Quarterly Statement of FINANCIAL CONDITION for Boston Private Bank & Trust Company Second Quarter 2019 BOSTON PRIVATE offers a full spectrum of wealth, trust, and banking services designed to FINANCIAL HIGHLIGHTS (as of 6/30/2019) give you one trusted resource to help simplify and strengthen your financial life. $7.6 Billion Assets Under Management1 Every individual and organization has a different reason WHY they work so hard. At Boston Private, we strive to understand what drives our clients, so $6.5 Billion Total Deposits that we can help them live and work the way they want. Understanding what our clients’ wealth is really for enables us to formulate a custom strategy $7.1 Billion and solution to help them achieve their goals, Total Loans hopes and dreams for today and tomorrow. Headquartered in Boston, we serve clients from 8.99% Tier 1 Leverage Capital Ratio our offices located in the major markets of Greater (Above the 5.00% required Boston, San Francisco, San Jose, Los Angeles, and by the FDIC to be well-capitalized) Palm Beach Gardens.2 Capital ratios in excess of levels Asset Low levels of problem loans due Capital banking regulators consider to be to our underwriting standards. Quality Base well-capitalized. $1.9 billion of cash, high-quality Liquidity unpledged investment securities, IDC Superior Profile and borrowing capacity from the Rating3 Federal Home Loan Bank. bostonprivate.com

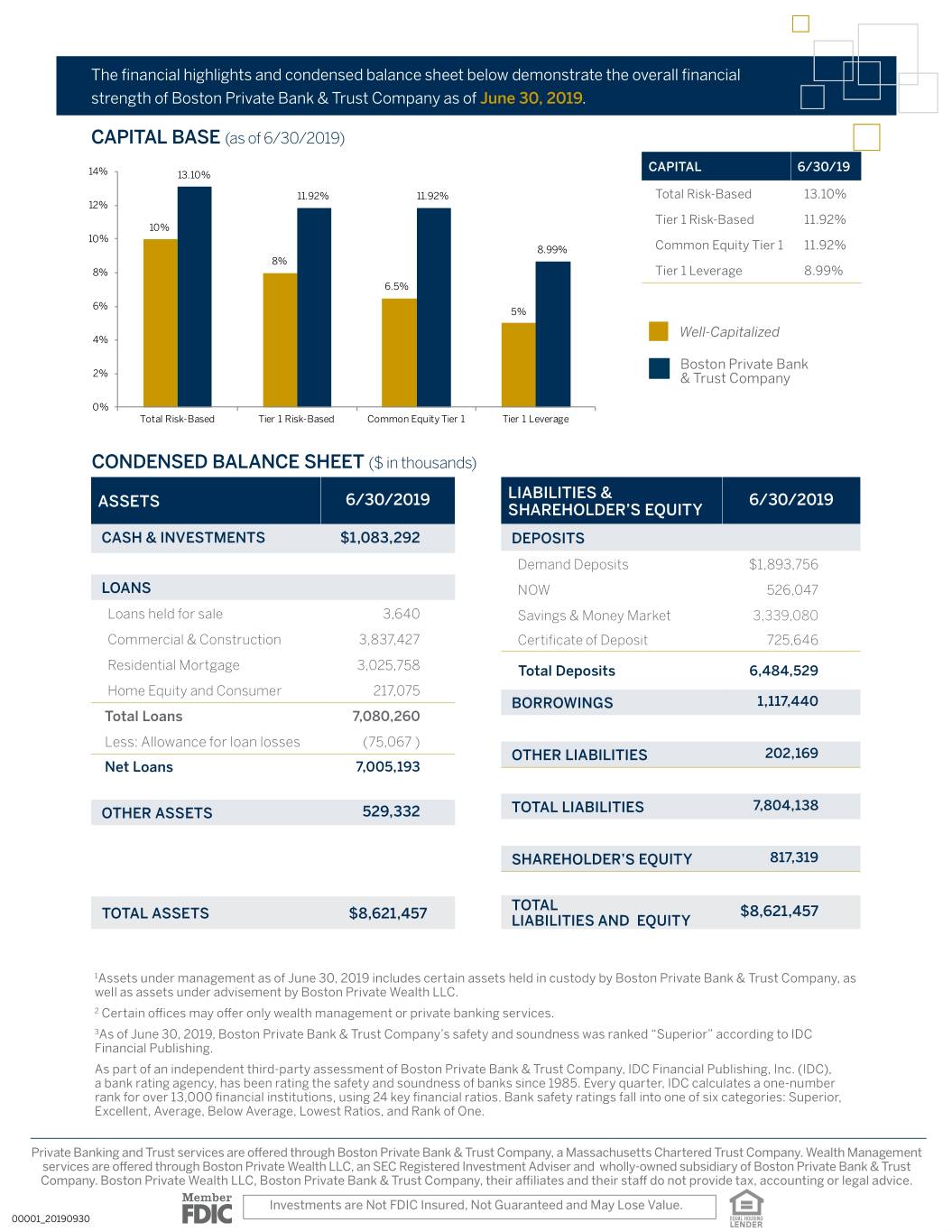

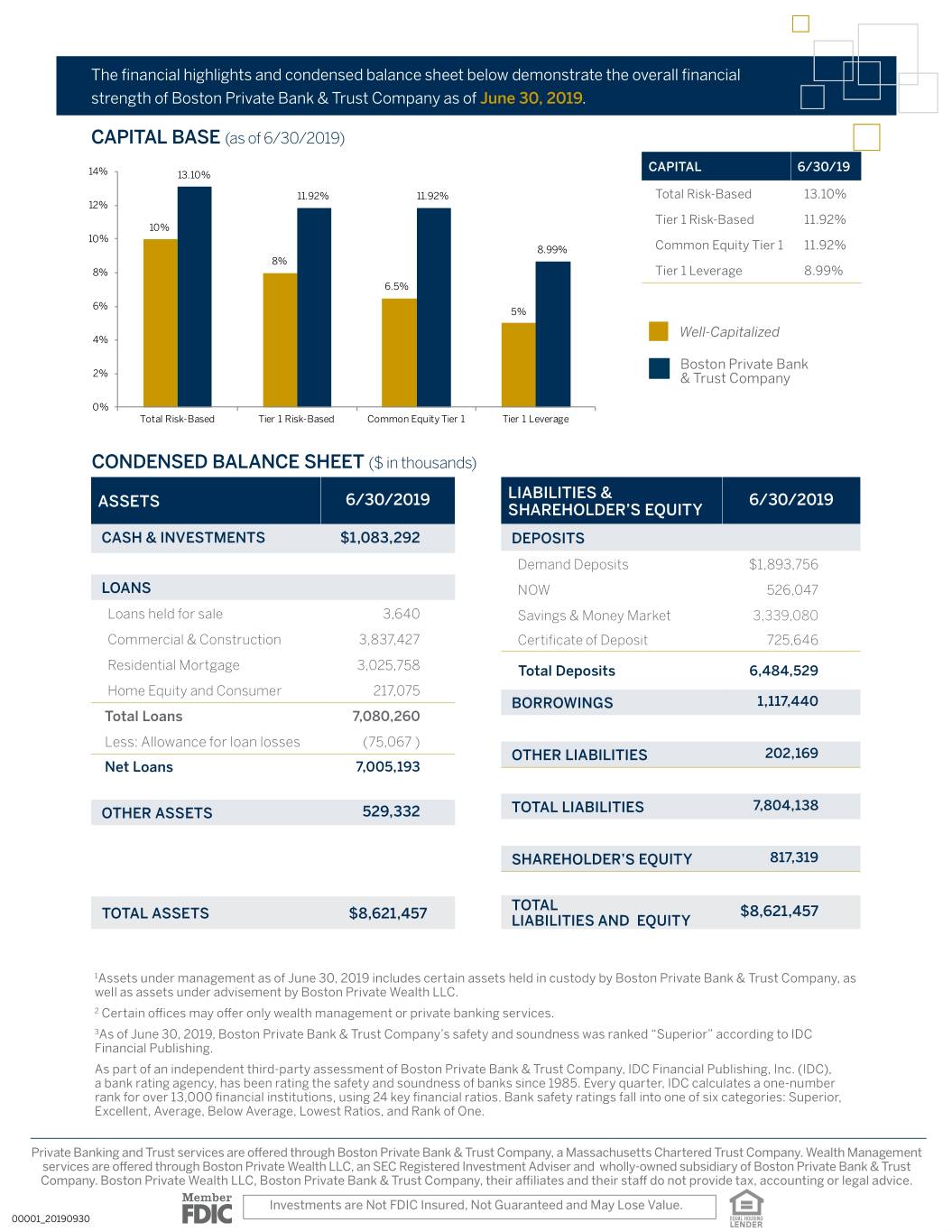

The financial highlights and condensed balance sheet below demonstrate the overall financial strength of Boston Private Bank & Trust Company as of June 30, 2019. CAPITAL BASE (as of 6/30/2019) CAPITAL 6/30/19 14% 13.10% 11.92% 11.92% Total Risk-Based 13.10% 12% Tier 1 Risk-Based 11.92% 10% 10% 8.99% Common Equity Tier 1 11.92% 8% 8% Tier 1 Leverage 8.99% 6.5% 6% 5% Well-Capitalized 4% Boston Private Bank 2% & Trust Company 0% Total Risk-Based Tier 1 Risk-Based Common Equity Tier 1 Tier 1 Leverage CONDENSED BALANCE SHEET ($ in thousands) LIABILITIES & ASSETS 6/30/2019 6/30/2019 SHAREHOLDER’S EQUITY CASH & INVESTMENTS $1,083,292 DEPOSITS Demand Deposits $1,893,756 LOANS NOW 526,047 Loans held for sale 3,640 Savings & Money Market 3,339,080 Commercial & Construction 3,8 37,427 Certificate of Deposit 725,646 Residential Mortgage 3,025,758 Total Deposits 6,484,529 Home Equity and Consumer 217,075 BORROWINGS 1,117,440 Total Loans 7,080,260 Less: Allowance for loan losses (75,067 ) OTHER LIABILITIES 202,169 Net Loans 7,005,193 7,804,138 OTHER ASSETS 529,332 TOTAL LIABILITIES SHAREHOLDER’S EQUITY 817,319 TOTAL TOTAL ASSETS $8,621,457 $8,621,457 LIABILITIES AND EQUITY 1Assets under management as of June 30, 2019 includes certain assets held in custody by Boston Private Bank & Trust Company, as well as assets under advisement by Boston Private Wealth LLC. 2 Certain offices may offer only wealth management or private banking services. 3As of June 30, 2019, Boston Private Bank & Trust Company’s safety and soundness was ranked “Superior” according to IDC Financial Publishing. As part of an independent third-party assessment of Boston Private Bank & Trust Company, IDC Financial Publishing, Inc. (IDC), a bank rating agency, has been rating the safety and soundness of banks since 1985. Every quarter, IDC calculates a one-number rank for over 13,000 financial institutions, using 24 key financial ratios. Bank safety ratings fall into one of six categories: Superior, Excellent, Average, Below Average, Lowest Ratios, and Rank of One. Private Banking and Trust services are offered through Boston Private Bank & Trust Company, a Massachusetts Chartered Trust Company. Wealth Management services are offered through Boston Private Wealth LLC, an SEC Registered Investment Adviser and wholly-owned subsidiary of Boston Private Bank & Trust Company. Boston Private Wealth LLC, Boston Private Bank & Trust Company, their affiliates and their staff do not provide tax, accounting or legal advice. Investments are Not FDIC Insured, Not Guaranteed and May Lose Value. 00001_20190930