UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-05309

Nuveen Investment Funds, Inc.

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Kevin J. McCarthy

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: December 31

Date of reporting period: December 31, 2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Mutual Funds

Nuveen Equity Funds

For investors seeking long-term capital appreciation potential.

Annual Report

December 31, 2011

| Share Class / Ticker Symbol | ||||||||||

| Fund Name | Class A | Class B | Class C | Class R3 | Class I | |||||

Nuveen Global Infrastructure Fund | FGIAX | — | FGNCX | FGNRX | FGIYX | |||||

Nuveen Real Asset Income Fund | NRIAX | — | NRICX | NRIRX | NRIIX | |||||

Nuveen Real Estate Securities Fund | FREAX | FREBX | FRLCX | FRSSX | FARCX | |||||

LIFE IS COMPLEX.

Nuveen makes things e-simple.

It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Fund information is ready. No more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish.

Free e-Reports right to your e-mail!

www.investordelivery.com

If you receive your Nuveen Fund distributions and statements from your financial advisor or brokerage account.

OR

www.nuveen.com/accountaccess

If you receive your Nuveen Fund distributions and statements directly from Nuveen.

| Must be preceded by or accompanied by a prospectus. | NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE |

| 4 | ||||

| 5 | ||||

| 13 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| 24 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| 42 | ||||

| 48 | ||||

| 60 | ||||

| 64 | ||||

| 70 | ||||

| 71 | ||||

Letter to Shareholders

Dear Shareholders,

These are perplexing times for investors. The global economy continues to struggle. The solutions being implemented in the eurozone to deal with the debt crises of many of its member countries are not yet seen as sufficient by the financial markets. The political paralysis in the U.S. has prevented the compromises necessary to deal with the fiscal imbalance and government spending priorities. The efforts by individual consumers, governments and financial institutions to reduce their debts are increasing savings but reducing demand for the goods and services that drive employment. These developments are undermining the rebuilding of confidence by consumers, corporations and investors that is so essential to a resumption of economic growth.

Although it is painfully slow, progress is being made. In Europe, the turnover of a number of national governments reflects the realization by politicians and voters alike that leaders who practiced business as usual had to be replaced by leaders willing to face problems and accept the hard choices needed to resolve them. The recent coordinated efforts by central banks in the U.S. and Europe to provide liquidity to the largest European banks indicates that these monetary authorities are committed to facilitating a recovery in the European banking sector.

In the U.S., the failure of the congressionally appointed Debt Reduction Committee was a blow to those who hoped for a bipartisan effort to finally begin addressing the looming fiscal crisis. Nevertheless, Congress and the administration cannot ignore the issue for long. The Bush era tax cuts are scheduled to expire on December 31, 2012, and six months later the $1.2 trillion of mandatory across-the-board spending cuts under the Budget Control Act of 2011 begin to go into effect. Any legislative modification would require bipartisan support and the prospects for a bipartisan solution are unclear. The impact of these two developments would be a mixed blessing: a meaningful reduction in the annual budget deficit at the cost of slowing the economic recovery.

It is in these particularly volatile markets that professional investment management is most important. Skillful investment teams who have experienced challenging markets and remain committed to their investment disciplines are critical to the success of an investor’s long-term objectives. In fact, many long-term investment track records are built during challenging markets when managers are able to protect investors against these economic crosscurrents. Experienced investment teams know that volatile markets put a premium on companies and investment ideas that will weather the short-term volatility and that compelling values and opportunities are opened up when markets overreact to negative developments. By maintaining appropriate time horizons, diversification and relying on practiced investment teams, we believe that investors can achieve their long-term investment objectives.

As always, I encourage you to contact your financial consultant if you have any questions about your investment in a Nuveen Fund. On behalf of the other members of your Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

Robert P. Bremner

Chairman of the Board

February 22, 2012

| 4 | Nuveen Investments |

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by a national rating agency.

These Funds feature portfolio management by Nuveen Asset Management, LLC, an affiliate of Nuveen Investments. For the Nuveen Global Infrastructure Fund, Jay Rosenberg, who has more than 17 years of financial industry experience, and John Wenker, with 29 years of experience, have been the managers since its inception on December 17, 2007. For the Nuveen Real Asset Income Fund, Jay and John, along with portfolio manager Jeff Schmitz, CFA, who has 26 years of experience, have managed the Fund since its inception on September 13, 2011. For the Nuveen Real Estate Securities Fund, John assumed portfolio management responsibilities in 1999, while Jay has been on the management team of the Fund since 2005. In addition, Scott Sedlak was named associate portfolio manager of the Nuveen Real Estate Securities Fund effective March 21, 2011. He has more than 12 years of financial industry experience.

While this is an annual report, none of these Funds are reviewing a full twelve months of performance.

Effective November 1, 2011, the Nuveen Global Infrastructure and the Nuveen Real Estate Securities Funds changed their fiscal year ends from October 31 to December 31. Therefore, the portfolio management teams’ discussions of key investment strategies and performance for those two Funds cover the two-month period ended December 31, 2011. The change in fiscal years did not affect the objectives, investment strategies or portfolio management of the Funds.

The Nuveen Real Asset Income Fund launched during the reporting period; therefore, its performance discussion encompasses the period from its inception on September 13, 2011, through December 31, 2011.

What were the general market conditions for these abbreviated reporting periods?

During this short period encompassing several months in late 2011, the U.S. economy continued to show signs of slowly beginning to recover from the recent recession. The country’s gross domestic product (GDP) grew at an annual rate of 2.8% in the fourth quarter of 2011 and the unemployment picture showed some improvement, with the national unemployment rate standing at 8.5% as of December 2011. However, the housing market continued to be a weak spot. For the twelve months ended November 2011 (the most recent data available at the time this report was prepared), the average home price in the Standard & Poor’s (S&P)/Case-Shiller Index lost 1.3%, with 18 of the 20 major metropolitan areas reporting lower values. In addition, the U.S. economic picture continued to be clouded by concerns about the European debt crisis and efforts to reduce the federal deficit.

| Nuveen Investments | 5 |

In an attempt to improve the overall economic environment, the Federal Reserve (Fed) continued to hold the benchmark fed funds rate at the record low level of zero to 0.25% that it had established in December 2008. In January 2012, (following the close of this reporting period), the central bank stated that economic conditions would likely warrant maintaining this low rate through 2014. The Fed also implemented a program to extend the average maturity of its U.S. Treasury holdings by purchasing $400 billion of these securities with maturities of six to thirty years and selling an equal amount of U.S. Treasury securities with maturities of three years or less. The goals of this program, which the Fed expects to complete by the end of June 2012, are to lower longer-term interest rates, support a stronger economic recovery and help ensure that inflation remains at levels consistent with the Fed’s mandates of maximum employment and price stability.

The U.S. equity markets experienced periods of volatility over the reporting period, and posted mixed results for the full year. The Dow Jones Industrial Average gained 8.38% in 2011, and the broader S&P 500 Index ended the year up 2.11%. The NASDAQ Composite Index finished in the red, slipping 0.83% during 2011.

During this shortened period, the uncertain prospects for global growth and the eurozone financial crisis continued to be the main drivers of global financial markets. Most eurozone economies continued to weaken, and some were expecting even more slow down as tighter fiscal policies and credit conditions depressed economic activities. The MSCI EAFE Index, a common measure of international equity performance, lost 11.73% in 2011.

Nuveen Global Infrastructure Fund

How did the Fund perform during the two-month period ended December 31, 2011?

The table in the Fund Performance and Expense Ratios section of this report provides Class A Share total returns for the Fund for the two-month, one-year, and since inception periods ended December 31, 2011. The Fund’s Class A Shares at net asset value (NAV) outperformed the Standard & Poor’s (S&P) Global Infrastructure Index and the Lipper classification average over the two-month period.

What strategies were used to manage the Fund during the reporting period? How did these strategies influence performance?

The Fund seeks to provide capital appreciation and income potential by investing primarily in equity securities issued by U.S. and non-U.S. companies that typically derive the majority of their value from owned or operated infrastructure assets. During the two-month period covered by this report, our strategy for managing the Fund remained focused on buying global infrastructure companies that own and operate long-life assets and that have visible cash flows, strong balance sheets, manageable amounts of leverage and inelastic demand characteristics. We believe these types of companies will have ongoing access to capital and the best chances for producing sustainable and growing cash flow over time. The Fund is structured using a number of core infrastructure companies that we believe should provide long-term outperformance versus the market, combined with more opportunistic holdings that we believe are undervalued by the market. We have exposure around the globe with a mixture of holdings that we believe

| 6 | Nuveen Investments |

represent significant current value, as well as positions in companies that may prove to be more stable in a faltering global economy.

Over this two-month period, the Fund experienced widespread strength across a number of sectors, with the most favorable results relative to the benchmark found in electric utilities, gas utilities, diversified infrastructure, ports and water. Only two sectors, pipelines and toll roads, contributed negatively to performance. Also, the Fund’s return benefited from the ongoing execution of one of our long-term strategies, which is avoiding securities where the impact of political uncertainty in our opinion is not fully discounted into valuation. In that regard, we continued to be rewarded for the Fund’s broad underweight to Europe.

The electric utilities and gas utilities sectors were two areas that benefited from this calculated decision to be underexposed to Southern Europe in particular as countries like Italy and Spain continued to experience a high degree of political and regulatory risk. While European governments attempt to increase revenues, we are concerned that infrastructure assets will continue to provide “low hanging fruit” for tax increases and consumer relief. We believe the austerity and revenue raising measures haven’t yet taken their full toll on the regulated companies in these countries. Elsewhere in the gas utilities sector, the Fund benefited from our diversified exposure to holdings throughout Asia and the United States.

In the diversified infrastructure sector, performance was aided by our position in Brookfield Infrastructure Partners, a company with a strong combination of assets throughout Australia, North America, South America and Europe. Its holdings include a regulated rail system, a coal terminal, gas supply, energy distribution, ports and electricity transmission. The company’s stock performed very well during the period on the heels of a successful equity raise. It also continued to provide strong returns on capital and offer an attractive dividend yield.

In the port sector, performance benefited from our underexposure to Chinese and Hong Kong ports. We reduced these positions after seeing weaker cargo data coming from Shenzhen and Hong Kong. However, toward the end of the period, we began to see port cargo data increasing due to stronger demand from North America, despite slowing demand from Europe. Therefore, we’ve become less concerned about this exposure as we move forward.

In water infrastructure, part of the Fund’s outperformance came from the avoidance of California water utilities, which faced regulatory and capital uncertainty during the period. Elsewhere in the sector, we experienced favorable performance from a water utility for the Sao Paulo state in Brazil. The company is benefiting from the state’s move toward adopting a formal regulatory framework similar to what exists for other Brazilian utilities.

With the Fund’s favorable results during the period, only two sectors were a drag on performance: pipelines and toll roads. Pipelines were the primary area of underperformance due to the Fund’s underweight versus the benchmark, particularly in a few companies that performed well. We have been cautious about investing in pipeline firms whose revenues come from exploration and production (E&P) businesses, which have a much higher volatility profile compared to more pure pipeline businesses.

| Nuveen Investments | 7 |

The continued volatility in the infrastructure segment stemming from the ongoing political uncertainty underscores the benefits of investing in listed infrastructure companies. The Fund continues to offer investors diversification from many standpoints — including regulatory, country, currency, sector and asset — that may be difficult to obtain with a private equity or direct investment. The situation in Southern Europe reminds us of the potential consequences of being too concentrated in large, expensive assets that can be vulnerable to unforeseen events and political uncertainties. We believe it takes very active management to decipher and act on which companies are really at risk and which ones are being unnecessarily penalized by the market and represent attractive buying opportunities. We continue to own companies where we have the highest conviction and where we still see quite a bit of certainty in terms of their cash-flow visibility. The current “risk-on” trade gives us the opportunity to invest again in some of the more stable, core infrastructure companies that we have a lot of conviction in, but that had previously been overvalued.

Nuveen Real Asset Income Fund

How did the Fund perform during the since-inception period ended December 31, 2011?

The table in the Fund Performance and Expense Ratios section of this report provides Class A Share total returns for the Fund for the since-inception period ended December 31, 2011. The Fund’s Class A Shares at net asset value (NAV) underperformed the Barclays Capital index and the custom blend benchmark, but outperformed the Lipper classification average over the period from inception on September 13, 2011, through December 31, 2011.

What strategies were used to manage the Fund during the reporting period? How did these strategies influence performance?

The Fund launched and became fully invested during this reporting period. The Fund’s objective is to seek a high level of current income and the potential for capital appreciation by investing in a global portfolio of infrastructure and commercial real estate related securities (i.e. real assets) across the capital markets. These securities include a combination of infrastructure and real estate common stock, infrastructure and real estate preferred stock, and infrastructure and real estate related debt. Our goal is to combine these securities into a portfolio that provides investors with an attractive level of income and dampens levels of risk versus the broader equity market.

During this initial investing period, we allocated the portfolio’s assets with an eye toward our long-term target allocations: 30% in global infrastructure common stock, 12.5% in REIT common stock, 12.5% in global infrastructure preferred stock and hybrids, 20% in real estate investment trust (REIT) preferred stock and 25% in debt securities. We selected securities through an investment process that screens for companies and assets in certain areas of the real assets market that historically have provided higher dividend yields than other sectors and industries. From the group of securities providing the highest yields, we then focused on owning those companies and securities with the highest total return potential. Our process places a premium on finding securities whose revenues come from

| 8 | Nuveen Investments |

tangible assets with long-term concessions, contracts or leases, and are therefore capable of producing steady, predictable and recurring cash flows.

We use a team-based investment approach for this Fund, drawing on the research capabilities and sector expertise of Nuveen Asset Management, LLC’s Real Estate, Infrastructure and Global Taxable Fixed Income teams. Together these teams oversaw more than $5.3 billion in real estate, global infrastructure and high-yield related products as of December 31, 2011. The teams employ a bottom-up, fundamental approach to security selection and portfolio construction. True to the long-term investment process we’ve used for our other products, we look for more mature companies that demonstrate consistent and growing cash flow, strong balance sheets, and histories of being good stewards of shareholder capital.

With our primary goal being to generate income, our intent is to find and invest in the highest yielding segments within each asset class. Therefore, in the infrastructure common equity portion of the portfolio, the Fund has substantial exposure in global electric transmission and electric utilities. This segment also has a significant weighting in gas pipelines. Other examples of industries with exposure to stable businesses are privatized post offices, and other areas with high amounts of distributed cash flows like airports and toll roads. In the Fund’s real estate common equity segment, we’re primarily focused on securities found in the net lease, community center, strip mall, health care and suburban office space sectors.

In the preferred stock arena, the Fund is invested in companies with which we are familiar, that we believe have the strongest balance sheets, and that we think can weather the current environment the best. Among infrastructure preferred holdings, the Fund’s exposure is focused primarily on investment-grade utilities from the U.S. and Canada, some pipeline exposure, and Asian and European hybrid securities. Compared to real estate common equity, the real estate preferred portion of the Fund is more diversified across all the sectors our real estate team follows. Here we have a strong focus on owning higher yielding, non-rated securities. These companies have higher yields because they are smaller cap in nature, not necessarily because of inferior balance sheets.

In the Fund’s high-yield portion, our Global Taxable Fixed Income team is drawing upon its broad expertise across U.S. and non-U.S. securities. While our team follows the entire spectrum of high-yield industries, we are focused on buying securities from the real asset categories for this Fund. Oftentimes in the high-yield debt segment, as well as in the hybrids mentioned earlier, we are able to invest in companies and assets that we know well, but may not have listed equity securities (i.e. a government owned entity). At the end of the reporting period, the high-yield portion of the portfolio was diversified among 30 bonds across the energy infrastructure, pipelines and distribution, utilities, health care, airlines and other transportation, general industrials, and technology infrastructure sectors. The majority of the bonds were U.S. domiciled; however, we did have one position in Canada, one in Mexico and one in Latin America. We avoided European bonds, which we plan to do until some of the current political and regulatory uncertainty is resolved. However over the long term, the Fund’s non-U.S. exposure may be considerably higher as we become more comfortable with conditions in Europe.

| Nuveen Investments | 9 |

We did not find any attractive opportunities in the commercial mortgage-backed securities space during the period, so the Fund does not currently have exposure there.

As can be expected, in the strongly advancing market we experienced since inception, the equity portions of the Fund outperformed the preferred and fixed-income sectors. The best-performing sectors in the portfolio were the global infrastructure and real estate common equities. The Fund’s slight underweight in common equity during the period was a drag on performance. As equities rallied, we took some proceeds and reinvested mainly in the preferred sector. Our goal is to actively shift the Fund’s allocation mix to dampen volatility, especially when we see certain sectors being overbought or overextended.

Over time, the Fund’s portfolio should be relatively balanced between U.S. and non-U.S. exposure. However, at the end of this reporting period, the overall portfolio was roughly 60% U.S. and 40% non-U.S. exposure, primarily because of our underweight to Europe. Once Europe has achieved some stability, we intend to be more evenly balanced as there are many European companies with qualifying dividend yields that we are currently avoiding in the portfolio.

Nuveen Real Estate Securities Fund

How did the Fund perform during the two-month period ended December 31, 2011?

The table in the Fund Performance and Expense Ratios section of this report provides Class A Share total returns for the Fund for the two-month, one-year, five-year and ten-year periods ended December 31, 2011. The Fund’s Class A Shares at net asset value (NAV) performed in line with the Morgan Stanley REIT Index and the Lipper classification average over the two-month period.

What strategies were used to manage the Fund during the reporting period? How did these strategies influence performance?

The Fund seeks to provide above-average income potential and long-term capital appreciation by investing in income-producing common stocks of publicly traded companies engaged in the real estate industry. During the two-month period covered by this report, we continued to implement the Fund’s strategy of investing on a relative-value basis with a focus on individual stocks rather than economic or market cycles. We also continued to invest the Fund in a fairly sector-neutral manner, with a goal of providing shareholders a well-diversified portfolio of public real estate stocks. Our sector-neutral approach reduced the impact of any one property type on the performance of the Fund. Additionally, we continued to invest in a broader universe of stocks than our benchmark index to access more dynamic parts of the commercial real estate cycle.

During the period, commercial real estate market fundamentals continued to improve as occupancy levels increased, rental rates for many property types were stable or increasing and same-store net operating income increased. However, the broader commercial real estate market still faces the challenges of the slow improvement in the economy. Although more transactions are taking place and investment opportunities are available,

lenders are being selective with financing. Also, investors in commercial mortgage-backed

| 10 | Nuveen Investments |

securities are being very selective about loans included in new offerings. In this environment, public real estate companies continue to have an advantage with availability of capital and cost of capital.

The Fund once again benefited from individual stock selection during this reporting period. Consistent with our investment process, the Fund retained its historical bias toward higher quality companies with consistent, visible cash flows. However, we also invested in select lower quality companies that we believed were more levered to the early recovery stage of the commercial real estate cycle. Our strategy of investing on a relative-value basis helped the Fund avoid several underperforming stocks.

The Fund’s best-performing sectors on a relative basis were community centers, hotel real estate investment trusts (REITs) and apartment companies. In the community center sector, a lower-than-index weight in an underperformer, Kimco Realty, benefited the Fund’s results. In the hotel segment, a modest overweight to RLJ Lodging Trust, a small-cap REIT, contributed favorably as did an underweight to Hospitality Properties Trust, which underperformed during the two-month period. In the apartment sector, a lower-than-index weight in another lagging stock, Apartment Investment & Management, also aided results in the period.

The Fund’s worst-performing sectors on a relative value basis were net lease and health care REITs. Overall, the net lease sector was an underperformer and the Fund’s position in National Retail Properties hurt performance. In health care, an underweight to a couple of the better performing companies, such as HCP and Omega Healthcare, hurt Fund results.

As mentioned above, we continued to invest in a broader universe of stocks than our benchmark index. We believe this helps to shelter the Fund somewhat from the short-term adverse effects of sector rotation and negative sentiment. During the period, this exposure comprised approximately 6% of the Fund’s assets and included real estate operating companies, international real estate stocks and infrastructure stocks with heavy real estate foundations. Additionally, we maintained a cautious approach to weightings in suburban office companies, believing the fundamental environment for central business district office companies was stronger.

Commercial real estate is a lagging cyclical sector highly dependent on good economic conditions and healthy employment growth. Many of the public real estate companies continue to experience improvements in occupancy levels and rental rates. We believe the public commercial real estate sector is well positioned to participate in opportunities available from stronger economic growth. Private capital is very active in the commercial real estate market, both to buy and to finance assets, contributing to demand for a variety of property types. The low level of new supply will likely benefit the sector as conditions continue to improve.

Risk Considerations

Mutual fund investing involves risk; principal loss is possible. Equity investments such as those held by the funds, are subject to market risk, call risk, derivatives risk, other investment companies risk, common stock risk, and tax risks associated with MLPs and REITS. Concentration in specific sectors may involve greater risk and volatility than more

| Nuveen Investments | 11 |

diversified investments: real estate sector involves the risk of exposure to economic downturns and changes in real estate values, rents, property taxes, interest rates and tax laws; infrastructure-related securities may involve greater exposure to adverse economic, regulatory, political, legal, and other changes affecting such securities. Foreign investments involve additional risks, including currency fluctuation, political and economic instability, lack of liquidity, and differing legal and accounting standards. These risks are magnified in emerging markets. Investments in small- and mid-cap companies are subject to greater volatility. In addition, a fund will bear its proportionate share of any fees and expenses paid by the ETFs in which it invests.

Debt or fixed income securities such as those held by the Nuveen Real Asset Income Fund, are subject to market risk, credit risk, interest rate risk and income risk. As interest rates rise, bond prices fall. Below investment grade or high yield debt securities are subject to liquidity risk and heightened credit risk. Preferred securities are subordinated to bonds and other debt instruments in a company’s capital structure and therefore are subject to greater credit risk. Asset-backed and mortgage-backed securities are subject to additional risks such as prepayment risk, liquidity risk, default risk and adverse economic developments.

| 12 | Nuveen Investments |

Fund Performance and Expense Ratios (Unaudited)

The Fund Performance and Expense Ratios for each Fund are shown on the following six pages.

Returns quoted represent past performance, which is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Returns without sales charges would be lower if the sales charge were included. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Returns may reflect a contractual agreement between certain Funds and the investment adviser to waive certain fees and expenses; see Notes to Financial Statements, Footnote 7 — Management Fees and Other Transactions with Affiliates for more information. In addition, returns may reflect a voluntary expense limitation by the Funds’ investment adviser that may be modified or discontinued at any time without notice. For the most recent month-end performance visit www.nuveen.com or call (800) 257-8787.

Returns reflect differences in sales charges and expenses, which are primarily differences in distribution and service fees. Fund returns assume reinvestment of dividends and capital gains.

Comparative index and Lipper return information is provided for the Funds’ Class A Shares at net asset value (NAV) only.

The expense ratios shown reflect the Funds’ total operating expenses (before fee waivers or expense reimbursements, if any) as shown in the Funds’ most recent prospectus. The expense ratios include management fees and other fees and expenses.

| Nuveen Investments | 13 |

Fund Performance and Expense Ratios (Unaudited) (continued)

Nuveen Global Infrastructure Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this page.

Fund Performance

Average Annual Total Returns as of December 31, 2011*

| Cumulative |

| Average Annual |

| |||||||||

| 2-Month | 1-Year | Since Inception** | ||||||||||

Class A Shares at NAV | 0.81% | 0.14% | -0.38% | |||||||||

Class A Shares at maximum Offering Price | -4.97% | -5.57% | -1.83% | |||||||||

Standard & Poor’s (S&P) Global Infrastructure Index*** | -1.65% | -0.39% | -4.66% | |||||||||

Lipper Specialty/Miscellaneous Funds Classification Average*** | -2.39% | -3.37% | -2.58% | |||||||||

Class C Shares | 0.62% | -0.52% | 13.36% | |||||||||

Class R3 Shares | 0.68% | -0.65% | 13.71% | |||||||||

Class I Shares | 0.85% | 0.40% | -0.15% | |||||||||

Class A Shares have a maximum 5.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within twelve months of purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are available to only certain retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| Gross Expense Ratios | Net Expense Ratios | |||||||

Class A Shares | 1.72% | 1.25% | ||||||

Class C Shares | 2.47% | 2.00% | ||||||

Class R3 Shares | 1.97% | 1.50% | ||||||

Class I Shares | 1.47% | 1.00% | ||||||

The Fund’s adviser has contractually agreed to waive fees and/or reimburse expenses through February 29, 2012, so that total annual Fund operating expenses, after waivers and excluding any acquired Fund fees and expenses, do not exceed 1.25%, 2.00%, 1.50% and 1.00%, respectively, for Class A, Class C, Class R3 and Class I Shares. Fee waivers and expense reimbursements will not be terminated prior to that time without the approval of the Fund’s Board of Directors.

| * | Two-month returns are cumulative; all other returns are annualized. |

| ** | Since inception returns for Class A and Class I Shares, and for the comparative index and Lipper classification average, are from 12/17/07; since inception returns for Class C and Class R3 Shares are from 11/3/08. |

| *** | Refer to the Glossary of Terms Used in this Report for definitions. |

| 14 | Nuveen Investments |

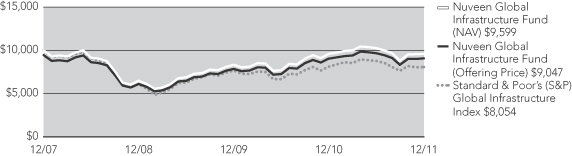

Growth of an Assumed $10,000 Investment as of December 31, 2011 — Class A Shares

The graph does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

| Nuveen Investments | 15 |

Fund Performance and Expense Ratios (Unaudited) (continued)

Nuveen Real Asset Income Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this page.

Fund Performance

Cumulative Total Returns as of December 31, 2011

| Cumulative | ||||

| Since Inception* | ||||

Class A Shares at NAV | 3.06% | |||

Class A Shares at maximum Offering Price | -2.86% | |||

Barclays Capital U.S. Corporate High Yield Index** | 3.72% | |||

Real Asset Income Blend** | 5.04% | |||

Lipper Global Flexible Portfolio Classification Average** | -1.17% | |||

Class C Shares | 2.82% | |||

Class R3 Shares | 2.95% | |||

Class I Shares | 3.13% | |||

Class A Shares have a maximum 5.75% sales charge. Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within twelve months of purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are available to only certain retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| Gross Expense Ratios | Net Expense Ratios | |||||

Class A Shares | 1.37% | 1.20% | ||||

Class C Shares | 2.12% | 1.95% | ||||

Class R3 Shares | 1.62% | 1.45% | ||||

Class I Shares | 1.12% | 0.95% | ||||

The Fund’s adviser has contractually agreed to waive fees and/or reimburse expenses through April 30, 2014 so that total annual Fund operating expenses (excluding 12b-1 distribution and/or service fees, interest expenses, taxes, fees incurred in acquiring and disposing of portfolio securities and extraordinary expenses) do not exceed 0.95% of the average daily net assets of any class of Fund shares. The expense limitation expiring April 30, 2014, may be terminated or modified prior to that date only with the approval of the Board of Directors of the Fund.

| * | Since inception returns are from 9/13/11. |

| ** | Refer to the Glossary of Terms Used in this Report for definitions. |

| 16 | Nuveen Investments |

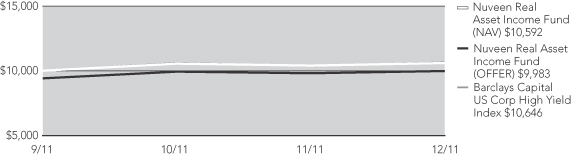

Growth of an Assumed $10,000 Investment as of December 31, 2011 – Class A Shares

The graph does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

| Nuveen Investments | 17 |

Fund Performance and Expense Ratios (Unaudited) (continued)

Nuveen Real Estate Securities Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this page.

Fund Performance

Average Annual Total Returns as of December 31, 2011*

| Cumulative |

| Average Annual |

| |||||||||||||

| 2-Month | 1-Year | 5-Year | 10-Year | |||||||||||||

Class A Shares at NAV | 0.72% | 7.69% | 0.09% | 12.06% | ||||||||||||

Class A Shares at maximum Offering Price | -5.06% | 1.49% | -1.09% | 11.39% | ||||||||||||

Morgan Stanley REIT Index** | 0.75% | 8.69% | -1.51% | 10.16% | ||||||||||||

Lipper Real Estate Funds Classification Average** | 0.76% | 7.64% | -1.81% | 9.68% | ||||||||||||

Class B Shares w/o CDSC*** | 0.55% | 6.84% | -0.66% | 11.22% | ||||||||||||

Class B Shares w/CDSC*** | -4.49% | 1.84% | -0.82% | 11.22% | ||||||||||||

Class C Shares | 0.60% | 6.88% | -0.65% | 11.22% | ||||||||||||

Class R3 Shares | 0.66% | 7.41% | -0.15% | 11.85% | ||||||||||||

Class I Shares | 0.78% | 7.96% | 0.35% | 12.34% | ||||||||||||

Class A Shares have a maximum 5.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within twelve months of purchase. Class B Shares have a CDSC that begins at 5% for redemptions during the first year and declines periodically until after six years when the charge becomes 0%. Class B Shares automatically convert to Class A Shares eight years after purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are available to only certain retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| Expense Ratios | ||||

Class A Shares | 1.29% | |||

Class B Shares | 2.04% | |||

Class C Shares | 2.04% | |||

Class R3 Shares | 1.54% | |||

Class I Shares | 1.04% | |||

| * | Two-month returns are cumulative; all other returns are annualized. |

| ** | Refer to the Glossary of Terms Used in this Report for definitions. |

| *** | Class B Shares are available only upon the exchange of Class B Shares from another Nuveen mutual fund for which U.S. Bancorp Fund Services, LLC serves as transfer agent or for purposes of dividend reinvestment, but Class B shares are not available for new accounts or for additional investment into existing accounts. |

| 18 | Nuveen Investments |

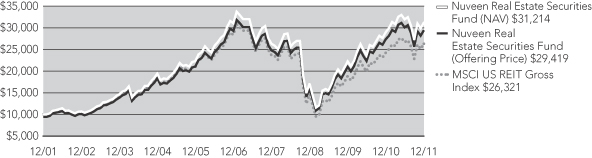

Growth of an Assumed $10,000 Investment as of December 31, 2011 — Class A Shares

The graph does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

| Nuveen Investments | 19 |

Holding Summaries (Unaudited) as of December 31, 2011

This data relates to the securities held in each Fund’s portfolio of investments. It should not be construed as a measure of performance for the Fund itself.

Nuveen Global Infrastructure Fund

Portfolio Allocation1

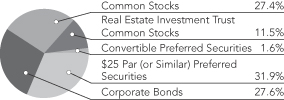

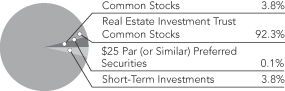

Nuveen Real Asset Income Fund

Portfolio Allocation1

Nuveen Real Estate Securities Fund

Portfolio Allocation3

| Portfolio Composition1 | ||||

| Transportation Infrastructure | 23.9% | |||

| Electric Utilities | 18.4% | |||

| Oil, Gas & Consumable Fuels | 12.9% | |||

| Multi-Utilities | 12.2% | |||

| Gas Utilities | 7.1% | |||

| Commercial Services & Supplies | 4.6% | |||

| Wireless Telecommunication Services | 4.1% | |||

| Short-Term Investments | 3.1% | |||

| Other | 13.7% | |||

| Portfolio Composition1 | ||||

| Retail | 11.9% | |||

| Electric Utilities | 11.3% | |||

| Diversified | 8.7% | |||

| Energy | 8.1% | |||

| Specialized | 7.9% | |||

| Multi-Utilities | 7.0% | |||

| Industrials | 6.8% | |||

| Financials | 6.1% | |||

| Office | 5.1% | |||

| Transportation | 4.7% | |||

| Oil, Gas & Consumable Fuels | 3.6% | |||

| Health Care | 3.2% | |||

| Utilities | 3.2% | |||

| Other | 12.4% | |||

| Portfolio Composition3 | ||||

| Retail | 28.0% | |||

| Residential | 20.4% | |||

| Specialized | 19.8% | |||

| Office | 10.6% | |||

| Diversified | 8.9% | |||

| Short-Term Investments | 3.8% | |||

| Other | 8.5% | |||

| Top Five Common Stock Holdings2 | ||||

| Enbridge Inc. | 5.1% | |||

| American Tower Corporation | 4.2% | |||

| National Grid PLC, Sponsored ADR | 3.4% | |||

| Transurban Group | 3.3% | |||

| Fraport AG | 2.9% | |||

| Country Allocation1 | ||||

| United States | 33.8% | |||

| Canada | 10.9% | |||

| Hong Kong | 9.3% | |||

| United Kingdom | 7.5% | |||

| Brazil | 6.4% | |||

| Austrailia | 5.4% | |||

| Singapore | 4.9% | |||

| Germany | 3.9% | |||

| Other | 17.9% | |||

| Top Five Common Stock Holdings2 | ||||

| National Retail Properties, Inc. | 13.9% | |||

National Grid PLC, Sponsored ADR | 7.7% | |||

Equatorial Energia SA | 4.2% | |||

Scottish and Southern Energy PLC | 3.8% | |||

Oesterreichische Post Ag | 3.6% | |||

| Country Allocation1 | ||||

| United States | 59.3% | |||

| Canada | 6.0% | |||

| Australia | 5.2% | |||

| United Kingdom | 4.9% | |||

| Singapore | 4.6% | |||

| Other | 20.0% | |||

| Top Five Common Stock Holdings2 | ||||

| Simon Property Group, Inc. | 11.8% | |||

Public Storage Inc. | 5.2% | |||

Vornado Realty Trust | 4.7% | |||

AvalonBay Communities, Inc. | 4.1% | |||

Equity Residential | 3.9% | |||

| 1 | As a percentage of total investments as of December 31, 2011. Holdings are subject to change. |

| 2 | As a percentage of total common stocks as of December 31, 2011. Holdings are subject to change. |

| 3 | As a percentage of total investments (excluding investments purchased with collateral from securities lending) as of December 31, 2011. Holdings are subject to change. |

| 20 | Nuveen Investments |

As a shareholder of one or more of the Funds, you incur two types of costs: (1) transaction costs, including up-front and back-end sales charges (loads) or redemption fees, where applicable; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees, where applicable; and other Fund expenses. The Examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. Since the expense examples for Nuveen Global Infrastructure Fund, Nuveen Real Asset Income Fund and Nuveen Real Estate Securities Fund reflect only 61, 110 and 61 days, respectively, of the Funds’ operations, they may not provide a meaningful understanding of the Funds’ ongoing expenses.

The Examples below are based on an investment of $1,000 invested at the beginning of the period and held for the period.

The information under “Actual Performance,” together with the amount you invested, allows you to estimate actual expenses incurred over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period” to estimate the expenses incurred on your account during this period.

The information under “Hypothetical Performance,” provides information about hypothetical account values and hypothetical expenses based on the respective Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you incurred for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds or share classes. In addition, if these transaction costs were included, your costs would have been higher.

Nuveen Global Infrastructure Fund

| Actual Performance | Hypothetical Performance (5% annualized return before expenses) | |||||||||||||||||||||||||||||||||

| A Shares | C Shares | R3 Shares | I Shares | A Shares | C Shares | R3 Shares | I Shares | |||||||||||||||||||||||||||

| Beginning Account Value (11/01/11) | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | ||||||||||||||||||

| Ending Account Value (12/31/11) | $ | 1,008.10 | $ | 1,006.20 | $ | 1,006.80 | $ | 1,008.50 | $ | 1,006.30 | $ | 1,005.05 | $ | 1,005.88 | $ | 1,006.72 | ||||||||||||||||||

| Expenses Incurred During Period | $ | 2.06 | $ | 3.32 | $ | 2.48 | $ | 1.64 | $ | 2.06 | $ | 3.32 | $ | 2.48 | $ | 1.64 | ||||||||||||||||||

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of 1.23%, 1.98%, 1.48% and 0.98% for Classes A, C, R3 and I, respectively, multiplied by the average account value over the period, multiplied by 61/365 (to reflect the two-month period).

Nuveen Real Asset Income Fund

| Actual Performance | Hypothetical Performance (5% annualized return before expenses) | |||||||||||||||||||||||||||||||||

| A Shares | C Shares | R3 Shares | I Shares | A Shares | C Shares | R3 Shares | I Shares | |||||||||||||||||||||||||||

| Beginning Account Value (9/13/11) | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | ||||||||||||||||||

| Ending Account Value (12/31/11) | $ | 1,030.60 | $ | 1,028.20 | $ | 1,029.50 | $ | 1,031.30 | $ | 1,011.41 | $ | 1,009.17 | $ | 1,010.66 | $ | 1,012.15 | ||||||||||||||||||

| Expenses Incurred During Period | $ | 3.58 | $ | 5.84 | $ | 4.33 | $ | 2.82 | $ | 3.54 | $ | 5.79 | $ | 4.29 | $ | 2.79 | ||||||||||||||||||

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of 1.18%, 1.93%, 1.43% and 0.93% for Classes A, C, R3 and I, respectively, multiplied by the average account value over the period, multiplied by 109/365 (to reflect the 109 days in the period since commencement of operations).

Nuveen Real Estate Securities Fund

| Actual Performance | Hypothetical Performance (5% annualized return before expenses) | |||||||||||||||||||||||||||||||||||||||||

| A Shares | B Shares | C Shares | R3 Shares | I Shares | A Shares | B Shares | C Shares | R3 Shares | I Shares | |||||||||||||||||||||||||||||||||

| Beginning Account Value (11/01/11) | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | ||||||||||||||||||||||

| Ending Account Value (12/31/11) | $ | 1,007.20 | $ | 1,005.50 | $ | 1,006.00 | $ | 1,006.60 | $ | 1,007.80 | $ | 1,006.22 | $ | 1,004.96 | $ | 1,004.96 | $ | 1,005.80 | $ | 1,006.63 | ||||||||||||||||||||||

| Expenses Incurred During Period | $ | 2.15 | $ | 3.40 | $ | 3.40 | $ | 2.57 | $ | 1.73 | $ | 2.15 | $ | 3.40 | $ | 3.40 | $ | 2.56 | $ | 1.73 | ||||||||||||||||||||||

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of 1.28%, 2.03%, 2.03%, 1.53% and 1.03% for Classes A, B, C, R3 and I, respectively, multiplied by the average account value over the period, multiplied by 61/365 (to reflect the two-month period).

| Nuveen Investments | 21 |

Independent Registered

Public Accounting Firm

To the Board of Directors and Shareholders of

Nuveen Global Infrastructure Fund

Nuveen Real Asset Income Fund

Nuveen Real Estate Securities Fund

In our opinion, the accompanying statements of assets and liabilities, including the portfolios of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Nuveen Global Infrastructure Fund, Nuveen Real Asset Income Fund, and Nuveen Real Estate Securities Fund (hereinafter referred to as the “Funds”) at December 31, 2011, the results of their operations, the changes in their net assets, and the financial highlights for the two months or period ended December 31, 2011 in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Funds’ management; our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audit, which included confirmation of securities at December 31, 2011 by correspondence with the custodian and brokers, provides a reasonable basis for our opinion.

PRICEWATERHOUSECOOPERS LLP

Chicago, IL

February 29, 2012

| 22 | Nuveen Investments |

Report of

Independent Registered

Public Accounting Firm

The Board of Directors and Shareholders

Nuveen Global Infrastructure Fund (formerly First American Global Infrastructure Fund)

Nuveen Real Estate Securities Fund (formerly First American Real Estate Securities Fund)

We have audited the accompanying statements of assets and liabilities, including the portfolios of investments of Nuveen Global Infrastructure Fund (formerly First American Global Infrastructure Fund) and Nuveen Real Estate Securities Fund (formerly First American Real Estate Securities Fund) (series of Nuveen Investment Funds, Inc.) (collectively, the “Funds”) as of October 31, 2011, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the periods indicated therein. These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Funds’ internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Funds’ internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of October 31, 2011, by correspondence with the custodian and brokers or by other appropriate auditing procedures where replies from brokers were not received. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial positions of Nuveen Global Infrastructure Fund (formerly First American Global Infrastructure Fund) and Nuveen Real Estate Securities Fund (formerly First American Real Estate Securities Fund) at October 31, 2011, the results of their operations for the year then ended, the changes in their net assets for each of the two years in the period then ended, and the financial highlights for each of the periods indicated therein in conformity with U.S. generally accepted accounting principles.

As discussed in Note 9, the statement of operations, the statement of changes in net assets, and financial highlights for the year ended October 31, 2011 for the Nuveen Real Estate Securities Fund have been restated to correct the classification of certain financial statement line items and financial highlights as of and for the year ended October 31, 2011. The restatement did not impact the Nuveen Global Infrastructure Fund financial statements.

Chicago, Illinois

December 28, 2011

Except for Note 9, as to which the date is February 29, 2012

| Nuveen Investments | 23 |

Nuveen Global Infrastructure Fund

December 31, 2011

| Shares | Description (1) | Value | ||||||||||||

COMMON STOCKS – 96.0% | ||||||||||||||

Air Freight & Logistics – 1.5% | ||||||||||||||

| 34,320 | Oesterreichische Post Ag | $ | 1,034,952 | |||||||||||

| 2,347,154 | Singapore Post Limited | 1,691,985 | ||||||||||||

Total Air Freight & Logistics | 2,726,937 | |||||||||||||

Commercial Services & Supplies – 4.5% | ||||||||||||||

| 2,012,796 | China Everbright International Limited | 728,241 | ||||||||||||

| 63,698 | Covanta Holding Corporation | 872,026 | ||||||||||||

| 34,248 | Progressive Waste Solutions Ltd | 670,918 | ||||||||||||

| 121,745 | Serco Group PLC | 896,185 | ||||||||||||

| 32,938 | Standard Parking Corporation, (2) | 588,602 | ||||||||||||

| 131,742 | Waste Connections Inc. | 4,365,930 | ||||||||||||

Total Commercial Services & Supplies | 8,121,902 | |||||||||||||

Construction & Engineering – 1.0% | ||||||||||||||

| 150,560 | Ferrovial SA | 1,817,087 | ||||||||||||

Diversified Telecommunication Services – 0.4% | ||||||||||||||

| 309,188 | Singapore Telecommunications Limited | 736,588 | ||||||||||||

Electric Utilities – 18.3% | ||||||||||||||

| 131,093 | Brookfield Infrastructure Partners LP | 3,631,276 | ||||||||||||

| 660,992 | Cheung Kong Infrastructure Holdings Lt | 3,872,368 | ||||||||||||

| 9,574 | Cia De Transmissao De Energia | 297,652 | ||||||||||||

| 12,042 | Cia Energetica Do Ceara-Pr A | 222,408 | ||||||||||||

| 32,078 | CLP Holdings Limited | 272,803 | ||||||||||||

| 261,354 | E CL SA | 694,512 | ||||||||||||

| 36,008 | E ON AG | 776,876 | ||||||||||||

| 186,887 | EDP Energias do Brasil SA | 4,158,054 | ||||||||||||

| 9,115 | Elia System Operator SA NV | 353,086 | ||||||||||||

| 46,795 | Emera Inc | 1,517,651 | ||||||||||||

| 32,469 | Enersis SA | 572,428 | ||||||||||||

| 213,921 | Equatorial Energia SA – ORD | 1,453,092 | ||||||||||||

| 23,979 | Exelon Corporation | 1,039,969 | ||||||||||||

| 33,900 | Fortis Inc | 1,110,423 | ||||||||||||

| 58,225 | Fortum Oyj | 1,242,646 | ||||||||||||

| 40,329 | Hafslund ASA, Class B, (3) | 391,095 | ||||||||||||

| 16,137 | ITC Holdings Corporation | 1,224,476 | ||||||||||||

| 299,766 | Power Assets Holding Ltd | 2,217,387 | ||||||||||||

| 354,650 | Power Grid Corp of India Ltd | 668,496 | ||||||||||||

| 131,703 | PPL Corporation | 3,874,702 | ||||||||||||

| 96,679 | Scottish and Southern Energy PLC | 1,938,324 | ||||||||||||

| 524,710 | SP Ausnet, (2) | 504,472 | ||||||||||||

| 38,008 | Tauron Polska Energia SA | 58,926 | ||||||||||||

| 14,958 | UIL Holdings Corporation | 529,064 | ||||||||||||

| 6,776 | Unitil Corp. | 192,303 | ||||||||||||

Total Electric Utilities | 32,814,489 | |||||||||||||

Gas Utilities – 7.1% | ||||||||||||||

| 204,040 | APA Group | 937,026 | ||||||||||||

| 25,811 | Atmos Energy Corporation | 860,797 | ||||||||||||

| 24 | Nuveen Investments |

| Shares | Description (1) | Value | ||||||||||||

Gas Utilities (continued) | ||||||||||||||

| 15,154 | Chesapeake Utilities Corporation | $ | 656,926 | |||||||||||

| 2,099,286 | Cityspring Infrastructure | 542,200 | ||||||||||||

| 20,587 | GAIL India Ltd., GDR | 899,652 | ||||||||||||

| 1,015,975 | Hong Kong and China Gas Company Limtied | 2,354,640 | ||||||||||||

| 169,969 | Questar Corporation | 3,375,584 | ||||||||||||

| 32,026 | Rubis | 1,674,562 | ||||||||||||

| 107,675 | Tokyo Gas Company Limited | 495,218 | ||||||||||||

| 728,977 | Towngas China Co Ltd | 394,214 | ||||||||||||

| 156,229 | Xinao Gas Holdings | 500,876 | ||||||||||||

Total Gas Utilities | 12,691,695 | |||||||||||||

Independent Power Producers & Energy Traders – 1.2% | ||||||||||||||

| 26,212 | Brookfield Renewable Energy | 698,815 | ||||||||||||

| 30,682 | Endesa SA Chile | 1,360,747 | ||||||||||||

Total Independent Power Producers & Energy Traders | 2,059,562 | |||||||||||||

Industrial Conglomerates – 0.7% | ||||||||||||||

| 138,882 | Beijing Enterprises Holdings | 833,299 | ||||||||||||

| 136,818 | SembCorp Industries Limited | 427,210 | ||||||||||||

Total Industrial Conglomerates | 1,260,509 | |||||||||||||

Machinery – 0.1% | ||||||||||||||

| 117,712 | Hyflux Limited | 109,358 | ||||||||||||

Media – 1.5% | ||||||||||||||

| 113,882 | Ses | 2,733,374 | ||||||||||||

Multi-Utilities – 12.1% | ||||||||||||||

| 26,009 | Atco Ltd | 1,537,946 | ||||||||||||

| 11,012 | Canadian Utilities Limited, Class A | 665,206 | ||||||||||||

| 14,913 | CenterPoint Energy, Inc. | 299,602 | ||||||||||||

| 473,737 | Centrica PLC | 2,128,403 | ||||||||||||

| 13,213 | Dominion Resources, Inc. | 701,346 | ||||||||||||

| 237,090 | DUET Group | 425,580 | ||||||||||||

| 540,618 | Hera SpA | 771,762 | ||||||||||||

| 169,557 | Iren SpA | 159,649 | ||||||||||||

| 119,230 | National Grid PLC, Sponsored ADR | 5,780,270 | ||||||||||||

| 83,286 | NiSource Inc. | 1,983,040 | ||||||||||||

| 61,777 | OGE Energy Corp. | 3,503,374 | ||||||||||||

| 33,967 | RWE AG, Sponsored ADR | 1,193,560 | ||||||||||||

| 17,332 | Sempra Energy | 953,260 | ||||||||||||

| 20,919 | Vector Limited | 40,220 | ||||||||||||

| 57,154 | Xcel Energy, Inc. | 1,579,737 | ||||||||||||

Total Multi-Utilities | 21,722,955 | |||||||||||||

Oil, Gas & Consumable Fuels – 12.8% | ||||||||||||||

| 1,606,845 | China Suntien Green Energy | 281,373 | ||||||||||||

| 100,928 | El Paso Corporation | 2,681,657 | ||||||||||||

| 13,448 | El Paso Pipeline Partners, LP | 465,570 | ||||||||||||

| 31,892 | Enbridge Energy Partners LP | 1,058,495 | ||||||||||||

| 236,460 | Enbridge Inc. | 8,845,969 | ||||||||||||

| Nuveen Investments | 25 |

Portfolio of Investments

Nuveen Global Infrastructure Fund (continued)

December 31, 2011

| Shares | Description (1) | Value | ||||||||||||

Oil, Gas & Consumable Fuels (continued) | ||||||||||||||

| 2,422 | Holly Energy Partners LP | $ | 130,328 | |||||||||||

| 37,816 | Keyera Corp | 1,856,000 | ||||||||||||

| 46,973 | Kinder Morgan, Inc. | 1,511,121 | ||||||||||||

| 136,434 | Spectra Energy Corporation | 4,195,346 | ||||||||||||

| 16,070 | Spectra Energy Partners, LP | 513,597 | ||||||||||||

| 18,229 | TransCanada Corporation | 796,060 | ||||||||||||

| 41,780 | Veresen Inc | 627,469 | ||||||||||||

Total Oil, Gas & Consumable Fuels | 22,962,985 | |||||||||||||

Real Estate – 0.4% | ||||||||||||||

| 579,866 | Parkway Life Real Estate | 800,247 | ||||||||||||

Road & Rail – 3.1% | ||||||||||||||

| 801,455 | ComfortDelGro Corporation | 874,337 | ||||||||||||

| 713,382 | MTR Corporation | 2,310,093 | ||||||||||||

| 162,671 | QR National LTD | 569,018 | ||||||||||||

| 1,374,890 | SMRT Corporation Limited | 1,876,223 | ||||||||||||

Total Road & Rail | 5,629,671 | |||||||||||||

Transportation Infrastructure – 23.7% | ||||||||||||||

| 110,574 | Abertis Infraestructuras SA | 1,765,978 | ||||||||||||

| 17,489 | Aeroports de Paris | 1,199,660 | ||||||||||||

| 590,886 | Anhui Expressway Co Ltd-H | 346,927 | ||||||||||||

| 219,646 | Atlantia SpA | 3,516,497 | ||||||||||||

| 258,045 | Auckland International Airport Limited | 506,172 | ||||||||||||

| 327,145 | Australian Infrastructure Fd | 645,784 | ||||||||||||

| 24,208 | Autostrada Torino-Milano | 234,514 | ||||||||||||

| 137,242 | Brisa Auto-Estrada de Portugal SA | 452,056 | ||||||||||||

| 325,185 | CCR SA | 2,130,417 | ||||||||||||

| 530,424 | China Merchants Holdings International Company Limited | 1,540,065 | ||||||||||||

| 223,120 | Cosco Pacific Limited | 260,564 | ||||||||||||

| 86,725 | EcoRodovias Infraestrutura de Logistica SA | 648,607 | ||||||||||||

| 8,071 | Flughafen Wien AG | 305,489 | ||||||||||||

| 934 | Flughafen Zuerich AG | 324,161 | ||||||||||||

| 100,578 | Fraport AG | 4,946,566 | ||||||||||||

| 243,094 | Groupe Eurotunnel SA | 1,654,921 | ||||||||||||

| 368,302 | Hopewell Highway Infrastructure | 184,469 | ||||||||||||

| 1,013,617 | Hutchison Port Holdings Trust | 628,443 | ||||||||||||

| 482,265 | Infratil Limited | 705,741 | ||||||||||||

| 1,605,967 | International Container Term Services Inc | 1,940,856 | ||||||||||||

| 87,737 | Japan Airport Terminal Company | 1,141,026 | ||||||||||||

| 56,976 | Kamigumi Company Limited | 491,517 | ||||||||||||

| 11,278 | Koninklijke Vopak NV | 595,903 | ||||||||||||

| 99,691 | Macquarie Atlas Road Group | 137,651 | ||||||||||||

| 547,917 | OHL Mexico SAB DE, (2) | 844,175 | ||||||||||||

| 208,627 | Port of Tauranga Limited | 1,615,828 | ||||||||||||

| 65,070 | Santos Brasil Participacoes SA | 860,623 | ||||||||||||

| 671,053 | SATS Limited | 1,112,343 | ||||||||||||

| 82,930 | Sias SPA | 624,672 | ||||||||||||

| 26 | Nuveen Investments |

| Shares | Description (1) | Value | ||||||||||||

Transportation Infrastructure (continued) | ||||||||||||||

| 280,076 | Sydney Airport | $ | 761,987 | |||||||||||

| 988,221 | Transurban Group | 5,680,419 | ||||||||||||

| 142,556 | Westshore Terminals Income Fund | 3,201,650 | ||||||||||||

| 96,538 | Wilson Sons Ltd, BDR | 1,314,604 | ||||||||||||

| 383,016 | Zhejiang Expressway Company Limited | 248,552 | ||||||||||||

Total Transportation Infrastructure | 42,568,837 | |||||||||||||

Water Utilities – 3.6% | ||||||||||||||

| 4,967 | American States Water Co. | 173,348 | ||||||||||||

| 12,736 | American Water Works Company | 405,769 | ||||||||||||

| 22,728 | Aqua America Inc. | 501,152 | ||||||||||||

| 34,268 | Companhia de Saneamento Basico do Estado de Sao Paulo, ADR | 1,907,014 | ||||||||||||

| 17,394 | Companhia de Saneamento de Minas Gervais Copasa MG | 311,465 | ||||||||||||

| 269,619 | Guangdong Investment Limited | 163,509 | ||||||||||||

| 85,995 | Manila Water Company | 38,041 | ||||||||||||

| 13,142 | Middlesex Water Company | 245,230 | ||||||||||||

| 50,785 | Severn Trent PLC | 1,179,873 | ||||||||||||

| 153,912 | United Utilities PLC | 1,448,482 | ||||||||||||

Total Water Utilities | 6,373,883 | |||||||||||||

Wireless Telecommunication Services – 4.0% | ||||||||||||||

| 120,332 | American Tower Corporation, (2) | 7,221,123 | ||||||||||||

Total Common Stocks (cost $162,830,881) | 172,351,202 | |||||||||||||

| Shares | Description (1) | Value | ||||||||||||

SHORT-TERM INVESTMENTS – 3.1% | ||||||||||||||

Money Market Funds – 3.1% | ||||||||||||||

| 5,534,437 | State Street Institutional Liquid Reserve Fund, 0.150% (4) | $ | 5,534,437 | |||||||||||

Total Short-Term Investments (cost $5,534,437) | 5,534,437 | |||||||||||||

Total Investments (cost $168,365,318) – 99.1% | 177,885,639 | |||||||||||||

Other Assets Less Liabilities – 0.9% | 1,654,232 | |||||||||||||

Net Assets – 100% | $ | 179,539,871 | ||||||||||||

| For Fund portfolio compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report which may combine industry sub-classifications into sectors for reporting ease. |

| (1) | All percentages shown in the Portfolio of Investments are based on net assets. |

| (2) | Non-income producing; issuer has not declared a dividend within the past twelve months. |

| (3) | For fair value measurement disclosure purposes, Common Stock categorized as Level 2. See Notes to Financial Statements, Footnote 1 – General Information and Significant Accounting Policies, Investment Valuation for more information. |

| (4) | The rate shown is the annualized seven-day effective yield as of December 31, 2011. |

| ADR | American Depositary Receipt. |

| BDR | Brazilian Depositary Receipt. |

| GDR | Global Depositary Receipt. |

See accompanying notes to financial statements.

| Nuveen Investments | 27 |

Nuveen Real Asset Income Fund

December 31, 2011

| Shares | Description (1) | Value | ||||||||||||

COMMON STOCKS – 27.0% | ||||||||||||||

Air Freight & Logistics – 2.6% | ||||||||||||||

| 4,722 | Oesterreichische Post Ag | $ | 142,396 | |||||||||||

| 173,332 | Singapore Post Limited | 124,949 | ||||||||||||

Total Air Freight & Logistics | 267,345 | |||||||||||||

Capital Markets – 0.3% | ||||||||||||||

| 7,500 | Macquarie Korea Infra | 32,552 | ||||||||||||

Electric Utilities – 8.2% | ||||||||||||||

| 2,677 | Brookfield Infrastructure Partners LP | 74,153 | ||||||||||||

| 1,793 | Cia Energetica Do Ceara-Pr A | 33,116 | ||||||||||||

| 2,000 | E ON AG | 43,150 | ||||||||||||

| 5,821 | EDP Energias do Brasil SA | 129,512 | ||||||||||||

| 24,388 | Equatorial Energia SA | 165,659 | ||||||||||||

| 1,213 | Exelon Corporation | 52,608 | ||||||||||||

| 2,404 | Fortum Oyj | 51,306 | ||||||||||||

| 2,068 | PPL Corporation | 60,841 | ||||||||||||

| 7,558 | Scottish and Southern Energy PLC | 151,531 | ||||||||||||

| 42,018 | SP Ausnet | 40,397 | ||||||||||||

| 1,356 | Unitil Corp. | 38,483 | ||||||||||||

Total Electric Utilities | 840,756 | |||||||||||||

Gas Utilities – 1.5% | ||||||||||||||

| 349,416 | Cityspring Infrastructure | 90,247 | ||||||||||||

| 88,446 | Envestra Limited | 64,681 | ||||||||||||

Total Gas Utilities | 154,928 | |||||||||||||

Independent Power Producers & Energy Traders – 0.4% | ||||||||||||||

| 1,390 | Brookfield Renewable Energy | 37,058 | ||||||||||||

Media – 0.8% | ||||||||||||||

| 3,316 | Ses | 79,590 | ||||||||||||

Multi-Utilities – 5.7% | ||||||||||||||

| 4,500 | Centrica PLC | 20,218 | ||||||||||||

| 62,322 | DUET Group | 111,869 | ||||||||||||

| 54,996 | Hera SpA | 78,510 | ||||||||||||

| 24,104 | Iren SpA | 22,695 | ||||||||||||

| 6,241 | National Grid PLC, Sponsored ADR | 302,564 | ||||||||||||

| 26,639 | Vector Limited | 51,217 | ||||||||||||

Total Multi-Utilities | 587,073 | |||||||||||||

Oil, Gas & Consumable Fuels – 3.1% | ||||||||||||||

| 1,092 | El Paso Pipeline Partners, LP | 37,805 | ||||||||||||

| 3,802 | Enbridge Energy Partners, LP | 126,188 | ||||||||||||

| 540 | Holly Energy Partneres, LP | 29,057 | ||||||||||||

| 986 | Spectra Energy Partners, LP | 31,513 | ||||||||||||

| 6,383 | Veresen Inc | 95,862 | ||||||||||||

Total Oil, Gas & Consumable Fuels | 320,425 | |||||||||||||

Telecommunication Services – 0.3% | ||||||||||||||

| 14,924 | Singapore Telecommunications Limited | 35,554 | ||||||||||||

| 28 | Nuveen Investments |

| Shares | Description (1) | Value | ||||||||||||||||

Transportation – 3.9% | ||||||||||||||||||

| 6,044 | Abertis Infraestructuras SA | $ | 96,529 | |||||||||||||||

| 101,000 | Anhui Expressway Co Ltd | 59,300 | ||||||||||||||||

| 4,009 | Autostrada Torino-Milano | 38,837 | ||||||||||||||||

| 71,000 | Hopewell Highway Infrastructure | 35,561 | ||||||||||||||||

| 6,448 | Transurban Group | 37,064 | ||||||||||||||||

| 118,464 | Hutchison Port Holdings Trust | 73,448 | ||||||||||||||||

| 226,000 | Xiamen International Port | 33,464 | ||||||||||||||||

| 5,574 | Australian Infrastructure Fd | 11,003 | ||||||||||||||||

| 538 | Flughafen Wien AG | 20,363 | ||||||||||||||||

Total Transportation | 405,569 | |||||||||||||||||

Water Utilities – 0.2% | ||||||||||||||||||

| 2,165 | United Utilities PLC | 20,375 | ||||||||||||||||

Total Common Stocks (cost $2,753,087) | 2,781,225 | |||||||||||||||||

| Shares | Description (1) | Value | ||||||||||||||||

REAL ESTATE INVESTMENT TRUST COMMON STOCKS – 11.2% | ||||||||||||||||||

Diversified – 1.6% | ||||||||||||||||||

| 4,070 | Liberty Property Trust | $ | 125,682 | |||||||||||||||

| 1,486 | Washington Real Estate Investment Trust | 40,642 | ||||||||||||||||

Total Diversified | 166,324 | |||||||||||||||||

Mortgage – 0.4% | ||||||||||||||||||

| 2,158 | Starwood Property Trust Inc. | 39,945 | ||||||||||||||||

Office – 1.1% | ||||||||||||||||||

| 9,690 | Franklin Street Properties Corporation | 96,416 | ||||||||||||||||

| 610 | Mack-Cali Realty Corporation | 16,281 | ||||||||||||||||

Total Office | 112,697 | |||||||||||||||||

Retail – 6.6% | ||||||||||||||||||

| 501 | Equity One Inc. | 8,507 | ||||||||||||||||

| 20,757 | National Retail Properties, Inc. | 547,570 | ||||||||||||||||

| 830 | Ramco-Gershenson Properties Trust | 8,159 | ||||||||||||||||

| 5,191 | Urstadt Biddle Properties Inc. | 93,853 | ||||||||||||||||

| 3,537 | Westfield Group | 28,254 | ||||||||||||||||

Total Retail | 686,343 | |||||||||||||||||

Specialized – 1.5% | ||||||||||||||||||

| 120 | Entertainment Properties Trust | 5,245 | ||||||||||||||||

| 99,475 | Parkway Life Real Estate | 137,281 | ||||||||||||||||

| 341 | Universal Health Realty Income Trust | 13,297 | ||||||||||||||||

Total Specialized | 155,823 | |||||||||||||||||

Total Real Estate Investment Trust Common Stocks (cost $1,137,692) | 1,161,132 | |||||||||||||||||

| Shares | Description (1) | Coupon | Ratings (2) | Value | ||||||||||||||

CONVERTIBLE PREFERRED SECURITIES – 1.6% | ||||||||||||||||||

Energy – 0.5% | ||||||||||||||||||

| 1,000 | El Paso Energy Capital Trust I, Convertible Preferred | 4.750% | BB– | $ | 46,040 | |||||||||||||

Financials – 1.1% | ||||||||||||||||||

| 5,135 | Brookfield Asset Management | 4.750% | N/R | 117,595 | ||||||||||||||

Total Convertible Preferred Securities (cost $159,745) | 163,635 | |||||||||||||||||

| Nuveen Investments | 29 |

Portfolio of Investments

Nuveen Real Asset Income Fund (continued)

December 31, 2011

| Shares | Description (1) | Coupon | Ratings (2) | Value | ||||||||||||||

$25 PAR (OR SIMILAR) PREFERRED SECURITIES – 31.3% | ||||||||||||||||||

Diversified – 6.9% | ||||||||||||||||||

| 6,781 | Brookfield Asset Management | 5.630% | N/R | $ | 129,796 | |||||||||||||

| 5,135 | Brookfield Asset Management | 4.750% | N/R | 118,300 | ||||||||||||||

| 3,629 | Cousins Property Inc. | 7.750% | N/R | 87,459 | ||||||||||||||

| 2,406 | PS Business Parks, Inc. | 7.200% | Baa3 | 60,511 | ||||||||||||||

| 3,473 | PS Business Parks, Inc. | 7.000% | Baa3 | 87,589 | ||||||||||||||

| 4,535 | Vornado Realty Trust, Series H | 6.750% | Baa3 | 113,874 | ||||||||||||||

| 4,509 | Vornado Realty Trust, Series F | 6.750% | Baa3 | 114,664 | ||||||||||||||

Total Diversified | 712,193 | |||||||||||||||||

Electric Utilities – 2.9% | ||||||||||||||||||

| 131 | Connecticut Power & Light Company | 2.200% | BBB– | 5,891 | ||||||||||||||

| 158 | Connecticut Power & Light Company | 4.500% | BBB– | 7,461 | ||||||||||||||

| 522 | Entergy Louisiana LLC | 6.950% | Ba1 | 52,249 | ||||||||||||||

| 949 | Fortis Inc | 4.900% | N/R | 23,987 | ||||||||||||||

| 221 | Georgia Power Company | 6.500% | A– | 24,222 | ||||||||||||||

| 200 | Pacific Gas & Electric Corporation | 5.000% | BBB | 5,166 | ||||||||||||||

| 1,480 | Pacific Gas and Electric Company | 5.000% | BBB | 36,704 | ||||||||||||||

| 632 | Peco Energy Company | 4.680% | BBB | 57,980 | ||||||||||||||

| 72 | Peco Energy Company | 4.300% | BBB | 6,512 | ||||||||||||||

| 3,166 | PPL Electric Utilities Corporation | 6.250% | BBB– | 80,238 | ||||||||||||||

Total Electric Utilities | 300,410 | |||||||||||||||||

Industrials – 2.0% | ||||||||||||||||||

| 878 | Dupont Fabros Technology | 7.875% | Ba2 | 22,047 | ||||||||||||||

| 1,964 | First Industrial Realty Trust, Inc., Series J | 7.250% | B2 | 42,403 | ||||||||||||||

| 1,696 | First Industrial Realty Trust, Inc., Series K | 7.250% | B+ | 36,837 | ||||||||||||||

| 876 | First Potomac Realty Trust | 7.750% | N/R | 22,224 | ||||||||||||||