UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-05309

Nuveen Investment Funds, Inc.

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Kevin J. McCarthy

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: December

Date of reporting period: December 31, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Mutual Funds

Nuveen Equity Funds

For investors seeking long-term capital appreciation potential.

Annual Report

December 31, 2012

| | | | | | | | | | |

| | | Share Class / Ticker Symbol |

| | | | | |

| Fund Name | | Class A | | Class B | | Class C | | Class R3 | | Class I |

Nuveen Global Infrastructure Fund | | FGIAX | | — | | FGNCX | | FGNRX | | FGIYX |

Nuveen Real Asset Income Fund | | NRIAX | | — | | NRICX | | NRIRX | | NRIIX |

Nuveen Real Estate Securities Fund | | FREAX | | FREBX | | FRLCX | | FRSSX | | FARCX |

LIFE IS COMPLEX.

Nuveen makes things e-simple.

It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Fund information is ready. No more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish.

Free e-Reports right to your e-mail!

www.investordelivery.com

If you receive your Nuveen Fund distributions and statements from your financial advisor or brokerage account.

OR

www.nuveen.com/accountaccess

If you receive your Nuveen Fund distributions and statements directly from Nuveen.

| | | | | | |

| Must be preceded by or accompanied by a prospectus. | | NOT FDIC INSURED | | MAY LOSE VALUE | | NO BANK GUARANTEE |

Table of Contents

Chairman’s

Letter to Shareholders

Dear Shareholders,

Despite the global economy’s ability to muddle through the many economic headwinds of 2012, investors continue to have good reasons to remain cautious. The European Central Bank’s decisions to extend intermediate term financing to major European banks and to support sovereign debt markets have begun to show signs of a stabilized euro area financial market. The larger member states of the European Union (EU) are working diligently to strengthen the framework for a tighter financial and banking union and meaningful progress has been made by agreeing to centralize large bank regulation under the European Central Bank. However, economic conditions in the southern tier members are not improving and the pressures on their political leadership remain intense. The jury is out on whether the respective populations will support the continuing austerity measures that are needed to meet the EU fiscal targets.

In the U.S., the Fed remains committed to low interest rates into 2015 through its third program of Quantitative Easing (QE3). Inflation remains low but a growing number of economists are expressing concern about the economic distortions resulting from negative real interest rates. The highly partisan atmosphere in Congress led to a disappointingly modest solution for dealing with the end-of-year tax and spending issues. Early indications for the new Congressional term have not given much encouragement that the atmosphere for dealing with the sequestration legislation and the debt ceiling issues, let alone a more encompassing “grand bargain,” will be any better than the last Congress. Over the longer term, there are some encouraging trends for the U.S. economy: house prices are beginning to recover, banks and corporations continue to strengthen their financial positions and incentives for capital investment in the U.S. by domestic and foreign corporations are increasing due to more competitive energy and labor costs.

During 2012 U.S. investors have benefited from strong returns in the domestic equity markets and solid returns in most fixed income markets. However, many of the macroeconomic risks of 2012 remain unresolved, including negotiating through the many U.S. fiscal issues, managing the risks of another year of abnormally low U.S. interest rates, sustaining the progress being made in the euro area and reducing the potential economic impact of geopolitical issues, particularly in the Middle East. In the face of these uncertainties, the experienced investment professionals at Nuveen Investments seek out investments that are enjoying positive economic conditions. At the same time they are always on the alert for risks in markets subject to excessive optimism or for opportunities in markets experiencing undue pessimism. Monitoring this process is a critical function for the Fund Board as it oversees your Nuveen Fund on your behalf.

As always, I encourage you to communicate with your financial consultant if you have any questions about your investment in a Nuveen Fund. On behalf of the other members of your Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

Robert P. Bremner

Chairman of the Board

February 22, 2013

Portfolio Managers’ Comments

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

These Funds feature portfolio management by Nuveen Asset Management, LLC, an affiliate of Nuveen Investments. For the Nuveen Global Infrastructure Fund, Jay Rosenberg and John Wenker have been the managers since its inception in 2007. Effective December 1, 2012, Nuveen Asset Management added Tryg Sarsland as a co-portfolio manager to the Fund. For the Nuveen Real Asset Income Fund, Jay and John, along with portfolio manager Jeff Schmitz, CFA, have managed the Fund since its inception in 2011. For the Nuveen Real Estate Securities Fund, John assumed portfolio management responsibilities in 1999, while Jay has been on the management team of the Fund since 2005. In addition, co-portfolio manager Scott Sedlak joined the Nuveen Real Estate Securities Fund’s management team in 2011. On the following pages, the portfolio management teams for these Funds examine economic and market conditions, key investment strategies and the Funds’ performance for the twelve-month period ended December 31, 2012.

What were the general market conditions and trends over the course of the

reporting period?

During this period, the U.S. economy’s progress toward recovery from recession

continued at a moderate pace. The Federal Reserve (Fed) maintained its efforts to

improve the overall economic environment by holding the benchmark fed funds rate at

the record low level of zero to 0.25% that it established in December 2008. The central

bank decided during its December 2012 meeting to keep the fed funds rate at “exceptionally low levels” until either the unemployment rate reaches 6.5% or expected inflation goes above 2.5%. The Fed also affirmed its decision, announced in September

2012, to purchase $40 billion of mortgage-backed securities each month in an effort to

stimulate the housing market. In addition to this new, open-ended stimulus program, the Fed plans to continue its program to extend the average maturity of its holdings of

U.S. Treasury securities through the end of December 2012. The goals of these actions,

which together will increase the Fed’s holdings of longer-term securities by approximately

$85 billion a month through the end of the year, are to put downward pressure on longer-term interest rates, make broader financial conditions more accommodative and support a stronger economic recovery as well as continued progress toward the Fed’s mandates of maximum employment and price stability.

In the fourth quarter 2012, the U.S. economy, as measured by the U.S. gross domestic

product (GDP), decreased at an estimated annualized rate of 0.1%, down from a 3.1% increase in the third quarter. This slight decline was due to lower inventory investment, federal spending and net exports. The Consumer Price Index (CPI) rose 1.7% year-over-year as of December 2012, after a 3.0% increase in 2011. The core CPI (which excludes

food and energy) increased 1.9% during the period, staying just within the Fed’s unofficial objective of 2.0% or lower for this inflation measure. As of January 2013, the national unemployment rate was 7.9%, slightly higher than the 7.8% unemployment rate for December 2012 but below the 8.3% level recorded in January 2012. The housing market continued to show signs of improvement, with the average home price in the S&P/Case-Shiller Index of 20 major metropolitan areas rising 5.5% for the twelve months ended November 2012 (most recent data available at the time this report was prepared). This was the largest year-over-year price gain since August 2006. The outlook for the U.S. economy remained clouded by uncertainty about global financial markets and the continued negotiations by Congress regarding potential spending cuts and tax policy reform.

The U.S. equity markets delivered impressive gains in 2012 despite significant market volatility and overarching economic uncertainty brought on by the European credit crisis, combined with the presidential election and its ultimate impact on the fiscal cliff. Congress averted the fiscal cliff with tax legislation, but spending cuts and entitlement reforms still need to be addressed in 2013. Asset flows continued into bonds from equities, and into passive equity strategies away from active managers. The move to fiscal austerity has reduced monetary stimulus globally with no meaningful increase in interest rates or inflationary expectations.

Nuveen Global Infrastructure Fund

How did the Fund perform during the twelve-month period ended December 31, 2012?

The table in the Fund Performance and Expense Ratios section of this report provides Class A Share total returns for the Fund for the one-year, five-year and since-inception periods ended December 31, 2012. The Fund’s Class A Shares at net asset value (NAV) outperformed the S&P Global Infrastructure Index and the Lipper classification average over the twelve-month period.

What strategies were used to manage the Fund during the reporting period? How did these strategies influence performance?

The Fund seeks to provide capital appreciation and income potential by investing primarily in equity securities issued by U.S. and non-U.S. companies that typically derive the majority of their value from owned or operated infrastructure assets. During the twelve-month period, our strategy for managing the Fund remained consistent as we focused on buying global infrastructure companies that own and operate long life assets that have visible cash flows, strong balance sheets, manageable amounts of leverage and inelastic demand characteristics. We believe these types of companies will have ongoing access to capital and the best chances for producing sustainable and growing cash flow. The Fund is structured using a number of core infrastructure companies that we believe should provide long-term outperformance versus the market, combined with more opportunistic holdings that we believe are undervalued by the market in the short term. We have exposure around the globe to a mixture of holdings that represent significant value, as well as positions in companies that may prove to be more stable in a slowly growing global economy.

Over the fiscal year period, the Fund outpaced its benchmarks as a result of strong stock selection and favorable weights in several sectors, particularly an underweight in electric utilities, technology infrastructure, water and gas utilities. The toll road sector was the only detractor of note during the period, although the waste sector and a small cash position were also slight drags on results. Additionally, the Fund’s returns benefited from the ongoing execution of one of our long-term strategies, which is to execute a great deal of caution in owning securities from regions where political, fiscal or monetary uncertainty is rampant. During the reporting period, this strategy was particularly fruitful in the electric utilities sector, as noted below.

The electric utilities sector was the strongest performing area in the Fund relative to the benchmark during the fiscal year. The Fund benefited both from a substantial underweight to electric utilities as well as favorable stock selection across the space. A great deal of the positive attribution resulted from our ongoing underweight in continental European electric utilities, based on economic sensitivity as well as heightened political and regulatory risk as Eurozone countries attempt to fix the region’s sovereign debt crisis. Electric utility stocks in countries such as Germany fell to five-year lows based on these very low power prices. As we’ve discussed since the inception of the Fund, we favor investments in stable, regulated companies with long-term contracts or concessions that are not as commodity price sensitive. We attempt to avoid exposure in companies that derive too much of their cash flows from spot market generation, or that could be significantly impacted by political and/or regulatory uncertainty. Elsewhere in the sector, results were aided by our increased exposure to U.S. regulated utilities. We took advantage of a sell-off in U.S. regulated utilities during the period and added holdings to the Fund, which benefited results as the stocks rebounded. Toward the end of the fiscal year, we continued to add to positions in the U.S. regulated segment, after several key issues that we’d been monitoring were resolved.

The Fund also continued to be rewarded for its long held positions in the technology infrastructure sector, an area not represented in the S&P Global Infrastructure Index. We own a handful of technology infrastructure holdings spread across the cell phone tower, data center and satellite industries. In particular, we saw positive results from our emphasis on cell phone tower providers, which we have invested in since the Fund’s inception. Many of these companies continued to benefit from stable, sound fundamentals and a number of favorable long-term trends in the sector, including the very strong demand from wireless customers for increasing amounts of data.

Meanwhile, the Fund’s outperformance in water infrastructure was the culmination of several favorable positions from Brazil and Hong Kong. In particular, the Fund experienced strong results from a water utility it owns from the Sao Paulo state in Brazil. The company benefited from a commitment by the state’s regulators to adopt a more formal regulatory framework similar to what exists for other Brazilian utilities. Meanwhile, several Hong Kong based water companies performed well over the fiscal year. The Chinese government’s most recent “5-year plan” continued to lay out the country’s vision for growth, but with more of a focus on environmental services given that pollution is rampant throughout the mainland. While several contracts had been awarded earlier in 2012 for development in these areas, the transition of government delayed the regulatory

approval and permit process. After the government transition was completed in the final quarter of the year, the approval process accelerated and benefited companies in the water sector.

The gas utilities sector also added favorably to twelve-month returns. In particular, the Fund was rewarded for our significant underweight position to a large French company in the benchmark. This particular underweight was part of our larger decision to de-emphasize European integrated utilities due to continued economic softness and political risks. Our wariness proved correct as the company sold off dramatically after announcing that financial results would be hindered by the weak European economy and tighter restrictions surrounding its ability to raise energy prices in France. The Fund also experienced strong performance from a gas utility in Hong Kong, which benefited from a stable business environment, a benign regulatory environment and its status as a monopoly provider in the region. Additionally, the Fund saw favorable results from some of its smaller-cap U.S. gas companies that have good regulatory environments.

The toll road sector was the Fund’s greatest area of underperformance during the fiscal year. The shortfall was primarily due to our broad based European underweight, particularly in Italy and Spain as stocks rebounded from significant lows of the prior year. The toll road sector ended up being a relatively strong performing area in the benchmark. In the waste sector, which is not represented in the benchmark, one of our solid waste collection and recycling companies from the United States traded off during the fiscal year. It had raised a significant amount of capital for a potential buyout, but was outbid for those assets. Although the market sold off the stock, we remained confident in this name and it continued to be one of the larger weights in the Fund. Finally, the Fund’s results were hindered by small position in cash during a period where the market experienced a strong advance.

During the fiscal year, approximately one-third of the Fund was positioned in the United States, which is slightly higher than our historical average of around 25% U.S. exposure. This was primarily due to the Fund’s underweight to Europe, but also the result of a short-term opportunity we took advantage of in the master limited partnership (MLP) and regulated utilities marketplaces. Prior to the U.S. presidential election, MLPs and regulated utilities had been trading well above historical valuations as they were considered somewhat of a safe haven during the global financial crisis. However, these segments sold off pretty significantly after the election as concerns increased regarding potential tax increases. We used the sell-off to bolster the Fund’s position in both of those areas, and they subsequently recovered.

Nuveen Real Asset Income Fund

How did the Fund perform during the twelve-month period ended December 31, 2012?

The table in the Fund Performance and Expense Ratios section of this report provides Class A Share total returns for the Fund for the one-year and since-inception periods ended December 31, 2012. The Fund’s Class A Shares at net asset value (NAV) outperformed the Barclays U.S. Corporate High Yield Index, the custom blend benchmark and the Lipper classification average over the twelve-month period.

What strategies were used to manage the Fund during the reporting period? How did these strategies influence performance?

The Fund seeks to provide a high level of current income and the potential for capital appreciation by investing in a global portfolio of infrastructure and commercial real estate related securities (i.e. real assets) across the capital markets. These securities include a combination of infrastructure and real estate common stock, infrastructure and real estate preferred stock, and infrastructure and real estate related debt. Our goal is to combine these securities into a portfolio that provides investors with an attractive level of income and dampens levels of risk versus the broader equity market. We continued to select securities using an investment process that screens for companies and assets across the real assets market that provide higher dividend yields. From the group of securities providing the highest yields, we focus on owning those companies and securities with the highest total return potential in the Fund. Our process places a premium on finding securities whose revenues come from tangible assets with long-term concessions, contracts or leases and are therefore capable of producing steady, predictable and recurring cash flows. The Fund’s management team employs a bottom-up, fundamental approach to security selection and portfolio construction. We look for stable companies that demonstrate consistent and growing cash flow, strong balance sheets and histories of being good stewards of shareholder capital.

Over the twelve-month reporting period, the Fund continued to generate a higher level of yield than its custom blend benchmark, while experiencing positive attribution from all five of its major segments. The Fund’s top-performing area for the year was real estate investment trust (REIT) preferreds, followed by REIT common equity, infrastructure common equity, infrastructure preferreds and high yield. Performance also benefited from several strategic asset allocation changes we made during the year, as noted below.

Both categories of real estate investment were the top-performing segments of the Fund during the one-year reporting period. In the REIT preferred portion of the Fund, strong results continued to be driven by exposure to non-rated securities. As the period progressed, we increased the Fund’s weight in REIT preferreds via additional non-rated opportunities uncovered by our research team, which proved beneficial as these securities outperformed. The Fund ended the reporting period with an overweight in the REIT preferred sector. Outperformance was quite widespread across the REIT common equity portion of the Fund, particularly from some of the more stable and mature companies in higher-yielding areas such as health care REITs, net lease, hotel REITs, community centers and industrial. We avoided some of the more cyclical segments of the real estate market. In both the REIT common equity and preferred sectors, we avoided European exposure, concentrating our holdings primarily in the United States, Singapore and Australia.

Within the infrastructure common equity sector, the Fund benefited from a significant underweight in the electric utilities sector, paired with an overweight in electric transmission. A great deal of the segment’s positive attribution resulted from our ongoing underweight to continental European electric utilities, as stocks in countries such as Germany fell to five-year lows based on low power prices. As we’ve discussed since the inception of the Fund, we like to invest in stable, regulated companies with long-term contracts or concessions that are not as commodity price sensitive. Results in infrastructure common equity were also aided by our increased exposure to U.S. regulated utilities.

In the infrastructure preferred/hybrid space, results benefited from our research team’s careful selection of global hybrid bonds, which subsequently performed extremely well. At period end, the Fund’s infrastructure preferred portfolio was comprised almost entirely of these global hybrids.

The Fund’s high yield bond portfolio slightly outperformed the index as a number of our individual credits performed well. Fund holdings were spread across the United States, emerging markets and Europe and diversified across a number of real asset categories, with the greatest concentrations in the industrial, electric and gas utilities, and pipeline sectors. Throughout the one-year period, the high-yield segment continued to be supported by investors’ quest for yield, along with strong underlying company fundamentals, a gradually improving economy and low default rates. Performance was also aided by our focus on the higher-quality tier of the high yield market.

The Fund ended the fiscal year period with weights that were intentionally off-target due to our active asset allocation. Infrastructure common equity was at an even greater underweight versus six months ago, based on our continued lack of confidence in European shares. However, within the sector we were quite active traders as a result of a short-term opportunity in the higher-yielding master limited partnership (MLP) and regulated utilities marketplaces. Prior to the U.S. presidential election, MLPs and regulated utilities had been trading well above historical valuations as they were considered somewhat of a safe haven during the global financial crisis. However, these segments sold off significantly after the election over concerns regarding potential tax increases. We used the sell-off to bolster the Fund’s position in both of those areas, and they subsequently recovered. We typically only own MLPs if the majority of their cash flows come from guaranteed, fee-based arrangements without a lot of commodity price sensitivity.

After the high yield segment’s strong run in 2012, we decided there were better opportunities in the other asset classes. As yields continued to drop dramatically in the segment, we sold some of the Fund’s securities that dipped below the 5% yield threshold. This lowered the Fund’s high yield exposure by period end; however, we reallocated the proceeds across the other four segments.

As noted earlier, we also found a number of non-rated opportunities in the REIT preferred sector that were relatively attractive versus other options in the Fund, but the breadth of these opportunities diminished. Therefore, the Fund’s REIT preferred portfolio ended the period at a much higher weight, while also more concentrated than it was a year ago as we consolidated holdings in larger positions.

Geographically, the Fund ended the period with increased exposure to the U.S., mostly because of our ongoing underweight to the euro zone countries due to the continued political and regulatory risk. We had also reduced the Fund’s exposure to the United Kingdom, Singapore and Hong Kong as we found better opportunities in the U.S. The Fund continued to have significant exposure within Australia, primarily on the equity side. Australia still has higher interest rates and higher yields, while the market is performing very well. Our long-term target for geographic distribution remains at roughly 50% U.S. exposure and 50% non-U.S. exposure.

Nuveen Real Estate Securities Fund

How did the Fund perform during the twelve-month period ended December 31, 2012?

The table in the Fund Performance and Expense Ratios section of this report provides Class A Share total returns for the Fund for the one-year, five-year and ten-year periods ended December 31, 2012. The Fund’s Class A Shares at net asset value (NAV) outperformed the MSCI U.S. REIT Index and the Lipper classification average over the twelve-month period.

What strategies were used to manage the Fund during the reporting period? How did these strategies influence performance?

The Fund seeks to provide above average income potential and long-term capital appreciation by investing in income producing common stocks of publicly traded companies engaged in the real estate industry. During the twelve-month reporting period, we continued to implement the Fund’s strategy of investing on a relative value basis with a focus on individual stocks rather than economic or market cycles. We also continued to invest the Fund in a fairly sector neutral manner, with a goal of providing a well-diversified portfolio of public real estate stocks to our shareholders. Our sector neutral approach reduced the impact of any one property type on the performance of the Fund. Additionally, we continued to invest in a broader universe of stocks than our benchmark index to access more dynamic parts of the commercial real estate cycle.

During the reporting period, the commercial real estate market outperformed the broader U.S. equity market. Real estate investment trust (REIT) fundamentals remained positive as they continued to have access to low-cost capital, generally solid balance sheets and growing dividends as they pass through much of the income growth they experience to shareholders. However, dividend payout ratios did remain low compared to historical measures.

In the REIT market’s continued strong advance, the Fund’s relative returns once again benefited from stock selection, particularly in the community center, office, apartment and infrastructure segments. In community centers, solid stock selection across the sector led to modest outperformance. The Fund particularly benefited from overweights to “non-grocery” type anchors and subsequent underweights to two grocery focused anchors. Our underweights were predicated on the belief that the valuation spread between grocery anchors and non-grocery anchors appeared to be too great. With little to no new construction of community centers and increased demand from national mid and large box tenants, we believed there would continue to be higher occupancy and positive leasing spreads for the non-grocery anchored assets. Therefore, we expected the spread between the lower valuation non-grocery anchors and the higher valuation grocery anchors to compress. Our thesis proved correct as our positioning in the community center sector was the largest driver of positive returns relative to the benchmark.

In the office sector, our Fund’s underweight to data centers contributed positively to returns as this type of real estate underperformed. Data center companies have been affected by additional supply coming on line combined with operators commenting on softness in demand. This led to concern that potential lower lease rates would impact

overall profitability. Our belief was that the market had not yet discounted these dynamics appropriately; therefore, the Fund’s underweight to these names relative to the index was beneficial. Also, the Fund benefited from its underweight throughout most of the period to New York City, given uncertainty surrounding employment in the financial services sector. In addition, the Fund benefited from a significant underweight to an externally advised company that experienced substantial weakness as its dividend exceeded cash flow. We tend not to own companies like this as core positions in the Fund’s portfolio.

Although the apartment sector’s returns lagged the broader REIT space, the Fund outperformed as a result of overweight positions in Sunbelt companies and underweight positions in companies with more highly leveraged balance sheets and less operational skill. In addition, the Fund benefited from its infrastructure exposure during the period, an area that is not represented in the benchmark. Within infrastructure, the Fund was rewarded for positions in cellular tower companies. These firms continued to benefit from the ongoing build-out of the nation’s wireless network, in order to keep pace with consumers’ ever-increasing demands for wireless data.

While the mall sector outperformed the overall benchmark, and our portfolio weight was generally in line, the Fund underperformed as a result of stock selection. Our Fund’s underweight position in one name was the biggest reason for the performance shortfall. During the fiscal year, one of the company’s significant shareholders published a letter he had sent to the management team requesting they sell the company to a competitor. The quoted price range for the sale was at a substantial premium to where the stock traded in the market, leading the company to rally significantly on the event. The Fund’s results were also hindered by its small position in cash during a period where the real estate market experienced a strong advance.

The Fund’s overall sector positioning was again little changed during the period. As is typical for the strategy from a management perspective, variations in the Fund were on the margin and were generated from the bottom up, affecting individual company holdings rather than making any sweeping sector changes.

Risk Considerations

Mutual fund investing involves risk; principal loss is possible. Equity investments such as those held by the Funds, are subject to market risk, call risk, derivatives risk, other investment companies risk, common stock risk, and tax risks associated with MLPs and REITs. Concentration in specific sectors may involve greater risk and volatility than more diversified investments: real estate sector involves the risk of exposure to economic downturns and changes in real estate values, rents, property taxes, interest rates and tax laws; infrastructure related securities may involve greater exposure to adverse economic, regulatory, political, legal, and other changes affecting such securities. Foreign investments involve additional risks, including currency fluctuation, political and economic instability, lack of liquidity, and differing legal and accounting standards. These risks are magnified in emerging markets. Investments in small- and mid-cap companies are subject to greater volatility. In addition, a Fund will bear its proportionate share of any fees and expenses paid by the ETFs in which it invests.

Debt or fixed income securities, such as those held by the Nuveen Real Asset Income Fund, are subject to market risk, credit risk, interest rate risk and income risk. As interest rates rise, bond prices fall. Below investment grade or high yield debt securities are subject to liquidity risk and heightened credit risk. Preferred securities are subordinated to bonds and other debt instruments in a company’s capital structure and therefore are subject to greater credit risk. Asset-backed and mortgage-backed securities are subject to additional risks such as prepayment risk, liquidity risk, default risk and adverse economic developments.

[THIS PAGE INTENTIONALLY LEFT BLANK]

Fund Performance and Expense Ratios

The Fund Performance and Expense Ratios for each Fund are shown on the following six pages.

Returns quoted represent past performance, which is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Returns without sales charges would be lower if the sales charge were included. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Returns may reflect a contractual agreement between certain Funds and the investment adviser to waive certain fees and expenses; see Notes to Financial Statements, Footnote 7 — Management Fees and Other Transactions with Affiliates for more information. In addition, returns may reflect a voluntary expense limitation by the Funds’ investment adviser that may be modified or discontinued at any time without notice. For the most recent month-end performance visit www.nuveen.com or call (800) 257-8787.

Returns reflect differences in sales charges and expenses, which are primarily differences in distribution and service fees. Fund returns assume reinvestment of dividends and capital gains.

Comparative index and Lipper return information is provided for the Funds’ Class A Shares at net asset value (NAV) only.

The expense ratios shown reflect the Funds’ total operating expenses (before fee waiver and/or expense reimbursements, if any) as shown in the Funds’ most recent prospectus. The expense ratios include management fees and other fees and expenses.

Fund Performance and Expense Ratios (continued)

Nuveen Global Infrastructure Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this page.

Fund Performance

Average Annual Total Returns as of December 31, 2012

| | | | | | | | | | | | |

| |

| | | Average Annual | |

| | | |

| | | 1-Year | | | 5-Year | | | Since

Inception* | |

Class A Shares at NAV | | | 15.52% | | | | 2.09 | % | | | 2.59% | |

Class A Shares at maximum Offering Price | | | 8.93% | | | | 0.88 | % | | | 1.39% | |

S&P Global Infrastructure Index** | | | 11.89% | | | | -2.06 | % | | | -1.58% | |

Lipper Specialty/Miscellaneous Funds Classification Average** | | | 6.74% | | | | -0.12 | % | | | 0.28% | |

| | | |

Class C Shares | | | 14.58% | | | | N/A | | | | 13.65% | |

Class R3 Shares | | | 15.36% | | | | N/A | | | | 14.11% | |

Class I Shares | | | 15.78% | | | | 2.33 | % | | | 2.83% | |

Class A Shares have a maximum 5.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within twelve months of purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are only available for purchase by eligible retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| | | | | | | | |

| | |

| | | Gross

Expense

Ratios | | | Net

Expense

Ratios | |

Class A Shares | | | 1.59% | | | | 1.23% | |

Class C Shares | | | 2.34% | | | | 1.98% | |

Class R3 Shares | | | 1.84% | | | | 1.48% | |

Class I Shares | | | 1.34% | | | | 0.98% | |

The Fund’s investment adviser has contractually agreed to waive fees and/or reimburse other Fund expenses through February 28, 2013, so that total annual Fund operating expenses, after fee waivers and/or expense reimbursements and excluding acquired fund fees and expenses, do not exceed 1.25%, 2.00%, 1.50% and 1.00%, for Class A, Class C, Class R3 and Class I Shares, respectively. Fee waivers and/or expense reimbursements will not be terminated prior to that time without the approval of the Fund’s Board of Directors.

| * | Since inception returns for Class A and Class I Shares, and for the comparative index and Lipper classification average, are from 12/17/07; since inception returns for Class C and Class R3 Shares are from 11/03/08. |

| ** | Refer to the Glossary of Terms Used in this Report for definitions. Indexes and Lipper averages are not available for direct investment. |

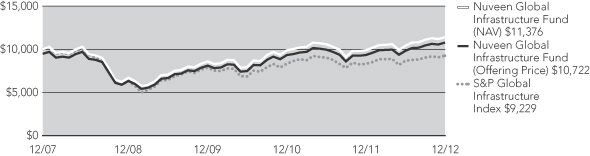

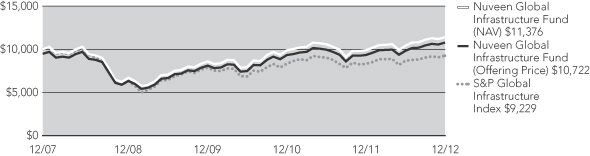

Growth of an Assumed $10,000 Investment as of December 31, 2012 — Class A Shares

The graphs do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

Fund Performance and Expense Ratios (continued)

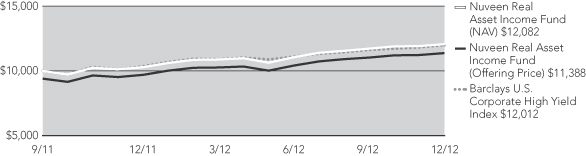

Nuveen Real Asset Income Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this page.

Fund Performance

Average Annual Total Returns as of December 31, 2012

| | | | | | | | |

| | | Average Annual | |

| | |

| | | 1-Year | | | Since

Inception* | |

Class A Shares at NAV | | | 17.22% | | | | 15.67% | |

Class A Shares at maximum Offering Price | | | 10.49% | | | | 10.51% | |

Barclays U.S. Corporate High Yield Index** | | | 15.81% | | | | 15.14% | |

Real Asset Income Blend** | | | 12.76% | | | | 14.10% | |

Lipper Global Flexible Portfolio Funds Classification Average** | | | 10.24% | | | | 7.27% | |

| | |

Class C Shares | | | 16.36% | | | | 14.81% | |

Class I Shares | | | 17.50% | | | | 15.94% | |

Class A Shares have a maximum 5.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within twelve months of purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| | | | | | |

| | |

| | | Gross

Expense

Ratios | | | Net

Expense

Ratios |

Class A Shares | | | 1.71% | | | 1.18% |

Class C Shares | | | 2.46% | | | 1.93% |

Class I Shares | | | 1.46% | | | 0.93% |

The Fund’s investment adviser has agreed to waive fees and/or reimburse expenses through April 30, 2014 so that total annual Fund operating expenses (excluding 12b-1 distribution and/or service fees, interest expenses, taxes, acquired fund fees and expenses, fees incurred in acquiring and disposing of portfolio securities and extraordinary expenses) do not exceed 0.95% of the average daily net assets of any class of Fund shares. The expense limitation expiring April 30, 2014, may be terminated or modified prior to that date only with the approval of the Board of Directors of the Fund.

| * | Since inception returns are from 9/13/11. |

| ** | Refer to the Glossary of Terms Used in this Report for definitions. Indexes and Lipper averages are not available for direct investment. |

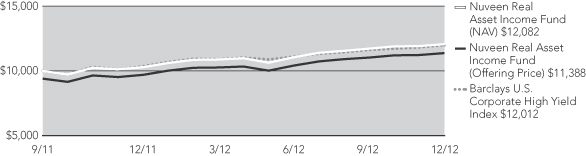

Growth of an Assumed $10,000 Investment as of December 31, 2012 – Class A Shares

The graphs do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

Fund Performance and Expense Ratios (continued)

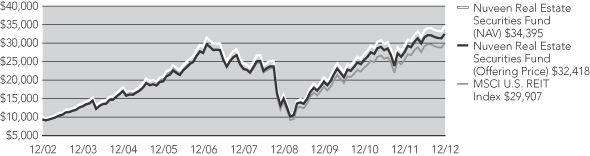

Nuveen Real Estate Securities Fund

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this page.

Fund Performance

Average Annual Total Returns as of December 31, 2012

| | | | | | | | | | | | |

| |

| | | Average Annual | |

| | | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

Class A Shares at NAV | | | 18.07% | | | | 7.00% | | | | 13.15% | |

Class A Shares at maximum Offering Price | | | 11.31% | | | | 5.74% | | | | 12.48% | |

MSCI U.S. REIT Index* | | | 17.77% | | | | 5.58% | | | | 11.58% | |

Lipper Real Estate Funds Classification Average* | | | 17.73% | | | | 4.95% | | | | 10.78% | |

| | | |

Class B Shares w/o CDSC | | | 17.18% | | | | 6.19% | | | | 12.31% | |

Class B Shares w/CDSC | | | 12.18% | | | | 6.03% | | | | 12.31% | |

Class C Shares | | | 17.19% | | | | 6.21% | | | | 12.32% | |

Class R3 Shares | | | 17.80% | | | | 6.74% | | | | 12.92% | |

Class I Shares | | | 18.34% | | | | 7.26% | | | | 13.44% | |

Class A Shares have a maximum 5.75% sales charge (Offering Price). Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within twelve months of purchase. Class B Shares have a CDSC that begins at 5% for redemptions during the first year and declines periodically until after six years when the charge becomes 0%. Class B Shares automatically convert to Class A Shares eight years after purchase. Class C Shares have a 1% CDSC for redemptions within less than twelve months, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are only available for purchase by eligible retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

Expense Ratios as of Most Recent Prospectus

| | | | |

| |

| | | Expense

Ratios | |

Class A Shares | | | 1.29% | |

Class B Shares | | | 2.04% | |

Class C Shares | | | 2.04% | |

Class R3 Shares | | | 1.54% | |

Class I Shares | | | 1.04% | |

| * | Refer to the Glossary of Terms Used in this Report for definitions. Indexes and Lipper averages are not available for direct investment. |

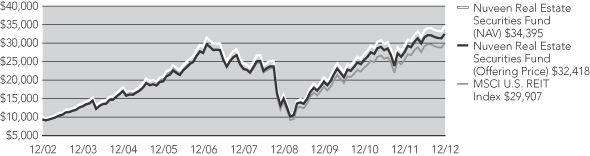

Growth of an Assumed $10,000 Investment as of December 31, 2012 — Class A Shares

The graphs do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

Holding Summaries as of December 31, 2012

This data relates to the securities held in each Fund’s portfolio of investments. It should not be construed as a measure of performance for the Fund itself.

Nuveen Global Infrastructure Fund

Portfolio Allocation1

| | | | |

| Common Stocks | | | 91.9% | |

| Real Estate Investment Trust Common Stocks | | | 5.6% | |

| Preferred Stocks | | | 0.1% | |

| Investment Companies | | | 0.4% | |

| Short-Term Investments | | | 0.5% | |

| Other2 | | | 1.5% | |

| | | | |

Top Five Common Stock & Real Estate Investment Trust

Common Stock Holdings1 | |

| American Tower REIT Inc. | | | 5.1% | |

| Williams Companies, Inc. | | | 4.8% | |

| CLP Holdings Limited | | | 3.9% | |

| Enbridge Inc. | | | 3.6% | |

| National Grid PLC, Sponsored ADR | | | 3.6% | |

Nuveen Real Asset Income Fund

Portfolio Allocation1

| | | | |

| Common Stocks | | | 19.8% | |

| Real Estate Investment Trust Common Stocks | | | 18.0% | |

| Convertible Preferred Securities | | | 2.2% | |

| $25 Par (or similar) Preferred Securities | | | 33.4% | |

| Corporate Bonds | | | 23.0% | |

| Investment Companies | | | 1.3% | |

| Short-Term Investments | | | 1.8% | |

| Other2 | | | 0.5% | |

Nuveen Real Estate Securities Fund

Portfolio Allocation1

| | | | |

| Common Stocks | | | 0.4% | |

| Real Estate Investment Trust Common Stocks | | | 98.2% | |

| $25 Par (or similar) Preferred Securities | | | 0.2% | |

| Investment Companies | | | 0.1% | |

| Short-Term Investments | | | 0.7% | |

| Other3 | | | 0.4% | |

| | | | |

| Portfolio Composition1 | |

| Transportation | | | 20.8% | |

| Electric Utilities | | | 20.3% | |

| Oil, Gas & Consumable Fuels | | | 19.0% | |

| Multi-Utilities | | | 11.7% | |

| Gas Utilities | | | 8.2% | |

| Water Utilities | | | 5.8% | |

| Specialized | | | 5.6% | |

| Short-Term Investments | | | 0.5% | |

| Other4 | | | 8.1% | |

| | | | |

| Portfolio Composition1 | |

| Retail | | | 13.4% | |

| Electric Utilities | | | 11.4% | |

| Oil, Gas & Consumable Fuels | | | 9.5% | |

| Specialized | | | 8.5% | |

| Real Estate Investment Trusts | | | 6.9% | |

| Diversified | | | 5.9% | |

| Multi-Utilities | | | 5.0% | |

| Diversified Financial Services | | | 4.3% | |

| Industrials | | | 4.2% | |

| Office | | | 3.9% | |

| Health Care Providers & Services | | | 3.8% | |

| Transportation | | | 3.2% | |

| Short-Term Investments | | | 1.8% | |

| Other4 | | | 18.2% | |

| | | | |

| Portfolio Composition1 | | | |

| Retail | | | 29.6% | |

| Specialized | | | 24.4% | |

| Residential | | | 17.6% | |

| Office | | | 13.9% | |

| Diversified | | | 7.7% | |

| Industrial | | | 5.0% | |

| Short-Term Investments | | | 0.7% | |

| Other5 | | | 1.1% | |

| | | | |

| Country Allocation1 | |

| United States | | | 40.7% | |

| Hong Kong | | | 10.4% | |

| United Kingdom | | | 7.2% | |

| Australia | | | 7.0% | |

| Canada | | | 5.6% | |

| Singapore | | | 3.6% | |

| Germany | | | 3.1% | |

| Japan | | | 3.0% | |

| Short-Term Investments6 | | | 0.5% | |

| Other7 | | | 18.9% | |

| | | | |

Top Five Common Stock & Real Estate

Investment Trust Common Stock

Holdings1 | |

| National Retail Properties, Inc. | | | 3.1% | |

| Spark Infrastructure Group | | | 2.5% | |

| Liberty Property Trust | | | 2.2% | |

| National Grid PLC, Sponsored ADR | | | 2.2% | |

| DUET Group | | | 1.9% | |

| | | | |

| Country Allocation1 | |

| United States | | | 71.4% | |

| Australia | | | 8.7% | |

| Philippines | | | 3.0% | |

| United Kingdom | | | 2.7% | |

| Short-Term Investments6 | | | 1.8% | |

| Other7 | | | 12.4% | |

| | | | |

Top Five Common Stock & Real Estate

Investment Trust Common Stock

Holdings1 | |

| Simon Property Group, Inc. | | | 11.8% | |

| Boston Properties, Inc. | | | 5.6% | |

| Public Storage, Inc. | | | 5.6% | |

| Ventas Inc. | | | 4.0% | |

| Health Care Property Investors Inc. | | | 3.9% | |

| 1 | As a percentage of net assets. Holdings are subject to change. |

| 2 | Other assets less liabilities. |

| 3 | Other assets less liabilities, which includes investments purchased with collateral from securities lending as presented in the Fund’s Portfolio of Investments. |

| 4 | Includes other assets less liabilities and all industries less than 5.6% of net assets for Nuveen Global Infrastructure Fund and all industries less than 3.2% of net assets for Nuveen Real Asset Income Fund. |

| 5 | Includes other assets less liabilities, which includes investments purchased with collateral from securities lending as presented in the Fund’s Portfolio of Investments and all industries less than 5.0% of net assets. |

| 6 | Denominated in U.S. Dollars. |

| 7 | Includes other assets less liabilities and all countries less than 3.0% of net assets for Nuveen Global Infrastructure Fund and all countries less than 2.7% of net assets for Nuveen Real Asset Income Fund. |

Expense Examples

As a shareholder of one or more of the Funds, you incur two types of costs: (1) transaction costs, including up-front and back-end sales charges (loads) or redemption fees, where applicable; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees, where applicable; and other Fund expenses. The Examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Examples below are based on an investment of $1,000 invested at the beginning of the period and held through the period.

The information under “Actual Performance,” together with the amount you invested, allows you to estimate actual expenses incurred over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period” to estimate the expenses incurred on your account during this period.

The information under “Hypothetical Performance,” provides information about hypothetical account values and hypothetical expenses based on the respective Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you incurred for the period. You may use this information to compare the ongoing costs of investing in the Fund and other Funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds or share classes. In addition, if these transaction costs were included, your costs would have been higher.

Nuveen Global Infrastructure Fund

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual Performance | | | | | Hypothetical Performance

(5% annualized return before expenses) | |

| | | A Shares | | | C Shares | | | R3 Shares | | | I Shares | | | | | A Shares | | | C Shares | | | R3 Shares | | | I Shares | |

| Beginning Account Value (7/01/12) | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | |

| Ending Account Value (12/31/12) | | $ | 1,097.70 | | | $ | 1,093.30 | | | $ | 1,096.80 | | | $ | 1,099.20 | | | | | $ | 1,018.95 | | | $ | 1,015.18 | | | $ | 1,017.65 | | | $ | 1,020.16 | |

| Expenses Incurred During Period | | $ | 6.49 | | | $ | 10.42 | | | $ | 7.85 | | | $ | 5.22 | | | | | $ | 6.24 | | | $ | 10.03 | | | $ | 7.56 | | | $ | 5.03 | |

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of 1.23%, 1.98%, 1.49% and 0.99% for Classes A, C, R3 and I, respectively, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

Nuveen Real Asset Income Fund

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual Performance | | | | | Hypothetical Performance

(5% annualized return before expenses) | |

| | | A Shares | | | C Shares | | | I Shares | | | | | A Shares | | | C Shares | | | I Shares | |

| Beginning Account Value (7/01/12) | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | |

| Ending Account Value (12/31/12) | | $ | 1,092.50 | | | $ | 1,087.90 | | | $ | 1,093.30 | | | | | $ | 1,019.25 | | | $ | 1,015.48 | | | $ | 1,020.51 | |

| Expenses Incurred During Period | | $ | 6.15 | | | $ | 10.08 | | | $ | 4.84 | | | | | $ | 5.94 | | | $ | 9.73 | | | $ | 4.67 | |

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of 1.17%, 1.92% and 0.92% for Classes A, C and I, respectively, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

Nuveen Real Estate Securities Fund

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual Performance | | | | | Hypothetical Performance

(5% annualized return before expenses) | |

| | | A Shares | | | B Shares | | | C Shares | | | R3 Shares | | | I Shares | | | | | A Shares | | | B Shares | | | C Shares | | | R3 Shares | | | I Shares | |

| Beginning Account Value (7/01/12) | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | |

| Ending Account Value (12/31/12) | | $ | 1,027.20 | | | $ | 1,023.30 | | | $ | 1,023.70 | | | $ | 1,026.20 | | | $ | 1,028.30 | | | | | $ | 1,018.80 | | | $ | 1,015.03 | | | $ | 1,015.03 | | | $ | 1,017.55 | | | $ | 1,020.06 | |

| Expenses Incurred During Period | | $ | 6.42 | | | $ | 10.22 | | | $ | 10.22 | | | $ | 7.69 | | | $ | 5.15 | | | | | $ | 6.39 | | | $ | 10.18 | | | $ | 10.18 | | | $ | 7.66 | | | $ | 5.13 | |

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of 1.26%, 2.01%, 2.01%, 1.51% and 1.01% for Classes A, B, C, R3 and I, respectively, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

Report of

Independent Registered

Public Accounting Firm

To the Board of Directors and Shareholders of

Nuveen Global Infrastructure Fund

Nuveen Real Asset Income Fund

Nuveen Real Estate Securities Fund

In our opinion, the accompanying statements of assets and liabilities, including the portfolios of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Nuveen Global Infrastructure Fund, Nuveen Real Asset Income Fund, and Nuveen Real Estate Securities Fund (hereinafter referred to as the “Funds”) at December 31, 2012, the results of each of their operations for the year then ended, the changes in each of their net assets for the year ended December 31, 2012 and for the two months ended December 31, 2011 for Nuveen Global Infrastructure Fund and Nuveen Real Estate Securities Fund and for the period September 13, 2011 (commencement of operations) through December 31, 2011 for Nuveen Real Asset Income Fund and the financial highlights for the year ended December 31, 2012 and for the two months ended December 31, 2011 for Nuveen Global Infrastructure Fund and Nuveen Real Estate Securities Fund and for the period September 13, 2011 (commencement of operations) through December 31, 2011 for Nuveen Real Asset Income Fund, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2012 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion. The financial statements as of and for the year ended October 31, 2011 and the financial statement highlights for each of the four years in the period ended October 31, 2011 of the Nuveen Global Infrastructure Fund and Nuveen Real Estate Securities Fund were audited by other auditors whose report dated December 28, 2011 expressed an unqualified opinion on those statements, except for the reclassification of certain financial statement line items in the statement of operations, the statement of changes in net assets, and financial highlights for the year ended October 31, 2011 for the Nuveen Real Estate Securities Fund as to which the date is February 29, 2012.

PricewaterhouseCoopers LLP

Chicago, Illinois

February 28, 2013

Portfolio of Investments

Nuveen Global Infrastructure Fund

December 31, 2012

| | | | | | | | | | | | | | |

| Shares | | | Description (1) | | | | | | | | Value | |

| | | | | | | | | | | | | | |

| | | | COMMON STOCKS – 91.9% | | | | | | | | | | |

| | | | | |

| | | | Air Freight & Logistics – 0.9% | | | | | | | | | | |

| | | | | |

| | 3,124,517 | | | Singapore Post Limited | | | | | | | | $ | 2,944,354 | |

| | | | Commercial Services & Supplies – 2.3% | | | | | | | | | | |

| | | | | |

| | 8,430,405 | | | China Everbright International Limited | | | | | | | | | 4,324,861 | |

| | | | | |

| | 309,699 | | | Serco Group PLC | | | | | | | | | 2,712,898 | |

| | | | | |

| | 29,600 | | | Standard Parking Corporation | | | | | | | | | 650,904 | |

| | | | Total Commercial Services & Supplies | | | | | | | | | 7,688,663 | |

| | | | Electric Utilities – 20.3% | | | | | | | | | | |

| | | | | |

| | 19,315 | | | Brookfield Infrastructure Partners LP | | | | | | | | | 680,854 | |

| | | | | |

| | 18,708 | | | Cez As | | | | | | | | | 669,257 | |

| | | | | |

| | 944,209 | | | Cheung Kong Infrastructure Holdings Ltd | | | | | | | | | 5,832,380 | |

| | | | | |

| | 1,528,227 | | | CLP Holdings Limited | | | | | | | | | 12,839,912 | |

| | | | | |

| | 12,837 | | | Duke Energy Corporation | | | | | | | | | 819,001 | |

| | | | | |

| | 950,203 | | | E CL SA | | | | | | | | | 2,231,067 | |

| | | | | |

| | 32,494 | | | Edison International | | | | | | | | | 1,468,404 | |

| | | | | |

| | 24,745 | | | EDP Energias do Brasil SA | | | | | | | | | 150,948 | |

| | | | | |

| | 7,694 | | | Elia System Operator SA NV | | | | | | | | | 347,327 | |

| | | | | |

| | 53,527 | | | Emera Inc | | | | | | | | | 1,869,436 | |

| | | | | |

| | 9,526 | | | Fortis Inc | | | | | | | | | 327,717 | |

| | | | | |

| | 80,564 | | | Hafslund ASA, Class B | | | | | | | | | 656,660 | |

| | | | | |

| | 34,985 | | | ITC Holdings Corporation | | | | | | | | | 2,690,696 | |

| | | | | |

| | 32,720 | | | NextEra Energy Inc. | | | | | | | | | 2,263,897 | |

| | | | | |

| | 42,211 | | | Northeast Utilities | | | | | | | | | 1,649,606 | |

| | | | | |

| | 16,812 | | | OGE Energy Corp. | | | | | | | | | 946,684 | |

| | | | | |

| | 19,365 | | | Pepco Holdings, Inc. | | | | | | | | | 379,748 | |

| | | | | |

| | 38,862 | | | Pinnacle West Capital Corporation | | | | | | | | | 1,981,185 | |

| | | | | |

| | 300,563 | | | Power Grid Corp of India Ltd | | | | | | | | | 634,071 | |

| | | | | |

| | 43,406 | | | Scottish & Southern Energy | | | | | | | | | 1,009,807 | |

| | | | | |

| | 148,838 | | | Southern Company | | | | | | | | | 6,371,755 | |

| | | | | |

| | 3,241,076 | | | Spark Infrastructure Group | | | | | | | | | 5,666,321 | |

| | | | | |

| | 316,442 | | | Transmissora Alianca de Energia Eletrica SA, WI/DD | | | | | | | | | 3,369,199 | |

| | | | | |

| | 153,746 | | | Unitil Corp. | | | | | | | | | 3,985,096 | |

| | | | | |

| | 170,502 | | | Westar Energy Inc. | | | | | | | | | 4,879,767 | |

| | | | | |

| | 122,945 | | | Xcel Energy, Inc. | | | | | | | | | 3,283,861 | |

| | | | Total Electric Utilities | | | | | | | | | 67,004,656 | |

| | | | Gas Utilities – 7.8% | | | | | | | | | | |

| | | | | |

| | 1,077 | | | Atmos Energy Corporation | | | | | | | | | 37,824 | |

| | | | | |

| | 3,982 | | | Chesapeake Utilities Corporation | | | | | | | | | 180,783 | |

| | | | | |

| | 1,070,001 | | | China Resources Gas Group Limited | | | | | | | | | 2,218,570 | |

| | | | | |

| | 393,848 | | | ENN Energy Holdings Limited | | | | | | | | | 1,725,798 | |

| | | | | |

| | 31,606 | | | GAIL India Ltd, GDR | | | | | | | | | 1,222,482 | |

| | | | | |

| | 848,670 | | | Hong Kong and China Gas Company Limited | | | | | | | | | 2,331,730 | |

| | | | | |

| | 9,069 | | | Northwest Natural Gas Company | | | | | | | | | 400,850 | |

| | | | | |

| | 179,036 | | | Osaka Gas Company Limited | | | | | | | | | 650,317 | |

| | | | | |

| | 242,698 | | | Petronas Gas Berhad | | | | | | | | | 1,549,204 | |

Portfolio of Investments

Nuveen Global Infrastructure Fund (continued)

December 31, 2012

| | | | | | | | | | | | | | |

| Shares | | | Description (1) | | | | | | | | Value | |

| | | | | | | | | | | | | | |

| | | | Gas Utilities (continued) | | | | | | | | | | |

| | | | | |

| | 16,198 | | | Piedmont Natural Gas Company | | | | | | | | $ | 507,159 | |

| | | | | |

| | 206,366 | | | Questar Corporation | | | | | | | | | 4,077,792 | |

| | | | | |

| | 61,039 | | | Southwest Gas Corporation | | | | | | | | | 2,588,664 | |

| | | | | |

| | 1,520,470 | | | Tokyo Gas Company Limited | | | | | | | | | 6,947,113 | |

| | | | | |

| | 30,169 | | | WGL Holdings Inc. | | | | | | | | | 1,182,323 | |

| | | | Total Gas Utilities | | | | | | | | | 25,620,609 | |

| | | | Independent Power Producers & Energy Traders – 0.3% | | | | | | | | | | |

| | | | | |

| | 12,847 | | | Brookfield Renewable Energy Partners LP | | | | | | | | | 379,456 | |

| | | | | |

| | 12,065 | | | Endesa SA Chile | | | | | | | | | 588,893 | |

| | | | Total Independent Power Producers & Energy Traders | | | | | | | | | 968,349 | |

| | | | Industrial Conglomerates – 0.8% | | | | | | | | | | |

| | | | | |

| | 135,176 | | | Beijing Enterprises Holdings | | | | | | | | | 886,657 | |

| | | | | |

| | 9,937 | | | NWS Holdings Limited | | | | | | | | | 16,795 | |

| | | | | |

| | 391,957 | | | SembCorp Industries Limited | | | | | | | | | 1,709,059 | |

| | | | Total Industrial Conglomerates | | | | | | | | | 2,612,511 | |

| | | | Media – 0.4% | | | | | | | | | | |

| | | | | |

| | 40,775 | | | SES SA | | | | | | | | | 1,174,357 | |

| | | | Multi-Utilities – 11.7% | | | | | | | | | | |

| | | | | |

| | 1,423 | | | Alliant Energy Corporation | | | | | | | | | 62,484 | |

| | | | | |

| | 356,113 | | | CenterPoint Energy, Inc. | | | | | | | | | 6,855,175 | |

| | | | | |

| | 499,418 | | | Centrica PLC | | | | | | | | | 2,725,685 | |

| | | | | |

| | 63,122 | | | CMS Energy Corporation | | | | | | | | | 1,538,914 | |

| | | | | |

| | 9,692 | | | Dominion Resources, Inc. | | | | | | | | | 502,046 | |

| | | | | |

| | 686,881 | | | DUET Group | | | | | | | | | 1,490,113 | |

| | | | | |

| | 210,192 | | | E ON SE | | | | | | | | | 3,942,389 | |

| | | | | |

| | 366,603 | | | Hera SpA | | | | | | | | | 595,103 | |

| | | | | |

| | 205,658 | | | National Grid PLC, Sponsored ADR | | | | | | | | | 11,812,996 | |

| | | | | |

| | 158,733 | | | NiSource Inc. | | | | | | | | | 3,950,864 | |

| | | | | |

| | 24,885 | | | PG&E Corporation | | | | | | | | | 999,879 | |

| | | | | |

| | 31,087 | | | Vector Limited | | | | | | | | | 70,274 | |

| | | | | |

| | 107,208 | | | Wisconsin Energy Corporation | | | | | | | | | 3,950,615 | |

| | | | Total Multi-Utilities | | | | | | | | | 38,496,537 | |

| | | | Oil, Gas & Consumable Fuels – 19.0% | | | | | | | | | | |

| | | | | |

| | 8,175 | | | AltaGas Limited | | | | | | | | | 275,897 | |

| | | | | |

| | 3,125 | | | Boardwalk Pipeline Partners, LP | | | | | | | | | 77,813 | |

| | | | | |

| | 275,256 | | | Enbridge Inc. | | | | | | | | | 11,924,090 | |

| | | | | |

| | 213,456 | | | Enterprise Products Partnership LP | | | | | | | | | 10,689,876 | |

| | | | | |

| | 15,899 | | | Gibson Energy Incorporated | | | | | | | | | 384,408 | |

| | | | | |

| | 933 | | | Kinder Morgan Energy Partners LP | | | | | | | | | 74,444 | |

| | | | | |

| | 223,942 | | | Kinder Morgan, Inc. | | | | | | | | | 7,911,871 | |

| | | | | |

| | 4,691 | | | Oiltanking Partners LP | | | | | | | | | 177,601 | |

| | | | | |

| | 1,730,979 | | | Sinopec Kantons Holdings Limited | | | | | | | | | 1,146,512 | |

| | | | | |

| | 313,999 | | | Spectra Energy Corporation | | | | | | | | | 8,597,293 | |

| | | | | |

| | 58,022 | | | TransCanada Corporation | | | | | | | | | 2,745,601 | |

| | | | | |

| | 31,311 | | | Veresen Inc. | | | | | | | | | 372,383 | |

| | | | | | | | | | | | | | |

| Shares | | | Description (1) | | | | | | | | Value | |

| | | | | | | | | | | | | | |

| | | | Oil, Gas & Consumable Fuels (continued) | | | | | | | | | | |

| | | | | |

| | 54,297 | | | Western Gas Partners, LP | | | | | | | | $ | 2,586,166 | |

| | | | | |

| | 484,796 | | | Williams Companies, Inc. | | | | | | | | | 15,872,214 | |

| | | | Total Oil, Gas & Consumable Fuels | | | | | | | | | 62,836,169 | |

| | | | Road & Rail – 0.8% | | | | | | | | | | |

| | | | | |

| | 249,081 | | | ComfortDelGro Corporation | | | | | | | | | 366,430 | |

| | | | | |

| | 169,946 | | | MTR Corporation | | | | | | | | | 673,417 | |

| | | | | |

| | 1,097,612 | | | SMRT Corporation Limited | | | | | | | | | 1,517,780 | |

| | | | Total Road & Rail | | | | | | | | | 2,557,627 | |

| | | | Transportation – 20.8% | | | | | | | | | | |

| | | | | |

| | 160,213 | | | Abertis Infraestructuras SA | | | | | | | | | 2,646,155 | |

| | | | | |

| | 45,594 | | | Aeroports de Paris, WI/DD | | | | | | | | | 3,530,035 | |

| | | | | |

| | 218,344 | | | Atlantia SpA | | | | | | | | | 3,964,841 | |

| | | | | |

| | 1,576,521 | | | Auckland International Airport Limited | | | | | | | | | 3,489,550 | |

| | | | | |

| | 1,443,351 | | | China Merchants Holdings International Company Limited | | | | | | | | | 4,713,611 | |

| | | | | |

| | 917,675 | | | Cosco Pacific Limited | | | | | | | | | 1,330,595 | |

| | | | | |

| | 4,283 | | | Flughafen Zuerich AG | | | | | | | | | 1,983,186 | |

| | | | | |

| | 94,604 | | | Fraport AG | | | | | | | | | 5,518,865 | |

| | | | | |

| | 339,887 | | | Groupe Eurotunnel SA | | | | | | | | | 2,641,185 | |

| | | | | |

| | 20,975 | | | Hamburger Hafen und Logistik AG | | | | | | | | | 495,656 | |

| | | | | |

| | 2,767,776 | | | International Container Terminal Services Inc | | | | | | | | | 5,000,235 | |

| | | | | |

| | 113,844 | | | Japan Airport Terminal Company | | | | | | | | | 1,175,259 | |

| | | | | |

| | 937,622 | | | Jiangsu Expressway Company Limited | | | | | | | | | 976,216 | |

| | | | | |

| | 127,970 | | | Kamigumi Company Limited | | | | | | | | | 1,021,051 | |

| | | | | |

| | 126,319 | | | Koninklijke Vopak NV | | | | | | | | | 8,929,238 | |

| | | | | |

| | 257,459 | | | Macquarie Atlas Roads Group | | | | | | | | | 448,534 | |

| | | | | |

| | 263,162 | | | Port of Tauranga Limited, WI/DD | | | | | | | | | 2,869,786 | |

| | | | | |

| | 8,608 | | | Santos Brasil Participacoes SA | | | | | | | | | 122,761 | |

| | | | | |

| | 419,760 | | | SATS Limited | | | | | | | | | 1,002,384 | |

| | | | | |

| | 1,541,955 | | | Sydney Airport | | | | | | | | | 5,431,634 | |

| | | | | |

| | 1,526,538 | | | Transuburban Group | | | | | | | | | 9,703,629 | |

| | | | | |

| | 108,954 | | | Wilson Sons Ltd, BDR | | | | | | | | | 1,702,290 | |

| | | | Total Transportation | | | | | | | | | 68,696,696 | |

| | | | Water Utilities – 5.8% | | | | | | | | | | |

| | | | | |

| | 931,849 | | | Aguas Andinas SA-A | | | | | | | | | 661,258 | |

| | | | | |

| | 119,984 | | | American Water Works Company | | | | | | | | | 4,455,006 | |

| | | | | |

| | 345 | | | California Water Service Group | | | | | | | | | 6,331 | |

| | | | | |

| | 23,310 | | | Companhia de Saneamento Basico do Estado de Sao Paulo, ADR | | | | | | | | | 1,948,017 | |

| | | | | |

| | 78,084 | | | Companhia de Saneamento de Minas Gervais Copasa MG | | | | | | | | | 1,668,462 | |

| | | | | |

| | 79,235 | | | Connecticut Water Service, Inc. | | | | | | | | | 2,359,618 | |

| | | | | |

| | 1,049,747 | | | Guangdong Investment Limited | | | | | | | | | 831,428 | |

| | | | | |

| | 1,019,817 | | | Hyflux Limited | | | | | | | | | 1,079,258 | |

| | | | | |

| | 986,770 | | | Manila Water Company | | | | | | | | | 770,697 | |

| | | | | |

| | 15,292 | | | Middlesex Water Company | | | | | | | | | 299,112 | |

| | | | | |

| | 353,127 | | | Pennon Group PLC | | | | | | | | | 3,604,491 | |

| | | | | |

| | 57,628 | | | Severn Trent PLC | | | | | | | | | 1,482,884 | |

Portfolio of Investments

Nuveen Global Infrastructure Fund (continued)

December 31, 2012

| | | | | | | | | | | | | | |

| Shares | | | Description (1) | | | | | | | | Value | |

| | | | | | | | | | | | | | |

| | | | Water Utilities (continued) | | | | | | | | | | |

| | | | | |

| | 1,949 | | | SJW Corporation | | | | | | | | $ | 51,843 | |

| | | | Total Water Utilities | | | | | | | | | 19,218,405 | |

| | | | Wireless Telecommunication Services – 1.0% | | | | | | | | | | |

| | | | | |

| | 31,906 | | | Crown Castle International Corporation, (2) | | | | | | | | | 2,302,337 | |

| | | | | |

| | 15,393 | | | SBA Communications Corporation, (2) | | | | | | | | | 1,093,211 | |

| | | | Total Wireless Telecommunication Services | | | | | | | | | 3,395,548 | |

| | | | Total Common Stocks (cost $278,417,669) | | | | | | | | | 303,214,481 | |

| | | | | |

| Shares | | | Description (1) | | | | | | | | Value | |

| | | | REAL ESTATE INVESTMENT TRUST COMMON STOCKS – 5.6% | | | | | | | | | | |

| | | | | |

| | | | Specialized – 5.6% | | | | | | | | | | |

| | | | | |

| | 216,962 | | | American Tower REIT Inc. | | | | | | | | $ | 16,764,654 | |

| | | | | |

| | 1,010,637 | | | Parkway Life Real Estate | | | | | | | | | 1,785,565 | |

| | | | Total Real Estate Investment Trust Common Stocks (cost $14,308,224) | | | | | | | | | 18,550,219 | |

| | | | | |

| Shares | | | Description (1) | | | | | | | | Value | |

| | | | PREFERRED STOCKS – 0.1% | | | | | | | | | | |

| | | | | |

| | | | Independent Power Producers & Energy Traders – 0.1% | | | | | | | | | | |

| | | | | |

| | 31,989 | | | COPEL | | | | | | | | $ | 491,031 | |

| | | | Total Preferred Stocks (cost $649,496) | | | | | | | | | 491,031 | |

| | | | | |

| Shares | | | Description (1) | | | | | | | | Value | |

| | | | INVESTMENT COMPANIES – 0.4% | | | | | | | | | | |

| | | | | |

| | | | Gas Utilities – 0.4% | | | | | | | | | | |

| | | | | |

| | 3,378,298 | | | Cityspring Infrastructure Trust | | | | | | | | $ | 1,219,755 | |

| | | | Total Investment Companies (cost $1,196,576) | | | | | | | | | 1,219,755 | |

| | | | | |

| Shares | | | Description (1) | | | | | | | | Value | |

| | | | SHORT-TERM INVESTMENTS – 0.5% | | | | | | | | | | |

| | | | | |

| | | | Money Market Funds – 0.5% | | | | | | | | | | |

| | | | | |

| | 1,721,023 | | | State Street Institutional Liquid Reserve Fund, 0.170%, (3) | | | | | | | | $ | 1,721,023 | |

| | | | Total Short-Term Investments (cost $1,721,023) | | | | | | | | | 1,721,023 | |

| | | | Total Investments (cost $296,292,988) – 98.5% | | | | | | | | | 325,196,509 | |

| | | | Other Assets Less Liabilities – 1.5% | | | | | | | | | 4,908,110 | |

| | | | Net Assets – 100% | | | | | | | | $ | 330,104,619 | |

| | | | For Fund portfolio compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report which may combine industry sub-classifications into sectors for reporting ease. |

| | (1) | | All percentages shown in the Portfolio of Investments are based on net assets. |

| | (2) | | Non-income producing; issuer has not declared a dividend within the past twelve months. |

| | (3) | | The rate shown is the annualized seven-day effective yield as of the end of the reporting period. |

| | ADR | | American Depositary Receipt. |

| | BDR | | Brazilian Depositary Receipt. |

| | GDR | | Global Depositary Receipt. |

| | REIT | | Real Estate Investment Trust. |

| | WI/DD | | Investment, or portion of investment, purchased on a when-issued or delayed delivery basis. |

See accompanying notes to financial statements.

Portfolio of Investments

Nuveen Real Asset Income Fund

December 31, 2012

| | | | | | | | | | | | | | |

| Shares | | | Description (1) | | | | | | | | Value | |

| | | | | | | | | | | | | | |

| | | | COMMON STOCKS – 19.8% | | | | | | | | | | |

| | | | | |

| | | | Air Freight & Logistics – 0.4% | | | | | | | | | | |

| | | | | |

| | 207,332 | | | Singapore Post Limited | | | | | | | | $ | 195,377 | |

| | | | Electric Utilities – 7.0% | | | | | | | | | | |

| | | | | |

| | 1,742 | | | Duke Energy Corporation | | | | | | | | | 111,140 | |

| | | | | |

| | 1,270 | | | EDP Energias do Brasil SA | | | | | | | | | 7,747 | |

| | | | | |

| | 27 | | | Hafslund ASA, Class B | | | | | | | | | 220 | |

| | | | | |

| | 14,209 | | | Pepco Holdings, Inc. | | | | | | | | | 278,638 | |

| | | | | |

| | 8,368 | | | Scottish & Southern Energy | | | | | | | | | 194,675 | |