Exhibit 99.1

MULTI-COLOR AND PRO FORMA COMBINEDNON-GAAP FINANCIAL MEASURES

This offering memorandum contains financial information with respect to Multi-Color, on a consolidated basis, Constantia Labels, on a combined basis and Multi-Color and Constantia Labels together on a combined basis. Certain of this information is not presented in accordance with US GAAP, such as Multi-Color EBITDA, Multi-Color Adjusted EBITDA, Multi-Color Adjusted EBITDA margin, Pro Forma Combined EBITDA, Pro Forma Combined Adjusted EBITDA-pre-synergies, Pro Forma Combined Adjusted EBITDA-post-synergies, Ratio of Net Secured Debt/Pro Forma Combined Adjusted EBITDA-post-synergies, Ratio of Total Net Debt/Pro Forma Combined Adjusted EBITDA-post synergies (collectively,“Non-GAAP Measures”), none of which is a measurement of financial performance under US GAAP.

We present theNon-GAAP Measures because they, along with our US GAAP results, are measures management uses to assess financial performance. We also believe that such measures provide investors with alternative methods for assessing our operating results in a manner that enables them to more thoroughly evaluate our performance. While providing useful information, theNon-GAAP Measures should not be considered in isolation or as a substitute for consolidated statements of operations or cash flows prepared in accordance with US GAAP and should not be construed as an indication of our operating performance or as a measure of liquidity. TheNon-GAAP Measures may have material limitations as performance measures and analytical tools because they exclude items that are necessary elements of our costs and operations. In addition, certain of theNon-GAAP Measures, including “Adjusted EBITDA” and “EBITDA”, may not be comparable to other similarly titled measures of other companies because each company may define these measures differently, limiting their usefulness as comparative measures.

For a description of how we define EBITDA and Adjusted EBITDA, how these measures are calculated from net income and a reconciliation of Multi-Color EBITDA and Multi-Color Adjusted EBITDA, see Note 2 under “Summary Historical Consolidated Financial Information and Other Data for Multi-Color Corporation” and, with respect to the combined business, for how Pro Forma Combined EBITDA and Pro Forma Combined Adjusted EBITDA are reconciled to pro forma net income, see Note 3 under “Summary Unaudited Pro Forma Combined Financial Data.”

The SEC has adopted rules to regulate the use in filings with the SEC and public disclosures and press releases ofnon-GAAP financial measures, such as EBITDA and Adjusted EBITDA, that are derived on the basis of methodologies other than in accordance with US GAAP.

These rules require, among other things:

| | • | | a presentation with equal or greater prominence of the most comparable financial measure or measures calculated and presented in accordance with US GAAP; and |

| | • | | a statement disclosing the purposes for which our management uses thenon-GAAP financial measure. |

The rules prohibit, among other things:

| | • | | exclusion of charges or liabilities that require cash settlement or would have required cash settlement absent an ability to settle in another manner, fromnon-GAAP liquidity measures; |

| | • | | adjustment of anon-GAAP performance measure to eliminate or smooth items identified as nonrecurring, infrequent or unusual, when the nature of the charge or gain is such that it is reasonably likely to recur; and |

| | • | | presentation ofnon-GAAP financial measures on the face of any financial information. |

NON-IFRS FINANCIAL MEASURES

This offering memorandum contains financial information with respect to Constantia Labels that is not presented in accordance with IFRS, such as Constantia Labels EBITDA and Constantia Labels Adjusted EBITDA (collectively,“Non-IFRS Measures”), none of which is a measurement of financial performance under IFRS.

Constantia Labels presents theNon-IFRS Measures because they, along with its IFRS results, are measures that Constantia Labels’ management uses to assess financial performance. Constantia Labels’ management believes that theNon-IFRS Measures provide investors with alternative methods for assessing Constantia Labels’ operating results in a manner that enables them to more thoroughly evaluate Constantia Labels’ performance. TheNon-IFRS Measures are provided to give investors access to the types of measures that Constantia Labels’ management uses in analyzing its results. While providing useful information, theNon-IFRS Measures should not be considered in isolation or as a substitute for consolidated statements of operations or cash flows prepared in accordance with IFRS and should not be construed as an indication of Constantia Labels’ operating performance or as a measure of liquidity. TheNon-IFRS Measures may have material limitations as performance measures and analytical tools because they exclude items that are necessary elements of Constantia Labels’ costs and operations. In addition, certain measures, including “Adjusted EBITDA” and “EBITDA” may not be comparable to other similarly titled measures of other companies because each company may define measures differently, limiting their usefulness as comparative measures.

For a description of how Constantia Labels defines Constantia Labels EBITDA and Constantia Labels Adjusted EBITDA and how these measures are calculated from Constantia Labels’ net income and a reconciliation of Constantia Labels EBITDA and Constantia Labels Adjusted EBITDA, see Note 2 under “Summary Historical Consolidated Financial Information and Other Data for Constantia Labels.”

The SEC has adopted rules to regulate the use in filings with the SEC and public disclosures and press releases ofnon-IFRS financial measures, such as EBITDA and Adjusted EBITDA, that are derived on the basis of methodologies other than in accordance with IFRS.

These rules require, among other things:

| | • | | a presentation with equal or greater prominence of the most comparable financial measure or measures calculated and presented in accordance with IFRS; and |

| | • | | a statement disclosing the purposes for which management uses thenon-IFRS financial measure. |

The rules prohibit, among other things:

| | • | | exclusion of charges or liabilities that require cash settlement or would have required cash settlement absent an ability to settle in another manner, fromnon-IFRS liquidity measures; |

| | • | | adjustment of anon-IFRS performance measure to eliminate or smooth items identified as nonrecurring, infrequent or unusual, when the nature of the charge or gain is such that it is reasonably likely to recur; and |

| | • | | presentation ofnon-IFRS financial measures on the face of any financial information. |

TheNon-IFRS Measures presented in this offering memorandum may not comply with these rules.

The Combination of Multi-Color and Constantia Labels

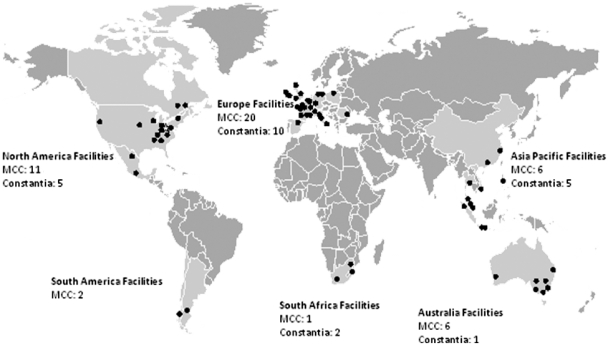

Multi-Color Corporation is a leading global provider of label solutions supporting a number of the world’s most prominent brands, including leading producers of wine & spirit, home & personal care, food & beverage, healthcare and specialty consumer products. We manufacture our products in 46 facilities located in 20 countries across North America, South America, Europe, Australia, South Africa and Asia. We have approximately 5,500 employees and serve over 4,000 customers globally. We believe we have established ourselves as a leader in most of our major product lines, with the ability to service customers on a global basis. For the twelve months ended June 30, 2017, Multi-Color generated net revenues and Adjusted EBITDA of approximately $929.2 million and $163.0 million, respectively. The Company’s shares are publicly traded on the NASDAQ Global Select Market (LABL) with a current equity market capitalization of approximately $1.4 billion.

On July 16, 2017, Multi-Color entered into a Sale and Purchase Agreement (as amended, the “Purchase Agreement”) with Constantia Flexibles Germany GmbH and certain of its affiliates pursuant to which Multi-Color agreed to purchase the Labels Division of Constantia Flexibles (“Constantia Labels”) in exchange for cash and shares of Multi-Color having a combined value of approximately $1.3 billion (the “Constantia Labels Acquisition”). Constantia Labels is a global leader in innovative label solutions serving the food, beverage and consumer packaged goods end markets, with leading positions in beer and in-mold labels. For the twelve months ended June 30, 2017, Constantia Labels generated net revenues and Adjusted EBITDA of approximately €617.4 million and €109.4 million, respectively.

For the twelve months ended June 30, 2017, on a pro forma basis after giving effect to the Constantia Labels Acquisition, the Combined Company generated net revenues of approximately $1,602.3 million and Adjusted EBITDA of $300.0 million, inclusive of $15 million of identified run-rate cost synergies.

Combination Rationale

We believe the Constantia Labels Acquisition will create a company with significant scale and geographic, end-market, customer, and product diversification. The combined operations provide a competitive advantage within the label industry, creating a “best in class” global label platform being #1 in food & beverage , #1 in wine & spirit, #2 in home & personal care and an emerging global role in healthcare. We believe that the combined operations will provide increased opportunities in these markets as we leverage Multi-Color’s strong home & personal care customer relationships in North America with Constantia Labels’ European operational

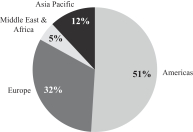

footprint and assets. In addition, we believe we can leverage Constantia’s strong food & beverage customer relationships with Multi-Color’s North American operational footprint and assets in order to accelerate growth opportunities for the Combined Company. The stronger combined footprint in Asia will provide additional opportunities to achieve further revenue synergies. Combining the two companies will allow an increased and more geographically diverse customer base over which our products are currently sold, increasing our end-market share. After giving effect to the Constantia Labels Acquisition, we will have more than 8,000 employees across 69 facilities in 23 countries. Our end-markets will be significantly diversified with no end-market segment representing more than 26% of our pro forma combined net revenues. In addition, the end-markets which the Combined Company will serve, including home & personal care, wine & spirit, food & beverage, and healthcare, encompass a breadth of sectors that have historically been resistant to recessions. The existing customer base of Multi-Color and Constantia Labels are highly complementary and have minimal overlap, and as such we believe the Constantia Labels Acquisition will allow for cross selling opportunities to existing customers.

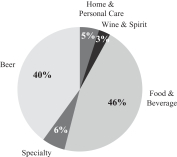

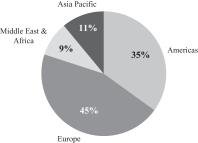

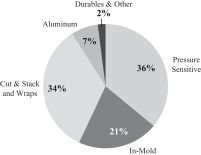

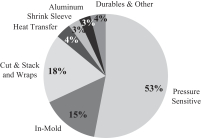

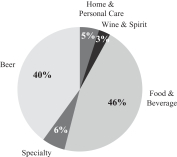

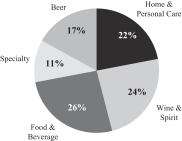

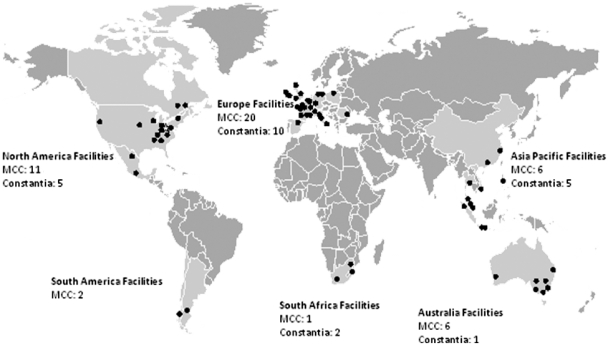

Increased End Market Diversification

The Constantia Labels Acquisition will significantly increase our end market diversification by bringing together the #1 player in food & beverage, the #1 player in wine & spirits and the #2 player in home and personal care. The transaction will significantly increase our exposure to the stable food & beverage end market which we believe represents approximately 65% of the world label volume including alcoholic beverage.

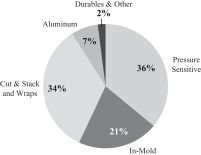

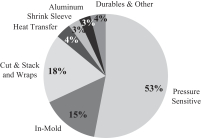

Net Revenue by End Market for Twelve Months Ended June 30, 2017

| | | | |

Multi-Color Corporation | | Constantia Labels | | Combined Company |

| |

| |

|

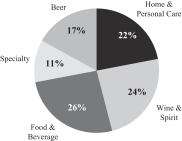

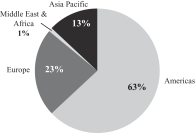

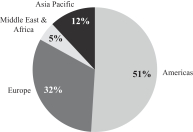

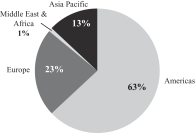

Geographic Platform Expansion Enhances Ability to Service Customers

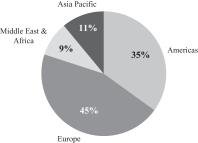

We believe that our expanded global platform will increase our geographic diversity, providing benefits to our customers. The Constantia Labels Acquisition broadens the Company’s scale and geographic reach to 69 manufacturing facilities in 23 countries across North America, Europe, South Africa and the Asia Pacific region. This allows us to broaden our support to our current global customers and provides us with an opportunity to serve new customers in new geographic markets. For the twelve months ended June 30, 2017, approximately 63% of Multi-Color’s net revenues were derived from the Americas. After the Constantia Labels Acquisition, net revenues derived from the Americas will be reduced to 51% of the Company’s pro forma net revenues. The Combined Company will also have an increased presence in the anticipated high growth Middle East and Africa regions.

Net Revenue by Geography for Twelve Months Ended June 30, 2017

| | | | |

Multi-Color Corporation | | Constantia Labels | | Combined Company |

| |  | |  |

Combined Global Footprint

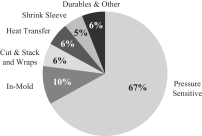

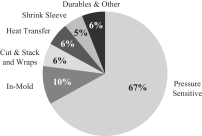

Increased Scale and Diversification within Product Offerings

We believe the Combined Company will be the market leader in in-mold labels after combining Multi-Color’s #1 position in blow molded labels in North America with Constantia Label’s #1 position in injection molded labels in Europe. Aluminum will be a new product offering for Multi-Color as a result of the Constantia Labels Acquisition. Our expanded product portfolio will allow us to better serve a breadth of end markets, enhancing our value proposition with existing customers and creating opportunities with new customers.

Net Revenue by Product Offering for Twelve Months Ended June 30, 2017

| | | | |

Multi-Color Corporation | | Constantia Labels | | Combined Company |

| |

| |

|

Technological Enhancements

The Constantia Labels Acquisition will provide Multi-Color with access to high value technologies, including access to Constantia Label’s proprietary Spear seal process, its proprietary engineering for pressure sensitive label products, and its proprietary engineering for in-mold label products. We believe that the expanded use of high value technologies in combination with our scale will drive innovation and lead to improved product offerings and margins over time.

Enhanced Leadership Team

We expect that Constantia Labels Acquisition will provide us with added depth in our leadership team. It is expected that Mike Henry, Executive Vice President of Constantia Labels, will become Multi-Color’s Chief Executive Officer in January 2018. With more than 18 years of experience in the label industry, Mr. Henry brings a wealth of knowledge and experience to Multi-Color. We believe the combination of two strong and complementary management teams will allow us to combine and continue the growth of the Company.

Synergy Potential

We believe the Constantia Labels Acquisition will result in approximately $15 million of net run-rate cost synergies on an annual basis, which we expect will be realized through cost consolidations and selling, general and administrative expense rationalizations.

| | • | | We believe we will be able to save an estimated $16 million or 2% of acquired revenues from a combination of purchasing synergies, including having access to Constantia Labels’ pressure sensitive label coating capability in North America and Europe which provide lower cost pressure sensitive label substrates that will drive synergy savings for Multi-Color, operating synergies and plant consolidations. |

| | • | | We believe we will be able to leverage SG&A and create an additional $2 million in value from eliminating duplicate functions. |

| | • | | Additionally, we expect to incur an estimated $3 million of additional costs annually related to increased accounting fees, anticipated corporate overhead expenses, and additional compliance and internal audit expenses. |

It is expected that synergies will be phased in evenly over time and will be realized on an annual basis by the end of fiscal year 2020.

Summary Unaudited Pro Forma Combined Financial Data

The following summary unaudited pro forma combined financial information gives effect to the Transactions. The unaudited pro forma combined statements of operations for the period ended June 30, 2017 reflect the Transactions as if they had occurred on April 1, 2016. The unaudited pro forma combined balance sheet as of June 30, 2017 reflects the Transactions as if they had occurred on June 30, 2017. The pro forma adjustments are based on the information available at the time of the preparation of this offering memorandum.

The summary unaudited pro forma combined financial information that follows is presented for informational purposes only and is not intended to represent or be indicative of the consolidated results of operations or financial position that would have been reported had the Transactions been completed as of April 1, 2016 (with respect to the statement of operations data), or as of June 30, 2017 (with respect to balance sheet data), and should not be taken as representative of the future consolidated results of operations or financial position of the Combined Company. In connection with the summary unaudited pro forma combined financial information, we allocated the preliminary purchase price for the Constantia Labels Acquisition to the acquired assets and liabilities based upon their estimated fair value. These estimates are based on financial information available at the time of the preparation of this offering memorandum. Based on the timing of the closing of the Transactions and other factors, we cannot assure you that the actual adjustments will not differ materially from the pro forma adjustments reflected in the summary unaudited pro forma combined financial information. It is expected that, following the consummation of the Transactions, the Combined Company will incur non-recurring expenses associated with the Transactions and integration of the operations of the two companies. These expenses and integration costs are not reflected in this summary unaudited pro forma combined financial information. Except where specified below, the summary unaudited pro forma combined financial information also does not give effect to the potential impact of any anticipated synergies, operating efficiencies or cost savings that may result from the Transactions.

| | | | |

| | | Unaudited Pro

Forma

Twelve Months

Ended

June 30, 2017

($ in millions) | |

Combined statement of operations (1) | | | | |

Net revenue | | $ | 1,602.3 | |

Cost of revenues | | | 1,282.6 | |

| | | | |

Gross Profit | | | 319.7 | |

Selling and administrative expenses | | | 164.5 | |

Facility closure expenses | | | 0.8 | |

| | | | |

Operating Income | | | 154.3 | |

Interest expense | | | 82.1 | |

Other expense (income), net | | | (5.5 | ) |

| | | | |

Income before income taxes | | | 77.7 | |

Income tax expense | | | 14.5 | |

| | | | |

Net Income, inclusive of non-controlling interests | | | 63.2 | |

Less net income attributable to non-controlling interests | | | 0.4 | |

| | | | |

Net income | | $ | 62.8 | |

| | | | |

| |

Certain Balance Sheet Data | | | | |

Cash and cash equivalents (2) | | $ | 70.9 | |

Accounts receivable, net of allowance | | | 275.1 | |

Inventory, net | | | 167.4 | |

Property, plant and equipment | | | 466.2 | |

Total assets | | | 2,791.8 | |

Secured debt, excluding unamortized debt issuance costs (4) | | | 920.6 | |

Total debt, excluding unamortized debt issuance costs (4) | | | 1,650.6 | |

Total shareholder’s equity | | | 617.8 | |

| | | | |

| | | Unaudited Pro

Forma

Twelve Months

Ended

June 30, 2017

($ in millions) | |

| |

Financial and Other Data | | | | |

Pro Forma Combined EBITDA (3) | | $ | 271.6 | |

Pro Forma Combined Adjusted EBITDA-pre-synergies (3) | | | 285.0 | |

Pro Forma Combined Adjusted EBITDA-post-synergies (3) | | | 300.0 | |

Ratio of Net Secured Debt/Pro Forma Combined Adjusted EBITDA-post synergies (4) | | | 2.8x | |

Ratio of Total Net Debt/Pro Forma Combined Adjusted EBITDA-post synergies (4) | | | 5.3x | |

| (1) | Numbers may not foot due to rounding. |

| (2) | The cash consideration payable to the Sellers pursuant to the Purchase Agreement remains subject to closing adjustments as outlined in the Purchase Agreement. Actual cash transferred by Multi-Color will be subject to the final closing adjustment calculations as well as the Euro to U.S. dollar exchange rate, which could have material impact on these unaudited pro forma combined financial statements. In addition, the net cash position will be impacted by the currency forward entered into by the Company to hedge the transfer of Euro on the closing date. |

| (3) | We define “Pro Forma Combined EBITDA” for the periods presented above as earnings before interest, taxes, depreciation and amortization after giving effect to the Transactions. Pro Forma Combined EBITDA does not represent, and should not be considered as, an alternative to net income or cash flows from operating activities, each as determined in accordance with US GAAP. We define “Pro Forma Combined Adjusted EBITDA-pre-synergies” for the periods presented above as Pro Forma Combined EBITDA adjusted for stock-based compensation expense, integration expenses, acquisition-related expenses, purchase accounting adjustments for inventory, non-cash goodwill and asset impairments, plant consolidation expenses and other non-cash items we determine to be non-recurring, unusual or outside the normal scope of operations, but not adjusted for any synergies related to the Transactions. We define “Pro Forma Combined Adjusted EBITDA-post-synergies” as “Pro Forma Combined Adjusted EBITDA-pre-synergies” adjusted to reflect $15 million of expected synergies related to the Transactions. We have presented Pro Forma Combined EBITDA; Pro Forma Combined Adjusted EBITDA-pre-synergies and Pro Forma Combined Adjusted EBITDA-post-synergies in this offering memorandum because we believe they are useful financial measurements for assessing operating performance as they provide investors with additional bases to evaluate our performance. In addition, we use these metrics to further our understanding of our historical and prospective consolidated operating performance. In addition, we use Pro Forma Combined Adjusted EBITDA-pre-synergies and Pro Forma Combined Adjusted EBITDA-post-synergies to evaluate the ordinary course of our operations, before certain selected items, even though those items may be recurring, because we believe to effectively compare our core operating performance from period to period on a historical and prospective basis, this metric should exclude items relating to acquisitions, integration and plant consolidation, and other selected items incurred outside the ordinary course of our operations. Other companies may calculate Pro Forma Combined EBITDA; Pro Forma Combined Adjusted EBITDA-pre-synergies and Pro Forma Combined Adjusted EBITDA-post-synergies differently than we do. Pro Forma Combined EBITDA; Pro Forma Combined Adjusted EBITDA-pre-synergies and Pro Forma Combined Adjusted EBITDA-post-synergies are not measures of performance under US GAAP and should not be considered as a substitute for our net income prepared in accordance with US GAAP. Pro Forma Combined EBITDA; Pro Forma Combined Adjusted EBITDA-pre-synergies and Pro Forma Combined Adjusted EBITDA-post-synergies have limitations as analytical tools, and you should not consider them in isolation or as a substitute for analysis of our results as reported under US GAAP. Some of these limitations are: Pro Forma Combined EBITDA; Pro Forma Combined Adjusted EBITDA-pre-synergies and Pro Forma Combined Adjusted EBITDA-post-synergies do not reflect our cash expenditures, or future requirements, for capital expenditures or contractual commitments; Pro Forma Combined EBITDA; Pro Forma Combined Adjusted EBITDA-pre-synergies and Pro Forma Combined Adjusted EBITDA-post-synergies do not reflect interest expense or the cash requirements necessary to service interest or principal payments on our debt; Pro Forma Combined EBITDA; Pro Forma Combined Adjusted EBITDA-pre-synergies and Pro Forma |

| | Combined Adjusted EBITDA-post-synergies do not reflect income tax expense or the cash requirements necessary to pay for income tax obligations; and although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and Pro Forma Combined EBITDA; Pro Forma Combined Adjusted EBITDA-pre-synergies and Pro Forma Combined Adjusted EBITDA-post-synergies do not reflect any cash requirements for such replacements. In addition, in evaluating Pro Forma Combined Adjusted EBITDA-pre-synergies and Pro Forma Combined Adjusted EBITDA-post-synergies you should be aware that in the future we may incur expenses that are the same as or similar to some of the adjustments in this presentation. Our presentation of Pro Forma Combined Adjusted EBITDA-pre-synergies and Pro Forma Combined Adjusted EBITDA-post-synergies should not be construed as an inference that our future results will not be unaffected by unusual or non-recurring items. |

The following table sets forth the reconciliation of net income to Pro Forma Combined EBITDA and Pro Forma Combined Adjusted EBITDA-pre-synergies and Pro Forma Combined Adjusted EBITDA-post-synergies for the twelve months ended June 30, 2017:

| | | | |

(Dollars in millions) | | Twelve Months

Ended

June 30, 2017 | |

Net income | | $ | 63.2 | |

Income tax expense | | | 14.5 | |

Interest expense | | | 82.1 | |

Depreciation | | | 71.7 | |

Amortization | | | 40.1 | |

Pro Forma Combined EBITDA | | | 271.6 | |

Acquisitions/Divestitures (4) | | $ | 0.9 | |

Stock-Based Compensation | | | 3.0 | |

Acquisition Costs and Expenses | | | 1.8 | |

Plant Closure Expenses | | | 0.1 | |

Capitalized Labor (b) | | | (0.5 | ) |

Standalone Adjustments (c) | | | 0.7 | |

Mexico – Operational Items (d) | | | 1.2 | |

Non-recurring Items (e) | | | 1.0 | |

Management Salaries (f) | | | 1.1 | |

CF Headquarters costs (g) | | | 4.3 | |

Other (h) | | | (0.2 | ) |

| | | | |

Total Adjustments | | $ | 13.4 | |

Pro Forma Combined Adjusted EBITDA-pre-synergies | | $ | 285.0 | |

Estimated Constantia Labels Acquisition Synergies | | | 15.0 | |

| | | | |

Pro Forma Combined Adjusted EBITDA-post-synergies | | $ | 300.0 | |

| | | | |

| | (a) | Pro Forma EBITDA adjusted to give pro forma effect to acquisitions and divestitures. |

| | (b) | Elimination of capitalized salaries. |

| | (c) | Add backs related to items that would not remain as a standalone entity including half-year audits, IT services, holding costs and trading margin. |

| | (d) | Extraordinary waste costs caused by complications with outsourced digital printing in Mexico during the fiscal year ended December 31, 2016. Outsourcing will not be necessary going forward. |

| | (e) | Non-recurring items including restructuring and severance costs, written-off receivables, down-time and costs related to fire damage, financial costs and consulting fees. |

| | (f) | The management team (former owners) was replaced by a new manager; add-back reflects the change in compensation for the new manager. |

| | (g) | Fee charged by Constantia to Constantia Labels for the Constantia corporate headquarter expenses. |

| | (h) | Includes the reclassification of factoring fees to interest expense, gain from sale of fixed assets, and the release of provisions for bad debt. |

| (4) | We define secured debt as total debt that is secured by a lien on our assets. Net Secured Debt and Total Net Debt are defined as total secured debt and total debt, respectively, less cash and cash equivalents after giving pro forma effect to the Transactions. |

Summary Historical Consolidated Financial Information and Other Data for Constantia Labels

The following summary historical consolidated financial information and other data of Constantia Labels, prepared in accordance with IFRS, as of December 31, 2016 and 2015, and for the years ended December 31, 2016 and 2015, have been derived from and should be read together with the audited consolidated combined financial statements and related notes included elsewhere in this offering memorandum. The following summary historical consolidated combined financial information and other data as of June 30, 2017 and for the six months ended June 30, 2017 and 2016 and at June 30, 2017 have been derived from and should be read together with the unaudited consolidated financial statements and related notes included elsewhere in this offering memorandum. The following summary historical consolidated financial information and other data presented for the twelve months ended June 30, 2017, has been derived by taking the amounts from the historical audited consolidated financial statements for the year ended December 31, 2016, subtracting the amounts from the historical unaudited consolidated financial statements for the six months ended June 30, 2016, and adding the amounts from the historical unaudited consolidated financial statements for the six months ended June 30, 2017. The financial statements for Constantia Labels for the fiscal year ended December 31, 2014 are not included in this offering memorandum and, pursuant to a waiver provided by the SEC dated September 1, 2017 with respect to the requirements of Rule 3-05 of Regulation S-X, will not be filed with the SEC on a Current Report on Form 8-K.

The summary historical consolidated financial information and other data for Constantia Labels are not necessarily indicative of future performance. The financial information and data provided in this table are only a summary, do not provide all of the information or data contained in our financial statements.

| | | | | | | | | | | | | | | | | | | | |

| | | Fiscal Year Ended | | | Six Months Ended | | | Twelve

Months

Ended | |

(Euro in millions) (1) | | Dec. 31,

2015 | | | Dec. 31,

2016 | | | June 30,

2016 | | | June 30,

2017 | | | June 30,

2017 | |

Net revenues | | € | 540.8 | | | € | 604.7 | | | € | 304.5 | | | € | 317.3 | | | € | 617.4 | |

Cost of revenues | | | (439.8 | ) | | | (493.7 | ) | | | (244.6 | ) | | | (253.2 | ) | | | (502.3 | ) |

| | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 101.1 | | | | 111.0 | | | | 59.9 | | | | 64.1 | | | | 115.1 | |

Selling, general and administrative expenses and other | | | 48.6 | | | | 55.0 | | | | 28.2 | | | | 30.8 | | | | 57.6 | |

| | | | | | | | | | | | | | | | | | | | |

Operating income | | | 52.4 | | | | 56.0 | | | | 31.7 | | | | 33.3 | | | | 57.5 | |

Interest expense | | | 16.8 | | | | 19.3 | | | | 9.2 | | | | 10.4 | | | | 20.5 | |

Other income (expense), net | | | 0.7 | | | | (2.0 | ) | | | (0.4 | ) | | | 5.7 | | | | 4.2 | |

| | | | | | | | | | | | | | | | | | | | |

Income before income taxes | | | 36.4 | | | | 34.7 | | | | 22.2 | | | | 28.6 | | | | 41.2 | |

Income tax expense | | | 9.8 | | | | 4.1 | | | | 7.5 | | | | 9.2 | | | | 5.8 | |

| | | | | | | | | | | | | | | | | | | | |

Net income | | € | 26.6 | | | € | 30.6 | | | € | 14.7 | | | € | 19.4 | | | € | 35.3 | |

| | | | | | | | | | | | | | | | | | | | |

Net income attributable to Owners of the Company | | € | 18.0 | | | € | 23.2 | | | € | 10.7 | | | € | 14.7 | | | € | 27.2 | |

| | | | | | | | | | | | | | | | | | | | |

Balance sheet data: | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | € | 10.4 | | | € | 23.6 | | | | | | | € | 23.9 | | | € | 23.9 | |

Net Working capital | | | (64.1 | ) | | | (27.7 | ) | | | | | | | (13.9 | ) | | | (13.9 | ) |

Total assets | | | 645.6 | | | | 692.4 | | | | | | | | 684.2 | | | | 684.2 | |

Total debt | | | 112.6 | | | | 144.2 | | | | | | | | 135.0 | | | | 135.0 | |

Stockholders’ equity (2) | | | 111.1 | | | | 125.4 | | | | | | | | 130.3 | | | | 130.3 | |

| | | | | |

Cash flow data: | | | | | | | | | | | | | | | | | | | | |

Net cash provided by operating activities | | € | 73.9 | | | € | 62.8 | | | € | 23.4 | | | € | 20.1 | | | € | 59.5 | |

Net cash used in investing activities | | | (49.8 | ) | | | (60.8 | ) | | | (44.5 | ) | | | (8.7 | ) | | | (25.0 | ) |

Net cash provided by/(used in) financing activities | | | (19.0 | ) | | | 11.0 | | | | 33.8 | | | | (10.7 | ) | | | (33.5 | ) |

Capital expenditures | | | (33.2 | ) | | | (38.0 | ) | | | (19.4 | ) | | | (13.2 | ) | | | (31.8 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | Fiscal Year Ended | | | Six Months Ended | | | Twelve

Months

Ended | |

(Euro in millions) (1) | | Dec. 31,

2015 | | | Dec. 31,

2016 | | | June 30,

2016 | | | June 30,

2017 | | | June 30,

2017 | |

| | | | | |

Other financial data: | | | | | | | | | | | | | | | | | | | | |

EBITDA (3) | | € | 91.7 | | | € | 100.0 | | | € | 52.8 | | | € | 55.7 | | | € | 103.0 | |

Adjusted EBITDA (3) | | | 99.1 | | | | 106.6 | | | | 55.7 | | | | 58.4 | | | | 109.4 | |

Adjusted EBITDA margin (4) | | | 18.3 | % | | | 17.6 | % | | | 18.3 | % | | | 18.4 | % | | | 17.7 | % |

| (1) | Numbers may not foot due to rounding. |

| (2) | The number used to report stockholders’ equity is the same as the total invested equity attributable to Constantia Labels. |

| (3) | We define “EBITDA” for the periods presented above as earnings before interest, taxes, depreciation and amortization. EBITDA does not represent, and should not be considered as, an alternative to net income or cash flows from operating activities, each as determined in accordance with GAAP or IFRS. We define “Adjusted EBITDA” for the periods presented above as EBITDA adjusted for stock-based compensation expense, integration expenses, acquisition-related expenses, purchase accounting adjustments for inventory, non-cash goodwill and asset impairments, plant consolidation expenses and other non-cash items we determine to be non-recurring, unusual or outside the normal scope of operations. We have presented EBITDA and Adjusted EBITDA in this offering memorandum because we believe they are useful financial measurements for assessing operating performance as they provide investors with additional bases to evaluate our performance. In addition, we use these metrics to further our understanding of our historical and prospective consolidated operating performance. In addition, we use Adjusted EBITDA to evaluate the ordinary course of our operations, before certain selected items, even though those items may be recurring, because we believe to effectively compare our core operating performance from period to period on a historical and prospective basis, this metric should exclude items relating to acquisitions, integration and plant consolidation, and other selected items incurred outside the ordinary course of our operations. Other companies may calculate EBITDA and Adjusted EBITDA differently than we do. EBITDA and Adjusted EBITDA are not measures of performance under GAAP or IFRS and should not be considered as a substitute for our net income prepared in accordance with GAAP or IFRS. EBITDA and Adjusted EBITDA have limitations as analytical tools, and you should not consider them in isolation or as a substitute for analysis of our results as reported under GAAP or IFRS. Some of these limitations are: EBITDA and Adjusted EBITDA do not reflect our cash expenditures, or future requirements, for capital expenditures or contractual commitments; EBITDA and Adjusted EBITDA do not reflect interest expense or the cash requirements necessary to service interest or principal payments on our debt; EBITDA and Adjusted EBITDA do not reflect income tax expense or the cash requirements necessary to pay for income tax obligations; and although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and EBITDA and Adjusted EBITDA do not reflect any cash requirements for such replacements. In addition, in evaluating Adjusted EBITDA you should be aware that in the future we may incur expenses that are the same as or similar to some of the adjustments in this presentation. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will not be unaffected by unusual or non-recurring items. |

The following table sets forth the reconciliation of net income to EBITDA and Adjusted EBITDA for the periods indicated:

| | | | | | | | | | | | | | | | | | | | |

| | | Fiscal Year Ended | | | Six Months Ended | | | Twelve Months

Ended | |

| | | | |

(Euro in millions) (a) | | Dec. 31,

2015 | | | Dec. 31,

2016 | | | June 30,

2016 | | | June 30,

2017 | | | June 30,

2017 | |

Net income, as reported | | € | 26.6 | | | € | 30.6 | | | € | 14.7 | | | € | 19.4 | | | € | 35.3 | |

Interest expense, net | | | 16.0 | | | | 21.3 | | | | 9.6 | | | | 4.7 | | | | 16.4 | |

Income tax expense | | | 9.8 | | | | 4.1 | | | | 7.5 | | | | 9.2 | | | | 5.8 | |

Depreciation & Amortization | | | 39.4 | | | | 44.0 | | | | 21.0 | | | | 22.4 | | | | 45.5 | |

| | | | | | | | | | | | | | | | | | | | |

EBITDA | | € | 91.7 | | | € | 100.0 | | | € | 52.8 | | | € | 55.7 | | | € | 103.0 | |

| | | | | |

Acquisitions/Divestitures EBITDA (b) | | € | 5.8 | | | € | 0.2 | | | € | 0.7 | | | € | 0.0 | | | € | (0.5 | ) |

Capitalized Labor (c) | | | (0.4 | ) | | | (0.4 | ) | | | (0.2 | ) | | | (0.2 | ) | | | (0.4 | ) |

Standalone Adjustments (d) | | | 0.4 | | | | 0.7 | | | | 0.2 | | | | 0.2 | | | | 0.7 | |

Mexico—Operational Item (e) | | | — | | | | 1.1 | | | | 0.0 | | | | 0.0 | | | | 1.1 | |

Non-Recurring Items (f) | | | 0.1 | | | | 0.8 | | | | 0.1 | | | | 0.2 | | | | 0.9 | |

Management Salaries (g) | | | — | | | | 1.3 | | | | 0.7 | | | | 0.4 | | | | 1.0 | |

CF Headquarters Costs (h) | | | 2.1 | | | | 3.3 | | | | 1.5 | | | | 2.2 | | | | 3.9 | |

Other (i) | | | (0.6 | ) | | | (0.3 | ) | | | (0.1 | ) | | | (0.1 | ) | | | (0.2 | ) |

| | | | | | | | | | | | | | | | | | | | |

Adjustments | | | 7.4 | | | | 6.6 | | | | 3.0 | | | | 2.7 | | | | 6.5 | |

| | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA | | € | 99.1 | | | € | 106.6 | | | € | 55.7 | | | € | 58.4 | | | € | 109.4 | |

| | | | | | | | | | | | | | | | | | | | |

| | (a) | Numbers may not foot due to rounding. |

| | (b) | EBITDA adjusted to give pro forma effect to the Pemara and Afripack Labels acquisitions made during the fiscal year ended December 31, 2015 (pro forma adjustments not available for the fiscal year ended December 31, 2014) and the closing of Printer Labels during the fiscal year ended December 31, 2016. |

| | (c) | Elimination of capitalized salaries (amount not assumed the same across all periods). |

| | (d) | Add backs related to items that would not remain as a standalone entity including half-year audits, IT services, holding costs and trading margin. |

| | (e) | Extraordinary waste costs caused by complications with outsourced digital printing in Mexico in during the fiscal year ended December 31, 2016. Outsourcing will not be necessary going forward. |

| | (f) | Non-recurring items including restructuring and severance costs, written-off receivables, down-time and costs related to a fire damage, financial products and consulting fees. |

| | (g) | The management team (former owners) was replaced by a new manager; add-back reflects the change in compensation for the new manager. |

| | (h) | Fee charged by Constantia to Constantia Labels for the Constantia corporate headquarters. |

| | (i) | Includes the reclassification of factoring fees to interest expense, gain from sale of fixed assets, and the release of provisions for bad debt. |

| (4) | We define Adjusted EBITDA margin as Adjusted EBITDA as a percentage of Net revenues. |

UNAUDITED PRO FORMA COMBINED FINANCIAL INFORMATION

(Dollar amounts presented in thousands, except per share amounts)

On July 16, 2017, Multi-Color Corporation, (“MCC” or the “Company”) entered into a Sale and Purchase Agreement (the “Purchase Agreement”) with Constantia Flexibles Holdings GmbH and its subsidiaries (“Constantia”) to purchase the Labels Division of Constantia (the “Acquisition”), with the Acquisition to be effected through the acquisition by the Company of certain of the issued and outstanding capital stock of Constantia’s subsidiaries and certain specified assets of other Constantia subsidiaries. The aggregate consideration to be paid by the Company to the Sellers is approximately $1.3 billion (€1.15 billion) (the “Purchase Price”), payable in cash and approximately 3.4 million shares of the Company’s common stock (based on a price of €65.40 and which shall not exceed 19.9% of the Company’s current stock outstanding). The cash portion of the Purchase Price is subject to adjustments based on matters such as working capital and indebtedness balances at the time of closing.

In connection with the Constantia Labels Acquisition, the Company intends to (i) enter into (A) a $250 million senior secured term loan A facility (the “TLA Facility”), (B) a $400 million senior secured term loan B facility (the “TLB Facility”) and (C) a $400 million senior secured revolving facility (the “Revolving Facility”, and collectively with the TLA Facility and the TLB Facility, the “Senior Secured Credit Facilities”), which Senior Secured Credit Facilities will be secured on a first priority basis by substantially all of the Company’s assets, and (ii) issue the $480 million senior unsecured notes offered hereby.

The unaudited pro forma combined financial information is presented to illustrate the effects of the Acquisition by the Company and the related financing transactions including the Commitment Letter and this Offering Memorandum (collectively, the “Transaction”).

The unaudited pro forma combined balance sheet as of June 30, 2017 and the unaudited pro forma combined statements of income for the year ended March 31, 2017, and the twelve months ended June 30, 2017 are based upon, derived from and should be read in conjunction with the historical audited consolidated financial statements of the Company for the year ended March 31, 2017, the historical unaudited condensed consolidated financial statements of the Company for the three-month period ended June 30, 2017, and the combined financial statements of Constantia Labels.

The Company prepares its financial information in accordance with accounting principles generally accepted in the United States (“US GAAP”) with all amounts stated in U.S. dollars. Constantia Labels prepared its financial information in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) with historical amounts presented in Euro.

The unaudited pro forma combined statements of income assume that the Transaction occurred on April 1, 2016, the beginning of our fiscal year ended March 31, 2017. The unaudited pro forma combined balance sheet as of June 30, 2017 assumes that the Transaction occurred on June 30, 2017. The historical combined financial information has been adjusted to give effect to pro forma events that are: (1) directly attributable to the Acquisition, (2) factually supportable, and (3) with respect to the statement of operations are expected to have a continuing impact on the combined results. In the opinion of management, all adjustments necessary to present fairly the unaudited pro forma combined financial information have been made. The assumptions underlying the pro forma adjustments are described fully in the accompanying notes, which should be read in conjunction with the unaudited pro forma combined financial information.

For purposes of the pro forma combined balance sheet, we utilized the unaudited combined balance sheet of Constantia Labels as of June 30, 2017. For purposes of the pro forma combined statement of income for the year ended March 31, 2017, results for Constantia Labels were derived from the audited combined statement of income of Constantia Labels for the year ended December 31, 2016.

For purposes of the pro forma combined statement of income for the twelve months ended June 30, 2017, results for Constantia Labels were derived from the audited combined statement of income for the year

ended December 31, 2016, plus the unaudited combined statement of income for the six months ended June 30, 2017, minus the unaudited combined statement of income for the six months ended June 30, 2016. Results for the Company were derived from the audited consolidated statement of income for the year ended March 31, 2017, plus the unaudited consolidated statement of income for the three months ended June 30, 2017, minus the unaudited consolidated statement of income for the three months ended June 30, 2016.

The unaudited pro forma combined financial information is not necessarily indicative of the combined financial position or results of operations that would have been realized had the Transaction occurred as of the dates indicated, nor is it meant to be indicative of any anticipated combined financial position or future results of operations that the Company will experience after the Transaction. In addition, the accompanying unaudited pro forma combined statements of operations do not include any expected cost savings, operating synergies, or revenue enhancements that may be realized subsequent to the Transaction, or the impact of anynon-recurring activity and transaction-related or integration-related costs.

Unaudited Pro Forma Combined Balance Sheet

As of June 30, 2017

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | As Reported | | | | | | | | | | | | | | | | |

| (In $ thousands) | | Historical

Multi-Color | | | Historical Labels,

Adjusted for US

GAAP and

Reclassifications

(Footnote 2) | | | Adjustments

for the Labels

Division

Acquisition | | | Footnote

Reference | | | Adjustments

for Financing | | | Footnote

Reference | | | Pro Forma | |

ASSETS | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Current assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 25,891 | | | $ | 27,299 | | | $ | (1,057,781 | ) | | | 3 | (a) | | $ | 1,322,340 | | | | 4 | (a) | | $ | 70,862 | |

| | | | | | | | | | | (10,448 | ) | | | 3 | (l) | | | (225,139 | ) | | | 4 | (b) | | | | |

| | | | | | | | | | | (11,300 | ) | | | 3 | (n) | | | | | | | | | | | | |

Accounts receivable, net of allowance | | | 144,759 | | | | 189,262 | | | | (58,910 | ) | | | 3 | (d) | | | — | | | | | | | | 275,111 | |

Other receivables | | | 8,144 | | | | 11,653 | | | | (34 | ) | | | 3 | (d) | | | — | | | | | | | | 19,763 | |

Inventories, net | | | 70,418 | | | | 90,392 | | | | 6,608 | | | | 3 | (f) | | | — | | | | | | | | 167,418 | |

Prepaid expenses | | | 11,507 | | | | 3,286 | | | | — | | | | | | | | — | | | | | | | | 14,793 | |

Other current assets | | | 2,032 | | | | 3,866 | | | | — | | | | | | | | — | | | | | | | | 5,898 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total current assets | | | 262,751 | | | | 325,758 | | | | (1,131,865 | ) | | | | | | | 1,097,201 | | | | | | | | 553,845 | |

Assets held for sale | | | — | | | | — | | | | — | | | | | | | | — | | | | | | | | — | |

Property, plant and equipment, net of accumulated depreciation | | | 256,060 | | | | 210,143 | | | | — | | | | 3 | (g) | | | — | | | | | | | | 466,203 | |

Goodwill | | | 420,406 | | | | 168,143 | | | | (168,143 | ) | | | 3 | (e) | | | — | | | | | | | | 1,155,855 | |

| | | | | | | | | | | 735,449 | | | | 3 | (k) | | | | | | | | | | | | |

Intangible assets, net | | | 170,244 | | | | 56,997 | | | | (56,997 | ) | | | 3 | (e) | | | — | | | | | | | | 580,244 | |

| | | | | | | | | | | 410,000 | | | | 3 | (h) | | | | | | | | | | | | |

Othernon-current assets | | | 5,674 | | | | 16,190 | | | | — | | | | | | | | — | | | | | | | | 21,864 | |

Deferred income tax assets | | | 2,859 | | | | 10,957 | | | | — | | | | | | | | — | | | | | | | | 13,816 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 1,117,994 | | | $ | 788,188 | | | $ | (211,556 | ) | | | | | | $ | 1,097,201 | | | | | | | $ | 2,791,827 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(continued on next page)

Unaudited Pro Forma Combined Balance Sheet

As of June 30, 2017

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | As Reported | | | | | | | | | | | | | | | | |

| (In $ thousands) | | Historical

Multi-

Color | | | Historical

Labels,

Adjusted for US

GAAP and

Reclassifications

(Footnote 2) | | | Adjustments

for the Labels

Division

Acquisition | | | Footnote

Reference | | | Adjustments

for Financing | | | Footnote

Reference | | | Pro Forma | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Current liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Current portion of long-term debt | | $ | 2,530 | | | $ | 192,800 | | | $ | (186,032 | ) | | | 3 | (d) | | $ | 11,942 | | | | 4 | (a) | | $ | 21,240 | |

Accounts payable | | | 87,933 | | | | 114,307 | | | | (6,925 | ) | | | 3 | (d) | | | — | | | | | | | | 195,315 | |

Accrued expenses and other liabilities | | | 49,086 | | | | 34,505 | | | | 1,085 | | | | 3 | (c) | | | — | | | | | | | | 83,438 | |

| | | | | | | | | | | (1,238 | ) | | | 3 | (d) | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total current liabilities | | | 139,549 | | | | 341,612 | | | | (193,110 | ) | | | | | | | 11,942 | | | | | | | | 299,993 | |

Long-term debt | | | 474,659 | | | | 147,540 | | | | (116,731 | ) | | | 3 | (d) | | | 1,315,119 | | | | 4 | (a) | | | 1,597,725 | |

| | | | | | | | | | | | | | | | | | | (222,862 | ) | | | 4 | (b) | | | | |

Deferred income tax liabilities | | | 67,473 | | | | 34,322 | | | | 129,148 | | | | 3 | (j) | | | — | | | | | | | | 230,943 | |

Other liabilities | | | 20,433 | | | | 80,824 | | | | (67,279 | ) | | | 3 | (c) | | | — | | | | | | | | 45,395 | |

| | | | | | | | | | | 11,417 | | | | 3 | (c) | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities | | | 702,114 | | | | 604,298 | | | | (236,555 | ) | | | | | | | 1,104,199 | | | | | | | | 2,174,056 | |

Commitments and contingencies | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Shareholders’ equity: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Preferred stock | | | — | | | | — | | | | — | | | | | | | | — | | | | | | | | — | |

Common stock | | | 1,059 | | | | — | | | | 338 | | | | 3 | (b) | | | — | | | | | | | | 1,397 | |

Paid-in capital | | | 160,629 | | | | — | | | | 229,199 | | | | 3 | (b) | | | — | | | | | | | | 389,828 | |

Treasury stock | | | (11,420 | ) | | | — | | | | — | | | | | | | | — | | | | | | | | (11,420 | ) |

Retained earnings | | | 329,717 | | | | — | | | | (10,448 | ) | | | 3 | (l) | | | (4,721 | ) | | | 4 | (a) | | | 300,971 | |

| | | | | | | | | | | (11,300 | ) | | | 3 | (n) | | | (2,277 | ) | | | 4 | (b) | | | | |

Accumulated other comprehensive income (loss) | | | (66,665 | ) | | | 14,977 | | | | (14,977 | ) | | | 3 | (m) | | | — | | | | | | | | (66,665 | ) |

Invested equity of LABELS | | | — | | | | 132,272 | | | | (132,272 | ) | | | 3 | (m) | | | — | | | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total stockholders’ equity attributable to Multi-Color Corporation | | | 413,320 | | | | 147,249 | | | | 60,540 | | | | | | | | (6,998 | ) | | | | | | | 614,111 | |

Noncontrolling interests | | | 2,560 | | | | 36,641 | | | | (35,541 | ) | | | 3 | (i) | | | — | | | | | | | | 3,660 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total stockholders’ equity | | | 415,880 | | | | 183,890 | | | | 24,999 | | | | | | | | (6,998 | ) | | | | | | | 617,771 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities and stockholders’ equity | | $ | 1,117,994 | | | $ | 788,188 | | | $ | (211,556 | ) | | | | | | $ | 1,097,201 | | | | | | | $ | 2,791,827 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Unaudited Pro Forma Combined Statements of Income

For the Fiscal Year Ended March 31, 2017

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | As Reported | | | | | | | | | | | | | | | | |

(In $ thousands, except for per share

amounts) | | Historical

Multi-Color | | | Historical Labels,

Adjusted for US

GAAP and

Reclassifications

(Footnote 2) | | | Adjustments

for the Labels

Division

Acquisition | | | Footnote

Reference | | | Adjustments

for Financing | | | Footnote

Reference | | | Pro Forma | |

Net revenues | | $ | 923,295 | | | $ | 669,359 | | | $ | — | | | | | | | $ | | | | | | | | $ | 1,592,654 | |

Cost of revenues | | | 726,486 | | | | 546,555 | | | | — | | | | | | | | | | | | | | | | 1,273,041 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 196,809 | | | | 122,804 | | | | — | | | | | | | | — | | | | | | | | 319,613 | |

Selling, general and administrative expenses | | | 84,922 | | | | 64,810 | | | | 13,950 | | | | 5 | (a) | | | | | | | | | | | 163,682 | |

Facility closure expenses | | | 921 | | | | — | | | | — | | | | | | | | | | | | | | | | 921 | |

Goodwill impairment | | | — | | | | — | | | | — | | | | | | | | | | | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating income | | | 110,966 | | | | 57,994 | | | | (13,950 | ) | | | | | | | — | | | | | | | | 155,010 | |

Interest expense | | | 25,488 | | | | 21,361 | | | | (3,291 | ) | | | 5 | (b) | | | 62,025 | | | | 6 | (a) | | | 82,203 | |

| | | | | | | | | | | | | | | | | | | (23,380 | ) | | | 6 | (b) | | | | |

Other expense (income), net | | | (2,735 | ) | | | (1,469 | ) | | | (2,967 | ) | | | 5 | (b) | | | | | | | | | | | (7,171 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income before income taxes | | | 88,213 | | | | 38,102 | | | | (7,692 | ) | | | | | | | (38,645 | ) | | | | | | | 79,978 | |

Income tax expense | | | 26,848 | | | | 4,462 | | | | (2,385 | ) | | | 5 | (c) | | | (11,980 | ) | | | 6 | (c) | | | 16,945 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | 61,365 | | | | 33,640 | | | | (5,307 | ) | | | | | | | (26,665 | ) | | | | | | | 63,033 | |

Less: Net income attributable to noncontrolling interests | | | 369 | | | | 8,219 | | | | (7,897 | ) | | | 5 | (d) | | | | | | | | | | | 691 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income attributable to Multi-Color Corporation | | $ | 60,996 | | | $ | 25,421 | | | $ | 2,590 | | | | | | | $ | (26,665 | ) | | | | | | $ | 62,342 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Weighted average shares and equivalents outstanding: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | | 16,879 | | | | | | | | | | | | | | | | | | | | | | | | 20,263 | |

Diluted | | | 17,024 | | | | | | | | | | | | | | | | | | | | | | | | 20,408 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic earnings per common share | | $ | 3.61 | | | | | | | | | | | | | | | | | | | | | | | $ | 3.08 | |

Diluted earnings per common share | | $ | 3.58 | | | | | | | | | | | | | | | | | | | | | | | $ | 3.05 | |

Unaudited Pro Forma Combined Statements of Income

For the Twelve Months Ended June 30, 2017

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | As Reported | | | | | | | | | | | | | | | | |

(In $ thousands, except for per share

amounts) | | Historical

Multi-Color | | | Historical Labels,

Adjusted for US

GAAP and

Reclassifications

(Footnote 2) | | | Adjustments for

the Labels

Acquisition | | | Footnote

Reference | | | Adjustments

for Financing | | | Footnote

Reference | | | Pro Forma | |

Net revenues | | $ | 929,241 | | | $ | 673,067 | | | $ | | | | | | | | $ | | | | | | | | $ | 1,602,308 | |

Cost of revenues | | | 735,068 | | | | 547,570 | | | | | | | | | | | | | | | | | | | | 1,282,638 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 194,173 | | | | 125,497 | | | | — | | | | | | | | — | | | | | | | | 319,670 | |

Selling, general and administrative expenses | | | 85,857 | | | | 65,254 | | | | 14,081 | | | | 7 | (a) | | | | | | | | | | | 164,527 | |

| | | | | | | | | | | (665 | ) | | | 7 | (b) | | | | | | | | | | | | |

Facility closure expenses | | | 798 | | | | — | | | | | | | | | | | | | | | | | | | | 798 | |

Goodwill impairment | | | — | | | | — | | | | | | | | | | | | | | | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating income | | | 107,518 | | | | 60,243 | | | | (13,416 | ) | | | | | | | — | | | | | | | | 154,345 | |

Interest expense | | | 25,367 | | | | 22,386 | | | | (3,257 | ) | | | 7 | (c) | | | 61,869 | | | | 8 | (a) | | | 82,073 | |

| | | | | | | | | | | | | | | | | | | (24,292 | ) | | | 8 | (b) | | | | |

Other expense (income), net | | | (1,266 | ) | | | (6,706 | ) | | | 2,513 | | | | 7 | (c) | | | | | | | | | | | (5,459 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income before income taxes | | | 83,417 | | | | 44,563 | | | | (12,672 | ) | | | | | | | (37,577 | ) | | | | | | | 77,731 | |

Income tax expense | | | 23,820 | | | | 6,288 | | | | (3,928 | ) | | | 7 | (d) | | | (11,649 | ) | | | 8 | (c) | | | 14,531 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | 59,597 | | | | 38,275 | | | | (8,744 | ) | | | | | | | (25,928 | ) | | | | | | | 63,200 | |

Less: Net income attributable to noncontrolling interests | | | 300 | | | | 8,897 | | | | (8,800 | ) | | | 7 | (e) | | | | | | | | | | | 397 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income attributable to Multi-Color Corporation | | $ | 59,297 | | | $ | 29,378 | | | $ | 56 | | | | | | | $ | (25,928 | ) | | | | | | $ | 62,803 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Weighted average shares and equivalents outstanding: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | | 16,909 | | | | | | | | | | | | | | | | | | | | | | | | 20,293 | |

Diluted | | | 17,093 | | | | | | | | | | | | | | | | | | | | | | | | 20,477 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic earnings per common share | | $ | 3.51 | | | | | | | | | | | | | | | | | | | | | | | $ | 3.09 | |

Diluted earnings per common share | | $ | 3.47 | | | | | | | | | | | | | | | | | | | | | | | $ | 3.07 | |

Multi-Color, Inc.

Notes to the Unaudited Pro Forma Combined Financial Information

1. Basis of Presentation

The Acquisition is being accounted for as a business combination using the acquisition method of accounting under the provisions of Accounting Standards Codification (“ASC”) Topic 805, “Business Combinations” (“ASC 805”), and using the fair value concepts defined in ASC Topic 820, “Fair Value Measurements” (“ASC 820”). ASC 820 defines the term “fair value” and sets forth the valuation requirements for any asset or liability measured at fair value, expands related disclosure requirements and specifies a hierarchy of valuation techniques based on the nature of the inputs used to develop fair value measures. Fair value is defined in ASC 820 as “the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date”. This is an exit price concept for the valuation of the asset or liability. In addition, market participants are assumed to be buyers and sellers in the principal (or the most advantageous) market for the asset or liability. Many of these fair value measurements can be highly subjective, and it is possible that other professionals, applying reasonable judgment to the same facts and circumstances, could develop and support a range of alternative estimated amounts. Under ASC 805, all assets acquired and liabilities assumed are recorded at their acquisition date fair value.

The allocation of the purchase price as reflected in the unaudited pro forma combined financial information is based upon management’s preliminary estimates of the fair market value of the assets acquired and liabilities assumed, as if the Constantia Labels Acquisition had occurred on the above specified dates. This allocation of the purchase price depends upon certain estimates and assumptions, all of which are preliminary and, in some instances, are incomplete and have been made solely for the purpose of developing the unaudited pro forma combined financial information. Any adjustments to the preliminary estimated fair value amounts could have a significant impact on the unaudited pro forma combined financial information contained herein, and our future results of operations and financial position.

Assets acquired and liabilities assumed in a business combination that arise from contingencies must be recognized at fair value if the fair value can be reasonably estimated. If the fair value of an asset or liability that arises from a contingency cannot be determined, the asset or liability would be recognized in accordance with ASC 450, “Disclosure of Certain Loss Contingencies” (“ASC 450”). If the fair value is not determinable and the ASC 450 criteria are not met, no asset or liability would be recognized. Management is not aware of any material contingencies related to Constantia Labels.

2. Labels Division IFRS to US GAAP Adjustments, Reclassifications, and Foreign Currency Translation

The historical financial information of Constantia Labels was prepared in accordance with IFRS as issued by the IASB with all amounts presented in Euro. Constantia Labels’ unaudited financial information reflected in the pro forma financial information have been adjusted for the identified differences between IFRS and US GAAP and translated from the Euro amounts into U.S. dollars. In addition, certain balances were reclassified from Constantia Labels’ unaudited combined financial statements so that their presentation would be consistent with that of the Company. These adjustments and reclassifications are based on management’s preliminary analysis. When management completes a final review as required by acquisition accounting rules, additional differences or reclassifications may be identified that, when conformed, could have a material impact on the unaudited pro forma combined financial information contained herein and our future results of operations and financial position.

Unaudited Labels Division Balance Sheet presented in US GAAP as of June 30, 2017

The following table reflects the adjustments made to Constantia Labels’ unaudited combined balance sheet as of June 30, 2017 to convert from IFRS to US GAAP and from Euro to U.S. dollars using the spot rate of $1.1427 to €1.00 as of June 30, 2017.

| | | | | | | | | | | | | | | | | | | | |

| (in thousands) | | Labels

IFRS

(Euro) | | | IFRS to

US GAAP

Adjustments and

Reclassifications

(Euro) | | | Footnote | | | Labels

US GAAP

(Euro) | | | Labels

US GAAP

(USD) | |

ASSETS | | | | | | | | | | | | | | | | | | | | |

Current assets: | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | € | 23,890 | | | € | — | | | | | | | € | 23,890 | | | $ | 27,299 | |

Accounts receivable, net of allowance | | | — | | | | 114,074 | | | | 2 | (a) | | | 165,627 | | | | 189,262 | |

| | | | | | | 51,553 | | | | 2 | (c) | | | | | | | | |

Other receivables | | | 65,134 | | | | (51,553 | ) | | | 2 | (c) | | | 10,198 | | | | 11,653 | |

| | | | | | | (3,383 | ) | | | 2 | (c) | | | | | | | | |

Inventories, net | | | 79,104 | | | | — | | | | | | | | 79,104 | | | | 90,392 | |

Prepaid expenses | | | — | | | | 2,876 | | | | 2 | (b) | | | 2,876 | | | | 3,286 | |

Other current assets | | | — | | | | 3,383 | | | | 2 | (c) | | | 3,383 | | | | 3,866 | |

Trade receivables | | | 114,074 | | | | (114,074 | ) | | | 2 | (a) | | | — | | | | — | |

Tax receivables | | | 2,876 | | | | (2,876 | ) | | | 2 | (b) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total current assets | | | 285,078 | | | | — | | | | | | | | 285,078 | | | | 325,758 | |

Assets held for sale | | | — | | | | — | | | | | | | | — | | | | — | |

Property, plant and equipment, net of accumulated depreciation | | | — | | | | 183,900 | | | | 2 | (d) | | | 183,900 | | | | 210,143 | |

Goodwill | | | 139,783 | | | | 7,362 | | | | 2 | (k) | | | 147,145 | | | | 168,143 | |

Intangible assets, net | | | 51,704 | | | | (1,825 | ) | | | 2 | (l) | | | 49,879 | | | | 56,997 | |

Othernon-current assets | | | — | | | | 14,168 | | | | 2 | (e) | | | 14,168 | | | | 16,190 | |

Deferred income tax assets | | | 9,589 | | | | — | | | | | | | | 9,589 | | | | 10,957 | |

Tangible assets | | | 183,900 | | | | (183,900 | ) | | | 2 | (d) | | | — | | | | — | |

Other noncurrent and financial assets | | | 14,168 | | | | (14,168 | ) | | | 2 | (e) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total assets | | € | 684,222 | | | € | 5,537 | | | | | | | € | 689,759 | | | $ | 788,188 | |

| | | | | | | | | | | | | | | | | | | | |

(continued on next page)

| | | | | | | | | | | | | | | | | | | | |

| (in thousands) | | Labels

IFRS

(Euro) | | | IFRS to

US GAAP

Adjustments and

Reclassifications

(Euro) | | | Footnote | | | Labels

US GAAP

(Euro) | | | Labels

US GAAP

(USD) | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | | | | | | | | | | | | | |

Current liabilities: | | | | | | | | | | | | | | | | | | | | |

Current portion of long-term debt | | € | — | | | € | 5,923 | | | | 2 | (g) | | € | 168,723 | | | $ | 192,800 | |

| | | | | | | 162,800 | | | | 2 | (i) | | | | | | | | |

Accounts payable | | | — | | | | 93,972 | | | | 2 | (a) | | | 100,032 | | | | 114,307 | |

| | | | | | | 6,060 | | | | 2 | (i) | | | | | | | | |

Accrued expenses and other liabilities | | | — | | | | 21,571 | | | | 2 | (i) | | | 30,196 | | | | 34,505 | |

| | | | | | | 8,625 | | | | 2 | (f) | | | | | | | | |

Provisions | | | 202 | | | | (202 | ) | | | 2 | (f) | | | — | | | | — | |

Interest-bearing financial liabilities | | | 5,923 | | | | (5,923 | ) | | | 2 | (g) | | | — | | | | — | |

Trade payables | | | 93,972 | | | | (93,972 | ) | | | 2 | (a) | | | — | | | | — | |

Tax liabilities | | | 8,423 | | | | (8,423 | ) | | | 2 | (f) | | | — | | | | — | |

Other current liabilities | | | 190,431 | | | | (190,431 | ) | | | 2 | (i) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total current liabilities | | | 298,951 | | | | — | | | | | | | | 298,951 | | | | 341,612 | |

Long-term debt | | | — | | | | 129,115 | | | | 2 | (g) | | | 129,115 | | | | 147,540 | |

Deferred income tax liabilities | | | 30,036 | | | | — | | | | | | | | 30,036 | | | | 34,322 | |

Other liabilities | | | 69,827 | | | | 904 | | | | 2 | (h) | | | 70,731 | | | | 80,824 | |

Provisions | | | 1,304 | | | | (400 | ) | | | 2 | (m) | | | — | | | | — | |

| | | | | | | (904 | ) | | | 2 | (h) | | | | | | | — | |

Interest-bearing financial liabilities | | | 129,115 | | | | (129,115 | ) | | | 2 | (g) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total liabilities | | | 529,233 | | | | (400 | ) | | | | | | | 528,833 | | | | 604,298 | |

Commitments and contingencies | | | | | | | | | | | | | | | | | | | | |

Shareholders’ equity: | | | | | | | | | | | | | | | | | | | | |

Preferred stock | | | — | | | | — | | | | | | | | — | | | | — | |

Common stock | | | — | | | | — | | | | | | | | — | | | | — | |

Paid-in capital | | | — | | | | — | | | | | | | | — | | | | — | |

Treasury stock | | | — | | | | — | | | | | | | | — | | | | — | |

Retained earnings | | | — | | | | — | | | | | | | | — | | | | — | |

Accumulated other comprehensive income | | | — | | | | 13,107 | | | | 2 | (j) | | | 13,107 | | | | 14,977 | |

Total invested equity attributable to Division LABELS | | | 130,286 | | | | (13,107 | ) | | | 2 | (j) | | | 115,754 | | | | 132,272 | |

| | | | | | | (1,825 | ) | | | 2 | (l) | | | | | | | | |

| | | | | | | 400 | | | | 2 | (m) | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Total stockholders’ equity attributable to Division LABELS | | | 130,286 | | | | (1,425 | ) | | | | | | | 128,861 | | | | 147,249 | |

Noncontrolling interests | | | 24,703 | | | | 7,362 | | | | 2 | (k) | | | 32,065 | | | | 36,641 | |

| | | | | | | | | | | | | | | | | | | | |

Total stockholders’ equity | | | 154,989 | | | | 5,937 | | | | | | | | 160,926 | | | | 183,890 | |

| | | | | | | | | | | | | | | | | | | | |

Total liabilities and stockholders’ equity | | € | 684,222 | | | € | 5,537 | | | | | | | € | 689,759 | | | $ | 788,188 | |

| | | | | | | | | | | | | | | | | | | | |

| 2(a) | To reclassify trade receivables and trade payables to accounts receivable, net of allowance and accounts payable, respectively. |

| 2(b) | To reclassify tax receivables to prepaid expenses. |

| 2(c) | To reclassify certain other receivables. Receivables between Constantia Labels and Constantia of €51,553 were reclassified to accounts receivable, net, and €3,383 of miscellaneous assets were reclassified to other current assets. |

| 2(d) | To reclassify tangible assets to property, plant and equipment, net of accumulated depreciation. |

| 2(e) | To reclassify other noncurrent and financial assets to othernon-current assets. |

| 2(f) | To reclassify current provisions and tax liabilities to accrued expenses and other liabilities. |

| 2(g) | To reclassify current and noncurrent interest-bearing financial liabilities to current portion of long-term debt and long-term debt, respectively. |

| 2(h) | To reclassify noncurrent provisions to other liabilities. |

| 2(i) | To reclassify other current liabilities to various accounts. Payables between Constantia Labels and Constantia of €6,060 were reclassified to accounts payable; €162,800 of loans between Constantia Labels and Constantia were reclassified to current portion of long-term debt; and the remaining balance of €21,571 was reclassified to accrued expenses and other liabilities. |

| 2(j) | To reclassify cumulative translation differences to accumulated other comprehensive income. |

| 2(k) | Represents an adjustment to noncontrolling interest to align IFRS with US GAAP. Upon making an acquisition, Constantia Labels accounted for noncontrolling interest at their proportionate share of the net identifiable assets of the acquiree at the acquisition date. Under US GAAP, noncontrolling interests must be recorded based on their fair value. The approximated difference between the proportionate value versus fair value was recorded to historical goodwill. |

| 2(l) | To eliminate capitalized development costs. Under IFRS, development costs can be capitalized under certain conditions; however, these costs do not qualify for capitalization under US GAAP and will be expensed as incurred. |

| 2(m) | Reflects the elimination of a noncurrent provision that was recognized for an onerous lease contract. Under IFRS, Constantia Labels recorded a provision on a contract for which the unavoidable costs of meeting the contractual obligations exceed the economic benefits expected to be received. Under US GAAP, provisions are generally not recognized for unfavorable contracts unless the entity has ceased using the rights under the contract. There is no adjustment to the unaudited pro forma combined statements of income as the provision was originally recorded prior to the periods being presented. |

Unaudited Labels Division Statement of Income presented in US GAAP for the Year Ended December 31, 2016 and the Twelve Months ended June 30, 2017

The following table reflects the adjustments made to Constantia Labels’ unaudited combined statements of income for the year ended December 31, 2016 to convert from IFRS to US GAAP and from Euro to U.S. dollars using a historical average exchange rate of $1.1070 to €1.00 from January 1, 2016 to December 31, 2016.

Unaudited Labels Division Statement of Income presented in US GAAP for the Year Ended December 31, 2016

| | | | | | | | | | | | | | | | | | | | |

| (In thousands except forper-share amounts) | | Labels

IFRS

(Euro) | | | IFRS to US GAAP

Adjustments and

Reclassifications

(Euro) | | | Footnote | | | Labels

US GAAP

(Euro) | | | Labels

US GAAP

(USD) | |

Net revenues | | € | 604,660 | | | € | — | | | | | | | € | 604,660 | | | $ | 669,359 | |

Cost of revenues | | | 493,726 | | | | — | | | | | | | | 493,726 | | | | 546,555 | |

| | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 110,934 | | | | — | | | | | | | | 110,934 | | | | 122,804 | |

Selling, general and administrative expenses | | | — | | | | 58,546 | | | | 2 | (n) | | | 58,546 | | | | 64,810 | |

Facility closure expenses | | | — | | | | — | | | | | | | | — | | | | — | |

Goodwill impairment | | | — | | | | — | | | | | | | | — | | | | — | |

Selling expenses | | | 30,639 | | | | (30,639 | ) | | | 2 | (n) | | | — | | | | — | |

Other income | | | (5,626 | ) | | | 5,626 | | | | 2 | (p) | | | — | | | | — | |

Other expenses | | | 2,312 | | | | (2,312 | ) | | | 2 | (p) | | | — | | | | — | |

Administration expenses | | | 26,166 | | | | (26,166 | ) | | | 2 | (n) | | | — | | | | — | |

Research and development expenses | | | 1,486 | | | | 255 | | | | 2 | (o) | | | — | | | | — | |

| | | | | | | (1,741 | ) | | | 2 | (n) | | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Operating income | | | 55,957 | | | | (3,569 | ) | | | | | | | 52,388 | | | | 57,994 | |

Interest expense | | | 19,296 | | | | — | | | | | | | | 19,296 | | | | 21,361 | |

Other expense (income), net | | | — | | | | (1,327 | ) | | | 2 | (p) | | | (1,327 | ) | | | (1,469 | ) |

Interest income | | | (289 | ) | | | 289 | | | | 2 | (p) | | | — | | | | — | |

Other financial expense (income) | | | 2,276 | | | | (2,276 | ) | | | 2 | (p) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Income before income taxes | | | 34,674 | | | | (255 | ) | | | | | | | 34,419 | | | | 38,102 | |

Income tax expense | | | 4,095 | | | | (64 | ) | | | 2 | (q) | | | 4,031 | | | | 4,462 | |

| | | | | | | | | | | | | | | | | | | | |

Net income | | | 30,579 | | | | (191 | ) | | | | | | | 30,388 | | | | 33,640 | |

Less: Net income attributable to noncontrolling interests | | | 7,425 | | | | — | | | | | | | | 7,425 | | | | 8,219 | |

| | | | | | | | | | | | | | | | | | | | |

Net income attributable to Division LABELS | | € | 23,154 | | | € | (191 | ) | | | | | | € | 22,963 | | | $ | 25,421 | |

| | | | | | | | | | | | | | | | | | | | |

The following table reflects the adjustments made to Constantia Labels’ unaudited combined statement of income for the twelve months ended June 30, 2017 to convert from IFRS to US GAAP and from Euro to U.S. dollars using a historical average exchange rate of $1.0901 to €1.00 from June 30, 2016 to June 30, 2017.

Unaudited Labels Division Statement of Income presented in US GAAP for the Twelve Months Ended June 30, 2017

| | | | | | | | | | | | | | | | | | | | |

| (In thousands except forper-share amounts) | | Labels

IFRS

(Euro) | | | IFRS to US GAAP

Adjustments and

Reclassifications

(Euro) | | | Footnote | | | Labels

US GAAP

(Euro) | | | Labels

US GAAP

(USD) | |

Net revenues | | € | 617,436 | | | € | — | | | | | | | € | 617,436 | | | $ | 673,067 | |

Cost of revenues | | | 502,312 | | | | — | | | | | | | | 502,312 | | | | 547,570 | |

| | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 115,124 | | | | — | | | | | | | | 115,124 | | | | 125,497 | |

Selling, general and administrative expenses | | | — | | | | 59,860 | | | | 2 | (n) | | | 59,860 | | | | 65,254 | |

Facility closure expenses | | | — | | | | — | | | | | | | | — | | | | — | |

Goodwill impairment | | | — | | | | — | | | | | | | | — | | | | — | |

Selling expenses | | | 31,631 | | | | (31,631 | ) | | | 2 | (n) | | | — | | | | — | |

Administration expenses | | | 26,346 | | | | (26,346 | ) | | | 2 | (n) | | | — | | | | — | |

Other income | | | (4,787 | ) | | | 4,787 | | | | 2 | (p) | | | — | | | | — | |

Other expenses | | | 2,799 | | | | (2,799 | ) | | | 2 | (p) | | | — | | | | — | |

Research and development expenses | | | 1,611 | | | | 272 | | | | 2 | (o) | | | — | | | | — | |

| | | | | | | (1,883 | ) | | | 2 | (n) | | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Operating income | | | 57,524 | | | | (2,260 | ) | | | | | | | 55,264 | | | | 60,243 | |

Interest expense | | | 20,536 | | | | — | | | | | | | | 20,536 | | | | 22,386 | |

Other expense (income), net | | | — | | | | (6,152 | ) | | | 2 | (p) | | | (6,152 | ) | | | (6,706 | ) |

Interest income | | | (305 | ) | | | 305 | | | | 2 | (p) | | | — | | | | — | |

Other financial expense (income) | | | (3,859 | ) | | | 3,859 | | | | 2 | (p) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |