| 2015 Annual Report uscellular.com |

|

|

| Honoring Our Founder “ A deep-rooted conviction of mine has always been that the customer is king.” – LeRoy Carlson, 1989, TDS: The First Twenty Years “ Roy has always had the ability to anticipate the rapidly changing telecommunications industry – a skill that was invaluable as we founded U.S. Cellular. His willingness to embrace change, combined with his commitment to providing the customer with outstanding service, will forever motivate and inspire U.S. Cellular.” – Kenneth Meyers, CEO – U.S. Cellular U.S. Cellular® celebrates the 100th birthday of our founder, LeRoy (Roy) T. Carlson. His vision, leadership, values, and business principles set the foundation for the company that U.S. Cellular is today. Roy’s belief in delivering exceptional customer service and the latest technology, and his unwavering commitment to the nation’s rural and suburban communities are still the focus of our business; they provide the basis on which U.S. Cellular will continue to grow our business and serve the needs of our customers, associates and shareholders. “ The concept I had in mind was simple: bring together a group of small, primarily rural, telephone companies whose skills, strengths and assets could be shared by all.” – LeRoy Carlson, 1989, TDS: The First Twenty Years “ The key to harnessing the business power and potential of communications technology is to respect and understand the people who use, develop and support it.” – LeRoy Carlson, 2002 KPMG Illinois High Tech Awards ceremony “ The people who live in these rural and suburban areas should have the same and equal access to the full range of technological advances available today as those enjoyed by people who live in urban areas.” – LeRoy Carlson, 1979, TDS Annual Report |

i | Dear Shareholders U.S. CELLULAR 1 2015 was a good year for U.S. Cellular, in part because we achieved two important goals: we reignited customer growth and improved profitability, laying the foundation for continued success. In a constantly changing industry, we are always looking forward to the next challenge, and to the next opportunity. What new products are we rolling out? What new technology will provide new capabilities tomorrow, or threaten our business model? In this environment, it is worthwhile to clarify how we define and pursue success at U.S. Cellular. As a mid-sized operator, we seek to use our relatively smaller size to our competitive advantage. We differentiate ourselves from the national wireless giants by providing an outstanding customer experience in the rural and suburban American markets where we operate. This starts with a network that provides high-quality services in the “Middle of Anywhere” and is complemented by our associates, who take a more personal approach to knowing and serving our customers. We have a prominent local presence in each of our communities. Under this business model, our customers win on a number of levels, because our plans offer them a high-quality network experience at competitive prices. With satisfied customers, we can better grow our sales and our profits, and thereby build shareholder value. Another key piece of this model is that our whole organization is involved in our success. Our passionate associates are engaged and innovative in serving our customers and also in giving back to the communities in which they live and we do business. This business model is all about the values and focus that permeate the whole organization. Over the long term, we believe it is a successful model for the very competitive wireless market in which we operate. U.S. Cellular exists to provide exceptional wireless communication services which enhance consumers’ lives, increase the competitiveness of local businesses, and improve the efficiency of government operations in the mid-sized and rural markets we serve. Our local focus is a unique differentiator that allows our associates to deliver outstanding customer service by treating customers like neighbors, not numbers. |

| 2 U.S. CELLULAR Customer growth has been and will continue to be our number one priority. U.S. Cellular’s Best-in-Quality Network We know our best-in-quality network is a competitive advantage. While other companies vie for market share in some of the nation’s largest cities, usually against three or four wireless providers, U.S. Cellular focuses on smaller cities and on rural and suburban markets. Overall, we have an effective mix of what we consider to be low-band coverage and mid-band capacity in these markets, often making us a particularly strong competitor. In 2015, we continued to invest in our network to provide more capacity to meet growing demands for data services and to provide better in-home coverage. We also completed our 4G LTE deployment. Completing the 4G LTE deployment was the culmination of a four-year effort, and one of our major priorities for the year. With 4G LTE, we can provide our customers, even in the more remote rural areas, with all the benefits of our data services, also creating new growth opportunities for us. In 2015, we secured 4G LTE roaming agreements with national carriers to further enhance our customers’ data experience. Building on the strength of our newly completed 4G LTE network, we are further refining our network strategy and are planning to begin the multi-year rollout of Voice over LTE (VoLTE). We are designing VoLTE to bring even more quality services and products to our customers over the next few years, and increase our flexibility to pursue attractive new revenue opportunities. Reigniting customer growth to increase revenue and profitability Customer growth has been and will continue to be our number one priority. We are proud of our 2015 accomplishments and excited about our prospects, even while acknowledging that adding new customers is increasingly difficult in this industry. We plan to grow by focusing on what our customers desire: competitive pricing and promotions that showcase our high-quality 4G LTE network. Supporting this effort, we are redesigning our stores into retail destinations that can enhance the customer experience and further boost sales. We successfully repositioned our company to grow our customer base again, even in the face of a very competitive wireless market. We saw a steady and meaningful improvement in our churn levels as we delivered high levels of customer satisfaction. We also continued to see former customers return to U.S. Cellular, representing approximately 20% of new accounts. We continue to manage our expense levels, which contributed to stronger margin and growth in operating cash flow in 2015. Customer and revenue growth is crucial to improving our margin and profitability. We see opportunity for revenue Completing the 4G LTE deployment was the culmination of a four-year effort, and one of our major priorities for the year. |

| Investing in our associates and our communities Associate engagement is a priority at U.S. Cellular and foundational to our business model. Our associates are on the front line of fulfilling U.S. Cellular’s commitment to outstanding customer service. We ensure that all associates have the best training and knowledge, so they can best serve our customers. We are honored to be named as one of Forbes Best Employers for the second year in a row. Together, we strive to build a connection with our communities that extends beyond our business by supporting causes that strengthen the neighborhoods where our customers live, work, and play. As a company, we partner with local and national non-profits, provide in-kind gifts, support associate volunteerism, and match personal donations made by our associates. In support of our commitment to enhancing learning opportunities, we focus our giving efforts on K-12 and Science, Technology, Engineering, and Math (STEM) programs. U.S. Cellular also donated more than $1 million to Boys & Girls Clubs and National 4-H Council in 2015, and our associates volunteered more than 32,000 hours of their time to a variety of non-profit organizations in our markets. We launched a nationwide holiday giving campaign to highlight the positive acts of youth in many of our communities through the “Future of Good” campaign, by encouraging consumers to upload a photo to the campaign’s online gallery. For each photo uploaded, U.S. Cellular contributed to National 4-H Council and Boys & Girls Clubs of America. In addition, we pledged both in-kind and monetary contributions to three selected youths from Oklahoma, Missouri, and Wisconsin who are doing extraordinary acts of good in their communities. U.S. CELLULAR 3 growth from further smartphone penetration that will allow us to monetize data usage. In addition, sales of our Shared Connect data plans create more devices per account. These plans, and the increasing use of connected devices like tablets by our customers, drive them to choose larger data buckets, resulting in revenue growth. Our cell towers are a strategic asset. Although they represent a modest portion of our revenue, we receive high-margin rental income from them, which we expect to increase in the future. Equally important, our cell tower assets enable us to control and maintain the high-quality network we need while we continue to enhance technologies for our customers. The rapidly growing small and medium business (SMB) market and regional government agencies are a natural fit for U.S. Cellular given our local focus. We have reorganized our sales force to build these channels and expanded our business pricing portfolio to include shared data and machine-tomachine offerings. As the needs of our SMB customers grow, we continue to expand our Business Solutions Product Catalog with products like international roaming, fleet management applications, and wireless priority service. Recent enhancements to our online efforts and our promotions are increasing brand recognition in the SMB space. For the second year, U.S. Cellular sponsored casting calls for the ABC hit show “Shark Tank”, taking the show to Oklahoma City, Oklahoma; Knoxville, Tennessee; and Portland, Maine to provide small business owners and other entrepreneurs with opportunities to pitch their ideas to the show’s experts. |

| Sincerely, Kenneth R. Meyers LeRoy T. Carlson, Jr. President and Chairman Chief Executive Officer 4 U.S. CELLULAR Honoring U.S. Cellular’s visionary founder This year, U.S. Cellular is celebrating the legacy of our centenarian founder, LeRoy T. (Roy) Carlson. From our first customers in 1985, to our Company today that includes more than 4 million customers, we continue to operate on Roy’s basic principle, that “the customer is king.” A key element of U.S. Cellular’s brand strength is this focus on satisfying each and every one of our customers. It is the foundation upon which we intend to continue building shareholder value and growing our business. Thank you Overall, we are very proud of our accomplishments achieved in 2015, and how they position us for the future. Thank you to the passionate associates of U.S. Cellular for your dedication and innovation in providing outstanding services, products, and experiences to our customers across the nation. Thank you also to each of our shareholders and our debt holders for your continuing support of our long-term growth and development. Regulatory We are advocating in Washington to help make sure that the government auctions of new spectrum are designed so that a mid-size carrier like U.S. Cellular can participate and be successful in further strengthening our network. We are thoroughly considering our participation in the 600 MHz auction. Working with elected officials, we also are advocating in support of a robust mobility fund to draw attention to the ongoing need for Universal Service Fund support to bring wireless broadband to rural communities, and have been gratified by the encouragement received from elected officials in these communities. Upgrading our Annual Report We have changed the format of our annual report this year, revising the Management’s Discussion and Analysis section by adding charts and other graphics to more plainly and clearly explain our business and our performance. We hope you find this information and format helpful and, as always, welcome your feedback. |

UNITED STATES CELLULAR CORPORATION

ANNUAL REPORT TO SHAREHOLDERS FOR THE YEAR ENDED DECEMBER 31, 2015

Pursuant to SEC Rule 14a-3

The following audited financial statements and certain other financial information for the year ended December 31, 2015, represent U.S. Cellular's annual report to shareholders as required by the rules and regulations of the Securities and Exchange Commission ("SEC").

The following information was filed with the SEC on February 24, 2016 as Exhibit 13 to U.S. Cellular's Annual Report on Form 10-K for the year ended December 31, 2015. Such information has not been updated or revised since the date it was originally filed with the SEC. Accordingly, you are encouraged to review such information together with any subsequent information that we have filed with the SEC and other publicly available information.

| United States Cellular Corporation and Subsidiaries | Exhibit 13 |

FINANCIAL REPORTS CONTENTS

| | Page No. | |

|---|---|---|

| | | |

Management's Discussion and Analysis of Financial Condition and Results of Operations | 1 | |

| | | |

Executive Overview | 1 | |

| | | |

Terms used by U.S. Cellular | 4 | |

| | | |

Operational Overview | 5 | |

| | | |

Financial Overview | 8 | |

| | | |

Liquidity and Capital Resources | 14 | |

| | | |

Contractual and Other Obligations | 19 | |

| | | |

Consolidated Cash Flows | 19 | |

| | | |

Consolidated Balance Sheet Analysis | 21 | |

| | | |

Applications of Critical Accounting Policies and Estimates | 22 | |

| | | |

Other Items | 25 | |

| | | |

Regulatory Matters | 25 | |

| | | |

Private Securities Litigation Reform Act of 1995 Safe Harbor Cautionary Statement | 27 | |

| | | |

Market Risk | 30 | |

| | | |

Supplemental Information | 32 | |

| | | |

Consolidated Statement of Operations | 34 | |

| | | |

Consolidated Statement of Cash Flows | 35 | |

| | | |

Consolidated Balance Sheet – Assets | 36 | |

| | | |

Consolidated Balance Sheet – Liabilities and Equity | 37 | |

| | | |

Consolidated Statement of Changes in Equity | 38 | |

| | | |

Notes to Consolidated Financial Statements | 41 | |

| | | |

Reports of Management | 69 | |

| | | |

Report of Independent Registered Public Accounting Firm | 71 | |

| | | |

Selected Consolidated Financial Data | 72 | |

| | | |

Consolidated Quarterly Information (Unaudited) | 73 | |

| | | |

Shareholder Information | 74 | |

| | | |

| | ||

| | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | ||

![]()

Management's Discussion and Analysis ("MD&A") should be read in conjunction with the Financial Statements and Notes to Consolidated Financial Statements for the year ended December 31, 2015. This report contains statements that are not based on historical facts, including the words "believes," "anticipates," "intends," "expects" and similar words. These statements constitute and represent "forward looking statements" as this term is defined in the Private Securities Litigation Reform Act of 1995. Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, events or developments to be significantly different from any future results, events or developments expressed or implied by such forward looking statements.

U.S. Cellular uses certain "non-GAAP financial measures" throughout the MD&A. A discussion of the reason U.S. Cellular uses these measures and a reconciliation of these measures to their most directly comparable measures determined in accordance with accounting principles generally accepted in the United States of America ("GAAP") are included in the Supplemental Information section within the MD&A of this Form 10-K Report.

General

United States Cellular Corporation ("U.S. Cellular") owns, operates, and invests in wireless markets throughout the United States. U.S. Cellular is an 84%-owned subsidiary of Telephone and Data Systems, Inc. ("TDS"). U.S. Cellular's strategy is to attract and retain wireless customers through a value proposition comprised of a high-quality network, outstanding customer service, and competitive devices, plans, and pricing, all provided with a local focus.

1

| | ||

| | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | ||

OPERATIONS |

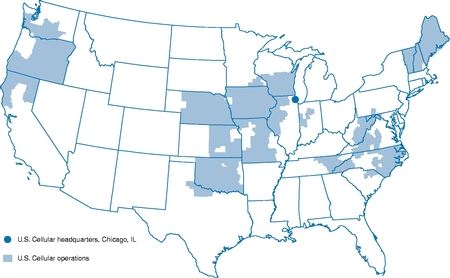

- §

- Serves approximately 4.9 million customers including 4.4 million postpaid and 0.4 million prepaid customers.

- §

- Operates in 23 states.

- §

- Employs approximately 6,400 employees.

- §

- Headquartered in Chicago, Illinois.

- §

- 6,297 cell sites including 3,978 owned towers in service.

| |

Significant Financial and Operating Matters

The following is a summary of certain selected information contained in the comprehensive MD&A that follows. The overview does not contain all of the information that may be important. You should carefully read the entire MD&A and not rely solely on the highlights.

- §

- Net income attributable to U.S. Cellular shareholders was $241.3 million in 2015, compared to a net loss of $42.8 million in 2014. The year-over-year improvement was attributable to several factors including (i) increased equipment revenues bolstered by equipment installment plan activity; (ii) reduced cost of equipment sold due to fewer equipment sales transactions overall and lower cost per unit sold; (iii) reduced selling, general and administrative expenses; and (iv) increased gains from sales and exchanges of businesses and licenses. Diluted earnings per share was $2.84 compared to a diluted loss per share of $0.51 one year ago.

- §

- In March 2015, U.S. Cellular announced that it would discontinue its loyalty reward program effective September 1, 2015. All unredeemed reward points expired at that time and the deferred revenue balance related to such expired points was recognized as service revenues. The amount of deferred revenue recognized upon discontinuation of this program was $58.2 million.

- §

- U.S. Cellular, through its limited partnership interest in Advantage Spectrum L.P. ("Advantage Spectrum"), was the provisional winning bidder for 124 licenses for an aggregate winning bid of $338.3 million in Auction 97. See Note 6 – Acquisitions, Divestitures and Exchanges and Note 13 – Variable Interest Entities in the Notes to Consolidated Financial Statements for additional information related to these transactions.

- §

- U.S. Cellular completed license exchanges and the sale of towers outside of its operating markets. See Note 6 – Acquisitions, Divestitures and Exchanges for additional information related to these transactions.

2

| | ||

| | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | ||

- §

- Total additions to Property, plant and equipment were $533.1 million, including expenditures to complete the network rollout of 4G LTE, construct cell sites, increase capacity in existing cell sites and switches, outfit new and remodel existing retail stores and enhance billing and other customer management related systems and platforms.

Significant Trends and Developments

Technology and Support Systems:

- §

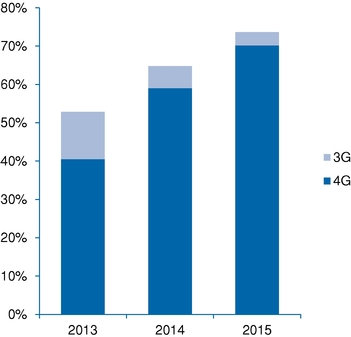

- U.S. Cellular continued to deploy 4G LTE as a result of U.S. Cellular's strategic initiative to enhance its network. 4G LTE now reaches 99% of postpaid customers and 98% of cell sites. The adoption of data-rich smartphones and connected devices is driving significant growth in data traffic. At the end of the year, 72% of postpaid customers had 4G capable devices, with the LTE network handling 81% of data traffic. Also, U.S. Cellular began user trials related to VoLTE technology to allow customers to utilize the LTE network for both voice and data services, and these trials are anticipated to continue into 2016.

- §

- In 2015, U.S. Cellular spent $285.8 million in cash for license acquisitions, the majority of which came from U.S. Cellular's participation in Auction 97 indirectly through its limited partnership interest in Advantage Spectrum. Advantage Spectrum was the provisional winning bidder of 124 AWS licenses for an aggregate bid of $338.3 million, after its expected designated entity discount of 25%. Advantage Spectrum's bid amount, less the initial deposit amount of $60.0 million paid in 2014, was paid to the FCC in March 2015. These licenses have not yet been granted by the FCC. U.S. Cellular's strategy is to continue to obtain interests in and access to wireless licenses in current operating markets. This strategy will help ensure adequate spectrum to deliver a best-in-class network that meets the growing capacity and speed requirements of U.S. Cellular customers.

Asset Management:

- §

- U.S. Cellular continued to pursue opportunities to monetize non-strategic assets to support investment in the business. In December 2014, U.S. Cellular entered into an agreement with a third party to sell 595 towers and certain related contracts, assets, and liabilities for $159.0 million in cash. The gain recognized was $3.8 million and $108.2 million in 2014 and 2015, respectively. This agreement and related transactions are referred to as the "Tower Sale."

- §

- Additionally, U.S. Cellular entered into various agreements to transfer certain non-operating licenses to third parties in exchange for receiving licenses in operating markets and cash. In connection with these various agreements, U.S. Cellular received cash totaling $145.0 million and recognized an aggregate pre-tax gain of $149.1 million in 2015.

- §

- In January 2016, U.S. Cellular entered into an agreement to purchase a 700 MHz A Block license for $36.0 million. The transaction is expected to close in the third quarter of 2016 pending regulatory approval. In February 2016, U.S. Cellular entered into multiple agreements with third parties that provide for the transfer of certain AWS and PCS spectrum licenses and approximately $30 million in cash to U.S. Cellular, in exchange for U.S. Cellular transferring certain AWS, PCS and 700 MHz licenses to the third parties. The transactions are subject to regulatory approval and other customary closing conditions, and are expected to close in 2016. Upon closing of the transactions, U.S. Cellular expects to recognize a gain.

Products and Services:

- §

- U.S. Cellular continued to leverage competitive value-based pricing for its plans and services, including equipment installment plan offerings. U.S. Cellular will continue to offer equipment installment plans in 2016. To the extent that customers adopt these plans, U.S. Cellular expects an increase in equipment sales revenues. However, certain of the equipment installment plans provide the customer with a reduction in the monthly access charge for the device; thus, to the extent that existing customers adopt such plans, U.S. Cellular expects a reduction in retail service revenues and ARPU.

- §

- U.S. Cellular launched iconic Samsung and Apple devices and expanded the portfolio of tablets and connected devices in line with the strategic initiative to increase gross additions, reduce churn, and increase data usage.

- §

- U.S. Cellular continued to expand distribution through third-party national and on-line retailers. As a growing base of customers purchase wireless service outside of corporate and agent owned locations, U.S. Cellular will continue to explore new relationships with additional third-party retailers as part of the strategy to expand distribution.

3

| | ||

| | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | ||

- §

- U.S. Cellular also expanded its solutions available to business and government customers, including a growing suite of machine-to-machine solutions across various categories. U.S. Cellular will continue to enhance its advanced wireless services and connected solutions for consumer, business and government customers.

All defined terms in this MD&A are used as defined in the Notes to Consolidated Financial Statements, and additional terms are defined below:

- §

- 4G LTE – fourth generation Long-Term Evolution which is a wireless broadband technology.

- §

- Auction 97 – An FCC auction of AWS-3 spectrum licenses that ended in January 2015.

- §

- Average Billings per Account ("ABPA") – metric is calculated by dividing total postpaid service revenues plus equipment installment plan billings by the average number of postpaid accounts by the number of months in the period.

- §

- Average Billings per User ("ABPU") – metric is calculated by dividing total postpaid service revenues plus equipment installment plan billings by the average number of postpaid customers by the number of months in the period.

- §

- Average Revenue per Account ("ARPA") – metric is calculated by dividing total postpaid service revenues by the average number of postpaid accounts by the number of months in the period.

- §

- Average Revenue per User ("ARPU") – metric is calculated by dividing a revenue base by an average number of customers by the number of months in the period. These revenue bases and customer populations are shown below:

- §

- Postpaid ARPU – consists of total postpaid service revenues and postpaid customers.

- §

- Service Revenue ARPU – consists of total postpaid, prepaid and reseller service revenues, inbound roaming and other service revenues and postpaid, prepaid and reseller customers.

- §

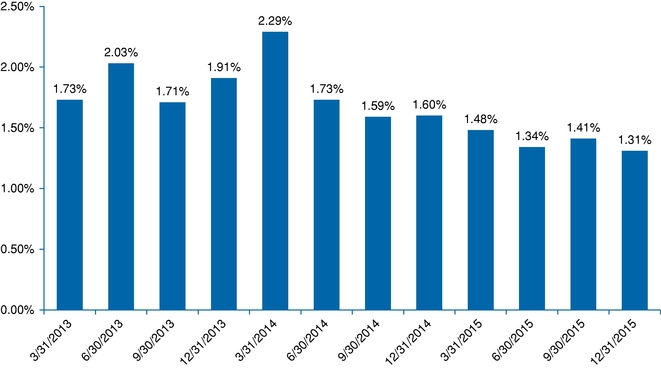

- Churn Rate – represents the percentage of the customers that disconnect service each month. These rates represent the average monthly churn rate for each respective period.

- §

- FCC – Federal Communications Commission

- §

- Gross Additions – represents the total number of new customers added during the period, without regard to customers who terminate service.

- §

- Net Additions (Losses) – represents the total number of new customers added during the period, net of customers who terminate service during that period.

- §

- Smartphone Penetration – is calculated by dividing postpaid smartphone customers by total postpaid customers.

- §

- VoLTE – Voice over Long-Term Evolution which is a technology specification that defines the standards and procedures for delivering voice communication and data over 4G LTE networks.

4

| | ||

| | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | ||

| | | |

| Retail Customer Composition December 31, 2015 | Postpaid Customer Results | |

|  | |

2015-2014 Commentary | 2014-2013 Commentary | |

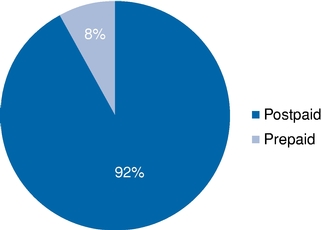

Postpaid customers comprised approximately 92% of U.S. Cellular's retail customers at December 31, 2015. U.S. Cellular believes the increase in net additions in 2015 is a result of competitive products and services priced to offer the best value to customers, improved speed to market for product offerings, and expanded equipment installment plan offerings. U.S. Cellular also believes postpaid churn continued to decline from 2014 levels due to an improved customer experience and strong retention programs. Total retail customers at the period ended December 31, 2015, 2014 and 2013 were 4,796,000, 4,646,000 and 4,610,000, respectively. | Postpaid customers comprised approximately 93% of U.S. Cellular's retail customers at December 31, 2014. Postpaid churn in 2013 and the first half of 2014 was adversely affected by the billing system conversion in 2013; however it improved over the course of 2014. | |

| | | |

5

| | ||

| | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | ||

| | | |

Quarterly Postpaid Churn Rate | ||

| ||

| | | |

Smartphone Penetration | 2015-2014 Commentary | |

| | | |

| Smartphone penetration increased to 74% of the postpaid handset customer base, up from 65% a year ago. The percentage of postpaid handset customers with feature phones has continued to decrease from 35% in 2014 to 26% in 2015 and is expected to continue declining as handset gross additions consist primarily of smartphones. During the fourth quarter of 2015, smartphones represented 91% of total handset sales. Continued growth in revenues and costs related to data products and services may result in increased operating expenses and the need for additional investment in spectrum, network capacity and network enhancements. 2014-2013 Commentary Smartphone penetration increased to 65% of the postpaid handset customer base, up from 53% a year ago. This contributed to increased service revenues from data. | |

| | | |

6

| | ||

| | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | ||

| | | |

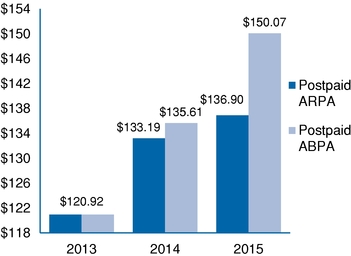

Postpaid ARPU/ABPU | Postpaid ARPA/ABPA | |

| | | |

|  | |

| | | |

2015-2014 Commentary

Postpaid ARPU decreased in 2015 due to industry-wide price competition, including discounts on shared data plans provided to customers on equipment installment plans and those providing their own device at the time of activation or renewal partially offset by the continued adoption of smartphones and shared data plans. The increase in postpaid ARPA is the result of increased postpaid connections per account driven by increased connected device penetration.

U.S. Cellular implemented equipment installment plans on a broad basis in 2014. These plans increase equipment sales revenue as customers pay for their wireless devices in installments at a total device price that is generally higher than the device price offered to customers in conjunction with alternative plans that are subject to a service contract. Equipment installment plans also have the impact of reducing service revenues as many equipment installment plans provide for reduced monthly access charges. In order to reflect the ARPU and ARPA trend for the impact of equipment installment plans in 2014 and 2015, U.S. Cellular has also presented ARPU and ARPA plus average monthly equipment installment plan billings per customer (ABPU) and account (ABPA), respectively. U.S. Cellular believes presentation of these measures is useful in order to reflect the trends in total revenues per customer and account.

2014-2013 Commentary

The increases are a result of increased smartphone penetration, increased adoption of shared data plans, and the special issuance of loyalty rewards points which negatively impacted these metrics in 2013, partially offset by discounts on shared data plans provided to customers on equipment installment plans and those providing their own device at the time of activation or renewal.

7

| | ||

| | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | ||

The Divestiture Transaction and the NY1 & NY2 Deconsolidation were consummated in the second quarter of 2013 as further described in Note 6 — Acquisitions, Divestitures and Exchanges and Note 8 — Investments in Unconsolidated Entities in the Notes to Consolidated Financial Statements. The information presented below includes the Divestiture Markets and the NY1 & NY2 Partnerships for the portion of 2013 prior to the respective transactions.

Components of Operating Income (Loss)

Year Ended December 31, | 2015 | 2014 | 2013 | 2015 vs. 2014 | 2014 vs. 2013 | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | |

(Dollars in thousands) | |||||||||||||||||||||

Retail service | $ | 2,994,353 | $ | 3,012,984 | $ | 3,165,496 | $ | (18,631 | ) | (1)% | $ | (152,512 | ) | (5)% | |||||||

Inbound roaming | 191,801 | 224,090 | 263,186 | (32,289 | ) | (14)% | (39,096 | ) | (15)% | ||||||||||||

Other | 164,277 | 160,863 | 166,091 | 3,414 | 2% | (5,228 | ) | (3)% | |||||||||||||

| | | | | | | | | | | | | | | | | | | | | | |

Service revenues | 3,350,431 | 3,397,937 | 3,594,773 | (47,506 | ) | (1)% | (196,836 | ) | (5)% | ||||||||||||

Equipment sales | 646,422 | 494,810 | 324,063 | 151,612 | 31% | 170,747 | 53% | ||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | |

Total operating revenues | 3,996,853 | 3,892,747 | 3,918,836 | 104,106 | 3% | (26,089 | ) | (1)% | |||||||||||||

System operations (excluding | 775,042 | 769,911 | 763,435 | 5,131 | 1% | 6,476 | 1% | ||||||||||||||

Cost of equipment sold | 1,052,810 | 1,192,669 | 999,000 | (139,859 | ) | (12)% | 193,669 | 19% | |||||||||||||

Selling, general and administrative | 1,493,730 | 1,591,914 | 1,677,395 | (98,184 | ) | (6)% | (85,481 | ) | (5)% | ||||||||||||

| | | | | | | | | | | | | | | | | | | | | | |

| 3,321,582 | 3,554,494 | 3,439,830 | (232,912 | ) | (7)% | 114,664 | 3% | ||||||||||||||

Operating cash flow* | 675,271 | 338,253 | 479,006 | 337,018 | 100% | (140,753 | ) | (29)% | |||||||||||||

Depreciation, amortization and accretion | 606,455 | 605,997 | 803,781 | 458 | – | (197,784 | ) | (25)% | |||||||||||||

(Gain) loss on asset disposals, net | 16,313 | 21,469 | 30,606 | (5,156 | ) | (24)% | (9,137 | ) | (30)% | ||||||||||||

(Gain) loss on sale of business and other exit costs, net | (113,555 | ) | (32,830 | ) | (246,767 | ) | (80,725 | ) | >(100)% | 213,937 | 87% | ||||||||||

(Gain) loss on license sales and exchanges | (146,884 | ) | (112,993 | ) | (255,479 | ) | (33,891 | ) | (30)% | 142,486 | 56% | ||||||||||

| | | | | | | | | | | | | | | | | | | | | | |

Total operating expenses | 3,683,911 | 4,036,137 | 3,771,971 | (352,226 | ) | (9)% | 264,166 | 7% | |||||||||||||

| | | | | | | | | | | | | | | | | | | | | | |

Operating income (loss) | $ | 312,942 | $ | (143,390 | ) | $ | 146,865 | $ | 456,332 | >100% | $ | (290,255 | ) | >(100)% | |||||||

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA* | $ | 852,152 | $ | 480,325 | $ | 615,204 | $ | 371,827 | 77% | $ | (134,879 | ) | (22)% | ||||||||

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

Capital expenditures | $ | 533,053 | $ | 557,615 | $ | 737,501 | $ | (24,562 | ) | (4)% | $ | (179,886 | ) | (24)% | |||||||

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

- *

- Represents a non-GAAP financial measure. Refer to Supplemental Information within this MD&A for a reconciliation of this measure.

8

| | ||

| | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | ||

| |

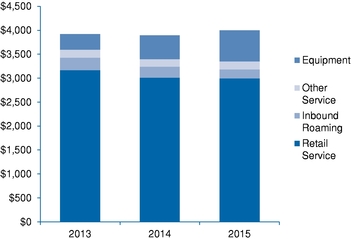

Total Operating Revenues |

| Service revenues consist of: § Charges for access, airtime, roaming, recovery of regulatory costs and value added services, including data products and services ("retail service") § Charges to other wireless carriers whose customers use U.S. Cellular's wireless systems when roaming § Amounts received from the Federal USF § Tower rental revenues Equipment revenues consist of: § Sales of wireless devices and related accessories to new and existing customers, agents, and third-party distributors | |

| | | |

Key components of changes in the statement of operations line items were as follows:

2015-2014 Commentary

Total operating revenues

Service revenues decreased as a result of (i) a decrease in retail service revenues driven by industry-wide price competition, including discounts on shared data plans provided to customers on equipment installment plans and those providing their own device at the time of activation or renewal; and (ii) reductions in inbound roaming revenue driven by lower roaming rates. Such reductions were partially offset by an increase in the average customer base, continued adoption of shared data plans, and the $58.2 million of revenue recognized in 2015 from unredeemed rewards points upon termination of U.S. Cellular's rewards program.

Revenue representing amounts received from the Federal USF for the year ended December 31, 2015 was $92.1 million, which remained flat year over year. Pursuant to the FCC's Reform Order ("Reform Order"), U.S. Cellular's current Federal USF support is being phased down at the rate of 20% per year beginning July 1, 2012. The Phase II Mobility Fund was not operational as of July 2014 and, therefore, as provided by the Reform Order, the phase down was suspended at 60% of the baseline amount. U.S. Cellular will continue to receive USF support at the 60% level until the FCC takes further action. At this time, U.S. Cellular cannot predict what changes that the FCC might make to the USF high cost support program and, accordingly, cannot predict whether such changes will have a material adverse effect on U.S. Cellular's business, financial condition or results of operations.

Equipment sales revenues increased due primarily to an increase in average revenue per device sold driven by sales under equipment installment plans, a mix shift to smartphones and connected devices and an increase in accessory sales, partially offset by a decrease in the number of devices sold. Equipment installment plan sales contributed $350.7 million and $190.4 million in 2015 and 2014, respectively.

System operations expenses

Maintenance, utility and cell site expenses increased $13.3 million, or 4%, reflecting higher support costs and utility usage for the expanded 4G LTE network and the completion of certain tower maintenance and repair projects.

Expenses incurred when U.S. Cellular's customers used other carriers' networks while roaming increased $19.4 million, or 11%, driven primarily by an increase in data roaming usage, partially offset by lower rates and voice volume.

Customer usage expenses decreased $27.6 million, or 13%, driven by lower fees for platform and content providers, a decrease in long distance charges driven by rate reductions, and a decrease in circuit costs from the migration to LTE.

9

| | ||

| | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | ||

U.S. Cellular expects system operations expenses to increase in the future to support the continued growth in cell sites and other network facilities as it continues to add capacity, enhance quality and deploy new technologies as well as to support increases in total customer usage, particularly data usage. However, these increases are expected to be offset to some extent by cost savings generated by shifting data traffic to the 4G LTE network from the 3G network.

Cost of equipment sold

The decrease in Cost of equipment sold is a result of an 11% reduction in devices sold and a decrease in the average cost per device sold driven by the lower cost of smartphones and connected devices. Cost of equipment sold in 2015 included $448.7 million related to equipment installment plan sales compared to $280.3 million in 2014. Loss on equipment was $406.4 million and $697.9 million for 2015 and 2014, respectively.

Selling, general and administrative expenses

Selling expenses decreased $20.5 million, or 3%, due primarily to lower agent and retail commission expenses driven by fewer activations and renewals, partially offset by increased advertising expenses.

General and administrative expenses decreased $77.7 million, or 9%, due primarily to lower consulting expenses related to the billing system and customer service operations, and lower rates for roamer administration.

Depreciation, amortization and accretion expense

Depreciation, amortization and accretion expense remained relatively flat year over year.

(Gain) loss on asset disposals, net

The decrease in Loss on asset disposals was due primarily to fewer write-offs and disposals of certain network assets.

(Gain) loss on sale of business and other exit costs, net

The net gain in 2015 was due primarily to a $108.2 million gain recognized on the Tower Sale. The net gain in 2014 was due primarily to $29.3 million of gain related to the continuing impact of the Divestiture Transaction. See Note 6 — Acquisitions, Divestitures and Exchanges in the Notes to Consolidated Financial Statements for additional information.

(Gain) loss on license sales and exchanges, net

The net gains in 2015 and 2014 were due to license sales and exchanges with third parties. See Note 6 — Acquisitions, Divestitures and Exchanges in the Notes to Consolidated Financial Statements for additional information.

2014-2013 Commentary

Total operating revenues

Service revenues decreased as a result of a decrease in the average customer base (including the reductions caused by the Divestiture Transaction and NY1 and NY2 Deconsolidation) and a reduction in revenues from the Federal USF. A decrease in Inbound roaming revenues caused by reductions in inbound roaming rates and voice volumes partially offset by higher inbound roaming data usage further contributed to the decrease in service revenues.

Such reductions were partially offset by increased revenues as a result of higher smartphone penetration and tower rental revenues.

Equipment sales revenues increased due to an increase in the average revenue per device sold due primarily to the implementation of equipment installment plans on a broad basis in 2014, and increases in the sales of connected devices and accessories. This increase is partially offset by a decrease in sales of other device categories, primarily the feature phone category, and the effects of the Divestiture Transaction and the NY1 & NY2 Deconsolidation. Equipment installment plan sales contributed $190.4 million and $0.8 million in 2014 and 2013, respectively.

System operations expenses

Maintenance, utility and cell site expenses increased $26.6 million, or 8%, reflecting higher support costs for the expanded 4G LTE network and completion of certain maintenance projects, partially offset by the impacts of the Divestiture Transaction and NY1 & NY2 Deconsolidation.

10

| | ||

| | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | ||

Expenses incurred when U.S. Cellular's customers used other carriers' networks while roaming increased $5.8 million, or 3%, driven primarily by an increase in data roaming usage, partially offset by lower rates, lower voice usage, and the impacts of the Divestiture Transaction and NY1 & NY2 Deconsolidation.

Customer usage expenses decreased $25.9 million, or 11%, driven by impacts of the Divestiture Transaction and NY1 & NY2 Deconsolidation, by lower fees for platform and content providers, a decrease in long distance charges driven by rate reductions, and a decrease in circuit costs from LTE migration.

Cost of equipment sold

The increase in Cost of equipment sold was the result of a 22% increase in the average cost per device sold, which more than offset the impact of selling fewer devices. Average cost per device sold increased due to general customer preference for higher priced 4G LTE smartphones and tablets. Cost of equipment sold in 2014 includes $280.3 million related to equipment installment plan sales compared to $0.8 million in 2013. Loss on equipment was $697.9 million and $674.9 million for 2014 and 2013, respectively.

Selling, general and administrative expenses

Selling, general and administrative expenses decreased $85.5 million, or 5%, in 2014 due to the impacts of the Divestiture Transaction, NY1 & NY2 Deconsolidation and lower consulting expenses in 2014 related to the billing system conversion in the prior year.

Depreciation, amortization and accretion expense

Depreciation, amortization and accretion decreased due to acceleration of Depreciation, amortization and accretion resulting from the Divestiture Transaction. Accelerated depreciation resulting from the Divestiture Transaction was $13.1 million and $158.5 million in 2014 and 2013, respectively.

(Gain) loss on asset disposals, net

The decrease in Loss on asset disposals was due primarily to fewer write-offs and disposals of certain network assets.

(Gain) loss on sale of business and other exit costs, net

The net gain in 2014 and 2013 was due primarily to $29.3 million and $248.4 million of gain recognized related to the Divestiture Transaction. See Note 6 — Acquisitions, Divestitures and Exchanges in the Notes to Consolidated Financial Statements for additional information.

(Gain) loss on license sales and exchanges

The net gain in 2014 and 2013 was due to license sales and exchanges with third parties. See Note 6 — Acquisitions, Divestitures and Exchanges in the Notes to Consolidated Financial Statements for additional information.

11

| | ||

| | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | ||

Components of Other Income (Expense)

Year Ended December 31, | 2015 | 2014 | 2013 | 2015 vs. 2014 | 2014 vs. 2013 | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

(Dollars in thousands) | ||||||||||||||||||||

Operating income (loss) | $ | 312,942 | $ | (143,390 | ) | $ | 146,865 | $456,332 | >100% | $ | (290,255 | ) | >(100)% | |||||||

Equity in earnings of unconsolidated entities | 140,083 | 129,764 | 131,949 | 10,319 | 8% | (2,185 | ) | (2)% | ||||||||||||

Interest and dividend income | 36,332 | 12,148 | 3,961 | 24,184 | >100% | 8,187 | >100% | |||||||||||||

Gain (loss) on investments | – | – | 18,556 | – | N/M | (18,556 | ) | N/M | ||||||||||||

Interest expense | (86,194 | ) | (57,386 | ) | (43,963 | ) | (28,808 | ) | (50)% | (13,423 | ) | (31)% | ||||||||

Other, net | 466 | 160 | 288 | 306 | >100% | (128 | ) | (44)% | ||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

Total investment and other income | 90,687 | 84,686 | 110,791 | 6,001 | 7% | (26,105 | ) | (24)% | ||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

Income (loss) before income taxes | 403,629 | (58,704 | ) | 257,656 | 462,333 | >100% | (316,360 | ) | >(100)% | |||||||||||

Income tax expense (benefit) | 156,334 | (11,782 | ) | 113,134 | 168,116 | >100% | (124,916 | ) | >(100)% | |||||||||||

| | | | | | | | | | | | | | | | | | | | | |

Net income (loss) | 247,295 | (46,922 | ) | 144,522 | 294,217 | >100% | (191,444 | ) | >(100)% | |||||||||||

Less: Net income (loss) attributable to noncontrolling interests, net of tax | 5,948 | (4,110 | ) | 4,484 | 10,058 | >100% | (8,594 | ) | >(100)% | |||||||||||

| | | | | | | | | | | | | | | | | | | | | |

Net income (loss) attributable to U.S. Cellular shareholders | $ | 241,347 | $ | (42,812 | ) | $ | 140,038 | $284,159 | >100% | $ | (182,850 | ) | >(100)% | |||||||

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

N/M – Percentage change not meaningful

2015-2014 Commentary

Equity in earnings of unconsolidated entities

Equity in earnings of unconsolidated entities represents U.S. Cellular's share of net income from entities in which it has a noncontrolling interest and that are accounted for by the equity method. U.S. Cellular's investment in the Los Angeles SMSA Limited Partnership ("LA Partnership") contributed $74.0 million and $71.8 million to Equity in earnings of unconsolidated entities in 2015 and 2014, respectively.

Interest and dividend income

Interest and dividend income increased due to imputed interest income recognized on equipment installment plans of $33.9 million and $8.7 million in 2015 and 2014, respectively. See Note 3 — Equipment Installment Plans in the Notes to Consolidated Financial Statements for additional information.

Interest expense

Interest expense increased from 2014 to 2015 due primarily to U.S. Cellular's issuance of $275 million of 7.25% Senior Notes in December 2014, borrowing of $225 million on its Term Loan in July 2015 and the $300 million of 7.25% Senior Notes issued in November 2015.

Income tax expense

The effective tax rates on Income before income taxes for 2015 and 2014 were 38.7% and 20.1%, respectively. The following significant discrete and other items impacted income tax expense for these years:

2015 — The effective tax rate for 2015 is consistent with a normalized tax rate inclusive of federal and state tax. There were no significant discrete items that impacted the rate.

2014 — Includes tax expense of $6.4 million related to a valuation allowance recorded against certain state deferred tax assets. The effective tax rate in 2014 is lower due to the effect of this item combined with the loss in 2014 in Income (loss) before income taxes.

See Note 4 — Income Taxes in the Notes to Consolidated Financial Statements for a discussion of income tax expense and the overall effective tax rate on Income before income taxes.

12

| | ||

| | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | ||

Net income (loss) attributable to noncontrolling interests, net of tax

The increase from 2014 to 2015 is due to higher income from certain partnerships in 2015.

2014-2013 Commentary

Equity in earnings of unconsolidated entities

Equity in earnings of unconsolidated entities represents U.S. Cellular's share of net income from entities in which it has a noncontrolling interest and that are accounted for by the equity method. U.S. Cellular's investment in the LA Partnership contributed $71.8 million and $78.4 million to Equity in earnings of unconsolidated entities in 2014 and 2013, respectively.

Interest and dividend income

Interest and dividend income increased due to imputed interest income recognized on equipment installment plans of $8.7 million 2014. See Note 3 — Equipment Installment Plans in the Notes to Consolidated Financial Statements for additional information.

Gain (loss) on investments

In 2013, U.S. Cellular recognized a non-cash pre-tax gain of $18.5 million in connection with the deconsolidation of the NY1 & NY2 Partnerships. See Note 6 — Acquisitions, Divestitures and Exchanges and Note 8 — Investments in Unconsolidated Entities in the Notes to Consolidated Financial Statements for additional information.

Interest expense

Interest expense increased $13.4 million from 2013 due primarily to a decrease in capitalized interest related to fewer network and systems projects. Interest cost capitalized was $6.2 million and $18.4 million for 2014 and 2013, respectively.

Income tax expense

The effective tax rates on Income before income taxes for 2014 and 2013 were 20.1% and 43.9%, respectively. The following significant discrete and other items impacted income tax expense for these years:

2014 — Includes tax expense of $6.4 million related to valuation allowance recorded against certain state deferred tax assets. The effective tax rate in 2014 is lower due to the effect of this item combined with the loss in 2014 in Income (loss) before income taxes.

2013 — Includes tax expense of $20.4 million related to the NY1 & NY2 Deconsolidation and the Divestiture Transaction, and a tax benefit of $5.4 million resulting from statute of limitation expirations.

See Note 4 — Income Taxes in the Notes to Consolidated Financial Statements for a discussion of income tax expense and the overall effective tax rate on Income before income taxes.

Net income (loss) attributable to noncontrolling interests, net of tax

The decrease from 2013 to 2014 is due primarily to the elimination of the noncontrolling interest as a result of the NY1 & NY2 Deconsolidation on April 3, 2013 and lower income from certain partnerships in 2014.

13

| | ||

| | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | ||

LIQUIDITY AND CAPITAL RESOURCES

Sources of Liquidity

U.S. Cellular believes that existing cash and investment balances, funds available under its revolving credit facilities, and expected cash flows from operating and investing activities provide liquidity for U.S. Cellular to meet its normal day-to-day operating needs and debt service requirements for the coming year.

U.S. Cellular operates a capital-intensive business. U.S. Cellular has used internally-generated funds and also has obtained substantial funds from external sources for general corporate purposes. In the past, U.S. Cellular's existing cash and investment balances, funds available under its revolving credit facility, funds from other financing sources, including a term loan and other long-term debt, and cash flows from operating, investing and financing activities, including sales of assets or businesses, provided sufficient liquidity and financial flexibility for U.S. Cellular to meet its normal day-to-day operating needs and debt service requirements, to finance the build-out and enhancement of markets and to fund acquisitions. There is no assurance that this will be the case in the future. It may be necessary from time to time to increase the size of the existing revolving credit facility, to put in place a new credit facility, or to obtain other forms of financing in order to fund potential expenditures. U.S. Cellular's liquidity would be adversely affected if, among other things, U.S. Cellular is unable to obtain short or long-term financing on acceptable terms, U.S. Cellular makes spectrum license purchases in FCC auctions or from other parties, the LA Partnership does not resume or reduces distributions compared to prior historical levels and/or ETC and/or other regulatory support payments continue to decline. In addition, although sales of assets or businesses by U.S. Cellular have been an important source of liquidity for U.S. Cellular in recent periods, U.S. Cellular does not expect a similar level of such sales in the future, which will reduce a source of liquidity for U.S. Cellular. In recent years, U.S. Cellular's credit rating has declined to sub-investment grade.

In certain recent periods, U.S. Cellular has incurred negative free cash flow (defined as Cash flows from operating activities less Cash used for additions to property, plant and equipment) and this will continue in the future if operating results do not improve. U.S. Cellular currently expects to have negative free cash flow in 2016. U.S. Cellular may require substantial additional capital for, among other uses, funding day-to-day operating needs, working capital, acquisitions of providers of wireless telecommunications services, spectrum license or system acquisitions, system development and network capacity expansion, debt service requirements, the repurchase of shares, the payment of dividends, or making additional investments. There can be no assurance that sufficient funds will continue to be available to U.S. Cellular or its subsidiaries on terms or at prices acceptable to U.S. Cellular. Insufficient cash flows from operating activities, changes in its credit ratings, defaults of the terms of debt or credit agreements, uncertainty of access to capital, deterioration in the capital markets, reduced regulatory capital at banks which in turn limits their ability to borrow and lend, other changes in the performance of U.S. Cellular or in market conditions or other factors could limit or restrict the availability of financing on terms and prices acceptable to U.S. Cellular, which could require U.S. Cellular to reduce its acquisition, capital expenditure and business development programs, reduce the acquisition of spectrum licenses, and/or reduce or cease share repurchases and/or the payment of dividends. U.S. Cellular cannot provide assurances that circumstances that could have a material adverse effect on its liquidity or capital resources will not occur. Any of the foregoing would have an adverse impact on U.S. Cellular's businesses, financial condition or results of operations.

Cash and Cash Equivalents

Cash and cash equivalents include cash and money market investments. The primary objective of U.S. Cellular's Cash and cash equivalents is for use in its operations and acquisition, capital expenditure and business development programs.

14

| | ||

| | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | ||

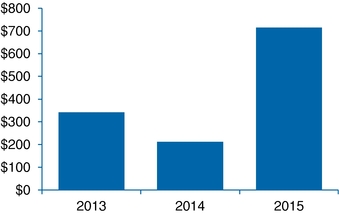

| |

U.S. Cellular Cash and Cash Equivalents |

| At December 31, 2015, U.S. Cellular's cash and cash equivalents totaled $715.4 million. The majority of U.S. Cellular's Cash and cash equivalents was held in bank deposit accounts and in money market funds that invest exclusively in U.S. Treasury Notes or in repurchase agreements fully collateralized by such obligations. U.S. Cellular monitors the financial viability of the money market funds and direct investments in which it invests and believes that the credit risk associated with these investments is low. | |

| | | |

Financing

Revolving Credit Facility

U.S. Cellular has a revolving credit facility available for general corporate purposes including spectrum purchases and capital expenditures, with a maximum borrowing capacity of $300 million. As of December 31, 2015, the unused capacity under this agreement was $282.5 million. U.S. Cellular did not borrow or repay any cash amounts under its revolving credit facility in 2015, and had no cash borrowings outstanding under its revolving credit facility as of December 31, 2015. The continued availability of the revolving credit facility requires U.S. Cellular to comply with certain negative and affirmative covenants, maintain certain financial ratios and make representations regarding certain matters at the time of each borrowing. The covenants also prescribe certain terms associated with intercompany loans from TDS or TDS subsidiaries to U.S. Cellular or U.S. Cellular subsidiaries. There were no intercompany loans at December 31, 2015 or 2014. U.S. Cellular believes that it was in compliance as of December 31, 2015 with all of the financial and other covenants and requirements set forth in its revolving credit facility.

See Note 11 — Debt in the Notes to Consolidated Financial Statements for additional information regarding the revolving credit facility.

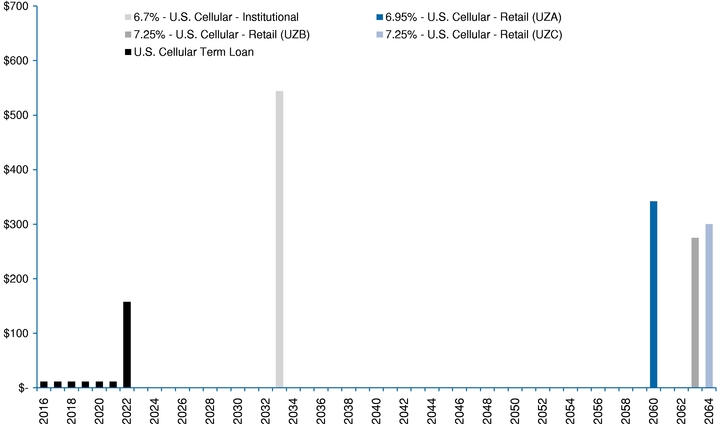

Term Loan

In January 2015, U.S. Cellular entered into a senior term loan credit facility. In July 2015, U.S. Cellular borrowed the full amount of $225 million available under this facility in two separate draws. Principal reductions will be due and payable in quarterly installments of $2.8 million beginning in March 2016 through December 2021, and the remaining unpaid balance will be due and payable in January 2022. This facility was entered into for general corporate purposes, including working capital, spectrum purchases and capital expenditures.

The continued availability of the term loan facility requires U.S. Cellular to comply with certain negative and affirmative covenants, maintain certain financial ratios and make representations regarding certain matters at the time of each borrowing, that are substantially the same as those in U.S. Cellular's revolving credit facility described above. U.S. Cellular believes that it was in compliance at December 31, 2015 with all of the financial and other covenants and requirements set forth in the term loan facility.

See Note 11 — Debt in the Notes to Consolidated Financial Statements for additional information.

Financial Covenants

As noted above, the revolving credit facility and senior term loan facility require U.S. Cellular to comply with certain affirmative and negative covenants, including certain financial covenants. In particular, under these agreements, as amended, beginning July 1, 2014, U.S. Cellular is required to maintain the Consolidated Leverage Ratio at a level not to

15

| | ||

| | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | ||

exceed 3.75 to 1.00 for the period of the four fiscal quarters most recently ended (this was 3.00 to 1.00 prior to July 1, 2014). The maximum permitted Consolidated Leverage Ratio decreases beginning January 1, 2016 from 3.75 to 3.50, with further decreases effective July 1, 2016 and January 1, 2017 (and will return to 3.00 to 1.00 at that time). U.S. Cellular believes it was in compliance at December 31, 2015 with all such covenants. However, depending on U.S. Cellular's future financial performance, there is a risk that U.S. Cellular could fail to satisfy the financial covenants in the future. If U.S. Cellular breaches a financial or other covenant of either of these agreements, it would result in a default under that agreement, and could involve a cross-default under other debt instruments. This could in turn cause the affected lenders to accelerate the repayment of principal and accrued interest on any outstanding debt under such agreements and, if they choose, terminate the facility. If appropriate, U.S. Cellular may request the applicable lender for an amendment of financial covenants in the U.S. Cellular revolving credit facility and the U.S. Cellular term loan facility, in order to provide additional financial flexibility to U.S. Cellular, and may also seek other changes to such facilities. There is no assurance that the lenders will agree to any amendments. If the lenders agree to amendments, this may result in additional payments or higher interest rates payable to the lenders and/or additional restrictions. Restrictions in such debt instruments may limit U.S. Cellular's operating and financial flexibility.

Other Long-Term Financing

U.S. Cellular has an effective shelf registration statement on Form S-3 to issue senior or subordinated debt securities. The proceeds from any such issuance may be used for general corporate purposes, including: the possible reduction of other short-term or long-term debt, spectrum purchases, and capital expenditures; in connection with acquisition, construction and development programs; for working capital; to provide additional investments in subsidiaries; or the repurchase of shares. The U.S. Cellular shelf registration statement permits U.S. Cellular to issue at any time and from time to time senior or subordinated debt securities in one or more offerings, up to the amount registered. The ability of U.S. Cellular to complete an offering pursuant to such shelf registration statement is subject to market conditions and other factors at the time.

In November 2015, U.S. Cellular issued $300 million of 7.25% Senior Notes due in 2064 for general corporate purposes including spectrum purchases, reducing the available amount on U.S. Cellular's shelf registration statement from $500 million to $200 million. U.S. Cellular has the authority to replenish this shelf registration statement back to $500 million.

U.S. Cellular believes that it was in compliance as of December 31, 2015 with all covenants and other requirements set forth in its long-term debt indentures. U.S. Cellular has not failed to make nor does it expect to fail to make any scheduled payment of principal or interest under such indentures.

The long-term debt principal payments due for the next five years represent less than 4% of the total gross long-term debt obligation at December 31, 2015. Refer to Market Risk — Long-Term Debt for additional information regarding required principal payments and the weighted average interest rates related to U.S. Cellular's Long-term debt.

U.S. Cellular, at its discretion, may from time to time seek to retire or purchase its outstanding debt through cash purchases and/or exchanges for other securities, in open market purchases, privately negotiated transactions, tender offers, exchange offers or otherwise. Such repurchases or exchanges, if any, will depend on prevailing market conditions, liquidity requirements, contractual restrictions and other factors. The amounts involved may be material.

See Note 11 — Debt in the Notes to Consolidated Financial Statements for additional information on long-term financing.

Credit Rating

In certain circumstances, U.S. Cellular's interest cost on its revolving credit and term loan facilities may be subject to increase if its current credit ratings from nationally recognized credit rating agencies are lowered, and may be subject to decrease if the ratings are raised. U.S. Cellular's facilities do not cease to be available nor do the maturity dates accelerate solely as a result of a downgrade in credit rating. However, a downgrade U.S. Cellular's credit rating could adversely affect its ability to renew the facilities or obtain access to other credit facilities in the future.

16

| | ||

| | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | ||

U.S. Cellular is rated at sub-investment grade. U.S. Cellular's credit ratings as of December 31, 2015, and the dates such ratings were issued/re-affirmed were as follows:

| Rating Agency | Rating | Outlook | ||

|---|---|---|---|---|

| | | | | |

| Moody's (re-affirmed November 2015) | Ba1 | —negative outlook | ||

| Standard & Poor's (re-affirmed November 2015) | BB | —stable outlook | ||

| Fitch Ratings (re-affirmed August 2015) | BB+ | —stable outlook | ||

| | | | | |

Capital Requirements

The discussion below is intended to highlight some of the significant cash outlays expected during 2016 and beyond and to highlight the spending incurred in prior years for these items. This discussion does not include cash required to fund normal operations, and is not a comprehensive list of capital requirements. Significant cash requirements that are not routine or in the normal course of business could arise from time to time.

Capital Expenditures

U.S. Cellular makes substantial investments to acquire wireless licenses and properties and to construct and upgrade wireless telecommunications networks and facilities to remain competitive and as a basis for creating long-term value for shareholders. In recent years, rapid changes in technology and new opportunities (such as 4G LTE technology) have required substantial investments in potentially revenue-enhancing and cost-reducing upgrades of U.S. Cellular's networks to remain competitive.

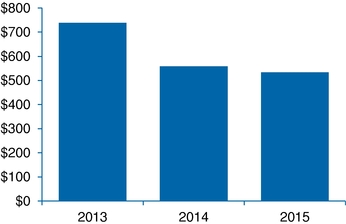

Capital expenditures (i.e., additions to property, plant and equipment and system development expenditures), which include the effects of accruals and capitalized interest, in 2015, 2014 and 2013 were as follows:

| |

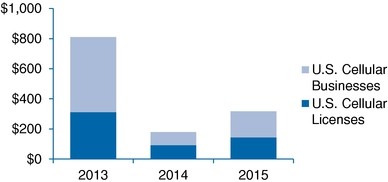

Capital Expenditures |

| In 2015, U.S. Cellular completed its deployment of 4G LTE technology in certain markets. U.S. Cellular's capital expenditures for 2016 are expected to be approximately $500 million. These expenditures are expected to be for the following general purposes: § Expand and enhance network coverage, including construction of a new regional connectivity center and providing additional capacity to accommodate increased network usage, principally data usage, by current customers; § Deploy VoLTE technology in certain markets; § Expand and enhance the retail store network; and § Develop and enhance office systems. | |

| | | |

U.S. Cellular plans to finance its capital expenditures program for 2016 using primarily Cash flows from operating activities, existing cash balances, borrowings under its revolving credit agreement and/or other long-term debt.

Acquisitions, Divestitures and Exchanges

U.S. Cellular assesses its existing wireless interests on an ongoing basis with a goal of improving the competitiveness of its operations and maximizing its long-term return on capital. In general, U.S. Cellular may not disclose such transactions until there is a definitive agreement. See Note 6 — Acquisitions, Divestitures and Exchanges in the Notes to Consolidated Financial Statements for additional information related to significant transactions. As part of this strategy, U.S. Cellular reviews attractive opportunities to acquire additional wireless operating markets and wireless spectrum, including pursuant to FCC auctions. Cash payments for acquisitions of licenses were $285.8 million, $38.2 million and $16.5 million in 2015, 2014 and 2013, respectively.

17

| | ||

| | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | ||

Cash received from divestitures in 2015, 2014 and 2013 were as follows:

| |

Cash Payments Received from Divestitures |

| U.S. Cellular may seek to divest outright or include in exchanges for other wireless interests those interests that are not strategic to its long-term success. As a result, U.S. Cellular may be engaged from time to time in negotiations relating to the acquisition, divestiture or exchange of companies, properties or wireless spectrum. | |

| | | |

In February 2016, U.S. Cellular filed an application to participate as a forward auction bidder for 600 MHz broadcast television spectrum licenses in an FCC auction referred to as Auction 1000. Auction 1000 is expected to commence with the broadcaster initial commitment deadline on March 29, 2016. Forward auction bidding is likely to begin a couple of months later and could continue for three months or longer. See "Regulatory Matters — FCC Auction 1000." Prior to becoming a qualified bidder, U.S. Cellular must make an upfront payment, the size of which establishes its initial bidding eligibility. If U.S. Cellular is a winning bidder in the auction, it may be required to make additional payments to the FCC that may be substantial. In such event, U.S. Cellular plans to finance such payments from its existing cash balances, borrowings under its revolving credit agreement and/or additional long-term debt.

Due to the FCC's anti-collusion rules, U.S. Cellular may not disclose any details relating to its participation or information about whether or not it is a winning bidder unless and until it is announced as a winning bidder by the FCC.

Due to changes in FCC rules, U.S. Cellular will not be participating in Auction 1000 through a limited partnership that is a "designated entity" which qualifies for a discount of 25% on any licenses won in the auction, as U.S. Cellular has done in prior auctions. Instead, U.S. Cellular will be participating in the auction directly and will not qualify for any discount on licenses that may be won in the auction.

To the extent that existing competitors or new entrants acquire low-band (600 MHz) spectrum in U.S. Cellular markets in Auction 1000, U.S. Cellular could face increased competition over time from competitors that hold more efficient and superior low-band spectrum, which would have an adverse effect on U.S. Cellular's wireless competitive position.

In January 2016, U.S. Cellular entered into an agreement to purchase a 700 MHz A Block license for $36.0 million. In February 2016, U.S. Cellular entered into multiple agreements with third parties that provide for the transfer of certain AWS and PCS spectrum licenses and approximately $30 million in cash to U.S. Cellular, in exchange for U.S. Cellular transferring certain AWS, PCS and 700 MHz licenses to the third parties.

Variable Interest Entities

U.S. Cellular consolidates certain entities because they are "variable interest entities" under GAAP. See Note 13 — Variable Interest Entities in the Notes to Consolidated Financial Statements for additional information related to these variable interest entities. U.S. Cellular may elect to make additional capital contributions and/or advances to these variable interest entities in future periods in order to fund their operations.

Common Share Repurchase Program

In 2009, the Board of Directors of U.S. Cellular authorized the repurchase from time to time of up to 1,300,000 Common Shares on an annual basis beginning in 2009 and continuing each year thereafter, on a cumulative basis. As of December 31, 2015, there were 4,755,298 U.S. Cellular Common Shares available for purchase under this program, which increased by 1,300,000 Common Shares on January 1, 2016. This authorization does not have an expiration date.

18

| | ||

| | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | ||

There were limited U.S. Cellular share repurchases in 2015. Depending on its future financial performance, construction, development or acquisition programs, and available sources of financing, U.S. Cellular may not have sufficient liquidity or capital resources to make significant share repurchases. Therefore, there is no assurance that U.S. Cellular will make any significant amount of share repurchases in the future.

For additional information related to the current repurchase authorization and repurchases made during 2015, 2014 and 2013, see Note 15 — Common Shareholders' Equity in the Notes to Consolidated Financial Statements.

Off-Balance Sheet Arrangements

U.S. Cellular had no transactions, agreements or other contractual arrangements with unconsolidated entities involving "off-balance sheet arrangements," as defined by SEC rules, that had or are reasonably likely to have a material current or future effect on its financial condition, results of operations, liquidity, capital expenditures or capital resources.

CONTRACTUAL AND OTHER OBLIGATIONS

At December 31, 2015, the resources required for contractual obligations were as follows:

| | | Payments Due by Period | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Total | Less Than 1 Year | 1 - 3 Years | 3 - 5 Years | More Than 5 Years | |||||||||||

| | | | | | | | | | | | | | | | | |

(Dollars in millions) | ||||||||||||||||

Long-term debt obligations1 | $ | 1,686.3 | $ | 11.3 | $ | 22.6 | $ | 22.6 | $ | 1,629.8 | ||||||

Interest payments on long-term debt obligations | 3,798.7 | 109.1 | 218.2 | 218.2 | 3,253.2 | |||||||||||

Operating leases2 | 1,203.5 | 142.0 | 228.9 | 160.9 | 671.7 | |||||||||||

Capital leases | 3.8 | 0.2 | 0.5 | 0.6 | 2.5 | |||||||||||

Purchase obligations3 | 1,087.1 | 562.7 | 336.9 | 132.9 | 54.6 | |||||||||||

| | | | | | | | | | | | | | | | | |

| $ | 7,779.4 | $ | 825.3 | $ | 807.1 | $ | 535.2 | $ | 5,611.8 | |||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

- 1

- Includes current and long-term portions of debt obligations. The total long-term debt obligation differs from Long-term debt, net in the Consolidated Balance Sheet due to capital leases, debt issuance costs and the unamortized discount related to U.S. Cellular's 6.7% Senior Notes. See Note 11 — Debt in the Notes to Consolidated Financial Statements for additional information.

- 2

- Includes future lease costs related to office space, retail sites, cell sites and equipment. See Note 12 — Commitments and Contingencies in the Notes to Consolidated Financial Statements for additional information.

- 3

- Includes obligations payable under non-cancellable contracts, commitments for network facilities and transport services, agreements for software licensing, long-term marketing programs, and agreements with Apple to purchase certain minimum quantities of Apple iPhone products and fund marketing programs related to the Apple iPhone and iPad products.

The table above excludes liabilities related to "unrecognized tax benefits" as defined by GAAP because U.S. Cellular is unable to predict the period of settlement of such liabilities. Such unrecognized tax benefits were $38.5 million at December 31, 2015. See Note 4 — Income Taxes in the Notes to Consolidated Financial Statements for additional information on unrecognized tax benefits.

See Note 12 — Commitments and Contingencies in the Notes to Consolidated Financial Statements for additional information.

U.S. Cellular operates a capital- and marketing-intensive business. U.S. Cellular utilizes cash on hand, cash from operating activities, cash proceeds from divestitures and disposition of investments, short-term credit facilities and long-term debt financing to fund its acquisitions (including licenses), construction costs, operating expenses and share repurchases. Cash flows may fluctuate from quarter to quarter and year to year due to seasonality, the timing of acquisitions and divestitures, capital expenditures and other factors. The following discussion summarizes U.S. Cellular's cash flow activities in 2015, 2014 and 2013.

19

| | ||

| | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | ||

2015 Commentary

Cash Flows from Operating Activities

Cash flows from operating activities were $555.1 million in 2015. An increase in cash flows from operating activities was due primarily to improved net income and working capital factors. In 2015, increased receivables related to equipment installment plans decreased cash flows from operating activities. In the near term and as the popularity of equipment installment plans increases, U.S. Cellular expects this trend to continue.

In December 2015, as part of the Protecting Americans from Tax Hikes Act of 2015, bonus depreciation was enacted which allowed U.S. Cellular to accelerate deductions for depreciation, resulting in an overpayment of estimated tax amounts paid during 2015. Primarily as a result of this overpayment, U.S. Cellular has recorded $34.3 million of Income taxes receivable at December 31, 2015. U.S. Cellular paid income taxes, net of refunds, of $59.2 million in 2015.