UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number | 811-05202 |

| | |

| | BNY Mellon Investment Funds IV, Inc. | |

| | (Exact name of Registrant as specified in charter) | |

| | | |

| | c/o BNY Mellon Investment Adviser, Inc. 240 Greenwich Street New York, New York 10286 | |

| | (Address of principal executive offices) (Zip code) | |

| | | |

| | Deirdre Cunnane, Esq. 240 Greenwich Street New York, New York 10286 | |

| | (Name and address of agent for service) | |

| |

| Registrant's telephone number, including area code: | (212) 922-6400 |

| | |

Date of fiscal year end: | 10/31 | |

| Date of reporting period: | 10/31/2023 | |

| | | | | | | |

The following N-CSR relates only to the Registrant's series listed below and does not relate to any series of the Registrant with a different fiscal year end and, therefore, different N-CSR reporting requirements. A separate N-CSR will be filed for any series with a different fiscal year end, as appropriate.

BNY Mellon Bond Market Index Fund

BNY Mellon Institutional S&P 500 Stock Index Fund

BNY Mellon Tax Managed Growth Fund

FORM N-CSR

Item 1. Reports to Stockholders.

BNY Mellon Bond Market Index Fund

| |

ANNUAL REPORT October 31, 2023 |

| |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.im.bnymellon.com and sign up for eCommunications. It’s simple and only takes a few minutes. |

| |

The views expressed in this report reflect those of the portfolio manager(s) only through the end of the period covered and do not necessarily represent the views of BNY Mellon Investment Adviser, Inc. or any other person in the BNY Mellon Investment Adviser, Inc. organization. Any such views are subject to change at any time based upon market or other conditions and BNY Mellon Investment Adviser, Inc. disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund in the BNY Mellon Family of Funds are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund in the BNY Mellon Family of Funds. |

| |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

THE FUND

FOR MORE INFORMATION

Back Cover

DISCUSSION OF FUND PERFORMANCE (Unaudited)

For the period from November 1, 2022, through October 31, 2023, as provided by Nancy G. Rogers, CFA and Gregg Lee, CFA, Portfolio Managers

Market and Fund Performance Overview

For the 12-month period ended October 31, 2023, the BNY Mellon Bond Market Index Fund (the “fund”) produced a total return of .24% for Class I shares and −.02% for Investor shares.1 In comparison, the Bloomberg US Aggregate Bond Index (the “Index”) achieved a total return of .36% for the same period.2

Absolute returns were slightly positive in the fixed-income market, but all sectors posted excess returns versus Treasuries. The difference in returns between the fund and the Index was primarily the result of operating expenses that are not reflected in the Index’s results.

The Fund’s Investment Approach

The fund seeks to match the total return of the Index. To pursue its goal, the fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in bonds that are included in the Index (or other instruments with similar economic characteristics). To maintain liquidity, the fund may invest up to 20% of its assets in various short-term, fixed-income securities and money market instruments.

The fund’s investments are selected by a “sampling” process, which is a statistical process used to select bonds so that the fund has investment characteristics that closely approximate those of the Index. By using this sampling process, the fund typically will not invest in all of the securities in the Index.

Inflation Declines, Rate Hikes Eased

Fixed-income markets posted a positive performance during the reporting period. Despite a rise in longer-term Treasury yields, the yield curve remained inverted, driven in part by continued rate hikes by the Federal Reserve (the “Fed”). The Fed raised the federal funds rate six times during the reporting period, bringing the target rate to 5.25-5.50%.

Yields rose across the curve, with the two-year maturity rising to 5.09% and 30-year maturity finishing the period at 5.09% as well. The yield on the 10-year Treasury hit a low of 3.31% and rose to a high of 4.99%, finishing the period at 4.93%.

The dominant theme during the reporting period was the Fed’s continued efforts to fight inflation while also hoping to avoid causing a recession. Inflation continued to respond to the Fed’s policy, though it remained well above the 2% target rate.

Easing pricing pressures allowed the Fed to slow the size of its rate increases. After hikes of 75 basis points (“bps”) in November 2022 and 50 bps in December 2022, the Fed followed with increases of 25 bps in February, March and May 2023, before implementing pauses at the June and September 2023 meetings. Total rate increases numbered six, and the total magnitude came to 225 bps.

Broad-based gains in the bond market came despite a banking crisis in March 2023 that involved two bank failures, Silicon Valley Bank and Signature Bank. In addition, First Republic Bank was acquired by J.P. Morgan, and Credit Suisse was acquired by UBS. Markets were largely calmed by the FDIC’s regulatory response, which secured deposits, and by the Fed, which provided extra liquidity. These banks comprised a negligible portion of the Index, and performance was not affected.

In August 2023, an impasse in Congress regarding whether to raise the debt ceiling produced some volatility. In October 2023, the market experienced a delayed and slight reaction to the decision of Fitch Ratings to downgrade the U.S. government’s credit rating from AAA to AA+, based on the growing debt burden and the government’s apparent inability to take necessary actions. Given the large

2

portion of the Index that consists of Treasury securities, the downgrade lowered the overall Index rating on the U.S. government bonds, but from a market perspective this proved to be a non-event.

Also in October 2023, the attack on Israel by Hamas raised concerns about the possibility of a broader conflict in the Middle East. The prospect of a wider war also brought to the forefront the possibility that a resulting increase in oil prices could further stoke inflation.

Market Posts Broad-based, but Minimal Gains

The Index gained 0.36%, with gains relative to Treasuries occurring across the board. Corporates were the leading sector, outperforming Treasuries by over 400 bps. The leading portions of this sector were industrials, utilities and financials.

On the other hand, the securitized sector, which includes mortgage-backed securities, asset-backed securities and commercial mortgage-backed securities, produced a negative absolute return. But relative to Treasuries, the return was positive.

Replicating the Composition of the Index

As an index fund, we attempt to match closely the returns of the Index by approximating its composition and credit quality. Although we do not actively manage the fund’s investments in response to the macroeconomic environment, we continue to monitor factors which affect the fund’s investments.

November 15, 2023

¹ Total return includes reinvestment of dividends and any capital gains paid. The fund’s return reflects the absorption of certain fund expenses by BNY Mellon Investment Adviser, Inc. pursuant to an agreement. Had these expenses not been absorbed, returns would have been lower. Past performance is no guarantee of future results. Share price, yield and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost.

² Source: Lipper Inc. — The Bloomberg U.S. Aggregate Bond Index is a broad-based, flagship benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market. The Index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and nonagency). Investors cannot invest directly in any index.

Bonds are subject generally to interest-rate, credit, liquidity and market risks, to varying degrees, all of which are more fully described in the fund’s prospectus. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes, and rate increases can cause price declines.

Indexing does not attempt to manage market volatility, use defensive strategies, or reduce the effects of any long-term periods of poor index performance. The correlation between fund and index performance may be affected by the fund’s expenses and use of sampling techniques, changes in securities markets, changes in the composition of the index, and the timing of purchases and redemptions of fund shares.

3

FUND PERFORMANCE (Unaudited)

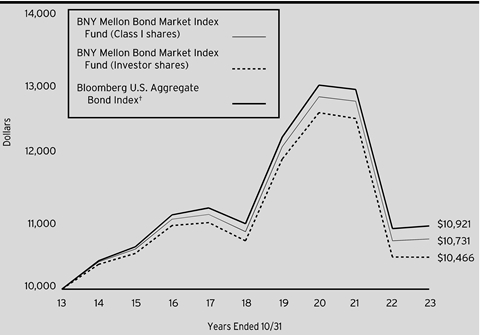

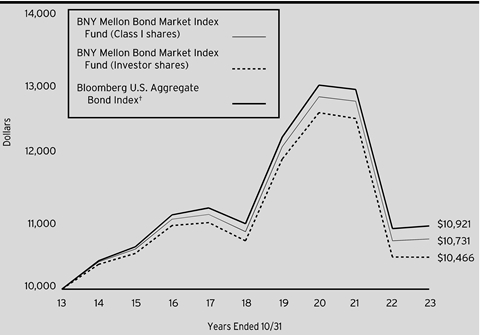

Comparison of change in value of a $10,000 investment in Investor shares and Class I shares of BNY Mellon Bond Market Index Fund with a hypothetical investment of $10,000 in the Bloomberg U.S. Aggregate Bond Index (the “Index”).

† Source: Lipper Inc.

Past performance is not predictive of future performance.

The above graph compares a hypothetical investment of $10,000 made in each of the Investor shares and Class I shares of BNY Mellon Bond Market Index Fund on 10/31/13 to a hypothetical investment of $10,000 made in the Index on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account all applicable fees and expenses for Investor shares and Class I shares. The Index is a broad-based flagship benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market. The Index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and nonagency). Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

4

| | | | |

Average Annual Total Returns as of 10/31/2023 |

| 1 Year | 5 Years | 10 Years |

Class I shares | .24% | -.20% | .71% |

Investor shares | -.02% | -.45% | .46% |

Bloomberg U.S. Aggregate Bond Index | .36% | -.06% | .88% |

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to www.im.bnymellon.com for the fund’s most recent month-end returns.

The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

5

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in BNY Mellon Bond Market Index Fund from May 1, 2023 to October 31, 2023. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | |

Expenses and Value of a $1,000 Investment | |

Assume actual returns for the six months ended October 31, 2023 | |

| | | | |

| | Class I | Investor Shares | |

Expenses paid per $1,000† | $.73 | $1.95 | |

Ending value (after expenses) | $938.70 | $937.50 | |

COMPARING YOUR FUND’S EXPENSES WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (“SEC”) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | |

Expenses and Value of a $1,000 Investment | |

Assuming a hypothetical 5% annualized return for the six months ended October 31, 2023 | |

| | | | |

| | Class I | Investor Shares | |

Expenses paid per $1,000† | $.77 | $2.04 | |

Ending value (after expenses) | $1,024.45 | $1,023.19 | |

† | Expenses are equal to the fund’s annualized expense ratio of .15% for Class I and .40% for Investor Shares, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

6

STATEMENT OF INVESTMENTS

October 31, 2023

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Bonds and Notes - 100.5% | | | | | |

Aerospace & Defense - .4% | | | | | |

General Dynamics Corp., Gtd. Notes | | 3.50 | | 5/15/2025 | | 150,000 | | 145,601 | |

General Dynamics Corp., Gtd. Notes | | 4.25 | | 4/1/2050 | | 150,000 | | 116,971 | |

HEICO Corp., Gtd. Notes | | 5.35 | | 8/1/2033 | | 100,000 | | 91,834 | |

L3Harris Technologies, Inc., Sr. Unscd. Notes | | 5.05 | | 4/27/2045 | | 200,000 | | 166,160 | |

Lockheed Martin Corp., Sr. Unscd. Notes | | 3.55 | | 1/15/2026 | | 117,000 | | 112,513 | |

Lockheed Martin Corp., Sr. Unscd. Notes | | 4.07 | | 12/15/2042 | | 250,000 | | 193,872 | |

Northrop Grumman Corp., Sr. Unscd. Notes | | 4.03 | | 10/15/2047 | | 160,000 | | 116,434 | |

Northrop Grumman Corp., Sr. Unscd. Notes | | 4.70 | | 3/15/2033 | | 100,000 | | 91,121 | |

RTX Corp., Sr. Unscd. Notes | | 3.13 | | 5/4/2027 | | 110,000 | | 100,238 | |

RTX Corp., Sr. Unscd. Notes | | 4.13 | | 11/16/2028 | | 210,000 | | 192,925 | |

RTX Corp., Sr. Unscd. Notes | | 4.63 | | 11/16/2048 | | 105,000 | | 80,872 | |

RTX Corp., Sr. Unscd. Notes | | 7.20 | | 8/15/2027 | | 150,000 | | 154,080 | |

The Boeing Company, Sr. Unscd. Notes | | 2.95 | | 2/1/2030 | | 125,000 | | 103,291 | |

The Boeing Company, Sr. Unscd. Notes | | 3.50 | | 3/1/2039 | | 200,000 | | 136,180 | |

The Boeing Company, Sr. Unscd. Notes | | 3.75 | | 2/1/2050 | | 125,000 | | 79,582 | |

The Boeing Company, Sr. Unscd. Notes | | 3.83 | | 3/1/2059 | | 100,000 | | 59,951 | |

The Boeing Company, Sr. Unscd. Notes | | 5.15 | | 5/1/2030 | | 250,000 | | 234,360 | |

The Boeing Company, Sr. Unscd. Notes | | 5.93 | | 5/1/2060 | | 200,000 | | 168,437 | |

| | 2,344,422 | |

Agriculture - .3% | | | | | |

Altria Group, Inc., Gtd. Notes | | 2.35 | | 5/6/2025 | | 250,000 | | 237,011 | |

Altria Group, Inc., Gtd. Notes | | 3.40 | | 2/4/2041 | | 80,000 | | 49,055 | |

Altria Group, Inc., Gtd. Notes | | 3.70 | | 2/4/2051 | | 200,000 | | 116,617 | |

Altria Group, Inc., Gtd. Notes | | 4.80 | | 2/14/2029 | | 150,000 | | 140,537 | |

Archer-Daniels-Midland Co., Sr. Unscd. Notes | | 2.50 | | 8/11/2026 | | 350,000 | | 324,759 | |

BAT Capital Corp., Gtd. Notes | | 3.56 | | 8/15/2027 | | 43,000 | | 39,000 | |

BAT Capital Corp., Gtd. Notes | | 4.39 | | 8/15/2037 | | 180,000 | | 130,911 | |

BAT Capital Corp., Gtd. Notes | | 5.65 | | 3/16/2052 | | 200,000 | | 150,528 | |

BAT International Finance PLC, Gtd. Notes | | 1.67 | | 3/25/2026 | | 200,000 | | 180,162 | |

7

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Bonds and Notes - 100.5% (continued) | | | | | |

Agriculture - .3% (continued) | | | | | |

Philip Morris International, Inc., Sr. Unscd. Notes | | 4.50 | | 3/20/2042 | | 300,000 | | 229,650 | |

Reynolds American, Inc., Gtd. Notes | | 5.70 | | 8/15/2035 | | 100,000 | | 85,733 | |

| | 1,683,963 | |

Airlines - .3% | | | | | |

American Airlines Pass Through Trust, Ser. 2016-1, Cl. AA | | 3.58 | | 1/15/2028 | | 363,456 | | 331,815 | |

JetBlue Pass Through Trust, Ser. 2019-1, Cl. AA | | 2.75 | | 5/15/2032 | | 252,448 | | 212,013 | |

Southwest Airlines Co., Sr. Unscd. Notes | | 5.13 | | 6/15/2027 | | 125,000 | | 120,666 | |

Southwest Airlines Co., Sr. Unscd. Notes | | 5.25 | | 5/4/2025 | | 200,000 | | 197,287 | |

United Airlines Pass Through Trust, Ser. 2013-1, Cl. A | | 4.30 | | 8/15/2025 | | 553,252 | | 530,375 | |

| | 1,392,156 | |

Asset-Backed Certificates - .0% | | | | | |

Verizon Master Trust, Ser. 2021-2, CI. A | | 0.99 | | 4/20/2028 | | 200,000 | | 190,606 | |

Asset-Backed Certificates/Auto Receivables - .2% | | | | | |

GM Financial Consumer Automobile Receivables Trust, Ser. 2023-1, Cl. A3 | | 4.66 | | 2/16/2028 | | 200,000 | | 195,924 | |

Honda Auto Receivables Owner Trust, Ser. 2021-1, CI. A4 | | 0.42 | | 1/21/2028 | | 400,000 | | 383,733 | |

Toyota Auto Receivables Owner Trust, Ser. 2021-A, Cl. A4 | | 0.39 | | 6/15/2026 | | 300,000 | | 284,225 | |

Toyota Auto Receivables Owner Trust, Ser. 2022-C, CI. A3 | | 3.76 | | 4/15/2027 | | 250,000 | | 242,744 | |

Toyota Auto Receivables Owner Trust, Ser. 2022-C. CI. A4 | | 3.77 | | 2/15/2028 | | 100,000 | | 94,889 | |

World Omni Auto Receivables Trust, Ser. 2023-B, CI. A3 | | 4.66 | | 5/15/2028 | | 150,000 | | 146,733 | |

| | 1,348,248 | |

Asset-Backed Certificates/Credit Cards - .2% | | | | | |

BA Credit Card Trust, Ser. 2022-A1, Cl. A1 | | 3.53 | | 11/15/2027 | | 200,000 | | 193,271 | |

Barclays Dryrock Issuance Trust, Ser. 2022-1, CI. A | | 3.07 | | 2/15/2028 | | 200,000 | | 192,249 | |

Capital One Multi-Asset Execution Trust, Ser. 2021-A2, CI. A2 | | 1.39 | | 7/15/2030 | | 300,000 | | 248,878 | |

Synchrony Card Funding LLC, Ser. 2022-A1, Cl. A | | 3.37 | | 4/15/2028 | | 250,000 | | 241,000 | |

| | 875,398 | |

8

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Bonds and Notes - 100.5% (continued) | | | | | |

Automobiles & Components - .5% | | | | | |

American Honda Finance Corp., Sr. Unscd. Notes | | 4.60 | | 4/17/2030 | | 100,000 | | 93,039 | |

American Honda Finance Corp., Sr. Unscd. Notes | | 5.13 | | 7/7/2028 | | 100,000 | | 97,496 | |

Cummins, Inc., Sr. Unscd. Notes | | 1.50 | | 9/1/2030 | | 100,000 | | 76,443 | |

Cummins, Inc., Sr. Unscd. Notes | | 2.60 | | 9/1/2050 | | 100,000 | a | 54,976 | |

General Motors Co., Sr. Unscd. Notes | | 4.20 | | 10/1/2027 | | 180,000 | a | 166,773 | |

General Motors Co., Sr. Unscd. Notes | | 5.20 | | 4/1/2045 | | 340,000 | | 252,906 | |

General Motors Financial Co., Inc., Sr. Unscd. Notes | | 1.25 | | 1/8/2026 | | 200,000 | | 179,278 | |

General Motors Financial Co., Inc., Sr. Unscd. Notes | | 2.35 | | 1/8/2031 | | 200,000 | | 149,004 | |

General Motors Financial Co., Inc., Sr. Unscd. Notes | | 2.40 | | 4/10/2028 | | 300,000 | | 253,027 | |

General Motors Financial Co., Inc., Sr. Unscd. Notes | | 2.70 | | 6/10/2031 | | 30,000 | | 22,574 | |

General Motors Financial Co., Inc., Sr. Unscd. Notes | | 2.75 | | 6/20/2025 | | 200,000 | | 188,806 | |

General Motors Financial Co., Inc., Sr. Unscd. Notes | | 5.85 | | 4/6/2030 | | 100,000 | a | 94,555 | |

Magna International, Inc., Sr. Unscd. Notes | | 2.45 | | 6/15/2030 | | 200,000 | | 161,514 | |

Mercedes-Benz Finance North America LLC, Gtd. Notes | | 8.50 | | 1/18/2031 | | 200,000 | | 231,346 | |

PACCAR Financial Corp., Sr. Unscd. Notes | | 5.05 | | 8/10/2026 | | 200,000 | a | 198,841 | |

Toyota Motor Corp., Sr. Unscd. Bonds | | 3.67 | | 7/20/2028 | | 200,000 | | 185,771 | |

Toyota Motor Corp., Sr. Unscd. Notes | | 5.12 | | 7/13/2033 | | 100,000 | a | 96,232 | |

Toyota Motor Credit Corp., Sr. Unscd. Notes | | 1.65 | | 1/10/2031 | | 150,000 | | 113,592 | |

Toyota Motor Credit Corp., Sr. Unscd. Notes | | 4.63 | | 1/12/2028 | | 200,000 | | 193,690 | |

| | 2,809,863 | |

Banks - 6.0% | | | | | |

Banco Bilbao Vizcaya Argentaria SA, Sr. Unscd. Bonds | | 5.86 | | 9/14/2026 | | 200,000 | | 197,090 | |

Banco Bilbao Vizcaya Argentaria SA, Sr. Unscd. Notes | | 6.14 | | 9/14/2028 | | 200,000 | | 195,361 | |

Banco Santander SA, Sr. Unscd. Notes | | 3.80 | | 2/23/2028 | | 400,000 | | 355,901 | |

Bank of America Corp., Sr. Unscd. Notes | | 1.90 | | 7/23/2031 | | 200,000 | | 148,856 | |

Bank of America Corp., Sr. Unscd. Notes | | 1.92 | | 10/24/2031 | | 250,000 | | 184,439 | |

9

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Bonds and Notes - 100.5% (continued) | | | | | |

Banks - 6.0% (continued) | | | | | |

Bank of America Corp., Sr. Unscd. Notes | | 2.30 | | 7/21/2032 | | 260,000 | | 191,897 | |

Bank of America Corp., Sr. Unscd. Notes | | 2.50 | | 2/13/2031 | | 270,000 | | 212,889 | |

Bank of America Corp., Sr. Unscd. Notes | | 2.57 | | 10/20/2032 | | 125,000 | | 93,652 | |

Bank of America Corp., Sr. Unscd. Notes | | 2.59 | | 4/29/2031 | | 250,000 | | 197,162 | |

Bank of America Corp., Sr. Unscd. Notes | | 2.68 | | 6/19/2041 | | 145,000 | | 88,459 | |

Bank of America Corp., Sr. Unscd. Notes | | 2.83 | | 10/24/2051 | | 250,000 | | 138,238 | |

Bank of America Corp., Sr. Unscd. Notes | | 2.97 | | 2/4/2033 | | 120,000 | | 92,008 | |

Bank of America Corp., Sr. Unscd. Notes | | 2.97 | | 7/21/2052 | | 85,000 | a | 48,801 | |

Bank of America Corp., Sr. Unscd. Notes | | 3.19 | | 7/23/2030 | | 130,000 | | 109,058 | |

Bank of America Corp., Sr. Unscd. Notes | | 3.97 | | 3/5/2029 | | 150,000 | | 135,766 | |

Bank of America Corp., Sr. Unscd. Notes | | 4.27 | | 7/23/2029 | | 180,000 | | 163,848 | |

Bank of America Corp., Sr. Unscd. Notes | | 5.00 | | 1/21/2044 | | 250,000 | | 209,730 | |

Bank of America Corp., Sr. Unscd. Notes | | 5.08 | | 1/20/2027 | | 200,000 | | 194,741 | |

Bank of America Corp., Sr. Unscd. Notes | | 5.87 | | 9/15/2034 | | 150,000 | | 141,310 | |

Bank of America Corp., Sr. Unscd. Notes | | 6.20 | | 11/10/2028 | | 300,000 | | 298,099 | |

Bank of America Corp., Sr. Unscd. Notes, Ser. N | | 3.48 | | 3/13/2052 | | 50,000 | | 31,579 | |

Bank of America Corp., Sub. Notes | | 3.85 | | 3/8/2037 | | 200,000 | | 157,859 | |

Bank of America Corp., Sub. Notes | | 4.00 | | 1/22/2025 | | 250,000 | | 243,374 | |

Bank of America Corp., Sub. Notes, Ser. L | | 4.18 | | 11/25/2027 | | 250,000 | | 230,047 | |

Bank of Montreal, Sr. Unscd. Notes | | 0.95 | | 1/22/2027 | | 300,000 | | 267,593 | |

BankUnited, Inc., Sub. Notes | | 5.13 | | 6/11/2030 | | 90,000 | | 71,375 | |

Barclays PLC, Sr. Unscd. Notes | | 4.34 | | 1/10/2028 | | 200,000 | | 182,871 | |

Barclays PLC, Sr. Unscd. Notes | | 4.38 | | 1/12/2026 | | 200,000 | | 190,952 | |

Barclays PLC, Sr. Unscd. Notes | | 5.25 | | 8/17/2045 | | 300,000 | | 242,214 | |

Barclays PLC, Sr. Unscd. Notes | | 5.30 | | 8/9/2026 | | 200,000 | | 195,216 | |

Barclays PLC, Sr. Unscd. Notes | | 5.83 | | 5/9/2027 | | 200,000 | | 195,477 | |

Barclays PLC, Sr. Unscd. Notes | | 6.22 | | 5/9/2034 | | 200,000 | | 183,417 | |

Citigroup, Inc., Sr. Unscd. Notes | | 3.06 | | 1/25/2033 | | 95,000 | | 73,174 | |

Citigroup, Inc., Sr. Unscd. Notes | | 3.11 | | 4/8/2026 | | 450,000 | | 429,577 | |

10

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Bonds and Notes - 100.5% (continued) | | | | | |

Banks - 6.0% (continued) | | | | | |

Citigroup, Inc., Sr. Unscd. Notes | | 3.67 | | 7/24/2028 | | 500,000 | | 453,122 | |

Citigroup, Inc., Sr. Unscd. Notes | | 3.79 | | 3/17/2033 | | 200,000 | | 162,429 | |

Citigroup, Inc., Sr. Unscd. Notes | | 3.88 | | 1/24/2039 | | 60,000 | | 44,931 | |

Citigroup, Inc., Sr. Unscd. Notes | | 4.08 | | 4/23/2029 | | 100,000 | | 90,980 | |

Citigroup, Inc., Sr. Unscd. Notes | | 4.28 | | 4/24/2048 | | 200,000 | | 147,243 | |

Citigroup, Inc., Sr. Unscd. Notes | | 4.65 | | 7/23/2048 | | 150,000 | | 115,612 | |

Citigroup, Inc., Sr. Unscd. Notes | | 4.91 | | 5/24/2033 | | 70,000 | | 62,062 | |

Citigroup, Inc., Sr. Unscd. Notes | | 6.27 | | 11/17/2033 | | 300,000 | | 291,413 | |

Citigroup, Inc., Sr. Unscd. Notes | | 6.63 | | 1/15/2028 | | 100,000 | | 103,225 | |

Citigroup, Inc., Sub. Notes | | 5.50 | | 9/13/2025 | | 500,000 | | 493,156 | |

Citigroup, Inc., Sub. Notes | | 6.68 | | 9/13/2043 | | 250,000 | | 239,180 | |

Deutsche Bank AG, Sr. Unscd. Notes | | 2.13 | | 11/24/2026 | | 200,000 | | 180,635 | |

Deutsche Bank AG, Sr. Unscd. Notes | | 3.96 | | 11/26/2025 | | 400,000 | | 385,807 | |

Deutsche Bank AG, Sr. Unscd. Notes | | 6.12 | | 7/14/2026 | | 150,000 | | 147,716 | |

Deutsche Bank AG, Sub. Notes | | 7.08 | | 2/10/2034 | | 200,000 | a | 176,256 | |

Discover Bank, Sr. Unscd. Notes | | 4.25 | | 3/13/2026 | | 400,000 | | 377,635 | |

Fifth Third Bancorp, Sr. Unscd. Notes | | 2.55 | | 5/5/2027 | | 200,000 | | 172,807 | |

HSBC Holdings PLC, Sr. Unscd. Notes | | 1.59 | | 5/24/2027 | | 200,000 | | 176,210 | |

HSBC Holdings PLC, Sr. Unscd. Notes | | 2.63 | | 11/7/2025 | | 400,000 | | 383,607 | |

HSBC Holdings PLC, Sr. Unscd. Notes | | 3.90 | | 5/25/2026 | | 295,000 | | 278,425 | |

HSBC Holdings PLC, Sr. Unscd. Notes | | 3.97 | | 5/22/2030 | | 300,000 | | 259,289 | |

HSBC Holdings PLC, Sr. Unscd. Notes | | 4.95 | | 3/31/2030 | | 400,000 | | 368,081 | |

HSBC Holdings PLC, Sr. Unscd. Notes | | 5.40 | | 8/11/2033 | | 300,000 | | 269,872 | |

JPMorgan Chase & Co., Sr. Unscd. Notes | | 1.05 | | 11/19/2026 | | 150,000 | | 134,936 | |

JPMorgan Chase & Co., Sr. Unscd. Notes | | 1.56 | | 12/10/2025 | | 300,000 | | 283,953 | |

JPMorgan Chase & Co., Sr. Unscd. Notes | | 1.58 | | 4/22/2027 | | 300,000 | | 267,713 | |

JPMorgan Chase & Co., Sr. Unscd. Notes | | 1.76 | | 11/19/2031 | | 75,000 | | 55,509 | |

JPMorgan Chase & Co., Sr. Unscd. Notes | | 2.08 | | 4/22/2026 | | 250,000 | | 235,019 | |

JPMorgan Chase & Co., Sr. Unscd. Notes | | 2.52 | | 4/22/2031 | | 390,000 | | 310,304 | |

JPMorgan Chase & Co., Sr. Unscd. Notes | | 2.53 | | 11/19/2041 | | 80,000 | | 47,835 | |

JPMorgan Chase & Co., Sr. Unscd. Notes | | 2.58 | | 4/22/2032 | | 300,000 | | 231,787 | |

JPMorgan Chase & Co., Sr. Unscd. Notes | | 2.74 | | 10/15/2030 | | 220,000 | | 180,810 | |

JPMorgan Chase & Co., Sr. Unscd. Notes | | 2.96 | | 1/25/2033 | | 110,000 | | 85,737 | |

11

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Bonds and Notes - 100.5% (continued) | | | | | |

Banks - 6.0% (continued) | | | | | |

JPMorgan Chase & Co., Sr. Unscd. Notes | | 3.30 | | 4/1/2026 | | 500,000 | | 471,307 | |

JPMorgan Chase & Co., Sr. Unscd. Notes | | 3.51 | | 1/23/2029 | | 135,000 | | 121,165 | |

JPMorgan Chase & Co., Sr. Unscd. Notes | | 3.90 | | 1/23/2049 | | 105,000 | | 72,675 | |

JPMorgan Chase & Co., Sr. Unscd. Notes | | 4.01 | | 4/23/2029 | | 200,000 | | 182,207 | |

JPMorgan Chase & Co., Sr. Unscd. Notes | | 4.26 | | 2/22/2048 | | 200,000 | | 147,745 | |

JPMorgan Chase & Co., Sr. Unscd. Notes | | 4.49 | | 3/24/2031 | | 300,000 | | 270,734 | |

JPMorgan Chase & Co., Sr. Unscd. Notes | | 4.85 | | 7/25/2028 | | 200,000 | | 191,178 | |

KeyBank NA, Sub. Notes | | 6.95 | | 2/1/2028 | | 100,000 | | 92,957 | |

KfW, Govt. Gtd. Bonds | | 0.38 | | 7/18/2025 | | 245,000 | | 225,685 | |

KfW, Govt. Gtd. Bonds | | 3.63 | | 4/1/2026 | | 100,000 | | 96,772 | |

KfW, Govt. Gtd. Bonds | | 3.75 | | 2/15/2028 | | 105,000 | | 100,033 | |

KfW, Govt. Gtd. Notes | | 0.63 | | 1/22/2026 | | 250,000 | | 226,688 | |

KfW, Govt. Gtd. Notes | | 2.00 | | 5/2/2025 | | 700,000 | | 666,860 | |

KfW, Govt. Gtd. Notes | | 4.13 | | 7/15/2033 | | 200,000 | a | 185,413 | |

Landwirtschaftliche Rentenbank, Govt. Gtd. Notes | | 2.38 | | 6/10/2025 | | 250,000 | | 238,660 | |

Lloyds Banking Group PLC, Sr. Unscd. Notes | | 4.55 | | 8/16/2028 | | 300,000 | | 276,832 | |

Lloyds Banking Group PLC, Sr. Unscd. Notes | | 4.98 | | 8/11/2033 | | 300,000 | a | 260,615 | |

Lloyds Banking Group PLC, Sub. Notes | | 4.58 | | 12/10/2025 | | 220,000 | | 209,293 | |

M&T Bank Corp., Sr. Unscd. Notes | | 4.55 | | 8/16/2028 | | 200,000 | | 182,645 | |

Mitsubishi UFJ Financial Group, Inc., Sr. Unscd. Notes | | 1.41 | | 7/17/2025 | | 200,000 | | 184,862 | |

Mitsubishi UFJ Financial Group, Inc., Sr. Unscd. Notes | | 2.05 | | 7/17/2030 | | 200,000 | | 152,491 | |

Mitsubishi UFJ Financial Group, Inc., Sr. Unscd. Notes | | 4.29 | | 7/26/2038 | | 200,000 | | 162,278 | |

Mitsubishi UFJ Financial Group, Inc., Sr. Unscd. Notes | | 5.24 | | 4/19/2029 | | 200,000 | | 192,485 | |

Mitsubishi UFJ Financial Group, Inc., Sr. Unscd. Notes | | 5.35 | | 9/13/2028 | | 300,000 | | 290,519 | |

Mizuho Financial Group, Inc., Sr. Unscd. Notes | | 2.20 | | 7/10/2031 | | 200,000 | | 151,975 | |

Mizuho Financial Group, Inc., Sr. Unscd. Notes | | 5.67 | | 5/27/2029 | | 300,000 | | 291,991 | |

Morgan Stanley, Sr. Unscd. Notes | | 1.51 | | 7/20/2027 | | 140,000 | | 122,934 | |

Morgan Stanley, Sr. Unscd. Notes | | 1.59 | | 5/4/2027 | | 300,000 | | 266,644 | |

12

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Bonds and Notes - 100.5% (continued) | | | | | |

Banks - 6.0% (continued) | | | | | |

Morgan Stanley, Sr. Unscd. Notes | | 1.79 | | 2/13/2032 | | 375,000 | | 271,438 | |

Morgan Stanley, Sr. Unscd. Notes | | 2.24 | | 7/21/2032 | | 155,000 | | 114,366 | |

Morgan Stanley, Sr. Unscd. Notes | | 2.51 | | 10/20/2032 | | 95,000 | | 71,087 | |

Morgan Stanley, Sr. Unscd. Notes | | 2.70 | | 1/22/2031 | | 175,000 | | 140,659 | |

Morgan Stanley, Sr. Unscd. Notes | | 2.94 | | 1/21/2033 | | 85,000 | | 65,255 | |

Morgan Stanley, Sr. Unscd. Notes | | 3.77 | | 1/24/2029 | | 180,000 | | 162,394 | |

Morgan Stanley, Sr. Unscd. Notes | | 4.00 | | 7/23/2025 | | 200,000 | | 193,628 | |

Morgan Stanley, Sr. Unscd. Notes | | 4.38 | | 1/22/2047 | | 250,000 | | 186,829 | |

Morgan Stanley, Sr. Unscd. Notes | | 5.12 | | 2/1/2029 | | 200,000 | | 190,475 | |

Morgan Stanley, Sr. Unscd. Notes | | 5.42 | | 7/21/2034 | | 100,000 | | 91,302 | |

Morgan Stanley, Sr. Unscd. Notes | | 6.34 | | 10/18/2033 | | 100,000 | | 98,071 | |

Morgan Stanley, Sr. Unscd. Notes | | 7.25 | | 4/1/2032 | | 300,000 | | 320,292 | |

Morgan Stanley, Sub. Notes | | 3.95 | | 4/23/2027 | | 250,000 | | 230,295 | |

National Australia Bank Ltd., Sr. Unscd. Notes | | 2.50 | | 7/12/2026 | | 250,000 | | 230,824 | |

NatWest Group PLC, Sr. Unscd. Notes | | 4.80 | | 4/5/2026 | | 500,000 | | 481,905 | |

NatWest Group PLC, Sr. Unscd. Notes | | 7.47 | | 11/10/2026 | | 300,000 | | 305,355 | |

Northern Trust Corp., Sub. Notes | | 3.95 | | 10/30/2025 | | 346,000 | | 334,087 | |

Royal Bank of Canada, Sr. Unscd. Notes | | 1.15 | | 6/10/2025 | | 200,000 | a | 185,829 | |

Royal Bank of Canada, Sr. Unscd. Notes | | 4.88 | | 1/12/2026 | | 250,000 | | 244,725 | |

State Street Corp., Sr. Unscd. Notes | | 3.15 | | 3/30/2031 | | 300,000 | | 250,498 | |

State Street Corp., Sr. Unscd. Notes | | 5.27 | | 8/3/2026 | | 100,000 | | 98,432 | |

State Street Corp., Sub. Notes | | 3.03 | | 11/1/2034 | | 225,000 | | 185,926 | |

Sumitomo Mitsui Financial Group, Inc., Sr. Unscd. Notes | | 0.95 | | 1/12/2026 | | 300,000 | | 268,331 | |

Sumitomo Mitsui Financial Group, Inc., Sr. Unscd. Notes | | 3.45 | | 1/11/2027 | | 160,000 | | 147,752 | |

Sumitomo Mitsui Financial Group, Inc., Sr. Unscd. Notes | | 5.52 | | 1/13/2028 | | 200,000 | | 194,852 | |

Sumitomo Mitsui Financial Group, Inc., Sr. Unscd. Notes | | 5.71 | | 1/13/2030 | | 300,000 | | 289,100 | |

Sumitomo Mitsui Financial Group, Inc., Sr. Unscd. Notes | | 5.78 | | 7/13/2033 | | 200,000 | a | 190,055 | |

Sumitomo Mitsui Financial Group, Inc., Sr. Unscd. Notes | | 5.80 | | 7/13/2028 | | 200,000 | | 196,373 | |

Sumitomo Mitsui Financial Group, Inc., Sub. Notes | | 6.18 | | 7/13/2043 | | 100,000 | | 93,674 | |

Synovus Bank/Columbus GA, Sr. Unscd. Notes | | 5.63 | | 2/15/2028 | | 250,000 | | 222,130 | |

The Bank of Nova Scotia, Sr. Unscd. Notes | | 1.30 | | 6/11/2025 | | 200,000 | | 185,544 | |

13

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Bonds and Notes - 100.5% (continued) | | | | | |

Banks - 6.0% (continued) | | | | | |

The Bank of Nova Scotia, Sr. Unscd. Notes | | 1.30 | | 9/15/2026 | | 300,000 | | 263,216 | |

The Bank of Nova Scotia, Sub. Notes | | 4.50 | | 12/16/2025 | | 250,000 | | 241,156 | |

The Goldman Sachs Group, Inc., Sr. Unscd. Bonds | | 4.22 | | 5/1/2029 | | 200,000 | | 182,625 | |

The Goldman Sachs Group, Inc., Sr. Unscd. Notes | | 1.43 | | 3/9/2027 | | 150,000 | | 133,253 | |

The Goldman Sachs Group, Inc., Sr. Unscd. Notes | | 1.54 | | 9/10/2027 | | 140,000 | | 121,839 | |

The Goldman Sachs Group, Inc., Sr. Unscd. Notes | | 1.95 | | 10/21/2027 | | 130,000 | | 114,045 | |

The Goldman Sachs Group, Inc., Sr. Unscd. Notes | | 2.38 | | 7/21/2032 | | 170,000 | | 126,240 | |

The Goldman Sachs Group, Inc., Sr. Unscd. Notes | | 2.62 | | 4/22/2032 | | 300,000 | | 228,665 | |

The Goldman Sachs Group, Inc., Sr. Unscd. Notes | | 2.64 | | 2/24/2028 | | 100,000 | | 88,610 | |

The Goldman Sachs Group, Inc., Sr. Unscd. Notes | | 2.65 | | 10/21/2032 | | 120,000 | | 90,262 | |

The Goldman Sachs Group, Inc., Sr. Unscd. Notes | | 3.10 | | 2/24/2033 | | 130,000 | | 101,104 | |

The Goldman Sachs Group, Inc., Sr. Unscd. Notes | | 3.21 | | 4/22/2042 | | 300,000 | | 194,812 | |

The Goldman Sachs Group, Inc., Sr. Unscd. Notes | | 3.44 | | 2/24/2043 | | 65,000 | | 42,964 | |

The Goldman Sachs Group, Inc., Sr. Unscd. Notes | | 3.81 | | 4/23/2029 | | 150,000 | | 134,781 | |

The Goldman Sachs Group, Inc., Sr. Unscd. Notes | | 5.80 | | 8/10/2026 | | 100,000 | | 99,005 | |

The Goldman Sachs Group, Inc., Sub. Notes | | 4.25 | | 10/21/2025 | | 130,000 | | 124,645 | |

The Goldman Sachs Group, Inc., Sub. Notes | | 6.75 | | 10/1/2037 | | 250,000 | | 244,372 | |

The Korea Development Bank, Sr. Unscd. Notes | | 4.38 | | 2/15/2028 | | 200,000 | | 191,150 | |

The PNC Financial Services Group, Inc., Sr. Unscd. Notes | | 3.45 | | 4/23/2029 | | 200,000 | | 172,789 | |

The Toronto-Dominion Bank, Sr. Unscd. Notes | | 0.75 | | 1/6/2026 | | 300,000 | | 268,349 | |

The Toronto-Dominion Bank, Sr. Unscd. Notes | | 1.15 | | 6/12/2025 | | 200,000 | | 185,391 | |

Truist Financial Corp., Sr. Unscd. Notes | | 1.20 | | 8/5/2025 | | 200,000 | | 182,642 | |

Truist Financial Corp., Sr. Unscd. Notes | | 1.95 | | 6/5/2030 | | 200,000 | | 149,164 | |

U.S. Bancorp, Sr. Unscd. Notes | | 1.38 | | 7/22/2030 | | 200,000 | | 142,171 | |

14

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Bonds and Notes - 100.5% (continued) | | | | | |

Banks - 6.0% (continued) | | | | | |

U.S. Bancorp, Sr. Unscd. Notes | | 4.84 | | 2/1/2034 | | 200,000 | | 170,960 | |

UBS Group AG, Sr. Unscd. Notes | | 3.75 | | 3/26/2025 | | 250,000 | | 240,808 | |

Wells Fargo & Co., Sr. Unscd. Notes | | 2.16 | | 2/11/2026 | | 145,000 | | 137,187 | |

Wells Fargo & Co., Sr. Unscd. Notes | | 2.19 | | 4/30/2026 | | 400,000 | | 376,384 | |

Wells Fargo & Co., Sr. Unscd. Notes | | 2.57 | | 2/11/2031 | | 545,000 | | 431,711 | |

Wells Fargo & Co., Sr. Unscd. Notes | | 3.55 | | 9/29/2025 | | 200,000 | | 191,034 | |

Wells Fargo & Co., Sr. Unscd. Notes | | 4.15 | | 1/24/2029 | | 135,000 | | 122,658 | |

Wells Fargo & Co., Sr. Unscd. Notes | | 4.54 | | 8/15/2026 | | 150,000 | | 145,415 | |

Wells Fargo & Co., Sr. Unscd. Notes | | 5.56 | | 7/25/2034 | | 100,000 | | 91,578 | |

Wells Fargo & Co., Sub. Notes | | 4.10 | | 6/3/2026 | | 500,000 | | 472,317 | |

Wells Fargo & Co., Sub. Notes | | 4.30 | | 7/22/2027 | | 500,000 | | 466,200 | |

Wells Fargo & Co., Sub. Notes | | 4.65 | | 11/4/2044 | | 250,000 | | 184,410 | |

Wells Fargo Bank NA, Sr. Unscd. Notes | | 5.45 | | 8/7/2026 | | 250,000 | | 247,725 | |

Westpac Banking Corp., Sr. Unscd. Notes | | 2.85 | | 5/13/2026 | | 200,000 | | 187,453 | |

Westpac Banking Corp., Sr. Unscd. Notes | | 5.46 | | 11/18/2027 | | 200,000 | | 198,571 | |

Westpac Banking Corp., Sub. Notes | | 2.67 | | 11/15/2035 | | 200,000 | | 145,444 | |

Westpac Banking Corp., Sub. Notes | | 2.96 | | 11/16/2040 | | 200,000 | | 116,872 | |

Westpac Banking Corp., Sub. Notes | | 5.41 | | 8/10/2033 | | 200,000 | | 175,895 | |

| | 33,508,324 | |

Beverage Products - .4% | | | | | |

Anheuser-Busch Cos. LLC/Anheuser-Busch InBev Worldwide, Inc., Gtd. Notes | | 3.65 | | 2/1/2026 | | 315,000 | | 302,925 | |

Anheuser-Busch Cos. LLC/Anheuser-Busch InBev Worldwide, Inc., Gtd. Notes | | 4.70 | | 2/1/2036 | | 290,000 | | 255,366 | |

Anheuser-Busch InBev Worldwide, Inc., Gtd. Notes | | 3.50 | | 6/1/2030 | | 100,000 | | 87,922 | |

Anheuser-Busch InBev Worldwide, Inc., Gtd. Notes | | 4.60 | | 4/15/2048 | | 250,000 | | 202,713 | |

Anheuser-Busch InBev Worldwide, Inc., Gtd. Notes | | 5.45 | | 1/23/2039 | | 120,000 | | 110,787 | |

Anheuser-Busch InBev Worldwide, Inc., Gtd. Notes | | 5.80 | | 1/23/2059 | | 300,000 | | 277,320 | |

Constellation Brands, Inc., Sr. Unscd. Notes | | 2.88 | | 5/1/2030 | | 200,000 | | 164,792 | |

Keurig Dr Pepper, Inc., Gtd. Notes | | 4.50 | | 4/15/2052 | | 100,000 | | 74,063 | |

Molson Coors Beverage Co., Gtd. Notes | | 4.20 | | 7/15/2046 | | 150,000 | | 106,458 | |

PepsiCo, Inc., Sr. Unscd. Notes | | 2.63 | | 7/29/2029 | | 200,000 | | 173,188 | |

PepsiCo, Inc., Sr. Unscd. Notes | | 2.75 | | 10/21/2051 | | 40,000 | | 23,263 | |

PepsiCo, Inc., Sr. Unscd. Notes | | 2.88 | | 10/15/2049 | | 150,000 | | 91,286 | |

15

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Bonds and Notes - 100.5% (continued) | | | | | |

Beverage Products - .4% (continued) | | | | | |

PepsiCo, Inc., Sr. Unscd. Notes | | 3.50 | | 7/17/2025 | | 250,000 | | 242,380 | |

The Coca-Cola Company, Sr. Unscd. Notes | | 2.88 | | 5/5/2041 | | 150,000 | | 100,930 | |

The Coca-Cola Company, Sr. Unscd. Notes | | 3.00 | | 3/5/2051 | | 200,000 | | 124,864 | |

| | 2,338,257 | |

Building Materials - .1% | | | | | |

Carrier Global Corp., Sr. Unscd. Notes | | 2.49 | | 2/15/2027 | | 34,000 | | 30,437 | |

Johnson Controls International PLC, Sr. Unscd. Notes | | 5.13 | | 9/14/2045 | | 6,000 | | 4,944 | |

Johnson Controls International PLC/Tyco Fire & Security Finance SCA, Sr. Unscd. Notes | | 4.90 | | 12/1/2032 | | 200,000 | | 184,838 | |

Owens Corning, Sr. Unscd. Notes | | 7.00 | | 12/1/2036 | | 69,000 | | 69,460 | |

| | 289,679 | |

Chemicals - .3% | | | | | |

Celanese US Holdings LLC, Gtd. Notes | | 6.17 | | 7/15/2027 | | 200,000 | | 195,293 | |

Celanese US Holdings LLC, Gtd. Notes | | 6.70 | | 11/15/2033 | | 100,000 | a | 95,035 | |

DuPont de Nemours, Inc., Sr. Unscd. Notes | | 4.49 | | 11/15/2025 | | 100,000 | | 97,474 | |

DuPont de Nemours, Inc., Sr. Unscd. Notes | | 4.73 | | 11/15/2028 | | 100,000 | | 95,623 | |

DuPont de Nemours, Inc., Sr. Unscd. Notes | | 5.42 | | 11/15/2048 | | 125,000 | | 108,551 | |

Ecolab, Inc., Sr. Unscd. Notes | | 1.30 | | 1/30/2031 | | 150,000 | | 110,464 | |

Ecolab, Inc., Sr. Unscd. Notes | | 2.13 | | 8/15/2050 | | 175,000 | | 85,213 | |

NewMarket Corp., Sr. Unscd. Notes | | 2.70 | | 3/18/2031 | | 200,000 | | 153,855 | |

Nutrien Ltd., Sr. Unscd. Notes | | 5.25 | | 1/15/2045 | | 191,000 | | 156,771 | |

The Dow Chemical Company, Sr. Unscd. Notes | | 3.60 | | 11/15/2050 | | 200,000 | | 126,378 | |

The Dow Chemical Company, Sr. Unscd. Notes | | 6.30 | | 3/15/2033 | | 200,000 | a | 201,030 | |

The Sherwin-Williams Company, Sr. Unscd. Notes | | 4.25 | | 8/8/2025 | | 300,000 | | 291,711 | |

The Sherwin-Williams Company, Sr. Unscd. Notes | | 4.50 | | 6/1/2047 | | 100,000 | | 75,536 | |

Westlake Corp., Sr. Unscd. Notes | | 3.38 | | 8/15/2061 | | 200,000 | | 103,457 | |

| | 1,896,391 | |

Commercial & Professional Services - .3% | | | | | |

Duke University, Unscd. Bonds, Ser. 2020 | | 2.76 | | 10/1/2050 | | 100,000 | | 58,532 | |

Equifax, Inc., Sr. Unscd. Notes | | 5.10 | | 12/15/2027 | | 200,000 | | 192,728 | |

16

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Bonds and Notes - 100.5% (continued) | | | | | |

Commercial & Professional Services - .3% (continued) | | | | | |

Global Payments, Inc., Sr. Unscd. Notes | | 4.80 | | 4/1/2026 | | 300,000 | | 289,871 | |

Moody's Corp., Sr. Unscd. Notes | | 2.00 | | 8/19/2031 | | 200,000 | a | 150,882 | |

PayPal Holdings, Inc., Sr. Unscd. Notes | | 1.65 | | 6/1/2025 | | 200,000 | | 187,739 | |

PayPal Holdings, Inc., Sr. Unscd. Notes | | 2.85 | | 10/1/2029 | | 95,000 | | 80,834 | |

President & Fellows of Harvard College, Unscd. Bonds | | 3.15 | | 7/15/2046 | | 250,000 | | 165,757 | |

S&P Global, Inc., Gtd. Notes | | 2.30 | | 8/15/2060 | | 100,000 | | 46,549 | |

S&P Global, Inc., Gtd. Notes | | 2.70 | | 3/1/2029 | | 50,000 | | 43,370 | |

The Georgetown University, Sr. Unscd. Bonds | | 5.12 | | 4/1/2053 | | 100,000 | | 86,602 | |

The Leland Stanford Junior University, Unscd. Bonds | | 3.65 | | 5/1/2048 | | 105,000 | | 75,962 | |

The Washington University, Sr. Unscd. Bonds, Ser. 2022 | | 3.52 | | 4/15/2054 | | 100,000 | | 67,920 | |

University of Southern California, Sr. Unscd. Notes | | 5.25 | | 10/1/2111 | | 40,000 | a | 33,818 | |

William Marsh Rice University, Unscd. Bonds | | 3.57 | | 5/15/2045 | | 250,000 | | 181,430 | |

| | 1,661,994 | |

Commercial Mortgage Pass-Through Certificates - 1.0% | | | | | |

Bank, Ser. 2019-BN21, Cl. A5 | | 2.85 | | 10/17/2052 | | 400,000 | | 329,584 | |

Bank, Ser. 2020-BN27, Cl. AS | | 2.55 | | 4/15/2063 | | 150,000 | | 112,334 | |

BBCMS Mortgage Trust, Ser. 2020-C7, Cl. AS | | 2.44 | | 4/15/2053 | | 200,000 | | 150,105 | |

BBCMS Mortgage Trust, Ser. 2022-C15, CI. A5 | | 3.66 | | 4/15/2055 | | 300,000 | | 248,271 | |

Benchmark Mortgage Trust, Ser. 2019-B10, Cl. A4 | | 3.72 | | 3/15/2062 | | 300,000 | | 264,237 | |

Benchmark Mortgage Trust, Ser. 2020-IG1, Cl. A3 | | 2.69 | | 9/15/2043 | | 400,000 | | 303,374 | |

Benchmark Mortgage Trust, Ser. 2020-IG1, Cl. AS | | 2.91 | | 9/15/2043 | | 500,000 | | 371,414 | |

Benchmark Mortgage Trust, Ser. 2022-B35, CI. A5 | | 4.44 | | 5/15/2055 | | 150,000 | | 127,873 | |

CFCRE Commercial Mortgage Trust, Ser. 2017-C8, Cl. A4 | | 3.57 | | 6/15/2050 | | 250,000 | | 227,405 | |

Commercial Mortgage Trust, Ser. 2016-CR28, Cl. A4 | | 3.76 | | 2/10/2049 | | 535,000 | | 504,102 | |

GS Mortgage Securities Trust, Ser. 2019-GC42, Cl. A4 | | 3.00 | | 9/10/2052 | | 250,000 | | 209,597 | |

GS Mortgage Securities Trust, Ser. 2020-GC45, Cl. AS | | 3.17 | | 2/13/2053 | | 200,000 | | 158,013 | |

17

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Bonds and Notes - 100.5% (continued) | | | | | |

Commercial Mortgage Pass-Through Certificates - 1.0% (continued) | | | | | |

JPMBB Commercial Mortgage Securities Trust, Ser. 2015-C33, Cl. A4 | | 3.77 | | 12/15/2048 | | 300,000 | | 283,853 | |

Morgan Stanley Bank of America Merrill Lynch Trust, Ser. 2015-C20, Cl. A4 | | 3.25 | | 2/15/2048 | | 275,000 | | 264,187 | |

SG Commercial Mortgage Securities Trust, Ser. 2016-C5, Cl. A4 | | 3.06 | | 10/10/2048 | | 600,000 | | 544,836 | |

UBS Commercial Mortgage Trust, Ser. 2018-C12, Cl. A5 | | 4.30 | | 8/15/2051 | | 500,000 | | 452,709 | |

Wells Fargo Commercial Mortgage Trust, Ser. 2018-C44, Cl. A5 | | 4.21 | | 5/15/2051 | | 900,000 | | 826,079 | |

Wells Fargo Commercial Mortgage Trust, Ser. 2019-C50, Cl. ASB | | 3.64 | | 5/15/2052 | | 200,000 | | 185,160 | |

| | 5,563,133 | |

Consumer Discretionary - .1% | | | | | |

Marriott International, Inc., Sr. Unscd. Notes | | 5.00 | | 10/15/2027 | | 200,000 | | 193,276 | |

Warnermedia Holdings, Inc., Gtd. Notes | | 4.28 | | 3/15/2032 | | 100,000 | | 82,951 | |

Warnermedia Holdings, Inc., Gtd. Notes | | 5.14 | | 3/15/2052 | | 200,000 | | 141,629 | |

Warnermedia Holdings, Inc., Gtd. Notes | | 5.39 | | 3/15/2062 | | 200,000 | | 140,173 | |

| | 558,029 | |

Consumer Durables & Apparel - .1% | | | | | |

NIKE, Inc., Sr. Unscd. Notes | | 3.38 | | 3/27/2050 | | 300,000 | | 202,043 | |

Ralph Lauren Corp., Sr. Unscd. Notes | | 2.95 | | 6/15/2030 | | 200,000 | a | 167,613 | |

| | 369,656 | |

Consumer Staples - .2% | | | | | |

Church & Dwight Co., Inc., Sr. Unscd. Notes | | 3.95 | | 8/1/2047 | | 150,000 | | 107,679 | |

Colgate-Palmolive Co., Sr. Unscd. Notes | | 3.70 | | 8/1/2047 | | 100,000 | a | 73,565 | |

Haleon US Capital LLC, Gtd. Notes | | 3.63 | | 3/24/2032 | | 250,000 | | 208,391 | |

Kenvue, Inc., Gtd. Notes | | 5.20 | | 3/22/2063 | | 100,000 | | 84,980 | |

The Estee Lauder Companies, Inc., Sr. Unscd. Notes | | 2.60 | | 4/15/2030 | | 150,000 | | 123,708 | |

The Procter & Gamble Company, Sr. Unscd. Notes | | 1.00 | | 4/23/2026 | | 100,000 | | 90,423 | |

The Procter & Gamble Company, Sr. Unscd. Notes | | 1.95 | | 4/23/2031 | | 200,000 | | 158,505 | |

Unilever Capital Corp., Gtd. Notes | | 1.38 | | 9/14/2030 | | 300,000 | | 228,681 | |

| | 1,075,932 | |

18

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Bonds and Notes - 100.5% (continued) | | | | | |

Diversified Financials - .9% | | | | | |

Aercap Ireland Capital DAC/AerCap Global Aviation Trust, Gtd. Notes | | 3.30 | | 1/30/2032 | | 299,000 | | 231,600 | |

Affiliated Managers Group, Inc., Sr. Unscd. Notes | | 3.50 | | 8/1/2025 | | 250,000 | | 238,871 | |

Air Lease Corp., Sr. Unscd. Notes | | 3.38 | | 7/1/2025 | | 300,000 | | 284,848 | |

Ally Financial, Inc., Sr. Unscd. Notes | | 5.80 | | 5/1/2025 | | 250,000 | a | 244,767 | |

American Express Co., Sr. Unscd. Notes | | 3.30 | | 5/3/2027 | | 300,000 | | 274,657 | |

Blackstone Secured Lending Fund, Sr. Unscd. Notes | | 3.63 | | 1/15/2026 | | 300,000 | | 277,202 | |

Blue Owl Capital Corp., Sr. Unscd. Notes | | 3.40 | | 7/15/2026 | | 200,000 | | 178,511 | |

Capital One Financial Corp., Sr. Unscd. Notes | | 3.27 | | 3/1/2030 | | 200,000 | | 164,071 | |

Capital One Financial Corp., Sub. Notes | | 3.75 | | 7/28/2026 | | 450,000 | | 413,270 | |

CI Financial Corp., Sr. Unscd. Notes | | 4.10 | | 6/15/2051 | | 300,000 | | 159,743 | |

CME Group, Inc., Sr. Unscd. Notes | | 3.00 | | 3/15/2025 | | 250,000 | | 242,076 | |

FS KKR Capital Corp., Sr. Unscd. Notes | | 3.40 | | 1/15/2026 | | 200,000 | | 183,007 | |

Intercontinental Exchange, Inc., Sr. Unscd. Notes | | 2.10 | | 6/15/2030 | | 200,000 | | 157,408 | |

Intercontinental Exchange, Inc., Sr. Unscd. Notes | | 2.65 | | 9/15/2040 | | 75,000 | | 47,158 | |

Intercontinental Exchange, Inc., Sr. Unscd. Notes | | 3.00 | | 6/15/2050 | | 200,000 | | 117,865 | |

Intercontinental Exchange, Inc., Sr. Unscd. Notes | | 4.60 | | 3/15/2033 | | 50,000 | | 44,757 | |

Intercontinental Exchange, Inc., Sr. Unscd. Notes | | 5.20 | | 6/15/2062 | | 65,000 | | 53,829 | |

Jefferies Financial Group, Inc., Sr. Unscd. Debs. | | 6.45 | | 6/8/2027 | | 35,000 | | 34,783 | |

Legg Mason, Inc., Gtd. Notes | | 5.63 | | 1/15/2044 | | 100,000 | | 88,291 | |

Mastercard, Inc., Sr. Unscd. Notes | | 3.85 | | 3/26/2050 | | 100,000 | | 73,158 | |

Nomura Holdings, Inc., Sr. Unscd. Notes | | 2.17 | | 7/14/2028 | | 300,000 | | 246,972 | |

Oaktree Specialty Lending Corp., Sr. Unscd. Notes | | 7.10 | | 2/15/2029 | | 100,000 | | 95,379 | |

Prospect Capital Corp., Sr. Unscd. Notes | | 3.36 | | 11/15/2026 | | 300,000 | | 257,987 | |

Sixth Street Specialty Lending, Inc., Sr. Unscd. Notes | | 6.95 | | 8/14/2028 | | 100,000 | | 97,319 | |

The Charles Schwab Corp., Sr. Unscd. Notes | | 2.90 | | 3/3/2032 | | 200,000 | a | 152,893 | |

Visa, Inc., Sr. Unscd. Notes | | 1.10 | | 2/15/2031 | | 300,000 | | 222,350 | |

Visa, Inc., Sr. Unscd. Notes | | 2.00 | | 8/15/2050 | | 140,000 | | 71,595 | |

19

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Bonds and Notes - 100.5% (continued) | | | | | |

Diversified Financials - .9% (continued) | | | | | |

Visa, Inc., Sr. Unscd. Notes | | 3.65 | | 9/15/2047 | | 55,000 | | 39,632 | |

| | 4,693,999 | |

Educational Services - .0% | | | | | |

California Institute of Technology, Unscd. Bonds | | 4.32 | | 8/1/2045 | | 110,000 | | 87,592 | |

Electronic Components - .1% | | | | | |

Honeywell International, Inc., Sr. Unscd. Notes | | 1.10 | | 3/1/2027 | | 200,000 | | 174,646 | |

Jabil, Inc, Sr. Unscd. Notes | | 5.45 | | 2/1/2029 | | 100,000 | | 96,238 | |

Jabil, Inc., Sr. Unscd. Notes | | 3.00 | | 1/15/2031 | | 200,000 | | 158,526 | |

| | 429,410 | |

Energy - 1.7% | | | | | |

Baker Hughes Holdings LLC/Baker Hughes Co-Obligor, Inc., Sr. Unscd. Notes | | 4.49 | | 5/1/2030 | | 200,000 | | 183,900 | |

BP Capital Markets America, Inc., Gtd. Notes | | 3.80 | | 9/21/2025 | | 150,000 | | 145,747 | |

BP Capital Markets America, Inc., Gtd. Notes | | 3.94 | | 9/21/2028 | | 300,000 | | 278,640 | |

BP Capital Markets America, Inc., Gtd. Notes | | 4.23 | | 11/6/2028 | | 100,000 | | 93,936 | |

BP Capital Markets America, Inc., Gtd. Notes | | 4.81 | | 2/13/2033 | | 100,000 | | 91,416 | |

Canadian Natural Resources Ltd., Sr. Unscd. Notes | | 6.25 | | 3/15/2038 | | 200,000 | | 187,038 | |

Cenovus Energy, Inc., Sr. Unscd. Notes | | 6.75 | | 11/15/2039 | | 34,000 | | 32,892 | |

Chevron Corp., Sr. Unscd. Notes | | 3.08 | | 5/11/2050 | | 150,000 | | 94,270 | |

ConocoPhillips Co., Gtd. Notes | | 5.05 | | 9/15/2033 | | 100,000 | | 93,225 | |

ConocoPhillips Co., Gtd. Notes | | 5.70 | | 9/15/2063 | | 100,000 | | 89,320 | |

ConocoPhillips Co., Gtd. Notes | | 5.95 | | 3/15/2046 | | 100,000 | | 94,067 | |

ConocoPhillips Co., Sr. Unscd. Notes | | 6.95 | | 4/15/2029 | | 125,000 | | 133,404 | |

Devon Energy Corp., Sr. Unscd. Notes | | 5.85 | | 12/15/2025 | | 71,000 | | 70,546 | |

Enbridge, Inc., Gtd. Notes | | 4.25 | | 12/1/2026 | | 250,000 | | 237,628 | |

Energy Transfer LP, Gtd. Notes | | 5.00 | | 5/15/2044 | | 250,000 | | 187,893 | |

Energy Transfer LP, Sr. Unscd. Notes | | 2.90 | | 5/15/2025 | | 300,000 | | 285,872 | |

Energy Transfer LP, Sr. Unscd. Notes | | 3.75 | | 5/15/2030 | | 200,000 | | 171,005 | |

Energy Transfer LP, Sr. Unscd. Notes | | 4.95 | | 1/15/2043 | | 200,000 | | 150,026 | |

Energy Transfer LP, Sr. Unscd. Notes | | 6.10 | | 12/1/2028 | | 200,000 | | 197,667 | |

Energy Transfer LP, Sr. Unscd. Notes | | 6.25 | | 4/15/2049 | | 95,000 | | 83,665 | |

Energy Transfer LP, Sr. Unscd. Notes | | 6.55 | | 12/1/2033 | | 100,000 | | 98,768 | |

Enterprise Products Operating LLC, Gtd. Notes | | 3.70 | | 2/15/2026 | | 200,000 | | 191,289 | |

20

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Bonds and Notes - 100.5% (continued) | | | | | |

Energy - 1.7% (continued) | | | | | |

Enterprise Products Operating LLC, Gtd. Notes | | 3.95 | | 1/31/2060 | | 95,000 | | 63,694 | |

Enterprise Products Operating LLC, Gtd. Notes | | 4.25 | | 2/15/2048 | | 75,000 | | 56,184 | |

Enterprise Products Operating LLC, Gtd. Notes | | 4.90 | | 5/15/2046 | | 200,000 | | 164,778 | |

Enterprise Products Operating LLC, Gtd. Notes | | 5.35 | | 1/31/2033 | | 200,000 | | 190,721 | |

EOG Resources, Inc., Sr. Unscd. Notes | | 3.90 | | 4/1/2035 | | 200,000 | | 164,231 | |

Equinor ASA, Gtd. Notes | | 3.63 | | 4/6/2040 | | 200,000 | | 148,314 | |

Exxon Mobil Corp., Sr. Unscd. Notes | | 2.99 | | 3/19/2025 | | 300,000 | | 290,283 | |

Exxon Mobil Corp., Sr. Unscd. Notes | | 3.10 | | 8/16/2049 | | 230,000 | | 143,084 | |

Halliburton Co., Sr. Unscd. Bonds | | 7.45 | | 9/15/2039 | | 300,000 | | 327,436 | |

Halliburton Co., Sr. Unscd. Notes | | 3.80 | | 11/15/2025 | | 167,000 | | 161,402 | |

Hess Corp., Sr. Unscd. Notes | | 5.60 | | 2/15/2041 | | 250,000 | | 232,348 | |

Kinder Morgan, Inc., Gtd. Notes | | 3.60 | | 2/15/2051 | | 200,000 | | 120,535 | |

Marathon Oil Corp., Sr. Unscd. Notes | | 6.60 | | 10/1/2037 | | 150,000 | | 143,496 | |

Marathon Petroleum Corp., Sr. Unscd. Notes | | 4.75 | | 9/15/2044 | | 150,000 | | 113,627 | |

MPLX LP, Sr. Unscd. Notes | | 4.90 | | 4/15/2058 | | 115,000 | | 81,042 | |

MPLX LP, Sr. Unscd. Notes | | 5.00 | | 3/1/2033 | | 100,000 | | 88,600 | |

MPLX LP, Sr. Unscd. Notes | | 5.50 | | 2/15/2049 | | 150,000 | | 121,186 | |

ONEOK Partners LP, Gtd. Notes | | 6.85 | | 10/15/2037 | | 60,000 | | 58,805 | |

ONEOK, Inc., Gtd. Notes | | 5.55 | | 11/1/2026 | | 100,000 | | 98,825 | |

ONEOK, Inc., Gtd. Notes | | 5.80 | | 11/1/2030 | | 100,000 | | 96,296 | |

ONEOK, Inc., Gtd. Notes | | 6.05 | | 9/1/2033 | | 100,000 | a | 95,885 | |

ONEOK, Inc., Gtd. Notes | | 6.63 | | 9/1/2053 | | 100,000 | | 93,540 | |

Phillips 66, Gtd. Notes | | 1.30 | | 2/15/2026 | | 200,000 | | 180,678 | |

Plains All American Pipeline LP/PAA Finance Corp., Sr. Unscd. Notes | | 4.90 | | 2/15/2045 | | 250,000 | | 180,490 | |

Sabine Pass Liquefaction LLC, Sr. Scd. Notes | | 5.00 | | 3/15/2027 | | 300,000 | | 289,024 | |

Shell International Finance BV, Gtd. Notes | | 2.38 | | 11/7/2029 | | 200,000 | | 167,423 | |

Shell International Finance BV, Gtd. Notes | | 2.75 | | 4/6/2030 | | 250,000 | | 211,433 | |

Shell International Finance BV, Gtd. Notes | | 3.25 | | 4/6/2050 | | 250,000 | | 157,787 | |

Shell International Finance BV, Gtd. Notes | | 4.13 | | 5/11/2035 | | 260,000 | | 221,832 | |

Spectra Energy Partners LP, Gtd. Notes | | 5.95 | | 9/25/2043 | | 200,000 | | 174,488 | |

Suncor Energy, Inc., Sr. Unscd. Notes | | 4.00 | | 11/15/2047 | | 50,000 | | 33,617 | |

Suncor Energy, Inc., Sr. Unscd. Notes | | 6.50 | | 6/15/2038 | | 150,000 | | 144,316 | |

21

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Bonds and Notes - 100.5% (continued) | | | | | |

Energy - 1.7% (continued) | | | | | |

Tennessee Gas Pipeline Co. LLC, Gtd. Debs. | | 7.63 | | 4/1/2037 | | 70,000 | | 74,968 | |

The Williams Companies, Inc., Sr. Unscd. Notes | | 4.00 | | 9/15/2025 | | 100,000 | | 96,193 | |

The Williams Companies, Inc., Sr. Unscd. Notes | | 5.30 | | 8/15/2028 | | 100,000 | | 96,422 | |

The Williams Companies, Inc., Sr. Unscd. Notes | | 6.30 | | 4/15/2040 | | 200,000 | | 188,993 | |

TotalEnergies Capital International SA, Gtd. Notes | | 2.83 | | 1/10/2030 | | 170,000 | | 145,037 | |

TotalEnergies Capital International SA, Gtd. Notes | | 3.46 | | 7/12/2049 | | 50,000 | | 33,121 | |

Transcanada Pipelines Ltd., Sr. Unscd. Notes | | 4.88 | | 5/15/2048 | | 60,000 | | 45,440 | |

Transcanada Pipelines Ltd., Sr. Unscd. Notes | | 6.20 | | 10/15/2037 | | 75,000 | | 70,004 | |

Transcanada Pipelines Ltd., Sr. Unscd. Notes | | 7.63 | | 1/15/2039 | | 300,000 | | 317,983 | |

Valero Energy Corp., Sr. Unscd. Notes | | 6.63 | | 6/15/2037 | | 165,000 | | 162,150 | |

Valero Energy Corp., Sr. Unscd. Notes | | 7.50 | | 4/15/2032 | | 170,000 | | 180,538 | |

| | 9,418,463 | |

Environmental Control - .1% | | | | | |

Waste Management, Inc., Gtd. Notes | | 4.15 | | 7/15/2049 | | 250,000 | | 187,583 | |

Waste Management, Inc., Gtd. Notes | | 4.63 | | 2/15/2033 | | 100,000 | | 90,757 | |

Waste Management, Inc., Gtd. Notes | | 4.63 | | 2/15/2030 | | 100,000 | | 94,024 | |

| | 372,364 | |

Financials - .0% | | | | | |

Brookfield Corp., Sr. Unscd. Notes | | 4.00 | | 1/15/2025 | | 250,000 | | 243,752 | |

Food Products - .5% | | | | | |

Campbell Soup Co., Sr. Unscd. Notes | | 3.30 | | 3/19/2025 | | 200,000 | | 192,288 | |

Campbell Soup Co., Sr. Unscd. Notes | | 4.15 | | 3/15/2028 | | 80,000 | | 74,565 | |

Conagra Brands, Inc., Sr. Unscd. Notes | | 4.85 | | 11/1/2028 | | 100,000 | | 94,004 | |

Conagra Brands, Inc., Sr. Unscd. Notes | | 5.30 | | 10/1/2026 | | 100,000 | | 98,323 | |

Conagra Brands, Inc., Sr. Unscd. Notes | | 5.40 | | 11/1/2048 | | 60,000 | | 48,059 | |

General Mills, Inc., Sr. Unscd. Notes | | 2.88 | | 4/15/2030 | | 150,000 | | 124,069 | |

General Mills, Inc., Sr. Unscd. Notes | | 3.00 | | 2/1/2051 | | 150,000 | | 85,989 | |

Hormel Foods Corp., Sr. Unscd. Notes | | 1.80 | | 6/11/2030 | | 200,000 | | 156,629 | |

JBS USA LUX SA/JBS USA Food Co./JBS USA Finance, Inc., Gtd. Notes | | 2.50 | | 1/15/2027 | | 200,000 | | 175,793 | |

22

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Bonds and Notes - 100.5% (continued) | | | | | |

Food Products - .5% (continued) | | | | | |

JBS USA LUX SA/JBS USA Food Co./JBS USA Finance, Inc., Gtd. Notes | | 5.75 | | 4/1/2033 | | 200,000 | | 176,894 | |

Kraft Heinz Foods Co., Gtd. Notes | | 4.38 | | 6/1/2046 | | 200,000 | | 146,439 | |

Kraft Heinz Foods Co., Gtd. Notes | | 6.50 | | 2/9/2040 | | 100,000 | | 97,385 | |

McCormick & Co., Inc., Sr. Unscd. Notes | | 0.90 | | 2/15/2026 | | 200,000 | | 178,935 | |

McCormick & Co., Inc., Sr. Unscd. Notes | | 2.50 | | 4/15/2030 | | 300,000 | | 240,536 | |

Mondelez International, Inc., Sr. Unscd. Notes | | 2.75 | | 4/13/2030 | | 138,000 | | 113,709 | |

Pilgrim's Pride Corp., Gtd. Notes | | 6.25 | | 7/1/2033 | | 100,000 | | 92,025 | |

Sysco Corp., Gtd. Notes | | 5.38 | | 9/21/2035 | | 200,000 | | 182,964 | |

The Kroger Company, Sr. Unscd. Notes | | 3.70 | | 8/1/2027 | | 300,000 | | 277,921 | |

The Kroger Company, Sr. Unscd. Notes | | 7.50 | | 4/1/2031 | | 200,000 | | 214,660 | |

Tyson Foods, Inc., Sr. Unscd. Bonds | | 5.15 | | 8/15/2044 | | 250,000 | | 198,127 | |

| | 2,969,314 | |

Foreign Governmental - 1.2% | | | | | |

Canada, Sr. Unscd. Bonds | | 1.63 | | 1/22/2025 | | 200,000 | | 191,060 | |

Export Development Canada, Govt. Gtd. Notes | | 3.88 | | 2/14/2028 | | 100,000 | | 95,625 | |

Export-Import Bank of Korea, Sr. Unscd. Notes | | 5.00 | | 1/11/2028 | | 300,000 | | 294,460 | |

Finland, Sr. Unscd. Bonds | | 6.95 | | 2/15/2026 | | 25,000 | | 25,765 | |

Hungary, Sr. Unscd. Notes | | 7.63 | | 3/29/2041 | | 300,000 | | 308,223 | |

Indonesia, Sr. Unscd. Notes | | 3.50 | | 1/11/2028 | | 300,000 | | 276,781 | |

Indonesia, Sr. Unscd. Notes | | 3.85 | | 10/15/2030 | | 300,000 | | 266,958 | |

Indonesia, Sr. Unscd. Notes | | 4.35 | | 1/11/2048 | | 300,000 | | 229,065 | |

Israel, Sr. Unscd. Bonds | | 3.88 | | 7/3/2050 | | 250,000 | | 166,424 | |

Israel, Sr. Unscd. Notes | | 3.38 | | 1/15/2050 | | 300,000 | | 182,567 | |

Mexico, Sr. Unscd. Notes | | 2.66 | | 5/24/2031 | | 300,000 | | 234,432 | |

Mexico, Sr. Unscd. Notes | | 4.28 | | 8/14/2041 | | 300,000 | | 215,178 | |

Mexico, Sr. Unscd. Notes | | 5.00 | | 4/27/2051 | | 250,000 | | 185,310 | |

Mexico, Sr. Unscd. Notes | | 5.55 | | 1/21/2045 | | 350,000 | a | 292,556 | |

Panama, Sr. Unscd. Bonds | | 3.88 | | 3/17/2028 | | 250,000 | | 225,168 | |

Panama, Sr. Unscd. Bonds | | 4.50 | | 4/16/2050 | | 200,000 | | 126,027 | |

Panama, Sr. Unscd. Notes | | 6.40 | | 2/14/2035 | | 300,000 | | 276,121 | |

Peru, Sr. Unscd. Bonds | | 6.55 | | 3/14/2037 | | 370,000 | | 374,862 | |

Peru, Sr. Unscd. Bonds | | 7.35 | | 7/21/2025 | | 300,000 | | 307,584 | |

Philippines, Sr. Unscd. Bonds | | 3.70 | | 2/2/2042 | | 400,000 | | 289,404 | |

Philippines, Sr. Unscd. Bonds | | 10.63 | | 3/16/2025 | | 400,000 | | 427,607 | |

Philippines, Sr. Unscd. Notes | | 5.17 | | 10/13/2027 | | 200,000 | | 197,250 | |

23

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Bonds and Notes - 100.5% (continued) | | | | | |

Foreign Governmental - 1.2% (continued) | | | | | |

Philippines, Sr. Unscd. Notes | | 5.61 | | 4/13/2033 | | 200,000 | | 196,875 | |

Poland, Sr. Unscd. Notes | | 5.50 | | 11/16/2027 | | 300,000 | | 301,942 | |

Province of Alberta Canada, Sr. Unscd. Notes | | 3.30 | | 3/15/2028 | | 80,000 | | 74,236 | |

Province of British Columbia Canada, Sr. Unscd. Bonds, Ser. USD2 | | 6.50 | | 1/15/2026 | | 225,000 | | 229,977 | |

Province of Quebec Canada, Sr. Unscd. Debs., Ser. PD | | 7.50 | | 9/15/2029 | | 100,000 | | 111,619 | |

Province of Quebec Canada, Sr. Unscd. Notes | | 3.63 | | 4/13/2028 | | 100,000 | | 94,095 | |

Uruguay, Sr. Unscd. Bonds | | 4.98 | | 4/20/2055 | | 105,000 | | 88,256 | |

Uruguay, Sr. Unscd. Bonds | | 7.63 | | 3/21/2036 | | 300,000 | | 340,881 | |

| | 6,626,308 | |

Health Care - 2.8% | | | | | |

Abbott Laboratories, Sr. Unscd. Notes | | 1.40 | | 6/30/2030 | | 200,000 | a | 155,326 | |

Abbott Laboratories, Sr. Unscd. Notes | | 4.90 | | 11/30/2046 | | 200,000 | | 172,687 | |

AbbVie, Inc., Sr. Unscd. Notes | | 3.60 | | 5/14/2025 | | 170,000 | | 164,518 | |

AbbVie, Inc., Sr. Unscd. Notes | | 4.25 | | 11/21/2049 | | 290,000 | | 217,808 | |

AbbVie, Inc., Sr. Unscd. Notes | | 4.25 | | 11/14/2028 | | 110,000 | | 103,596 | |

AbbVie, Inc., Sr. Unscd. Notes | | 4.75 | | 3/15/2045 | | 200,000 | | 164,057 | |

Aetna, Inc., Sr. Unscd. Notes | | 4.75 | | 3/15/2044 | | 250,000 | | 193,417 | |

Aetna, Inc., Sr. Unscd. Notes | | 6.63 | | 6/15/2036 | | 150,000 | | 150,480 | |

Amgen, Inc., Sr. Unscd. Notes | | 2.45 | | 2/21/2030 | | 70,000 | | 57,173 | |

Amgen, Inc., Sr. Unscd. Notes | | 2.60 | | 8/19/2026 | | 250,000 | | 230,385 | |

Amgen, Inc., Sr. Unscd. Notes | | 2.80 | | 8/15/2041 | | 200,000 | | 123,802 | |

Amgen, Inc., Sr. Unscd. Notes | | 3.00 | | 1/15/2052 | | 200,000 | a | 113,738 | |

Amgen, Inc., Sr. Unscd. Notes | | 3.38 | | 2/21/2050 | | 60,000 | | 37,110 | |

Amgen, Inc., Sr. Unscd. Notes | | 4.40 | | 2/22/2062 | | 200,000 | | 138,478 | |

Amgen, Inc., Sr. Unscd. Notes | | 4.66 | | 6/15/2051 | | 100,000 | | 76,167 | |

AstraZeneca PLC, Sr. Unscd. Notes | | 1.38 | | 8/6/2030 | | 370,000 | | 282,109 | |

AstraZeneca PLC, Sr. Unscd. Notes | | 4.38 | | 8/17/2048 | | 45,000 | | 35,713 | |

AstraZeneca PLC, Sr. Unscd. Notes | | 4.38 | | 11/16/2045 | | 205,000 | | 163,086 | |

Banner Health, Unscd. Bonds | | 2.34 | | 1/1/2030 | | 300,000 | | 243,956 | |

Baxalta, Inc., Gtd. Notes | | 5.25 | | 6/23/2045 | | 200,000 | | 170,667 | |

Becton Dickinson & Co., Sr. Unscd. Notes | | 3.73 | | 12/15/2024 | | 386,000 | | 376,598 | |

Becton Dickinson & Co., Sr. Unscd. Notes | | 4.69 | | 2/13/2028 | | 100,000 | | 95,760 | |

Biogen, Inc., Sr. Unscd. Notes | | 4.05 | | 9/15/2025 | | 250,000 | | 241,353 | |

Boston Scientific Corp., Sr. Unscd. Notes | | 1.90 | | 6/1/2025 | | 300,000 | | 282,292 | |

24

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Bonds and Notes - 100.5% (continued) | | | | | |

Health Care - 2.8% (continued) | | | | | |

Bristol-Myers Squibb Co., Sr. Unscd. Notes | | 0.75 | | 11/13/2025 | | 200,000 | | 182,432 | |

Bristol-Myers Squibb Co., Sr. Unscd. Notes | | 2.35 | | 11/13/2040 | | 200,000 | | 120,142 | |

Bristol-Myers Squibb Co., Sr. Unscd. Notes | | 2.95 | | 3/15/2032 | | 55,000 | | 44,731 | |

Bristol-Myers Squibb Co., Sr. Unscd. Notes | | 3.40 | | 7/26/2029 | | 78,000 | | 70,001 | |

Bristol-Myers Squibb Co., Sr. Unscd. Notes | | 3.55 | | 3/15/2042 | | 40,000 | | 28,370 | |

Bristol-Myers Squibb Co., Sr. Unscd. Notes | | 3.90 | | 2/20/2028 | | 90,000 | | 84,653 | |

Bristol-Myers Squibb Co., Sr. Unscd. Notes | | 4.35 | | 11/15/2047 | | 90,000 | | 68,500 | |

Bristol-Myers Squibb Co., Sr. Unscd. Notes | | 4.55 | | 2/20/2048 | | 70,000 | | 55,180 | |

Cardinal Health, Inc., Sr. Unscd. Notes | | 4.60 | | 3/15/2043 | | 300,000 | | 228,115 | |

Cencora, Inc., Sr. Unscd. Notes | | 2.80 | | 5/15/2030 | | 100,000 | | 82,325 | |

Centene Corp., Sr. Unscd. Notes | | 2.45 | | 7/15/2028 | | 230,000 | | 193,689 | |

Centene Corp., Sr. Unscd. Notes | | 2.63 | | 8/1/2031 | | 190,000 | | 142,901 | |

CVS Health Corp., Sr. Unscd. Notes | | 1.75 | | 8/21/2030 | | 85,000 | | 64,265 | |

CVS Health Corp., Sr. Unscd. Notes | | 3.25 | | 8/15/2029 | | 100,000 | | 86,431 | |

CVS Health Corp., Sr. Unscd. Notes | | 4.30 | | 3/25/2028 | | 300,000 | | 281,191 | |

CVS Health Corp., Sr. Unscd. Notes | | 4.78 | | 3/25/2038 | | 250,000 | | 206,956 | |

CVS Health Corp., Sr. Unscd. Notes | | 5.05 | | 3/25/2048 | | 200,000 | | 157,365 | |

Danaher Corp., Sr. Unscd. Notes | | 4.38 | | 9/15/2045 | | 250,000 | | 198,099 | |

Dignity Health, Scd. Bonds | | 5.27 | | 11/1/2064 | | 154,000 | | 124,302 | |

Elevance Health, Inc., Sr. Unscd. Notes | | 2.25 | | 5/15/2030 | | 200,000 | | 159,509 | |

Elevance Health, Inc., Sr. Unscd. Notes | | 3.60 | | 3/15/2051 | | 60,000 | | 38,544 | |

Eli Lilly & Co., Sr. Unscd. Notes | | 3.10 | | 5/15/2027 | | 250,000 | | 232,341 | |

Gilead Sciences, Inc., Sr. Unscd. Notes | | 1.20 | | 10/1/2027 | | 80,000 | | 67,644 | |

Gilead Sciences, Inc., Sr. Unscd. Notes | | 4.15 | | 3/1/2047 | | 220,000 | | 162,169 | |

GlaxoSmithKline Capital, Inc., Gtd. Bonds | | 6.38 | | 5/15/2038 | | 300,000 | | 312,466 | |

HCA, Inc., Gtd. Notes | | 4.13 | | 6/15/2029 | | 110,000 | | 97,663 | |

HCA, Inc., Gtd. Notes | | 5.13 | | 6/15/2039 | | 50,000 | | 41,166 | |

HCA, Inc., Gtd. Notes | | 5.25 | | 6/15/2049 | | 100,000 | | 76,932 | |

HCA, Inc., Gtd. Notes | | 5.38 | | 2/1/2025 | | 300,000 | | 296,884 | |

Humana, Inc., Sr. Unscd. Notes | | 4.95 | | 10/1/2044 | | 150,000 | | 120,344 | |

Humana, Inc., Sr. Unscd. Notes | | 5.75 | | 3/1/2028 | | 150,000 | | 149,482 | |

25

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Bonds and Notes - 100.5% (continued) | | | | | |

Health Care - 2.8% (continued) | | | | | |

Johnson & Johnson, Sr. Unscd. Notes | | 2.10 | | 9/1/2040 | | 400,000 | | 243,134 | |

Johnson & Johnson, Sr. Unscd. Notes | | 2.45 | | 3/1/2026 | | 180,000 | | 169,153 | |

Johnson & Johnson, Sr. Unscd. Notes | | 3.50 | | 1/15/2048 | | 50,000 | | 35,384 | |

Kaiser Foundation Hospitals, Gtd. Notes | | 3.15 | | 5/1/2027 | | 300,000 | | 278,166 | |

Kaiser Foundation Hospitals, Unscd. Bonds, Ser. 2021 | | 3.00 | | 6/1/2051 | | 70,000 | | 41,151 | |

Memorial Sloan-Kettering Cancer Center, Sr. Unscd. Notes, Ser. 2015 | | 4.20 | | 7/1/2055 | | 200,000 | | 147,184 | |

Merck & Co., Inc., Sr. Unscd. Notes | | 1.45 | | 6/24/2030 | | 200,000 | | 153,847 | |

Merck & Co., Inc., Sr. Unscd. Notes | | 2.35 | | 6/24/2040 | | 50,000 | | 31,044 | |

Merck & Co., Inc., Sr. Unscd. Notes | | 2.45 | | 6/24/2050 | | 60,000 | | 32,271 | |

Merck & Co., Inc., Sr. Unscd. Notes | | 2.75 | | 2/10/2025 | | 250,000 | | 241,856 | |

Merck & Co., Inc., Sr. Unscd. Notes | | 3.90 | | 3/7/2039 | | 55,000 | | 43,706 | |

Merck & Co., Inc., Sr. Unscd. Notes | | 4.05 | | 5/17/2028 | | 200,000 | a | 190,457 | |

Merck & Co., Inc., Sr. Unscd. Notes | | 4.50 | | 5/17/2033 | | 200,000 | | 181,904 | |

Merck & Co., Inc., Sr. Unscd. Notes | | 5.15 | | 5/17/2063 | | 60,000 | | 51,176 | |

Mount Sinai Hospital, Scd. Bonds, Ser. 2019 | | 3.74 | | 7/1/2049 | | 300,000 | | 199,640 | |

Mylan, Inc., Gtd. Notes | | 5.40 | | 11/29/2043 | | 150,000 | | 110,449 | |

Northwell Healthcare, Inc., Scd. Notes | | 3.98 | | 11/1/2046 | | 250,000 | | 174,798 | |

Novartis Capital Corp., Gtd. Notes | | 2.20 | | 8/14/2030 | | 240,000 | | 195,247 | |

Novartis Capital Corp., Gtd. Notes | | 2.75 | | 8/14/2050 | | 60,000 | | 35,692 | |

Pfizer Investment Enterprises Pte Ltd., Gtd. Notes | | 4.45 | | 5/19/2028 | | 200,000 | | 191,247 | |

Pfizer Investment Enterprises Pte Ltd., Gtd. Notes | | 4.75 | | 5/19/2033 | | 200,000 | | 183,911 | |

Pfizer Investment Enterprises Pte Ltd., Gtd. Notes | | 5.30 | | 5/19/2053 | | 200,000 | | 175,121 | |

Pfizer, Inc., Sr. Unscd. Notes | | 0.80 | | 5/28/2025 | | 300,000 | | 279,017 | |

Pfizer, Inc., Sr. Unscd. Notes | | 2.55 | | 5/28/2040 | | 300,000 | | 190,591 | |

Pfizer, Inc., Sr. Unscd. Notes | | 3.45 | | 3/15/2029 | | 100,000 | | 90,854 | |

Providence St. Joseph Health Obligated Group, Unscd. Notes, Ser. I | | 3.74 | | 10/1/2047 | | 250,000 | | 166,984 | |

Quest Diagnostics, Inc., Sr. Unscd. Notes | | 3.50 | | 3/30/2025 | | 250,000 | | 241,270 | |

Stryker Corp., Sr. Unscd. Notes | | 3.50 | | 3/15/2026 | | 250,000 | | 237,798 | |

Stryker Corp., Sr. Unscd. Notes | | 4.38 | | 5/15/2044 | | 100,000 | | 77,098 | |

Takeda Pharmaceutical Co. Ltd., Sr. Unscd. Notes | | 5.00 | | 11/26/2028 | | 200,000 | | 193,157 | |

The Cigna Group, Gtd. Notes | | 3.88 | | 10/15/2047 | | 75,000 | | 51,168 | |

The Cigna Group, Gtd. Notes | | 4.13 | | 11/15/2025 | | 130,000 | | 125,986 | |

The Cigna Group, Gtd. Notes | | 4.38 | | 10/15/2028 | | 230,000 | | 215,065 | |

26

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Bonds and Notes - 100.5% (continued) | | | | | |

Health Care - 2.8% (continued) | | | | | |

The Cigna Group, Sr. Unscd. Notes | | 2.38 | | 3/15/2031 | | 80,000 | | 62,340 | |

Thermo Fisher Scientific, Inc., Sr. Unscd. Notes | | 2.80 | | 10/15/2041 | | 200,000 | | 127,534 | |

Trinity Health Corp., Scd. Bonds | | 4.13 | | 12/1/2045 | | 200,000 | | 150,652 | |

UnitedHealth Group, Inc., Sr. Unscd. Notes | | 2.30 | | 5/15/2031 | | 75,000 | | 59,042 | |

UnitedHealth Group, Inc., Sr. Unscd. Notes | | 3.05 | | 5/15/2041 | | 75,000 | | 50,085 | |

UnitedHealth Group, Inc., Sr. Unscd. Notes | | 4.20 | | 5/15/2032 | | 45,000 | | 39,917 | |

UnitedHealth Group, Inc., Sr. Unscd. Notes | | 4.25 | | 6/15/2048 | | 80,000 | | 59,907 | |

UnitedHealth Group, Inc., Sr. Unscd. Notes | | 4.45 | | 12/15/2048 | | 60,000 | | 46,315 | |

UnitedHealth Group, Inc., Sr. Unscd. Notes | | 4.75 | | 7/15/2045 | | 280,000 | | 230,100 | |

UnitedHealth Group, Inc., Sr. Unscd. Notes | | 4.95 | | 5/15/2062 | | 75,000 | | 60,957 | |

UnitedHealth Group, Inc., Sr. Unscd. Notes | | 5.25 | | 2/15/2028 | | 150,000 | | 149,066 | |

UnitedHealth Group, Inc., Sr. Unscd. Notes | | 5.30 | | 2/15/2030 | | 150,000 | | 147,288 | |

UnitedHealth Group, Inc., Sr. Unscd. Notes | | 5.35 | | 2/15/2033 | | 100,000 | | 96,159 | |

UnitedHealth Group, Inc., Sr. Unscd. Notes | | 6.05 | | 2/15/2063 | | 100,000 | | 95,383 | |

UnitedHealth Group, Inc., Sr. Unscd. Notes | | 6.88 | | 2/15/2038 | | 210,000 | | 225,373 | |

UPMC, Scd. Bonds | | 5.04 | | 5/15/2033 | | 100,000 | | 92,891 | |

Viatris, Inc., Gtd. Notes | | 2.70 | | 6/22/2030 | | 150,000 | | 115,248 | |

Zoetis, Inc., Sr. Unscd. Notes | | 3.00 | | 5/15/2050 | | 150,000 | | 89,317 | |

Zoetis, Inc., Sr. Unscd. Notes | | 5.40 | | 11/14/2025 | | 200,000 | | 198,598 | |

Zoetis, Inc., Sr. Unscd. Notes | | 5.60 | | 11/16/2032 | | 200,000 | | 194,014 | |

| | 15,430,780 | |

Industrial - .7% | | | | | |

3M Co., Sr. Unscd. Notes | | 2.25 | | 9/19/2026 | | 300,000 | a | 271,914 | |

3M Co., Sr. Unscd. Notes | | 2.38 | | 8/26/2029 | | 390,000 | a | 318,490 | |

Caterpillar Financial Services Corp., Sr. Unscd. Notes | | 0.80 | | 11/13/2025 | | 200,000 | | 182,177 | |

Caterpillar, Inc., Sr. Unscd. Bonds | | 6.05 | | 8/15/2036 | | 237,000 | | 240,531 | |

Caterpillar, Inc., Sr. Unscd. Notes | | 3.25 | | 4/9/2050 | | 150,000 | | 97,975 | |

CNH Industrial Capital LLC, Gtd. Notes | | 4.55 | | 4/10/2028 | | 100,000 | | 94,022 | |

Eaton Corp., Gtd. Notes | | 4.15 | | 11/2/2042 | | 200,000 | | 155,666 | |

27

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Bonds and Notes - 100.5% (continued) | | | | | |

Industrial - .7% (continued) | | | | | |

GE Capital International Funding Co., Gtd. Notes | | 4.42 | | 11/15/2035 | | 300,000 | | 261,416 | |

Illinois Tool Works, Inc., Sr. Unscd. Notes | | 3.90 | | 9/1/2042 | | 170,000 | | 131,014 | |

Ingersoll Rand, Inc., Sr. Unscd. Notes | | 5.70 | | 8/14/2033 | | 100,000 | | 94,534 | |

Jacobs Engineering Group, Inc., Gtd. Notes | | 6.35 | | 8/18/2028 | | 100,000 | | 99,496 | |

John Deere Capital Corp., Sr. Unscd. Notes | | 0.70 | | 1/15/2026 | | 200,000 | | 180,399 | |

John Deere Capital Corp., Sr. Unscd. Notes | | 1.45 | | 1/15/2031 | | 300,000 | | 225,112 | |

John Deere Capital Corp., Sr. Unscd. Notes | | 4.15 | | 9/15/2027 | | 200,000 | | 191,441 | |

John Deere Capital Corp., Sr. Unscd. Notes | | 4.95 | | 7/14/2028 | | 100,000 | | 97,593 | |

Parker-Hannifin Corp., Sr. Unscd. Notes | | 3.25 | | 6/14/2029 | | 300,000 | | 263,688 | |

Parker-Hannifin Corp., Sr. Unscd. Notes | | 4.00 | | 6/14/2049 | | 40,000 | | 28,659 | |

Stanley Black & Decker, Inc., Sr. Unscd. Notes | | 2.30 | | 3/15/2030 | | 300,000 | | 235,852 | |

Textron, Inc., Sr. Unscd. Notes | | 4.00 | | 3/15/2026 | | 500,000 | | 478,809 | |

Xylem, Inc., Sr. Unscd. Notes | | 4.38 | | 11/1/2046 | | 150,000 | | 107,780 | |

| | 3,756,568 | |

Information Technology - .7% | | | | | |

Adobe, Inc., Sr. Unscd. Notes | | 3.25 | | 2/1/2025 | | 250,000 | | 243,530 | |

Autodesk, Inc., Sr. Unscd. Notes | | 4.38 | | 6/15/2025 | | 250,000 | | 244,497 | |

Concentrix Corp., Sr. Unscd. Notes | | 6.85 | | 8/2/2033 | | 100,000 | | 90,379 | |

Electronic Arts, Inc., Sr. Unscd. Notes | | 1.85 | | 2/15/2031 | | 200,000 | a | 152,295 | |

Fiserv, Inc., Sr. Unscd. Notes | | 4.40 | | 7/1/2049 | | 100,000 | | 72,629 | |

Fiserv, Inc., Sr. Unscd. Notes | | 5.63 | | 8/21/2033 | | 100,000 | | 93,843 | |

Intuit, Inc., Sr. Unscd. Notes | | 5.13 | | 9/15/2028 | | 200,000 | a | 196,912 | |

Microsoft Corp., Sr. Unscd. Notes | | 2.53 | | 6/1/2050 | | 361,000 | | 206,844 | |

Microsoft Corp., Sr. Unscd. Notes | | 3.04 | | 3/17/2062 | | 360,000 | | 214,002 | |

Oracle Corp., Sr. Unscd. Notes | | 2.88 | | 3/25/2031 | | 205,000 | | 164,396 | |

Oracle Corp., Sr. Unscd. Notes | | 2.95 | | 4/1/2030 | | 150,000 | | 124,371 | |

Oracle Corp., Sr. Unscd. Notes | | 3.25 | | 11/15/2027 | | 250,000 | | 226,429 | |

Oracle Corp., Sr. Unscd. Notes | | 3.85 | | 7/15/2036 | | 250,000 | | 190,796 | |

Oracle Corp., Sr. Unscd. Notes | | 4.00 | | 11/15/2047 | | 160,000 | | 106,465 | |

Oracle Corp., Sr. Unscd. Notes | | 4.10 | | 3/25/2061 | | 210,000 | | 131,833 | |

Oracle Corp., Sr. Unscd. Notes | | 4.50 | | 5/6/2028 | | 100,000 | a | 94,658 | |