UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to Rule § 240.14a-12

THE NEIMAN MARCUS GROUP, INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| x | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

ONE MARCUS SQUARE

1618 MAIN STREET

DALLAS, TEXAS 75201

July 18, 2005

Dear Stockholder:

The board of directors of The Neiman Marcus Group, Inc. (“Neiman Marcus” or the “Company”) has unanimously approved a merger providing for the acquisition of the Company by Newton Acquisition, Inc., an entity currently owned indirectly by private equity funds sponsored by TPG Advisors III, Inc., TPG Advisors IV, Inc., Warburg Pincus & Co., Warburg Pincus LLC and Warburg Pincus Partners LLC. If the merger is completed, you will receive $100.00 in cash, without interest, for each share of the Company’s common stock you own.

You will be asked, at a special meeting of the Company’s stockholders, to adopt the merger agreement. The board of directors has unanimously approved and declared advisable the merger, the merger agreement and the transactions contemplated by the merger agreement and has unanimously declared that the merger, the merger agreement and the transactions contemplated by the merger agreement are fair to, and in the best interests of, the Company’s stockholders.The board of directors unanimously recommends that the Company’s stockholders vote “FOR” the adoption of the merger agreement.

The time, date and place of the special meeting to consider and vote upon the adoption of the merger agreement are as follows:

8:00 a.m. Eastern Time,August 16, 2005

Marriott Boston Newton Hotel

2345 Commonwealth Avenue

Newton, Massachusetts 02466

The proxy statement attached to this letter provides you with information about the proposed merger and the special meeting of the Company’s stockholders. We encourage you to read the entire proxy statement carefully. You may also obtain more information about the Company from documents we have filed with the Securities and Exchange Commission.

YOUR VOTE IS IMPORTANT REGARDLESS OF THE NUMBER OF SHARES OF THE COMPANY’S COMMON STOCK YOU OWN. BECAUSE THE ADOPTION OF THE MERGER AGREEMENT REQUIRES THE AFFIRMATIVE VOTE OF THE HOLDERS OF A MAJORITY OF THE COMBINED VOTING POWER OF THE COMPANY’S OUTSTANDING SHARES OF COMMON STOCK ENTITLED TO VOTE THEREON, A FAILURE TO VOTE WILL HAVE THE SAME EFFECT AS A VOTE “AGAINST” THE MERGER. ACCORDINGLY, YOU ARE REQUESTED TO SUBMIT YOUR PROXY BY PROMPTLY COMPLETING, SIGNING AND DATING THE ENCLOSED PROXY CARD AND RETURNING IT IN THE ENVELOPE PROVIDED OR TO SUBMIT YOUR PROXY BY TELEPHONE OR INTERNET PRIOR TO THE SPECIAL MEETING, WHETHER OR NOT YOU PLAN TO ATTEND THE SPECIAL MEETING.

Submitting your proxy will not prevent you from voting your shares in person if you subsequently choose to attend the special meeting.

Thank you for your cooperation and continued support.

Very truly yours,

Richard A. Smith

Chairman of the Board

THIS PROXY STATEMENT IS DATEDJULY 18, 2005

AND IS FIRST BEING MAILED TO STOCKHOLDERS ON OR ABOUTJULY 18, 2005.

ONE MARCUS SQUARE

1618 MAIN STREET

DALLAS, TEXAS 75201

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD AUGUST 16, 2005

Dear Stockholder:

A special meeting of stockholders of The Neiman Marcus Group, Inc., a Delaware corporation (“Neiman Marcus” or the “Company”), will be held onAugust 16, 2005, at8:00 a.m., Eastern Time, atthe Marriott Boston Newton Hotel, 2345 Commonwealth Avenue, Newton, Massachusetts, for the following purposes:

| | 1. | To consider and vote on the adoption of the Agreement and Plan of Merger, dated as of May 1, 2005 (as it may be amended from time to time, the “merger agreement”), among the Company, Newton Acquisition, Inc. (“Parent”) and Newton Acquisition Merger Sub, Inc., a wholly-owned subsidiary of Parent (“Merger Sub”), pursuant to which, upon the merger becoming effective, each outstanding share of Class A Common Stock, par value $0.01 per share, of the Company (the “Class A common stock”), Class B Common Stock, par value $0.01 per share, of the Company (the “Class B common stock”) and Class C Common Stock, par value $0.01 per share, of the Company (the “Class C common stock”, and together with the Class A common stock and Class B common stock, the “common stock”) (other than shares held in the treasury of the Company or owned by Parent, Merger Sub or any direct or indirect wholly-owned subsidiary of Parent or the Company and other than shares held by stockholders who properly demand statutory appraisal rights) will be converted into the right to receive $100.00 in cash, without interest; |

| | 2. | To approve the adjournment of the special meeting, if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of the meeting to adopt the merger agreement; and |

| | 3. | To transact such other business as may properly come before the special meeting or any adjournment or postponement thereof. |

Only stockholders of record onJuly 11, 2005, are entitled to notice of and to vote at the special meeting and at any adjournment or postponement of the special meeting. All stockholders of record are cordially invited to attend the special meeting in person.

The adoption of the merger agreement requires the approval of the holders of a majority of the combined voting power of the outstanding shares of common stock entitled to vote thereon. Even if you plan to attend the special meeting in person, we request that you complete, sign, date and return the enclosed proxy in the envelope provided, or submit your proxy by telephone or the Internet prior to the special meeting and thus ensure that your shares will be represented at the special meeting if you are unable to attend. If you sign, date and mail your proxy card without indicating how you wish to vote, your proxy will be voted in favor of the adoption of the merger agreement. If you fail to return your proxy card or fail to submit your proxy by telephone or the Internet and do not attend the special meeting in person, the effect will be that your shares will not be counted for purposes of determining whether a quorum is present at the special meeting and, if a quorum is present, will have the same effect as a vote against the adoption of the merger agreement. If you are a stockholder of record and you attend the special meeting and wish to vote in person, you may withdraw your proxy and vote in person.

Stockholders of Neiman Marcus who do not vote in favor of the adoption of the merger agreement will have the right to seek appraisal of the fair value of their shares if the merger is completed, but only if they submit a written demand for appraisal to the Company before the vote is taken on the merger agreement and they comply with all requirements of Delaware law, which are summarized in the accompanying proxy statement.

By order of the board of directors,

Brenda A. Sanders

Corporate Secretary

July 18, 2005

TABLE OF CONTENTS

i

ii

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING AND THE MERGER

The following questions and answers address briefly some questions you may have regarding the special meeting and the proposed merger. These questions and answers may not address all questions that may be important to you as a stockholder of The Neiman Marcus Group, Inc. Please refer to the more detailed information contained elsewhere in this proxy statement, the annexes to this proxy statement and the documents referred to or incorporated by reference in this proxy statement. In this proxy statement, the terms “Neiman Marcus,” “Company,” “we,” “our,” “ours,” and “us” refer to The Neiman Marcus Group, Inc. and references to subsidiaries of the Company include the Company’s majority-owned subsidiaries, Kate Spade LLC and Gurwitch Products, L.L.C.

| | Q: | What is the proposed transaction? |

| | A: | The proposed transaction is the acquisition of the Company by an entity currently owned indirectly by private equity funds sponsored by TPG Advisors III, Inc. and TPG Advisors IV, Inc. (together, “TPG”) and Warburg Pincus & Co., Warburg Pincus LLC and Warburg Pincus Partners LLC (together, “Warburg Pincus”, and together with TPG, the “Sponsors”) pursuant to an Agreement and Plan of Merger, dated as of May 1, 2005 (the “merger agreement”), among the Company, Newton Acquisition, Inc. (“Parent”) and Newton Acquisition Merger Sub, Inc., a wholly-owned subsidiary of Parent (“Merger Sub”). Once the merger agreement has been adopted by the Company’s stockholders and the other closing conditions under the merger agreement have been satisfied or waived, Merger Sub will merge with and into Neiman Marcus (the “merger”). Neiman Marcus will be the surviving corporation in the merger (the “surviving corporation”) and will become a wholly-owned subsidiary of Parent. |

| | Q: | What will I receive in the merger? |

| | A: | Upon completion of the merger, whether you hold our Class A or Class B common stock, you will receive $100.00 in cash, without interest and less any required withholding taxes, for each share of our common stock that you own. For example, if you own 100 shares of our common stock, you will receive $10,000.00 in cash in exchange for your shares of common stock, less any required withholding taxes. You will not own shares in the surviving corporation. |

| | Q: | Where and when is the special meeting? |

| | A: | The special meeting will take place atthe Marriott Boston Newton Hotel, 2345 Commonwealth Avenue, Newton, Massachusetts, onAugust 16, 2005, at8:00 a.m. Eastern Time. |

| | Q: | What vote of our stockholders is required to adopt the merger agreement? |

| | A: | For us to complete the merger, stockholders holding at least a majority of the combined voting power of our common stock outstanding at the close of business on the record date must vote “FOR” the adoption of the merger agreement. Accordingly, failure to vote or an abstention will have the same effect as a vote against adoption of the merger agreement. For the purpose of the vote on the merger, each share of Class A common stock and each share of Class B common stock will have one vote. |

| | | Richard A. Smith, the Chairman of our board of directors, and members of his family have entered into a stockholder agreement, pursuant to which they have agreed to vote their shares, which as of the record date represent approximately12.4% of the combined voting power of our common stock, in favor of the adoption of the merger agreement and against any competing transaction proposed to the Company’s stockholders, unless the merger agreement is terminated in accordance with its terms. |

| | Q: | How does the Company’s board of directors recommend that I vote? |

| | A: | Our board of directors unanimously recommends that our stockholders vote “FOR” the adoption of the merger agreement. You should read “The Merger—Reasons for the Merger” for a discussion of the factors that our board of directors considered in deciding to recommend the adoption of the merger agreement. |

1

| | Q: | What do I need to do now? |

| | A: | We urge you to read this proxy statement carefully, including its annexes, and to consider how the merger affects you. If you are a stockholder of record, then you can ensure that your shares are voted at the special meeting by submitting your proxy via: |

| | • | | telephone, using the toll-free number listed on each proxy card (if you are a registered stockholder, that is if you hold your stock in your name) or vote instruction card (if your shares are held in “street name,” meaning that your shares are held in the name of a broker, bank or other nominee and your bank, broker or nominee makes telephone voting available); |

| | • | | the Internet, at the address provided on each proxy card (if you are a registered stockholder) or vote instruction card (if your shares are held in “street name” and your bank, broker or nominee makes Internet voting available); or |

| | • | | mail, by completing, signing, dating and mailing each proxy card or vote instruction card and returning it in the envelope provided. |

| | Q: | If my shares are held in “street name” by my broker, will my broker vote my shares for me? |

| | A: | Yes, but only if you provide instructions to your broker on how to vote. You should follow the directions provided by your broker regarding how to instruct your broker to vote your shares. Without those instructions, your shares will not be voted, which will have the same effect as voting against the merger. |

| | A: | Yes, you can change your vote at any time before your proxy is voted at the special meeting. If you are a registered stockholder, you may revoke your proxy by notifying the Company’s Corporate Secretary in writing or by submitting a new proxy by telephone, the Internet or mail, in each case, dated after the date of the proxy being revoked. In addition, your proxy may be revoked by attending the special meeting and voting in person (you must vote in person, simply attending the special meeting will not cause your proxy to be revoked). |

| | | Please note that if you hold your shares in “street name” and you have instructed a broker to vote your shares, the above-described options for changing your vote do not apply, and instead you must follow the instructions received from your broker to change your vote. |

| | Q: | What does it mean if I get more than one proxy card or vote instruction card? |

| | A: | If your shares are registered differently or are in more than one account, you will receive more than one card. Please complete and return all of the proxy cards or vote instruction cards you receive (or submit your proxy by telephone or the Internet, if available to you) to ensure that all of your shares are voted. |

| | Q: | Should I send in my stock certificates now? |

| | A: | No. Shortly after the merger is completed, you will receive a letter of transmittal with instructions informing you how to send in your stock certificates to the paying agent in order to receive the merger consideration. You should use the letter of transmittal to exchange stock certificates for the merger consideration to which you are entitled as a result of the merger. DO NOT SEND ANY STOCK CERTIFICATES WITH YOUR PROXY. |

| | Q: | Who can help answer my other questions? |

| | A: | If you have more questions about the merger, please contact Stacie Shirley, our VP, Finance and Treasurer, at (214) 757-2967. If you need assistance in submitting your proxy or voting your shares or need additional copies of the proxy statement or the enclosed proxy card, you should contact Brenda Sanders at (214) 743-7615. You may also contact our proxy solicitation agent,Innisfree M&A Incorporated, toll-free at(877) 456-3507. If your broker holds your shares, you should also call your broker for additional information. |

2

SUMMARY

The following summary highlights selected information from this proxy statement and may not contain all of the information that may be important to you. Accordingly, we encourage you to read carefully this entire proxy statement, its annexes and the documents referred to or incorporated by reference in this proxy statement. Each item in this summary includes a page reference directing you to a more complete description of that item.

The Parties to the Merger (Page 14)

The Neiman Marcus Group, Inc.

One Marcus Square

1618 Main Street

Dallas, Texas 75201

(214) 743-7600

The Neiman Marcus Group, Inc. is among the leading luxury retailers in the world, focusing on high-end apparel, accessories, jewelry, beauty and decorative home products. At the end of our previous fiscal year, July 31, 2004, we operated 35 Neiman Marcus stores, two Bergdorf Goodman stores and fourteen Last Call clearance centers. We also sell merchandise through Neiman Marcus Direct, our catalog and online operations, and own majority interests in Kate Spade LLC and Gurwitch Products, L.L.C., which produces the Laura Mercier line of cosmetics.

Newton Acquisition, Inc.

c/o Texas Pacific Group

301 Commerce Street, Suite 3300

Fort Worth, TX 76102

(817) 871-4000

and

c/o Warburg Pincus LLC

466 Lexington Avenue

New York, NY 10017

(212) 878-0600

Parent is a Delaware corporation owned in equal parts by the Sponsors through certain investment funds affiliated with the Sponsors. Parent was formed solely for the purpose of entering into the merger agreement and consummating the transactions contemplated by the merger agreement. It has not conducted any activities to date other than activities incidental to its formation and in connection with the transactions contemplated by the merger agreement.

Newton Acquisition Merger Sub, Inc.

c/o Texas Pacific Group

301 Commerce Street, Suite 3300

Fort Worth, TX 76102

(817) 871-4000

and

c/o Warburg Pincus LLC

466 Lexington Avenue

New York, NY 10017

(212) 878-0600

3

Merger Sub is a Delaware corporation and a wholly-owned subsidiary of Parent. Merger Sub was formed solely for the purpose of entering into the merger agreement and consummating the transactions contemplated by the merger agreement. It has not conducted any activities to date other than activities incidental to its formation and in connection with the transactions contemplated by the merger agreement.

Parent and Merger Sub are each entities currently indirectly owned by private equity funds sponsored by TPG Advisors III, Inc., TPG Advisors IV, Inc., Warburg Pincus & Co., Warburg Pincus LLC and Warburg Pincus Partners LLC.

Each of TPG Advisors III, Inc. and TPG Advisors IV, Inc. (together, “TPG”) is serving as the sole general partner of related entities engaged in making investments in securities of public and private companies.

Warburg Pincus & Co., Warburg Pincus LLC and Warburg Pincus Partners LLC (together, “Warburg Pincus”) are engaged in making private equity and related investments.

The Special Meeting

Time, Place and Date (Page 15)

The special meeting will be held onAugust 16, 2005, starting at8:00 a.m., Eastern Time, atthe Marriott Boston Newton Hotel, 2345 Commonwealth Avenue, Newton, Massachusetts.

Purpose (Page 15)

You will be asked to consider and vote upon adoption of the merger agreement. The merger agreement provides that Merger Sub will be merged with and into the Company, and each outstanding share of the Company’s common stock (other than shares held in the treasury of the Company or owned by Parent, Merger Sub or any direct or indirect wholly-owned subsidiary of Parent or the Company and other than shares held by stockholders who properly demand statutory appraisal rights) will be converted into the right to receive $100.00 in cash, without interest.

The persons named in the accompanying proxy card will also have discretionary authority to vote upon other business, if any, that properly comes before the special meeting and any adjournments or postponements of the special meeting.

Record Date and Quorum (Page 15)

You are entitled to vote at the special meeting if you owned shares of the Company’s common stock at the close of business onJuly 11, 2005, the record date for the special meeting. You will have one vote for each share of the Company’s common stock that you owned on the record date. As of the record date, there were48,947,578 shares of the Company’s common stock entitled to be voted, consisting of29,525,199 shares of Class A common stock and19,422,379 shares of Class B common stock. (There were no outstanding shares of the Company’s Class C common stock as of the record date.)

Required Vote (Page 15)

For us to complete the merger, stockholders holding at least a majority in combined voting power of our common stock outstanding at the close of business on the record date must vote “FOR” the adoption of the merger agreement. All of our stockholders are entitled to one vote per share, and there is no difference in voting power between holders of the Class A common stock and the Class B common stock for purposes of voting to adopt the merger agreement. A failure to vote your shares of the Company’s common stock or an abstention will have the same effect as a vote against the merger.

4

In connection with the execution of the merger agreement, Richard A. Smith, the Chairman of our board of directors, and members of his family (collectively, the “Smith Family Holders”), entered into a stockholder agreement pursuant to which they have agreed to vote in favor of the merger and against any competing transaction proposed to the Company’s stockholders, unless the merger agreement is terminated in accordance with its terms. As of the record date, the Smith Family Holders beneficially own an aggregate of6,055,057 shares of Neiman Marcus common stock (excluding options), which represents approximately12.4% of the voting power for purposes of voting on the adoption of the merger agreement.

Share Ownership of Directors and Executive Officers (Page 15)

As of the record date, the directors and current executive officers of Neiman Marcus beneficially owned in the aggregate (excluding options) approximately8.4% of the shares of the Company’s common stock entitled to vote at the special meeting. Each of them either agreed to vote, or has advised us that he or she plans to vote, all of his or her shares in favor of the adoption of the merger agreement.

Voting and Proxies (Page 16)

Any Neiman Marcus stockholder of record entitled to vote may submit a proxy by telephone, the Internet or returning the enclosed proxy card by mail, or may vote in person by appearing at the special meeting. If your shares are held in “street name” by your broker, you should instruct your broker on how to vote your shares using the instructions provided by your broker. If you do not provide your broker with instructions, your shares will not be voted and that will have the same effect as a vote against the merger.

Revocability of Proxy (Page 16)

Any Neiman Marcus stockholder of record who executes and returns a proxy card (or submits a proxy via telephone or the Internet) may revoke the proxy at any time before it is voted in any one of the following ways:

| | • | | filing with the Company’s Corporate Secretary, at or before the special meeting, a written notice of revocation that is dated a later date than the proxy; |

| | • | | sending a later-dated proxy relating to the same shares to the Company’s Corporate Secretary, at or before the special meeting; |

| | • | | submitting a later-dated proxy by the Internet or by telephone, at or before the special meeting; or |

| | • | | attending the special meeting and voting in person by ballot. |

Simply attending the special meeting will not constitute revocation of a proxy. If you have instructed your broker to vote your shares, the above-described options for revoking your proxy do not apply and instead you must follow the directions provided by your broker to change these instructions.

When the Merger Will be Completed (Page 51)

We are working to complete the merger as soon as possible. We anticipate completing the merger during the last calendar quarter of 2005, subject to adoption of the merger agreement by the Company’s stockholders and the satisfaction of the other closing conditions. In addition, Merger Sub is not obligated to complete the merger until the expiration of a 40 consecutive calendar day “marketing period” throughout which Merger Sub shall have the financial information that the Company is required to provide pursuant to the merger agreement to complete its debt financing of the merger. So long as we have provided all required financial information to Merger Sub for purposes of its completing its offerings of debt securities, the marketing period

5

will begin to run on the later of (i) September 1, 2005 and (ii) the date on which we file our annual report on Form 10-K for the fiscal year ended July 30, 2005 with the Securities and Exchange Commission (“SEC”).

Effects of the Merger (Page 52)

If the merger agreement is adopted by the Company’s stockholders and the other conditions to closing are satisfied, Merger Sub will be merged with and into the Company, with the Company being the surviving corporation. Upon completion of the merger, the Company’s common stock will be converted into the right to receive $100 per share, without interest and less any required withholding taxes. Following the completion of the merger, we will no longer be a public company and you will cease to have any ownership interest in the Company and will not participate in any future earnings and growth of the Company.

Board Recommendation (Page 29)

After careful consideration, our board of directors has unanimously:

| | • | | determined that the merger, the merger agreement and the transactions contemplated by the merger agreement are advisable, fair to and in the best interests of the Company and its stockholders; |

| | • | | approved the merger agreement; and |

| | • | | recommended that Neiman Marcus’ stockholders vote “FOR” the adoption of the merger agreement. |

In reaching its decision, our board of directors continuously consulted with our management team and advisors in considering the proposed merger agreement. Members of management generally participated in meetings of our board of directors. In considering the recommendation of the Company’s board of directors with respect to the merger, you should be aware that some of the Company’s directors and executive officers who participated in meetings of our board of directors have interests in the merger that are different from, or in addition to, the interests of our stockholders generally. See “Interests of the Company’s Directors and Executive Officers in the Merger” beginning on page 40.

For the factors considered by our board of directors in reaching its decision to approve and adopt the merger agreement and the merger, see “The Merger—Reasons for the Merger” beginning on page26.

Stockholder Agreement with the Smith Family Holders (Page 69 and Annex B)

The Smith Family Holders, including, among others, Richard A. Smith, the Chairman of our board of directors, and Robert A. Smith and Brian J. Knez, the co-Vice Chairmen of our board, have entered into a stockholder agreement, dated as of May 1, 2005, with Parent and Merger Sub with respect to the 6,055,057 shares of common stock (16,471 shares of Class A common stock and 6,038,586 shares of Class B common stock) owned in the aggregate by the Smith Family Holders as of the date of the stockholder agreement as well as any shares of common stock acquired by the Smith Family Holders after such date. As of the record date, the Smith Family Holders held6,055,057 shares of the Company’s common stock.

The Smith Family Holders have agreed to vote all of these shares in favor of the adoption of the merger agreement and against any competing transaction proposed to the Company’s stockholders, unless the merger agreement is terminated in accordance with its terms, and have delivered an irrevocable proxy to Parent for the purpose of voting such shares. The stockholder agreement will terminate upon the earlier of (i) the termination of the merger agreement and (ii) the effective time of the merger. The full text of the stockholder agreement is attached to this proxy statement as Annex B. We encourage you to read the full text of the stockholder agreement in its entirety.

Opinion of JPMorgan (Page 29 and Annex C)

J.P. Morgan Securities Inc. (“JPMorgan”) delivered its opinion to the Company’s board of directors that, as of the date of its opinion and based upon and subject to the factors and assumptions set forth therein, the merger

6

consideration of $100.00 in cash per share to be received by the Company’s Class A and Class B stockholders pursuant to the merger agreement was fair, from a financial point of view, to such stockholders (other than the Smith Family Holders).

The opinion of JPMorgan is addressed to the Company’s board of directors, is directed only to the consideration to be paid in the merger and does not constitute a recommendation as to how any of our stockholders should vote with respect to the merger agreement or whether such stockholders should exercise any dissenter’s rights or appraisal rights with respect to the merger or any other matter. The full text of the written opinion of JPMorgan, dated May 1, 2005, which sets forth the procedures followed, limitations on the review undertaken, matters considered and assumptions made in connection with such opinion, is attached as Annex C to this proxy statement. We recommend that you read the opinion carefully in its entirety. Pursuant to the terms of the engagement letter with JPMorgan, the Company has agreed to pay to JPMorgan a fee. Payment of the fee to JPMorgan is not contingent upon consummation of the merger.

Financing (Page 37)

The Company and the Sponsors estimate that the total amount of funds necessary to consummate the merger and related transactions (including payment of the aggregate merger consideration, the repayment or refinancing of some of the Company’s currently outstanding debt and all related fees and expenses) will be approximately $5.4 billion. Merger Sub has received commitments from Credit Suisse First Boston with respect to the financing.

In connection with the execution and delivery of the merger agreement, Merger Sub has obtained commitments to provide up to approximately $3.9 billion in debt financing (not all of which is expected to be drawn at closing) consisting of (1) a senior secured asset-based revolving facility with a maximum availability of $600 million and (2) term and bridge loan facilities and senior secured notes with an aggregate principal amount of up to $3.3 billion to finance, in part, the payment of the merger consideration, the repayment or refinancing of certain debt of the Company outstanding on the closing date of the merger and to pay fees and expenses in connection therewith and, in the case of the revolving facility, for general corporate purposes after the closing date of the merger.

Parent has agreed to use its reasonable best efforts to arrange the debt financing on the terms and conditions described in the commitments. In addition, Parent and Merger Sub have obtained an aggregate of $1.55 billion in equity commitments from the Sponsors. The facilities and notes contemplated by the debt financing commitments are conditioned on the merger being consummated prior to the merger agreement termination date, as well as other conditions, as described in further detail under “The Merger—Financing—Debt Financing” beginning on page 38.

The closing of the merger is not conditioned on the receipt of the debt financing by Merger Sub. Parent, however, is not required to consummate the merger until after the completion of the marketing period as described above under “When the Merger Will be Completed” and in further detail under “The Merger Agreement—Effective Time; The Marketing Period” beginning on page51.

Treatment of Stock Options (Page 40)

The merger agreement provides that all outstanding Company stock options issued pursuant to the Company’s stock option and incentive plans, whether or not vested or exercisable, will be cashed out and canceled (to the extent permitted under the governing plan documents and related agreements) in connection with

7

the completion of the merger. Each option holder will receive an amount in cash, less applicable withholding taxes and without interest, equal to the product of:

| | • | | the number of shares of our common stock subject to each option as of the effective time of the merger, multiplied by |

| | • | | the excess, if any, of $100.00 over the exercise price per share of common stock subject to such option. |

Treatment of Restricted Stock and Stock Units (Page 41)

The merger agreement provides that:

| | • | | each outstanding share of our restricted stock, the restrictions of which have not lapsed immediately prior to the effective time of the merger, will become fully vested and will be converted into the right to receive $100.00 in cash, without interest and less applicable withholding taxes; and |

| | • | | each outstanding right to receive our common stock, restricted stock or cash equal to or based on the value of our common stock pursuant to a stock unit award under any of our stock or other incentive plans, whether or not vested, will be canceled, and the holder of the stock unit will be entitled to receive $100.00 in cash, without interest and less applicable withholding taxes, for each share of common stock subject to the stock unit award. |

Interests of the Company’s Directors and Executive Officers in the Merger (Page 40)

Our directors and executive officers may have interests in the merger that are different from, or in addition to, yours, including the following:

| | • | | our directors and executive officers will have their vested and unvested stock options, restricted stock and stock unit awards canceled and cashed out in connection with the merger, meaning that they will receive cash payments for each share of common stock subject to such option equal to the excess, if any, of $100.00 per share over the exercise price per share of their options, without interest and less applicable withholding taxes, and they will receive $100.00 per share for their restricted stock and stock unit awards, without interest and less applicable withholding taxes; |

| | • | | each of our current executive officers has a change of control termination protection agreement that provides certain severance payments and benefits in the case of his or her termination of employment under certain circumstances and, in addition, the agreements provide that in the event any benefit received by the executive officer gives rise to an excise tax for the executive officer, the executive officer is also entitled to a “gross-up” payment in an amount that would place the executive officer in the same after-tax position that he or she would have been in if no excise tax had applied (except for certain circumstances in which the agreements specify that the benefits payable to the executive will be reduced to eliminate the applicability of such excise taxes); |

| | • | | at the completion of the merger, the Company will terminate all its non-qualified deferred compensation plans, including the key employee bonus plan, key employee deferred compensation plan and deferred compensation plan for non-employee directors and any other non-qualified deferred compensation plans in which our executive officers or directors participate, and will cause all accounts thereunder to be paid out to participants in cash; |

| | • | | the merger agreement provides for indemnification arrangements for each of our current and former directors and officers that will continue for six years following the effective time of the merger as well as insurance coverage covering his or her service to the Company as a director or officer; and |

| | • | | although no agreements have been entered into as of the date of this proxy statement, the Sponsors have informed us that it is their intention to retain members of our existing management team with the |

8

| | surviving corporation after the merger is completed, and in that connection, members of management currently are engaged in discussions with representatives of Parent and we believe that these persons are likely to enter into new arrangements with Parent, Merger Sub or their affiliates regarding employment with, and the right to purchase or participate in the equity of, the surviving corporation, although such matters are subject to further negotiation and discussion and no terms or conditions have been finalized. |

Material United States Federal Income Tax Consequences (Page 47)

If you are a U.S. holder of our common stock, the merger will be a taxable transaction to you. For U.S. federal income tax purposes, your receipt of cash in exchange for your shares of the Company’s common stock generally will cause you to recognize a gain or loss measured by the difference, if any, between the cash you receive in the merger and your adjusted tax basis in your shares. If you are a non-U.S. holder of our common stock, the merger will generally not be a taxable transaction to you under U.S. federal income tax laws unless you have certain connections to the United States. You should consult your own tax advisor for a full understanding of how the merger will affect your taxes.

Regulatory Approvals (Page 49)

The Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “Hart-Scott-Rodino Act”) provides that transactions such as the merger may not be completed until certain information has been submitted to the Federal Trade Commission and the Antitrust Division of the U.S. Department of Justice and certain waiting period requirements have been satisfied. On May 13, 2005 and on May16, 2005, the Company andNewton Holding, LLC (an affiliate of TPG and Warburg Pincus), respectively, each filed a Notification and Report Form with the Antitrust Division and the Federal Trade Commission and requested an early termination of the waiting period. The Federal Trade Commission granted early termination of the waiting period initiated by these filings onMay 25, 2005.

Except as noted above with respect to the required filings under the Hart-Scott-Rodino Act and the filing of a certificate of merger in Delaware at or before the effective date of the merger, we are unaware of any material federal, state or foreign regulatory requirements or approvals required for the execution of the merger agreement or completion of the merger.

Procedure for Receiving Merger Consideration (Page 54)

As soon as practicable after the effective time of the merger, a paying agent will mail a letter of transmittal and instructions to you and the other Neiman Marcus stockholders. The letter of transmittal and instructions will tell you how to surrender your stock certificates or book-entry shares in exchange for the merger consideration.You should not return your stock certificates with the enclosed proxy card, and you should not forward your stock certificates to the paying agent without a letter of transmittal.

No Solicitation of Transactions (Page 60)

The merger agreement restricts our ability to solicit or engage in discussions or negotiations with a third party regarding specified transactions involving the Company. Notwithstanding these restrictions, under certain limited circumstances required for our board of directors to comply with its fiduciary duties, our board of directors may respond to an unsolicited written bona fide proposal for an alternative acquisition or terminate the merger agreement and enter into an agreement with respect to a superior proposal after paying the termination fee specified in the merger agreement.

Conditions to Closing (Page 64)

Before we can complete the merger, a number of conditions must be satisfied. These include:

| | • | | the receipt of Company stockholder approval; |

9

| | • | | the absence of governmental orders that have the effect of making the merger illegal or that otherwise prohibit the closing; |

| | • | | the expiration or termination of the waiting period under the Hart-Scott-Rodino Act; |

| | • | | performance by each of the parties of its covenants under the merger agreement in all material respects; and |

| | • | | the accuracy of the Company’s representations and warranties, except to the extent the failure of such representations and warranties to be true and correct would not constitute a material adverse effect. |

Other than the conditions pertaining to the Company stockholder approval, the absence of governmental orders and the expiration or termination of the HSR Act waiting period, either the Company, on the one hand, or Parent and Merger Sub, on the other hand, may elect to waive conditions to their respective performance and complete the merger. None of the Company, Parent or Merger Sub, however, has any intention to waive any condition as of the date of this proxy statement.

Termination of the Merger Agreement (Page 65)

Neiman Marcus, Parent and Merger Sub may agree in writing to terminate the merger agreement at any time without completing the merger, even after the stockholders of Neiman Marcus have adopted the merger agreement. The merger agreement may also be terminated at any time prior to the effective time of the merger in certain other circumstances, including:

| | • | | by either Parent or the Company if: |

| | o | | the closing has not occurred on or before November 1, 2005, provided that if the marketing period has not ended on or before August 15, 2005, then such date is extended to the earlier of (i) the tenth business day following the final day of the marketing period and (ii) December 16, 2005 (and in certain specified circumstances related to regulatory matters such date may be extended by either Parent or us by three months beyond either applicable date); |

| | o | | a final, non-appealable governmental order prohibits the merger; |

| | o | | the Company stockholders do not adopt the merger agreement at the special meeting or any postponement or adjournment thereof; |

| | o | | there is a material breach by the non-terminating party of its representations, warranties, covenants or agreements in the merger agreement such that the closing conditions would not be satisfied; |

| | • | | by Parent, if our board of directors withdraws or adversely modifies its recommendation or approval of the merger agreement or recommends or approves another acquisition proposal; |

| | • | | by the Company, prior to the special meeting, if we receive a superior proposal, but only after we have provided Parent a three business day period to revise the terms and conditions of the merger agreement, negotiate in good faith with Parent with respect thereto and only if we pay the termination fee described below; or |

| | • | | by the Company, if certain conditions to closing have been satisfied or waived and the closing has not occurred after completion of the marketing period. |

Termination Fees and Expenses (Page 66)

Under certain circumstances, in connection with the termination of the merger agreement, the Company will be required to pay Parent$140.3 million in termination fees.

10

In the event the merger agreement is terminated because the Company’s stockholders fail to adopt the merger agreement at the special meeting or any adjournment or postponement thereof, the Company is required to reimburse Parent for expenses incurred in connection with the merger agreement, up to a maximum of $20 million, which amount will be offset against the termination fee described above, if payable.

In the event that the Company terminates the merger agreement because Parent (i) breaches its obligations to effect the closing and satisfy its obligations with respect to payment of the merger consideration when all conditions to the closing are satisfied and the marketing period has expired and (ii) Parent fails to effect the closing because of a failure to receive the proceeds of one or more of the debt financings contemplated by the debt financing commitments or because of its refusal to accept debt financing on terms materially less beneficial to it than the terms set forth in the debt financing commitments, Merger Sub will be required to pay the Company a $140.3 million termination fee. This termination fee payable to the Company is the exclusive remedy of the Company unless, in general, Parent is otherwise in breach of the merger agreement, in which case the Company may pursue a damages claim. The aggregate liability of Parent and its affiliates arising from any breach of the merger agreement is in any event capped at $500,000,000.

The Credit Card Transaction (Page 50)

On July 7, 2005, the Company closed the previously announced strategic alliance with HSBC-North America’s Retail Services business to support and enhance the credit operations of the Company and its subsidiaries. In connection with the transaction, HSBC Retail Services purchased the private label credit card accounts and related assets of the Company and its subsidiary Bergdorf Goodman, Inc., as well as the outstanding balances associated with such accounts. The total purchase price was comprised of the face value of the receivables and accumulated accounts receivable collections, or approximately $653 million, which included approximately $540 million in net cash proceeds and the assumption of or repayment of approximately $113 million of the Company’s securitization liabilities. The Company also will receive on-going payments related to credit sales generated under the arrangements with HSBC Retail Services. In addition, pursuant to the terms of the arrangement, the Company will continue to handle key customer service functions.

Market Price of Neiman Marcus Stock (Page 71)

Our Class A common stock and Class B common stock are each listed on the New York Stock Exchange (the “NYSE”) under the trading symbols “NMG.A” and “NMG.B”, respectively. On April 29, 2005, which was the last trading day before we announced the merger, the Company’s Class A common stock closed at $98.32 per share and the Company’s Class B common stock closed at $97.20 per share.On July15, 2005, which was the last trading day before the date of this proxy statement, the Company’s Class A common stock closed at $97.42 per share and the Company’s Class B common stock closed at $97.00 per share.

Rights of Appraisal (Page 76 and Annex D)

Delaware law provides you with appraisal rights in the merger. This means that, if you comply with the procedures for perfecting appraisal rights provided for under Delaware law, you are entitled to have the fair value of your shares determined by the Delaware Court of Chancery and to receive payment based on that valuation in lieu of the merger consideration. The ultimate amount you receive in an appraisal proceeding may be more or less than, or the same as, the amount you would have received under the merger agreement.

To exercise your appraisal rights, you must deliver a written demand for appraisal to the Company before the vote on the merger agreement at the special meeting and you must not vote in favor of the adoption of the merger agreement. Your failure to follow exactly the procedures specified under Delaware law will result in the loss of your appraisal rights. A copy of Section 262 of the General Corporation Law of the State of Delaware (“DGCL”) is attached to this proxy statement as Annex D.

11

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING INFORMATION

This proxy statement, and the documents to which we refer you in this proxy statement, contain forward-looking statements based on estimates and assumptions. Forward-looking statements include information concerning possible or assumed future results of operations of the Company, the expected completion and timing of the merger and other information relating to the merger. There are forward-looking statements throughout this proxy statement, including, among others, under the headings “Summary,” “The Merger,” “The Merger—Opinion of JPMorgan” and in statements containing the words “believes,” “plans,” “expects,” “anticipates,” “intends,” “estimates” or other similar expressions. For each of these statements, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. You should be aware that forward-looking statements involve known and unknown risks and uncertainties. Although we believe that the expectations reflected in these forward-looking statements are reasonable, we cannot assure you that the actual results or developments we anticipate will be realized, or even if realized, that they will have the expected effects on the business or operations of the Company. These forward-looking statements speak only as of the date on which the statements were made and we undertake no obligation to update or revise any forward-looking statements made in this proxy statement or elsewhere as a result of new information, future events or otherwise. In addition to other factors and matters contained or incorporated in this document, we believe the following factors could cause actual results to differ materially from those discussed in the forward-looking statements:

| | • | | Considerations Relating to the Merger Agreement and the Merger: |

| | • | | the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; |

| | • | | the outcome of the legal proceedings that have been instituted against us and others following announcement of the merger agreement; |

| | • | | the failure of the merger to close for any other reason; |

| | • | | the amount of the costs, fees, expenses and charges related to the merger; |

| | • | | Political and General Economic Conditions: |

| | • | | current political and general economic conditions or changes in such conditions; |

| | • | | terrorist activities in the United States; |

| | • | | political, social, economic, or other events resulting in the short or long-term disruption in business at the Company’s stores, distribution centers or offices; |

| | • | | Customer Demographic Issues: |

| | • | | changes in the demographic or retail environment; |

| | • | | changes in consumer confidence resulting in a reduction of discretionary spending on goods that are, or are perceived to be, “luxuries”; |

| | • | | changes in consumer preferences or fashion trends; |

| | • | | changes in the Company’s relationships with its key customers; |

| | • | | Merchandise Procurement and Supply Chain Considerations: |

| | • | | changes in the Company’s relationships with designers, vendors and other sources of merchandise, including adverse changes in their financial viability; |

| | • | | delays in receipt of merchandise ordered by the Company due to work stoppages and/or other causes of delay in connection with either the manufacture or shipment of such merchandise; |

12

| | • | | changes in foreign currency exchange rates; |

| | • | | significant increases in paper, printing and postage costs; |

| | • | | Industry and Competitive Factors: |

| | • | | competitive responses to the Company’s marketing, merchandising and promotional efforts and/or inventory liquidations by vendors or other retailers; |

| | • | | seasonality of the retail business; |

| | • | | adverse weather conditions or natural disasters, particularly during peak selling seasons; |

| | • | | delays in anticipated store openings and renovations; |

| | • | | Employee Considerations: |

| | • | | changes in key management personnel; |

| | • | | changes in the Company’s relationships with certain of its key sales associates; |

| | • | | Legal and Regulatory Issues: |

| | • | | changes in government or regulatory requirements increasing the Company’s costs of operations; |

| | • | | litigation that may have an adverse effect on the financial results or reputation of the Company; |

| | • | | impact of funding requirements related to the Company’s noncontributory defined benefit pension plan; |

| | • | | the design and implementation of new information systems as well as enhancements of existing systems; and |

| | • | | risks, uncertainties and factors set forth in our reports and documents filed with the SEC (which reports and documents should be read in conjunction with this proxy statement; see “Where You Can Find Additional Information”). |

13

THE PARTIES TO THE MERGER

The Neiman Marcus Group, Inc.

The Neiman Marcus Group, Inc. is among the leading luxury retailers in the world, focusing on high-end apparel, accessories, jewelry, beauty and decorative home products. At the end of our previous fiscal year, July 31, 2004, we operated 35 Neiman Marcus stores, two Bergdorf Goodman stores and fourteen Last Call clearance centers. We also sell merchandise through Neiman Marcus Direct, our catalog and online operations, including through the Internet sites www.neimanmarcus.com, www.bergdorfgoodman.com and www.horchow.com. In addition, we own majority interests in Kate Spade LLC and Gurwitch Products, L.L.C., which produces the Laura Mercier line of cosmetics.

The Neiman Marcus Group, Inc. is incorporated in the state of Delaware with its principal executive offices at One Marcus Square, 1618 Main Street, Dallas, Texas 75201 and its telephone number is (214) 743-7600.

Newton Acquisition, Inc.

Parent is a Delaware corporation with its principal executive offices at c/o Texas Pacific Group, 301 Commerce Street, Suite 3300, Fort Worth, TX 76102. Parent’s telephone number is(817) 871-4000. Parent is indirectly owned in equal parts by the Sponsors through certain investment funds affiliated with the Sponsors. Parent was formed solely for the purpose of entering into the merger agreement and consummating the transactions contemplated by the merger agreement. It has not conducted any activities to date other than activities incidental to its formation and in connection with the transactions contemplated by the merger agreement.

Newton Acquisition Merger Sub, Inc.

Merger Sub is a Delaware corporation and a wholly-owned subsidiary of Parent. Merger Sub’s principal executive offices are located at c/o Texas Pacific Group, 301 Commerce Street, Suite 3300, Fort Worth, TX 76102 and its telephone number is(817) 871-4000. Merger Sub was organized solely for the purpose of entering into the merger agreement and consummating the transactions contemplated by the merger agreement. It has not conducted any activities to date other than activities incidental to its formation and in connection with the transactions contemplated by the merger agreement. Under the terms of the merger agreement, Merger Sub will merge with and into us. The Company will survive the merger and Merger Sub will cease to exist.

The current indirect owners of Parent, and through Parent, Merger Sub, consist of private equity funds sponsored by TPG Advisors III, Inc. and TPG Advisors IV, Inc., Warburg Pincus & Co., Warburg Pincus LLC and Warburg Pincus Partners LLC.

Each of TPG Advisors III, Inc. and TPG Advisors IV, Inc. (together, “TPG”) is serving as the sole general partner of related entities engaged in making investments in securities of public and private companies.

Warburg Pincus & Co., Warburg Pincus LLC and Warburg Pincus Partners LLC (together, “Warburg Pincus”) are engaged in making private equity and related investments.

14

THE SPECIAL MEETING

Time, Place and Purpose of the Special Meeting

This proxy statement is being furnished to our stockholders as part of the solicitation of proxies by our board of directors for use at the special meeting to be held onTuesday, August 16, 2005, starting at8:00 a.m., Eastern Time, atthe Marriott Boston Newton Hotel, 2345 Commonwealth Avenue, Newton, Massachusetts or at any postponement or adjournment thereof. The purpose of the special meeting is for our stockholders to consider and vote upon the adoption of the merger agreement. Our stockholders must adopt the merger agreement for the merger to occur. If the stockholders fail to adopt the merger agreement, the merger will not occur. A copy of the merger agreement is attached to this proxy statement as Annex A. This proxy statement and the enclosed form of proxy are first being mailed to our stockholders on or aboutJuly 18, 2005.

Record Date and Quorum

The holders of record of the Company’s common stock as of the close of business onJuly 11, 2005, the record date for the special meeting, are entitled to receive notice of, and to vote at, the special meeting. On the record date, there were48,947,578 shares of the Company’s common stock outstanding (which includes29,525,199 shares of our Class A common stock and19,422,379 shares of our Class B common stock).

The holders of a majority of the outstanding shares of the Company’s common stock on the record date represented in person or by proxy will constitute a quorum for purposes of the special meeting. A quorum is necessary to hold the special meeting. Any shares of the Company’s common stock held in treasury by the Company or by any of our subsidiaries are not considered to be outstanding for purposes of determining a quorum. Once a share is represented at the special meeting, it will be counted for the purpose of determining a quorum at the special meeting and any postponement or adjournment of the special meeting. However, if a new record date is set for the adjourned special meeting, then a new quorum will have to be established.

Required Vote

Completion of the merger requires the adoption of the merger agreement by the affirmative vote of the holders of a majority in combined voting power of the Company’s common stock outstanding on the record date. Each outstanding share of the Company’s common stock on the record date entitles the holder to one vote at the special meeting. For the purpose of voting on the matters at the special meeting there is no difference in voting power between shares of Class A common stock and shares of Class B common stock.

As ofJuly 11, 2005, the record date, the directors and current executive officers of Neiman Marcus beneficially owned (excluding options and excluding shares beneficially owned by Richard A. Smith, Robert A. Smith and Brian J. Knez, each of whom is party to the stockholder agreement discussed below), in the aggregate,449,417 shares of the Company’s common stock, or approximately0.9% of the outstanding shares of the Company’s common stock. The directors and current executive officers have informed Neiman Marcus that they intend to vote all of their shares of the Company’s common stock “FOR” the adoption of the merger agreement and “FOR” any postponement or adjournment of the special meeting, if necessary or appropriate to solicit additional proxies.

The Smith Family Holders, including, among others, Richard A. Smith, the Chairman of our board of directors, and Robert A. Smith and Brian J. Knez, the co-Vice Chairmen of our board, have entered into a stockholder agreement with Parent and Merger Sub with respect to the 6,055,057 shares of common stock (16,471 shares of Class A common stock and 6,038,586 shares of Class B common stock) owned in the aggregate by the Smith Family Holders as of the date of the stockholder agreement. As of the record date, the aggregate number of shares of the Company’s common stock owned by the Smith Family Holders subject to the stockholders agreementremains 6,055,057 shares, which represents approximately12.4% of the voting power of all outstanding shares of the Company’s common stock. The Smith Family Holders have agreed to vote all of these shares in favor of the adoption of the merger agreement and against any competing transaction proposed to the Company’s stockholders, unless the merger agreement is terminated in accordance with its terms.

15

Proxies; Revocation

If you are a stockholder of record and submit a proxy by telephone or the Internet or by returning a signed proxy card by mail, your shares will be voted at the special meeting as you indicate on your proxy card or by such other method. If no instructions are indicated on your proxy card, your shares of the Company’s common stock will be voted “FOR” the adoption of the merger agreement and “FOR” any postponement or adjournment of the special meeting, if necessary or appropriate to solicit additional proxies.

If your shares are held in “street name” by your broker, you should instruct your broker how to vote your shares using the instructions provided by your broker. If you have not received such voting instructions or require further information regarding such voting instructions, contact your broker and they can give you directions on how to vote your shares. Under the rules of the NYSE, brokers who hold shares in “street name” for customers may not exercise their voting discretion with respect to the approval of non-routine matters such as the merger proposal and thus, absent specific instructions from the beneficial owner of such shares, brokers are not empowered to vote such shares with respect to the adoption of the merger agreement (i.e., “broker non-votes”). Shares of Company common stock held by persons attending the special meeting but not voting, or shares for which the Company has received proxies with respect to which holders have abstained from voting, will be considered abstentions. Abstentions and properly executed broker non-votes, if any, will be treated as shares that are present and entitled to vote at the special meeting for purposes of determining whether a quorum exists but will have the same effect as a vote “AGAINST” adoption of the merger agreement.

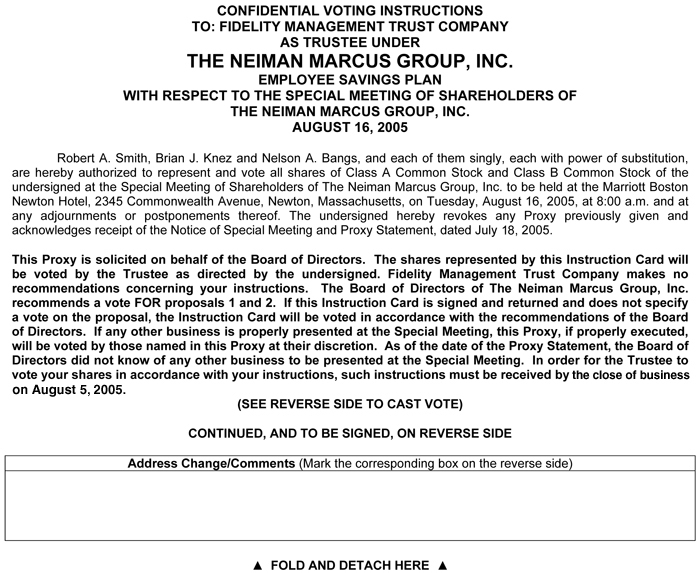

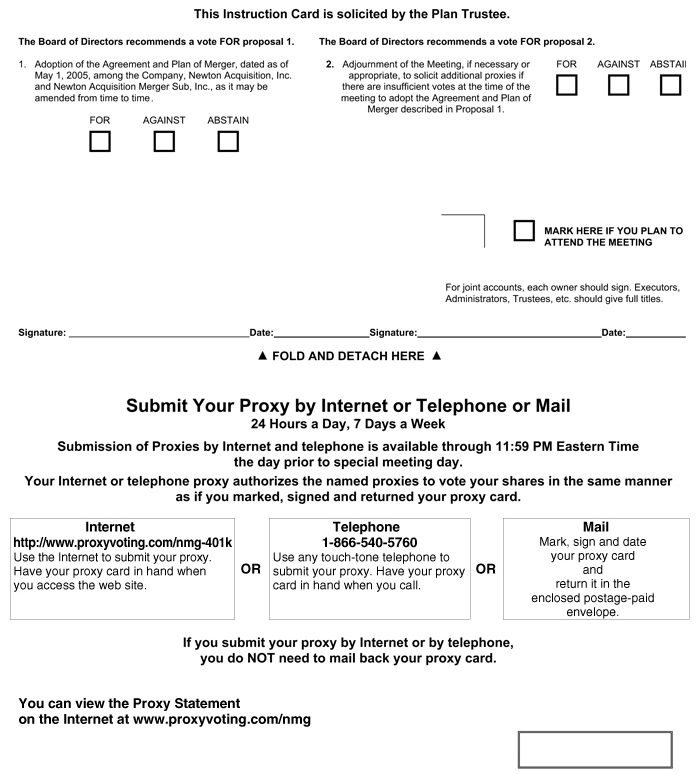

If you participate in the Company’s employee savings plan, you will receive a voting instruction card with respect to those shares of common stock subject to the plan which will provide Fidelity Investments, the plan’s record keeper, with instructions on how to vote such shares. You must submit your voting instructions for your shares to Fidelity by the close of business onAugust 5, 2005 to allow Fidelity time to receive your voting instructions and vote on behalf of the plan. If you hold shares of common stock outside of the employee savings plan, you will receive a separate proxy or voting instruction card for such shares. In order to have all of your shares counted at the meeting, you must complete and submit all cards which you receive.

You may revoke your proxy at any time before the vote is taken at the special meeting. To revoke your proxy, you must either advise our Corporate Secretary in writing, submit a proxy by telephone, the Internet or mail dated after the date of the proxy you wish to revoke or attend the special meeting and vote your shares in person. Attendance at the special meeting will not by itself constitute revocation of a proxy.

Please note that if you have instructed your broker to vote your shares, the options for revoking your proxy described in the paragraph above do not apply and instead you must follow the directions provided by your broker to change these instructions.

Neiman Marcus does not expect that any matter other than the adoption of the merger agreement (and to approve the adjournment of the meeting, if necessary or appropriate to solicit additional proxies) will be brought before the special meeting. If, however, any such other matter is properly presented at the special meeting or any adjournment or postponement of the special meeting, the persons appointed as proxies will have discretionary authority to vote the shares represented by duly executed proxies in accordance with their discretion and judgment.

Submitting Proxies Via the Internet or by Telephone

Stockholders of record and many stockholders who hold their shares through a broker or bank will have the option to submit their proxies or voting instructions via the Internet or by telephone. There are separate arrangements for using the Internet and telephone to submit your proxy depending on whether you are a

16

stockholder of record or your shares are held in “street name” by your broker. If your shares are held in “street name,” you should check the voting instruction card provided by your broker to see which options are available and the procedures to be followed.

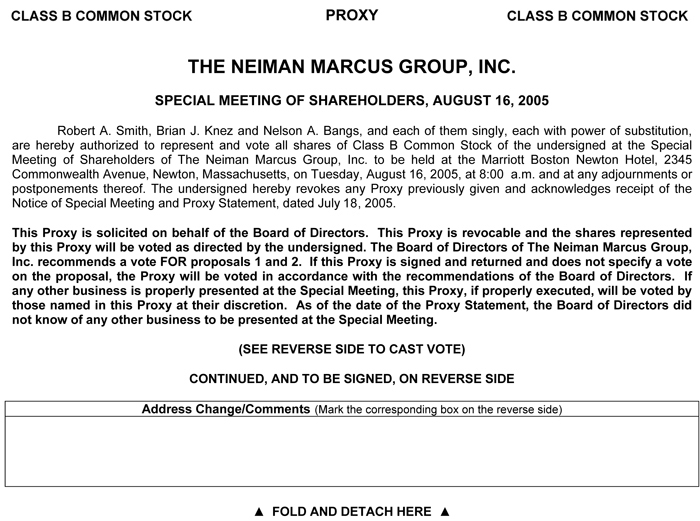

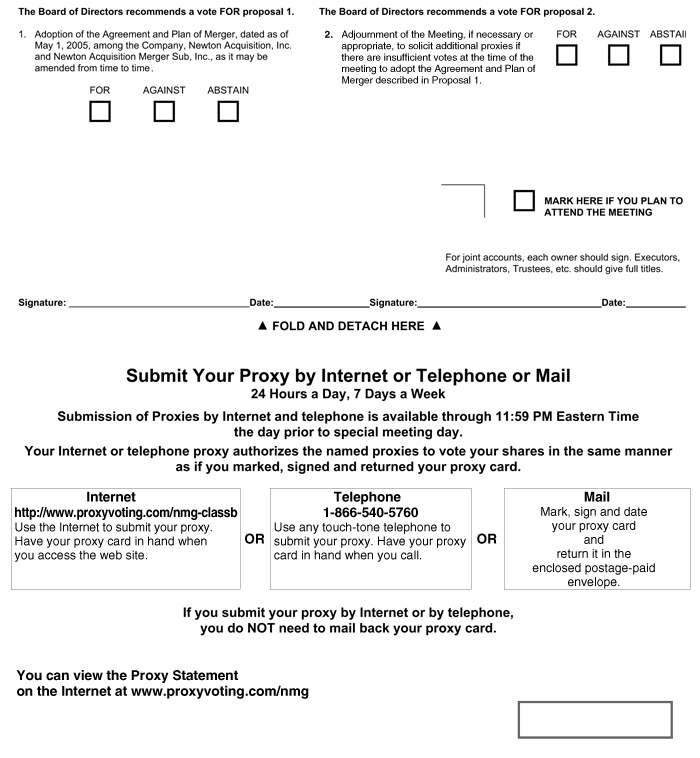

In addition to submitting the enclosed proxy card by mail, Neiman Marcus stockholders of record may submit their proxies:

| | • | | via the Internet by visiting a website established for that purpose atwww.proxyvoting.com/nmg (with respect to shares of Class A common stock), www.proxyvoting.com/nmg-classb (with respect to shares of Class B common stock) and www.proxyvoting.com/nmg-401k (with respect to shares of common stock subject to the Company’s employee savings plan) and following the instructions on the website; or |

| | • | | by telephone by calling the toll-free number1-866-540-5760 in the United States, Puerto Rico or Canada on a touch-tone phone and following the recorded instructions. |

Adjournments and Postponements

Although it is not currently expected, the special meeting may be adjourned or postponed for the purpose of soliciting additional proxies. Any adjournment may be made without notice (if the adjournment is not for more than thirty days), other than by an announcement made at the special meeting of the time, date and place of the adjourned meeting. Whether or not a quorum exists, holders of a majority of the shares of the Company’s common stock present in person or represented by proxy at the special meeting and entitled to vote thereat may adjourn the special meeting. Any signed proxies received by the Company in which no voting instructions are provided on such matter will be voted in favor of an adjournment in these circumstances. Any adjournment or postponement of the special meeting for the purpose of soliciting additional proxies will allow the Company’s stockholders who have already sent in their proxies to revoke them at any time prior to their use at the special meeting as adjourned or postponed.

Solicitation of Proxies

The Company will pay the cost of this proxy solicitation. In addition to soliciting proxies by mail, directors, officers and employees of Neiman Marcus may solicit proxies personally and by telephone, facsimile or other electronic means of communication. These persons will not receive additional or special compensation for such solicitation services. Neiman Marcus will, upon request, reimburse brokers, banks and other nominees for their expenses in sending proxy materials to their customers who are beneficial owners and obtaining their voting instructions. The Company has retained Innisfree M&A Incorporated to assist it in the solicitation of proxies for the special meeting and will pay Innisfree M&A Incorporated a fee of approximately $15,000, plus reimbursement of out-of-pocket expenses.

17

THE MERGER

Background of the Merger

As part of its ongoing evaluation of its business, the Company’s board of directors and management regularly evaluates the Company’s long-term strategic alternatives and prospects for continued operations as an independent company. The Company’s 2000 fiscal year (which ended July 29, 2000) was one of the most successful years in its history in terms of financial results, and these strong results continued into the beginning of the Company’s 2001 fiscal year. During the latter part of the Company’s 2001 fiscal year and continuing into the Company’s 2002 and 2003 fiscal years (which ended on August 3, 2002 and August 2, 2003, respectively), the luxury retail market operated amid substantial economic uncertainty, which adversely affected the operating results of the Company and several other luxury retailers. The Company reported substantially improved operating results for its 2004 fiscal year (which ended on July 31, 2004) as a result of an overall improvement in the economy, in addition to on-going initiatives of the Company relating to, among other things, improved inventory efficiencies and a continued disciplined approach to capital expenditures.

While recognizing the Company’s performance for its 2004 fiscal year was greatly improved relative to its 2002 and 2003 fiscal years and the Company’s overall business was stronger, the Company’s board of directors also understood the cyclical nature of the luxury retail industries in which it operates and the effect these factors have on the Company’s financial results and share price. In that connection, the board of directors also noted that the Company’s stock price was trading at all-time highs in the latter part of 2004. Moreover, the Company’s board of directors recognized that given its improved operating results and the relative strength of the financial markets, an opportunity might exist for the stockholders to realize substantial value through a strategic alternative that might not be available at another time. The board of directors also considered the extent to which the Company could incur more leverage and the desirability of returning cash to stockholders. Accordingly, in the Fall of 2004, the board of directors considered it to be an appropriate time to explore its strategic alternatives. In that context, the Company contacted Goldman, Sachs & Co. to assist the Company in considering all of its available strategic alternatives, including continuing to execute the Company’s strategic plan.

Following these initial contacts, representatives of Goldman Sachs met with various members of the Company’s management team to discuss strategic alternatives available to the Company, and on December 6, 2004, a meeting of the Company’s board of directors was convened to thoroughly review and discuss these strategic alternatives.

At the December 6, 2004 board meeting, Mr. Richard A. Smith, Chairman of the Company’s board of directors, opened the meeting by setting forth an agenda for the meeting and explaining the rationale for reviewing the Company’s strategic alternatives at that time. Representatives of Simpson Thacher & Bartlett, which had provided legal services to the Company in the past, were also present at this meeting and reviewed with the board of directors the fiduciary duties of directors in the context of considering strategic options relating to the Company. Members of the Company’s management then made a presentation concerning the Company’s strategy, business, results of operations and prospects, including its current and projected cash needs and capital expenditure requirements. Management responded to questions from the Board. The Company’s board of directors discussed the challenges and opportunities that the Company may face in the future. The Board, while considering opportunities (such as growth in the Company’s Internet business, favorable demographics and store initiatives designed to increase productivity), also recognized the risks associated with remaining an independent company. Members of the Company’s management further outlined various strategic alternatives available to the Company, including the risks and benefits of making changes in its corporate direction, engaging in merger and acquisition activity, expanding the Company’s stock buy-back program, engaging in a potential recapitalization of the Company’s operations and selling the entire Company. Management also discussed the possibility of selling, financing or outsourcing the Company’s credit card portfolio. The board of directors discussed the benefits of pursuing a potential credit card transaction in connection with either a recapitalization or sale. The board of directors discussed the risks associated with engaging in a credit card transaction, particularly given that the Company’s credit card holders represent a critical element of the Company’s customer base and the need to

18

carefully select a credit partner in the event that an outsourcing arrangement, pursuant to which the Company would continue to maintain some level of control over how its customers’ credit card accounts were managed, was entered into as part of any such transaction.

Representatives of Goldman Sachs were present at the December 6, 2004 meeting and provided a preliminary analysis to the Company’s board of directors regarding the financial aspects of a recapitalization and a potential sale of the Company. In that connection, Goldman Sachs also presented a detailed analysis of potential buyers, which included the financial implications of a business combination for both strategic and financial buyers. The board of directors discussed the various alternatives and representatives of management, Goldman Sachs and Simpson Thacher & Bartlett each responded to questions. The board of directors also discussed the risks of a potential sale process, including information leaks. Following these discussions, the board of directors authorized Goldman Sachs to refine its analysis and continue its review of the Company (including with respect to the credit card portfolio) in anticipation of a decision by the board at a subsequent meeting as to whether to explore a sale transaction with third parties. The board of directors further authorized Goldman Sachs and management to engage in discussions with credit rating agencies in an effort to gauge the effect that a variety of leveraged capital structures would have on the Company’s debt rating, given the possibility that private equity firms could emerge as the candidates most interested in a business combination transaction with the Company and also to help refine judgments regarding a potential recapitalization of the company. This information, along with further information regarding a potential credit card transaction, would also assist any potential purchasers in assessing how much they could pay if preliminary indications of interest were solicited.

On January 14, 2005, following the annual meeting of shareholders of the Company, the board of directors met to receive an update as to the on-going progress of the strategic review and to discuss whether to continue exploring a possible sale of the Company or other alternatives. Representatives of Goldman Sachs and Simpson Thacher & Bartlett were present at this meeting. James E. Skinner, Senior Vice President and Chief Financial Officer of the Company, presented the Company’s five-year financial plan. Mr. Skinner responded to questions from the board of directors and the board of directors discussed the risks and opportunities associated with the five-year plan. Following Mr. Skinner’s presentation, representatives of Goldman Sachs provided a status update of the various strategic alternatives available to the Company being explored, including a recapitalization, and responded to questions from the board of directors. Goldman Sachs updated the board regarding management’s meetings with credit rating agencies, which Goldman Sachs had attended, and discussed the availability of private equity capital and favorable capital markets and the impact these factors could have in terms of generating interest from financial sponsors. Goldman Sachs also addressed the potential pool of strategic buyers, including one potential buyer that the Company might wish to contact at the outset of the process before any other potential purchasers were solicited. In assessing the potential pool of strategic buyers, Goldman Sachs assessed both their willingness and financial ability to acquire the Company. The board of directors discussed the pool of strategic buyers. In the context of the board of directors assessing whether any strategic buyers were likely to be highly interested in and capable of acquiring the Company, the board noted the very limited number of inquiries from strategic buyers in the years following the time that the Company was spun off from its parent company, including when the Company stock price was trading at all-time lows. The board also discussed the minimal cost and revenue synergies that a strategic buyer of the Company could reasonably expect to achieve in connection with a purchase of the Company. The board of directors also considered the increased risk of information leaks (and competitive risks of sharing information) with strategic buyers. The board of directors discussed these alternatives, and management and Goldman Sachs responded to questions.

Also during the course of the January 14, 2005 meeting, the board of directors discussed with Goldman Sachs and management possible next steps in the event the board of directors were to authorize further exploration of a sale transaction. During the course of this discussion, Goldman Sachs expressed its willingness to facilitate the process by offering a financing package for any potential acquisition of the Company that would be available to all potential purchasers. Representatives of Goldman Sachs described the ways in which the availability of financing could enhance confidentiality, speed and certainty in exploring and completing a

19