SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form6-K

Report of Foreign Private Issuer

Pursuant to Rule13a-16 or15d-16

of the Securities Exchange Act 1934

Report on Form6-K dated May 24, 2018

BRITISH TELECOMMUNICATIONS PLC

(Translation of registrant’s name into English)

BT Centre

81 Newgate Street

London EC1A 7AJ

England

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form20-F or Form40-F.

Form20-F ☒ Form40-F ☐

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

Enclosure: British Telecommunications plc — Annual Report & Form20-F 2018

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | |

| British Telecommunications plc |

| |

| By: | | /s/ Heather Brierley |

| | Name: | | Heather Brierley |

| | Title: | | Secretary |

Date: May 24, 2018

2

BRITISH TELECOMMUNICATIONS plc

Annual

Report &

Form20-F

2018

As a wholly-owned subsidiary of BT Group plc, British Telecommunications plc meets the conditions set forth in General Instruction (I) (1)(a) and (b) of Form 10-K as applied to reports on Form 20-F and is therefore filing this Form 20-F with the reduced disclosure format.

| | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | | |

| THE STRATEGIC REPORT | | | | GOVERNANCE | | | | FINANCIAL STATEMENTS | | | | ADDITIONAL INFORMATION |

| | | | | | | | | | | | |

Overview

British Telecommunications plc (‘the group’ or ‘the company’ ) is the principal operating subsidiary of BT Group plc. We’re a wholly-owned subsidiary of BT Group plc. The BT Group plc Board has ultimate responsibility for the management of the group while the Executive Committee of BT Group plc is our key management committee. It monitors the group’s financial, operational and customer service performance and has cross-business oversight of BT’s customer-facing units. It also reviews the group’s key risks and considers potential threats and opportunities facing the business.

British Telecommunications plc leverages the governance structure and processes of BT Group plc, including:

| | | | | | |

| – | | BT Group plc Board | | – | | Governance Committee |

| | | |

| – | | Executive Committee | | – | | Investment Committee |

| | | |

| – | | Audit & Risk Committee | | | | |

Key management personnel comprise executive andnon-executive directors of the BT Group plc Executive Committee, as well as members of the BT plc Board.

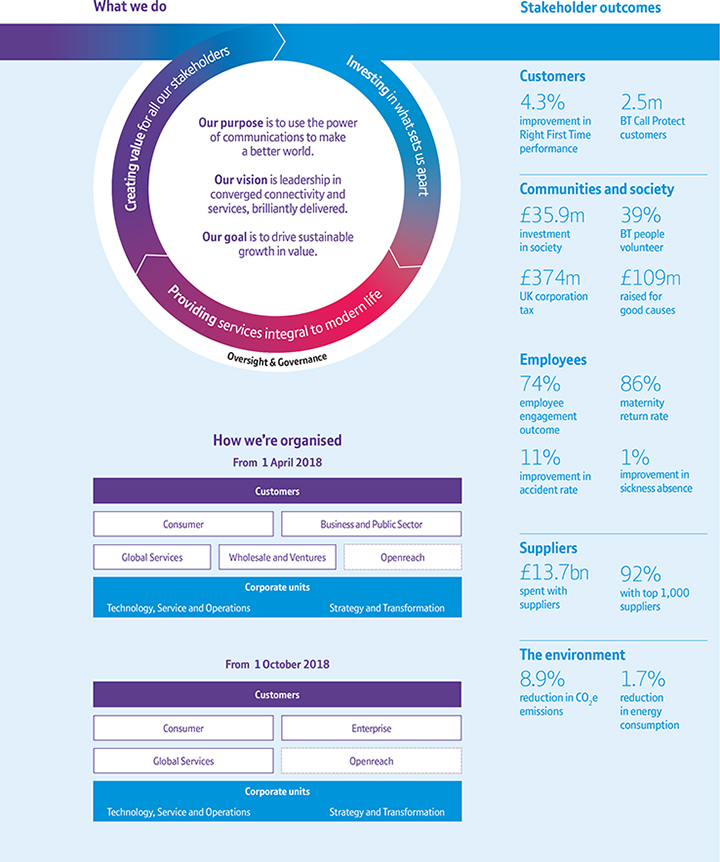

Our strategy

Our strategy in the year had three pillars: deliver great customer experience, invest for growth and transform our costs.

They work together: the better our customers’ experience, the more we sell and the less time and money we spend putting things right. And the better we manage our costs, the more we can invest in improving our customers’ experience and in products and services that will create growth.

Pages 3 to 7 describe our performance against the strategy.

Looking ahead, we’re evolving our strategy to build on our strengths and allow us to respond to market opportunities and challenges. You can find more detail on page 10

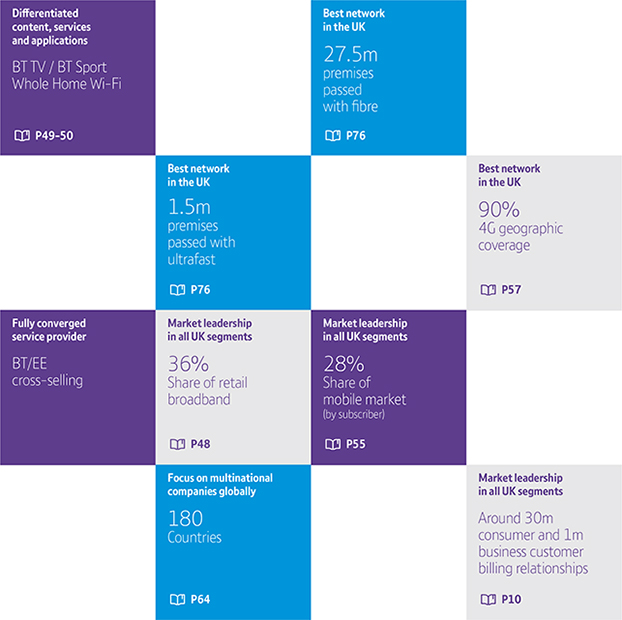

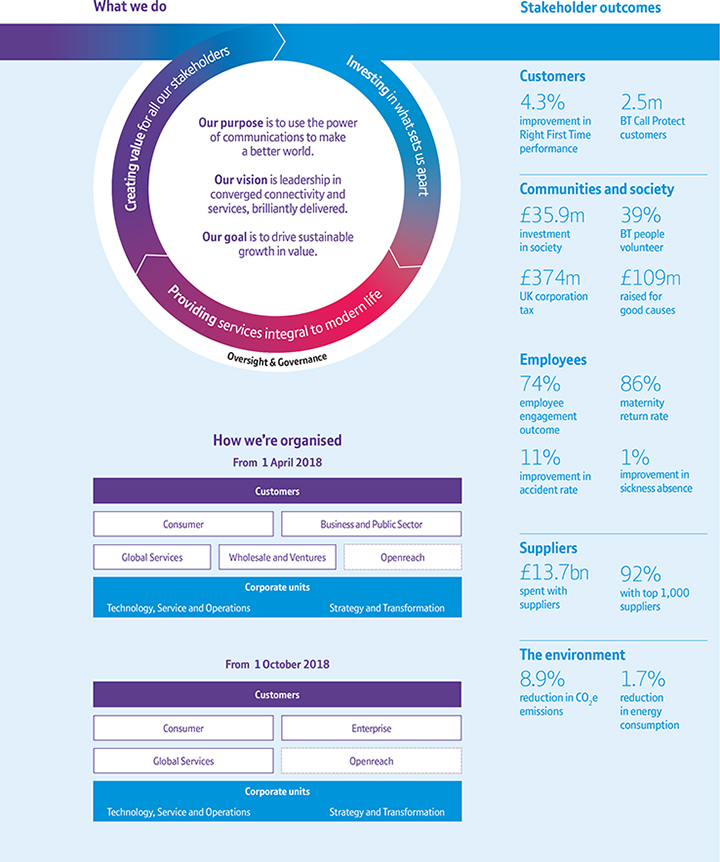

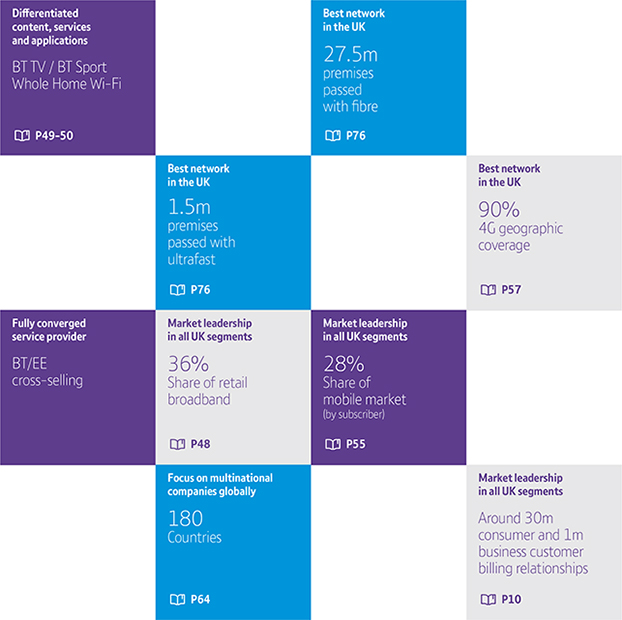

The graphic below shows the main elements of our strategy in the year. You’ll find more details on our purpose and goal, in the context of our business model, on page 12.

| | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | | |

| THE STRATEGIC REPORT | | | | GOVERNANCE | | | | FINANCIAL STATEMENTS | | | | ADDITIONAL INFORMATION |

| | | | | | | | | | | | |

Our strategy - how we performed

Delivering great customer experience

Customer experience remains central to our strategy and long-term growth – whether that’s improving our service levels, providing a more reliable network or introducing new products. We’re making good progress but we know there is still much more to do.

We believe that continuously improving customer experience drives growth. That’s why progress on customer experience is central to judging the group’s performance. We have two main measures of customer experience: customer perception (based on Net Promoter Score) and doing things Right First Time.

How we did in the year

We’ve built on earlier progress and have delivered seven quarters of continuous growth in customer perception. This year we saw an 8.3 point improvement on last year’s results.

Right First Time performance has improved by 4.3%, helped by better planning and resourcing. This means our network has had fewer faults and we’ve delivered high levels of service despite some terrible weather.

Everyone in BT has a role to play in delivering these results and every CFU has improved its customer perception and Right First Time scores.

We’ve also seen a drop in complaints made to Ofcom over the last year. EE saw complaints fall to their lowest level while complaints about BT Consumer broadband have fallen by 18%.

What difference did our customers see?

Our customers tell us they expect a reliable service, great networks and products that fit their digital, mobile and‘always-on’ lives. We‘ve made progress in all of these areas:

Deliver a consistent and reliable service

| – | On average we answered calls from BT Consumer customers in 41 seconds, a minute quicker than last year. |

| – | EE won the What Mobile award for Best Customer Support for the third year running. |

| – | We now have more than 600 EE shops including five new ‘showcase’ stores offeringface-to-face chats with advisers and highlighting the best of our network and technology partners. |

| – | Our customers are using our digital channels more, with online chat up 20% this year and more than 2m downloads of the ‘My BT’ app. |

| – | Openreach achieved all 60 of Ofcom’s copper Minimum Service Levels. |

| – | Ethernet performance keeps improving – with delivery times cut by a third since last year. |

| – | We’re continuing our transparent approach to performance by publishing quarterly updates on service levels via bt.com and ee.co.uk. |

Great customer experience from our network

| – | We’ve hired almost 2,400 more engineers into Openreach. We’ve also improved our resource planning so that we meet network repair targets more than 80% of the time. |

| – | We’ve continued to weatherproof our networks leading to 3.7% fewer network faults this year. |

| – | BT Consumer customers are now getting faster broadband speeds with average download speeds improving by 20% to 43Mbps. |

Products that fit our customers’ lives

| – | BT Consumer launched ultrafast products at 152Mbps and 314Mbps with minimum speed guarantees. |

| – | EE launched a new 4G antenna service that brings superfast broadband speeds to rural areas where fixed broadband is slow or not available. |

| – | A year after the launch of our BT Call Protect service we’ve protected 2.5m customers by diverting more than 90m nuisance calls. |

| – | And we’ve launched a new ‘BT Business’ app for business customers who want to interact with us digitally. |

| | | | | | |

| | | |

| | British Telecommunications plc Annual Report & Form 20-F 2018 | | 3 |

Our strategy - How we performed continued

Investing for growth

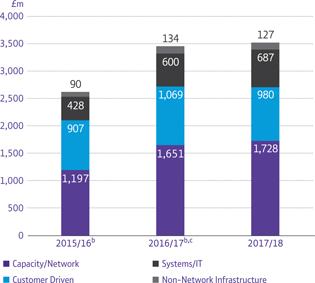

We’ve been putting money and resources into five strategic areas. Together, they underpin our strategy and our operational and financial performance, which in turn contribute to our KPIs (on page 6).

With good progress on the integration of EE within the group and with a fast-paced digitisation of the UK economy, we’ve placed a particular focus this year on enabling convergence and on infrastructure leadership as key drivers of future growth.

| | | | | | |

| | | |

| 4 | | British Telecommunications plc Annual Report & Form 20-F 2018 | | |

| | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | | |

| THE STRATEGIC REPORT | | | | GOVERNANCE | | | | FINANCIAL STATEMENTS | | | | ADDITIONAL INFORMATION |

| | | | | | | | | | | | |

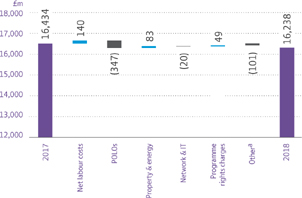

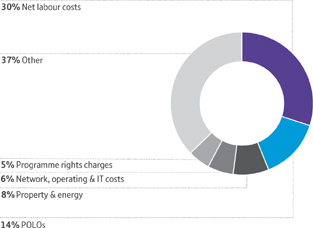

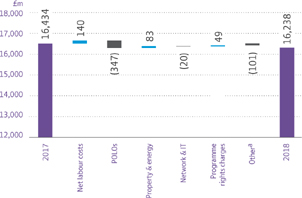

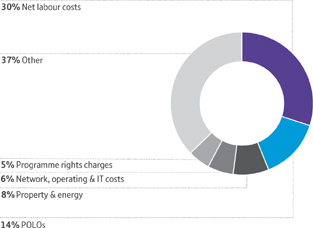

Transforming our costs

Our approach

Rigorous analysis, leadership and strong governance help us stay focused on both transforming costs and improving customer experience.

We benchmark the costs of doing business against other companies inside and outside our sector to see where we can do even better.

Most improvement initiatives are owned and run within individual business units. Our largest programmes span multiple business units or drive complex changes in a single business unit and often need centralco-ordination.

How we did in the year

This year we’ve increased the cumulative EE integration savings to £290m and we’re on track to deliver on our £400m commitment by the end of 2019/20.

The first phase of our restructuring activities has produced £180m of savings against our commitment to deliver £300m over two years.

Key achievements this year included:

| – | creating more synergies from integrating BT and EE. We’ve done this by combining functions, making good use of our increased purchasing power, and completing accommodation moves to bring teams together and save money from closing unneeded buildings |

| – | establishing a new unit, Customer and Enterprise Transformation, within the Strategy and Transformation team. The new unit helps us make investments and take decisions that better support our customer experience and productivity priorities |

| – | becoming even more efficient by creating a Central Business Services unit which brings together customer contact management services, contract delivery services, revenue assurance and billing. |

Looking ahead

We will continue to deliver against our EE integration and first phase restructuring commitments.

We’re also launching new cost transformation initiatives within each business unit, as well as some larger cross-business programmes.

The combination of new and existing initiatives will ensure we deliver against our new strategic target of £1.5bn gross cost reduction over the next three years.

| | | | | | |

| | | |

| | British Telecommunications plc Annual Report & Form 20-F 2018 | | 5 |

Key performance indicators

Demanding market conditions and actions we have taken to exit lower margin business in our enterprise divisions have impacted our financial performance. We’ve achieved our customer experience goal for the year, but want to go further.

Progress against our KPIs

We use three key performance indicators (KPIs) to measure how we’re doing against our strategy. Our financial KPIs include the trend in underlying revenue excluding transit and adjusted EBITDA. Customer service improvement is the keynon-financial KPI for us.

Our KPIs are chosen because they reflect the key elements of our strategy.

We’ve outlined our performance against each KPI here, together with an explanation of how we define each measure.

You can find reconciliations of the financial measures to the closest IFRS measure in the Additional information section on pages 209 to 210.

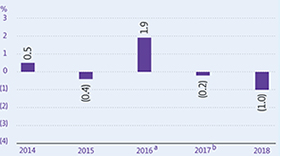

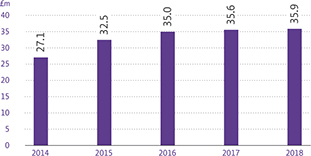

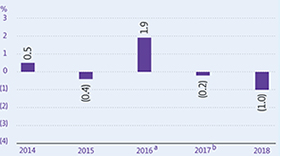

Underlying revenue excluding transit

Underlying revenue reflects the overall performance of the group that will contribute to sustainable profitable revenue growth. We exclude the impact of specific items, foreign exchange movements, acquisitions and disposals. We focus on the trend in underlying revenue excluding transit because transit traffic is low margin and is affected by reductions in mobile termination rates, which are outside our control.

Our key measure of the group’s revenue trend, underlying revenue excluding transit, was down 1.0% (2016/17: down 0.2%).

-1.0%

2018 trend in underlying

revenue excluding transit

Performance

Our revenue performance has been impacted by challenges in our enterprise businesses, particularly in Global Services where revenue declined due to ongoing demanding market conditions and lower IP Exchange volumes and equipment sales in line with our strategy to reduce low margin business. We explain more about the performance of our customer-facing units from page 48.

Trend in underlying revenue excluding transit

Year ended 31 March

a Calculated as though EE was not part of the group until 1 April 2016.

b Calculated as though EE had been part of the group from 1 April 2015.

| | | | | | |

| | | |

| 6 | | British Telecommunications plc Annual Report & Form 20-F 2018 | | |

| | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | | |

| THE STRATEGIC REPORT | | | | GOVERNANCE | | | | FINANCIAL STATEMENTS | | | | ADDITIONAL INFORMATION |

| | | | | | | | | | | | |

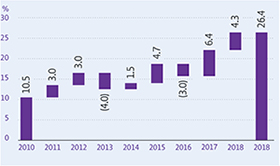

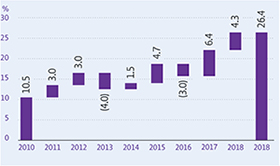

Customer service measure

Right First Time is our key measure of customer service. This tracks how often we keep the promises we make to our customers. This could be about keeping to appointment times, completing orders when we agreed or fixing faults within an agreed period. As well as improving service and the customer experience, keeping our promises should mean that there is less work to do to correct our mistakes, and so reduces our costs.

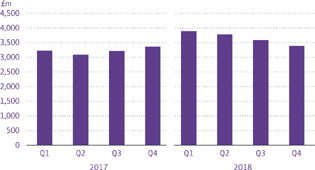

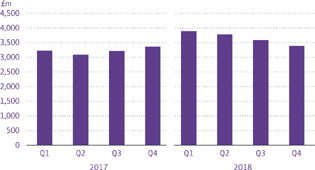

Adjusted EBITDA

Adjusted EBITDA is defined as group profit before depreciation, amortisation, net finance expense, taxation and is before specific items. We consider adjusted EBITDA to be a useful measure of our operating performance because it approximates the underlying operating cash flow by eliminating depreciation and amortisation.

| | | | |

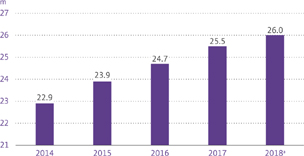

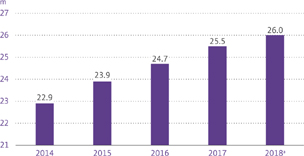

Our customer service measure Right First Time was up 4.3% compared with up 6.4% last year. +4.3% 2018 customer service measure Performance Improving the service we deliver is key. Our Right First Time measure was up 4.3% (2016/17: up 6.4%). We’re making good progress in some areas and every customer-facing unit has improved its Right First Time scores. Despite these improvements, we’re looking ahead at improving customer experience further. You can read more about our customer service on page 3. Customer service improvementa At 31 March

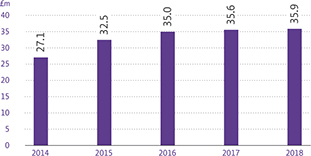

a Cumulative improvement from 1 April 2009. | | | | Adjusted EBITDA was down 2% (2016/17: up 18%). -2% 2018 adjusted EBITDA Performance Adjusted EBITDA was down 2% reflecting the decline in volumes, investment in mobile devices and customer experience along with higher business rates and pension costs, partly offset by cost savings. Adjusted EBITDA Year ended 31 March

|

| | | | | | |

| | | |

| | British Telecommunications plc Annual Report & Form 20-F 2018 | | 7 |

Ournon-financial performance as a sustainable and responsible business

Our integrated approach to reporting means that the requirements of the newNon-Financial Reporting Directive are addressed throughout the Strategic Report.

For ease of reference, information pertaining to each of the matters addressed by the new regulation can be found on the following pages: Human rights (page 21); Employees (page 22); Social (page 25); Environmental (page 31); Anti-corruption and bribery (page 34).

Additionally,non-financial matters have long been embedded in our business model as stakeholder outcomes on page 13, and within our principal risks and uncertainties on pages 34 to 47.Non-financial performance indicators are linked to our ambitions and foundation measures as a sustainable and responsible business and can be seen in the table below.

Target met

Target met  Target failed

Target failed  Ongoing

Ongoing

| | | | | | | | | | |

| | | Our ambitions | | 2016/17 performance | | 2017/18 performance | | Status | | Page |

|

Creating a connected society | | By 2020, more than 9/10 people in the UK will have access to our fibre-based products and services | | 8.8 out of 10 UK premises passed | | Ambition superseded: 95% of premises now passed by superfast broadband | | n/ma | | 25 |

| | |

| | By 2020, to help 10m people overcome social disadvantage through the benefits our products and services can bring | | 3.9m people reached | | 4.6m people reached | |  | | 25 |

|

Creating a culture of tech literacy | | By 2020, to help 5m children to receive better teaching in computer skills | | 1.1m children reached | | 1.6m children reached | |  | | 26 |

|

Supporting charities and communities | | By 2020, to use our skills and technology to help generate more than £1bn for good causes | | £95m raised for good causes | | £109m raised for good causes | |  | | 26 |

| | | | Cumulative total: £422m since 2012 | | Cumulative total: £531m since 2012 | | | | |

| | |

| | By 2020, to inspire 66%(two-thirds) of our people to volunteer | | 31% of BT people volunteering | | 39% of BT people volunteering | |  | | 23 |

|

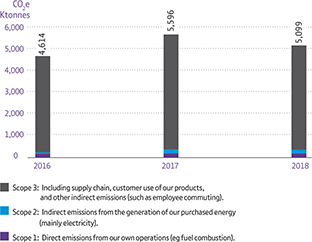

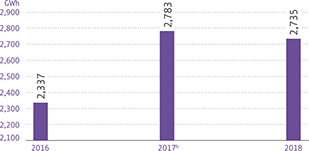

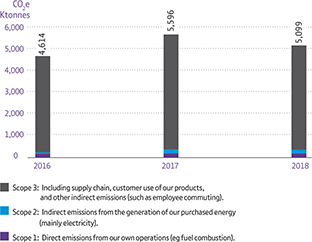

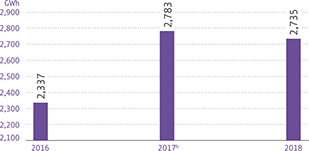

Delivering environmental benefits | | By 2020, to enable customers to reduce their carbon emissions by at least three times theend-to-end carbon impact of our business | | 1.8:1 achieved | | 2.2:1 achieved | |  | | 31 |

| | |

| | By 2030, to cut our carbon emissions intensity by 87%, compared with 2016/17 levels | | n/m (new ambition) | | 6.8% reduction | |  | | 31 |

|

aincluding other network operators. | | | | | | | | |

| | | | | |

| | | Our foundation measures | | 2016/17 performance | | 2017/18 performance | | Status | | Page |

|

Investment in society | | Investment to accelerate our purposeful business approach; to be more than 1% of adjusted profit before tax (PBT) | | 1.03% of PBT invested 1.08% 5-year average | | 1.02% of PBT invested 1.06%5-year average | |  | | 25 |

|

Customers | | Customer service:to consistently improve RFT across our entire customer base | | 6.4% improvement | | 4.3% improvement | |  | | 3 |

|

Employees | | Employee engagement index:to maintain or improve our relationship with our employees | | 71% favourable | | 74% favourable | |  | | 23 |

| | |

| | Sickness absence rate:to maintain or reduce % of calendar days lost to sickness | | 2.32% calendar days lost to sickness | | 2.30% calendar days lost to sickness | |  | | 24 |

| | |

| | Ethical performance:to maintain or improve our employees’ perception of our ethical performance | | 76% favourable | | 83% favourable | |  | | 34 |

| | |

| | Ethics training:all employeesbto complete annual training on our ethics code (including our zero tolerance approach to Anti-Corruption & Bribery) | | 99.3% trained | | 99.5% trained | |  | | 34 |

|

Supply chain | | Ethical trading:across our supply chain, with focus on human rights. Achieve 100%follow-up within three months, for all suppliers identified as high or medium risk, through our ethical standards questionnaire | | 100%follow-up within three months | | 100%follow-up within three months | |  | | 27 |

| | |

| | Renewable electricity:by 2020 to buy 100% of our electricity world-wide from renewable sources, wherever markets allow | | 77%cbought from renewable sources | | 81% bought from renewable sources | |  | | 27 |

| | |

| | Carbon emissions:by 2030, to reduce our supply chain carbon emissions by 29%, compared with 2016/17 levels. | | n/m (new target) | | 6.3% reduction | |  | | 27 |

|

To find out more about these measures, our methodologies and how our results are calculated, take a look atbt.com/deliveringourpurpose

an/m - not meaningful.

bAt least 99.5%, excluding those on maternity, paternity or long-term sick leave or with other extenuating circumstances.

c 2016/17 energy figures restated – see bt.com/deliveringourpurpose for details.

| | | | | | |

| | | |

| 8 | | British Telecommunications plc Annual Report & Form 20-F 2018 | | |

| | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | | |

| THE STRATEGIC REPORT | | | | GOVERNANCE | | | | FINANCIAL STATEMENTS | | | | ADDITIONAL INFORMATION |

| | | | | | | | | | | | |

| | | | | | |

| | | |

| | British Telecommunications plc Annual Report & Form 20-F 2018 | | 9 |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | | |

| | | | | | | | |

| | Our evolving strategy | | |

| | | | | | | | |

| | |

| | We have evolved our strategy to focus on converged connectivity and services | | |

| | | | |

| | Well positioned to drive sustained growth in value We have a strong set of assets, including a leading position in the UK in fixed and mobile access networks, with strong and clearly segmented brands. We have deep relationships with a wide range of customers including 30m consumers, 1m businesses and around 1,500 multinational corporations. We also enjoy close strategic partnerships with key content, technology, device and service vendors. Combined, this means that we are uniquely positioned to lead network, product and service convergence across the consumer and enterprise markets, which we see as a critical market trend and an opportunity to drive further value for our business. | | | | Navigating a demanding environment Like all businesses, we must continually adapt to our market environment. Data consumption and network capacity requirements are increasing exponentially and our enterprise customers want to migrate from legacy communications products towards digital, converged and secure products and solutions. Competition remains intense across the sector from both established players and new entrants. We are also seeing a new wave of infrastructure investment infibre-to-the-premises and mobile coverage and technology. And recent regulatory outcomes are reducing Openreach’s returns towards its allowed cost of capital. | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | An evolution of our strategy We have evolved our strategy to build on our strengths and allow us to respond to market opportunities and challenges. | | |

| | |

| |  | | |

| | | | | | | | |

| | | | | | | | |

| | 10 British Telecommunications plc Annual Report & Form 20-F 2018 | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | |

| THE STRATEGIC REPORT | | | | GOVERNANCE | | | | FINANCIAL STATEMENTS | | | | ADDITIONAL INFORMATION | | |

| | | | | | | | | | | | | | |

| | | | | | |

| | | |

| | | | | | |

Our purpose remains to use the power of communications to make a better world. This drives everything that we do. Our vision is leadership in converged connectivity and services, delivered brilliantly in the UK and for multinational corporations. This highlights our commitment to convergence as a growing category of products and service. Our goal is to drive sustainable growth in value. This reflects our commitment to balance top and bottom-line growth and to create value from our investment in our integrated network and differentiated products and services. We will deliver these through three strategic priorities: 1. Deliver differentiated customer experiences We will further differentiate our propositions, to retain and expand value. We’ll do this by creating innovative new propositions, improving value for money, offering better service, and making it easier to do business with us. We’ve made progress with customer experience in recent years, but there’s much more to do. 2. Invest in integrated network leadership In UK fixed, we’ll drivetake-up of our superfast network and accelerate our investments in ultrafast through fibre to the premises to 3m homes by 2020 and through Gfast. In UK mobile, we’ll expand our leadership in 4G coverage and capacity, and we intend to lead the market to 5G too. Ultimately our aim is to build a single, integratedall-IP fibre network. Our investment will allow us to progressively close down legacy products such as the public switched telephone network, lead the market in advanced digital products, improve customer experience, and reduce our operating costs. | | | | 3. Transform our operating model We’re creating a more lean and agile organisation, with a simplified operating model, and more straightforward decision-making. The steps we’re taking to achieve this include: – simplifying our operating model by creating four customer-facing units focused on Consumer, Enterprise, multinational corporations through Global Services and fixed access networks through Openreach – having fewer, bigger, more accountable leadership roles and simplifying and delayering our management structures – accelerating the delivery of Digital GS, introducing new digital products with a greater focus on our top global customers – reducing inefficiencies from being housed in numerous sites across the UK to focus on around 30 modern,fit-for-purpose sites to create a more collaborative, open and customer-focused working culture – move from buying to strategic sourcing, consolidating our spend and standardising our products – make better use of digitalisation to improve customer-experience and reduce costs to serve. These strategic priorities will be tailored to the differentneeds of our key customers in each of our customer-facing units: – forUK ConsumerandEnterprise, our focus will be on accelerating the development of converged services – inGlobal Services, our focus will be on evolving towards a more digital proposition and operating model – Openreach will focus on delivering unmatchedUK-wide fixed access to all CPs. Outcomes from our transformation As a result of our transformation we’ll be more efficient, productive, focused, and better able to deliver excellent experiences to our customers. There should be a substantial positive impact on our financial performance, albeit offset in the short term by recent regulatory outcomes: Over three years we’re targeting improvements in our customer experience metrics, revenue generating units per customer, converged product penetration and digital interaction with our customers. We’ll deliver a three-year reduction of around 13,000 mainly back office and middle management roles, partially offset by new hires to support customer service and network deployment. We expect the programme to cost £800m and have atwo-year payback. Ultimately, we will create afit-for-future organisation to drive sustainable growth in value for all our stakeholders as the leader in convergent connectivity and service in the UK and for multinational corporations. | | |

| | | |

| | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | |

| | British Telecommunications plc Annual Report & Form 20-F 2018 | | 11 | | |

| | | | |

| | | | | | | | |

Our business model

We create value for our stakeholders by developing and selling products and services that are an essential part of modern life.

Who we are

We’re one of the world’s leading communications services companies. We’re based in the UK and serve customers in 180 countries

(see page 64).

International Integrated Reporting

Council’s capitals

This key provides a mapping to the ‘capitals’ of the IIRC’s Integrated Reporting (IR) Framework.

You can find out more at: www.theiirc.org

You can find out more at: www.theiirc.org

Financial

Financial

Human

Human

Manufactured

Manufactured

Intellectual

Intellectual

Social

Social

Natural

Natural

| | | | | | | | | | |

What sets us apart | | | | | | |

|

| | | | | |

| |  | | Financial strength | | | | £3.0bn | | |

| | | | We’re focused on growing our cash flow over the long term. | | | | normalised free cash flow generated in 2017/18 | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | |

| | | | | |

| |  | | Our people | | | | 105,800 | | |

| | | | Their commitment, expertise | | | | employees | | |

| | | | and diversity are key to our success. | | | | 82,200 | | |

| | | | | | | in the UK | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | |

| | | | | |

| |  | | Networks and physical assets | | | | 27.5m | | |

| | | | We continue to invest in these to improve the experience we offer our customers. | | | | premises passed by our fibre footprint | | |

| | | | | | 90% | | |

| | | | | | | | 4G geographic coverage | | |

| | | | | | | | | | |

| | | | |

| | | | | |

| |  | | Research and development | | | | c£510m | | |

| | | | We’re one of the largest investors in research and development in the UK. | | | | R&D spend | | |

| | | | | | 97 | | |

| | | | | | patents filed | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | |

| | | | | |

| |  | | Our culture | | | | Personal | | |

| | | | ‘The BT Way’ and our values express how we work together and what we expect from our people. | | | | Simple Brilliant | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | |

| | | | | |

| |  | | Our brand | | | | | | |

| | | | Our brands are a key asset. | | | | | | |

| | | |

| | | |  | | |

| | | | | |

| | | | | | | | | | |

| | | | |

| | | | | |

| |  | | Natural resources | | | | 81% | | |

| | | | We use some natural resources in doing business. | | | | of the electricity we buy worldwide comes from renewable sources | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | |

| | | |

| 12 | | British Telecommunications plc Annual Report & Form 20-F 2018 | | |

| | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | | |

| THE STRATEGIC REPORT | | | | GOVERNANCE | | | | FINANCIAL STATEMENTS | | | | ADDITIONAL INFORMATION |

| | | | | | | | | | | | |

| | | | | | |

| | | |

| | British Telecommunications plc Annual Report & Form 20-F 2018 | | 13 |

What we do

This section details our purpose, goal and strategy in the context of our business model. It also explains how we create value for our stakeholders by providing services that are integral to modern life.

| | |

| | Our purpose, goal and strategy |

Our purpose

Our business model is built around our purpose, which is as simple as it is ambitious: to use the power of communications to make a better world.

Sustainability, ethics and human rights

To achieve our purpose, we must do business responsibly. That means behaving ethically, respecting people and the environment. We are a signatory to the UN Global Compact principles and we’re actively contributing to the UN Sustainable Development Goals.

We have a steering group that oversees human rights governance and policies and we’re committed to implementing the UN Guiding Principles on Business and Human Rights.

Every year we publish a statement which sets out our stance on modern slavery and human trafficking. And we don’t tolerate bribery or corruption.

Non-financial information reporting

New regulations onnon-financial information mean we must report on the following topics:

| | |

P21 Respect for human rights P21 Respect for human rights

| |  P31 Environmental matters P31 Environmental matters |

| |

P22Employee matters P22Employee matters

| |  P34Anti-corruption and P34Anti-corruption and

bribery |

P25Social matters P25Social matters

| | |

There are references to our policies in these areas, along with how we’ve done against various measures, throughout the Strategic Report. Some of the outcomes feature in the business model graphic on page 13. We’ve listed others in the summary of ournon-financial performance on page 8.

Read more in our Delivering our Purpose report.

Read more in our Delivering our Purpose report.

Our goal

Our goal is to drive sustainable growth in value. We’ll achieve this by giving our customers a great experience and products and services they value.

Our strategy

To follow our purpose and achieve our goal, our strategy is built around the three pillars outlined on page 11: delivering differentiated customer experiences, investing in integrated network leadership, and transforming our operating model.

They work together. The better our customers’ experience, the more we’ll sell and the less time and money we’ll spend putting things right.

And the leaner and more agile we are, and the better we manage our costs, the more we can invest in the business while maintaining a strong balance sheet (page 16). It’s a virtuous circle that balances short-term performance with long-term value creation.

| | |

| | Investing in what sets us apart |

We invest in building and maintaining communications networks in the UK and overseas. We also invest in differentiated products, services and applications to run over those networks.

Customer expectations are rising all the time. We believe that getting customer experience right is a competitive advantage. So we’re investing in our people (eg more contact centre roles, more multi-skilled advisors) and our processes (eg reducing missed appointments).

Some of our investments, like TV sports rights, last just a few years. Other investments, like our fibre broadband network, are much longer term, withpay-back periods of more than a decade.

We have a distinct combination of people, technology, content, networks and other physical assets that sets us apart from competitors. Importantly, we also have the financial strength to keep investing in these areas while balancing short, medium and long-term interests

| | |

| | Providing services integral to modern life |

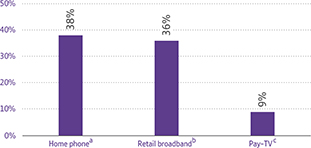

We sell fixed-voice, broadband, mobile and TV products and services to individuals and households in the UK. For businesses we offer communications services ranging from phone and broadband through to complex managed networks and IT services and cybersecurity protection. Many public services rely on our technologies and in the UK and Ireland we help other communications providers to serve their own customers. And underpinning all this, we provide the connectivity that’s essential in a digital economy.

There’s growing demand for a lot of our products and services because they play such an integral role in modern life. And we’ll benefit as customers use more digital services and increasingly want value, reliability and consistent service.

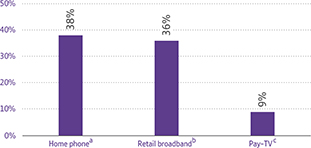

Market context

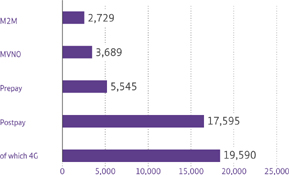

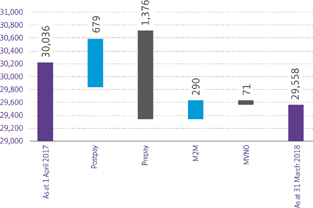

Consumer broadband continues to switch to fibre, to meet customers’ demands for higher bandwidth. Meanwhile people are making fewer landline calls, replacing them with mobile phones, voice over IP or instant messaging. In mobile, there’s continuing growth in data use – and postpaid subscriptions are growing at the expense of prepaid.

At the same time,SIM-only tariffs are becoming more popular because people are keeping their phones for longer. In TV, there’s growth in subscriptionvideo-on-demand (SVoD), largely as a complement topay-TV services. And customers are increasingly using digital service channels, like apps and online chat, to interact with their service provider. Business customers are using landlines, leased lines and traditional voice services less as the market moves to data and IP voice. Other growing areas include cloud services, hosting, security and data protection. Business broadband is switching to fibre. And Ethernet and dedicated internet access services are also becoming more widespread as businesses rely more and more on connectivity.

| | | | | | |

| | | |

| 14 | | British Telecommunications plc Annual Report & Form 20-F 2018 | | |

| | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | | |

| THE STRATEGIC REPORT | | | | GOVERNANCE | | | | FINANCIAL STATEMENTS | | | | ADDITIONAL INFORMATION |

| | | | | | | | | | | | |

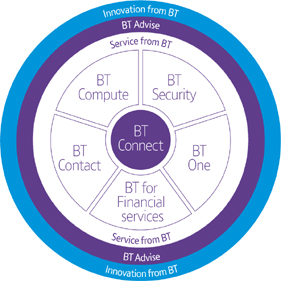

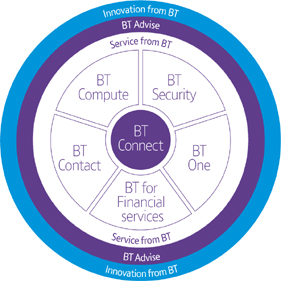

‘Digitalisation’ or digital transformation is now a top priority for many businesses, particularly multinational corporations. It’s not an end in itself. But it does help companies achieve objectives like transforming costs, operating more efficiently or improving customer experience. Our ‘Cloud of clouds’ strategy (page 65) positions us well to be a trusted partner in our customers’ digital future.

We aim to be the UK’s leading converged operator – bringing together our fixed and mobile network assets to make sure our customers are always connected to the best possible network, and selling converged propositions that offer much more than simple ‘bundles’. We’re uniquely placed to do it – with the brands, scale and breadth of capabilities to benefit from convergence.

Our strategy puts us in a strong position to drive, and benefit from, these market trends. You can find out more in the customer-facing unit sections from page 48.

Channels to market

We sell our products and services through our customer-facing units.

We do it through a range of channels including online, contact centres and account managers. We also have around 600 EE stores in the UK.

Multibrand strategy

We have three retail brands (page 19). They let us serve different sectors of the market and lead to higher consideration by potential customers when they’re deciding whether to buy from us or one of our competitors. Add to that the cross-selling between our retail brands and we have an opportunity to sell more to more people.

Diverse revenue streams

Our revenue mostly comes from subscriptions or contracts. Individuals, households and SMEs pay for standalone or bundled services, typically on12- to24-month contracts.‘Pay-as-you-go’ mobile services are also available.

Large corporate and public sector customers usually buy managed networked IT services on contracts spanning several years. Wholesale customer contracts range from one month for regulated products, to five years or more for major managed services deals.

Other sources of revenue include our ventures (page 69), consultancy, device sales and advertising (online, BT Sport TV channels and InLinkUK kiosks).

| | |

| | Creating value for all our stakeholders |

What we do, matters – to millions of people. We help them communicate, enjoy entertainment, do business and generally live their lives. And we contribute directly to communities and the health of the UK by providing jobs, supporting suppliers, paying tax and encouraging our people to volunteer.

Sustainability is integral to our purpose and the value we create. We’re committed to using 100% renewable electricity (where markets allow) and we’re encouraging our suppliers, customers and people to do the same. At the same time, our products and services are helping to tackle climate change.

Our business generates emissions. From our operations, supply chain, and through the energy our customers use to power our products. But we’re contributing to a lower-carbon economy by cutting our own carbon footprint and helping customers cut theirs. The emission savings for our customers outweigh our own footprint. This means we’re a ‘net positive’ business (see page 31).

From a purely financial perspective, our carbon-saving products and services contribute £5.3bn revenue to our businessa.

| | |

| | Oversight and governance |

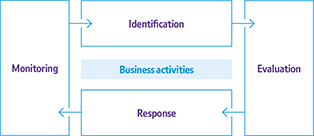

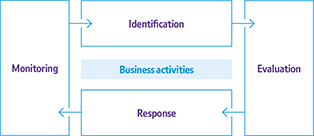

The markets we operate in are dynamic and very competitive, particularly the UK. There are many risks and opportunities, so it’s important that our strategy and business model are flexible and sustainable. To help us we:

| – | have a risk management framework to identify and mitigate the challenges we face (page 33) |

| – | use insight teams to keep us in tune with market drivers and customer expectations |

| – | talk and listen to our stakeholders to understand what’s important to them |

| – | use BT Group plc governance committees to ensure we’re making the right investments and investing with discipline. |

Together, these things help us anticipate and respond to changes in our markets including macro events like Brexit and the prospect of the UK leaving the single European market.

We know we can deliver value over the short, medium and long term. It’s this confidence that underpins our assessment of the future prospects and viability of the group.

The Design Council and BT Investment Board

TheDesign Council was asub-committee of BT Group plcOperating Committee. It was responsible for making sure capital investments in our networks, systems, platforms and products reflected our strategy, served the needs of our customers and were delivered cost-effectively. TheDesign Council was dissolved in October 2017 following the creation of theExecutiveCommittee.

From December 2017 the BT Group plc BT Investment Board has been responsible for providing input and recommendations to support the group chief executive on major capex and opex decisions.

| a | The list of our carbon-saving products and services is established and verified by Carbon Trust; the associated revenue is based on total external sales, independently verified by Lloyd’s Register. |

| | | | | | |

| | | |

| | British Telecommunications plc Annual Report & Form 20-F 2018 | | 15 |

Our resources and culture

In this section we talk about the resources that set us apart

and underpin our business model. We also describe our

culture and approach, and commitment to respecting

human rights.

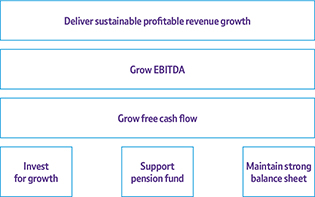

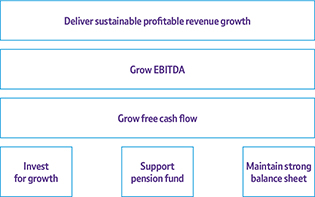

Financial strength

Our financial strength means we can make long-term investments while supporting other areas of the business.

Our financial strategy has been consistent for a number of years:

We have a prudent financial policy and adhere to a disciplined process for the allocation of capital between four main uses: investment in the business; supporting the pension fund; and maintaining a strong balance sheet. We also have strong governance and investment processes/controls. Together, they help us make the right decisions when it comes to planning investments, growing our business, and managing our level of debt and credit metrics.

Healthy finances also mean we can support the business in other ways. For example we continue to invest in R&D to stay at the forefront of a rapidly-changing industry, and in training, developing and supporting our people.

Our networks and physical assets

Our network, service and IT platforms support the products our customers rely on around the world.

Network platforms

Our UK fixed-line network is one of our most valuable assets and our investment in fibre broadband is key to providing services to UK consumers and businesses. Our fibre broadband network now passes more than 27.5m UK premises, and we providefibre-to-the-premises to more customers than any other UK service provider. To meet the demand from businesses, we’re continuing to expand Ethernet availability.

This year we’ve again had record levels of traffic across our UK network, with a peak demand of 9.75Tbps. The investments we’ve made in broadband technology mean that more customers get faster speeds and better reliability over our network.

We’ve also developed new technology that should more than double our previous records for data transmission speeds. Our latest breakthrough should deliver speeds of up to 13Tbps over a single fibre. This more than doubles the world record of 5.6Tbps we set last year.

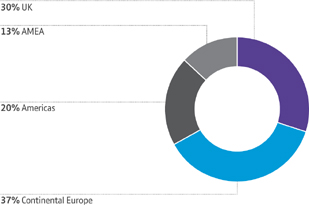

Our global reach

Our global network is supported byin-country networks and infrastructure. The UK has our widest range of network services, access technologies and coverage. But we also have extensive networks in Brazil, Germany, Italy, the Netherlands, the Republic of Ireland and Spain.

The scale and reach of our global multi-protocol label switching (MPLS) network gives us a competitive advantage. Our virtual private network (VPN) services offer customers the convenience and security of a private network but over the public internet. We use our MPLS network, plus a combination of owned and leased fibre connections, to connect our points of presence (PoPs) around the world. For the final connection into the customers’ premises, we either use our own circuits, or lease connections from telecoms operators in that country. If customers need service in very remote places, we make use of our extensive satellite connections.

Security is an important part of our business. The expertise we’ve gained from protecting our own networks helps us secure our customers’ networks. We’ve seen that hacking tools, phishing scams and disruptive malware are becoming more sophisticated yet more accessible – so we’ve responded by continuing to develop our cyberdefence capability.

| | | | | | |

| | | |

| 16 | | British Telecommunications plc Annual Report & Form 20-F 2018 | | |

| | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | | |

| THE STRATEGIC REPORT | | | | GOVERNANCE | | | | FINANCIAL STATEMENTS | | | | ADDITIONAL INFORMATION |

| | | | | | | | | | | | |

Mobile network

We are investing in 4G geographic coverage and capability, consolidating the EE network’s position as the biggest and fastest in the UK. We aim to expand 4G to reach 95% of the UK’s geography by the end of 2020.

Wi-fi

We run one of the world’s biggestwi-fi networks, with around 5.9m hotspots.

Progress this year

This year we’ve:

| – | achieved 99.999% availability in our core network for broadband customers |

| – | deployed Ethernet and optical nodes into 38 data centres belonging to other companies to help grow business connectivity services. |

| – | upgraded 935 exchanges and migrated more than 309,000 customers to faster broadband services that are cheaper and more energy efficient for us to run |

| – | launched the BT Agile Connect service |

| – | reached more than 90% of the UK’s geography with our 4G network, giving many rural and remote areas access to 4G |

| – | built 323 new sites on the Emergency Service Network (ESN) |

| – | installed 138 InLinkUK units, providing users with freewi-fi at up to 1Gbps, free UK phone calls, rapid mobile device charging and touchscreen access to local digital services. |

Service platforms

We run a number of service platforms that combine our network and IT resources. They underpin many of our products. Our five core service platforms are voice and mobile, broadband and internet access, TV, Ethernet and managed data, and emerging services.

Our TV platform supports a growing number of customers. Our voice and mobile platform supports EE, BT Mobile and Plusnet Mobile; it also underpins the Emergency Services Network (ESN).

Progress this year

This year we’ve:

| – | shown the Ashes live from Australia – with enhanced digital experience, so BT Sport customers watching online or via the app can skip straight to key moments |

| �� | carried over one billion minutes a month on our BT Conferencing platform. |

IT systems platforms

Our IT systems let us manage processes, handle customer information and deliver products and services. They’re critical to serving customers and running our business.

We’ve completed the first phase of our EE integration programme. This involved moving EE people to BT systems so all our people could benefit from a single, consistent set of applications.

Progress this year

We’re simplifying the different technologies we use. This year we’ve:

| – | brought together BT and EE datacentre and core IT applications management |

| – | deployed robotic process automation, using software robots to carry out automated tasks, including order entry and order management, to cut costs and improve our back-office processes. |

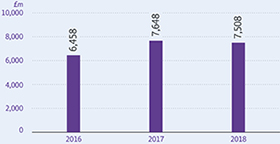

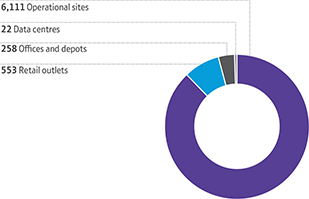

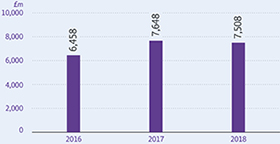

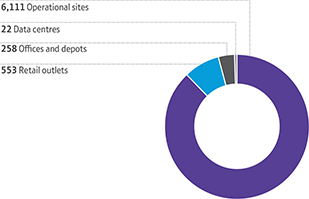

Properties

We have around 7,000 properties in the UK and 1,700 across the rest of the world.

We lease most of our UK properties from Telereal Trillium, part of the William Pears group. We signed a sale and leaseback arrangement with them in 2001. The majority (88%) of our UK properties are operational sites housing fixed and mobile telecoms and broadband kit. The rest are retail outlets, offices, contact centres, depots and data centres. We also have the BT Sport TV studios in London.

In the UK, we’ve rationalised and disposed of office, depot and data centre space in Croydon, Harrogate, Oxford and Wolverhampton.

Outside the UK, we’ve consolidated key office and operational locations in New York, Cincinnati, São Paulo, Frankfurt and Munich.

BT property portfolio (UK)a

a excludes leased cell sites, concessions in other retailers’ stores and franchisee-owned leases.

Research and development

Commercial success increasingly depends on innovation – that’s why we invest in R&D. The result is an enviable track record of scientific breakthroughs, engineering successes and commercial progress.

A proud history of innovation

In 1837, Sir William Fothergill Cooke and Sir Charles Wheatstone filed a patent for the world’s first practical electric telegraph. From this they founded The Electric Telegraph Company. This business eventually grew into BT.

Ingenuity transforms the world

Our innovation has continued to transform communications since

Cooke and Wheatstone’s electric telegraph. Often that impact has been wider than just communications. Colossus was the world’s first electronic programmable computer. It was created by GPO engineer Tommy Flowers in 1943, and heralded the start of the computer age. In 1984, we deployed the world’s first commercial 140Mbps single-mode optical fibre link. This technology is now the backbone of communications, carrying huge volumes of internet traffic around the globe. We made the world’s first live data call over GPRS (a mobile technology) in 1999. Less than 20 years later, mobile data has transformed the way people live.

You can read more about our innovation at

You can read more about our innovation at

btplc.com/innovation/innovation

| | | | | | |

| | | |

| | British Telecommunications plc Annual Report & Form 20-F 2018 | | 17 |

Our resources and culture continued

We showcased our innovation at two major events this year.

Innovation 2017 was held at Adastral Park, our global R&D headquarters in Suffolk, UK. It was attended by 625 customers and influencers, including government, investors, journalists and analysts. New Scientist Live hosted 30,000 visitors over four days. We sponsored its technology zone.

This year we invested around £510m (2016/17: around £520m) in R&D. Over the last decade we’ve been one of the largest investors in R&D both in the UK, and globally in the telecoms sector.a

Our research keeps producing new inventions. In 2017/18 we filed patent applications for 97 inventions (2016/17: 102), and as of 31 March 2018 had a worldwide portfolio of more than 5,000 patents and applications.

97

patent applications filed in 2017/18

5,000

patents and applications in our worldwide portfolio

Open innovation

No-one has a monopoly on good ideas. That’s why we work with partners, universities and customers from around the world.

There are eight BT global development centres. Our biggest is the innovation campus Adastral Park. Around 3,600 people work there and we share it with more than 90 other high-tech companies.

We have extensive, long-standing, joint-research programmes with Cambridge University (UK), Massachusetts Institute of Technology (USA), Tsinghua University (China), Khalifa University (UAE) and more than 30 other universities globally.

We’ve used ideas inspired by our collaboration with MIT or Artificial Intelligence (AI) and machine learning to create algorithms that give us a deeper understanding of our access network. This year we launched a five-year research collaboration with Huawei and the University of Cambridge. It will focus on photonics, digital and access network infrastructure and media technologies, alongside work aimed at boosting the impact of communications technologies in society.

We’ve opened the BT Ireland Innovation Centre with Ulster University in Belfast. It will work alongside the Belfast Global Development Centre and BT Labs at Adastral Park in Suffolk on projects including Internet of Things, artificial intelligence and data analytics for customer experience and cybersecurity.

Repurposed innovation

We like to repurpose innovations from other industries and apply them to our business. This year we flew a drone across a river in a Welsh valley to deliver a fibre. We’re looking into new ways to roll out fibre without so much digging. These include new directional drilling techniques and autonomous robots that propel themselves through the ground like worms.

Our researchers are investigating the application of artificial intelligence and machine learning techniques to the operation of 5G networks.

We’re also exploring how we can use a technique from the mobile world – called beamforming – to improve our copper lines’ performance. It exploits the interference or ‘crosstalk’ between copper cable pairs to boost the speed achievable on a line.

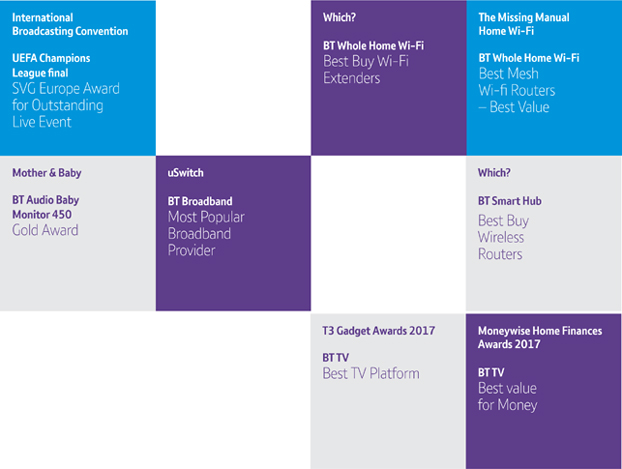

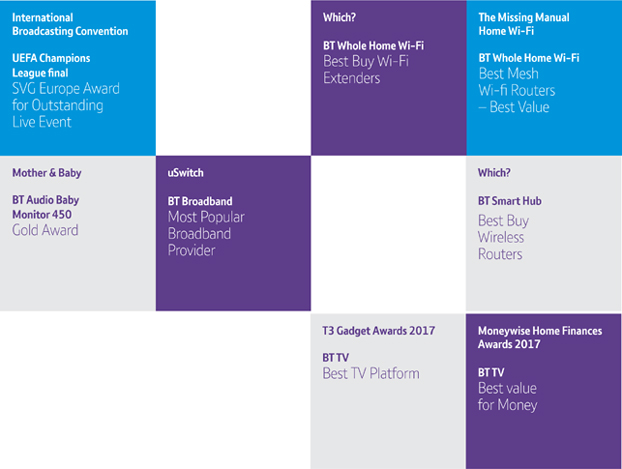

Awards for our research and development

We’re proud that our R&D is recognised outside BT. Here are some of the awards we’ve won this year.

| – | UK IT Awards: Best IoT (Internet of Things) Project |

| – | TM Forum 2017: Excellence Award for Smart City Innovator of the Year |

| – | TM Forum 2017: Outstanding Achievement Award |

| – | The Engineer magazine: Collaborate to Innovate Awards 2017 |

a Comparison based on total R&D spend 2007/8 to 2016/17. Source: EU Industrial R&D Investment Scoreboard, http://iri.jrc.ec.europa.eu/scoreboard.html

| | | | | | |

| | | |

| 18 | | British Telecommunications plc Annual Report & Form 20-F 2018 | | |

| | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | | |

| THE STRATEGIC REPORT | | | | GOVERNANCE | | | | FINANCIAL STATEMENTS | | | | ADDITIONAL INFORMATION |

| | | | | | | | | | | | |

| | | | | | |

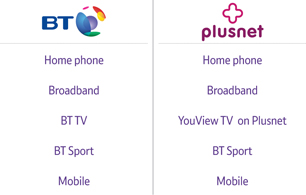

Brand and reputation We own three strong retail brands: BT, EE and Plusnet. Between them, they cover UK and global markets for consumers, businesses and the public sector. We’ve positioned these three brands to maximise their customer reach and minimise overlap. This multi-brand approach makes us more agile in our markets and broadens our overall appeal. We also own the Openreach brand, with which we serve communication providers. Lots of things affect our brands and reputation. But peoples’ direct interactions with us play a big part. That’s why we’re committed to optimising every aspect of customer experience: from our products to our service experience to our communication. For more on how we’re improving customer experience, see page 3 and our customer-facing units from page 48. | | | |

| | The BT brand stretches across consumer, business and public sector markets within the UK and across multinational business markets in 180 countries. |

| | | | | This year, we unveiled Ultrafast Fibre, the first and only fibre broadband with a 100Mbps speed guarantee, and we were host broadcaster of the UEFA Champions League Final in Cardiff. |

| | | | | In the UK business market, we have the highest awareness of any telecoms, networks and IT services brand. Strong business wins included network services for Severn Trent Water and mobility services for FirstGroup Plc. |

| | | | | BT was recognised as a leader for the 14thconsecutive time in Gartner’s Magic Quadrant for Network Service Providers, Globala. (See page 66). |

| | | | | And BT was named a ‘Leader’ in the IDC MarketScape for Worldwide Managed Security Services 2017 Vendor Assessmentb. |

| | | | | |

| | |

| | EE is the UK’s biggest mobile network operator, positioned at the cutting edge of technology. |

| | | | With around 600 retail stores across the UK, we are also first for spontaneous brand awareness, despite being the youngest major UK mobile brand by almost a decade. |

| | | | | EE’s mobile network has been independently recognised as the best overall network by RootMetrics and in 2017, it was the only network in the UK able to offer mobile connectivity for the new Apple Watch. |

| | | | | |

| | |

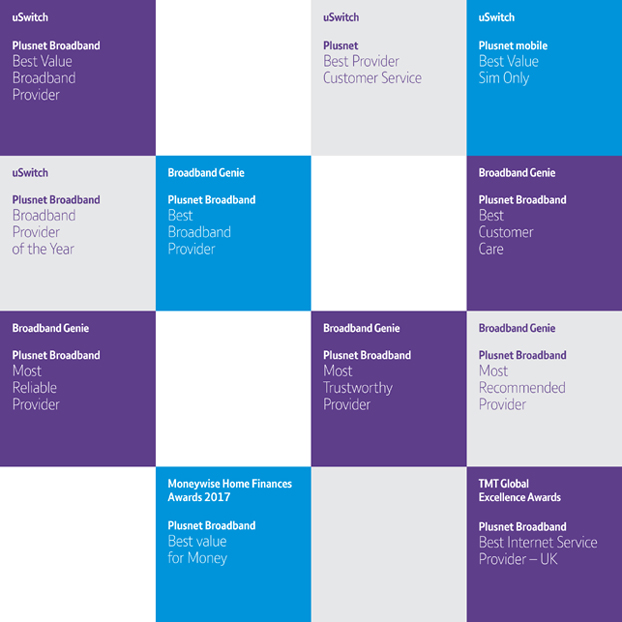

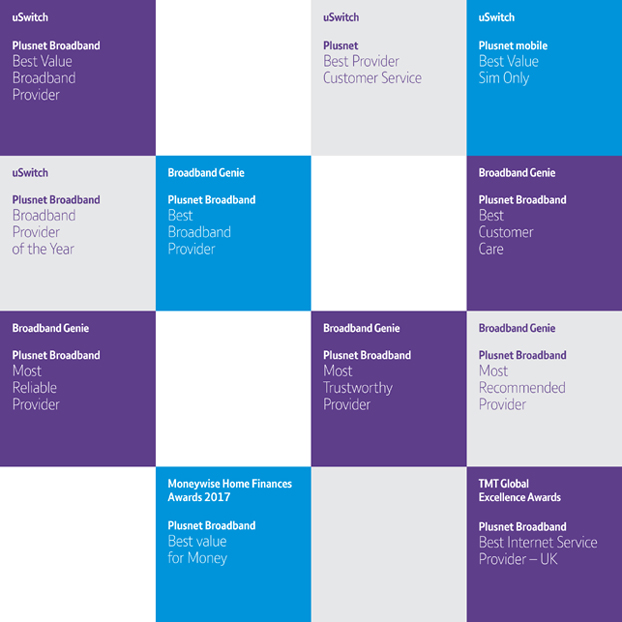

| | Plusnet offers UK customers a great value range of broadband and mobile services. |

| | | | In 2018, Plusnet’s outstanding customer service continued to be acknowledged with industry awards, including uSwitch’s Best Customer Service for the fifth consecutive year. |

| | | | | At the same awards, we also won Best Value for Money, Best Home Broadband and – despite only launching mobile in 2016 – BestValue Mobile(SIM-only). |

| | | | | |

| | |

| | Openreach (page 73) builds and maintains Britain’s digital communications network. |

| | | | | More than 25,000 engineers take care of 165 million kilometres of network, working in every community, every day. |

| | | | | This year, Openreach launched a new brand identity, reflecting commitments made as part of the DCR settlement (page 29). The programme to change all assets has already begun, including our buildings, vans and uniforms. |

a Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organisation and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

b MarketScape for Global Managed Security Services Vendor Assessment 2017, Martha Vazquez, 1 December 2017.

| | | | | | |

| | | |

| | British Telecommunications plc Annual Report & Form 20-F 2018 | | 19 |

Our resources and culture continued

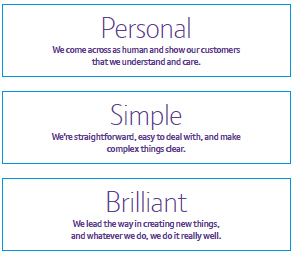

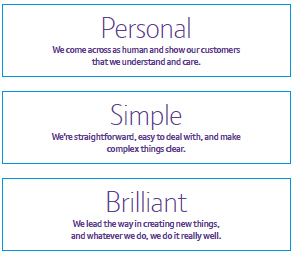

Our culture

We want our culture to reflect our values of personal, simple and brilliant, for our people and our customers.

Our values

We’re proudly personal, simple and brilliant in many ways already. That includes our history of pioneering innovation, a strong volunteering ethos, diverse career development for our people, and our ability to disrupt the market and reinvent ourselves when we need to – as through ventures like BT Sport, the 2012 Olympics and the acquisition of EE.

Embedding our values further

There’s more to do to be personal, simple and brilliant every day.

So we’ve launched a multi-year transformation programme to simplify our organisation, improve business performance, and reform our culture and capabilities.

This year we’ve begun simplifying how we do things – by helping our people take personal ownership to resolve their customers’ issues and introducing new ways to make better and faster decisions. That means making sure accountabilities are clear and decisions are made at the right level of the organisation, as close to customers as possible.

We’ve encouraged more diverse thinking in the business by attracting more diverse talent. This year we doubled our graduate intake and quadrupled our apprentice intake across the group. We’re offering more career development opportunities for our people, as well as inspiring fresh perspectives.

We’re also building new programmes and resources to help our people be brilliant, clarifying the key skills and behaviours they need now and in the future (including Management Essentials, Business Essentials and Connected Leaders (see page 23).

Finally, we’ve been helping our people do the right thing by:

| – | regularly reaffirming our expectation that everyone acts with integrity through our ethical code |

| – | creating a safe environment where everyone can speak up about risks and concerns |

| – | equipping our leaders to have more regular open and honest conversations so they make better-informed decisions. |

The BT Way

All of this will come together in ‘The BT Way’ – a three-part guide to reflect how we work together as a company, how we treat each other and how we expect everyone to behave. It will include:

| – | how we’reorganisedand how we deliver for our customers |

| – | what we expect from our people through our updatedethical code |

| – | what’s important to us and how we do things as expressed throughour values. |

Our efforts are having a positive impact

In January’sBT-wide ‘Your Say’ employee engagement survey, we did better than previous years on all our values scores:

| | | | | | | | | | | | | | |

| | +4% improvement in our Personal score (75%) | | | | | | +3% improvement in our Simple score (62%) | | | | | | +3% improvement in our Brilliant score (70%) |

| | | | | | |

| | | |

| 20 | | British Telecommunications plc Annual Report & Form 20-F 2018 | | |

| | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | | |

| THE STRATEGIC REPORT | | | | GOVERNANCE | | | | FINANCIAL STATEMENTS | | | | ADDITIONAL INFORMATION |

| | | | | | | | | | | | |

Respecting human rights

We’re committed to respecting human rights in our own business and through our broader relationships.

We believe that everyone is entitled to basic rights and freedoms, whoever they are and wherever they live. These are established in The International Bill of Human Rights and the International Labour Organisation’s Declaration on Fundamental Principles and Rights at Work.

We’ve been a signatory to the UN Global Compact since it was established in 2000 – this is the world’s largest corporate sustainability initiative. We use the UN Guiding Principles on Business and Human Rights (UN Guiding Principles) to guide our approach.

How could we impact human rights?

As a global company we could impact human rights either directly, or indirectly through our business relationships. Our biggest impact could be on customers’ rights to privacy and free expression.

We must comply with lawful government requests for information about how people use our services and the content of their communications, but this could impact our customers’ rights to privacy.

Free expression includes the right to access information. As a communications company, we need to consider situations where we might need to limit people’s access to content. We could also affect: our people’s rights if our employment standards fall short; workers in our supply chain through our buying practices; and communities where we operate, if we don’t stick to environmental standards.

How do we manage human rights in BT?

Our ethical code sets out the standards we expect of our people and those who work on our behalf, including how they respect human rights.

We have a team dedicated to human rights integration and a Human Rights Steering Group chaired by a member of our Executive Committee. This year it considered a range of issues, including:

| – | contracts we’re monitoring for human rights issues |

| – | our second Modern Slavery Act statement and programme |

| – | our second privacy and free expression report |

| – | the impact on human rights when broadcasting large sporting events. |

What we’ve been doing this year

We’ve been pulling together our existing policies on human rights issues into one overarching policy. As part of that we’ve reviewed our operations in key countries outside the UK with the help of a leading law firm.

Due diligence

In April 2017 we launched our enhanced customer due diligence process. To embed the key principles with our sales teams we held calls andface-to-face training.

| a | wiltonpark.org.uk/wp-content/uploads/WP1546-Report.pdf |

| b | btplc.com/Thegroup/Ourcompany/Ourvalues/ModernSlaveryAct |

| c | gov.uk/government/news/leading-businesses-unite-to-tackle-slavery |

| d | ihrb.org/focus-areas/mega-sporting-events/2017-sporting-chance-forum-meeting-report |

In our due diligence checks we look for whether:

| – | our product/service could be used for defence, military, law enforcement, security or cybersecurity purposes |

| – | the customer or end user is a government, government agency or state-owned company |

| – | the service is being provided in an extreme or high-risk country (based on external measures). |

If these criteria are met we look into things in more detail – which might include contractual protections or internal monitoring arrangements.

Modern slavery

In June 2017 weco-sponsored a residential summit of international experts which explored the role of technology in tackling modern slavery. Building on the findingsa we’re establishing an industry collaboration to address the challenges and opportunities for technology to help end modern slavery.

We published our second Modern Slavery Act statementb in August 2017. It explained our progress and the steps we’ve taken to prevent modern slavery in our business and supply chain. We’re also reviewing our policies, processes and procedures with the help of external experts.

We’ve continued to support the UK Modern Slavery Helpline partnering with anti-slavery charity Unseen – for more details see our Delivering Our Purpose Report.

In October 2017 Gavin Patterson joined the first Business Against Slavery Forumc hosted by the Home Office. The forum is a way for companies to collaborate and drive change on identifying and tackling modern slavery.

Sport and human rights

Big sporting events have a hugely positive social impact. But they can also carry human rights risks like labour rights violations and community displacement.

Throughout the year we’ve continued working with the participants in the Mega-Sporting Events Platform for Human Rights. With input from other broadcasters, we’ve created a tool to help identify human rights risks when broadcasting. We presented it at the second Sporting Chance Forumd in November 2017. The team at BT Sport team are trialling the tool in their compliance processes.

Priorities for the year ahead

We’ll launch our overarching human rights policy and embed it in our business having reviewed our existing metrics to support the new policy.

We’ll be refreshing our privacy and free expression report with data on information requests in countries outside the UK. We’ll also cover what we do on cybersecurity.

| | | | | | |

| | | |

| | British Telecommunications plc Annual Report & Form 20-F 2018 | | 21 |

Our stakeholders

As well as our people, our main stakeholders are customers, communities, lenders, pension schemes, suppliers, government and regulatory bodies.

Our people

People are the key to transforming our business. We want BT to be a place where people feel engaged and inspired to be the best they can be. We want them to use their skills and our technology to deliver great products and services for customers, communities and societies around the world.

Our people strategy is summed up by our ambition to be a great place to work. We want to deliver a great customer experience by getting our employee experience right. That means making BT a place where our people can do brilliant things. At the heart of this are our values.

Personal. Simple. Brilliant.

They guide our decisions and behaviours.

All of our people have a role to play in bringing our values to life – wherever they are and whatever job they do.

Our workforce

At 31 March 2018 we had 105,800 full-time equivalent (FTE) employees in 59 countries, with 82,200 based in the UK.

As our business evolves to meet our customers’ needs, we aim to reskill and redeploy our people to avoid redundancies where possible. Last year in the UK we redeployed almost 850 people, letting us keep experienced people with the skills we need for the future. More than a third of our redeployed people are in engineering or customer service. We’ve further developed their skills through training programmes.

Hiring talented people

We’ve increased awareness of BT as a brilliant employer by publishing engaging and informative careers content on social media. It’s making a difference. In 2017 we were recognised by Marketing Week as one of the ‘Best Places For Marketeers To Work’. Our content is continually liked and shared across social media and we’ve had over 1.3 million visits to our careers site.

This year, excluding acquisitions, we hired almost 14,100 people, of which almost 10,100 wereUK-based.

We’ve hired almost 2,400 engineers into Openreach as improving the quality of our customer relationships remains central to our people strategy.

Finally, we have converted almost 840 skilled agency workers to permanent employees because we recognise how important it is to keep experience inside our business.

Hiring more apprentices

We hired more than 2,100 new apprentices across the group in 2017/18. This is more than double the previous year’s intake, following the introduction of the apprenticeship levy in April 2017. We plan to take on a further 4,600 apprentices next year.

Hiring more graduates

This year, we recruited 460 graduates globally, and we plan to hire more than 480 next year.

Awards

Once again we’re in The Times Top 100 Graduate Employers. We’re one of only three companies in the IT and telecoms sector to feature in the top 100.

Recognition

We’ve been named ‘large employer of the year’ at the Scottish Training Federation and the BPP awards, and ‘creative and digital employer of the year’ at the Asian apprentice awards.

Reputation

We’re extremely proud our apprenticeship programmes have recently been graded ‘excellent’ in all areas in the latest Education Scotland audit.

Investing for growth

We never stop learning – whether that’s on the job or inface-to-face training. Our digital academy platform enables our people to solve problems and share knowledge and ideas with colleagues.

It’s how we adapt to a changing world and rise to tomorrow’s challenges. This year we’ve launched these new learning programmes:

| | |

| |

Global new joiner programme | | A refreshed induction for new hires, globally. We’ve rolled out corporate induction events and launched a new website for new joiners, which gets 14,000 visits a month. |

| |

Business Essentials | | A suite of foundation-level online learning resources for everyone in BT, covering 18 core skills. |

| |

Management Essentials | | These workshops help people managers to have better conversations with their team. The online platform helps them get to grips with the fundamentals of managing people at BT. |

Following 2016’s launch of the Fibre Academy and showcase, we’ve opened a new training centre called ‘Open Street’. It replicates the Openreach fibre and copper network from exchange to customer premises, with a working exchange, street cabinets, houses and business premises. It includes theend-to-end underground and over ground accessible network for our engineers to train and accredit on. It’s open for network demonstrations for BT as well as our external customers.

Investing for change

In such a fast moving industry we must invest in the skills, capabilities, methods and tools to define and deliver change in the

| | | | | | |

| | | |

| 22 | | British Telecommunications plc Annual Report & Form 20-F 2018 | | |

| | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | | |

| THE STRATEGIC REPORT | | | | GOVERNANCE | | | | FINANCIAL STATEMENTS | | | | ADDITIONAL INFORMATION |

| | | | | | | | | | | | |

right way. We’ve developed a new change approach to improve our customer experience, growing our business and making BT an even better place to work.

Our change approach

We define change by understanding where we are today and what we and our customers need. We create a solution to deliver the change. And through this cycle, we take steps to engage our people.

Leadership

This year, we’ve invested heavily in leaders. We’ve appointed 42 senior leaders, with 19 of these coming from other organisations. We’ve launched the Connected Leaders development programme to identify the type of leaders we want to attract and develop internally. It’s been a huge success; with over 39,000 people accessing the online development platform, 8,000 leaders completing a personal development assessment and more than 700 attending our learning programmes.

We’ve also launched two new development programmes targeted at people with high potential.

| | |

| |

Future Leaders | | In 2017/18, we’ve taken on more than 300 people with high potential and developed them to become leaders for the first time. More than 40% of the 2016/17 cohort have gone on to become managers. |

| |

Senior Talent Programmes | | We’ve identified more than 80 senior leaders as having high potential for the future, and started accelerating their career development. |

Engaging our people

Around 93,000 (86%) of our people responded to our ‘Your Say’ engagement survey in January 2018. It’s our highest ever completion rate. The survey results show improved overall engagement at 74%. This is encouraging. There’s been a steady improvement in many categories since June 2017.

| | | | | | | | |

| | | |

BT | | | % Fav. | | | | Change | |

Engagement outcome | | 74% | | | +2% | |

Leading our people | | 59% | | | +5% | |

Managing our people | | 81% | | | +2% | |

Empowering and equipping our

people | | 61% | | | +2% | |

Enabling outstanding customer experience | | 64% | | | +3% | |

Working together | | 65% | | | +2% | |

Personal growth | | 73% | | | +3% | |

We tell our people about company results, major business decisions and other things that affect them through lots of different channels. Leaders regularly meet their teams through roundtables, town hall debates, site visits, webcasts and blogs.

We also listen to our people’s concerns through more formal engagement with our European Consultative Council, the

Communication Workers Union, Prospect and EE employee representatives in the UK.

Volunteering

| | |

| |

Our 2020 ambition | | |

| |

| 66% | | Inspiretwo-thirds of |

| | our people to volunteer |

As part of our commitment to support charities and communities, (page 26), our people get up to three working days a year to volunteer. Volunteering means they can use their skills, energy and enthusiasm to tackle an issue or make a practical difference in their communities. Our volunteering website lists opportunities and lets everyone log activities centrally.

This year more than 2,000 of our people spent almost 5,000 days supporting our work to build a culture of tech literacy as Barefoot and Work Ready volunteers (see page 26).

Overall, 39% of our people registered their volunteering activity this year.

| | | | | | |

| | | |

| | British Telecommunications plc Annual Report & Form 20-F 2018 | | 23 |

Our stakeholders continued

Diversity at work

We want a diverse workforce that matches our customers and delivers our business goals.

In March 2018 we reported our first Gender Pay Gap data under new government guidelines, relating to data from April 2017. Our gap is below the UK average. But we are still working hard to be more diverse and inclusive, and to have women better represented at all levels in our business.

Around 26% of our workforce and 28% of our management are women. Three out of eleven Board members are women (27%). And 42% of our new executive hires have been women.

By 2020 we want women in 40% of our most senior roles. To support this, we’re widening our Tech Women programme which develops talented BT women into senior roles where they’re underrepresented. This year we extended the programme to 172% more women than last year, including those outside the UK. In March, the programme won the BQF ‘Innovation in Diversity’ award.

We’ve also launched an extra employee network to connect mums who are returning to work. Our maternity return rate is 86%, measured one year after women returned to work.

We’ve been named in the Business in the Community’s 100 Top Employers for Best Employers for Race 2017.

Around 12% of our people have a Black, Asian or Minority Ethnic (BAME) background. Around 19% of our external appointments come from a BAME background.

Sponsorship helps build an environment where diversity is valued. So our senior leaders have had Inclusive Leadership workshops to help them overcome unintentional bias in decision making. We’ve also appointed executive sponsors for women, women in tech, race, disability and LGBT+.

Health, safety and wellbeing

Improving our people’s wellbeing is just the right thing to do. But it also drives better business performance.

The latest research is helping us determine what we need to do to foster good physical, psychological and emotional health in our workplace – beyond our commitment to ‘zero avoidable harm’. Our global health, safety and wellbeing policy sets out our approach and the Executive Committee and Board regularly monitor progress.

Our accident rate has dropped by a further 11% to its lowest-ever level and far fewer injuries are serious. Our risk profile is changing as we recruit more young people and we’ve responded by enhancing training and improving health and safety systems.

Fewer people took time off sick this year and our absence rate has dropped by 1% to 2.3% (against our 2.24% target).

Mental health is still our biggest focus. We endorse all the recommendations of the UK Government’s Stevenson/Farmer review. Prevention is key. Today work-related problems account for 16% of people seeking psychological support, compared with 36%