Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

Filed by SafeNet, Inc.

Subject Company: Rainbow Technologies, Inc.

Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934

File No. 0-20634

[LOGO]

The Foundation of High Assurance Security

Safe Harbor

Cautionary Statement Regarding Forward-Looking Statements

Statements contained in this document that are not historical facts could be deemed to be forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements are based on management’s current expectations and beliefs, are not guarantees of future performance and are subject to a number of risks, uncertainties and assumptions that could cause actual results to differ materially from those described in the forward-looking statements, including, among others: the risk that the SafeNet and Rainbow businesses will not be integrated successfully; costs related to the proposed merger; the risk that SafeNet and Rainbow will fail to obtain the required stockholder approvals; the risk that the transaction will not close; the risk that the businesses of the companies will suffer due to uncertainty; and other economic, business, competitive, and/or regulatory factors affecting the SafeNet and Rainbow businesses generally, including those set forth in their filings with the Securities and Exchange Commission, including each of Rainbow’s and SafeNet’s Annual Reports on Form 10-K for the fiscal year ended December 31, 2002, their most recent Quarterly Reports on Form 10-Q and their Current Reports on Form 8-K. If any of these risks or uncertainties materializes or any of these assumptions proves incorrect, SafeNet’s and Rainbow’s results could differ materially from SafeNet’s and Rainbow’s expectations in these statements. SafeNet and Rainbow assume no obligation and do not intend to update or alter these forward-looking statements, whether as a result of new information, future events, or otherwise.

Where You Can Find Additional Information

SafeNet and Rainbow intend to file with the SEC a joint proxy statement/prospectus and other relevant materials in connection with the transaction described in this document. The joint proxy statement/prospectus will be mailed tothe stockholders of SafeNet and Rainbow. Investors and security holders of SafeNet and Rainbow are urged to read the joint proxy statement/prospectus and the other relevant materials when they become available because they will contain important information about SafeNet, Rainbow and the transaction. The joint proxy statement/prospectus and other relevant materials (when they become available), and any other documents filed by SafeNet or Rainbow with the SEC, may be obtained free of charge at the SEC’s web site at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents filed with the SEC by SafeNet by contacting Michelle Layne, SafeNet Investor Relations, 8029 Corporate Drive, Baltimore, Maryland 21236, (410) 933-5895. Investors and security holders may obtain free copies of the documents filed with the SEC by Rainbow by contacting Rainbow Investor Relations, 50 Technology Drive, Irvine, California 92718 (949) 450-7377. Investors and security holders are urged to read the joint proxy statement/prospectus and the other relevant materials when they become available before making any voting or investment decision.

SafeNet and its executive officers, directors and employees may be deemed to be participants in the solicitation of proxies from the stockholders of SafeNet and Rainbow in favor of the transaction. A list of the names of SafeNet’s executive officers and directors, and a description of their respective interests in SafeNet, are set forth in the proxy statement for SafeNet’s 2003 Annual Meeting of Stockholders, which was filed with the SEC on April 30, 2003. Investors and security holders may obtain additional information regarding the interests of SafeNet’s executive officers and directors in the transaction by reading the joint proxy statement/prospectus when it becomes available.

Rainbow and its executive officers, directors and employees may be deemed to be participants in the solicitation of proxies from the stockholders of SafeNet and Rainbow in favor of the transaction. A list of the names of Rainbow’s executive officers and directors, and a description of their respective interests in Rainbow, are set forth in the proxy statement for Rainbow’s 2003 Annual Meeting of Stockholders, which was filed with the SEC on April 28, 2003. Investors and security holders may obtain additional information regarding the interests of Rainbow’s executive officers and directors in the transaction by reading the joint proxy statement/prospectus when it becomes available.

[LOGO]

2

ANTHONY CAPUTO | | WALTER STRAUB |

Chairman and CEO | | Chairman and CEO |

[LOGO] | | [LOGO] |

| | |

CAROLE ARGO |

CFO |

[LOGO] |

3

Transaction Summary

Consideration: | 0.374 SFNT shares for every RNBO share |

| |

Pro Forma Ownership: | SFNT – 57% / RNBO – 43% |

| |

Shares Issued: | 11.1MM Fully Diluted |

| |

Financial Impact: | Immediately accretive |

| |

New Directors: | Walter Straub, Chairman and CEO Rainbow Arthur Money, Former Asst. Secretary of Defense |

| |

Key Conditions: | SafeNet and Rainbow shareholder approval Regulatory approval and other customary conditions |

| |

Target Closing: | Q1 2004 |

[LOGO]

4

Two Industry Leaders

[LOGO]

• Founded: 1983

• LTM Revenues: $56.8

• Employees: 215

• Key Customers:

Government agencies, OEMs and financial institutions

• A leading provider of network security products

[LOGO]

• Founded: 1984

• LTM Revenues: $136.2

• Employees: 570

• Key Customers:

Government agencies, ISVs and financial institutions

• A leading provider of information security solutions

Both companies are strong standalone entities with proven track records of execution

5

A Shared Vision

We are:

Encryption-based security experts with 20-year histories

The Mission:

To be the leading provider of high assurance security solutions

6

Strategic Rationale

• Accelerates growth in the important government security market, with a comprehensive offering of VPN, WAN and top secret security products

• The addition of high growth SSL VPN and authentication tokens strengthens competitive position in the commercial market

• Leading position in high growth digital rights management market

• Leverages and expands SafeNet’s comprehensive distribution platform

• Substantial scale and synergy opportunities enhance a proven financial track record

7

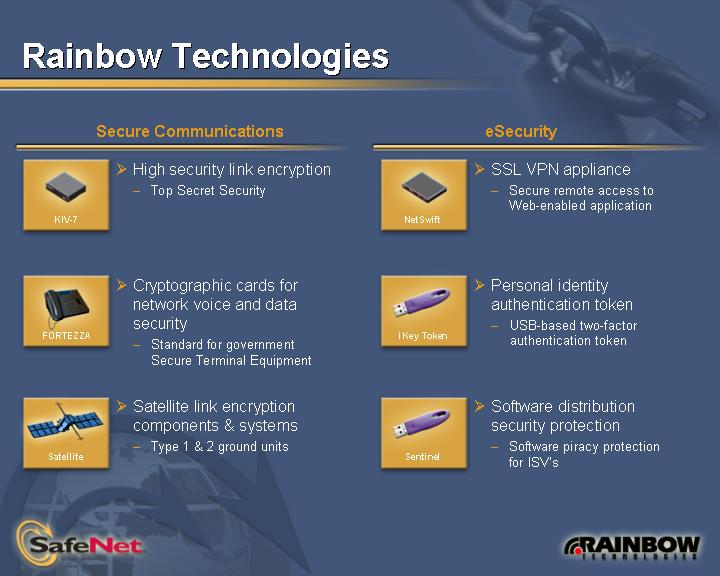

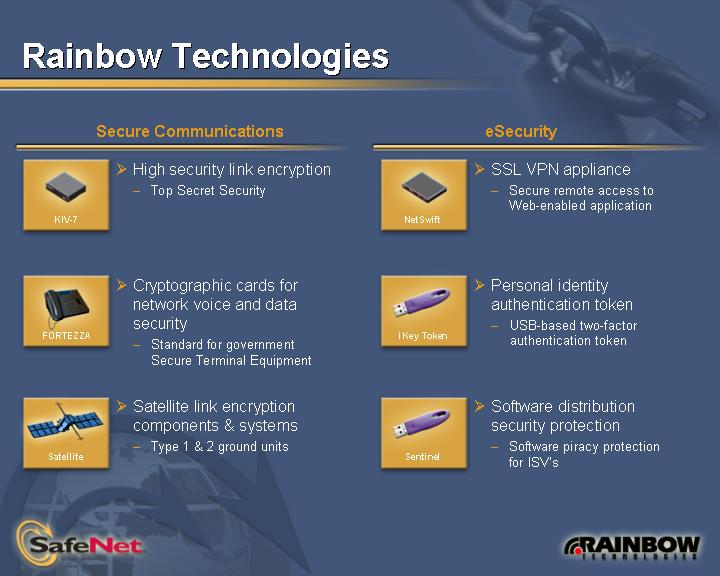

Rainbow Technologies

Secure Communications

[GRAPHIC]

• High security link encryption

• Top Secret Security

[GRAPHIC]

• Cryptographic cards for network voice and data security

• Standard for government Secure Terminal Equipment

[GRAPHIC]

• Satellite link encryption components & systems

• Type 1 & 2 ground units

eSecurity

[GRAPHIC]

• SSL VPN appliance

• Secure remote access to Web-enabled application

[GRAPHIC]

• Personal identity authentication token

• USB-based two-factor authentication token

[GRAPHIC]

• Software distribution security protection

• Software piracy protection for ISV’s

8

SafeNet Model

Sensitivity to Security

Enterprise

Embedded (OEM)

Network Infrastructure

Embedded (OEM)

Wireless/ Semiconductor

Price Points

Gov’t Financial | Systems |

| |

Large

Enterprises | Hardware

Chips |

| |

Small/Medium

Enterprises | Software |

| |

Consumers | Intellectual Property |

9

Enterprise Security Division

Enterprise

Gov’t Financial | Embedded |

| |

Large

Enterprises | Embedded (OEM)

Network Infrastructure |

| |

Small/Medium

Enterprises | |

| |

Consumers | Embedded (OEM)

Wireless/ Semiconductor |

10

Government Customers

[LOGOS]

11

Strong Government Spending

Cryptographic Modernization

• Encryption used at virtually every federal agency

• Government cryptographic inventory declining at significant rate

• Maintenance problem

• Obsolete encryption algorithms

• Logistics difficulties

• Cryptographic Modernization — 15-year effort to modernize the nation’s cryptographic systems

• DoD and NSA purchasing new inventory and funding R&D

• KIV-7 represents a significant percent of the installed base that will be upgraded

[CHART]

• High Assurance IP Encryptors

• PKI development / deployment

• Security management infrastructure

12

SafeEnterprise System for Government

[GRAPHIC]

13

[GRAPHIC]

14

[GRAPHIC]

15

SafeEnterprise Government Components

Appliances and Encryption Devices

• HighAssurance Gateways: IPSec VPN gateways

• WAN Encryptors for ATM, Frame Relay, Link and SONET

• Classified Network Security Systems:

• KIV-7 Type-1 Link encryptor

• FORTEZZA secure messaging and telephone encryption

• Government and commercial satellite uplink and downlink encryption

• Chrysalis-ITS Luna HSM for root key management

Software

• Security Management Center: Comprehensive security management platform

• SoftRemote: VPN client software

Services

• SafeNet Trusted Services: Outsourced VPN solution

16

Government Customer Benefits

• Only company that can offer top secret / classified and commercial grade products

• Requirement of many government agencies, including NSA

• Significant barrier to entry

• Ease of use

• Lower total cost of ownership

• Greater resources and customer support

• Stronger Security

• Vertical integrated solution

• High assurance reputation

17

Case Study: Homeland Security

Private Network

[GRAPHIC]

Classified Network

Homeland Security

• Major SafeNet and Rainbow deployments at Department of Homeland Security

• Provider for new high speed backbone network

• INS

• Customs

• Secret Service

• Leveraging opportunity to expand into VPN

• Customized VPN chips for Homeland Security

• “E-Gov” software contract

18

Commercial Customers

[LOGOS]

19

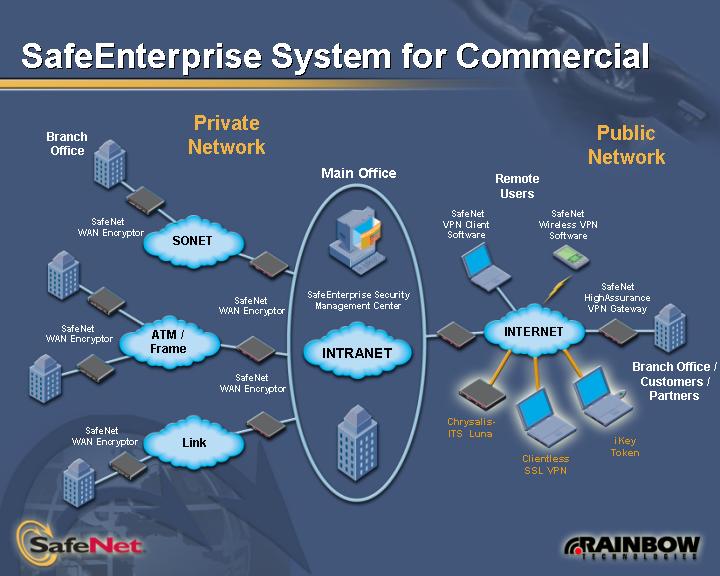

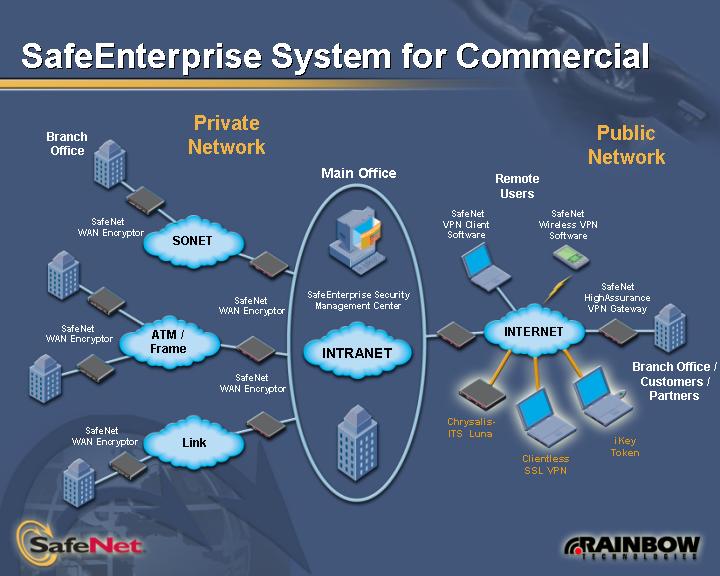

SafeEnterprise System for Commercial

[GRAPHIC]

20

Enhanced Growth Opportunity

• VPNs enable secure data transfer over the Internet

• Low cost replacement for private networks

• SSL VPNs allow for secure, clientless remote access

• Lower-cost alternative than IPSec VPNs

• Rainbow is the leader in USB token authentication

• Rapid adoption due to low price and convenience

• Increase in number of remote and mobile workers

• 105 MM mobile U.S. workers by 2006 -IDC

VPN Hardware Opportunity

[CHART]

Source: Infonetics Research, June 2003

USB Token Opportunity

[CHART]

Source: IDC 2002

21

SafeEnterprise System for Commercial

[GRAPHIC]

22

Commercial Customer Benefits

• Most comprehensive product portfolio from a single vendor

• Only fully integrated VPN and WAN security platform

• Adds SSL VPN appliances and USB tokens

• Security management software

• Ease of use

• Lower total cost of ownership

• Greater resources and customer support

• Stronger Security

• Vertical integrated solution

• High assurance reputation

23

Embedded Security Division

Enterprise | | |

| | |

| Gov’t

Financial | Embedded |

| | |

| Large

Enterprises | Embedded (OEM)

Network Infrastructure |

| | |

| Small / Medium

Enterprises | |

| | |

| Consumers | Embedded (OEM) |

| | Wireless/

Semiconductor |

24

Embedded Customers

• Deploying our leading technology to a large number of end users

Network Infrastructure

[LOGOS]

Wireless / Semiconductor

[LOGOS]

Software

[LOGOS]

25

Embedded Security Products

Hardware Solutions

• SafeXcel Chips: Silicon chips for embedded, accelerated security

• Momentum, Velocity, Transaction and Content Inspection Series

• SafeXcel Cards: Accelerator PCI plug-in cards built with SafeXcel Chips

• Sentinel SuperPro: Software piracy protection

• Cryptoswift: SSL Acceleration boards and chips

Software

• SoftRemote: VPN client software

• CGX Library: Embedded cryptographic software

• SSH Toolkits: VPN software toolkits

• Sentinel License Manager: Software product for software piracy

Embedded IP

• SafeNet chip designs licensed to semiconductor manufacturers

26

Sentinel

Sentinel is the leader in new enforcement technologies for more creative licensing

• RNBO provides technology to help software publishers protect their intellectual property:

• Client/Server model: software licensing

• Host model: license enforcement keys

• Web/ASP model: access control system

• Rainbow is the leader in software licensing authentication tokens

• SafeNet has the experience to distribute these leading solutions into its vast OEM channel

• A $40 MM annual business with high gross margins

Software Authentication Token Market Share

[CHART]

Source: IDC

27

New Market Opportunity

Evolution of Digital Rights Management

[CHART]

28

Case Study: TI

Wireless Core Security Components

[GRAPHIC]

Security Protocols

Filtering Firewall

Antivirus

Secure Billing

Security Peripherals

Secure Voice/Fax

Digital Rights Management

File Encryption

29

[LOGO]

30

Proven Financial Performance

• Strong sequential quarterly revenue growth

• Met or exceeded Wall Street analyst consensus estimates for last nine quarters

• Consistent operating margin performance

• Track record of quarterly operating cash flow

31

Strong Quarterly Revenue Growth

($ in MMs)

[CHART]

32

SafeNet Q3:03 Results

• SafeNet reported strong Q3:03 results on October 22, 2003

• Revenues of $17.6 MM, an increase of 99% YoY and 14% QoQ

• Gross margin of 77%

• Operating margin of 22%

• Net income of $2.6 MM, or $0.20 per share versus Q3:02 EPS of $0.10 per share

• Milestones in quarter

• Entered into exclusive marketing and sales agreement with CTAM for its ATM and SONET fiber line encryption appliances

• Chosen for the IBM Blue Logic IP Collaboration Program

• Launched SafeXcel -1840, 1, and 2 chips

Note: EPS figures represent Non-GAAP estimates which exclude acquisition related charges and assumes a 35% tax rate.

33

Rainbow Q3:03 Results

• Rainbow reported Q3:03 results on October 22, 2003

• Revenues of $35.4 MM, an increase of 17% YoY

• Secure Communications –$22.9 MM (65% of total)

• eSecurity –$12.5 MM (35% of total)

• Gross margins

• Secure Communications –22%(1)

• eSecurity –77%

• Operating margin of 11%

• Secure Communications –16%

• eSecurity –3%

• Earnings per share of $0.10 versus Q3:02 EPS of $0.07

• Outlook

• Strong demand for voice and data security solutions and link encryption products

• Experiencing solid demand for software protection products, and sales activity for iKey and iGate products has shown improvement

(1) Due to government accounting, cost of goods sold contains items that would normally be accounted for as operating expenses

34

The Combined Organization — Illustrative Financial Impact

• I/B/E/S estimate for combined company 2004 revenues | | $ | 241 | MM(1) |

| | | |

• SafeNet I/B/E/S 2004 EPS(Non-GAAP) | | $ | 0.93 | (1) |

| | | |

• Estimated 2004 accretion to I/B/E/S EPS from Rainbow | | +$0.17 | (2) |

| | | |

• Estimated impact of 2004 cost synergies from the transaction | | +$0.10 - $0.15 | (3) |

| | | |

• Estimated Pro Forma 2004 EPS (Non-GAAP) | | $ | 1.20- $1.25 | (4) |

Note: EPS figures represent Non-GAAP estimates which exclude amortization of intangibles, deferred compensation expense and other merger-related costs. Assumes a 35% tax rate.

(1) Source: I/B/E/S estimates as of 10/22/2003, adjusted to include 2004 estimate for SSH. The presentation of these I/B/E/S estimates is for illustrative purposes only.

(2) Source: I/B/E/S estimate as of 10/22/2003.

(3) Based on preliminary estimates of pre-tax annual cost savings of $4 - 6 million.

(4) For illustrative purposes only. Assumes full-year contribution from Rainbow.

35

The Combined Organization

• Experienced management team

• Both companies have successfully integrated several acquisitions

• Nearly 800 employees worldwide

• 215 SafeNet employees

• 570 Rainbow employees

• Supports 5,000 customers in more than 100 countries

• 40 years of combined security leadership

36

Integration Plan / Milestones

ACquisition Announcement | | Acquisition Closing | | Integration Completion |

• Integration Team in Place

• Formal Integration Plan

• Combined Product Offering Defined

• Top 10 Priorities

• Branding Strategy

• Business Unit Objectives Identified

• Transition Plans Documented

• Unified Business Processes

• Common Support Infrastructure

• Consistent Technology Platform

• First Level Synergies Realized

• Combined Product Offering

37

Strategic Rationale

• Accelerates growth in the important government security market, with a comprehensive offering of VPN, WAN and top secret security products

• The addition of high growth SSLVPN and authentication tokens strengthens competitive position in the commercial market

• Leading position in high growth digital rights management market

• Leverages and expands SafeNet’s comprehensive distribution platform

• Substantial scale and synergy opportunities enhance a proven financial track record

38

[LOGO]

The Foundation of High Assurance Security

Thank You

39