1

Annual Meeting of Stockholders

May 26, 2016

NYSE MKT: HRT

http://ts3.mm.bing.net/th?id=HN.607987715257336002&pid=1.7

www.arthrt.com

www.micronproducts.com

2

NYSE MKT: HRT

Salvatore Emma, Jr. – President & CEO

Derek T. Welch – CFO

http://ts3.mm.bing.net/th?id=HN.607987715257336002&pid=1.7

3

Safe Harbor Statement

These slides (and the accompanying oral discussion) contain “forward-looking statements” within the meaning

of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks and

uncertainties and should not be considered as guarantees of future performance. The factors that could cause

the actual results of the Company to differ materially from the results expressed or implied by such statements

include but are not limited to our ability to obtain and retain order volumes from customers who represent

significant proportions of net sales; our ability to maintain our pricing model, offset higher costs with price

increases and/or decrease our cost of sales; variability of customer delivery requirements; the level of and

ability to generate sales of higher margin products and services; our ability to renew our credit facility and

manage our level of debt and provisions in the debt agreements which could make the Company sensitive to

the effects of economic downturns and limit our ability to react to changes in the economy or our industry;

failure to comply with financial and other covenants in our credit facility; reliance on revenues from exports

and impact on financial results due to economic uncertainty or downturns in foreign markets; volatility in

commodity and energy prices and our ability to offset higher costs with price increases; continued availability

of supplies or materials used in manufacturing at competitive prices; variations in the mix of products sold;

continued availability of supplies or materials used in manufacturing at competitive prices; and the amount

and timing of investments in capital equipment, sales and marketing, engineering and information technology

resources. More information about factors that potentially could affect the Company's financial results is

included in the Company's Annual Report on Form 10-K and other filings with the Securities and Exchange

Commission.

4

Market data as of May 10, 2016, Source: Bloomberg, Shares Outstanding as of March 10, 2016; Ownership as of most recent filing

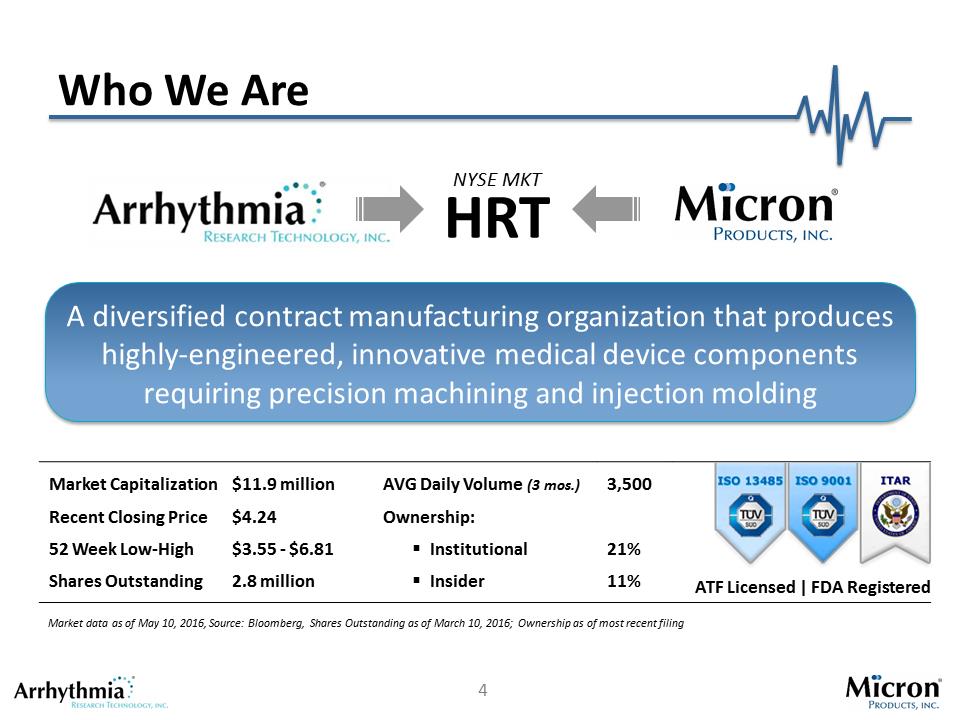

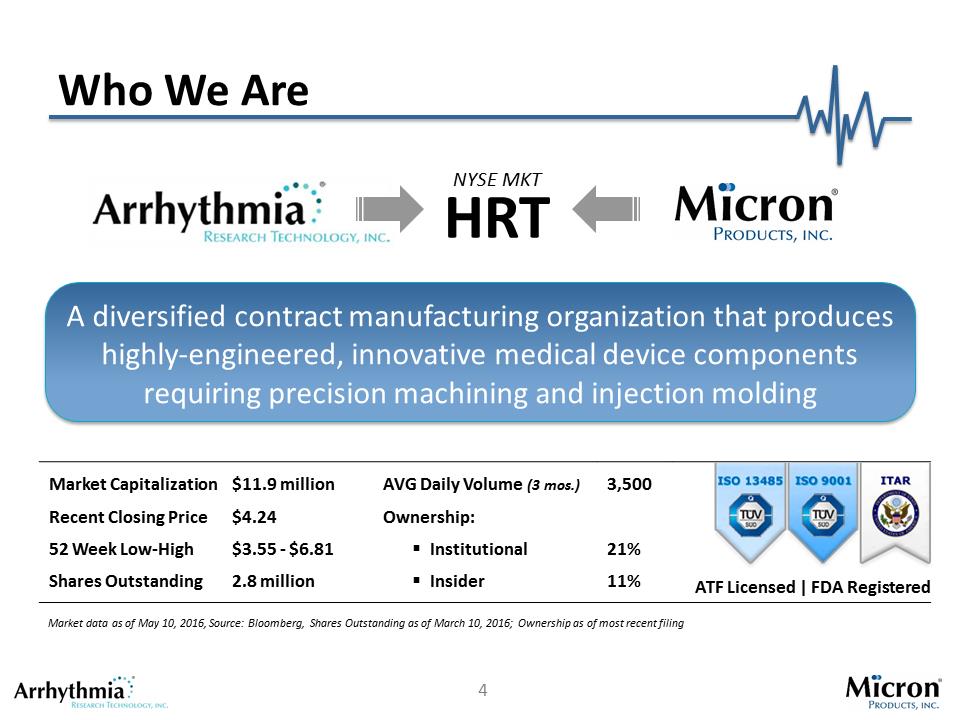

Who We Are

A diversified contract manufacturing organization that produces

highly-engineered, innovative medical device components

requiring precision machining and injection molding

NYSE MKT

HRT

Market Capitalization

$11.9 million

AVG Daily Volume (3 mos.)

3,500

Recent Closing Price

$4.24

Ownership:

ATF Licensed | FDA Registered

52 Week Low-High

$3.55 - $6.81

.Institutional

21%

Shares Outstanding

2.8 million

.Insider

11%

ISO 13485 Certified

ISO 9001 Certified

ITAR Registered

5

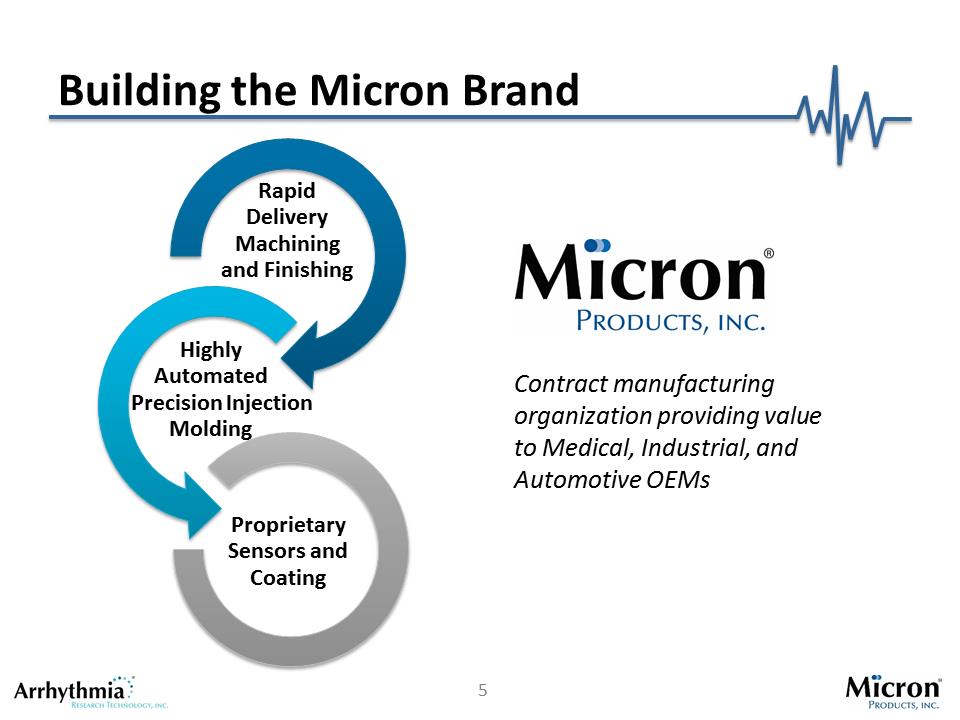

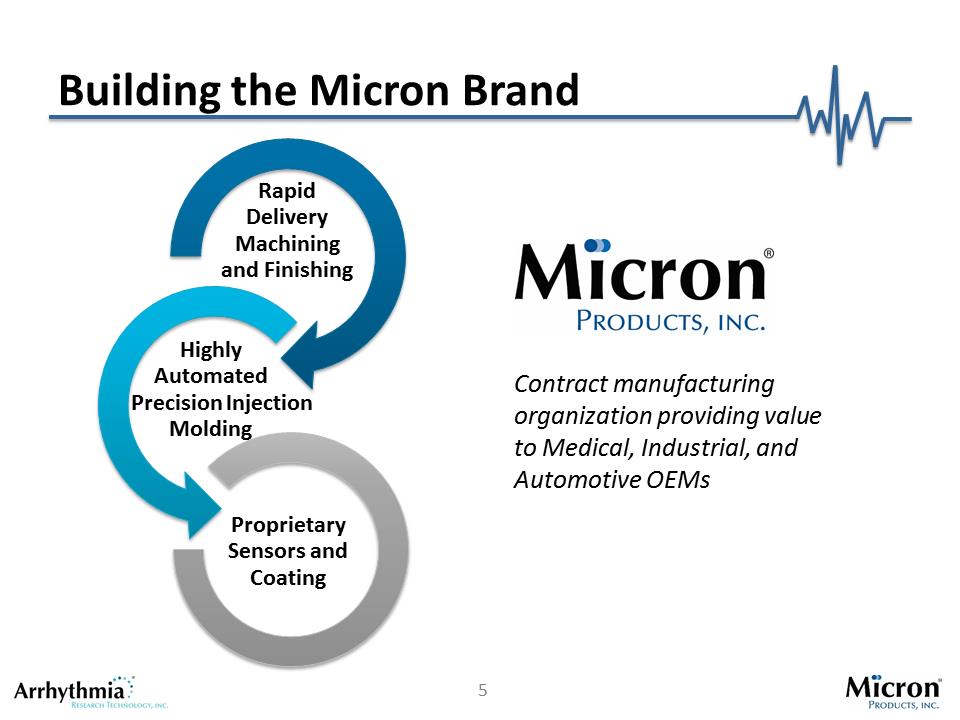

Building the Micron Brand

Rapid

Delivery

Machining

and Finishing

Highly

Automated

Precision Injection

Molding

Proprietary

Sensors and

Coating

Contract manufacturing

organization providing value

to Medical, Industrial, and

Automotive OEMs

6

Key Growth Drivers

.In-depth plastic injection molding expertise, capability, &

capacity

.Multi-product international business

.Strong and growing focus on medical sector (80% medical)

.Innovative process for new products, capabilities, ideas.

.3 focused business sectors

.Strong, highly motivated team

.Excellent customer portfolio including several major OEMs

.Partnership alliances for logistics and supply

.Expanding product portfolio shipping to 35 countries

7

.Rapid production of personalized and off the shelf

implants; offer just-in-time replenishment for customers

.State-of-the-art machining equipment produces complex

components to tight tolerances; best in class surface

finishes

.FDA-registered facilities and ISO 13485 certification

Best-in-class machining and finishing of orthopedic implants & instrumentation

Differentiators

Market Size

$8 billion outsourced market

Machining

8

Market Size

Differentiators

Molding

.High-quality automated processes; Engineered-to-order

.Expertise to produce to extremely tight tolerances required

by medical, industrial, consumer and defense markets

.Molding capacity from 15-tons through 300-tons

.More than 35 horizontal and vertical injection molding

machines for high volume and low volume applications

.Environmentally-controlled manufacturing

Forward Looking Infrared Scope Diopter Ring

Class 10,000 Clean Room Molding/Assembly

Festooned Clip for Auto Seat Bolstering

>$300 billion

Expert in high precision injection molding

9

Differentiators

Market Size

Sensors

.The Micron process guarantees durability and superior

electrical performance: higher quality, higher yields

.Meets or exceeds all AAMI industry standards and

customer specifications

.FDA-registered facilities and ISO 13485 certification

.Servicing the medical electrode industry since 1978

Leading manufacturer of silver/silver chloride sensors for electrodes

Silver Sensor MicroSense Gemini E3912A2-085

Silver Sensor E3311A2

Silver Sensor Micro Sense Gemini G3911

Nickel Plated Sensor, Micro Sense Gemini MS4205-N

Micro Sense Agility Sensor A4626A2

Micro Sense Agility Sensor A5020A2

MicronSense Radio Translucent Carbon Sensor F4209C

Micro Sense Agility Sensor A4606A2

MicroSense Profile Series Silver Sensor D4208C

$20 million

10

NYSE MKT: HRT

Financial Overview

http://ts3.mm.bing.net/th?id=HN.607987715257336002&pid=1.7

11

Net Sales

Machining

•Sales of machined orthopedic implant components was down due to lower than expected

volume from a large customer versus their forecast

Sensors

•Trend to smaller parts, less silver

•Strong US dollar

•Aggressive competition

Custom Thermoplastic Injection Molding

•Increased demand for automotive, consumer and medical device components

2016 Outlook

•Expanded sales force creating new business

•Have added new customers in the second quarter Q2-16

•Orders for new machined and finished orthopedic implants, surgical instruments, and plastic

injection molded components are in production

•Increased orders for the design and manufacture of tooling which is good indication of

future production

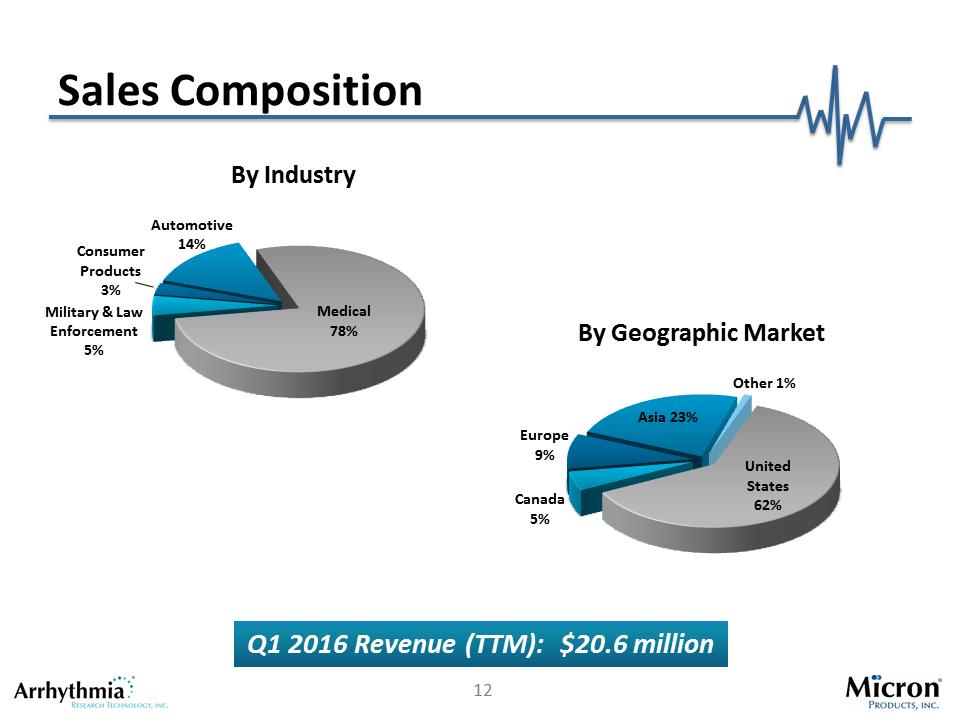

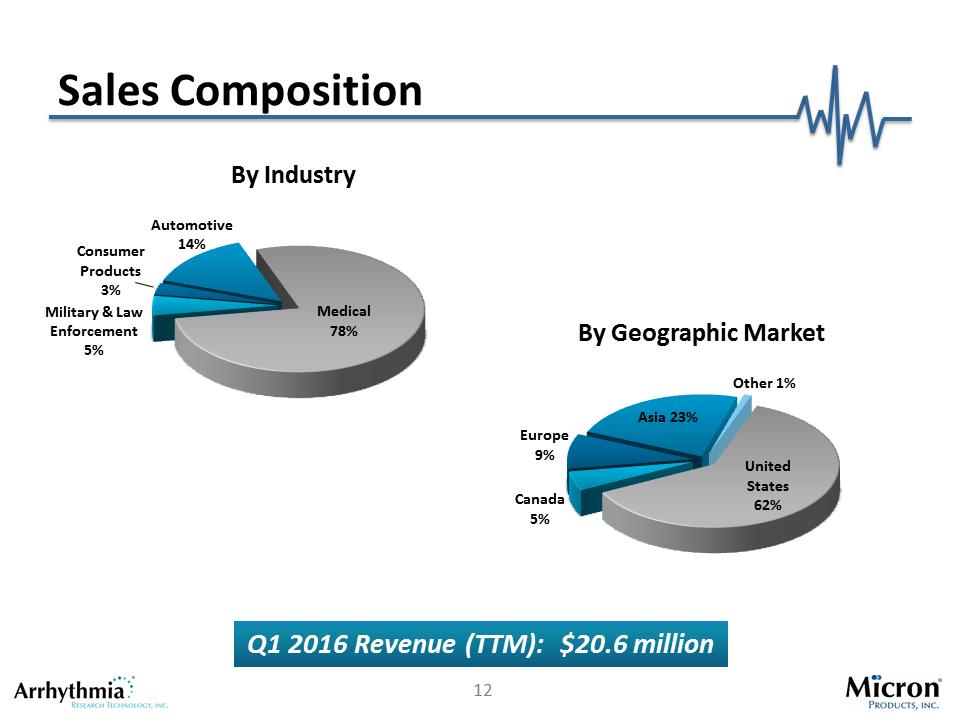

12

Sales Composition

Medical

78%

Consumer

Products

3%

United

States

62%

Canada

5%

Europe

9%

Asia 23%

Other 1%

By Industry

By Geographic Market

Q1 2016 Revenue (TTM): $20.6 million

Military & Law

Enforcement

5%

Automotive

14%

Orthopedics

25%

13

Sales and Profitability Strategy

Top-line Growth

.Expanded sales force

.Strengthen existing customer relationships and grow new opportunities by

cross-selling plastic and machining capabilities.

.Vertical integration, control supply and distribution, do more for customers

.Leverage expertise in engineering and development to manufacture

proprietary products for OEMs

Expand margins and improve profitability

.Drive growth in higher margin markets by expanding manufacturing capacity

and increasing technical capabilities

.Invest in state-of-the-art automation and technology

.Improvement in efficiency and productivity

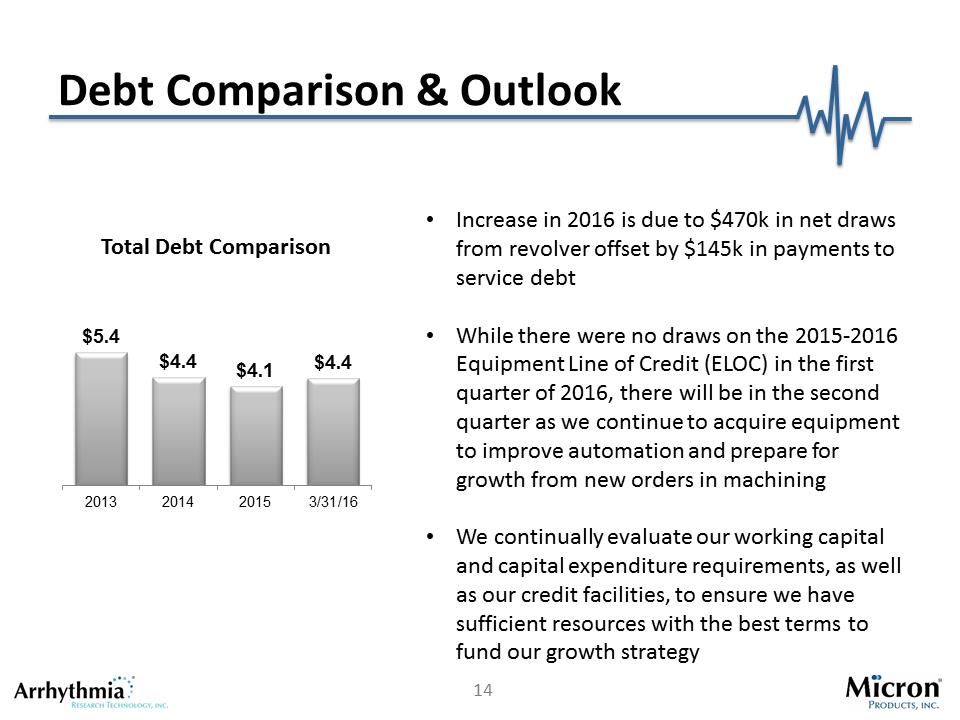

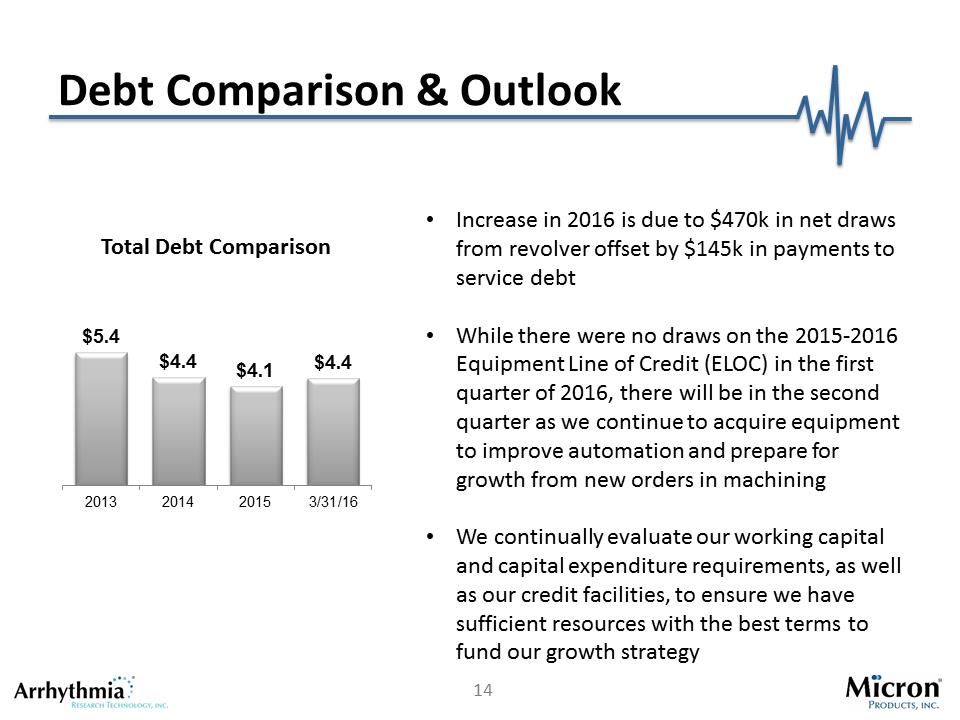

14

Debt Comparison & Outlook

$5.4

$4.4

$4.1

$4.4

2013

2014

2015

3/31/16

Total Debt Comparison

•Increase in 2016 is due to $470k in net draws

from revolver offset by $145k in payments to

service debt

•While there were no draws on the 2015-2016

Equipment Line of Credit (ELOC) in the first

quarter of 2016, there will be in the second

quarter as we continue to acquire equipment

to improve automation and prepare for

growth from new orders in machining

•We continually evaluate our working capital

and capital expenditure requirements, as well

as our credit facilities, to ensure we have

sufficient resources with the best terms to

fund our growth strategy

15

Questions

NYSE MKT: HRT

http://ts3.mm.bing.net/th?id=HN.607987715257336002&pid=1.7