UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14A-101)

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE SECURITIES

EXCHANGE ACT OF 1934 (AMENDMENT NO. ___)

| Filed by Registrant | | þ |

| |

| Filed by a Party other than the Registrant | | o |

Check the appropriate box:

| o | | Preliminary Proxy Statement. |

| |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)). |

| |

| þ | | Definitive Proxy Statement. |

| |

| o | | Definitive Additional Materials. |

| |

| o | | Soliciting Material Pursuant to Section 240.14a-12. |

FIRST AMERICAN INVESTMENT FUNDS, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | | No fee required. |

| |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| o | | Fee paid previously with preliminary materials. |

| |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

IMPORTANT NOTICE TO STOCKHOLDERS

November 10, 2010

Although we recommend that you read the complete Proxy Statement, for your convenience, we have provided a brief overview of the issues to be voted on.

| | |

| Q. | | Why am I receiving this Proxy Statement? |

| |

| A. | | You are a stockholder of one or more series (each a “Fund” and, collectively, the “Funds”) of First American Investment Funds, Inc. (the “Company”). FAF Advisors, Inc. (“FAF”), a wholly-owned subsidiary of U.S. Bank National Association (“U.S. Bank”), serves as investment adviser and administrator to each Fund. On July 29, 2010, U.S. Bank and FAF entered into a definitive agreement with Nuveen Investments, Inc. (“Nuveen”), Nuveen Asset Management (“NAM”) and certain Nuveen affiliates whereby NAM will acquire a portion of the asset management business of FAF (the “Transaction”). The acquired business includes the assets of FAF used in providing investment advisory services, research, sales and distribution in connection with equity, fixed income, real estate, global infrastructure and asset allocation investment products (other than the money market business and closed-end funds advised by FAF), including the Funds. In connection with the Transaction, the Board of Directors of the Company (the “Board”) considered a number of proposals designed to integrate the Funds into the Nuveen family of funds, including the appointment of NAM as investment adviser and Nuveen Investments, LLC as distributor to the Funds. |

| | |

| Q. | | What proposals are stockholders being asked to consider? |

| | |

| A. | | You are being asked to approve a new investment advisory agreement (the “New Advisory Agreement”) for each Fund with NAM and a newsub-advisory agreement for each Fund between NAM and a wholly-owned subsidiary of NAM formed in anticipation of an internal restructuring (the “NAMSub-Advisory Agreement”). NAM will enter into thissub-advisory agreement at the later of the closing of the internal restructuring or the closing of the Transaction. If you are a shareholder of the International Fund or the International Select Fund, you are also being asked to approve a newsub-advisory agreement between NAM and your Fund’s currentsub-advisor (each a “New InternationalSub-Advisory Agreement”). You also are being asked to consider the election of a new Board. |

| | |

| Q. | | How will the Transaction affect me as a Fund stockholder? |

| | |

| A. | | Your Fund will be integrated into the Nuveen family of funds and be rebranded as a Nuveen Fund. Upon the closing of the Transaction, NAM will not only serve as investment adviser to the Funds, but will also provide many related services such as administration, marketing and distribution, and shareholder services. Shortly after closing of the Transaction, you will have access to all of the investment choices and all of the shareholder services available to Nuveen shareholders. The investment objective of your Fund and its principal investment strategies will not change as a result of the Transaction. Except for the tax free bond funds, the portfolio managers for each Fund in place immediately prior to the Transaction are expected to remain the same. |

| | |

| | The Board, FAF and NAM believe that the Transaction may benefit each Fund’s stockholders in a number of ways, including: the potential for lower investment management fees as assets increase as a result of management fee breakpoints, lower overall fund expenses as the Funds realize economies of scale from being part of a larger fund complex, expanded investment choices within the fund complex and affiliation with a well-recognized fund sponsor. |

| |

| Q. | | How does the proposed New Advisory Agreement differ from the current agreement? |

| |

| A. | | While the investment advisory services to be provided under the proposed New Advisory Agreement are similar to those under the current investment advisory agreement between the Company and FAF (the “Current Advisory Agreement”), there are some differences in the terms of the Agreements. One important difference is that the fee rate under the New Advisory Agreement will be comprised of a fund-level fee rate and a complex-wide level fee rate, both of which include breakpoints, while the Current Advisory Agreement only charges a fund-level fee rate which, in most cases, does not include breakpoints. Another |

1

| | |

| | important difference is that the services provided by NAM under the New Advisory Agreement include certain administrative services, whereas under the current structure, these administrative services and certain additional services are provided pursuant to a separate administrative agreement between the Funds and FAF (the “Current Administrative Agreement”) and administrative fees are paid by the Funds separately from advisory fees. Accordingly, the fee rates paid under the New Advisory Agreement are higher for most Funds than the fee rates paid under the Current Advisory Agreement because the services to be provided under the New Advisory Agreement are more extensive than those provided under the Current Advisory Agreement. The maximum fee rates payable under the New Advisory Agreement are lower than the total fees payable under the Current Advisory Agreement and the Current Administrative Agreement, in the aggregate. However, certain services provided to the Funds under the Current Administrative Agreement, including certain accounting services, will not be provided to the Funds under the New Advisory Agreement and will be delegated to other service providers. In addition, certain fees paid by FAF under the Current Administrative Agreement, including certain networking and sub-transfer agency fees, will not be paid by NAM under the New Advisory Agreement and will be paid for directly by the Funds. |

| | |

| | Your Fund will be integrated into the Nuveen family of funds and will adopt the fee and expense structure of the Nuveen Funds. Although Nuveen has not contractually committed to implement expense caps for certain Funds, the Nuveen fee and expense structure is expected to result in the same or lower net expenses immediately following the Transaction, assuming the Funds’ net assets at the time of the closing of the Transaction are no lower than their June 30, 2010 level, adjusted to reflect a decrease in net assets (where applicable) from redemptions by the U.S. Bank 401(k) Plan that are expected to occur prior to the closing of the Transaction. However, for certain Funds, gross expenses may be higher following the Transaction. Please review the detailed information with respect to your Fund in the enclosed Proxy Statement. |

| | |

| | Comparisons of certain provisions of the New Advisory Agreement and the Current Advisory Agreement are included in the enclosed Proxy Statement and a form of the New Advisory Agreement is included as an appendix. |

| | |

| Q. | | How do the proposed New InternationalSub-Advisory Agreements differ from the current agreements? |

| | |

| A. | | The terms of the New InternationalSub-Advisory Agreements are identical in all material respects to those of the currentsub-advisory agreements between FAF and eachsub-advisor for the International Fund and International Select Fund (the “Current InternationalSub-Advisory Agreements”), except for their dates of effectiveness and term. The fee rates payable by NAM to eachsub-advisor under the New InternationalSub-Advisory Agreements are identical to those paid by FAF under the Current InternationalSub-Advisory Agreements. |

| | |

| | Comparisons of certain provisions of the New InternationalSub-Advisory Agreements and the Current InternationalSub-Advisory Agreements are included in the enclosed Proxy Statement and forms of the New InternationalSub-Advisory Agreements are included as appendices. |

| |

| Q. | | Who are being nominated to serve as directors? |

| |

| A. | | There are ten nominees, one of whom currently serves on the Board. The other nine nominees currently serve as directors or trustees to various Nuveen funds and were recommended by the current Board to serve upon the closing of the Transaction. It is expected that the current member of the Board who is being nominated will join the boards of other Nuveen Funds. The proposed use of a single board for all funds in the Nuveen family of funds is expected to result in enhanced supervision, administrative efficiencies and cost savings. |

| |

| Q. | | What happens if the proposals are not approved? |

| |

| A. | | The closing of the Transaction is subject to the satisfaction or waiver of customary conditions. If the closing conditions are not satisfied or waived, the Transaction will not close. If the Transaction does not close, none of the proposals in the enclosed Proxy Statement will take effect and the current Board will continue to serve and will take such actions as it deems in the best interest of the Funds. |

2

| | |

| | If the Transaction closes but the stockholders of a specific Fund have not approved a New Advisory Agreement, the then current Board will take such actions as it deems in the best interest of the Fund, which may include terminating the Current Advisory Agreement and entering into an interim investment advisory agreement with NAM. |

| |

| Q. | | How does my Fund’s Board recommend that I vote? |

| | |

| A. | | The Board recommends that you vote FOR the approval of the New Advisory Agreement and NAMSub-Advisory Agreement, FOR the approval of any New InternationalSub-Advisory Agreement, if applicable, and FOR the election of the nominees as listed in the enclosed Proxy Statement. |

| | |

| Q. | | Who will pay for the proxy solicitation? |

| | |

| A. | | The expenses associated with the proxy materials, including the preparation, printing and mailing of the enclosed proxy cards, the accompanying notice and proxy statement, will not be borne by any Fund. NAM and U.S. Bank will share any costs associated with the preparation, printing and mailing of the proxy statement, solicitation of proxy votes and the costs of holding the stockholder meetings. |

| | |

| Q. | | Whom do I call if I have questions? |

| | |

| A. | | If you need any assistance, or have any questions regarding the proposals or how to vote your shares, please call The Altman Group, your Fund’s proxy solicitor, at(800) 317-8033. Please have your proxy materials available when you call. |

| |

| Q. | | How do I vote my shares? |

| |

| A. | | You can vote your shares by completing and signing the enclosed proxy card, and mailing it in the enclosed postage-paid envelope. Alternatively, you may vote by telephone by calling the toll-free number on the proxy card or by computer by going to the Internet address provided on the proxy card and following the instructions, using your proxy card as a guide. |

| |

| Q. | | Will anyone contact me? |

| |

| A. | | You may receive a call from The Altman Group to verify that you received your proxy materials, to answer any questions you may have about the proposals and to encourage you to vote your proxy. |

| | |

| | We recognize the inconvenience of the proxy solicitation process and would not impose on you if we did not believe that the matters being proposed were important and in the best interests of the Funds. Once your vote has been registered with the proxy solicitor, your name will be removed from the solicitor’sfollow-up contact list. |

3

800 NICOLLET MALL

MINNEAPOLIS, MINNESOTA 55402

(800) 677-3863

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

DECEMBER 17, 2010

November 10, 2010

First American Investment Funds, Inc.

California Tax Free Fund

Colorado Tax Free Fund

Core Bond Fund

Equity Income Fund

Equity Index Fund

Global Infrastructure Fund

High Income Bond Fund

Inflation Protected Securities Fund

Intermediate Government Bond Fund

Intermediate Tax Free Fund

Intermediate Term Bond Fund

International Fund

International Select Fund

Large Cap Growth Opportunities Fund

Large Cap Select Fund

Large Cap Value Fund

Mid Cap Growth Opportunities Fund

Mid Cap Index Fund

Mid Cap Select Fund

Mid Cap Value Fund

Minnesota Intermediate Tax Free Fund

Minnesota Tax Free Fund

Missouri Tax Free Fund

Nebraska Tax Free Fund

Ohio Tax Free Fund

Oregon Intermediate Tax Free Fund

Quantitative Large Cap Core Fund

Real Estate Securities Fund

Short Tax Free Fund

Short Term Bond Fund

Small Cap Growth Opportunities Fund

Small Cap Index Fund

Small Cap Select Fund

Small Cap Value Fund

Tactical Market Opportunities Fund

Tax Free Fund

Total Return Bond Fund

(each a “Fund,” and collectively, the “Funds”)

To the Stockholders of the Above Funds:

Notice is hereby given that a special meeting of stockholders (the “Special Meeting”) of the Funds listed above will be held at the offices of FAF Advisors, Inc., 800 Nicollet Mall, 3rd Floor — Training Room A, Minneapolis, MN 55402, on December 17, 2010 at 11:00 a.m. central time, for the following purposes:

Matters to Be Voted on by Stockholders:

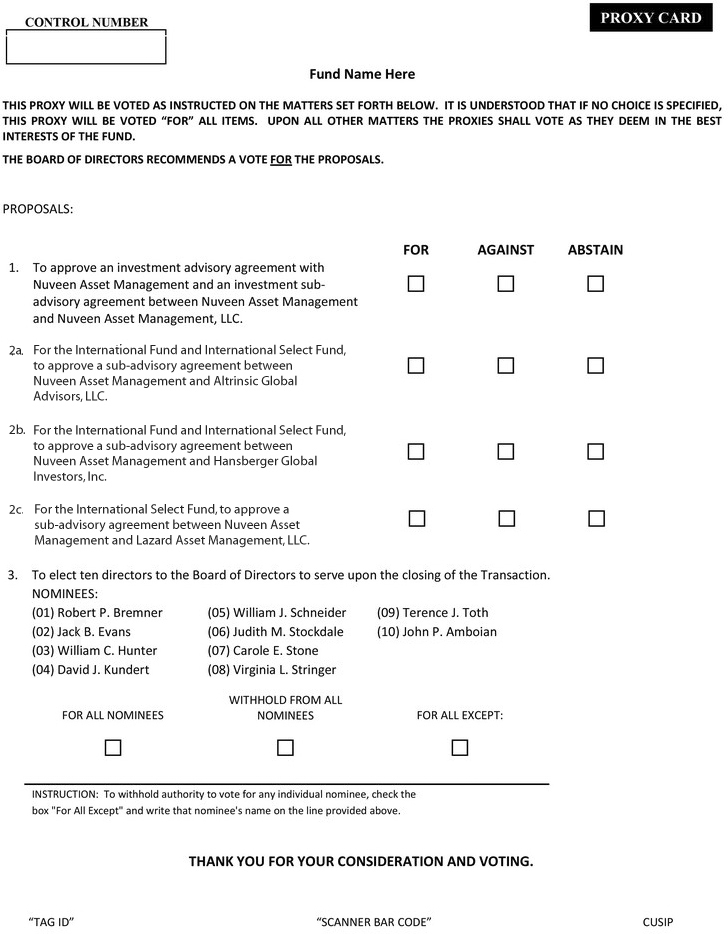

1. For each Fund, to approve an investment advisory agreement with Nuveen Asset Management and an investmentsub-advisory agreement between Nuveen Asset Management and Nuveen Asset Management, LLC.

2. For the International Fund and International Select Fund only, to approvesub-advisory agreements between Nuveen Asset Management and each Fund’s currentsub-advisors.

3. For each Fund, to elect ten directors to the Board of Directors to serve upon the closing of the Transaction.

4. To transact such other business as may properly come before the Special Meeting.

Stockholders of record at the close of business on October 25, 2010 are entitled to notice of and to vote at the Special Meeting.

All stockholders are cordially invited to attend the Special Meeting. In order to avoid delay and additional expense and to assure that your shares are represented, please vote as promptly as possible, regardless of whether you plan to attend the Special Meeting. You may vote by mail, telephone or over the Internet. To vote

1

by mail, please mark, sign, date and mail the enclosed proxy card. No postage is required if mailed in the United States. To vote by telephone, please call the toll-free number located on your proxy card and follow the recorded instructions, using your proxy card as a guide. To vote over the Internet, go to the Internet address provided on your proxy card and follow the instructions, using your proxy card as a guide.

Thomas S. Schreier, Jr.

President

2

800 NICOLLET MALL

MINNEAPOLIS, MINNESOTA 55402

(800) 677-3863

PROXY STATEMENT

November 10, 2010

This Proxy Statement is first being mailed to stockholders on or about November 12, 2010.

First American Investment Funds, Inc.

California Tax Free Fund

Colorado Tax Free Fund

Core Bond Fund

Equity Income Fund

Equity Index Fund

Global Infrastructure Fund

High Income Bond Fund

Inflation Protected Securities Fund

Intermediate Government Bond Fund

Intermediate Tax Free Fund

Intermediate Term Bond Fund

International Fund

International Select Fund

Large Cap Growth Opportunities Fund

Large Cap Select Fund

Large Cap Value Fund

Mid Cap Growth Opportunities Fund

Mid Cap Index Fund

Mid Cap Select Fund

Mid Cap Value Fund

Minnesota Intermediate Tax Free Fund

Minnesota Tax Free Fund

Missouri Tax Free Fund

Nebraska Tax Free Fund

Ohio Tax Free Fund

Oregon Intermediate Tax Free Fund

Quantitative Large Cap Core Fund

Real Estate Securities Fund

Short Tax Free Fund

Short Term Bond Fund

Small Cap Growth Opportunities Fund

Small Cap Index Fund

Small Cap Select Fund

Small Cap Value Fund

Tactical Market Opportunities Fund

Tax Free Fund

Total Return Bond Fund

(each a “Fund,” and collectively, the “Funds”)

General Information

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of First American Investment Funds, Inc. (the “Company”), a Maryland corporation, on behalf of each Fund, of proxies to be voted at a special meeting of stockholders (the “Special Meeting”) to be held at the offices of FAF Advisors, Inc., 800 Nicollet Mall, 3rd Floor — Training Room A, Minneapolis, MN 55402, on December 17, 2010 at 11:00 a.m. central time, and at any and all adjournments thereof.

All properly executed proxies received prior to the Special Meeting will be voted at the Special Meeting in accordance with the instructions marked thereon or as otherwise provided. Unless instructions to the contrary are marked, properly executed proxies will be voted “FOR” the approval of the New Advisory Agreement (as defined below) and NAMSub-Advisory Agreement (as defined below), “FOR” the approval of the New InternationalSub-Advisory Agreements (as defined below), if applicable, and “FOR” the election of the Director Nominees (as defined below). Any proxy may be revoked at any time prior to the exercise thereof by giving written notice to the Secretary of the Company at the address indicated above, by voting again using your original proxy card or through the Internet or toll-free telephone call, or by voting in person at the Special Meeting.

Those persons who were stockholders of record at the close of business on October 25, 2010 (the “Record Date”) will be entitled to one vote for each share held and a proportionate fractional vote for each fractional

1

share held. The following table lists the number of shares of each Fund issued and outstanding as of the Record Date.

| | | | | |

| | | Outstanding

| |

Fund | | Shares | |

| |

| California Tax Free Fund | | | 9,924,648.814 | |

| Colorado Tax Free Fund | | | 6,530,602.272 | |

| Core Bond Fund | | | 114,199,123.073 | |

| Equity Income Fund | | | 65,924,582.032 | |

| Equity Index Fund | | | 41,889,825.600 | |

| Global Infrastructure Fund | | | 16,215,587.904 | |

| High Income Bond Fund | | | 51,643,126.266 | |

| Inflation Protected Securities Fund | | | 18,443,937.919 | |

| Intermediate Government Bond Fund | | | 19,670,901.685 | |

| Intermediate Tax Free Fund | | | 74,348,647.539 | |

| Intermediate Term Bond Fund | | | 75,903,695.417 | |

| International Fund | | | 58,191,556.466 | |

| International Select Fund | | | 89,497,795.988 | |

| Large Cap Growth Opportunities Fund | | | 19,980,777.087 | |

| Large Cap Select Fund | | | 11,548,668.299 | |

| Large Cap Value Fund | | | 23,885,353.276 | |

| Mid Cap Growth Opportunities Fund | | | 33,677,175.299 | |

| Mid Cap Index Fund | | | 22,384,832.713 | |

| Mid Cap Select Fund | | | 4,152,316.050 | |

| Mid Cap Value Fund | | | 26,190,918.981 | |

| Minnesota Intermediate Tax Free Fund | | | 24,198,264.310 | |

| Minnesota Tax Free Fund | | | 15,768,026.512 | |

| Missouri Tax Free Fund | | | 14,159,592.206 | |

| Nebraska Tax Free Fund | | | 4,157,055.590 | |

| Ohio Tax Free Fund | | | 6,320,482.214 | |

| Oregon Intermediate Tax Free Fund | | | 16,540,395.492 | |

| Quantitative Large Cap Core Fund | | | 9,988,334.668 | |

| Real Estate Securities Fund | | | 135,896,997.355 | |

| Short Tax Free Fund | | | 31,908,282.981 | |

| Short Term Bond Fund | | | 79,230,226.719 | |

| Small Cap Growth Opportunities Fund | | | 9,275,891.768 | |

| Small Cap Index Fund | | | 6,717,298.302 | |

| Small Cap Select Fund | | | 64,222,374.998 | |

| Small Cap Value Fund | | | 20,798,789.541 | |

| Tactical Market Opportunities Fund | | | 2,571,102.051 | |

| Tax Free Fund | | | 48,809,587.541 | |

| Total Return Bond Fund | | | 68,318,222.711 | |

Summary of Proposals and Funds Affected

The following chart specifies the Funds whose stockholders will be entitled to vote at the Special Meeting on each of the proposals being presented for stockholder consideration. The proposals are set forth in the Notice of Special Meeting and are discussed in detail in this Proxy Statement.

2

| | | | | |

Proposal | | Affected Funds | | Page Number |

| |

| Proposal 1: To approve an investment advisory agreement with Nuveen Asset Management and an investmentsub-advisory agreement between Nuveen Asset Management and Nuveen Asset Management, LLC. | | Each Fund, voting separately. | | 5 |

| | | | | |

| | | | | |

| Proposal 2: To approve asub-advisory agreement between Nuveen Asset Management and each Fund’s currentsub-advisors. | | International Fund

International Select Fund

In each case, voting separately. | | 38 |

| | | | | |

| | | | | |

| Proposal 3: To elect ten directors to the Board of Directors. | | All Funds, voting together. | | 42 |

| | | | | |

| | | | | |

| Proposal 4: To transact such other business as may properly come before the Special Meeting. | | Each Fund, voting separately. | | |

Background

FAF Advisors, Inc. (“FAF”), a wholly-owned subsidiary of U.S. Bank National Association (“U.S. Bank”), serves as investment adviser and administrator to each Fund. On July 29, 2010, U.S. Bank and FAF entered into a definitive agreement (the “Asset Purchase Agreement”) with Nuveen Investments, Inc. (“Nuveen”), Nuveen Asset Management (“NAM”) and certain Nuveen affiliates, whereby NAM will acquire a portion of the asset management business of FAF (the “Transaction”). The consideration payable under the Asset Purchase Agreement consists of a cash payment payable at the closing date in the amount of eighty million dollars ($80,000,000), subject to certain closing adjustments. In addition, U.S. Bank will receive a 9.5% equity interest in NAM’s ultimate parent company. The acquired business includes the assets of FAF used in providing investment advisory services, research, sales and distribution in connection with equity, fixed income, real estate, global infrastructure and asset allocation investment products (other than the money market business and closed-end funds advised by FAF), including the Funds. In connection with the Transaction, the Board of Directors of the Funds (the “Board”) considered a number of proposals designed to integrate the Funds into the Nuveen family of funds, including the appointment of NAM as investment adviser and Nuveen Investments, LLC as distributor to the Funds. The Board also considered a proposal in connection with an internal restructuring of NAM, for Nuveen Asset Management, LLC (“NAM LLC”), a wholly-owned subsidiary of NAM formed in anticipation of the restructuring, to serve assub-advisor for each Fund.

The Board has approved, and you are being asked to approve, a new investment advisory agreement (the “New Advisory Agreement”) for each Fund with NAM and an investmentsub-advisory agreement between NAM and NAM LLC (the “NAMSub-Advisory Agreement”). For the International Fund and the International Select Fund, you are being asked to approve newsub-advisory agreements between NAM and such Funds’ currentsub-advisors (each, a “New InternationalSub-Advisory Agreement”). You also are being asked to consider the election of ten nominees (the “Director Nominees”) to the Board, one of whom currently serves on the Board. The other nine Director Nominees currently serve as trustees or directors of various registered investment companies sponsored by Nuveen (the “Nuveen Funds”) and were recommended by the current Board to serve upon the consummation of the Transaction.

The Transaction is expected to close during the fourth quarter of 2010 and is subject to the satisfaction or waiver of customary conditions, including FAF maintaining a specified percentage of its revenues between signing and closing, which will be largely impacted by whether the proposed New Advisory Agreement for the Funds and new advisory agreements for other funds advised by FAF are approved.

As part of the Transaction, it is expected that substantially all investment professionals employed by FAF whose employment responsibilities relate primarily to the acquired business will be offered employment by NAM or NAM LLC. The portfolio managers for each Fund employed by FAF (with the exception of the tax

3

free bond funds) in place immediately prior to the Transaction are expected to remain the same after the Transaction.

The New Advisory Agreement, the New InternationalSub-Advisory Agreements and the election of the Director Nominees, if approved, will take effect as of the closing of the Transaction. The NAMSub-Advisory Agreement, if approved, will take effect at the later of the internal restructuring or the closing of the Transaction.

Section 15(f)

The Board has been advised that, in connection with carrying out the Transaction, the parties to the Asset Purchase Agreement are obligated to use their best efforts to ensure reliance on Section 15(f) of the Investment Company Act of 1940, as amended (the “1940 Act”), which provides a safe harbor for an investment adviser to an investment company, and any of the investment adviser’s affiliated persons (as that term is defined in the 1940 Act ), to receive any amount or benefit in connection with a sale of an interest in the investment adviser, provided that two conditions are met.

First, for a period of not less than three years after the closing of the Transaction, the Asset Purchase Agreement provides that no more than 25% of the members of the Board shall be “interested persons” of Nuveen, FAF or their affiliates. Second, for a period of not less than two years following the closing of the Transaction, the Asset Purchase Agreement provides that Nuveen and its affiliates shall not impose any “unfair burden” on any Fund as a result of the Transaction. An “unfair burden” would include any arrangement whereby an adviser, or any “interested person” of the adviser, would receive or be entitled to receive any compensation, directly or indirectly, from the Funds or their stockholders (other than fees for bona fide investment advisory or other services) or from any person in connection with the purchase or sale of securities or other property to, from or on behalf of the Funds (other than bona fide ordinary compensation as principal underwriter for a Fund).

Consistent with the parties’ reliance on Section 15(f), NAM has committed to certain undertakings to maintain current fee capsand/or to waive fees or reimburse expenses to maintain net management fees at certain levels and Nuveen has represented to the Board that Nuveen and its affiliates will not take any action that imposes an “unfair burden” on any Fund as a result of the Transaction. In addition, as of the closing of the Transaction, at least 75% of the members of the then current board of directors of the Company will not be “interested persons” of Nuveen, FAF or their affiliates.

Other

The Board has also approved (i) Nuveen Investments, LLC to serve as distributor of the Funds following the closing of the Transaction, (ii) U.S. Bank to continue to serve as custodian of the Funds, and (iii) U.S. Bancorp Fund Services, LLC, an affiliate of U.S. Bank, to continue to provide transfer agent and fund accounting/administrative services to the Funds. The Asset Purchase Agreement provides that for a specified period following the closing of the Transaction, subject to its fiduciary duty and the ongoing ability of U.S. Bank and its affiliates to provide services at competitive rates and levels of service, NAM agrees to recommend the continuation, extension or renewal of contracts with U.S. Bank and its affiliates to provide custody, transfer agency and fund accounting/administrative services to the Funds. The Asset Purchase Agreement also provides that, subject to the ability to obtain services at competitive rates and levels of service, NAM agrees to recommend the continued use of U.S. Bank or an affiliate to act as securities lending agent for all funds for which U.S. Bank serves as custodian, including the Funds.

As soon as practicable following the closing of the Transaction, it is expected that the Company will change its name to Nuveen Investment Funds, Inc. and the following Fund names are expected to change.

| | | |

Current Fund Name | | New Fund Name |

| |

| Minnesota Tax Free Fund | | Minnesota Municipal Bond Fund |

| Minnesota Intermediate Tax Free Fund | | Minnesota Intermediate Municipal Bond Fund |

| Nebraska Tax Free Fund | | Nebraska Municipal Bond Fund |

| Oregon Intermediate Tax Free Fund | | Oregon Intermediate Municipal Bond Fund |

4

PROPOSAL 1:

APPROVAL OF INVESTMENT ADVISORY

AGREEMENT AND NAMSUB-ADVISORY AGREEMENT

Introduction

At the Special Meeting, stockholders of each Fund will be asked to approve a New Advisory Agreement for the Fund with NAM. A comparison of the proposed New Advisory Agreement and the current investment advisory agreement between the Company and FAF (the “Current Advisory Agreement”) is included below. The date of the Current Advisory Agreement applicable to each Fund, the date on which it was last submitted for approval by stockholders and the date on which it was last approved by the Board are provided inExhibit A. In addition, the table set forth inExhibit Blists other funds registered under the 1940 Act with similar investment objectives and policies to the Funds that are advised orsub-advised by NAM, the net assets of those funds and the management/sub-advisory fee rates payable to NAM. As part of the proposal to approve a New Advisory Agreement for each Fund, stockholders also will be asked to approve the NAMSub-Advisory Agreement between NAM and NAM LLC that will take effect at the later of the completion of an internal restructuring of NAM or the closing of the Transaction. A description of the internal restructuring and the terms of the NAMSub-Advisory Agreement are included below. Forms of the New Advisory Agreement and NAMSub-Advisory Agreement are attached hereto asAppendix AandAppendix B, respectively.

The New Advisory Agreement will take effect as of the closing of the Transaction. If the Transaction closes and the stockholders of a Fund have not approved a New Advisory Agreement for that Fund, the Board will take such actions as it deems in the best interest of the Fund, which may include terminating the Current Advisory Agreement and entering into an interim investment advisory agreement with NAM.

The New Advisory Agreement

While the terms of the New Advisory Agreement are similar to those of the Current Advisory Agreement, there are some important differences. The New Advisory Agreement is intended to standardize the terms of the Funds’ investment management agreements with the agreements currently used by the Nuveen Funds. Despite the differences in contractual terms described below, the advisory services to be provided under the New Advisory Agreement are expected to be substantially similar to those provided under the Current Advisory Agreement.

One important difference between the Current Advisory Agreement and the New Advisory Agreement is that the fee rate under the New Advisory Agreement is comprised of a fund-level fee rate and a complex-wide level fee rate, both of which include breakpoints, while the Current Advisory Agreement only charges a fund-level fee rate which, in most cases, does not include breakpoints. Because the advisory fee rate is based in part on complex-wide asset levels, the advisory fee rates of the Funds may increase in the future if complex-wide assets were to decrease. Complex-wide assets may fluctuate due to a variety of factors including fluctuations in the market value of portfolio assets of other funds in the Nuveen complex, increases or decreases in the amounts of outstanding leverage of closed-end funds, or liquidations of other funds in the complex.

Another important difference between the Current Advisory Agreement and the New Advisory Agreement is that the services provided by NAM to each Fund under the New Advisory Agreement include certain administrative services, whereas, under the current structure, these administrative services and certain additional services are provided pursuant to a separate administrative agreement with FAF (the “Current Administrative Agreement”) and administrative fees are paid by the Funds separately from advisory fees. Accordingly, the fee rates paid under the New Advisory Agreement are higher for most Funds than the fee rates under the Current Advisory Agreement because the services to be provided under the New Advisory Agreement are more extensive than those provided under the Current Advisory Agreement. The maximum fee rates payable under the New Advisory Agreement are lower than the total amount of fees payable under both the Current Advisory Agreement and the Current Administrative Agreement in the aggregate. However, certain services provided to the Funds under the Current Administrative Agreement, including certain accounting services, will not be provided to the Funds under the New Advisory Agreement and will be delegated to other service providers. In addition, certain fees paid by FAF under the Current Administrative Agreement, including

5

certain networking and sub-transfer agency fees, will not be paid by NAM under the New Advisory Agreement and will be paid directly by the Funds.

Due to the greater economies of scale of the Nuveen complex and the commitments discussed below, except as described below, it is expected that the gross annual expense ratio for most Funds will be the same or lower immediately following the Transaction based on the assumptions below. However, the gross expense ratio is expected to be higher for the following Funds immediately following the closing of the Transaction: Large Cap Growth Opportunities Fund, Mid Cap Growth Opportunities Fund, Mid Cap Value Fund, Real Estate Securities Fund, Small Cap Select Fund and Small Cap Value Fund. Nevertheless, as a result of the commitments discussed below, it is expected that immediately following the closing of the Transaction, the net expense ratio of each Fund will be the same or lower than the Fund’s net expense ratio as of June 30, 2010, adjusted (where applicable) to reflect a decrease in net assets resulting from redemptions by the U.S. Bank 401(k) Plan expected to occur prior to the closing of the Transaction (the “Adjusted June 30 Expense Ratio”), assuming the Fund’s net assets at the time of the closing of the Transaction are no lower than their adjusted June 30 level. The anticipated redemptions by the U.S. Bank 401(k) Plan are unrelated to the Transaction.

Except as described in the following paragraph, NAM has committed that it will maintain all current expense caps through December 31, 2011. In addition, except as noted in the following paragraph, NAM has agreed during the two-year period following the closing of the Transaction (the “Closing Period”) to waive fees or reimburse expenses to the extent necessary to keep net management fees from exceeding the Proposed Net Management Fees (as defined below), unless a decrease in fee waivers or expense reimbursements would not cause a Fund’s Class Y share net expense ratio to exceed its Class Y share Adjusted June 30 Expense Ratio. Proposed Net Management Fees are the contractual fees under the New Advisory Agreement based on Fund and Nuveen complex assets as of June 30, 2010, adjusted to reflect a decrease in net assets (where applicable) from redemptions by the U.S. Bank 401(k) Plan expected to occur prior to closing of the Transaction, minus any proposed fee waivers and expense reimbursements.

For the California, Colorado, Nebraska and Ohio Tax-Free Funds, NAM will maintain current expense caps through their currently scheduled termination on June 30, 2011. In addition, NAM will waive fees and reimburse expenses for such Funds until December 31, 2011 in order to maintain Class Y share expenses at current expense caps plus 0.20%. For the remainder of the Closing Period, NAM will waive fees or reimburse expenses to the extent necessary to keep net management fees from exceeding Proposed Net Management Fees plus 0.20%, unless a decrease in fee waivers or expense reimbursements would not cause a Fund’s Class Y share net expense ratio to exceed its Class Y share Adjusted June 30 Expense Ratio plus 0.20%.

Information about NAM

NAM is a wholly-owned subsidiary of Nuveen. Nuveen is a wholly-owned subsidiary of Windy City Investment Holdings, L.L.C. (“Windy City”), a limited liability company formed by investors led by Madison Dearborn Partners, LLC (“MDP”), a private equity investment firm based in Chicago, Illinois. Windy City is controlled by MDP on behalf of the Madison Dearborn Capital Partner V funds. In addition, Bank of America Corporation (“BAC”), through one or more of its wholly-owned subsidiaries, holds an approximate 32% interest in Windy City’s non-voting equity. Nuveen had approximately $150 billion of assets under management as of June 30, 2010. In connection with the Transaction, U.S. Bank will acquire a 9.5% ownership interest in Windy City.

The principal business address of NAM, Nuveen and each directorand/or principal executive officer of NAM is 333 West Wacker Drive, Chicago, IL 60606. The names and principal occupations of the directorsand/or officers of Nuveen are set forth inExhibit D. The principal business address of MDP and BAC are 70 West Madison Street, Chicago, IL 60602 and 100 North Tryon Street, Charlotte, NC 28255, respectively.

Comparison of the Current Advisory Agreement to the New Advisory Agreement

Set forth below is a general description of certain terms of the New Advisory Agreement and a general comparison of those terms to the terms of the Current Advisory Agreement. The following discussion of the

6

similarities and differences between the New Advisory Agreement and the Current Advisory Agreement is qualified in its entirety by reference to the actual terms of the New Advisory Agreement, the form of which is included inAppendix A. You are encouraged to reviewAppendix Afor the complete terms of the New Advisory Agreement.

Investment Advisory Services. The investment advisory services to be provided by NAM to the Funds under the New Advisory Agreement generally are similar to the investment advisory services provided by FAF to the Funds under the Current Advisory Agreement. The Current Advisory Agreement provides that, subject to the supervision of the Board, FAF will manage the investment of the assets of the Funds. The New Advisory Agreement similarly provides that, subject to the supervision of the Board, NAM will manage the investment and reinvestment of the assets of the Funds.

The Current Advisory Agreement and the New Advisory Agreement authorize the adviser to select brokers and place orders for securities and utilize an affiliate of the adviser as a broker, subject to the supervision of the Board and provided that all brokerage transactions and procedures are in accordance with all applicable laws and regulations. Additionally, both the Current Advisory Agreement and the New Advisory Agreement require the adviser to make certain reports to the Board, including any reports with regard to placement of securities transactions for the Funds.

The Current Advisory Agreement contains a provision permitting FAF, subject to the approval by the Board, to enter into investmentsub-advisory agreements with one or moresub-advisors with respect to any Fund. The Current Advisory Agreement requires that any suchsub-advisor be registered under the Investment Advisers Act of 1940, and that FAF oversee and supervise eachsub-advisor and make recommendations to the Board regarding the hiring, retention, and termination of suchsub-advisors. Similarly, the New Advisory Agreement authorizes NAM to retain one or moresub-advisors, subject to the approval by the Board in accordance with the requirements of Section 15 of the 1940 Act. FAF currently retainssub-advisors to performsub-advisory services with respect to the International Fund and International Select Fund, and NAM intends to retain thesub-advisors currently in place.

As discussed above, one important difference between the Current Advisory Agreement and the New Advisory Agreement is that the services provided by NAM to each Fund under the New Advisory Agreement include certain administrative services. Under the current structure, administrative services are provided separately pursuant to the Current Administrative Agreement between the Funds and FAF.

Fees and Expenses. The fee structure of the Funds will reflect the fee and expense structure of the Nuveen Funds, which differs from the current fee and expense structure. The differences are as follows:

| | |

| | • | NAM provides advisory and certain administrative services pursuant to a single agreement and a single fee, while FAF provides advisory and administrative services pursuant to separate agreements and separate fees; |

| | |

| | • | Under the new fee structure, certain expenses that are currently covered through the administrative fee will not be covered through the new advisory fee, but will be paid directly by the Funds; |

| | |

| | • | The new management fee schedule is comprised of a fund-level fee rate and a complex-wide fee rate, while the current management fee schedule is only comprised of a fund-level fee rate; and |

| |

| | • | The new management fee schedule includes fund-level and complex-level breakpoints, while the current fee schedules generally do not include breakpoints. |

Under the Current Advisory Agreement, each Fund pays FAF a fee at the annual rate shown below as a percentage of average daily net assets.

| | | | | |

| | | Current Management

|

Fund | | Fee Rate |

| |

| California Tax Free Fund | | | 0.50 | % |

| Colorado Tax Free Fund | | | 0.50 | % |

| Core Bond Fund | | | 0.50 | % |

7

| | | | | |

| | | Current Management

|

Fund | | Fee Rate |

| |

| Equity Income Fund* | | | 0.65 | % |

| Equity Index Fund | | | 0.25 | % |

| Global Infrastructure Fund | | | 0.90 | % |

| High Income Bond Fund | | | 0.70 | % |

| Inflation Protected Securities Fund | | | 0.50 | % |

| Intermediate Government Bond Fund | | | 0.50 | % |

| Intermediate Tax Free Fund | | | 0.50 | % |

| Intermediate Term Bond Fund | | | 0.50 | % |

| International Fund | | | 1.00 | % |

| International Select Fund | | | 1.00 | % |

| Large Cap Growth Opportunities Fund* | | | 0.65 | % |

| Large Cap Select Fund* | | | 0.65 | % |

| Large Cap Value Fund* | | | 0.65 | % |

| Mid Cap Growth Opportunities Fund | | | 0.70 | % |

| Mid Cap Index Fund | | | 0.25 | % |

| Mid Cap Select Fund | | | 0.70 | % |

| Mid Cap Value Fund | | | 0.70 | % |

| Minnesota Intermediate Tax Free Fund | | | 0.50 | % |

| Minnesota Tax Free Fund | | | 0.50 | % |

| Missouri Tax Free Fund | | | 0.50 | % |

| Nebraska Tax Free Fund | | | 0.50 | % |

| Ohio Tax Free Fund | | | 0.50 | % |

| Oregon Intermediate Tax Free Fund | | | 0.50 | % |

| Quantitative Large Cap Core Fund | | | 0.30 | % |

| Real Estate Securities Fund | | | 0.70 | % |

| Short Tax Free Fund | | | 0.50 | % |

| Short Term Bond Fund | | | 0.50 | % |

| Small Cap Growth Opportunities Fund | | | 1.00 | % |

| Small Cap Index Fund | | | 0.40 | % |

| Small Cap Select Fund | | | 0.70 | % |

| Small Cap Value Fund | | | 0.70 | % |

| Tactical Market Opportunities Fund | | | 0.75 | % |

| Tax Free Fund | | | 0.50 | % |

| Total Return Bond Fund | | | 0.60 | % |

| | |

| * | | The Current Advisory Agreement provides for a breakpoint schedule with respect to each of Large Cap Growth Opportunities Fund, Large Cap Select Fund, Large Cap Value Fund, and Equity Income Fund. The advisory fee paid separately by each of these Funds is based on an annual rate of 0.65% for the first $3 billion of each Fund’s average daily net assets; 0.625% for average daily net assets in excess of $3 billion up to $5 billion; and 0.60% for average daily net assets in excess of $5 billion. |

In addition, under the Current Administrative Agreement, each Fund pays FAF a fee at the annual rates set forth below, which is calculated daily and paid monthly by applying the annual effective rate to the aggregate daily net assets of all of the open-end mutual funds advised by FAF, other than the series of First American Strategy Funds, Inc. (“Complex-Wide Assets”), and then allocating to each Fund its proportionate share.

8

| | | | | |

Complex-Wide Assets

| | Annual Effective Rate at

|

Breakpoint Level | | Breakpoint Level (%) |

| |

| First $8 billion | | | 0.250 | |

| Next $17 billion | | | 0.235 | |

| Next $25 billion | | | 0.220 | |

| Over $50 billion | | | 0.200 | |

Under the New Advisory Agreement, each Fund will pay NAM, on the first business day of the next succeeding calendar month, a fee at a rate equal to the sum of a fund-level fee rate and a complex-level fee rate. As discussed above, because NAM also will provide certain administrative services under the New Advisory Agreement, the fee rates paid under the New Advisory Agreement generally are higher than the advisory fees under the Current Advisory Agreement shown above because they include the bundled advisory fee and administrative fee. As discussed on page 6, immediately following the closing of the Transaction, the gross expense ratio of certain Funds is expected to be higher. However, immediately following the Transaction, the net expense ratio of each Fund is expected to be the same or lower than the Fund’s Adjusted June 30 Expense Ratio, assuming the Fund’s net assets at the time of the closing of the Transaction are no lower than their adjusted June 30, 2010 levels.

The tables beginning on page 12 provide a comparison of the annual operating expenses for each Fund as of each Fund’s most recent fiscal period ended June 30, 2010 or April 30, 2010, as applicable, and pro forma fees and expenses as of such date adjusted to reflect a decrease in net assets for some Funds from redemptions by the U.S. Bank 401(k) Plan expected to occur prior to closing of the Transaction and the payment by each Fund under the new expense structure of certain fees and for certain administrative services paid for or provided by FAF under the Current Administrative Agreement.

The fund-level fee rate for each Fund under the New Advisory Agreement is computed by applying the following annual rates to the average daily net assets of the Fund:

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | Assets of

|

| | | First

| | Next

| | Next

| | Next

| | Next

| | $2 Billion

|

Fund | | $125 Million | | $125 Million | | $250 Million | | $500 Million | | $1 Billion | | or More |

| |

| California Tax Free Fund | | | 0.45 | % | | | 0.4375 | % | | | 0.4250 | % | | | 0.4125 | % | | | 0.4000 | % | | | 0.3750 | % |

| Colorado Tax Free Fund | | | 0.45 | % | | | 0.4375 | % | | | 0.4250 | % | | | 0.4125 | % | | | 0.4000 | % | | | 0.3750 | % |

| Core Bond Fund | | | 0.45 | % | | | 0.4375 | % | | | 0.4250 | % | | | 0.4125 | % | | | 0.4000 | % | | | 0.3750 | % |

| Equity Income Fund | | | 0.60 | % | | | 0.5875 | % | | | 0.5750 | % | | | 0.5625 | % | | | 0.5500 | % | | | 0.5250 | % |

| Equity Index Fund | | | 0.10 | % | | | 0.0875 | % | | | 0.0750 | % | | | 0.0625 | % | | | 0.0500 | % | | | 0.0250 | % |

| Global Infrastructure Fund | | | 0.75 | % | | | 0.7375 | % | | | 0.7250 | % | | | 0.7125 | % | | | 0.7000 | % | | | 0.6750 | % |

| High Income Bond Fund | | | 0.60 | % | | | 0.5875 | % | | | 0.5750 | % | | | 0.5625 | % | | | 0.5500 | % | | | 0.5250 | % |

| Inflation Protected Securities Fund | | | 0.45 | % | | | 0.4375 | % | | | 0.4250 | % | | | 0.4125 | % | | | 0.4000 | % | | | 0.3750 | % |

| Intermediate Government Bond Fund | | | 0.45 | % | | | 0.4375 | % | | | 0.4250 | % | | | 0.4125 | % | | | 0.4000 | % | | | 0.3750 | % |

| Intermediate Tax Free Fund | | | 0.40 | % | | | 0.3875 | % | | | 0.3750 | % | | | 0.3625 | % | | | 0.3500 | % | | | 0.3250 | % |

| Intermediate Term Bond Fund | | | 0.45 | % | | | 0.4375 | % | | | 0.4250 | % | | | 0.4125 | % | | | 0.4000 | % | | | 0.3750 | % |

| International Fund | | | 0.85 | % | | | 0.8375 | % | | | 0.8250 | % | | | 0.8125 | % | | | 0.8000 | % | | | 0.7750 | % |

| International Select Fund | | | 0.85 | % | | | 0.8375 | % | | | 0.8250 | % | | | 0.8125 | % | | | 0.8000 | % | | | 0.7750 | % |

| Large Cap Growth Opportunities Fund | | | 0.65 | % | | | 0.6375 | % | | | 0.6250 | % | | | 0.6125 | % | | | 0.6000 | % | | | 0.5750 | % |

| Large Cap Select Fund | | | 0.55 | % | | | 0.5375 | % | | | 0.5250 | % | | | 0.5125 | % | | | 0.5000 | % | | | 0.4750 | % |

| Large Cap Value Fund | | | 0.55 | % | | | 0.5375 | % | | | 0.5250 | % | | | 0.5125 | % | | | 0.5000 | % | | | 0.4750 | % |

| Mid Cap Growth Opportunities Fund | | | 0.70 | % | | | 0.6875 | % | | | 0.6750 | % | | | 0.6625 | % | | | 0.6500 | % | | | 0.6250 | % |

| Mid Cap Index Fund | | | 0.15 | % | | | 0.1375 | % | | | 0.1250 | % | | | 0.1125 | % | | | 0.1000 | % | | | 0.0750 | % |

| Mid Cap Select Fund | | | 0.70 | % | | | 0.6875 | % | | | 0.6750 | % | | | 0.6625 | % | | | 0.6500 | % | | | 0.6250 | % |

| Mid Cap Value Fund | | | 0.70 | % | | | 0.6875 | % | | | 0.6750 | % | | | 0.6625 | % | | | 0.6500 | % | | | 0.6250 | % |

9

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | Assets of

|

| | | First

| | Next

| | Next

| | Next

| | Next

| | $2 Billion

|

Fund | | $125 Million | | $125 Million | | $250 Million | | $500 Million | | $1 Billion | | or More |

| |

| Minnesota Intermediate Tax Free Fund | | | 0.35 | % | | | 0.3375 | % | | | 0.3250 | % | | | 0.3125 | % | | | 0.3000 | % | | | 0.2750 | % |

| Minnesota Tax Free Fund | | | 0.35 | % | | | 0.3375 | % | | | 0.3250 | % | | | 0.3125 | % | | | 0.3000 | % | | | 0.2750 | % |

| Missouri Tax Free Fund | | | 0.45 | % | | | 0.4375 | % | | | 0.4250 | % | | | 0.4125 | % | | | 0.4000 | % | | | 0.3750 | % |

| Nebraska Tax Free Fund | | | 0.35 | % | | | 0.3375 | % | | | 0.3250 | % | | | 0.3125 | % | | | 0.3000 | % | | | 0.2750 | % |

| Ohio Tax Free Fund | | | 0.45 | % | | | 0.4375 | % | | | 0.4250 | % | | | 0.4125 | % | | | 0.4000 | % | | | 0.3750 | % |

| Oregon Intermediate Tax Free Fund | | | 0.35 | % | | | 0.3375 | % | | | 0.3250 | % | | | 0.3125 | % | | | 0.3000 | % | | | 0.2750 | % |

| Quantitative Large Cap Core Fund | | | 0.30 | % | | | 0.2875 | % | | | 0.2750 | % | | | 0.2625 | % | | | 0.2500 | % | | | 0.2250 | % |

| Real Estate Securities Fund | | | 0.70 | % | | | 0.6875 | % | | | 0.6750 | % | | | 0.6625 | % | | | 0.6500 | % | | | 0.6250 | % |

| Short Tax Free Fund | | | 0.25 | % | | | 0.2375 | % | | | 0.2250 | % | | | 0.2125 | % | | | 0.2000 | % | | | 0.1750 | % |

| Short Term Bond Fund | | | 0.30 | % | | | 0.2875 | % | | | 0.2750 | % | | | 0.2625 | % | | | 0.2500 | % | | | 0.2250 | % |

| Small Cap Growth Opportunities Fund | | | 0.80 | % | | | 0.7875 | % | | | 0.7750 | % | | | 0.7625 | % | | | 0.7500 | % | | | 0.7250 | % |

| Small Cap Index Fund | | | 0.15 | % | | | 0.1375 | % | | | 0.1250 | % | | | 0.1125 | % | | | 0.1000 | % | | | 0.0750 | % |

| Small Cap Select Fund | | | 0.70 | % | | | 0.6875 | % | | | 0.6750 | % | | | 0.6625 | % | | | 0.6500 | % | | | 0.6250 | % |

| Small Cap Value Fund | | | 0.70 | % | | | 0.6875 | % | | | 0.6750 | % | | | 0.6625 | % | | | 0.6500 | % | | | 0.6250 | % |

| Tactical Market Opportunities Fund | | | 0.60 | % | | | 0.5875 | % | | | 0.5750 | % | | | 0.5625 | % | | | 0.5500 | % | | | 0.5250 | % |

| Tax Free Fund | | | 0.40 | % | | | 0.3875 | % | | | 0.3750 | % | | | 0.3625 | % | | | 0.3500 | % | | | 0.3250 | % |

| Total Return Bond Fund | | | 0.45 | % | | | 0.4375 | % | | | 0.4250 | % | | | 0.4125 | % | | | 0.4000 | % | | | 0.3750 | % |

The complex-level fee rate under the New Advisory Agreement is calculated by reference to the total daily net qualifying assets of all open-end and closed-end Nuveen Funds organized in the United States, excluding assets attributable to certain funds of funds. As of the close of the Transaction, a portion of FAF fund assets ($2 billion) will be considered qualifying assets for purposes of the complex-wide fee schedule. Subsequent growth of FAF fund assets will be deemed qualifying assets for purpose of the schedule. The complex-level fee rate will be calculated pursuant to the following schedule:

| | | | | |

Complex-Level Asset

| | Effective Rate at

|

Breakpoint Level | | Breakpoint Level |

| ($ billion) | | (%) |

| |

| 55 | | | 0.2000 | |

| 56 | | | 0.1996 | |

| 57 | | | 0.1989 | |

| 60 | | | 0.1961 | |

| 63 | | | 0.1931 | |

| 66 | | | 0.1900 | |

| 71 | | | 0.1851 | |

| 76 | | | 0.1806 | |

| 80 | | | 0.1773 | |

| 91 | | | 0.1691 | |

| 125 | | | 0.1599 | |

| 200 | | | 0.1505 | |

| 250 | | | 0.1469 | |

| 300 | | | 0.1445 | |

As illustrated in the tables above, the New Advisory Agreement includes breakpoints in both the fund-level fee rate and the complex-level fee rate. By contrast, the Current Advisory Agreement only includes breakpoints for the Large Cap Growth Opportunities Fund, Large Cap Select Fund, Large Cap Value Fund, and Equity Income Fund.

10

Exhibit Cshows the contractual management fee and administrative fee paid by each Fund to FAF during each Fund’s most recently completed fiscal year under the Current Advisory Agreement and Current Administrative Agreement compared to the fees that would have been paid to NAM under the New Advisory Agreement.

Expenses. The Current Advisory Agreement generally provides that FAF will (i) provide each Fund with all necessary office space, personnel and facilities necessary and incident to the performance of its obligations under the Current Advisory Agreement, and (ii) pay or be responsible for payment of all compensation to personnel of each Fund and the officers and directors of each Fund who are affiliated with FAF or any entity which controls, is controlled by or is under common control with FAF. The New Advisory Agreement also generally provides that NAM will be responsible for furnishing, at its expense, office space, facilities and equipment and providing officers and employees to carry out its duties under the New Advisory Agreement.

Limitation on Liability. The Current Advisory Agreement provides that FAF agrees to indemnify the Company and each Fund with respect to any loss, liability, judgment, cost or penalty which the Fund may directly or indirectly suffer or incur in any way arising out of or in connection with any breach of the Current Advisory Agreement by FAF. Additionally, the Current Advisory Agreement provides that FAF shall be liable to each Fund and its stockholders or former stockholders for any negligence or willful misconduct on the part of FAF or any of its directors, officers, employees, representatives or agents in connection with the responsibilities assumed by it under the Current Advisory Agreement. The New Advisory Agreement provides that NAM shall not be liable for any losses except for losses resulting from willful misfeasance, bad faith, or gross negligence on the part of NAM in the performance of its obligations and duties, or by reason of its reckless disregard of its obligations and duties under the New Advisory Agreement. The New Advisory Agreement does not provide for indemnification to the Funds.

Term, Continuance and Termination. The Current Advisory Agreement provides that, unless earlier terminated, it will remain in effect for each Fund for a period of two years from the date of its execution. Thereafter, the Current Advisory Agreement provides that it will remain in effect from year to year, but only so long as such continuation is specifically approved in the manner required by the 1940 Act. The New Advisory Agreement provides that, unless earlier terminated, it will remain in effect with respect to each Fund for an initial term as specified therein (which shall not exceed two years). Thereafter, the New Advisory Agreement provides that it will remain in effect from year to year, but only so long as such continuation is approved in the manner required by the 1940 Act. Additionally, as required by law, the New Advisory Agreement and the Current Advisory Agreement provide that they will terminate automatically in the event of an assignment (as defined under the 1940 Act). Both the New Advisory Agreement and the Current Advisory Agreement also provide that they may be terminated at any time with respect to a Fund, without payment of any penalty, by the Board or by the vote of a majority of the outstanding voting securities of the applicable Fund upon at least sixty (60) days’ written notice to the other party. The Current Advisory Agreement also contains a provision regarding modification. The Current Advisory Agreement may be modified by mutual consent, such consent as to any Fund only to be authorized by a majority of the directors who are not parties to the Current Advisory Agreement or “interested persons” (as defined in the 1940 Act) of FAF or of the Fund and the vote of a majority of the outstanding shares of such Fund. Although not specified in the agreement, under applicable law, modification of the New Advisory Agreement would also be subject to the provisions of the 1940 Act.

Governing Law. The Current Advisory Agreement is governed by Minnesota law. The New Advisory Agreement is governed by Illinois law.

Current and Pro Forma Expense Comparisons

The tables below provide a comparison of each Fund’s current and pro forma expenses. Current expenses represent the actual annual operating expenses for each Fund as of each Fund’s most recent fiscal period ended June 30, 2010 or April 30, 2010, as applicable, adjusted to reflect a decrease in net assets for some Funds from redemptions by the U.S. Bank 401(k) Plan expected to occur prior to the closing of the Transaction. Current management fees include fees paid under both the Current Advisory Agreement and the Current Administrative Agreement. Pro forma expenses represent the estimated annual operating expenses for each Fund as of each Fund’s most recent fiscal year ended June 30, 2010 orsix-month fiscal period ended April 30,

11

2010 (annualized), as applicable, under the new fee and expense structure, also adjusted to reflect any decrease in net assets from redemptions by the U.S. Bank 401(k) Plan. Pro forma management fees represent the contractual fund-level and complex-wide level fee rate based on such asset levels. The full breakpoint schedules for the fund-level fees and the complex-wide level fees are shown on pages 9 and 10.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Pro

| | | | | | Pro

| | | | | | Pro

| | | | | | Pro

| | | | | | Pro

| |

| | | Current

| | | Forma

| | | Current

| | | Forma

| | | Current

| | | Forma

| | | Current

| | | Forma

| | | Current

| | | Forma

| |

California Tax Free Fund | | Class A | | | Class A | | | Class B | | | Class B | | | Class C | | | Class C | | | Class R | | | Class R | | | Class Y | | | Class Y | |

| |

| Management Fees | | | 0.72 | % | | | 0.65 | % | | | — | | | | — | | | | 0.72 | % | | | 0.65 | % | | | — | | | | — | | | | 0.72 | % | | | 0.65 | % |

| Distribution (12b-1) Fees | | | 0.25 | % | | | 0.20 | % | | | — | | | | — | | | | 0.65 | % | | | 0.65 | % | | | — | | | | — | | | | 0.00 | % | | | 0.00 | % |

| Other Expenses | | | 0.21 | % | | | 0.10 | % | | | — | | | | — | | | | 0.21 | % | | | 0.10 | % | | | — | | | | — | | | | 0.21 | % | | | 0.10 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross Annual Operating Expenses | | | 1.18 | % | | | 0.95 | % | | | — | | | | — | | | | 1.58 | % | | | 1.40 | % | | | — | | | | — | | | | 0.93 | % | | | 0.75 | % |

Less 12b-1 Fee Waiver/

Reimbursement | | | (0.10 | )% | | | (0.05 | )% | | | — | | | | — | | | | 0.00 | % | | | 0.00 | % | | | — | | | | — | | | | 0.00 | % | | | 0.00 | % |

| Less Expense Reimbursement | | | (0.43 | )% | | | (0.05 | )% | | | — | | | | — | | | | (0.43 | )% | | | (0.05 | )% | | | — | | | | — | | | | (0.43 | )% | | | (0.05 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Annual Operating Expenses** | | | 0.65 | % | | | 0.85 | % | | | — | | | | — | | | | 1.15 | % | | | 1.35 | % | | | — | | | | — | | | | 0.50 | % | | | 0.70 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Pro

| | | | | | Pro

| | | | | | Pro

| | | | | | Pro

| | | | | | Pro

| |

| | | Current

| | | Forma

| | | Current

| | | Forma

| | | Current

| | | Forma

| | | Current

| | | Forma

| | | Current

| | | Forma

| |

Colorado Tax Free Fund | | Class A | | | Class A | | | Class B | | | Class B | | | Class C | | | Class C | | | Class R | | | Class R | | | Class Y | | | Class Y | |

| |

| Management Fees | | | 0.72 | % | | | 0.65 | % | | | — | | | | — | | | | 0.72 | % | | | 0.65 | % | | | — | | | | — | | | | 0.72 | % | | | 0.65 | % |

| Distribution (12b-1) Fees | | | 0.25 | % | | | 0.20 | % | | | — | | | | — | | | | 0.65 | % | | | 0.65 | % | | | — | | | | — | | | | 0.00 | % | | | 0.00 | % |

| Other Expenses | | | 0.32 | % | | | 0.14 | % | | | — | | | | — | | | | 0.32 | % | | | 0.14 | % | | | — | | | | — | | | | 0.32 | % | | | 0.14 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross Annual Operating Expenses | | | 1.29 | % | | | 0.99 | % | | | — | | | | — | | | | 1.69 | % | | | 1.44 | % | | | — | | | | — | | | | 1.04 | % | | | 0.79 | % |

| Less Expense Reimbursement | | | (0.54 | )% | | | (0.09 | )% | | | — | | | | — | | | | (0.54 | )% | | | (0.09 | )% | | | — | | | | — | | | | (0.54 | )% | | | (0.09 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Annual Operating Expenses** | | | 0.75 | % | | | 0.90 | % | | | — | | | | — | | | | 1.15 | % | | | 1.35 | % | | | — | | | | — | | | | 0.50 | % | | | 0.70 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Pro

| | | | | | Pro

| | | | | | Pro

| | | | | | Pro

| | | | | | Pro

| |

| | | Current

| | | Forma

| | | Current

| | | Forma

| | | Current

| | | Forma

| | | Current

| | | Forma

| | | Current

| | | Forma

| |

Core Bond Fund | | Class A | | | Class A | | | Class B | | | Class B | | | Class C | | | Class C | | | Class R | | | Class R | | | Class Y | | | Class Y | |

| |

| Management Fees | | | 0.72 | % | | | 0.62 | % | | | 0.72 | % | | | 0.62 | % | | | 0.72 | % | | | 0.62 | % | | | 0.72 | % | | | 0.62 | % | | | 0.72 | % | | | 0.62 | % |

| Distribution (12b-1) Fees | | | 0.25 | % | | | 0.25 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 0.50 | % | | | 0.50 | % | | | 0.00 | % | | | 0.00 | % |

| Other Expenses | | | 0.04 | % | | | 0.08 | % | | | 0.04 | % | | | 0.08 | % | | | 0.04 | % | | | 0.08 | % | | | 0.04 | % | | | 0.08 | % | | | 0.04 | % | | | 0.08 | % |

| Acquired Fund Fees and Expenses | | | 0.01 | % | | | 0.01 | % | | | 0.01 | % | | | 0.01 | % | | | 0.01 | % | | | 0.01 | % | | | 0.01 | % | | | 0.01 | % | | | 0.01 | % | | | 0.01 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross Annual Operating Expenses | | | 1.02 | % | | | 0.96 | % | | | 1.77 | % | | | 1.71 | % | | | 1.77 | % | | | 1.71 | % | | | 1.27 | % | | | 1.21 | % | | | 0.77 | % | | | 0.71 | % |

| Less Expense Reimbursement | | | (0.06 | )% | | | 0.00 | % | | | (0.06 | )% | | | 0.00 | % | | | (0.06 | )% | | | 0.00 | % | | | (0.06 | )% | | | 0.00 | % | | | (0.06 | )% | | | 0.00 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Annual Operating Expenses* | | | 0.96 | % | | | 0.96 | % | | | 1.71 | % | | | 1.71 | % | | | 1.71 | % | | | 1.71 | % | | | 1.21 | % | | | 1.21 | % | | | 0.71 | % | | | 0.71 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Pro

| | | | | | Pro

| | | | | | Pro

| | | | | | Pro

| | | | | | Pro

| |

| | | Current

| | | Forma

| | | Current

| | | Forma

| | | Current

| | | Forma

| | | Current

| | | Forma

| | | Current

| | | Forma

| |

Equity Income Fund | | Class A | | | Class A | | | Class B | | | Class B | | | Class C | | | Class C | | | Class R | | | Class R | | | Class Y | | | Class Y | |

| |

| Management Fees | | | 0.87 | % | | | 0.78 | % | | | 0.87 | % | | | 0.78 | % | | | 0.87 | % | | | 0.78 | % | | | 0.87 | % | | | 0.78 | % | | | 0.87 | % | | | 0.78 | % |

| Distribution (12b-1) Fees | | | 0.25 | % | | | 0.25 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 0.50 | % | | | 0.50 | % | | | 0.00 | % | | | 0.00 | % |

| Other Expenses | | | 0.07 | % | | | 0.12 | % | | | 0.07 | % | | | 0.12 | % | | | 0.07 | % | | | 0.12 | % | | | 0.07 | % | | | 0.12 | % | | | 0.07 | % | | | 0.12 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Annual Operating Expenses | | | 1.19 | % | | | 1.15 | % | | | 1.94 | % | | | 1.90 | % | | | 1.94 | % | | | 1.90 | % | | | 1.44 | % | | | 1.40 | % | | | 0.94 | % | | | 0.90 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Pro

| | | | | | Pro

| | | | | | Pro

| | | | | | Pro

| | | | | | Pro

| |

| | | Current

| | | Forma

| | | Current

| | | Forma

| | | Current

| | | Forma

| | | Current

| | | Forma

| | | Current

| | | Forma

| |

Equity Index Fund | | Class A | | | Class A | | | Class B | | | Class B | | | Class C | | | Class C | | | Class R | | | Class R | | | Class Y | | | Class Y | |

| |

| Management Fees | | | 0.47 | % | | | 0.27 | % | | | 0.47 | % | | | 0.27 | % | | | 0.47 | % | | | 0.27 | % | | | 0.47 | % | | | 0.27 | % | | | 0.47 | % | | | 0.27 | % |

| Distribution (12b-1) Fees | | | 0.25 | % | | | 0.25 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 0.50 | % | | | 0.50 | % | | | 0.00 | % | | | 0.00 | % |

| Other Expenses | | | 0.08 | % | | | 0.15 | % | | | 0.08 | % | | | 0.15 | % | | | 0.08 | % | | | 0.15 | % | | | 0.08 | % | | | 0.15 | % | | | 0.08 | % | | | 0.15 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross Annual Operating Expenses | | | 0.80 | % | | | 0.67 | % | | | 1.55 | % | | | 1.42 | % | | | 1.55 | % | | | 1.42 | % | | | 1.05 | % | | | 0.92 | % | | | 0.55 | % | | | 0.42 | % |

| Less Expense Reimbursement | | | (0.18 | )% | | | (0.05 | )% | | | (0.18 | )% | | | (0.05 | )% | | | (0.18 | )% | | | (0.05 | )% | | | (0.18 | )% | | | (0.05 | )% | | | (0.18 | )% | | | (0.05 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Annual Operating Expenses* | | | 0.62 | % | | | 0.62 | % | | | 1.37 | % | | | 1.37 | % | | | 1.37 | % | | | 1.37 | % | | | 0.87 | % | | | 0.87 | % | | | 0.37 | % | | | 0.37 | % |

| | |

| * | | NAM has agreed to maintain current expense caps through December 31, 2011. |

| | |

| ** | | NAM has agreed to waive fees and reimburse expenses until December 31, 2011 in order to maintain Class Y share expenses at current expense caps plus 0.20%. Pro forma net annual operating expenses do not take into account NAM’s commitment to maintain current expense caps in place through June 30, 2011, which expense caps are reflected in current net annual operating expenses. |

12

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Pro

| | | | | | Pro

| | | | | | Pro

| | | | | | Pro

| | | | | | Pro

| |

| | | Current

| | | Forma

| | | Current

| | | Forma

| | | Current

| | | Forma

| | | Current

| | | Forma

| | | Current

| | | Forma

| |

Global Infrastructure Fund | | Class A | | | Class A | | | Class B | | | Class B | | | Class C | | | Class C | | | Class R | | | Class R | | | Class Y | | | Class Y | |

| |

| Management Fees | | | 1.12 | % | | | 0.95 | % | | | — | | | | — | | | | 1.12 | % | | | 0.95 | % | | | 1.12 | % | | | 0.95 | % | | | 1.12 | % | | | 0.95 | % |

| Distribution (12b-1) Fees | | | 0.25 | % | | | 0.25 | % | | | — | | | | — | | | | 1.00 | % | | | 1.00 | % | | | 0.50 | % | | | 0.50 | % | | | 0.00 | % | | | 0.00 | % |

| Other Expenses | | | 0.60 | % | | | 0.62 | % | | | — | | | | — | | | | 0.60 | % | | | 0.62 | % | | | 0.60 | % | | | 0.62 | % | | | 0.60 | % | | | 0.62 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross Annual Operating Expenses | | | 1.97 | % | | | 1.82 | % | | | — | | | | — | | | | 2.72 | % | | | 2.57 | % | | | 2.22 | % | | | 2.07 | % | | | 1.72 | % | | | 1.57 | % |

| Less Expense Reimbursement | | | (0.72 | )% | | | (0.57 | )% | | | — | | | | — | | | | (0.72 | )% | | | (0.57 | )% | | | (0.72 | )% | | | (0.57 | )% | | | (0.72 | )% | | | (0.57 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Annual Operating Expenses* | | | 1.25 | % | | | 1.25 | % | | | — | | | | — | | | | 2.00 | % | | | 2.00 | % | | | 1.50 | % | | | 1.50 | % | | | 1.00 | % | | | 1.00 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Pro

| | | | | | Pro

| | | | | | Pro

| | | | | | Pro

| | | | | | Pro

| |

| | | Current

| | | Forma

| | | Current

| | | Forma

| | | Current

| | | Forma

| | | Current

| | | Forma

| | | Current

| | | Forma

| |

High Income Bond Fund | | Class A | | | Class A | | | Class B | | | Class B | | | Class C | | | Class C | | | Class R | | | Class R | | | Class Y | | | Class Y | |

| |

| Management Fees | | | 0.92 | % | | | 0.79 | % | | | 0.92 | % | | | 0.79 | % | | | 0.92 | % | | | 0.79 | % | | | 0.92 | % | | | 0.79 | % | | | 0.92 | % | | | 0.79 | % |

| Distribution (12b-1) Fees | | | 0.25 | % | | | 0.25 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 0.50 | % | | | 0.50 | % | | | 0.00 | % | | | 0.00 | % |

| Other Expenses | | | 0.10 | % | | | 0.15 | % | | | 0.10 | % | | | 0.15 | % | | | 0.10 | % | | | 0.15 | % | | | 0.10 | % | | | 0.15 | % | | | 0.10 | % | | | 0.15 | % |

| Acquired Fund Fees and Expenses | | | 0.04 | % | | | 0.04 | % | | | 0.04 | % | | | 0.04 | % | | | 0.04 | % | | | 0.04 | % | | | 0.04 | % | | | 0.04 | % | | | 0.04 | % | | | 0.04 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross Annual Operating Expenses | | | 1.31 | % | | | 1.23 | % | | | 2.06 | % | | | 1.98 | % | | | 2.06 | % | | | 1.98 | % | | | 1.56 | % | | | 1.48 | % | | | 1.06 | % | | | 0.98 | % |

| Less Expense Reimbursement | | | (0.17 | )% | | | (0.09 | )% | | | (0.17 | )% | | | (0.09 | )% | | | (0.17 | )% | | | (0.09 | )% | | | (0.17 | )% | | | (0.09 | )% | | | (0.17 | )% | | | (0.09 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Annual Operating Expenses* | | | 1.14 | % | | | 1.14 | % | | | 1.89 | % | | | 1.89 | % | | | 1.89 | % | | | 1.89 | % | | | 1.39 | % | | | 1.39 | % | | | 0.89 | % | | | 0.89 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Pro

| | | | | | Pro

| | | | | | Pro

| | | | | | Pro

| | | | | | Pro

| |

| | | Current

| | | Forma

| | | Current

| | | Forma

| | | Current

| | | Forma

| | | Current

| | | Forma

| | | Current

| | | Forma

| |

Inflation Protected Securities Fund | | Class A | | | Class A | | | Class B | | | Class B | | | Class C | | | Class C | | | Class R | | | Class R | | | Class Y | | | Class Y | |

| |

| Management Fees | | | 0.72 | % | | | 0.64 | % | | | — | | | | — | | | | 0.72 | % | | | 0.64 | % | | | 0.72 | % | | | 0.64 | % | | | 0.72 | % | | | 0.64 | % |

| Distribution (12b-1) Fees | | | 0.25 | % | | | 0.25 | % | | | — | | | | — | | | | 1.00 | % | | | 1.00 | % | | | 0.50 | % | | | 0.50 | % | | | 0.00 | % | | | 0.00 | % |

| Other Expenses | | | 0.17 | % | | | 0.21 | % | | | — | | | | — | | | | 0.17 | % | | | 0.21 | % | | | 0.17 | % | | | 0.21 | % | | | 0.17 | % | | | 0.21 | % |

| Acquired Fund Fees and Expenses | | | 0.01 | % | | | 0.01 | % | | | — | | | | — | | | | 0.01 | % | | | 0.01 | % | | | 0.01 | % | | | 0.01 | % | | | 0.01 | % | | | 0.01 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross Annual Operating Expenses | | | 1.15 | % | | | 1.11 | % | | | — | | | | — | | | | 1.90 | % | | | 1.86 | % | | | 1.40 | % | | | 1.36 | % | | | 0.90 | % | | | 0.86 | % |

| Less Expense Reimbursement | | | (0.29 | )% | | | (0.25 | )% | | | — | | | | — | | | | (0.29 | )% | | | (0.25 | )% | | | (0.29 | )% | | | (0.25 | )% | | | (0.29 | )% | | | (0.25 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Annual Operating Expenses* | | | 0.86 | % | | | 0.86 | % | | | — | | | | — | | | | 1.61 | % | | | 1.61 | % | | | 1.11 | % | | | 1.11 | % | | | 0.61 | % | | | 0.61 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Pro

| | | | | | Pro

| | | | | | Pro

| | | | | | Pro

| | | | | | Pro

| |

| | | Current

| | | Forma

| | | Current

| | | Forma

| | | Current

| | | Forma

| | | Current

| | | Forma

| | | Current

| | | Forma

| |

Intermediate Government Bond Fund | | Class A | | | Class A | | | Class B | | | Class B | | | Class C | | | Class C | | | Class R | | | Class R | | | Class Y | | | Class Y | |

| |

| Management Fees | | | 0.72 | % | | | 0.65 | % | | | — | | | | — | | | | 0.72 | % | | | 0.65 | % | | | 0.72 | % | | | 0.65 | % | | | 0.72 | % | | | 0.65 | % |

| Distribution (12b-1) Fees | | | 0.25 | % | | | 0.25 | % | | | — | | | | — | | | | 1.00 | % | | | 1.00 | % | | | 0.50 | % | | | 0.50 | % | | | 0.00 | % | | | 0.00 | % |

| Other Expenses | | | 0.22 | % | | | 0.17 | % | | | — | | | | — | | | | 0.22 | % | | | 0.17 | % | | | 0.22 | % | | | 0.17 | % | | | 0.22 | % | | | 0.17 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross Annual Operating Expenses | | | 1.19 | % | | | 1.07 | % | | | — | | | | — | | | | 1.94 | % | | | 1.82 | % | | | 1.44 | % | | | 1.32 | % | | | 0.94 | % | | | 0.82 | % |

Less 12b-1 Fee Waiver/

Reimbursement | | | (0.10 | )% | | | (0.10 | )% | | | — | | | | — | | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % |

| Less Expense Reimbursement | | | (0.34 | )% | | | (0.22 | )% | | | — | | | | — | | | | (0.34 | )% | | | (0.22 | )% | | | (0.34 | )% | | | (0.22 | )% | | | (0.34 | )% | | | (0.22 | )% |