Exhibit 99.1

BOSTON PRIVATE BANK & TRUST COMPANY

ANNUAL REPORT OF FINANCIAL CONDITION AS OF DECEMBER 31, 2008

Dear Friend,

Despite trying economic times and the banking industry’s worst downturn since the Depression, I am pleased to report that Boston Private Bank & Trust Company demonstrated its strength and stability with an increase in business volumes and positive earnings growth in 2008.

Highlights of our 2008 financial results include net income of $24.6 million, up 11% versus last year and a stark contrast to the average earnings from peer banks, which were down overall during the same period. Revenues rose 9% and non-interest income was down only 1% from the previous year. Balance sheet assets exceeded $3 billion, up 10% from 2007, funded by a strong increase of 13% in deposits.

In the midst of the credit crisis, Boston Private Bank & Trust achieved a lending milestone— our commercial loan portfolio reached $1 billion in the third quarter, finishing the year at $1.1 billion—and we continue to lend to qualified businesses and individuals. Our residential lending group achieved 9% growth due to our unique portfolio lending capability and consistent credit quality. In spite of a downward spiraling stock market during the latter half of 2008, our investment management group still delivered great results. Year over year revenue growth was at 4% as a result of balanced portfolio management, solid client retention, and $500 million of new client assets.

We took measures in 2008 to protect our clients’ interests, including participating in the FDIC’s Transaction Account Guarantee Program, through which all non-interest-bearing transaction and NOW accounts are fully guaranteed for the entire amount in the account through December 31, 2009. Coverage under this program is in addition to and separate from the coverage available under the FDIC’s general deposit insurance rules.

Our parent company, Boston Private Financial Holdings, Inc. (BPFH), continued to improve its capital strength over the year. In July of 2008, it raised $173 million in private and public capital. In November, under the TARP Capital Purchase Program, BPFH secured additional funding of $154 million, which they have put to work at their subsidiary banks to increase lending. Boston Private Bank increased its lending in the fourth quarter 2008 by $50 million.

As one of 15 subsidiaries of BPFH, Boston Private Bank & Trust operates individually, and neither our liquidity nor our regulatory capital ratios—which comfortably exceed regulatory minimums— are affected directly by the actions of BPFH or other affiliates. Boston Private Bank & Trust continues to lend to individuals, businesses, and the community. This ongoing commitment to our community has earned us an “outstanding” Community Reinvestment Act rating for eight years.

We recognize that now, perhaps more than ever, our clients need advice they can trust. At Boston Private Bank & Trust you have dedicated advisors who are always ready to help you. You can count on our knowledge, our expertise, and our exceptional service. I want to thank you for your business, for your confidence in us, and for recommending Boston Private Bank & Trust to your colleagues and friends. If there is anything more that we can do to earn your continued trust, please let me know.

Sincerely,

Mark D. Thompson

CEO & President

“We recognize that now, perhaps more than ever, our clients need advice they can trust.”

www.bostonprivatebank.com

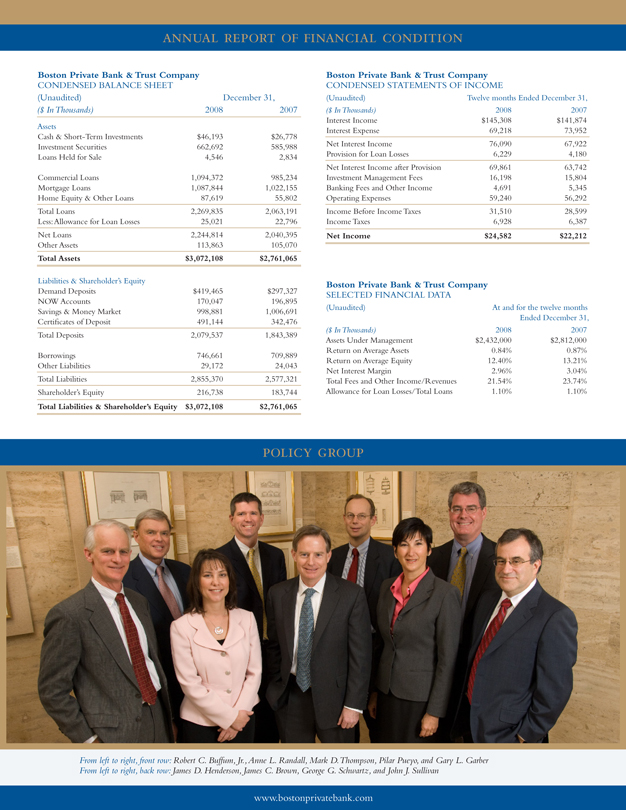

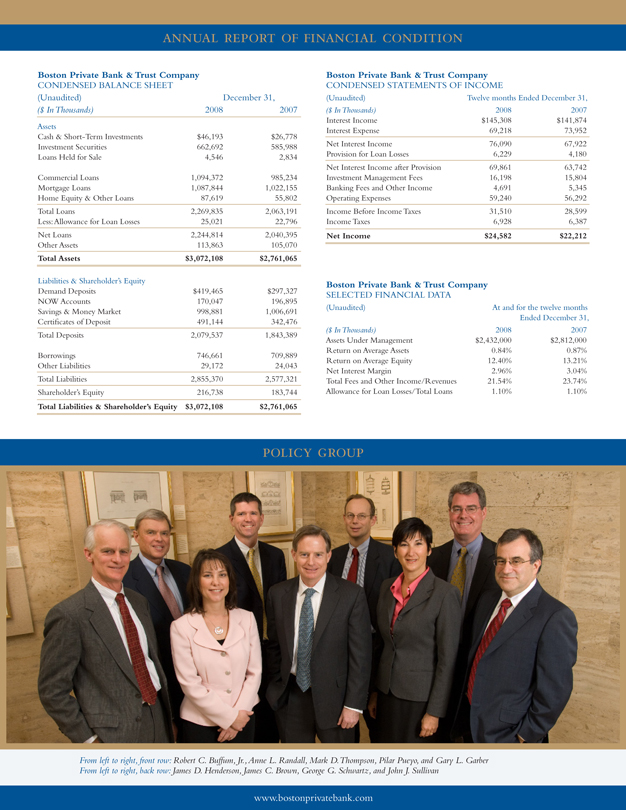

ANNUAL REPORT OF FINANCIAL CONDITION

Boston Private Bank & Trust Company

CONDENSED BALANCE SHEET

(Unaudited) December 31,

($ In Thousands) 2008 2007 Assets Cash & Short-Term Investments $46,193 $26,778 Investment Securities 662,692 585,988 Loans Held for Sale 4,546 2,834

Commercial Loans 1,094,372 985,234 Mortgage Loans 1,087,844 1,022,155 Home Equity & Other Loans 87,619 55,802 Total Loans 2,269,835

2,063,191 Less: Allowance for Loan Losses 25,021 22,796 Net Loans 2,244,814 2,040,395 Other Assets 113,863 105,070

Total Assets $3,072,108 $2,761,065

Liabilities & Shareholder’s Equity

Demand Deposits $419,465 $297,327 NOW Accounts 170,047 196,895 Savings & Money Market 998,881 1,006,691 Certificates of Deposit 491,144 342,476 Total Deposits 2,079,537 1,843,389

Borrowings 746,661 709,889 Other Liabilities 29,172 24,043 Total Liabilities 2,855,370 2,577,321 Shareholder’s Equity 216,738 183,744

Total Liabilities & Shareholder’s Equity $3,072,108 $2,761,065

Boston Private Bank & Trust Company

CONDENSED STATEMENTS OF INCOME

(Unaudited) Twelve months Ended December 31,

($ In Thousands) 2008 2007 Interest Income $145,308 $141,874 Interest Expense 69,218 73,952 Net Interest Income 76,090 67,922 Provision for Loan Losses 6,229 4,180 Net Interest Income after Provision 69,861 63,742 Investment Management Fees 16,198 15,804 Banking Fees and Other Income 4,691 5,345 Operating Expenses 59,240 56,292 Income Before Income Taxes 31,510 28,599 Income Taxes 6,928 6,387

Net Income $24,582 $22,212

Boston Private Bank & Trust Company

SELECTED FINANCIAL DATA

(Unaudited) At and for the twelve months Ended December 31,

($ In Thousands) 2008 2007 Assets Under Management $2,432,000 $2,812,000 Return on Average Assets 0.84% 0.87% Return on Average Equity 12.40% 13.21% Net Interest Margin 2.96% 3.04% Total Fees and Other Income/Revenues 21.54% 23.74% Allowance for Loan Losses/Total Loans 1.10% 1.10%

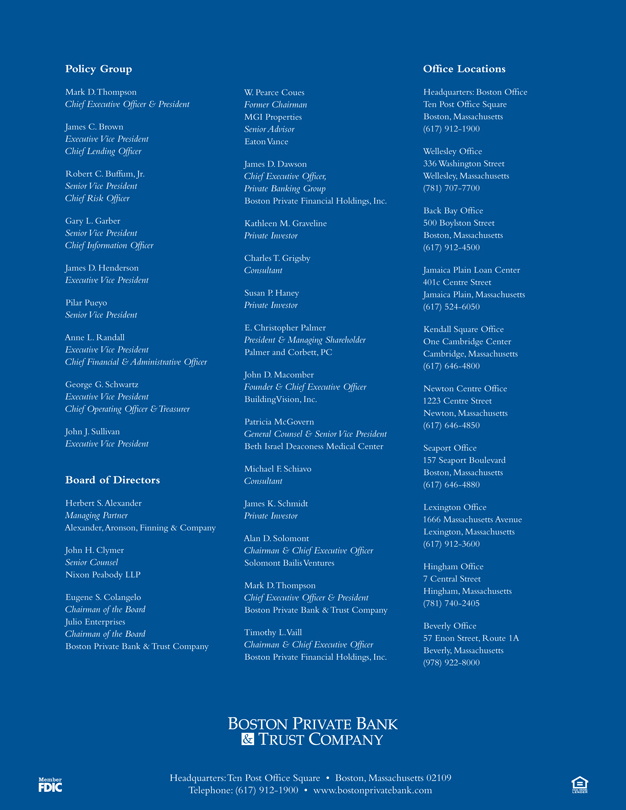

POLICY GROUP

From left to right, front row: Robert C. Buffum, Jr., Anne L. Randall, Mark D. Thompson, Pilar Pueyo, and Gary L. Garber From left to right, back row: James D. Henderson, James C. Brown, George G. Schwartz, and John J. Sullivan

www.bostonprivatebank.com

Policy Group

Mark D. Thompson

Chief Executive Officer & President

James C. Brown

Executive Vice President Chief Lending Officer

Robert C. Buffum, Jr.

Senior Vice President Chief Risk Officer

Gary L. Garber

Senior Vice President Chief Information Officer

James D. Henderson

Executive Vice President

Pilar Pueyo

Senior Vice President

Anne L. Randall

Executive Vice President

Chief Financial & Administrative Officer

George G. Schwartz

Executive Vice President

Chief Operating Officer & Treasurer

John J. Sullivan

Executive Vice President

Board of Directors

Herbert S. Alexander

Managing Partner

Alexander, Aronson, Finning & Company

John H. Clymer

Senior Counsel

Nixon Peabody LLP

Eugene S. Colangelo

Chairman of the Board

Julio Enterprises

Chairman of the Board

Boston Private Bank & Trust Company

W. Pearce Coues

Former Chairman

MGI Properties

Senior Advisor

Eaton Vance

James D. Dawson

Chief Executive Officer, Private Banking Group

Boston Private Financial Holdings, Inc.

Kathleen M. Graveline

Private Investor

Charles T. Grigsby

Consultant

Susan P. Haney

Private Investor

E. Christopher Palmer

President & Managing Shareholder

Palmer and Corbett, PC

John D. Macomber

Founder & Chief Executive Officer

BuildingVision, Inc.

Patricia McGovern

General Counsel & Senior Vice President

Beth Israel Deaconess Medical Center

Michael F. Schiavo

Consultant

James K. Schmidt

Private Investor

Alan D. Solomont

Chairman & Chief Executive Officer

Solomont Bailis Ventures

Mark D. Thompson

Chief Executive Officer & President

Boston Private Bank & Trust Company

Timothy L. Vaill

Chairman & Chief Executive Officer

Boston Private Financial Holdings, Inc.

Office Locations

Headquarters: Boston Office Ten Post Office Square Boston, Massachusetts (617) 912-1900

Wellesley Office 336 Washington Street Wellesley, Massachusetts (781) 707-7700

Back Bay Office 500 Boylston Street Boston, Massachusetts (617) 912-4500

Jamaica Plain Loan Center 401c Centre Street Jamaica Plain, Massachusetts (617) 524-6050

Kendall Square Office One Cambridge Center Cambridge, Massachusetts (617) 646-4800

Newton Centre Office 1223 Centre Street Newton, Massachusetts (617) 646-4850

Seaport Office 157 Seaport Boulevard Boston, Massachusetts (617) 646-4880

Lexington Office

1666 Massachusetts Avenue Lexington, Massachusetts (617) 912-3600

Hingham Office

7 Central Street Hingham, Massachusetts (781) 740-2405

Beverly Office

57 Enon Street, Route 1A

Beverly, Massachusetts (978) 922-8000

BOSTON PRIVATE BANK & TRUST COMPANY

Headquarters: Ten Post Office Square • Boston, Massachusetts 02109

Telephone: (617) 912-1900 • www.bostonprivatebank.co

Member FDIC

EQUAL HOUSING LENDER