SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 18-K/A

For Foreign Governments and Political Subdivisions Thereof

AMENDMENT NO. 5

to

ANNUAL REPORT

of

KfW

(Name of Registrant)

Date of end of last fiscal year: December 31, 2010

SECURITIES REGISTERED

(As of the close of the fiscal year)*

| | | | |

| TITLE OF ISSUE | | AMOUNT AS TO WHICH REGISTRATION IS EFFECTIVE | | NAMES OF EXCHANGES ON WHICH REGISTERED |

| N/A | | N/A | | N/A |

| * | The registrant files annual reports on Form 18-K on a voluntary basis. |

Name and address of person authorized to receive notices

and communications from the Securities and Exchange Commission:

KRYSTIAN CZERNIECKI

Sullivan & Cromwell LLP

Neue Mainzer Strasse 52

60311 Frankfurt am Main, Germany

The undersigned registrant hereby amends its Annual Report on Form 18-K for the fiscal year ended December 31, 2010, as subsequently amended, as follows:

| | - | Exhibit (d) is hereby amended by adding the text under the caption “Presentation of Financial and Other Information” on page 1 hereof to the “Presentation of Financial and Other Information” section; |

| | - | Exhibit (d) is hereby amended by adding the text under the caption “Exchange Rate Information” on page 1 hereof to the “Exchange Rate Information” section; |

| | - | Exhibit (d) is hereby amended by replacing the text in the “Recent Developments—The Federal Republic of Germany—Overview of Key Economic Figures” section with the text under the caption “Recent Developments—The Federal Republic of Germany—Overview of Key Economic Figures” on pages 2-4 hereof; |

| | - | Exhibit (d) is hereby amended by adding the section “Recent Developments—The Federal Republic of Germany—Public Finance” on pages 4-5 hereof to the “Recent Developments—The Federal Republic of Germany” section; |

| | - | Exhibit (d) is hereby amended by adding the text under the caption “Recent Developments—The Federal Republic of Germany—Other Recent Developments” on pages 5-6 hereof to the “Recent Developments—The Federal Republic of Germany—Other Recent Developments” section; |

| | - | Exhibit (d) is hereby amended by replacing the text under the caption “KfW” with the text on pages 7 to 166 hereof; and |

| | - | Exhibit (e) is hereby replaced by Exhibit (e) attached hereto. |

This report is intended to be incorporated by reference into KfW’s prospectus dated May 20, 2011 and any future prospectus filed by KfW with the Securities and Exchange Commission to the extent such prospectus states that it incorporates by reference this report.

TABLE OF CONTENTS

ii

iii

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

On March 28, 2012, the euro foreign exchange reference rate as published by the European Central Bank was EUR 1.00 = U.S. dollar 1.3337 (EUR 0.7498 per U.S. dollar).

EXCHANGE RATE INFORMATION

We file reports with the Securities and Exchange Commission giving financial and economic data expressed in euro.

The following table shows the high and low noon buying rates for euro, expressed as U.S. dollars per EUR 1.00, for each month from January 2012 through March 23, 2012, as published on a weekly basis by the Federal Reserve Bank of New York.

| | | | |

| | | High | | Low |

January 2012 | | 1.3192 | | 1.2682 |

February 2012 | | 1.3463 | | 1.3087 |

March 2012 (through March 23, 2012) | | 1.3320 | | 1.3025 |

No representation is made that the euro or U.S. dollar amounts referred to herein or referred to in the documents which incorporate this information by reference could have been or could be converted into U.S. dollars or euro, as the case may be, at any particular rate.

1

RECENT DEVELOPMENTS

THE FEDERAL REPUBLIC OF GERMANY

Overview of Key Economic Figures

The following economic information regarding the Federal Republic is derived from the public official documents cited below. Certain of the information is preliminary.

Gross Domestic Product (GDP)

GROSS DOMESTIC PRODUCT

(adjusted for price, seasonal and calendar effects)

| | | | | | | | | | | | | | | | | | |

Reference period | | Percentage change on

previous quarter | | Percentage change on the same quarter in

previous year |

4th quarter 2010 | | | | | | | | | | | | | | | | 0.5 | | 3.7 |

1st quarter 2011 | | | | | | | | | | | | | | | | 1.3 | | 4.7 |

2nd quarter 2011 | | | | | | | | | | | | | | | | 0.3 | | 2.9 |

3rd quarter 2011 | | | | | | | | | | | | | | | | 0.6 | | 2.7 |

4th quarter 2011 | | | | | | | | | | | | | | | | -0.2 | | 2.0 |

At year-end 2011, the German economy suffered a slight setback as GDP in the fourth quarter of 2011 shrank compared to the third quarter of 2011. The result for the full-year 2011 remained unchanged, however, with price adjusted GDP increasing by 3.0% compared to 2010 (price and calendar adjusted: +3.1%).

Compared to the third quarter of 2011, the main factor which contributed positively to economic growth in the fourth quarter of 2011 was capital formation. In particular, capital formation in construction in the fourth quarter of 2011 increased (+1.9%) compared to the third quarter of 2011. Capital formation in machinery and equipment in the fourth quarter of 2011 remained at the same level as in the third quarter of 2011. Private final consumption expenditure declined slightly (-0.2%) in the fourth quarter of 2011 compared to the third quarter of 2011, while general government final consumption expenditure increased marginally (+0.1%). Overall, domestic uses had a slightly positive effect on GDP (contribution to growth: +0.1 percentage points) in the fourth quarter of 2011 compared to the third quarter of 2011. Foreign trade had a negative impact on German economic development in the fourth quarter of 2011: exports of goods and services declined by 0.8% compared to the third quarter of 2011. Because imports declined by 0.3% in the fourth quarter of 2011 compared to the third quarter of 2011 and thus declined less than exports, the balance of exports and imports contributed negatively (-0.3 percentage points) to GDP growth in the period under review.

In a year-on-year comparison, GDP in the fourth quarter of 2011 increased compared to the fourth quarter of 2010.

Source: Statistisches Bundesamt, Ausführliche Ergebnisse zur Wirtschaftsleistung im 4. Quartal 2011, press release of February 24, 2012

(https://www.destatis.de/DE/PresseService/Presse/Pressemitteilungen/2012/02/PD12_063_811.html).

Inflation Rate

INFLATION RATE

(based on overall consumer price index)

| | | | | | | | | | | | | | | | | | |

Reference period | | Percentage change on

previous month | | Percentage change on the same month in

previous year |

February 2011 | | | | | | | | | | | | | | | | 0.5 | | 2.1 |

March 2011 | | | | | | | | | | | | | | | | 0.5 | | 2.1 |

April 2011 | | | | | | | | | | | | | | | | 0.2 | | 2.4 |

May 2011 | | | | | | | | | | | | | | | | 0.0 | | 2.3 |

June 2011 | | | | | | | | | | | | | | | | 0.1 | | 2.3 |

July 2011 | | | | | | | | | | | | | | | | 0.4 | | 2.4 |

August 2011 | | | | | | | | | | | | | | | | 0.0 | | 2.4 |

September 2011 | | | | | | | | | | | | | | | | 0.1 | | 2.6 |

October 2011 | | | | | | | | | | | | | | | | 0.0 | | 2.5 |

November 2011 | | | | | | | | | | | | | | | | 0.0 | | 2.4 |

December 2011 | | | | | | | | | | | | | | | | 0.7 | | 2.1 |

January 2012 | | | | | | | | | | | | | | | | -0.4 | | 2.1 |

February 2012 | | | | | | | | | | | | | | | | 0.7 | | 2.3 |

2

Consumer prices in Germany were 2.3% higher in February 2012 compared to February 2011, with the inflation rate increasing after having remained at 2.1% in the previous two months.

The inflation rate in February 2012 was again driven by price increases in energy (+8.0% compared to February 2011). The monthly energy price increases have continuously exceeded the overall consumer price increases since March 2010. In February 2012, prices for household energy increased by 7.6% compared to the same month in 2011. Motor fuels were 8.9% more expensive in February 2012 compared to February 2011. Excluding energy prices, the inflation rate would have been only +1.6% in February 2012 compared to February 2011. Prices for food increased by 2.7% in February 2012 compared to February 2011. Prices for goods overall increased above average by 3.4% in February 2012 compared to February 2011, while prices for services increased below average by 1.2% compared to a year earlier.

Compared to January 2012, the consumer price index in February 2012 increased significantly, mainly due to seasonal price increases especially for vegetables, cut flowers, clothing, package holidays and accommodation services.

Source: Statistisches Bundesamt, Verbraucherpreise Februar 2012: + 2,3 % gegenüber Februar 2011, press release of March 9, 2012 (https://www.destatis.de/DE/PresseService/Presse/Pressemitteilungen/2012/03/PD12_085_611.html).

Unemployment Rate

UNEMPLOYMENT RATE

(percent of unemployed persons in the total labor force according to the

International Labour Organization (ILO) definition) (1)

| | | | | | | | | | | | | | | | | | | | | | |

Reference period | | Original percentages | | Adjusted percentages (2) |

January 2011 | | | | | | | | | | | | | | | | | | | | 6.9 | | 6.5 |

February 2011 | | | | | | | | | | | | | | | | | | | | 6.6 | | 6.3 |

March 2011 | | | | | | | | | | | | | | | | | | | | 6.5 | | 6.2 |

April 2011 | | | | | | | | | | | | | | | | | | | | 5.9 | | 6.1 |

May 2011 | | | | | | | | | | | | | | | | | | | | 5.8 | | 6.0 |

June 2011 | | | | | | | | | | | | | | | | | | | | 6.0 | | 5.9 |

July 2011 | | | | | | | | | | | | | | | | | | | | 6.1 | | 5.9 |

August 2011 | | | | | | | | | | | | | | | | | | | | 6.0 | | 5.8 |

September 2011 | | | | | | | | | | | | | | | | | | | | 5.3 | | 5.8 |

October 2011 | | | | | | | | | | | | | | | | | | | | 5.2 | | 5.7 |

November 2011 | | | | | | | | | | | | | | | | | | | | 5.5 | | 5.7 |

December 2011 | | | | | | | | | | | | | | | | | | | | 5.5 | | 5.7 |

January 2012 | | | | | | | | | | | | | | | | | | | | 6.3 | | 5.7 |

February 2012 | | | | | | | | | | | | | | | | | | | | 5.9 | | 5.7 |

| (1) | The time series on unemployment are based on the German Labour Force Survey (“LFS”) as from October 30, 2007 as the source of information for, among other things, the monthly ILO unemployment data. With the release of data for March 2011, the Statistical Office of the EU Communities and the Federal Statistical Office partly modified the previous, provisional method of calculating harmonized monthly unemployment figures, which had been in place since October 2007. The modified method continues to be based on the LFS and leads to marginal revisions of the unemployment series as published through February 2011. The changes concern some of the source data used for the denominator of the unemployment rate and the estimation method to adjust for seasonal variations. The employment data used in the denominator are now taken from the same source as the unemployment data, the LFS (in the past, employment figures were taken from the employment accounts as part of national accounting). This improves international harmonization as well as the internal consistency of the rate. Due to this change, the unemployment rate for Germany increased by about 0.2 percentage points. The general development was not affected, however. The use of auxiliary information derived from the German unemployment register for purposes of making seasonal adjustments has been discontinued. Because a number of methodological issues remain to be addressed before fully-fledged seasonal adjustments can be made to the LFS-based series, LFS-based trend estimations (trend cycle component) will temporarily be published in lieu of seasonally adjusted series. |

| (2) | Adjusted for seasonal and irregular effects (trend cycle component). |

The number of employed persons increased by approximately 550,000 persons, or 1.4%, in February 2012 compared to February 2011. Compared to January 2012, the number of employed persons in February 2012 increased by approximately 41,000, or 0.1%, after elimination of seasonal variations.

The number of unemployed persons in February 2012 decreased by approximately 270,000, or 9.2%, compared to February 2011. When adjusted for seasonal and irregular effects (trend cycle component), the number of unemployed persons in February 2012 increased by 20,000, or 0.8%, compared to January 2012.

Sources: Statistisches Bundesamt, February 2012: Weiterer Anstieg der Zahl der Erwerbstätigen, press release of March 29, 2012 (https://www.destatis.de/DE/PresseService/Presse/Pressemitteilungen/2012/03/PD12_115_132.html);

Statistisches Bundesamt, Genesis-Online Datenbank, Tabelle 13231-0003, Erwerbslosenquote: Deutschland, Monate, Geschlecht, Altersgruppen, Original- und bereinigte Daten

(https://www-genesis.destatis.de/genesis/online/data;jsessionid=A90AACB738748E7846B0AEA895D2AC1E.tomcat_GO_1_1?operation=abruftabelleBearbeiten&levelindex=2&levelid=1332423247923&auswahloperation=abruftabelleAuspraegungAuswaehlen&auswahlverzeichnis=ordnungsstruktur&auswahlziel=wer auswahlziel=werteabruf&selectionname=13231-0003&auswahltext=&werteabruf=Werteabruf).

3

Current Account and Foreign Trade

CURRENT ACCOUNT AND FOREIGN TRADE

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | (balance in EUR billion) (1) |

Item | | January 2012 | | January 2011 |

Foreign trade | | | | | | | | | | | | | | | | 13.1 | | 10.1 |

Services | | | | | | | | | | | | | | | | -2.4 | | 0.2 |

Factor income (net) | | | | | | | | | | | | | | | | 3.9 | | 3.4 |

Current transfers | | | | | | | | | | | | | | | | -4.3 | | -4.0 |

Supplementary trade items | | | | | | | | | | | | | | | | -2.4 | | -1.0 |

| | | | | | | | | | | | | | | | | | |

Current account | | | | | | | | | | | | | | | | 8.0 | | 8.6 |

| | | | | | | | | | | | | | | | | | |

| (1) | Figures may not add up due to rounding. |

Source: Statistisches Bundesamt, Deutsche Ausfuhren im Januar 2012: + 9,3 % zum Januar 2011, press release of March 9, 2012

(https://www.destatis.de/DE/PresseService/Presse/Pressemitteilungen/2012/03/PD12_084_51.html).

Public Finance

Revenues and Expenditures

The following table presents revenues and expenditures in the public sector for 2007 to 2011:

GENERAL GOVERNMENT ACCOUNTS (1)

| | | | | | | | | | | | | | | | | | | | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| | | | |

| | | (EUR in billions) | |

Federal Government, Länder governments and municipalities | | | | | | | | | | | | | | | | | | | | |

Revenue | | | 740.7 | | | | 689.8 | | | | 683.5 | | | | 705.5 | | | | 684.3 | |

of which: Taxes (2) | | | 587.8 | | | | 548.9 | | | | 546.3 | | | | 572.6 | | | | 558.4 | |

Expenditure | | | 781.2 | | | | 798.1 | | | | 744.4 | | | | 714.1 | | | | 689.6 | |

| | | | | | | | | | | | | | | | | | | | |

Balance | | | -40.4 | | | | -108.3 | | | | -60.9 | | | | -8.6 | | | | -5.3 | |

Social security funds | | | | | | | | | | | | | | | | | | | | |

Revenue | | | 525.9 | | | | 515.2 | | | | 491.4 | | | | 485.7 | | | | 476.3 | |

Expenditure | | | 510.8 | | | | 512.9 | | | | 506.6 | | | | 478.5 | | | | 465.5 | |

| | | | | | | | | | | | | | | | | | | | |

Balance | | | 15.1 | | | | 2.3 | | | | -15.2 | | | | 7.2 | | | | 10.8 | |

General Government | | | | | | | | | | | | | | | | | | | | |

Revenue | | | 1,148.2 | | | | 1,079.8 | | | | 1,066.0 | | | | 1,088.2 | | | | 1,062.3 | |

Expenditure | | | 1,173.5 | | | | 1,185.8 | | | | 1,142.1 | | | | 1,089.6 | | | | 1,056.8 | |

| | | | | | | | | | | | | | | | | | | | |

Balance | | | -25.3 | | | | -106.0 | | | | -76.1 | | | | -1.4 | | | | 5.5 | |

| | | | | | | | | | | | | | | | | | | | |

| (1) | Definition according to the national accounts. |

| (2) | Excluding capital taxes and taxes of domestic sectors to EU. |

Source: Statistisches Bundesamt, Fachserie 18, Reihe 1.4 – 2011 (March 2012), Tables 3.4.3.2, 3.4.3.3 and 3.4.3.7.

4

Debt of the Federal Government

The following table summarizes the direct debt of the Federal Government as of December 31, 2011:

SUMMARYOFTHE DIRECT DEBTOFTHE FEDERAL GOVERNMENT

| | | | |

| | | Principal amount

outstanding as of

December 31, 2011 | |

| | | (EUR in millions) | |

Federal Bonds | | | 650,736 | |

Inflation-linked Securities | | | 46,000 | |

Five-year Federal Notes | | | 203,000 | |

Federal Treasury Notes | | | 136,000 | |

Federal Savings Notes | | | 8,208 | |

Treasury Discount Paper | | | 57,830 | |

Federal Treasury Financing Paper | | | 467 | |

German Government Day-Bonds | | | 2,154 | |

Further short term debt (< 1 year) | | | 1,115 | |

Borrowers’ note loans | | | 12,061 | |

of which: | | | | |

– From residents | | | 11,844 | |

– From non-residents | | | 217 | |

Old debt (1) | | | 4,417 | |

of which: | | | | |

Equalization claims | | | 4,137 | |

Other | | | 40 | |

Repurchased debt | | | 46,364 | |

Medium-term notes of Treuhandanstalt | | | 0 | |

| | | | |

Total | | | 1,075,664 | |

| | | | |

| (1) | Mainly equalization and covering claims of the Deutsche Bundesbank, other banks and insurance companies in connection with the currency reform of 1948. |

Source: Bundesministerium der Finanzen, Übersicht über den Stand der Schuld der Bundesrepublik Deutschland zum 31. Dezember 2011, Bundesanzeiger Nr.38 of March 7, 2012, page 975-976.

Other Recent Developments

Responses to the European Sovereign Debt Crisis

On March 2, 2012, 25 European leaders signed the Treaty on Stability, Coordination and Governance, also known as the fiscal compact, aimed at strengthening fiscal discipline and introducing stricter surveillance within the euro area.

Sources: European Council, Fiscal compact signed: Strengthened fiscal discipline and convergence in the euro area, press release of March 2, 2012; (http://www.consilium.europa.eu/uedocs/cms_data/docs/pressdata/en/ec/128454.pdf); Treaty on Stability, Coordination and Governance in the Economic and Monetary Union (http://www.european-council.europa.eu/media/639235/st00tscg26_en12.pdf).

After a sufficient number of private sector creditors accepted the voluntary debt exchange for Greek debt in early March 2012, the Euro Area Member States formally approved the second adjustment program for Greece on March 14, 2012. Under the second program, the European Financial Stability Facility (“EFSF”) and the International Monetary Fund (“IMF”) commit the undisbursed amounts of the first program plus an additional EUR 130 billion for the years 2012 to 2014. The EFSF has committed an overall amount of EUR 144.7 billion (including the already committed or disbursed amounts for the involvement of private sector creditors and bank recapitalization) for this period, while the IMF has committed to contribute EUR 28 billion over the course of a four-year period.

5

Sources: Bundesfinanzministerium, Griechenland: erfolgreicher Schuldenschnitt, press release of March 9, 2012 (http://www.bundesregierung.de/Content/DE/Artikel/2012/03/2012-03-09-griechenland-schuldenschnitt.html); Statement by Commission Vice-President Olli Rehn on private sector participation in the second Greek programme, dated March 9, 2012 (http://europa.eu/rapid/pressReleasesAction.do?reference=MEMO/12/174); Summary for non-specialists, Occasional Papers No. 94/March 2012, The Second Economic Adjustment Programme for Greece, March 2012 (http://ec.europa.eu/economy_finance/publications/occasional_paper/2012/pdf/ocp94_summary_en.pdf); Statement by the President of the Eurogroup, Jean-Claude Juncker, press release of March 14, 2012 (http://www.consilium.europa.eu/uedocs/cms_Data/docs/pressdata/en/ecofin/128941.pdf).

The European Central Bank has recently carried out two longer term refinancing operations with a maturity of three years. In the first of these operations, on December 22, 2011, EUR 489.2 billion was settled; and in the second, EUR 529.5 billion was settled on March 1, 2012.

Sources: ECB, Consolidated Financial Statement of the Eurosystem as at December 23, 2011, press release dated December 28, 2011 (http://www.ecb.eu/press/pr/wfs/2011/html/fs111228.en.html); ECB, Consolidated Financial Statement of the Eurosystem as at March 2, 2012, press release dated March 6, 2012 (http://www.ecb.eu/press/pr/wfs/2012/html/fs120306.en.html).

6

KFW

GENERAL

Overview

KfW is a public law institution (Anstalt des öffentlichen Rechts) serving domestic and international public policy objectives of the Federal Government (“Federal Government”) of the Federal Republic of Germany (“Federal Republic”). KfW promotes its financing activities under the umbrella brand name KfW Bankengruppe. It conducts its business in the following business areas:

| | • | | KfW Mittelstandsbank (KfW SME Bank) promotes small and medium-sized enterprises (“SMEs”), business founders, start-ups and self-employed professionals; |

| | • | | KfW Privatkundenbank (KfW Private Client Bank) provides housing-related loans and grants as well as financing for education to private individuals; |

| | • | | KfW Kommunalbank (KfW Municipal Bank) offers financing for infrastructure projects, primarily for municipalities, and grants global funding instruments to promotional institutes of the German federal states (“Landesförderinstitute”); |

| | • | | Export and project finance: KfW IPEX-Bank GmbH (“KfW IPEX-Bank”) offers customized financing for exports and project and corporate financing worldwide. KfW IPEX-Bank is a legally independent entity wholly owned by KfW; |

| | • | | Promotion of developing and transition countries: KfW Entwicklungsbank (KfW Development Bank) is responsible for KfW’s public sector development cooperation activities, and DEG - Deutsche Investitions- und Entwicklungsgesellschaft mbH (German Investment and Development Company, “DEG”) finances private-sector investments in developing countries. DEG is a legally independent entity wholly owned by KfW; and |

| | • | | Capital markets, which comprises KfW’s treasury, funding, securitization and other capital markets-related activities. |

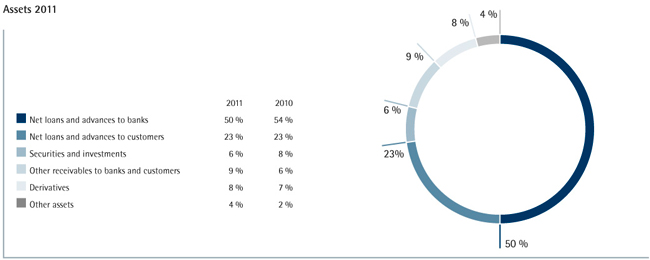

As of December 31, 2011, KfW held total assets of EUR 494.8 billion, including loans and advances of EUR 365.1 billion. KfW’s promotional business volume amounted to EUR 70.4 billion in 2011.

KfW’s offices are located at Palmengartenstraße 5-9, 60325 Frankfurt am Main, Federal Republic of Germany. KfW’s telephone number is 011-49-69-74310. KfW also maintains branch offices in Berlin and Bonn, Germany, as well as a liaison office to the European Union in Brussels, Belgium.

Ownership

The Federal Republic holds 80% of KfW’s capital, and the German federal states (each, a “Land” and together, the “Länder”) hold the remaining 20%. The Law Concerning KfW (Gesetz über die Kreditanstalt für Wiederaufbau, or the “KfW Law”) does not provide for shareholders’ meetings; instead, the Board of Supervisory Directors assumes the responsibilities of a shareholders’ meeting. For more information on the Board of Supervisory Directors, see “Management and Employees—Board of Supervisory Directors.”

Shares in KfW’s capital may not be pledged or transferred to entities other than the Federal Republic or the Länder. Capital contributions have been, and are expected to continue to be, made to KfW in such proportions as to maintain the relative shares of capital held by the Federal Republic and the Länder.

7

Legal Status

KfW is organized under the KfW Law as a public law institution with unlimited duration. As a public law institution serving public policy objectives of the Federal Government, KfW itself is not subject to corporate taxes (although certain of its subsidiaries are) and as a promotional bank does not seek to maximize profits. KfW does, however, seek to maintain an overall level of profitability that allows it to strengthen its equity base in order to support its promotional activities and to grow the volume of its business. KfW is prohibited from distributing profits, which are instead allocated to statutory and special reserves. KfW is also prohibited from taking deposits, conducting current account business or dealing in securities for the account of others.

Relationship with the Federal Republic

Guarantee of the Federal Republic

The KfW Law expressly provides that the Federal Republic guarantees all existing and future obligations of KfW in respect of money borrowed, bonds and notes issued and derivative transactions entered into by KfW, as well as obligations of third parties that are expressly guaranteed by KfW (KfW Law, Article 1a). Under this statutory guarantee (the “Guarantee of the Federal Republic”), if KfW fails to make any payment of principal or interest or any other amount required to be paid with respect to securities issued by KfW, or if KfW fails to make any payment required to be made under KfW’s guarantee when that payment is due and payable, the Federal Republic will be liable at all times for that payment as and when it becomes due and payable. The Federal Republic’s obligation under the Guarantee of the Federal Republic ranks equally, without any preference, with all of its other present and future unsecured and unsubordinated indebtedness. Holders of securities issued by KfW or issued under KfW’s guarantee may enforce this obligation directly against the Federal Republic without first having to take legal action against KfW. The Guarantee of the Federal Republic is strictly a matter of statutory law and is not evidenced by any contract or instrument. It may be subject to defenses available to KfW with respect to the obligations covered.

Institutional Liability (Anstaltslast)

KfW is a public law institution (Anstalt des öffentlichen Rechts). Accordingly, under the German administrative law principle of Anstaltslast, the Federal Republic, as the constituting body of KfW, has an obligation to safeguard KfW’s economic basis. Under Anstaltslast, the Federal Republic must keep KfW in a position to pursue its operations and enable it, in the event of financial difficulties, through the allocation of funds or in some other appropriate manner, to meet its obligations when due. Anstaltslast is not a formal guarantee of KfW’s obligations by the Federal Republic, and creditors of KfW do not have a direct claim against the Federal Republic. Nevertheless, the effect of this legal principle is that KfW’s obligations, including the obligations to the holders of securities issued by it or issued under KfW’s guarantee, are fully backed by the credit of the Federal Republic. The obligation of the Federal Republic under Anstaltslast would constitute a charge on public funds that, as a legally established obligation, would be payable without the need for any appropriation or any other action by the German Parliament.

Understanding with the European Commission

In order to clarify that the Federal Republic’s responsibility for KfW’s obligations was and is compatible with European Union (“EU”) law prohibitions against state aid, the German Federal Ministry of Finance and the European Commissioner for Competition held discussions which were formalized in an understanding reached on March 1, 2002. In the understanding with the European Commission, it was agreed that, in respect of the promotional activities for which KfW is responsible, KfW will continue to benefit from Anstaltslast and the Guarantee of the Federal Republic. The understanding acknowledged that KfW’s role in providing financing for, in particular, small and medium-sized enterprises, risk capital, environmental protection, technology/innovation, infrastructure and housing, as well as its cooperation with developing countries, is promotional and thus compatible with EU rules.

In the area of export and project finance, the understanding with the European Commission required KfW to transfer to a legally independent subsidiary that portion of export finance and domestic and international project finance activities which the European Commission deemed to fall outside the scope of the promotional activities of KfW. The transfer of such activities was to be effected by December 31, 2007 and as from that date KfW has not been permitted to fund the subsidiary at other than market rates of interest or to extend to the subsidiary any benefits of Anstaltslast or the Guarantee of the Federal Republic.

8

KfW continues to be permitted, however, to engage directly in the following promotional export and project finance activities:

| | • | | implementation of international promotional programs, such as the interest-rate subsidized CIRR (Commercial Interest Reference Rate) and LASU (Large Aircraft Sector Understanding) schemes, which are recognized as promotional activities in accordance with the Organization for Economic Cooperation and Development (“OECD”) consensus; |

| | • | | participation in syndicated financing activities outside the EU, the European Economic Area and countries holding the status of official candidate for EU membership, subject to certain conditions, and sole financing activities in countries in which sufficient sources of financing do not exist; and |

| | • | | participation in projects in the interest of the EU that are co-financed by the European Investment Bank or similar European financing institutions. |

The European Commission transformed the understanding into a decision, which the Federal Republic formally accepted. A part of the Promotional Bank Restructuring Act (Förderbankenneustrukturierungsgesetz) implemented the understanding with the European Commission and amended the KfW Law and KfW’s by-laws accordingly.

On January 1, 2008, KfW IPEX-Bank GmbH, a limited liability corporation (Gesellschaft mit beschränkter Haftung) formed as a wholly owned subsidiary of KfW, commenced operations as a legally independent entity, thus satisfying the requirements set forth in the understanding with the European Commission. KfW IPEX-Bank conducts those export and project finance activities which the European Commission deemed to fall outside the scope of KfW’s promotional activities directly and on its own behalf. KfW provides funding for KfW IPEX Bank at market rates based on the ratings assigned to KfW IPEX-Bank by international rating agencies. The permitted promotional export and project finance activities are conducted by KfW IPEX-Bank in its own name on behalf of KfW on a trust basis. In accordance with the understanding with the European Commission, KfW IPEX-Bank obtained a banking license and is subject to the German Banking Act (Gesetz über das Kreditwesen — KWG) and the corporate tax regime. For more information on KfW IPEX-Bank, see “Business—Export and Project Finance (KfW IPEX-Bank).”

Supervision

Under the KfW Law, the Federal Ministry of Finance, in consultation with the Federal Ministry of Economics and Technology, supervises KfW and has the power to adopt all measures necessary to safeguard the compliance of KfW’s business operations with applicable laws, KfW’s by-laws and other regulations. Subject to the foregoing, the Federal Ministry of Finance does not have the right to influence business decisions made by KfW’s Executive Board or Board of Supervisory Directors. KfW’s overall activities are supervised by its Board of Supervisory Directors, which consists of seven Federal Ministers, seven appointees of each of the two houses of Parliament, the Bundesrat and the Bundestag, and representatives of various sectors and institutions of the German economy. For more information on the Executive Board and the Board of Supervisory Directors, see “Management and Employees.”

Effective January 1, 2011, KfW’s by-laws were amended, primarily with a view to bringing them broadly in line with the recommendations and proposals of the Public Corporate Governance Code of the Federation (the “Code”). The Code sets forth standards for the sound and responsible management of unlisted entities in which the Federal Republic of Germany holds a majority interest – in particular, with respect to the management and supervision of such entities by their governing bodies. Amendments to KfW’s by-laws in response to the Code’s standards involved, among other things, specifying the required qualifications of members of the Executive Board and the Board of Supervisory Directors, introducing references to the applicability of the business judgment rule to members of the Executive Board and the Board of Supervisory Directors, and providing for a regular review of the quality and efficiency of the Board of Supervisory Directors’ activities. Further, certain limits on decisions by the Executive Board, which need to be submitted to the Board of Supervisory Directors for approval, were raised.

Effective May 1, 2011, KfW’s by-laws were amended. The amendment was designed to enhance the efficiency of the decision-making processes of the Board of Supervisory Directors, primarily by delegating all approvals of loan commitments to its Credit Committee (Kreditausschuss).

9

KfW is generally exempt from the requirements of the German Banking Act (Gesetz über das Kreditwesen - KWG). Nevertheless, KfW applies certain rules of the German Banking Act on a voluntary basis. KfW plans to broaden its voluntary application of the German Banking Act to the extent appropriate. The plans may lead to further amendments of KfW’s by-laws. Any decision with respect to such amendments will be determined by KfW’s Board of Supervisory Directors and approved by the Federal Ministry of Finance. KfW is currently unable to predict whether, when or in what form such plans may be realized or such amendments will be implemented.

In addition to the annual audit of its financial statements, KfW, as a government-owned entity, is subject to an audit that meets the requirements of the Budgeting and Accounting Act (Haushaltsgrundsätzegesetz). The Budgeting and Accounting Act requires that this audit and the resulting reporting be designed so as to enable the Board of Supervisory Directors, the responsible Federal Ministries, and the Federal Court of Auditors (Bundesrechnungshof) to form their own opinions and to take action as and when required. One of the specific aspects to be covered by this audit and the related reporting is the proper conduct of KfW’s business by its management.

Under the terms of various agreements concluded between KfW and the government authorities sponsoring KfW’s programs, KfW is required to have an auditor report on the proper discharge of KfW’s duties and the efficiency and effectiveness of its administration.

Corporate Background

KfW was established in 1948 by the Administration of the Combined Economic Area, the immediate predecessor of the Federal Republic. Originally, KfW’s purpose was to distribute and lend funds of the European Recovery Program, which is also known as Marshall Plan (the “ERP”). Even today, several of KfW’s programs to promote the German and European economies are supported using funds for subsidizing interest rates from the so-called “ERP Special Fund.” KfW has expanded and internationalized its operations over the past decades. In 1994, following the reunification of the Federal Republic and the former German Democratic Republic (“GDR”), KfW assumed the operations of the former central bank of the GDR (Staatsbank), which was located in Berlin, Germany.

In September 2001, KfW acquired DEG from the Federal Republic. DEG is a limited liability company that acts as the German development finance institution for the promotion of private enterprises in developing countries and countries in transition. For more information on DEG, see “Business—Promotion of Developing and Transition Countries—DEG - Deutsche Investitions- und Entwicklungsgesellschaft mbH.”

In 2003, Deutsche Ausgleichsbank (“DtA”), which was based in Bonn, Germany, merged into KfW. DtA was formed in 1950 as a public law institution and promotional bank particularly active in the area of lending to SMEs and start-up businesses. The merger was accomplished through the Promotional Bank Restructuring Act and was designed to restructure and simplify promotional banking in the Federal Republic and harmonize it with the understanding reached with the European Commission.

10

BUSINESS

Introduction

KfW currently conducts its business in the following business areas:

| | • | | KfW Mittelstandsbank (KfW SME Bank), which focuses on SMEs and other commercial clients; |

| | • | | KfW Privatkundenbank (KfW Private Client Bank), which focuses on private clients; |

| | • | | KfW Kommunalbank (KfW Municipal Bank), which is responsible for public clients, such as municipalities and Landesförderinstitute; |

| | • | | Export and project finance (KfW IPEX-Bank); |

| | • | | Promotion of developing and transition countries (KfW Entwicklungsbank and DEG); and |

| | • | | Capital markets, which comprises KfW’s treasury, funding, securitization, and other capital markets-related activities. |

The following table sets forth the relative size of each of the business areas in terms of commitments for each of the years indicated.

PROMOTIONAL BUSINESS VOLUMEBY BUSINESS AREA

| | | | | | | | | | | | | | |

| | | Year ended December 31, |

| | | 2011 | | | | 2010 |

| | | (EUR in millions) |

KfW Mittelstandsbank (1) | | | | 22,407 | | | | | | | | 28,630 | | |

| | | | | | | |

KfW Privatkundenbank | | | | 16,722 | | | | | | | | 20,025 | | |

| | | | | | | |

KfW Kommunalbank (2) | | | | 11,798 | | | | | | | | 15,387 | | |

| | | | | | | |

Export and project finance (KfW IPEX-Bank) | | | | 13,409 | | | | | | | | 9,336 | | |

| | | | | | | |

Promotion of developing and transition countries | | | | 5,755 | | | | | | | | 5,679 | | |

of which KfW Entwicklungsbank | | | | 4,532 | | | | | | | | 4,452 | | |

of which DEG — Deutsche Investitions- und Entwicklungsgesellschaft mbH | | | | 1,223 | | | | | | | | 1,226 | | |

| | | | | | | |

Capital markets (2) | | | | 1,147 | | | | | | | | 2,525 | | |

| | | | | | | | | | | | | | |

| | | | | | | |

Total promotional business volume (3) | | | | 70,390 | | | | | | | | 81,351 | | |

| | | | | | | | | | | | | | |

| | | | | | | |

Special mandate by the Federal Government | | | | — | | | | | | | | 22,336 | | |

| | | | | | | | | | | | | | |

| | | | | | | |

Total commitments (4) | | | | 70,390 | | | | | | | | 103,687 | | |

| | | | | | | | | | | | | | |

| (1) | Commitments for 2011 include EUR 165 million under the KfW Sonderprogramm that will not be disbursed due to cancellations and withdrawals occurring after the contractual loan commitments but prior to or on December 31, 2011. In addition, commitments for 2011 include EUR 127 million in grants for advisory services compared with EUR 126 million for 2010. In the disclosure for 2010, the latter commitments were reported under a separate line item. Amounts for 2010 set forth in the table above have been adjusted to reflect this change and deviate from amounts which KfW disclosed previously. |

| (2) | In 2011, the responsibility for granting global loans in Europe was transferred from KfW Kommunalbank to the capital markets business area. Commitment figures for 2010 have been adjusted to reflect this change in reporting and deviate from the amounts disclosed previously. |

| (3) | Total promotional business volume has been adjusted for commitments of EUR 847 million in 2011 (2010: EUR 231 million) made by KfW IPEX-Bank relating to export and project finance and refinanced under certain of KfW Mittelstandsbank’s promotional programs. |

| (4) | Commitments represent the volume of funds committed for loans and other business transactions (with the exception of program-based global loans to Landesförderinstitute) in the relevant year, including amounts to be disbursed in future years, and do not include amounts disbursed in the relevant year pursuant to commitments made in prior years. In the case of program-based global loans to the Landesförderinstitute, commitments represent the actual volume of funds disbursed in the relevant year. |

The following table sets forth the total economic capital required of KfW Bankengruppe as well as the relative size of each of the operative business areas in terms of the percentage of economic capital required for each of the years indicated. The balance of economic capital required relates to group functions. The economic capital required has been calculated on a solvency level of 99.99%. For more information concerning economic capital required of KfW Bankengruppe, see “Financial Section—Risk Report—Risk Management Approach of KfW Bankengruppe—Economic Risk-Bearing Capacity” and note 37 to the financial statements.

11

ECONOMIC CAPITAL REQUIRED

| | | | | | | | |

| | | As of December 31, | |

| | | 2011 | | | 2010 | |

Total economic capital required (in EUR millions) | | | 12,558 | | | | 11,274 | |

of which KfW Mittelstandsbank | | | 17 % | | | | 21 % | |

of which KfW Privatkundenbank | | | 10 % | | | | 12 % | |

of which KfW Kommunalbank (1) | | | 1 % | | | | 2 % | |

of which export and project finance (KfW IPEX-Bank) | | | 20 % | | | | 21 % | |

of which promotion of developing and transition countries (KfW Entwicklungsbank and DEG) | | | 13 % | | | | 11 % | |

of which capital markets (1) | | | 14 % | | | | 17 % | |

| (1) | In 2011, the responsibility for granting global loans in Europe was transferred from KfW Kommunalbank to the capital markets business area. Figures for 2010 have been adjusted to reflect this change in reporting and deviate from the amounts disclosed previously. |

Domestic Promotional Business

General

To support the economic and policy objectives of the Federal Government, KfW offers a broad range of financing programs in Germany and, to a limited extent, elsewhere in Europe, as well as grants funded from the federal budget for domestic promotional purposes. KfW’s predominant domestic finance activities are conducted by the KfW Mittelstandsbank, KfW Privatkundenbank and KfW Kommunalbank business areas. Further promotional activities targeting the domestic market are reported under the capital markets business area.

Under the KfW Law, KfW must generally involve banks or other financing institutions when granting financings. Therefore, KfW involves commercial banks in the handling of its loans by extending loans to commercial banks, which, in turn, on-lend the funds to the ultimate borrowers. To a limited extent, however, KfW is allowed to grant financings directly to the ultimate borrower (e.g., for financings of municipalities in the KfW Kommunalbank business area).

By lending to commercial banks, KfW, in principle, insulates itself from credit exposure to the ultimate borrower and gains the benefit of the commercial banks’ knowledge of their customers as well as their administrative and servicing expertise. KfW monitors its exposures to, and the credit standing of, each banking institution to which it lends. In its KfW Mittelstandsbank, KfW Privatkundenbank and KfW Kommunalbank business areas, KfW currently lends to approximately 230 banks.

KfW’s German commercial banking on-lending customers include the nine German Landesbanken. The Landesbanken are German public law financial institutions that have traditionally focused on the banking business for and in the Land in which they operate. Originally, obligations of the Landesbanken benefited from government credit support (Gewährträgerhaftung). Under a settlement reached with the European Commission in July 2001 relating to state aid to the Landesbanken, however, borrowings by the Landesbanken incurred after the settlement date and maturing after December 31, 2015 and all borrowings incurred after July 19, 2005 no longer benefit from government credit support. KfW’s long-term receivables from on-lending operations involving Landesbanken amounted to EUR 70.9 billion as of December 31, 2011. Of this amount, EUR 14.5 billion, or 20.5 %, continues to benefit from government credit support. Since the settlement, KfW’s credit line management has increased its focus on the individual financial strength of each institution. In addition, most of the loans to the Landesbanken have been, and will continue to be, secured by collateral. Over time, the risk profile of the loans to the Landesbanken has been shifting from government risk to a profile more comparable to KfW’s other loans to the banking sector.

KfW offers two different models for processing KfW loans to commercial banks. KfW’s traditional and most important model for handling its lending business is based on individual loan applications by each borrower within the framework of specified loan, mezzanine capital or equity participation instruments. Under the other model, KfW extends global loans or global funding facilities to Landesförderinstitute, to selected commercial banks in Germany and Europe and, to a limited extent to leasing companies in Germany.

12

Individual Loans. KfW explicitly defines detailed formal requirements for each loan that it extends to a commercial bank as well as for each loan the commercial bank on-lends to the ultimate borrower under each of its lending programs. Borrowers do not apply directly to KfW, however, and may only apply for a KfW loan through a bank of their choice. The intermediate bank appraises the financial and business situation of the applicant, takes collateral for the loan and assumes liability for repayment to KfW. Loans made by commercial banks, as borrowers, are normally collateralized by real property or other assets, or are guaranteed by the Federal Republic or by one of the Länder. The processing of individual loans within KfW’s lending programs is characterized by two formally separate loan approvals - first by the intermediate bank and then by KfW - for each borrower. KfW’s loan approval, however, is in most cases depending solely on a review of the loan application, based on compliance with the formal requirements defined for the particular lending program.

KfW applies different pricing models for granting loans: a fixed-rate pricing model; and a risk-adjusted pricing model. Under the fixed-rate pricing model, the commercial banks to which KfW lends are permitted to on-lend the funds at fixed spreads over the applicable interest rate payable to KfW. This fixed-rate pricing model is applied to KfW Privatkundenbank’s lending programs and some of KfW Mittelstandsbank’s lending programs for start-up financing. Under the risk-adjusted pricing model, KfW establishes pricing categories based on a combination of the borrower’s creditworthiness and the collateral securing the loan. Under each lending program, KfW sets maximum interest rates for each pricing category. The on-lending banks assess the risk profile of the borrower and the collateral securing the loan to determine the applicable pricing category for each loan and the applicable maximum interest rate for the pricing category. KfW’s role in the pricing process is limited to verifying that banks derive the appropriate maximum interest rate from the ultimate borrower’s creditworthiness and the collateral provided.

In the traditional SME lending programs offered by KfW, the on-lending banks are liable to KfW and bear the risk of customer default as described above. In recent years, KfW Mittelstandsbank has constantly been reworking and renewing its SME financing programs to increase its support for SMEs. Under those lending programs, to which the risk-adjusted pricing model applies, KfW offers the option of a partial exemption from liability to on-lending banks. If the on-lending bank applies for an exemption from liability, KfW bears the risk not retained by the bank and the risk margin is shared pro rata between KfW and the bank. The risk-adjusted pricing model applies amongst others to KfW Mittelstandsbank’s largest and most important lending program, the KfW Unternehmerkredit, or Entrepreneurial Loan program. In addition, mezzanine capital and equity participations offered by KfW Mittelstandsbank and its special programs for investments by micro-enterprises are designed so that KfW assumes direct exposure to the credit risk of the ultimate borrower, which is covered or compensated in different ways: by means of risk premiums included in the interest rate charged to the ultimate borrower; or by means of guarantees from the Federal Government or the European Investment Fund.

Global Loans and Global Funding Facilities. Global loans and global funding facilities differ from KfW’s individual loans primarily in terms of simplified processing, the lack of a requirement for formal loan approval by KfW with respect to each individual ultimate borrower, and, in general, a higher degree of flexibility for the on-lending Landesförderinstitute, commercial banks and other institutions. KfW expects the receiving institutions or banks to on-lend these funds within a reasonable period of time. In contrast to KfW’s individual loans, these global loans offer greater loan structure flexibility. As a result, global loans and global funding facilities entail lower administrative costs for both KfW and the on-lending Landesförderinstitute, commercial banks or other institutions compared with KfW’s traditional lending programs. Accordingly, an on-lending bank’s or institution’s customers generally benefit from favorable interest rates as well as from streamlined processes.

KfW offers different kinds of global loans and global funding facilities: global loans to Landesförderinstitute, global funding facilities to Landesförderinstitute; and global loans to commercial banks or other institutions. Most of the Landesförderinstitute are independent public law institutions and benefit from explicit guarantees by the respective German federal state (Land). KfW extends global loans to 17 Landesförderinstitute, each of which is responsible for promotional issues within its Land or Länder, as the case may be. Landesförderinstitute use KfW’s global loans to finance specified investments relating to SMEs, housing projects and municipal infrastructure projects in their respective Land within the framework of cooperative loan programs of the Landesförderinstitut and KfW. The conditions of each cooperative loan program must comply with the conditions of the relevant KfW program. The funds to Landesförderinstitute are extended in the form of lump sums, which are then broken down and granted to the final borrower as individual loans. Moreover, KfW extends global funding facilities exclusively to Landesförderinstitute for their own promotional funding purposes, thus offering Landesförderinstitute broad flexibility with respect to the use of funds extended in their promotional business without a direct link to any of KfW’s lending programs.

13

Finally, KfW extends global loans to selected commercial banks in Germany and, to a limited extent, elsewhere in Europe in the form of a lump sum, which the banks break down and grant as individual loans to finance SMEs, housing projects and municipal infrastructure projects, and, increasingly, energy efficiency projects. Leasing companies in Germany are also entitled to apply for global loans, which they split into individual lease contracts in order to finance leasing projects with SMEs in Germany.

Strategic Focus

KfW places strong emphasis on managing the quality of its promotional activities. In this context, KfW systematically classifies all of its financing programs based on formal and content criteria, such as sustainability, subsidiarity and customer value. After the phase-out of several economic stimulus packages in 2010, KfW decided to focus its strategy on long-term qualitative growth. In order to reach this goal, KfW implemented measures to streamline and focus existing product lines according to this strategy. As a result, KfW broadened its supply of products and programs with high promotional effects and quality, while reducing products or programs of comparatively lower promotional quality. For example, KfW decided to further increase its commitments in respect of environmental and climate protection measures. In order to support the Federal Government’s strategy to reduce CO2 emissions, KfW intends to emphasize promotional measures in the field of renewable energy, energy efficiency and innovations in order to support the government’s strategy for the transition to a more sustainable energy set-up (Energiewende). In 2011, financings for environmental and climate protection accounted for nearly one-third of KfW’s total promotional business volume.

Participation in Government Stimulus Packages

In order to stabilize and strengthen the German economy, which had been negatively affected by the global economic and financial crisis, the Federal Government implemented packages of stimulus measures, which provide for the participation of KfW, in late 2008. These measures were amended in 2009. Against the backdrop of a lack of funding from financial institutions, KfW Mittelstandsbank initiated the KfW Sonderprogramm under the Federal Republic’s packages of measures to promote investments. This program was designed to safeguard businesses, primarily small- and medium-sized, but also larger enterprises, against a lack of funding from financial institutions and to provide project financing. The KfW Sonderprogramm offered financings primarily through KfW’s ordinary individual loan program, but also global loans to commercial banks and direct loans to large businesses and for project financing. In addition to the KfW Sonderprogramm, the measures under the Federal Government’s stimulus packages comprised financings of housing-related investments of individuals (KfW Privatkundenbank), financings of investments relating to innovation and energy efficiency by SMEs (KfW Mittelstandsbank), and financings of municipal infrastructure projects (KfW Kommunalbank).

At year-end 2010, the application period for various credit programs, which had been initiated in connection with the Federal Government’s economic stimulus measures (including, among others, the KfW Sonderprogramm) expired according to plan. However, new commitments relating to loan applications that were submitted prior to the December 31, 2010 deadline could be made until June 30, 2011.

KfW Mittelstandsbank (KfW SME Bank)

KfW Mittelstandsbank promotes SMEs, business founders, start-ups and self-employed professionals; it offers financings for various purposes to companies in different stages of development. According to the KfW-Mittelstandspanel 2011 survey of SMEs in Germany, there were nearly 3.8 million SMEs (including enterprises with an annual group turnover of up to EUR 500 million) in 2010. SMEs accounted for 55% of the gross investment by the German corporate sector, employed 70% of the workforce and trained 80% of the apprentices in 2010.

KfW Mittelstandsbank provides financings in the sectors of start-up financing and general investments, innovation and environmental protection, primarily by means of loans, including global loans to Landesförderinstitute as well as commercial banks (2011: EUR 20.7 billion, 2010: EUR 27.3 billion), mezzanine capital (2011: EUR 1.5 billion, 2010: EUR 1.1 billion) and equity participations (2011: EUR 0.2 billion, 2010: EUR 0.2 billion).

14

The following table shows KfW Mittelstandsbank’s commitments by sector for each of the years indicated.

KFW MITTELSTANDSBANK COMMITMENTS

| | | | | | | | | | | | | | |

| | | Year ended December 31, |

| | | 2011 | | | | 2010 |

| | | | | (EUR in millions) | | |

Start-up financing and general investment | | | | 9,365 | | | | | | | | 15,397 | | |

of which KfW Sonderprogramm (1) | | | | 691 | | | | | | | | 6,176 | | |

of which advisory services (2) | | | | 127 | | | | | | | | 126 | | |

Innovation | | | | 2,214 | | | | | | | | 2,119 | | |

Environmental investment | | | | 10,828 | | | | | | | | 11,113 | | |

| | | | | | | | | | | | | | |

Total commitments (3) | | | | 22,407 | | | | | | | | 28,630 | | |

| | | | | | | | | | | | | | |

of which global loans to Landesförderinstitute | | | | 4,131 | | | | | | | | 4,512 | | |

of which global loans to commercial banks | | | | 330 | | | | | | | | 1,600 | | |

| (1) | Commitments for 2011 include EUR 165 million under the KfW Sonderprogramm that will not be disbursed due to cancellations and withdrawals occurring after the contractual loan commitments but prior to or on December 31, 2011 (2010: EUR 1,514 million). The amount for 2010 includes the cancellation of one major commitment of EUR 1.15 billion. |

| (2) | In 2010, grants for advisory services were not reported under KfW Mittelstandsbank commitments, but under “Others.” Accordingly, total commitments for 2010 deviate from the amounts disclosed previously. |

| (3) | Commitments represent the volume of funds committed for loans and other business transactions (with the exception of program-based global loans to Landesförderinstitute) in the relevant year, including amounts to be disbursed in future years, and do not include amounts disbursed in the relevant year pursuant to commitments made in prior years. In the case of program-based global loans to the Landesförderinstitute, commitments represent the actual volume of funds disbursed in the relevant year. |

To support the German economy, KfW Mittelstandsbank committed financings in the amount of EUR 22.4 billion in 2011 (2010: EUR 28.6 billion). This decrease was principally attributable to reduced commitments under the KfW Sonderprogramm, which amounted to EUR 0.7 billion in 2011 (2010: EUR 6.2 billion). For more information, see “Participation in Government Stimulus Packages” above. Commitments in 2011 included EUR 4.1 billion extended as global loans to Landesförderinstitute (2010: EUR 4.5 billion), and EUR 0.3 billion extended as global loans to commercial banks (2010: EUR 1.6 billion).

KfW Mittelstandsbank primarily offers loan programs. In some cases, KfW Mittelstandsbank offers the on-lending banks a partial exemption from liability as described above. This is the case for KfW Unternehmerkredit, which is the most important SME loan program and offers financing for a broad range of investments, such as construction and purchases of machinery, in the start-up financing and general investment sector.

KfW Mittelstandsbank extends mezzanine capital in the form of unsecured subordinated loans, which contain equity-like elements combining characteristics of debt and equity capital. The on-lending bank is not liable to KfW Mittelstandsbank for the subordinated loan. In its mezzanine financing, KfW Mittelstandsbank seeks to tailor the terms and conditions of its lending to each borrower’s risk profile in order to provide a better correlation between yield and risk weighting. As a result, the interest rate of the subordinated loan takes into account the prevailing rates in the capital markets as well as the borrower’s credit standing. The borrower’s creditworthiness is first assessed by the on-lending bank. However, as KfW Mittelstandsbank fully assumes the risk of the subordinated loan, it reserves the right to review and, if necessary, to revise the bank’s assessment by applying KfW Mittelstandsbank’s own rating standards.

Finally, KfW Mittelstandsbank provides loans to equity investors. These investors, in turn, make equity investments in SMEs. In addition, KfW Mittelstandsbank provides equity for innovative SMEs by direct investment on a pari passu basis with private investors as well as equity for established SMEs from a designated equity fund, which was established together with private investors in 2010.

15

Start-up Financing and General Investment Programs

KfW Mittelstandsbank provides start-up financing and financial support for general investments for a wide range of purposes such as investments in property and buildings, in plant and machinery, equipment or in takeovers. In 2011, commitments in this sector amounted to EUR 9.4 billion (2010: EUR 15.4 billion). Commitments in form of KfW Unternehmerkredite amounted to EUR 6.3 billion in 2011 (2010: EUR 8.0 billion). The decrease in commitments for start-up financing and financial support for general investments in 2011 was mainly attributable to the economic recovery in Germany, reflecting a declining need for additional financing support through KfW.

Commitments under the KfW Sonderprogramm amounted to EUR 0.7 billion in 2011 (2010: EUR 6.2 billion). This decrease reflected the end of this program, which expired in accordance with its terms during the first half of 2011.

KfW Mittelstandsbank also offers advisory support to individuals and businesses to facilitate a better understanding of the German Federal Government’s various business-related promotional programs. KfW partially funds coaching and advisory services for individual entrepreneurs and for SMEs to support the early start-up phase of new businesses or to determine the necessary steps for a turnaround in case of temporary difficulties. Furthermore, KfW, in cooperation with the Federal Ministry of Economics and Technology, supports energy efficiency consultancy services for SMEs. In 2011, KfW extended EUR 127 million in grants for advisory services (2010: EUR 126 million).

Innovation Programs

KfW Mittelstandsbank provides financing for innovations by extending funds for research and development activities either by means of mezzanine capital or direct equity investments. In 2011, commitments amounted to EUR 2.2 billion (2010: EUR 2.1 billion).

Environmental Investment Programs

KfW Mittelstandsbank finances environmental protection projects, in particular, for measures aiming at increasing energy efficiency, reducing greenhouse gas emissions and promoting the use of sources of renewable energy. In 2011, commitments decreased slightly to EUR 10.8 billion (2010: EUR 11.1 billion).

KfW Privatkundenbank (KfW Private Client Bank)

KfW Privatkundenbank provides housing-related loans and grants as well as financing for education to private individuals. The following table shows KfW Privatkundenbank’s commitments by sector for each of the years indicated.

KFW PRIVATKUNDENBANK COMMITMENTS

| | | | | | | | | | | | | | |

| | | Year ended December 31, |

| | | 2011 | | | | 2010 |

| | | | | (EUR in millions) |

Housing investment programs | | | | 14,553 | | | | | | | | 17,973 | | |

Education programs | | | | 2,169 | | | | | | | | 2,052 | | |

| | | | | | | | | | | | | | |

Total commitments (1) | | | | 16,722 | | | | | | | | 20,025 | | |

| | | | | | | | | | | | | | |

of which global loans to Landesförderinstitute | | | | 662 | | | | | | | | 790 | | |

of which global loans to commercial banks | | | | — | | | | | | | | 500 | | |

| (1) | Commitments represent the volume of funds committed for loans and other business transactions (with the exception of program-based global loans to Landesförderinstitute) in the relevant year, including amounts to be disbursed in future years, and do not include amounts disbursed in the relevant year pursuant to commitments made in prior years. In the case of program-based global loans to the Landesförderinstitute, commitments represent the actual volume of funds disbursed in the relevant year. |

16

In 2011, KfW Privatkundenbank’s commitments amounted to EUR 16.7 billion (2010: EUR 20.0 billion). This decrease was in line with KfW’s expectations and was due to minor adjustments to KfW Privatkundenbank’s housing investment programs. The decrease also reflected the reduced federal budget available for energy-efficiency financing. Commitments in 2011 included EUR 0.7 billion extended as global loans to Landesförderinstitute (2010: EUR 0.8 billion). In 2011, no global loans to commercial banks were granted by KfW Privatkundenbank (2010: EUR 0.5 billion).

Housing Investment Programs

KfW Privatkundenbank’s housing investment programs provide funds for the promotion of home ownership, for energy-efficient construction and rehabilitation, and for the improvement of accessibility to existing homes. Some of these programs are subsidized through interest rate reductions paid for by federal funds. Commitments in 2011 amounted to EUR 14.6 billion (2010: EUR 18.0 billion), of which EUR 6.5 billion (2010: EUR 8.7 billion) were granted for energy efficient construction and rehabilitation measures and EUR 5.9 billion (2010: EUR 6.5 billion) for home ownership promotion programs. The decrease in these commitments was mainly attributable to the lower federal budget available for energy-efficiency financing. In 2011, KfW Privatkundenbank streamlined or closed existing lending programs to reduce overlaps between different programs. As part of KfW’s general focus on supporting measures for the transition to a more sustainable energy set-up (Energiewende), KfW Privatkundenbank will continue to focus its activities besides others on energy-efficient construction and rehabilitation.

Education Programs

KfW Privatkundenbank supports students and employees in advanced occupational training with direct loans. Some of these programs are subsidized through interest rate reductions paid for by federal funds. In 2011, commitments amounted to EUR 2.2 billion (2010: EUR 2.1 billion). This increase was due to an increase in commitments in most of the educational programs.

KfW Kommunalbank (KfW Municipal Bank)

KfW Kommunalbank provides financing for infrastructure projects to municipalities, municipal companies and non-profit organizations. KfW Kommunalbank is also responsible for granting global loans and global funding facilities to Landesförderinstitute. The following table shows commitments of KfW Kommunalbank for each of the years indicated.

KFW KOMMUNALBANK COMMITMENTS

| | | | | | | | | | | | | | |

| | | Year ended December 31, |

| | | 2011 | | | | 2010 |

| | | | | (EUR in millions) |

Municipal infrastructure programs | | | | 4,148 | | | | | | | | 6,137 | | |

of which global loans to Landesförderinstitute | | | | 559 | | | | | | | | 772 | | |

Global funding facilities to Landesförderinstitute | | | | 7,650 | | | | | | | | 9,150 | | |

Global loans to commercial banks in Germany | | | | — | | | | | | | | 100 | | |

Global loans to commercial banks in Europe (1) | | | | — | | | | | | | | — | | |

| | | | | | | | | | | | | | |

Total commitments (2) | | | | 11,798 | | | | | | | | 15,387 | | |

| | | | | | | | | | | | | | |

| (1) | In 2011, the responsibility for granting global loans to commercial banks in Europe was transferred to the Capital Markets business area. Commitments in 2011 amounted to EUR 10 million and are reported under Capital Markets commitments. Commitment figures for 2010 have been adjusted to reflect this change in reporting and deviate from the amounts disclosed previously. |

| (2) | Commitments represent the volume of funds committed for loans and other business transactions (with the exception of program-based global loans to Landesförderinstitute) in the relevant year, including amounts to be disbursed in future years, and do not include amounts disbursed in the relevant year pursuant to commitments made in prior years. In the case of program-based global loans to the Landesförderinstitute, commitments represent the actual volume of funds disbursed in the relevant year. |

In 2011, total commitments under KfW Kommunalbank’s programs decreased to EUR 11.8 billion (2010: EUR 15.4 billion). This significant decline was mainly due to a decrease in commitments in global funding facilities to Landesförderinstitute as well as for special loan facilities for municipal infrastructure projects covered by the Federal Governments stimulus packages, which expired on December 31, 2010 according to plan.

17

Municipal Infrastructure Programs

KfW Kommunalbank provides financing for investments in municipal and social infrastructure, predominantly as direct loans to municipalities (i.e., local and municipal authorities and municipal special-purpose associations). Infrastructure investments by private companies that are majority-owned by municipal authorities and social investments made by non-profit organizations are financed according to KfW’s ordinary on-lending scheme involving commercial banks. Some of these municipal infrastructure programs are subsidized by federal funds. Commitments for these programs decreased to EUR 4.1 billion in 2011 (2010: EUR 6.1 billion).

Global Funding Facilities to Landesförderinstitute

In 2011, KfW extended global funding facilities in the amount of EUR 7.7 billion to Landesförderinstitute (2010: EUR 9.2 billion). The decline was mainly due to a decrease in demand from the Landesförderinstitute.

Global Loans to Commercial Banks

In 2011, no global loans were extended to commercial banks in Germany (2010: EUR 0.1 billion).

Export and Project Finance (KfW IPEX-Bank)

Business

KfW IPEX-Bank focuses on supporting the internationalization and the competitiveness of internationally operating German and European companies, offering project, export and trade financing. It provides medium and long-term investment and export financings in the form of amortizing loans, guarantees or leasing financings as well as project, object and acquisition financings. It also offers derivative instruments to allow its clients to hedge interest and currency risk. KfW IPEX-Bank also offers instruments for short-term trade financing, such as participations in letters of credit.

As a strategic shareholding in the area of lease operations, KfW IPEX-Bank holds a 50% stake in Railpool Holding GmbH & Co. KG, an asset manager in rail transportation established in 2008.

KfW IPEX-Bank’s principal customers are German and European corporations (and their customers) with international operations and larger medium-sized companies in basic and manufacturing industries, as well as in the retail, health, telecommunications, power / renewables, water, shipping, aviation, rail, transport and social infrastructure sectors.

Traditionally, the bulk of loans extended by KfW IPEX-Bank has been used for export and project financings to buyers of German or European exports. In recent years, KfW IPEX-Bank has increasingly extended loans to finance direct investments by German enterprises and other corporate purposes linked to the internationalization of German companies. In addition, KfW IPEX-Bank co-finances large-scale infrastructure projects and means of transport (e.g., airplanes and vessels) in the German and European transport sector. KfW IPEX-Bank also provides, as part of its core business, financings for environment and climate protection projects. Finally, KfW IPEX-Bank’s loans are also used to secure sources of raw materials for the German industry.

KfW IPEX-Bank’s loans are generally extended directly to the ultimate borrower, and KfW IPEX-Bank grants a significant portion of these loans at its own risk. KfW IPEX-Bank regularly cooperates with other financial institutions by way of consortia and syndications. In some cases, KfW IPEX-Bank may arrange for commercial banks to assume the risk on portions of loans made by KfW IPEX-Bank through “risk-participations,” for which KfW IPEX-Bank pays a fee to the bank assuming the risk. KfW IPEX-Bank is eligible to act as on-lending bank under certain of KfW’s promotional programs. In 2011, KfW IPEX-Bank refinanced loan commitments for export and project finance under KfW’s promotional programs in the amount of EUR 847 million (2010: EUR 231 million).

From time to time, KfW IPEX-Bank also enters into framework loan agreements with foreign banks, which enable such banks to extend loans to their customers for the purpose of importing equipment from German or other European exporters. Because the amounts of individual loans are usually small, the related transaction costs are relatively high. The framework agreements help to reduce these transaction costs.

18

Loans extended by KfW IPEX-Bank are generally secured by collateral and often benefit from a payment guarantee or other security arrangement. Loans extended to finance direct investments may benefit from an investment guarantee against political risk by the Federal Republic if the host country risk is assessed to be substantial.

A portion of export finance loans extended by KfW IPEX-Bank is guaranteed by the Federal Republic through Euler Hermes Kreditversicherungs-AG, the official German export credit insurer (“HERMES”). HERMES insurance covers up to 95% of KfW IPEX-Bank’s risk, so that the risk of the portion covered is the equivalent of German government risk. HERMES also provides coverage for related deliveries from other, mainly European, countries provided that they do not exceed a certain portion of the total delivery for which an export finance loan was extended. Furthermore, KfW IPEX-Bank’s financings frequently benefit from a guarantee by a foreign export credit agency or a government instrumentality in the buyer’s country.

For borrowers in other European and OECD countries where the country risk is not considered high, KfW IPEX-Bank has been increasingly extending loans on the basis of ordinary banking collateral (e.g., mortgages on aircraft or ships) without seeking the benefit of HERMES or similar coverage. In addition, even when HERMES coverage is sought, KfW IPEX-Bank often extends loans on which the insured portion is less than 95%. As of December 31, 2011, KfW IPEX-Bank’s outstanding loans and guarantees outside Germany amounted to EUR 35 billion, of which EUR 7.6 billion, or 22%, were export finance loans (partly) guaranteed by HERMES.

Corporate Background

As of January 1, 2008, and in accordance with the understanding reached between the European Commission and the Federal Republic, KfW IPEX-Bank commenced operations as a legally independent entity wholly owned by KfW. For more information, see “General—Relationship with the Federal Republic—Understanding with the European Commission.” KfW IPEX-Bank conducts the portion of export and project finance activities which the European Commission deemed to fall outside the scope of KfW’s promotional activities directly and on its own behalf, while it conducts the promotional export and project finance activities in its own name on behalf of KfW on a trust basis. As of December 31, 2011, KfW IPEX-Bank’s total outstanding loans and guarantees (including promotional activities) amounted to EUR 48.7 billion (year-end 2010: EUR 47.3 billion). KfW IPEX-Bank is located in Frankfurt am Main, Germany, and maintains a branch office in London, United Kingdom. As of December 31, 2011, KfW IPEX-Bank employed 527 persons (excluding managing directors, but including temporary personnel).

KfW IPEX-Bank is approved as an IRB (internal rating based-advanced) bank under the Basel II rules by the relevant German supervisory authorities — the Bundesanstalt für Finanzdienstleistungsaufsicht (Federal Financial Supervisory Authority) and Deutsche Bundesbank (German Central Bank).

Commitments

In 2011, total commitments of export and project finance amounted to EUR 13.4 billion (including commitments under the CIRR scheme for ship financings, which is supported by the federal budget) (2010: EUR 9.3 billion). The following table shows commitments in KfW’s business area export and project finance in 2011 and 2010.

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended December 31, |

| | | 2011 | | 2010 |

| | | (EUR in millions) | | (in % of total) | | (EUR in millions) | | (in % of total) |

Commercial business | | | | 7,039 | | | | | 52 | | | | | 5,396 | | | | | 58 | |

Promotional business (conducted on behalf of KfW) | | | | 6,370 | | | | | 48 | | | | | 3,940 | | | | | 42 | |

| | | | | | | | | | | | | | | | | | | | |

Total commitments (1) | | | | 13,409 | | | | | 100 | | | | | 9,336 | | | | | 100 | |

| | | | | | | | | | | | | | | | | | | | |

| (1) | Commitments represent the volume of funds committed for loans and other business transactions in the relevant year, including amounts to be disbursed in future years, and do not include amounts disbursed in the relevant year pursuant to commitments made in prior years. |

19

The following table shows KfW IPEX-Bank’s commitments by sectors in 2011 and 2010.

| | | | | | | | | | |

| | | Year ended December 31, |

| | | 2011 | | 2010 |

| | | (EUR in millions) |

Power, renewables and water | | | | 2,122 | | | | | 1,774 | |

Shipping | | | | 1,977 | | | | | 1,300 | |

Aviation and rail | | | | 1,964 | | | | | 1,031 | |

Basic industries | | | | 1,469 | | | | | 815 | |

Manufacturing industries, telecommunications, retail and health (1) | | | | 1,302 | | | | | 1,478 | |

Transport and social infrastructure | | | | 1,169 | | | | | 941 | |

Financial institutions, trade and commodity finance | | | | 983 | | | | | 741 | |

Leveraged finance, mezzanine and equity | | | | 462 | | | | | 197 | |

CIRR for ship finance | | | | 1,960 | | | | | 1,058 | |

| | | | | | | | | | |

Total commitments | | | | 13,409 | | | | | 9,336 | |

| | | | | | | | | | |

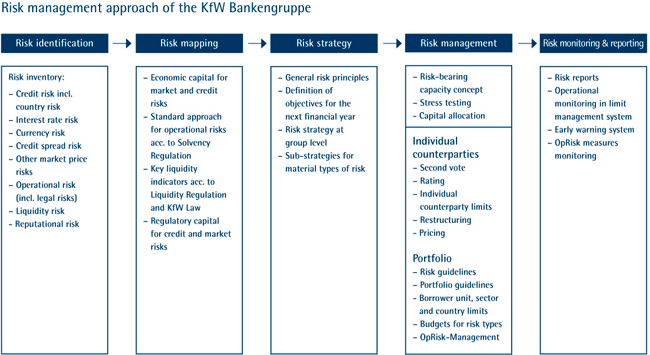

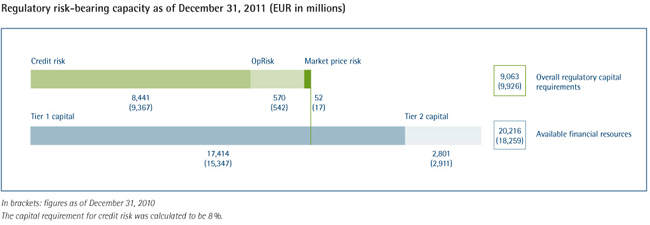

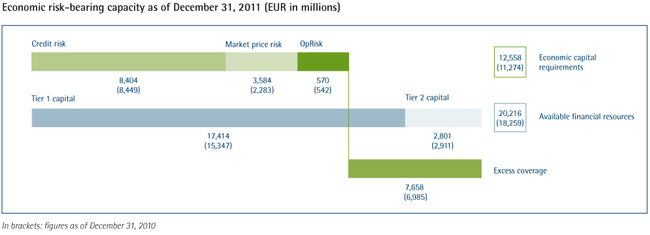

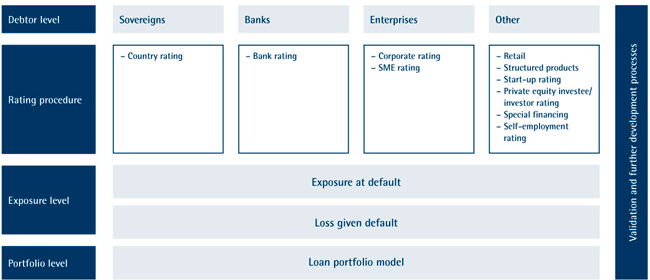

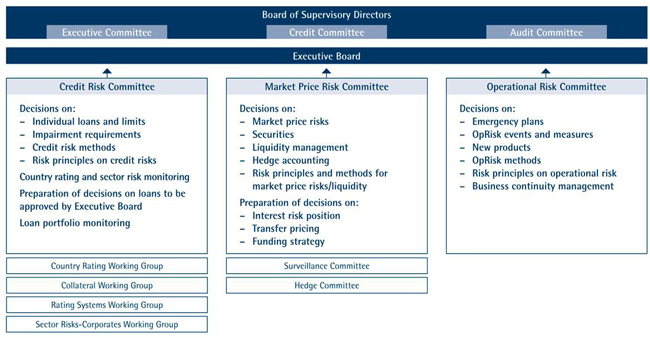

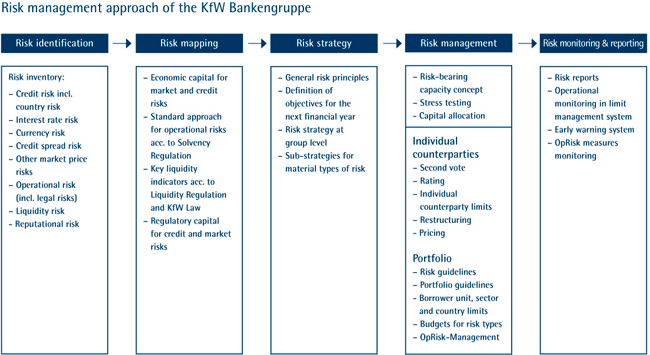

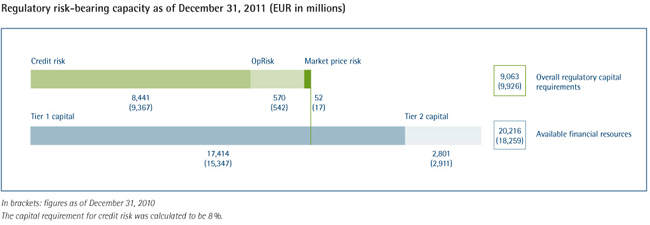

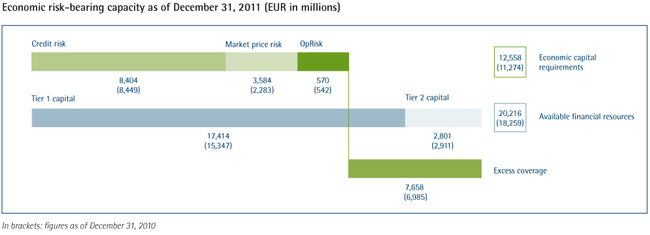

| (1) | In 2011, the telecommunications and media sector was merged into the manufacturing industries, retail and health sector. The previous year figure was adapted accordingly. |