UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☒ | Soliciting Material Under Rule 14a-12 |

| Boston Private Financial Holdings, Inc. |

(Name of Registrant as Specified in Its Charter) |

| |

HoldCo Opportunities Fund III, L.P. HoldCo Asset Management, LP VM GP VII LLC VM GP II LLC VIKARAN GHEI MICHAEL ZAITZEFF Jeita L. DenG Merrie S. Frankel Laurie M. Shahon |

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials: |

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

HoldCo Opportunities Fund III, L.P. (“HoldCo Fund”), together with the participants named herein (collectively, “HoldCo”), intends to file a preliminary proxy statement and accompanying WHITE proxy card with the Securities and Exchange Commission to be used to solicit votes for the election of its slate of director nominees at the 2021 annual meeting of shareholders of Boston Private Financial Holdings, Inc., a Massachusetts corporation (the “Company”), and has filed a definitive proxy statement and accompanying WHITE proxy card with the Securities and Exchange Commission to be used to solicit votes to oppose the merger between the Company and SVB Financial Group, a Delaware corporation, at the special meeting of shareholders of the Company to be held virtually on April 27, 2021.

Item 1: On March 30, 2021, HoldCo issued the below press release, which contained a link to an Investor Presentation. The Investor Presentation is attached hereto as Exhibit 99.1 and incorporated herein by reference.

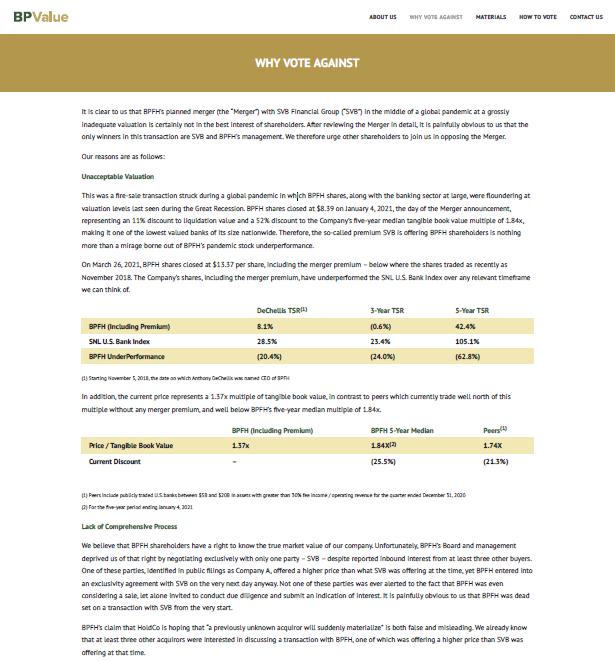

HoldCo Issues Detailed Presentation on Boston Private’s Proposed Merger with SVB

Highlights Numerous Reasons Why BPFH Shareholders Should Vote NO

Believes BPFH is Worth Significantly More than SVB’s Current Offer

Believes HoldCo’s Three Director Nominees Would Add Urgently Needed Expertise to BPFH’s Board and Ensure Value is Maximized for all BPFH Shareholders

Presentation and Additional Materials Available at www.BPValue.com

HoldCo Asset Management, LP and its managed funds (collectively, "HoldCo"), which own 4,049,816 shares of common stock of Boston Private Financial Holdings, Inc. (NASDAQ: BPFH) ("Boston Private," "BPFH," or the "Company"), representing approximately 4.9% of the Company’s outstanding shares, today issued an investor presentation detailing its strong opposition to BPFH’s planned merger (the “Merger”) with SVB Financial Group (“SVB”) and urging all shareholders to vote NO.

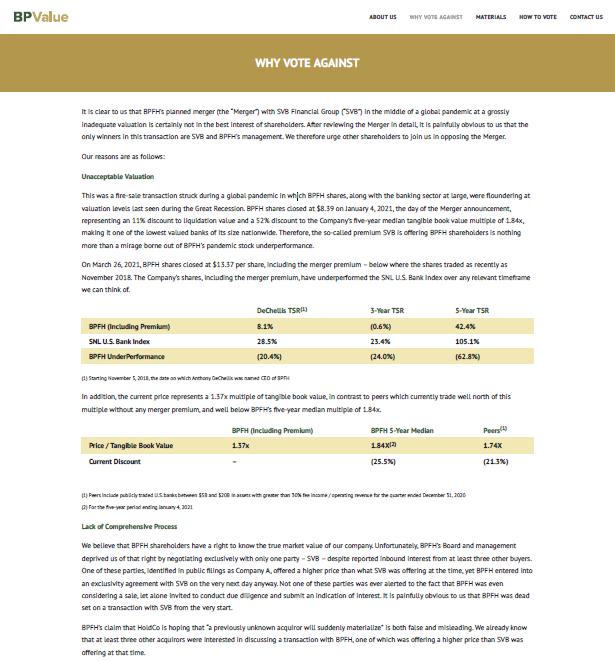

The presentation describes, among other things, the non-existent sales process and conflict-riddled negotiations that resulted in what HoldCo believes is a grossly inadequate valuation for BPFH. The presentation also outlines how voting against the Merger today will pave the way for a competitive and comprehensive sales process supervised by a stronger, independent Board – with the addition of the three highly-qualified candidates HoldCo has nominated for election as directors.

The presentation and additional materials are available here: www.BPValue.com.

HoldCo urges all BPFH shareholders to vote NO on the proposed Merger.

About HoldCo Asset Management

HoldCo Asset Management, LP is an investment adviser located in New York City. HoldCo was founded by Vik Ghei and Misha Zaitzeff. HoldCo currently has over $1 billion in regulatory assets under management.

HoldCo is being represented by the law firm Olshan Frome Wolosky LLP.

CERTAIN INFORMATION CONCERNING PARTICIPANTS

HoldCo Opportunities Fund III, L.P. ("HoldCo Fund"), together with the participants named herein (collectively, "HoldCo"), intends to file a preliminary proxy statement and accompanying WHITE proxy card with the Securities and Exchange Commission to be used to solicit votes for the election of its slate of director nominees at the 2021 annual meeting of shareholders of Boston Private Financial Holdings, Inc., a Massachusetts corporation (the "Company"), and has filed a definitive proxy statement and accompanying WHITE proxy card with the Securities and Exchange Commission to be used to solicit votes to oppose the merger between the Company and SVB Financial Group, a Delaware corporation, at the special meeting of shareholders of the Company to be held virtually on April 27, 2021.

HOLDCO STRONGLY ADVISES ALL SHAREHOLDERS OF THE COMPANY TO READ EACH THE PROXY STATEMENTS AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEBSITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THE PROXY SOLICITATIONS WILL PROVIDE COPIES OF THE PROXY STATEMENTS WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS’ PROXY SOLICITOR.

The Participants in the proxy solicitation with regard to the Annual Meeting are anticipated to be HoldCo Fund, VM GP VII LLC ("VM GP VII"), HoldCo Asset Management, LP ("HoldCo Asset Management"), VM GP II LLC ("VM GP II"), Vikaran Ghei, Michael Zaitzeff, Jeita L. Deng, Merrie S. Frankel and Laurie M. Shahon. The Participants in the proxy solicitation with regard to the Special Meeting are anticipated to be HoldCo Fund, VM GP VII, HoldCo Asset Management, VM GP II, Vikaran Ghei and Michael Zaitzeff.

As of the date hereof, HoldCo Fund directly owned 4,049,816 shares of Common Stock, par value $1.00 per share, of the Company (the "Common Stock"). As the general partner of HoldCo Fund, VM GP VII may be deemed to beneficially own the 4,049,816 shares of Common Stock owned directly by HoldCo Fund. As the investment manager of HoldCo Fund, HoldCo Asset Management may be deemed to beneficially own the 4,049,816 shares of Common Stock owned directly by HoldCo Fund. As the general partner of HoldCo Asset Management, VM GP II may be deemed to beneficially own the 4,049,816 shares of Common Stock owned directly by HoldCo Fund. As Members of each of VM GP VII and VM GP II, each of Messrs. Ghei and Zaitzeff may be deemed to beneficially own the 4,049,816 shares of Common Stock owned directly by HoldCo Fund. As of the date hereof, none of Mses. Deng, Frankel or Shahon beneficially own any securities of the Company.

Contacts

Investor

John Ferguson / Joe Mills

Saratoga Proxy Consulting LLC

(212) 257-1311

info@saratogaproxy.com

Media:

Dan Zacchei / Joe Germani

Sloane & Company

Dzacchei@sloanepr.com / JGermani@sloanepr.com

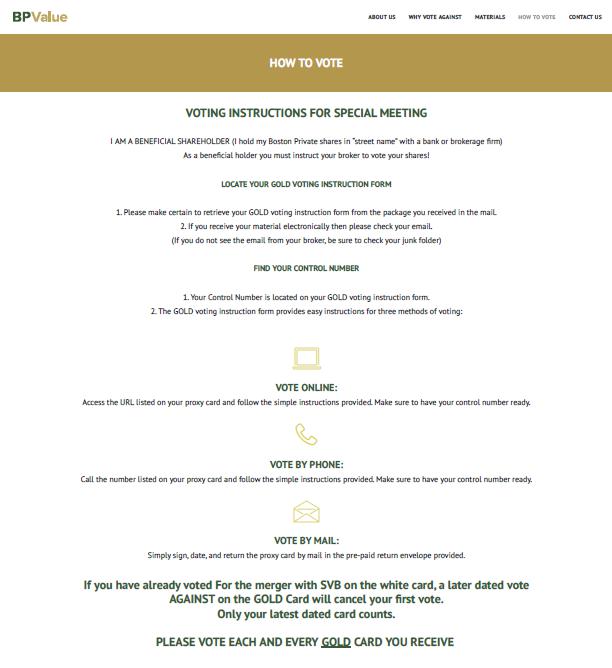

Item 2: On March 30, 2021, HoldCo posted the following materials, including the Investor Presentation, to www.bpvalue.com: