Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05324

ELFUN DIVERSIFIED FUND

(Exact name of registrant as specified in charter)

One Iron Street

Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

| (Name and Address of Agent for Service) | Copy to: | |

Joshua A. Weinberg, Esq. Managing Director and Managing Counsel c/o SSGA Funds Management, Inc. One Iron Street Boston, Massachusetts 02210 | Timothy W. Diggins, Esq. Ropes & Gray LLP 800 Boylston Street Boston, Massachusetts 02110-2624 |

Registrant’s telephone number, including area code: (617) 664-7037

Date of fiscal year end: December 31

Date of reporting period: June 30, 2018

Table of Contents

Item 1. Shareholder Report.

Table of Contents

Semi-Annual Report

June 30, 2018

Elfun Funds

Elfun International Equity Fund

Elfun Trusts

Elfun Diversified Fund

Elfun Tax-Exempt Income Fund

Elfun Income Fund

Elfun Government Money Market Fund

Table of Contents

Elfun Funds

Semi-Annual Report

June 30, 2018 (Unaudited)

| Page | ||||

| Notes to Performance | 1 | |||

| Understanding Your Fund’s Expenses, Fund Information and Schedules of Investments | ||||

| 2 | ||||

| 7 | ||||

| 11 | ||||

| 44 | ||||

| 53 | ||||

| 75 | ||||

| Notes to Schedules of Investments | 79 | |||

| Financial Statements | ||||

| 80 | ||||

| 86 | ||||

| 88 | ||||

| 90 | ||||

| Notes to Financial Statements | 93 | |||

| Other Information | 102 | |||

This report has been prepared for shareholders and may be distributed to others only if accompanied with a current prospectus and/or summary prospectus.

Table of Contents

Elfun Funds

Notes to Performance — June 30, 2018 (Unaudited)

Information on the following performance pages relates to the Elfun Funds.

Total returns take into account changes in share price and assume reinvestment of all dividends and capital gains distributions, if any. Total returns shown are net of Fund expenses.

The performance data quoted represents past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Periods less than one year are not annualized. Please call toll-free (800) 242-0134 or visit the Funds’ website at http://www.ssga.com/geam for the most recent month-end performance data.

A portion of the Elfun Tax-Exempt Income Fund’s income may be subject to state, federal and/or alternative minimum tax. Capital gains, if any, are subject to capital gains tax.

An investment in a Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) or any other government agency. An investment in a Fund is subject to risk, including possible loss of principal invested.

State Street Global Advisors Funds Distributors, LLC, member of FINRA & SIPC is the principal underwriter and distributor of the Elfun Funds and an indirect wholly-owned subsidiary of State Street Corporation. References to State Street may include State Street Corporation and its affiliates. The Funds pay State Street Bank and Trust Company for its services as custodian and Fund Accounting agent, and pay SSGA Funds Management, Inc. for investment advisory and administrative services.

| Notes to Performance | 1 |

Table of Contents

Elfun International Equity Fund

Understanding Your Fund’s Expenses — June 30, 2018 (Unaudited)

As a shareholder of the Fund you incur ongoing costs. Ongoing costs include portfolio management fees, professional fees, administrative fees and other Fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in units of the Fund during the period. The information in the following table is based on an investment of $1,000, which is invested at the beginning of the period and held for the entire six-month period ended June 30, 2018.

Actual Expenses

The first section of the table provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given under the heading “Expenses paid during the period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholders reports of other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs, such as sales charges or redemption fees, if any. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| Actual Fund Return | Hypothetical 5% Return (2.5% for the period) | |||||||

Account value at the beginning of the period January 1, 2018 | $ | 1,000.00 | $ | 1,000.00 | ||||

Account value at the end of the period June 30, 2018 | $ | 966.50 | $ | 1,023.06 | ||||

Expenses paid during the period* | $ | 1.71 | $ | 1.76 | ||||

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.35% (for the period January 1, 2018-June 30, 2018), multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| 2 | Elfun International Equity Fund |

Table of Contents

Elfun International Equity Fund

Fund Information — June 30, 2018 (Unaudited)

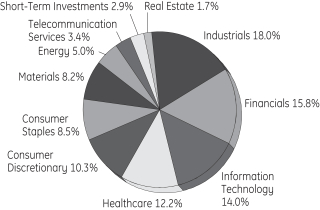

Sector Allocation

Portfolio Composition as a % of Fair Value of $223,473 (in thousands) as of June 30, 2018 (a)(b)

Top Ten Largest Holdings

as of June 30, 2018 (as a % of Fair Value) (a)(b)

Nestle S.A. | 3.36 | % | ||

ASML Holding N.V. | 2.76 | % | ||

Bayer AG | 2.50 | % | ||

SAP SE | 2.44 | % | ||

Daikin Industries Ltd. | 2.38 | % | ||

AIA Group Ltd. | 2.33 | % | ||

BHP Billiton PLC | 2.30 | % | ||

Roche Holding AG | 2.28 | % | ||

Equinor ASA | 2.15 | % | ||

Vodafone Group PLC | 2.11 | % |

| (a) | Fair Value basis is inclusive of short-term investments in State Street Institutional Treasury Money Market – Premier Class and State Street Institutional U.S. Government Money Market Fund – Class G Shares. |

| (b) | The securities information regarding holdings, allocations and other characteristics is presented to illustrate examples of securities that the Fund has bought and the diversity of areas in which the Fund may invest as of a particular date. It may not be representative of the Fund’s current or future investments and should not be construed as a recommendation to purchase or sell a particular security. |

| Elfun International Equity Fund | 3 |

Table of Contents

Elfun International Equity Fund

Schedule of Investments — June 30, 2018 (Unaudited)

| Number of Shares | Fair $ | |||||||

| Common Stock - 96.6%† |

| |||||||

Australia - 0.7% |

| |||||||

Suncorp Group Ltd. | 149,214 | 1,608,500 | ||||||

|

| |||||||

Belgium - 1.6% |

| |||||||

Anheuser-Busch InBev S.A. | 35,699 | 3,605,353 | ||||||

|

| |||||||

Canada - 1.7% |

| |||||||

Brookfield Asset Management Inc., Class A (h) | 27,705 | 1,123,195 | ||||||

Cenovus Energy Inc. (h) | 115,804 | 1,201,661 | ||||||

Seven Generations Energy Ltd., Class A (a) | 126,619 | 1,394,739 | ||||||

|

| |||||||

| 3,719,595 | ||||||||

|

| |||||||

China - 1.3% |

| |||||||

New Oriental Education & Technology Group Inc. ADR | 30,951 | 2,929,822 | ||||||

|

| |||||||

France - 12.3% |

| |||||||

Air Liquide S.A. | 34,323 | 4,315,952 | ||||||

Airbus SE | 32,626 | 3,819,154 | ||||||

AXA S.A. | 130,520 | 3,202,449 | ||||||

BNP Paribas S.A. | 72,913 | 4,528,044 | ||||||

Schneider Electric SE | 55,799 | 4,652,881 | ||||||

Valeo S.A. | 61,642 | 3,369,642 | ||||||

Vivendi S.A. | 153,989 | 3,775,589 | ||||||

|

| |||||||

| 27,663,711 | ||||||||

|

| |||||||

Germany - 12.2% |

| |||||||

Bayer AG | 50,677 | 5,582,497 | ||||||

Fresenius SE & Company KGaA | 27,354 | 2,197,278 | ||||||

HeidelbergCement AG | 38,134 | 3,209,245 | ||||||

Infineon Technologies AG | 133,849 | 3,411,493 | ||||||

KION Group AG (h) | 35,287 | 2,539,528 | ||||||

SAP SE | 47,108 | 5,442,346 | ||||||

Wacker Chemie AG | 17,156 | 2,246,420 | ||||||

Zalando SE (a) | 48,595 | 2,716,006 | ||||||

|

| |||||||

| 27,344,813 | ||||||||

|

| |||||||

Hong Kong - 2.3% |

| |||||||

AIA Group Ltd. | 596,367 | 5,214,586 | ||||||

|

| |||||||

India - 1.4% |

| |||||||

ICICI Bank Ltd. | 795,927 | 3,199,275 | ||||||

|

| |||||||

Ireland - 1.7% |

| |||||||

Kerry Group PLC, Class A | 35,872 | 3,752,660 | ||||||

|

| |||||||

Italy - 0.5% |

| |||||||

Intesa Sanpaolo S.p.A. | 390,615 | 1,134,000 | ||||||

|

| |||||||

| Number of Shares | Fair $ | |||||||

Japan - 27.8% |

| |||||||

Daikin Industries Ltd. | 44,400 | 5,319,261 | ||||||

Disco Corp. | 14,900 | 2,543,755 | ||||||

FANUC Corp. | 19,200 | 3,814,346 | ||||||

Hoya Corp. | 78,200 | 4,447,089 | ||||||

Kao Corp. | 55,500 | 4,233,964 | ||||||

Keyence Corp. | 5,600 | 3,162,876 | ||||||

Komatsu Ltd. | 150,500 | 4,304,464 | ||||||

Mitsubishi UFJ Financial Group Inc. | 789,600 | 4,498,863 | ||||||

Mitsui Fudosan Company Ltd. | 160,118 | 3,865,441 | ||||||

Murata Manufacturing Company Ltd. | 27,697 | 4,655,967 | ||||||

Nidec Corp. | 28,700 | 4,307,656 | ||||||

Secom Company Ltd. | 41,400 | 3,179,613 | ||||||

Sekisui House Ltd. | 201,100 | 3,558,489 | ||||||

Shimano Inc. | 17,200 | 2,524,913 | ||||||

SoftBank Group Corp. | 39,401 | 2,836,132 | ||||||

Subaru Corp. | 103,800 | 3,022,209 | ||||||

Tokio Marine Holdings Inc. | 44,149 | 2,069,839 | ||||||

|

| |||||||

| 62,344,877 | ||||||||

|

| |||||||

Netherlands - 4.7% |

| |||||||

ASML Holding N.V. | 31,138 | 6,169,475 | ||||||

ING Groep N.V. | 300,509 | 4,325,395 | ||||||

|

| |||||||

| 10,494,870 | ||||||||

|

| |||||||

Norway - 2.1% |

| |||||||

Equinor ASA | 180,941 | 4,804,136 | ||||||

|

| |||||||

Portugal - 1.7% |

| |||||||

Galp Energia SGPS S.A. | 202,594 | 3,863,860 | ||||||

|

| |||||||

South Africa - 0.5% |

| |||||||

Naspers Ltd., Class N | 4,431 | 1,126,642 | ||||||

|

| |||||||

Sweden - 3.4% |

| |||||||

Assa Abloy AB, Class B | 202,189 | 4,314,541 | ||||||

Hexagon AB, Class B | 60,504 | 3,378,241 | ||||||

|

| |||||||

| 7,692,782 | ||||||||

|

| |||||||

Switzerland - 7.0% |

| |||||||

Givaudan S.A. | 1,413 | 3,204,669 | ||||||

Nestle S.A. | 96,900 | 7,504,517 | ||||||

Roche Holding AG | 22,950 | 5,097,560 | ||||||

|

| |||||||

| 15,806,746 | ||||||||

|

| |||||||

Taiwan - 1.1% |

| |||||||

Taiwan Semiconductor Manufacturing Company Ltd. | 349,900 | 2,484,653 | ||||||

|

| |||||||

See Notes to Schedules of Investments and Notes to Financial Statements.

| 4 | Elfun International Equity Fund |

Table of Contents

Elfun International Equity Fund

Schedule of Investments, continued — June 30, 2018 (Unaudited)

| Number of Shares | Fair $ | |||||||

United Kingdom - 12.6% |

| |||||||

AstraZeneca PLC | 44,267 | 3,070,039 | ||||||

BHP Billiton PLC | 228,561 | 5,147,988 | ||||||

Prudential PLC | 196,132 | 4,491,373 | ||||||

Shire PLC | 66,342 | 3,735,631 | ||||||

Smith & Nephew PLC | 171,247 | 3,160,723 | ||||||

Smiths Group PLC | 176,088 | 3,947,515 | ||||||

Vodafone Group PLC | 1,940,020 | 4,708,204 | ||||||

|

| |||||||

| 28,261,473 | ||||||||

|

| |||||||

| Total Common Stock (Cost $182,332,695) |

| 217,052,354 | ||||||

|

| |||||||

| Rights - 0.0%* |

| |||||||

Italy - 0.0%* |

| |||||||

Intesa Sanpaolo S.p.A. | 390,615 | — | ||||||

|

| |||||||

| Total Investments in Securities (Cost $182,332,695) |

| 217,052,354 | ||||||

|

| |||||||

| Number of Shares | Fair $ | |||||||

| Short-Term Investments - 2.9% |

| |||||||

State Street Institutional Treasury Money Market Fund - Premier Class 1.73% (d)(p) | 3,220,293 | 3,220,293 | ||||||

State Street Institutional U.S. Government Money Market Fund - Class G Shares 1.86% (d)(p) | 3,200,819 | 3,200,819 | ||||||

|

| |||||||

| Total Short-Term Investments (Cost $6,421,112) |

| 6,421,112 | ||||||

|

| |||||||

| Total Investments (Cost $188,753,807) |

| 223,473,466 | ||||||

| Other Assets and Liabilities, net - 0.5% |

| 1,144,579 | ||||||

|

| |||||||

| NET ASSETS - 100.0% |

| 224,618,045 | ||||||

|

| |||||||

Other Information:

The Fund had the following short futures contracts open at June 30, 2018:

| Description | Expiration date | Number of Contracts | Notional Amount | Value | Unrealized Appreciation | |||||||||||||||

MSCI EAFE Mini Index Futures | September 2018 | 7 | (688,655 | ) | $ | (684,390 | ) | $ | 4,265 | |||||||||||

|

| |||||||||||||||||||

During the period ended June 30, 2018, average notional value related to futures contracts was $2,452,153 or 1.1% of net assets.

The following table presents the Fund’s investments measured at fair value on a recurring basis at June 30, 2018:

| Fund | Investments | Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Elfun International Equity Fund | Investments in Securities | |||||||||||||||||

Common Stock | $ | 217,052,354 | $ | — | $ | — | $ | 217,052,354 | ||||||||||

Short-Term Investments | 6,421,112 | — | — | 6,421,112 | ||||||||||||||

|

|

|

|

|

|

|

| |||||||||||

Total Investments in Securities | $ | 223,473,466 | $ | — | $ | — | $ | 223,473,466 | ||||||||||

|

|

|

|

|

|

|

| |||||||||||

Other Financial Instruments | ||||||||||||||||||

Short Futures Contracts - Unrealized Appreciation | $ | 4,265 | $ | — | $ | — | $ | 4,265 | ||||||||||

|

|

|

|

|

|

|

| |||||||||||

See Notes to Schedules of Investments and Notes to Financial Statements.

| Elfun International Equity Fund | 5 |

Table of Contents

Elfun International Equity Fund

Schedule of Investments, continued — June 30, 2018 (Unaudited)

The Fund was invested in the following sectors at June 30, 2018 (unaudited):

| Sector | Percentage (based on Fair Value) | |||

Diversified Banks | 7.91% | |||

Pharmaceuticals | 6.15% | |||

Packaged Foods & Meats | 5.04% | |||

Integrated Oil & Gas | 4.42% | |||

Life & Health Insurance | 4.34% | |||

Building Products | 4.31% | |||

Electrical Components & Equipment | 4.01% | |||

Semiconductor Equipment | 3.90% | |||

Wireless Telecommunication Services | 3.38% | |||

Construction Machinery & Heavy Trucks | 3.06% | |||

Electronic Equipment & Instruments | 2.93% | |||

Semiconductors | 2.64% | |||

Specialty Chemicals | 2.44% | |||

Application Software | 2.44% | |||

Diversified Metals & Mining | 2.30% | |||

Electronic Components | 2.08% | |||

Healthcare Supplies | 1.99% | |||

Industrial Gases | 1.93% | |||

Personal Products | 1.90% | |||

Industrial Conglomerates | 1.77% | |||

Diversified Real Estate Activities | 1.73% | |||

Aerospace & Defense | 1.71% | |||

Industrial Machinery | 1.71% | |||

Movies & Entertainment | 1.69% | |||

| Sector | Percentage (based on Fair Value) | |||

Biotechnology | 1.67% | |||

Property & Casualty Insurance | 1.65% | |||

Brewers | 1.61% | |||

Home Building | 1.59% | |||

Auto Parts & Equipment | 1.51% | |||

Construction Materials | 1.44% | |||

Multi-Line Insurance | 1.43% | |||

Security & Alarm Services | 1.42% | |||

Healthcare Equipment | 1.42% | |||

Automobile Manufacturers | 1.35% | |||

Education Services | 1.31% | |||

Internet & Direct Marketing Retail | 1.22% | |||

Leisure Products | 1.13% | |||

Healthcare Services | 0.98% | |||

Oil & Gas Exploration & Production | 0.62% | |||

Cable & Satellite | 0.50% | |||

Asset Management & Custody Banks | 0.50% | |||

|

| |||

| 97.13% | ||||

|

| |||

Short-Term Investments | ||||

Short-Term Investments | 2.87% | |||

|

| |||

| 2.87% | ||||

|

| |||

| 100.00% | ||||

|

| |||

Affiliate Table

| Number of Shares Held at 12/31/17 | Value At 12/31/17 | Cost of Purchases | Proceeds from Shares Sold | Realized Gain (Loss) | Change in Unrealized Appreciation/ Depreciation | Number of Shares Held at 6/30/18 | Value at 6/30/18 | Dividend Income | Capital Gains Distributions | |||||||||||||||||||||||||||||||

State Street Institutional Treasury Money Market Fund - Premier Class | — | $ | — | $ | 13,408,531 | $ | 10,188,238 | $ | — | $ | — | 3,220,293 | $ | 3,220,293 | $ | 24,312 | $ | — | ||||||||||||||||||||||

State Street Institutional U.S. Government Money Market Fund - Class G Shares | 10,975,209 | 10,975,209 | 16,510,142 | 24,284,532 | — | — | 3,200,819 | 3,200,819 | 38,014 | — | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

TOTAL | $ | 10,975,209 | $ | 29,918,673 | $ | 34,472,770 | $ | — | $ | — | $ | 6,421,112 | $ | 62,326 | $ | — | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

See Notes to Schedules of Investments and Notes to Financial Statements.

| 6 | Elfun International Equity Fund |

Table of Contents

Understanding Your Fund’s Expenses — June 30, 2018 (Unaudited)

As a shareholder of the Fund you incur ongoing costs. Ongoing costs include portfolio management fees, professional fees, administrative fees and other Fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in units of the Fund during the period. The information in the following table is based on an investment of $1,000, which is invested at the beginning of the period and held for the entire six-month period ended June 30, 2018.

Actual Expenses

The first section of the table provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given under the heading “Expenses paid during the period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholders reports of other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs, such as sales charges or redemption fees, if any. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| Actual Fund Return | Hypothetical 5% Return (2.5% for the period) | |||||||

Account value at the beginning of the period January 1, 2018 | $ | 1,000.00 | $ | 1,000.00 | ||||

Account value at the end of the period June 30, 2018 | $ | 1,041.40 | $ | 1,023.90 | ||||

Expenses paid during the period* | $ | 0.91 | $ | 0.90 | ||||

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.18% (for the period January 1, 2018-June 30, 2018), multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| Elfun Trusts | 7 |

Table of Contents

Elfun Trusts

Fund Information — June 30, 2018 (Unaudited)

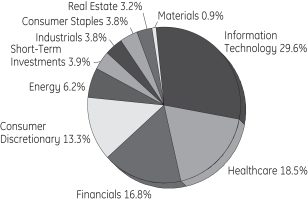

Sector Allocation

Portfolio Composition as a % of Fair Value of $2,776,555 (in thousands) as of June 30, 2018 (a)(b)

Top Ten Largest Holdings

as of June 30, 2018 (as a % of Fair Value) (a)(b)

Visa Inc., Class A | 5.49 | % | ||

JPMorgan Chase & Co. | 4.50 | % | ||

Apple Inc. | 4.13 | % | ||

CME Group Inc. | 4.07 | % | ||

The Charles Schwab Corp. | 3.79 | % | ||

PepsiCo Inc. | 3.76 | % | ||

Amazon.com Inc. | 3.49 | % | ||

Alphabet Inc., Class C | 3.34 | % | ||

Microsoft Corp. | 3.29 | % | ||

Schlumberger Ltd. | 3.26 | % |

| (a) | Fair Value basis is inclusive of short-term investments in State Street Institutional Treasury Money Market Fund – Premier Class and State Street Institutional U.S. Government Money Market Fund – Class G Shares. |

| (b) | The securities information regarding holdings, allocations and other characteristics is presented to illustrate examples of securities that the Fund has bought and the diversity of areas in which the Fund may invest as of a particular date. It may not be representative of the Fund’s current or future investments and should not be construed as a recommendation to purchase or sell a particular security. |

| 8 | Elfun Trusts |

Table of Contents

Elfun Trusts

Schedule of Investments — June 30, 2018 (Unaudited)

| Number of Shares | Fair Value $ | |||||||

| Common Stock - 96.1%† |

| |||||||

Application Software - 4.1% |

| |||||||

Intuit Inc. | 190,000 | 38,817,950 | ||||||

salesforce.com Inc. (a) | 540,000 | 73,656,000 | ||||||

|

| |||||||

| 112,473,950 | ||||||||

|

| |||||||

Biotechnology - 6.3% |

| |||||||

Alexion Pharmaceuticals Inc. (a) | 570,000 | 70,765,500 | ||||||

Biogen Inc. (a) | 95,000 | 27,572,800 | ||||||

Gilead Sciences Inc. | 450,000 | 31,878,000 | ||||||

Vertex Pharmaceuticals Inc. (a) | 270,000 | 45,889,200 | ||||||

|

| |||||||

| 176,105,500 | ||||||||

|

| |||||||

Cable & Satellite - 7.0% |

| |||||||

Charter Communications Inc., Class A (a) | 240,000 | 70,370,400 | ||||||

Comcast Corp., Class A | 1,600,000 | 52,496,000 | ||||||

Liberty Global PLC, Class C (a) | 2,300,000 | 61,203,000 | ||||||

Sirius XM Holdings Inc. | 1,600,000 | 10,832,000 | ||||||

|

| |||||||

| 194,901,400 | ||||||||

|

| |||||||

Data Processing & Outsourced Services - 5.5% |

| |||||||

Visa Inc., Class A | 1,150,000 | 152,317,500 | ||||||

|

| |||||||

Diversified Banks - 4.5% |

| |||||||

JPMorgan Chase & Co. | 1,200,000 | 125,040,000 | ||||||

|

| |||||||

Financial Exchanges & Data - 6.6% |

| |||||||

CME Group Inc. | 690,000 | 113,104,800 | ||||||

S&P Global Inc. | 350,000 | 71,361,500 | ||||||

|

| |||||||

| 184,466,300 | ||||||||

|

| |||||||

Healthcare Distributors - 0.4% |

| |||||||

Henry Schein Inc. (a) | 170,000 | 12,348,800 | ||||||

|

| |||||||

Healthcare Equipment - 2.8% |

| |||||||

Boston Scientific Corp. (a) | 870,000 | 28,449,000 | ||||||

Medtronic PLC | 560,000 | 47,941,600 | ||||||

|

| |||||||

| 76,390,600 | ||||||||

|

| |||||||

Healthcare Supplies - 2.5% |

| |||||||

The Cooper Companies Inc. | 295,000 | 69,457,750 | ||||||

|

| |||||||

Industrial Machinery - 0.7% |

| |||||||

Dover Corp. | 275,000 | 20,130,000 | ||||||

|

| |||||||

Integrated Oil & Gas - 2.2% |

| |||||||

Chevron Corp. | 490,000 | 61,950,700 | ||||||

|

| |||||||

| Number of Shares | Fair Value $ | |||||||

Internet & Direct Marketing Retail - 3.5% |

| |||||||

Amazon.com Inc. (a) | 57,000 | 96,888,600 | ||||||

|

| |||||||

Internet Software & Services - 8.1% |

| |||||||

Alibaba Group Holding Ltd. ADR (a) | 170,000 | 31,540,100 | ||||||

Alphabet Inc., Class A (a) | 38,000 | 42,909,220 | ||||||

Alphabet Inc., Class C (a) | 83,000 | 92,598,950 | ||||||

Facebook Inc., Class A (a) | 300,000 | 58,296,000 | ||||||

|

| |||||||

| 225,344,270 | ||||||||

|

| |||||||

Investment Banking & Brokerage - 3.8% |

| |||||||

The Charles Schwab Corp. | 2,060,000 | 105,266,000 | ||||||

|

| |||||||

Movies & Entertainment - 2.5% |

| |||||||

The Walt Disney Co. | 650,000 | 68,126,500 | ||||||

|

| |||||||

Oil & Gas Equipment & Services - 3.3% |

| |||||||

Schlumberger Ltd. | 1,350,000 | 90,490,500 | ||||||

|

| |||||||

Oil & Gas Exploration & Production - 0.7% |

| |||||||

Diamondback Energy Inc. | 150,000 | 19,735,500 | ||||||

|

| |||||||

Pharmaceuticals - 6.5% |

| |||||||

Allergan PLC | 480,000 | 80,025,600 | ||||||

Johnson & Johnson | 460,000 | 55,816,400 | ||||||

Merck & Company Inc. | 275,000 | 16,692,500 | ||||||

Pfizer Inc. | 750,000 | 27,210,000 | ||||||

|

| |||||||

| 179,744,500 | ||||||||

|

| |||||||

Regional Banks - 1.6% |

| |||||||

First Republic Bank | 450,000 | 43,555,500 | ||||||

|

| |||||||

Reinsurance - 0.3% |

| |||||||

Alleghany Corp. | 15,000 | 8,624,550 | ||||||

|

| |||||||

Restaurants - 0.4% |

| |||||||

Starbucks Corp. | 200,000 | 9,770,000 | ||||||

|

| |||||||

Semiconductor Equipment - 2.5% |

| |||||||

Applied Materials Inc. | 1,500,000 | 69,285,000 | ||||||

|

| |||||||

Semiconductors - 2.0% |

| |||||||

Broadcom Inc. | 230,000 | 55,807,200 | ||||||

|

| |||||||

Soft Drinks - 3.8% |

| |||||||

PepsiCo Inc. | 960,000 | 104,515,200 | ||||||

|

| |||||||

Specialized REITs - 3.2% |

| |||||||

American Tower Corp. | 620,000 | 89,385,400 | ||||||

|

| |||||||

Specialty Chemicals - 0.8% |

| |||||||

Albemarle Corp. | 250,000 | 23,582,500 | ||||||

|

| |||||||

See Notes to Schedules of Investments and Notes to Financial Statements.

| Elfun Trusts | 9 |

Table of Contents

Elfun Trusts

Schedule of Investments, continued — June 30, 2018 (Unaudited)

| Number of Shares | Fair Value $ | |||||||

Systems Software - 3.3% |

| |||||||

Microsoft Corp. | 925,000 | 91,214,250 | ||||||

|

| |||||||

Technology Hardware, Storage & Peripherals - 4.1% |

| |||||||

Apple Inc. | 620,000 | 114,768,200 | ||||||

|

| |||||||

Trading Companies & Distributors - 3.1% |

| |||||||

United Rentals Inc. (a) | 580,000 | 85,619,600 | ||||||

|

| |||||||

| Total Common Stock (Cost $1,513,919,604) |

| 2,667,305,770 | ||||||

|

| |||||||

| Short-Term Investments - 3.9% |

| |||||||

State Street Institutional Treasury Money Market Fund - Premier Class 1.74% (b)(p) | 54,744,131 | 54,744,131 | ||||||

| Number of Shares | Fair Value $ | |||||||

State Street Institutional U.S. Government Money Market Fund - Class G Shares 1.86% (b)(p) | 54,504,723 | 54,504,723 | ||||||

|

| |||||||

| Total Short-Term Investments (Cost $109,248,854) |

| 109,248,854 | ||||||

|

| |||||||

| Total Investments (Cost $1,623,168,458) |

| 2,776,554,624 | ||||||

| Other Assets and Liabilities, net - 0.0%* |

| 831,659 | ||||||

|

| |||||||

| NET ASSETS - 100.0% |

| 2,777,386,283 | ||||||

|

| |||||||

The following table presents the Fund’s investments measured at fair value on a recurring basis at June 30, 2018:

| Fund | Investments | Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Elfun Trusts | Investments in Securities | |||||||||||||||||

Common Stock | $ | 2,667,305,770 | $ | — | $ | — | $ | 2,667,305,770 | ||||||||||

Short-Term Investments | 109,248,854 | — | — | 109,248,854 | ||||||||||||||

|

|

|

|

|

|

|

| |||||||||||

Total Investments in Securities | $ | 2,776,554,624 | $ | — | $ | — | $ | 2,776,554,624 | ||||||||||

|

|

|

|

|

|

|

| |||||||||||

Affiliate Table

| Number of Shares Held at 12/31/17 | Value At 12/31/17 | Cost of Purchases | Proceeds from Shares Sold | Realized Gain (Loss) | Change in Unrealized Appreciation/ Depreciation | Number of Shares Held at 6/30/18 | Value at 6/30/18 | Dividend Income | Capital Gains Distributions | |||||||||||||||||||||||||||||||

State Street Institutional Treasury Money Market Fund - Premier Class | — | $ | — | $ | 85,129,983 | $ | 30,385,852 | $ | — | $ | — | 54,744,131 | $ | 54,744,131 | $ | 315,270 | $ | — | ||||||||||||||||||||||

State Street Institutional U.S. Government Money Market Fund - Class G Shares | 78,219,855 | 78,219,855 | 124,840,983 | 148,556,115 | — | — | 54,504,723 | 54,504,723 | 439,223 | — | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

TOTAL | $ | 78,219,855 | $ | 209,970,966 | $ | 178,941,967 | $ | — | $ | — | $ | 109,248,854 | $ | 754,493 | $ | — | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

See Notes to Schedules of Investments and Notes to Financial Statements.

| 10 | Elfun Trusts |

Table of Contents

Understanding Your Fund’s Expenses — June 30, 2018 (Unaudited)

As a shareholder of the Fund you incur ongoing costs. Ongoing costs include portfolio management fees, professional fees, administrative fees and other Fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in units of the Fund during the period. The information in the following table is based on an investment of $1,000, which is invested at the beginning of the period and held for the entire six-month period ended June 30, 2018.

Actual Expenses

The first section of the table provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given under the heading “Expenses paid during the period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholders reports of other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs, such as sales charges or redemption fees, if any. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| Actual Fund Return | Hypothetical 5% Return (2.5% for the period) | |||||||

Account value at the January 1, 2018 | $ | 1,000.00 | $ | 1,000.00 | ||||

Account value at the June 30, 2018 | $ | 993.00 | $ | 1,022.86 | ||||

Expenses paid during the period* | $ | 1.93 | $ | 1.96 | ||||

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.39% (for the period January 1, 2018 - June 30, 2018), multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| Elfun Diversified Fund | 11 |

Table of Contents

Elfun Diversified Fund

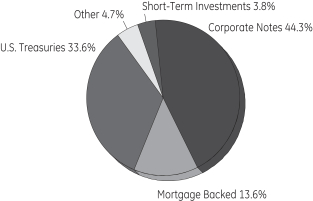

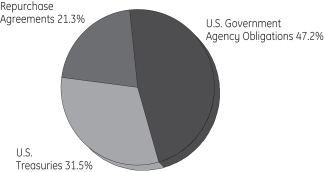

Fund Information — June 30, 2018 (Unaudited)

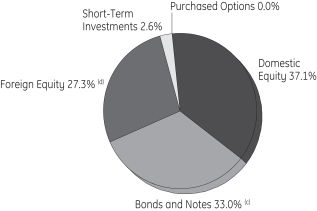

Sector Allocation

Portfolio Composition as a % of Fair Value of $202,935 (in thousands) as of June 30, 2018 (a)(b)

Top Ten Largest Equity Holdings

as of June 30, 2018 (as a % of Fair Value) (a)(b)

Apple Inc. | 1.50 | % | ||

Microsoft Corp. | 1.25 | % | ||

Amazon.com Inc. | 1.13 | % | ||

Facebook Inc., Class A | 0.76 | % | ||

Berkshire Hathaway Inc., Class B | 0.59 | % | ||

JPMorgan Chase & Co. | 0.58 | % | ||

Exxon Mobil Corp. | 0.57 | % | ||

Alphabet Inc., Class C | 0.56 | % | ||

Alphabet Inc., Class A | 0.55 | % | ||

Johnson & Johnson | 0.53 | % |

| (a) | Fair Value basis is inclusive of short-term investment in several money market funds. |

| (b) | The securities information regarding holdings, allocations and other characteristics is presented to illustrate examples of securities that the Fund has bought and the diversity of areas in which the Fund may invest as of a particular date. It may not be representative of the Fund’s current or future investments and should not be construed as a recommendation to purchase or sell a particular security. |

| (c) | Includes investment in SPDR Bloomberg Barclays High Yield Bond ETF. |

| (d) | Includes investment in State Street Global Equity ex-U.S. Index Portfolio. |

| 12 | Elfun Diversified Fund |

Table of Contents

Elfun Diversified Fund

Schedule of Investments — June 30, 2018 (Unaudited)

| Number of Shares | Fair Value $ | |||||||

| Domestic Equity - 37.8%† | ||||||||

Common Stock - 37.6% | ||||||||

Advertising - 0.0%* | ||||||||

Omnicom Group Inc. (a) | 741 | 56,520 | ||||||

The Interpublic Group of Companies Inc. | 1,166 | 27,335 | ||||||

|

| |||||||

| 83,855 | ||||||||

|

| |||||||

Aerospace & Defense - 1.0% |

| |||||||

Arconic Inc. | 1,319 | 22,437 | ||||||

General Dynamics Corp. (a) | 931 | 173,548 | ||||||

Harris Corp. (a) | 409 | 59,117 | ||||||

Huntington Ingalls Industries Inc. | 145 | 31,435 | ||||||

L3 Technologies Inc. (a) | 272 | 52,312 | ||||||

Lockheed Martin Corp. (a) | 835 | 246,685 | ||||||

Northrop Grumman Corp. (a) | 586 | 180,313 | ||||||

Raytheon Co. (a) | 969 | 187,192 | ||||||

Rockwell Collins Inc. (a) | 547 | 73,670 | ||||||

Textron Inc. (a) | 898 | 59,188 | ||||||

The Boeing Co. (a) | 1,840 | 617,339 | ||||||

TransDigm Group Inc. (a) | 165 | 56,949 | ||||||

United Technologies Corp. (a) | 2,469 | 308,700 | ||||||

|

| |||||||

| 2,068,885 | ||||||||

|

| |||||||

Agricultural & Farm Machinery - 0.1% |

| |||||||

Deere & Co. (a) | 1,094 | 152,949 | ||||||

|

| |||||||

Agricultural Products - 0.0%* |

| |||||||

Archer-Daniels-Midland Co. (a) | 1,905 | 87,314 | ||||||

|

| |||||||

Air Freight & Logistics - 0.3% |

| |||||||

CH Robinson Worldwide Inc. | 443 | 37,063 | ||||||

Expeditors International of Washington Inc. | 597 | 43,643 | ||||||

FedEx Corp. (a) | 803 | 182,331 | ||||||

United Parcel Service Inc., Class B (a) | 2,274 | 241,569 | ||||||

|

| |||||||

| 504,606 | ||||||||

|

| |||||||

Airlines - 0.2% | ||||||||

Alaska Air Group Inc. | 455 | 27,479 | ||||||

American Airlines Group Inc. (a) | 1,444 | 54,816 | ||||||

Delta Air Lines Inc. (a) | 2,150 | 106,513 | ||||||

Southwest Airlines Co. (a) | 1,782 | 90,670 | ||||||

United Continental Holdings Inc. (a)(b) | 826 | 57,598 | ||||||

|

| |||||||

| 337,076 | ||||||||

|

| |||||||

Alternative Carriers - 0.0%* | ||||||||

CenturyLink Inc. (a) | 3,074 | 57,307 | ||||||

|

| |||||||

| Number of Shares | Fair Value $ | |||||||

Apparel Retail - 0.2% | ||||||||

Foot Locker Inc. | 400 | 21,062 | ||||||

L Brands Inc. | 887 | 32,714 | ||||||

Ross Stores Inc. (a) | 1,275 | 108,058 | ||||||

The Gap Inc. | 810 | 26,237 | ||||||

The TJX Companies Inc. (a) | 2,128 | 202,545 | ||||||

|

| |||||||

| 390,616 | ||||||||

|

| |||||||

Apparel, Accessories & Luxury Goods - 0.1% |

| |||||||

Hanesbrands Inc. | 1,196 | 26,337 | ||||||

Michael Kors Holdings Ltd. (b) | 477 | 31,769 | ||||||

PVH Corp. | 256 | 38,329 | ||||||

Ralph Lauren Corp. | 208 | 26,151 | ||||||

Tapestry Inc. | 936 | 43,722 | ||||||

Under Armour Inc., Class A (b) | 679 | 15,265 | ||||||

Under Armour Inc., Class C (b) | 682 | 14,378 | ||||||

VF Corp. (a) | 1,122 | 91,466 | ||||||

|

| |||||||

| 287,417 | ||||||||

|

| |||||||

Application Software - 0.6% |

| |||||||

Adobe Systems Inc. (a)(b) | 1,626 | 396,436 | ||||||

ANSYS Inc. (b) | 260 | 45,288 | ||||||

Autodesk Inc. (a)(b) | 751 | 98,450 | ||||||

Cadence Design Systems Inc. (b) | 900 | 38,980 | ||||||

Citrix Systems Inc. (b) | 406 | 42,566 | ||||||

Intuit Inc. (a) | 808 | 165,079 | ||||||

salesforce.com Inc. (a)(b) | 2,308 | 314,812 | ||||||

Synopsys Inc. (b) | 500 | 42,786 | ||||||

|

| |||||||

| 1,144,397 | ||||||||

|

| |||||||

Asset Management & Custody Banks - 0.4% |

| |||||||

Affiliated Managers Group Inc. | 162 | 24,085 | ||||||

Ameriprise Financial Inc. (a) | 506 | 70,780 | ||||||

BlackRock Inc. (a) | 406 | 202,611 | ||||||

Franklin Resources Inc. | 992 | 31,795 | ||||||

Invesco Ltd. | 1,409 | 37,424 | ||||||

Northern Trust Corp. (a) | 732 | 75,316 | ||||||

State Street Corp. (a)(c) | 1,195 | 111,244 | ||||||

T Rowe Price Group Inc. (a) | 799 | 92,757 | ||||||

The Bank of New York Mellon Corp. (a) | 3,355 | 180,936 | ||||||

|

| |||||||

| 826,948 | ||||||||

|

| |||||||

Auto Parts & Equipment - 0.0%* |

| |||||||

BorgWarner Inc. | 639 | 27,587 | ||||||

|

| |||||||

Automobile Manufacturers - 0.2% |

| |||||||

Ford Motor Co. (a) | 12,955 | 143,416 | ||||||

General Motors Co. (a) | 4,153 | 163,632 | ||||||

|

| |||||||

| 307,048 | ||||||||

|

| |||||||

See Notes to Schedules of Investments and Notes to Financial Statements.

| Elfun Diversified Fund | 13 |

Table of Contents

Elfun Diversified Fund

Schedule of Investments, continued — June 30, 2018 (Unaudited)

| Number of Shares | Fair Value $ | |||||||

Automotive Retail - 0.1% | ||||||||

Advance Auto Parts Inc. | 272 | 36,912 | ||||||

AutoZone Inc. (a)(h) | 87 | 58,373 | ||||||

CarMax Inc. (a) | 603 | 43,943 | ||||||

O’Reilly Automotive Inc. (a)(h) | 289 | 79,064 | ||||||

|

| |||||||

| 218,292 | ||||||||

|

| |||||||

Biotechnology - 1.0% | ||||||||

AbbVie Inc. (h) | 5,061 | 468,903 | ||||||

Alexion Pharmaceuticals Inc. (a)(h) | 738 | 91,624 | ||||||

Amgen Inc. (h) | 2,240 | 413,482 | ||||||

Biogen Inc. (a)(h) | 711 | 206,361 | ||||||

Celgene Corp. (a)(h) | 2,360 | 187,432 | ||||||

Gilead Sciences Inc. (h) | 4,376 | 309,997 | ||||||

Incyte Corp. (h) | 580 | 38,861 | ||||||

Regeneron Pharmaceuticals Inc. (a)(h) | 249 | 85,903 | ||||||

Vertex Pharmaceuticals Inc. (a)(h) | 826 | 140,388 | ||||||

|

| |||||||

| 1,942,951 | ||||||||

|

| |||||||

Brewers - 0.0%* | ||||||||

Molson Coors Brewing Co., Class B | 581 | 39,539 | ||||||

|

| |||||||

Broadcasting - 0.1% | ||||||||

CBS Corp., Class B (h) | 1,163 | 65,387 | ||||||

Discovery Inc., Class A (a) | 561 | 15,430 | ||||||

Discovery Inc., Class C (a) | 887 | 22,621 | ||||||

|

| |||||||

| 103,438 | ||||||||

|

| |||||||

Building Products - 0.1% | ||||||||

AO Smith Corp. (h) | 500 | 29,577 | ||||||

Fortune Brands Home & Security Inc. | 463 | 24,861 | ||||||

Johnson Controls International PLC (h) | 3,020 | 101,021 | ||||||

Masco Corp. | 1,093 | 40,902 | ||||||

|

| |||||||

| 196,361 | ||||||||

|

| |||||||

Cable & Satellite - 0.4% | ||||||||

Charter Communications Inc., Class A (a)(h) | 611 | 179,154 | ||||||

Comcast Corp., Class A (h) | 15,396 | 505,145 | ||||||

DISH Network Corp., Class A (a) | 800 | 26,891 | ||||||

|

| |||||||

| 711,190 | ||||||||

|

| |||||||

Casinos & Gaming - 0.0%* | ||||||||

MGM Resorts International (h) | 1,700 | 49,355 | ||||||

Wynn Resorts Ltd. | 265 | 44,349 | ||||||

|

| |||||||

| 93,704 | ||||||||

|

| |||||||

| Number of Shares | Fair Value $ | |||||||

Commodity Chemicals - 0.1% |

| |||||||

LyondellBasell Industries N.V., Class A (h) | 1,064 | 116,889 | ||||||

|

| |||||||

Communications Equipment - 0.4% |

| |||||||

Cisco Systems Inc. (h) | 15,700 | 675,573 | ||||||

F5 Networks Inc. (a)(h) | 207 | 35,699 | ||||||

Juniper Networks Inc. | 1,045 | 28,656 | ||||||

Motorola Solutions Inc. (h) | 513 | 59,700 | ||||||

|

| |||||||

| 799,628 | ||||||||

|

| |||||||

Computer & Electronics Retail - 0.0%* |

| |||||||

Best Buy Company Inc. (h) | 828 | 61,760 | ||||||

|

| |||||||

Construction & Engineering - 0.0%* |

| |||||||

Fluor Corp. | 514 | 25,076 | ||||||

Jacobs Engineering Group Inc. | 446 | 28,319 | ||||||

Quanta Services Inc. (a) | 558 | 18,640 | ||||||

|

| |||||||

| 72,035 | ||||||||

|

| |||||||

Construction Machinery & Heavy Trucks - 0.2% |

| |||||||

Caterpillar Inc. (h) | 1,977 | 268,222 | ||||||

Cummins Inc. (h) | 539 | 71,690 | ||||||

PACCAR Inc. (h) | 1,125 | 69,708 | ||||||

|

| |||||||

| 409,620 | ||||||||

|

| |||||||

Construction Materials - 0.1% |

| |||||||

Martin Marietta Materials Inc. | 211 | 47,127 | ||||||

Vulcan Materials Co. (h) | 449 | 57,952 | ||||||

|

| |||||||

| 105,079 | ||||||||

|

| |||||||

Consumer Finance - 0.3% | ||||||||

American Express Co. (h) | 2,420 | 237,162 | ||||||

Capital One Financial Corp. (h) | 1,631 | 149,891 | ||||||

Discover Financial Services (h) | 1,157 | 81,466 | ||||||

Synchrony Financial (h) | 2,296 | 76,643 | ||||||

|

| |||||||

| 545,162 | ||||||||

|

| |||||||

Copper - 0.0%* | ||||||||

Freeport-McMoRan Inc. (h) | 4,627 | 79,870 | ||||||

|

| |||||||

Data Processing & Outsourced Services - 1.2% |

| |||||||

Alliance Data Systems Corp. | 158 | 36,846 | ||||||

Automatic Data Processing Inc. (h) | 1,471 | 197,321 | ||||||

Broadridge Financial Solutions Inc. | 390 | 44,890 | ||||||

Fidelity National Information Services Inc. (h) | 1,092 | 115,785 | ||||||

Fiserv Inc. (a)(h) | 1,364 | 101,059 | ||||||

FleetCor Technologies Inc. (a) | 300 | 63,196 | ||||||

Global Payments Inc. (h) | 508 | 56,637 | ||||||

See Notes to Schedules of Investments and Notes to Financial Statements.

| 14 | Elfun Diversified Fund |

Table of Contents

Elfun Diversified Fund

Schedule of Investments, continued — June 30, 2018 (Unaudited)

| Number of Shares | Fair Value $ | |||||||

Mastercard Inc., Class A (h) | 3,076 | 604,496 | ||||||

Paychex Inc. (h) | 1,109 | 75,801 | ||||||

PayPal Holdings Inc. (a)(h) | 3,716 | 309,432 | ||||||

The Western Union Co. | 1,491 | 30,313 | ||||||

Total System Services Inc. | 531 | 44,881 | ||||||

Visa Inc., Class A (h) | 5,928 | 785,164 | ||||||

|

| |||||||

| 2,465,821 | ||||||||

|

| |||||||

Department Stores - 0.0%* | ||||||||

Kohl’s Corp. | 552 | 40,244 | ||||||

Macy’s Inc. | 919 | 34,401 | ||||||

Nordstrom Inc. | 429 | 22,216 | ||||||

|

| |||||||

| 96,861 | ||||||||

|

| |||||||

Distillers & Vintners - 0.1% | ||||||||

Brown-Forman Corp., Class B (h) | 892 | 43,721 | ||||||

Constellation Brands Inc., Class A (h) | 584 | 127,824 | ||||||

|

| |||||||

| 171,545 | ||||||||

|

| |||||||

Distributors - 0.0%* | ||||||||

Genuine Parts Co. | 490 | 44,981 | ||||||

LKQ Corp. (a) | 1,036 | 33,053 | ||||||

|

| |||||||

| 78,034 | ||||||||

|

| |||||||

Diversified Banks - 1.9% | ||||||||

Bank of America Corp. (h) | 31,492 | 887,761 | ||||||

Citigroup Inc. (h) | 8,565 | 573,171 | ||||||

JPMorgan Chase & Co. (h) | 11,324 | 1,179,963 | ||||||

U.S. Bancorp (h) | 5,261 | 263,157 | ||||||

Wells Fargo & Co. (h) | 14,655 | 812,475 | ||||||

|

| |||||||

| 3,716,527 | ||||||||

|

| |||||||

Diversified Chemicals - 0.3% |

| |||||||

DowDuPont Inc. (h) | 7,756 | 511,279 | ||||||

Eastman Chemical Co. (h) | 486 | 48,585 | ||||||

|

| |||||||

| 559,864 | ||||||||

|

| |||||||

Diversified Support Services - 0.0%* |

| |||||||

Cintas Corp. (h) | 297 | 54,970 | ||||||

Copart Inc. (a) | 700 | 39,596 | ||||||

|

| |||||||

| 94,566 | ||||||||

|

| |||||||

Drug Retail - 0.1% | ||||||||

Walgreens Boots Alliance Inc. (a) | 2,851 | 171,111 | ||||||

|

| |||||||

Electric Utilities - 0.7% | ||||||||

Alliant Energy Corp. | 840 | 35,549 | ||||||

American Electric Power Company Inc. (h) | 1,646 | 113,986 | ||||||

Duke Energy Corp. (h) | 2,337 | 184,810 | ||||||

| Number of Shares | Fair Value $ | |||||||

Edison International (h) | 1,043 | 65,991 | ||||||

Entergy Corp. | 600 | 48,474 | ||||||

Evergy Inc. | 899 | 50,479 | ||||||

Eversource Energy (h) | 1,102 | 64,589 | ||||||

Exelon Corp. (h) | 3,260 | 138,877 | ||||||

FirstEnergy Corp. (h) | 1,572 | 56,451 | ||||||

NextEra Energy Inc. (h) | 1,558 | 260,233 | ||||||

PG&E Corp. (h) | 1,638 | 69,714 | ||||||

Pinnacle West Capital Corp. | 411 | 33,111 | ||||||

PPL Corp. (h) | 2,380 | 67,950 | ||||||

The Southern Co. (h) | 3,410 | 157,918 | ||||||

Xcel Energy Inc. (h) | 1,636 | 74,733 | ||||||

|

| |||||||

| 1,422,865 | ||||||||

|

| |||||||

Electrical Components & Equipment - 0.2% |

| |||||||

AMETEK Inc. (h) | 755 | 54,483 | ||||||

Eaton Corporation PLC (h) | 1,458 | 108,973 | ||||||

Emerson Electric Co. (h) | 2,084 | 144,090 | ||||||

Rockwell Automation Inc. (h) | 404 | 67,159 | ||||||

|

| |||||||

| 374,705 | ||||||||

|

| |||||||

Electronic Components - 0.1% |

| |||||||

Amphenol Corp., Class A (h) | 999 | 87,067 | ||||||

Corning Inc. (h) | 2,803 | 77,114 | ||||||

|

| |||||||

| 164,181 | ||||||||

|

| |||||||

Electronic Equipment & Instruments - 0.0%* |

| |||||||

FLIR Systems Inc. | 503 | 26,149 | ||||||

|

| |||||||

Electronic Manufacturing Services - 0.0%* |

| |||||||

IPG Photonics Corp. (a) | 100 | 22,071 | ||||||

|

| |||||||

Environmental & Facilities Services - 0.1% |

| |||||||

Republic Services Inc. | 772 | 52,776 | ||||||

Stericycle Inc. (a) | 314 | 20,504 | ||||||

Waste Management Inc. (h) | 1,312 | 106,721 | ||||||

|

| |||||||

| 180,001 | ||||||||

|

| |||||||

Fertilizers & Agricultural Chemicals - 0.1% |

| |||||||

CF Industries Holdings Inc. | 701 | 31,127 | ||||||

FMC Corp. | 424 | 37,828 | ||||||

The Mosaic Co. | 1,064 | 29,848 | ||||||

|

| |||||||

| 98,803 | ||||||||

|

| |||||||

Financial Exchanges & Data - 0.4% |

| |||||||

Cboe Global Markets Inc. | 400 | 41,629 | ||||||

CME Group Inc. (h) | 1,133 | 185,723 | ||||||

Intercontinental Exchange Inc. (h) | 1,910 | 140,482 | ||||||

Moody’s Corp. (h) | 534 | 91,080 | ||||||

MSCI Inc. | 300 | 49,630 | ||||||

Nasdaq Inc. | 421 | 38,426 | ||||||

See Notes to Schedules of Investments and Notes to Financial Statements.

| Elfun Diversified Fund | 15 |

Table of Contents

Elfun Diversified Fund

Schedule of Investments, continued — June 30, 2018 (Unaudited)

| Number of Shares | Fair Value $ | |||||||

S&P Global Inc. (h) | 846 | 172,492 | ||||||

|

| |||||||

| 719,462 | ||||||||

|

| |||||||

Food Distributors - 0.1% | ||||||||

Sysco Corp. (h) | 1,638 | 111,867 | ||||||

|

| |||||||

Food Retail - 0.0%* | ||||||||

The Kroger Co. (h) | 2,717 | 77,307 | ||||||

|

| |||||||

Footwear - 0.2% | ||||||||

NIKE Inc., Class B (h) | 4,335 | 345,421 | ||||||

|

| |||||||

General Merchandise Stores - 0.1% |

| |||||||

Dollar General Corp. (h) | 839 | 82,728 | ||||||

Dollar Tree Inc. (a)(h) | 812 | 69,023 | ||||||

Target Corp. (h) | 1,845 | 140,444 | ||||||

|

| |||||||

| 292,195 | ||||||||

|

| |||||||

Gold - 0.0%* | ||||||||

Newmont Mining Corp. (h) | 1,700 | 64,115 | ||||||

|

| |||||||

Health Care REITs - 0.1% | ||||||||

HCP Inc. | 1,527 | 39,430 | ||||||

Ventas Inc. (h) | 1,238 | 70,507 | ||||||

Welltower Inc. (h) | 1,269 | 79,556 | ||||||

|

| |||||||

| 189,493 | ||||||||

|

| |||||||

Healthcare Distributors - 0.1% |

| |||||||

AmerisourceBergen Corp. | 568 | 48,435 | ||||||

Cardinal Health Inc. (h) | 1,102 | 53,813 | ||||||

Henry Schein Inc. (a) | 554 | 40,245 | ||||||

McKesson Corp. (h) | 705 | 94,049 | ||||||

|

| |||||||

| 236,542 | ||||||||

|

| |||||||

Healthcare Equipment - 0.9% |

| |||||||

Abbott Laboratories (h) | 5,747 | 350,510 | ||||||

ABIOMED Inc. (a) | 140 | 57,268 | ||||||

Baxter International Inc. (h) | 1,698 | 125,381 | ||||||

Becton Dickinson and Co. (h) | 887 | 212,490 | ||||||

Boston Scientific Corp. (a)(h) | 4,559 | 149,080 | ||||||

Danaher Corp. (h) | 2,054 | 202,689 | ||||||

Edwards Lifesciences Corp. (a)(h) | 690 | 100,444 | ||||||

Hologic Inc. (a) | 948 | 37,683 | ||||||

IDEXX Laboratories Inc. (a)(h) | 301 | 65,600 | ||||||

Intuitive Surgical Inc. (a)(h) | 367 | 175,603 | ||||||

ResMed Inc. | 500 | 51,791 | ||||||

Stryker Corp. (h) | 1,088 | 183,720 | ||||||

Varian Medical Systems Inc. (a) | 321 | 36,505 | ||||||

Zimmer Biomet Holdings Inc. (h) | 700 | 78,009 | ||||||

|

| |||||||

| 1,826,773 | ||||||||

|

| |||||||

| Number of Shares | Fair Value $ | |||||||

Healthcare Facilities - 0.1% | ||||||||

HCA Healthcare Inc. (h) | 942 | 96,653 | ||||||

Universal Health Services Inc., Class B | 306 | 34,105 | ||||||

|

| |||||||

| 130,758 | ||||||||

|

| |||||||

Healthcare Services - 0.3% | ||||||||

CVS Health Corp. (h) | 3,332 | 214,416 | ||||||

DaVita Inc. (a) | 532 | 36,943 | ||||||

Envision Healthcare Corp. (h) | 433 | 19,058 | ||||||

Express Scripts Holding Co. (a)(h) | 1,857 | 143,380 | ||||||

Laboratory Corporation of America Holdings (a)(h) | 346 | 62,119 | ||||||

Quest Diagnostics Inc. | 465 | 51,123 | ||||||

|

| |||||||

| 527,039 | ||||||||

|

| |||||||

Healthcare Supplies - 0.1% | ||||||||

Align Technology Inc. (a)(h) | 250 | 85,538 | ||||||

DENTSPLY SIRONA Inc. | 753 | 32,961 | ||||||

The Cooper Companies Inc. | 171 | 40,265 | ||||||

|

| |||||||

| 158,764 | ||||||||

|

| |||||||

Healthcare Technology - 0.0%* |

| |||||||

Cerner Corp. (a)(h) | 1,026 | 61,353 | ||||||

|

| |||||||

Home Building - 0.1% | ||||||||

D.R. Horton Inc. | 1,153 | 47,276 | ||||||

Lennar Corp., Class A | 856 | 44,942 | ||||||

PulteGroup Inc. | 899 | 25,849 | ||||||

|

| |||||||

| 118,067 | ||||||||

|

| |||||||

Home Entertainment Software - 0.2% |

| |||||||

Activision Blizzard Inc. (h) | 2,535 | 193,474 | ||||||

Electronic Arts Inc. (a)(h) | 1,016 | 143,279 | ||||||

Take-Two Interactive Software Inc. (a) | 390 | 46,163 | ||||||

|

| |||||||

| 382,916 | ||||||||

|

| |||||||

Home Furnishings - 0.0%* | ||||||||

Leggett & Platt Inc. | 494 | 22,056 | ||||||

Mohawk Industries Inc. (a) | 212 | 45,430 | ||||||

|

| |||||||

| 67,486 | ||||||||

|

| |||||||

Home Improvement Retail - 0.5% |

| |||||||

Lowe’s Companies Inc. (h) | 2,730 | 260,910 | ||||||

The Home Depot Inc. (h) | 3,831 | 747,432 | ||||||

|

| |||||||

| 1,008,342 | ||||||||

|

| |||||||

Hotel & Resort REITs - 0.0%* |

| |||||||

Host Hotels & Resorts Inc. | 2,433 | 51,271 | ||||||

|

| |||||||

See Notes to Schedules of Investments and Notes to Financial Statements.

| 16 | Elfun Diversified Fund |

Table of Contents

Elfun Diversified Fund

Schedule of Investments, continued — June 30, 2018 (Unaudited)

| Number of Shares | Fair Value $ | |||||||

Hotels, Resorts & Cruise Lines - 0.2% |

| |||||||

Carnival Corp. (h) | 1,319 | 75,594 | ||||||

Hilton Worldwide Holdings Inc. (h) | 960 | 75,995 | ||||||

Marriott International Inc., Class A (h) | 998 | 126,348 | ||||||

Norwegian Cruise Line Holdings Ltd. (a) | 600 | 28,352 | ||||||

Royal Caribbean Cruises Ltd. (h) | 571 | 59,157 | ||||||

|

| |||||||

| 365,446 | ||||||||

|

| |||||||

Household Appliances - 0.0%* |

| |||||||

Whirlpool Corp. | 249 | 36,419 | ||||||

|

| |||||||

Household Products - 0.5% | ||||||||

Church & Dwight Company Inc. | 875 | 46,517 | ||||||

Colgate-Palmolive Co. (h) | 2,914 | 188,858 | ||||||

Kimberly-Clark Corp. (h) | 1,170 | 123,249 | ||||||

The Clorox Co. | 446 | 60,323 | ||||||

The Procter & Gamble Co. (h) | 8,410 | 656,486 | ||||||

|

| |||||||

| 1,075,433 | ||||||||

|

| |||||||

Housewares & Specialties - 0.0%* |

| |||||||

Newell Brands Inc. | 1,682 | 43,387 | ||||||

|

| |||||||

Human Resource & Employment Services - 0.0%* |

| |||||||

Robert Half International Inc. | 366 | 23,835 | ||||||

|

| |||||||

Hypermarkets & Super Centers - 0.4% |

| |||||||

Costco Wholesale Corp. (h) | 1,456 | 304,279 | ||||||

Walmart Inc. (h) | 4,792 | 410,439 | ||||||

|

| |||||||

| 714,718 | ||||||||

|

| |||||||

Independent Power Producers & Energy Traders - 0.0%* |

| |||||||

AES Corp. | 2,435 | 32,657 | ||||||

NRG Energy Inc. | 1,065 | 32,700 | ||||||

|

| |||||||

| 65,357 | ||||||||

|

| |||||||

Industrial Conglomerates - 0.6% |

| |||||||

3M Co. (h) | 1,981 | 389,704 | ||||||

General Electric Co. (h) | 28,733 | 391,058 | ||||||

Honeywell International Inc. (h) | 2,517 | 362,576 | ||||||

Roper Technologies Inc. (h) | 335 | 92,432 | ||||||

|

| |||||||

| 1,235,770 | ||||||||

|

| |||||||

Industrial Gases - 0.1% | ||||||||

Air Products & Chemicals Inc. (h) | 723 | 112,597 | ||||||

Praxair Inc. (h) | 964 | 152,461 | ||||||

|

| |||||||

| 265,058 | ||||||||

|

| |||||||

Industrial Machinery - 0.3% | ||||||||

Dover Corp. | 543 | 39,749 | ||||||

Flowserve Corp. | 482 | 19,474 | ||||||

| Number of Shares | Fair Value $ | |||||||

Fortive Corp. (h) | 1,011 | 77,959 | ||||||

Illinois Tool Works Inc. (h) | 1,027 | 142,281 | ||||||

Ingersoll-Rand PLC (h) | 834 | 74,836 | ||||||

Parker-Hannifin Corp. (h) | 423 | 65,925 | ||||||

Snap-on Inc. | 182 | 29,252 | ||||||

Stanley Black & Decker Inc. (h) | 521 | 69,195 | ||||||

Xylem Inc. | 563 | 37,936 | ||||||

|

| |||||||

| 556,607 | ||||||||

|

| |||||||

Industrial REITs - 0.1% | ||||||||

Duke Realty Corp. | 1,080 | 31,356 | ||||||

Prologis Inc. REIT (h) | 1,752 | 115,093 | ||||||

|

| |||||||

| 146,449 | ||||||||

|

| |||||||

Insurance Brokers - 0.1% | ||||||||

Arthur J Gallagher & Co. | 567 | 37,018 | ||||||

Marsh & McLennan Companies Inc. (h) | 1,714 | 140,500 | ||||||

|

| |||||||

| 177,518 | ||||||||

|

| |||||||

Integrated Oil & Gas - 1.1% |

| |||||||

Chevron Corp. (h) | 6,379 | 806,500 | ||||||

Exxon Mobil Corp. (h) | 14,085 | 1,165,255 | ||||||

Occidental Petroleum Corp. (h) | 2,522 | 211,043 | ||||||

|

| |||||||

| 2,182,798 | ||||||||

|

| |||||||

Integrated Telecommunication Services - 0.7% |

| |||||||

AT&T Inc. (h) | 24,194 | 776,873 | ||||||

Verizon Communications Inc. (h) | 13,777 | 693,125 | ||||||

|

| |||||||

| 1,469,998 | ||||||||

|

| |||||||

Internet & Direct Marketing Retail - 1.6% |

| |||||||

Amazon.com Inc. (a)(h) | 1,345 | 2,286,233 | ||||||

Booking Holdings Inc. (a)(h) | 156 | 316,228 | ||||||

Expedia Group Inc. | 410 | 49,279 | ||||||

Netflix Inc. (a)(h) | 1,437 | 562,487 | ||||||

TripAdvisor Inc. (a) | 422 | 23,511 | ||||||

|

| |||||||

| 3,237,738 | ||||||||

|

| |||||||

Internet Software & Services - 2.0% |

| |||||||

Akamai Technologies Inc. (a) | 540 | 39,545 | ||||||

Alphabet Inc., Class A (a)(h) | 992 | 1,120,158 | ||||||

Alphabet Inc., Class C (a)(h) | 1,010 | 1,126,808 | ||||||

eBay Inc. (a)(h) | 3,210 | 116,396 | ||||||

Facebook Inc., Class A (a)(h) | 7,969 | 1,548,537 | ||||||

Twitter Inc. (a) | 2,100 | 91,708 | ||||||

VeriSign Inc. (a) | 287 | 39,441 | ||||||

|

| |||||||

| 4,082,593 | ||||||||

|

| |||||||

Investment Banking & Brokerage - 0.4% |

| |||||||

E*TRADE Financial Corp. (a)(h) | 913 | 55,841 | ||||||

Morgan Stanley (h) | 4,566 | 216,430 | ||||||

See Notes to Schedules of Investments and Notes to Financial Statements.

| Elfun Diversified Fund | 17 |

Table of Contents

Elfun Diversified Fund

Schedule of Investments, continued — June 30, 2018 (Unaudited)

| Number of Shares | Fair Value $ | |||||||

Raymond James Financial Inc. | 400 | 35,742 | ||||||

The Charles Schwab Corp. (h) | 3,986 | 203,686 | ||||||

The Goldman Sachs Group Inc. (h) | 1,185 | 261,377 | ||||||

|

| |||||||

| 773,076 | ||||||||

|

| |||||||

IT Consulting & Other Services - 0.3% |

| |||||||

Cognizant Technology Solutions Corp., Class A (h) | 1,961 | 154,901 | ||||||

DXC Technology Co. (h) | 944 | 76,098 | ||||||

Gartner Inc. (a) | 300 | 39,872 | ||||||

International Business Machines Corp. (h) | 2,848 | 397,868 | ||||||

|

| |||||||

| 668,739 | ||||||||

|

| |||||||

Leisure Products - 0.0%* |

| |||||||

Hasbro Inc. | 344 | 31,759 | ||||||

Mattel Inc. | 1,263 | 20,742 | ||||||

|

| |||||||

| 52,501 | ||||||||

|

| |||||||

Life & Health Insurance - 0.3% |

| |||||||

Aflac Inc. (h) | 2,614 | 112,455 | ||||||

Brighthouse Financial Inc. (a) | 341 | 13,665 | ||||||

Lincoln National Corp. | 684 | 42,580 | ||||||

MetLife Inc. (h) | 3,390 | 147,805 | ||||||

Principal Financial Group Inc. | 888 | 47,021 | ||||||

Prudential Financial Inc. (h) | 1,396 | 130,541 | ||||||

Torchmark Corp. | 375 | 30,530 | ||||||

Unum Group | 757 | 28,002 | ||||||

|

| |||||||

| 552,599 | ||||||||

|

| |||||||

Life Sciences Tools & Services - 0.3% |

| |||||||

Agilent Technologies Inc. (h) | 1,118 | 69,138 | ||||||

Illumina Inc. (a)(h) | 484 | 135,178 | ||||||

IQVIA Holdings Inc. (a) | 500 | 49,911 | ||||||

Mettler-Toledo International Inc. (a) | 88 | 50,921 | ||||||

PerkinElmer Inc. | 405 | 29,659 | ||||||

Thermo Fisher Scientific Inc. (h) | 1,329 | 275,290 | ||||||

Waters Corp. (a) | 270 | 52,271 | ||||||

|

| |||||||

| 662,368 | ||||||||

|

| |||||||

Managed Healthcare - 0.8% |

| |||||||

Aetna Inc. (h) | 1,096 | 201,117 | ||||||

Anthem Inc. (h) | 855 | 203,517 | ||||||

Centene Corp. (a)(h) | 685 | 84,400 | ||||||

Cigna Corp. (h) | 807 | 137,151 | ||||||

Humana Inc. (h) | 469 | 139,590 | ||||||

UnitedHealth Group Inc. (h) | 3,192 | 783,127 | ||||||

|

| |||||||

| 1,548,902 | ||||||||

|

| |||||||

| Number of Shares | Fair Value $ | |||||||

Metal & Glass Containers - 0.0%* |

| |||||||

Ball Corp. | 1,192 | 42,384 | ||||||

|

| |||||||

Motorcycle Manufacturers - 0.0%* |

| |||||||

Harley-Davidson Inc. | 553 | 23,278 | ||||||

|

| |||||||

Movies & Entertainment - 0.4% |

| |||||||

The Walt Disney Co. (h) | 4,928 | 516,506 | ||||||

Twenty-First Century Fox Inc., Class A (h) | 3,521 | 174,961 | ||||||

Twenty-First Century Fox Inc., Class B | 1,409 | 69,423 | ||||||

Viacom Inc., Class B | 1,083 | 32,665 | ||||||

|

| |||||||

| 793,555 | ||||||||

|

| |||||||

Multi-Line Insurance - 0.1% |

| |||||||

American International Group Inc. (h) | 2,984 | 158,214 | ||||||

Assurant Inc. | 144 | 14,905 | ||||||

Loews Corp. | 911 | 43,985 | ||||||

The Hartford Financial Services Group Inc. (h) | 1,195 | 61,102 | ||||||

|

| |||||||

| 278,206 | ||||||||

|

| |||||||

Multi-Sector Holdings - 0.6% |

| |||||||

Berkshire Hathaway Inc., Class B (a)(h) | 6,400 | 1,194,564 | ||||||

Jefferies Financial Group Inc. | 997 | 22,676 | ||||||

|

| |||||||

| 1,217,240 | ||||||||

|

| |||||||

Multi-Utilities - 0.4% |

| |||||||

Ameren Corp. | 800 | 48,681 | ||||||

CenterPoint Energy Inc. | 1,491 | 41,316 | ||||||

CMS Energy Corp. | 979 | 46,288 | ||||||

Consolidated Edison Inc. (h) | 1,065 | 83,050 | ||||||

Dominion Energy Inc. (h) | 2,125 | 144,883 | ||||||

DTE Energy Co. (h) | 623 | 64,562 | ||||||

NiSource Inc. | 1,192 | 31,327 | ||||||

Public Service Enterprise Group Inc. (h) | 1,638 | 88,682 | ||||||

SCANA Corp. | 528 | 20,339 | ||||||

Sempra Energy (h) | 874 | 101,481 | ||||||

WEC Energy Group Inc. (h) | 1,096 | 70,857 | ||||||

|

| |||||||

| 741,466 | ||||||||

|

| |||||||

Office REITs - 0.1% |

| |||||||

Alexandria Real Estate Equities Inc. | 330 | 41,638 | ||||||

Boston Properties Inc. (h) | 538 | 67,478 | ||||||

SL Green Realty Corp. | 275 | 27,648 | ||||||

Vornado Realty Trust | 601 | 44,428 | ||||||

|

| |||||||

| 181,192 | ||||||||

|

| |||||||

See Notes to Schedules of Investments and Notes to Financial Statements.

| 18 | Elfun Diversified Fund |

Table of Contents

Elfun Diversified Fund

Schedule of Investments, continued — June 30, 2018 (Unaudited)

| Number of Shares | Fair Value $ | |||||||

Oil & Gas Drilling - 0.0%* |

| |||||||

Helmerich & Payne Inc. | 400 | 25,512 | ||||||

|

| |||||||

Oil & Gas Equipment & Services - 0.3% |

| |||||||

Baker Hughes a GE Co. (h) | 1,492 | 49,283 | ||||||

Halliburton Co. (h) | 2,963 | 133,515 | ||||||

National Oilwell Varco Inc. (h) | 1,295 | 56,205 | ||||||

Schlumberger Ltd. (h) | 4,579 | 306,932 | ||||||

|

| |||||||

| 545,935 | ||||||||

|

| |||||||

Oil & Gas Exploration & Production - 0.6% |

| |||||||

Anadarko Petroleum Corp. (h) | 1,694 | 124,086 | ||||||

Apache Corp. (h) | 1,321 | 61,757 | ||||||

Cabot Oil & Gas Corp. | 1,618 | 38,509 | ||||||

Cimarex Energy Co. | 308 | 31,336 | ||||||

Concho Resources Inc. (a)(h) | 478 | 66,132 | ||||||

ConocoPhillips (h) | 3,936 | 274,025 | ||||||

Devon Energy Corp. (h) | 1,674 | 73,590 | ||||||

EOG Resources Inc. (h) | 1,914 | 238,160 | ||||||

EQT Corp. | 838 | 46,241 | ||||||

Hess Corp. (h) | 865 | 57,860 | ||||||

Marathon Oil Corp. (h) | 2,929 | 61,100 | ||||||

Newfield Exploration Co. (a) | 729 | 22,053 | ||||||

Noble Energy Inc. (h) | 1,583 | 55,849 | ||||||

Pioneer Natural Resources Co. (h) | 557 | 105,407 | ||||||

|

| |||||||

| 1,256,105 | ||||||||

|

| |||||||

Oil & Gas Refining & Marketing - 0.3% |

| |||||||

Andeavor (h) | 449 | 58,902 | ||||||

HollyFrontier Corp. | 590 | 40,375 | ||||||

Marathon Petroleum Corp. (h) | 1,559 | 109,381 | ||||||

Phillips 66 (h) | 1,395 | 156,674 | ||||||

Valero Energy Corp. (h) | 1,438 | 159,375 | ||||||

|

| |||||||

| 524,707 | ||||||||

|

| |||||||

Oil & Gas Storage & Transportation - 0.1% |

| |||||||

Kinder Morgan Inc. (h) | 6,481 | 114,522 | ||||||

ONEOK Inc. (h) | 1,341 | 93,645 | ||||||

The Williams Companies Inc. (h) | 2,813 | 76,263 | ||||||

|

| |||||||

| 284,430 | ||||||||

|

| |||||||

Packaged Foods & Meats - 0.4% |

| |||||||

Campbell Soup Co. | 716 | 29,027 | ||||||

Conagra Brands Inc. | 1,266 | 45,235 | ||||||

General Mills Inc. (h) | 1,944 | 86,042 | ||||||

Hormel Foods Corp. | 817 | 30,401 | ||||||

Kellogg Co. | 833 | 58,203 | ||||||

McCormick & Company Inc. | 373 | 43,302 | ||||||

Mondelez International Inc., Class A (h) | 4,984 | 204,345 | ||||||

The Hershey Co. | 463 | 43,088 | ||||||

The JM Smucker Co. | 390 | 41,918 | ||||||

| Number of Shares | Fair Value $ | |||||||

The Kraft Heinz Co. (h) | 2,013 | 126,457 | ||||||

Tyson Foods Inc., Class A (h) | 993 | 68,369 | ||||||

|

| |||||||

| 776,387 | ||||||||

|

| |||||||

Paper Packaging - 0.1% |

| |||||||

Avery Dennison Corp. | 279 | 28,488 | ||||||

International Paper Co. (h) | 1,429 | 74,424 | ||||||

Packaging Corporation of America | 300 | 33,539 | ||||||

Sealed Air Corp. | 614 | 26,066 | ||||||

WestRock Co. | 843 | 48,069 | ||||||

|

| |||||||

| 210,586 | ||||||||

|

| |||||||

Personal Products - 0.1% |

| |||||||

Coty Inc., Class A | 1,737 | 24,496 | ||||||

The Estee Lauder Companies Inc., Class A (h) | 731 | 104,310 | ||||||

|

| |||||||

| 128,806 | ||||||||

|

| |||||||

Pharmaceuticals - 1.7% |

| |||||||

Allergan PLC (h) | 1,115 | 185,894 | ||||||

Bristol-Myers Squibb Co. (h) | 5,473 | 302,877 | ||||||

Eli Lilly & Co. (h) | 3,195 | 272,630 | ||||||

Johnson & Johnson (h) | 8,918 | 1,082,111 | ||||||

Merck & Company Inc. (h) | 8,933 | 542,234 | ||||||

Mylan N.V. (a)(h) | 1,630 | 58,909 | ||||||

Nektar Therapeutics (a) | 550 | 26,857 | ||||||

Pfizer Inc. (h) | 19,533 | 708,658 | ||||||

Zoetis Inc. (h) | 1,624 | 138,350 | ||||||

|

| |||||||

| 3,318,520 | ||||||||

|

| |||||||

Property & Casualty Insurance - 0.2% |

| |||||||

Cincinnati Financial Corp. | 523 | 34,970 | ||||||

The Allstate Corp. (h) | 1,210 | 110,439 | ||||||

The Progressive Corp. (h) | 1,923 | 113,747 | ||||||

The Travelers Companies Inc. (h) | 909 | 111,209 | ||||||

|

| |||||||

| 370,365 | ||||||||

|

| |||||||

Publishing - 0.0%* | ||||||||

News Corp., Class A | 1,411 | 21,874 | ||||||

News Corp., Class B | 442 | 7,010 | ||||||

|

| |||||||

| 28,884 | ||||||||

|

| |||||||

Railroads - 0.4% | ||||||||

CSX Corp. (h) | 2,959 | 188,727 | ||||||

Kansas City Southern | 351 | 37,194 | ||||||

Norfolk Southern Corp. (h) | 937 | 141,367 | ||||||

Union Pacific Corp. (h) | 2,598 | 368,087 | ||||||

|

| |||||||

| 735,375 | ||||||||

|

| |||||||

Real Estate Services - 0.0%* |

| |||||||

CBRE Group Inc., Class A (a) | 1,009 | 48,178 | ||||||

|

| |||||||

See Notes to Schedules of Investments and Notes to Financial Statements.

| Elfun Diversified Fund | 19 |

Table of Contents

Elfun Diversified Fund

Schedule of Investments, continued — June 30, 2018 (Unaudited)

| Number of Shares | Fair Value $ | |||||||

Regional Banks - 0.5% | ||||||||

BB&T Corp. (h) | 2,527 | 127,462 | ||||||

Citizens Financial Group Inc. (h) | 1,661 | 64,614 | ||||||

Comerica Inc. (h) | 556 | 50,552 | ||||||

Fifth Third Bancorp (h) | 2,221 | 63,743 | ||||||

Huntington Bancshares Inc. (h) | 3,607 | 53,240 | ||||||

KeyCorp (h) | 3,402 | 66,476 | ||||||

M&T Bank Corp. (h) | 466 | 79,291 | ||||||

People’s United Financial Inc. | 1,150 | 20,804 | ||||||

Regions Financial Corp. (h) | 3,627 | 64,489 | ||||||

SunTrust Banks Inc. (h) | 1,523 | 100,549 | ||||||

SVB Financial Group (a)(h) | 180 | 51,977 | ||||||

The PNC Financial Services Group Inc. (h) | 1,582 | 213,729 | ||||||

Zions Bancorporation | 652 | 34,354 | ||||||

|

| |||||||

| 991,280 | ||||||||

|

| |||||||

Research & Consulting Services - 0.1% |

| |||||||

Equifax Inc. | 406 | 50,797 | ||||||

Nielsen Holdings PLC | 1,101 | 34,057 | ||||||

Verisk Analytics Inc. (a)(h) | 514 | 55,330 | ||||||

|

| |||||||

| 140,184 | ||||||||

|

| |||||||

Residential REITs - 0.2% | ||||||||

Apartment Investment & Management Co., Class A | 579 | 24,493 | ||||||

AvalonBay Communities Inc. (h) | 477 | 81,993 | ||||||

Equity Residential (h) | 1,181 | 75,219 | ||||||

Essex Property Trust Inc. | 223 | 53,314 | ||||||

Mid-America Apartment Communities Inc. | 396 | 39,867 | ||||||

UDR Inc. | 817 | 30,671 | ||||||

|

| |||||||

| 305,557 | ||||||||

|

| |||||||

Restaurants - 0.4% | ||||||||

Chipotle Mexican Grill Inc. (a) | 83 | 35,805 | ||||||

Darden Restaurants Inc. | 388 | 41,541 | ||||||

McDonald’s Corp. (h) | 2,599 | 407,239 | ||||||

Starbucks Corp. (h) | 4,655 | 227,399 | ||||||

Yum! Brands Inc. (h) | 1,088 | 85,105 | ||||||

|

| |||||||

| 797,089 | ||||||||

|

| |||||||

Retail REITs - 0.2% | ||||||||

Federal Realty Investment Trust | 265 | 33,537 | ||||||

GGP Inc. | 1,957 | 39,983 | ||||||

Kimco Realty Corp. | 1,570 | 26,675 | ||||||

Realty Income Corp. | 955 | 51,371 | ||||||

Regency Centers Corp. | 500 | 31,041 | ||||||

Simon Property Group Inc. (h) | 1,052 | 179,041 | ||||||

The Macerich Co. | 346 | 19,664 | ||||||

|

| |||||||

| 381,312 | ||||||||

|

| |||||||

| Number of Shares | Fair Value $ | |||||||

Semiconductor Equipment - 0.2% |

| |||||||

Applied Materials Inc. (h) | 3,292 | 152,060 | ||||||

KLA-Tencor Corp. (h) | 528 | 54,139 | ||||||

Lam Research Corp. (h) | 542 | 93,687 | ||||||

|

| |||||||

| 299,886 | ||||||||

|

| |||||||

Semiconductors - 1.4% | ||||||||

Advanced Micro Devices Inc. (a) | 2,850 | 42,722 | ||||||

Analog Devices Inc. (h) | 1,204 | 115,488 | ||||||

Broadcom Inc. (h) | 1,353 | 328,293 | ||||||

Intel Corp. (h) | 15,633 | 777,117 | ||||||

Microchip Technology Inc. (h) | 798 | 72,579 | ||||||

Micron Technology Inc. (a)(h) | 3,812 | 199,902 | ||||||

NVIDIA Corp. (h) | 2,011 | 476,407 | ||||||

Qorvo Inc. (a) | 392 | 31,427 | ||||||

QUALCOMM Inc. (h) | 4,975 | 279,198 | ||||||

Skyworks Solutions Inc. (h) | 576 | 55,671 | ||||||

Texas Instruments Inc. (h) | 3,272 | 360,739 | ||||||

Xilinx Inc. (a) | 853 | 55,667 | ||||||

|

| |||||||

| 2,795,210 | ||||||||

|

| |||||||

Soft Drinks - 0.6% | ||||||||

Monster Beverage Corp. (a)(h) | 1,397 | 80,051 | ||||||

PepsiCo Inc. (h) | 4,724 | 514,305 | ||||||

The Coca-Cola Co. (h) | 12,797 | 561,279 | ||||||

|

| |||||||

| 1,155,635 | ||||||||

|

| |||||||

Specialized Consumer Services - 0.0%* |

| |||||||

H&R Block Inc. | 765 | 17,435 | ||||||

|

| |||||||

Specialized REITs - 0.4% | ||||||||

American Tower Corp. (h) | 1,475 | 212,652 | ||||||

Crown Castle International Corp. (h) | 1,372 | 147,930 | ||||||

Digital Realty Trust Inc. (h) | 701 | 78,218 | ||||||

Equinix Inc. (h) | 264 | 113,492 | ||||||

Extra Space Storage Inc. | 393 | 39,226 | ||||||

Iron Mountain Inc. | 905 | 31,685 | ||||||

Public Storage (h) | 491 | 111,389 | ||||||

SBA Communications Corp. (a)(h) | 400 | 66,049 | ||||||

Weyerhaeuser Co. (h) | 2,453 | 89,437 | ||||||

|

| |||||||

| 890,078 | ||||||||

|