UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | |

| (Mark One) | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2020

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-09712

UNITED STATES CELLULAR CORPORATION

(Exact name of Registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 62-1147325 |

| (State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

8410 West Bryn Mawr, Chicago, Illinois 60631

(Address of principal executive offices) (Zip code)

Registrant's telephone number, including area code: (773) 399-8900

| | | | | | | | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Shares, $1 par value | | USM | | New York Stock Exchange |

| 6.95% Senior Notes due 2060 | | UZA | | New York Stock Exchange |

| 7.25% Senior Notes due 2063 | | UZB | | New York Stock Exchange |

| 7.25% Senior Notes due 2064 | | UZC | | New York Stock Exchange |

| 6.25% Senior Notes due 2069 | | UZD | | New York Stock Exchange |

| | | | | | | | | | | | | | | | | | | | | | | |

| Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | Yes | ☒ | No | ☐ |

| | | | | | | |

| Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). | Yes | ☒ | No | ☐ |

| | | | | | | |

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. |

| Large accelerated filer | ☒ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

| | | | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | Yes | ☐ | No | ☒ |

The number of shares outstanding of each of the issuer's classes of common stock, as of September 30, 2020, is 53,029,600 Common Shares, $1 par value, and 33,005,900 Series A Common Shares, $1 par value.

| | | | | |

| United States Cellular Corporation |

|

| Quarterly Report on Form 10-Q |

| For the Period Ended September 30, 2020 |

| |

| Index | Page No. |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | | |

| United States Cellular Corporation Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Executive Overview

The following discussion and analysis compares United States Cellular Corporation’s (UScellular) financial results for the three and nine months ended September 30, 2020, to the three and nine months ended September 30, 2019. It should be read in conjunction with UScellular’s interim consolidated financial statements and notes included herein, and with the description of UScellular’s business, its audited consolidated financial statements and Management's Discussion and Analysis of Financial Condition and Results of Operations (MD&A) included in UScellular’s Annual Report on Form 10-K (Form 10-K) for the year ended December 31, 2019. Certain numbers included herein are rounded to millions for ease of presentation; however, certain calculated amounts and percentages are determined using the unrounded numbers.

This report contains statements that are not based on historical facts, including the words “believes,” “anticipates,” “estimates,” “expects,” “plans,” “intends,” “projects” and similar expressions. These statements constitute and represent “forward looking statements” as this term is defined in the Private Securities Litigation Reform Act of 1995. Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, events or developments to be significantly different from any future results, events or developments expressed or implied by such forward looking statements. See Private Securities Litigation Reform Act of 1995 Safe Harbor Cautionary Statement for additional information.

UScellular uses certain “non-GAAP financial measures” and each such measure is identified in the MD&A. A discussion of the reason UScellular determines these metrics to be useful and reconciliations of these measures to their most directly comparable measures determined in accordance with accounting principles generally accepted in the United States of America (GAAP) are included in the Supplemental Information Relating to Non-GAAP Financial Measures section within the MD&A of this Form 10-Q Report.

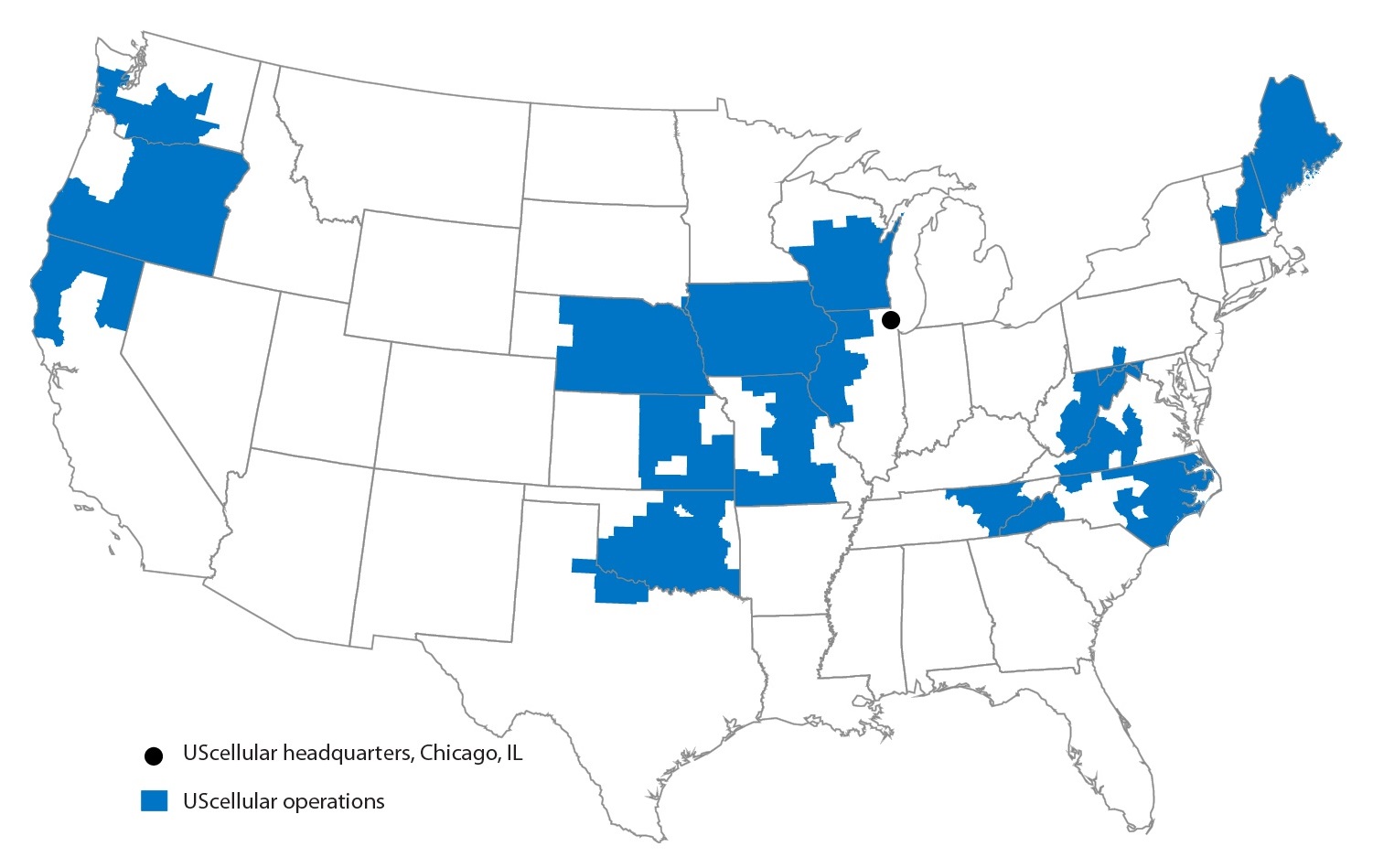

General

UScellular owns, operates, and invests in wireless markets throughout the United States. UScellular is an 82%-owned subsidiary of Telephone and Data Systems, Inc. (TDS). UScellular’s strategy is to attract and retain wireless customers through a value proposition comprised of a high-quality network, outstanding customer service, and competitive devices, plans, and pricing, all provided with a community focus.

COVID-19 considerations

The impact of the global spread of coronavirus (COVID-19) on UScellular's future operations is uncertain. There are many factors, including the severity and duration of the outbreak, as well as other direct and indirect impacts, that are expected to negatively impact UScellular.

COVID-19 impacts on UScellular's business for the nine months ended September 30, 2020 include a reduction in certain components of service revenues and equipment sales, a reduction in sales promotion costs and a reduction in handset subscriber gross additions and defections. The impacts of COVID-19 on this and future periods are expected to negatively affect UScellular’s results of operations, cash flows and financial position. The extent and duration of these impacts are uncertain due to many factors and could be material. Certain impacts on and actions by UScellular related to COVID-19 include, but are not limited to, the following:

•Taking action to keep associates safe, including implementing a work-from-home strategy for employees whose jobs can be performed remotely. In addition, to keep associates, customers, and communities safe, UScellular temporarily closes retail stores for enhanced cleanings, continues to operate with reduced store hours, and provides associates with personal protective equipment to be worn during customer interactions. UScellular has also implemented a daily health check process for associates and requires social distancing and mask wearing in all company facilities, including stores. Throughout this period of change, UScellular has continued serving its customers and ensuring its wireless network remains fully operational.

•Participation in the FCC Keep Americans Connected Pledge, through June 30, 2020, to not turn-off service or charge late fees due to a customer’s inability to pay their bill due to circumstances related to COVID-19. This resulted in a reduction in non-pay defections, as well as reduced service revenues, for the nine months ended September 30, 2020. During the third quarter of 2020, certain accounts that were part of the Pledge were terminated due to non-payment. Many of the remaining accounts that were on the Pledge are on payment arrangements of varying durations, and UScellular expects additional terminations due to non-payment in future periods.

•Waiving overage charges and certain other charges. This resulted in reduced service revenues during the three and nine months ended September 30, 2020.

•Supporting the communities in which UScellular operates. Through UScellular’s partnership with the Boys & Girls Clubs, UScellular has contributed to the Boys & Girls Clubs’ COVID-19 Relief Fund to support children, families and communities. These funds are dispersed directly to more than 50 clubs in UScellular’s service regions to support the most immediate needs of youth in areas of importance such as providing food for children who rely on their Boys & Girls Clubs for their dinner, care for children of essential workers and first responders, and digital learning resources. In addition to monetary donations, in-person volunteerism has been replaced by virtual volunteerism, with associates participating in events such as reading for the visually impaired and mentoring for students.

•Recognizing income tax benefits associated with the enactment of the CARES Act. This legislation resulted in a reduction to income tax expense for the three and nine months ended September 30, 2020 and is projected to result in a reduction of income tax expense recognized for the remainder of 2020 as part of the estimated annual effective tax rate, and a cash refund in 2021 of taxes paid in prior years.

•Monitoring its supply chain to assess impacts to availability and costs of device inventory and network equipment and services, including monitoring the dependency on third parties to continue network related projects. At this time, UScellular expects to be able to meet customer demand for devices and services and to be able to continue its 4G LTE network modernization and 5G deployment with no significant disruptions.

•Tracking increased customer usage. At this time, UScellular believes its network capacity is sufficient to accommodate expected increased usage.

•Monitoring roaming behaviors. Both inbound and outbound roaming traffic have been dampened by COVID-19 as wireless customers are reducing travel. The extent to which roaming traffic will be impacted by the pandemic in the future will depend upon governmental mandates and customer behavior in response to the outbreak.

See the following areas within this MD&A for additional discussion of the impacts of COVID-19:

•Operational Overview

•Financial Overview — Income tax expense

•Liquidity and Capital Resources

•Risk Factors

OPERATIONS

▪Serves customers with 5.0 million connections including 4.4 million postpaid, 0.5 million prepaid and 0.1 million reseller and other connections

▪Operates in 21 states

▪Employs approximately 5,300 associates

▪4,246 owned towers

▪6,758 cell sites in service

UScellular Mission and Strategy

UScellular’s mission is to provide exceptional wireless communication services which enhance consumers’ lives, increase the competitiveness of local businesses, and improve the efficiency of government operations in the mid-sized and rural markets served.

UScellular plans to continue to execute on its strategies to grow and protect its customer base, grow revenues, drive improvements in the overall cost structure, and invest in its network and system capabilities. Strategic efforts include:

▪UScellular offers economical and competitively priced service plans and devices to its customers and is focused on increasing revenues from sales of related products such as accessories and device protection plans and from new services such as home internet. In addition, UScellular is focused on expanding its solutions available to business and government customers.

▪UScellular continues to devote efforts to enhance its network capabilities. UScellular will complete its deployment of VoLTE technology in the fourth quarter of 2020. VoLTE technology allows customers to utilize a 4G LTE network for both voice and data services and offers enhanced services such as high definition voice and simultaneous voice and data sessions.

▪UScellular has launched commercial 5G services in portions of Iowa, Maine, Maryland, North Carolina, Oregon, Virginia, Washington, West Virginia and Wisconsin and will continue to launch in additional areas throughout 2020 and beyond. 5G technology is expected to help address customers' growing demand for data services as well as create opportunities for new services requiring high speed, reliability and low latency. In addition to the deployment of 5G technology, UScellular is also modernizing its 4G LTE network to further enhance 4G LTE speeds.

▪UScellular assesses its existing wireless interests on an ongoing basis with a goal of improving the competitiveness of its operations and maximizing its long-term return on capital. As part of this strategy, UScellular actively seeks attractive opportunities to acquire wireless spectrum, including pursuant to FCC auctions such as Auctions 103, 105 and 107.

Terms Used by UScellular

The following is a list of definitions of certain industry terms that are used throughout this document:

▪4G LTE – fourth generation Long-Term Evolution, which is a wireless technology that enables more network capacity for more data per user as well as faster access to data compared to third generation (3G) technology.

▪5G – fifth generation wireless technology that is expected to help address customers’ growing demand for data services as well as create opportunities for new services requiring high speed and reliability as well as low latency.

▪Account – represents an individual or business financially responsible for one or multiple associated connections. An account may include a variety of types of connections such as handsets and connected devices.

▪Auctions 103, 105 and 107 – Auction 103 is an FCC auction of 37, 39, and 47 GHz wireless spectrum licenses that started in December 2019 and concluded in March 2020. Auction 105 is an FCC auction of 3.5 GHz wireless spectrum licenses that started in July 2020 and concluded in September 2020. Auction 107 is an FCC auction of 3.7-3.98 GHz wireless spectrum licenses that is scheduled to begin in December 2020.

▪Churn Rate – represents the percentage of the connections that disconnect service each month. These rates represent the average monthly churn rate for each respective period.

▪Connections – individual lines of service associated with each device activated by a customer. Connections are associated with all types of devices that connect directly to the UScellular network.

▪Connected Devices – non-handset devices that connect directly to the UScellular network. Connected devices include products such as tablets, wearables, modems, and hotspots.

▪Coronavirus Aid, Relief, and Economic Security (CARES) Act – economic relief package signed into law on March 27, 2020 to address the public health and economic impacts of COVID-19, including a variety of tax provisions.

▪EBITDA – refers to earnings before interest, taxes, depreciation, amortization and accretion and is used in the non-GAAP metric Adjusted EBITDA throughout this document. See Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for additional information.

▪FCC Keep Americans Connected Pledge – voluntary FCC initiative in response to the COVID-19 pandemic to ensure that Americans do not lose their broadband or telephone connectivity as a result of the exceptional circumstance.

▪Free Cash Flow – non-GAAP metric defined as Cash flows from operating activities less Cash paid for additions to property, plant and equipment. See Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for additional information.

▪Gross Additions – represents the total number of new connections added during the period, without regard to connections that were terminated during that period.

▪Net Additions (Losses) – represents the total number of new connections added during the period, net of connections that were terminated during that period.

▪OIBDA – refers to operating income before depreciation, amortization and accretion and is used in the non-GAAP metric Adjusted OIBDA throughout this document. See Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for additional information.

▪Postpaid Average Revenue per Account (Postpaid ARPA) – metric which is calculated by dividing total postpaid service revenues by the average number of postpaid accounts and by the number of months in the period.

▪Postpaid Average Revenue per User (Postpaid ARPU) – metric which is calculated by dividing total postpaid service revenues by the average number of postpaid connections and by the number of months in the period.

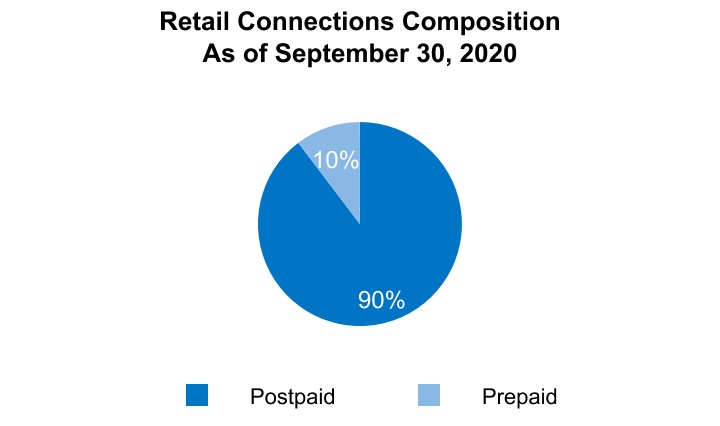

▪Retail Connections – the sum of postpaid connections and prepaid connections.

▪Universal Service Fund (USF) – a system of telecommunications collected fees and support payments managed by the FCC intended to promote universal access to telecommunications services in the United States.

▪VoLTE – Voice over Long-Term Evolution is a technology specification that defines the standards and procedures for delivering voice communications and related services over 4G LTE networks.

Operational Overview

| | | | | | | | | | | | | | | | | |

| | | | | |

| As of September 30, | | 2020 | | 2019 |

| Retail Connections – End of Period | | |

| Postpaid | | 4,401,000 | | | 4,395,000 |

| Prepaid | | 506,000 | | | 510,000 |

| Total | | 4,907,000 | | | 4,905,000 |

| | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q3 2020 | | Q3 2019 | | Q3 2020 vs. Q3 2019 | | YTD 2020 | | YTD 2019 | YTD 2020 vs. YTD 2019 |

| Postpaid Activity and Churn | |

| Gross Additions | | | | | | | | | | |

| Handsets | 102,000 | | | 124,000 | | | (18) | % | | 277,000 | | | 328,000 | | (16) | % |

| Connected Devices | 66,000 | | | 39,000 | | | 69 | % | | 152,000 | | | 108,000 | | 41 | % |

| Total Gross Additions | 168,000 | | | 163,000 | | | 3 | % | | 429,000 | | | 436,000 | | (2) | % |

| Net Additions (Losses) | | | | | | | | | | |

| Handsets | — | | | (2,000) | | | N/M | | (17,000) | | | (26,000) | | 35 | % |

| Connected Devices | 28,000 | | | (17,000) | | | N/M | | 32,000 | | | (51,000) | | N/M |

| Total Net Additions (Losses) | 28,000 | | | (19,000) | | | N/M | | 15,000 | | | (77,000) | | N/M |

| Churn | | | | | | | | | | |

| Handsets | 0.88 | % | | 1.09 | % | | | | 0.85 | % | | 1.02 | % | |

| Connected Devices | 2.35 | % | | 3.44 | % | | | | 2.56 | % | | 3.17 | % | |

| Total Churn | 1.06 | % | | 1.38 | % | | | | 1.05 | % | | 1.29 | % | |

N/M - Percentage change not meaningful

Total postpaid handset net additions increased for the three and nine months ended September 30, 2020, when compared to the same period last year. Handset defections decreased as a result of lower consumer switching activity related to COVID-19, as well as a reduction in non-pay defections. Partially offsetting the decrease in defections were lower gross additions resulting from lower consumer switching activity.

Total postpaid connected device net additions increased for the three and nine months ended September 30, 2020, when compared to the same period last year. The increase is due to (i) an increase in gross additions due to increased demand for internet related products given a need for remote connectivity related to COVID-19 and (ii) a decrease in tablet defections.

Postpaid Revenue

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2020 | | 2019 | | 2020 vs. 2019 | | 2020 | | 2019 | | 2020 vs. 2019 |

| Average Revenue Per User (ARPU) | $ | 47.10 | | | $ | 46.16 | | | 2 % | | $ | 46.84 | | | $ | 45.82 | | | 2 | % |

| | | | | | | | | | | |

| Average Revenue Per Account (ARPA) | $ | 123.27 | | | $ | 119.87 | | | 3 % | | $ | 122.28 | | | $ | 119.39 | | | 2 | % |

| | | | | | | | | | | |

Postpaid ARPU and Postpaid ARPA increased for the three and nine months ended September 30, 2020, when compared to the same period last year, due primarily to (i) an increase in device protection plan revenues, (ii) an increase in regulatory recovery revenues, and (iii) having proportionately fewer tablet connections, which on a per-unit basis contribute less revenue than other connected devices and smartphones. In addition, an increase in average connections per account for the three and nine months ended September 30, 2020, when compared to the same periods last year, contributed to the increase in Postpaid ARPA. These increases were partially offset by the impact of waiving overage charges and late payment and related fees, measures UScellular took to assist customers during the COVID-19 pandemic.

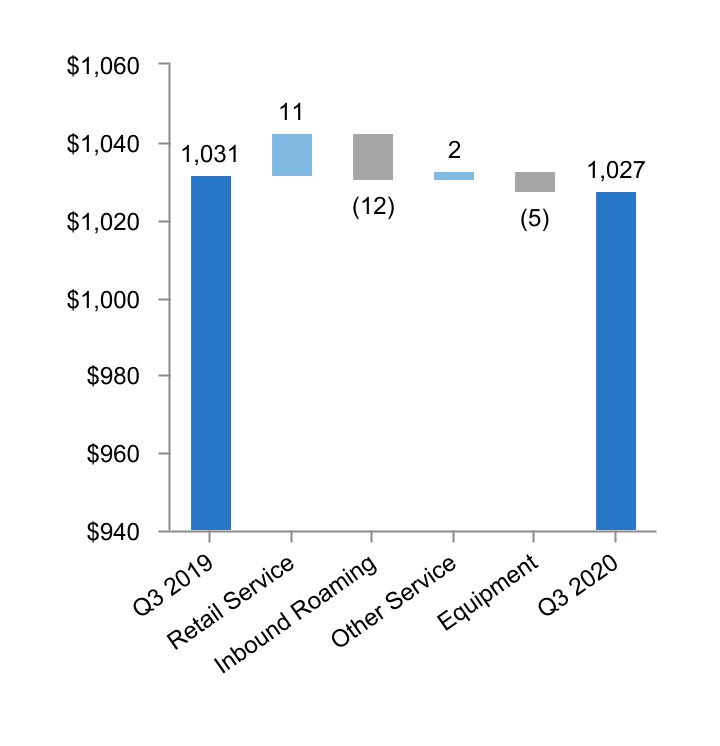

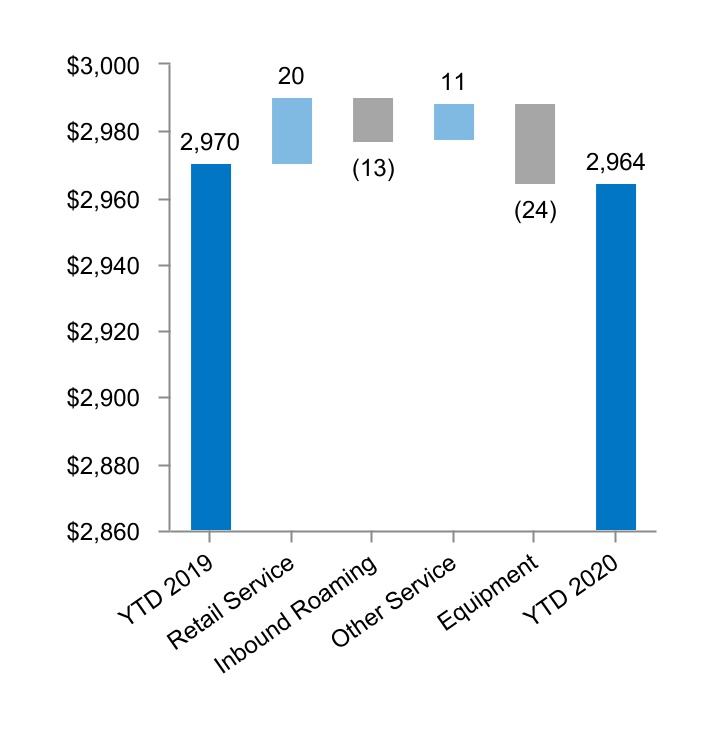

Financial Overview

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2020 | | 2019 | | 2020 vs. 2019 | | 2020 | | 2019 | | 2020 vs. 2019 |

| (Dollars in millions) | | | | | | | | | | | |

| Retail service | $ | 674 | | | $ | 663 | | | 2 | % | | $ | 2,004 | | | $ | 1,984 | | | 1 | % |

| Inbound roaming | 42 | | | 54 | | | (23) | % | | 119 | | | 132 | | | (10) | % |

| Other | 59 | | | 57 | | | 3 | % | | 167 | | | 156 | | | 7 | % |

| Service revenues | 775 | | | 774 | | | – | | 2,290 | | | 2,272 | | | 1 | % |

| Equipment sales | 252 | | | 257 | | | (2) | % | | 674 | | | 698 | | | (3) | % |

| Total operating revenues | 1,027 | | | 1,031 | | | – | | 2,964 | | | 2,970 | | | – |

| | | | | | | | | | | |

| System operations (excluding Depreciation, amortization and accretion reported below) | 203 | | | 199 | | | 2 | % | | 580 | | | 568 | | | 2 | % |

| Cost of equipment sold | 257 | | | 266 | | | (4) | % | | 692 | | | 724 | | | (4) | % |

| Selling, general and administrative | 335 | | | 358 | | | (6) | % | | 994 | | | 1,027 | | | (3) | % |

| Depreciation, amortization and accretion | 161 | | | 181 | | | (11) | % | | 516 | | | 524 | | | (2) | % |

| | | | | | | | | | | |

| (Gain) loss on asset disposals, net | 6 | | | 5 | | | 15 | % | | 14 | | | 13 | | | 10 | % |

| (Gain) loss on sale of business and other exit costs, net | — | | | — | | | N/M | | — | | | (1) | | | N/M |

| (Gain) loss on license sales and exchanges, net | — | | | 2 | | | N/M | | — | | | — | | | N/M |

| Total operating expenses | 962 | | | 1,011 | | | (5) | % | | 2,796 | | | 2,855 | | | (2) | % |

| | | | | | | | | | | |

| Operating income | $ | 65 | | | $ | 20 | | | N/M | | $ | 168 | | | $ | 115 | | | 46 | % |

| | | | | | | | | | | |

| Net income | $ | 85 | | | $ | 24 | | | N/M | | $ | 227 | | | $ | 115 | | | 98 | % |

Adjusted OIBDA (Non-GAAP)1 | $ | 232 | | | $ | 208 | | | 12 | % | | $ | 698 | | | $ | 651 | | | 7 | % |

Adjusted EBITDA (Non-GAAP)1 | $ | 282 | | | $ | 256 | | | 10 | % | | $ | 841 | | | $ | 793 | | | 6 | % |

Capital expenditures2 | $ | 216 | | | $ | 170 | | | 27 | % | | $ | 621 | | | $ | 467 | | | 33 | % |

N/M - Percentage change not meaningful

1Refer to Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for a reconciliation of this measure.

2Refer to Liquidity and Capital Resources within this MD&A for additional information on Capital expenditures.

Operating Revenues

Three Months Ended September 30, 2020 and 2019

(Dollars in millions)

Operating Revenues

Nine Months Ended September 30, 2020 and 2019

(Dollars in millions)

Service revenues consist of:

▪Retail Service - Charges for voice, data and value-added services and recovery of regulatory costs

▪Inbound Roaming - Charges to other wireless carriers whose customers use UScellular’s wireless systems when roaming

▪Other Service - Amounts received from the Federal USF, tower rental revenues, and miscellaneous other service revenues

Equipment revenues consist of:

▪Sales of wireless devices and related accessories to new and existing customers, agents, and third-party distributors

Key components of changes in the statement of operations line items were as follows:

Total operating revenues

Retail service revenues increased for the three and nine months ended September 30, 2020, primarily as a result of an increase in Postpaid ARPU as previously discussed in the Operational Overview section, partially offset by a decline in the average number of postpaid subscribers.

Inbound roaming revenues decreased for the three months ended September 30, 2020, primarily driven by lower data revenues resulting from lower rates. Inbound roaming revenues decreased for the nine months ended September 30, 2020, primarily driven by lower data revenues, with lower rates partially offset by higher usage. UScellular expects inbound roaming revenues to continue to decline as a result of a decrease in rates, and the merger of Sprint and T-Mobile.

Other service revenues increased for the nine months ended September 30, 2020, resulting from increases in tower rental revenues and miscellaneous other service revenues.

Equipment sales revenues decreased for the three and nine months ended September 30, 2020, due primarily to a decrease in new smartphone and accessory sales, partially offset by an increase in used smartphone sales.

System operations expenses

System operations expenses increased for the three months ended September 30, 2020, due to an increase in roaming expense as a result of higher data roaming usage, partially offset by lower data rates, and an increase in cell site rent expense. System operations expenses increased for the nine months ended September 30, 2020 due to increased cell site rent expense, non-capitalizable costs to add network capacity and costs to decommission network assets, partially offset by a decrease in roaming expense as a result of lower data rates, partially offset by higher data usage.

Cost of equipment sold

Cost of equipment sold decreased for the three and nine months ended September 30, 2020, due primarily to a decrease in new smartphone and accessory sales, partially offset by an increase in used smartphone sales.

Selling, general and administrative expenses

Selling, general and administrative expenses decreased for the three and nine months ended September 30, 2020, driven primarily by a decrease in bad debts expense.

Depreciation, amortization and accretion

Depreciation, amortization, and accretion decreased for the three months ended September 30, 2020, due to certain billing system assets reaching their end of life and lower accelerated depreciation of certain assets due to changes in network technology. Depreciation, amortization, and accretion decreased for the nine months ended September 30, 2020, due to certain billing system assets reaching their end of life, partially offset by accelerated depreciation of certain assets due to changes in network technology.

Components of Other Income (Expense)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2020 | | 2019 | | 2020 vs. 2019 | | 2020 | | 2019 | | 2020 vs. 2019 |

| (Dollars in millions) | | | | | | | | | | | |

| Operating income | $ | 65 | | | $ | 20 | | | N/M | | $ | 168 | | | $ | 115 | | | 46 | % |

| | | | | | | | | | | |

| Equity in earnings of unconsolidated entities | 48 | | | 44 | | | 10 | % | | 137 | | | 128 | | | 7 | % |

| Interest and dividend income | 2 | | | 4 | | | (59) | % | | 6 | | | 14 | | | (55) | % |

| Gain (loss) on investments | 3 | | | — | | | N/M | | 3 | | | — | | | N/M |

| Interest expense | (29) | | | (29) | | | – | | (76) | | | (87) | | | 11 | % |

| | | | | | | | | | | |

| Total investment and other income | 24 | | | 19 | | | 27 | % | | 70 | | | 55 | | | 27 | % |

| | | | | | | | | | | |

| Income before income taxes | 89 | | | 39 | | | N/M | | 238 | | | 170 | | | 40 | % |

| Income tax expense | 4 | | | 15 | | | (78) | % | | 11 | | | 55 | | | (80) | % |

| | | | | | | | | | | |

| Net income | 85 | | | 24 | | | N/M | | 227 | | | 115 | | | 98 | % |

| Less: Net income attributable to noncontrolling interests, net of tax | — | | | 1 | | | (28) | % | | 3 | | | 6 | | | (47) | % |

| Net income attributable to UScellular shareholders | $ | 85 | | | $ | 23 | | | N/M | | $ | 224 | | | $ | 109 | | | N/M |

N/M - Percentage change not meaningful

Equity in earnings of unconsolidated entities

Equity in earnings of unconsolidated entities represents UScellular’s share of net income from entities in which it has a noncontrolling interest and that are accounted for using the equity method. UScellular’s investment in the Los Angeles SMSA Limited Partnership (LA Partnership) contributed pretax income of $20 million for both the three months ended September 30, 2020 and 2019, and $63 million and $60 million for the nine months ended September 30, 2020 and 2019, respectively. See Note 8 — Investments in Unconsolidated Entities in the Notes to Consolidated Financial Statements for additional information.

Interest and dividend income

Interest and dividend income decreased for the three and nine months ended September 30, 2020, primarily driven by lower interest rates.

Gain (Loss) on investments

The Gain on investments for the three and nine months ended September 30, 2020 relates to UScellular’s divestiture of a non-strategic investment.

Interest expense

Interest expense decreased for the nine months ended September 30, 2020, primarily as a result of a higher amount of capitalized interest. Also contributing to the decrease was a $100 million principal prepayment made in October 2019 on a senior term loan. These factors were partially offset by an increase in interest expense related to new borrowings.

Income tax expense

The effective tax rate on Income before income taxes for the three months ended September 30, 2020 and 2019, was 3.7% and 37.4%, respectively. The effective tax rate on Income before income taxes for the nine months ended September 30, 2020 and 2019, was 4.7% and 32.5%, respectively. The lower effective tax rate in 2020 as compared to 2019 is due primarily to the income tax benefits of the CARES Act enacted on March 27, 2020.

The CARES Act provides retroactive eligibility of bonus depreciation on qualified improvement property put into service after December 31, 2017 and a 5-year carryback of net operating losses generated in years 2018-2020. As the statutory federal tax rate applicable to certain years within the carryback period is 35%, carryback to those years provides a tax benefit in excess of the current federal statutory rate of 21%, resulting in a reduction of income tax expense. UScellular projects that the income tax effects of the CARES Act will result in a reduction of income tax expense recognized throughout the 2020 tax year as part of the estimated annual effective tax rate, and a cash refund in 2021 of taxes paid in prior years.

Liquidity and Capital Resources

Sources of Liquidity

UScellular operates a capital-intensive business. Historically, UScellular has used internally-generated funds and also has obtained substantial funds from external sources for general corporate purposes. In the past, UScellular’s existing cash and investment balances, funds available under its revolving credit and receivables securitization agreements, funds from other financing sources, including a term loan and other long-term debt, and cash flows from operating and certain investing and financing activities, including sales of assets or businesses, provided sufficient liquidity and financial flexibility for UScellular to meet its normal day-to-day operating needs and debt service requirements, to finance the build-out and enhancement of markets and to fund acquisitions, primarily of wireless spectrum licenses. There is no assurance that this will be the case in the future. See Market Risk for additional information regarding maturities of long-term debt.

UScellular has incurred negative free cash flow at times in the past and this could occur in the future, and forecasting future cash flow is more challenging with the various risks and uncertainties related to COVID-19. However, UScellular believes that existing cash and investment balances, funds available under its revolving credit, term loan and receivables securitization agreements, and expected cash flows from operating and investing activities will provide sufficient liquidity for UScellular to meet its normal day-to-day operating needs and debt service requirements for the coming year. UScellular will continue to monitor the rapidly changing business and market conditions and plans to take appropriate actions, as necessary, to meet its liquidity needs.

UScellular may require substantial additional capital for, among other uses, funding day-to-day operating needs including working capital, acquisitions of providers of wireless telecommunications services, wireless spectrum license or system acquisitions, capital expenditures, debt service requirements, the repurchase of shares, or making additional investments. It may be necessary from time to time to increase the size of the existing revolving credit agreement, to put in place new credit agreements, or to obtain other forms of financing in order to fund potential expenditures. UScellular made payments related to wireless spectrum auctions in 2020 (see Regulatory Matters - Spectrum Auctions). UScellular also expects annual capital expenditures in 2020 to be higher than in 2019, due primarily to investments to enhance network speed and capacity and to continue deploying VoLTE and 5G technology in its network. UScellular’s liquidity would be adversely affected if, among other things, UScellular is unable to obtain financing on acceptable terms, UScellular makes significant wireless spectrum license purchases, distributions from unconsolidated entities are discontinued or significantly reduced compared to historical levels, or Federal USF and/or other regulatory support payments decline.

UScellular’s credit rating currently is sub-investment grade. There can be no assurance that sufficient funds will continue to be available to UScellular or its subsidiaries on terms or at prices acceptable to UScellular. Insufficient cash flows from operating activities, changes in UScellular's credit ratings, defaults of the terms of debt or credit agreements, uncertainty of access to capital, deterioration in the capital markets, reduced regulatory capital at banks which in turn limits their ability to borrow and lend, other changes in the performance of UScellular or in market conditions or other factors could limit or restrict the availability of financing on terms and prices acceptable to UScellular, which could require UScellular to reduce its acquisition, capital expenditure and business development programs, reduce the acquisition of wireless spectrum licenses, and/or reduce or cease share repurchases. Any of the foregoing developments would have an adverse impact on UScellular’s business, financial condition or results of operations. UScellular cannot provide assurance that circumstances that could have a material adverse effect on its liquidity or capital resources will not occur.

Cash and Cash Equivalents

Cash and cash equivalents include cash and money market investments. The primary objective of UScellular’s Cash and cash equivalents is for use in its operations and acquisition, capital expenditure and business development programs including the purchase of wireless spectrum licenses.

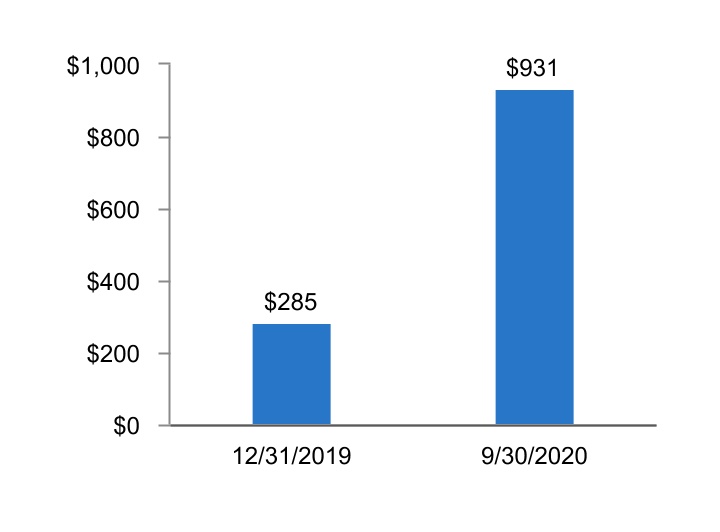

Cash and Cash Equivalents

(Dollars in millions)

At September 30, 2020, UScellular's cash and cash equivalents totaled $931 million compared to $285 million at December 31, 2019.

The majority of UScellular’s Cash and cash equivalents are held in bank deposit accounts and in money market funds that purchase only debt issued by the U.S. Treasury or U.S. government agencies.

Financing

In March 2020, UScellular entered into a new $300 million unsecured revolving credit agreement with certain lenders and other parties. Amounts under the new revolving credit agreement may be borrowed, repaid and reborrowed from time to time until maturity in March 2025. As a result of the new agreement, UScellular's previous revolving credit agreement due to expire in May 2023 was terminated. As of September 30, 2020, there were no outstanding borrowings under the revolving credit agreement, except for letters of credit, and the unused borrowing capacity was $298 million.

In March 2020, UScellular amended its senior term loan credit agreement in order to conform the agreement with its revolving credit agreement. There were no significant changes to other key terms of the senior term loan credit agreement. In June 2020, UScellular amended and restated its senior term loan agreement and increased its borrowing capacity to $300 million. There were no significant changes to other key terms of the UScellular senior term loan credit agreement. As of September 30, 2020, the unused borrowing capacity was $217 million.

UScellular, through its subsidiaries, also has a receivables securitization agreement to permit securitized borrowings using its equipment installment plan receivables. In April 2020, UScellular borrowed $125 million under its receivables securitization agreement. The unused capacity under this agreement was $75 million as of September 30, 2020, subject to sufficient collateral to satisfy the asset borrowing base provisions of the agreement. In October 2020, UScellular amended and restated its receivables securitization agreement to increase its total borrowing capacity to $300 million and extend the expiration date of the agreement to December 2022. There were no significant changes to other key terms of the receivables securitization agreement.

UScellular believes that it was in compliance with all of the financial covenants and requirements set forth in its revolving credit agreement, senior term loan credit agreement and receivables securitization agreement as of September 30, 2020.

In August 2020, UScellular issued $500 million of 6.25% Senior Notes due in 2069 for general corporate purposes.

See Note 9 — Debt in the Notes to Consolidated Financial Statements for additional information related to the receivables securitization agreement and 6.25% Senior Notes.

UScellular has an effective shelf registration statement on Form S-3 to issue senior or subordinated debt securities.

Capital Expenditures

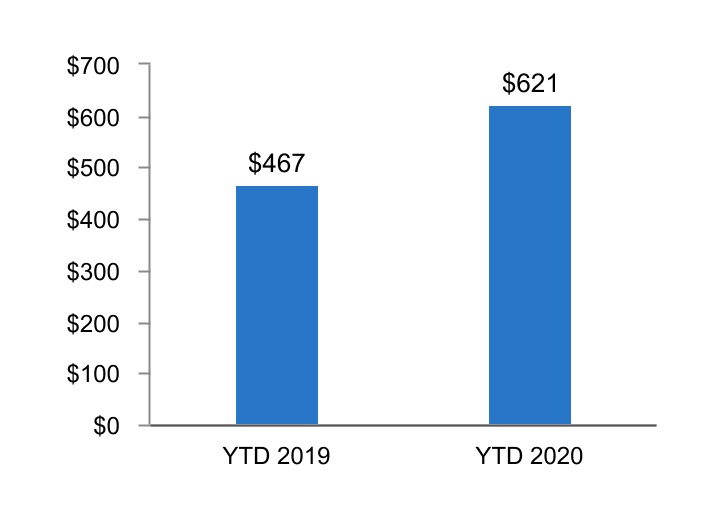

Capital expenditures (i.e., additions to property, plant and equipment and system development expenditures; excludes wireless spectrum license additions), which include the effects of accruals and capitalized interest, for the nine months ended September 30, 2020 and 2019, were as follows:

Capital Expenditures

(Dollars in millions)

UScellular’s capital expenditures for the nine months ended September 30, 2020 and 2019, were $621 million and $467 million, respectively.

Capital expenditures for the full year 2020 are expected to be between $850 million and $950 million. These expenditures are expected to be used principally for the following purposes:

▪Enhance and maintain UScellular's network coverage, including deploying VoLTE technology and providing additional speed and capacity to accommodate increased data usage by current customers;

▪Continue deploying 5G technology in its network; and

▪Invest in information technology to support existing and new services and products.

UScellular intends to finance its capital expenditures for 2020 using primarily Cash flows from operating activities, existing cash balances and, if required, additional debt financing from its receivables securitization agreement, senior term loan credit agreement, revolving credit agreement and/or other forms of financing.

Acquisitions, Divestitures and Exchanges

UScellular may be engaged from time to time in negotiations (subject to all applicable regulations) relating to the acquisition, divestiture or exchange of companies, properties or wireless spectrum licenses (including pursuant to FCC auctions). In general, UScellular may not disclose such transactions until there is a definitive agreement.

Variable Interest Entities

UScellular consolidates certain “variable interest entities” as defined under GAAP. See Note 10 — Variable Interest Entities in the Notes to Consolidated Financial Statements for additional information related to these variable interest entities. UScellular may elect to make additional capital contributions and/or advances to these variable interest entities in future periods in order to fund their operations.

Common Share Repurchase Program

During the nine months ended September 30, 2020, UScellular repurchased 803,836 Common Shares for $23 million at an average cost per share of $29.00. As of September 30, 2020, the total cumulative amount of UScellular Common Shares authorized to be repurchased is 4,507,000. For additional information related to the current repurchase authorization, see Unregistered Sales of Equity Securities and Use of Proceeds.

Contractual and Other Obligations

There were no material changes outside the ordinary course of business between December 31, 2019 and September 30, 2020, to the Contractual and Other Obligations disclosed in MD&A included in UScellular’s Form 10-K for the year ended December 31, 2019, except for the following items. In April 2020, UScellular borrowed $125 million under its receivables securitization agreement. In August 2020, UScellular issued $500 million of 6.25% Senior Notes due in 2069.

Off-Balance Sheet Arrangements

UScellular had no transactions, agreements or other contractual arrangements with unconsolidated entities involving “off-balance sheet arrangements,” as defined by SEC rules, that had or are reasonably likely to have a material current or future effect on its financial condition, results of operations, liquidity, capital expenditures or capital resources.

Consolidated Cash Flow Analysis

UScellular operates a capital-intensive business. UScellular makes substantial investments to acquire wireless spectrum licenses and properties and to construct and upgrade wireless telecommunications networks and facilities as a basis for creating long-term value for shareholders. In recent years, rapid changes in technology and new opportunities have required substantial investments in potentially revenue‑enhancing and cost-saving upgrades to UScellular’s networks. Cash flows may fluctuate from quarter to quarter and year to year due to seasonality, the timing of acquisitions and divestitures, capital expenditures and other factors. The following discussion summarizes UScellular's cash flow activities for the nine months ended September 30, 2020 and 2019.

2020 Commentary

UScellular’s Cash, cash equivalents and restricted cash increased $657 million. Net cash provided by operating activities was $950 million due to net income of $227 million adjusted for non-cash items of $626 million, distributions received from unconsolidated entities of $118 million including $43 million in distributions from the LA Partnership, and changes in working capital items which decreased net cash by $21 million. The working capital changes were primarily influenced by tax impacts from the CARES Act and annual employee bonus payments, partially offset by the timing of vendor payments and collections of customer and agent receivables.

Cash flows used for investing activities were $855 million. Cash paid for additions to property, plant and equipment totaled $690 million. Cash payments for wireless spectrum license acquisitions were $169 million.

Cash flows provided by financing activities were $562 million, reflecting the issuance of $500 million of 6.25% Senior Notes and $125 million borrowed under the receivables securitization agreement. These were partially offset by the repurchase of $23 million of Common Shares and payment of debt issuance costs of $20 million.

2019 Commentary

UScellular’s Cash, cash equivalents and restricted cash decreased $8 million. Net cash provided by operating activities was $687 million due to net income of $115 million plus non-cash items of $486 million and distributions received from unconsolidated entities of $99 million, including $33 million in distributions from the LA Partnership. This was offset by changes in working capital items which decreased net cash by $13 million. The more significant working capital changes were increases in accounts receivables and equipment installment plan receivables, offset by an increase to accrued taxes.

Cash flows used for investing activities were $647 million. Cash paid for additions to property, plant and equipment totaled $439 million. Cash payments for wireless spectrum license acquisitions were $257 million. These were partially offset by Cash received from divestitures and exchanges of $32 million and cash received from the redemption of short-term Treasury bills of $29 million.

Cash flows used for financing activities were $48 million, reflecting the repurchase of $21 million of Common Shares and ordinary activity such as the scheduled repayments of debt.

Consolidated Balance Sheet Analysis

The following discussion addresses certain captions in the consolidated balance sheet and changes therein. This discussion is intended to highlight the significant changes and is not intended to fully reconcile the changes. Changes in financial condition during 2020 were as follows:

Income taxes receivable

Income taxes receivable increased $128 million primarily reflecting future tax refunds attributable to the expected carryback of 2020 net operating losses, as allowed under the CARES Act which was enacted in March 2020.

Deferred income tax liability, net

Deferred income tax liability, net increased $158 million due primarily to full deductibility for tax purposes of qualified property placed in service during the current year.

Long-term debt, net

Long-term debt, net increased $606 million due primarily to $500 million of 6.25% Senior Notes issued in August 2020 and $125 million borrowed under UScellular's receivables securitization agreement in April 2020.

Supplemental Information Relating to Non-GAAP Financial Measures

UScellular sometimes uses information derived from consolidated financial information but not presented in its financial statements prepared in accordance with GAAP to evaluate the performance of its business. Specifically, UScellular has referred to the following measures in this Form 10-Q Report:

▪EBITDA

▪Adjusted EBITDA

▪Adjusted OIBDA

▪Free cash flow

Certain of these measures are considered “non-GAAP financial measures” under U.S. Securities and Exchange Commission Rules. Following are explanations of each of these measures.

EBITDA, Adjusted EBITDA and Adjusted OIBDA

EBITDA, Adjusted EBITDA and Adjusted OIBDA are defined as net income adjusted for the items set forth in the reconciliation below. EBITDA, Adjusted EBITDA and Adjusted OIBDA are not measures of financial performance under GAAP and should not be considered as alternatives to Net income or Cash flows from operating activities, as indicators of cash flows or as measures of liquidity. UScellular does not intend to imply that any such items set forth in the reconciliation below are non-recurring, infrequent or unusual; such items may occur in the future.

Management uses Adjusted EBITDA and Adjusted OIBDA as measurements of profitability, and therefore reconciliations to Net income and Operating income are deemed appropriate. Management believes Adjusted EBITDA and Adjusted OIBDA are useful measures of UScellular’s operating results before significant recurring non-cash charges, gains and losses, and other items as presented below as they provide additional relevant and useful information to investors and other users of UScellular’s financial data in evaluating the effectiveness of its operations and underlying business trends in a manner that is consistent with management’s evaluation of business performance. Adjusted EBITDA shows adjusted earnings before interest, taxes, depreciation, amortization and accretion, and gains and losses, while Adjusted OIBDA reduces this measure further to exclude Equity in earnings of unconsolidated entities and Interest and dividend income in order to more effectively show the performance of operating activities excluding investment activities. The following table reconciles EBITDA, Adjusted EBITDA and Adjusted OIBDA to the corresponding GAAP measures, Net income and Operating income.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2020 | | 2019 | | 2020 | | 2019 |

| (Dollars in millions) | | | | | | | |

| Net income (GAAP) | $ | 85 | | | $ | 24 | | | $ | 227 | | | $ | 115 | |

| Add back: | | | | | | | |

| Income tax expense | 4 | | | 15 | | | 11 | | | 55 | |

| Interest expense | 29 | | | 29 | | | 76 | | | 87 | |

| Depreciation, amortization and accretion | 161 | | | 181 | | | 516 | | | 524 | |

| EBITDA (Non-GAAP) | 279 | | | 249 | | | 830 | | | 781 | |

| Add back or deduct: | | | | | | | |

| | | | | | | |

| (Gain) loss on asset disposals, net | 6 | | | 5 | | | 14 | | | 13 | |

| (Gain) loss on sale of business and other exit costs, net | — | | | — | | | — | | | (1) | |

| (Gain) loss on license sales and exchanges, net | — | | | 2 | | | — | | | — | |

| (Gain) loss on investments | (3) | | | — | | | (3) | | | — | |

| Adjusted EBITDA (Non-GAAP) | 282 | | | 256 | | | 841 | | | 793 | |

| Deduct: | | | | | | | |

| Equity in earnings of unconsolidated entities | 48 | | | 44 | | | 137 | | | 128 | |

| Interest and dividend income | 2 | | | 4 | | | 6 | | | 14 | |

| | | | | | | |

| Adjusted OIBDA (Non-GAAP) | 232 | | | 208 | | | 698 | | | 651 | |

| Deduct: | | | | | | | |

| Depreciation, amortization and accretion | 161 | | | 181 | | | 516 | | | 524 | |

| | | | | | | |

| (Gain) loss on asset disposals, net | 6 | | | 5 | | | 14 | | | 13 | |

| (Gain) loss on sale of business and other exit costs, net | — | | | — | | | — | | | (1) | |

| (Gain) loss on license sales and exchanges, net | — | | | 2 | | | — | | | — | |

| Operating income (GAAP) | $ | 65 | | | $ | 20 | | | $ | 168 | | | $ | 115 | |

Free Cash Flow

The following table presents Free cash flow, which is defined as Cash flows from operating activities less Cash paid for additions to property, plant and equipment. Free cash flow is a non-GAAP financial measure which UScellular believes may be useful to investors and other users of its financial information in evaluating liquidity, specifically, the amount of net cash generated by business operations after deducting Cash paid for additions to property, plant and equipment.

| | | | | | | | | | | |

| Nine Months Ended

September 30, |

| 2020 | | 2019 |

| (Dollars in millions) | | | |

| Cash flows from operating activities (GAAP) | $ | 950 | | | $ | 687 | |

| Less: Cash paid for additions to property, plant and equipment | 690 | | | 439 | |

| Free cash flow (Non-GAAP) | $ | 260 | | | $ | 248 | |

Application of Critical Accounting Policies and Estimates

UScellular prepares its consolidated financial statements in accordance with GAAP. UScellular’s significant accounting policies are discussed in detail in Note 1 — Summary of Significant Accounting Policies and Recent Accounting Pronouncements, Note 2 — Revenue Recognition and Note 10 — Leases in the Notes to Consolidated Financial Statements and UScellular’s Application of Critical Accounting Policies and Estimates is discussed in detail in Management’s Discussion and Analysis of Financial Condition and Results of Operations, both of which are included in UScellular’s Form 10-K for the year ended December 31, 2019.

Recent Accounting Pronouncements

See Note 1 — Basis of Presentation in the Notes to Consolidated Financial Statements for information on recent accounting pronouncements.

Regulatory Matters

5G Fund

On October 27, 2020, the FCC adopted rules creating the 5G Fund for Rural America, which will distribute up to $9 billion over ten years to bring 5G wireless broadband connectivity to rural America. The 5G Fund will be implemented through a two-phase competitive process, using multi-round auctions to award support. The winning bidders will be required to meet certain minimum speed requirements and interim and final deployment milestones. The order provides that the 5G Fund be in lieu of the previously proposed fund (the Phase II Connect America Mobility Fund) for the development of 4G LTE. The order also provides that over time a growing percentage of the legacy support a carrier receives must be used for 5G deployment.

UScellular cannot predict at this time when the 5G fund auction will occur, when the phase down period for its existing legacy support from the Federal USF will commence, or whether the 5G fund auction will provide opportunities to UScellular to offset any loss in existing support.

FCC Rulemaking - Restoring Internet Freedom

In December 2017, the FCC approved rules reversing or revising decisions made in the FCC’s 2015 Open Internet and Title II Order (Restoring Internet Freedom). The 2017 action reversed the FCC’s 2015 decision to reclassify Broadband Internet Access Services as telecommunications services subject to regulation under Title II of the Telecommunications Act. The 2017 action also reversed the FCC’s 2015 restrictions on blocking, throttling and paid prioritization, and modified transparency rules relating to such practices. Several parties filed suit in federal court challenging the 2017 actions. On October 1, 2019, the Court of Appeals for the D.C. Circuit issued an order reaffirming the FCC in most respects, but limiting the FCC's ability to preempt state and local net neutrality laws. On February 19, 2020, the FCC issued a Public Notice seeking comment on three issues under further consideration by the FCC based on a recent D.C. Circuit decision. On October 27, 2020, the FCC adopted an Order on Remand in response to the U.S. Court of Appeals for the D.C. Circuit’s remand on the three issues under further consideration by the FCC and found no basis to alter the FCC’s conclusions in the Restoring Internet Freedom Order.

A number of states, including certain states in which UScellular operates, have adopted or considered laws intended to reinstate aspects of the foregoing net neutrality regulations that were reversed or revised by the FCC in 2017. To the extent such laws are enacted, it is expected that legal proceedings will be pursued challenging such laws, subject now to the DC Circuit ruling limiting the FCC's preemptive authority in this matter. UScellular cannot predict the outcome of these proceedings or the impact on its business.

Spectrum Auctions

On July 11, 2019, the FCC released a Public Notice establishing procedures for an auction offering wireless spectrum licenses in the 37, 39 and 47 GHz bands (Auction 103). On March 12, 2020, the FCC announced by public notice that UScellular was the provisional winning bidder for 237 wireless spectrum licenses for a purchase price of $146 million. In June 2020, the wireless spectrum licenses from Auction 103 were granted by the FCC.

On March 2, 2020, the FCC released a Public Notice establishing procedures for an auction offering wireless spectrum licenses in the 3.5 GHz band (Auction 105). On September 2, 2020, the FCC announced by public notice that UScellular was the provisional winning bidder for 243 wireless spectrum licenses for a purchase price of $14 million. The wireless spectrum licenses are expected to be granted by the FCC in the fourth quarter of 2020.

On August 7, 2020, the FCC released a Public Notice establishing procedures for an auction offering wireless spectrum licenses in the 3.7-3.98 GHz bands (Auction 107). UScellular filed an application to participate in Auction 107 on September 21, 2020. Bidding in Auction 107 is scheduled to begin on December 8, 2020.

Rural Digital Opportunity Fund

On January 30, 2020, the FCC adopted the Rural Digital Opportunity Fund Report and Order, which establishes the framework for the Rural Digital Opportunity Fund (Auction 904). Auction 904 is a two phase reverse auction to provide funding for high speed fixed broadband service in underserved rural areas. On July 15, 2020, UScellular filed an application to participate in Auction 904. Phase I began on October 29, 2020.

Private Securities Litigation Reform Act of 1995

Safe Harbor Cautionary Statement

This Form 10-Q, including exhibits, contains statements that are not based on historical facts and represent forward-looking statements, as this term is defined in the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, that address activities, events or developments that UScellular intends, expects, projects, believes, estimates, plans or anticipates will or may occur in the future are forward-looking statements. The words “believes,” “anticipates,” “estimates,” “expects,” “plans,” “intends,” “projects” and similar expressions are intended to identify these forward-looking statements, but are not the exclusive means of identifying them. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, events or developments to be significantly different from any future results, events or developments expressed or implied by such forward-looking statements. Such risks, uncertainties and other factors include, but are not limited to, those set forth below, as more fully described under “Risk Factors” in UScellular’s Form 10-K for the year ended December 31, 2019 and in this Form 10-Q. Each of the following risks could have a material adverse effect on UScellular’s business, financial condition or results of operations. However, such factors are not necessarily all of the important factors that could cause actual results, performance or achievements to differ materially from those expressed in, or implied by, the forward-looking statements contained in this document. Other unknown or unpredictable factors also could have material adverse effects on future results, performance or achievements. UScellular undertakes no obligation to update publicly any forward-looking statements whether as a result of new information, future events or otherwise. You should carefully consider the Risk Factors in UScellular’s Form 10-K for the year ended December 31, 2019, the following factors and other information contained in, or incorporated by reference into, this Form 10-Q to understand the material risks relating to UScellular’s business, financial condition or results of operations.

▪The impact of the COVID-19 pandemic on UScellular's business is uncertain, but depending on its duration and severity it could have a material adverse effect on UScellular's business, financial condition or results of operations.

▪Intense competition in the markets in which UScellular operates could adversely affect UScellular’s revenues or increase its costs to compete.

▪A failure by UScellular to successfully execute its business strategy (including planned acquisitions, spectrum acquisitions, divestitures and exchanges) or allocate resources or capital effectively could have an adverse effect on UScellular’s business, financial condition or results of operations.

▪Uncertainty in UScellular’s future cash flow and liquidity or the inability to access capital, deterioration in the capital markets, other changes in UScellular’s performance or market conditions, changes in UScellular’s credit ratings or other factors could limit or restrict the availability of financing on terms and prices acceptable to UScellular, which could require UScellular to reduce its construction, development or acquisition programs, reduce the amount of wireless spectrum licenses acquired, and/or reduce or cease share repurchases.

▪UScellular has a significant amount of indebtedness which could adversely affect its financial performance and in turn adversely affect its ability to make payments on its indebtedness, comply with terms of debt covenants and incur additional debt.

▪Changes in roaming practices or other factors could cause UScellular's roaming revenues to decline from current levels, roaming expenses to increase from current levels and/or impact UScellular's ability to service its customers in geographic areas where UScellular does not have its own network, which could have an adverse effect on UScellular's business, financial condition or results of operations.

▪A failure by UScellular to obtain access to adequate radio spectrum to meet current or anticipated future needs and/or to accurately predict future needs for radio spectrum could have an adverse effect on UScellular’s business, financial condition or results of operations.

▪To the extent conducted by the FCC, UScellular may participate in FCC auctions for additional spectrum or for funding in certain Universal Service programs in the future directly or indirectly and, during certain periods, will be subject to the FCC’s anti-collusion rules, which could have an adverse effect on UScellular.

▪Failure by UScellular to timely or fully comply with any existing applicable legislative and/or regulatory requirements or changes thereto could adversely affect UScellular’s business, financial condition or results of operations.

▪An inability to attract people of outstanding talent throughout all levels of the organization, to develop their potential through education and assignments, and to retain them by keeping them engaged, challenged and properly rewarded could have an adverse effect on UScellular's business, financial condition or results of operations.

▪UScellular’s assets and revenue are concentrated in the U.S. wireless telecommunications industry. Consequently, its operating results may fluctuate based on factors related primarily to conditions in this industry.

▪UScellular’s smaller scale relative to larger competitors that may have greater financial and other resources than UScellular could cause UScellular to be unable to compete successfully, which could adversely affect its business, financial condition or results of operations.

▪Changes in various business factors, including changes in demand, consumer preferences and perceptions, price competition, churn from customer switching activity and other factors, could have an adverse effect on UScellular’s business, financial condition or results of operations.

▪Advances or changes in technology could render certain technologies used by UScellular obsolete, could put UScellular at a competitive disadvantage, could reduce UScellular’s revenues or could increase its costs of doing business.

▪Complexities associated with deploying new technologies present substantial risk and UScellular investments in unproven technologies may not produce the benefits that UScellular expects.

▪UScellular receives regulatory support and is subject to numerous surcharges and fees from federal, state and local governments, and the applicability and the amount of the support and fees are subject to great uncertainty, which could have an adverse effect on UScellular’s business, financial condition or results of operations.

▪Changes in UScellular’s enterprise value, changes in the market supply or demand for wireless spectrum licenses, adverse developments in the business or the industry in which UScellular is involved and/or other factors could require UScellular to recognize impairments in the carrying value of its wireless spectrum licenses and/or physical assets.

▪Costs, integration problems or other factors associated with acquisitions, divestitures or exchanges of properties or wireless spectrum licenses and/or expansion of UScellular’s business could have an adverse effect on UScellular’s business, financial condition or results of operations.

▪A failure by UScellular to complete significant network construction and systems implementation activities as part of its plans to improve the quality, coverage, capabilities and capacity of its network, support and other systems and infrastructure could have an adverse effect on its operations.

▪Difficulties involving third parties with which UScellular does business, including changes in UScellular's relationships with or financial or operational difficulties of key suppliers or independent agents and third party national retailers who market UScellular’s services, could adversely affect UScellular’s business, financial condition or results of operations.

▪UScellular has significant investments in entities that it does not control. Losses in the value of such investments could have an adverse effect on UScellular’s financial condition or results of operations.

▪A failure by UScellular to maintain flexible and capable telecommunication networks or information technology, or a material disruption thereof, could have an adverse effect on UScellular’s business, financial condition or results of operations.

▪UScellular has experienced, and in the future expects to experience, cyber-attacks or other breaches of network or information technology security of varying degrees on a regular basis, which could have an adverse effect on UScellular's business, financial condition or results of operations.

▪Changes in facts or circumstances, including new or additional information, could require UScellular to record adjustments to amounts reflected in the financial statements, which could have an adverse effect on UScellular’s business, financial condition or results of operations.

▪Disruption in credit or other financial markets, a deterioration of U.S. or global economic conditions or other events could, among other things, impede UScellular’s access to or increase the cost of financing its operating and investment activities and/or result in reduced revenues and lower operating income and cash flows, which would have an adverse effect on UScellular’s business, financial condition or results of operations.

▪Settlements, judgments, restraints on its current or future manner of doing business and/or legal costs resulting from pending and future litigation could have an adverse effect on UScellular’s business, financial condition or results of operations.

▪The possible development of adverse precedent in litigation or conclusions in professional studies to the effect that radio frequency emissions from wireless devices and/or cell sites cause harmful health consequences, including cancer or tumors, or may interfere with various electronic medical devices such as pacemakers, could have an adverse effect on UScellular’s business, financial condition or results of operations.

▪Claims of infringement of intellectual property and proprietary rights of others, primarily involving patent infringement claims, could prevent UScellular from using necessary technology to provide products or services or subject UScellular to expensive intellectual property litigation or monetary penalties, which could have an adverse effect on UScellular’s business, financial condition or results of operations.

▪There are potential conflicts of interests between TDS and UScellular.

▪Certain matters, such as control by TDS and provisions in the UScellular Restated Certificate of Incorporation, may serve to discourage or make more difficult a change in control of UScellular or have other consequences.

▪The market price of UScellular’s Common Shares is subject to fluctuations due to a variety of factors.

▪Any of the foregoing events or other events could cause revenues, earnings, capital expenditures and/or any other financial or statistical information to vary from UScellular’s forward-looking estimates by a material amount.

Risk Factors

In addition to the information set forth in this Form 10-Q, you should carefully consider the factors discussed in Part I, “Item 1A. Risk Factors” in UScellular’s Annual Report on Form 10-K for the year ended December 31, 2019, which could materially affect UScellular’s business, financial condition or future results. The risks described in this Form 10-Q and the Form 10-K for the year ended December 31, 2019, may not be the only risks that could affect UScellular. Additional unidentified or unrecognized risks and uncertainties could materially adversely affect UScellular’s business, financial condition and/or operating results. Subject to the foregoing and other than the risk factor set forth below, UScellular has not identified for disclosure any material changes to the risk factors as previously disclosed in UScellular’s Annual Report on Form 10-K for the year ended December 31, 2019.

The impact of the COVID-19 pandemic on UScellular's business is uncertain, but depending on its duration and severity it could have a material adverse effect on UScellular's business, financial condition or results of operations.

The impact of the global spread of COVID-19 on UScellular's future operations is uncertain. Public health emergencies, such as COVID-19, pose the risk that UScellular or its associates, agents, partners and suppliers may be unable to conduct business activities for an extended period of time and/or provide the level of service expected. UScellular's ability to attract customers, maintain an adequate supply chain and execute on its business strategies and initiatives could be negatively impacted by this outbreak. Additionally, COVID-19 has caused and could continue to cause increased unemployment, economic downturn and credit market deterioration, all of which could negatively impact UScellular. The extent of the impact of COVID-19 on UScellular's business, financial condition and results of operations will depend on future circumstances, including the severity of the disease, the duration of the outbreak, actions taken by governmental authorities and other possible direct and indirect consequences, all of which are uncertain and cannot be predicted.

Quantitative and Qualitative Disclosures about Market Risk

Market Risk

Refer to the disclosure under Market Risk in UScellular’s Form 10-K for the year ended December 31, 2019, for additional information, including information regarding required principal payments and the weighted average interest rates related to UScellular’s Long-term debt. There have been no material changes to such information since December 31, 2019 except the following: in April 2020, UScellular borrowed $125 million under its receivables securitization agreement and in August 2020 UScellular issued $500 million of 6.25% Senior Notes due in 2069. Such transactions changed the weighted average interest rate on long-term debt obligations to 6.3% at September 30, 2020 from 6.8% at December 31, 2019.

See Note 3 — Fair Value Measurements in the Notes to Consolidated Financial Statements for additional information related to the fair value of UScellular’s Long-term debt as of September 30, 2020.

Financial Statements

United States Cellular Corporation

Consolidated Statement of Operations

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2020 | | 2019 | | 2020 | | 2019 |

| (Dollars and shares in millions, except per share amounts) | | | | | | | |

| Operating revenues | | | | | | | |

| Service | $ | 775 | | | $ | 774 | | | $ | 2,290 | | | $ | 2,272 | |

| Equipment sales | 252 | | | 257 | | | 674 | | | 698 | |

| Total operating revenues | 1,027 | | | 1,031 | | | 2,964 | | | 2,970 | |

| | | | | | | |

| Operating expenses | | | | | | | |

| System operations (excluding Depreciation, amortization and accretion reported below) | 203 | | | 199 | | | 580 | | | 568 | |

| Cost of equipment sold | 257 | | | 266 | | | 692 | | | 724 | |

| Selling, general and administrative | 335 | | | 358 | | | 994 | | | 1,027 | |

| Depreciation, amortization and accretion | 161 | | | 181 | | | 516 | | | 524 | |

| | | | | | | |

| (Gain) loss on asset disposals, net | 6 | | | 5 | | | 14 | | | 13 | |

| (Gain) loss on sale of business and other exit costs, net | 0 | | | 0 | | | 0 | | | (1) | |

| (Gain) loss on license sales and exchanges, net | 0 | | | 2 | | | 0 | | | 0 | |

| Total operating expenses | 962 | | | 1,011 | | | 2,796 | | | 2,855 | |

| | | | | | | |

| Operating income | 65 | | | 20 | | | 168 | | | 115 | |

| | | | | | | |

| Investment and other income (expense) | | | | | | | |

| Equity in earnings of unconsolidated entities | 48 | | | 44 | | | 137 | | | 128 | |

| Interest and dividend income | 2 | | | 4 | | | 6 | | | 14 | |

| Gain (loss) on investments | 3 | | | 0 | | | 3 | | | 0 | |

| Interest expense | (29) | | | (29) | | | (76) | | | (87) | |

| | | | | | | |

| Total investment and other income | 24 | | | 19 | | | 70 | | | 55 | |

| | | | | | | |

| Income before income taxes | 89 | | | 39 | | | 238 | | | 170 | |

| Income tax expense | 4 | | | 15 | | | 11 | | | 55 | |

| Net income | 85 | | | 24 | | | 227 | | | 115 | |

| Less: Net income attributable to noncontrolling interests, net of tax | 0 | | | 1 | | | 3 | | | 6 | |

| Net income attributable to UScellular shareholders | $ | 85 | | | $ | 23 | | | $ | 224 | | | $ | 109 | |

| | | | | | | |

| Basic weighted average shares outstanding | 86 | | | 86 | | | 86 | | | 87 | |

| Basic earnings per share attributable to UScellular shareholders | $ | 0.98 | | | $ | 0.27 | | | $ | 2.60 | | | $ | 1.26 | |

|

| |

| | | | |

| Diluted weighted average shares outstanding | 88 | | | 88 | | | 87 | | | 88 | |

| Diluted earnings per share attributable to UScellular shareholders | $ | 0.97 | | | $ | 0.27 | | | $ | 2.56 | | | $ | 1.24 | |

The accompanying notes are an integral part of these consolidated financial statements.

United States Cellular Corporation

Consolidated Statement of Cash Flows

(Unaudited)

| | | | | | | | | | | |

| Nine Months Ended

September 30, |

| 2020 | | 2019 |

| (Dollars in millions) | | | |

| Cash flows from operating activities | | | |

| Net income | $ | 227 | | | $ | 115 | |

| Add (deduct) adjustments to reconcile net income to net cash flows from operating activities | | | |

| Depreciation, amortization and accretion | 516 | | | 524 | |

| Bad debts expense | 52 | | | 77 | |

| Stock-based compensation expense | 25 | | | 32 | |

| Deferred income taxes, net | 158 | | | (34) | |

| Equity in earnings of unconsolidated entities | (137) | | | (128) | |

| Distributions from unconsolidated entities | 118 | | | 99 | |

| | | |

| (Gain) loss on asset disposals, net | 14 | | | 13 | |

| (Gain) loss on sale of business and other exit costs, net | 0 | | | (1) | |

| | | |

| (Gain) loss on investments | (3) | | | 0 | |

| Other operating activities | 1 | | | 3 | |

| Changes in assets and liabilities from operations | | | |

| Accounts receivable | 31 | | | (35) | |

| Equipment installment plans receivable | 13 | | | (42) | |

| Inventory | 5 | | | 3 | |

| Accounts payable | 77 | | | (4) | |

| Customer deposits and deferred revenues | (23) | | | (1) | |

| Accrued taxes | (102) | | | 81 | |

| Accrued interest | 14 | | | 9 | |

| Other assets and liabilities | (36) | | | (24) | |

| Net cash provided by operating activities | 950 | | | 687 | |

| | | |

| Cash flows from investing activities | | | |

| Cash paid for additions to property, plant and equipment | (690) | | | (439) | |

| Cash paid for licenses | (169) | | | (257) | |

| Cash received from investments | 1 | | | 29 | |

| Cash paid for investments | (1) | | | (11) | |

| Cash received from divestitures and exchanges | 1 | | | 32 | |

| | | |

| Other investing activities | 3 | | | (1) | |

| Net cash used in investing activities | (855) | | | (647) | |

| | | |

| Cash flows from financing activities | | | |

| Issuance of long-term debt | 625 | | | 0 | |

| Repayment of long-term debt | (6) | | | (14) | |

| Common Shares reissued for benefit plans, net of tax payments | (12) | | | (8) | |

| Repurchase of Common Shares | (23) | | | (21) | |

| Payment of debt issuance costs | (20) | | | (1) | |

| Distributions to noncontrolling interests | (2) | | | (3) | |

| Other financing activities | 0 | | | (1) | |

| Net cash provided by (used in) financing activities | 562 | | | (48) | |

| | | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | 657 | | | (8) | |

| | | |

| Cash, cash equivalents and restricted cash | | | |