Quarterly Statement of FINANCIAL CONDITION for Boston Private Bank & Trust Company First Quarter 2019 BOSTON PRIVATE offers a full spectrum of wealth, trust, and banking services designed to FINANCIAL HIGHLIGHTS (as of 3/31/2019) give you one trusted resource to help simplify and strengthen your financial life. $7.6 Billion Assets Under Management1 Every individual and organization has a different reason WHY they work so hard. At Boston Private, we strive to understand what drives our clients, so $6.8 Billion Total Deposits that we can help them live and work the way they want. Understanding what our clients’ wealth is really for enables us to formulate a custom strategy $6.9 Billion and solution to help them achieve their goals, Total Loans hopes and dreams for today and tomorrow. Headquartered in Boston, we serve clients from 9.05% Tier 1 Leverage Capital Ratio our offices located in the major markets of Greater (Above the 5.00% required Boston, San Francisco, San Jose, Los Angeles, and by the FDIC to be well-capitalized) Palm Beach Gardens.2 Capital ratios in excess of levels Asset Low levels of problem loans due Capital banking regulators consider to be to our underwriting standards. Quality Base well-capitalized. $3.0 billion of cash, high-quality Liquidity unpledged investment securities, IDC Superior Profile and borrowing capacity from the Rating3 Federal Home Loan Bank. bostonprivate.com

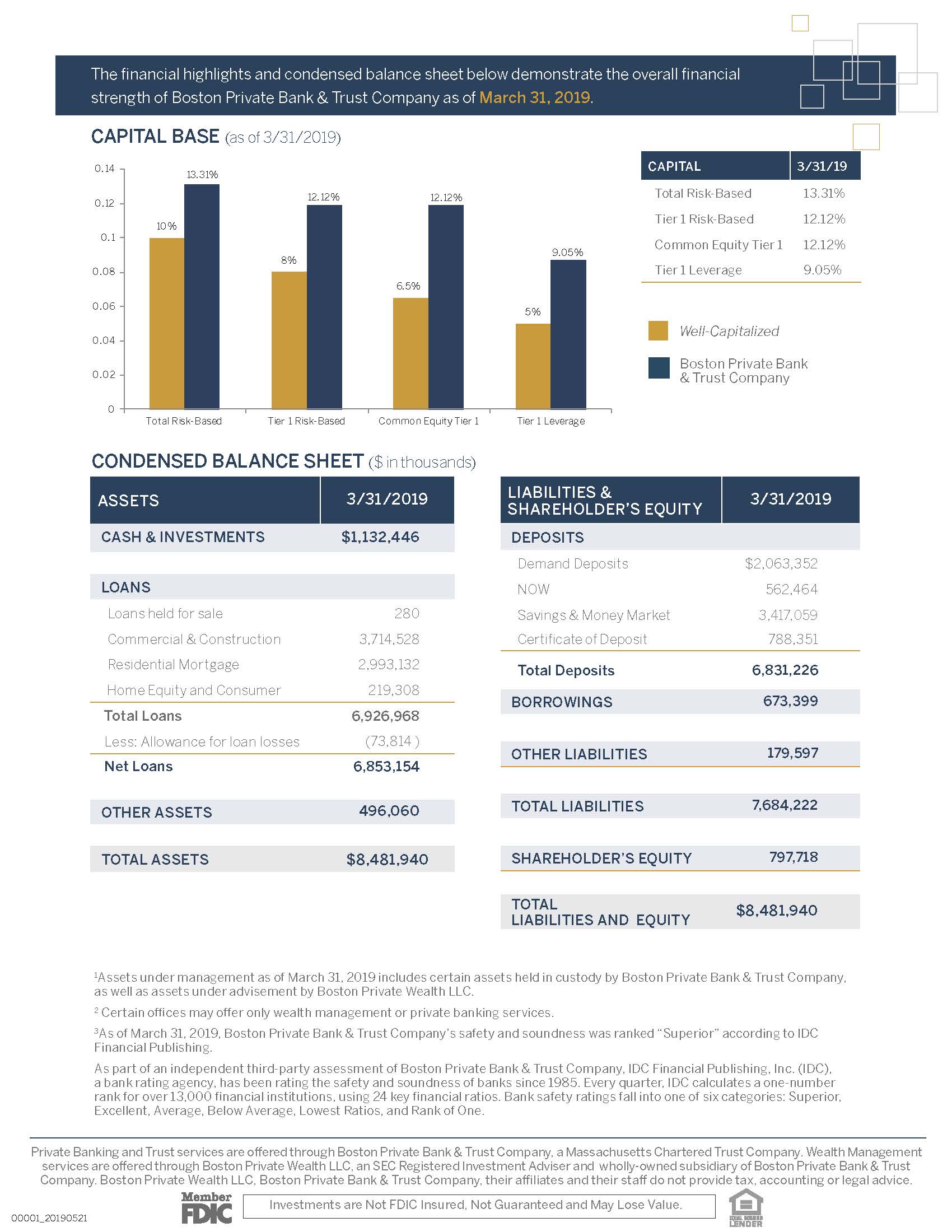

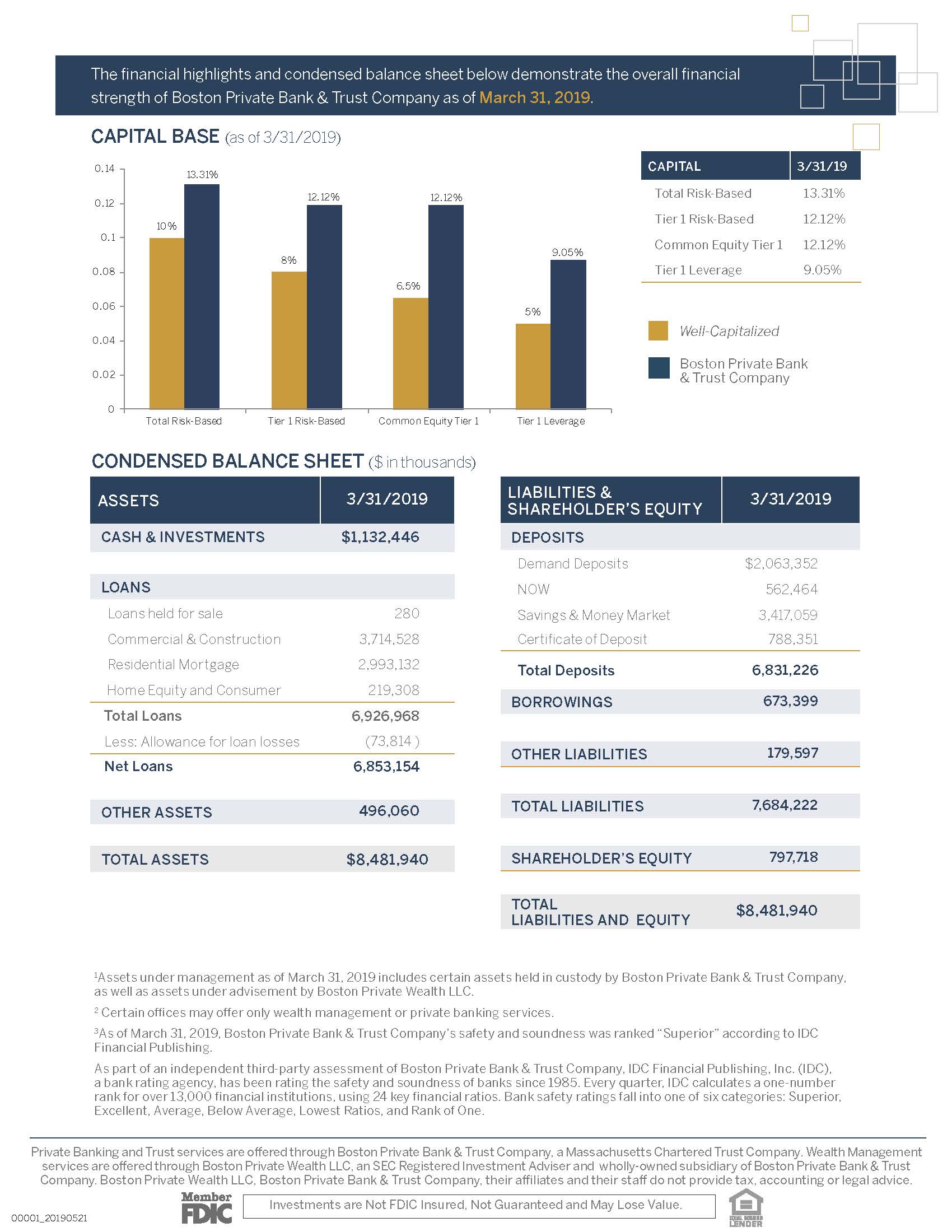

The financial highlights and condensed balance sheet below demonstrate the overall financial strength of Boston Private Bank & Trust Company as of March 31, 2019. CAPITAL BASE (as of 3/31/2019) 0.14 CAPITAL 3/31/19 13.31% 12.12% 12.12% Total Risk-Based 13.31% 0.12 Tier 1 Risk-Based 12.12% 10% 0.1 Common Equity Tier 1 12.12% 9.05% 8% 0.08 Tier 1 Leverage 9.05% 6.5% 0.06 5% Well-Capitalized 0.04 Boston Private Bank 0.02 & Trust Company 0 Total Risk-Based Tier 1 Risk-Based Common Equity Tier 1 Tier 1 Leverage CONDENSED BALANCE SHEET ($ in thousands) LIABILITIES & ASSETS 3/31/2019 3/31/2019 SHAREHOLDER’S EQUITY CASH & INVESTMENTS $1,132,446 DEPOSITS Demand Deposits $2,063,352 LOANS NOW 562,464 Loans held for sale 280 Savings & Money Market 3,417,059 Commercial & Construction 3,714,528 Certificate of Deposit 788,351 Residential Mortgage 2,993,132 Total Deposits 6,831,226 Home Equity and Consumer 219,308 BORROWINGS 673,399 Total Loans 6,926,968 Less: Allowance for loan losses (73,814 ) OTHER LIABILITIES 179,597 Net Loans 6,853,154 7,684,222 OTHER ASSETS 496,060 TOTAL LIABILITIES TOTAL ASSETS $8,481,940 SHAREHOLDER’S EQUITY 797,718 TOTAL $8,481,940 LIABILITIES AND EQUITY 1Assets under management as of March 31, 2019 includes certain assets held in custody by Boston Private Bank & Trust Company, as well as assets under advisement by Boston Private Wealth LLC. 2 Certain offices may offer only wealth management or private banking services. 3As of December 31, 2018, Boston Private Bank & Trust Company’s safety and soundness was ranked “Superior” according to IDC Financial Publishing. As part of an independent third-party assessment of Boston Private Bank & Trust Company, IDC Financial Publishing, Inc. (IDC), a bank rating agency, has been rating the safety and soundness of banks since 1985. Every quarter, IDC calculates a one-number rank for over 13,000 financial institutions, using 24 key financial ratios. Bank safety ratings fall into one of six categories: Superior, Excellent, Average, Below Average, Lowest Ratios, and Rank of One. Private Banking and Trust services are offered through Boston Private Bank & Trust Company, a Massachusetts Chartered Trust Company. Wealth Management services are offered through Boston Private Wealth LLC, an SEC Registered Investment Adviser and wholly-owned subsidiary of Boston Private Bank & Trust Company. Boston Private Wealth LLC, Boston Private Bank & Trust Company, their affiliates and their staff do not provide tax, accounting or legal advice. Investments are Not FDIC Insured, Not Guaranteed and May Lose Value. 00001_20190429