EXHIBIT 99.1

| | | | | |

| Table of Contents | |

| |

| Third Quarter 2022 | |

| Supplemental Financial and Operating Data | Page |

| |

| Income Statements | |

| Wellhead Volumes and Prices | |

| Balance Sheets | |

| Cash Flows Statements | |

| Non-GAAP Financial Measures | |

| Adjusted Net Income (Loss) | |

| Adjusted Net Income Per Share | |

| Cash Flow from Operations and Free Cash Flow | |

| Net Debt-to-Total Capitalization Ratio | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

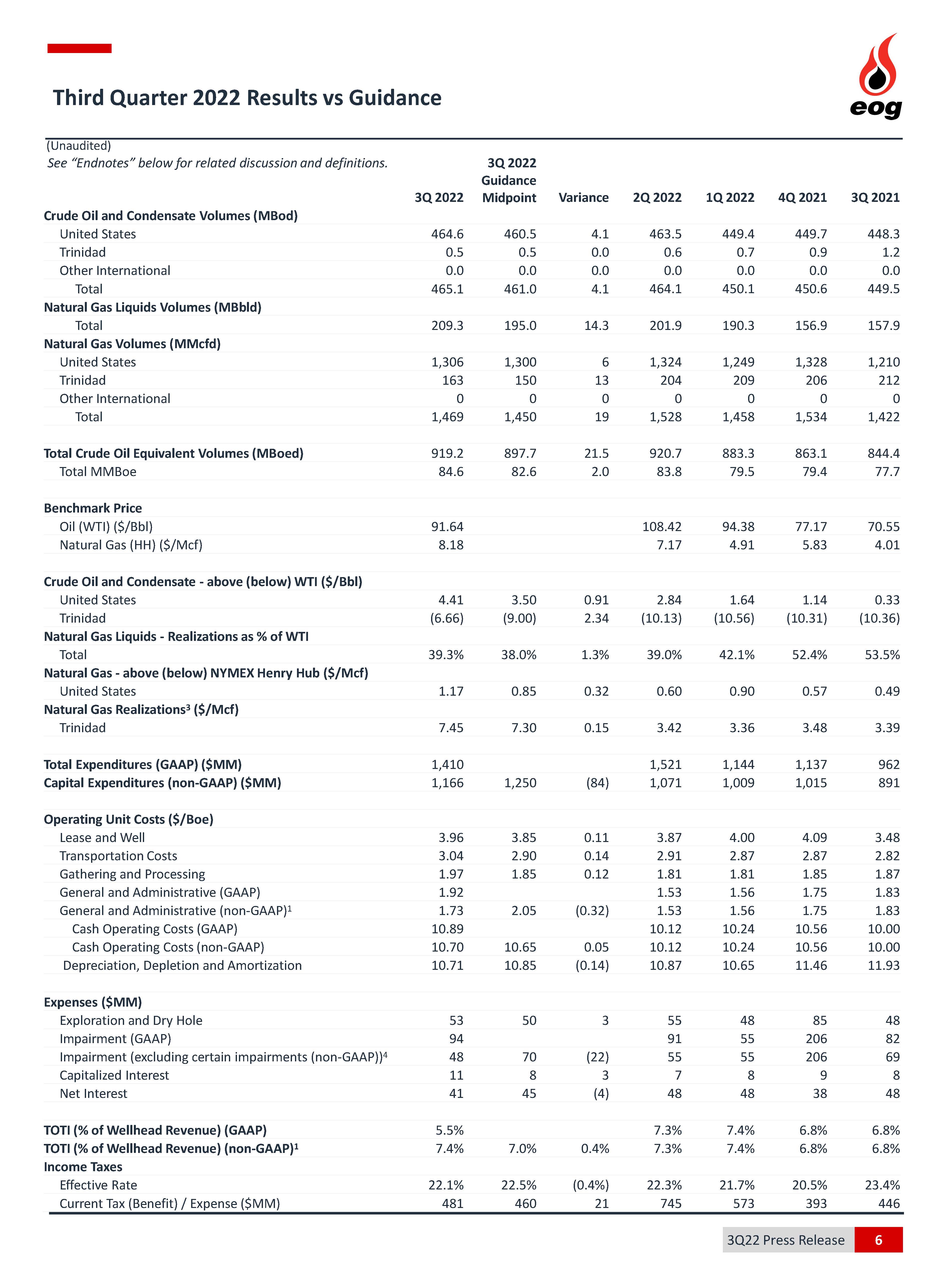

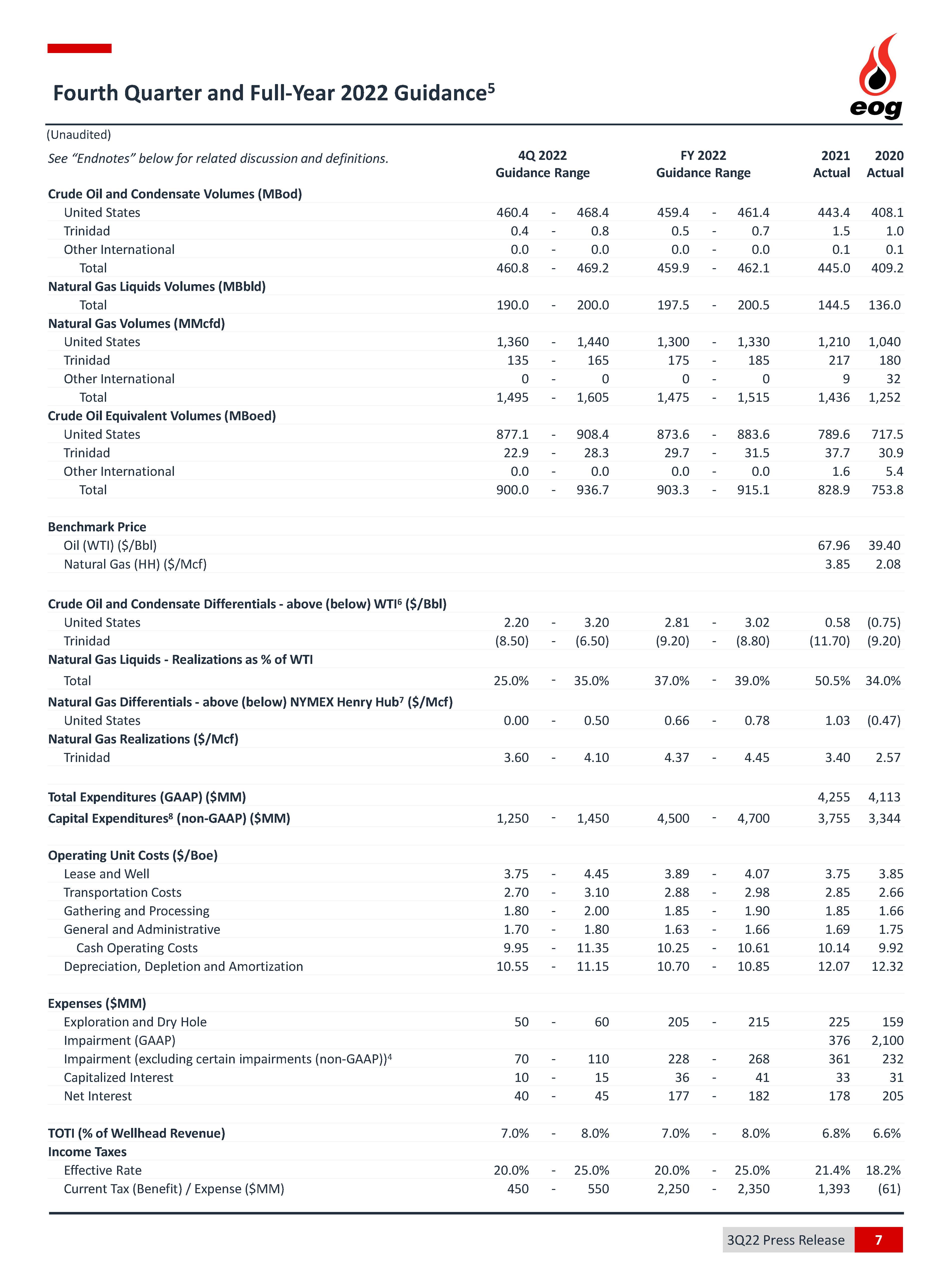

| Income Statements | | | | | | | | | |

| In millions of USD, except share data (in millions) and per share data (Unaudited) | | | | |

| 3Q 2022 | | 2Q 2022 | | 3Q 2021 | | YTD 2022 | | YTD 2021 |

| Operating Revenues and Other | | | | | | | | | |

| Crude Oil and Condensate | 4,109 | | | 4,699 | | | 2,929 | | | 12,697 | | | 7,879 | |

| Natural Gas Liquids | 693 | | | 777 | | | 548 | | | 2,151 | | | 1,229 | |

| Natural Gas | 1,235 | | | 1,000 | | | 568 | | | 2,951 | | | 1,597 | |

| Losses on Mark-to-Market Financial Commodity Derivative Contracts | (18) | | | (1,377) | | | (494) | | | (4,215) | | | (1,288) | |

| Gathering, Processing and Marketing | 1,561 | | | 2,169 | | | 1,186 | | | 5,199 | | | 3,056 | |

| Gains (Losses) on Asset Dispositions, Net | (21) | | | 97 | | | 1 | | | 101 | | | 46 | |

| Other, Net | 34 | | | 42 | | | 27 | | | 99 | | | 79 | |

| Total | 7,593 | | | 7,407 | | | 4,765 | | | 18,983 | | | 12,598 | |

| | | | | | | | | |

| Operating Expenses | | | | | | | | | |

| Lease and Well | 335 | | | 324 | | | 270 | | | 977 | | | 810 | |

| Transportation Costs | 257 | | | 244 | | | 219 | | | 729 | | | 635 | |

| Gathering and Processing Costs | 167 | | | 152 | | | 145 | | | 463 | | | 412 | |

| Exploration Costs | 35 | | | 35 | | | 44 | | | 115 | | | 112 | |

| Dry Hole Costs | 18 | | | 20 | | | 4 | | | 41 | | | 28 | |

| Impairments | 94 | | | 91 | | | 82 | | | 240 | | | 170 | |

| Marketing Costs | 1,621 | | | 2,127 | | | 1,184 | | | 5,031 | | | 3,013 | |

| Depreciation, Depletion and Amortization | 906 | | | 911 | | | 927 | | | 2,664 | | | 2,741 | |

| General and Administrative | 162 | | | 128 | | | 142 | | | 414 | | | 372 | |

| Taxes Other Than Income | 334 | | | 472 | | | 277 | | | 1,196 | | | 731 | |

| Total | 3,929 | | | 4,504 | | | 3,294 | | | 11,870 | | | 9,024 | |

| | | | | | | | | |

| Operating Income | 3,664 | | | 2,903 | | | 1,471 | | | 7,113 | | | 3,574 | |

| Other Income, Net | 40 | | | 27 | | | 6 | | | 66 | | | — | |

| Income Before Interest Expense and Income Taxes | 3,704 | | | 2,930 | | | 1,477 | | | 7,179 | | | 3,574 | |

| Interest Expense, Net | 41 | | | 48 | | | 48 | | | 137 | | | 140 | |

| Income Before Income Taxes | 3,663 | | | 2,882 | | | 1,429 | | | 7,042 | | | 3,434 | |

| Income Tax Provision | 809 | | | 644 | | | 334 | | | 1,560 | | | 755 | |

| Net Income | 2,854 | | | 2,238 | | | 1,095 | | | 5,482 | | | 2,679 | |

| | | | | | | | | |

| Dividends Declared per Common Share | 2.2500 | | | 2.5500 | | | 0.4125 | | | 6.5500 | | | 2.2375 | |

| Net Income Per Share | | | | | | | | | |

| Basic | 4.90 | | | 3.84 | | | 1.88 | | | 9.40 | | | 4.62 | |

| Diluted | 4.86 | | | 3.81 | | | 1.88 | | | 9.34 | | | 4.59 | |

| Average Number of Common Shares | | | | | | | | | |

| Basic | 583 | | | 583 | | | 581 | | | 583 | | | 580 | |

| Diluted | 587 | | | 588 | | | 584 | | | 587 | | | 584 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Wellhead Volumes and Prices | | | | | | | | | | | | | | |

| (Unaudited) | | |

| 3Q 2022 | | 3Q 2021 | | % Change | | | | | | | | 2Q 2022 | | YTD 2022 | | YTD 2021 | | % Change |

| | | | | | | | | | | | | | | | | | | |

Crude Oil and Condensate Volumes (MBbld) (A) | | | | | | | | | | | | | | | | | |

| United States | 464.6 | | | 448.3 | | | 4 | % | | | | | | | | 463.5 | | | 459.2 | | | 441.3 | | | 4 | % |

| Trinidad | 0.5 | | | 1.2 | | | -58 | % | | | | | | | | 0.6 | | | 0.7 | | | 1.7 | | | -59 | % |

Other International (B) | — | | | — | | | | | | | | | | | — | | | — | | | 0.1 | | | -100 | % |

| Total | 465.1 | | | 449.5 | | | 3 | % | | | | | | | | 464.1 | | | 459.9 | | | 443.1 | | | 4 | % |

| | | | | | | | | | | | | | | | | | | |

Average Crude Oil and Condensate Prices ($/Bbl) (C) | | | | | | | | | | | | | | | | | | | |

| United States | $ | 96.05 | | | $ | 70.88 | | | 36 | % | | | | | | | | $ | 111.26 | | | $ | 101.16 | | | $ | 65.18 | | | 55 | % |

| Trinidad | 84.98 | | | 60.19 | | | 41 | % | | | | | | | | 98.29 | | | 88.84 | | | 54.33 | | | 64 | % |

Other International (B) | — | | | — | | | | | | | | | | | — | | | — | | | 42.36 | | | -100 | % |

| Composite | 96.04 | | | 70.85 | | | 36 | % | | | | | | | | 111.25 | | | 101.14 | | | 65.14 | | | 55 | % |

| | | | | | | | | | | | | | | | | | | |

Natural Gas Liquids Volumes (MBbld) (A) | | | | | | | | | | | | | | | | | | | |

| United States | 209.3 | | | 157.9 | | | 33 | % | | | | | | | | 201.9 | | | 200.6 | | | 140.4 | | | 43 | % |

| Total | 209.3 | | | 157.9 | | | 33 | % | | | | | | | | 201.9 | | | 200.6 | | | 140.4 | | | 43 | % |

| | | | | | | | | | | | | | | | | | | |

Average Natural Gas Liquids Prices ($/Bbl) (C) | | | | | | | | | | | | | | | | | | | |

| United States | $ | 36.02 | | | $ | 37.72 | | | -4 | % | | | | | | | | $ | 42.28 | | | $ | 39.29 | | | $ | 32.07 | | | 23 | % |

| Composite | 36.02 | | | 37.72 | | | -4 | % | | | | | | | | 42.28 | | | 39.29 | | | 32.07 | | | 23 | % |

| | | | | | | | | | | | | | | | | | | |

Natural Gas Volumes (MMcfd) (A) | | | | | | | | | | | | | | | | | | | |

| United States | 1,306 | | | 1,210 | | | 8 | % | | | | | | | | 1,324 | | | 1,293 | | | 1,170 | | | 11 | % |

| Trinidad | 163 | | | 212 | | | -23 | % | | | | | | | | 204 | | | 192 | | | 221 | | | -13 | % |

Other International (B) | — | | | — | | | | | | | | | | | — | | | — | | | 12 | | | -100 | % |

| Total | 1,469 | | | 1,422 | | | 3 | % | | | | | | | | 1,528 | | | 1,485 | | | 1,403 | | | 6 | % |

| | | | | | | | | | | | | | | | | | | |

Average Natural Gas Prices ($/Mcf) (C) | | | | | | | | | | | | | | | | | | | |

| United States | $ | 9.35 | | | $ | 4.50 | | | 108 | % | | | | | | | | $ | 7.77 | | | $ | 7.68 | | | $ | 4.30 | | | 79 | % |

| Trinidad | 7.45 | | (E) | 3.39 | | | 120 | % | | | | | | | | 3.42 | | | 4.55 | | (E) | 3.38 | | | 35 | % |

Other International (B) | — | | | — | | | | | | | | | | | — | | | — | | | 5.67 | | | -100 | % |

| Composite | 9.14 | | | 4.34 | | | 111 | % | | | | | | | | 7.19 | | | 7.28 | | | 4.17 | | | 75 | % |

| | | | | | | | | | | | | | | | | | | |

Crude Oil Equivalent Volumes (MBoed) (D) | | | | | | | | | | | | | | | | | | | |

| United States | 891.6 | | | 807.9 | | | 10 | % | | | | | | | | 886.1 | | | 875.3 | | | 776.8 | | | 13 | % |

| Trinidad | 27.6 | | | 36.5 | | | -24 | % | | | | | | | | 34.6 | | | 32.6 | | | 38.5 | | | -15 | % |

Other International (B) | — | | | — | | | | | | | | | | | — | | | — | | | 2.0 | | | -100 | % |

| Total | 919.2 | | | 844.4 | | | 9 | % | | | | | | | | 920.7 | | | 907.9 | | | 817.3 | | | 11 | % |

| | | | | | | | | | | | | | | | | | | |

Total MMBoe (D) | 84.6 | | | 77.7 | | | 9 | % | | | | | | | | 83.8 | | | 247.8 | | | 223.1 | | | 11 | % |

| | | | | | | | | | | | | | | | | | | |

(A)Thousand barrels per day or million cubic feet per day, as applicable.

(B)Other International includes EOG's China and Canada operations. The China operations were sold in the second quarter of 2021.

(C)Dollars per barrel or per thousand cubic feet, as applicable. Excludes the impact of financial commodity derivative instruments (see Note 12 to the Condensed Consolidated Financial Statements in EOG's Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2022).

(D)Thousand barrels of oil equivalent per day or million barrels of oil equivalent, as applicable; includes crude oil and condensate, NGLs and natural gas. Crude oil equivalent volumes are determined using a ratio of 1.0 barrel of crude oil and condensate or NGLs to 6.0 thousand cubic feet of natural gas. MMBoe is calculated by multiplying the MBoed amount by the number of days in the period and then dividing that amount by one thousand.

(E)Includes revenue adjustment of $3.37 per Mcf and $0.96 per Mcf ($0.37 per Mcf and $0.12 per Mcf of EOG's composite wellhead natural gas price) for the quarter and year-to-date, respectively, related to a price adjustment per a provision of the natural gas sales contract with NGC amended in July 2022 for natural gas sales during the period from September 2020 through June 2022.

| | | | | | | | | | | |

| Balance Sheets | | | |

| In millions of USD, except share data (Unaudited) |

| September 30, | | December 31, |

| 2022 | | 2021 |

| Current Assets | | | |

| Cash and Cash Equivalents | 5,272 | | | 5,209 | |

| Accounts Receivable, Net | 3,343 | | | 2,335 | |

| Inventories | 872 | | | 584 | |

| Income Taxes Receivable | 93 | | | — | |

| Other | 621 | | | 456 | |

| Total | 10,201 | | | 8,584 | |

|

| Property, Plant and Equipment | | | |

| Oil and Gas Properties (Successful Efforts Method) | 67,065 | | | 67,644 | |

| Other Property, Plant and Equipment | 4,659 | | | 4,753 | |

| Total Property, Plant and Equipment | 71,724 | | | 72,397 | |

| Less: Accumulated Depreciation, Depletion and Amortization | (42,623) | | | (43,971) | |

| Total Property, Plant and Equipment, Net | 29,101 | | | 28,426 | |

| Deferred Income Taxes | 18 | | | 11 | |

| Other Assets | 1,167 | | | 1,215 | |

| Total Assets | 40,487 | | | 38,236 | |

|

| Current Liabilities | | | |

| Accounts Payable | 2,718 | | | 2,242 | |

| Accrued Taxes Payable | 542 | | | 518 | |

| Dividends Payable | 437 | | | 436 | |

| Liabilities from Price Risk Management Activities | 243 | | | 269 | |

| Current Portion of Long-Term Debt | 1,282 | | | 37 | |

| Current Portion of Operating Lease Liabilities | 235 | | | 240 | |

| Other | 289 | | | 300 | |

| Total | 5,746 | | | 4,042 | |

| | | |

| Long-Term Debt | 3,802 | | | 5,072 | |

| Other Liabilities | 2,573 | | | 2,193 | |

| Deferred Income Taxes | 4,517 | | | 4,749 | |

| Commitments and Contingencies | | | |

| | | |

| Stockholders' Equity | | | |

| Common Stock, $0.01 Par, 1,280,000,000 Shares Authorized and 587,891,710 Shares Issued at September 30, 2022 and 585,521,512 Shares Issued at December 31, 2021 | 206 | | | 206 | |

| Additional Paid in Capital | 6,155 | | | 6,087 | |

| Accumulated Other Comprehensive Loss | (6) | | | (12) | |

| Retained Earnings | 17,563 | | | 15,919 | |

| Common Stock Held in Treasury, 646,861 Shares at September 30, 2022 and 257,268 Shares at December 31, 2021 | (69) | | | (20) | |

| Total Stockholders' Equity | 23,849 | | | 22,180 | |

| Total Liabilities and Stockholders' Equity | 40,487 | | | 38,236 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash Flows Statements | | | | | | | | | |

| In millions of USD (Unaudited) | | | | | | | | | |

| 3Q 2022 | | 2Q 2022 | | 3Q 2021 | | YTD 2022 | | YTD 2021 |

| Cash Flows from Operating Activities | | | | | | | | | |

| Reconciliation of Net Income to Net Cash Provided by Operating Activities: | | | | | | | | | |

| Net Income | 2,854 | | | 2,238 | | | 1,095 | | | 5,482 | | | 2,679 | |

| Items Not Requiring (Providing) Cash | | | | | | | | | |

| Depreciation, Depletion and Amortization | 906 | | | 911 | | | 927 | | | 2,664 | | | 2,741 | |

| Impairments | 94 | | | 91 | | | 82 | | | 240 | | | 170 | |

| Stock-Based Compensation Expenses | 34 | | | 30 | | | 51 | | | 99 | | | 117 | |

| Deferred Income Taxes | 327 | | | (102) | | | (111) | | | (240) | | | (244) | |

| (Gains) Losses on Asset Dispositions, Net | 21 | | | (97) | | | (1) | | | (101) | | | (46) | |

| Other, Net | (5) | | | (16) | | | 2 | | | (15) | | | 15 | |

| Dry Hole Costs | 18 | | | 20 | | | 4 | | | 41 | | | 28 | |

| Mark-to-Market Financial Commodity Derivative Contracts Total Losses | 18 | | | 1,377 | | | 494 | | | 4,215 | | | 1,288 | |

| Net Cash Payments for Settlements of Financial Commodity Derivative Contracts | (847) | | | (2,114) | | | (293) | | | (3,257) | | | (516) | |

| Other, Net | 12 | | | 19 | | | 7 | | | 33 | | | 8 | |

| Changes in Components of Working Capital and Other Assets and Liabilities | | | | | | | | | |

| Accounts Receivable | 392 | | | (522) | | | (145) | | | (1,008) | | | (639) | |

| Inventories | (140) | | | (157) | | | (6) | | | (311) | | | 95 | |

| Accounts Payable | (88) | | | 259 | | | (68) | | | 301 | | | 115 | |

| Accrued Taxes Payable | (53) | | | (536) | | | 206 | | | 24 | | | 286 | |

| Other Assets | (129) | | | 71 | | | 167 | | | (271) | | | (55) | |

| Other Liabilities | 1,269 | | | 433 | | | (260) | | | (548) | | | (317) | |

| Changes in Components of Working Capital Associated with Investing Activities | 90 | | | 143 | | | 45 | | | 301 | | | (100) | |

| Net Cash Provided by Operating Activities | 4,773 | | | 2,048 | | | 2,196 | | | 7,649 | | | 5,625 | |

| Investing Cash Flows | | | | | | | | | |

| Additions to Oil and Gas Properties | (1,102) | | | (1,349) | | | (846) | | | (3,390) | | | (2,689) | |

| Additions to Other Property, Plant and Equipment | (103) | | | (75) | | | (50) | | | (248) | | | (147) | |

| Proceeds from Sales of Assets | 79 | | | 110 | | | 8 | | | 310 | | | 154 | |

| Other Investing Activities | — | | | (30) | | | — | | | (30) | | | — | |

| Changes in Components of Working Capital Associated with Investing Activities | (90) | | | (143) | | | (45) | | | (301) | | | 100 | |

| Net Cash Used in Investing Activities | (1,216) | | | (1,487) | | | (933) | | | (3,659) | | | (2,582) | |

| Financing Cash Flows | | | | | | | | | |

| Long-Term Debt Repayments | — | | | — | | | — | | | — | | | (750) | |

| Dividends Paid | (1,312) | | | (1,486) | | | (820) | | | (3,821) | | | (1,278) | |

| Treasury Stock Purchased | (37) | | | (15) | | | (21) | | | (95) | | | (33) | |

| Proceeds from Stock Options Exercised and Employee Stock Purchase Plan | — | | | 13 | | | — | | | 17 | | | 9 | |

| Repayment of Finance Lease Liabilities | (8) | | | (9) | | | (9) | | | (27) | | | (27) | |

| Net Cash Used in Financing Activities | (1,357) | | | (1,497) | | | (850) | | | (3,926) | | | (2,079) | |

| Effect of Exchange Rate Changes on Cash | (1) | | | — | | | — | | | (1) | | | — | |

| Increase (Decrease) in Cash and Cash Equivalents | 2,199 | | | (936) | | | 413 | | | 63 | | | 964 | |

| Cash and Cash Equivalents at Beginning of Period | 3,073 | | | 4,009 | | | 3,880 | | | 5,209 | | | 3,329 | |

| Cash and Cash Equivalents at End of Period | 5,272 | | | 3,073 | | | 4,293 | | | 5,272 | | | 4,293 | |

| | | | | | | | | | | | | | |

| Non-GAAP Financial Measures | | |

| | | | |

| | | | |

To supplement the presentation of its financial results prepared in accordance with generally accepted accounting principles in the United States of America (GAAP), EOG’s quarterly earnings releases and related conference calls, accompanying investor presentation slides and presentation slides for investor conferences contain certain financial measures that are not prepared or presented in accordance with GAAP. These non-GAAP financial measures may include, but are not limited to, Adjusted Net Income (Loss), Cash Flow from Operations Before Working Capital, Free Cash Flow, Net Debt and related statistics.

A reconciliation of each of these measures to their most directly comparable GAAP financial measure and related discussion is included in the tables on the following pages and can also be found in the “Reconciliations & Guidance” section of the “Investors” page of the EOG website at www.eogresources.com.

As further discussed in the tables on the following pages, EOG believes these measures may be useful to investors who follow the practice of some industry analysts who make certain adjustments to GAAP measures (for example, to exclude non-recurring items) to facilitate comparisons to others in EOG’s industry, and who utilize non-GAAP measures in their calculations of certain statistics (for example, return on capital employed and return on equity) used to evaluate EOG’s performance.

EOG believes that the non-GAAP measures presented, when viewed in combination with its financial and operating results prepared in accordance with GAAP, provide a more complete understanding of the factors and trends affecting the company’s performance. As is discussed in the tables on the following pages, EOG uses these non-GAAP measures for purposes of (i) comparing EOG’s financial and operating performance with the financial and operating performance of other companies in the industry and (ii) analyzing EOG’s financial and operating performance across periods.

The non-GAAP measures presented should not be considered in isolation, and should not be considered as a substitute for, or as an alternative to, EOG’s reported Net Income (Loss), Long-Term Debt (including Current Portion of Long-Term Debt), Net Cash Provided by Operating Activities and other financial results calculated in accordance with GAAP. The non-GAAP measures presented should be read in conjunction with EOG's consolidated financial statements prepared in accordance with GAAP.

In addition, because not all companies use identical calculations, EOG’s presentation of non-GAAP measures may not be comparable to, and may be calculated differently from, similarly titled measures disclosed by other companies, including its peer companies. EOG may also change the calculation of one or more of its non-GAAP measures from time to time – for example, to account for changes in its business and operations or to more closely conform to peer company or industry analysts’ practices.

| | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted Net Income (Loss) | | | | | | |

| In millions of USD, except share data (in millions) and per share data (Unaudited) | | | | | | | |

| | | | | | | |

| The following tables adjust the reported Net Income (Loss) (GAAP) to reflect actual net cash received from (payments for) settlements of financial commodity derivative contracts by eliminating the unrealized mark-to-market (gains) losses from these transactions, to eliminate the net (gains) losses on asset dispositions, to add back impairment charges related to certain of EOG's assets (which are generally (i) attributable to declines in commodity prices, (ii) related to sales of certain oil and gas properties or (iii) the result of certain other events or decisions (e.g., a periodic review of EOG's oil and gas properties or other assets) - see "Revenues, Costs and Margins Per Barrel of Oil Equivalent" below for additional related discussion) and to make certain other adjustments to exclude non-recurring and certain other items as further described below. EOG believes this presentation may be useful to investors who follow the practice of some industry analysts who adjust reported company earnings to match hedge realizations to production settlement months and make certain other adjustments to exclude non-recurring and certain other items. EOG management uses this information for purposes of comparing its financial performance with the financial performance of other companies in the industry. |

| | | | | | | |

| 3Q 2022 |

| Before

Tax | | Income Tax Impact | | After

Tax | | Diluted Earnings per Share |

| | | | | | | |

| Reported Net Income (GAAP) | 3,663 | | | (809) | | | 2,854 | | | 4.86 | |

| Adjustments: | | | | | | | |

| Losses on Mark-to-Market Financial Commodity Derivative Contracts | 18 | | | (4) | | | 14 | | | 0.03 | |

Net Cash Payments for Settlements of Financial Commodity Derivative Contracts (1) | (847) | | | 184 | | | (663) | | | (1.13) | |

| Add: Losses on Asset Dispositions, Net | 21 | | | (3) | | | 18 | | | 0.03 | |

| Add: Certain Impairments | 46 | | | (8) | | | 38 | | | 0.06 | |

| Less: Severance Tax Refund | (115) | | | 25 | | | (90) | | | (0.15) | |

| Add: Severance Tax Consulting Fees | 16 | | | (3) | | | 13 | | | 0.02 | |

| Less: Interest on Severance Tax Refund | (7) | | | 2 | | | (5) | | | (0.01) | |

| Adjustments to Net Income | (868) | | | 193 | | | (675) | | | (1.15) | |

| | | | | | | |

| Adjusted Net Income (Non-GAAP) | 2,795 | | | (616) | | | 2,179 | | | 3.71 | |

| | | | | | | |

| Average Number of Common Shares (Non-GAAP) | | | | | | | |

| Basic | | | | | | | 583 | |

| Diluted | | | | | | | 587 | |

| | | | | | | |

(1) Consistent with its customary practice, in calculating Adjusted Net Income (Loss) (non-GAAP), EOG subtracts from reported Net Income (Loss) (GAAP) the total net cash paid for settlements of financial commodity derivative contracts during such period. For the third quarter of 2022, such amount was $847 million, of which $63 million was related to the early termination of certain contracts.

| | | | | | | | | | | | | | | | | | | | | | | |

Adjusted Net Income (Loss) (Continued) | | | | | | |

| In millions of USD, except share data (in millions) and per share data (Unaudited) | | | | | | | |

| 2Q 2022 |

| Before

Tax | | Income Tax Impact | | After

Tax | | Diluted Earnings per Share |

| | | | | | | |

| Reported Net Income (GAAP) | 2,882 | | | (644) | | | 2,238 | | | 3.81 | |

| Adjustments: | | | | | | | |

| Losses on Mark-to-Market Financial Commodity Derivative Contracts | 1,377 | | | (299) | | | 1,078 | | | 1.82 | |

| Net Cash Payments for Settlements of Financial Commodity Derivative Contracts | (2,114) | | | 459 | | | (1,655) | | | (2.81) | |

| Less: Gains on Asset Dispositions, Net | (97) | | | 21 | | | (76) | | | (0.13) | |

| Add: Certain Impairments | 36 | | | (7) | | | 29 | | | 0.05 | |

| Adjustments to Net Income | (798) | | | 174 | | | (624) | | | (1.07) | |

| | | | | | | |

| Adjusted Net Income (Non-GAAP) | 2,084 | | | (470) | | | 1,614 | | | 2.74 | |

| | | | | | | |

| Average Number of Common Shares (Non-GAAP) | | | | | | | |

| Basic | | | | | | | 583 | |

| Diluted | | | | | | | 588 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| 3Q 2021 |

| Before

Tax | | Income Tax Impact | | After

Tax | | Diluted Earnings per Share |

| | | | | | | |

| Reported Net Income (GAAP) | 1,429 | | | (334) | | | 1,095 | | | 1.88 | |

| Adjustments: | | | | | | | |

| Losses on Mark-to-Market Financial Commodity Derivative Contracts | 494 | | | (108) | | | 386 | | | 0.65 | |

| Net Cash Payments for Settlements of Financial Commodity Derivative Contracts | (293) | | | 64 | | | (229) | | | (0.39) | |

| Less: Gains on Asset Dispositions, Net | (1) | | | — | | | (1) | | | — | |

| Add: Certain Impairments | 13 | | | — | | | 13 | | | 0.02 | |

| Adjustments to Net Income | 213 | | | (44) | | | 169 | | | 0.28 | |

| | | | | | | |

| Adjusted Net Income (Non-GAAP) | 1,642 | | | (378) | | | 1,264 | | | 2.16 | |

| | | | | | | |

| Average Number of Common Shares (Non-GAAP) | | | | | | | |

| Basic | | | | | | | 581 | |

| Diluted | | | | | | | 584 | |

| | | | | | | | | | | |

| Adjusted Net Income Per Share | | | |

| In millions of USD, except share data (in millions), per share data, production volume data and per Boe data (Unaudited) |

| | | |

| 2Q 2022 Adjusted Net Income per Share (Non-GAAP) | | | 2.74 | |

| | | |

| Realized Price | | | |

| 3Q 2022 Composite Average Wellhead Revenue per Boe | 71.40 | | | |

| Less: 2Q 2022 Composite Average Wellhead Revenue per Boe | (77.29) | | | |

| Subtotal | (5.89) | | | |

| Multiplied by: 3Q 2022 Crude Oil Equivalent Volumes (MMBoe) | 84.6 | | | |

| Total Change in Revenue | (498) | | | |

| Less: Income Tax Benefit (Provision) Imputed (based on 23%) | 115 | | | |

| Change in Net Income | (383) | | | |

| Change in Diluted Earnings per Share | | | (0.65) | |

| | | |

| Net Cash Received from (Payments for) Settlements of Financial Commodity Derivative Contracts | | |

| 3Q 2022 Net Cash Received from (Payments for) Settlement of Financial Commodity Derivative Contracts | (847) | | | |

| Less: Income Tax Benefit (Provision) | 184 | | | |

| After Tax - (a) | (663) | | | |

| 2Q 2022 Net Cash Received from (Payments for) Settlement of Financial Commodity Derivative Contracts | (2,114) | | | |

| Less: Income Tax Benefit (Provision) | 459 | | | |

| After Tax - (b) | (1,655) | | | |

| Change in Net Income - (a) - (b) | 992 | | | |

| Change in Diluted Earnings per Share | | | 1.69 | |

| | | |

| Wellhead Volumes | | | |

| 3Q 2022 Crude Oil Equivalent Volumes (MMBoe) | 84.6 | | | |

| Less: 2Q 2022 Crude Oil Equivalent Volumes (MMBoe) | (83.8) | | | |

| Subtotal | 0.8 | | | |

| Multiplied by: 3Q 2022 Composite Average Margin per Boe (Non-GAAP) (Including Total Exploration Costs) (refer to "Revenues, Costs and Margins Per Barrel of Oil Equivalent" schedule) | 43.00 | | | |

| Change in Revenue | 34 | | | |

| Less: Income Tax Benefit (Provision) Imputed (based on 23%) | (8) | | | |

| Change in Net Income | 26 | | | |

| Change in Diluted Earnings per Share | | | 0.04 | |

| | | |

| | | | | | | | | | | |

Adjusted Net Income Per Share (Continued) | | | |

| In millions of USD, except share data (in millions), per share data, production volume data and per Boe data (Unaudited) |

| | | | | | | | | | | |

| | | |

| Operating Cost per Boe | | | |

| 2Q 2022 Total Operating Cost per Boe (Non-GAAP) (including Total Exploration Costs) (refer to "Revenues, Costs and Margins Per Barrel of Oil Equivalent" schedule) | 28.50 | | | |

| Less: 2Q 2022 Taxes Other Than Income | (5.63) | | | |

| Less: 3Q 2022 Total Operating Cost per Boe (Non-GAAP) (including Total Exploration Costs) (refer to "Revenues, Costs and Margins Per Barrel of Oil Equivalent" schedule) | (28.40) | | | |

| Add: 3Q 2022 Taxes Other Than Income (Non-GAAP) | 5.31 | | | |

| Subtotal | (0.22) | | | |

| Multiplied by: 3Q 2022 Crude Oil Equivalent Volumes (MMBoe) | 84.6 | | | |

| Change in Before-Tax Net Income | (19) | | | |

| Less: Income Tax Benefit (Provision) Imputed (based on 23%) | 4 | | | |

| Change in Net Income | (15) | | | |

| Change in Diluted Earnings per Share | | | (0.03) | |

| | | |

Other (1) | | | (0.08) | |

| | | |

| 3Q 2022 Adjusted Net Income per Share (Non-GAAP) | | | 3.71 | |

| | | |

| 3Q 2022 Average Number of Common Shares (Non-GAAP) - Diluted | 587 | | | |

| | | |

(1)Includes gathering, processing and marketing revenue, other revenue, marketing costs, taxes other than income, other income (expense), interest expense and the effect of changes in the effective income tax rate.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash Flow from Operations and Free Cash Flow | |

| In millions of USD (Unaudited) | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| The following tables reconcile Net Cash Provided by Operating Activities (GAAP) to Cash Flow from Operations Before Working Capital (Non-GAAP). EOG believes this presentation may be useful to investors who follow the practice of some industry analysts who adjust Net Cash Provided by Operating Activities for Changes in Components of Working Capital and Other Assets and Liabilities, Changes in Components of Working Capital Associated with Investing and Financing Activities and certain other adjustments to exclude non-recurring and certain other items as further described below. EOG defines Free Cash Flow (Non-GAAP) for a given period as Cash Flow from Operations Before Working Capital (Non-GAAP) (see below reconciliation) for such period less the total capital expenditures (Non-GAAP) during such period, as is illustrated below. EOG management uses this information for comparative purposes within the industry. To further the comparability of EOG’s financial results with those of EOG’s peer companies and other companies in the industry, EOG now utilizes Cash Flow from Operations Before Working Capital (Non-GAAP), instead of Discretionary Cash Flow (Non-GAAP), in calculating its Free Cash Flow (Non-GAAP). Accordingly, Free Cash Flow (Non-GAAP) for the third quarter 2022, second quarter 2022 and nine-month period ended September 30, 2022 have been calculated on such basis, and the calculations of Free Cash Flow (Non-GAAP) for each of the prior periods shown have been revised and conformed. |

| | | | | | | | | | | | | |

| | | | | 3Q 2022 | | 2Q 2022 | | 3Q 2021 | | YTD 2022 | | YTD 2021 |

| | | | | | | | | | | | | |

| Net Cash Provided by Operating Activities (GAAP) | | | | | 4,773 | | | 2,048 | | | 2,196 | | | 7,649 | | | 5,625 | |

| | | | | | | | | | | | | |

| Adjustments: | | | | | | | | | | | | | |

| Changes in Components of Working Capital and Other Assets and Liabilities | | | | | | | | | | | | | |

| Accounts Receivable | | | | | (392) | | | 522 | | | 145 | | | 1,008 | | | 639 | |

| Inventories | | | | | 140 | | | 157 | | | 6 | | | 311 | | | (95) | |

| Accounts Payable | | | | | 88 | | | (259) | | | 68 | | | (301) | | | (115) | |

| Accrued Taxes Payable | | | | | 53 | | | 536 | | | (206) | | | (24) | | | (286) | |

| Other Assets | | | | | 129 | | | (71) | | | (167) | | | 271 | | | 55 | |

| Other Liabilities | | | | | (1,269) | | | (433) | | | 260 | | | 548 | | | 317 | |

| Changes in Components of Working Capital Associated with Investing Activities | | | | | (90) | | | (143) | | | (45) | | | (301) | | | 100 | |

| Cash Flow from Operations Before Working Capital (Non-GAAP) | | | | | 3,432 | | | 2,357 | | | 2,257 | | | 9,161 | | | 6,240 | |

| | | | | | | | | | | | | |

| Cash Flow from Operations Before Working Capital (Non-GAAP) | | | | | 3,432 | | | 2,357 | | | 2,257 | | | 9,161 | | | 6,240 | |

| Less: | | | | | | | | | | | | | |

Total Capital Expenditures (Non-GAAP) (a) | | | | | (1,166) | | | (1,071) | | | (891) | | | (3,246) | | | (2,740) | |

| Free Cash Flow (Non-GAAP) | | | | | 2,266 | | | 1,286 | | | 1,366 | | | 5,915 | | | 3,500 | |

| | | | | | | | | | | | | |

| (a) See below reconciliation of Total Expenditures (GAAP) to Total Capital Expenditures (Non-GAAP): |

| | | | | | | | | | | | | |

| | | | | 3Q 2022 | | 2Q 2022 | | 3Q 2021 | | YTD 2022 | | YTD 2021 |

| | | | | | | | | | | | | |

| Total Expenditures (GAAP) | | | | | 1,410 | | | 1,521 | | | 962 | | | 4,075 | | | 3,118 | |

| Less: | | | | | | | | | | | | | |

| Asset Retirement Costs | | | | | (139) | | | (43) | | | (8) | | | (209) | | | (56) | |

| Non-Cash Acquisition Costs of Unproved Properties | | | | | (28) | | | (21) | | | (15) | | | (107) | | | (37) | |

| Non-Cash Finance Leases | | | | | | | | | | | — | | | (74) | |

| Acquisition Costs of Proved Properties | | | | | (42) | | | (351) | | | (4) | | | (398) | | | (99) | |

| Exploration Costs | | | | | (35) | | | (35) | | | (44) | | | (115) | | | (112) | |

| Total Capital Expenditures (Non-GAAP) | | | | | 1,166 | | | 1,071 | | | 891 | | | 3,246 | | | 2,740 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Net Debt-to-Total Capitalization Ratio | | | | | | | | |

| In millions of USD, except ratio data (Unaudited) | | | | | | | | | | | |

| | | | | | | | | | | |

| The following tables reconcile Current and Long-Term Debt (GAAP) to Net Debt (Non-GAAP) and Total Capitalization (GAAP) to Total Capitalization (Non-GAAP), as used in the Net Debt-to-Total Capitalization ratio calculation. A portion of the cash is associated with international subsidiaries; tax considerations may impact debt paydown. EOG believes this presentation may be useful to investors who follow the practice of some industry analysts who utilize Net Debt and Total Capitalization (Non-GAAP) in their Net Debt-to-Total Capitalization ratio calculation. EOG management uses this information for comparative purposes within the industry. |

| | | | | | | | | | | |

| | | | | | | September 30, 2022 | | June 30,

2022 | | September 30,

2021 |

| | | | | | | | | | | |

| Total Stockholders' Equity - (a) | | | | | | | 23,849 | | | 22,312 | | | 21,765 | |

| | | | | | | | | | | |

| Current and Long-Term Debt (GAAP) - (b) | | | | | | | 5,084 | | | 5,091 | | | 5,117 | |

| Less: Cash | | | | | | | (5,272) | | | (3,073) | | | (4,293) | |

| Net Debt (Non-GAAP) - (c) | | | | | | | (188) | | | 2,018 | | | 824 | |

| | | | | | | | | | | |

| Total Capitalization (GAAP) - (a) + (b) | | | | | | | 28,933 | | | 27,403 | | | 26,882 | |

| | | | | | | | | | | |

| Total Capitalization (Non-GAAP) - (a) + (c) | | | | | | | 23,661 | | | 24,330 | | | 22,589 | |

| | | | | | | | | | | |

| Debt-to-Total Capitalization (GAAP) - (b) / [(a) + (b)] | | | | | | | 17.6 | % | | 18.6 | % | | 19.0 | % |

| | | | | | | | | | | |

| Net Debt-to-Total Capitalization (Non-GAAP) - (c) / [(a) + (c)] | | | | | | | -0.8 | % | | 8.3 | % | | 3.6 | % |