UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No.)

Filed by the Registrant x |

Filed by a Party other than the Registrant o |

| Check the appropriate box: |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to Section 240.14a-12 |

Galaxy Nutritional Foods, Inc.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)| Payment of Filing Fee (Check the appropriate box): |

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

Dear Stockholder,

You are cordially invited to attend the Annual Meeting of Stockholders on Friday, January 18, 2008 at 10:00 a.m., Eastern Standard Time, at Galaxy's offices at 5955 T.G. Lee Blvd., Suite 201, Orlando, FL 32822.

The following Notice of Annual Meeting of Stockholders and Proxy Statement describe the formal business to be transacted at the Annual Meeting. During the Annual Meeting we will also report on our operations. Our 2007 Annual Report accompanies this Proxy Statement.

Whether or not you plan to attend the Annual Meeting, we hope you will vote as soon as possible. You may vote your proxy by mailing a completed proxy card or by voting over the telephone. Voting your proxy will ensure your representation at the Annual Meeting.

Sincerely,

| /s/ Michael E. Broll | |

| Michael E. Broll |

| Chief Executive Officer |

| December 14, 2007 |

GALAXY NUTRITIONAL FOODS, INC.

5955 T.G. Lee Blvd. Suite 201

Orlando, Florida 32822

(407) 855-5500

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD FRIDAY, JANUARY 18, 2008

To the Stockholders:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Galaxy Nutritional Foods, Inc. (“Galaxy” or the “Company”), will be held at 10:00 a.m., Eastern Standard Time, on Friday, January 18, 2008, at Galaxy's headquarters, located at 5955 T.G. Lee Blvd., Suite 201, Orlando, FL 32822 for the following purposes:

| 1. | To elect four directors, for a term of one year each, until the next Annual Meeting of Stockholders and until their successors are elected and qualified. |

| 2. | To ratify the retention of Cross, Fernandez and Riley, LLP as the independent registered public accounting firm of Galaxy for the fiscal year ending March 31, 2008. |

| 3. | To transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

The Board has fixed the close of business on December 3, 2007, as the record date (the "Record Date") for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and all adjourned meetings thereof.

| | BY ORDER OF THE BOARD OF DIRECTORS |

| | | |

| | | /s/ LeAnn Hitchcock |

| | | LeAnn Hitchcock |

| | | Corporate Secretary |

| Orlando, Florida | | |

| December 14, 2007 | | |

STOCKHOLDERS ARE REQUESTED TO VOTE YOUR SHARES BY PHONE OR BY SIGNING THE ENCLOSED PROXY CARD AND RETURNING IT IN THE ENCLOSED POSTAGE PREPAID ENVELOPE. IF YOU ATTEND THE MEETING, YOU MAY REVOKE YOUR PROXY AND VOTE IN PERSON.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION (“SEC”) NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED THIS TRANSACTION, PASSED UPON THE MERITS OR FAIRNESS OF THIS TRANSACTION, OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE INFORMATION CONTAINED IN THIS PROXY STATEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. TABLE OF CONTENTS

INFORMATION CONCERNING MEETING, VOTING AND SOLICITATION | | 1-2 |

| Time and Place | | 1 |

| Record Date | | 1 |

| Quorum and Required Vote | | 1 |

| Revoking Your Proxy | | 2 |

| Solicitation and Costs | | 2 |

| Information About Galaxy Nutritional Foods, Inc | | 2 |

| Questions | | 2 |

| | | |

CAUTIONARY NOTICE REGARDING FORWARD LOOKING STATEMENTS | | 3 |

| | | |

PROPOSAL NO. 1 – ELECTION OF DIRECTORS | | 4-5 |

| Board of Directors | | 4 |

| Communications with the Board | | 4 |

| Committees of the Board | | 4 |

| Nominees | | 4 |

| Vote Required for Election | | 5 |

| | | |

PROPOSAL NO. 2 – RATIFICATION OF THE RETENTION OF GALAXY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | 6-8 |

| Auditor’s Fees | | 6 |

| Audit Committee Pre-Approval Policies and Procedures | | 7 |

| Audit Committee Report | | 7 |

| Vote Required for Approval | | 8 |

| | | |

CORPORATE GOVERNANCE | | 9 |

| Director Independence | | 9 |

| Code of Ethics | | 9 |

| Standing Committees | | 9 |

| | | |

EXECUTIVES & COMPENSATION | | 10-19 |

| Directors, Executive Officers and Significant Employees | | 10 |

| Compensation Discussion and Analysis | | 11 |

| Summary Compensation Table | | 14 |

| Grants of Plan-Based Awards for Fiscal 2007 | | 15 |

| Outstanding Equity Awards at March 31, 2007 | | 16 |

| Option Exercises and Stock Vested for Fiscal 2007 | | 16 |

| Director Compensation for Fiscal 2007 | | 17 |

| Compensation Committee Interlocks and Insider Participation | | 18 |

| Other Related Party Transactions | | 19 |

| Review, Approval or Ratification of Transactions with Related Parties | | 20 |

| | | |

SECURITY OWNERSHIP AND RELATED STOCKHOLDER MATTERS | | 21-25 |

| Equity Compensation Plan Information | | 21 |

| Security Ownership of Certain Beneficial Owners | | 21 |

| Security Ownership of Management | | 23 |

| Change in Control | | 24 |

| Section 16(a) Beneficial Ownership Reporting Compliance | | 24 |

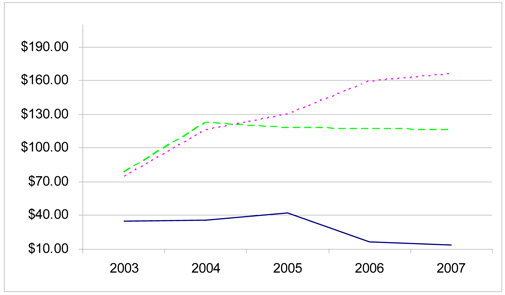

| Stock Performance Graph | | 25 |

| | | |

OTHER BUSINESS | | 26 |

| | | |

STOCKHOLDER PROPOSALS | | 26 |

| | | |

AVAILABLE INFORMATION | | 26 |

| | | |

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE | | 26 |

GALAXY NUTRITIONAL FOODS, INC.

2441 Viscount Row

Orlando, Florida 32822

PROXY STATEMENT

FOR

THE ANNUAL MEETING OF STOCKHOLDERS

to be held Friday, January 18, 2008

This proxy statement and the enclosed proxy card are first being mailed on or about December 21, 2007 to Galaxy’s stockholders entitled to vote at the Annual Meeting of Stockholders (the “Annual Meeting”). References in this proxy statement to “Galaxy”, “we”, “us”, “our’, or the “Company” refers to Galaxy Nutritional Foods, Inc., a Delaware corporation.

INFORMATION CONCERNING MEETING, VOTING AND SOLICITATION

TIME AND PLACE

The Annual Meeting will be held on Friday, January 18, 2008, at 10:00 a.m., Eastern Standard Time, at Galaxy’s headquarters, located at 5955 T.G. Lee Blvd Suite 201, Orlando, FL 32822.

RECORD DATE

Only stockholders of record at the close of business on December 3, 2007 (the "Record Date") are entitled to notice of and to vote at the Annual Meeting and any adjournment thereof. Each stockholder will be entitled to cast one vote for each Common Share then owned. As of the Record Date, there were 17,110,016 Common Shares representing an equal number of votes entitled to be cast at the Annual Meeting.

QUORUM AND REQUIRED VOTE

The presence at the Annual Meeting in person or by proxy of the holders of at least a majority of the issued and outstanding Common Shares as of the Record Date is necessary to establish a quorum to conduct business at the Annual Meeting. Each stockholder is entitled to cast one vote for each Common Share owned on the Record Date. Votes cast by proxy or in person at the Annual Meeting will be tabulated by an inspector of election appointed by the Board of Directors and will determine whether a quorum is present. At the Annual Meeting, we will be asking our stockholders to vote on a proposal 1) to elect certain directors; and 2) to ratify the retention of Cross, Fernandez, & Riley, LLP as the independent registered public accounting firm of Galaxy for the fiscal year ending March 31, 2008. Any stockholder given a proxy has the right to withhold authority for any named director or to vote for any individual nominee to the Board of Directors by writing that nominee's name in the space provided on the proxy.

Under Delaware law and our Certificate of Incorporation and Bylaws, the affirmative vote of only a majority of the votes cast at the Annual Meeting is necessary to approve Proposal No. 1 - Election of Directors and Proposal No. 2 - Ratification of the Retention of Galaxy’s Independent Registered Public Accounting Firm.

The Board urges you to vote your Common Shares by phone or by completing, dating and signing the enclosed proxy card and to returning it promptly in the enclosed postage prepaid envelope so that a quorum can be assured for the Annual Meeting and your Common Shares can be voted as you wish.

Stockholders holding Common Shares in "street name" should review the information provided to them by their nominee (such as a broker or bank). This information will describe the procedures to follow to instruct the nominee how to vote the street name shares and how to revoke previously given instructions.

Broker non-votes and abstentions are counted toward the establishment of a quorum for the Annual Meeting. Unless revoked, all properly executed proxies will be voted as specified. Proxies that are signed but that lack any specification will be voted “FOR” Proposal No. 1 - Election of Directors and Proposal No. 2 - Ratification of the Retention of Galaxy’s Independent Registered Public Accounting Firm.

The enclosed proxy, when properly signed, also confers discretionary authority with respect to other matters which may be properly brought before the Annual Meeting and of which the management was not aware prior to December 3, 2007, the last date that Galaxy considers to be a reasonable time prior to the mailing date for submitting stockholder proposals under the SEC's shareholder proposal rules. At the time of printing this Proxy Statement, the management of Galaxy is not aware of any other matters to be presented for action at the Annual Meeting. If, however, other matters which are not now known to the management should properly come before the Annual Meeting, the proxies hereby solicited will be exercised on such matters in accordance with the best judgment of the proxy holders. Common Shares represented by executed and unrevoked proxies will be voted in accordance with the instructions contained therein or, in the absence of such instructions, in accordance with the recommendations of the Board.

REVOKING YOUR PROXY

You may revoke your proxy by either (i) submitting a later dated proxy or a written revocation to the attention of LeAnn C. Hitchcock, Corporate Secretary, on or before January 17, 2008, or (ii) by attending the Annual Meeting and voting in person or giving notice of revocation in open meeting before the proxy is exercised. Attending the Annual Meeting will not, by itself, revoke a proxy.

SOLICITATION AND COSTS

The enclosed proxy is made by and solicited on behalf of our Board of Directors. Proxies may be solicited by the directors, officers and other employees of Galaxy, in person or by telephone, telegraph or mail only for use at the Annual Meeting. Galaxy will bear the costs of preparing, assembling, printing and mailing this Proxy Statement and the enclosed proxy and all other costs of the Board's solicitation of Proxies for the Annual Meeting. Brokerage houses and other nominees, fiduciaries, and custodians nominally holding Common Shares as of the Record Date will be requested to forward proxy soliciting material to the beneficial owners of such Common Shares, and will be reimbursed by us for their reasonable expenses.

INFORMATION ABOUT GALAXY NUTRITIONAL FOODS, INC.

Galaxy is principally engaged in developing and globally marketing plant-based cheese alternatives, organic dairy and other organic and natural food products to grocery and natural foods retailers, mass merchandisers and foodservice accounts. Veggie, the leading brand in the grocery cheese alternative category and Galaxy’s top selling product group, is primarily merchandised in the produce section and provides calcium and protein without cholesterol, saturated fat or trans-fat. Other popular brands include: Rice, Veggy, Vegan, Rice Vegan and Wholesome Valley. We are dedicated to developing nutritious and delicious food products made with high quality natural ingredients that exceed the expectations of today’s health conscious consumers.

QUESTIONS

If you have any questions about the Annual Meeting or the proposals to be voted on at the Annual Meeting, or if you need assistance with regard to voting your shares or need additional copies of this proxy statement or copies of any of our public filings referred to in this proxy statement, please contact our investor relations department at:

Galaxy Nutritional Foods, Inc.

5955 T.G. Lee Blvd., Suite 201

Orlando, Florida 32822

Attention: Investor Relations

Telephone No.: (407) 855-5500

Facsimile No.: (407) 855-1099

Our public filings can also be accessed at the SEC’s website at www.sec.gov.

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

When used in this Proxy Statement the words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “seek,” “project,” “estimate,” “may,” “will,” “could,” “should,” “potential,” or “continue” or the negative or variations of these words or similar expressions are intended to identify "forward-looking statements." Such statements are subject to certain risks and uncertainties that could cause actual results to differ materially from results presently anticipated or projected. Forward-looking statements in this report are not based on historical facts, but rather reflect the current expectations of our management concerning future results and events. It should be noted that the protections provided by Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934, do not apply to the discussions in this Proxy Statement related to the "going private" transaction being submitted to the stockholders at the Annual Meeting. We have attempted to qualify our forward-looking statements with appropriate cautionary language to take advantage of the judicially created doctrine of "bespeaks caution" and other protections. Galaxy cautions you not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Galaxy advises readers that Galaxy’s actual results may differ materially from any opinions or statements expressed with respect to future periods in any current statements in this Proxy Statement or in our other filings with the SEC.

We do not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions, which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

Please see the section of this Proxy Statement entitled "Available Information."

PROPOSAL NO. 1 - ELECTION OF DIRECTORS

BOARD OF DIRECTORS

The primary responsibility of the Board of Directors (the “Board”) is to foster the long-term success of Galaxy, consistent with its fiduciary duty to the stockholders. The Board has responsibility for establishing broad corporate policies, setting strategic direction, and overseeing management, which is responsible for the day-to-day operations of Galaxy. In fulfilling this role, each director must exercise his good faith business judgment of the best interests of Galaxy. We do not have a policy regarding Board members’ attendance at our Annual Meeting of Stockholders, but we do encourage all Board members to attend the Annual Stockholders’ Meeting. All Board members attended the last Annual Meeting of Stockholders held on September 29, 2006. The Board typically holds regular meetings throughout the year and special meetings are held when necessary. The Board met, or took written action in lieu of a meeting, thirteen times during the fiscal year ended March 31, 2007, and each director attended at least 75% of these meetings.

COMMUNICATIONS WITH THE BOARD

Stockholders who wish to communicate with the Board may do so by writing to Non-Management Directors, Board of Directors, Galaxy Nutritional Foods, Inc. 5955 T.G. Lee Blvd., Suite 201, Orlando, FL 32822 Attention: Corporate Secretary. The non-management directors have established procedures for the handling of communications from stockholders and directed the Corporate Secretary to act as their agent in processing any communications received. All communications that relate to matters that are within the scope of the responsibilities of the Board are to be forwarded to the non-management directors. Communications that relate to ordinary business matters that are not within the scope of the Board's responsibilities, such as consumer complaints, are to be sent to the appropriate executive. Solicitations, junk mail and obviously frivolous or inappropriate communications are not to be forwarded, but will be made available to any non-management director who wishes to review them.

COMMITTEES OF THE BOARD

Since January 2006, the Board maintains no separate standing committees. The functions of the audit committee, compensation committee and nominating committee are being carried out by the entire Board. Any issues that arise are addressed by the independent directors or the entire Board, as necessary. All directors were present for at least 75% of any meetings requiring functions of the committees.

On November 15, 2004, the Board determined that it would not establish a formal nominating committee and it adopted certain procedural guidelines for director nominations. All directors participate in the consideration and selection of director nominees. There have been no material changes to these procedures since their adoption in fiscal 2005.

The Board has adopted corporate governance guidelines and charters for its audit and compensation committee functions and a code of business conduct and ethics that applies to the members of its Board. All of these materials may be acquired free of charge by requesting a copy by writing to: Corporate Secretary, Galaxy Nutritional Foods, Inc. 5955 T.G. Lee Blvd., Suite 201, Orlando, FL 32822 or visiting Galaxy’s website at www.galaxyfoods.com.

Audit Committee

The functions of the audit committee are being carried out by the entire Board. Any issues that arise are addressed by the independent directors or the entire Board, as necessary. On August 17, 2006, the Board resolved that when the Board acts in the capacity of the audit committee, Mr. Robert S. Mohel would serve as the Audit Committee Chairman. Mr. Mohel was determined to be an "audit committee financial expert" within the meaning of the SEC regulations based on his experience as a practicing Certified Public Accountant.

Compensation Committee

Since January 2006, the Board has been operating without a formal compensation committee. Any issues that arise are addressed by the independent directors or the entire Board, as necessary. The Board evaluates and determines compensation for the Chief Executive Officer and then grants the Chief Executive Officer discretionary authority to evaluate and determine compensation for the other employees of Galaxy.

NOMINEES

Our Board is currently comprised of four members. It is proposed that the four directors presented hereon be elected to hold office until the next Annual Meeting of Stockholders and until their successors have been elected and qualified.

All of the nominees are currently serving as directors of Galaxy, all have consented to being named herein and all have indicated their intention to serve as our directors, if elected. Mr. Lipka agreed to serve as a director of Galaxy at the request of Frederick A. DeLuca, a beneficial owner of more than 50% of Galaxy’s common stock. Both Mr. Lipka and Mr. DeLuca are members of the Board of Directors of Doctors Associates, Inc. The Board determined that each of the following nominees for director is independent as defined within the listing standards of the AMEX: Peter J. Jungsberger and Robert S. Mohel.

The nominees for the Board of Directors and certain information about them are set forth below:

DAVID H. LIPKA |

| Age: | 77 |

| First Elected: | 2002 |

| Experience: | Galaxy Nutritional Foods, Inc. - Chairman of the Board of Directors (Aug. 2003-present); Director of Doctors Associates, Inc. (Subway Stores) and consultant to SCIS Food Services Co. (2001-present); DCA Food Industries – various management positions including President & Chief Executive Officer (1955-1995). |

| Other Directorships: | Doctors Associates, Inc., Sublink Acquisition LLC |

| | |

MICHAEL E. BROLL |

| Age: | 59 |

| First Elected: | 2003 |

| Experience: | Galaxy Nutritional Foods, Inc. - Chief Executive Officer (July 2004-present); Chef Solutions Inc., a subsidiary of Lufthansa Service Group - President and CEO (1999 to 2002); Allied-Domecq Retailing - head of its total supply chain for North America (1997 to 1999); Ready Pac Produce, Inc. - President and COO (1995 to 1997); Nestle USA - head of all supply chains for the chilled food group in North America (1993 to 1995); Pillsbury Company - Vice President of Operations for the bakery group supply chain (1991 to 1993) |

| Other Directorships: | None |

| | |

PETER J. JUNGSBERGER |

| Age: | 40 |

| First Elected: | 2006 |

| Experience: | Futuristic Foods, Inc. – consultant (2003-2006); SCIS Food Services, Inc./ Chef Solutions, Inc. – Vice President of Sales (2002-2003); Landau Foods – Founder & CEO (1984-2002). |

| Other Directorships: | None |

| | |

ROBERT S. MOHEL, CPA |

| Age: | 53 |

| First Elected: | 2006 |

| Experience: | Mohel, Elliott, Bauer & Gass CPA’s, P.A. – partner (June 1980-present). |

| Other Directorships: | None |

VOTE REQUIRED FOR ELECTION

The affirmative vote of the holders of a majority of outstanding shares of common stock present or represented at the Annual Meeting is required for the election of each of the nominees named above. Unless you specify otherwise, your proxy will be voted “FOR” the election of the nominees named above, all of whom are now directors. Abstentions, broker non-votes, and instructions on the accompanying proxy card to withhold authority to vote for one or more of the nominees will result in the respective nominees receiving fewer votes. If any nominee becomes unavailable, your proxy will be voted for a new nominee designated by the Board unless the Board reduces the number of directors to be elected. The Board knows of no reason why any nominee should be unable or unwilling to serve, but if such be the case, proxies will be voted for the election of some other person. In no event, however, shall the proxies be voted for a greater number of persons than the number of nominees named.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES DESCRIBED ABOVE.

| PROPOSAL NO. 2 - | TO RATIFY THE RETENTION OF CROSS, FERNANDEZ & RILEY, LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM OF GALAXY FOR THE FISCAL YEAR ENDING MARCH 31, 2008. |

On July 18, 2006, the Board selected Cross, Fernandez & Riley, LLP (“CFR”), an independent member of the BDO Seidman Alliance network of firms, as the new independent accountant to audit the registrant’s financial statements. Certain employees of CFR were previously contracted by BDO Seidman, LLP (our former independent accountant) to perform audit work on Galaxy for the fiscal years ended March 31, 2006 and 2005. Approximately 55% and 75% of the total hours spent by the auditors in carrying out the audit of our financial statements for the fiscal years ended March 31, 2006 and 2005, respectively, were spent by CFR. All audit work conducted by CFR was reviewed by BDO Seidman. Other than communications in connection with the audit work performed by CFR for these periods and prior to July 18, 2006, there were no discussions between Galaxy and CFR regarding the application of accounting principles to specific completed or contemplated transactions, or the type of audit opinion that might be rendered on our financial statements. Furthermore, other than communications in connection with the audit work performed by CFR, no written or oral advice was provided by CFR that was an important factor considered by Galaxy in reaching a decision as to any accounting, auditing or financial reporting issue. Other than in connection with the audit work for the fiscal years ended March 31, 2006 and 2005, we have not consulted with CFR regarding any matter that was either the subject of a disagreement (as defined in paragraph (a)(1)(iv) of Item 304 of Regulation S-K and the related instructions to this item) or a reportable event (as described in paragraph (a)(1)(v) of Item 304 of Regulation S-K).

We expect that a representative of CFR will be present during the Annual Meeting. The representative will have an opportunity to make a statement if he or she so desires and is expected to be available to respond to appropriate questions from stockholders.

AUDITOR’S FEES

Audit Fees

With respect to the fiscal year ended March 31, 2007, the aggregate fees (including expenses) charged to Galaxy by CFR for auditing the annual financial statements and reviewing interim financial statements were $100,065. With respect to the fiscal years ended March 31, 2007 and 2006, the aggregate fees (including expenses) charged to Galaxy by BDO Seidman, LLP for auditing the annual financial statements and reviewing interim financial statements were $2,800 and $276,022, respectively. Audit fees consist of those fees incurred in connection with statutory and regulatory filings or engagements; fees necessary to perform an audit or review in accordance with Generally Accepted Auditing Standards; and services that generally only an independent accountant reasonably can provide, such as comfort letters, statutory audits, attest services, consents and assistance with and review of documents filed with the SEC. These fees also include charges for the review and responses to SEC comment letters, accounting research in connection with the audit and audit committee meeting attendance.

Approximately 55% of the total hours spent by the auditors in carrying out the audit of our financial statements for the fiscal year ended March 31, 2006 were spent by CFR. CFR and its employees are not full-time, permanent employees of BDO Seidman, LLP.

Audit-Related Fees

During the fiscal years ended March 31, 2007 and 2006, CFR charged Galaxy $10,500 and $8,280, respectively. BDO Seidman, LLP charged Galaxy $6,468 and $6,313 during the fiscal years ended March 31, 2007 and 2006, respectively. Audit-related fees consist of the fees for auditing our 401k plan, due diligence procedures and research and consultation on proposed transactions.

Tax Fees

CFR prepared our annual federal and state income tax returns and assisted Galaxy in some additional tax research. During each of the fiscal years ended March 31, 2007 and 2006, CFR charged Galaxy $8,767 and $8,418, respectively for these services. BDO Seidman, LLP did not render any tax services during the fiscal years ended March 31, 2007 and 2006.

All Other Fees

There were no fees for other services charged to Galaxy by CFR or BDO Seidman, LLP during the fiscal years ended March 31, 2007 and 2006.

AUDIT COMMITTEE PRE-APPROVAL POLICIES AND PROCEDURES

The Audit Committee's pre-approval policy is as follows:

| | · | The Audit Committee will review and pre-approve on an annual basis any known audit, audit-related, tax and all other services, along with acceptable cost levels, to be performed by any audit firm. The Audit Committee may revise the pre-approved services during the period based on subsequent determinations. Pre-approved services typically include: statutory audits, quarterly reviews, regulatory filing requirements, consultation on new accounting and disclosure standards, employee benefit plan audits, reviews and reporting on our internal controls and specified tax matters. |

| | · | Any proposed service that is not pre-approved on an annual basis requires a specific pre-approval by the Audit Committee, including cost level approval. |

| | · | The Audit Committee may delegate pre-approval authority to the Audit Committee chairman. The chairman must report to the Audit Committee, at the next Audit Committee meeting, any pre-approval decisions made. |

Since January 2006, the Board has been fulfilling the function of the audit committee. On August 17, 2006, the Board resolved that when the Board acts in the capacity of the audit committee, Mr. Robert S. Mohel would serve as the Audit Committee Chairman. Mr. Mohel was determined to be an "audit committee financial expert" within the meaning of the regulations of the SEC based on his experience as a practicing Certified Public Accountant. As a company quoted on the OTC Bulletin Board, we are not subject to any independence standards. However, we strive to have a Board comprised of at least 50% independent directors. The Board considers Mr. Jungsberger and Mr. Mohel to be independent directors as neither of them receive compensation from Galaxy other than for their services on the Board of Directors. It is the Board's intent that if issues arise that require action be taken by independent directors, those issues will be addressed by the independent directors of the Board as necessary.

The Audit Committee is responsible for approving all engagements to perform audit or non-audit services prior to Galaxy’s engaging CFR or BDO Seidman, LLP. All of the services under the headings Audit Fees, Audit-Related Fees, Tax Fees, and All Other Fees were approved by the Audit Committee pursuant to Rule 2-01 paragraph (c)(7)(i)(C) of Regulation S-X of the Exchange Act.

The Audit Committee considered and determined that CFR’s and BDO Seidman, LLP’s provision of non-audit services to Galaxy during the fiscal years ended March 31, 2007 and 2006 is compatible with maintaining their independence.

AUDIT COMMITTEE REPORT FOR FISCAL YEAR ENDED MARCH 31, 2007

The Board as the Audit Committee operates under a written charter, which sets forth its responsibilities and duties, as well as requirements for the Committee’s composition and meetings. The Board as the Audit Committee held four telephonic meetings during the fiscal year ended March 31, 2007 and all Board members were in attendance for at least 75% of these meetings.

Since January 2006, the Board has been fulfilling the function of the audit committee. It is the Board's intent that if issues arise that require action be taken by independent directors, those issues will be addressed by the remaining independent directors of the Board as necessary. At each of the meetings, the Board reviewed and discussed the audited and non-audited financial statements, various business risks of Galaxy, financial management, accounting, and internal control issues with the Chief Financial Officer, the Internal Auditor, and CFR.

In each of its quarterly and annual meetings with representatives from CFR, Galaxy’s independent registered public accounting firm, the Board had them address the following issues:

| | · | Are the significant judgments and accounting estimates made by management in preparing the financial statements appropriate? |

| | · | Based on the auditor’s experience, and their knowledge of Galaxy, do Galaxy’s financial statements fairly present to investors, Galaxy’s financial position and performance for the reporting period in accordance with generally accepted accounting principles and SEC disclosure requirements? |

| | · | Based on the auditor’s experience, and their knowledge of Galaxy, has Galaxy implemented sufficient internal controls that are appropriate? |

| | · | During the reporting period, have there been any disagreements with management or have the auditors received any communication indicating any improprieties with respect to Galaxy’s management, accounting and reporting procedures or reports? |

The Board discussed with its independent registered public accounting firm the relationship by which they are retained by the Board and are required to raise any concerns about Galaxy’s management or financial reporting and procedures directly with the Board. In this context, the Board discussed with the independent public accounting firm the matters required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees, as amended.

The Board received from CFR the written disclosures and the letter required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, and the Board discussed with CFR that firm’s independence. The Board concluded that CFR is independent from Galaxy and its management.

Based on the Board’s review and discussions with Galaxy’s management, CFR and BDO Seidman, LLP, the Board recommended that Galaxy’s audited financial statements for Galaxy be included in Galaxy’s Annual Report on Form 10-K for the fiscal year ended March 31, 2007 to be filed with the Securities Exchange Commission.

The Audit Committee reviewed and discussed the fees paid to CFR and BDO Seidman, LLP during fiscal 2007 for audit, audit-related, tax and other services, and determined that the provision of non-audit services is compatible with CFR’s and BDO Seidman, LLP’s independence.

Respectively submitted by the members of the Board of Directors on December 10, 2007:

|

| Michael E. Broll |

|

| Robert S. Mohel |

VOTE REQUIRED FOR APPROVAL

The affirmative vote of the holders of a majority of outstanding shares of common stock present or represented at the Annual Meeting is required for the approval of this proposal. In accordance with Delaware law, abstentions will be counted for purposes of determining both whether a quorum is present at the meeting and the total number of shares represented and voting on this proposal. While broker non-votes will be counted for purposes of determining the presence or absence of a quorum, broker non-votes will not be counted for purposes of determining the number of shares represented and voting with respect to the particular proposal on which the broker has expressly not voted and, accordingly, will not affect the approval of this proposal.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE "FOR" THE RETENTION OF CROSS, FERNANDEZ & RILEY, LLP AS GALAXY'S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE CURRENT FISCAL YEAR.

CORPORATE GOVERNANCE

DIRECTOR INDEPENDENCE

Our Board is responsible for overseeing and interacting with senior management with respect to key aspects of our business, including strategic planning, management development and succession, operating performance, compliance and stockholder returns. It is the responsibility of the Board to select and evaluate a well-qualified Chief Executive Officer of high integrity, and to approve the appointment of other members of the senior management team. The Board provides general advice and counsel to our Chief Executive Officer and other senior executives.

As of December 10, 2007, the Board is comprised of the four positions. The current members of the Board are David H. Lipka, Michael E. Broll, Peter J. Jungsberger and Robert S. Mohel.

The Board typically holds regular meetings throughout the year and special meetings are held when necessary. We do not have a policy with regard to directors' attendance at Annual Meetings of Stockholders. However, the members of the Board typically attend the Annual Meeting of Stockholders, unless an emergency prevents them from doing so, and an organizational meeting follows immediately thereafter. All Board members attended the last Annual Meeting of Stockholders held on September 29, 2006. The Board of Directors met thirteen times during the fiscal year ended March 31, 2007, and each director attended at least 75% of these meetings.

As a company quoted on the OTC Bulletin Board, we are not subject to any independence standards. However, we strive to have a Board comprised of at least 50% independent directors. The Board considers Mr. Jungsberger and Mr. Mohel as independent directors. Mr. Broll is not an independent director due to his status as an employee of Galaxy and Mr. Lipka is not an independent director due to his annual compensation of $120,000 for his service as Chairman of the Board. During the fiscal year ended March 31, 2007, Mr. M.A. Patrice Videlier was a director until his resignation on May 2, 2006, Ms. Joanne Bethlahmy was a director until her resignation on July 20, 2006 and Mr. Angelo S. Morini was a director until his resignation on March 8, 2007. Mr. Videlier and Ms. Bethlahmy were considered independent directors. Mr. Morini was not considered independent due to his former position as an employee of Galaxy and payments he is receiving under the terms of his employment agreement.

CODE OF ETHICS

We have adopted a Code of Ethics as defined in Item 406 of Regulation S-K promulgated under the Securities Act of 1933, as amended, which code applies to all of our directors and employees, including our principal executive officer, principal financial officer, principal accounting officer and persons performing similar functions. We recently updated our Code of Ethics and have filed the revision as Exhibit 14.1 to our Annual Report on Form 10-K. Additionally, we have adopted corporate governance guidelines and charters for our Audit and Compensation Committees. All of these materials are available free of charge on our website at www.galaxyfoods.com or by requesting a copy by writing to: Corporate Secretary, Galaxy Nutritional Foods, Inc. 5955 T.G. Lee Blvd., Suite 201, Orlando, FL 32822.

STANDING COMMITTEES

Since January 2006, the Board maintains no separate standing committees. The functions of the audit committee, compensation committee and nominating committee are being carried out by the entire Board. Any issues that arise are addressed by the independent directors or the entire Board, as necessary.

On August 17, 2006, the Board resolved that when the Board acts in the capacity of the audit committee, Mr. Robert S. Mohel would serve as the Audit Committee Chairman. Mr. Mohel was determined to be an "audit committee financial expert" within the meaning of the SEC regulations based on his experience as a practicing Certified Public Accountant.

On November 15, 2004, the Board determined that it would not establish a formal nominating committee and it adopted certain procedural guidelines for director nominations. All directors participate in the consideration and selection of director nominees. There have been no material changes to these procedures since their adoption in fiscal 2005.

EXECUTIVES & COMPENSATION

DIRECTORS, EXECUTIVE OFFICERS AND SIGNIFICANT EMPLOYEES

The following table sets forth the current directors, executive officers and significant employees of Galaxy as of December 10, 2007, as well as their respective ages and positions with Galaxy:

Name | | Age | | Positions | |

| David H. Lipka | | | 78 | | | Director, Chairman of the Board of Directors | |

| Michael E. Broll | | | 59 | | | Director, Chief Executive Officer | |

| Peter J. Jungsberger | | | 40 | | | Director | |

| Robert S. Mohel | | | 54 | | | Director, Chairman of the Audit Committee | |

| Salvatore J. Furnari | | | 42 | | | Chief Financial Officer, Senior V.P. of Finance | |

| John W. Jackson | | | 49 | | | Senior Vice President of Global Sales | |

| Thomas J. Perno | | | 53 | | | Vice President of Contract Manufacturing | |

| Kulbir Sabharwal | | | 64 | | | Vice President of Technical Services | |

| Hilary Taube | | | 35 | | | Vice President of Marketing | |

The Board of Directors (the “Board”) is comprised of the four members. Three of the four directors are non-employee directors. The Chairman of the Board and the directors hold office until the next Annual Meeting of Stockholders and until their successors have been duly elected and qualified. The executive officers of Galaxy are elected annually at the first Board meeting following the Annual Meeting of Stockholders, and hold office until their respective successors are duly elected and qualified, unless sooner displaced. There are no family relationships between any of our directors and executive officers. All of the executive officers devote their full time to the operations of Galaxy.

Since January 2006, the Board has been fulfilling the function of the audit committee, compensation committee and nominating committee. Any issues that arise are addressed by the independent directors or the entire Board, as necessary.

Directors

David H. Lipka spent forty years (1955-1995) with DCA Food Industries Inc., an international manufacturer of food ingredients and equipment with combined sales in excess of $1 billion per annum, holding positions of President, Chief Executive Officer, and Chief Operating Officer. Since 2001, Mr. Lipka served on the Board of Directors of Doctor's Associates Inc. (Subway Stores) and has served on numerous boards including Corinthian Capital Partners LLC (2006-current), Dunkin Donuts Inc. (1989-1994), Allied-Lyons Inc. (1988-1994), and Kerry Group PLC (1995-1996). Mr. Lipka is currently the Chief Executive Officer of Sub K LLC. Mr. Lipka has also been Chairman and Chief Executive Officer of Pennant Foods and Leons Baking Company. He obtained a B.S. degree from Brooklyn College and attended the Graduate School of Business at New York University. Since December 2002, Mr. Lipka has agreed to serve as a director of Galaxy at the request of Frederick A. DeLuca, a beneficial owner of more than 50% of our common stock. Both Mr. Lipka and Mr. DeLuca are members of the Board of Directors of Doctor’s Associates Inc.

Michael E. Broll was appointed as a director of Galaxy in December 2003 and as Chief Executive Officer of Galaxy in July 2004. Mr. Broll has been a private investor and consultant in the food industry, and was President and Chief Executive Officer, from 1999 to 2002, of Chef Solutions Inc., a subsidiary of Lufthansa Service Group (“LSG”). Chef Solutions Inc specialized in providing convenient baked foods and prepared meals to food service and retail segments of the food industry. As an executive of SCIS/Sky Chef’s a subsidiary of ONEX Corporation, a Canadian based private equity group, Mr. Broll assembled a group of six companies in the bakery and prepared food business to ultimately form and merge into a one new entity called Chef Solutions Inc., an ONEX controlled company. Chef Solutions Inc. was subsequently sold to LSG in 2001. Mr. Broll's career also includes major executive assignments with Allied-Domecq Retailing as the head of its total supply chain for North America from 1997 to 1999, Ready Pac Produce, Inc. as President and Chief Operating Officer from 1995 to 1997, Nestle USA as the head of all supply chains for the chilled food group in North America from 1993 to 1995, and Pillsbury Company as Vice President of Operations for the bakery group supply chain from 1991 to 1993. Mr. Broll received his B.S. in Economics from the University of Illinois in 1978.

Peter J. Jungsberger is an independent investor, consultant and entrepreneur with many years of experience in the food industry. From October 2003 to November 2004, he worked with the management of Fresh Pack Foods, Inc. in product development, the restructuring of deli departments, and obtaining contracts with a major grocery chain and manufacturers involving fresh food and whole meal replacement products. From May 2003 to January 2006, Mr. Jungsberger developed and marketed whole meal products to Winn Dixie under a contract with Futuristic Foods, Inc. He served as Senior Vice President of Sales at SCIS Food Services, Inc. / Chef Solutions, Inc. from May 2002 through January 2003, where he increased revenues and realized significant savings through a realignment of the sales force, route consolidation, the implementation of second-tier distribution networks, and the facilitation of a national presence. Mr. Jungsberger was also founder and Chief Executive Officer of Landau Foods, an innovative company producing high quality meal solution products for the retail and food service markets, from 1984 until the company was sold to SCIS Food Services in 2002. Mr. Jungsberger was appointed as a director of Galaxy in August 2006.

Robert S. Mohel, C.P.A., has been a practicing accountant since September 1975. He has been a partner with the Certified Public Accounting firm of Mohel, Elliott, Bauer & Gass CPA’s, P.A. since 1980. He has extensive experience in auditing, tax, structural finance and general accounting. Mr. Mohel is a member of the American Institute of Certified Public Accountants and the New Jersey Society of Certified Public Accountants. Mr. Mohel received his B.S. in Business Administration from Babson College in Wellesley, MA in 1975. Mr. Mohel was appointed as a director of Galaxy in August 2006.

Executive Officers

Salvatore J. Furnari, CPA was appointed as our Chief Financial Officer in July 2002. From November 2001 until July 2002, Mr. Furnari served as our Controller. Prior to joining Galaxy, Mr. Furnari was Corporate Controller and Treasurer of Pritchard Industries, Inc., a national commercial cleaning company. From 1998 through 1999, he served as Chief Financial Officer and Vice President of Finance for Garage Management Corporation; and from 1993 until 1998, he was Chief Financial Officer of American Asset Corporation. Mr. Furnari received his B.S. in Accounting from Queens College in New York City in May 1987.

John W. Jackson has worked in our sales department since 1993 and is currently the Senior Vice President of Global Sales for Galaxy. From 1985 through 1992, Mr. Jackson was director of sales for H.J. Heinz Company. Mr. Jackson received his B.S. in Business Administration and Accounting from Mars Hill College in 1980.

Significant Employees

Thomas J. Perno has worked for Galaxy since 1983. He began as a Shipping and Receiving Supervisor, he was later promoted to Plant Manager and then to Vice President of Operations. In December 2006, his position changed to Vice President of Contract Manufacturing. Mr. Perno received his M.S. in Electrical Engineering from Penn State University in 1976.

Kulbir Sabharwal has been Vice President of Technical Services for Galaxy since 1991. Dr. Sabharwal worked as the Director of Research and Quality Control for Gilardies Frozen Foods from 1987 to 1990 and for Fisher Cheese Company from 1972 to 1986. Dr. Sabharwal received his Ph.D. in Food Science and Nutrition from Ohio State University in 1972.

Hilary Taube was named Vice President of Marketing in May 2007. Ms. Taube has worked for Galaxy since 2005. Previously, she was Product Manager in the Kitchen Division at The Holmes Group, based in Massachusetts, where she managed a variety of new product development projects for brand re-launch and spearheaded packaging, sales collateral and marketing activities related to the repositioning of key brands. Ms. Taube has extensive experience with market research, including focus groups and one-on-one interviews. Before joining The Holmes Group, she was Product Manager at Webster Industries. Ms. Taube obtained a B.S. in Business Management and Marketing from Cornell University in 1995 and earned an M.B.A from the F.W. Olin Graduate School of Business at Babson College in 2001.

COMPENSATION DISCUSSION AND ANALYSIS

The following is a discussion of our program for compensation of our executive officers and directors. As of December 10, 2007, we do not have a compensation committee, and as such, our Board is responsible for determining our compensation program.

Compensation Program Objectives

Our Board determines the compensation program provided to our Chief Executive Officer in its sole discretion. The Chief Executive Officer then determines the compensation provided to other executive officers and employees of Galaxy. Our executive compensation program is designed to attract and retain talented executives to meet our short-term and long-term business objectives with a package that is fair and equitable to all parties involved. In doing so, we attempt to align our executives' interests with the interests of our stockholders by providing an adequate compensation package to such executives. This executive compensation package typically includes a (i) base salary, which we believe is competitive with other companies of our relative size; (ii) performance bonuses, (iii) stock options or stock awards; (iv) auto allowances; and (v) other standard employee benefits. In December 2007, the Board also adopted a 2007 Stay, Severance and Sales Bonus Plan (“the Plan”).

Base Salary

The base salary component of our compensation program is intended to compensate our senior executives for their job responsibilities and allows us to attract and retain top talent, consistent with our objectives. Base salaries are reviewed annually by the Board. Adjustments are made based on the qualifications and experience of the executive, the performance of the executive, recommendations from the Chief Executive Officer for all executives except himself and the performance of Galaxy. The Board separately reviews the performance of the Chief Executive Officer, as described above, and makes adjustments as warranted. Due to significant working capital deficiencies in the past, our executive officers did not receive any base salary increases in the past three fiscal years.

Performance Bonuses

Annual bonuses are largely based on Galaxy’s and executive performance. Currently, there are no specific strategic, financial and operating performance measures upon which the performance bonus is calculated. Rather the Board reviews the financial condition of Galaxy along with the performance of the executive during the year and recommends a bonus amount or pool that can be distributed among the employees. As we have had significant working capital deficiencies in the past, our executive officers received minimal, if any, bonuses during the fiscal years ended March 31, 2006 and 2005. As a result of the vast improvements in operations and cash flows in fiscal 2007, the Board recommended a bonus pool of $250,000 for the fiscal year ended March 31, 2007. We did not distribute $37,475 from the bonus pool, but this remaining amount will be used for future bonus recommendations.

Stock Options or Stock Awards

We grant certain options to our executive and non-executive employees and directors as part of our compensation package. This package may include short-term and long-term stock-based compensation to certain executives which is intended to align the performance of our executives with our short and long-term business strategies. Typically, stock options are issued with an exercise price at or above the current market value of our common stock. Accordingly, they have minimal current value. However, there is consideration related to the fact that the option has the potential for an appreciated future value. As such, the future value may be the most significant factor of the option. We value the future value of our option and stock awards in accordance with SFAS 123R using the Black-Scholes option-pricing model. We believe that the direct or potential ownership of stock will also provide incentive to our executives to be mindful of the perspective of Galaxy’s stockholders.

Auto Allowances

We often grant standard auto allowances to our executive and non-executive employees as part of our compensation package. These allowances are to cover the executive’s auto expenses related to their job function, but may entail a personal use element which is reported as taxable income at year-end.

Other Standard Employee Benefits

Galaxy offers competitive health, dental, life and disability insurance packages to all our employees. Additionally, we offer 50% employer matching on an employee’s contribution to their 401(k) plan up to 6% of their salary. We offer these employee benefits to all of our employees to provide security and a level of protection that will enable the employees to work without having the distraction of having to manage undue risk. The health insurance also provides access to preventative medical care which may contribute to the overall well being of the employee by helping the employee function at a high energy level and manage job related stress. We believe these employee benefits lead to enhanced job performance by our employees.

Additionally, our executive and certain non-executive employees receive other de-minimus employee benefits such as cell phones and computers that are directly related to job functions but may contain a personal use element. These de-minimus benefits are considered to be a goodwill gesture that contributes to enhanced job performance.

2007 Stay, Severance and Sales Bonus Plan

Galaxy has a Plan to provide incentives and protections to certain key executives and directors in connection with a possible sale of Galaxy. The Plan provides for a stay bonus pool up to $475,000 to be paid following Galaxy’s receipt of a definitive purchase offer (as defined in the Plan) upon the earlier of the consummation of a sale of Galaxy pursuant to such purchase offer or the termination of the purchase offer (other than as a result of a breach by Galaxy). The stay bonus pool is to be paid $125,000 to David H. Lipka (our Chairman) and $100,000 to Michael E. Broll (our Chief Executive Officer). The remaining $250,000 of the stay bonus pool is currently unallocated and may be granted to other key executives at the discretion of Messrs Lipka and Broll. The Plan also provides for a severance bonus of $125,000 to be paid to David H. Lipka and $100,000 to be paid to Michael E. Broll in the event their positions are terminated other than for Cause (as defined in the Plan) or they resign within one year after the consummation of a sale of Galaxy. Finally, the Plan provides for a sales bonus pool to be determined based on a range of selling prices and paid upon the consummation of a sale of Galaxy. The minimum sales bonus pool will be $250,000 if the sale is in excess of a specified minimum sales target and will increase up to a maximum of 1.8% of the total sales price. The sales bonus pool will be allocated 55.5% to David H. Lipka and 44.5% to Michael E. Broll.

Compensation of Management

Employment Agreements

Michael E. Broll. On July 8, 2004, Michael E. Broll, a member of our Board, was appointed as our Chief Executive Officer. We entered into a one-year employment agreement with Mr. Broll pursuant to which Mr. Broll is entitled to receive an annual base salary of $200,000 plus a performance bonus at the discretion of the Board, standard health benefits, a housing allowance up to $3,500 per month and an auto allowance of $1,500 per month. Mr. Broll was awarded a discretionary cash bonus of $75,000 in the fiscal year ended March 31, 2007. Effective April 1, 2007, the Board increased Mr. Broll’s annual base salary from $200,000 to $240,000. The employment agreement renews automatically for one-year periods unless cancelled by either party ninety days prior to the end of the term. In the event Mr. Broll’s employment is terminated without cause, he will be entitled to receive one year of his base salary subject to normal payroll deductions payable at the option of Galaxy in a lump sum or over a period of one year. Upon a merger or sale of Galaxy, we may assign our rights and obligations under the agreement to the successor or purchaser. Pursuant to a third amendment to Mr. Broll’s employment agreement, if he resigns within six months after a sale of Galaxy, he would also be entitled to receive one year of his base salary subject to normal payroll deductions payable at the option of Galaxy in a lump sum or over a period of one year. We estimate that a termination obligation for Mr. Broll would be approximately $240,000 plus the employer portion of payroll taxes using the current salary rates in effect as of April 1, 2007. In accordance with a 2007 Stay, Severance and Sales Bonus Plan, Mr. Broll is entitled to receive (1) a stay bonus of $100,000 to be paid following Galaxy’s receipt of a definitive purchase offer (as defined in the Plan) upon the earlier of the consummation of a sale of Galaxy pursuant to such purchase offer or the termination of the purchase offer (other than as a result of a breach by Galaxy);(2) a $100,000 severance bonus in the event his position is terminated or he resigns within one year after the consummation of a sale of Galaxy; and (3) 44.5% of a sales bonus pool to be determined based on a range of selling prices to be paid upon the consummation of a sale of Galaxy. The minimum sales bonus pool will be $250,000 if the sale is in excess of a specified minimum sales target and will increase up to a maximum of 1.8% of the total sales price.

Salvatore J. Furnari. On November 11, 2001, Mr. Furnari was appointed as Controller and on July 8, 2002, he was appointed as our Chief Financial Officer. Under the terms of his current employment agreement, which has no stated end, he will receive an annual base salary of $145,000. Mr. Furnari is entitled to standard health benefits and an auto allowance of $1,500 per month. Mr. Furnari was awarded a discretionary cash bonus of $29,500 in the fiscal year ended March 31, 2007. Effective April 1, 2007, Mr. Furnari’s annual base salary increased to $149,350. In the event Mr. Furnari’s employment is terminated without cause or his position as Chief Financial Officer and responsibilities change without his consent, he will be entitled to receive one year of his base salary, vacation pay, auto allowance and health benefits as severance subject to normal payroll deductions over a period of one year. Additionally, if there is a change of control, any unvested stock options would become immediately and fully vested. We estimate that a termination obligation for Mr. Furnari would be approximately $199,160 plus the employer portion of payroll taxes using the current salary, auto and benefit rates in effect as of April 1, 2007.

John W. Jackson. In August 1993, Mr. Jackson was appointed as Senior Vice President of Global Sales. Mr. Jackson’s current employment agreement has no stated end and provides for a base salary of $144,900 and an auto allowance of $1,500 per month. Mr. Jackson is also entitled to a bonus that shall not exceed 40% of his base salary based on certain personal and Galaxy goals as established by our Chief Executive Officer. Mr. Jackson was awarded a discretionary cash bonus of $15,000 in the fiscal year ended March 31, 2007. Effective April 1, 2007, Mr. Jackson’s annual base salary increased to $149,247. In the event of a change in ownership of Galaxy which results in his termination, Mr. Jackson will be entitled to receive three years of his base salary as severance. In the event Mr. Jackson’s employment is otherwise terminated, he is entitled to receive one year of his base salary as severance. We estimate that a termination by Galaxy, other than relating to a change of ownership, would result in a termination obligation for Mr. Jackson of approximately $149,247 plus the employer portion of payroll taxes using the current salary rates in effect as of April 1, 2007. In the event of a change of ownership that results in a termination, we estimate that a termination obligation for Mr. Jackson would be approximately $447,741 plus the employer portion of payroll taxes using the current salary rates in effect as of April 1, 2007.

SUMMARY COMPENSATION TABLE

The following table sets forth the compensation during the fiscal years ended March 31, 2007, 2006 and 2005 paid to the following individuals (each, a “Named Executive Officer”): (i) all individuals serving as our Principal Executive Officer (“PEO”) during the last fiscal year; (ii) all individuals serving as our Principal Financial Officer (“PFO”) during the last fiscal year; (iii) our three other most highly compensated executive officers who were serving as executive officers as of March 31, 2007; and (iv) up to two additional individuals for whom disclosure would have been provided pursuant to clause (iii) above, but for the fact that the individual was not serving as an executive officer at the end of the last completed fiscal year. However, in the cases of clauses (iii) and (iv) above, no disclosure is provided for any individual whose total annual compensation does not exceed $100,000.

| (a) | | (b) | | (c) | | (d) | | (e) | | (f) | | (g) | | (h) | | (i) | | (j) | |

Name and Principal Position | | Year | | Salary ($) | | Bonus ($) | | Stock Awards ($) | | Option Awards ($) | | Non-Equity Incentive Plan Compensation ($) | | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | | All Other Compensation ($)(11) | | Total ($) | |

| | | | | | | | | | | | | | | | | | | | |

Michael E. Broll (1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| PEO | | | 2007 | | | 200,000 | | | 75,000 | | | - | | | 18,000 | (2) | | - | | | - | | | 49,946 | (3) | | 342,946 | |

| | | | 2006 | | | 200,000 | | | - | | | - | | | - | | | - | | | - | | | 56,753 | (3) | | 256,753 | |

| | | | 2005 | | | 143,846 | | | 25,000 | | | - | | | - | | | - | | | - | | | 32,310 | (3) | | 201,156 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Salvatore J. Furnari (4) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| PFO | | | 2007 | | | 145,000 | | | 29,500 | | | - | | | - | | | - | | | - | | | 22,740 | (6) | | 197,240 | |

| | | | 2006 | | | 145,000 | | | 3,000 | | | - | | | - | | | - | | | - | | | 20,788 | (6) | | 168,788 | |

| | | | 2005 | | | 145,000 | | | - | | | - | | | 41,300 | | | - | | | - | | | 27,450 | (6) | | 213,750 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

John W. Jackson (7) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Senior VP of | | | 2007 | | | 144,900 | | | 15,000 | | | - | | | - | (8) | | - | | | - | | | 22,351 | (10) | | 182,251 | |

| Global Sales | | | 2006 | | | 144,900 | | | - | | | - | | | - | | | - | | | - | | | 20,898 | (10) | | 165,798 | |

| | | | 2005 | | | 144,820 | | | - | | | - | | | 5,040 | (9) | | - | | | - | | | 20,396 | (10) | | 170,256 | |

| | (1) | On July 8, 2004, Michael E. Broll, a member of our Board, was appointed as our Chief Executive Officer. We entered into a one-year employment agreement with Mr. Broll pursuant to which Mr. Broll is entitled to receive an annual base salary of $200,000 plus a performance bonus at the discretion of the Board, standard health benefits, a housing allowance up to $3,500 per month and an auto allowance of $1,500 per month. Mr. Broll was awarded a discretionary cash bonus of $75,000 and $25,000 in the fiscal years ended March 31, 2007 and 2005, respectively. Effective April 1, 2007, the Board increased Mr. Broll’s annual base salary from $200,000 to $240,000. |

| | (2) | On August 17, 2006, we granted Mr. Broll an option to purchase 100,000 shares of our common stock at an exercise price of $0.44 per share, which is equal to 110% of the closing market price on the date of grant. This option is fully vested and exercisable with an expiration date of August 17, 2011. This option was not issued under any stockholder approved Equity Incentive Plan. We estimated the fair value of the option award to be $18,000 in accordance with SFAS 123R using the assumptions disclosed in Note 1 of our Financial Statements for the year ended March 31, 2007. |

| | (3) | We paid Mr. Broll $18,000 for an auto allowance plus $31,946 for housing expenses during the fiscal year ended March 31, 2007. We paid Mr. Broll $18,000 for an auto allowance plus $37,740 for housing expenses during the fiscal year ended March 31, 2006. We paid Mr. Broll $12,000 for an auto allowance plus $20,310 for housing expenses during the fiscal year ended March 31, 2005. During the fiscal year ended March 31, 2006, Mr. Broll received an employer match on his 401(k) contributions in the amount of $1,013. |

| | (4) | On July 8, 2002, Salvatore J. Furnari was appointed Chief Financial Officer of Galaxy. From November 2002 to July 8, 2002, he worked as our Controller. Mr. Furnari is entitled to receive an annual base salary of $145,000 and an auto allowance of $1,500 per month. Effective April 1, 2007, Mr. Furnari’s annual base salary increased to $149,350. Mr. Furnari was awarded a discretionary cash bonus of $29,500 and $3,000 in the fiscal years ended March 31, 2007 and 2006. |

| | (5) | In consideration for past performance and continued employment, on October 1, 2004, we granted Mr. Furnari an option to purchase 70,000 shares of our common stock at an exercise price of $2.05 per share. The closing market price on the date of grant was $1.20 per share. This option is fully vested and exercisable with an expiration date of October 1, 2014. This option was not issued under any stockholder approved Equity Incentive Plan. We estimated the fair value of the option award to be $41,300 in accordance with SFAS 123 using the assumptions disclosed in Note 1 of our Financial Statements for the year ended March 31, 2007. |

| | (6) | During the fiscal years ended March 31, 2007, 2006 and 2005, Mr. Furnari received an auto allowance of $18,000, $18,000 and $27,450, respectively. Additionally, in the fiscal years ended March 31, 2007 and 2006, Mr. Furnari received compensation for unused vacation time totaling $4,740 and $2,788, respectively. |

| | (7) | Effective April 1, 2004, John W. Jackson’s employment agreement provides for an annual base salary of $144,900 and an auto allowance of $1,500 per month. Effective April 1, 2007, Mr. Jackson’s annual base salary increased to $149,247. |

| | (8) | During the fiscal year ended March 31, 2007, Mr. Jackson allowed an option to purchase 7,143 shares at an exercise price of $2.05 to expire, unexercised on its expiration date of May 16, 2006. There was no compensation expense previously calculated on the award that was granted in 1996, since awards made to employees were valued under the recognition and measurement principles of APB 25 as further detailed in Note 1 of our Financial Statements for the year ended March 31, 2007. |

| | (9) | In consideration for past performance and continued employment, on October 1, 2004, we granted to Mr. Jackson an option to purchase 7,000 shares of our common stock at an exercise price of $1.28 per share. The closing market price on the date of grant was $1.20 per share. This option is fully vested and exercisable with an expiration date of October 1, 2014. We estimated the fair value of the option award to be $5,040 in accordance with SFAS 123 using the assumptions disclosed in Note 1 of our Financial Statements for the year ended March 31, 2007. |

| | (10) | During the fiscal years ended March 31, 2007, 2006 and 2005, Mr. Jackson received an auto allowance of $18,000, $18,000 and $17,500, respectively. During the fiscal years ended March 31, 2007, 2006 and 2005, Mr. Jackson received an employer match on his 401(k) contributions on which he is 100% vested in the amount of $4,351, $2,898 and $2,896, respectively. |

| | (11) | Other than the information described in the footnotes above, there were no other annual compensation, perquisites or other personal benefits, securities or property greater than $10,000 paid to or on behalf of the Named Executive Officers. The employer portion of health benefits paid on behalf of the Named Executive Officers are not included in the Summary Compensation Table as they are generally available to all salaried employees. |

GRANTS OF PLAN-BASED AWARDS FOR FISCAL 2007

| (a) | | (b) | | (c) (f) | | (d) (g) | | (e) (h) | | (i) | | (j) | | (k) | | (l) | | (m) | |

| | | | | Estimated Future Payouts under Non-Equity & Equity Incentive Plan Awards (1) | | | | | | | | | | | |

| Name | | Grant Date | | Threshold ($) (#) | | Target ($) (#) | | Maximum ($) (#) | | All Other Stock Awards: Number of Shares of Stock or Units (#) | | All Other Option Awards: Number of Securities Underlying Options (#) | | Exercise or Base Price of Option Awards ($/Sh) | | Closing Market Price on Date of Grant ($/Sh) | | Grant Date Fair Value of Stock and Option Awards ($) | |

Michael E. Broll (2) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| PEO | | | 08/17/06 | | | - | | | - | | | - | | | - | | | 100,000 | | | 0.44 | | | 0.40 | | | 18,000 | |

| (1) | There were no estimated future payouts under Non-equity or Equity Incentive Plans to any Named Executive Officers during the fiscal year ended March 31, 2007, and there are no thresholds or maximums (or equivalent items) for such awards. |

| (2) | On August 17, 2006, we granted Mr. Broll an option to purchase 100,000 shares of our common stock at an exercise price of $0.44 per share, which is equal to 110% of the closing market price on the date of grant. This option is fully vested and exercisable with an expiration date of August 17, 2011. This option was not issued under any stockholder approved Equity Incentive Plan. We estimated the fair value of the option award to be $18,000 in accordance with SFAS 123R using the assumptions disclosed in Note 1 of our Financial Statements for the year ended March 31, 2007. |

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

| (a) | | (b) | | (c) | | (d) | | (e) | | (f) | | (g) | | (h) | | (i) | | (i) | |

| | | Option Awards | | Stock Awards | |

| Name | | Number of Securities Underlying Unexercised Options (#) Exercisable | | Number of Securities Underlying Unexercised Options (#) Unexercisable | | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | | Option Exercise Price ($/Sh) | | Option Expiration Date | | Number of Shares or Units of Stock That Have Not Vested (#) | | Market Value of Shares or Units That Have Not Vested ($) | | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) | |

| | | | | | | | | | | | | | | | | | | | |

Michael E. Broll | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| PEO | | | 200,000 | (1) | | - | | | - | | | 3.29 | | | 12/17/08 | | | - | | | - | | | - | | | - | |

| | | | 100,000 | (1) | | - | | | - | | | 0.44 | | | 08/17/11 | | | - | | | - | | | - | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Salvatore J. Furnari | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| PFO | | | 10,000 | (2) | | - | | | - | | | 2.05 | | | 11/12/11 | | | - | | | - | | | - | | | - | |

| | | | (3) | | - | | | - | | | 2.05 | | | 07/08/12 | | | - | | | - | | | - | | | - | |

| | | | | (1) | | - | | | - | | | 2.05 | | | 10/01/14 | | | - | | | - | | | - | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

John W. Jackson | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Senior VP of | | | 14,286 | (3) | | - | | | - | | | 2.05 | | | 09/24/08 | | | - | | | - | | | - | | | - | |

| Global Sales | | | 75,000 | (2) | | - | | | - | | | 2.05 | | | 04/19/11 | | | - | | | - | | | - | | | - | |

| | | | | (3) | | - | | | - | | | 1.28 | | | 10/01/14 | | | - | | | - | | | - | | | - | |

| (1) | These options were not issued under any stockholder approved Equity Incentive Plan. |

| (2) | These options were not issued under any stockholder approved Equity Incentive Plan, but were later individually approved by the stockholders on September 30, 2003. |

| (3) | These options were issued under Galaxy’s 1996 Stock Plan, as amended, that was approved by the stockholders in 1996 and 2001. |

OPTION EXERCISES AND STOCK VESTED FOR FISCAL 2007

There were no options exercised or stock vested by any Named Executive Officer during the fiscal year ended March 31, 2007.

DIRECTOR COMPENSATION FOR FISCAL 2007

| (a) | | (b) | | (c) | | (d) | | (e) | | (f) | | (g) | | (h) | |

| Name | | Fees Earned or Paid in Cash ($) | | Stock Awards ($) | | Option Awards ($) | | Non-Equity Incentive Plan Compensation ($) | | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | | All Other Compensation ($) | | Total ($) | |

| | | | | | | | | | | | | | | | |

David H. Lipka (1) | | | | | | | | | | | | | | | | | | | | | | |

| Chairman | | | 115,000 | | | - | | | 18,000 | (2) | | - | | | - | | | - | | | 133,000 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Peter J. Jungsberger (3) | | | | | | | | | | | | | | | | | | | | | | |

| Director | | | 6,000 | | | - | | | 19,000 | (4) | | - | | | - | | | - | | | 25,000 | |

Robert S. Mohel (3) (5) | | | | | | | | | | | | | | | | | | | | | | |

| Audit Committee Chairman | | | 13,500 | | | - | | | 19,000 | (4) | | - | | | - | | | - | | | 32,500 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Angelo S. Morini (6) | | | | | | | | | | | | | | | | | | | | | | |

| Former Director | | | - | | | - | | | 18,000 | (2) | | - | | | - | | | 350,290 | | | 368,290 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Joanne R. Bethlahmy (3) | | | | | | | | | | | | | | | | | | | | | | |

| Former Director | | | - | | | - | | | 5,500 | (7) | | - | | | - | | | - | | | 5,500 | |

| | | | | | | | | | | | | | | | | | | |

M.A. Patrice Videlier (3) (8) | | | | | | | | | | | | | | | | | | |

| Former Director | | | - | | | - | | | - | | | - | | | - | | | - | | | - | |

| (1) | On August 17, 2006, in recognition of Mr. David H. Lipka’s substantial efforts on behalf of Galaxy, the Board voted to increase his compensation in his capacity as Chairman of the Board, from $60,000 per year to $120,000 per year. As a result of this increase, Mr. Lipka is no longer considered an “independent” director within the meaning of applicable securities regulations. Additionally in March 2007, Mr. Lipka was awarded a bonus of $20,000 for the fiscal year ended March 31, 2007. In accordance with a 2007 Stay, Severance and Sales Bonus Plan, Mr. Lipka is entitled to receive (a) a stay bonus of $125,000 to be paid following Galaxy’s receipt of a definitive purchase offer (as defined in the Plan) upon the earlier of the consummation of a sale of Galaxy pursuant to such purchase offer or the termination of the purchase offer (other than as a result of a breach by Galaxy); (b) a $125,000 severance bonus in the event his position is terminated or he resigns within one year after the consummation of a sale of Galaxy; and (c) 55.5% of a sales bonus pool to be determined based on a range of selling prices to be paid upon the consummation of a sale of Galaxy. The minimum sales bonus pool will be $250,000 if the sale is in excess of a specified minimum sales target and will increase up to a maximum of 1.8% of the total sales price. |

| (2) | On August 17, 2006, we granted to both Mr. Lipka and Mr. Morini an option to purchase 100,000 shares of our common stock at an exercise price of $0.44 per share, which is equal to 110% of the closing market price on the date of grant. Such options are fully vested and exercisable with an expiration date of August 17, 2011. We estimated the fair value of the option awards to be $18,000 each in accordance with SFAS 123R using the assumptions disclosed in Note 1 of our Financial Statements for the year ended March 31, 2007. |

| (3) | Each independent director who served on the Board during the fiscal year ended March 31, 2007 was entitled to receive a fee of $1,500 plus expenses for each in-person Board meeting day they attended. The independent directors who served during the fiscal year ended March 31, 2007 were Mr. Jungsberger, Mr. Mohel, Ms. Bethlahmy and Mr. Videlier. |

| (4) | On August 7, 2006, we granted to both Mr. Jungsberger and Mr. Mohel an option to purchase 100,000 shares of our common stock at an exercise price of $0.45 per share, which is equal to 110% of the closing market price on the date of grant. Such options are fully vested and exercisable with an expiration date of August 7, 2011. We estimated the fair value of the option awards to be $19,000 each in accordance with SFAS 123R using the assumptions disclosed in Note 1 of our Financial Statements for the year ended March 31, 2007. |

| (5) | Mr. Robert S. Mohel receives $3,000 per quarter for his services as chairman of the audit committee. |