Table of Contents

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act 1934

Report on Form 6-K dated May 19, 2016

BRITISH TELECOMMUNICATIONS PLC

(Translation of registrant’s name into English)

BT Centre

81 Newgate Street

London EC1A 7AJ

England

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

Enclosure: British Telecommunications plc — Annual Report & Form 20-F 2016

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| British Telecommunications plc | ||

| By: | /s/ Heather Brierley | |

| Name: | Heather Brierley | |

| Title: | Secretary | |

Date: May 19, 2016

2

Table of Contents

Annual

Report &

Form 20-F

2016

As a wholly-owned subsidiary of BT Group plc, British Telecommunications plc meets the conditions set forth in General Instruction (I)(1)(a) and (b) of Form 10-K as applied to reports on Form 20-F and is therefore filing this Form 20-F with the reduced disclosure format.

Table of Contents

BT’s purpose is to use the power of communications to make a better world. It is one of the world’s leading providers of communications services and solutions, serving customers in 180 countries.

This is the BT plc Annual Report for the year ended 31 March 2016. It complies with UK regulations and comprises part of the Annual Report on Form 20-F for the US Securities and Exchange Commission to meet US regulations.

Please see the cautionary statement regarding forward-looking statements on page 142.

In this document, references to ‘BT’, ‘BT plc’, ‘the group’, ‘the company’, ‘we’ or ‘our’ are to British Telecommunications plc and its subsidiaries and lines of business, its internal service unit, or any of them as the context may require. References to ‘BT Group plc’ are to BT plc’s ultimate parent company.

A reference to a year expressed as 2015/16 is to the financial year ended 31 March 2016 and a reference to a year expressed as 2016 is to the calendar year. This convention applies similarly to any reference to a previous or subsequent year. References to ‘this year’, ‘the year’ and ‘the current year’ are to the financial year ended 31 March 2016. References to ‘last year’ and the ‘prior year’ are to the financial year ended 31 March 2015.

Table of Contents

| 2 | BT plc | |

Annual Report & Form 20-F 2016

| ||

| ||

British Telecommunications plc is the principal operating subsidiary of BT Group plc. We are a wholly owned subsidiary of BT Group plc. The BT Group plc Board has ultimate responsibility for the management of the group and the Operating Committee of BT Group plc is the key management committee. It monitors the group’s financial, operational and customer service performance and has cross-business oversight of BT’s lines of business. It also reviews the group’s key risks and considers the potential threats and opportunities to the business.

ThePurpose and strategy, Delivering our strategy, Our lines of business andGroup performance sections on pages 2 to 55 form theStrategic Report.

We present theaudited consolidated financial statements on pages 62 to 115 and 135 to 140.

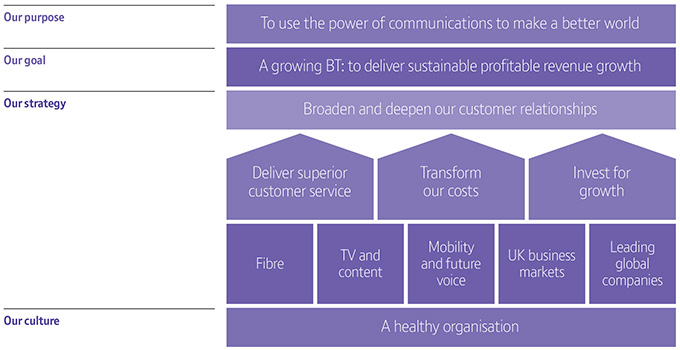

Our purpose is to use the power of communications to make a better world.

We’re here to meet the needs of our customers, delivering the experience, products and services that matter to them. Millions of individuals connect through us to their friends and family, and have huge amounts of information and entertainment at their fingertips. The smallest companies, right through to multinational corporations, use our services every day to conduct their business. Many public services rely on our technologies. And in the UK, most of the telecoms industry operates across our networks – we help more than 500 other communications providers to serve their customers.

Our success as a business depends on delivering value to all our customers. We try to think ahead, to anticipate what they want and to develop products, services and an overall experience that meet their needs, whether as individuals or as businesses.

Our services are vital to our customers and their communities. We look for ways of using and developing those services to deliver economic growth and wider societal benefits. To bring our purpose to life, we’ve set a number of challenging long-term ambitions that make a positive impact on the societies, communities and environment we operate in (page 18).

By creating value for our customers and society we grow our business and reward our shareholders for their investment in us.

Our goal is to deliver sustainable profitable revenue growth.

In previous years, we relied on cost transformation to offset declining revenues, so that we could grow our cash flows and the value of our business. This year, we grew our revenue, driven by the investments we have been making.

In the years ahead, we expect revenue growth, combined with continued transformation of our costs, to provide a platform for long-term and sustainable cash flow growth.

We’ll reinvest some of the cash we generate back into the business, to enable us to grow over the long term. A virtuous circle. And we’ll also use it to give back to our shareholders and other stakeholders.

Our strategy is founded on broadening and deepening our customer relationships.

The diagram below shows our strategy in the year and how it supports our goal and purpose. It sits at the centre of our business model.

For 2016/17 our strategy is evolving. The three pillars remain broadly the same but with a wider focus on the overall customer experience rather than just on customer service. And with our acquisition of EE our investment areas are more focused on having the best integrated network in the UK and being a fully converged service provider.

Table of Contents

| The Strategic Report | 3 | |

Purpose and strategy

| ||

| ||

To deliver sustainable profitable revenue growth, we need stronger relationships with our customers. That means making sure we stay relevant to them as markets, lifestyles and technologies change.

The three pillars of our strategy help us do that: delivering superior customer service; transforming our costs; and investing for growth. The better our customer service, the more we’ll sell and the less time and money we need to spend putting things right. And the better we manage our costs, the better value for money we can offer our customers and the more we can invest in giving customers what they need, today and tomorrow. These are the principles that drive our business model (page 6).

Deliver superior customer service

Every day we touch the lives of millions, providing services that help people get the most out of their working and personal lives. Our customers’ experience is affected by the quality, reliability and value of our products and services. And by how responsive we are when we need to provide new services or sort out problems. Their expectations continue to rise as our networks play an increasingly important role in their lives and businesses.

Getting the customer experience right, and improving the quality of our customer relationships, is at the heart of our strategy for growth. And also supports our drive for cost transformation.

Customer experience is one of the measures we use to set our executives’ annual bonus. It is made up of the Right First Time (RFT) metric and a customer perception measure. RFT is our key internal measure of customer service. It tracks how often we keep the promises we make to our customers.

How we did in the year

Our performance in the first quarter of the year was good. But in the second, third and fourth quarters, our service was impacted by electrical storms, system and network outages as well as 11 separate winter storms over a five-month period. The storms resulted in record levels of flooding and while we received much praise for our response, they had a significant impact on our service. We recovered well in the fourth quarter and ended the year with a positive upturn in our service measures. But we missed our RFT target for the year as a whole. Performance was down 3.0% against a 4.7% increase in the prior year.

We need to redouble our efforts into next year as we know that we need to do much better. We’re investing in jobs and we’re multiskilling our people to give us better flexibility and capacity.

In last year’s Annual Report we outlined a number of specific areas that we would focus on this year. We’ve made good progress against each of these, although we recognise that we need to do more.

Acting on insight | We’ve redesigned the way we launch new products to more clearly reflect customer feedback and insight.

BT Mobile was our first product launch in which customer experience was a specific design criteria from the outset. Our net promoter score is highest among consumers taking BT Mobile.

We’re rolling out this approach to other products under development.

| |||||

| Keeping our customers connected | We’ve invested more to help make our services more resilient. Our investment in proactive network maintenance is up by 22%, improving the fault profile of our network.

| |||||

| Creating great tools and systems | Our new ‘My BT’ app won a Digital Experience Award, and has been downloaded more than 435,000 times. 51% of users check the app monthly and 21% use it weekly. We’re updating it every quarter. Recent developments include allowing customers to pay their bills, monitor their broadband usage, find out about network issues, and view their orders and any faults.

In BT Wholesale we’ve invested significantly in our online capabilities including: improved search engines and navigation; personalised online order and fault management; and better online chat support.

| |||||

| Working better across our organisation | We’ve invested in broadening our contact centre agents’ skills and tools, letting them take greater ownership of customer issues and increasing the number of issues addressed in a single call.

Where we’ve introduced this, in relation to the provision of new connections, complaints are 50% lower and customer satisfaction is up more than 17%. We’re extending this model across all our contact centres.

| |||||

Supporting our people | We’re bringing our call centres back to the UK, with 60% of BT Consumer customer calls being answered within the UK by the end of the year. And we’re planning to extend that to more than 90% by the end of March 2017.

To do this we have hired more than 900 people in the UK and plan to hire a further 1,000 over the course of the year ahead.

EE is creating 600 new roles to support its plans to handle all customer service calls in the UK and Ireland by the end of 2016.

| |||||

Key priorities

Looking ahead, we’re focused on:

| • | investing further in our network, making it more resilient; |

| • | reducing the number of appointments missed by our engineers; |

| • | hiring more people into our contact centres; |

| • | investing more in our contact centre advisers, giving them the skills and tools to solve more customer issues; and |

| • | improving our online tools to make it easier for customers to serve themselves. |

Table of Contents

| 4 | BT plc | |

Annual Report & Form 20-F 2016

| ||

| ||

Transform our costs

Our approach to cost transformation

We run large and complex cost transformation programmes, led by a team of consultants. These consultants are BT people. They know our business better than anyone.

Our approach is based on a methodology honed over a decade. It’s underpinned by forensic data analysis, strong governance and the support of senior management.

Our largest cost transformation activities are driven ‘top-down’. They might be end-to-end programmes spanning multiple lines of business or complex changes contained within a single line of business. Continuous Improvement (CI) provides a complementary ‘bottom-up’ approach. CI makes small but important changes to how we do things every day. It has the added benefit of improving employee engagement.

Training is a key part of our approach. We have an in-house Cost Transformation Faculty, part of the BT Academy (page 7). The faculty is responsible for the continued development of our ‘change professionals’. This year we trained and coached more than 900 people. BT is the only UK organisation licensed by the British Quality Foundation to certify qualifications to the most advanced levels in Leana, Six Sigmab and Change & Project Management methodologies on such a scale.

How we did in the year

This year, our underlying operating costs excluding transit were up 2% mainly reflecting higher leaver costs and our investment in BT Sport Europe. These offset our cost transformation activities. Over the last seven years we’ve reduced our operating costs and capital expenditure by over £5bn.

Programmes this year included:

| • | reviewing and improving our end-to-end process for planning engineer visits. By creating centres of excellence where planners are based together, streamlining processes and improving systems, we’re reducing the cost of failure, eliminating inefficiencies and improving service; |

| • | developing a new operating model to govern how we serve the UK business market. By consolidating our sales and marketing teams, we’ll reduce administrative effort and duplication and focus our people on what really matters – selling to customers; |

| • | consolidating our IT functions to improve data security, system stability and to gain economies of scale. We’ve also made sure that our people have access to the right training programmes, career opportunities and are sharing best practice; |

| • | rationalising, standardising and automating our internal reporting function. We’ve also created a data analytics capability to improve decision-making and provide support on larger transformation programmes; |

| • | improving the efficiency and productivity of our off-shore shared service centres. In particular, we’re reducing the administrative resource required to operate these centres; and |

| • | reviewing and redesigning our overseas operations with the aim of ensuring that back-office functions are done from centres of excellence located in low-cost countries. We’ve also continued to apply best practice from our UK operations. |

Key priorities

Looking ahead, we’re focused on:

| • | realising substantial cost synergies from the integration of BT and EE; |

| • | streamlining our Ethernet delivery and broadband repair processes with the aim of improving customer experience and reducing cost; |

| • | reducing our network costs in the UK and overseas, which account for a large proportion of our overall costs; and |

| • | rationalising and standardising our products, networks, applications and platforms, to remove complexity and reduce cost. |

We’re confident that there are plenty of opportunities to reduce costs further. We see well over £1bn of gross opportunity over the next two years, much of which can be reinvested for growth. We continue to benchmark our cost of doing business against other large telecoms companies. While we’ve continued to improve our performance, we still see opportunity to do even better. Increasingly we look beyond the world of telecoms to other industries to identify more opportunities.

You can read about cost transformation within our lines of business from page 30. And the group’s operating costs are described on page 50.

| a | Lean is a methodology for achieving small, incremental changes in processes in order to eliminate waste and improve efficiency and quality. |

| b | Six Sigma is a data-driven methodology for eliminating defects in processes. |

Table of Contents

| The Strategic Report | 5 | |

Purpose and strategy

| ||

| ||

Invest for growth

We’re investing in five strategic areas. These are the things we believe will deliver sustainable profitable revenue growth – which will deliver value for our shareholders.

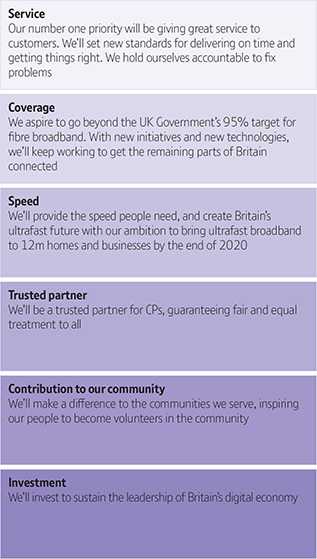

| Fibre | We’ve long been at the forefront of fibre innovation and investment and we aim to keep it that way. | |||||

| Our superfast fibre broadband network now reaches around 85% of the UK. With other networks, this takes availability to 90%. We plan to extend coverage even further, so that fibre availability goes beyond the UK Government’s current 95% target by the end of 2017. | ||||||

| We plan to start rolling out ultrafast broadband based on G.fast technology next year. Our new service is capable of delivering speeds of 300-500Mbps. We’re trialling the technology in a number of locations, including Huntingdon in Cambridgeshire and Gosforth in Tyne and Wear. With the right regulatory environment, the service will reach 10m homes and smaller businesses by the end of 2020 (with an ambition to get this to 12m), and the majority of premises within a decade. | ||||||

Our ultrafast ambitions also include rolling out significantly more fibre-to-the-premises (FTTP). We intend to build FTTP infrastructure in new housing developments in the UK. We’re also conducting trials to explore if FTTP can be installed faster and more efficiently in business parks and high streets. These trials – and feedback from industry – could lead to a new FTTP product being developed for SMEs with speeds of up to 1Gbps and strong service guarantees.

| ||||||

| TV and content | We’ve continued to improve our TV proposition: | |||||

| New sports channel– We launched BT Sport Europe, which is now the home of UEFA Champions League and UEFA Europa League football. We’ll show 350 matches each season for three years. | ||||||

| New services– We introduced a number of innovative services, including BT Sport Ultra HD – the first Ultra HD sports service in Europe. We launched BT Sport’s Connected Red Button service, which allows BT TV viewers to switch between matches and use a new ‘Goal Alert’ function to keep track of the action across a range of games. | ||||||

Richer content– We continued to add popular content and TV channels. We secured the exclusive rights to show the next Ashes cricket series. And we extended our rights to the FA Cup by another three years, to 2021.

Read more about these developments in the BT Consumer section from page 37.

| ||||||

| Mobility and future voice | We completed the acquisition of EE. We’re now the UK’s leading communications provider, bringing together the UK’s best 4G network with the UK’s largest fibre network. | |||||

| We want to transform the shape of communications by creating more innovative, converged products and services. We’ll address different parts of the consumer mobile market by using both the EE brand and the BT Mobile brand. | ||||||

We’re making progress towards our goal that by 2025 all our voice customers will be served using an IP voice solution, having migrated off our traditional telephony platform.

| ||||||

| UK business markets | We’ve continued to improve our product portfolio. We’re now better placed to meet the needs of our customers as they increasingly adopt IP and cloud-based services. | |||||

We’re reorganising our structure to take better advantage of the opportunities to grow our share of the UK business market. And to strengthen and deepen our relationships with UK customers. On 1 April 2016, we created a new line of business, ‘Business and Public Sector’. It will serve businesses – large and small – as well as the public sector in the UK and the Republic of Ireland.

| ||||||

| Leading global companies | We’re investing in our products, network and expertise to increase our share of spending by our large multinational customers (page 30). A particular area of focus is the ‘cloud’. We’re investing in new services that allow large organisations around the world to connect easily and securely to the applications and the data they need. We want to empower companies so they can integrate and orchestrate IT resources, irrespective of where they are hosted. | |||||

| New services launched this year included: | ||||||

• an extension of BT Cloud Connect to provide connectivity to HP Enterprise Helion Managed Cloud Services; | ||||||

• a cloud-based Distributed Denial of Service (DDoS) mitigation service; and | ||||||

• BT Assure Cyber Defence, an advanced security platform.

| ||||||

We want to build and sustain a culture that helps us respond quickly and effectively to changes in our markets. This is vital to the delivery of our strategy. We continue to make organisational changes with the aim of improving our culture and our ability to perform well. These changes centre on:

| • | unifying the organisation around a common set of values; |

| • | putting the customer first in everything we do; |

| • | developing a leadership style which helps to drive change and gives people the confidence to take responsibility; and |

| • | making BT an exciting place to work and a company our people are proud to work for. |

Table of Contents

| 6 | BT plc | |

Annual Report & Form 20-F 2016

| ||

| ||

This section explains how we deliver our strategy.

We describe our business model and the importance of our people, our physical assets and the research and development that we do. We report on the status of our brands and outline our relationships with our main stakeholders, including regulatory bodies. Finally we describe how we go about mitigating the principal risks and uncertainties that affect us.

We create value for shareholders by developing and selling services that are important to our customers and that benefit communities, the environment and society as a whole.

We invest to build and maintain communications networks in the UK and overseas; we develop products and services that run over those networks; and then we sell them to consumers, businesses and the public sector. By selling these services, we’re able to make a return on our investments. This means we can reinvest in the business to create value for our stakeholders over the short, medium and long term. A virtuous circle.

Who we are

We’re one of the world’s leading communications services companies.

Where we operate

We’re based in the UK but we have customers across 180 countries (see page 30).

Inputs

Our business model starts with the things that set us apart from our competitors. We have a strong combination of people, technology, networks and other physical assets. Our research and development activities support innovative new ways of doing things and advancements in our technology. And we have the financial strength to invest in these areas to stay ahead of the competition.

Then there are the relationships we have with our stakeholders such as our customers, and the natural resources we consume as part of doing business.

Outputs

The main output of our business is our portfolio of communications products and services. We make money by selling these in the UK and around the world through our customer-facing lines of business.

We sell through a range of channels including online, contact centres and account managers. And, following our acquisition of EE, the group now has 560 EE shops in the UK.

Our revenue is mostly subscription or contract-based. Individuals, households and SMEs pay for standalone or bundled services, typically on 12 to 24-month contracts. Large corporate and public-sector customers usually buy managed networked IT services on contracts spanning several years. Our wholesale customer contracts range from one month in length for regulated products, to five years or more for major managed services deals.

We invest in our people so they can do their jobs better and are more engaged. And we encourage them to volunteer to benefit the communities we serve. We also have a long history of innovation. It helps us offer new and improved products and services, find better ways of doing things and can generate valuable intellectual property for us. Finally, the waste and emissions produced by our

operations are considered to be outputs (more details of what we are doing to minimise these can be found on pages 16 and 17).

Outcomes

The financial outcome of what we do hinges on the performance of our lines of business. Together they contribute to the overall performance and key performance indicators (KPIs) of the group.

There’s much more to what we do than just making money. What we do matters. We help millions of people communicate, be entertained, do business and generally live their lives. We help our customers reduce their carbon footprint. And we contribute directly to communities and the health of the UK by providing jobs, working with suppliers and paying tax, and through our employees’ volunteering activities.

All of which contribute to the strength of our brands – which can influence whether a potential customer buys from us or one of our competitors.

Our approach

Our focus on delivering superior customer service, transforming our costs and investing for growth is central to what we do. They are key business activities. Better customer service means that we spend less time and money putting things right. These cost reductions, combined with savings from working more efficiently and the cash we generate from sales, mean we can invest in the future of our business.

Some investments, such as sports rights, have a lifespan of just a few years. Other investments, such as our fibre network, are much longer term and can have ‘pay-back’ periods stretching to more than ten years.

Delivering our strategy is as much about how we do things, as what we do. That’s why being a healthy organisation (see page 8) and living our corporate values (page 7) are so important to us. And that’s why our people are key to our success.

What sets us apart

We have a strong combination of people, technology, networks and other physical assets that set us apart from our competitors. Our research and development (R&D) activities are crucial to us – and to wider society. We have pioneered innovation in the telecoms arena, and our R&D supports new ways of doing things and advancements in our technology.

Importantly, we have the financial strength to invest in these areas to stay ahead of the competition.

A flexible and sustainable business model

Communications markets are dynamic and very competitive, particularly in the UK. There are risks and opportunities. Our Enterprise Risk Management framework (see page 19) helps us identify and mitigate the challenges and risks we face. And we do an annual materiality review to understand the societal and environmental issues that are important to our stakeholders.

We have a flexible and sustainable business model, enabling us to anticipate and respond to changes in our markets. It underpins our assessment of the future prospects of the group.

We see more and more demand for our products and services because they play such an integral role in modern life. We use ‘insight’ teams to make sure we stay in tune with market developments and customer expectations. And we use governance committees, such as the Design Council, to make sure we’re making the right investments. So we’re confident that we’ll be able to deliver value over the short, medium and long term.

Table of Contents

| The Strategic Report | 7 | |

Delivering our strategy

| ||

| ||

Design Council

|

The Design Council is a sub-committee of BT Group plc’s Operating Committee. It normally meets monthly. It is collectively responsible for aligning our capital investments in our networks, systems, platforms and products so that they are directed towards achieving our overall purpose and strategy, serve the needs of all of our customers and are delivered in a cost-effective manner.

|

We have the financial strength to make bold decisions and to invest in the things that set us apart.

Our goal is to deliver sustainable profitable revenue growth. Together with further transformation of our costs, we aim to grow our EBITDA and cash flow over the long term.

We have a prudent financial policy and strong governance over our decisions to make investments, manage our debt and grow our business, and over how we reward those who work for us and invest in us.

To build our business, we will continue to make bold decisions, and be prepared to make strategic investments.

At the same time as investing in our five strategic growth areas (see page 2), we intend to reduce our net debt (which increased after our acquisition of EE).

We’ll also continue to support the pension fund and to do so in a responsible way. And we’ll pay progressive dividends to our shareholders.

Our financial strategy has been consistent for a number of years, it is this approach gives us the financial flexibility to make long-term investments in the best interests of the company and our stakeholders; and also in the best interests of communities where we operate.

Our financial strength has underpinned the investments we’ve made in BT Sport in recent years, and which we’ll continue to make in the years ahead. And it meant that in January 2016 BT Group plc were able to complete the acquisition of EE, the leading mobile network operator in the UK.

It means we can invest over £3bn to help take fibre broadband to 95% of the country by the end of 2017, with plans to go even further. And with the right investment and regulatory environment, we’ll invest in ultrafast broadband to 10m premises (with an ambition of reaching 12m) by the end of 2020.

It also means we can support the business in other ways. For example, by making sure we continue to innovate and stay at the forefront of a rapidly-changing industry. And by investing in the training, development and support we give to our people.

Every day our people touch the lives of millions, providing products and services which are essential to the fabric of today’s society – underpinning everything from global trade and industry to economic growth and social infrastructure. They are at the heart of our ambition to deliver an excellent customer experience and sustainable profitable revenue growth.

Believing in what we do

A clear purpose guides everyone’s contribution in BT. By bringing together the best networks, technology and products and services for our customers, we use the power of communications to make a better world.

a Unless stated otherwise, figures in the Our people section exclude EE.

With EE joining the enlarged group, we’ve embraced the opportunity to combine the best of both cultures. Creating possibilities for employees is at the heart of this.

During the year we had five values to guide our people: Customer, Team, Honesty, Change and Pride. But we’re changing as a business so feel the time is right for a refreshed set of shared values. We asked our people what they thought. We asked our customers too – they said they want us to understand their needs, be easy to deal with and show we care. So from next year our values will be: Personal. Simple. Brilliant.

A global workforce

At 31 March 2016 we had 102,500 full-time equivalent (FTE) employees in 61 countries, with 81,400 of them based in the UK. This includes 12,800 who joined the group as part of EE.

We’re one of the largest employers in the UK, supporting its economy by providing jobs and income.

This year, excluding acquisitions, we recruited over 11,400 people, bringing fresh ideas and new approaches to help us innovate, learn and improve. Of these, more than 4,200 work in the UK.

We continued to transform our HR function, reviewing our systems, processes, policies and services. This has allowed us to simplify further the way we work and to improve the service our HR team offers our people.

As our business evolves to meet the needs of our customers, we adapt our organisation, redeploying people through the BT transition centre. This helps us avoid redundancies. Last year in the UK, 1,000 people were redeployed, meaning that we retained experienced people with the skills we need for the future.

Recruiting talented people

A customer-connected workforce

Improving the quality of our customer relationships is at the heart of our people strategy.

We’ve built on previous years, recruiting 900 new field engineers and more than 900 new people to work in customer-facing roles – in our UK contact centres. We’ve also converted 600 agency workers to permanent employees, so that we keep their skills and experience in the organisation.

Highest-ever graduate intake

In 2015/16 we hired 300 graduates globally, our highest intake to date, bringing us up to around 500 graduates in total. We’re planning on hiring around 300 again in 2016/17.

We were again in the top half of The Times Top 100 Graduate Employers. We’re one of only four companies in the IT and telecoms sector to feature in the top 100.

Hiring more apprentices

We hired 550 new apprentices into eight business operations learning a range of skills. Demand for apprentices continues to grow so we expect to hire even more next year.

Investing for growth

Learning matters at BT. We create meaningful roles so that people understand what they are responsible for. We also invest in learning and development to allow our people to build skills and careers to deliver successfully for our customers. The BT Academy helps them do this.

The Academy is not a physical place or building; it’s a combination of materials, events and activities. It gives people easy access to the knowledge and skills they need, when they need it, changing the

Table of Contents

| 8 | BT plc | |

Annual Report & Form 20-F 2016

| ||

| ||

way they learn and develop. It is organised across four ‘faculties’: Leadership, Technical, Customer and Business.

Each faculty supports a number of communities we call ‘professions’, providing both structured learning and ways to connect and share with others.

We’re very pleased with how the Academy has done in its first full year. Across the world employees used the Academy website over 400,000 times. Over 20% of our people each month are now sharing information and ideas as well as accessing learning materials online.

The tools we’ve developed have won awards – gold for Internal Learning Solution of the Year at the Learning and Performance Institute Annual Learning Awards 2016, and silver for Best Use of Technology in Learning at the Training Journal Awards 2015.

This year has seen many success stories culminating in the National Apprenticeship Finals in January 2016 where we had two finalists. We also won the Scottish SDS Macro Apprentice Employer Of The Year Award.

Preparing young people for employment

With growing demand for digital skills in the UK, we feel well-placed to help create a future supply of suitably-skilled people, helping both our own business and the national economy, and creating a brighter future for the country’s youth.

Creating a culture of tech literacy

We’ve made a long-term commitment to help build a culture of tech literacy. As our first goal we want to help 5m children by the end of 2020.

We are doing this by:

| • | Inspiring Kids to connect with exciting and relevant tech concepts; |

| • | Enabling Teachers to feel confident to show young people the way; and |

| • | Equipping Schools to be able to use technology effectively. |

We’re working with our partners – the British Computer Society and the National Schools Partnership – to deliver the Barefoot Computing Programme, which helps primary school teachers across the country deliver the new computing curriculum. Over the 2014/15 school year we supported 12,500 teachers, helping to give around 340,000 children better teaching in computer science. We’re on track to reach a further 15,000 teachers and 400,000 children by the end of the 2015/16 school year.

Getting young people ‘Work Ready’

We’re a founding partner of Movement to Work, a voluntary collaboration of UK employers committed to tackling youth unemployment. Our Work Ready programme helps 16–24 year-olds get better prepared for work, building both confidence and their core employability skills. This often supports people from disadvantaged backgrounds.

Our traineeship programme is at the heart of our strategy. Those not currently in education, employment or training can join BT for seven weeks of skills development and work experience. So far over 1,000 young people have taken part in this initiative, with more than 600 gaining recognised certificates in work skills and business administration. Many go on to get jobs, either in BT or elsewhere.

The Prince’s Trust

BT is part of The Prince’s Trust Technology Leadership Group, which helps thousands of young people turn their lives around each year. We’ve donated use of the BT Tower as a venue for the Trust’s

annual ICT Leaders Dinner for the last ten years – raising £96,000 in 2015.

Engaging our people

We continue to focus on the health of our organisation. From the rapid expansion of our Academy, through to the business initiatives that are driving ‘Continuous Improvement’ across BT, we are investing in a culture of strong employee engagement.

This also benefits our customers. We believe that highly-engaged employees provide the best experience for customers, helping us to broaden and deepen our relationship with them.

Twice a year more than 72,000 people provide feedback on working for BT through our employee engagement survey. Our surveys help us develop a focused people strategy and support action planning at a local level. Engagement levels have remained stable for the last two years at 3.8 (out of a maximum of 5, with a telecoms benchmark of 3.95).

We keep our people informed about company results, major business decisions and other things that affect them using a variety of digital channels. Leaders regularly connect with their teams through roundtable meetings, town hall debates, site visits, webcasts and blogs.

We consult with our people or their representatives on a regular basis, taking their views into account on decisions that affect them. In the UK we recognise two main trade unions. The Communication Workers Union represents people in engineering, administration and clerical positions. Prospect represents managerial and professional people.

Diversity at work

Diversity is part of our heritage – as far back as 1880 Henry Fawcett, who was blind, was appointed Postmaster General.

Improving the mix of our people remains a priority and, in particular, we’re encouraging more women to take up a career in technology. We’re proud of our Tech Literacy programmes and events like the BT Young Scientist and Technology exhibition that target young women in education. We’ve run recruitment campaigns in Openreach to attract more women into engineering and redesigned our entry schemes to try to get rid of any unconscious bias.

19,000 women now work for us – many with flexible contracts. That’s 21% of our workforce and more than 11,000 women in our management team (corresponding to 26%). At BT Group plc Board level we aim to have at least 25% female representation on our Board, and it currently sits at 27% (three out of 11 Board members). Our maternity return rate, measured one year after women come back, is 86%, well above the industry average.

Gender is only part of the story. Our aim is to create an inclusive culture that values all differences in people. Research shows that diverse teams are more innovative and can deliver a better experience to an equally diverse customer base.

This year we’ve focused on Inclusive Leadership training for senior management teams, specific programmes around working patterns and promoting our#bettertogether culture. The Race at Work report we sponsored with Business in the Community will set the direction for development programmes for our employees from black and minority ethnic backgrounds.

We are a ‘Two Ticks’a employer and we actively encourage the recruitment, development and retention of disabled people. We’ll automatically put an applicant with a disability or long-term health condition, who meets the minimum criteria for a vacancy, through

a Two Ticks is an accreditation that is given to organisations that are committed to employing disabled people.

Table of Contents

| The Strategic Report | 9 | |

Delivering our strategy

| ||

| ||

to the first stage of the recruitment process. We’re making progress on improving diversity but we recognise that there is a lot more we need to do.

Staying safe and well

We’re committed to having no avoidable health and safety incidents. The 11% reduction in the rate of lost time due to injury brings us to our lowest-ever level. However, some of our activities are inherently hazardous and the risks, particularly in external engineering, remain challenging to manage. We’ve accepted some localised and historic failures raised by the Health and Safety Executive. We’ve done a lot to mitigate the risks highlighted and we still compare well with industry benchmarks.

We haven’t done as well as we wanted on some indicators. Our sickness absence rate has risen by 5%, driven mainly by increasing levels of musculoskeletal and mental health conditions. We’ve measured our people’s sense of wellbeing for some time and the long-term improvements we’ve seen have continued this year with an increase of 0.5%. The pattern of sickness absence and wellbeing varies across the group and is strongly linked to the level of change taking place within a particular business area. We see the best results where changes have been well managed with a style that takes account of people’s perceptions. We’re sharing best practice on managing change across the lines of business and through the Academy.

We continue to focus on early intervention when people are sick or injured. Our company-funded schemes helped get 91% of people treated back into their role on full duties.

Volunteering

Our people can use up to three working days a year on volunteering activities. As well as having a positive impact on society, our employee engagement survey (see page 8) shows higher engagement levels from those who volunteer than from those who don’t.

Some people choose to help charities with particular issues needing their expert input and knowledge. Others use their energy and enthusiasm to make a practical difference in their local communities. That includes helping our tech literacy programme and promoting traineeships.

This year over 27% of our people spent nearly 45,000 days volunteering their time to support charities and community groups around the world. BT volunteers were involved in raising £8.5m for Children In Need and £2.9m for Sport Relief.

The EE business shares our passion for making a difference. It supports several charities through volunteering such as ‘Apps for Good’, in which young people use new technologies to design and make products that can make a difference to their world, gaining confidence and skills at the same time. Our combined contributions will benefit good causes in the years ahead.

Pay and benefits

We compare pay and benefits for our people with companies of similar size and complexity to ensure our remuneration is competitive. We make sure that our salaries meet or exceed the national minimum wage.

In the UK, most of our engineering and support people are paid on terms and conditions negotiated through collective bargaining with our recognised trade unions, ensuring fair terms and conditions for all. Our managers’ pay and any bonuses are determined by a combination of business performance and their personal contribution to the company.

Our executives may also receive long-term awards to reward the creation of shareholder value. The amount they ultimately receive is determined by the group’s performance over a three-year period. Directors must retain incentive shares for a further two-year period.

In line with our regulatory obligations, incentives for people in Openreach are tied solely to a combination of personal contribution and Openreach’s performance, rather than that of the wider group.

We support our people by providing a range of retirement savings plans. In the UK, our main defined benefit scheme is the BT Pension Scheme and our defined contribution scheme is the BT Retirement Saving Scheme. You can read more about these on page 54.

Sharing in success

Almost 60% of our people take part in one or more of BT’s savings-related share option plans (saveshare), which operate in over 25 countries. In August 2015, almost 13,000 people in our 2010 saveshare plan were able to buy shares at 104p, representing an average gain of around £10,000 each.

OUR NETWORKS AND PHYSICAL ASSETS

Our networks, platforms and IT systems are the foundations of the products our customers rely on around the world.

Network platforms

Our global reach

Our global network provides service to 180 countries and is supported by in-country networks and infrastructure. Most of our network assets are in the UK and Continental Europe. We continue to selectively expand the reach of our network to support multinational companies in other regions. And we use the expertise we gain from protecting BT’s own networks to help secure our customers’ networks.

The scale and reach of our global multi-protocol label switching (MPLS) network is a key competitive differentiator. This single IP-based network lets our customer-facing lines of business launch products and services quickly and cost-effectively, without having to invest in dedicated infrastructure for each product.

To help our multinational customers connect their sites we offer virtual private network (VPN) services, which are integral to our ‘Cloud of Clouds’ vision. VPNs provide the convenience and security of a private network, but over the public internet. We use our MPLS network together with a combination of owned and leased fibre connections to connect our points of presence (PoPs) around the world. For the final connection into the customers’ premises, we either use our own circuits, or rent connections from telecoms operators in that country. We also have an extensive satellite network which provides customers with connectivity around the world, including remote locations.

In-country networks

We have extensive networks in the UK, as well as in Germany, Italy, the Netherlands, the Republic of Ireland and Spain.

Our UK fixed-line network is one of our most valuable assets and our investment in fibre broadband is key to delivering modern, superfast services to UK consumers. To meet the demand from businesses, we’re continuing to expand the availability of Ethernet. And when our customers are away from their home or office, they can use one of more than 5.6m BT Wi-fi hotspots.

Our research shows that over the last five years, at peak times, data traffic in the core network has grown by around 50% a year, and we expect growth to continue at this rate. So we’re making sure that our core and access networks can cope with that demand.

Table of Contents

| 10 | BT plc | |

Annual Report & Form 20-F 2016

| ||

| ||

As a result of buying EE, we now own the UK’s largest mobile network. We’ll continue to invest in its coverage and capability, to consolidate its position as the biggest and fastest in the UK. At the end of March 2016 outdoor coverage of the UK population was:

| • | 2G over 99% |

| • | 3G over 98% |

| • | 4G over 96% |

We also want to expand 4G geographic coverage. This stands at 60% today and we plan to get this to 95% by 2020 with an ambition to go even further.

Between BT and EE, we have a combined 120MHz of paired mobile spectrum. This means we are able to offer speeds of up to 90Mbps in areas served by our 4G+ network.

We have access to over 18,500 basestation sites, via the Mobile Broadband Network Limited (MBNL) joint agreement between EE and Hutchison 3G UK (see page 140).

Progress this year

This year we’ve:

| • | installed new, more cost-effective MPS network routers in all 106 core exchanges in the UK; |

| • | installed new Ethernet switches into 169 exchanges, so even more businesses will have access to BT Ethernet services; |

| • | continued to roll out the latest technology, such as content caching; so we can use network capacity better and speed up the delivery of TV and Internet content; and |

| • | integrated the technology to allow BT Global Services to offer a software-defined WAN service. This lets enterprise customers use different types of network together, and provide various services to their users seamlessly, as if over just one network. |

Service platforms

We run a number of service platforms that combine our network and IT resources to underpin many of the key products we offer.

One such platform is BT Conferencing, which provides audio and video conferencing services to customers around the world. Our audio conferencing service is called BT MeetMe and is available with Dolby Voice for higher quality sound and a better user experience.

Our BT TV platform supports a growing number of customers and we’re increasing the range of services it delivers. We designed, developed and tested the new BT Ultra High Definition set-top box. We also launched our BT Sport app. It provides BT customers with functionality like goal replays, different camera angles and extra facts – all to enhance the viewing experience.

IT systems

Our IT systems enable us to manage our processes, handle customer information and deliver our products and services. They’re critical to serving our customers and running our business.

For example, our customer management systems hold customer and billing information. They include the technology that works with our online customer portals. And the technology used when customers call a contact centre.

This year we’ve:

| • | delivered an integrated set of applications that we call Consumer. com. It is part of our focus on broadening and deepening our customer relationships. It means we have a much easier way for our customers and contact centre agents to manage customer accounts, and track orders and fault management. It has resulted in around 10,000 fewer calls to our contact centres each week; |

| • | introduced ‘View My Engineer’ to help reduce missed appointments. A customer can use it to check details of scheduled engineer visits. It provides engineer contact details, indicates when the engineer is travelling to the appointment, when the work has been started and when the work has been done; and |

| • | continued to innovate in our data centres – improving their performance and removing older server technology. For example this year we started to roll out storage virtualisation which helps us store data more efficiently. |

Properties

We have around 7,000 properties in the UK and 1,730 across the rest of the world. The number of properties in the UK is higher than the 6,350 we had last year, mainly reflecting our acquisition of EE in January 2016. Through this, we’ve added 635 properties, of which around 560 are EE shops. There are also around 40 former shops EE is in the process of disposing of.

We lease the majority of our UK properties from Telereal Trillium, part of the William Pears group. We signed a sale and leaseback arrangement with them in 2001. 88% of our UK properties are operational sites housing fixed and mobile telecoms and broadband equipment. The rest are retail outlets, offices, contact centres, depots and data centres. We also have our BT Sport TV studios in London.

In the UK, we’ve been consolidating and disposing of surplus office space for several years and we’re working on further opportunities to streamline our real estate. We continue to reduce the size of the operational estate as new fibre-based technologies mean we can dispose of buildings and make energy savings. This year we brought our property management activities back into BT from Telereal Trillium. This will reduce costs by simplifying how we manage our UK property portfolio.

Outside the UK, our offices in Gurgaon, Kolkata and Bengaluru in India are now home to our Central Business Services organisation. This provides support to our lines of business. As part of our strategy of investing in high-growth regions, we’ve expanded our offices in Budapest and Debrecen in Hungary – so we can support our global customers more effectively and efficiently.

Table of Contents

| The Strategic Report | 11 | |

Delivering our strategy

| ||

| ||

We invest in research and development (R&D) as we believe commercial success is ever more dependent on it. Our long history of innovation combines scientific breakthrough, practical engineering and commercial purpose. We call this ‘purposeful innovation’.

Innovation heritage

Our origins can be traced back to an entrepreneurial fusion of business and innovation. In 1837 Sir William Fothergill Cooke (a businessman) and Sir Charles Wheatstone (an academic) filed a patent for the world’s first practical electric telegraph. This led to the founding of the Electric Telegraph Company in 1846, the seed company that eventually led to the formation of BT.

We’ve pioneered many of the technologies that we and customers now rely on. For example, in 1926 we established the world’s first two-way, trans-Atlantic conversation by radio telephone, from our wireless station near Rugby. And in 1943 Tommy Flowers, working in the telecoms division of the GPO, developed the world’s first programmable electronic computer, Colossus. In 1968, we installed the world’s first digital telephone exchange. We laid the world’s first, purpose-designed optical fibre submarine cable in Loch Fyne in 1980. And in 1984, we installed the world’s first 140Mbps commercial single-mode optical fibre link. Our global IP Exchange platform (GIPX) was the result of one of our research projects. And more recently, we’ve led the industry in setting out our vision for widescale deployment of ultrafast broadband.

We sponsor the Information Age gallery at the Science Museum where many of our historical innovations can be seen, including parts from Colossus.

This year we invested around £470m (2014/15: around £500m) in research and development. Over the years we’ve been one of the largest investors in R&D of any company in the UK, and globally in the telecoms sectora.

We’ve continued to grow the number of inventions we produce from our research activities. In 2015/16 we filed patent applications for 97 inventions (2014/15: 93).

We routinely seek patent protection in different countries and at 31 March 2016 had a worldwide portfolio of around 4,700 patents and applications.

Open innovation

We bring together expertise and resources (both our own and third-party) at our eight global development centres. Adastral Park in the UK is our technology headquarters. It’s an innovation campus which we share with around 70 high-tech companies, and is the workplace for around 3,700 people. This year we continued to grow our development centres in Kuala Lumpur and Bengaluru.

We’re keen to work with people outside BT. We have extensive, long-standing, joint-research programmes with Cambridge University (UK), Massachusetts Institute of Technology (US), Tsinghua University (China), Khalifa University (UAE) and over 30 other universities globally.

Our people help us innovate. This year our internal New Ideas Scheme had more than 1,700 submissions. It’s helping us provide a better service to our customers.

We run innovation showcases where business customers can discuss applications and solutions with our experts, and work with them on solving problems.

a Comparison based on total R&D spend over 2005/06 to 2014/15. Source: EU Industrial R&D Investment Scoreboard, http://iri.jrc.ec.europa.eu/scoreboard.html

Under our communications programme, ‘Ingenious’ we’re sharing BT’s innovation story with thought leaders, governments, and the media.

Examples of our research activities this year include:

G.fast speed improvements

We’ve been driving the standards for a new transmission system at the heart of our ultrafast broadband vision. This means we should be able to deploy ultrafast broadband far more quickly than previously thought possible.

XG-FAST trial

Working with Bell Labs, we’ve demonstrated speeds of 5.6Gbps over 35 metres of copper cable in lab conditions. This proves it’s possible to achieve very high broadband speeds over existing infrastructure.

Long-reach VDSL

We have shown in the lab that we can take a 2km long copper line currently achieving 9Mbps with standard VDSL, and increase this to 24Mbps and beyond.

Future-proofing exchange operations

We’ve been improving the tools that our exchange-based engineering teams use for planning their work. We use artificial intelligence and mathematical modelling to better forecast, plan and schedule where people and equipment will be needed.

Quantum communications

We’re also leading the world in demonstrating how quantum physics and optical engineering are on the cusp of providing much improved security for optical fibre systems. We’ve shown how a 200Gbps stream of encrypted data can be transmitted on the same 100km network link as a quantum encryption key. This work could offer enhanced security for the data networks of the future.

We own three strong brands: BT, EE and Plusnet. These are at the heart of our efforts to broaden and deepen our customer relationships. The experience our customers have is shaped not just by the service our front-line teams provide, but by everything we do: from the products and propositions we design, to the way we communicate with customers.

The BT brand continues to go from strength to strength. Brand Finance has valued it at $18.4bn, 14% more than a year ago. According to their analysis, BT is the 60th most valuable brand in the world and the third most valuable brand in the UK.

In March 2015, we re-entered the UK consumer mobile market, under the BT brand. In January 2016 we took ownership of the EE brand. Since its launch in 2012, the EE brand has achieved impressive results in terms of awareness and positive associations.

The Plusnet brand continues to offer a distinctive positioning of brilliant service at a great price. We’ll continue to run all three of our brands in the UK consumer market, offering products that meet different customer needs.

We continue to innovate for our customers, further building the strength and breadth of our brands. For example:

| • | In August, we added to our BT Sport offering, showing exclusive UEFA Champions League and UEFA Europa League games. We enhanced this with the launch of Europe’s first live ultra-HD sports TV channel. |

| • | We also embarked on a multi-year strategic technology partnership with the Williams Martini Racing Formula One team. We’re providing the team with innovative communications |

Table of Contents

| 12 | BT plc | |

Annual Report & Form 20-F 2016

| ||

| ||

technology to help improve car performance with instant access to real-time data. Our collaboration is already helping Williams to work better – connecting race tracks around the world with their headquarters in Oxfordshire. |

Using partnerships to raise awareness

Partnerships continue to be an important part of the way we build our reputation and show our support for good causes. For example we:

| • | launched our BT Sport Infinity Lab competition to find start-ups and entrepreneurs with innovative digital media and production solutions; |

| • | agreed multi-year sponsorship of the Institution of Engineering and Technology’s new Diamond Jubilee Scholarship Programme; |

| • | have continued to develop our Connecting Africa programme (see below); and |

| • | continued to support good causes including Children in Need in November 2015 and Sport Relief in March 2016 (see page 9). |

STAKEHOLDERS AND RELATIONSHIPS

As well as our people, our main stakeholders are: our customers; communities; BT Group plc’s shareholders; lenders; our pension schemes; suppliers; government; and regulatory authorities.

Our markets and customers

We sell fixed-voice, broadband, mobile and TV products and services to individuals and households in the UK. For small and medium-sized enterprises, as well as larger businesses in the UK, we offer fixed-voice, broadband, mobility, networking and IT services. In both the UK and globally we offer managed networked IT services to multinational corporations, domestic businesses and public sector organisations.

Some of our customers are also our competitors. This is because we sell wholesale products and services to other communications providers in the UK and overseas.

You can read about our markets, customers and the services we provide them in our lines of business section from page 36.

Communities and societya

BT’s purpose is embedded at the heart of our business, and has helped us to deliver economic growth and wider societal and environmental benefits. During the year we invested £35m to accelerate a number of environmental (see page 16) and societal priorities that help to bring our purpose to life. This investment is a mixture of cash, time volunteered, and in-kind contributions. It is equivalent to 1.1% of our previous year’s adjusted profit before tax. Over the last five years we’ve invested over £153m, an average of 1.18% of our adjusted profit before tax.

Creating a connected society

This year, we extended our fibre footprint in the UK to more than 25m premises and – in line with our 2020 goal – this means around 8.5 out of 10 people can now access fibre-based products and services (see page 45). We plan to extend coverage even further so that fibre availability in the UK exceeds the Government’s current target of 95% by the end of 2017.

We continue to push for greater digital inclusion, both by playing a leading role in the development of the Government’s Digital Inclusion Outcomes Framework, and through the use of our own products.

| a | Data excludes EE. |

We’re helping low income groups to get online with two products: BT Basic + Broadband and our BT Business Digital Inclusion for Social Housing solution. The launch of the ‘BT and Barclays Wi-Fi in Our Community’ initiative is providing access, guidance and coaching to those who need it most.

Keeping people safe online remains a priority. Internet Matters, the website we co-founded in 2014 to help parents keep their children safe online, has now had over 2.5m visitors. The Right Click, our partnership with UNICEF UK, has seen BT volunteers deliver 280 workshops in schools, teaching children and their parents how to use the internet safely.

This year we’ve developed a methodology to measure the social impact of our products and services. This has been successfully piloted on three propositions (BT Basic, Digital Inclusion for Social Housing and Mobile Health Worker) and it has been used on a corporate contract through our work with the Colombian government (page 32). Having a way to measure the wider benefits our products and services can bring shows how valuable ICT, and what we do, has become in people’s day-to-day lives. We can also use the methodology to influence how we develop our future products.

Outside the UK, our Connecting Africa programme has now successfully connected all 30 of the planned SOS Children’s Villages, in 13 countries, using BT’s satellite technology. We have used this in seven villages to provide a new Healthcare Management System, improving healthcare services for over 100,000 people.

We also continue to embed social and environmental criteria into our business processes, helping us to make better decisions, stimulate growth and spark innovation. In January we launched a BT Infinity Lab competition, in partnership with the Department of Transport, to stimulate social and environmental innovation in the SME sector.

Supporting charities and communities

This year we added £94m towards our £1bn target. £60m of this was raised via MyDonate, our commission-free online fundraising and donations platform. This takes our overall fundraising total to £327m.

As well as supporting a number of smaller charities and individual fundraisers, we again used MyDonate and our communications technology – with help from our volunteers – to support various large telethons (page 9). These included Comic Relief, Children in Need, and the Disasters Emergency Committee appeal after the earthquake in Nepal.

In the UK, we provide discounted calls and line rental charges to members of The Charities Club, saving those charities £1.2m on their phone bills.

We see sport as a positive vehicle for change in young people’s lives. Through the donations of BT Sport customers, The Supporters Club funded nine new sports charities and community sports foundations this year (four in the UK). And we encourage people to take up sport through the Join In campaign.

BT Group plc’s shareholders

BT Group plc has around 825,000 shareholders. As well as the Annual Report and Annual General Meeting, BT Group plc keeps its shareholders up to date with how we’re doing through regular mailings. These often include offers on our products and services that are only available to shareholders. Our website includes press releases, newsletters, presentations and webcasts that can also keep our shareholders informed.

Table of Contents

| The Strategic Report | 13 | |

Delivering our strategy

| ||

| ||

BT Group plc held a general meeting in April 2015 at which shareholders approved the acquisition of EE. And in January 2016 BT Group plc published a prospectus for the issue of new BT Group plc shares that were part of the consideration for the acquisition.

Most of BT Group plc shares are held by institutional investors. There is an extensive investor relations programme aimed at keeping existing investors informed and attracting new ones. This programme includes:

| • | reporting quarterly results, accompanied by a conference call or presentation from senior management; |

| • | ‘teach-ins’ on key topics; |

| • | site visits (for example this year we invited investors to an innovation event at Adastral Park); and |

| • | meetings and conference calls with investors both in the UK and around the world. |

In 2015/16, BT Group plc held 353 meetings or events with institutional investors. This compares with 369 in 2014/15.

We were voted the best company for investor relations in England in the Extel Survey 2015, for the second year running. We also maintained our second place in the European telecoms sector. And we won the IR Magazine award for best investor relations in the European Technology & Communications sector.

Our lenders

Our lenders, mainly banking institutions and bond holders, play an important role in our treasury and funding strategy.

These relationships are vital for funding the business and meeting our liquidity requirements. We tell you more about this on page 54.

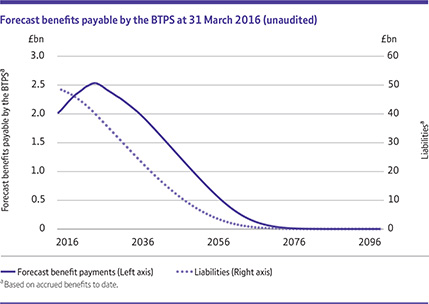

Our pension schemes

We operate defined benefit and defined contribution pension schemes. The largest is the BT Pension Scheme (BTPS) which has 301,500 members. You can read more about it on page 54.

Our suppliers

Our suppliers play a vital role; their products and services help us deliver our strategy. We source from across the world and currently have suppliers in over 150 countries. We spent around £10.2bn with our suppliers this year (2014/15: £9.4bn). Around 64% of our spend is with the top 100 suppliers.

We want to get the most from our suppliers – especially from their diversity, skills and innovation. The mix of suppliers keeps evolving as we expand into markets such as mobility, TV and televised sport. This year we’ve grown our supplier base in IT security, to support our growing investment in cyber security. But we’ve also removed over 2,800 suppliers from our procurement systems.

As part of integrating EE, we’re working to identify opportunities for cost savings and efficiencies through our combined spend.

Our approach to procurement

We have around 330 BT people in 30 countries working with suppliers. As part of our cost transformation activities we’ve concentrated on making the most of our relationships with our largest suppliers to get even better value. In-life contract management of our top 130 suppliers has delivered savings of around £18m.

We’ve continued our Purchase Order (PO) Intercept programme, reviewing all POs over £1,000 to make sure that we’re getting the best from our spend across BT. Our Central Business Services organisation has hired more people to support this programme. They’ve reviewed around 90,000 POs, accounting for £4bn of spend, and have saved us more than £15m.

The Procurement Profession, part of the BT Academy, has grown this year, developing a rich library of over 120 training modules. The website attracts more than 250 visits a month on average.

Our ambition is to have all our buyers accredited and licensed. And for a few of our expert practitioners to be recognised externally as fellows of CIPS (Chartered Institute of Procurement and Supply).

We now have 198 licensed buyers. And there are now five fellows of CIPS (2014/15: two) leading our procurement activities in BT.

Choosing our suppliers

We want to know who we’re doing business with and who is acting on our behalf. So we:

| • | choose suppliers using principles that make sure both we and the supplier act ethically and responsibly; |

| • | check that the goods and services we buy are made, delivered and disposed of in a socially and environmentally responsible way; and |

| • | measure things like suppliers’ energy use, environmental impact and labour standards, and work with them to improve these. |

Ethical standards in our supply chain

We want our suppliers’ employees to experience working conditions that are safe and fair. We send all but our lowest-risk suppliers an ethical standards questionnaire. Based on their responses, we follow up with any suppliers identified as high or medium risk. This year we met our target to achieve 100% follow-up action within three months. We also visit supplier sites to make sure they meet our standards. This year we visited 47 sites around the world, the same as last year.

To comply with the Dodd-Frank Act and our Securities and Exchange Commission (SEC) obligations, we repeated our annual research asking our BT product suppliers whether their products contain certain minerals which may have been sourced from conflict areas such as the Democratic Republic of the Congo. As a result we have a better understanding of our suppliers’ own supply chains but we’re not yet at the point where we can declare an individual product to be entirely conflict mineral free.

In June 2015 we filed with the SEC our 2014 report describing our conflict minerals approach and reflecting the supplier responses we received. We will file the report for 2015 in May 2016.

The Modern Slavery Act, which came into effect in 2015, has meant that we’re reviewing the processes we use with our suppliers to address human rights risks in our supply chain.

Paying our suppliers

This year the average number of days between invoice date and supplier payment was 62 days globally (2014/15: 60 days), with 54 days for UK invoices.

Suppliers can choose to use the BT Supplier Finance scheme which offers contracted suppliers the chance to be paid early. This reduces their financing costs. We introduced it in September 2013 and it’s now one of the largest supplier finance schemes in the UK, supporting over £1.4bn of spend. EE also operates a supplier finance scheme.

These schemes are attractive for SMEs (who make up around 40% of our supply base). It also supports UK government initiatives to encourage small business growth.

We also follow the principles of the Better Payment Practice Code set up by the Government in partnership with business organisations.

Table of Contents

| 14 | BT plc | |

Annual Report & Form 20-F 2016

| ||

| ||

Human rights

The human rights of our employees, people working in our supply chain, our customers and members of the communities where we operate could be affected by the way we do business. We think about what these effects could be and try to positively impact the experience and approach for those we work with. We also consider how we can remove or reduce potential negative impacts in accordance with the UN Guiding Principles for Business and Human Rights (UNGPs).

It’s important that everyone in BT, and everyone who works with us, understands our commitment to the UNGPs. That’s why we commit to them in The Way We Work, our statement of business practice.

We have other policies to address specific issues which might affect human rights, such as: supply chain standards; diversity and inclusion; and safety and wellbeing in the workplace.

We’re in the process of drawing together our approach into one overarching human rights policy so that anyone can easily access our principles and understand how we put them into practice.

As we’re a communications provider, the rights to privacy and freedom of expression are the human rights which could be most at risk from our operations:

| • | Privacy – because we must comply with laws on investigatory powers. These allow governments, in certain situations, to request information about how people use our services and the content of their communications. |

| • | Freedom of expression – because although we don’t host much online content ourselves, we do help people get online. So if we block content (which we do in very limited circumstances), that could clearly affect people’s rights to express their views and receive information. |

We support and respect people’s rights to privacy and free expression, though we accept that sometimes there may need to be limitations on those rights, as international human rights standards allow. Any limitations should be within clear legal frameworks with the right checks and balances. In December 2015 we published our Privacy and Free Expression in UK Communications report which explains our approach to this in more detail.

Our Human Rights Steering Group, which is chaired by a member of the BT Group plc Operating Committee, meets quarterly. This year it considered a broad range of issues, including:

| • | our approach to an overarching human rights policy; |

| • | our due diligence processes when it comes to winning business; |

| • | the Modern Slavery Act 2015; |

| • | our supply chain; and |

| • | specific human rights issues arising from day-to-day business. |

We’re developing an enhanced human rights due diligence tool for our global sales team. We’ve also undertaken detailed human rights impact assessments on a number of potential business opportunities. As a result, we took a range of mitigating steps such as including detailed contractual provisions, integrating human rights considerations into customer training and ongoing project monitoring. We’ve also turned down business opportunities on the basis of human rights concerns.

Our relationship with HM Government

We are one of the largest suppliers of networked IT services to the UK public sector. We work with more than 1,400 organisations across central, local and devolved government, healthcare, police and defence to provide some of the UK’s most vital services.

For example:

| • | We run N3, the National Health Service’s secure national network. |

| • | We provide telecoms services to the Ministry of Defence and contact centre and conferencing services to the Department for Work and Pensions. |

| • | We’ve recently started working with the NHS Islington Clinical Commissioning Group and the London Borough of Islington to provide a service that will help join up health and social care in Islington and improve the experience of care for the borough’s residents. |

| • | We’re working with Bromley Council to deliver computer and data centre services which will help provide them with greater flexibility in running their IT services. |

| • | We’re working with the Government to extend fibre broadband to rural areas under the Broadband Delivery UK (BDUK scheme). |

| • | In December, EE was awarded a contract to provide the emergency services workers with nationwide 4G voice and data services. |

We can be required by law to do certain things and provide certain services to the Government. For example, under the Communications Act, we (and others) can be required to provide or restore services during disasters. The Civil Contingencies Act 2004 also says that the Government can impose obligations on us (and others) at times of emergency or in connection with civil contingency planning.

The Secretary of State for the Home Department can also require us to take certain actions in the interests of national security.

Regulation