

Pressure sensitive labels adhere to a surface with pressure. The label typically consists of four elements – a substrate, which may include paper, foil or plastic; an adhesive, which may be permanent or removable; a release coating; and a backing material to protect the adhesive against premature contact with other surfaces. The release coating and protective backing are removed prior to application to the container, exposing the adhesive, and the label is pressed or rolled into place. Innovative features in this area include promotional neckbands, peel-away coupons and resealable labels, see-through window graphics, and holographic foil enhancements to cold and hot foil stamping.

The pressure sensitive market is the largest category of the overall label market and represents a significant growth opportunity. Our strategy is to be a premier global supplier of pressure sensitive labels that demand high impact graphics or are otherwise technically challenging.

In-Mold Labels:

The in-mold label (IML) process applies a label to a plastic container as the container is being formed in the mold cavity. The finished IML product is a finely detailed label that performs consistently well for plastic container manufacturers and adds marketing value and product security for consumer product companies.

Each component of the IML production process requires a special expertise for success. The components include the substrate (the base material for the label), inks, overcoats, varnishes and adhesives. We are unique in the industry in that we manufacture IMLs on rotogravure, flexographic and lithographic printing presses. There are several critical characteristics of a successful IML: the material needs a proper coefficient of friction so that the finished label is easily and consistently picked up and applied to the blow-molded container, the substrate must be able to hold the label’s inks, including metallics and fluorescents, overlay varnishes and adhesives and the material must be able to lay smoothly, without wrinkle or bulge, when applied to a very hot, just molded plastic container that will quickly shrink, along with the label, as its temperature falls. We continually search for alternate substrates to be used in the IML process in order to improve label performance and capabilities as well as to reduce substrate costs. Technical innovations in this area include the use of peel-away IML coupons, scented and holographic labels.

3

Glue-Applied Labels:

Glue-applied labels are adhered to containers using an adhesive applied during the labeling process. Available in roll-fed and sheeted formats, the labels are an attractive and cost-effective choice for high volume applications. Our facilities in Norway, Michigan, Watertown, Wisconsin, Napa, California and Griffith and Barossa Valley, Australia supply either offset or rotogravure glue-applied labels printed on paper and film.

Our innovations within glue-applied labels include peel-away promotional labels, thermochromics, holographics and metalized films. We also offer promotional products such as scratch-off coupons, static-clings and tags.

Heat Transfer Labels (HTLs):

HTLs are reverse printed and transferred from a special release liner onto the container using heat and pressure. The labels are a composition of inks and lacquers tailored to the customer’s specific needs. These labels are printed and then shipped to blow molders and/or contract decorators who transfer the labels to the containers. Once applied, the labels are permanently adhered to the container. The graphics capabilities include fine vignettes, metallic and thermochromatic inks, as well as the patented “frost”, giving an acid-etch appearance.

Therimage™ is our pioneer heat transfer label technology developed primarily for applications involving plastic containers serving consumer markets in personal care, home improvement products, food and beverage, and health and beauty. The addition of the Clear ADvantage™ brand provides premium graphics on both glass and plastic containers enabling this decorating technology to achieve the highly sought after “no label” look for the health and beauty aid, beverage, personal care, household chemical and promotional markets. Most recently, we have added the new “ink only” and flameless HTL technology to our capabilities in this area. Flameless technology enables us to provide a solution to customers who want to remove open flames from their operations, which are normally required to pre-treat and post-treat containers for Therimage™ and Clear ADvantage™ products. Flameless technology has applications in all the aforementioned markets.

Shrink Sleeve Labels:

Shrink sleeve labels are produced in colorful, cutting edge styles and materials. The labels are manufactured as sleeves, slid over glass or plastic bottles and then heated to conform precisely to the contours of the container. The 360-degree label and tamper resistant feature of the label are marketing advantages that many of our customers seek when choosing this label type.

The shrink sleeve market is a growing decorating technology as consumer product companies look for ways to differentiate their products. Several markets, such as the beverage market within the consumer goods industry, have adopted this decorating technology. Demand for this label solution in the food and personal care markets continues to grow and should broaden the sales opportunities for shrink sleeve labels.

Graphic Services:

In 1991, we were the first gravure printer in the U.S. to produce printing cylinders digitally without the use of film. Our Erlanger, Kentucky facility utilized a laser-exposing and chemical-engraved cylinder process developed by Think Laboratories in Japan. In February 2010, the Company entered into a supply agreement to fulfill its gravure cylinder requirements. As a part of the agreement, the Company sold certain assets associated with the manufacturing of gravure cylinders. The Erlanger facility is currently held for sale. Additionally, our Norway, Michigan facility utilizes a mechanical engraving process to produce print cylinders.

We provide graphics and pre-press services for our customers at all of our manufacturing locations. These services include the conversion of customer digital files and artwork into proofs, production of print layouts and printing plates, and product mock ups and samples for market research.

As a result of these capabilities, we are able to go from concept to printed label, thus increasing our customers’ speed and further enhancing our value proposition.

RESEARCH AND DEVELOPMENT

Our product leadership group focuses on research and development, product commercialization and technical service support. The group includes chemical, packaging and field engineers who are responsible for developing and commercializing innovative label and application solutions. Technical service personnel also assist customers and manufacturers in improving container and label performance. The services provided by this group differentiate us from many of our competitors and drive our selection for the most challenging projects.

Our research and development expenditures totaled approximately $2,658,000 in 2010, $3,426,000 in 2009, and $3,165,000 in 2008.

SALES AND MARKETING

We provide a complete line of label solutions and a variety of technical and graphic services. Our vision is to be the premier global resource of decorating solutions. We sell to a broad range of consumer product, food, beverage and wine and spirit companies located in North and South America, Australia and New Zealand, and South Africa. Our sales strategy is a consultative selling approach. Our sales organization reviews the requirements of the container and offers a number of alternative decorating methods. Our customers view us as an expert source of materials, methods and technologies with the ability to offer the most cost effective solution.

4

We have continued to make progress in expanding our customer base and portfolio of products, services and manufacturing locations in order to address issues related to customer concentration. During 2010, 2009 and 2008, sales to major customers (those with 10% or more of the Company’s net revenues) approximated 28%, 32% and 51%, respectively of the Company’s consolidated net revenues. Approximately 18%, 19% and 33% of sales in 2010, 2009 and 2008, respectively, were to the Procter & Gamble Company; approximately 10%, 13% and 18% of sales in 2010, 2009 and 2008, respectively, were to the Miller Brewing Company. Sales concentration with our major customers has been significantly reduced since we have added new customers and products with our acquisition of Collotype which has manufacturing operations in Australia, South Africa and California.

MANUFACTURING

We currently have 12 manufacturing facilities across the U.S., Australia and South Africa. Our wide range of capabilities and versatility facilitates our ability to respond quickly and effectively to changing customer needs. Our current printing equipment consists of gravure, offset, flexographic, letterpress and digital presses and label finishing operations. As part of a manufacturing expansion, plants in Troy and Batavia, Ohio were consolidated into a new and larger facility in Batavia, Ohio. The pre-existing Batavia facility was sold in June 2008 and the Troy facility was sold in July 2009. In July 2009, we closed our Framingham manufacturing facility and the business was transitioned into our Batavia, Ohio and Scottsburg, Indiana facilities. In February, 2010, the Company entered into a supply agreement to fulfill gravure cylinder requirements. As a part of the agreement, the Company sold certain assets associated with the manufacturing of gravure cylinders. The Erlanger facility is currently held for sale. The Norway, Michigan, Watertown and Green Bay, Wisconsin and Adelaide, South Australia plants are ISO 9001 certified.

At March 31, 2010, our backlog was approximately $13,615,000 ($11,735,000 in 2009). The backlog at March 31, 2010 represents one to two weeks of production volume at current staffing levels and is expected to be completed in the next fiscal year.

EMPLOYEES

As of March 31, 2010, we had approximately 1,113 permanent employees and 73 temporary employees, of which 77 are represented by the Graphics Communications Conference of the International Brotherhood of Teamsters Local 77P. The related labor contracts with this union expire in July 2010 and June 2011. We consider our labor relations to be good and have not experienced any work stoppages during the previous decade. All human resource and compensation systems have been developed to align our objectives with the goals of our shareholders.

RAW MATERIALS

Common to the printing industry, we purchase proprietary products from a number of raw material suppliers. To prevent potential disruptions to our manufacturing facilities, we have developed relationships with more than one supply source for each of our critical raw materials. Our raw material suppliers are major corporations with successful historical performance. Although we intend to prevent any long-term business interruption due to our inability to obtain raw materials, there could be short-term manufacturing disruptions during the customer qualification period for any new raw material source.

ACQUISITIONS

We are continually in pursuit of selective acquisitions that will contribute to our growth. We believe that acquisitions are a method of increasing our presence in existing markets, expanding into new markets, gaining new customers and product offerings and improving operating efficiencies through economies of scale. Through acquisitions, we intend to broaden our revenue stream by expanding our lines of innovative label solutions, offering a variety of technical and graphic services and fulfilling the specific needs and requirements of our customers. The printing and packaging industry is highly fragmented and offers many opportunities for acquisitions.

On February 29, 2008, we completed our largest acquisition to date when we purchased Collotype headquartered in Adelaide, South Australia. This acquisition added a substantial number of new customers, increased our position in the pressure sensitive label category, and expanded our geographic footprint with operations in Australia, South Africa and California, as well as expanding our market position in the wine and spirit industry. See Note 16 to our consolidated financial statements for geographic information relating to our net revenues and long-lived assets.

COMPETITION

We have a large number of competitors in the pressure sensitive and glue-applied label markets and several competitors in each of the IML, shrink sleeve, and HTL markets. Some of these competitors in the pressure sensitive and glue-applied label markets have greater financial and other resources than us. The competitors in IML, shrink sleeve and HTL markets are either private companies or subsidiaries of public companies and we cannot assess the financial resources of these organizations. We could be adversely affected should a competitor develop labels similar or technologically superior to our labels. We believe competition is principally dependent upon product performance, service, pricing, technical support and innovation.

PATENTS AND LICENSES

We own a number of patents and patent applications in the U.S., Australia, South Africa and the European Union that relate to the products and services we offer to our customers. Although these patents are important to us, we are not dependent upon any one patent. We believe that these patents, collectively, along with our ability to be a single source provider of many packaging needs, provide us with a competitive advantage over our competition. The expiration or unenforceability of any one of our patents would not have a material adverse effect on us.

5

REGULATION

Our operations are subject to regulation by federal, state and foreign (Australia and South Africa) environmental protection agencies. To ensure ongoing compliance with these requirements, we have implemented an internal compliance program. Additionally, we continue to make capital investments to maintain compliance with these environmental regulations and to improve our existing equipment. However, there can be no assurances that these regulations will not require expenditures beyond those that are currently anticipated.

In the U.S., the Food and Drug Administration regulates the raw materials used in labels for various products. These regulations apply to the consumer product companies for which we produce labels. We use materials specified by the consumer product companies in producing labels.

We rely on several large customers and the loss of one of these customers would have a material adverse impact on our operating results and cash flows.

For the fiscal year ended March 31, 2010, two customers accounted for approximately 28% of our consolidated sales and our top twenty-five customers accounted for 70% of our consolidated sales. While we maintain sales contracts with certain of our largest customers, such contracts do not guarantee sales levels and these contracts require renewal on a regular basis in the ordinary course of business. We cannot guarantee that these contracts will be successfully renewed in the future. The loss or substantial reduction in business of any of our major customers could have a material adverse impact on our operating results and cash flows.

Competition in our business could limit our ability to retain current customers and attract new customers.

We have a large number of competitors in the markets in which we operate. Some of our competitors have greater financial and other resources than us. We could face competitive pressure through (a) new products developed by our competitors that are of superior quality, fit our customers’ needs better or have lower prices; (b) patents obtained or developed by competitors; (c) consolidation of our competitors; (d) pricing pressures; and (e) loss of proprietary supplies of certain materials. The inability to successfully overcome competition in our business could have a material adverse impact on our operating results and cash flows.

Raw material cost increases or shortages could adversely affect our results of operations and cash flows.

As a manufacturer, our sales and profitability are dependent upon the availability and cost of raw materials, which are subject to price fluctuations, and the ability to control or pass on fluctuating costs of raw materials. Inflationary and other increases in the costs of raw materials and energy have occurred in the past and are continuing to recur. Our future performance depends in part on our ability to improve operating efficiencies and pass raw material cost increases to our customers.

We have risks related to the recent economic and credit conditions.

The Company’s operating cash flows provide funding for debt repayment and various discretionary items such as capital expenditures and dividends. Recent uncertainty in global economic conditions has negatively impacted the overall economy which has adversely impacted demand for our products and our ability to manage commercial relationships with our customers, suppliers and creditors.

Slower growth or a decline in key markets could adversely affect our profitability.

Our business could be negatively impacted by continued slower growth or a decline in key end use markets or applications for our products and services which could adversely affect our operating results and cash flows.

Changes in the regulatory or administrative environment could adversely affect our financial condition and results of operations.

Laws and regulations at both the state, federal and international levels frequently change and the cost of compliance cannot be precisely estimated. Any changes in regulations, the imposition of additional regulations, or the enactment of any new governmental legislation that impacts employment/labor, trade, health care, tax, environmental or other business issues could have an adverse impact on our financial condition and results of operations.

We are subject to risks associated with our international operations.

We have operations in the United States, Australia and South Africa, and we intend to continue expansion of our international operations. As a result, our business is exposed to risks inherent in foreign operations. These risks, which can vary substantially by market, include the difficulties associated with managing an organization with operations in multiple countries, compliance with differing laws and regulations (including tax laws, regulations and rates), restrictive actions by foreign governments, changes in economic conditions in each market, foreign customers who may have longer payment cycles than customers in the United States, political and social conditions (including wars, terrorist acts and political instability) and acts of nature, such as typhoons, tsunamis, or earthquakes.

6

Currency exchange rate fluctuations could have an adverse effect on our revenue and financial results.

Our revenues and earnings and the value of our foreign net assets are affected by fluctuations in foreign currency exchange rates, which may favorably or adversely affect reported earnings and net assets. Currency exchange rates fluctuate in response to, among other things, changes in local, regional or global economic conditions, the imposition of currency exchange restrictions and unexpected changes in regulatory or taxation environments.

Our ability to develop and market new products is critical for maintaining growth.

Our success depends upon the timely introduction of new products as well as improvements to current products. Research and development relies on innovation and requires anticipation of market trends. Our future results and ability to maintain or improve our competitive position will depend on our ability to successfully identify, develop and sell new or improved products.

We rely primarily on printing presses.

The long-term shutdown of our presses or malfunctions experienced with our presses could negatively impact our ability to fulfill customers’ orders and on-time delivery needs and adversely impact our operating results and cash flows.

Our ability to stay current with our information technology systems could have a material adverse impact on our business.

We are increasingly dependent on the information technology systems we have put into place and any significant breakdown, viruses or destruction could negatively impact our business. We upgrade and install new systems, which if installed or programmed incorrectly, could cause significant disruptions. If a disruption occurs, we could incur losses and costs for interruption of our operations.

If the quality of our products and services does not meet our customer expectations, we may experience decreased sales and earnings.

Occasionally, we ship products with quality issues resulting from defective material, manufacturing, packaging or design. Issues discovered after shipment may cause additional shipping costs, possible discounts or refunds, and potential loss of future sales. Issues discovered before shipping may cause delays in shipping, delays in the manufacturing process and potential cancelled orders. These quality issues could adversely affect our profitability as well as negatively impact our reputation.

Our business growth strategy is partially executed through acquisitions and we may not be successful with acquisitions.

Although we have completed many acquisitions, there can be no assurance that we will find quality businesses at acceptable prices to acquire in the future. With each acquisition that we may complete, we will encounter risks and uncertainties associated with the transaction. We may be unable to retain certain customers and employees and the integration of product lines, procedures, systems and goals may not be successful. Any expected cost synergies from an acquisition may be difficult to obtain. The failure in our ability to successfully integrate an acquisition may negatively impact our operating results and cash flows. Future acquisitions could cause us to incur additional debt, contingent liabilities and increased interest expense, as well as experience dilution in earnings per share.

Our leverage and restrictions contained in our debt agreements could have significant consequences.

As of March 31, 2010, our consolidated indebtedness, including current maturities of long-term indebtedness, was $86 million, which could have important consequences including the following:

| | • | | Increasing our vulnerability to general economic and industry conditions; |

| | • | | Requiring a substantial portion of cash flows from operating activities to be dedicated to the payment of principal and interest on our indebtedness and, as a result, reducing our ability to use our cash flows to fund our operations and capital expenditures, pay dividends, capitalize on future business opportunities and expand our business; |

| | • | | Exposing us to the risk of increased interest expense as certain of our borrowings are at variable rates of interest; |

| | • | | Limiting our ability to obtain additional financing for working capital, capital expenditures, additional acquisitions and other business purposes; and |

| | • | | Limiting our flexibility to adjust to changing market conditions and react to competitive pressures. |

We may be able to incur additional indebtedness in the future, subject to the restrictions contained in our debt agreements. If new indebtedness is added to our current debt levels, the related risks that we now face could intensify.

Our debt agreements contain covenants that limit our flexibility in operating our business.

The agreements governing our indebtedness contain various covenants that may adversely affect our ability to operate our business. Among other things, these covenants limit our ability to:

| | • | | Incur additional indebtedness; |

7

| | • | | Make certain investments or loans; |

| | • | | Transfer or sell certain assets; |

| | • | | Create or permit liens on assets; and |

| | • | | Consolidate, merge, sell or otherwise dispose of all or substantially all of our assets. |

The agreements governing our indebtedness also require us to maintain (i) a minimum consolidated net worth, (ii) a maximum consolidated leverage ratio of 3.25 to 1.00, stepping down to 3.00 to 1.00 at December 31, 2010 and for each fiscal quarter thereafter; and (iii) a minimum consolidated interest charge coverage ratio of 3.50 to 1.00. A breach of any of these covenants could result in a default under our debt agreements, which could prompt the lenders to declare all amounts outstanding under the debt agreements to be immediately due and payable and terminate commitments to extend further credit. If we were unable to repay these amounts, the lenders could proceed against the collateral that secures the indebtedness.

We need to comply with various environmental, health and safety laws.

We are subject to environmental, health and safety laws and regulations. We routinely incur costs in complying with these regulations and, if we fail to comply, could incur significant penalties. In addition, failure to comply with environmental requirements could require us to shut down or reduce production or create liability exposure. New environmental laws or regulations may be adopted that could constrain our operations or increase our environmental compliance costs.

We must be able to continue to effectively manage our growth.

We have experienced significant and steady growth over the last several years. Our growth, in particular the acquisition of Collotype in February 2008, places significant demands on our resources and personnel and we must continue to motivate and guide our growing and evolving workforce. The failure to effectively manage our growth could have a material adverse impact on our operating results and cash flows.

We have a significant amount of goodwill and other intangible assets on our balance sheet; an impairment of our goodwill or other intangible assets may adversely affect our operating results.

As of March 31, 2010, we had approximately $134 million of goodwill and intangible assets on our balance sheet, the value of which depends on a number of factors, including earnings growth, market capitalization and the overall success of our business. Accounting standards require us to test goodwill annually for impairment, and more frequently when events or circumstances indicate impairment may exist. There can be no assurance that future reviews of our goodwill and other intangible assets will not result in impairment charges. Although it does not affect cash flow, an impairment charge does have the effect of decreasing our earnings, assets and shareholders’ equity.

| ITEM 1B. | UNRESOLVED SECURITIES AND EXCHANGE COMMISSION STAFF COMMENTS |

None.

As of March 31, 2010, the Company owned 4 manufacturing facilities in the U.S. and leased 8 manufacturing facilities in the U.S., Australia and South Africa. The Company expanded its manufacturing operations in October 2007 with the purchase of a new manufacturing facility in Batavia, Ohio. Two of our plants in Ohio have been consolidated into this new facility. The pre-existing Batavia facility was sold in June 2008 and the Troy facility was sold in July 2009. Also, in July 2009, we closed our Framingham manufacturing facility and the business was transitioned into our Batavia, Ohio and Scottsburg, Indiana facilities. In November 2009, the Company moved its corporate headquarters from Sharonville, Ohio to its Batavia, Ohio facility. The previous corporate headquarters in Sharonville, Ohio is currently being subleased. In February, 2010, the Company entered into a supply agreement to fulfill gravure cylinder requirements. As a part of the agreement, the Company sold certain assets associated with the manufacturing of gravure cylinders. The Erlanger facility is currently held for sale.

All of the Company’s properties are in good condition, well maintained and adequate for our intended uses.

None.

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

Not Applicable.

8

PART II

| ITEM 5. | MARKET FOR THE REGISTRANT’S COMMON STOCK, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Our shares trade in the NASDAQ Global Select Market under the symbol LABL. The following table sets forth the high and low sales prices of our common stock (“Common Stock”) as reported in the NASDAQ Stock Market during fiscal years 2010 and 2009. Our stock is thinly traded and accordingly, the prices below may not be indicative of prices at which a large number of shares can be traded or reflective of prices that would prevail in a more active market.

| | | | | | | | | |

Quarter Ending: | | High | | Low | | Dividend Per Share |

March 31, 2010 | | $ | 13.60 | | $ | 11.03 | | $ | 0.05 |

December 31, 2009 | | $ | 14.73 | | $ | 10.92 | | $ | 0.05 |

September 30, 2009 | | $ | 17.55 | | $ | 12.08 | | $ | 0.05 |

June 30, 2009 | | $ | 14.44 | | $ | 10.76 | | $ | 0.05 |

| | | |

March 31, 2009 | | $ | 17.02 | | $ | 10.44 | | $ | 0.05 |

December 31, 2008 | | $ | 22.90 | | $ | 11.96 | | $ | 0.05 |

September 30, 2008 | | $ | 25.70 | | $ | 19.38 | | $ | 0.05 |

June 30, 2008 | | $ | 24.71 | | $ | 20.20 | | $ | 0.05 |

As of May 28, 2010, there were approximately 332 shareholders of record of the Common Stock.

Beginning in and since the fourth quarter of the fiscal year ended March 31, 2005, we have paid a quarterly dividend of $0.05 per common share.

9

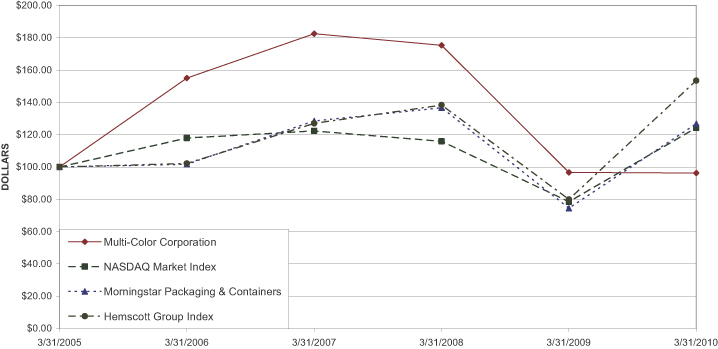

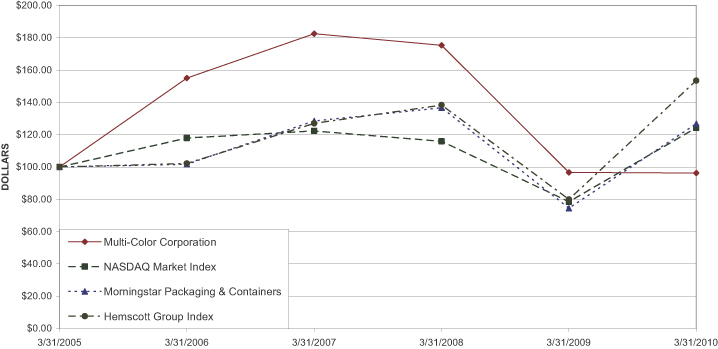

FIVE YEAR PERFORMANCE GRAPH

The following performance graph compares Multi-Color’s cumulative annual total shareholder return from April 1, 2005 through March 31, 2010, to that of the NASDAQ Market Index, a broad market index, the Hemscott Group Index—Packaging and Containers (“Hemscott index”), an index of approximately 34 printing and packaging industry peer companies, and the Morningstar Packaging & Containers Index (“Morningstar index”), an index of approximately 34 printing and packaging industry peer companies. Multi-Color has used the Hemscott Index as its comparative industry index in prior years. As a result of Morningstar’s acquisition of the Hemscott businesses, Multi-Color expects to use the Morningstar index, a comparable industry index, in future years. The graph assumes that the value of the investment in the common stock and each index was $100 on April 1, 2005, and that all dividends were reinvested. Stock price performances shown in the graph are not indicative of future price performances. This data was furnished by Morningstar, Inc.

COMPARISON OF 5-YEAR CUMULATIVE TOTAL RETURN AMONG

MULTI-COLOR CORPORATION, NASDAQ MARKET INDEX,

MORNINGSTAR PACKAGING & CONTAINERS AND HEMSCOTT GROUP INDEX

ASSUMES $100 INVESTED ON APR. 01, 2005

ASSUMES DIVIDEND REINVESTED

FISCAL YEAR ENDING MARCH 31, 2010

| | | | | | | | | | | | | | | | | | |

| | | 2005 | | 2006 | | 2007 | | 2008 | | 2009 | | 2010 |

Multi-Color Corporation | | $ | 100.00 | | $ | 154.98 | | $ | 182.43 | | $ | 175.30 | | $ | 96.66 | | $ | 96.21 |

Hemscott Group Index | | $ | 100.00 | | $ | 102.14 | | $ | 126.99 | | $ | 138.31 | | $ | 79.94 | | $ | 153.46 |

Morningstar Index | | $ | 100.00 | | $ | 101.66 | | $ | 128.46 | | $ | 136.68 | | $ | 74.47 | | $ | 126.73 |

NASDAQ Market Index | | $ | 100.00 | | $ | 117.89 | | $ | 122.27 | | $ | 115.88 | | $ | 78.46 | | $ | 124.22 |

10

| ITEM 6. | SELECTED FINANCIAL DATA |

(In thousands, except per share data)

| | | | | | | | | | | | | | | | |

| | | Year Ended March 31, |

| | | 2010 (1) | | 2009 (2)(5) | | | 2008 (3)(5) | | 2007 (4)(5) | | 2006 (5) |

Net revenues | | $ | 276,821 | | $ | 289,763 | | | $ | 210,307 | | $ | 192,551 | | $ | 176,945 |

Gross profit | | | 48,601 | | | 52,806 | | | | 38,926 | | | 37,149 | | | 32,996 |

Operating income | | | 22,911 | | | 22,865 | | | | 17,499 | | | 13,846 | | | 16,598 |

Income from continuing operations | | | 14,268 | | | 11,435 | | | | 16,007 | | | 8,612 | | | 9,041 |

Income (loss) from discontinued operations | | | — | | | (137 | ) | | | 6,977 | | | 2,414 | | | 592 |

Net income | | | 14,268 | | | 11,298 | | | | 22,984 | | | 11,026 | | | 9,633 |

Basic earnings per share: | | | | | | | | | | | | | | | | |

Income from continuing operations (6) | | $ | 1.17 | | $ | 0.94 | | | $ | 1.57 | | $ | 0.87 | | $ | 0.92 |

Income (loss) from discontinued operations (6) | | | — | | | (0.01 | ) | | | 0.68 | | | 0.24 | | | 0.06 |

| | | | | | | | | | | | | | | | |

Basic earnings per common share (6) | | $ | 1.17 | | $ | 0.93 | | | $ | 2.25 | | $ | 1.11 | | $ | 0.98 |

Diluted earnings per common share: | | | | | | | | | | | | | | | | |

Income from continuing operations (6) | | $ | 1.16 | | $ | 0.93 | | | $ | 1.52 | | $ | 0.84 | | $ | 0.89 |

Income (loss) from discontinued operations (6) | | | — | | | (0.01 | ) | | | 0.66 | | | 0.24 | | | 0.06 |

| | | | | | | | | | | | | | | | |

Diluted earnings per common share (6) | | $ | 1.16 | | $ | 0.92 | | | $ | 2.18 | | $ | 1.08 | | $ | 0.95 |

Weighted average shares outstanding – basic (6) | | | 12,209 | | | 12,156 | | | | 10,212 | | | 9,904 | | | 9,787 |

Weighted average shares outstanding – diluted (6) | | | 12,332 | | | 12,355 | | | | 10,520 | | | 10,221 | | | 10,105 |

Dividends declared per common share (6) | | $ | 0.20 | | $ | 0.20 | | | $ | 0.16 | | $ | 0.12 | | $ | 0.12 |

Dividends paid | | | 2,469 | | | 2,449 | | | | 1,688 | | | 1,323 | | | 1,305 |

Working capital | | | 19,934 | | | 13,531 | | | | 18,517 | | | 15,832 | | | 19,571 |

Total assets | | | 285,342 | | | 258,208 | | | | 314,080 | | | 107,081 | | | 113,634 |

Short-term debt | | | 10,001 | | | 10,002 | | | | 10,003 | | | 5,150 | | | 5,876 |

Long-term debt | | | 75,642 | | | 92,317 | | | | 121,748 | | | — | | | 21,925 |

Stockholders’ equity | | $ | 146,628 | | $ | 103,032 | | | $ | 119,938 | | $ | 64,423 | | $ | 53,004 |

| | | | | | | | | | | | | | | | |

| 1) | Fiscal 2010 results include a pre-tax gain of $3,451 ($2,141 after-tax) related to the sale of certain assets associated with the manufacture of gravure cylinders and a charge of $1,219 ($959 after-tax) for remaining lease obligations and other costs related to the relocation of the Company’s corporate headquarters from Sharonville, Ohio to its Batavia, Ohio facility. |

| 2) | Fiscal 2009 results include a pre-tax charge of $2,553 ($1,634 after-tax) for expenses related to the closure of the Framingham manufacturing facility. |

| 3) | Fiscal 2008 results include a pre-tax gain of $7,659 ($5,001 after-tax) on foreign currency forward contracts (included in income from continuing operations) and a pre-tax gain of $11,278 ($6,922 after-tax) from the sale of Quick Pak (included in income (loss) from discontinued operations). |

11

| 4) | Fiscal 2007 results include $3,048 in pre-tax charges for expenses related to two potential acquisitions that were terminated during the third quarter 2007. |

| 5) | Certain prior year amounts have been reclassified to conform to the current year presentation. |

| 6) | All share amounts have been adjusted to reflect the 3-for-2 stock split effective September 17, 2007. |

Refer to Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for a discussion of the impact of acquisitions completed during recent fiscal years that would impact the comparability of the selected financial data noted above. On February 29, 2008, we acquired Collotype which included seven label manufacturing plants in Australia, South Africa and the United States.

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

(In thousands, except per share data)

The following discussion and analysis should be read in conjunction with Multi-Color’s consolidated financial statements and notes thereto appearing elsewhere herein.

RESULTS OF OPERATIONS

The following table shows for the periods indicated, certain components of Multi-Color’s consolidated statements of income as a percentage of net revenues.

| | | | | | | | | |

| | | Percentage of Net Revenues | |

| | | 2010 | | | 2009 | | | 2008 | |

Net revenues | | 100.0 | % | | 100.0 | % | | 100.0 | % |

Cost of revenues | | 82.4 | % | | 81.8 | % | | 81.5 | % |

| | | | | | | | | |

Gross profit | | 17.6 | % | | 18.2 | % | | 18.5 | % |

Selling, general & administrative expenses | | 10.0 | % | | 9.5 | % | | 10.2 | % |

Gain on sale of certain cylinder assets | | (1.2 | )% | | — | | | — | |

Facility closure expense | | 0.5 | % | | 0.9 | % | | — | |

| | | | | | | | | |

Operating income | | 8.3 | % | | 7.8 | % | | 8.3 | % |

Interest expense | | 1.7 | % | | 2.4 | % | | 0.4 | % |

Net gain on foreign currency forward contracts | | — | | | — | | | (3.6 | )% |

Other (income) expense, net | | (0.1 | )% | | (0.1 | )% | | (0.3 | )% |

| | | | | | | | | |

Income from continuing operations before income tax | | 6.7 | % | | 5.5 | % | | 11.8 | % |

Income tax expense | | 1.5 | % | | 1.7 | % | | 4.2 | % |

| | | | | | | | | |

Income from continuing operations | | 5.2 | % | | 3.8 | % | | 7.6 | % |

Income from discontinued operations, net of tax | | — | | | — | | | 3.3 | % |

| | | | | | | | | |

Net income | | 5.2 | % | | 3.8 | % | | 10.9 | % |

| | | | | | | | | |

EXECUTIVE SUMMARY

We provide a complete line of innovative decorative label solutions and offer a variety of technical and graphic services to our customers based on their specific needs and requirements. Our customers include a wide range of consumer product companies and we supply labels for many of the world’s best known brands and products, including laundry detergent, fabric care, food, beverages, and wine and spirits.

During fiscal 2010, the Company had revenues of $276.8 million compared to $289.8 million in the prior year. The decrease in revenues was due to a 6% decline in sales volume and pricing partially offset by a 2% favorable foreign exchange impact. The sales decline attributable to volume and pricing was comprised of a $14.2 million or 5% decrease in sales volume and mix and $4 million or 1% of lower pricing. The 5% sales volume decline is primarily related to lower sales volumes to our top two customers.

Gross profit decreased 8% or $4.2 million in 2010 compared to 2009 due to a decrease in revenues as a result of a decrease in sales volume to our top two customers and lower pricing. Gross profit margins remained steady at approximately 18% of sales revenues compared to the prior year.

Operating income was steady at $22.9 million in 2010 compared to 2009 primarily due to the gain on sale of certain cylinder assets and lower facility closure costs offset by $1.8 million of non-cash fixed asset impairments and severance charges and the impact of lower sales volume and pricing.

The label markets we serve continue to experience a competitive environment and price pressures. We continually search for ways to reduce our costs through improved production and labor efficiencies, reduced substrate waste, new substrate options and lower substrate pricing.

We have continued to make progress in expanding our customer base and portfolio of products, services and manufacturing locations in order to address issues related to customer concentration. During 2010, 2009 and 2008, sales to major customers (those with 10% or more of the Company’s net revenues) approximated 28%, 32% and 51%, respectively of the Company’s consolidated net revenues. Approximately 18%, 19% and 33% of sales in 2010, 2009 and 2008, respectively, were to the Procter & Gamble Company; approximately

12

10%, 13% and 18% of sales in 2010, 2009 and 2008, respectively, were to the Miller Brewing Company. Sales concentration with our major customers has been significantly reduced since we have added new customers and products with our acquisition of Collotype which has manufacturing operations in Australia, South Africa and California. In addition, sales volumes to our two largest customers declined by 5% in 2010 contributing to the decline in customer concentration.

On February 12, 2010, the Company entered into a supply agreement to fulfill gravure cylinder requirements. As a part of the agreement, the Company sold certain assets associated with the manufacturing of gravure cylinders for $4.3 million in cash. The Company recorded an after-tax gain of $2.1 million on the sale in its fourth quarter fiscal 2010 financial results. The Erlanger facility is currently held for sale.

During fiscal 2010, the Company relocated its corporate headquarters from Sharonville, Ohio to its Batavia, Ohio facility in order to consolidate certain of its employees into existing owned office space. The lease for the Sharonville, Ohio location expires in April 2017. In connection with the relocation, the Company recorded a charge of $1.2 million for remaining lease obligations and other costs related to its Sharonville facility. The Sharonville, Ohio location is currently being subleased.

In January 2009, we announced plans to consolidate our heat transfer label (HTL) manufacturing business located in Framingham, Massachusetts into our other existing facilities. The transition began immediately, with final plant closure occurring in the second quarter of fiscal 2010. In connection with the closure of the Framingham facility, the Company recorded a total pre-tax charge of $2.6 during the fourth quarter period ending March 31, 2009, consisting of $1.4 million in cash charges for employee severance and other termination benefits related to 62 associates and $1.2 million in non-cash charges related to asset impairments. During the year ended March 31, 2010, the Company incurred employee retention charges of $261 recorded in selling, general and administrative expense. The remaining liability for employee severance and other termination benefits is expected to be paid by May 2010 and is recorded in accrued liabilities on the consolidated balance sheet.

On February 29, 2008, we acquired Collotype International Holdings Pty. Ltd. (Collotype) which is headquartered in Adelaide, South Australia. Collotype is the world’s leading and highly awarded pressure sensitive wine and spirit label manufacturer and a growing provider of labels in the fast-moving consumer goods marketplace in Australia. Collotype has manufacturing operations in Australia, South Africa and the United States (See Note 3 to the Company’s Consolidated Financial Statements).

Prior to June 2007, the Company was organized into two business segments: Decorating Solutions and Packaging Services. The Decorating Solutions segment’s primary operations involved the design and printing of labels, while the Packaging Services segment provided promotional packaging, assembling and fulfillment services. On July 2, 2007, we completed the sale of Quick Pak, whose operating results were reported as the Packaging Services segment (see Note 4 to the Company’s Consolidated Financial Statements). Accordingly, the results of Quick Pak have been presented as discontinued operations for all periods in the consolidated financial statements and the Company no longer reports any segment results.

Our vision is to be a premier global resource of decorating solutions. We currently serve customers located throughout North, Central and South America, Australia, South Africa and New Zealand. We continue to monitor and analyze new trends in the packaging and consumer products industries to ensure that we are providing appropriate services and products to our customers. Certain factors that influence our business include consumer spending, new product introductions, new packaging technologies and demographics.

Our key objectives for fiscal year 2011 include winning new customers, growing with existing customers, providing greater support to our blue chip customer base, improving our low cost manufacturing market position and continuing to develop our global operations foot print through selective acquisitions.

COMPARISON OF FISCAL YEARS ENDED MARCH 31, 2010 AND MARCH 31, 2009

| | | | | | | | | | | | | |

| | | 2010 | | 2009 | | $

Change | | | %

Change | |

Net Revenues | | $ | 276,821 | | $ | 289,763 | | $ | (12,942 | ) | | (4 | %) |

Net revenues decreased 4% to $276.8 million from $289.8 million. The decrease in revenues was due to a 6% decline in sales volume and pricing partially offset by a 2% favorable foreign exchange impact. The sales decline attributable to volume and pricing was comprised of a $14.2 million or 5% decrease in sales volume and mix and $4 million or 1% of lower pricing. The 5% sales volume decline is primarily related to lower sales volumes to our top two customers.

13

| | | | | | | | | | | | | | | |

| | | 2010 | | | 2009 | | | $

Change | | | %

Change | |

Cost of Revenues | | $ | 228,220 | | | $ | 236,957 | | | $ | (8,737 | ) | | (4 | )% |

% of Net Revenues | | | 82.4 | % | | | 81.8 | % | | | | | | | |

Gross Profit | | $ | 48,601 | | | $ | 52,806 | | | $ | (4,205 | ) | | (8 | )% |

% of Net Revenues | | | 17.6 | % | | | 18.2 | % | | | | | | | |

Cost of revenues decreased 4% or $8.7 million to $228.2 million due to lower North American sales volumes in fiscal year 2010. Gross profit decreased 8% or $4.2 million in 2010 compared to 2009 due to a decrease in revenues as a result of lower sales volume to our top two customers and lower pricing. Gross profit margins remained steady at approximately 18% of sales revenues compared to the prior year.

Selling, General & Administrative (SG&A), Gain on Sale of Certain Cylinder Assets and Facility Closure Expense

| | | | | | | | | | | | | | | |

| | | 2010 | | | 2009 | | | $

Change | | | %

Change | |

Selling, General & Administrative (SG&A) Expense | | $ | 27,662 | | | $ | 27,388 | | | $ | 274 | | | 1 | % |

% of Net Revenues | | | 10.0 | % | | | 9.5 | % | | | | | | | |

Gain on Sale of Certain Cylinder Assets | | $ | (3,451 | ) | | $ | — | | | $ | (3,451 | ) | | (100 | )% |

% of Net Revenues | | | (1.2 | %) | | | — | % | | | | | | | |

Facility Closure Expense | | $ | 1,479 | | | $ | 2,553 | | | $ | (1,074 | ) | | (42 | )% |

% of Net Revenues | | | 0.5 | % | | | 0.9 | % | | | | | | | |

SG&A expenses increased $274 compared to the prior year due to $1.1 million in severance charges and $940 in non-cash fixed asset impairments partially offset by the impact of cost reduction actions implemented in the prior year.

On February 12, 2010, the Company entered into a supply agreement to fulfill gravure cylinder requirements. As a part of the agreement, the Company sold certain assets associated with the manufacturing of gravure cylinders for $4.3 million in cash. The Company recorded a pre-tax gain of $3.5 million in the fiscal fourth quarter.

In connection with the closure of the Framingham facility, the Company incurred employee retention charges of $261 in fiscal year 2010 and in fiscal year 2009, a charge of $2.6 million consisting of $1.4 million in cash charges for employee severance and other termination benefits and plant shut down costs and $1.2 million in non-cash asset impairments.

In connection with the relocation of the Company’s corporate headquarters from Sharonville, OH to Batavia, OH, the Company recorded a charge of $1.2 million in facility closure expense in fiscal year 2010.

Interest and Other (Income) Expense

| | | | | | | | | | | | | | | |

| | | 2010 | | | 2009 | | | $

Change | | | %

Change | |

Interest Expense | | $ | 4,753 | | | $ | 6,841 | | | $ | (2,088 | ) | | (31 | )% |

Other (Income) Expense, net | | $ | (326 | ) | | $ | (378 | ) | | $ | 52 | | | 14 | % |

Interest expense decreased $2.1 million due to a $17 million or 16% net repayment of bank debt and lower interest rates. The decrease in other income was due primarily to lower scrap sales in fiscal year 2010.

| | | | | | | | | | | | | |

| | | 2010 | | 2009 | | $

Change | | | %

Change | |

Income Tax Expense | | $ | 4,216 | | $ | 4,967 | | $ | (751 | ) | | (15 | %) |

The Company’s effective tax rate was 23% in 2010 compared to 30% in 2009 due to income in lower tax jurisdictions and a recognized tax benefit related to a foreign exchange loss on intercompany loans and other items resulting in a $1 million benefit to income tax expense in the fourth quarter of fiscal 2010. The Company expects its annual effective tax rate to be approximately 30% in fiscal year 2011.

| | | | | | | | | | | | | |

| | | 2010 | | 2009 | | | $

Change | | %

Change | |

Income (Loss) from Discontinued Operations, Net of Tax | | $ | — | | $ | (137 | ) | | $ | 137 | | 100 | % |

The sale of Quick Pak was completed during fiscal year 2008 and additional income tax expense related to the sale was recorded in fiscal year 2009. There was no discontinued operations activity during fiscal year 2010.

14

COMPARISON OF FISCAL YEARS ENDED MARCH 31, 2009 AND MARCH 31, 2008

| | | | | | | | | | | | |

| | | 2009 | | 2008 | | $

Change | | %

Change | |

Net Revenues | | $ | 289,763 | | $ | 210,307 | | $ | 79,456 | | 38 | % |

The increase in revenues was due to the Collotype acquisition completed in February 2008, which generated $106.4 million in revenues in 2009 compared to $9.3 million in revenues for the year ended March 31, 2008. This increase was partially offset by a 9% reduction in North American revenues due to lower volumes as a result of the recessionary impact on consumer spending. 60% of the North American sales volume decline is attributable to our largest customer and the remaining 40% to our smaller regional customers.

| | | | | | | | | | | | | | |

| | | 2009 | | | 2008 | | | $

Change | | %

Change | |

Cost of Revenues | | $ | 236,957 | | | $ | 171,381 | | | $ | 65,576 | | 38 | % |

% of Net Revenues | | | 81.8 | % | | | 81.5 | % | | | | | | |

Gross Profit | | $ | 52,806 | | | $ | 38,926 | | | $ | 13,880 | | 36 | % |

% of Net Revenues | | | 18.2 | % | | | 18.5 | % | | | | | | |

Cost of Revenues increased 38% or $65.6 million and gross profit increased 36% or $13.9 million in 2009 compared to 2008 due to the Collotype acquisition, partially offset by the impact of the decrease in North American revenues and plant start-up costs incurred during the first half of the year for the new Batavia, Ohio manufacturing facility.

Selling, General & Administrative (SG&A) and Facility Closure Expense

| | | | | | | | | | | | | | |

| | | 2009 | | | 2008 | | | $

Change | | %

Change | |

Selling, General & Administrative Expense | | $ | 27,388 | | | $ | 21,427 | | | $ | 5,961 | | 28 | % |

% of Net Revenues | | | 9.5 | % | | | 10.2 | % | | | | | | |

Facility Closure Expense | | $ | 2,553 | �� | | $ | — | | | $ | 2,553 | | 100 | % |

% of Net Revenues | | | 0.9 | % | | | N/A | | | | | | | |

SG&A expenses increased $6.0 million due to comparable expenses from the Collotype acquisition. As a percent of sales, SG&A expenses were lower due to cost reduction actions and lower incentive pay as a result of not meeting our financial targets.

In connection with the closure of the Framingham facility, the Company recorded a charge in plant closure costs of $2.6 million consisting of $1.4 million in cash charges for employee severance and other termination benefits related to 62 associates and $1.2 million in non-cash charges related to asset impairments.

Interest, Net Gain on Foreign Currency Forward Contracts and Other (Income) Expense

| | | | | | | | | | | | | | |

| | | 2009 | | | 2008 | | | $

Change | | %

Change | |

Interest Expense | | $ | 6,841 | | | $ | 962 | | | $ | 5,879 | | NM | |

Net Gain on Foreign Currency Forward Contracts | | $ | — | | | $ | (7,659 | ) | | $ | 7,659 | | (100 | )% |

Other (Income) Expense, net | | $ | (378 | ) | | $ | (631 | ) | | $ | 253 | | (40 | )% |

Interest expense increased $5.9 million due to the debt incurred to finance the Collotype acquisition. During fiscal year 2009, the Company repaid $25 million or 19% of long-term debt due to strong cash flow and lower capital expenditures.

During 2008, the Company recorded $7.7 million of net gains on foreign currency forward contracts. The contracts were entered into in connection with the Collotype acquisition in order to purchase Australian dollars and were settled upon the completion of the acquisition in February 2008.

The decrease in other income was due primarily to lower investment income as a result of lower cash balances on hand during 2009.

| | | | | | | | | | | | | |

| | | 2009 | | 2008 | | $

Change | | | %

Change | |

Income Tax Expense | | $ | 4,967 | | $ | 8,820 | | $ | (3,853 | ) | | (44 | )% |

The Company’s effective tax rate was 30% in 2009 compared to 36% in 2008 due to income in lower tax jurisdictions and the finalization of the acquisition tax structure related to the Company’s international operations.

15

| | | | | | | | | | | | | |

| | | 2009 | | | 2008 | | $

Change | | | %

Change |

Income (Loss) from Discontinued Operations, Net of Tax | | $ | (137 | ) | | $ | 6,977 | | $ | (7,114 | ) | | NM |

The sale of Quick Pak was completed in July 2007 and therefore, there were 3 months of operations included in 2008 as compared to no operations in fiscal 2009. In addition, the sale of Quick Pak resulted in an after-tax gain of approximately $6.9 million recorded during the second quarter of fiscal 2008. During fiscal year 2009, additional income tax expense was recorded related to the sale of Quick Pak.

Critical Accounting Policies and Estimates

The preparation of consolidated financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenue and expenses. We continually evaluate our estimates, including, but not limited to, those related to revenue recognition, bad debts, inventories and any related reserves, income taxes, fixed assets, goodwill and intangible assets. We base our estimates on historical experience and on various other assumptions believed to be reasonable under the facts and circumstances. Actual results may differ from these estimates under different assumptions or conditions.

We believe the following critical accounting policies impact the more significant judgments and estimates used in the preparation of our consolidated financial statements. Additionally, our senior management has reviewed the critical accounting policies and estimates with the Board of Directors’ Audit and Finance Committee. For a more detailed discussion of the application of these and other accounting policies, refer to Note 2 of the Consolidated Financial Statements.

Revenue Recognition

The Company recognizes revenue on sales of products when the customer receives title to the goods, which is generally upon shipment or delivery depending on sales terms. Revenues are generally denominated in the currency of the country from which the product is shipped and are net of applicable returns and discounts.

Inventories

Inventories are valued at the lower of cost or market value and are maintained using the FIFO (first-in, first-out) or specific identification method. Excess and obsolete cost reductions are generally established based on inventory age.

Accounts Receivable

Our customers are primarily major consumer product and wine and spirit companies and container manufacturers. Accounts receivable consist of amounts due from customers in connection with our normal business activities and are carried at sales value less allowance for doubtful accounts. The allowance for doubtful accounts is established to reflect the expected losses of accounts receivable based on past collection history, age and specific individual risks identified. Losses may also depend to some degree on current and future economic conditions. Although future conditions are unknown to us and may result in additional credit losses, we do not anticipate significant adverse credit circumstances in fiscal 2011. If we are unable to collect all or part of the outstanding receivable balance, there could be a material impact on the Company’s operating results and cash flows.

Goodwill and Other Acquired Intangible Assets

We test goodwill and other intangible assets for impairment annually and/or whenever events or circumstances make it more likely than not that impairment may have occurred. The impairment test is completed based upon our assessment of the estimated fair value of goodwill and other intangible assets. The annual review for impairment of goodwill requires the use of estimates and assumptions which we believe are appropriate. Application of different estimates and assumptions could have a material impact on the consolidated statements of income.

The Company’s $117 million of goodwill at March 31, 2010 relates primarily to the acquisition of Collotype in 2008. The Company completed its annual goodwill impairment test in the fourth quarter of fiscal 2010. The first step of the impairment review compares the fair value of the Company to the carrying value. The fair value was calculated as of February 28, 2010 by calculating the Multi-Color market capitalization and adding a 15% control premium and comparing it to the Company’s shareholders’ equity balance. The result of the first step did not indicate potential impairment as the estimated fair value of its reporting unit exceeded the carrying value by $37 million. As a result, the second step of the impairment test was not required. Reasonably possible fluctuations in the stock price and market capitalization did not indicate impairment.

Impairment of Long-Lived Assets

We review long-lived assets for impairment whenever events or changes in circumstances indicate that assets might be impaired and the related carrying amounts may not be recoverable. The determination of whether impairment exists involves various estimates and assumptions, including the determination of the undiscounted cash flows estimated to be generated by the assets involved in the review. The cash flow estimates are based upon our historical experience, adjusted to reflect estimated future market and operating conditions. Measurement of an impairment loss requires a determination of fair value. We base our estimates of fair values on quoted market prices when available, independent appraisals as appropriate and industry trends or other market knowledge. Changes in the market condition and/or losses of a major production line could have a material impact on the consolidated statements of income.

16

Income Taxes

Income taxes are recorded based on the current year amounts payable or refundable, as well as the consequences of events that give rise to deferred tax assets and liabilities. Deferred tax assets and liabilities result from temporary differences between the tax basis and reported book basis of assets and liabilities and result in taxable or deductible amounts in future years. Our accounting for deferred taxes involves certain estimates and assumptions that we believe are appropriate. Future changes in regulatory tax laws and/or different positions held by taxing authorities may affect the amounts recorded for income taxes.

The benefits of tax positions are not recorded unless it is more likely than not the tax position would be sustained upon challenge by the appropriate tax authorities. Tax benefits that are more likely than not to be sustained are measured at the largest amount of benefit that is cumulatively greater than a 50% likelihood of being realized.

Liquidity and Capital Resources

Net cash flows from operating activities in 2010 were $27.6 million, a decrease of $351 compared to the $27.9 million provided by operating activities in 2009. The decrease was due to an increase in accounts receivable and inventories, partially offset by lower interest and income tax payments. Net cash flows from operating activities in 2009 were $27.9 million, an increase of $16.1 million compared to the $11.8 million provided by operating activities in 2008. The increase was due to cash generated from earnings, a decrease in accounts receivable and inventories and lower income tax payments.

Net cash flows used in investing activities were $1.0 million in 2010, $2.2 million in 2009 and $112.4 million in 2008. The investing activities in 2010 include capital expenditures of $6.3 million, partially offset by proceeds from the sale of property plant and equipment of $5.1 million. The investing activities in 2009 include capital expenditures of $10 million, partially offset by refunds from equipment deposits and proceeds from the sale of property plant and equipment. The investing activities in 2008 included the acquisition of Collotype and capital expenditures and equipment deposits relating to the Batavia, Ohio manufacturing facility expansions partially offset by proceeds from the sale of Quick Pak and proceeds on the settlement of foreign currency forward contracts.

Capital expenditures of $6.3 million in 2010 and $10 million in 2009 were funded primarily from cash flow from operations. Capital expenditures in 2009 and 2008 related primarily to the Batavia, Ohio manufacturing facility expansion. The projected amount of capital expenditures for 2011 is $13.9 million.

Cash used in financing activities in 2010 was $22.0 million compared to cash used in financing activities of $26.2 million in 2009. During 2010, net debt payments were $16.7 million compared to net debt payments of $25.0 million in 2009.

On February 29, 2008 and in connection with the Collotype acquisition (see Note 3 to the Company’s Consolidated Financial Statements), the Company executed a new five-year $200 million credit agreement with a consortium of bank lenders (Credit Facility) that expires in 2013. The new Credit Facility contains an election to increase the facility by up to an additional $50 million and the Company terminated its previous $50 million credit facility. At March 31, 2010, the aggregate principal amount of $180 million is available under the Credit Facility through: (i) a $110 million five-year revolving credit facility (“U.S. Revolving Credit Facility”); (ii) the Australian dollar equivalent of a $40 million five-year revolving credit facility (“Australian Sub-Facility”); and (iii) a $30 million term loan facility (“Term Loan Facility”), which amortizes $10 million per year.

The Credit Facility may be used for working capital, capital expenditures and other corporate purposes. Loans under the U.S. Revolving Credit Facility and Term Loan Facility bear interest either at: (i) the greater of (a) Bank of America’s prime rate in effect from time to time; and (b) the federal funds rate in effect from time to time plus 0.5%; or (ii) the applicable London interbank offered rate plus the applicable margin for such loans which ranges from 0.75% to 2.00% based on the Company’s leverage ratio at the time of the borrowing. Loans under the Australian Sub-Facility bear interest at the Bank Bill Swap Bid Rate (BBSY) plus the applicable margin for such loans which ranges from 0.75% to 2.00% based on Multi-Color’s leverage ratio at the time of the borrowing.

Available borrowings under the Credit Facility at March 31, 2010 consisted of $65 million under the U.S. Revolving Credit Facility and $29.4 million under the Australian Sub-Facility.

The Credit Facility contains customary representations and warranties as well as customary negative and affirmative covenants. The Credit Facility requires Multi-Color to maintain the following financial covenants: (i) a minimum consolidated net worth; (ii) a maximum consolidated leverage ratio of 3.25 to 1.00, stepping down to 3.00 to 1.00 at December 31, 2010 and for each fiscal quarter thereafter; and (iii) a minimum consolidated interest charge coverage ratio of 3.50 to 1.00. The Credit Facility contains customary mandatory and optional prepayment provisions, customary events of default, and is secured by capital stock of subsidiaries, intercompany debt and the Company’s property and assets, but excluding real property.

In April 2008, the Company entered into two interest rate swap agreements to manage its exposure to interest rate fluctuations on variable debt (See Note 10). The interest rate swaps cover a portion of the debt under the Term Loan Facility and U.S. Revolving Credit Facility. At March 31, 2010, the interest rate swaps resulted in interest payments based on a fixed rate ranging from 4.42% to 4.83% and the balance of the amortizing swap was $24 million.

We believe that we have both sufficient short and long-term liquidity and financing. We had a working capital position of $19.9 million at March 31, 2010 and we were in compliance with our loan covenants and current in our principal and interest payments on all debt.

17

The following table summarizes the Company’s contractual obligations as of March 31, 2010:

| | | | | | | | | | | | | | | | | | | | | |

(in thousands) | | Total | | Year 1 | | Year 2 | | Year 3 | | Year 4 | | Year 5 | | More than

5 years |

Long-term debt | | $ | 85,643 | | $ | 10,001 | | $ | 10,000 | | $ | 65,642 | | $ | — | | $ | — | | $ | — |

Interest on long-term debt (1) | | | 9,751 | | | 3,912 | | | 3,318 | | | 2,521 | | | — | | | — | | | — |

Rent due under operating leases | | | 23,457 | | | 4,069 | | | 3,686 | | | 3,555 | | | 3,477 | | | 3,405 | | | 5,265 |

Unconditional purchase obligations | | | 5,494 | | | 4,809 | | | 685 | | | — | | | — | | | — | | | — |

Pension and post retirement obligations | | | 1,020 | | | 35 | | | 59 | | | 49 | | | 37 | | | 62 | | | 778 |

Deferred compensation (2) | | | 867 | | | 533 | | | — | | | — | | | — | | | — | | | 334 |

Unrecognized tax benefits (3) | | | — | | | — | | | — | | | — | | | — | | | — | | | — |

| | | | | | | | | | | | | | | | | | | | | |

Total contractual cash obligations | | $ | 126,232 | | $ | 23,359 | | $ | 17,748 | | $ | 71,767 | | $ | 3,514 | | $ | 3,467 | | $ | 6,377 |

| | | | | | | | | | | | | | | | | | | | | |

| 1) | Interest on floating rate debt was estimated using projected forward LIBOR and BBSY rates as of March 31, 2010. |

| 2) | The more than 5 years column includes $334 of deferred compensation obligations as the timing of such payments are not determinable (See Note 11). |

| 3) | The table excludes $3,531 in liabilities related to unrecognized tax benefits as the timing and extent of such payments are not determinable. |

Inflation

We do not believe that our operations have been materially affected by inflation. Inflationary price increases for raw materials could adversely impact our sales and profitability in the future.

New Accounting Pronouncements

In February 2010, the Financial Accounting Standards Board (FASB) issued revised accounting guidance for the disclosure of the date through which subsequent events have been evaluated. This guidance is effective on the issuance date, which for the Company is March 31, 2010. This guidance did not have a material impact on the Company.

In January 2010, the FASB issued revised accounting guidance for improving disclosures about fair value measurements. Among other provisions, this update enhances the usefulness of existing fair value measurement disclosures by requiring both the disaggregation of certain information as well as the inclusion of more robust disclosures about valuation techniques and inputs to recurring and nonrecurring fair value measurements. This guidance is effective for interim and annual reporting periods beginning after December 15, 2009, which for the Company is April 1, 2010. This guidance did not have a material impact on the Company.

In December 2009, the FASB issued accounting guidance requiring companies to provide expanded disclosures for the assets of postretirement benefit plans, including defined benefit pension plans. Companies are required to disclose how investment decisions are made, including factors necessary to understand investment policies and strategies, the major categories of plan assets and the inputs, techniques used to measure the fair value of plan assets and significant concentrations of risk within plan assets. This guidance is effective for annual periods ending after December 15, 2009, which for the Company is March 31, 2010. This guidance did not have a material impact on the Company.