UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant Filed by a Party other than the Registrant

Check the appropriate box:

| | | | | |

| Preliminary Proxy Statement |

| Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material Pursuant to §240.14a-12 |

PAR PACIFIC HOLDINGS, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | |

| | No fee required. |

| | Fee paid previously with preliminary materials. |

| | |

|

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

PAR PACIFIC HOLDINGS, INC.

825 Town and Country Lane, Suite 1500

Houston, Texas 77024

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 3, 2022

Dear Stockholders:

We cordially invite you to attend our 2022 annual meeting of stockholders. The meeting will be held virtually at http://www.web.viewproxy.com/parpacific/2022 on Tuesday, May 3, 2022, at 8:30 a.m. (Houston time). At the meeting, stockholders will be asked to vote on the following matters:

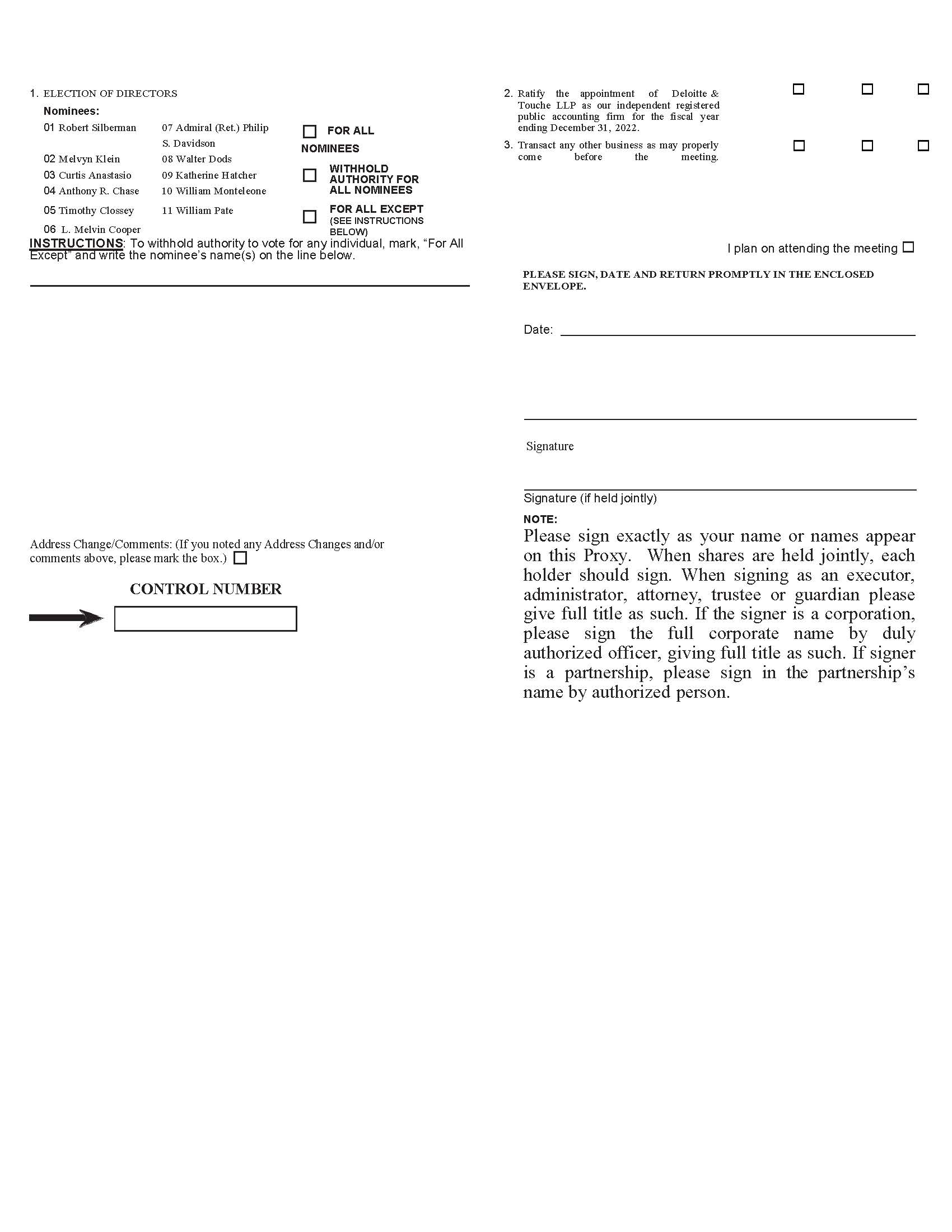

Proposal 1: To elect the Board of Directors; and

Proposal 2: To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022.

We will also transact any other business as may properly come before the meeting.

Stockholders who owned our common stock at the close of business on Friday, March 11, 2022 may attend and vote at the meeting. A stockholders’ list will be available at our offices at 825 Town and Country Lane, Suite 1500, Houston, Texas 77024 for the ten-day period prior to the meeting. We hope that you will be able to attend the meeting.

We provide our proxy materials, including our Proxy Statement and Annual Report, electronically on the internet. This expedites your receipt of proxy materials, conserves resources, and lowers the cost of the meeting. On or about March 23, 2022, we are posting our proxy materials at http://www.web.viewproxy.com/parpacific/2022 and mailing stockholders a Notice of Internet Availability of Proxy Materials that explains how to access the proxy materials on the internet. We are also mailing a printed set of the proxy materials to stockholders who have elected to receive paper copies. Stockholders may request a printed set of the proxy materials by following the instructions in the Notice.

Whether or not you plan to attend the meeting, please vote electronically via the Internet or, if you requested paper copies of the proxy materials, please complete, sign, date and return the accompanying proxy card in the enclosed postage-paid envelope. See “How do I cast my vote?” in the proxy statement for more details. We thank you for your continued support and look forward to your attendance at our virtual annual meeting.

By order of the Board of Directors,

Jeffrey R. Hollis,

Vice President, General Counsel, and Secretary

Houston, Texas

March 23, 2022

PAR PACIFIC HOLDINGS, INC.

825 Town and Country Lane, Suite 1500

Houston, Texas 77024

PROXY STATEMENT

INFORMATION CONCERNING SOLICITATION AND VOTING

Our Board of Directors (the “Board”) is soliciting proxies for the 2022 annual meeting of stockholders to be held virtually at http://www.web.viewproxy.com/parpacific/2022 on Tuesday, May 3, 2022, at 8:30 a.m. (Houston time), and at any adjournments or postponements of the meeting. This proxy statement contains important information for you to consider when deciding how to vote on the matters brought before the meeting. Please read it carefully.

Par Pacific Holdings, Inc. (the “Company” or “Par Pacific”) will pay the costs of soliciting proxies from stockholders. Our directors, officers and regular employees may solicit proxies on behalf of Par Pacific, without additional compensation, personally or by telephone or by email or through the Internet.

QUESTIONS AND ANSWERS

Q: Who can vote at the meeting?

A: The Board set March 11, 2022 as the record date for the meeting. You can attend and vote at the meeting if you were a common stockholder of Par Pacific at the close of business on the record date, March 11, 2022. On that date, there were 60,158,209 shares of our common stock outstanding and entitled to vote at the meeting.

Q: Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

A: Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the Internet. Accordingly, on or about March 23, 2022 we are sending a Notice of Internet Availability of Proxy Materials to our stockholders of record and beneficial owners. All stockholders will have the ability, beginning on or about March 23, 2022, to access the proxy materials on the website referred to in the Notice of Internet Availability of Proxy Materials or to request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice of Internet Availability of Proxy Materials.

In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis.

Q: What proposals will be voted on at the meeting?

A: Two proposals are scheduled to be voted upon at the meeting:

•The election of directors; and

•The ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022.

Q: Can I vote my shares by filling out and returning the Notice of Internet Availability of Proxy Materials?

A: No. The Notice of Internet Availability of Proxy Materials identifies the items to be voted on at the meeting, but you cannot vote by marking the Notice of Internet Availability of Proxy Materials and returning it. The Notice of Internet Availability of Proxy Materials provides instructions on how to vote via the Internet or by requesting and returning a paper proxy card, or by submitting a ballot at the meeting.

Q: How can I get electronic access to the proxy materials?

A: The Notice of Internet Availability of Proxy Materials will provide you with instructions regarding how to:

•View our proxy materials for the meeting on the Internet; and

•Instruct us to send future proxy materials to you electronically by email.

Choosing to receive future proxy materials by email will save us the cost of printing and mailing documents to you and will reduce the impact of our annual meetings on the environment. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you terminate it.

Q: How do I cast my vote?

A: For stockholders whose shares are registered in their own names, as an alternative to voting at the meeting, you may vote via the internet or, for those stockholders who request a paper proxy card in the mail, by mailing a completed proxy card. The Notice of Internet Availability of Proxy Materials provides information on how to vote via the Internet or request a paper proxy card and vote by mail. Those stockholders who request a paper proxy card and elect to vote by mail should sign and return the mailed proxy card in the prepaid and addressed envelope that was enclosed with the proxy materials, and your shares will be voted at the meeting in the manner you direct. In the event that you return a signed proxy

card on which no directions are specified, your shares will be voted as recommended by our Board on all matters, and in the discretion of the proxy holders as to any other matters that may properly come before the meeting or any postponement or adjournment of the meeting. We do not know of any other business to be considered at the meeting.

If your shares are registered in the name of a broker, bank or other nominee (typically referred to as being held in “street name”), you will receive instructions from your broker, bank or other nominee that must be followed in order for your broker, bank or other nominee to vote your shares per your instructions. Many brokerage firms and banks have a process for their beneficial holders to provide instructions via the Internet or over the telephone. If Internet or telephone voting is unavailable from your broker, bank or other nominee, please complete and return the enclosed voting instruction card in the addressed, postage paid envelope provided.

In the event you do not provide instructions on how to vote, your broker may have authority to vote your shares. Under the rules that govern brokers who are voting with respect to shares that are held in street name, brokers have the discretion to vote such shares on routine matters, but not on non-routine matters. Routine matters include the ratification of the appointment of independent auditors, but not the election of directors. Your vote is especially important. If your shares are held by a broker, your broker cannot vote your shares for these non-routine matters unless you provide voting instructions. Therefore, please instruct your broker regarding how to vote your shares promptly. See “Vote Required” following each proposal for further information.

If you hold shares through a broker, bank or other nominee and wish to be able to vote at the meeting, you must obtain a legal proxy from your broker, bank or other nominee and present it to the inspector of election with your ballot at the meeting.

Q: How do I attend the meeting? What do I need to do?

A: You are entitled to attend the meeting if you were a common stockholder at the close of business on the record date, March 11, 2022, or if you hold a valid legal proxy for the meeting. To vote during the meeting, you will need a control number. If you are a registered holder, your control number may be found on your proxy card or the Notice of Internet Availability of Proxy Materials. If you are a beneficial holder, your control number will be assigned to you in a confirmation email when you register for the meeting. You can register for the meeting by visiting http://www.web.viewproxy.com/parpacific/2022 and clicking “Virtual Meeting Registration.” Please register by 11:59 p.m. (EDT) on April 27, 2022. Once you have registered, follow the instructions in your confirmation email to attend the meeting.

Q: Can I revoke or change my proxy?

A: Yes. You may revoke or change a previously delivered proxy at any time before the meeting by delivering another proxy with a later date, by voting again via the internet or by delivering written notice of revocation of your proxy to our Secretary at our principal executive offices before the beginning of the meeting. You may also revoke your proxy by attending the meeting and voting, although attendance at the meeting will not, in and of itself, revoke a valid proxy that was previously delivered. If you hold shares through a broker, bank or other nominee, you must contact that nominee to revoke any prior voting instructions. You also may revoke any prior voting instructions by voting at the meeting if you obtain a legal proxy.

Q: How does the Board recommend I vote on the proposals?

A: The Board recommends you vote “FOR” each of the nominees to our Board of Directors, and “FOR” the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022.

Q: Who will count the vote?

A: The inspector of election will count the vote. Par Pacific’s Secretary will act as the inspector of election.

Q: What is a “quorum?”

A: A quorum is the number of shares that must be present to hold the meeting. The quorum requirement for the meeting is a majority of the outstanding shares as of the record date, present or represented by proxy at the meeting. Your shares will be counted for purposes of determining if there is a quorum if you are present and vote at the meeting; or have voted on the internet or by properly submitting a proxy card or voting instruction card by mail. Abstentions and broker non-votes also count toward the quorum. An abstention will have the same practical effect as a vote against the ratification of the appointment of our independent registered public accounting firm. “Broker non-votes” occur when brokers, banks or other nominees that hold shares on behalf of beneficial owners do not receive voting instructions from the beneficial owners prior to the meeting and do not have discretionary voting authority to vote those shares.

Q: What vote is required to approve each item?

A: The following table sets forth the voting requirement with respect to each of the proposals:

| | | | | | | | |

| Proposal 1 - Election of directors. | | The eleven nominees for election as directors at the annual meeting who receive the greatest number of “FOR” votes cast by the stockholders, a plurality, will be elected as our directors. |

| | |

| Proposal 2 - Ratification of appointment of independent registered public accounting firm. | | To be approved by stockholders, this proposal must receive the affirmative “FOR” vote of the holders of a majority of the shares of our common stock present or represented by proxy at the meeting and entitled to vote. |

Q: What does it mean if I get more than one Notice of Internet Availability of Proxy Materials?

A: Your shares are probably registered in more than one account. Please provide voting instructions for all Notices of Internet Availability of Proxy Materials, proxy and voting instruction cards you receive.

Q: How many votes can I cast?

A: On all matters you are entitled to one vote per share.

Q: Where can I find the voting results of the meeting?

A: The preliminary voting results will be announced at the meeting. The final results will be published in a current report on Form 8-K to be filed by us with the SEC within four business days of the meeting.

Proposal 1

ELECTION OF DIRECTORS

At the meeting, eleven directors are to be elected. Each director is to hold office until the next annual meeting of stockholders or until his or her successor is elected and qualified. The Nominating and Corporate Governance Committee, which consists solely of directors that are independent as defined in the listing standards of the New York Stock Exchange (“NYSE”), recommended the eleven directors to our Board of Directors. Based on that recommendation, the Board nominated such directors for election at the meeting. The nominees have consented to be nominated and have expressed their intention to serve if elected. We believe that the nominees possess the professional and personal qualifications necessary for board service and have highlighted particularly noteworthy attributes for each nominee in the individual biographies below. We have no reason to believe that any of the nominees will be unable to serve if elected to office and, to our knowledge, the nominees intend to serve the entire term for which election is sought. Only the nominees or substitute nominees designated by the Board will be eligible to stand for election as directors at the meeting.

Nominees

Certain information regarding the nominees is set forth below:

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Position | | Director Since |

| Robert Silberman (1) | | 64 | | Chairman of the Board | | 2014 |

| Melvyn Klein (1)(4) | | 79 | | Chairman Emeritus of the Board | | 2014 |

| Curtis Anastasio (2)(5) | | 65 | | Director | | 2014 |

| Timothy Clossey (2)(5) | | 63 | | Director | | 2014 |

| L. Melvin Cooper (2)(3) | | 68 | | Director | | 2012 |

| Walter Dods (3)(4) | | 80 | | Director | | 2015 |

| Katherine Hatcher (3)(4) | | 53 | | Director | | 2019 |

| Anthony Chase (3)(4) | | 67 | | Director | | 2021 |

| Philip Davidson (5) | | 62 | | Director | | 2021 |

| William Monteleone | | 38 | | Director, Executive Vice President and Chief Financial Officer | | 2012 |

| William Pate (1) | | 58 | | Director, President and Chief Executive Officer | | 2014 |

_________________________________________________________

(1)Member, Executive Committee of our Board of Directors.

(2)Member, Audit Committee of our Board of Directors.

(3)Member, Compensation Committee of our Board of Directors.

(4)Member, Nominating and Corporate Governance Committee of our Board of Directors.

(5)Member, Operations and Technology Committee of our Board of Directors.

Robert Silberman has served as the Chairman of our Board of Directors since January 2019 and has served as a member of our Board of Directors since August 2014. Mr. Silberman previously served as Vice Chairman of our Board of Directors. Mr. Silberman has been Executive Chairman of the Board of Directors of Strategic Education, Inc. since May 2013, Chairman of its Board from February 2003 to May 2013 and its Chief Executive Officer from March 2001 until May 2013. Strategic Education, Inc. is an education services company, and is a leading provider of graduate and undergraduate degree programs focusing on working adults. Mr. Silberman has been a managing director of Equity Group Investments (“EGI”) since March 2014 and has held certain other relationships with affiliates of EGI. Mr. Silberman previously served as the lead director of Covanta Holding Corporation, a publicly held international owner/operator of energy-from-waste and power generation facilities, from 2015 to 2020. Previously Mr. Silberman served as President and Chief Operating Officer of CalEnergy Company, Inc., an independent energy producer and wholly-owned subsidiary of Berkshire Hathaway Inc. Mr. Silberman was appointed by President George H. W. Bush as the U.S. Assistant Secretary of the Army and is a member of the Council on Foreign Relations. Mr. Silberman holds a Bachelor of Arts degree from Dartmouth College and a master's degree from The Johns Hopkins University School of Advanced International Studies. Mr. Silberman's positions as a current executive chairman and formerly as a long-tenured chief executive officer and board member of public companies, coupled with his financial background and experience investing in and growing energy and project development businesses, as well as his experience in the public sector, combine to provide valuable insight and perspective to both the Board and management.

Melvyn Klein has served as the Chairman Emeritus of our Board of Directors since January 2019. He was previously the Chairman of the Board since June 2014. Mr. Klein is a private investor and the founder of Melvyn N. Klein Interests and the President of JAKK Holding Corp. and was the managing general partner of the investment partnership GKH Partners, L.P. from 1987 until 2008. Mr. Klein was a member of the board of directors of Anixter International, Inc., a New York Stock Exchange listed company, which was acquired in 2020. Mr. Klein has been an attorney and counselor-at-law since 1968, and he is currently a member of the State Bar of Texas. Earlier in his career, he was a McKinsey & Company consultant and a senior officer of Donaldson, Lufkin and Jenrette, Inc. Mr. Klein has been the President and CEO of two American Stock Exchange listed companies: Altamil Corporation

and Eskey, Inc. Additionally, Mr. Klein was the controlling shareholder, co-founder, or a significant partner in a number of companies in several fields, including, among others, American Medical International, Inc. (subsequently merged to create Tenet Healthcare), UGHC/Arcus (subsequently sold to Koch Industries, Inc.-Flint Hills Resources, LP. and the balance merged with Iron Mountain), Savoy Pictures Entertainment, Inc. (subsequently merged with IAC Interactive), Hanover Compressor Company (subsequently merged to create Exterran Holdings Corp., which, in turn, has become Archrock, Inc. and Exterran Corporation), Cockrell Oil & Gas, L.P. (assets subsequently sold to UNOCAL), and Santa Fe Energy Resources, Inc. (subsequently merged in part with Chevron and in part with Devon Energy). Mr. Klein was appointed by President Reagan to the Executive Committee of the President’s Private Sector Survey on Cost Control in the Federal Government (Grace Commission) and by President Clinton to the U.S. State Department’s Advisory Committee on International Economic Policy. Mr. Klein received a Doctor of Jurisprudence degree from Columbia University and a Bachelor of Arts degree with Highest Honors in Economics from Colgate University. He also studied at the London School of Economics and Political Science and completed the coursework for a master’s degree at The Johns Hopkins University School of Advanced International Studies. Mr. Klein is a member and a board member of the Horatio Alger Association of Distinguished Americans, Inc. and the Former Chairman of the Board of Visitors of the M.D. Anderson Cancer Center and a continuing officer and member of the Executive Committee; in 2020, Mr. Klein was named a Life Member of the board. Mr. Klein is also a member of the Philosophical Society of Texas. Mr. Klein brings to the Board leadership and extensive public company board experience (Anixter International, Inc., Altamil Corporation, American Medical International, Inc., Hanover Compressor Company, Santa Fe Energy Resources, Inc., Devon Energy Corporation, Playboy Enterprises, Inc., Levitz Furniture Corp, Bush Universal, Inc., and others), which contribute to his familiarity with current issues and assists in his identifying and addressing appropriate corporate governance practices for us. Mr. Klein’s experience and accomplishments in building businesses, including a number of industry-leading companies, is of benefit to Par Pacific. Mr. Klein's experience in senior positions within the public sector also adds to the Board's depth and perspective.

Curtis Anastasio has served as a member of our Board of Directors since June 2014. Mr. Anastasio served as the Vice Chairman of our Board of Directors from September 2014 to April 2015. He is currently the Chairman of GasLog Partners LP, a subsidiary of GasLog Ltd., a growth-oriented international owner, operator and manager of liquefied natural gas (LNG) carriers, providing support to international energy companies as part of their LNG logistics chain. Appointed Executive Chairman in February 2014, Mr. Anastasio led the successful initial public offering of GasLog Partners LP in May 2014. Mr. Anastasio also serves as a founding director and current Audit Committee Chairman of The Chemours Company, a global leader in titanium technologies, fluoroproducts and

chemical solutions which was spun off from DuPont effective July 1, 2015. From January 2014 through December 2019, Mr. Anastasio was also a member of the Board of Directors of the Federal Reserve Bank - Dallas, and a member of its Audit Committee and Executive Committee. He previously served as President and Chief Executive Officer of NuStar Energy L. P., a publicly traded master limited partnership based in San Antonio, Texas. Mr. Anastasio was the President and Chief Executive Officer of NuStar Energy, L.P. from the time he led the initial public offering in April 2001, until he retired from the company on December 31, 2013. Since joining a predecessor of NuStar in 1988, he has held various positions in the upstream and downstream oil and gas industry, which have included responsibility for supply, trading, transportation, marketing, development and legal. Mr. Anastasio received a Juris Doctorate degree from Harvard Law School in 1981 and a Bachelor of Arts degree, magna cum laude, from Cornell University in 1978. After graduation, he practiced corporate law in New York City. Mr. Anastasio brings to the Board extensive experience in public companies generally, and with over 30 years of experience in the upstream and downstream oil and gas industry, invaluable industry knowledge and insight in investing and growing oil and gas businesses. Further, Mr. Anastasio brings a deep knowledge of finance and economic markets to the Board.

Timothy Clossey has served as a member of our Board of Directors since June 2014. Mr. Clossey is the President and owner of Spirit Technologies, a management coaching and engineering consulting services company. Mr. Clossey previously served as Production Manager and Major Projects Director for BP Cherry Point. He was a consultant to the board of directors at SaltChuk Resources on merger and acquisition opportunities and a board member at Timec, Inc., where Mr. Clossey chaired the Audit Committee, organized and chaired a Special Committee of Outside Directors and served on the Compensation Committee. Mr. Clossey served in multiple positions, including most recently as President and CEO of ARCO Marine, Inc. ("ARCO"). As VP Corporate Strategic Planning, Downstream for ARCO, Mr. Clossey was responsible for strategic planning for all of ARCO’s downstream companies. As Vice President of Engineering, Technology and R&D at ARCO, his role was responsible for leading ARCO’s Engineering and Research Center in Anaheim, California. As Manager, Clean Fuels Development Task Force at ARCO, Mr. Clossey lead the reformulated gasoline research and development efforts at the Technical Center as well as served in the government relations role working with industry associations such as Western States Petroleum Association and the American Petroleum Institute, as well as all Federal and State agencies working on reformulated gasoline regulations throughout the nation. Mr. Clossey graduated from Harvard Business School with an Executive Master of Business Administration. He received his Bachelor of Science degree in Chemical Engineering summa cum laude from Washington State University. Mr. Clossey's extensive and detailed experience in operational aspects of the petroleum refining industry provide the Board with insight into the operation, development, and growth of our businesses.

L. Melvin Cooper has served as a member of our Board of Directors since August 2012. Mr. Cooper served as the Senior Vice President and Chief Financial Officer of Forbes Energy Services Ltd. (OTCPK: FLSS) ("Forbes"), a former public company in the energy services industry from 2007 to his retirement in 2020. Forbes entered into a pre-packaged Chapter 11 plan in January 2017 and exited in April 2017. Prior to joining Forbes, Mr. Cooper served as Chief Financial Officer or President of companies involved in site preparation for oil and gas exploration companies, supplying products and services to new home builders, and supply chain management. Mr. Cooper served as a Director of Flotek Industries, Inc. (NYSE: FTK) from 2010 to 2020 and of SAExploration Holdings, Inc. (formerly NASDAQ: SAEX) from 2016 to 2020. Mr. Cooper earned a degree in accounting from Texas A&M University-Kingsville (formerly Texas A&I) in 1975. Mr. Cooper’s extensive experience in the energy industry and in corporate governance, as well as his financial background, brings significant additional operating, financial, and management experience to the Board.

Walter Dods has served as a member of our Board of Directors since June 2015. Mr. Dods was Chairman of the Board of First Hawaiian Bank from January 2005 until his retirement in December 2008. Mr. Dods has served as Chairman of the Board of Matson, Inc., a leading provider of ocean transportation and logistics services, a position he held from January 2010 until his retirement in April 2017, and as a director of Matson, Inc. from 1989 until 2017. He also currently serves on the boards of Pacific Guardian Life and Pohaku Pa’a. Additionally, Mr. Dods serves on several civic and community boards throughout the State of Hawaii, including Chaminade University of Honolulu. Mr. Dods was a shareholder of Koko’oha Investments, Inc. (“Koko’oha”), which is now known as Par Hawaii, LLC, and the Chairman of the Boards of each of Koko’oha and Mid Pac Petroleum, LLC, a wholly-owned subsidiary of Koko’oha, until our acquisition of Koko’oha in April 2015. In 2004, Mr. Dods was awarded the Order of the Rising Sun, with Gold and Silver Star, an imperial honor from the Government of Japan. Mr. Dods received a bachelor’s degree in business administration from the University of Hawaii. Mr. Dods' deep knowledge of the Hawaiian markets where we operate, ocean transportation and logistics, and the assets we acquired from Koko’oha and Mid Pac Petroleum provide the Board with experience and insight into the operation, development, and growth of our businesses. Further, his experience as a chairman or member of publicly held company boards of directors provides the Board with knowledge of governance and other related matters.

Katherine Hatcher has served as a member of our Board of Directors since January 2019. She is currently a development partner and advisory board member of NewQuest Properties, a privately owned, full-service company based in Houston, Texas engaged in commercial development, retail leasing, tenant representation, land

brokerage, and property management. Previously she served as President and Chief Operating Officer of NewQuest Properties from 2008 until 2021. She is also the founder of LL Interests, an affordable housing owner and developer. Before joining NewQuest Properties, Katherine was the president of the Gulf Coast States region for Verizon Wireless for eight years. Ms. Hatcher has been involved in and held board positions with various community organizations located in Houston, Texas, including the Greater Houston Partnership Board of Directors, MD Anderson’s Board of Visitors, Children’s Museum of Houston, the Houston Area Women’s Center, Youth About Business and Young Presidents Organization. She is also an alumna of The Center for Houston’s Future. Ms. Hatcher holds two master’s degrees from the University of North Carolina at Chapel Hill, one of which is in City and Regional Planning. Ms. Hatcher provides the Board with experience and insight into the operation, development, and growth of the Company’s businesses, particularly with regard to the Company’s real property assets.

Anthony Chase has served as a member of our Board of Directors since 2021. Mr. Chase is the Chairman and CEO of ChaseSource, L.P., a staffing, facilities management, and construction firm that he founded in 2006. Mr. Chase’s prior experience as an entrepreneur includes starting and selling three ventures. Chase Radio Partners owned seven radio stations and was sold to Clear Channel Communications in 1998. Mr. Chase opened the first three Cricket Wireless markets in Tennessee selling to Leap Wireless in 1998. Mr. Chase also sold ChaseCom, an enterprise that built and operated call centers around the world, to AT&T Corporation in 2007. He currently serves on the boards of Cullen/Frost Bankers, Inc., Nabors Industries Ltd., Heritage-Crystal Clean, Inc., and LyondellBasell Industries N.V. On January 28, 2022, Mr. Chase informed us that he will not stand for re-election to the Heritage-Crystal Clean, Inc. board once his term expires on May 4, 2022. In addition, his nonprofit board membership includes the Houston Endowment, Greater Houston Partnership, Texas Medical Center, and the MD Anderson Board of Visitors. Mr. Chase is a past Deputy Chairman of the Federal Reserve Bank of Dallas and a past Chairman of the Greater Houston Partnership, as well as a member of the Council on Foreign Relations and an Eagle Scout. Mr. Chase is a tenured Professor of Law at the University of Houston Law Center and an honors graduate of Harvard College, Harvard Law School and Harvard Business School. Mr. Chase provides the Board with experience and insight in corporate governance, banking, regulatory matters, and management and provision of human resources, as well as experience as an executive and as a board member of both public and private companies.

Philip Davidson has served as a member of our Board of Directors since 2021. Mr. Davidson was the Commander of the United States Indo-Pacific Command, headquartered in Honolulu, HI, from 2018 to 2021. He retired from active service in the U.S. Navy in May 2021 as a four-star Admiral after nearly 39 years of service. He

also serves on military advisory groups to the Sasakawa Peace Foundation USA (a 501(c)(3)), as well as the United States Institute of Peace, a national, nonpartisan, independent institute founded by Congress and dedicated to U.S. and global security. Mr. Davidson is a 1982 graduate of the U.S. Naval Academy, and a 1992 distinguished graduate of the U.S. Naval War College. He holds a Bachelor of Science degree in Physics and a Master of Arts in National Security and Strategic Studies. Mr. Davidson brings to the board significant leadership experience at the highest levels of military and governmental affairs.

William Monteleone has served as a member of our Board of Directors since August 2012 as well as on the Board of Managers of Laramie Energy since August 2012. In addition, Mr. Monteleone has served as our Executive Vice President and Chief Financial Officer since January 2022 and previously served as our Senior Vice President and Chief Financial Officer from March 2017 to January 2022, Senior Vice President of Mergers & Acquisitions from January 2015 to March 2017, and as our Chief Executive Officer from June 2013 to January 2015. Mr. Monteleone was most recently a Vice President at EGI, where he was employed from 2008 until August 2014, serving in a limited capacity from June 2013. At EGI, Mr. Monteleone was responsible for evaluating potential new investments and monitoring existing investments. Previously, Mr. Monteleone worked for Banc of America Securities LLC from 2006 to 2008 where he was involved in a variety of debt capital raising transactions, including leveraged buyouts, corporate-to-corporate acquisitions and other debt financing activities. In addition to our Board, Mr. Monteleone was previously on the Board of Directors of the following privately held companies: Wapiti Oil and Gas I, LLC, Wapiti Oil and Gas II, LLC, and Kuwait Energy Company. Mr. Monteleone graduated magna cum laude from Vanderbilt University with a bachelor's degree. Mr. Monteleone brings to the board investment banking experience and expertise with mergers and acquisitions, which assists us with the evaluation of potential investments and acquisition opportunities.

William Pate has served as our President and Chief Executive Officer since October 2015 and as a member of our Board of Directors since December 2014. Mr. Pate was previously Co-President of EGI. Mr. Pate had been employed by EGI or its predecessors in various capacities since 1994. Mr. Pate served as a director of Covanta Holdings Corporation from 1999 to 2016. He was the Chairman of the Board of Directors of Covanta from October 2004 through September 2005. Mr. Pate has previously served on the boards of directors of Exterran Holdings, Inc., Adams Respiratory Therapeutics, MiddleBrook Pharmaceuticals and CNA Surety Corp., as well as those of several private companies associated with EGI. Mr. Pate began his professional career at The First Boston Corporation as a financial analyst in the natural resources mergers and acquisitions group. Subsequently, he was employed as an associate at The Blackstone Group where he worked on private equity investments and merger advisory assignments. Mr. Pate holds a Juris Doctorate degree from the University of Chicago Law School and a Bachelor of

Arts degree from Harvard College. Mr. Pate brings to the Board familiarity with all aspects of capital markets, financial transactions and investing in a range of businesses across domestic and international markets. His experience as a board member of other public and private companies provides additional perspective on governance issues.

Director Independence

The listing standards of the NYSE require that our Board of Directors be comprised of at least a majority of independent directors. For a director to be considered independent under those standards, the Board must affirmatively determine that the director does not have any material relationship with us.

Based on these standards, our Board of Directors has affirmatively determined that Robert Silberman, Melvyn Klein, Curtis Anastasio, Timothy Clossey, L. Melvin Cooper, Walter Dods, Katherine Hatcher, Anthony Chase and Philip Davidson are independent. Messrs. Anastasio, Clossey, Cooper, Dods and Davidson and Ms. Hatcher have no relationship with us except as directors and stockholders, and Messrs. Klein, Silberman, Clossey and Chase have only the additional relationships described below. In determining the independence of Messrs. Silberman, Klein, Clossey and Chase, the Board engaged in the following analysis.

Mr. Silberman is a Managing Director of EGI and has held certain other relationships with affiliates of EGI, including membership on the investment committee of Zell Credit Opportunities Master Fund, L.P. (“ZCOF”). EGI is affiliated with ZCOF and EGI Investors L.L.C., beneficial owners of approximately 17.3% of our common stock as of March 11, 2022, as described under "Security Ownership of Certain Beneficial Owners and Management." Additionally, certain affiliates of EGI have participated in certain of the Company’s capital markets transactions. The Board reviewed payments made by us to EGI and its affiliates within the past three years, and Mr. Silberman’s role at EGI and its affiliates. See “Certain Relationships and Related Transactions.”

The Board also noted that certain directors, including Mr. Silberman and Mr. Klein, have direct and indirect relationships through other entities with other directors of the Company. The Board also reviewed a one-time cash award of $20,000 made in 2019 for services performed by Mr. Clossey in his capacity as an Audit Committee member related to a technical audit of the Company’s refineries in Hawaii, and certain payments made indirectly to Mr. Chase’s staffing company associated with individuals temporarily hired as consultants by Deloitte.

The Board determined that none of the aforementioned relationships or payments interfere with Mr. Silberman’s, Mr. Klein’s, Mr. Clossey's or Mr. Chase’s independent and objective oversight of Par Pacific’s

management or promotion of management’s accountability to Par Pacific’s stockholders or with their exercise of independent judgment as a director. Therefore, the Board concluded that Mr. Silberman, Mr. Klein, Mr. Clossey, and Mr. Chase each qualify as an independent director under applicable SEC rules and regulations and NYSE listing standards.

Board Leadership Structure and Role in Risk Oversight

Our Board of Directors believes that it should be free to choose the Chairman of the Board in any way that seems best for Par Pacific at any given period of time. Therefore, our Board of Directors does not have a policy regarding whether the role of the Chief Executive Officer and Chairman of the Board should be separate and, if they are to be separate, whether the Chairman of the Board should be selected from the non-employee directors or be an employee.

As set forth in our Corporate Governance Guidelines, our Board of Directors is responsible for the oversight of the Company and its business, including risk management. Together with the Board’s standing committees, the Board is responsible for ensuring that material risks are identified and managed appropriately. The Board and its committees regularly review material strategic, operational, financial, compensation and compliance risks with our senior management. The Audit Committee has oversight responsibility for financial risk (such as accounting, finance, internal controls, tax strategy and hedging), and also oversees compliance with our Code of Business Conduct and Ethics and with applicable laws and regulations. The Compensation Committee oversees compliance with our compensation plans. The Nominating and Corporate Governance Committee oversees compliance with our corporate governance principles, including our environmental, social and governance principles, and the Operations and Technology Committee oversees the Company’s operational results and the development of new technologies that impact the Company. Each of the committees report to the Board regarding the areas of risk they oversee.

Sustainability

At Par Pacific, we recognize the importance of ESG principles and focus our sustainability efforts toward improving ESG performance. We view sustainability as the fundamental process of shared value creation, in which strategic investment and innovation help our society achieve economic growth, environmental preservation and resource conservation to address the needs of future generations. We believe that promoting sustainable social,

environmental, and economic benefits wherever we operate creates long-term value for our Company, our stockholders and the communities where we work and live. As such, Par Pacific conducts its business and makes decisions according to the following principles:

•We maintain the highest standards of business conduct and ethics by conducting our affairs in an honest and ethical manner with unyielding personal and corporate integrity at the foundation of our business.

•We adhere to our values and strive to continually improve our ESG systems and processes to enhance our performance.

•We demonstrate integrity and respect for others, especially our employees and contractors, by setting goals and objectives that enhance our commitment to a safe workplace.

•We protect the environment by minimizing the use of any substance that may cause environmental damage, reducing waste generation and disposing of all waste through safe and responsible methods.

•We communicate an unyielding expectation that our Company and supply chain, including customers, suppliers, contractors, and employees, promote strong ESG performance and hold those to uncompromising accountability for our expectation.

•We focus on sustainable actions that promote health, fair dealing, and compliance throughout our business.

•We regularly report and improve our ESG progress while continuing to evaluate and improve our sustained ESG efforts.

•We are continuously developing frameworks and metrics that present our key ESG facts transparently.

Par Pacific believes a commitment to ESG priorities is positive for all its stakeholders, and thus has committed to embracing reporting frameworks from the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-related Financial Disclosures (TCFD). Par Pacific is committed to reducing greenhouse gas emissions and the risks of climate change as it delivers liquid fuel-based solutions to ensure energy security within the markets in which it operates.

In 2021, under Board oversight led by the Nominating and Corporate Governance Committee, Par Pacific published its inaugural sustainability report, which among other disclosures, reports performance data in alignment with the recommendations of SASB under the Oil and Gas – Refining and Marketing industry standard. This information is published on our website at https://www.parpacific.com/sites/par-pacific-corp-v2/files/par-pacific-corp/sustainability/Par%20Pacific%20Sustainability%20Report.pdf.

Pursuant to its charter, the Nominating and Corporate Governance Committee is tasked with assisting the Board in identifying, evaluating and reviewing social, political and environmental trends and related risks that could affect Par Pacific’s business activities and performance, and considering and making recommendations related to corporate responsibility, contributions, and reputation management. The committee periodically reviews and discusses with management, and makes recommendations to the Board on Par Pacific’s compliance with its policies, programs and practices regarding health, safety and environmental protection and Par Pacific’s strategy and performance in assessing and responding to climate-related risks and opportunities.

We recognize that our responsible stewardship impacts every employee, every contractor, and every member of

the communities where we operate, and we embrace that responsibility. We promote a culture of continual safety improvement with a keen eye for evaluating and managing risk, and monitor our programs, policies, and procedures to achieve these objectives. Through our continued focus on ESG principles, we believe we are well-positioned to drive sustainable performance and growth.

Communicating with our Board of Directors

Stockholders and other parties interested in communicating directly with the non-employee members of our Board of Directors may do so by writing to: Corporate Secretary, c/o Par Pacific Holdings, Inc., 825 Town and Country Lane, Suite 1500, Houston, Texas 77024. The Board maintains a process for handling letters received by Par Pacific and addressed to non-employee members of the Board. Under that process, our Corporate Secretary will forward such communication to the full Board of Directors or to any individual director or directors to whom the communication is directed unless the communication is threatening or illegal, uses profane language or is similarly inappropriate, in which case the Corporate Secretary has the authority to discard the communication or take appropriate legal action regarding the communication.

Although we do not have a formal policy regarding attendance by members of the Board at our annual meeting of stockholders, we encourage directors to attend. All of the members of the Board of Directors attended our 2021 annual meeting of stockholders.

Board and Committee Activity, Structure and Compensation

During 2021, our Board of Directors held six meetings. All directors attended at least 75% of the total meetings of the Board and the committees on which they served. The Board has adopted committee charters and

Corporate Governance Guidelines that, among other matters, describe the responsibilities and certain qualifications of our directors. Our committee charters, Corporate Governance Guidelines, and Code of Business Conduct and Ethics are available on our website at www.parpacific.com. Copies may also be obtained by writing to our Corporate Secretary at our principal executive offices. There were five standing committees of the Board during 2021: the Audit Committee, the Compensation Committee, the Executive Committee, the Nominating and Corporate Governance Committee, and the Operations and Technology Committee. Committee membership and the functions of those committees are described below. In accordance with applicable SEC rules and regulations and NYSE listing standards, all of the directors who serve on the Audit, Compensation or Nominating and Corporate Governance Committees have been determined by the Board, in its business judgment, to be “independent” from the Company and its management.

The chart below identifies directors who were members of each committee at the end of 2021, the number of meetings held by each committee during the year, the chairs of each committee and the Audit Committee financial experts.

| | | | | | | | | | | | | | | | | |

| Name | Audit | Compensation | Nominating and Corporate Governance | Operations and Technology | Executive |

| Robert Silberman | | | | | C |

| Melvyn Klein | | | C | | X |

| Curtis Anastasio | C, FE | | | X | |

| Timothy Clossey | X | | | C | |

| L. Melvin Cooper | X, FE | X | | | |

| Walter Dods | | C | X | | |

| William Pate | | | | | X |

| Katherine Hatcher | | X | X | | |

| Anthony Chase | | X | X | | |

| Philip Davidson | | | | X | |

| 2021 Meetings | Four | Five | Four | Four | Zero |

C = Committee Chair

FE = Financial Expert

X = Committee Member

Audit Committee. The current members of the Audit Committee are Curtis Anastasio (Chairman), L. Melvin Cooper and Timothy Clossey, and the committee met four times during 2021. Our Board of Directors has

determined that all of the members of the committee are independent under the listing standards of the NYSE and the rules of the SEC, and that Messrs. Anastasio and Cooper are audit committee financial experts under the rules of the SEC. The committee operates under a written charter adopted by our Board of Directors. The committee assists the Board in overseeing (i) the integrity of Par Pacific’s financial statements, (ii) Par Pacific’s compliance with legal and regulatory requirements, (iii) the independent registered public accounting firm’s qualifications and independence, and (iv) the performance of Par Pacific’s internal auditors (or other personnel responsible for the internal audit function) and Par Pacific’s independent auditor. In so doing, it is the responsibility of the committee to maintain free and open communication between the directors, the independent registered public accounting firm and the financial management of Par Pacific. The committee has the sole authority to select, evaluate, appoint or replace the independent registered public accounting firm and has the sole authority to approve all audit engagement fees and terms. The committee pre-approves all permitted non-auditing services to be provided by the independent auditors; discusses with management and the independent auditors our financial statements and any disclosures and SEC filings relating thereto; reviews the integrity of our financial reporting process; establishes policies for the hiring of employees or former employees of the independent registered public accounting firm; and investigates any matters pertaining to the integrity of management.

Compensation Committee. The current members of the Compensation Committee are Walter Dods (Chairman), L. Melvin Cooper, Katherine Hatcher and Anthony Chase and the committee met five times during 2021. Our Board of Directors has determined that all of the members of the committee are independent under the listing standards of the NYSE and the rules of the SEC. Each of the members of the committee is considered to be a “non-employee director” under Rule 16b-3 of the Securities Exchange Act of 1934, as amended (the "Exchange Act”). The committee operates under a written charter under which the committee, among other things, has the following authority: (i) to review and approve Par Pacific’s goals relating to the chief executive officer’s compensation, evaluate the chief executive officer’s performance under those goals and set the chief executive officer’s compensation; (ii) to evaluate, review and approve the compensation structure and process for our other officers and the officers of our subsidiaries; (iii) to evaluate, review and recommend to our Board any changes to, or additional, stock-based and other incentive compensation plans; (iv) to engage independent advisors to assist the members of the committee in carrying out their duties; and (v) to recommend inclusion of the Compensation Discussion and Analysis in this proxy statement or our Annual Report on Form 10-K, as applicable.

Compensation Committee Interlocks and Insider Participation

Walter Dods, L. Melvin Cooper, Katherine Hatcher and Anthony Chase served on the Compensation Committee in 2021. No member of the committee has served as one of our officers or employees at any time. None of our executive officers serve, or in the past fiscal year has served, as a member of the board of directors or compensation committee of any entity that has one or more of its executive officers serving on our Board of Directors or Compensation Committee.

Executive Committee. The current members of the Executive Committee are Robert Silberman (Chairman), William Pate and Melvyn Klein. The committee did not meet during 2021. The committee operates under a written charter adopted by the Board. The committee is responsible for exercising the powers and duties of the Board between Board meetings and while the Board is not in session, and implementing the policy decisions of the Board, but does not have the authority to approve certain actions on behalf of the Board, including (i) filling vacancies or changing membership of the Board or any of its committees, (ii) changing the size of the Board or any of its committees, (iii) electing or removing elected officers or directors or changing their compensation, (iv) amending our certificate of incorporation or bylaws, (v) adopting an agreement providing for the merger or consolidation of Par Pacific or recommending to the stockholders the sale, lease or exchange of all or substantially all of Par Pacific’s property and assets, (vi) recommending to the stockholders a dissolution of Par Pacific or a revocation of a dissolution, (vii) declaring a dividend, authorizing the issuance of stock (except pursuant to specific authorization by the Board), (viii) those matters which are expressly delegated to another committee of the Board, or (ix) matters which, under the General Corporation Law of the State of Delaware, our certificate of incorporation or our bylaws cannot be delegated by the Board to a committee of the Board.

Nominating and Corporate Governance Committee. The current members of the Nominating and Corporate Governance Committee are Melvyn Klein (Chairman), Walter Dods, Katherine Hatcher and Anthony Chase. The committee met four times during 2021. Our Board of Directors has determined that all of the members of the committee are independent under the listing standards of the NYSE and the rules of the SEC. The committee operates under a written charter adopted by the Board. The committee is responsible for determining the qualifications, skills and other expertise required to be a director, identifying and recommending qualified candidates to the Board for nomination as members of the Board, and recommending to the Board the corporate governance principles applicable to Par Pacific, including environmental, safety and health principles. The committee also leads the Board in its annual self-evaluations and recommends nominees to serve on each committee

of the Board. The committee, among other things, has the authority to evaluate candidates for the position of director, retain and terminate any search firm used to identify director candidates and review and reassess the adequacy of our corporate governance procedures. Additionally, the committee identifies, evaluates and reviews ESG trends and related risks that could affect the Company’s business activities.

Operations and Technology Committee. The current members of the Operations and Technology Committee are Timothy Clossey (Chairman), Curtis Anastasio and Philip Davidson. The committee met four times during 2021. The Committee operates under a written charter adopted by the Board. The Committee is responsible for evaluating reports from management regarding and overseeing Company operations and technology initiatives, evaluating and overseeing key project execution and implementation, and monitoring the Company’s compliance with environmental, health and safety rules and regulations.

Director Nominations Process. In identifying candidates for positions on the Board, the Nominating and Corporate Governance Committee generally relies on suggestions and recommendations from members of the Board, management and stockholders. After being identified by Par Pacific’s non-management directors, the Nominating and Corporate Governance Committee recommended Messrs. Chase and Davidson as Board Nominee candidates in 2021. In 2021, we did not use any search firm or pay fees to other third parties in connection with seeking or evaluating Board nominee candidates.

The committee does not set specific minimum qualifications for director positions. Instead, the committee believes that nominations for election or re-election to the Board should be based on a particular candidate’s merits and our needs after taking into account the current composition of the Board. When evaluating candidates annually for nomination for election, the committee considers an individual’s skills, diversity, independence from us, experience in areas that address the needs of the Board, and ability to devote adequate time to Board duties. The committee does not specifically define diversity, but values diversity of experience, perspective, education, race, gender and national origin as part of its overall annual evaluation of director nominees for election or re-election. Whenever a new seat or a vacated seat on the Board is being filled, candidates that appear to best fit the needs of the Board and the Company are identified and, unless such individuals are well known to the Board, they are interviewed and further evaluated by the committee. Candidates selected by the committee are then recommended to the full Board. After the Board approves a candidate, the Chair of the committee extends an invitation to the candidate to join the Board.

Our bylaws contain provisions that address the process by which a stockholder may nominate an individual to stand for election to the Board at our annual meeting of stockholders. We do not have a formal policy concerning stockholder nominations of individuals to stand for election to the Board, other than the provisions contained in our bylaws. Since our emergence from bankruptcy and except as previously provided by a stockholders agreement to which we were a party and which was terminated as of April 7, 2015, we have not received any recommendations from stockholders requesting that the Board consider a candidate for inclusion among the slate of nominees in any year, and therefore we believe that no formal policy, in addition to the provisions contained in our bylaws, concerning stockholder recommendations is needed.

Our bylaws provide that nominations for the election of directors may be made by any stockholder entitled to vote in the election of directors. To be timely, a stockholder’s notice must be delivered to or mailed and received at our principal executive offices not less than 90 days nor more than 120 days prior to the date of the meeting; provided, however, that in the event that public disclosure of the date of the meeting is first made less than 100 days prior to the date of the meeting, notice by the stockholder in order to be timely must be so received not later than the close of business on the tenth day following the day on which such public disclosure of the date of the meeting was made. To be in proper written form, a stockholder’s notice regarding nominations of persons for election to the Board must set forth (a) as to each proposed nominee, (i) the name, age, business address and residence address of the nominee, (ii) the principal occupation or employment of the nominee, (iii) the class or series and number of shares of our capital stock which are owned beneficially or of record by the nominee and (iv) any other information relating to the nominee that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors pursuant to Section 14 of the Exchange Act, and the rules and regulations promulgated thereunder; and (b) as to the stockholder giving the notice, (i) the name and record address of such stockholder, (ii) the class or series and number of shares of our capital stock which are owned beneficially or of record by such stockholder, (iii) a description of all arrangements or understandings between such stockholder and each proposed nominee and any other person or persons (including their names) pursuant to which the nomination(s) are to be made by such stockholder, (iv) a representation that such stockholder intends to appear in person or by proxy at the meeting to nominate the persons named in its notice and (v) any other information relating to such stockholder that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors pursuant to Section 14 of the Exchange Act and the rules and regulations promulgated thereunder. Such notice must be accompanied by a written consent of each proposed nominee to being named as a nominee and to serve as a director if elected.

2021 Compensation of Directors. Our employee directors are not separately compensated for their service as directors. During 2021, our non-employee directors (other than our Chairman of the Board and Chairman Emeritus) received an annual cash retainer of $70,000 and an annual common stock retainer of $90,000, provided that the non-employee directors may elect, at their option, to increase the stock component of the retainer with a corresponding reduction in the cash component of the retainer. Our Chairman Emeritus and Chairman each had compensation targets of $270,000 in 2021, with $120,000 in cash and $150,000 in common stock. The cash component of the retainer is paid quarterly, and the stock component is paid quarterly at the beginning of the period to which the compensation relates in grants of restricted stock or restricted stock units with a one-year vesting schedule from the date of grant.

In addition, the Chairman of the Audit Committee received an additional annual retainer of $20,000 and the members of the Audit Committee (other than the Chairman) received an annual retainer of $7,500, such retainers paid quarterly in cash. The Chairman of the Compensation Committee received an annual retainer of $15,000 and the Chairman of the Operations and Technology Committee received an annual retainer of $15,000. Mr. Klein, the Chairman of the Nominating and Corporate Governance Committee, waived his annual retainer of $5,000. There are no fees for the members of any other committee or for attendance at meetings. Non-employee directors are eligible to participate in the Par Pacific Holdings, Inc. Non-Qualified Deferred Compensation Plan (the “Deferred Compensation Plan”). See “Executive Compensation - Compensation Discussion and Analysis - Non-Qualified Deferred Compensation Plan” below for a summary of the material terms of the Deferred Compensation Plan.

The following table sets forth a summary of the compensation that we paid to our non-employee directors in 2021:

| | | | | | | | | | | | | | | | | | | | | | | |

| Name | Fees Earned or Paid in Cash ($) (3) | | Restricted Stock or Restricted Stock Unit Awards ($) (1) | | Option Awards ($) (1) | | Total ($) (2) |

| Robert Silberman | $ | 120,000 | | | $ | 150,000 | | | $ | — | | | $ | 270,000 | |

| Melvyn Klein | $ | 120,000 | | | $ | 150,000 | | | $ | — | | | $ | 270,000 | |

| Curtis Anastasio | $ | 90,000 | | | $ | 90,000 | | | $ | — | | | $ | 180,000 | |

| Anthony Chase | $ | 17,500 | | | $ | 22,500 | | | $ | — | | | $ | 40,000 | |

| Timothy Clossey | $ | 92,500 | | | $ | 90,000 | | | $ | — | | | $ | 182,500 | |

| L. Melvin Cooper | $ | 77,500 | | | $ | 90,000 | | | $ | — | | | $ | 167,500 | |

| Philip Davidson | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Walter Dods | $ | 85,000 | | | $ | 90,000 | | | $ | — | | | $ | 175,000 | |

| Katherine Hatcher | $ | 70,000 | | | $ | 90,000 | | | $ | — | | | $ | 160,000 | |

_________________________________________________________

(1)These amounts reflect the aggregate grant date fair value, calculated in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation-Stock Compensation (ASC 718), of awards pursuant to the Par Pacific Holdings, Inc. Second Amended and Restated 2012 Long-Term Incentive Plan (the “2012 Long Term Incentive Plan”). Assumptions used in the calculation of these amounts are included in “Note 18- Stockholders’ Equity” to our audited financial statements for the fiscal year ended December 31, 2021 included in our 2021 Annual Report on Form 10-K filed with the SEC on February 25, 2022. All our non-employee directors elected to receive their stock compensation for Board service in the form of restricted stock or restricted stock units with a one-year vesting period. During 2021, Messrs. Klein and Silberman elected to defer receipt of their vested restricted stock units until they leave Board service.

(2)As of December 31, 2021, no director has options. As of December 31, 2021, Messrs. Silberman, Klein, Anastasio, Clossey, Cooper, and Dods had 46,936, 54,593, 10,470, 11,695, 7,263, and 16,978 restricted stock units outstanding, respectively, and the other directors each had zero restricted stock units outstanding.

(3)The Chairman of the Board and the Chairman Emeritus of the Board each have an annual compensation target of $120,000 in cash, while the other independent Board members have an annual compensation target of $70,000 in cash. Additionally, certain members of the Board receive compensation for service on certain Board committees.

2022 Compensation of Directors. In February 2022, as part of its obligation to review director compensation under its charter, the Compensation Committee engaged Meridian Compensation Partners, LLC (“Meridian”), the Compensation Committee’s independent compensation consultant, to examine the amount and composition of annual director compensation, taking into account the form and amount of annual cash and equity compensation as compared to our customized peer group in 2022 and our compensation philosophy and objectives. As reflected in the Meridian analysis, the compensation paid to our directors was below the median of our peer group in both cash and equity components. Despite the results of the Meridian analysis, the Compensation Committee elected not to change annual director compensation during 2022.

Vote Required

The eleven nominees for election as directors at the annual meeting who receive the greatest number of votes cast by the stockholders, a plurality, will be elected as our directors. As a result, broker non-votes and abstentions will not be counted in determining which nominees received the largest number of votes cast. You may vote “FOR” all nominees, “AGAINST” all nominees or withhold your vote for any one or more of the nominees.

Board Recommendation

Our Board of Directors recommends a vote “FOR” all eleven nominees to the Board.

Proposal 2

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

General

The Audit Committee has selected Deloitte & Touche LLP, independent registered public accounting firm, to audit our consolidated financial statements for the fiscal year ending December 31, 2022. Deloitte & Touche has served as our independent registered public accounting firm since December 6, 2013. We are asking the stockholders to ratify the appointment of Deloitte & Touche as our independent registered public accounting firm for the fiscal year ending December 31, 2022. Deloitte & Touche was appointed by the Audit Committee in accordance with its charter.

In the event stockholders fail to ratify the appointment, the Audit Committee may reconsider this appointment. Even if the appointment is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent accounting firm at any time during the year if the Audit Committee determines that such a change would be in Par Pacific’s and our stockholders’ best interests.

The Audit Committee has approved all services provided by Deloitte & Touche. Representatives of Deloitte & Touche plan to attend the annual meeting and are expected to be available to answer appropriate questions. Its representatives also will have an opportunity to make a statement at the meeting if they so desire, although it is not expected that any statement will be made.

Audit Fees

The following table sets forth the fees incurred by us in fiscal years 2021 and 2020 for services performed by Deloitte & Touche LLP:

| | | | | | | | | | | |

| 2021 | | 2020 |

Audit Fees(1) | $ | 1,880,000 | | | $ | 1,758,500 | |

Audit Related Fees(2) | 72,500 | | | 67,000 | |

Tax Fees(3) | — | | | — | |

All Other Fees(4) | 4,103 | | | 4,103 | |

| Total Fees | $ | 1,956,603 | | | $ | 1,829,603 | |

(1)Audit fees are fees paid to Deloitte & Touche LLP for professional services related to the audit and quarterly reviews of our financial statements and for services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements.

(2)Audit related fees are fees paid to Deloitte & Touche LLP for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements that are not reported above under “Audit Fees.”

(3)Tax fees are fees paid for tax compliance (including filing state and federal tax returns), tax advice and tax planning. Tax fees do not include fees for services rendered in connection with the audit of Par Pacific’s financial statements.

(4)Other fees paid to Deloitte & Touche LLP for the fiscal years ended December 31, 2021 and 2020 relate to fees for a subscription to an accounting research tool.

Policy on Audit Committee Pre-Approval of Audit and Non-Audit Services of Independent Registered Public Accounting Firm

Our independent registered public accounting firm may not be engaged to provide non-audit services that are prohibited by law or regulation to be provided by it, nor may our independent registered public accounting firm be engaged to provide any other non-audit service unless it is determined that the engagement of the principal accountant provides a business benefit resulting from its inherent knowledge of us while not impairing its independence. Our Audit Committee must pre-approve permissible non-audit services. During each of the fiscal years 2021 and 2020, our Audit Committee approved 100% of the non-audit services provided to us by our independent registered public accounting firm.

Audit Committee Report

The Audit Committee assists our Board of Directors in overseeing (i) the integrity of Par Pacific’s financial statements, (ii) Par Pacific’s compliance with legal and regulatory requirements, (iii) the independent registered public accounting firm’s qualifications and independence, and (iv) the performance of Par Pacific’s internal auditors (or other personnel responsible for the internal audit function) and Par Pacific’s independent registered public accounting firm. In so doing, it is the responsibility of the committee to maintain free and open communication between the directors, the independent registered public accounting firm and the financial management of Par Pacific. The committee is directly responsible for the appointment, compensation, retention and oversight of the work of the independent registered public accounting firm for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for Par Pacific. The independent registered public accounting firm reports directly to the committee.

Management is responsible for the preparation, presentation, and integrity of Par Pacific’s consolidated financial statements, accounting and financial reporting principles, internal control over financial reporting, and procedures designed to ensure compliance with accounting standards, applicable laws, and regulations. Management is also responsible for objectively reviewing and evaluating the adequacy, effectiveness, and quality of Par Pacific’s system of internal control over financial reporting. Par Pacific’s independent auditor, Deloitte & Touche LLP, is responsible for performing an independent audit of the consolidated financial statements and expressing an opinion on the conformity of those financial statements with accounting principles generally accepted in the United States. The independent auditor is also responsible for expressing an opinion on the effectiveness of Par Pacific’s internal control over financial reporting. The committee’s responsibility is to monitor and oversee these processes and the engagement, independence and performance of Par Pacific’s independent auditor.

The committee has met with our independent auditor and discussed the overall scope and plans for their audit. The committee met with the independent auditor, with and without management present, to discuss the independent auditor’s opinion about the effectiveness of Par Pacific’s internal control over financial reporting. The committee also discussed with the independent auditor matters required to be discussed with audit committees under generally accepted auditing standards, including, among other things, matters related to the conduct of the audit of Par Pacific’s consolidated financial statements and the matters required to be discussed by the Public Company Accounting Oversight Board (“PCAOB”) and the SEC.

Our independent auditor also provided to the committee the written disclosures and the letter required by applicable requirements of the PCAOB regarding the independent auditor’s communications with the committee concerning independence, and the committee discussed with the independent auditor its independence. When considering Deloitte & Touche’s independence, the committee considered the non-audit services provided to Par Pacific by the independent auditor and concluded that such services are compatible with maintaining the auditor’s independence.

The committee has reviewed and discussed Par Pacific’s audited consolidated financial statements for the fiscal year ended December 31, 2021 with management and Deloitte & Touche. Based on the committee’s review of the audited consolidated financial statements and the meetings and discussions with management and the independent auditors, and subject to the limitations on the committee’s role and responsibilities referred to above and in the Audit Committee Charter, the committee recommended to our Board of Directors that Par Pacific’s audited consolidated financial statements for the fiscal year ended December 31, 2021 be included in Par Pacific’s Annual Report on Form 10-K as filed with the SEC.

AUDIT COMMITTEE

Curtis Anastasio, Chairman

Timothy Clossey

L. Melvin Cooper

Vote Required

The approval of the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022 requires the affirmative vote of the holders of a majority of the shares present at the meeting or represented by proxy and entitled to vote. As a result, abstentions will have the same practical effect as votes against this proposal. Because brokers generally have discretionary authority to vote on the ratification of our independent auditors, broker non-votes are generally not expected to result from the vote on this proposal. For the approval of the ratification of the appointment of Deloitte & Touche LLP, you may vote “FOR” or “AGAINST” or abstain from voting.

Board Recommendation

The Board recommends that you vote “FOR” the ratification of appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022.

OTHER INFORMATION

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information regarding the beneficial ownership of common stock as of March 11, 2022 of (i) each person who is known by us to own beneficially more than five percent of our outstanding shares of common stock, (ii) each named executive officer, (iii) each of our directors and (iv) all of our directors and executive officers as a group.

| | | | | | | | | | | | | | |

| Beneficial holders | | Amount and Nature of Beneficial

Ownership (1) |

| | Number | | Percentage |

| 5% Stockholders: | | | | |

| Zell Credit Opportunities Master Fund, L.P. (2) | | 10,416,774 | | 17.3% |

| BlackRock Inc. (3) | | 7,567,090 | | 12.6% |

| Rubric Capital Management LP (4) | | 3,700,000 | | 6.2% |

| The Vanguard Group, Inc. (5) | | 3,272,375 | | 5.4% |

| Directors and Named Executive Officers: | | | | |

| | | | |

| Curtis Anastasio (6) | | 84,807 | | * |

| Anthony Chase | | 1,431 | | * |

| Timothy Clossey (7) | | 64,219 | | * |

| L. Melvin Cooper (8) | | 47,753 | | * |

| Walter Dods (9) | | 91,701 | | * |

| Katherine Hatcher | | 22,173 | | * |

| Joseph Israel (10) | | 375,986 | | * |

| Melvyn Klein (11) | | 106,995 | | * |

| William Monteleone (12) | | 468,585 | | * |

| William Pate (13) | | 1,348,043 | | 2.2% |

| Robert Silberman (14) | | 102,301 | | * |

| James Matthew Vaughn (15) | | 212,251 | | * |

| Eric Wright | | 48,037 | | * |

| Philip Davidson | | — | | * |

| All directors and executive officers as a group (16 persons) (16) | | 2,974,282 | | 4.9% |

_________________________________________________________

* Denotes less than 1% beneficially owned.

(1)Based on 60,158,209 common shares outstanding as of March 11, 2022.

(2)Information based upon the Schedule 13D/A jointly filed with the SEC on February 28, 2022 by Zell Credit Opportunities Master Fund, L.P., Chai Trust Company, LLC, and EGI Investors, L.L.C., as supplemented by the Form 4 jointly filed with the SEC on March 11, 2022 by the same persons. The address for these persons is 2 North Riverside Plaza, Suite 600, Chicago, Illinois 60606. Chai Trust Company, LLC, an