UNITED STATES

SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05262

MFS SERIES TRUST VIII

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199 (Address of principal executive offices) (Zip code)

Christopher R. Bohane

Massachusetts Financial Services Company

111Huntington Avenue Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: October 31

Date of reporting period: April 30, 2024

ITEM 1. REPORTS TO STOCKHOLDERS.

Item 1(a):

Semiannual Report

April 30, 2024

| 1 |

| 3 |

| 5 |

| 26 |

| 28 |

| 30 |

| 31 |

| 36 |

| 52 |

| 53 |

| 53 |

| 53 |

| 53 |

| 53 |

The report is prepared for the general information of shareholders. It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

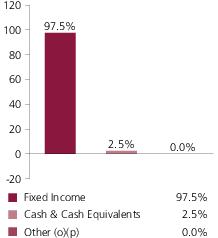

Portfolio structure at value (v)

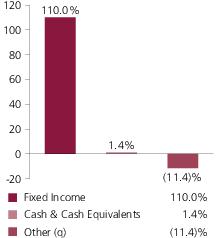

Portfolio structure reflecting equivalent exposure of derivative positions (i)

Fixed income sectors (i)

| U.S. Treasury Securities | 43.2% |

| Investment Grade Corporates | 28.7% |

| Collateralized Debt Obligations | 11.3% |

| High Yield Corporates | 8.9% |

| Mortgage-Backed Securities | 5.0% |

| Emerging Markets Bonds | 4.8% |

| Commercial Mortgage-Backed Securities | 2.5% |

| Residential Mortgage-Backed Securities | 2.4% |

| Asset-Backed Securities | 1.9% |

| Municipal Bonds | 1.2% |

| Non-U.S. Government Bonds | 0.1% |

Composition including fixed income credit quality (a)(i)

| AAA | 6.6% |

| AA | 5.0% |

| A | 11.2% |

| BBB | 25.7% |

| BB | 6.4% |

| B | 6.0% |

| CCC | 0.8% |

| U.S. Government | 31.8% |

| Federal Agencies | 5.0% |

| Not Rated | 11.5% |

| Cash & Cash Equivalents | 1.4% |

| Other | (11.4)% |

Portfolio facts

| Average Duration (d) | 6.0 |

| Average Effective Maturity (m) | 8.8 yrs. |

Portfolio Composition - continued

| (a) | For all securities other than those specifically described below, ratings are assigned to underlying securities utilizing ratings from Moody’s, Fitch, and Standard & Poor’s rating agencies and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. If none of the 3 rating agencies above assign a rating, but the security is rated by DBRS Morningstar, then the DBRS Morningstar rating is assigned. If none of the 4 rating agencies listed above rate the security, but the security is rated by the Kroll Bond Rating Agency (KBRA), then the KBRA rating is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). Securities rated BBB or higher are considered investment grade. All ratings are subject to change. U.S. Government includes securities issued by the U.S. Department of the Treasury. Federal Agencies includes rated and unrated U.S. Agency fixed-income securities, U.S. Agency mortgage-backed securities, and collateralized mortgage obligations of U.S. Agency mortgage-backed securities. |

Not Rated includes fixed income securities and fixed income derivatives that have not been rated by any rating agency. The fund may or may not have held all of these instruments on this date. The fund is not rated by these agencies.

| (d) | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value due to the interest rate move. The Average Duration calculation reflects the impact of the equivalent exposure of derivative positions, if any. |

| (i) | For purposes of this presentation, the components include the value of securities, and reflect the impact of the equivalent exposure of derivative positions, if any. These amounts may be negative from time to time. Equivalent exposure is a calculated amount that translates the derivative position into a reasonable approximation of the amount of the underlying asset that the portfolio would have to hold at a given point in time to have the same price sensitivity that results from the portfolio’s ownership of the derivative contract. When dealing with derivatives, equivalent exposure is a more representative measure of the potential impact of a position on portfolio performance than value. The bond component will include any accrued interest amounts. |

| (m) | In determining each instrument’s effective maturity for purposes of calculating the fund’s dollar-weighted average effective maturity, MFS uses the instrument’s stated maturity or, if applicable, an earlier date on which MFS believes it is probable that a maturity-shortening feature (such as a put, pre-refunding or prepayment) will cause the instrument to be repaid. Such an earlier date can be substantially shorter than the instrument’s stated maturity. |

| (p) | For purposes of the presentation of Portfolio structure at value, Other includes market value from currency derivatives and may be negative. |

| (q) | For purposes of this presentation, Other includes equivalent exposure from currency derivatives and/or any offsets to derivative positions and may be negative. |

| (v) | For purposes of this presentation, market value of fixed income and/or equity derivatives, if any, is included in Cash & Cash Equivalents. |

Where the fund holds convertible bonds, they are treated as part of the equity portion of the portfolio.

Cash & Cash Equivalents includes any cash, investments in money market funds, short-term securities, and other assets less liabilities. Please see the Statement of Assets and Liabilities for additional information related to the fund’s cash position and other assets and liabilities.

Percentages are based on net assets as of April 30, 2024.

The portfolio is actively managed and current holdings may be different.

Expense Table

Fund expenses borne by the shareholders during the period,

November 1, 2023 through April 30, 2024

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments, and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period November 1, 2023 through April 30, 2024.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense Table - continued

Share

Class | | Annualized

Expense

Ratio | Beginning

Account Value

11/01/23 | Ending

Account Value

4/30/24 | Expenses

Paid During

Period (p)

11/01/23-4/30/24 |

| A | Actual | 0.73% | $1,000.00 | $1,063.24 | $3.74 |

| Hypothetical (h) | 0.73% | $1,000.00 | $1,021.23 | $3.67 |

| B | Actual | 1.48% | $1,000.00 | $1,059.60 | $7.58 |

| Hypothetical (h) | 1.48% | $1,000.00 | $1,017.50 | $7.42 |

| C | Actual | 1.48% | $1,000.00 | $1,057.80 | $7.57 |

| Hypothetical (h) | 1.48% | $1,000.00 | $1,017.50 | $7.42 |

| I | Actual | 0.48% | $1,000.00 | $1,062.77 | $2.46 |

| Hypothetical (h) | 0.48% | $1,000.00 | $1,022.48 | $2.41 |

| R6 | Actual | 0.39% | $1,000.00 | $1,063.19 | $2.00 |

| Hypothetical (h) | 0.39% | $1,000.00 | $1,022.92 | $1.96 |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. |

Portfolio of Investments

4/30/24 (unaudited)

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| Issuer | | | Shares/Par | Value ($) |

| Bonds – 97.5% |

| Aerospace & Defense – 1.3% |

| Boeing Co., 2.196%, 2/04/2026 | | $ | 2,018,000 | $1,882,341 |

| Boeing Co., 6.528%, 5/01/2034 (n)(w) | | | 2,458,000 | 2,475,699 |

| Boeing Co., 5.705%, 5/01/2040 | | | 16,359,000 | 14,852,309 |

| Boeing Co., 5.805%, 5/01/2050 | | | 4,282,000 | 3,789,242 |

| Bombardier, Inc., 7.5%, 2/01/2029 (n) | | | 12,000,000 | 12,275,160 |

| TransDigm, Inc., 4.625%, 1/15/2029 | | | 25,500,000 | 23,357,745 |

| | | | | $58,632,496 |

| Apparel Manufacturers – 0.2% |

| Tapestry, Inc., 7%, 11/27/2026 | | $ | 2,424,000 | $2,470,362 |

| Tapestry, Inc., 7.35%, 11/27/2028 | | | 8,000,000 | 8,254,063 |

| | | | | $10,724,425 |

| Asset-Backed & Securitized – 18.1% |

| ACREC 2021-FL1 Ltd., “D”, FLR, 8.083% ((SOFR - 1mo. + 0.11448%) + 2.65%), 10/16/2036 (n) | | $ | 2,591,000 | $2,479,383 |

| ACREC 2023-FL2 LLC, “AS”, FLR, 8.153% (SOFR - 1mo. + 2.832%), 2/19/2038 (n) | | | 7,500,000 | 7,479,155 |

| ACRES 2021-FL2 Issuer Ltd., “C”, FLR, 8.081% ((SOFR - 1mo. + 0.11448%) + 2.65%), 1/15/2037 (n) | | | 3,162,000 | 3,070,084 |

| Allegro CLO Ltd., 2014-1RA, “C”, FLR, 8.586% ((SOFR - 3mo. + 0.26161%) + 3%), 10/21/2028 (n) | | | 1,250,000 | 1,243,745 |

| American Credit Acceptance Receivables Trust, 2024-2, “C”, 6.24%, 4/12/2030 (n) | | | 8,936,000 | 8,927,848 |

| AmeriCredit Automibile Receivables Trust, 2024-2, “B”, 6.1%, 12/13/2027 (n) | | | 3,733,000 | 3,729,607 |

| Arbor Realty Trust, Inc., CLO, 2021-FL1, “A”, FLR, 6.405% ((SOFR - 1mo. + 0.11448%) + 0.97%), 12/15/2035 (n) | | | 2,670,854 | 2,660,985 |

| Arbor Realty Trust, Inc., CLO, 2021-FL1, “AS”, FLR, 6.635% ((SOFR - 1mo. + 0.11448%) + 1.2%), 12/15/2035 (n) | | | 3,925,000 | 3,874,850 |

| Arbor Realty Trust, Inc., CLO, 2021-FL1, “B”, FLR, 6.935% ((SOFR - 1mo. + 0.11448%) + 1.5%), 12/15/2035 (n) | | | 4,406,000 | 4,303,820 |

| Arbor Realty Trust, Inc., CLO, 2021-FL1, “C”, FLR, 7.435% ((SOFR - 1mo. + 0.11448%) + 2%), 12/15/2035 (n) | | | 4,000,000 | 3,899,664 |

| Arbor Realty Trust, Inc., CLO, 2021-FL1, “D”, FLR, 8.385% ((SOFR - 1mo. + 0.11448%) + 2.95%), 12/15/2035 (n) | | | 2,701,000 | 2,632,773 |

| Arbor Realty Trust, Inc., CLO, 2021-FL2, “AS”, FLR, 6.835% ((SOFR - 1mo. + 0.11448%) + 1.4%), 5/15/2036 (n) | | | 6,095,000 | 6,043,162 |

| Arbor Realty Trust, Inc., CLO, 2021-FL2, “B”, FLR, 7.035% ((SOFR - 1mo. + 0.11448%) + 1.6%), 5/15/2036 (n) | | | 7,410,000 | 7,314,241 |

Portfolio of Investments (unaudited) – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Asset-Backed & Securitized – continued |

| Arbor Realty Trust, Inc., CLO, 2021-FL2, “C”, FLR, 7.385% ((SOFR - 1mo. + 0.11448%) + 1.95%), 5/15/2036 (n) | | $ | 875,000 | $859,964 |

| Arbor Realty Trust, Inc., CLO, 2021-FL2, “D” FLR, 7.935% ((SOFR - 1mo. + 11.448%) + 2.5%), 5/15/2036 (n) | | | 3,000,000 | 2,870,193 |

| Arbor Realty Trust, Inc., CLO, 2021-FL3, “B”, FLR, 7.035% ((SOFR - 1mo. + 0.11448%) + 1.6%), 8/15/2034 (n) | | | 3,925,000 | 3,802,116 |

| Arbor Realty Trust, Inc., CLO, 2021-FL3, “C”, FLR, 7.285% ((SOFR - 1mo. + 0.11448%) + 1.85%), 8/15/2034 (n) | | | 3,500,000 | 3,366,349 |

| Arbor Realty Trust, Inc., CLO, 2021-FL3, “D”, FLR, 7.635% ((SOFR - 1mo. + 0.11448%) + 2.2%), 8/15/2034 (n) | | | 539,000 | 509,774 |

| Arbor Realty Trust, Inc., CLO, 2021-FL4, “A”, FLR, 6.785% ((SOFR - 1mo. + 0.11448%) + 1.35%), 11/15/2036 (n) | | | 4,730,000 | 4,709,831 |

| Arbor Realty Trust, Inc., CLO, 2021-FL4, “AS”, FLR, 7.135% ((SOFR - 1mo. + 0.11448%) + 1.7%), 11/15/2036 (n) | | | 5,000,000 | 4,933,058 |

| Arbor Realty Trust, Inc., CLO, 2021-FL4, “C”, FLR, 7.735% ((SOFR - 1mo. + 0.11448%) + 2.3%), 11/15/2036 (n) | | | 1,124,000 | 1,094,092 |

| Arbor Realty Trust, Inc., CLO, 2021-FL4, “D”, FLR, 8.335% ((SOFR - 1mo. + 0.11448%) + 2.9%), 11/15/2036 (n) | | | 15,061,500 | 14,376,646 |

| Arbor Realty Trust, Inc., CLO, 2022-FL1, “A”, FLR, 6.78% (SOFR - 1mo. + 1.45%), 1/15/2037 (n) | | | 4,332,000 | 4,308,035 |

| Arbor Realty Trust, Inc., CLO, 2022-FL1, “C”, FLR, 7.63% (SOFR - 30 day + 2.3%), 1/15/2037 (n) | | | 1,500,000 | 1,474,149 |

| Arbor Realty Trust, Inc., CLO, 2022-FL1, “D”, FLR, 8.33% (SOFR - 30 day + 3%), 1/15/2037 (n) | | | 5,800,000 | 5,472,757 |

| Arbor Realty Trust, Inc., CLO, 2022-FL1, “E”, FLR, 9.08% (SOFR - 30 day + 3.75%), 1/15/2037 (n) | | | 4,500,000 | 4,258,811 |

| Arbor Realty Trust, Inc., CLO, 2022-FL2, “D”, FLR, 9.671% (SOFR - 1mo. + 4.35%), 5/15/2037 (n) | | | 8,038,000 | 7,897,132 |

| AREIT 2019-CRE3 Trust, “D”, FLR, 8.084% ((SOFR - 1mo. + 0.11448%) + 2.65%), 9/14/2036 (n) | | | 1,729,000 | 1,608,793 |

| AREIT 2022-CRE6 Trust, “B”, FLR, 7.18% (SOFR - 30 day + 1.85%), 1/20/2037 (n) | | | 2,957,000 | 2,892,277 |

| AREIT 2022-CRE6 Trust, “E”, FLR, 8.73% (SOFR - 30 day + 3.4%), 1/20/2037 (n) | | | 4,500,000 | 4,171,194 |

| AREIT 2022-CRE7 LLC, “B”, FLR, 8.56% (SOFR - 1mo. + 3.244%), 6/17/2039 (n) | | | 6,000,000 | 5,950,122 |

| ARI Fleet Lease Trust, 2023-B, “A2”, 6.05%, 7/15/2032 (n) | | | 1,483,018 | 1,487,320 |

| Bain Capital Credit CLO Ltd., 2020-4A, “BR”, FLR, 7.825% (SOFR - 3mo. + 2.5%), 10/20/2036 (n) | | | 12,000,000 | 12,076,716 |

| Balboa Bay Loan Funding Ltd., 2020-1A, “CR”, FLR, 7.686% ((SOFR - 3mo. + 0.26161%) + 2.1%), 1/20/2032 (n) | | | 2,083,333 | 2,084,273 |

| Ballyrock CLO 2023-25A Ltd., “A2”, FLR, 7.774% (SOFR - 3mo. + 2.45%), 1/25/2036 (n) | | | 10,000,000 | 10,059,410 |

Portfolio of Investments (unaudited) – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Asset-Backed & Securitized – continued |

| Bayview Financial Revolving Mortgage Loan Trust, FLR, 7.033% ((SOFR - 1mo. + 0.11448%) + 1.6%), 12/28/2040 (n) | | $ | 50,287 | $76,351 |

| BBCMS Mortgage Trust, 2019-C5, “A4”, 3.063%, 11/15/2052 | | | 500,000 | 439,103 |

| BBCMS Mortgage Trust, 2022-C18, “AS”, 6.348%, 12/15/2055 | | | 3,226,076 | 3,283,394 |

| BDS 2021-FL9 Ltd., “C”, FLR, 7.333% ((SOFR - 1mo. + 0.11448%) + 1.9%), 11/16/2038 (n) | | | 4,254,000 | 4,138,972 |

| Benchmark 2019-B10 Mortgage Trust, “AM”, 3.979%, 3/15/2062 | | | 1,000,000 | 897,334 |

| Benchmark 2019-B13 Mortgage Trust, “A4”, 2.952%, 8/15/2057 | | | 5,000,000 | 4,356,393 |

| Benchmark 2023-V3 Mortgage Trust, “AS”, 7.097%, 7/15/2056 | | | 10,000,000 | 10,324,084 |

| Benchmark 2024-V5 Mortgage Trust, “AM”, 6.417%, 1/10/2057 | | | 2,500,000 | 2,535,454 |

| Benefit Street Partners CLO Ltd., 2014-IVA, “CR4”, 7.721% (SOFR - 3mo. + 2.4%), 4/20/2034 (n) | | | 13,000,000 | 13,061,971 |

| BSPDF 2021-FL1 Issuer Ltd., “B”, FLR, 7.235% ((SOFR - 1mo. + 0.11448%) + 1.8%), 10/15/2036 (n) | | | 1,231,000 | 1,182,005 |

| BSPRT 2021-FL6 Issuer Ltd., “C”, FLR, 7.485% ((SOFR - 1mo. + 0.11448%) + 2.05%), 3/15/2036 (n) | | | 1,300,000 | 1,250,883 |

| BSPRT 2021-FL7 Issuer Ltd., “D”, FLR, 8.185% ((SOFR - 1mo. + 0.11448%) + 2.75%), 12/15/2038 (n) | | | 3,418,500 | 3,246,608 |

| BSPRT 2022-FL8 Issuer Ltd., “D”, FLR, 8.13% (SOFR - 30 day + 2.8%), 2/15/2037 (n) | | | 4,000,000 | 3,829,177 |

| Business Jet Securities LLC, 2021-1A, “C”, 5.067%, 4/15/2036 (n) | | | 145,951 | 141,171 |

| Business Jet Securities LLC, 2024-1A, “C”, 9.132%, 5/15/2039 (n) | | | 4,000,000 | 3,977,280 |

| BXMT 2021-FL4 Ltd., “B”, FLR, 6.981% ((SOFR - 1mo. + 0.11448%) + 1.55%), 5/15/2038 (n) | | | 2,123,000 | 1,965,296 |

| Capital Automotive, 2020-1A, “B1”, REIT, 4.17%, 2/15/2050 (n) | | | 764,773 | 740,065 |

| CHCP 2021-FL1 Ltd., “B”, FLR, 7.084% ((SOFR - 1mo. + 0.11448%) + 1.65%), 2/15/2038 (n) | | | 3,500,000 | 3,463,288 |

| CHCP 2021-FL1 Ltd., “C”, FLR, 7.534% ((SOFR - 1mo. + 0.11448%) + 2.1%), 2/15/2038 (n) | | | 549,500 | 539,615 |

| CLNC 2019-FL1 Ltd., “C”, FLR, 7.833% (SOFR - 1mo. + 2.51448%), 8/20/2035 (n) | | | 1,735,000 | 1,702,888 |

| Colt Funding LLC, 2024-1, “A1”, 5.835%, 2/25/2069 (n) | | | 16,515,761 | 16,357,377 |

| Colt Funding LLC, 2024-2, “A1”, 6.125%, 4/25/2069 (n) | | | 9,022,660 | 8,974,080 |

Portfolio of Investments (unaudited) – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Asset-Backed & Securitized – continued |

| Columbia Cent CLO 28 Ltd., “B-R”, 7.728%, 11/07/2030 (n) | | $ | 2,083,333 | $2,073,298 |

| Commercial Equipment Finance 2021-A, LLC, “A”, 2.05%, 2/16/2027 (n) | | | 357,946 | 353,075 |

| Commercial Mortgage Pass-Through Certificates, 2019-BN16, “AS”, 4.267%, 2/15/2052 | | | 2,230,000 | 2,044,805 |

| Commercial Mortgage Pass-Through Certificates, 2019-BN23, “A3”, 2.92%, 12/15/2052 | | | 5,777,000 | 5,007,367 |

| Commercial Mortgage Pass-Through Certificates, 2019-BNK17, “AS”, 3.976%, 4/15/2052 | | | 5,000,000 | 4,523,285 |

| Commercial Mortgage Pass-Through Certificates, 2023-BNK46, “B”, 6.999%, 8/15/2056 | | | 6,906,487 | 7,039,965 |

| Commercial Mortgage Trust, 2015-PC1, “A5”, 3.902%, 7/10/2050 | | | 1,805,893 | 1,769,850 |

| Consumers 2023 Securitization Funding LLC, 5.55%, 3/01/2028 | | | 9,250,000 | 9,217,183 |

| Crest Ltd., CDO, 7% (0.001% Cash or 7% PIK), 1/28/2040 (a)(p) | | | 917,264 | 9 |

| Cutwater 2015-1A Ltd., “BR”, FLR, 7.39% ((SOFR - 3mo. + 0.26161%) + 1.8%), 1/15/2029 (n) | | | 788,161 | 787,471 |

| DLLST LLC, 2024-1A, “A2”, 5.33%, 1/20/2026 (n) | | | 3,765,354 | 3,752,110 |

| Drive Auto Receivables Trust, 2024-1, “A2”, 5.83%, 12/15/2026 | | | 10,414,000 | 10,418,469 |

| Dryden Senior Loan Fund, 2017-49A, “CR”, CLO, FLR, 7.639% ((SOFR - 3mo. + 0.26161%) + 2.05%), 7/18/2030 (n) | | | 2,000,000 | 2,000,470 |

| Dryden Senior Loan Fund, 2022-113A, “BR”, FLR, 7.575% (SOFR - 3mo. + 2.25%), 10/20/2035 (n) | | | 7,500,000 | 7,502,722 |

| Empire District Bondco LLC, 4.943%, 1/01/2033 | | | 8,572,000 | 8,401,038 |

| Enterprise Fleet Financing 2023-3 LLC, “A2”, 6.4%, 3/20/2030 (n) | | | 7,112,000 | 7,182,507 |

| GLGU 2023-1A Ltd., “B”, FLR, 8.325% (SOFR - 3mo. + 3%), 7/20/2035 (n) | | | 15,000,000 | 15,242,355 |

| GLS Auto Select Receivables Trust, 2023-2A, 6.37%, 6/15/2028 (n) | | | 7,316,949 | 7,351,962 |

| GreatAmerica Leasing Receivables Funding LLC, 2024-1, “A3”, 4.98%, 1/18/2028 (n) | | | 4,250,000 | 4,190,371 |

| GS Mortgage Securities Trust, 2019-GC40, “AS”, 3.412%, 7/10/2052 | | | 2,200,000 | 1,910,000 |

| Hartwick Park CLO Ltd., 2023-1A, “B”, FLR, 7.591% (SOFR - 3mo. + 2.25%), 1/21/2036 (n) | | | 4,347,826 | 4,356,404 |

| Hartwick Park CLO, Ltd., 2023-1A, “C”, FLR, 8.091% (SOFR - 3mo. + 2.75%), 1/21/2036 (n) | | | 13,000,000 | 13,001,326 |

Portfolio of Investments (unaudited) – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Asset-Backed & Securitized – continued |

| HGI CRE CLO Ltd., 2021-FL3, “D”, FLR, 9.08% (SOFR - 30 day + 3.75%), 4/20/2037 (n) | | $ | 4,500,000 | $4,370,458 |

| HGI CRE CLO Ltd., 2022-FL3, “B”, FLR, 7.93% (SOFR - 1mo. + 2.6%), 4/20/2037 (n) | | | 3,000,000 | 2,992,164 |

| KKR Static CLO I Ltd. 2022-1A, “CR”, FLR, 7.875% (SOFR - 3mo. + 2.55%), 7/20/2031 (n) | | | 20,000,000 | 19,985,640 |

| KREF 2021-FL2 Ltd., “D”, FLR, 7.631% ((SOFR - 1mo. + 0.11448%) + 2.2%), 2/15/2039 (n) | | | 1,837,000 | 1,650,912 |

| LCCM 2021-FL2 Trust, “C”, FLR, 7.585% ((SOFR - 1mo. + 0.11448%) + 2.15%), 12/13/2038 (n) | | | 3,212,500 | 3,036,802 |

| LoanCore 2021-CRE5 Ltd., “C”, FLR, 7.785% (LIBOR - 1mo. + 2.35%), 7/15/2036 (n) | | | 3,000,000 | 2,875,407 |

| Madison Park Funding Ltd., 2017- 23A, “CR”, FLR, 7.586% ((SOFR - 3mo. + 0.26161%) + 2%), 7/27/2031 (n) | | | 3,000,000 | 2,997,762 |

| Magnetite XXXIX Ltd., 2023-39A, “C”, FLR, 7.874% (SOFR - 3mo. + 2.55%), 10/25/2033 (n) | | | 8,000,000 | 7,989,296 |

| MF1 2020-FL4 Ltd., “AS”, FLR, 7.531% ((SOFR - 1mo. + 0.11448%) + 2.1%), 11/15/2035 (n) | | | 5,547,500 | 5,529,310 |

| MF1 2020-FL4 Ltd., “B”, FLR, 8.18% ((SOFR - 1mo. + 0.11448%) + 2.75%), 11/15/2035 (n) | | | 4,829,000 | 4,816,613 |

| MF1 2020-FL4 Ltd., “C”, FLR, 9.031% (SOFR - 1mo. + 3.7145%), 11/15/2035 (n) | | | 6,500,000 | 6,500,459 |

| MF1 2021-FL5 Ltd., “AS”, FLR, 6.631% ((SOFR - 1mo. + 0.11448%) + 1.2%), 7/15/2036 (n) | | | 1,000,000 | 993,450 |

| MF1 2021-FL5 Ltd., “B”, FLR, 6.881% ((SOFR - 1mo. + 0.11448%) + 1.45%), 7/15/2036 (n) | | | 4,354,000 | 4,319,352 |

| MF1 2021-FL5 Ltd., “C”, FLR, 7.13% ((SOFR - 1mo. + 0.11448%) + 1.7%), 7/15/2036 (n) | | | 2,250,000 | 2,212,839 |

| MF1 2021-FL5 Ltd., “D”, FLR, 7.931% ((SOFR - 1mo. + 0.11448%) + 2.5%), 7/15/2036 (n) | | | 3,000,000 | 2,898,288 |

| MF1 2021-FL6 Ltd., “AS”, FLR, 6.883% ((SOFR - 1mo. + 0.11448%) + 1.45%), 7/16/2036 (n) | | | 3,200,000 | 3,153,396 |

| MF1 2021-FL6 Ltd., “C”, FLR, 7.283% ((SOFR - 1mo. + 0.11448%) + 1.85%), 7/16/2036 (n) | | | 4,462,603 | 4,317,979 |

| MF1 2022-FL10 Ltd., “B”, FLR, 9.054% (SOFR - 1mo. + 3.735%), 9/17/2037 (n) | | | 7,500,000 | 7,499,786 |

| MF1 2022-FL8 Ltd., “A”, FLR, 6.669% (SOFR - 1mo. + 1.35%), 2/19/2037 (n) | | | 8,743,156 | 8,678,422 |

| MF1 2022-FL8 Ltd., “D”, FLR, 7.969% (SOFR - 30 day + 2.65%), 2/19/2037 (n) | | | 5,000,000 | 4,739,656 |

| MF1 2022-FL8 Ltd., “E”, FLR, 8.469% (SOFR - 30 day + 3.15%), 2/19/2037 (n) | | | 4,500,000 | 4,196,119 |

Portfolio of Investments (unaudited) – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Asset-Backed & Securitized – continued |

| MF1 2022-FL9 Ltd., “B”, FLR, 8.468% (SOFR - 1mo. + 3.15%), 6/19/2037 (n) | | $ | 7,000,000 | $6,946,723 |

| MF1 2023-FL12 LLC, “AS”, FLR, 8.097% (SOFR - 1mo. + 2.778%), 10/19/2038 (n) | | | 15,000,000 | 14,955,138 |

| MF1 2024-FL14 LLC, “B”, FLR, 8.008% (SOFR - 1mo. + 2.689%), 3/19/2039 (n) | | | 8,208,757 | 8,197,634 |

| MF1 2024-FL14 LLC, “C”, FLR, 8.607% (SOFR - 1mo. + 3.289%), 3/19/2039 (n) | | | 8,750,765 | 8,736,186 |

| MF1 2024-FL14 LLC, “D”, FLR, 10.157% (SOFR - 1mo. + 4.838%), 3/19/2039 (n) | | | 6,500,000 | 6,489,236 |

| Morgan Stanley Residential Mortgage Loan Trust, 2024-NQM1, “A-1”, 6.152%, 12/25/2068 (n) | | | 15,799,007 | 15,727,126 |

| MSWF Commercial Mortgage Trust 2023-2, “A5”, 6.014%, 12/15/2056 | | | 7,198,942 | 7,427,516 |

| MSWF Commercial Mortgage Trust 2023-2, “AS”, 6.491%, 12/15/2056 | | | 4,949,272 | 5,109,368 |

| Neuberger Berman CLO Ltd., 2013-15A, “CR2”, FLR, 7.44% ((SOFR - 3mo. + 0.26161%) + 1.85%), 10/15/2029 (n) | | | 2,286,610 | 2,286,507 |

| Neuberger Berman CLO Ltd., 2016-21A, “CR2”, 7.636%, 4/20/2034 (n) | | | 1,750,000 | 1,750,989 |

| Neuberger Berman CLO Ltd., 2019-35A, “CR”, 7.636% (SOFR - 3mo. + 2.3%), 1/19/2033 (n) | | | 20,000,000 | 20,054,140 |

| Neuberger Berman CLO Ltd., 2023-53A, “C”, FLR, 7.923% (SOFR - 3mo. + 2.6%), 10/24/2032 (n) | | | 14,500,000 | 14,508,656 |

| New Residential Mortgage Loan Trust, 2024-NQMI, “A-1”, 6.129%, 3/25/2064 (n) | | | 28,647,150 | 28,430,984 |

| Oaktree CLO 2019-1A Ltd., “CR”, FLR, 7.936% ((SOFR - 3mo. + 0.26161%) + 2.35%), 4/22/2030 (n) | | | 3,236,356 | 3,204,167 |

| OBX Trust, 2024-NQM2, “A1”, 5.878%, 12/25/2063 (n) | | | 15,170,761 | 15,077,029 |

| OBX Trust, 2024-NQM3, “A1”, 6.129%, 12/25/2063 (n) | | | 7,464,327 | 7,430,491 |

| OSD CLO, 2023-27, Ltd., “B”, FLR, 7.728% (SOFR - 3mo. + 2.4%), 4/16/2035 (n) | | | 10,000,000 | 10,016,630 |

| OZLM Funding Ltd., 2012-2A, “A2RA”, 7.13% (SOFR - 3mo. + 1.8%), 7/30/2031 (n) | | | 20,000,000 | 19,971,940 |

| OZLM Funding Ltd., 2012-2A, “BR3”, 7.63% (SOFR - 3mo. + 2.3%), 7/30/2031 (n) | | | 17,400,000 | 17,406,873 |

| OZLM Ltd., 2017-21A, “BR”, 7.225% (SOFR - 3mo. + 1.9%), 1/20/2031 (n) | | | 27,500,000 | 27,503,657 |

| Palmer Square Loan Funding 2021-4A Ltd., “A1”, FLR, 6.39% ((SOFR - 3mo. + 0.26161%) + 0.8%), 10/15/2029 (n) | | | 2,311,879 | 2,315,231 |

| Palmer Square Loan Funding 2023-1A Ltd., “A2”, FLR, 7.824% (SOFR - 3mo. + 2.5%), 7/20/2031 (n) | | | 10,000,000 | 10,011,270 |

Portfolio of Investments (unaudited) – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Asset-Backed & Securitized – continued |

| PFP III 2021-8 Ltd., “D”, FLR, 7.583% ((SOFR - 1mo. + 0.11448%) + 2.15%), 8/09/2037 (n) | | $ | 4,274,000 | $4,009,211 |

| Race Point CLO Ltd., 2013-8A, “CR2”, FLR, 7.631% ((SOFR - 3mo. + 0.26161%) + 2.05%), 2/20/2030 (n) | | | 2,500,000 | 2,472,068 |

| Ready Capital Mortgage Financing 2023-FL12 LLC, FLR, 7.652% (SOFR - 1mo. + 2.335%), 5/25/2038 (n) | | | 7,202,339 | 7,215,714 |

| ReadyCap Commercial Mortgage Trust, 2021-FL7, “D”, FLR, 8.381% ((SOFR - 1mo. + 0.11448%) + 2.95%), 11/25/2036 (z) | | | 1,770,000 | 1,726,208 |

| Rockford Tower CLO Ltd., 2020-1A, “CR”, 8.025% (SOFR - 3mo. + 2.7%), 1/20/2036 (n) | | | 12,000,000 | 12,027,816 |

| SBNA Auto Lease Trust, 2024-A, “A2”, 5.45%, 1/20/2026 (n) | | | 5,002,000 | 4,991,204 |

| Starwood Commercial Mortgage, 2021-FL2, “D”, 8.233%, 4/18/2038 (n) | | | 3,000,000 | 2,699,310 |

| Starwood Commercial Mortgage, 2022-FL3, “D”, FLR, 8.08% (SOFR - 30 day + 2.75%), 11/15/2038 (n) | | | 2,750,000 | 2,520,678 |

| STORE Master Funding LLC, 2024-1A, “A3”, 5.93%, 5/20/2054 (n) | | | 3,700,000 | 3,683,287 |

| STORE Master Funding LLC, 2024-1A, “A4”, 5.94%, 5/20/2054 (n) | | | 900,000 | 888,641 |

| Stratus Static CLO Ltd., 2022-3A, “CR”, FLR, 7.725% (SOFR - 3mo. + 2.4%), 10/20/2031 (n) | | | 8,000,000 | 8,001,640 |

| TPG Real Estate Finance, 2021-FL4, “B”, FLR, 7.281% ((SOFR - 1mo. + 0.11448%) + 1.85%), 3/15/2038 (n) | | | 2,700,000 | 2,568,937 |

| UBS Commercial Mortgage Trust, 2017-C7, “A4”, 3.679%, 12/15/2050 | | | 1,052,000 | 971,065 |

| Verus Securitization Trust 2024-2, “A1”, 6.095%, 2/25/2069 (n) | | | 5,806,478 | 5,767,977 |

| Verus Securitization Trust, 2014-1, “A1”, 5.712%, 1/25/2069 (n) | | | 8,841,930 | 8,739,072 |

| Virginia Power Fuel Securitization LLC, 5.088%, 5/01/2027 | | | 6,200,000 | 6,150,657 |

| Voya CLO 2012-4A Ltd., “C1R3”, FLR, 8.89% ((SOFR - 3mo. + 0.26161%) + 3.3%), 10/15/2030 (n) | | | 1,737,638 | 1,738,357 |

| Voya CLO 2016-1A Ltd., “A2R”, FLR, 6.886% (SOFR - 3mo. + 1.562%), 1/20/2031 (n) | | | 1,000,000 | 995,000 |

| Voya CLO 2016-1A Ltd., “BR”, FLR, 7.386% (SOFR - 3mo. + 2.061%), 1/20/2031 (n) | | | 2,910,000 | 2,895,860 |

| Wells Fargo Commercial Mortgage Trust, 2016-C34, “A4”, 3.096%, 6/15/2049 | | | 1,740,000 | 1,651,200 |

| Wells Fargo Commercial Mortgage Trust, 2017-C42, “A5”, 3.589%, 12/15/2050 | | | 3,490,000 | 3,154,674 |

| Wells Fargo Commercial Mortgage Trust, 2017-RB1, “A5”, 3.635%, 3/15/2050 | | | 1,500,000 | 1,382,465 |

Portfolio of Investments (unaudited) – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Asset-Backed & Securitized – continued |

| Wells Fargo Commercial Mortgage Trust, 2018-C44, “A5”, 4.212%, 5/15/2051 | | $ | 1,500,000 | $1,404,748 |

| | | | | $809,498,550 |

| Automotive – 1.1% |

| Ford Motor Credit Co. LLC, 6.05%, 3/05/2031 | | $ | 22,999,000 | $22,620,711 |

| Hyundai Capital America, 2.1%, 9/15/2028 (n) | | | 2,000,000 | 1,721,612 |

| Hyundai Capital America, 5.35%, 3/19/2029 (n) | | | 4,963,000 | 4,877,495 |

| Hyundai Capital America, 6.375%, 4/08/2030 (n) | | | 6,896,000 | 7,081,672 |

| LKQ Corp., 6.25%, 6/15/2033 | | | 14,133,000 | 14,217,099 |

| | | | | $50,518,589 |

| Broadcasting – 0.6% |

| Discovery Communications LLC, 4.65%, 5/15/2050 | | $ | 946,000 | $685,752 |

| WarnerMedia Holdings, Inc., 4.279%, 3/15/2032 | | | 22,151,000 | 19,080,573 |

| WarnerMedia Holdings, Inc., 5.141%, 3/15/2052 | | | 8,054,000 | 6,168,671 |

| | | | | $25,934,996 |

| Brokerage & Asset Managers – 1.4% |

| Charles Schwab Corp., 5.853% to 5/19/2033, FLR (SOFR - 1 day + 2.5%) to 5/19/2034 | | $ | 11,266,000 | $11,217,752 |

| Charles Schwab Corp., 6.136% to 8/24/2033, FLR (SOFR - 1 day + 2.01%) to 8/24/2034 | | | 10,000,000 | 10,139,782 |

| Charles Schwab Corp., 5% to 6/01/2027, FLR (CMT - 5yr. + 3.256%) to 6/01/2170 | | | 11,272,000 | 10,533,640 |

| LPL Holdings, Inc., 4.625%, 11/15/2027 (n) | | | 2,794,000 | 2,662,395 |

| LPL Holdings, Inc., 4%, 3/15/2029 (n) | | | 7,300,000 | 6,619,344 |

| LPL Holdings, Inc., 4.375%, 5/15/2031 (n) | | | 24,858,000 | 22,116,270 |

| | | | | $63,289,183 |

| Building – 0.7% |

| Patrick Industries, Inc., 4.75%, 5/01/2029 (n) | | $ | 20,652,000 | $18,773,224 |

| Standard Industries, Inc., 4.375%, 7/15/2030 (n) | | | 6,900,000 | 6,111,002 |

| Standard Industries, Inc., 3.375%, 1/15/2031 (n) | | | 6,600,000 | 5,406,176 |

| | | | | $30,290,402 |

| Business Services – 0.4% |

| Fiserv, Inc., 5.6%, 3/02/2033 | | $ | 5,570,000 | $5,518,516 |

| Global Payments, Inc., 2.9%, 5/15/2030 | | | 3,563,000 | 3,036,665 |

| Global Payments, Inc., 2.9%, 11/15/2031 | | | 10,669,000 | 8,763,229 |

| | | | | $17,318,410 |

Portfolio of Investments (unaudited) – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Cable TV – 1.5% |

| CCO Holdings LLC/CCO Holdings Capital Corp., 4.5%, 8/15/2030 (n) | | $ | 11,300,000 | $9,182,961 |

| CCO Holdings LLC/CCO Holdings Capital Corp., 4.25%, 1/15/2034 (n) | | | 9,000,000 | 6,520,602 |

| Charter Communications Operating LLC/Charter Communications Operating Capital Corp., 3.9%, 6/01/2052 | | | 1,824,000 | 1,096,948 |

| Charter Communications Operating LLC/Charter Communications Operating Capital Corp., 5.25%, 4/01/2053 | | | 5,342,000 | 4,009,991 |

| CSC Holdings LLC, 4.125%, 12/01/2030 (n) | | | 12,100,000 | 7,686,184 |

| Sirius XM Radio, Inc., 5.5%, 7/01/2029 (n) | | | 14,200,000 | 13,180,978 |

| Sirius XM Radio, Inc., 4.125%, 7/01/2030 (n) | | | 8,000,000 | 6,784,485 |

| Time Warner Cable, Inc., 4.5%, 9/15/2042 | | | 2,031,000 | 1,429,205 |

| Virgin Media Finance PLC, 5%, 7/15/2030 (n) | | | 23,000,000 | 18,835,739 |

| | | | | $68,727,093 |

| Conglomerates – 1.4% |

| nVent Finance S.à r.l., 5.65%, 5/15/2033 | | $ | 9,324,000 | $9,202,848 |

| Regal Rexnord Corp., 6.3%, 2/15/2030 (n) | | | 14,247,000 | 14,307,919 |

| Regal Rexnord Corp., 6.4%, 4/15/2033 (n) | | | 19,274,000 | 19,430,314 |

| Sisecam UK PLC, 8.625%, 5/02/2032 (n)(w) | | | 5,865,000 | 5,942,418 |

| Westinghouse Air Brake Technologies Corp., 4.7%, 9/15/2028 | | | 7,534,000 | 7,251,506 |

| Westinghouse Air Brake Technologies Corp., 5.611%, 3/11/2034 | | | 6,667,000 | 6,554,012 |

| | | | | $62,689,017 |

| Consumer Products – 0.3% |

| Energizer Holdings, Inc., 4.375%, 3/31/2029 (n) | | $ | 16,000,000 | $14,134,026 |

| Consumer Services – 0.5% |

| Match Group Holdings II LLC, 5%, 12/15/2027 (n) | | $ | 3,300,000 | $3,124,569 |

| Match Group Holdings II LLC, 3.625%, 10/01/2031 (n) | | | 10,700,000 | 8,832,887 |

| Realogy Group LLC/Realogy Co-Issuer Corp., 5.75%, 1/15/2029 (n) | | | 14,500,000 | 10,121,252 |

| | | | | $22,078,708 |

| Electrical Equipment – 0.3% |

| Arrow Electronics, Inc., 5.875%, 4/10/2034 | | $ | 16,047,000 | $15,467,535 |

| Emerging Market Quasi-Sovereign – 0.6% |

| Ecopetrol S.A. (Republic of Colombia), 8.375%, 1/19/2036 | | $ | 7,454,000 | $7,246,380 |

| Ipoteka Bank (Republic of Uzbekistan), 5.5%, 11/19/2025 | | | 2,618,000 | 2,513,280 |

| Office Cherifien des Phosphates S.A. (Kingdom of Morocco), 6.75%, 5/02/2034 (n) | | | 7,663,000 | 7,528,898 |

Portfolio of Investments (unaudited) – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Emerging Market Quasi-Sovereign – continued |

| Petroleos Mexicanos, 5.95%, 1/28/2031 | | $ | 10,913,000 | $8,610,545 |

| | | | | $25,899,103 |

| Emerging Market Sovereign – 1.9% |

| Arab Republic of Egypt, 7.3%, 9/30/2033 | | $ | 10,765,000 | $8,597,898 |

| Dominican Republic, 4.875%, 9/23/2032 (n) | | | 4,536,000 | 3,968,998 |

| Federal Republic of Nigeria, 7.375%, 9/28/2033 | | | 12,904,000 | 10,701,287 |

| Federative Republic of Brazil, 10%, 1/01/2029 | | BRL | 41,789,000 | 7,650,272 |

| Oriental Republic of Uruguay, 8.25%, 5/21/2031 | | UYU | 239,716,000 | 5,932,695 |

| Republic of Angola, 8%, 11/26/2029 | | $ | 9,284,000 | 8,436,835 |

| Republic of Cote d'Ivoire, 4.875%, 1/30/2032 (n) | | EUR | 1,864,000 | 1,657,054 |

| Republic of Cote d'Ivoire, 7.625%, 1/30/2033 (n) | | $ | 12,331,000 | 11,786,833 |

| Republic of Turkey, 5.875%, 5/21/2030 | | EUR | 7,668,000 | 8,193,519 |

| Republic of Turkey, 7.625%, 5/15/2034 | | $ | 6,117,000 | 6,039,008 |

| United Mexican States, 7.75%, 5/29/2031 | | MXN | 195,500,000 | 10,108,494 |

| | | | | $83,072,893 |

| Energy - Independent – 1.1% |

| EQT Corp., 5%, 1/15/2029 | | $ | 7,249,000 | $6,995,239 |

| Medco Laurel Tree Pte. Ltd., 6.95%, 11/12/2028 (n) | | | 3,043,000 | 2,908,452 |

| Occidental Petroleum Corp., 6.625%, 9/01/2030 | | | 10,000,000 | 10,361,500 |

| Santos Finance Ltd., 6.875%, 9/19/2033 (n) | | | 23,934,000 | 24,598,192 |

| Sierracol Energy Andina LLC, 6%, 6/15/2028 (n) | | | 4,945,000 | 4,280,284 |

| | | | | $49,143,667 |

| Energy - Integrated – 0.2% |

| BP Capital Markets PLC, 6.45% to 3/01/2034, FLR ((CMT - 5yr. + 2.153%) + 0.25%) to 3/01/2054, FLR ((CMT - 5yr. + 2.153%) + 1%) to 9/01/2172 | | $ | 10,000,000 | $10,088,808 |

| Financial Institutions – 1.3% |

| AerCap Ireland Capital DAC/AerCap Global Aviation Trust, 5.75%, 6/06/2028 | | $ | 6,892,000 | $6,886,014 |

| AerCap Ireland Capital DAC/AerCap Global Aviation Trust, 3.3%, 1/30/2032 | | | 5,000,000 | 4,174,232 |

| Avolon Holdings Funding Ltd., 3.25%, 2/15/2027 (n) | | | 2,342,000 | 2,159,406 |

| Avolon Holdings Funding Ltd., 2.75%, 2/21/2028 (n) | | | 9,944,000 | 8,797,965 |

| Avolon Holdings Funding Ltd., 6.375%, 5/04/2028 (n) | | | 3,115,000 | 3,138,183 |

| Global Aircraft Leasing Co. Ltd., 6.5% (6.5% Cash or 7.25% PIK), 9/15/2024 (n)(p) | | | 11,009,825 | 10,414,986 |

| Macquarie AirFinance Holdings Ltd., 6.4%, 3/26/2029 (n) | | | 3,124,000 | 3,114,965 |

| Macquarie AirFinance Holdings Ltd., 6.5%, 3/26/2031 (n) | | | 1,625,000 | 1,626,214 |

| SMBC Aviation Capital Finance DAC, 5.55%, 4/03/2034 (n) | | | 20,000,000 | 19,147,657 |

| | | | | $59,459,622 |

Portfolio of Investments (unaudited) – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Food & Beverages – 1.0% |

| Bacardi Ltd., 5.15%, 5/15/2038 (n) | | $ | 955,000 | $871,299 |

| Bacardi-Martini B.V., 5.9%, 6/15/2043 (n) | | | 10,000,000 | 9,522,273 |

| Central American Bottling Corp., 5.25%, 4/27/2029 (n) | | | 2,293,000 | 2,140,721 |

| JBS USA Lux S.A./JBS USA Food Co./JBS USA Finance, Inc., 5.5%, 1/15/2030 | | | 8,400,000 | 8,108,507 |

| JBS USA Lux S.A./JBS USA Food Co./JBS USA Finance, Inc., 5.75%, 4/01/2033 | | | 16,415,000 | 15,698,847 |

| Post Holdings, Inc., 4.625%, 4/15/2030 (n) | | | 11,000,000 | 9,934,319 |

| | | | | $46,275,966 |

| Gaming & Lodging – 0.4% |

| Caesars Entertainment, Inc., 6.5%, 2/15/2032 (n) | | $ | 12,000,000 | $11,822,919 |

| Marriott International, Inc., 2.85%, 4/15/2031 | | | 654,000 | 548,564 |

| Marriott International, Inc., 2.75%, 10/15/2033 | | | 4,537,000 | 3,574,093 |

| | | | | $15,945,576 |

| Insurance – 1.3% |

| Corebridge Financial, Inc., 5.75%, 1/15/2034 | | $ | 13,000,000 | $12,770,503 |

| Corebridge Financial, Inc., 4.35%, 4/05/2042 | | | 473,000 | 379,223 |

| Corebridge Financial, Inc., 4.4%, 4/05/2052 | | | 1,412,000 | 1,083,347 |

| Corebridge Financial, Inc., 6.875% to 12/15/2027, FLR (CMT - 5yr. + 3.846%) to 12/15/2052 | | | 4,850,000 | 4,801,264 |

| MetLife, Inc., 5.375%, 7/15/2033 | | | 10,000,000 | 9,925,830 |

| Sammons Financial Group, Inc., 6.875%, 4/15/2034 (n) | | | 29,355,000 | 28,956,553 |

| | | | | $57,916,720 |

| Insurance - Health – 0.1% |

| Humana, Inc., 5.875%, 3/01/2033 | | $ | 6,326,000 | $6,320,781 |

| Insurance - Property & Casualty – 2.7% |

| Alliant Holdings Intermediate LLC/Alliant Holdings Co-Issuer, 6.75%, 10/15/2027 (n) | | $ | 16,250,000 | $15,935,046 |

| Alliant Holdings Intermediate LLC/Alliant Holdings Co-Issuer, 5.875%, 11/01/2029 (n) | | | 3,000,000 | 2,754,729 |

| American International Group, Inc., 5.125%, 3/27/2033 | | | 5,455,000 | 5,232,267 |

| AmWINS Group, Inc., 6.375%, 2/15/2029 (n) | | | 15,000,000 | 14,818,385 |

| Arthur J. Gallagher & Co., 5.45%, 7/15/2034 | | | 12,000,000 | 11,657,518 |

| Brown & Brown, Inc., 2.375%, 3/15/2031 | | | 6,452,000 | 5,201,348 |

| Brown & Brown, Inc., 4.2%, 3/17/2032 | | | 2,157,000 | 1,919,455 |

| Fairfax Financial Holdings Ltd., 4.85%, 4/17/2028 | | | 4,578,000 | 4,444,931 |

| Fairfax Financial Holdings Ltd., 3.375%, 3/03/2031 | | | 452,000 | 386,288 |

| Fairfax Financial Holdings Ltd., 5.625%, 8/16/2032 | | | 12,376,000 | 12,012,926 |

| Fairfax Financial Holdings Ltd., 6%, 12/07/2033 (n) | | | 11,400,000 | 11,313,321 |

| Fairfax Financial Holdings Ltd., 6.35%, 3/22/2054 (n) | | | 2,500,000 | 2,471,507 |

Portfolio of Investments (unaudited) – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Insurance - Property & Casualty – continued |

| Hub International Ltd., 5.625%, 12/01/2029 (n) | | $ | 5,850,000 | $5,384,248 |

| Hub International Ltd., 7.25%, 6/15/2030 (n) | | | 10,791,000 | 10,949,293 |

| Panther Escrow Issuer, 7.125%, 6/01/2031 (n) | | | 14,572,000 | 14,647,573 |

| | | | | $119,128,835 |

| International Market Quasi-Sovereign – 0.1% |

| Electricite de France S.A., 6.9%, 5/23/2053 (n) | | $ | 3,557,000 | $3,729,160 |

| Machinery & Tools – 0.8% |

| Ashtead Capital, Inc., 5.5%, 8/11/2032 (n) | | $ | 20,580,000 | $19,732,462 |

| Ashtead Capital, Inc., 5.55%, 5/30/2033 (n) | | | 8,008,000 | 7,667,821 |

| Ashtead Capital, Inc., 5.8%, 4/15/2034 (n) | | | 1,944,000 | 1,891,965 |

| Ritchie Bros Holdings, Inc., 7.75%, 3/15/2031 (n) | | | 5,000,000 | 5,185,615 |

| | | | | $34,477,863 |

| Major Banks – 6.0% |

| Banco Mercantil del Norte S.A., 6.625% to 1/24/2032, FLR (CMT - 10yr. + 5.034%) to 1/24/2171 | | $ | 4,868,000 | $4,289,634 |

| Bank of America Corp., 4.271% to 7/23/2028, FLR ((SOFR - 3mo. + 0.26161%) + 1.31%) to 7/23/2029 | | | 579,000 | 549,197 |

| Bank of America Corp., 2.572% to 10/20/2031, FLR (SOFR - 1 day + 1.21%) to 10/20/2032 | | | 8,268,000 | 6,669,904 |

| Bank of America Corp., 5.015% to 7/22/2032, FLR (SOFR - 1 day + 2.16%) to 7/22/2033 | | | 3,000,000 | 2,864,020 |

| Bank of America Corp., 5.288% to 4/25/2033, FLR (SOFR - 1 day + 1.630%) to 4/25/2034 | | | 10,503,000 | 10,116,844 |

| Bank of America Corp., 3.846% to 3/08/2032, FLR (CMT - 1yr. + 2%) to 3/08/2037 | | | 4,785,000 | 4,121,011 |

| Barclays PLC, 4.375%, 1/12/2026 | | | 1,325,000 | 1,292,138 |

| Barclays PLC, 7.437% to 11/02/2032, FLR (CMT - 1yr. + 3.5%) to 11/02/2033 | | | 5,972,000 | 6,459,928 |

| Barclays PLC, 8% to 9/15/2029, FLR (CMT - 5yr. + 5.431%) to 12/15/2171 | | | 15,000,000 | 14,750,311 |

| Capital One Financial Corp., 3.273% to 3/01/2029, FLR (SOFR - 1 day + 1.79%) to 3/01/2030 | | | 5,000,000 | 4,414,444 |

| Capital One Financial Corp., 7.624% to 10/30/2030, FLR (SOFR - 1 day + 3.07%) to 10/30/2031 | | | 5,078,000 | 5,464,436 |

| Capital One Financial Corp., 5.817% to 2/01/2033, FLR (SOFR - 1 day + 2.6%) to 2/01/2034 | | | 5,330,000 | 5,159,410 |

| Capital One Financial Corp., 6.377% to 6/08/2033, FLR (SOFR - 1 day + 2.860%) to 6/08/2034 | | | 12,190,000 | 12,269,452 |

| Capital One Financial Corp., 6.051% to 2/01/2034, FLR (SOFR - 1 day + 2.26%) to 2/01/2035 | | | 1,657,000 | 1,629,787 |

Portfolio of Investments (unaudited) – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Major Banks – continued |

| Deutsche Bank AG, 7.146% to 7/13/2026, FLR (SOFR - 1 day + 2.52%) to 7/13/2027 | | $ | 5,752,000 | $5,872,124 |

| Deutsche Bank AG, 2.311% to 11/16/2026, FLR (SOFR - 1 day + 1.219%) to 11/16/2027 | | | 2,217,000 | 2,016,809 |

| Deutsche Bank AG, 6.72% to 1/18/2028, FLR (SOFR - 1 day + 3.18%) to 1/18/2029 | | | 8,912,000 | 9,089,180 |

| Goldman Sachs Group, Inc., 2.65% to 10/21/2031, FLR (SOFR - 1 day + 1.264%) to 10/21/2032 | | | 6,695,000 | 5,421,216 |

| Goldman Sachs Group, Inc., 3.102% to 2/24/2032, FLR (SOFR - 1 day + 1.41%) to 2/24/2033 | | | 4,410,000 | 3,668,880 |

| HSBC Holdings PLC, 4.7% to 9/09/2031, FLR (CMT - 1yr. + 3.25%) to 9/09/2169 | | | 1,150,000 | 938,165 |

| HSBC Holdings PLC, 4% to 9/09/2026, FLR (CMT - 1yr. + 3.222%) to 9/09/2170 | | | 536,000 | 494,714 |

| Huntington Bancshares, Inc., 4.008% to 5/16/2024, FLR (SOFR - 1 day + 1.205%) to 5/16/2025 | | | 4,112,000 | 4,105,571 |

| Huntington National Bank, 5.65%, 1/10/2030 | | | 9,145,000 | 8,981,945 |

| JPMorgan Chase & Co., 4.851% to 7/25/2027, FLR (SOFR - 1 day + 1.99%) to 7/25/2028 | | | 4,000,000 | 3,918,079 |

| JPMorgan Chase & Co., 2.956% to 5/13/2030, FLR (SOFR - 1 day + 2.515%) to 5/13/2031 | | | 726,000 | 621,304 |

| JPMorgan Chase & Co., 2.963% to 1/25/2032, FLR (SOFR - 1 day + 1.26%) to 1/25/2033 | | | 4,000,000 | 3,323,557 |

| JPMorgan Chase & Co., 5.766%, 4/22/2035 | | | 17,245,000 | 17,256,534 |

| Morgan Stanley, 4.679% to 7/17/2025, FLR (SOFR - 1 day + 1.669%) to 7/17/2026 | | | 6,000,000 | 5,921,982 |

| Morgan Stanley, 5.449% to 7/20/2028, FLR (SOFR - 1 day + 1.63%) to 7/20/2029 | | | 1,796,000 | 1,785,016 |

| Morgan Stanley, 2.511% to 10/20/2031, FLR (SOFR - 1 day + 1.2%) to 10/20/2032 | | | 7,539,000 | 6,066,590 |

| Morgan Stanley, 5.424% to 7/21/2033, FLR (SOFR - 1 day + 1.88%) to 7/21/2034 | | | 9,774,000 | 9,484,085 |

| Morgan Stanley, 5.942% to 2/07/2034, FLR (CMT - 5yr. + 1.8%) to 2/07/2039 | | | 15,000,000 | 14,433,008 |

| PNC Financial Services Group, Inc., 5.676% to 1/22/2034, FLR (SOFR - 1 day + 1.902%) to 1/22/2035 | | | 14,643,000 | 14,346,112 |

| UBS Group AG, 4.703% to 8/05/2026, FLR (CMT - 1yr. + 2.05%) to 8/05/2027 (n) | | | 3,165,000 | 3,092,031 |

| UBS Group AG, 1.494% to 8/10/2026, FLR (CMT - 1yr. + 0.85%) to 8/10/2027 (n) | | | 3,500,000 | 3,169,636 |

| UBS Group AG, 5.699% to 2/08/2034, FLR (CMT - 1yr. + 1.77%) to 2/08/2035 (n) | | | 17,000,000 | 16,484,601 |

Portfolio of Investments (unaudited) – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Major Banks – continued |

| UBS Group AG, 4.375% to 2/10/2031, FLR (CMT - 1yr. + 3.313%) to 8/10/2171 (n) | | $ | 2,746,000 | $2,193,093 |

| UBS Group AG, 9.25% to 11/13/2033, FLR (CMT - 5yr. + 4.758%) to 5/13/2172 (n) | | | 7,091,000 | 7,782,280 |

| UBS Group Funding (Switzerland) AG, 4.253%, 3/23/2028 (n) | | | 1,618,000 | 1,533,432 |

| Wells Fargo & Co., 5.574% to 7/25/2028, FLR (SOFR - 1 day + 1.74%) to 7/25/2029 | | | 3,333,000 | 3,322,355 |

| Wells Fargo & Co., 2.572% to 2/11/2030, FLR ((SOFR - 3mo. + 0.26161%) + 1%) to 2/11/2031 | | | 5,515,000 | 4,666,546 |

| Wells Fargo & Co., 3.35% to 3/02/2032, FLR (SOFR - 1 day + 1.5%) to 3/02/2033 | | | 26,071,000 | 22,008,109 |

| Wells Fargo & Co., 3.9% to 3/15/2026, FLR (CMT - 1yr. + 3.453%) to 3/15/2071 | | | 4,785,000 | 4,538,515 |

| | | | | $266,585,985 |

| Medical & Health Technology & Services – 0.7% |

| Adventist Health System/West, 5.43%, 3/01/2032 | | $ | 5,185,000 | $5,085,939 |

| Alcon Finance Corp., 5.75%, 12/06/2052 (n) | | | 6,027,000 | 5,934,152 |

| CVS Health Corp., 5.3%, 6/01/2033 | | | 15,000,000 | 14,502,074 |

| Marin General Hospital, 7.242%, 8/01/2045 | | | 2,805,000 | 2,901,017 |

| ProMedica Toledo Hospital, “B”, 5.325%, 11/15/2028 | | | 1,437,000 | 1,346,024 |

| ProMedica Toledo Hospital, “B”, AGM, 5.75%, 11/15/2038 | | | 568,000 | 562,116 |

| Tower Health, 4.451%, 2/01/2050 | | | 1,730,000 | 857,602 |

| | | | | $31,188,924 |

| Metals & Mining – 1.3% |

| Anglo American Capital PLC, 2.25%, 3/17/2028 (n) | | $ | 1,192,000 | $1,051,173 |

| Anglo American Capital PLC, 2.875%, 3/17/2031 (n) | | | 6,067,000 | 5,090,474 |

| Anglo American Capital PLC, 5.5%, 5/02/2033 (n) | | | 9,497,000 | 9,262,218 |

| Anglo American Capital PLC, 4.75%, 3/16/2052 (n) | | | 6,305,000 | 5,179,665 |

| FMG Resources Ltd., 4.375%, 4/01/2031 (n) | | | 16,000,000 | 14,087,091 |

| Glencore Funding LLC, 2.85%, 4/27/2031 (n) | | | 7,907,000 | 6,555,795 |

| Novelis Corp., 3.875%, 8/15/2031 (n) | | | 10,100,000 | 8,552,822 |

| Samarco Mineracao S.A., 9% PIK to 12/30/2025, (4% Cash + 5% PIK) to 12/30/2026, (5.5% Cash + 3.5% PIK) to 12/30/2027, 9.25% Cash to 12/30/2029, 9.5% Cash to 6/30/2031 (a)(n)(p) | | | 9,909,405 | 8,965,156 |

| | | | | $58,744,394 |

| Midstream – 1.9% |

| Cheniere Energy, Inc., 5.65%, 4/15/2034 (n) | | $ | 10,000,000 | $9,786,767 |

| DCP Midstream Operating, LP, 3.25%, 2/15/2032 | | | 17,764,000 | 14,943,885 |

| Enbridge, Inc., 3.125%, 11/15/2029 | | | 1,344,000 | 1,194,097 |

Portfolio of Investments (unaudited) – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Midstream – continued |

| Enbridge, Inc., 5.7%, 3/08/2033 | | $ | 4,620,000 | $4,566,999 |

| Enbridge, Inc., 2.5%, 8/01/2033 | | | 1,923,000 | 1,485,948 |

| Enbridge, Inc., 5.625%, 4/05/2034 | | | 14,836,000 | 14,515,300 |

| Plains All American Pipeline LP, 3.8%, 9/15/2030 | | | 4,057,000 | 3,635,794 |

| Targa Resources Corp., 6.125%, 3/15/2033 | | | 13,342,000 | 13,508,066 |

| Targa Resources Corp., 4.95%, 4/15/2052 | | | 5,521,000 | 4,596,842 |

| Venture Global Calcasieu Pass LLC, 6.25%, 1/15/2030 (n) | | | 16,000,000 | 15,819,482 |

| | | | | $84,053,180 |

| Mortgage-Backed – 4.9% | |

| Fannie Mae, 6.5%, 5/01/2031 | | $ | 6,047 | $6,094 |

| Fannie Mae, 3%, 2/25/2033 (i) | | | 175,022 | 14,041 |

| Fannie Mae, 5.5%, 9/01/2034 - 11/01/2036 | | | 19,806 | 19,719 |

| Fannie Mae, 6%, 11/01/2034 | | | 65,948 | 66,813 |

| Fannie Mae, UMBS, 2.5%, 3/01/2050 | | | 46,228 | 37,084 |

| Fannie Mae, UMBS, 4.5%, 7/01/2052 - 3/01/2053 | | | 1,651,341 | 1,522,636 |

| Fannie Mae, UMBS, 6%, 10/01/2053 - 3/01/2054 | | | 65,065,988 | 64,533,452 |

| Fannie Mae, UMBS, 5.5%, 11/01/2053 - 5/01/2054 | | | 21,629,343 | 21,023,670 |

| Fannie Mae, UMBS, 6.5%, 11/01/2053 - 1/01/2054 | | | 9,950,007 | 10,026,718 |

| Freddie Mac, 1.209%, 6/25/2030 (i) | | | 32,007,364 | 1,731,960 |

| Freddie Mac, UMBS, 4.5%, 7/01/2052 - 7/01/2053 | | | 1,506,253 | 1,388,618 |

| Freddie Mac, UMBS, 3%, 6/01/2053 | | | 38,421 | 31,744 |

| Freddie Mac, UMBS, 5.5%, 11/01/2053 - 5/01/2054 | | | 22,870,374 | 22,222,314 |

| Freddie Mac, UMBS, 6%, 1/01/2054 - 2/01/2054 | | | 22,534,049 | 22,346,568 |

| Ginnie Mae, 3%, 9/20/2047 | | | 79,778 | 68,783 |

| UMBS, TBA, 2.5%, 5/25/2054 | | | 53,700,000 | 42,479,705 |

| UMBS, TBA, 6.5%, 5/25/2054 | | | 33,250,000 | 33,500,738 |

| | | | | $221,020,657 |

| Municipals – 1.2% |

| Alaska Industrial Development & Export Authority Rev., Taxable (Rental Car Facility Project at Ted Stevens Anchorage International Airport), “A”, NPFG, 5.25%, 3/01/2030 | | $ | 4,845,000 | $4,692,778 |

| Bridgeview, IL, Stadium and Redevelopment Projects, Taxable, AAC, 5.14%, 12/01/2036 | | | 1,205,000 | 1,044,248 |

| Escambia County, FL, Health Facilities Authority Rev., Taxable (Baptist Health Care Corp.), “B”, AGM, 3.607%, 8/15/2040 | | | 1,730,000 | 1,312,674 |

| Kentucky Higher Education Student Loan Corp. Rev., Taxable, “A-2”, 5.949%, 6/01/2037 | | | 10,000,000 | 9,567,362 |

| National Finance Authority, NH, Utility Refunding Rev., Taxable (Wheeling Power Co. Project), “A”, 6.89%, 4/01/2034 | | | 30,995,000 | 30,979,527 |

Portfolio of Investments (unaudited) – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Municipals – continued |

| Oklahoma Development Finance Authority, Health System Rev., Taxable (OU Medicine Project), “C”, 5.45%, 8/15/2028 | | $ | 3,750,000 | $3,477,520 |

| Port Beaumont, TX, Industrial Development Authority Facility Rev., Taxable (Jefferson Gulf Coast Energy Project), “B”, 4.1%, 1/01/2028 (n) | | | 2,755,000 | 2,332,700 |

| Puerto Rico Electric Power Authority Rev., “A”, 5%, 7/01/2042 (a)(d) | | | 30,000 | 7,875 |

| Puerto Rico Electric Power Authority Rev., “ZZ”, 5%, 7/01/2018 (a)(d) | | | 455,000 | 119,437 |

| Puerto Rico Sales Tax Financing Corp., Restructured Sales Tax Rev., Capital Appreciation, Taxable, “2019A-1”, 4.55%, 7/01/2040 | | | 1,326,000 | 1,059,340 |

| | | | | $54,593,461 |

| Natural Gas - Distribution – 0.1% |

| Boston Gas Co., 3.757%, 3/16/2032 (n) | | $ | 5,000,000 | $4,276,321 |

| Oils – 0.3% |

| FS Luxembourg S.à r.l., 8.875%, 2/12/2031 (n) | | $ | 8,766,000 | $8,345,685 |

| MC Brazil Downstream Trading S.à r.l., 7.25%, 6/30/2031 (n) | | | 3,242,062 | 2,808,883 |

| | | | | $11,154,568 |

| Other Banks & Diversified Financials – 2.3% |

| Ally Financial, Inc., 6.7%, 2/14/2033 | | $ | 10,634,000 | $10,431,794 |

| BBVA Bancomer S.A., 8.45% to 6/29/2033, FLR (CMT - 5yr. + 4.661%) to 6/29/2038 (n) | | | 5,833,000 | 6,022,345 |

| BBVA Bancomer S.A. (Texas), 8.125%, 1/08/2039 (n) | | | 7,000,000 | 7,091,791 |

| Discover Financial Services, 6.7%, 11/29/2032 | | | 11,552,000 | 11,836,603 |

| Intesa Sanpaolo S.p.A., 7.2%, 11/28/2033 (n) | | | 9,924,000 | 10,370,854 |

| Macquarie Group Ltd., 4.442% to 6/21/2032, FLR (SOFR - 1 day + 2.405%) to 6/21/2033 (n) | | | 8,358,000 | 7,541,132 |

| Macquarie Group Ltd., 6.255% to 12/07/2033, FLR (SOFR - 1 day + 2.303%) to 12/07/2034 (n) | | | 17,190,000 | 17,416,934 |

| Northern Trust Corp., 6.125%, 11/02/2032 | | | 6,550,000 | 6,737,918 |

| Synchrony Financial, 7.25%, 2/02/2033 | | | 9,603,000 | 9,370,224 |

| Truist Financial Corp., 5.711% to 1/24/2034, FLR (SOFR - 1 day + 1.922%) to 1/24/2035 | | | 18,734,000 | 18,181,102 |

| | | | | $105,000,697 |

| Pharmaceuticals – 0.7% |

| Bayer US Finance LLC, 6.5%, 11/21/2033 (n) | | $ | 15,000,000 | $14,950,027 |

| Organon Finance 1 LLC, 4.125%, 4/30/2028 (n) | | | 11,000,000 | 10,018,324 |

| Organon Finance 1 LLC, 5.125%, 4/30/2031 (n) | | | 8,000,000 | 6,917,614 |

| | | | | $31,885,965 |

Portfolio of Investments (unaudited) – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Precious Metals & Minerals – 0.5% |

| Eldorado Gold Corp., 6.25%, 9/01/2029 (n) | | $ | 3,500,000 | $3,296,075 |

| Northern Star Resources Ltd. Co., 6.125%, 4/11/2033 (n) | | | 20,176,000 | 19,909,884 |

| | | | | $23,205,959 |

| Printing & Publishing – 0.2% |

| Cimpress PLC, 7%, 6/15/2026 | | $ | 8,500,000 | $8,434,210 |

| Real Estate - Office – 0.7% |

| Boston Properties LP, REIT, 2.9%, 3/15/2030 | | $ | 10,000,000 | $8,354,261 |

| Boston Properties LP, REIT, 2.55%, 4/01/2032 | | | 11,423,000 | 8,738,784 |

| Boston Properties LP, REIT, 2.45%, 10/01/2033 | | | 17,139,000 | 12,415,767 |

| | | | | $29,508,812 |

| Real Estate - Retail – 0.2% |

| STORE Capital Corp., REIT, 4.625%, 3/15/2029 | | $ | 10,272,000 | $9,540,227 |

| Retailers – 0.6% |

| Alimentation Couche-Tard, Inc., 2.95%, 1/25/2030 (n) | | $ | 2,180,000 | $1,908,192 |

| Alimentation Couche-Tard, Inc., 5.267%, 2/12/2034 (n) | | | 25,000,000 | 24,120,013 |

| | | | | $26,028,205 |

| Specialty Chemicals – 0.5% |

| International Flavors & Fragrances, Inc., 2.3%, 11/01/2030 (n) | | $ | 8,000,000 | $6,488,706 |

| International Flavors & Fragrances, Inc., 5%, 9/26/2048 | | | 5,000,000 | 4,123,884 |

| International Flavors & Fragrances, Inc., 3.468%, 12/01/2050 (n) | | | 16,000,000 | 10,117,595 |

| | | | | $20,730,185 |

| Specialty Stores – 0.4% |

| DICK'S Sporting Goods, 3.15%, 1/15/2032 | | $ | 17,118,000 | $14,121,943 |

| Genuine Parts Co., 2.75%, 2/01/2032 | | | 5,031,000 | 4,092,317 |

| | | | | $18,214,260 |

| Telecommunications - Wireless – 0.7% |

| Cellnex Finance Co. S.A., 3.875%, 7/07/2041 (n) | | $ | 1,582,000 | $1,199,442 |

| Rogers Communications, Inc., 4.35%, 5/01/2049 | | | 8,961,000 | 6,915,497 |

| Rogers Communications, Inc., 4.55%, 3/15/2052 | | | 2,643,000 | 2,090,426 |

| Sitios Latinoamerica, S.A.B. de C.V., 5.375%, 4/04/2032 | | | 2,583,000 | 2,360,032 |

| T-Mobile USA, Inc., 2.55%, 2/15/2031 | | | 6,156,000 | 5,105,276 |

| T-Mobile USA, Inc., 4.375%, 4/15/2040 | | | 9,331,000 | 7,949,292 |

| Vodafone Group PLC, 5.625%, 2/10/2053 | | | 7,731,000 | 7,236,703 |

| | | | | $32,856,668 |

Portfolio of Investments (unaudited) – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Tobacco – 1.2% |

| B.A.T. Capital Corp., 3.215%, 9/06/2026 | | $ | 1,869,000 | $1,768,176 |

| B.A.T. Capital Corp., 6.343%, 8/02/2030 | | | 1,316,000 | 1,349,266 |

| B.A.T. Capital Corp., 4.742%, 3/16/2032 | | | 16,783,000 | 15,675,144 |

| Imperial Brands Finance PLC, 6.125%, 7/27/2027 (n) | | | 8,569,000 | 8,642,476 |

| Philip Morris International, Inc., 5.75%, 11/17/2032 | | | 5,581,000 | 5,618,856 |

| Philip Morris International, Inc., 5.375%, 2/15/2033 | | | 6,000,000 | 5,880,642 |

| Philip Morris International, Inc., 5.25%, 2/13/2034 | | | 16,000,000 | 15,434,402 |

| | | | | $54,368,962 |

| Transportation - Services – 0.2% |

| Acu Petroleo Luxembourg S.à r.l., 7.5%, 1/13/2032 (n) | | $ | 2,784,979 | $2,666,425 |

| Delhi International Airport Ltd., 6.45%, 6/04/2029 (n) | | | 2,461,000 | 2,390,246 |

| JSW Infrastructure Ltd., 4.95%, 1/21/2029 (n) | | | 2,855,000 | 2,625,265 |

| Toll Road Investors Partnership II LP, Capital Appreciation, NPFG, 0%, 2/15/2026 (n) | | | 307,000 | 265,944 |

| Toll Road Investors Partnership II LP, Capital Appreciation, NPFG, 0%, 2/15/2029 (n) | | | 889,000 | 601,852 |

| Toll Road Investors Partnership II LP, Capital Appreciation, NPFG, 0%, 2/15/2031 (n) | | | 307,000 | 176,433 |

| | | | | $8,726,165 |

| U.S. Treasury Obligations – 31.4% |

| U.S. Treasury Bonds, 1.375%, 11/15/2040 | | $ | 35,900,000 | $21,755,961 |

| U.S. Treasury Bonds, 1.75%, 8/15/2041 | | | 11,300,000 | 7,175,059 |

| U.S. Treasury Bonds, 2.375%, 2/15/2042 | | | 91,500,000 | 64,153,652 |

| U.S. Treasury Bonds, 4%, 11/15/2042 | | | 137,099,000 | 122,151,995 |

| U.S. Treasury Bonds, 3.875%, 5/15/2043 | | | 11,500,000 | 10,028,809 |

| U.S. Treasury Bonds, 4.375%, 8/15/2043 | | | 122,408,000 | 114,317,596 |

| U.S. Treasury Bonds, 4.75%, 11/15/2043 | | | 148,000,000 | 145,178,750 |

| U.S. Treasury Bonds, 4.5%, 2/15/2044 | | | 18,600,000 | 17,658,375 |

| U.S. Treasury Bonds, 2.5%, 2/15/2045 (f) | | | 7,646,000 | 5,247,068 |

| U.S. Treasury Bonds, 2.375%, 11/15/2049 | | | 9,526,900 | 6,075,632 |

| U.S. Treasury Bonds, 1.625%, 11/15/2050 | | | 8,400,000 | 4,389,656 |

| U.S. Treasury Bonds, 2.25%, 2/15/2052 | | | 106,300,000 | 64,822,239 |

| U.S. Treasury Bonds, 4%, 11/15/2052 | | | 43,474,000 | 38,094,092 |

| U.S. Treasury Bonds, 4.125%, 8/15/2053 | | | 109,700,000 | 98,232,922 |

| U.S. Treasury Notes, 5%, 8/31/2025 | | | 127,100,000 | 126,772,321 |

| U.S. Treasury Notes, 4.875%, 11/30/2025 | | | 40,000,000 | 39,831,250 |

| U.S. Treasury Notes, 4.25%, 1/31/2026 | | | 12,400,000 | 12,225,141 |

| U.S. Treasury Notes, 0.875%, 6/30/2026 | | | 88,000,000 | 80,633,437 |

| U.S. Treasury Notes, 4.375%, 12/15/2026 | | | 131,500,000 | 129,727,832 |

| U.S. Treasury Notes, 2.5%, 3/31/2027 (f) | | | 233,300,000 | 218,418,012 |

Portfolio of Investments (unaudited) – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| U.S. Treasury Obligations – continued |

| U.S. Treasury Notes, 4.125%, 7/31/2028 | | $ | 82,100,000 | $80,069,949 |

| | | | | $1,406,959,748 |

| Utilities - Electric Power – 2.1% |

| AES Gener S.A., 6.35% to 4/07/2025, FLR (CMT - 5yr. + 4.917%) to 4/07/2030, FLR (CMT - 5yr. + 5.167%) to 4/07/2045, FLR (CMT - 5yr. + 5.917%) to 10/07/2079 (n) | | $ | 440,000 | $428,503 |

| Buffalo Energy Mexico Holdings S.A. de C.V., 7.875%, 2/15/2039 (n) | | | 4,659,000 | 4,879,143 |

| Calpine Corp., 5.125%, 3/15/2028 (n) | | | 7,500,000 | 7,114,235 |

| Calpine Corp., 3.75%, 3/01/2031 (n) | | | 4,900,000 | 4,238,214 |

| Enel Finance International N.V., 7.5%, 10/14/2032 (n) | | | 20,669,000 | 22,689,314 |

| ENGIE Energía Chile S.A., 3.4%, 1/28/2030 | | | 4,000,000 | 3,419,728 |

| Greenko Power II Ltd. (Republic of India), 4.3%, 12/13/2028 | | | 4,193,100 | 3,733,270 |

| Jersey Central Power & Light Co., 2.75%, 3/01/2032 (n) | | | 359,000 | 291,580 |

| Mercury Chile Holdco LLC, 6.5%, 1/24/2027 (n) | | | 6,745,000 | 6,480,221 |

| NextEra Energy, Inc., 4.5%, 9/15/2027 (n) | | | 10,000,000 | 9,317,654 |

| NextEra Energy, Inc., 7.25%, 1/15/2029 (n) | | | 10,000,000 | 10,128,880 |

| Pacific Gas & Electric Co., 5.45%, 6/15/2027 | | | 6,067,000 | 6,028,360 |

| Pacific Gas & Electric Co., 3%, 6/15/2028 | | | 823,000 | 740,556 |

| Pacific Gas & Electric Co., 6.4%, 6/15/2033 | | | 4,021,000 | 4,091,460 |

| Pacific Gas & Electric Co., 6.95%, 3/15/2034 | | | 9,500,000 | 10,039,852 |

| Pacific Gas & Electric Co., 3.5%, 8/01/2050 | | | 3,017,000 | 1,934,988 |

| | | | | $95,555,958 |

| Utilities - Other – 0.1% |

| Aegea Finance S.à r.l., 9%, 1/20/2031 (n) | | $ | 3,779,000 | $3,954,512 |

| Total Bonds (Identified Cost, $4,516,095,050) | | $4,367,350,447 |

| Investment Companies (h) – 3.2% |

| Money Market Funds – 3.2% | |

| MFS Institutional Money Market Portfolio, 5.38% (v) (Identified Cost, $144,333,803) | | | 144,334,475 | $144,334,475 |

|

|

| Other Assets, Less Liabilities – (0.7)% | | (33,424,329) |

| Net Assets – 100.0% | $4,478,260,593 |

| (a) | Non-income producing security. |

| (d) | In default. |

| (f) | All or a portion of the security has been segregated as collateral for open futures contracts. |

| (h) | An affiliated issuer, which may be considered one in which the fund owns 5% or more of the outstanding voting securities, or a company which is under common control. At period end, the aggregate values of the fund's investments in affiliated issuers and in unaffiliated issuers were $144,334,475 and $4,367,350,447, respectively. |

Portfolio of Investments (unaudited) – continued

| (i) | Interest only security for which the fund receives interest on notional principal (Par amount). Par amount shown is the notional principal and does not reflect the cost of the security. |

| (n) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. At period end, the aggregate value of these securities was $1,597,977,877, representing 35.7% of net assets. |

| (p) | Payment-in-kind (PIK) security for which interest income may be received in additional securities and/or cash. |

| (v) | Affiliated issuer that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualized seven-day yield of the fund at period end. |

| (w) | When-issued security. |

| (z) | Restricted securities are not registered under the Securities Act of 1933 and are subject to legal restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are subsequently registered. Disposal of these securities may involve time-consuming negotiations and prompt sale at an acceptable price may be difficult. The fund holds the following restricted securities: |

| Restricted Securities | Acquisition

Date | Cost | Value |

| ReadyCap Commercial Mortgage Trust, 2021-FL7, “D”, FLR, 8.381% ((SOFR - 1mo. + 0.11448%) + 2.95%), 11/25/2036 | 11/12/21 | $1,770,000 | $1,726,208 |

| % of Net assets | | | 0.0% |

| The following abbreviations are used in this report and are defined: |

| AAC | Ambac Assurance Corp. |

| AGM | Assured Guaranty Municipal |

| CDO | Collateralized Debt Obligation |

| CLO | Collateralized Loan Obligation |

| CMT | Constant Maturity Treasury |

| FLR | Floating Rate. Interest rate resets periodically based on the parenthetically disclosed reference rate plus a spread (if any). The period-end rate reported may not be the current rate. All reference rates are USD unless otherwise noted. |

| LIBOR | London Interbank Offered Rate |

| NPFG | National Public Finance Guarantee Corp. |

| REIT | Real Estate Investment Trust |

| SOFR | Secured Overnight Financing Rate |

| TBA | To Be Announced |

| UMBS | Uniform Mortgage-Backed Security |

| Abbreviations indicate amounts shown in currencies other than the U.S. dollar. All amounts are stated in U.S. dollars unless otherwise indicated. A list of abbreviations is shown below: |

| BRL | Brazilian Real |

| EUR | Euro |

| MXN | Mexican Peso |

| UYU | Uruguayan Peso |

Portfolio of Investments (unaudited) – continued

Derivative Contracts at 4/30/24

| Forward Foreign Currency Exchange Contracts |

Currency

Purchased | Currency

Sold | Counterparty | Settlement

Date | Unrealized

Appreciation

(Depreciation) |

| Asset Derivatives |

| USD | 8,304,086 | BRL | 41,272,555 | Barclays Bank PLC | 5/03/2024 | $356,718 |

| USD | 7,980,308 | BRL | 41,272,555 | Citibank N.A. | 5/03/2024 | 32,939 |

| USD | 7,925,751 | BRL | 41,272,555 | Citibank N.A. | 7/02/2024 | 26,206 |

| USD | 10,784,258 | MXN | 182,306,465 | State Street Bank Corp. | 7/19/2024 | 277,781 |

| | | | | | | $693,644 |

| Liability Derivatives |

| BRL | 41,272,555 | USD | 7,980,308 | Barclays Bank PLC | 5/03/2024 | $(32,939) |

| BRL | 41,272,555 | USD | 7,970,752 | Citibank N.A. | 5/03/2024 | (23,383) |

| USD | 9,705,140 | EUR | 9,081,190 | Morgan Stanley Capital Services, Inc. | 7/19/2024 | (20,108) |

| | | | | | | $(76,430) |

| Futures Contracts |

| Description | Long/

Short | Currency | Contracts | Notional

Amount | Expiration

Date | Value/Unrealized

Appreciation

(Depreciation) |

| Asset Derivatives |

| Interest Rate Futures | | |

| U.S. Treasury Ultra Note 10 yr | Short | USD | 1,100 | $121,240,625 | June – 2024 | $1,525,368 |

| Liability Derivatives |

| Interest Rate Futures | | |

| U.S. Treasury Note 2 yr | Long | USD | 1,130 | $229,001,562 | June – 2024 | $(2,179,843) |

| U.S. Treasury Note 5 yr | Long | USD | 3,369 | 352,876,431 | June – 2024 | (4,082,403) |

| U.S. Treasury Ultra Bond 30 yr | Long | USD | 409 | 48,901,063 | June – 2024 | (3,104,223) |

| | | | | | | $(9,366,469) |

At April 30, 2024, the fund had liquid securities with an aggregate value of $7,015,400 to cover any collateral or margin obligations for certain derivative contracts.

See Notes to Financial Statements

Financial Statements

Statement of Assets and Liabilities

At 4/30/24 (unaudited)

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| Assets | |

| Investments in unaffiliated issuers, at value (identified cost, $4,516,095,050) | $4,367,350,447 |

| Investments in affiliated issuers, at value (identified cost, $144,333,803) | 144,334,475 |

| Cash | 3,479,026 |

| Restricted cash for MBS/TBA | 269,000 |

| Receivables for | |

| Forward foreign currency exchange contracts | 693,644 |

| Fund shares sold | 25,691,966 |

| Interest and dividends | 47,015,552 |

| Receivable from investment adviser | 150,274 |

| Other assets | 136,750 |

| Total assets | $4,589,121,134 |

| Liabilities | |

| Payables for | |

| Distributions | $119,213 |

| Forward foreign currency exchange contracts | 76,430 |

| Net daily variation margin on open futures contracts | 1,236,516 |

| Investments purchased | 10,638,560 |

| When-issued investments purchased | 8,323,000 |

| TBA purchase commitments | 77,837,018 |

| Fund shares reacquired | 11,619,994 |

| Payable to affiliates | |

| Administrative services fee | 3,368 |

| Shareholder servicing costs | 898,169 |

| Distribution and service fees | 11,159 |

| Payable for independent Trustees' compensation | 1,921 |

| Accrued expenses and other liabilities | 95,193 |

| Total liabilities | $110,860,541 |

| Net assets | $4,478,260,593 |

| Net assets consist of | |

| Paid-in capital | $4,709,362,129 |

| Total distributable earnings (loss) | (231,101,536) |

| Net assets | $4,478,260,593 |

| Shares of beneficial interest outstanding | 779,071,441 |

Statement of Assets and Liabilities (unaudited) – continued

| | Net assets | Shares

outstanding | Net asset value

per share (a) |

| Class A | $708,006,730 | 122,971,559 | $5.76 |

| Class B | 1,188,822 | 207,844 | 5.72 |

| Class C | 26,593,125 | 4,662,283 | 5.70 |

| Class I | 2,714,665,133 | 472,578,668 | 5.74 |

| Class R6 | 1,027,806,783 | 178,651,087 | 5.75 |

| (a) | Maximum offering price per share was equal to the net asset value per share for all share classes, except for Class A, for which the maximum offering price per share was $6.02 [100 / 95.75 x $5.76]. On sales of $100,000 or more, the maximum offering price of Class A shares is reduced. A contingent deferred sales charge may be imposed on redemptions of Class A, Class B, and Class C shares. Redemption price per share was equal to the net asset value per share for Classes I and R6. |

See Notes to Financial Statements

Financial Statements

Statement of Operations

Six months ended 4/30/24 (unaudited)

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

| Net investment income (loss) | |

| Income | |

| Interest | $101,071,388 |

| Dividends from affiliated issuers | 2,474,550 |

| Other | 47,778 |

| Total investment income | $103,593,716 |

| Expenses | |

| Management fee | $8,284,755 |

| Distribution and service fees | 919,844 |

| Shareholder servicing costs | 1,463,212 |

| Administrative services fee | 265,459 |

| Independent Trustees' compensation | 24,042 |

| Custodian fee | 82,925 |

| Shareholder communications | 73,366 |

| Audit and tax fees | 42,033 |

| Legal fees | 6,336 |

| Miscellaneous | 262,739 |

| Total expenses | $11,424,711 |

| Fees paid indirectly | (1,966) |

| Reduction of expenses by investment adviser and distributor | (1,989,435) |

| Net expenses | $9,433,310 |

| Net investment income (loss) | $94,160,406 |

Statement of Operations (unaudited) – continued

| Realized and unrealized gain (loss) |

| Realized gain (loss) (identified cost basis) | |

| Unaffiliated issuers | $(7,436,538) |

| Affiliated issuers | (27,124) |

| Futures contracts | (1,788,127) |

| Forward foreign currency exchange contracts | (1,106,652) |

| Foreign currency | 4,612 |

| Net realized gain (loss) | $(10,353,829) |

| Change in unrealized appreciation or depreciation | |

| Unaffiliated issuers | $76,549,914 |

| Affiliated issuers | (4,622) |

| Futures contracts | (1,153,704) |

| Forward foreign currency exchange contracts | 497,353 |

| Translation of assets and liabilities in foreign currencies | 7,694 |

| Net unrealized gain (loss) | $75,896,635 |

| Net realized and unrealized gain (loss) | $65,542,806 |

| Change in net assets from operations | $159,703,212 |

See Notes to Financial Statements

Financial Statements

Statements of Changes in Net Assets

These statements describe the increases and/or decreases in net assets resulting from operations, any distributions, and any shareholder transactions.

| | Six months ended | Year ended |

| | 4/30/24

(unaudited) | 10/31/23 |

| Change in net assets | | |

| From operations | | |

| Net investment income (loss) | $94,160,406 | $91,807,664 |

| Net realized gain (loss) | (10,353,829) | (33,405,299) |

| Net unrealized gain (loss) | 75,896,635 | (82,544,056) |

| Change in net assets from operations | $159,703,212 | $(24,141,691) |

| Total distributions to shareholders | $(94,723,531) | $(93,463,724) |

| Change in net assets from fund share transactions | $1,713,251,734 | $1,759,303,809 |

| Total change in net assets | $1,778,231,415 | $1,641,698,394 |

| Net assets | | |

| At beginning of period | 2,700,029,178 | 1,058,330,784 |

| At end of period | $4,478,260,593 | $2,700,029,178 |

See Notes to Financial Statements

Financial Statements

Financial Highlights

The financial highlights table is intended to help you understand the fund's financial performance for the semiannual period and the past 5 fiscal years (or life of a particular share class, if shorter). Certain information reflects financial results for a single fund share. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.

| Class A | Six months

ended | Year ended |

| | 4/30/24

(unaudited) | 10/31/23 | 10/31/22 | 10/31/21 | 10/31/20 | 10/31/19 |

| Net asset value, beginning of period | $5.55 | $5.70 | $7.05 | $7.04 | $6.80 | $6.27 |

| Income (loss) from investment operations |

| Net investment income (loss) (d) | $0.14 | $0.27 | $0.16 | $0.14 | $0.18 | $0.20 |

| Net realized and unrealized gain (loss) | 0.21 | (0.15) | (1.28) | 0.04 | 0.25 | 0.53 |

| Total from investment operations | $0.35 | $0.12 | $(1.12) | $0.18 | $0.43 | $0.73 |

| Less distributions declared to shareholders |

| From net investment income | $(0.14) | $(0.27) | $(0.16) | $(0.16) | $(0.19) | $(0.20) |

| From net realized gain | — | — | (0.07) | (0.01) | — | — |

| Total distributions declared to shareholders | $(0.14) | $(0.27) | $(0.23) | $(0.17) | $(0.19) | $(0.20) |

| Net asset value, end of period (x) | $5.76 | $5.55 | $5.70 | $7.05 | $7.04 | $6.80 |

| Total return (%) (r)(s)(t)(x) | 6.32(n) | 1.99 | (16.28) | 2.67 | 6.46 | 11.86 |

Ratios (%) (to average net assets)

and Supplemental data: |

| Expenses before expense reductions (f) | 0.84(a) | 0.89 | 0.93 | 0.95 | 0.99 | 1.09 |

| Expenses after expense reductions (f) | 0.73(a) | 0.73 | 0.73 | 0.73 | 0.76 | 1.02 |

| Net investment income (loss) | 4.88(a) | 4.65 | 2.55 | 2.02 | 2.64 | 3.05 |

| Portfolio turnover | 19(n) | 46 | 55 | 64 | 95 | 103 |

| Net assets at end of period (000 omitted) | $708,007 | $521,281 | $349,679 | $329,668 | $250,293 | $210,404 |

See Notes to Financial Statements

Financial Highlights – continued

| Class B | Six months

ended | Year ended |

| | 4/30/24

(unaudited) | 10/31/23 | 10/31/22 | 10/31/21 | 10/31/20 | 10/31/19 |

| Net asset value, beginning of period | $5.51 | $5.66 | $7.00 | $6.99 | $6.76 | $6.22 |

| Income (loss) from investment operations |

| Net investment income (loss) (d) | $0.12 | $0.22 | $0.11 | $0.09 | $0.13 | $0.15 |

| Net realized and unrealized gain (loss) | 0.21 | (0.14) | (1.27) | 0.04 | 0.24 | 0.54 |

| Total from investment operations | $0.33 | $0.08 | $(1.16) | $0.13 | $0.37 | $0.69 |

| Less distributions declared to shareholders |

| From net investment income | $(0.12) | $(0.23) | $(0.11) | $(0.11) | $(0.14) | $(0.15) |

| From net realized gain | — | — | (0.07) | (0.01) | — | — |

| Total distributions declared to shareholders | $(0.12) | $(0.23) | $(0.18) | $(0.12) | $(0.14) | $(0.15) |

| Net asset value, end of period (x) | $5.72 | $5.51 | $5.66 | $7.00 | $6.99 | $6.76 |

| Total return (%) (r)(s)(t)(x) | 5.96(n) | 1.22 | (16.90) | 1.91 | 5.54 | 11.27 |

Ratios (%) (to average net assets)

and Supplemental data: |

| Expenses before expense reductions (f) | 1.59(a) | 1.64 | 1.68 | 1.70 | 1.74 | 1.84 |

| Expenses after expense reductions (f) | 1.48(a) | 1.48 | 1.48 | 1.48 | 1.51 | 1.78 |

| Net investment income (loss) | 4.13(a) | 3.85 | 1.68 | 1.30 | 1.92 | 2.31 |

| Portfolio turnover | 19(n) | 46 | 55 | 64 | 95 | 103 |

| Net assets at end of period (000 omitted) | $1,189 | $1,413 | $2,005 | $4,365 | $6,402 | $11,016 |

See Notes to Financial Statements

Financial Highlights – continued

| Class C | Six months

ended | Year ended |

| | 4/30/24

(unaudited) | 10/31/23 | 10/31/22 | 10/31/21 | 10/31/20 | 10/31/19 |

| Net asset value, beginning of period | $5.50 | $5.65 | $6.98 | $6.97 | $6.74 | $6.21 |

| Income (loss) from investment operations |

| Net investment income (loss) (d) | $0.12 | $0.23 | $0.11 | $0.09 | $0.13 | $0.15 |

| Net realized and unrealized gain (loss) | 0.20 | (0.15) | (1.26) | 0.04 | 0.24 | 0.53 |

| Total from investment operations | $0.32 | $0.08 | $(1.15) | $0.13 | $0.37 | $0.68 |

| Less distributions declared to shareholders |

| From net investment income | $(0.12) | $(0.23) | $(0.11) | $(0.11) | $(0.14) | $(0.15) |

| From net realized gain | — | — | (0.07) | (0.01) | — | — |

| Total distributions declared to shareholders | $(0.12) | $(0.23) | $(0.18) | $(0.12) | $(0.14) | $(0.15) |

| Net asset value, end of period (x) | $5.70 | $5.50 | $5.65 | $6.98 | $6.97 | $6.74 |

| Total return (%) (r)(s)(t)(x) | 5.78(n) | 1.21 | (16.81) | 1.91 | 5.55 | 11.12 |

Ratios (%) (to average net assets)

and Supplemental data: |

| Expenses before expense reductions (f) | 1.59(a) | 1.64 | 1.68 | 1.70 | 1.74 | 1.84 |

| Expenses after expense reductions (f) | 1.48(a) | 1.48 | 1.48 | 1.48 | 1.51 | 1.78 |

| Net investment income (loss) | 4.11(a) | 3.89 | 1.74 | 1.30 | 1.90 | 2.31 |

| Portfolio turnover | 19(n) | 46 | 55 | 64 | 95 | 103 |

| Net assets at end of period (000 omitted) | $26,593 | $16,494 | $10,201 | $14,461 | $19,035 | $17,783 |

See Notes to Financial Statements

Financial Highlights – continued

| Class I | Six months

ended | Year ended |

| | 4/30/24

(unaudited) | 10/31/23 | 10/31/22 | 10/31/21 | 10/31/20 | 10/31/19 |

| Net asset value, beginning of period | $5.54 | $5.69 | $7.03 | $7.03 | $6.79 | $6.26 |

| Income (loss) from investment operations |

| Net investment income (loss) (d) | $0.15 | $0.29 | $0.18 | $0.16 | $0.20 | $0.21 |

| Net realized and unrealized gain (loss) | 0.20 | (0.15) | (1.28) | 0.03 | 0.25 | 0.54 |