Exhibit 99.1

Exhibit 99.1

Board of Directors

Herbert S. Alexander

Managing Partner

Alexander, Aronson, Finning &

Company

John H. Clymer

Partner

Nixon Peabody, LLP

Eugene S. Colangelo

Chairman of the Board

Julio Enterprises

Chairman of the Board

Boston Private Bank & Trust Company

W. Pearce Coues

Former Chairman

MGI Properties

James D. Dawson

President & Chief Operating Officer

Boston Private Bank & Trust Company

Kate S. Flather

Private Investor

Kathleen M. Graveline

Private Investor

Charles T. Grigsby

Senior Vice President

Massachusetts Capital Resource Company

Susan P. Haney

Private Investor

E. Christopher Palmer

Certified Public Accountant

Eugene Franklin Rivers, III

Co-Director

National Ten Point Leadership

Foundation

Michael F. Schiavo

Partner & Chief Financial Officer

General Kodiak Venture Partners

Alan D. Solomont

Chairman & Chief Executive Officer

Solomont Bailis Ventures

John Larkin Thompson

Nutter, McClennen & Fish

Mark D. Thompson

Chief Executive Officer

Boston Private Bank & Trust Company

Timothy L. Vaill

Chairman & Chief Executive Officer

Boston Private Financial Holdings, Inc.

Policy Group

Mark D. Thompson

Chief Executive Officer

James D. Dawson

President

Chief Operating Officer

James C. Brown

Senior Vice President

James D. Henderson

Executive Vice President

Barbara M. Houlihan

Executive Vice President

Chief Administrative Officer

Amy E. Hunter

Executive Vice President

Pilar Pueyo

Senior Vice President

Anne L. Randall

Executive Vice President

Chief Financial Officer

George S. Schwartz

Executive Vice President

Treasurer

Office Locations

Headquarters: Boston Office

Ten Post Office Square

Boston, Massachusetts

(617) 912-1900

Wellesley Office

336 Washington Street

Wellesley, Massachusetts

(781) 707-7700

Back Bay Office

500 Boylston Street

Boston, Massachusetts

(617) 912-4500

Jamaica Plain Loan Center

401c Centre Street

Jamaica Plain, Massachusetts

(617) 524-6050

Kendall Square Office

One Cambridge Center

Cambridge, Massachusetts

(617) 646-4800

Newton Centre Office

1223 Centre Street

Newton, Massachusetts

(617) 646-4850

Seaport Office

157 Seaport Boulevard

Boston, Massachusetts

(617) 646-4880

BOSTON PRIVATE BANK & TRUST COMPANY

Member FDIC

EQUAL HOUSING LENDER

HEADQUARTERS: TEN POST OFFICE SQUARE • BOSTON, MASSACHUSETTS 02109

TELEPHONE: 617-912-1900 • WWW.BOSTONPRIVATEBANK.COM

MEMBER OF BOSTON PRIVATE WEALTH MANAGEMENT GROUP

STATEMENT OF FINANCIAL CONDITION

A S O F D E C E M B E R 3 1 , 2 0 0 4

BOSTON PRIVATE BANK & TRUST COMPANY

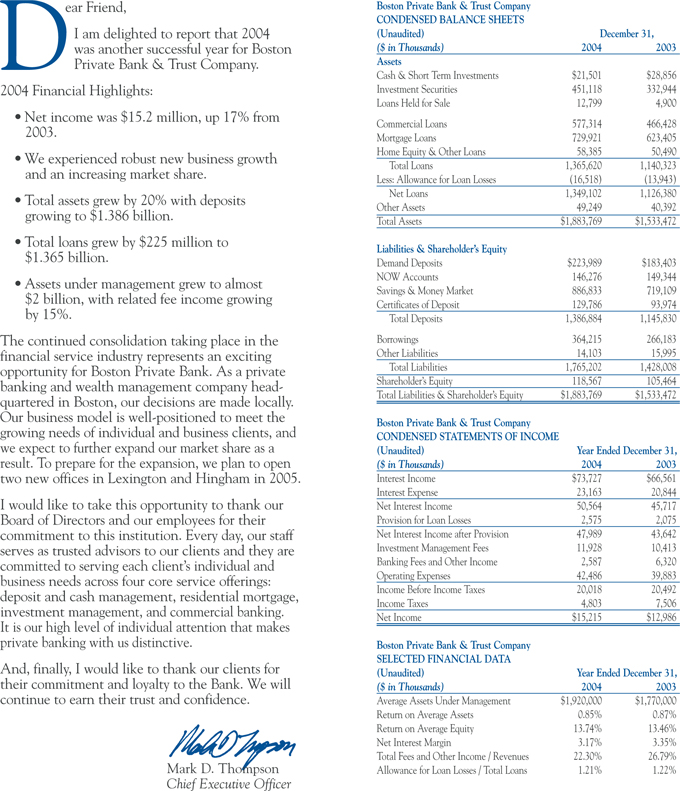

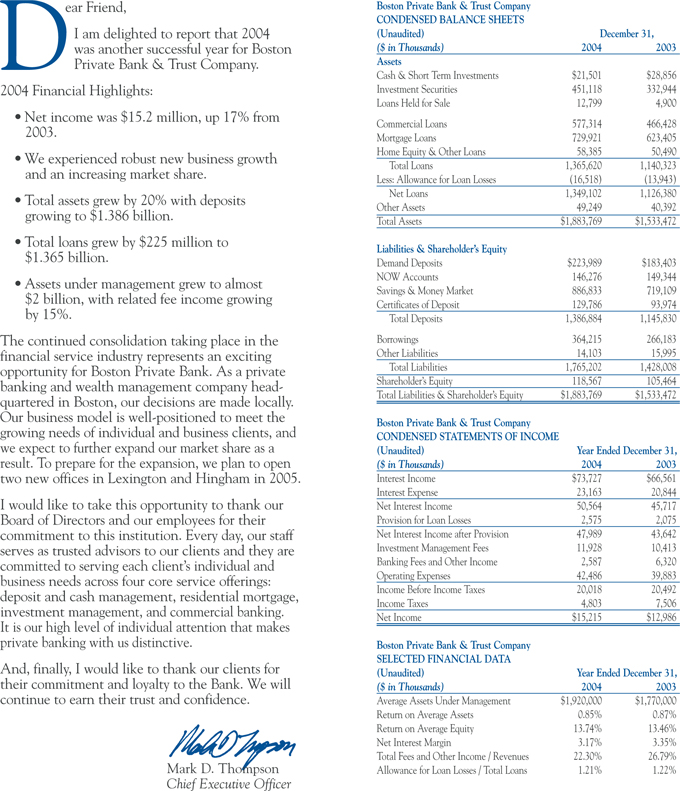

Dear Friend,

I am delighted to report that 2004 was another successful year for Boston Private Bank & Trust Company.

2004 Financial Highlights:

Net income was $15.2 million, up 17% from 2003.

We experienced robust new business growth and an increasing market share.

Total assets grew by 20% with deposits growing to $1.386 billion.

Total loans grew by $225 million to $1.365 billion.

Assets under management grew to almost $2 billion, with related fee income growing by 15%.

The continued consolidation taking place in the financial service industry represents an exciting opportunity for Boston Private Bank. As a private banking and wealth management company headquartered in Boston, our decisions are made locally. Our business model is well-positioned to meet the growing needs of individual and business clients, and we expect to further expand our market share as a result. To prepare for the expansion, we plan to open two new offices in Lexington and Hingham in 2005.

I would like to take this opportunity to thank our Board of Directors and our employees for their commitment to this institution. Every day, our staff serves as trusted advisors to our clients and they are committed to serving each client’s individual and business needs across four core service offerings: deposit and cash management, residential mortgage, investment management, and commercial banking. It is our high level of individual attention that makes private banking with us distinctive.

And, finally, I would like to thank our clients for their commitment and loyalty to the Bank. We will continue to earn their trust and confidence.

Mark D. Thompson

Chief Executive Officer

Boston Private Bank & Trust Company

CONDENSED BALANCE SHEETS

(Unaudited) December 31,

($ in Thousands) 2004 2003

Assets

Cash & Short Term Investments $21,501 $28,856

Investment Securities 451,118 332,944

Loans Held for Sale 12,799 4,900

Commercial Loans 577,314 466,428

Mortgage Loans 729,921 623,405

Home Equity & Other Loans 58,385 50,490

Total Loans 1,365,620 1,140,323

Less: Allowance for Loan Losses (16,518) (13,943)

Net Loans 1,349,102 1,126,380

Other Assets 49,249 40,392

Total Assets $1,883,769 $1,533,472

Liabilities & Shareholder’s Equity

Demand Deposits $223,989 $183,403

NOW Accounts 146,276 149,344

Savings & Money Market 886,833 719,109

Certificates of Deposit 129,786 93,974

Total Deposits 1,386,884 1,145,830

Borrowings 364,215 266,183

Other Liabilities 14,103 15,995

Total Liabilities 1,765,202 1,428,008

Shareholder’s Equity 118,567 105,464

Total Liabilities & Shareholder’s Equity $1,883,769 $1,533,472

Boston Private Bank & Trust Company

CONDENSED STATEMENTS OF INCOME

(Unaudited) Year Ended December 31,

($ in Thousands) 2004 2003

Interest Income $73,727 $66,561

Interest Expense 23,163 20,844

Net Interest Income 50,564 45,717

Provision for Loan Losses 2,575 2,075

Net Interest Income after Provision 47,989 43,642

Investment Management Fees 11,928 10,413

Banking Fees and Other Income 2,587 6,320

Operating Expenses 42,486 39,883

Income Before Income Taxes 20,018 20,492

Income Taxes 4,803 7,506

Net Income $15,215 $12,986

Boston Private Bank & Trust Company

SELECTED FINANCIAL DATA

(Unaudited) Year Ended December 31,

($ in Thousands) 2004 2003

Average Assets Under Management $1,920,000 $1,770,000

Return on Average Assets 0.85% 0.87%

Return on Average Equity 13.74% 13.46%

Net Interest Margin 3.17% 3.35%

Total Fees and Other Income / Revenues 22.30% 26.79%

Allowance for Loan Losses / Total Loans 1.21% 1.22%