Filed pursuant to Rule 433

Registration No. 333-260756

Invest in the everlasting. Green Bonds – Made by KfW. July 2022 Filed pursuant to Rule 433; Registration No . 333 - 260756

Disclaimer

Disclaimer

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. KfW's prospectus supplement relating to the bonds is available through the following link:

tm2131584-8_424b3 - none - 3.3125177s (sec.gov)

KfW's base prospectus relating to SEC-registered notes is available through the following link:

tm2131584-3_sb - none - 3.2656626s (sec.gov)

Alternatively, the issuer will arrange to send you the prospectus, which you may request by emailing investor.relations@kfw.de.

The following presentation may contain forward looking statements. These forward-looking statements can be identified by the use of forward-looking terminology, including the terms "believes," "estimates," "anticipates," "expects," "intends," "may," "will" or "should" or, in each case, their negative, or other variations or comparable terminology. These forward-looking statements include all matters that are not historical facts. They appear in a number of places throughout this presentation and include statements regarding KfW’s intentions, beliefs or current expectations. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. KfW cautions you that forward-looking statements are not guarantees of future performance or developments, which may differ materially from those made in or suggested by the forward-looking statements contained in this presentation. In addition, even if the performance or the developments are consistent with the forward-looking statements contained in this presentation, those developments may not be indicative of results or developments in subsequent periods not covered by this presentation.

The presentation only speaks as of its date. KfW undertakes no obligation, and does not expect to publicly update, or publicly revise, any forward-looking statement, whether as a result of new information, future events or otherwise. All subsequent written and oral forward-looking statements attributable to KfW or to persons acting on our behalf are expressly qualified in their entirety by the cautionary statements referred to above or contained elsewhere in this presentation.

Green Bonds - Made by KfW / July 2022 Green Bonds - Made by KfW / July 2022 | 2 |

KfW 3 Green Bonds - Made by KfW / July 2022 Overview and sustainability approach

KfW at a glance Shareholders › The promotional bank of the Federal Republic of Germany, established in 1948 as a public law institution. › Benefits from explicit and direct statutory guarantee and institutional liability by the Federal Republic of Germany. › Regulated by the “ Law concerning KfW ” and exempt from corporate taxes. › Zero risk weighting of KfW’s bonds. ( 2) › Supervision by the German Federal Ministry of Finance and the German Financial Supervisory Authority “ BaFin ” . › Subject to certain provisions of German and European bank regulatory laws by analogy, in large part with effect from January 1, 2016. 80% 20% Bonn Federal Republic of Germany German federal states Berlin Frankfurt Sustainability Credit Aaa AAA Moody‘s S&P AAA Scope “ Prime ” ISS ESG Ratings 1 Cologne (DEG) Headquarters: Frankfurt am Main Branches : Berlin, Bonn Germanyʼs flagship development agency German credit Professionally supervised and regulated MSCI AAA (1) A rating is not a recommendation to buy, sell or hold securities. Ratings are subject to revision or withdrawal at any time by th e assigning rating organization. Each rating should be evaluated independently of any other rating. (2) According to the standardized approach of the Capital Requirements Regulation (CRR) 4 Green Bonds - Made by KfW / July 2022 Moody‘s ESG Solutions Advanced

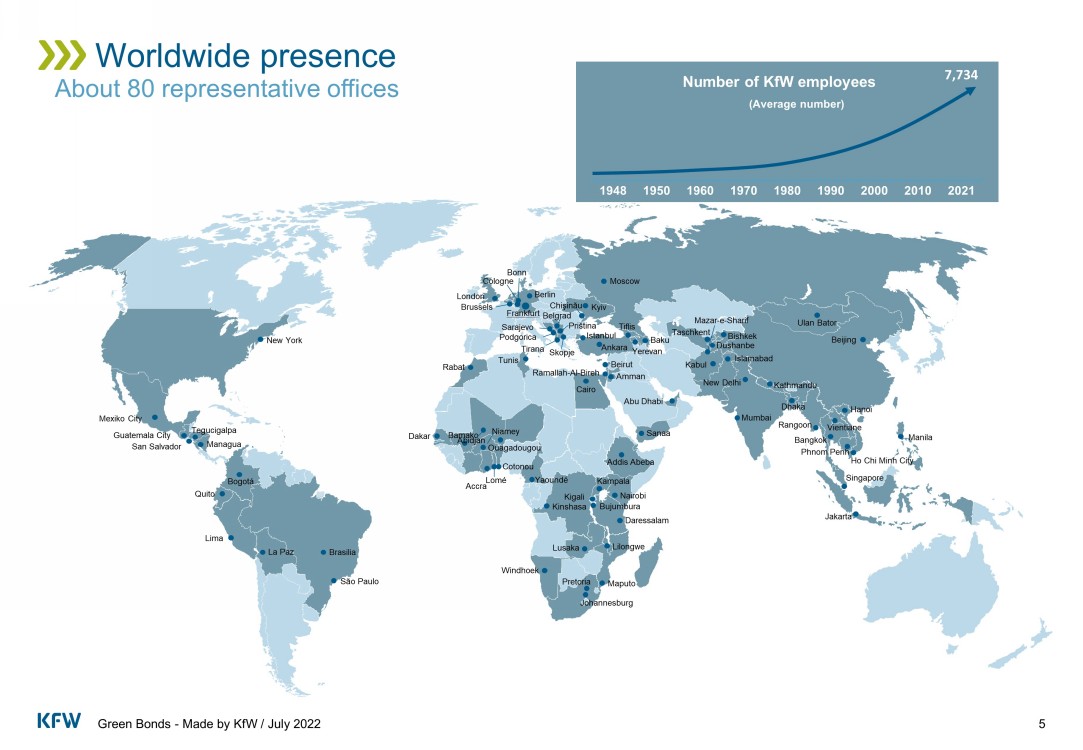

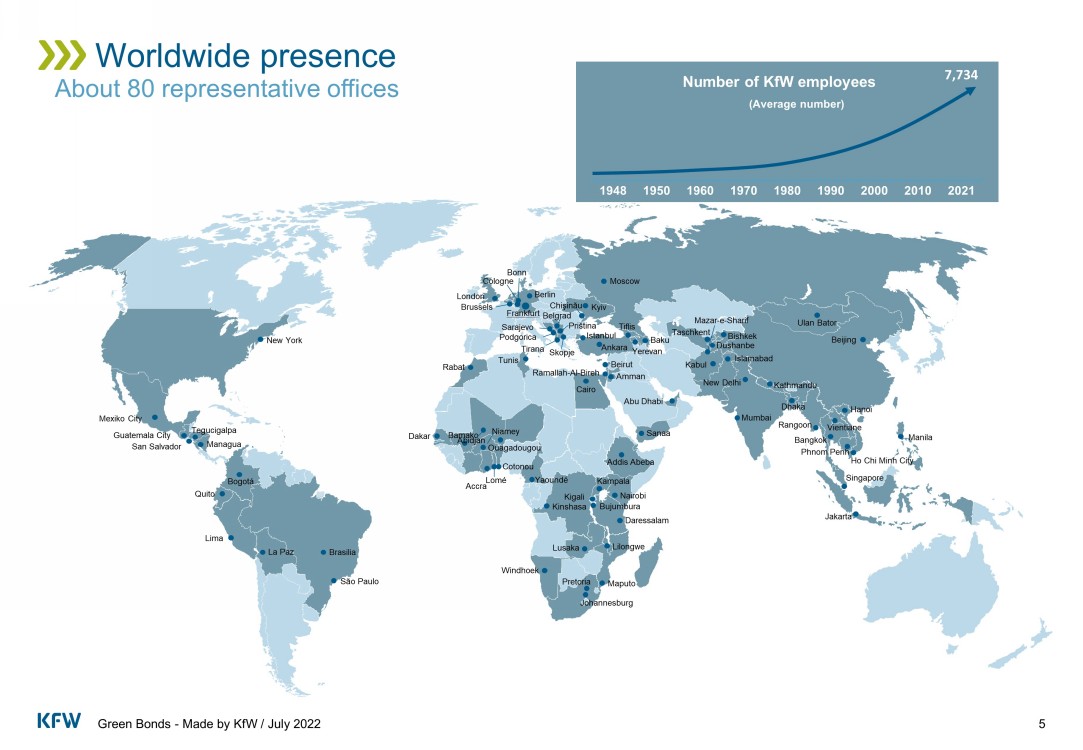

Green Bonds - Made by KfW / July 2022 A bout 80 representative offices Worldwide presence 7,734 1948 1950 1960 1970 1980 1990 2000 2010 2021 Tiflis Yerevan Amman Kampala Windhoek Pretoria Lusaka Skopje Ankara Kyiv Belgrad Priština Sarajevo Tirana Berlin Frankfurt Istanbul London Brussels Cologne Podgorica Bonn Cairo Ramallah - Al - Bireh Addis Abeba Kigali Rabat Dakar Accra Ouagadougou Yaoundé Bamako Cotonou Kinshasa Niamey Manila Baku Beijing Jakarta Kabul Islamabad Ulan Bator Hanoi Dhaka Bishkek Taschkent Dushanbe Bangkok Phnom Penh Kathmandu New Delhi Mumbai Moscow Lima La Paz Brasilia Managua Tegucigalpa Mexiko City São Paulo Quito Bogotá Guatemala City New York Sanaa Maputo Daressalam Lilongwe Abu Dhabi Johannesburg Nairobi San Salvador Singapore Bujumbura Rangoon Tunis Mazar - e - Sharif Vientiane Ho Chi Minh City Chişinău Lomé Beirut Number of KfW employees (Average number ) Abidjan 5

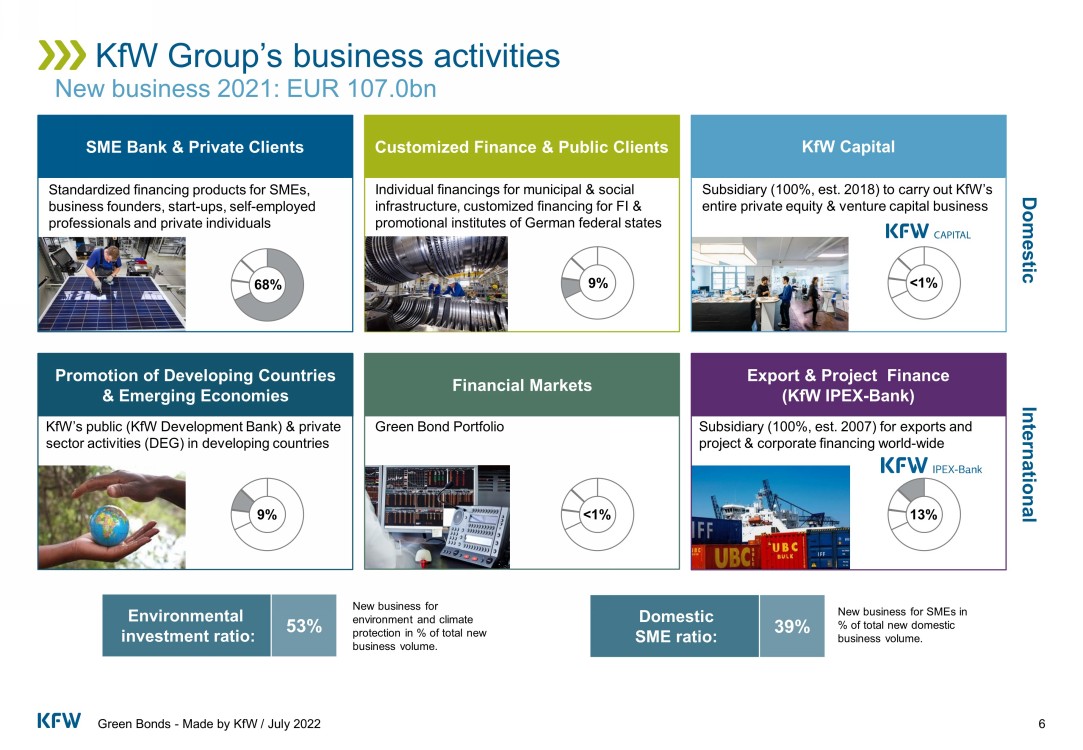

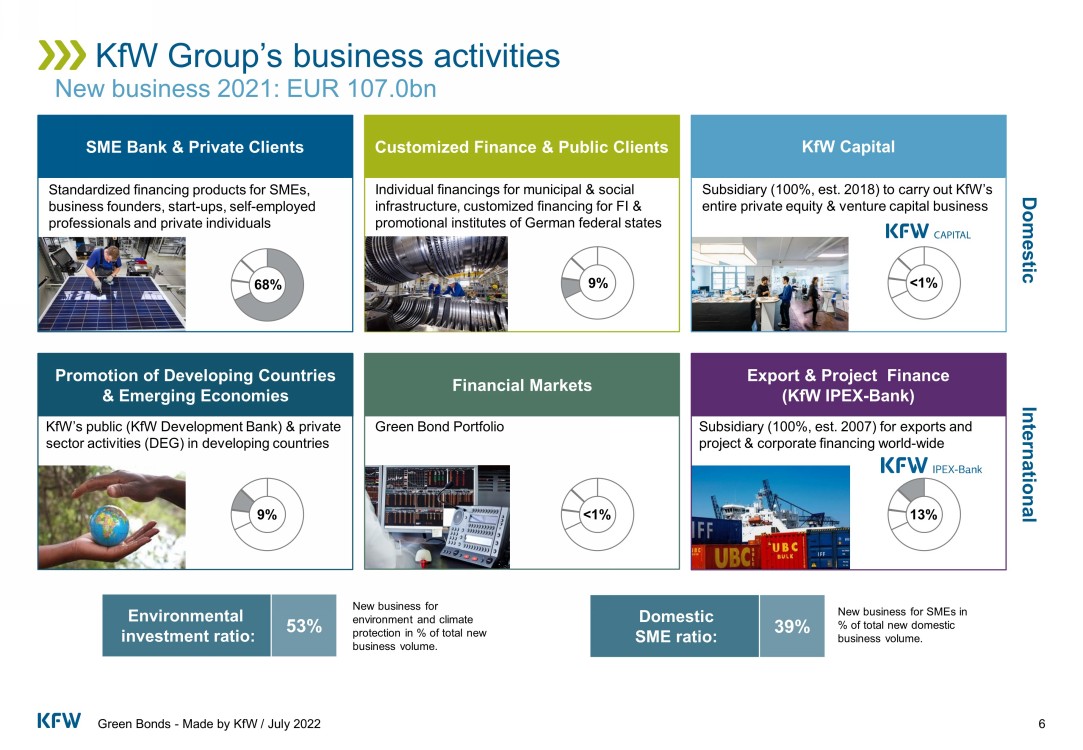

KfW Capital Promotion of Developing Countries & Emerging Economies Financial Markets New business 2021: EUR 107.0bn KfW Group’s business activities Individual financings for municipal & social infrastructure, customized financing for FI & promotional institutes of German federal states Customized Finance & Public Clients Subsidiary (100%, est. 2018) to carry out KfW ’ s entire private equity & venture capital business KfW’s public (KfW Development Bank) & private sector activities (DEG) in developing countries Green Bond Portfolio Export & Project Finance (KfW IPEX - Bank) Environmental investment ratio : New business for environment and climate protection in % of total new business volume. New business for SMEs in % of total new domestic business volume. 53% Domestic International Domestic SME ratio : 39% Subsidiary (100%, est. 2007) for exports and project & corporate financing world - wide Standardized financing products for SMEs, business founders, start - ups, self - employed professionals and private individuals SME Bank & Private Clients Green Bonds - Made by KfW / July 2022 6 68% 9% <1% 9% <1% 13%

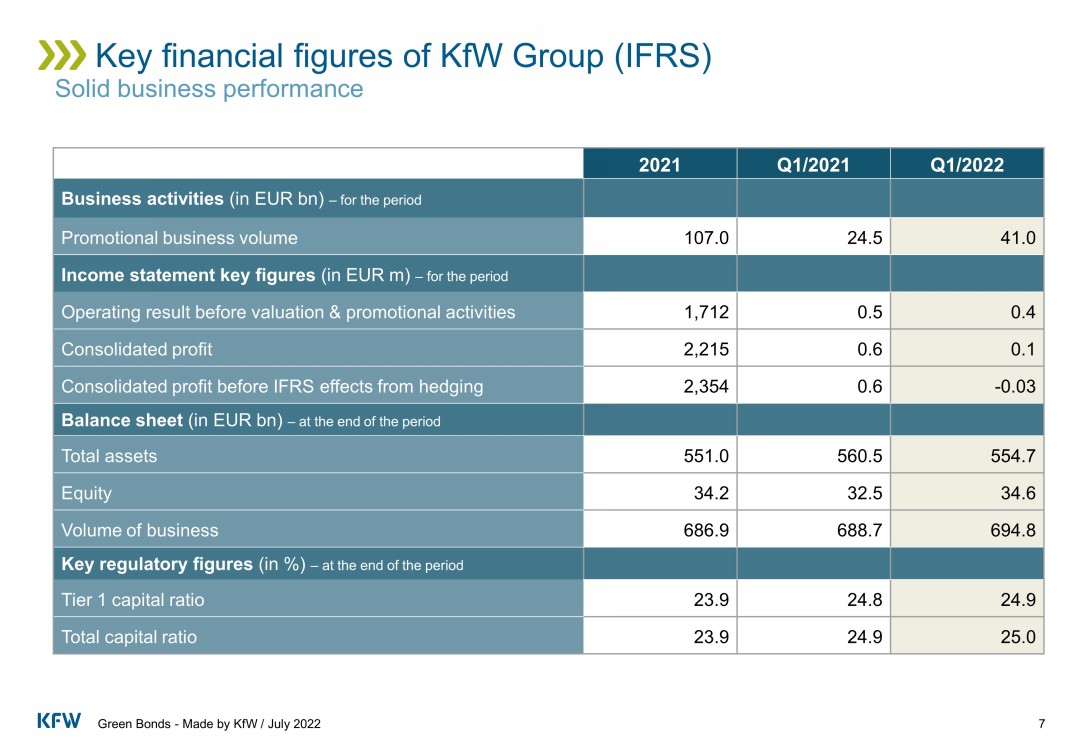

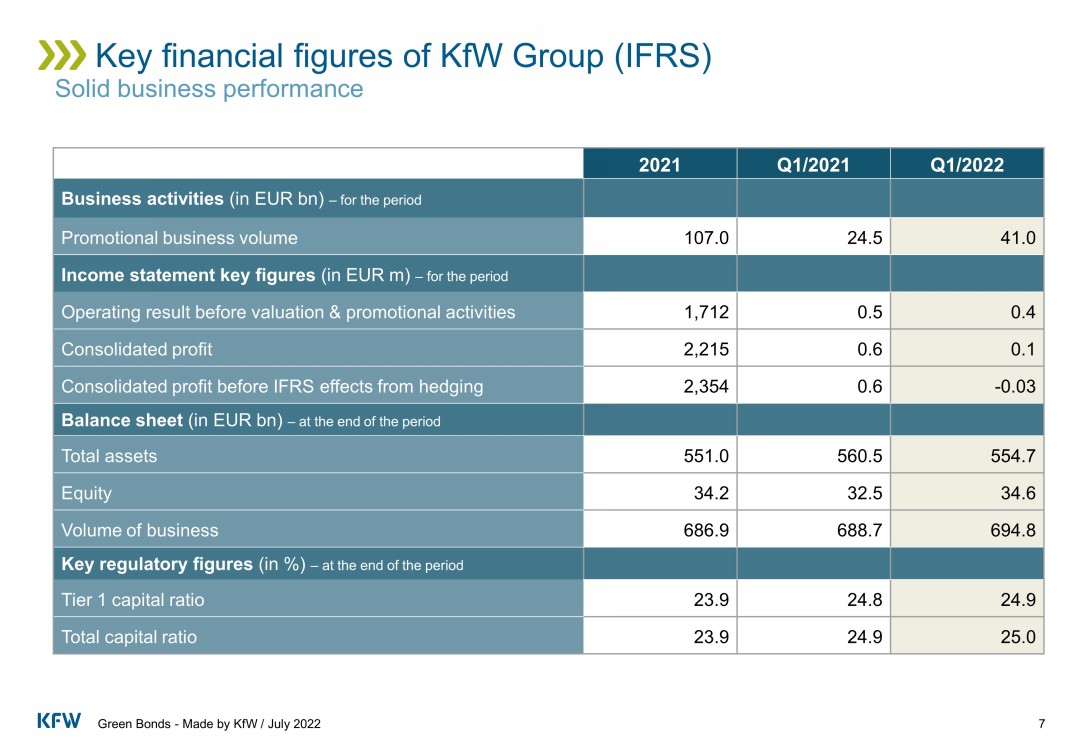

Green Bonds - Made by KfW / July 2022 Solid business performance Key financial figures of KfW Group (IFRS) 2021 Q1/2021 Q1/2022 Business activities (in EUR bn ) – for the period Promotional business volume 107.0 24.5 41.0 Income statement key figures (in EUR m) – for the period Operating result before valuation & promotional activities 1,712 0.5 0.4 Consolidated profit 2,215 0.6 0.1 Consolidated profit before IFRS effects from hedging 2,354 0.6 - 0.03 Balance sheet (in EUR bn ) – at the end of the period Total assets 551.0 560.5 554.7 Equity 34.2 32.5 34.6 Volume of business 686.9 688.7 694.8 Key regulatory figures (in %) – at the end of the period Tier 1 capital ratio 23.9 24.8 24.9 Total capital ratio 23.9 24.9 25.0 7

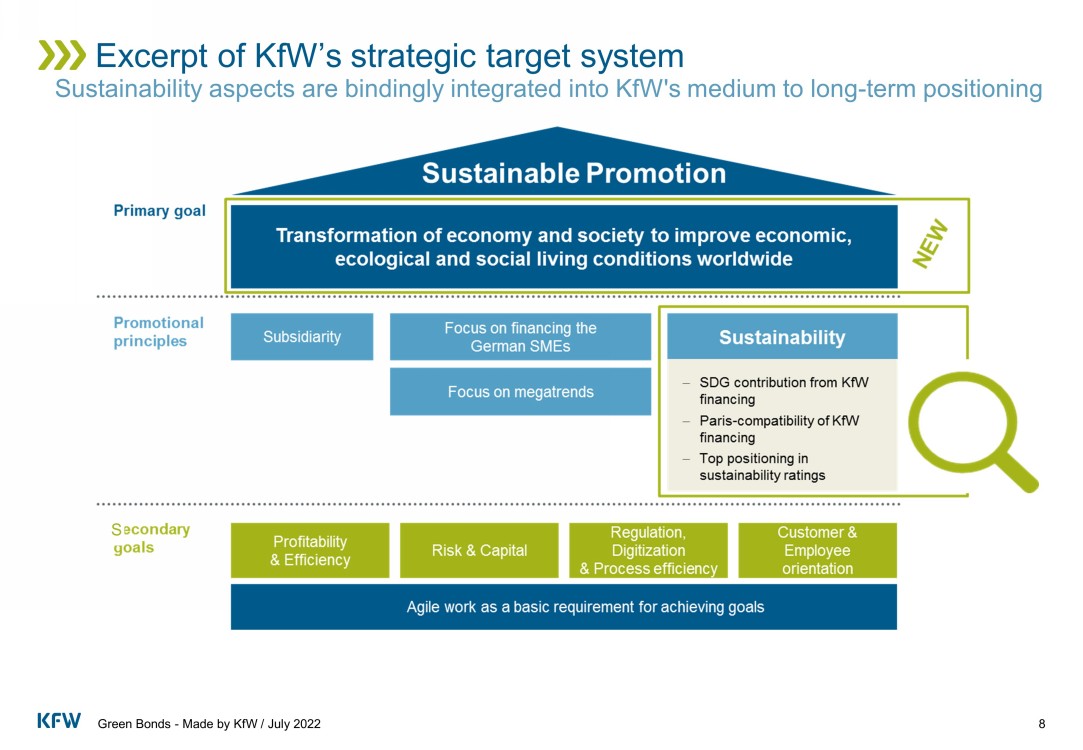

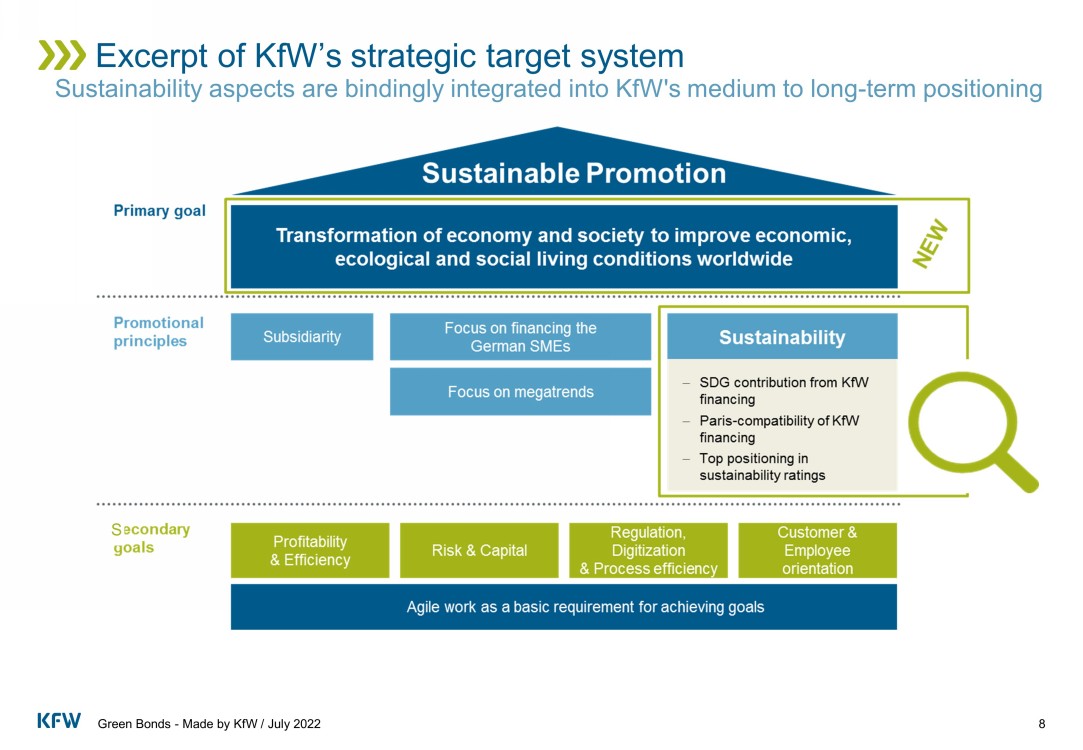

Green Bonds - Made by KfW / July 2022 Sustainability aspects are bindingly integrated into KfW's medium to long - term positioning Excerpt of KfW ʼ s strategic target system 8 S

Report according to EU Taxonomy » Contribution to strengthening the transparency of sustainable economic activities » Meeting the information needs of investors and stakeholders Paris compatibility of KfW financings » Support the economy in the transformation process » Promote sustaina - bility in the financial market » Achieve Paris climate goals Strengthening ESG risk management » Recognize ESG risks earlier » Protect asset position » Anticipate regula - tory requirements Green Bonds - Made by KfW / July 2022 Climate protection program transferred to Sustainable Finance concept Further development into a transformative promotional bank 9 Transforming the economy and society to improve economic, ecological and social living conditions worldwide Positioning is based on the sustainable finance concept (tranSForm ) SDG contribution of KfW financings » Make SDG contributions transparent » Communicate impacts more clearly » Further strengthen data management

A contribution to all of the United Nationsʼ Sustainable Development Goals SDG - MAPPING of KfW Groupʼs new business in 2021 Green Bonds - Made by KfW / July 2022 100% of KfW financing commitments are attributed to at least 1 SDG 10 SDGs with the highest commitment volume in FY 2021 » SDG 11 - Sustainable Cities and Communities: 55bn EUR (+20%) » SDG 13 - Climate action : 53bn EUR (+23%) » SDG 7 - Affordable and clean energy: 51bn EUR (+27%) After the focus in 2020 was on the short - and medium - term stabilization of the economy, the focus of new KfW commitments in 2021 was again on the important issues of the future , in particular climate protection, energy and sustainable cities and communities.

Green Bonds – Made by KfW KfW’s green bond framework and the green bonds ’ mode of operation 11 Green Bonds - Made by KfW / July 2022

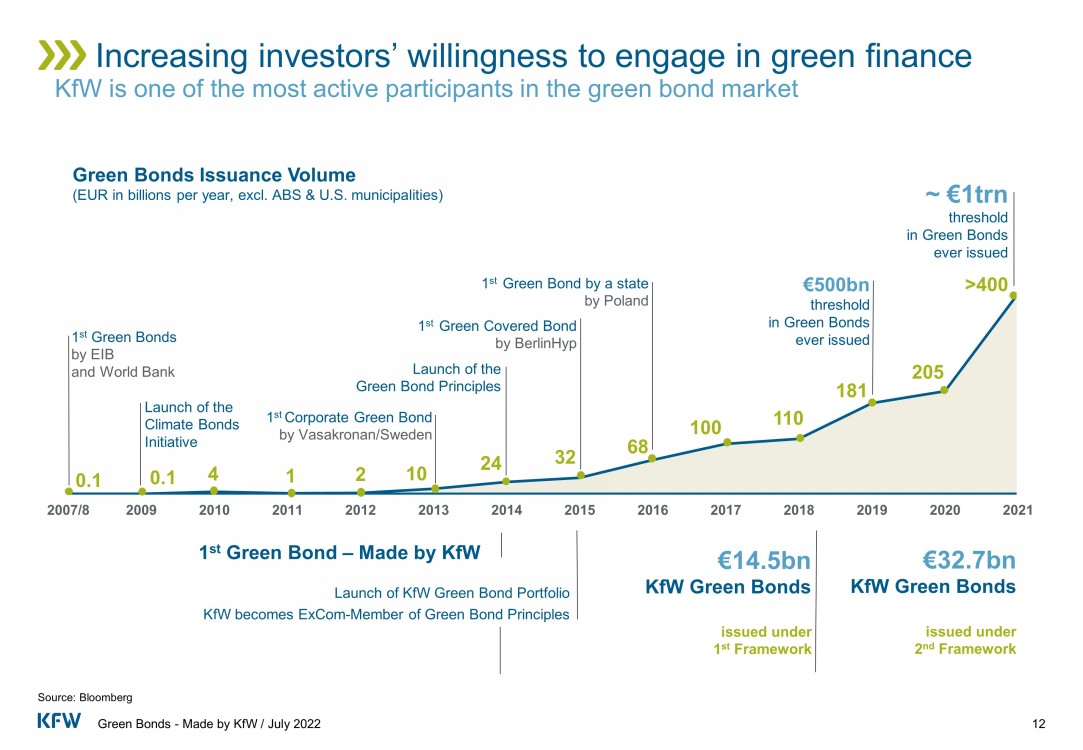

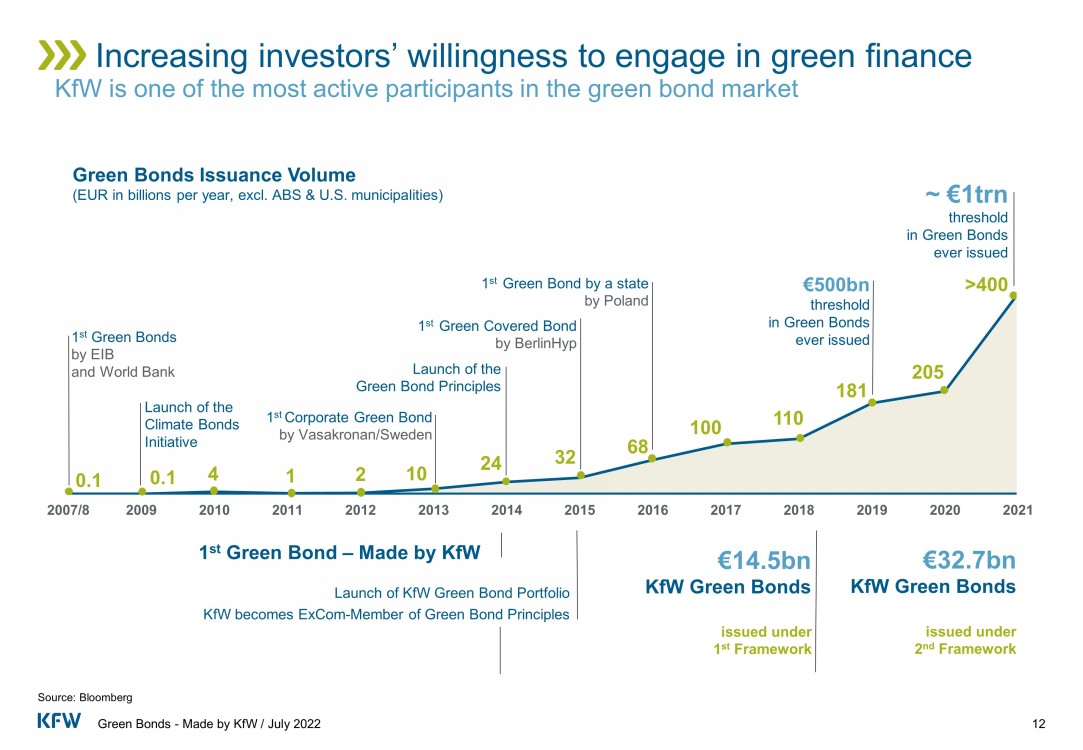

0.1 0.1 4 1 2 10 24 32 68 100 110 181 205 2007/8 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 ~ €1trn threshold in Green Bonds ever issued >400 Increasing investors ’ willingness to engage in green finance KfW is one of the most active participants in the green bond market 12 Green Bonds Issuance Volume (EUR in billions per year , excl. ABS & U.S. municipalities ) 1 st Green Bonds by EIB and World Bank Launch of the Climate Bonds Initiative 1 st Corporate Green Bond by Vasakronan / Sweden Launch of the Green Bond Principles 1 st Green Covered Bond by BerlinHyp 1 st Green Bond by a state by Poland €500bn threshold in Green Bonds ever issued 1 st Green Bond – Made by KfW Launch of KfW Green Bond Portfolio KfW becomes ExCom - Member of Green Bond Principles €14.5bn KfW Green Bonds issued under 1 st Framework Source: Bloomberg Green Bonds - Made by KfW / July 2022 issued under 2 nd Framework €32.7bn KfW Green Bonds

Funding How do “Green Bonds – Made by KfW“ work ? Liquidity management Lender On - lending bank Green Bonds - Made by KfW / July 2022 Socially responsible investors Renewable Energy & Energy Efficiency ~ 69 ,000 loans in 2021 Green Bonds – Made by KfW 13 Final borrower Green Bonds – Made by KfW 25.1% 24.8% 15.9% 9.1% 7.3% 5.3% 4.0% 8.5% 1.6% 1.2% 2.6% 94.6% 83.0% 1.9% 9.5% 5.2% 0.4% Residential buildings Wind energy Solar Other renewables Germany France Other OECD countries Underlying assets €21.29bn 2021 €16.2bn 2021 Other buildings The Netherlands GBP 1.25bn 5y. ( re - openings ) Various, totaling NOK 3bn, CNY 3.65bn, PLN 900m, SEK 2bn, HKD 850m, ZAR 1.25bn, MXN 1bn, HUF 5.75bn EUR 4bn 8y. EUR 4bn 10y. (incl. re - opening ) USD 3bn 5y. NOK 12bn 2y. ( re - openings ) AUD 1.3bn 3y. ( re - openings ) CAD 1bn 5y.

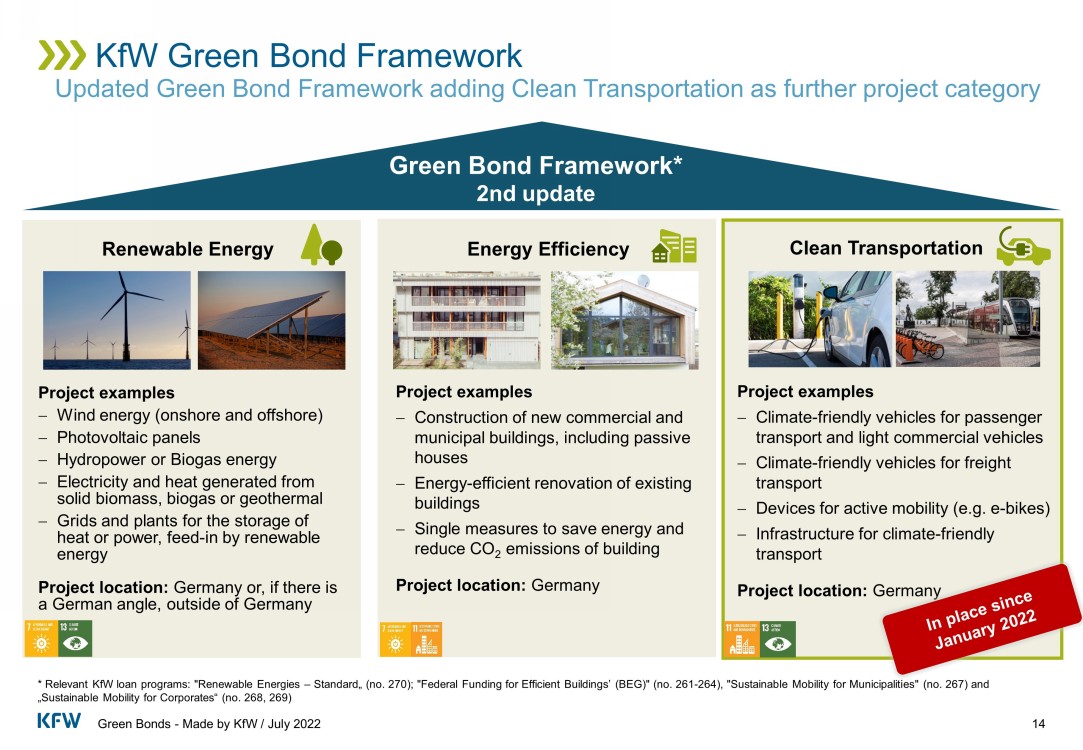

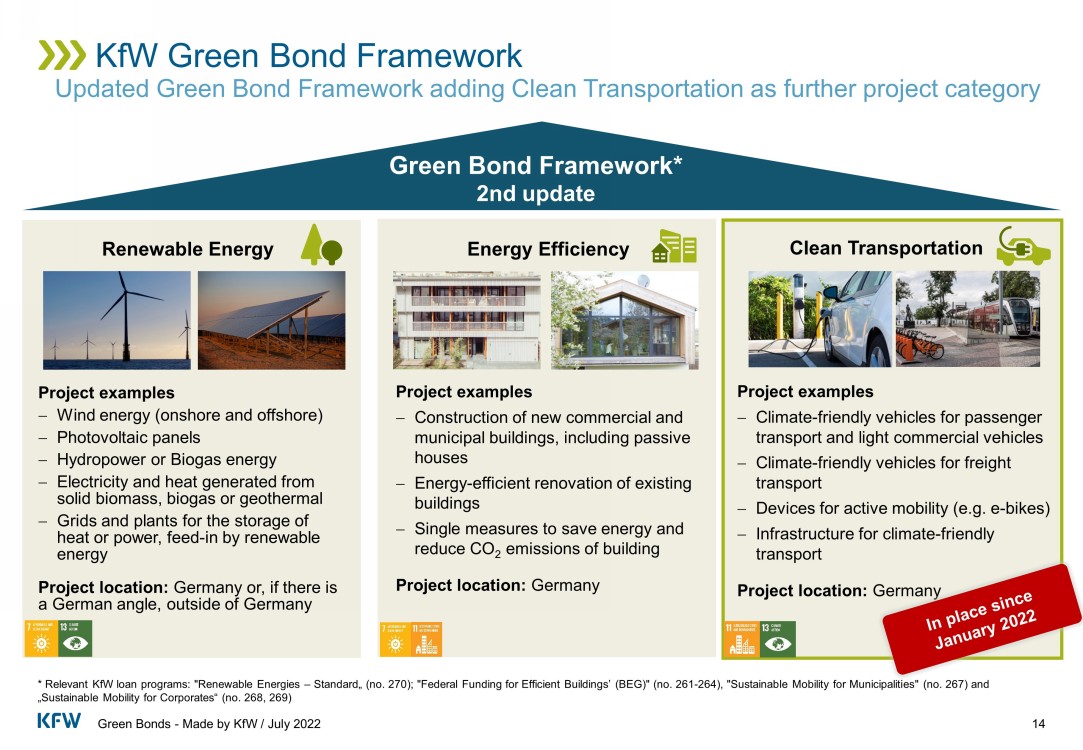

Green Bonds - Made by KfW / July 2022 14 Updated Green Bond Framework adding Clean Transportation as further project category KfW Green Bond Framework Renewable Energy Energy Efficiency Green Bond Framework* 2nd update Clean Transportation * Relevant KfW loan programs : " Renewable Energies – Standard„ ( no . 270) ; "Federal Funding for Efficient Buildings’ (BEG)" (no. 261 - 264), "Sustainable Mobility for Municipalities" (no. 267) and „Sustainable Mobility for Corporates“ (no. 268, 269) Project examples Wind energy (onshore and offshore) Photovoltaic panels Hydropower or Biogas energy Electricity and heat generated from solid biomass, biogas or geothermal Grids and plants for the storage of heat or power, feed - in by renewable energy Project location : Germany or, if there is a German angle, outside of Germany Project examples Construction of new commercial and municipal buildings, including passive houses Energy - efficient renovation of existing buildings Single measures to save energy and reduce CO 2 emissions of building Project location : Germany Project examples Climate - friendly vehicles for passenger transport and light commercial vehicles Climate - friendly vehicles for freight transport Devices for active mobility (e.g. e - bikes) Infrastructure for climate - friendly transport Project location : Germany

Green Bonds - Made by KfW / July 2022 15 External analysis by renowned research institution Independent expert opinion by CICERO Shades of Green Dark green : Allocated to projects and solutions that correspond to the long - term vision of a low carbon and climate resilient future Medium green : Allocated to projects and solutions that represent steps towards the long - term vision but are not quite there yet . Light green : Allocated to projects and solutions that are climate friendly but do not represent or contribute to the long - term vision . 1 Environmental Finance Bond Awards 2020 Second Party Opinion CICERO Shades of Green (Center for Int‘l Climate and Environmental Research Oslo/ Norway ) is an experienced , research center recognized as „ best external assessment provider“. 1 In line with ICMA GBP (June 2021) Shades of Green: medium green Governance : excellent Framework 2022: Renewable Energy, Energy Efficiency & Clean Transportation In line with ICMA GBP (June 2018) Shades of Green: medium green Governance : excellent Framework 2019: Renewable Energy & Energy Efficiency Shades of Green: dark green Governance : excellent Framework 2014: Renewable Energy

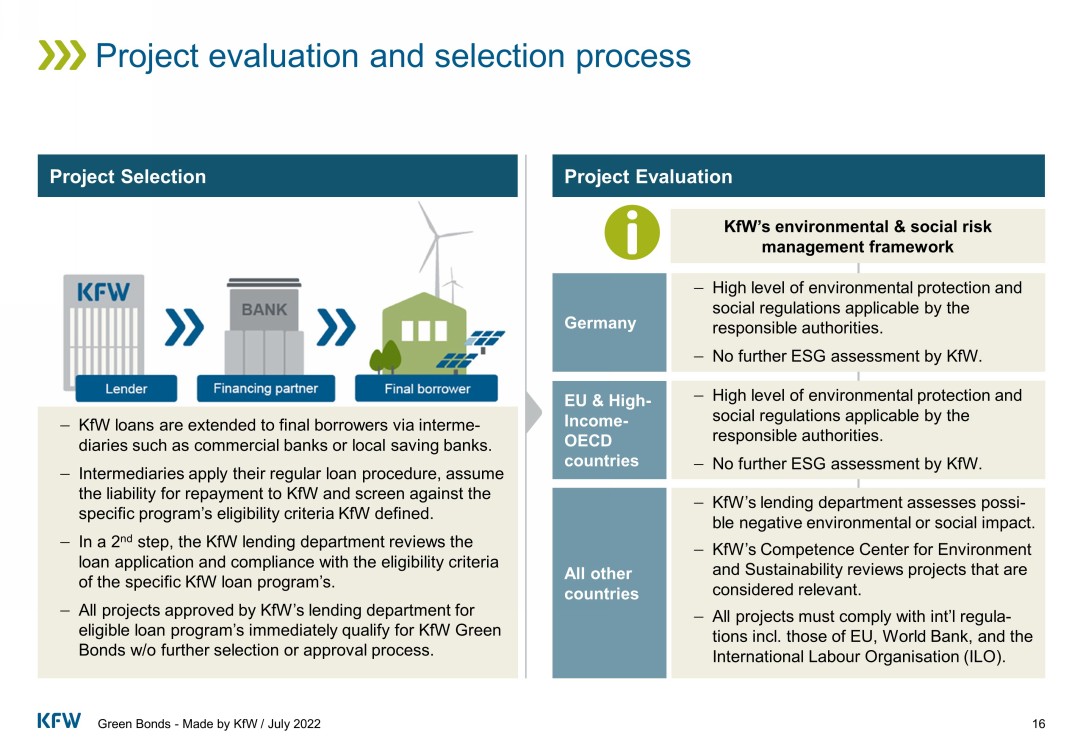

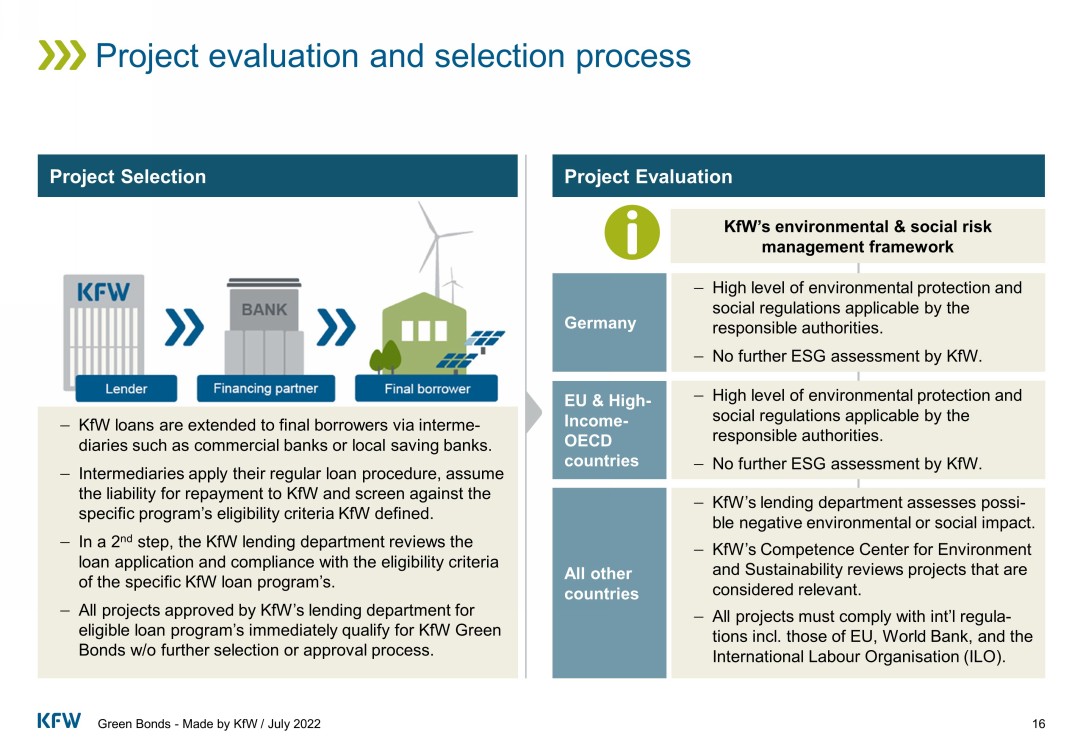

16 KfW loans are extended to final borrowers via interme - diaries such as commercial banks or local saving banks. Intermediaries apply their regular loan procedure, assume the liability for repayment to KfW and screen against the specific program’s eligibility criteria KfW defined. In a 2 nd step, the KfW lending department reviews the loan application and compliance with the eligibility criteria of the specific KfW loan program’s. All projects approved by KfW’s lending department for eligible loan program’s immediately qualify for KfW Green Bonds w/o further selection or approval process. Project evaluation and selection process Project Selection KfW’s environmental & social risk management framework Project Evaluation High level of environmental protection and social regulations applicable by the responsible authorities. No further ESG assessment by KfW. Germany High level of environmental protection and social regulations applicable by the responsible authorities. No further ESG assessment by KfW. EU & High - Income - OECD countries KfW ’ s lending department assesses possi - ble negative environmental or social impact . KfW ’ s Competence Center for Environment and Sustainability reviews projects that are considered relevant. All projects must comply with int ’ l regula - tions incl. those of EU, World Bank, and the International Labour Organisation (ILO). All other countries Green Bonds - Made by KfW / July 2022

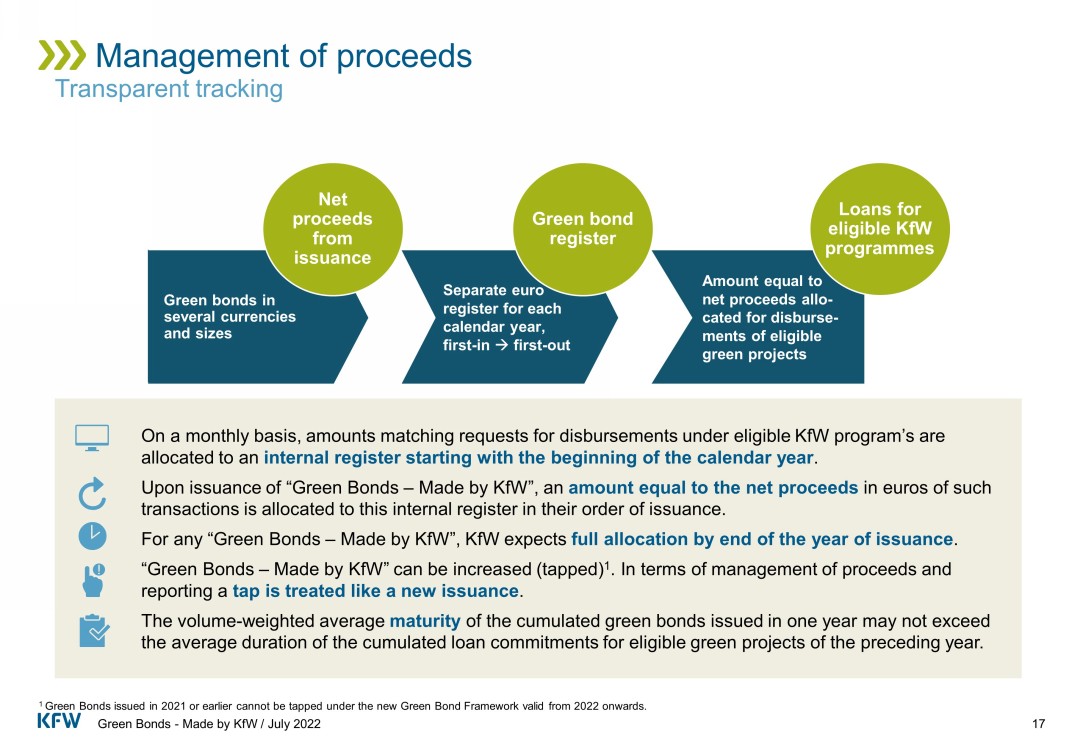

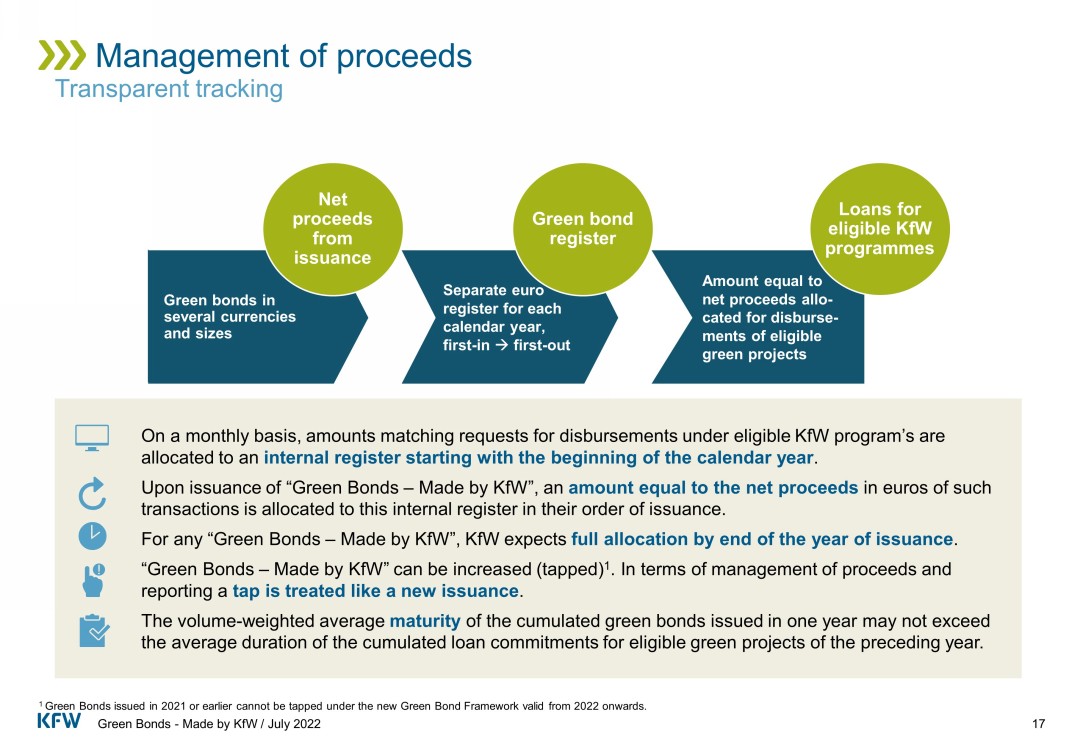

On a monthly basis, amounts matching requests for disbursements under eligible KfW program’s are allocated to an internal register starting with the beginning of the calendar year . Upon issuance of “Green Bonds – Made by KfW”, an amount equal to the net proceeds in euros of such transactions is allocated to this internal register in their order of issuance. For any “Green Bonds – Made by KfW”, KfW expects full allocation by end of the year of issuance . “Green Bonds – Made by KfW” can be increased (tapped) 1 . In terms of management of proceeds and reporting a tap is treated like a new issuance . The volume - weighted average maturity of the cumulated green bonds issued in one year may not exceed the average duration of the cumulated loan commitments for eligible green projects of the preceding year. Management of proceeds Transparent tracking 17 Separate euro register for each calendar year , first - in first - out Amount equal to net proceeds allo - cated for disburse - ments of eligible green projects Green bond register Green bonds in several currencies and sizes Net proceeds from issuance Loans for eligible KfW programmes Green Bonds - Made by KfW / July 2022 1 Green Bonds issued in 2021 or earlier cannot be tapped under the new Green Bond Framework valid from 2022 onwards .

18 Allocation Report Annual report until full allocation of an amount equal to net proceeds. Shows allocated and unallocated proceeds , if applicable. Shows breakdown by eligible category and country of the cumulated requests for disbursement of one calendar year. This non - dynamic set of projects is linked to the cumulated net proceeds of all green bonds issued in the same calendar year, therefore, all fully allocated “Green Bonds – Made by KfW” issued in one calendar year show the same breakdown by category/country . Prepared on a cumulated basis showing aggregated data . Impact Report One - off report once the relevant loan program’s have been evaluated for an entire calendar year. Shows the estimated social and environmental ex - ante impact in accordance with the Harmonized Framework for Impact Reporting. Core indicators are : GHG emissions reduced/avoided, renewable energy generation, capacity of renewable energy added, energy savings Prepared on a cumulated basis showing aggregated data for each calendar year as well as the key underlying methodology and assumptions to the estimations . The non - dynamic set of projects is linked to the cumulated net proceeds of all green bonds issued in the same calendar year, therefore, all “Green Bonds – Made by KfW” issued in one calendar year show the same impact per unit financed . High level of transparency to build up trustful relationship with investors Allocation and impact reporting on Green bonds KfW aims to create transparency and trust in the effectiveness of its “Green Bonds – Made by KfW” by means of a regular reporting. Two separate reports provide information about the allocation and impact .. Green Bonds - Made by KfW / July 2022

Green Bonds – Made by KfW Track record and highlight transactions 19 Green Bonds - Made by KfW / July 2022

Green Bonds - Made by KfW / July 2022 Highlights of KfW’s footprint in the green bond market Green Bonds – Made by KfW High Quality Aligned with GB Principles & Harmonized Framework for Impact Reporting, SPO from CICERO Shades of Green Among Market Leaders Over €50bn of “ Green Bonds – Made by KfW ” since 2014 make KfW one of the largest issuers globally. Liquidity Large sizes in benchmark maturities make KfW green bonds among the most liquid green bonds in the market. Thought Leader As member of the Exec. Committee of the ICMA Green Bond Principles, KfW is highly committed to foster green bond market standards. Variety KfW Green Bonds are avail - able in various currencies - in benchmark size and non - vanilla, tailor - made MTNs. Eligible project categories • Energy efficiency • Renewable energies • Clean transportation Global Engagement Engaging in and supporting of int’l and national initiatives to promote sustainability in capital markets (e.g. PRI, TCFD, EU TechExpert - Group). Green Bond Investor Since 2015 runs a dedicated green bond investment portfolio of €2 - 2.5bn mandated by the Federal Ministry of Environment. Contribution to SDGs 7: Affordable & Clean Energy, 11: Sustainable Cities & Com - munities, 13: Climate Action. 20 Credibility Top ESG ratings and a strong focus on green finance make KfW one of the most credible issuers of green bonds. Green Indices Eligible for many green indices like “The BofA Merrill Lynch GB Index”, “Barclays MSCI GB Index”, “S&P GB Index”, “ Solactive GB Index”. Invest in the everlasting. Green Bonds – Made by KfW

2014 2015 2016 2017 2018 2019 2020 2021 Jan-Jun 2022 DKK CNY MXN ZAR CAD PLN HUF NOK HKD SEK GBP AUD USD EUR Green Bonds - Made by KfW / July 2022 Overview on issuances and reporting Green Bonds – Made by KfW in EUR billions KfW Green Bonds issued > EUR 50.0bn 3.7 2.8 3.7 1.6 8.1 8.3 Year 2014 2015 2016 2017 2018 2019 2020 2021 2022 Details 2 Green Bonds issued 5 Green Bonds issued 4 Green Bonds issued 7 Green Bonds issued 3 Green Bonds & 1 promissory note loan issued 9 Green Bonds & 1 promissory note loan issued 11 Green Bonds +3 Taps 22 Green Bonds + 15 Taps 6 Green Bonds + 1 Tap Allocation Reporting in 2023 Impact Reporting Available mid - year 2022 in 2024 21 16.2 2.7 3.8

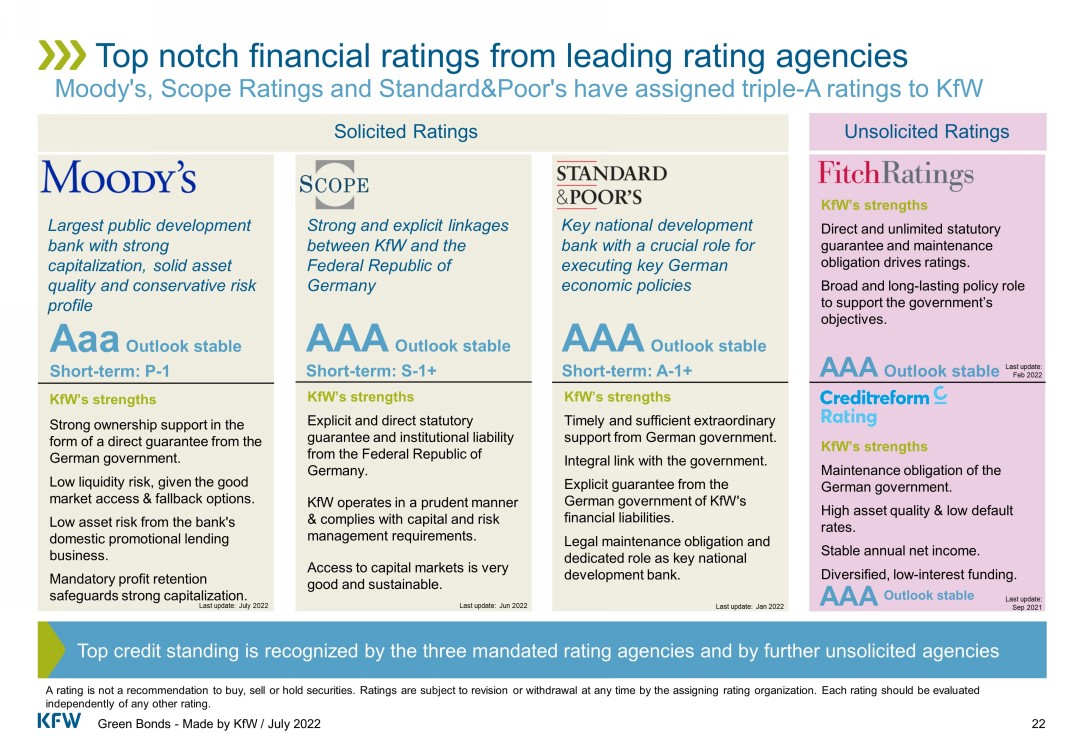

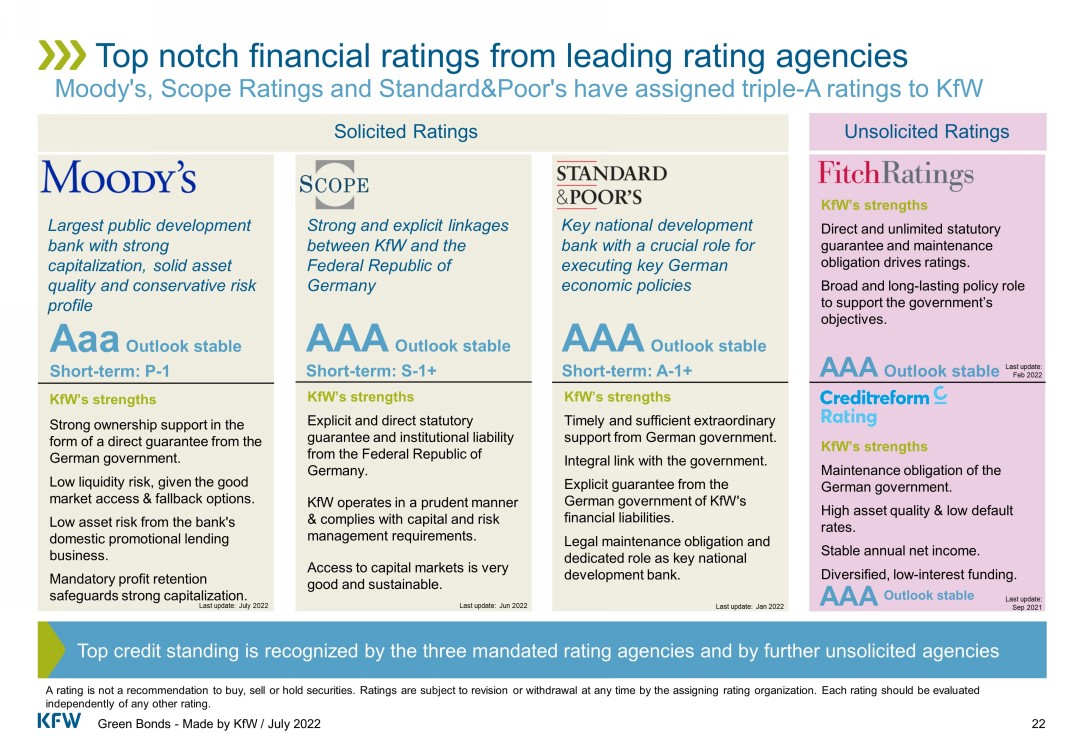

Top notch financial ratings from leading rating agencies Moody's, Scope Ratings and Standard&Poor's have assigned triple - A ratings to KfW KfW ’s strengths Timely and sufficient extraordinary support from German government . Integral link with the government . Explicit guarantee from the German government of KfW's financial liabilities. Legal maintenance obligation and dedicated role as key national development bank. KfW ’s strengths Direct and unlimited statutory guarantee and maintenance obligation drives ratings . Broad and long - lasting policy role to support the government’s objectives . KfW ’s strengths Maintenance obligation of the German government . High asset quality & low default rates . Stable annual net income . Diversified , low - interest funding . KfW ’s strengths Strong ownership support in the form of a direct guarantee from the German government. Low liquidity risk, given the good market access & fallback options. Low asset risk from the bank's domestic promotional lending business. Mandatory profit retention safeguards strong capitalization. Largest public development bank with strong capitalization, solid asset quality and conservative risk profile Top credit standing is recognized by the three mandated rating agencies and by further unsolicited agencies KfW ’s s trengths Explicit and direct statutory guarantee and institutional liability from the Federal Republic of Germany. KfW operates in a prudent manner & complies with capital and risk management requirements. Access to capital markets is very good and sustainable. Key national development bank with a crucial role for executing key German economic policies Last update: Jun 2022 Last update: Jan 2022 Last update: July 2022 Aaa Outlook stable Short - term: P - 1 AAA Outlook stable Last update: Feb 2022 AAA Outlook stable AAA Outlook stable Short - term: A - 1+ Strong and explicit linkages between KfW and the Federal Republic of Germany AAA Outlook stable Short - term: S - 1+ Last update: Sep 2021 Solicited Ratings Unsolicited Ratings Green Bonds - Made by KfW / July 2022 A rating is not a recommendation to buy, sell or hold securities. Ratings are subject to revision or withdrawal at any time by the assigning rating organization. Each rating should be evaluated independently of any other rating. 22

Top ESG ratings 1 confirm KfW’s holistic sustainability approach Renowned international rating agencies assign KfW to be among top - performers in ESG Green Bonds - Made by KfW / July 2022 KfW ’s strengths KfW received a rating of B - (on a scale of A+ to D - ) in the ISS ESG Corporate Rating. Prime standard within its peer group . KfW is among the best - rated institutions in its peer group Prime KfW has set a strategic objective of achieving top sustainability rankings among its peers . A+ D - B - Leader Industry KfW ’s s trengths KfW received a rating of AAA (on a scale of AAA to CCC) in the MSCI ESG Ratings assessment. While KfW’s Industry - Adjusted Score is at 9.3 out of 10, its Weighted - Average Key Issue Score is at 7.7 out of 10 (industry average: 5.5). KfW’s rating is at the highest level possible AAA 10 Last update: Mar 23, 2021 Last update: July 19, 2021 0 9.3 1_A rating is not a recommendation to buy, sell or hold securities. Ratings are subject to revision or withdrawal at any time by the assigning rating organization. Each rating should be evaluated independently of any other rating. 23 KfW ’s s trengths KfW received an ESG overall score of 60 which equals the performance level “advanced”. KfW’s ESG score belongs to the top 5% worldwide Last update: September 2021 100 0 60 Industry Advanced 55 2_ MSCI Disclaimer

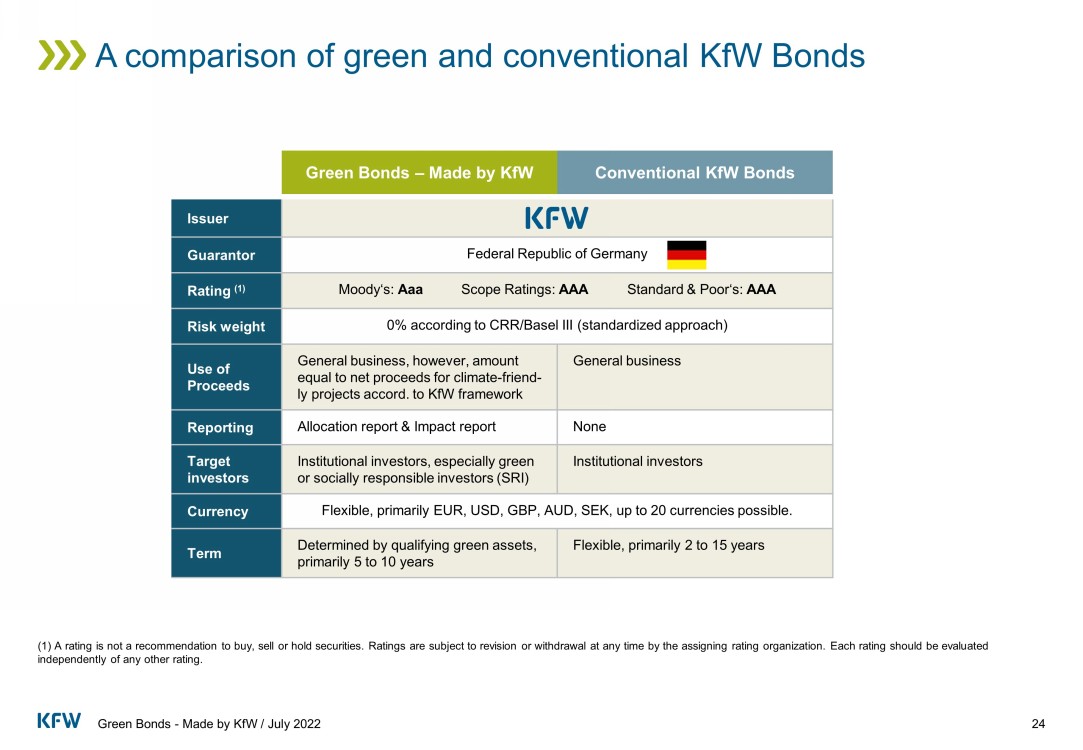

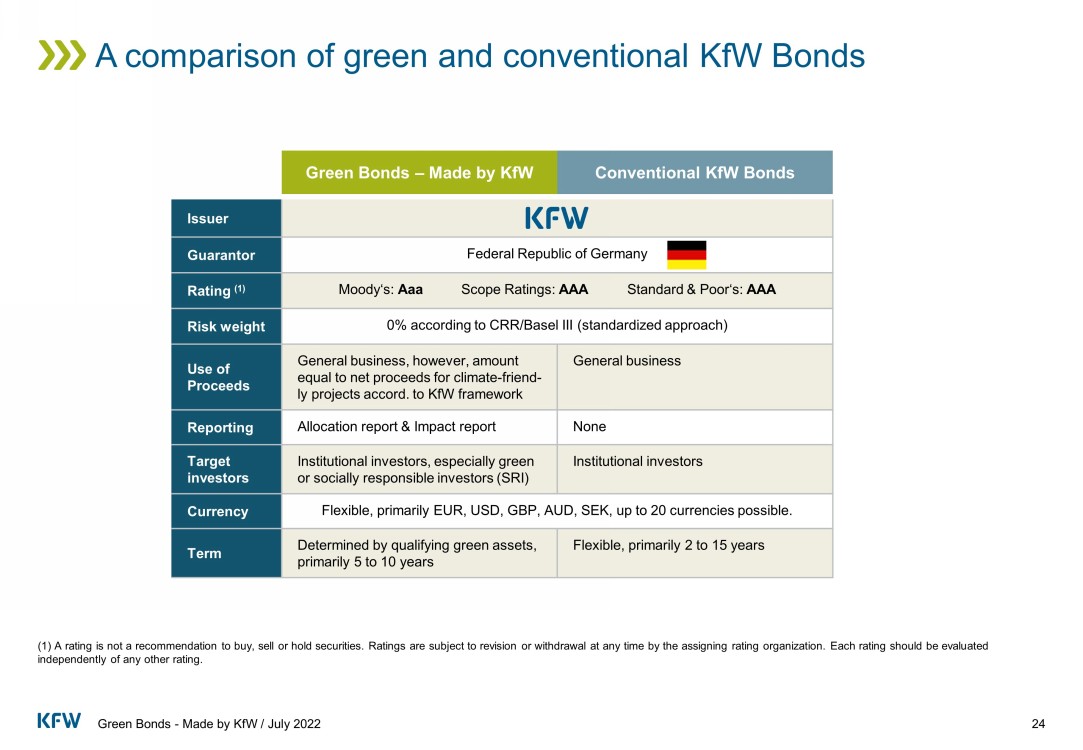

24 (1) A rating is not a recommendation to buy, sell or hold securities. Ratings are subject to revision or withdrawal at any ti me by the assigning rating organization. Each rating should be evaluated independently of any other rating. A comparison of green and conventional KfW Bonds Issuer Guarantor Federal Republic of Germany Rating (1) Moody‘s : Aaa Scope Ratings: AAA Standard & Poor‘s : AAA Risk weight 0% according to CRR/Basel III ( standardized approach ) Use of Proceeds General business, however, amount equal to net proceeds for climate - friend - ly projects accord. to K fW framework General business Reporting Allocation report & Impact report None Target investors Institutional investors, especially green or socially responsible investors (SRI ) Institutional investors Currency Flexible, primarily EUR, USD, GBP, AUD, SEK, up to 20 currencies possible . Term Determined by qualifying green assets, primarily 5 to 10 years Flexible, primarily 2 to 15 years Green Bonds – Made by KfW Conventional KfW Bonds Green Bonds - Made by KfW / July 2022

KfW in the debt capital markets KfW as an issuer of bonds and notes 25 Green Bonds - Made by KfW / July 2022

Basis of KfW’s funding Explicit and direct guarantee from the Federal Republic of Germany Defined by law Guarantee established in 1998 Direct , explicit and unconditional § 1a of the Law concerning KfW: The Federal Republic guarantees all obligations of KfW in respect of loans extended to and debt securities issued by KfW, fixed forward transactions or options entered into by KfW and other credits extended to KfW as well as credits extended to third parties inasmuch as they are expressly guaranteed by KfW. 26 Green Bonds - Made by KfW / July 2022

Tailor - made Placements Customized products for investor needs Flexible in currency , structure and maturity Format: EMTN , US - MTN , NSV , SSD Green Bonds – Made by KfW Liquid green bonds , diversified SRI investor base Focus: € and $ Regular offerings and taps Private placements possible Format: EMTN , Global, Kangaroo , US - MTN KfW Benchmark Programmes Large and highly liquid bonds , highly diversified investor base Regular offerings and taps Size: 3 – 5bn (7bn incl. taps, euro only ) €: 3, 5, 7, 10 and 15y $: 3, 5 and 10y Format: EMTN , Global Additional Public Bonds Large and liquid bonds , diversified investor base Tenors from 1 to 30y Liquid curves and strategic approach in ₤ and A$ Regular offerings and taps Format: EMTN , Global, Kangaroo , Kauri Wide selection of products addressing investor needs € $ € $ ₤ A$ NZ $ C$ SEK NOK € $ ¥ HK$ CN¥ ZAR … Green Bonds - Made by KfW / July 2022 27 € $ ₤ A$ NOK SEK HK$... € 56 .6bn Jan – Jun 20 22

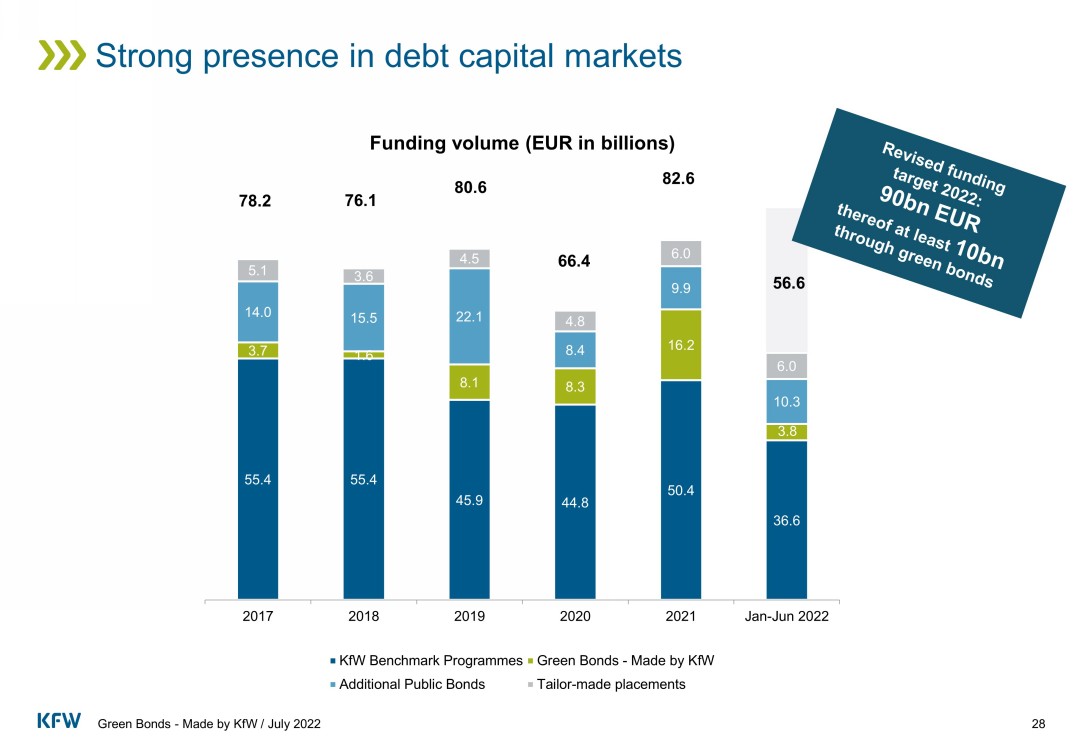

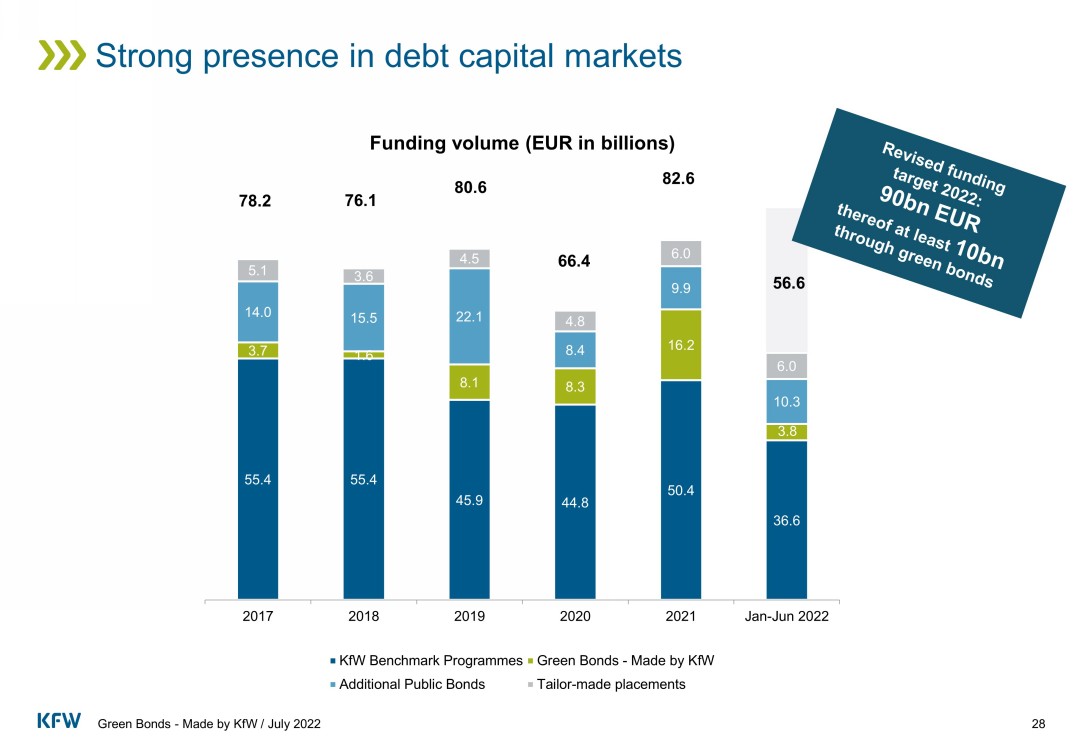

55.4 55.4 45.9 44.8 50.4 36.6 3.7 1.6 8.1 8.3 16.2 3.8 14.0 15.5 22.1 8.4 9.9 10.3 5.1 3.6 4.5 4.8 6.0 6.0 2017 2018 2019 2020 2021 Jan-Jun 2022 Funding volume (EUR in billions) KfW Benchmark Programmes Green Bonds - Made by KfW Additional Public Bonds Tailor-made placements Green Bonds - Made by KfW / July 2022 28 78.2 76.1 80.6 66.4 Strong presence in debt capital markets 82.6 56.6

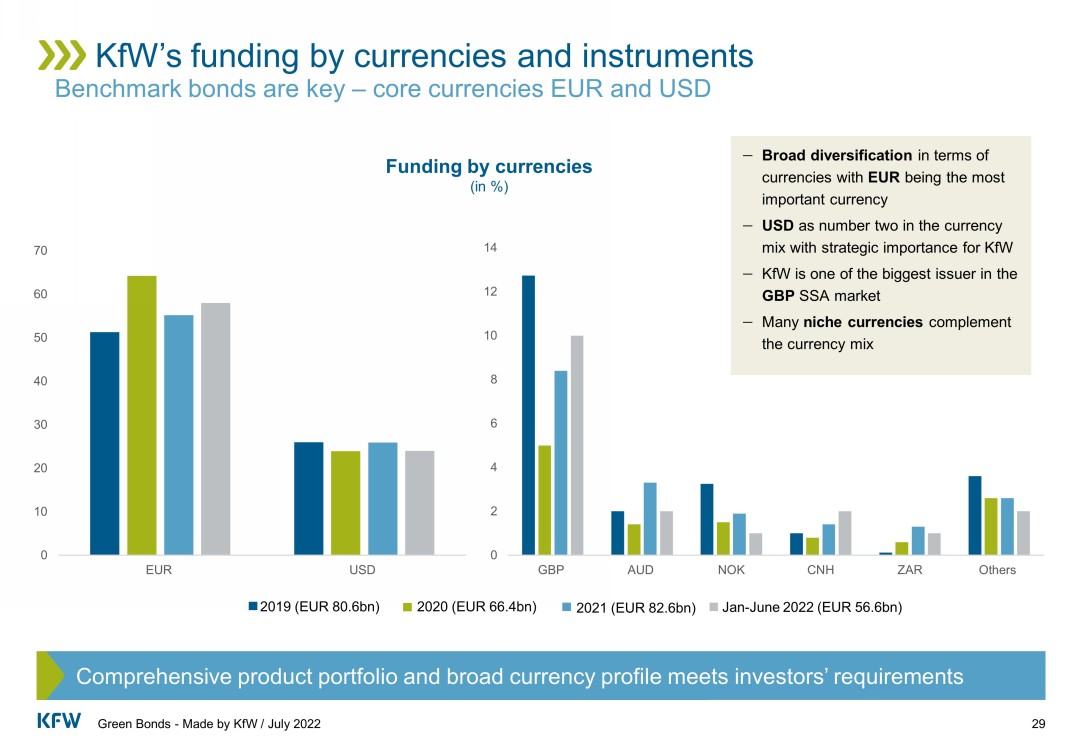

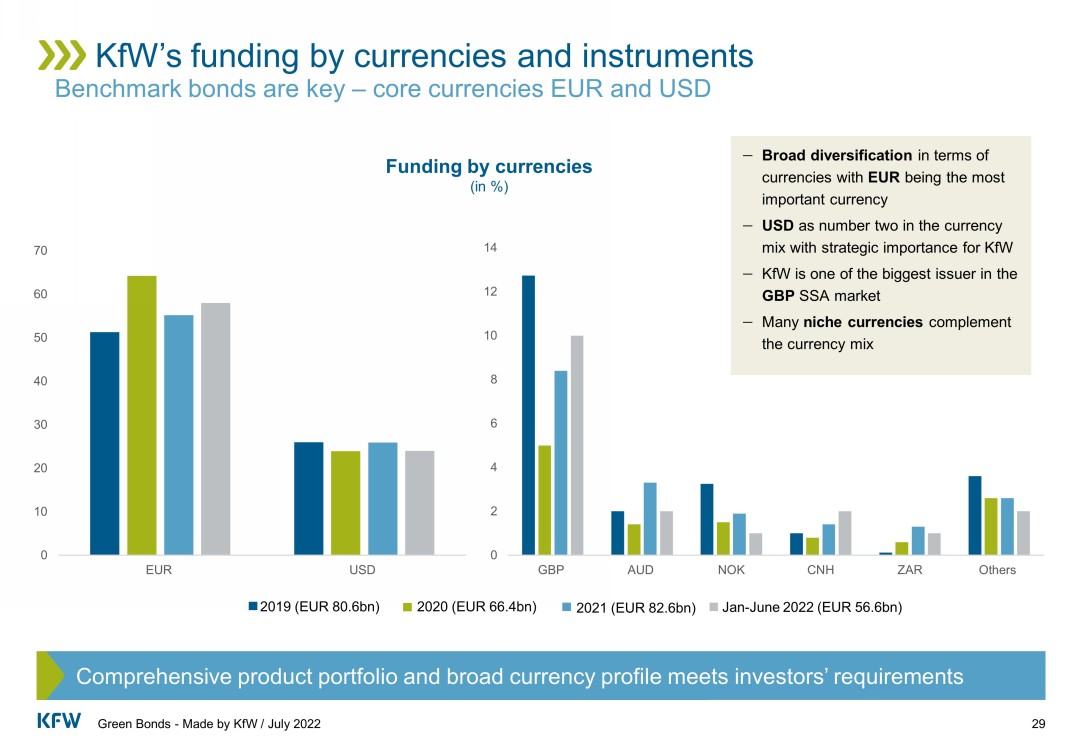

Benchmark bonds are key – core currencies EUR and USD KfW’s funding by currencies and instruments 2020 (EUR 66.4 bn ) Jan - June 2022 ( EUR 56.6 bn ) 2019 (EUR 80.6 bn ) 2021 (EUR 82.6bn) Green Bonds - Made by KfW / July 2022 29 Comprehensive product portfolio and broad currency profile meets investors’ requirements Broad diversification in terms of currencies with EUR being the most important currency USD as number two in the currency mix with strategic importance for KfW KfW is one of the biggest issuer in the GBP SSA market Many niche currencies complement the currency mix Funding by currencies (in %) 0 10 20 30 40 50 60 70 EUR USD 0 2 4 6 8 10 12 14 GBP AUD NOK CNH ZAR Others

Outlook 2022 Total funding volume expected in a range of EUR 90 bn in 2022 At least EUR 10bn funding by Green Bonds – depending on the demand for green loan programmes Continued wide range of bond formats and currencies planned for 2022 Vast majority of funding coming from EUR & USD benchmark bonds with initial volumes of EUR 3 to 5bn, tap of selected outstanding EUR benchmark bonds up to a volume of EUR 7bn planned Green Bonds - Made by KfW / July 2022 30 Outlook on funding year 2022

Green Bonds - Made by KfW / July 2022 31 Photo credits / references Title slide/Slide 30 full - page image: gettyImages , plainpicture / Piotr Krzeslak , Cultura Slide 4 Picture 1: KfW Photo Archive / Rüdiger Nehmzow P icture 2: KfW Photo Archive / Angelika Kohlmeier P icture 3: KfW Photo Archive / - P icture 4: DEG / Andreas Huppertz Slide 6 Picture 1: KfW - Photo Archive / photothek.net P icture 2: KfW - Photo Archive / Jürgen Lösel P icture 3: KfW - Photo Archive / Frank Blümler P icture 4: KfW Photo Archive / photothek.net P icture 5: KfW Bankengruppe / Jens Steingässer P icture 6: KfW - Photo Archive / Charlie Fawell Slide 14 Picture 1: KfW - Photo Archive / Charlie Fawell Picture 2: KfW - Photo Archive / Jonas Wresch Picture 3: KfW - Photo Archive / Claus Morgenstern Picture 4: KfW - Photo Archive / Claus Morgenstern Picture 5: iStock.com / Michael Flippo Picture 6: KfW - Photo Archive / Evgeny Makarov /Agentur Focus Slide 26 Deutscher Bundestag / Lichtblick / Achim Melde Disclaimer, slide 23: The use by KfW of any MSCI ESG Research LLC or its affiliates (”MSCI”) data, and the use of MSCI logos, trademarks, service marks or index names herein, do not constitute a sponsorship, endorsement, recommendation, or promotion of KfW by MSCI. MSCI services and data are the property of MSCI or its information providers, and are provided ‘as - is’ and without warranty. MSCI names and logos are trademarks or service marks of MSCI.

Green Bonds - Made by KfW / July 2022 Contacts Treasurer of KfW: Ext. Tim Armbruster - 5599 Treasury: Markus Schmidtchen - 4783 Capital Markets: Petra Wehlert - 4650 Sven Wabbels - 4148 Alexander Liebethal - 4656 Investor Relations: Jürgen Köstner - 3536 Vanessa Wiese - 7995 Andrea Nickolaizig - 68402 KfW Palmengartenstrasse 5 – 9 60325 Frankfurt am Main Germany Phone +49 69 7431 - Ext. Fax +49 69 7431 - 3986 investor.relations@kfw.de Bloomberg: KfW <GO> www.kfw.de/investor - relations 32

Disclaimer

Disclaimer Green Bonds - Made by KfW / July 2022

Green Bonds - Made by KfW / July 2022