Exhibit (e)

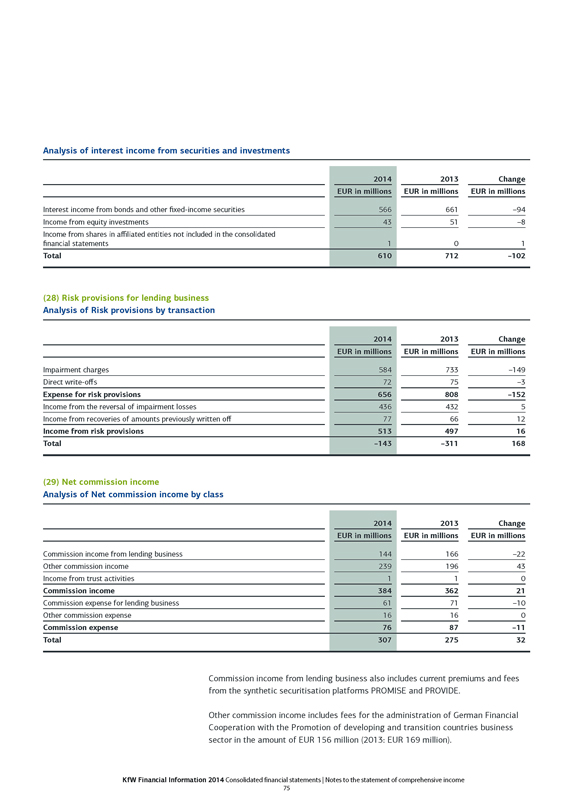

Group management report

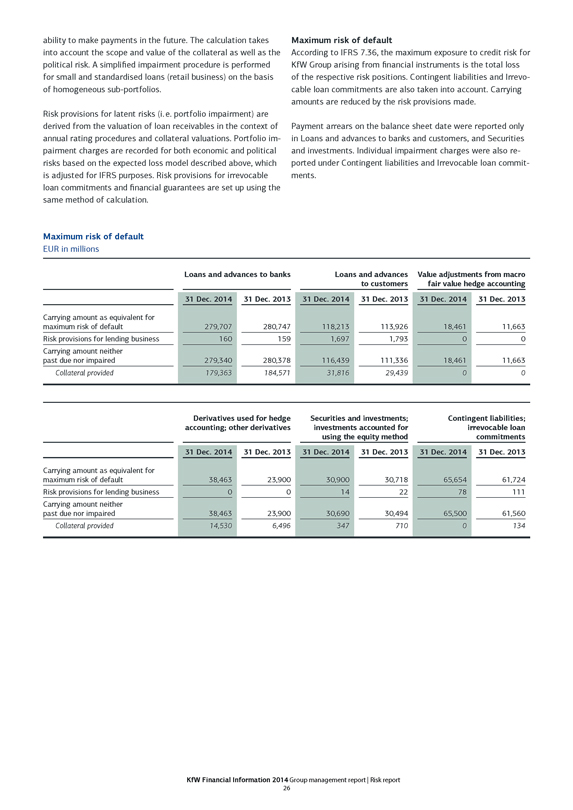

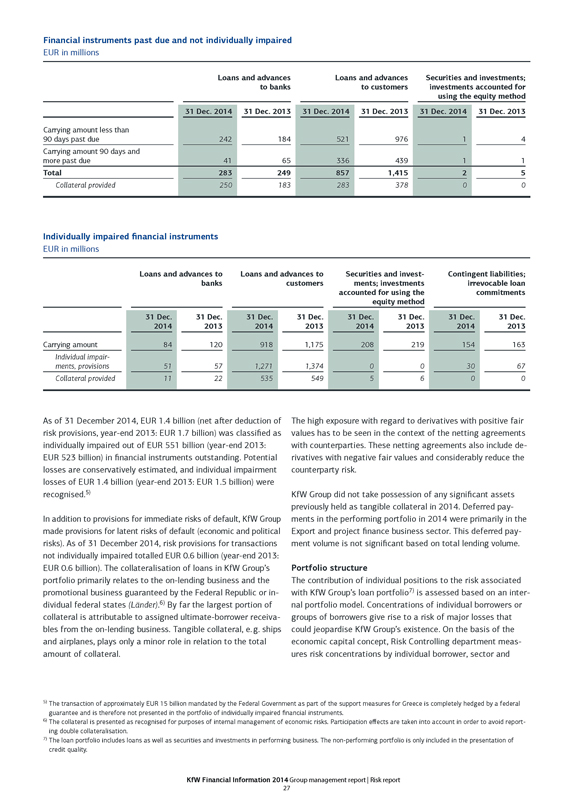

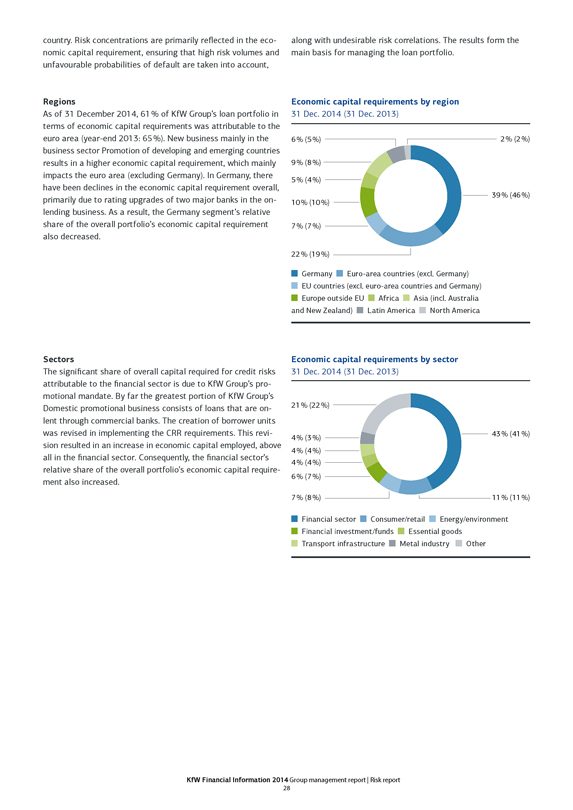

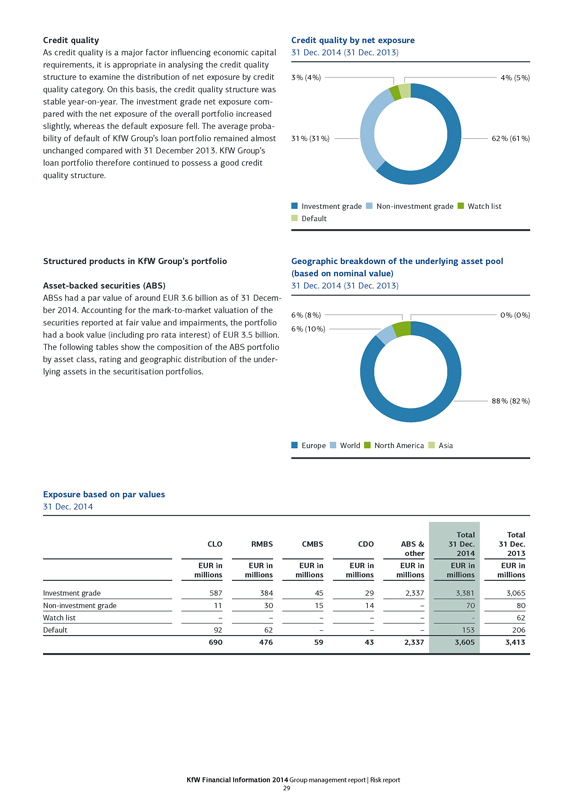

KFW

Basic information on KfW Group

Overview

Strategic objectives

Internal management system

Economic report

General economic environment

Development of KfW Group

Development of earnings position

Development of net assets

Development of financial position

Subsequent events (as of 3 March 2015)

Risk report

Current developments

Basic principles and objectives of risk management

Organisation of risk management and monitoring

Risk management approach of KfW Group

Overview

Internal capital adequacy assessment process

Types of risk

Counterparty default risk

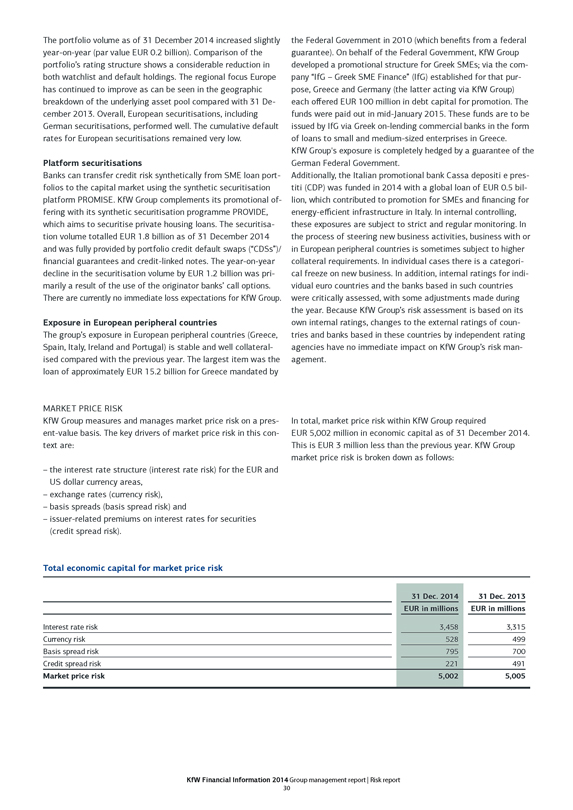

Market price risk

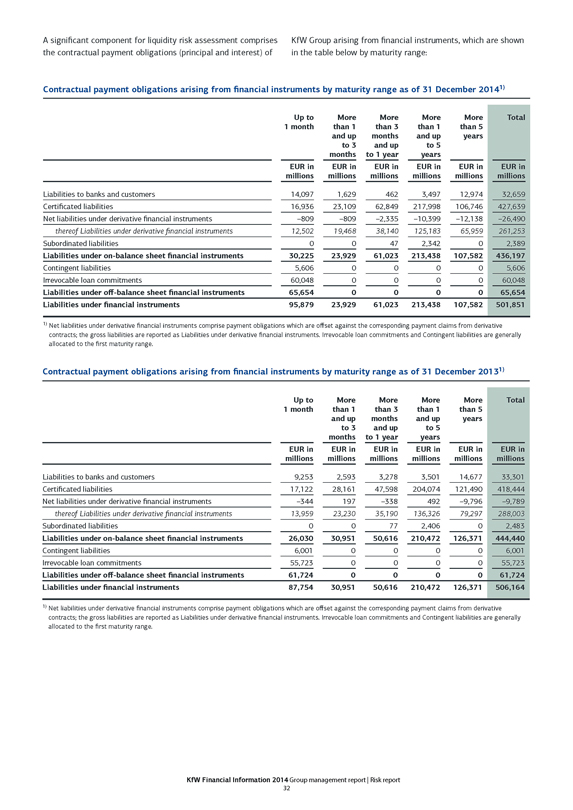

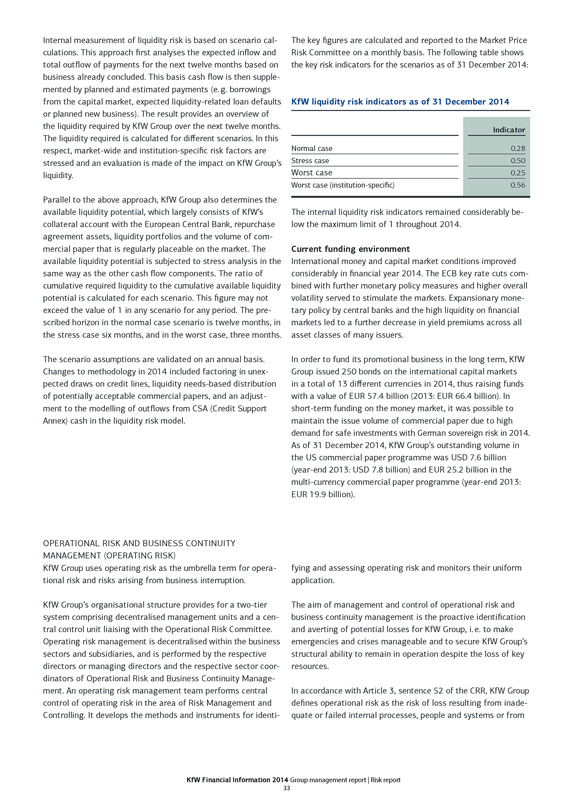

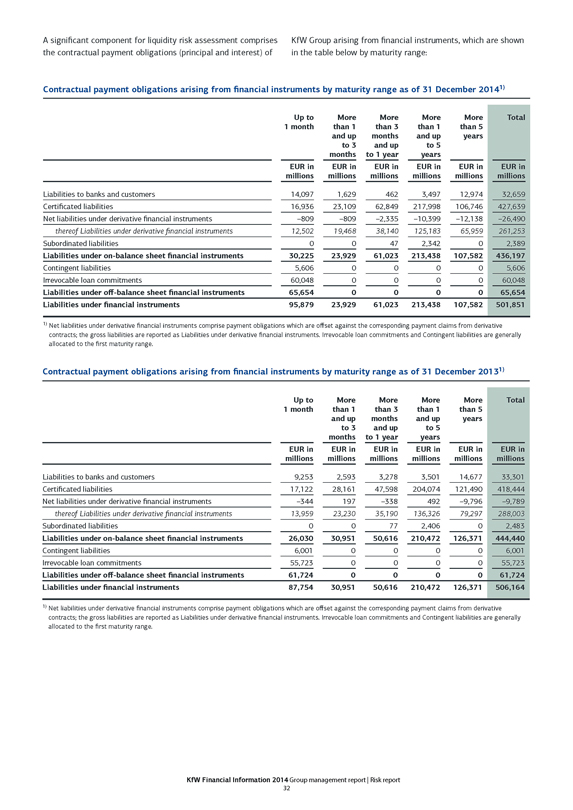

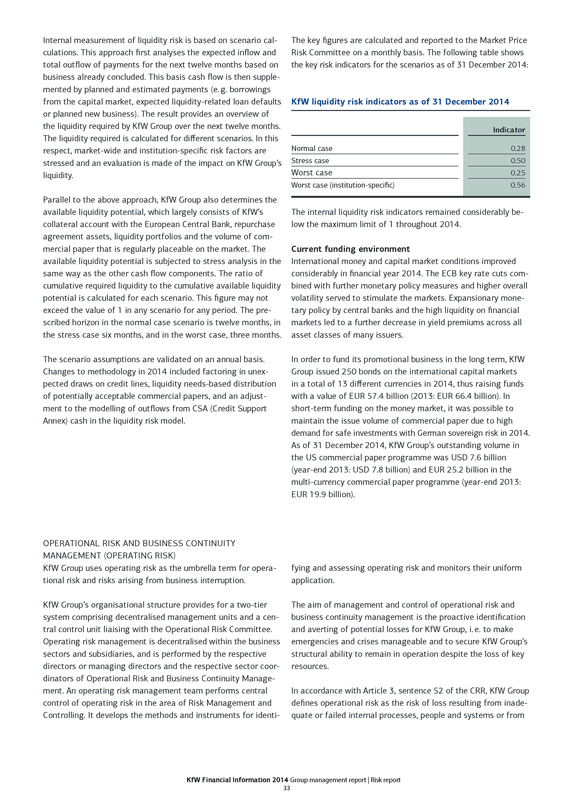

Liquidity risk

Operational risk and business continuity management (operating risk)

Other risks

Internal monitoring procedures

Forecast and opportunity report

General economic environment, development trends

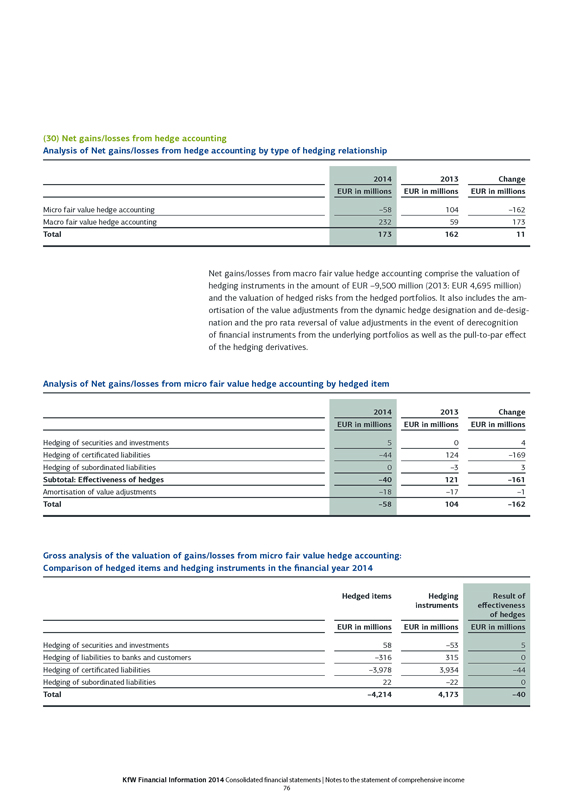

Risk outlook – Risk situation and risk-bearing capacity

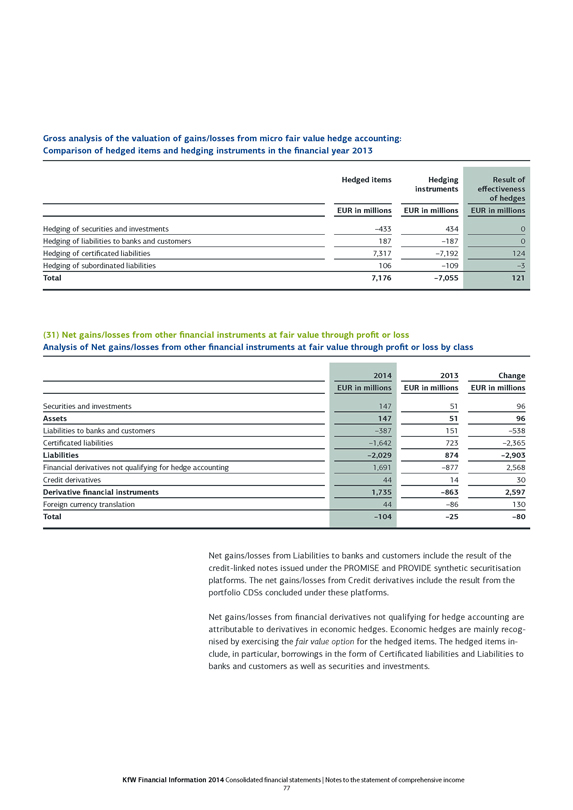

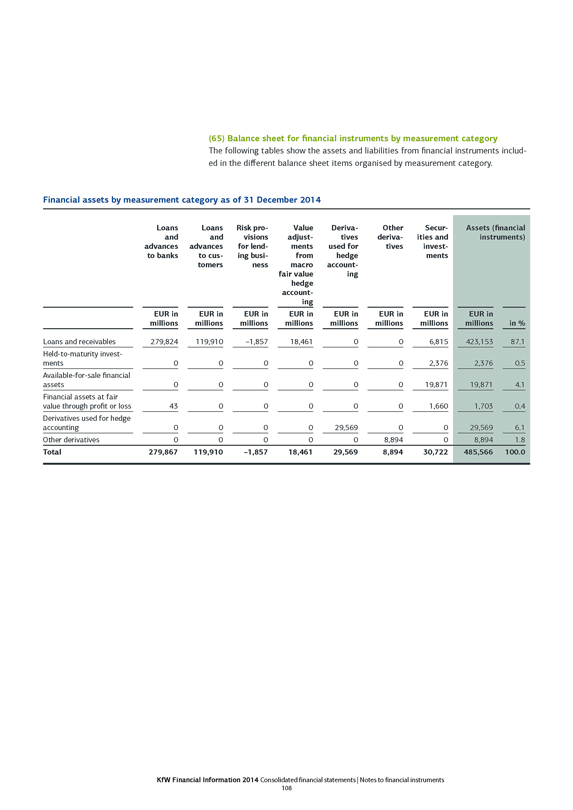

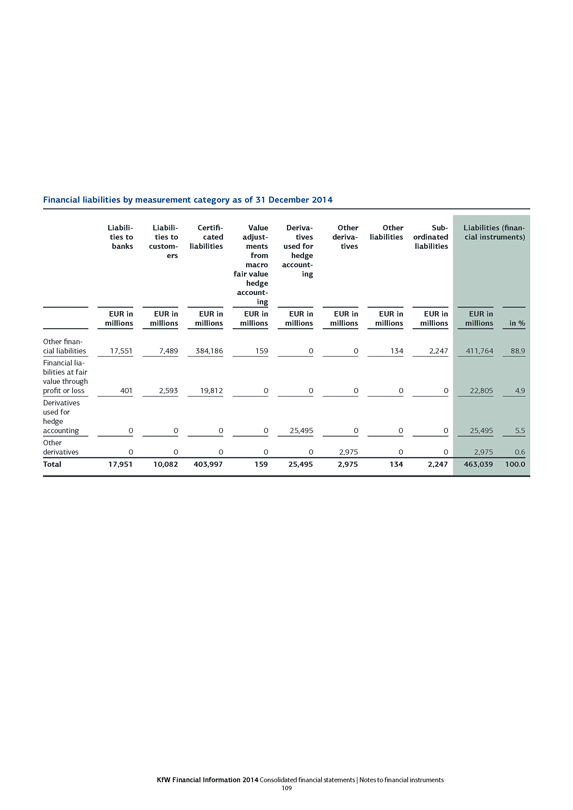

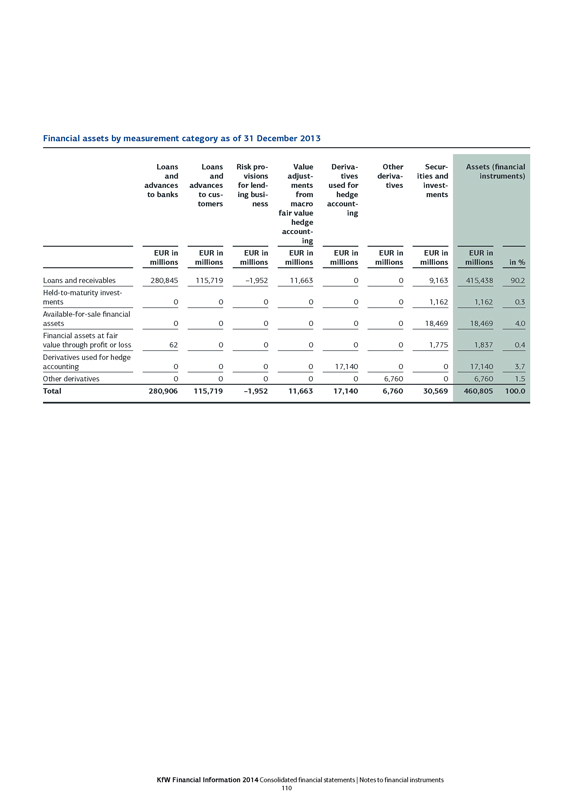

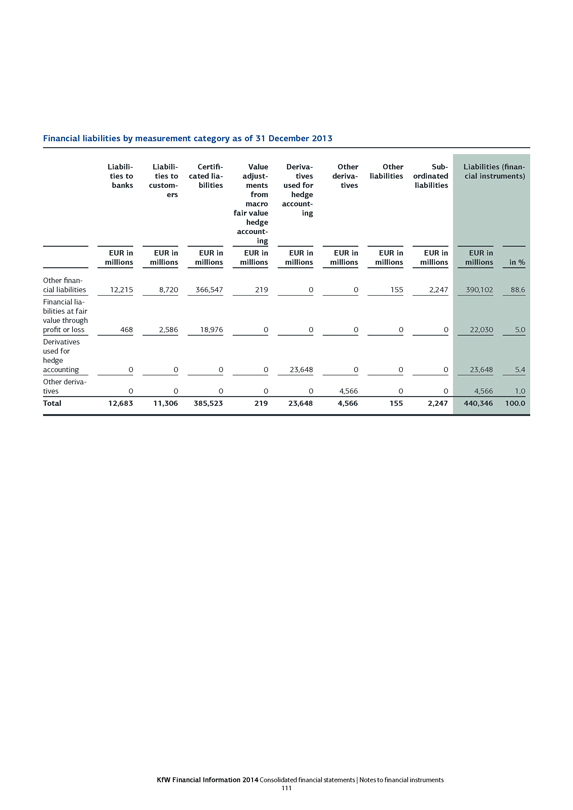

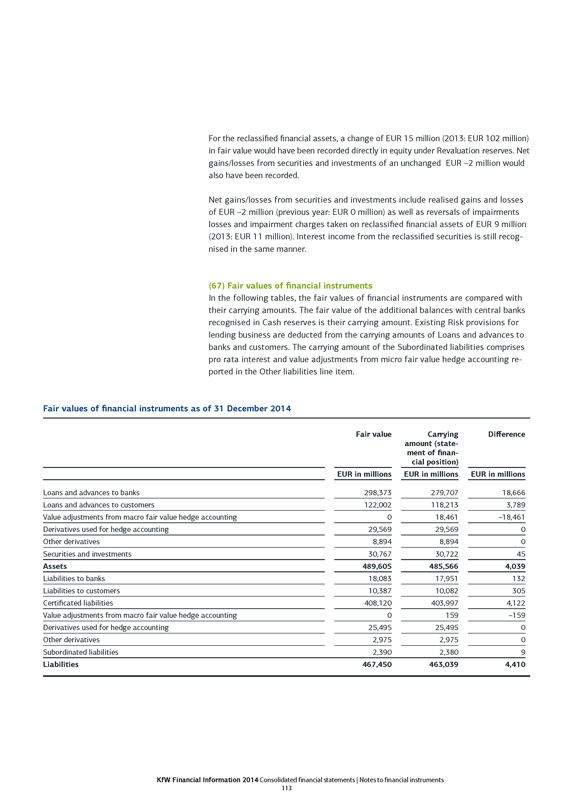

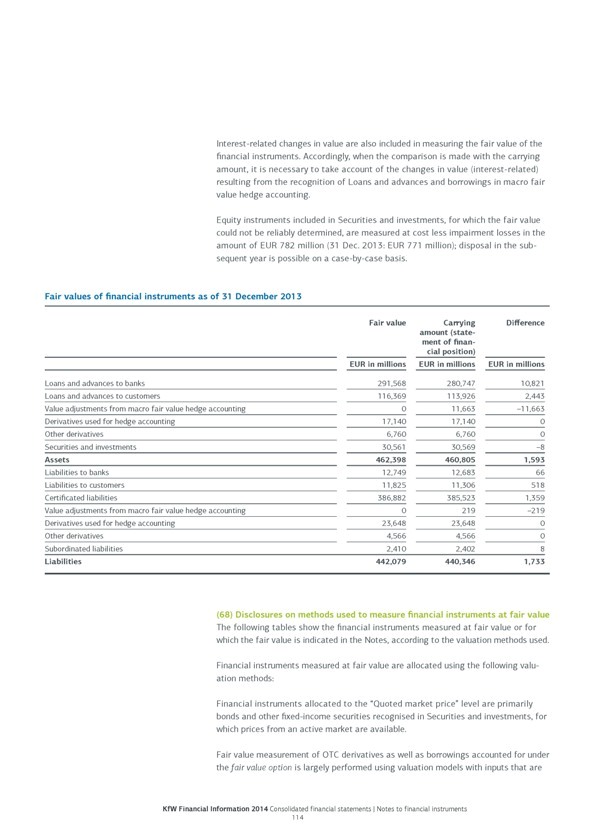

New business projections

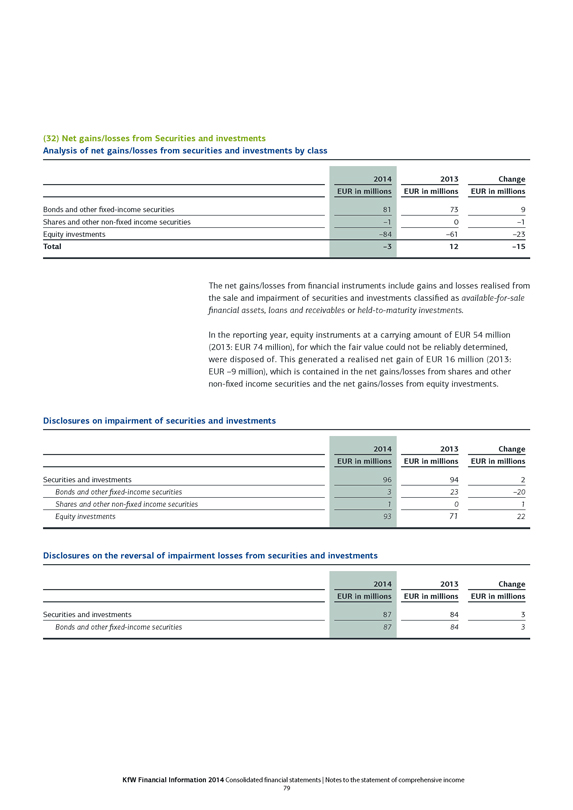

Funding projections

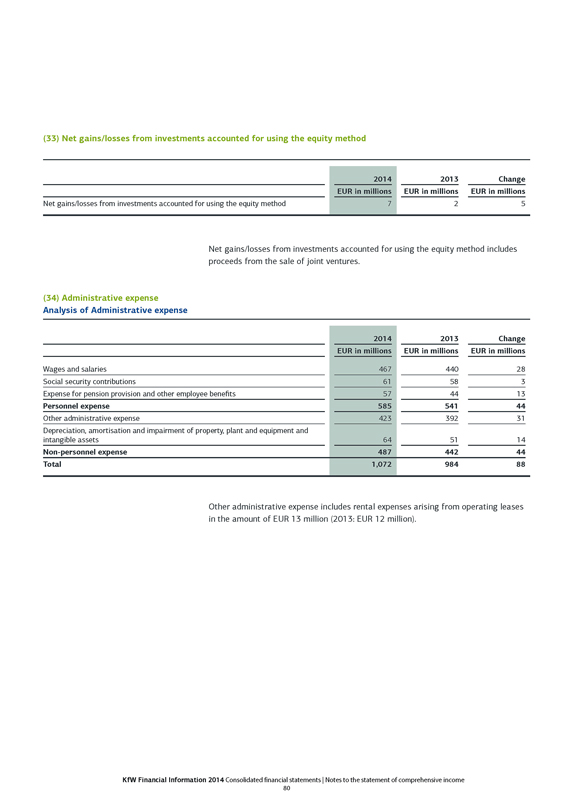

Earnings projections

HR strategy/development of workforce

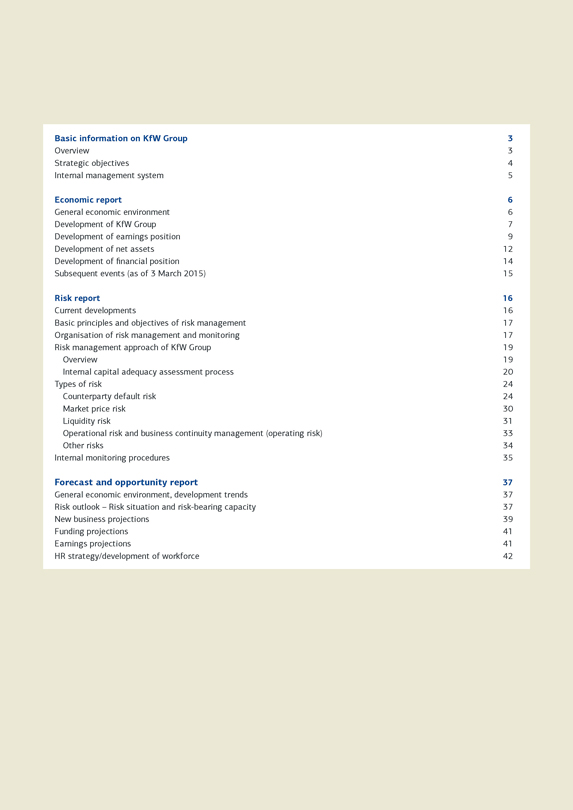

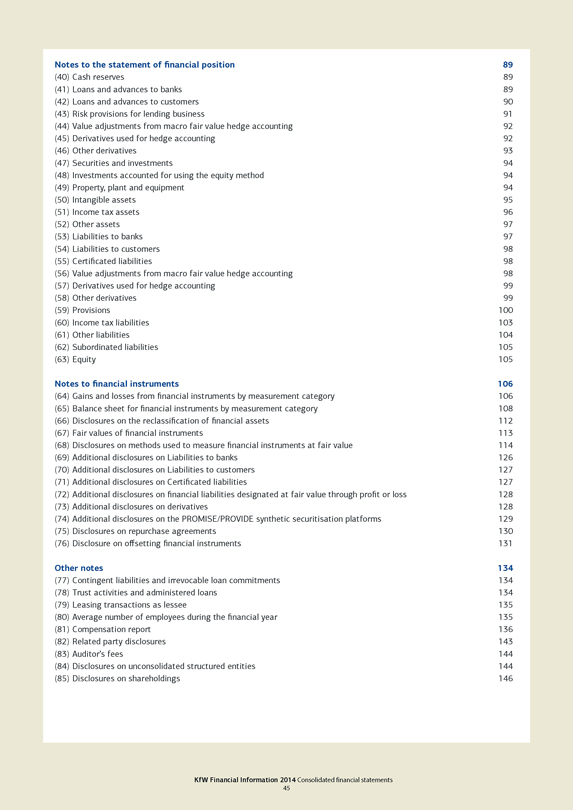

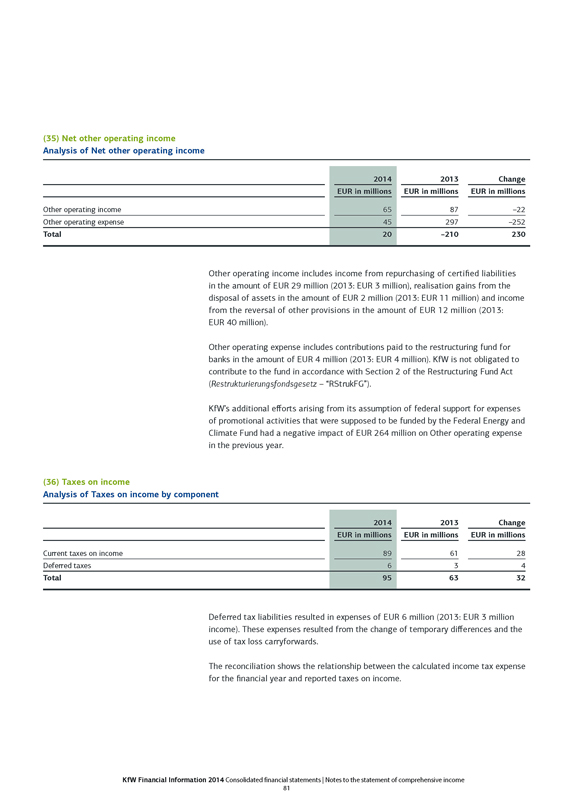

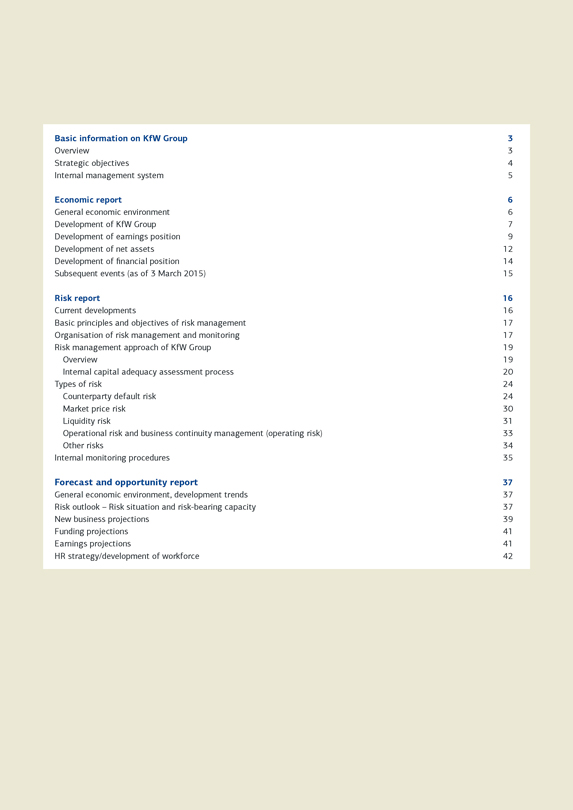

3 3 4 5 6 6 7 9 12 14 15 16 16 17 17 19 19 20 24 24 30 31 33 34 35 37 37 37 39 41 41 42

Basic information on KfW Group

Overview

KfW Group consists of KfW and five consolidated subsidiaries. As the promotional bank of the Federal Republic of Germany – which owns 80% of KfW while the German Federal States own

20% – KfW is one of the world’s leading promotional banks.

The institutional framework for the promotional mandate including the Federal Republic of Germany’s liability for KfW’s obligations is defined in the KfW Law.

KfW supports sustainable improvement of economic, social and environmental conditions around the world, with an emphasis on promotion of the German economy. In its promotional activities, KfW focuses on societal megatrends. A variety of different financing products and services address in particular the areas SMEs, start-ups, environmental protection, the housing sector, infrastructure, education, project and export finance, and development cooperation. The domestic promotional lending business

with enterprises and private individuals is characterised by the proven and successful strategy of on-lending, in which KfW extends loans to commercial banks, which, in turn, lend the funds to the ultimate borrowers at favourable rates. This strategy eliminates any need for KfW to have its own network of branch offices. Business activities are funded almost fully on the international capital markets; KfW is globally one of the most active and largest bond issuers. In addition to KfW, the group’s main operating subsidiaries are (i) KfW IPEX-Bank, which provides project and export financing, and (ii) DEG, which is active in promoting the private sector in developing and emerging market countries.

In accordance with the business sector structure for KfW Group, the sectors and their main products and services can be presented as follows:

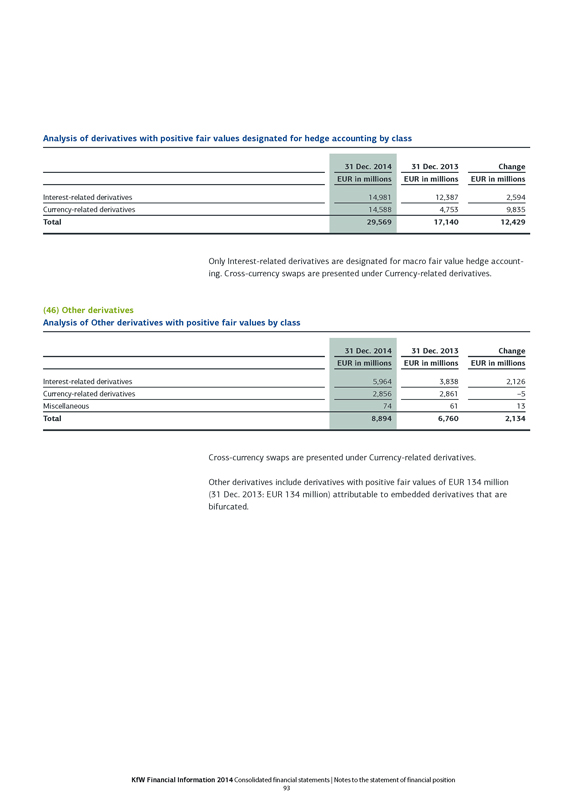

Mittelstandsbank (SME Bank)

Kommunal– und Privatkundenbank/Kreditinstitute

(Municipal and Private Client Bank/Credit Institutions)

Export and project finance

Promotion of developing and transition countries

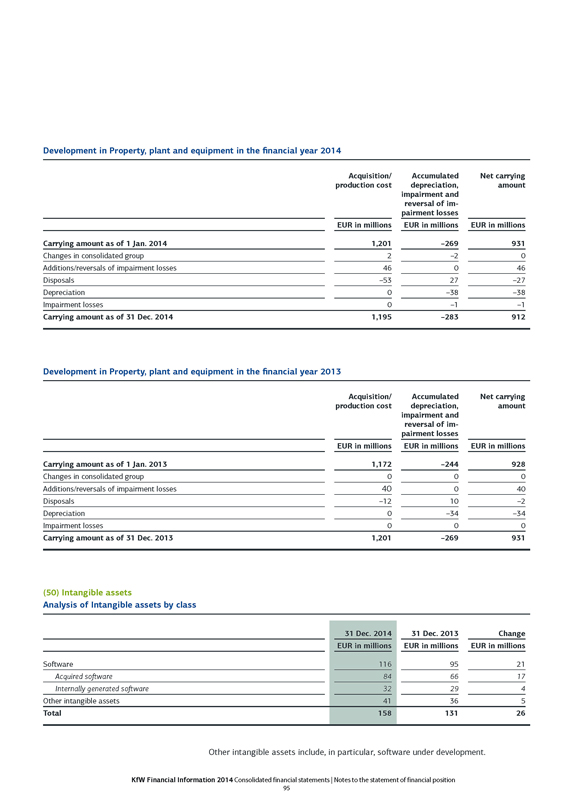

Capital markets

Head office

– Financing of corporate and industrial pollution control investments

– Equity financing

– Advisory services

– Financing for housing construction and modernisation

– Education finance

– Infrastructure and social finance

– General funding of the special credit institutions of the German Federal States

– Individual financing banks

– Transactions on behalf of the Federal Government

– Financing for German and European export activities

– Financing for projects and investments in German and European interests

– Promotion of developing and transition countries on behalf of the Federal

Government (budget funds) with complementary market funds raised by KfW

– Financing provided by DEG – Deutsche Investitions- und

Entwicklungsgesellschaft mbH (private enterprise financing)

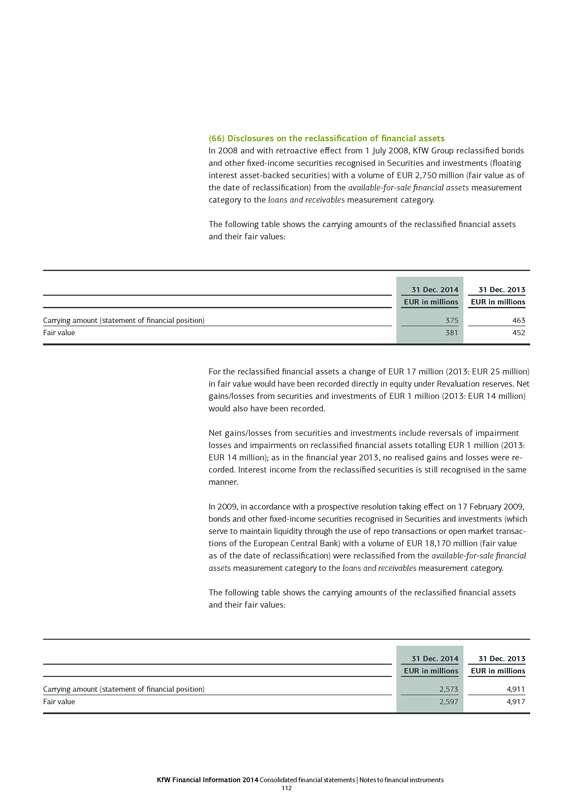

– Securities and money market investments

– Holding arrangements for the Federal Republic of Germany

– Transactions mandated by the Federal Government, loan granted to Greece

– Funding

– Central interest rate and currency management

– Strategic equity investments

KfW Financial Information 2014 Group management report | Basic information on KfW Group 3

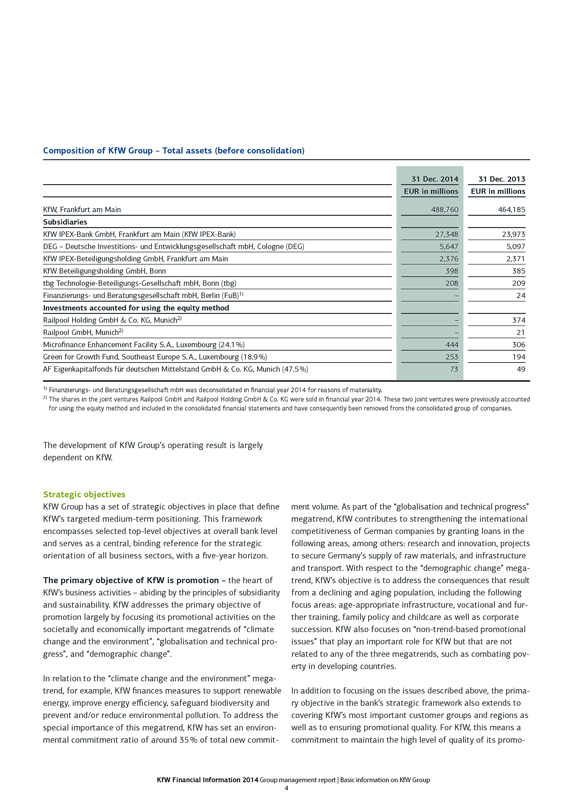

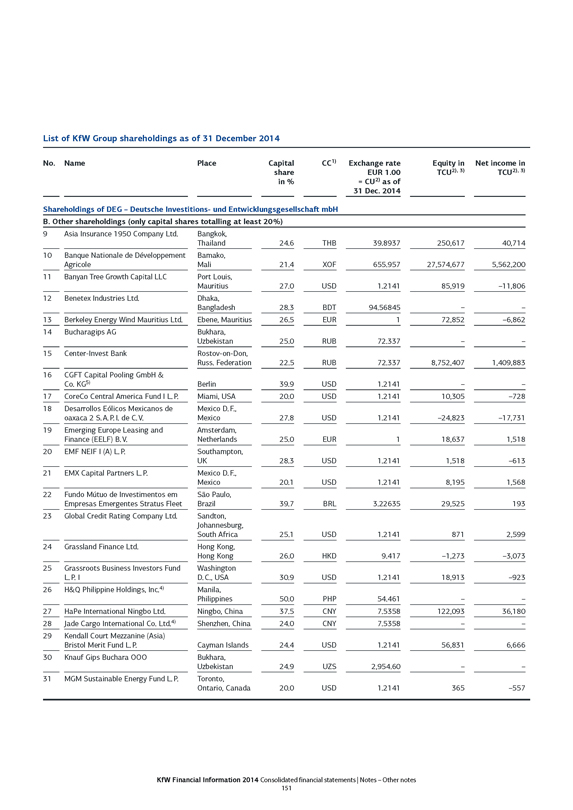

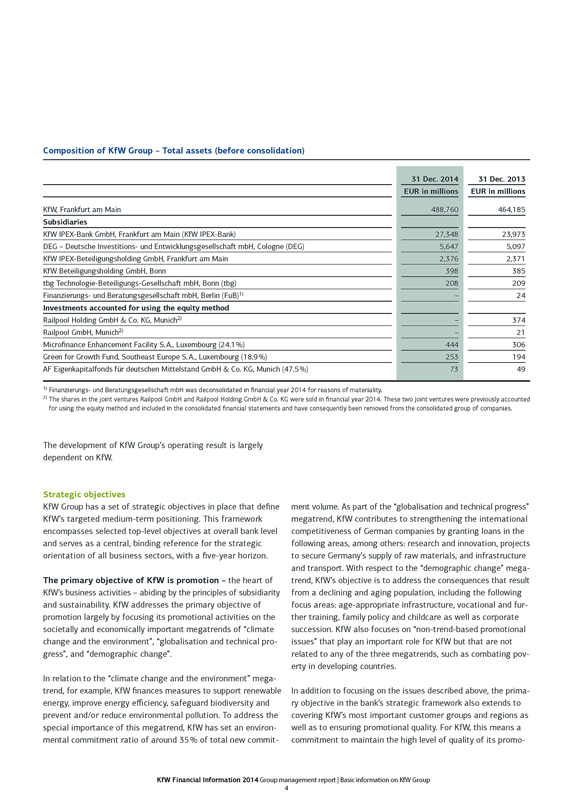

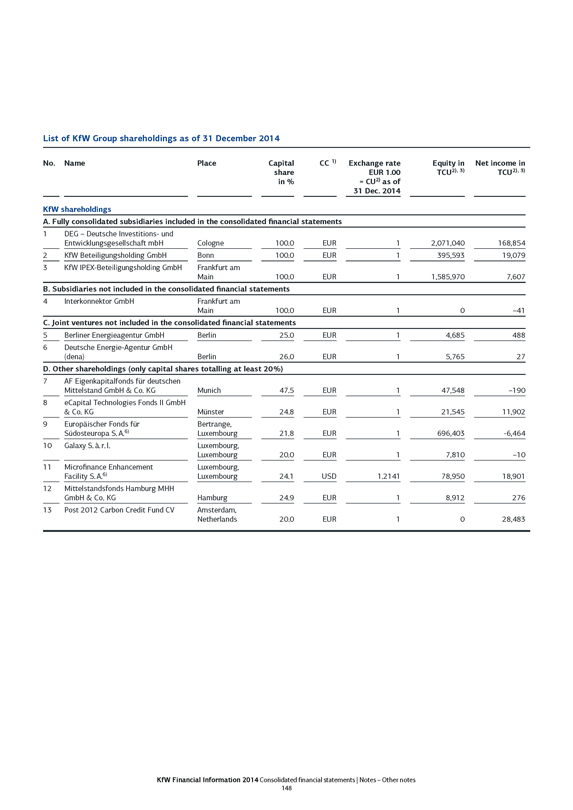

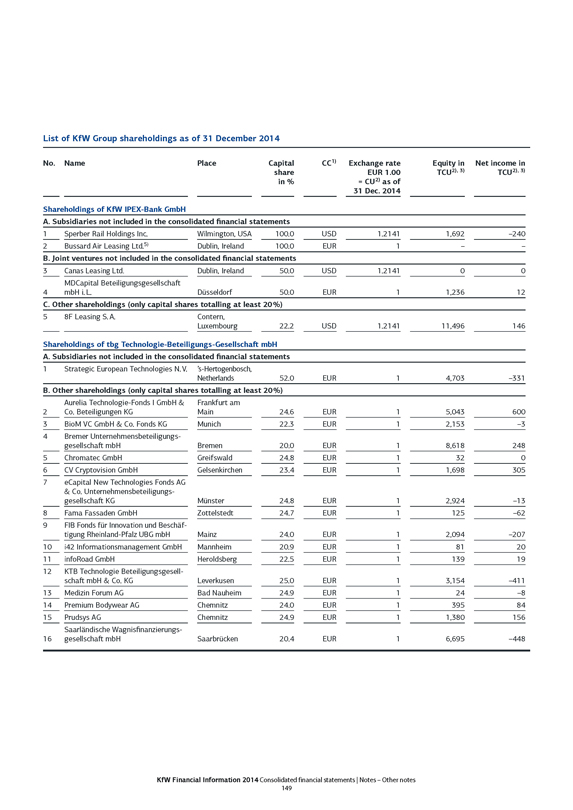

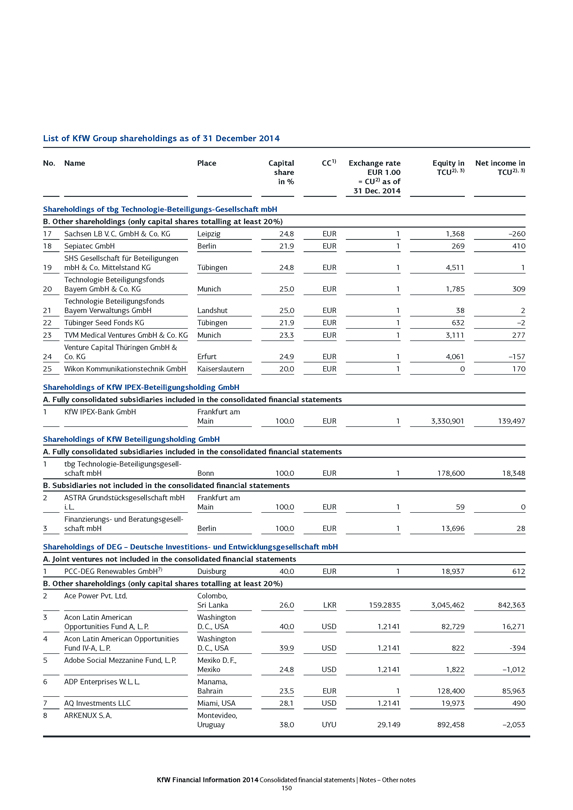

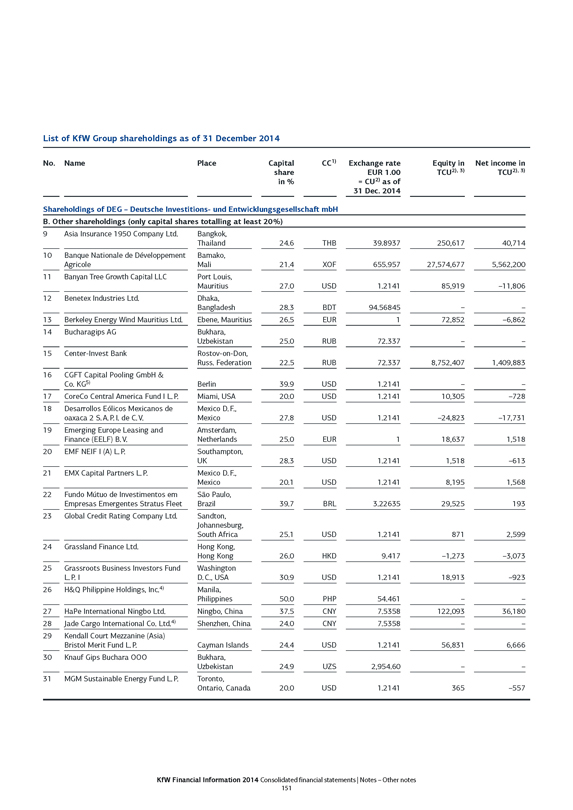

Composition of KfW Group – Total assets (before consolidation)

KfW, Frankfurt am Main

Subsidiaries

KfW IPEX-Bank GmbH, Frankfurt am Main (KfW IPEX-Bank)

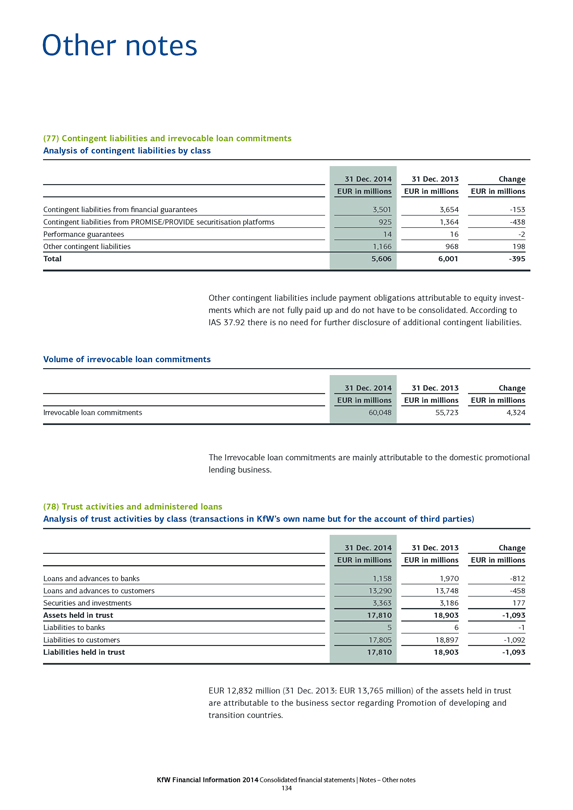

DEG – Deutsche Investitions- und Entwicklungsgesellschaft mbH, Cologne (DEG)

KfW IPEX-Beteiligungsholding GmbH, Frankfurt am Main

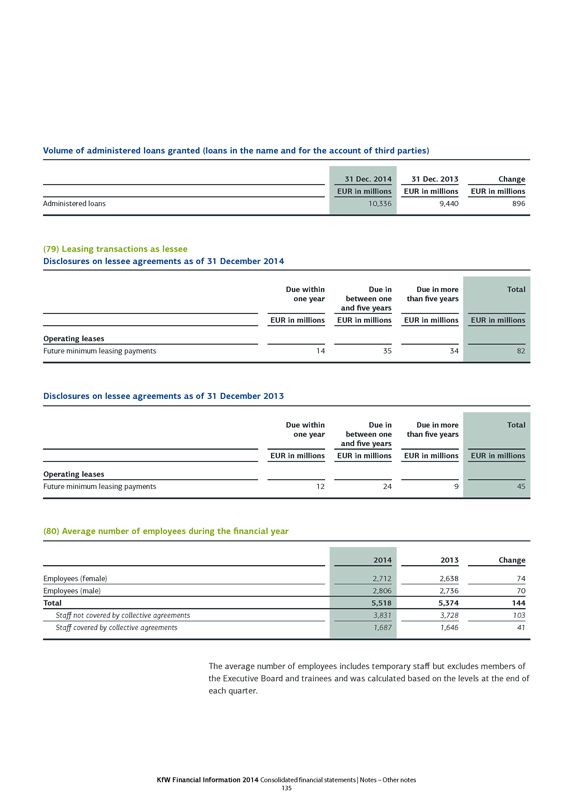

KfW Beteiligungsholding GmbH, Bonn

tbg Technologie-Beteiligungs-Gesellschaft mbH, Bonn (tbg)

Finanzierungs- und Beratungsgesellschaft mbH, Berlin (FuB)1)

Investments accounted for using the equity method

Railpool Holding GmbH & Co. KG, Munich2)

Railpool GmbH, Munich2)

Microfinance Enhancement Facility S.A., Luxembourg (24.1%)

Green for Growth Fund, Southeast Europe S.A., Luxembourg (18.9%)

AF Eigenkapitalfonds für deutschen Mittelstand GmbH & Co. KG, Munich (47.5%)

31 Dec. 2014 EUR in millions 488,760 27,348 5,647 2,376 398 208 – – – 444 253 73

31 Dec. 2013 EUR in millions 464,185 23,973 5,097 2,371 385 209 24 374 21 306 194 49

1) Finanzierungs- und Beratungsgesellschaft mbH was deconsolidated in financial year 2014 for reasons of materiality.

2) The shares in the joint ventures Railpool GmbH and Railpool Holding GmbH & Co. KG were sold in financial year 2014. These two joint ventures were previously accounted for using the equity method and included in the consolidated financial statements and have consequently been removed from the consolidated group of companies.

The development of KfW Group’s operating result is largely dependent on KfW.

Strategic objectives

KfW Group has a set of strategic objectives in place that define KfW’s targeted medium-term positioning. This framework encompasses selected top-level objectives at overall bank level and serves as a central, binding reference for the strategic orientation of all business sectors, with a five-year horizon.

The primary objective of KfW is promotion – the heart of KfW’s business activities – abiding by the principles of subsidiarity and sustainability. KfW addresses the primary objective of promotion largely by focusing its promotional activities on the societally and economically important megatrends of “climate change and the environment”, “globalisation and technical progress”, and “demographic change”.

In relation to the “climate change and the environment” megatrend, for example, KfW finances measures to support renewable energy, improve energy efficiency, safeguard biodiversity and prevent and/or reduce environmental pollution. To address the special importance of this megatrend, KfW has set an environmental commitment ratio of around 35% of total new commitment volume. As part of the “globalisation and technical progress” megatrend, KfW contributes to strengthening the international competitiveness of German companies by granting loans in the following areas, among others: research and innovation, projects to secure Germany’s supply of raw materials, and infrastructure and transport. With respect to the “demographic change” megatrend, KfW’s objective is to address the consequences that result from a declining and aging population, including the following focus areas: age-appropriate infrastructure, vocational and further training, family policy and childcare as well as corporate succession. KfW also focuses on “non-trend-based promotional issues” that play an important role for KfW but that are not related to any of the three megatrends, such as combating poverty in developing countries.

In addition to focusing on the issues described above, the primary objective in the bank’s strategic framework also extends to covering KfW’s most important customer groups and regions as well as to ensuring promotional quality. For KfW, this means a commitment to maintain the high level of quality of its promo-

KfW Financial Information 2014 Group management report | Basic information on KfW Group 4

tional products that it has achieved in recent years and sufficient coverage of KfW’s key regions and customer groups. KfW aims to have around 50% of new domestic promotional business volume utilised for the SME target group because of its special importance.

The stated priorities set for the primary objective are complemented by a set of secondary objectives or strict ancillary conditions that reflect profitability and risk-bearing capacity aspects. Moreover, KfW’s success depends upon continuing to pursue the path of professionalism in the modernisation process upon which it has embarked.

Internal management system

KfW has a closely interlinked strategy and planning process. The results of the strategic planning process are summarised in the business strategy adopted by the Executive Board, which comprises KfW Group’s strategic objectives for its main business activities as well as the contribution of the different business sectors to the strategic target system and measures for achieving the individual targets. The business strategy forms the basis for the risk strategy. The business and risk strategies are approved by the Executive Board and then presented to the supervisory body (Board of Supervisory Directors) for approval (at the last Board of Supervisory Directors meeting each year).

Conceived as a group-wide strategy process, group business sector planning is KfW Group’s central planning and management tool. The group business sector planning process deals first with strategic planning with a medium to long-term perspective and then with operational planning focused on the following financial year. The group-wide strategic objectives set by the Executive Board form the basis for the strategic planning stage.

Strategic courses of action are developed by the business sectors within this strategic activities framework. Assumptions are made with respect to the future development of determining factors on the basis of assessments of risks and opportunities. These assessments take into account internal factors and resources, as well as targeted earnings levels. The central areas

(e.g. Information Technology, Human Ressources, and Central Services) also play important roles in achieving the strategic objectives. By involving the central areas in the planning phase, the consistency of their strategic considerations with the larger strategic objectives is enhanced. Cost and FTE planning are conducted in parallel to business sector strategic planning for all areas, applying a top-down approach.

The Executive Board defines business sector objectives, including cost targets, for all sectors in the form of guidelines on the basis of a group-level assessment of these strategic considerations. The business sectors plan their new business, risks and earnings, and all areas of the bank plan their budgets for the following year based on these guidelines, taking into account any changes in external or internal factors. These plans are

checked for consistency with the group’s strategic planning and for any risk implications. A forecast for the following three years is then calculated in this context. The Executive Board either approves the resultant operating budget or instructs the business sectors to adjust their plans. Any changes to the business strategy are subject to consultation with risk management in order to ensure consistency of business and risk strategy. The operational planning process ends when management has adopted the final budget for the next financial year.

The Executive Board reviews achievement of the objectives both on a regular and an ad hoc basis during the current financial year. The assumptions concerning external and internal factors made when determining the business strategy are also subject to regular checks. As part of strategic controlling, the development of relevant control variables, their attainment, and the cause of any failure in this respect are analysed on an ongoing basis using the strategic objectives and the business sectors’ strategic plans. Ad hoc issues of strategic relevance are also addressed in consultation with group areas. Recommendations for action concerning potential strategy adjustments or an optimised use of resources are made to the Executive Board by means of the monthly strategic performance report and the quarterly strategy and efficiency report. The results of the analysis are included in further strategy discussions and strategic planning processes.

The achievement of objectives is regularly monitored by the Board of Supervisory Directors based on reports submitted to it according to the Bylaws of KfW. The commentary in these reports outlines analyses of causes and any potential plans for action.

Comprehensive and detailed reports are prepared on a monthly/quarterly basis as part of operational controlling. These detailed analyses comprise earnings, cost and full-time equivalents (“FTE”) developments and are reported to specific departments. Additionally, complete analyses and extrapolations of significant relevance to the overall group performance are also presented directly to the Executive Board.

KfW Financial Information 2014 Group management report | Basic information on KfW Group 5

Economic report

General economic environment

Overall, the development of the global economy was disappointing in 2014. Momentum in major countries and economic areas was considerably lower than anticipated at the beginning of the year. Among the industrialised countries, this was particularly the case for the euro area and Japan. Other industrialised countries performed surprisingly well (particularly the USA). As a group, the developing and emerging market countries continued to grow faster than the industrialised countries. Nevertheless, growth in many emerging market countries has decreased to a very low level, and some face real crises. This is the result of a variety of structural weaknesses that require fundamental reform and will take time to overcome. The decline of the oil price, which fell considerably in 2014, caused a swift from oil exporters to oil importers. Many oil exporting countries were able to weather the losses, but others encountered serious difficulties. This is particularly significant when combined with regional or geopolitical risks, as in the case of Russia. The world economy was affected by various geopolitical risks in 2014.

Economic recovery was moderate in member states of the European Economic and Monetary Union (“EMU”) in 2014 and the growth environment remained very fragile. This was due to increased geopolitical risks, ongoing high unemployment and the continuing difficulties in accessing credit for many businesses and private households. Overall, the economic output in EMU member states increased by 0.9% year-on-year in 2014. Growth was thus weaker than KfW expected a year ago. In particular the increased uncertainty resulting from worsening geopolitical conflicts had a negative impact.

Germany grew considerably more strongly in 2014 than in the two previous years. The continuing favourable situation on the labour market, with employment recently hitting an all-time high (42.7 million people in employment), once again had a positive impact on consumer spending and housing construction. Private investments in both equipment and commercial buildings returned to positive territory for the first time since 2011. Unlike in 2013, net exports had a stimulating effect on economic growth. Annual average price-adjusted GDP for 2014 rose by 1.6% overall. This means that KfW correctly anticipated the trends in the GDP expenditure components a year ago, but that economic growth was in the lower range of the group’s projections, which had predicted growth of up to 2%. This was largely due to the disappointing performance in the second and third quarters of 2014, when economic activity was more or less flat in the face of an increasingly unfavourable international environment. The recovery in investment stalled and companies were unsettled by dashed growth expectations in the euro area and the numerous geopolitical crises.

The key factors influencing the financial markets in 2014 were the worsening geopolitical conflicts and continuing very expansionary monetary policies of the world’s largest central banks. While the US Federal Reserve tapered its securities purchases over the course of the year, bringing them to a close at the end of October, the Japanese and European central banks expanded their monetary stimulus measures. Financial markets around the world thus continued to benefit from abundant liquidity. Given the geopolitical risks, safe investments were particularly in demand. The beneficiaries included bonds from European countries undergoing reforms. Yields fell considerably and, in the case of Italy and Spain, reached new all-time lows for ten-year maturities.

The sudden, sharp fall in crude oil prices caused substantial unrest on the financial markets in the second half of 2014. The currency and financial markets of some oil-producing countries came under more pressure in this environment.

In response to the fragile economic environment and falling inflation, key interest rates in the euro area were cut further in the course of 2014. The European Central Bank agreed its first ever negative deposit rate. It also launched programmes to buy covered bonds and asset-backed securities in the autumn and raised the prospect of further measures. In light of this, there was a major decline in money market rates in the euro area from mid-year onwards. Subject to some volatility, US money market rates trended almost sideways into the autumn. It was not until the end of the year that they rose somewhat amid speculation that key interest rates in the USA were about to turn. Over longer maturities, interest rates in the euro area saw a clear downward trend in 2014. Yields on ten-year German government bonds fell by almost 140 basis points to reach a new low of 0.54% p.a. in late December. Yields on ten-year US government bonds saw greater volatility during the year. By year-end they were a full 85 basis points lower than at the start. Yields on ten-year German government bonds in 2014 were down an average of 40 basis points year-on-year, while yields on ten-year US government bonds recorded an increase of around 20 basis points compared to their 2013 average. In the USA, the average slope of yield curves increased in 2014 compared to 2013, while those in Europe flattened.

The diverging monetary policy prospects in the euro area and the USA put considerable downward pressure on the EUR/USD exchange rate. This hit 1.21 at the end of December, the lowest it had been all year. The average exchange rate in 2014 was 1.33, almost unchanged on the previous year.

KfW Financial Information 2014 Group management report | Economic report 6

Development of KfW Group

KfW reported another highly satisfactory financial year in 2014. The plans and strategic objectives for the positioning targeted in the medium term were achieved overall. In spite of an increasingly difficult environment, the 2014 financial year was a successful one with a promotional business volume of EUR 74.1 billion (2013: EUR 72.5 billion). Promotional activities focused on the socially and economically significant megatrends of “climate change and the environment”, “globalisation and technical progress” and “demographic change”. The measures introduced for comprehensive modernisation were continued.

The earnings position developed better than expected, exceeding the figure reported in 2013, primarily as a result of the excellent valuation result. At EUR 2.0 billion, the Operating result before valuation (before promotional activity) is, as expected, lower year-on-year (2013: EUR 2.3 billion). This was primarily due to the deterioration of the interest rate environment. The figure was also lower than projected. The cost-income ratio (before promotional activity) increased to 34.4% as a result of declining operating income and increasing administrative costs. The latter were attributable in particular to modernisation efforts and regulatory measures, such as KfW’s mandatory application, by analogy, of the German Banking Act (Kreditwesengesetz – “KWG”). The valuation result closed with moderate expenses in net terms and thus much better than expected. This was primarily due to lower than projected net charges from risk provisions for lending business as well as to positive contributions to earnings from the securities and equity investment portfolios. At EUR 1.5 billion (2013: EUR 1.3 billion), consolidated profit exceeded the projected level. With this result, KfW is improving its capital base in order to safeguard its promotional capacity in the long term and to ensure it can meet higher regulatory requirements. In its current consolidated income projections for 2015, KfW expects Consolidated profit before IFRS effects from hedging of slightly under EUR 1 billion, which is in the range of strategic projections.

Consolidated total assets rose by EUR 24.3 billion to EUR 489.1 billion in 2014. This increase is primarily due to interest-rate and exchange-rate-induced fair value changes

in derivatives used for hedging purposes and their recognition in hedge accounting. The increase in the volume of new business is reflected in the EUR 7.1 billion rise in Net loans and advances to EUR 365.3 billion. Unscheduled repayments in domestic promotional lending business decreased year-on-year. The promotional business is primarily funded through the international capital markets. The volume of own issues reported under Certificated liabilities amounted to EUR 404.0 billion (year-end 2013: EUR 385.5 billion).

KfW Group’s business in 2014 was largely characterised by the following developments:

A. Successful promotional year for KfW

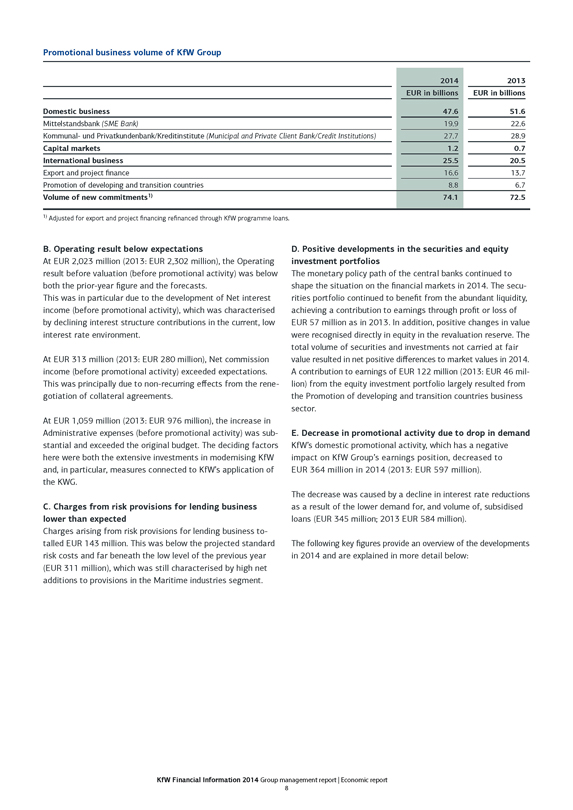

With a promotional business volume of EUR 74.1 billion in 2014 (2013: EUR 72.5 billion), the group exceeded its projected new business volume of EUR 69.4 billion.

KfW’s domestic promotional business reached a high level with commitments totalling EUR 47.6 billion, despite companies’ declining investment propensity (2013: EUR 51.6 billion). The decline on the previous year had been expected and primarily affects corporate financing by Mittelstandsbank. This development is also reflected by the decline in the SME share of financing to 44% (2013: 47%). Foreign business, meanwhile, recorded strong growth and reached EUR 25.5 billion. This development was due to both stronger demand in business sector Export and project finance and higher commitments in business sector Promotion of developing and transition countries. A high 36% across all business sectors was attributable to the “climate change and environment” megatrend (2013: 38%). The promotional business volume in the business sector Capital markets expanded to EUR 1.2 billion.

KfW raised EUR 57.4 billion on the international capital markets to fund its business activities (2013: EUR 65.4 billion). The lower borrowing, compared to both the previous year and the forecast level (EUR 65 to 70 billion), was largely due to declining yet still high unscheduled repayments in the lending business, which led to greater cash inflow than expected.

KfW Financial Information 2014 Group management report | Economic report 7

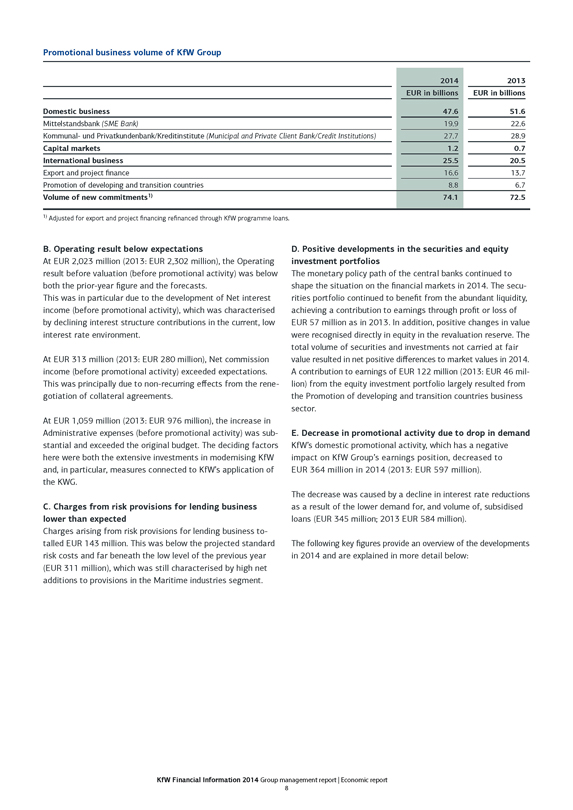

Promotional business volume of KfW Group

Domestic business

Mittelstandsbank (SME Bank)

Kommunal- und Privatkundenbank/Kreditinstitute (Municipal and Private Client Bank/Credit Institutions)

Capital markets

International business

Export and project finance

Promotion of developing and transition countries

Volume of new commitments1)

2014 EUR in billions 47.6 19.9 27.7 1.2 25.5 16.6 8.8 74.1

2013 EUR in billions 51.6 22.6 28.9 0.7 20.5 13.7 6.7 72.5

1) Adjusted for export and project financing refinanced through KfW programme loans.

B. Operating result below expectations

At EUR 2,023 million (2013: EUR 2,302 million), the Operating result before valuation (before promotional activity) was below both the prior-year figure and the forecasts.

This was in particular due to the development of Net interest income (before promotional activity), which was characterised by declining interest structure contributions in the current, low interest rate environment.

At EUR 313 million (2013: EUR 280 million), Net commission income (before promotional activity) exceeded expectations. This was principally due to non-recurring effects from the renegotiation of collateral agreements.

At EUR 1,059 million (2013: EUR 976 million), the increase in Administrative expenses (before promotional activity) was substantial and exceeded the original budget. The deciding factors here were both the extensive investments in modernising KfW and, in particular, measures connected to KfW’s application of the KWG.

C. Charges from risk provisions for lending business lower than expected

Charges arising from risk provisions for lending business totalled EUR 143 million. This was below the projected standard risk costs and far beneath the low level of the previous year (EUR 311 million), which was still characterised by high net additions to provisions in the Maritime industries segment.

D. Positive developments in the securities and equity investment portfolios

The monetary policy path of the central banks continued to shape the situation on the financial markets in 2014. The securities portfolio continued to benefit from the abundant liquidity, achieving a contribution to earnings through profit or loss of EUR 57 million as in 2013. In addition, positive changes in value were recognised directly in equity in the revaluation reserve. The total volume of securities and investments not carried at fair value resulted in net positive differences to market values in 2014. A contribution to earnings of EUR 122 million (2013: EUR 46 million) from the equity investment portfolio largely resulted from the Promotion of developing and transition countries business sector.

E. Decrease in promotional activity due to drop in demand

KfW’s domestic promotional activity, which has a negative impact on KfW Group’s earnings position, decreased to EUR 364 million in 2014 (2013: EUR 597 million).

The decrease was caused by a decline in interest rate reductions as a result of the lower demand for, and volume of, subsidised loans (EUR 345 million; 2013 EUR 584 million).

The following key figures provide an overview of the developments in 2014 and are explained in more detail below:

KfW Financial Information 2014 Group management report | Economic report 8

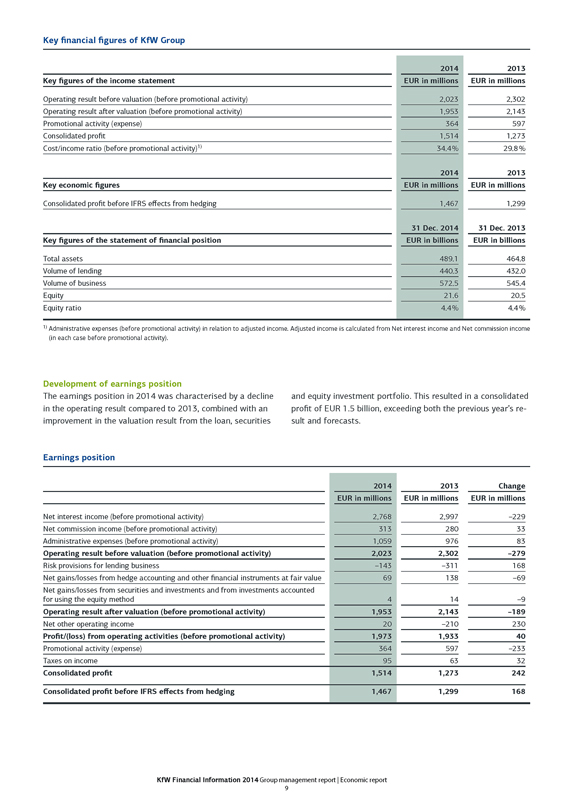

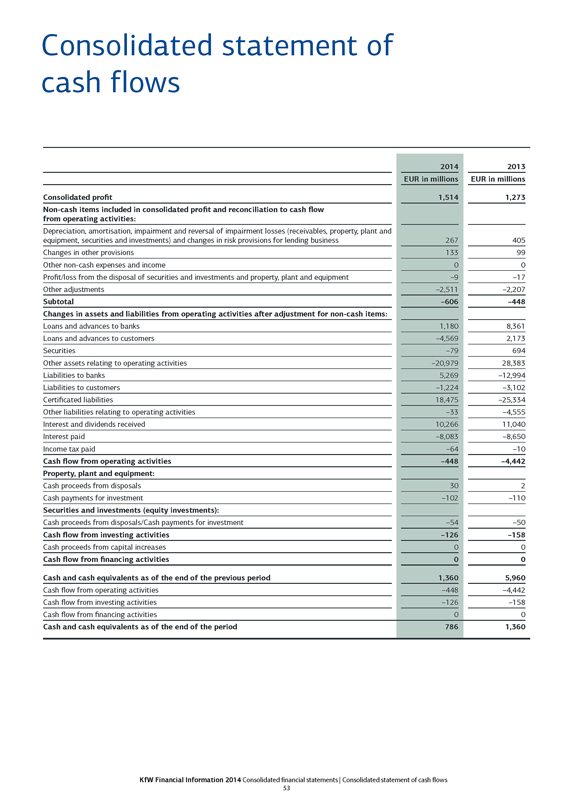

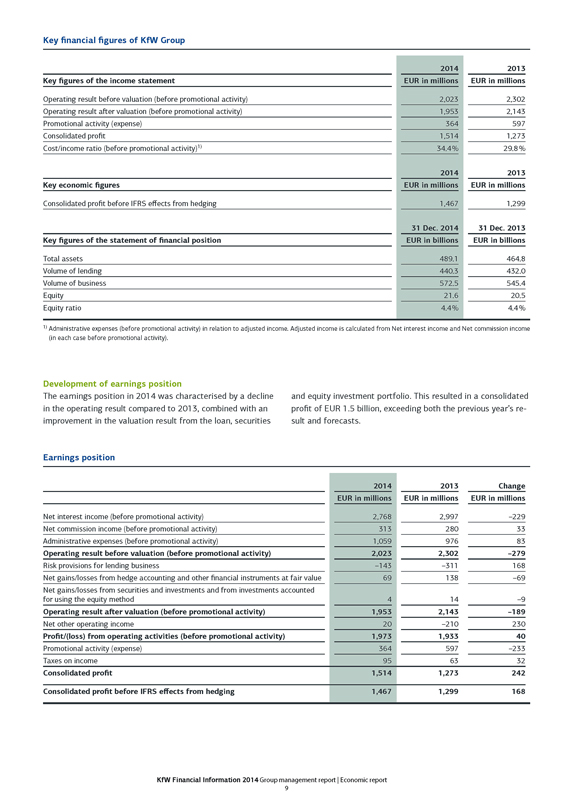

Key financial figures of KfW Group

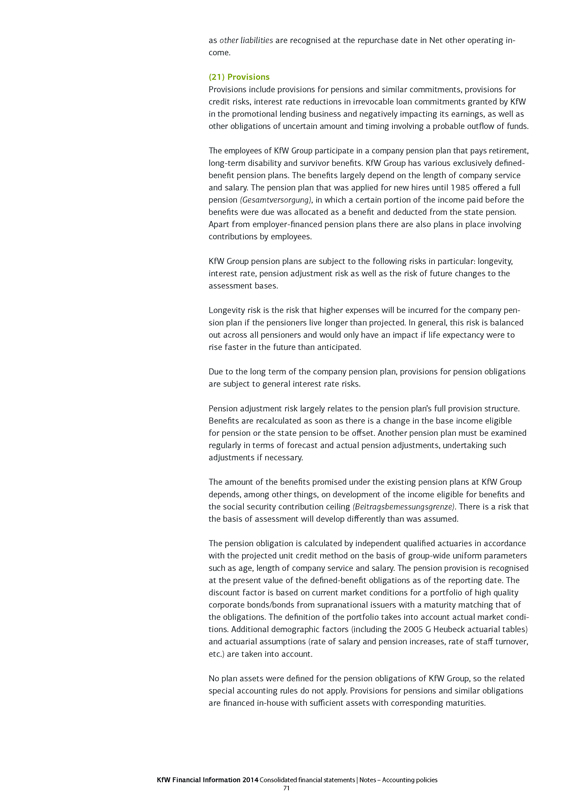

Key figures of the income statement

Operating result before valuation (before promotional activity)

Operating result after valuation (before promotional activity)

Promotional activity (expense)

Consolidated profit

Cost/income ratio (before promotional activity)1)

Key economic figures

Consolidated profit before IFRS effects from hedging

Key figures of the statement of financial position

Total assets

Volume of lending

Volume of business

Equity

Equity ratio

2014 EUR in millions 2,023 1,953 364 1,514 34.4% 2014 EUR in millions 1,467 31 Dec. 2014 EUR in billions 489.1 440.3 572.5 21.6 4.4%

2013 EUR in millions 2,302 2,143 597 1,273 29.8% 2013 EUR in millions 1,299 31 Dec. 2013 EUR in billions 464.8 432.0 545.4 20.5 4.4%

1) Administrative expenses (before promotional activity) in relation to adjusted income. Adjusted income is calculated from Net interest income and Net commission income (in each case before promotional activity).

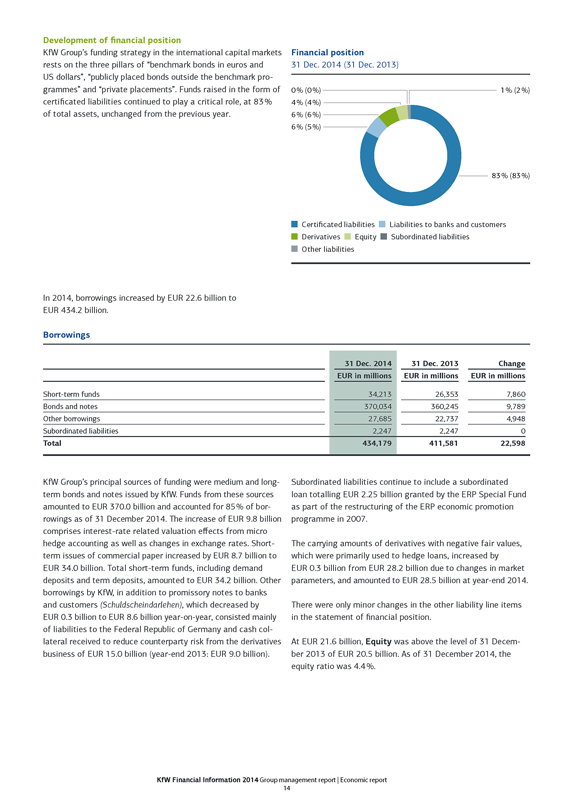

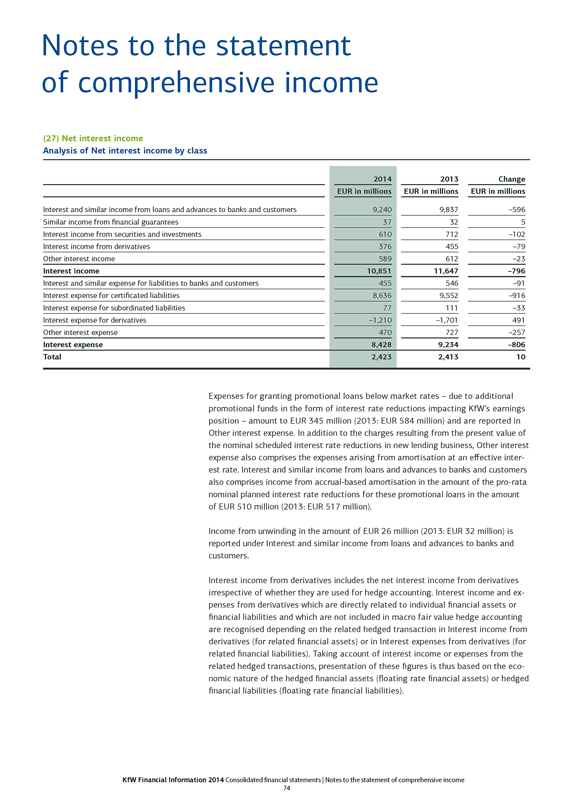

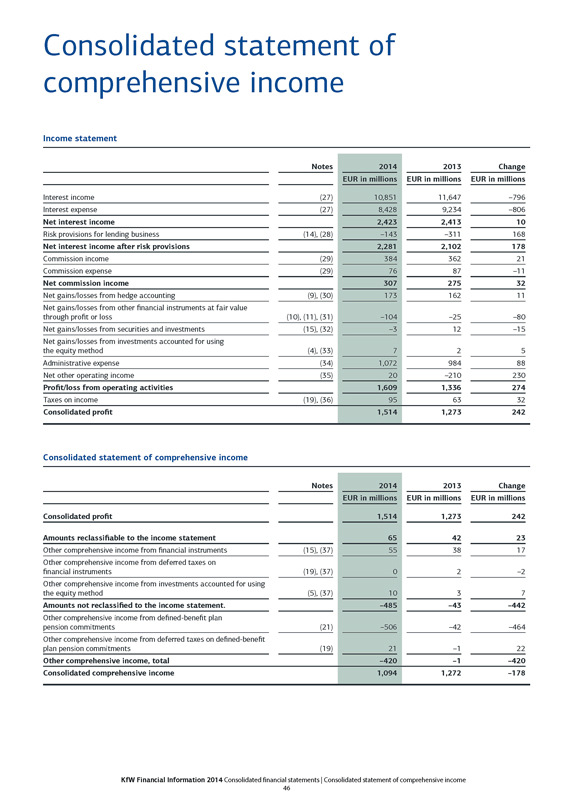

Development of earnings position

The earnings position in 2014 was characterised by a decline in the operating result compared to 2013, combined with an improvement in the valuation result from the loan, securities

and equity investment portfolio. This resulted in a consolidated profit of EUR 1.5 billion, exceeding both the previous year’s result and forecasts.

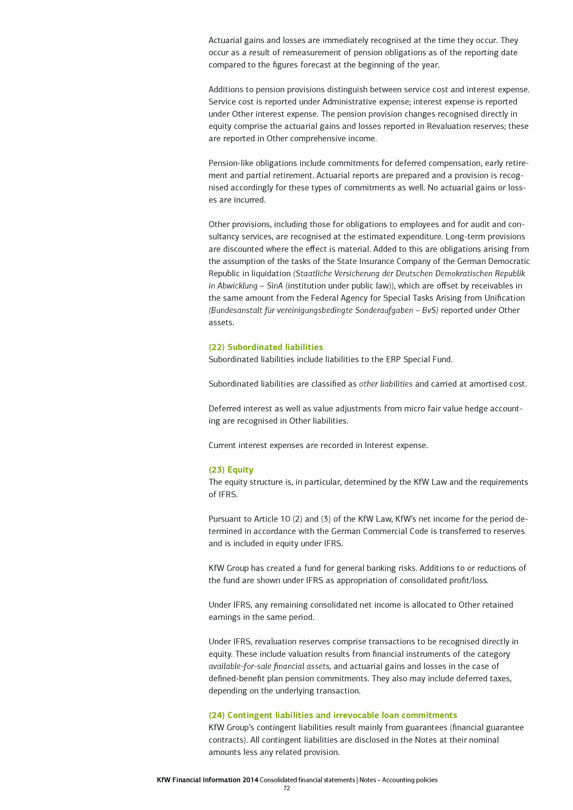

Earnings position

Net interest income (before promotional activity)

Net commission income (before promotional activity)

Administrative expenses (before promotional activity)

Operating result before valuation (before promotional activity)

Risk provisions for lending business

Net gains/losses from hedge accounting and other financial instruments at fair value

Net gains/losses from securities and investments and from investments accounted for using the equity method

Operating result after valuation (before promotional activity)

Net other operating income

Profit/(loss) from operating activities (before promotional activity)

Promotional activity (expense)

Taxes on income

Consolidated profit

Consolidated profit before IFRS effects from hedging

2014 EUR in millions 2,768 313 1,059 2,023 –143 69 4 1,953 20 1,973 364 95 1,514 1,467

2013 EUR in millions 2,997 280 976 2,302 –311 138 14 2,143 –210 1,933 597 63 1,273 1,299

Change EUR in millions –229 33 83 –279 168 –69 –9 –189 230 40 –233 32 242 168

KfW Financial Information 2014 Group management report | Economic report 9

At EUR 2,023 million (2013: EUR 2,302 million), the Operating result before valuation (before promotional activity) was below both the prior-year figure and forecasts.

At EUR 2,768 million, Net interest income (before promotional activity) decreased due to the worsening of the interest rate environment with a low interest rate and flatter yield curve than in the 2013 financial year (EUR 2,997 million). However, it remains the most important source of income.

While the interest margins in the lending business, particularly from the business sector Export and project finance, remained stable and KfW enjoyed very good funding opportunities given its high credit rating, Net interest income declined due to the lower profit from maturity transformation, which was less than expected. Interest rate movements resulted in lower income from reinvestment following the very high unscheduled repayments in the previous years and the declining but still high unscheduled repayments in the current financial year. Income from early repayment penalties as a result of unscheduled repayments in 2014, which may in the future lead to corresponding reduced income, was down year-on-year.

The Net commission income (before promotional activity) was EUR 313 million, which is higher than the 2013 figure of EUR 280 million.

Non-recurring compensation paid by derivatives partners following renegotiation of the collateral agreements totalled EUR 57 million in the 2014 financial year and was a key factor for the increase in Net commission income (before promotional activity). At EUR 82 million, loan processing fees moved in the opposite direction (2013: EUR 91 million). Income generated from managing Financial Cooperation on behalf of the German Federal Government in the business sector Promotion of developing and transition countries, which included non-recurring effects in the previous year due to renegotiation of the remuneration arrangement, also decreased, to EUR 156 million (2013: EUR 169 million). This item was offset by an increase in KfW’s Administrative expenses, in part, due to branch offices in partner countries.

The substantial rise in Administrative expenses (before promotional activity) to EUR 1,059 million (2013: EUR 976 million) was in particular due to the measures required to fulfil KWG requirements and to extensive investments in modernising KfW accounted for as Personnel and Non-personnel expenses. Projections were exceeded as a result of non-recurring effects.

Personnel expenses increased by EUR 44 million to EUR 585 million (2013: EUR 541 million). This was due to the higher number of employees, standard and performance-based pay increases as well as non-recurring charges connected to the ongoing revaluation of personnel measures taken in previous years.

Non-personnel expenses (before promotional activity) amounted to EUR 474 million (2013: EUR 434 million). Besides the non- recurring charges in connection with the ECB review of KfW IPEX-Bank, the increase of EUR 40 million was attributable

to advisory services. These services related in particular to the necessary fulfilment of regulatory requirements and the comprehensive modernisation of KfW’s IT architecture, which will continue to be intensively pursued in the next few years. This extensive project portfolio is also expected to lead to a rise in Administrative expenses in the future, particularly due to the mandatory application of significant bank regulatory requirements.

The cost-income ratio before promotional activity increased to

34.4% (2013: 29.8%). This was primarily due to the expected decline in operating income as well as increased expenditure associated with KfW’s mandatory application of the KWG and the further modernisation of KfW.

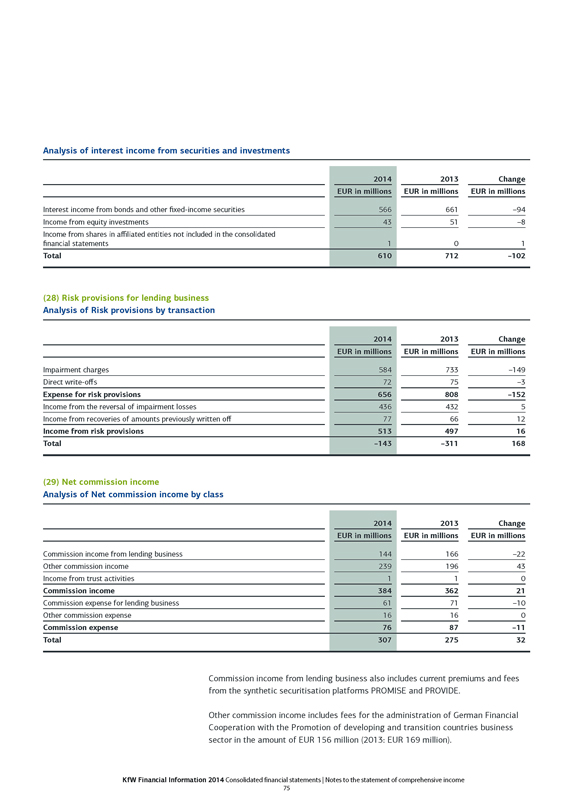

KfW Group’s Risk provisions for lending business resulted in charges of EUR 143 million (2013: EUR 311 million), which was below the projected standard risk costs. Risk provisions were required particularly in domestic business and in the Promotion of developing and transition countries business sector. Compared with the previous year, there was a lower requirement for risk provisioning of export and project financing in the Maritime industries segment.

At EUR 221 million, net additions to the provision for imminent credit risks including direct write-offs were significantly lower than in 2013 (EUR 382 million). This decline was particularly concentrated on the business sector Export and project finance with additions of just EUR 34 million (2013: EUR 218 million), especially in the Maritime industries segment with net additions of just EUR 4 million (2013: EUR 170 million). The Export and project finance business sector also recorded income from recoveries of loans written off totalling EUR 37 million (2013: EUR 22 million). The main focuses of the net additions in 2014 were the business sectors Promotion of developing and transition countries with EUR 64 million and Kommunal- und Privatkundenbank/Kreditinstitute with EUR 57 million. As of year-end 2014, risk provisions amounted to EUR 1.4 billion (2013: EUR

1.5 billion), of which EUR 0.7 billion (2013: EUR 0.9 billion) related to Export and project finance.

In 2014, there was almost no change in the risk provisions for loan portfolio risks which were not yet allocable. As of year-end 2014, risk provisions remained at EUR 0.6 billion.

Risk provisions for lending business cover all imminent and latent risks, reflecting the consistent implementation of KfW Group’s conservative risk policy.

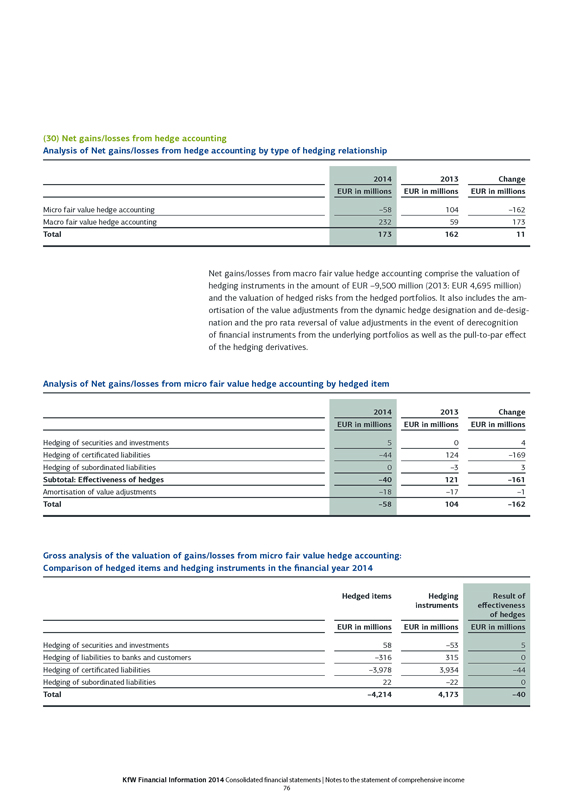

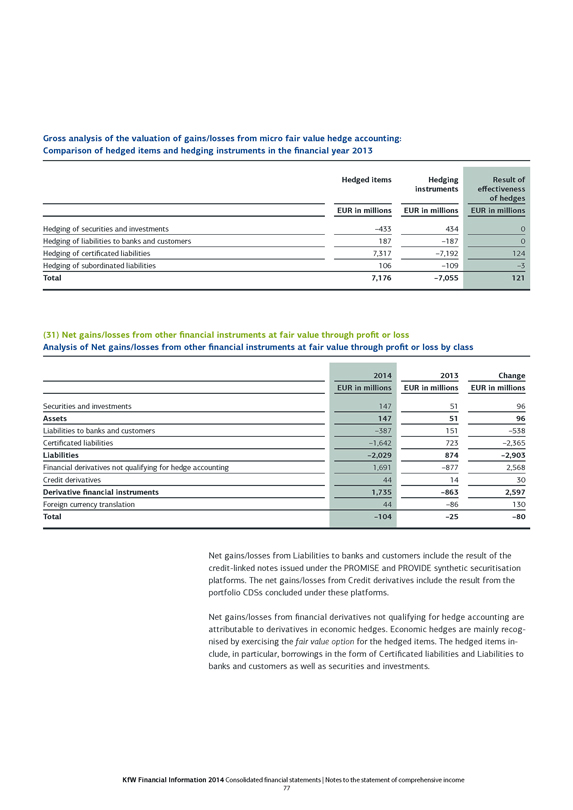

Net gains/losses from hedge accounting and other financial instruments at fair value stood at EUR 69 million (2013: EUR 138 million) and in 2014 were primarily driven by positive effects from the equity investment portfolio partially offset by the valuation of foreign currency positions and hedging transactions.

The equity investment portfolio measured at fair value through profit or loss was primarily influenced by the positive perfor-

KfW Financial Information 2014 Group management report | Economic report 10

mance of investments and the appreciation of the US dollar against the euro. It generated income of EUR 175 million (2013: EUR 78 million). This contribution is primarily attributable to the business activities of DEG in promoting developing and transitional countries.

The result from foreign currency translation had a negative effect with a charge of EUR 57 million (2013: EUR –10 million). This was primarily attributable to non-monetary financial instruments in the US dollar equity investment portfolio not recognised at fair value, which are recognised at the rate on the transaction date, while the relevant refinancing is converted at the exchange rate on the balance sheet date.

Hedge accounting, borrowings recognised at fair value, including derivatives used for hedging purposes, and other derivatives transactions had a total net negative effect on earnings of EUR 54 million (2013: EUR +56 million). The mark-to-market derivatives are part of economically hedged positions. However, situations where the other part of the hedging relationship cannot be carried at fair value or has to be measured with a different method inevitably result in temporary fluctuations in income that fully reverse over the term of the transaction. Hedging derivatives that in previous years had led to purely IFRS-induced negative earnings effects were sold early in the reporting year in order to optimise collateral management. This did not have a significant impact on risk management.

Net gains from securities and investments accounted for using the equity method of EUR 4 million (2013: EUR 14 million) largely resulted from offsetting developments in the securities and equity investment portfolio.

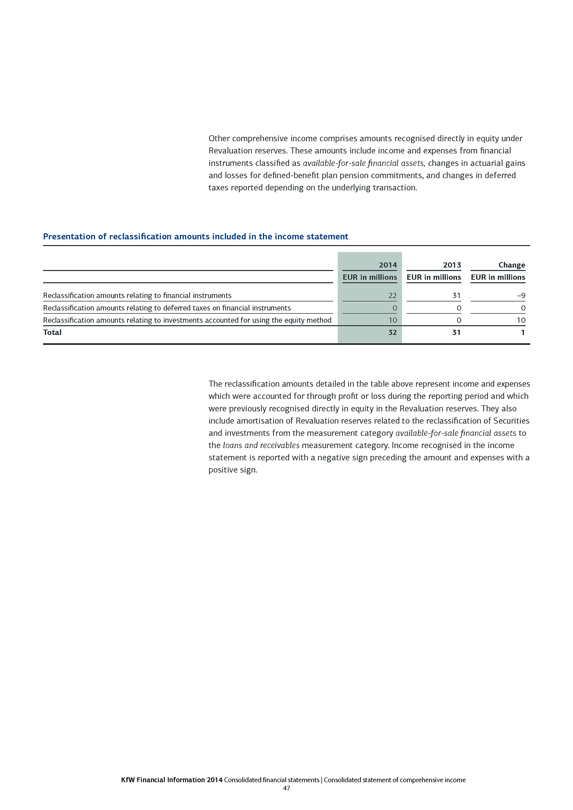

Net gains/losses from securities not carried at fair value through profit or loss slightly improved on 2013 with a positive earnings contribution of EUR 53 million (2013: EUR 43 million). Structured securities performed particularly well.

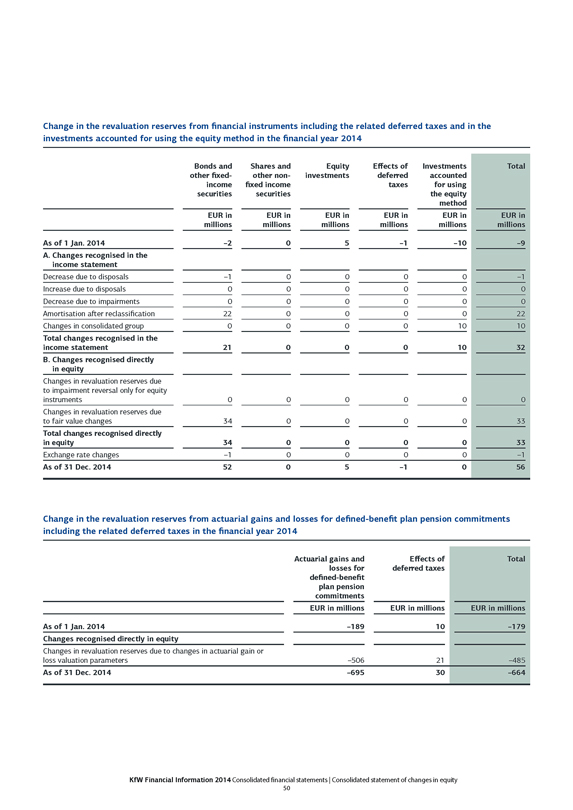

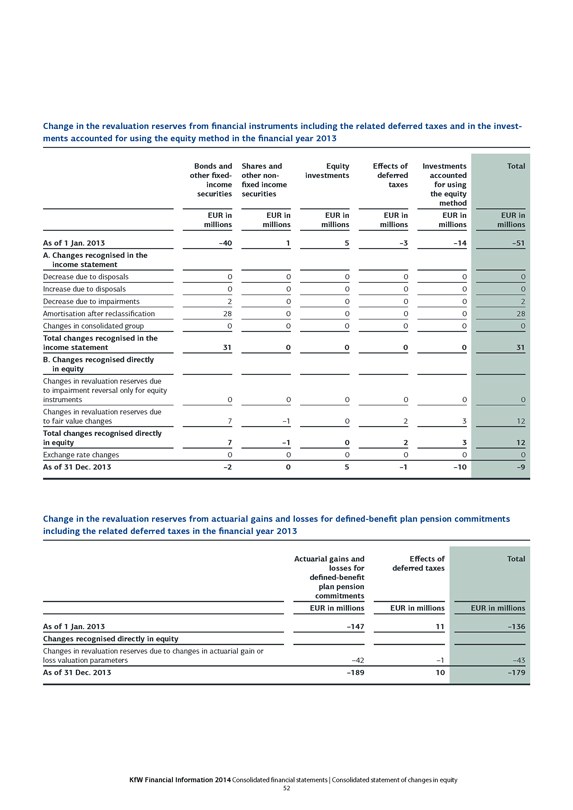

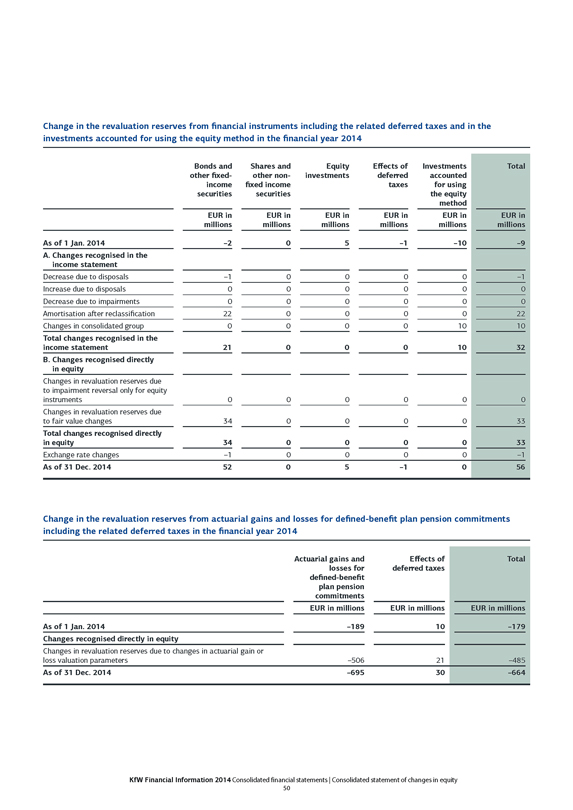

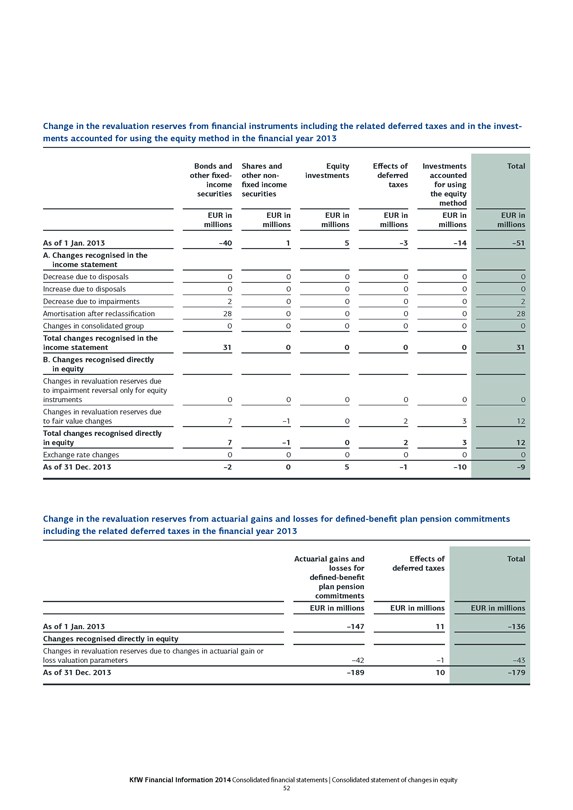

The general development of financial markets led to an increase in the value of securities not recognised through profit or loss of EUR 55 million (2013: EUR 38 million), which were recognised in equity under Revaluation reserves. These increases included write-ups of EUR 22 million (2013: EUR 28 million) due to the reclassifications between measurement categories that took place in 2008 (structured securities) and 2009 (securities held as a liquidity reserve).

Moreover, the net negative difference of EUR 8 million between the carrying amount and the fair value for those securities and investments not carried at fair value improved by EUR 53 million (2013: by EUR 169 million) to a positive difference of EUR 45 million as of 31 December 2014. This development was primarily due to price recoveries of well-collateralised covered bonds and securities in the ABS portfolio. Overall, the total volume decreased further and amounted to EUR 9.2 billion as of 31 December 2014 (year-end 2013: EUR 10.3 billion).

Net losses from equity investments not carried at fair value through profit or loss amounted to EUR 54 million were largely due to Mittelstandsbank’s domestic promotional lending portfolio. The comparable expense for financial year 2013 was EUR 32 million.

Net other operating income of EUR 20 million (2013:

EUR –210 million) includes income from repurchasing own issues of EUR 29 million. The previous year’s negative result was primarily due to the non-recurring charge of EUR 264 million from the substitution of federal funds.

KfW’s domestic promotional activity, which has a negative impact on KfW Group’s earnings, fell below the prior-year level to EUR 364 million in 2014 (2013: EUR 597 million). This was due to a decline in demand.

The key component of KfW’s promotional activity is interest rate reductions. KfW grants these for certain domestic promotional loans during the first fixed interest rate period in addition to passing on its favourable refinancing conditions. The volume of interest rate reductions provided fell to EUR 345 million in 2014 (2013: EUR 584 million). This was primarily due to the decline, due to demand factors, in volume of interest rate-reduced promotional loans in Mittelstandsbank’s corporate financing, which resulted from ongoing investment reticence, uncertainties in the economic environment and, at the same time, the healthy liquidity position of businesses. The generally low interest rates also reduced the potential to stimulate the promotional business with additional reductions.

Moreover, promotional activities, as reported in Net commission income and Administrative expenses, were provided in the amount of EUR 19 million (2013: EUR 13 million). These activities were particularly targeted at improving sales opportunities for KfW’s promotional products.

Accounting for taxes on income, a consolidated profit of EUR 1,514 million was recorded, which exceeded that of the previous year (EUR 1,273 million). This performance is characterised by a very good valuation result in 2014 and high non-recurring charges from the substitution of federal funds in 2013.

Consolidated profit before IFRS effects from hedging is a further key financial figure based on consolidated profit in accordance with IFRS. Derivative financial instruments are entered into for hedging purposes. Under IFRS, the requirements for recognition and valuation of derivatives and hedges nevertheless give rise to temporary net gains or losses. In KfW’s opinion, such net gains or losses do not sufficiently reflect economically effective hedges.

KfW Financial Information 2014 Group management report | Economic report 11

As a result, the following reconciliations were performed by eliminating temporary contributions to income in the amount of EUR –47 million (2013: EUR +27 million) as follows:

– Valuation results from micro and macro hedge accounting. All hedging relationships are economically effective and do not give rise to any net gain or loss over the entire life of the hedge.

– Net gains or losses from the use of the fair value option to avoid an accounting mismatch in the case of borrowings include related hedging derivatives. Accumulated over the entire life of the hedge, the economically effective hedges do not give rise to any net gain or loss.

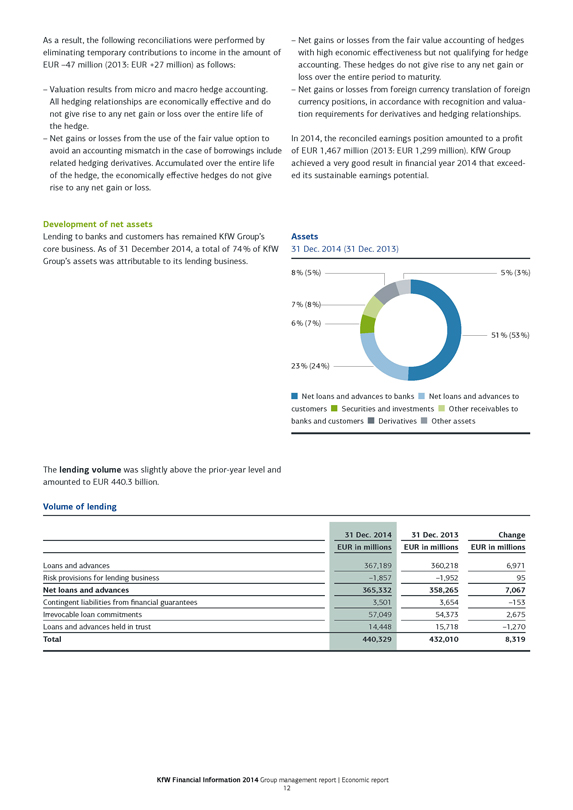

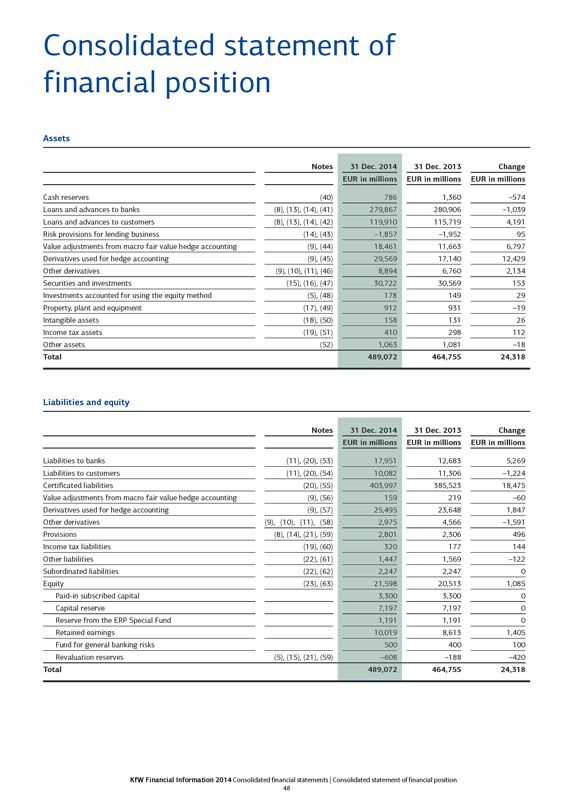

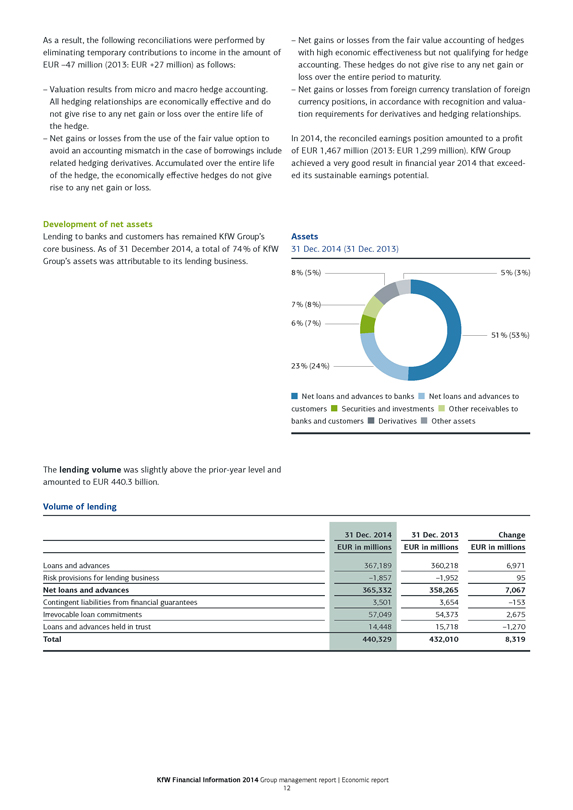

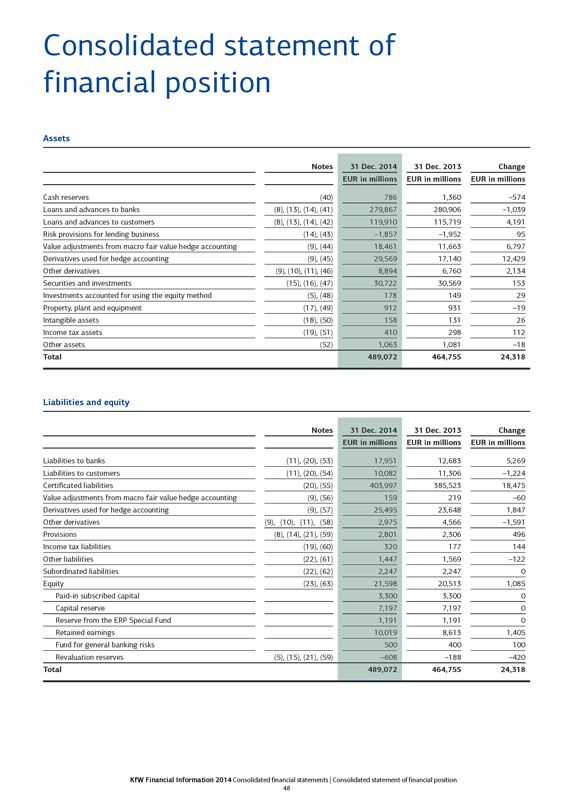

Development of net assets

Lending to banks and customers has remained KfW Group’s core business. As of 31 December 2014, a total of 74% of KfW Group’s assets was attributable to its lending business.

– Net gains or losses from the fair value accounting of hedges with high economic effectiveness but not qualifying for hedge accounting. These hedges do not give rise to any net gain or loss over the entire period to maturity.

– Net gains or losses from foreign currency translation of foreign currency positions, in accordance with recognition and valuation requirements for derivatives and hedging relationships.

In 2014, the reconciled earnings position amounted to a profit of EUR 1,467 million (2013: EUR 1,299 million). KfW Group achieved a very good result in financial year 2014 that exceeded its sustainable earnings potential.

Assets 31 Dec. 2014 (31 Dec. 2013) 8% 7% 6% 23% (24%) (5%) (8%) (7%)

5% (3%) 51% (53%)

Net loans and advances to banks Net loans and advances to customers Securities and investments Other receivables to banks and customers Derivatives Other assets

The lending volume was slightly above the prior-year level and amounted to EUR 440.3 billion.

Volume of lending

Loans and advances

Risk provisions for lending business

Net loans and advances

Contingent liabilities from financial guarantees

Irrevocable loan commitments

Loans and advances held in trust

Total

31 Dec. 2014 EUR in millions 367,189 –1,857 365,332 3,501 57,049 14,448 440,329

31 Dec. 2013 EUR in millions 360,218 –1,952 358,265 3,654 54,373 15,718 432,010

Change EUR in millions 6,971 95 7,067 –153 2,675 –1,270 8,319

KfW Financial Information 2014 Group management report | Economic report 12

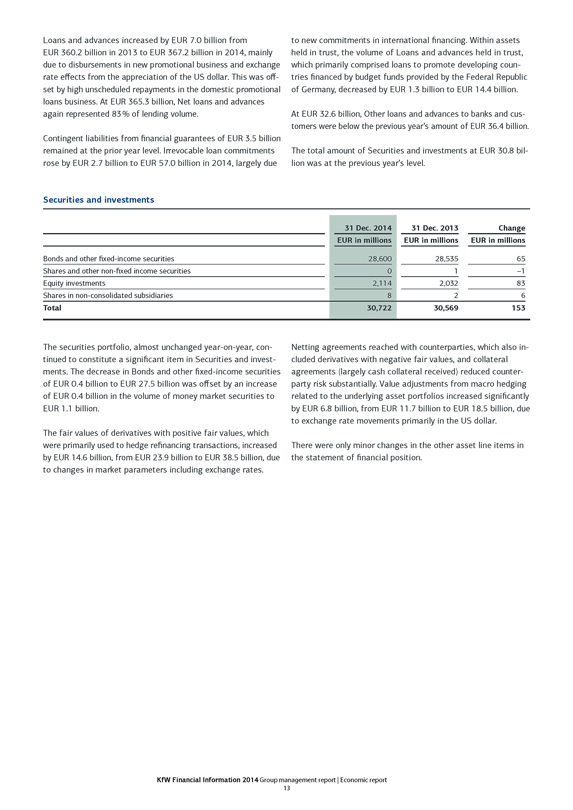

Loans and advances increased by EUR 7.0 billion from EUR 360.2 billion in 2013 to EUR 367.2 billion in 2014, mainly due to disbursements in new promotional business and exchange rate effects from the appreciation of the US dollar. This was offset by high unscheduled repayments in the domestic promotional loans business. At EUR 365.3 billion, Net loans and advances again represented 83% of lending volume.

Contingent liabilities from financial guarantees of EUR 3.5 billion remained at the prior year level. Irrevocable loan commitments rose by EUR 2.7 billion to EUR 57.0 billion in 2014, largely due

to new commitments in international financing. Within assets held in trust, the volume of Loans and advances held in trust, which primarily comprised loans to promote developing countries financed by budget funds provided by the Federal Republic of Germany, decreased by EUR 1.3 billion to EUR 14.4 billion.

At EUR 32.6 billion, Other loans and advances to banks and customers were below the previous year’s amount of EUR 36.4 billion.

The total amount of Securities and investments at EUR 30.8 billion was at the previous year’s level.

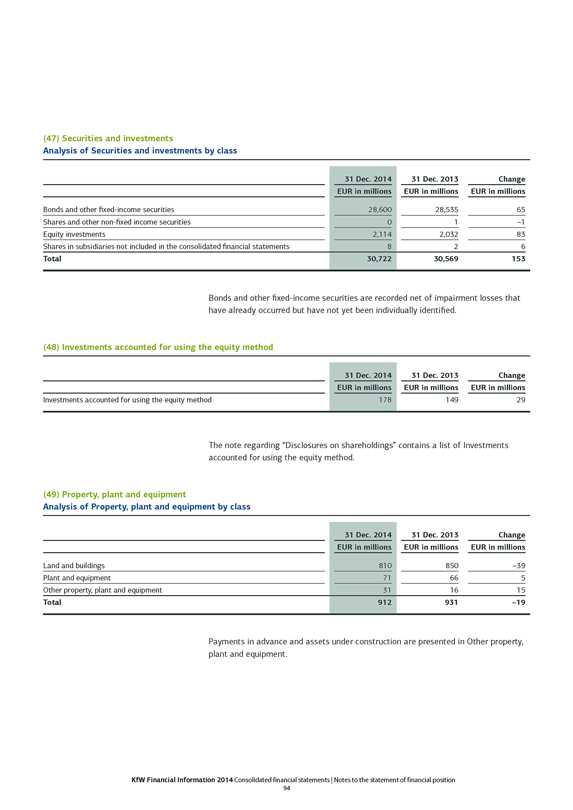

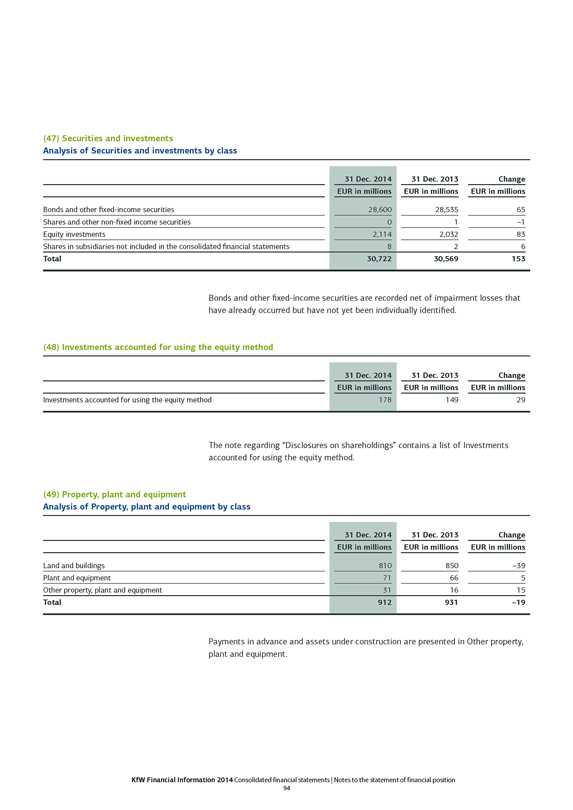

Securities and investments

Bonds and other fixed-income securities

Shares and other non-fixed income securities

Equity investments

Shares in non-consolidated subsidiaries

Total

31 Dec. 2014 EUR in millions 28,600 0 2,114 8 30,722

31 Dec. 2013 EUR in millions 28,535 1 2,032 2 30,569

Change EUR in millions 65 –1 83 6 153

The securities portfolio, almost unchanged year-on-year, continued to constitute a significant item in Securities and investments. The decrease in Bonds and other fixed-income securities of EUR 0.4 billion to EUR 27.5 billion was offset by an increase of EUR 0.4 billion in the volume of money market securities to EUR 1.1 billion.

The fair values of derivatives with positive fair values, which were primarily used to hedge refinancing transactions, increased by EUR 14.6 billion, from EUR 23.9 billion to EUR 38.5 billion, due to changes in market parameters including exchange rates.

Netting agreements reached with counterparties, which also included derivatives with negative fair values, and collateral agreements (largely cash collateral received) reduced counterparty risk substantially. Value adjustments from macro hedging related to the underlying asset portfolios increased significantly by EUR 6.8 billion, from EUR 11.7 billion to EUR 18.5 billion, due to exchange rate movements primarily in the US dollar.

There were only minor changes in the other asset line items in the statement of financial position.

KfW Financial Information 2014 Group management report | Economic report 13

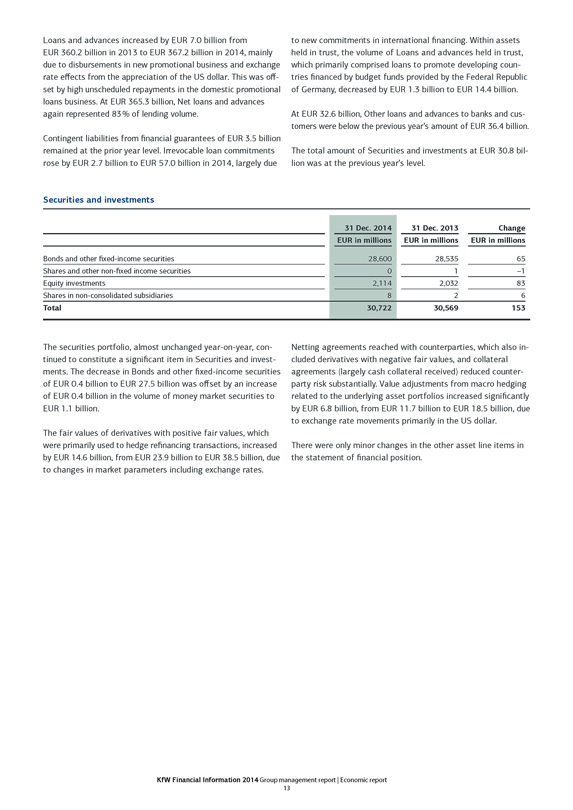

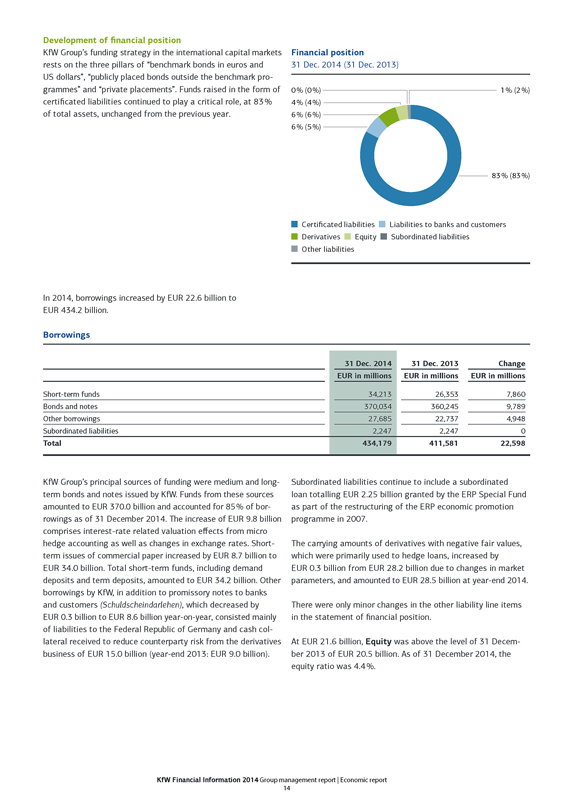

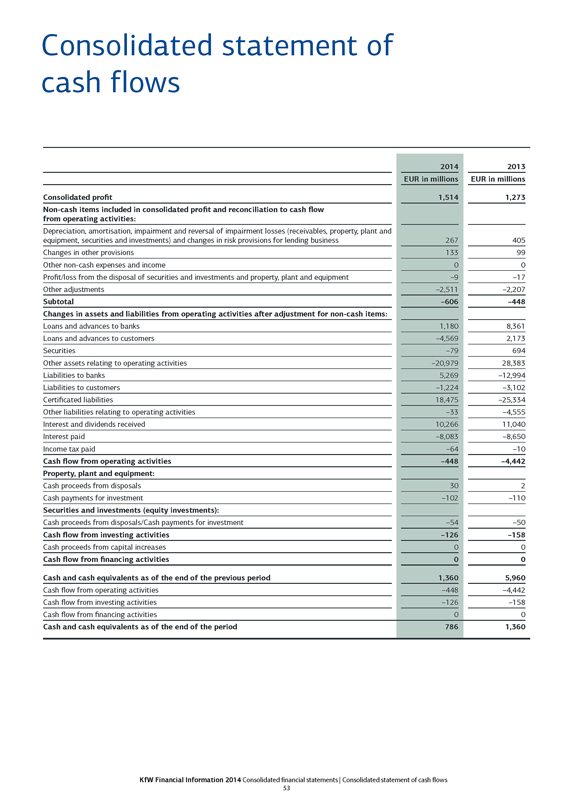

Development of financial position

KfW Group’s funding strategy in the international capital markets rests on the three pillars of “benchmark bonds in euros and US dollars”, “publicly placed bonds outside the benchmark programmes” and “private placements”. Funds raised in the form of certificated liabilities continued to play a critical role, at 83% of total assets, unchanged from the previous year.

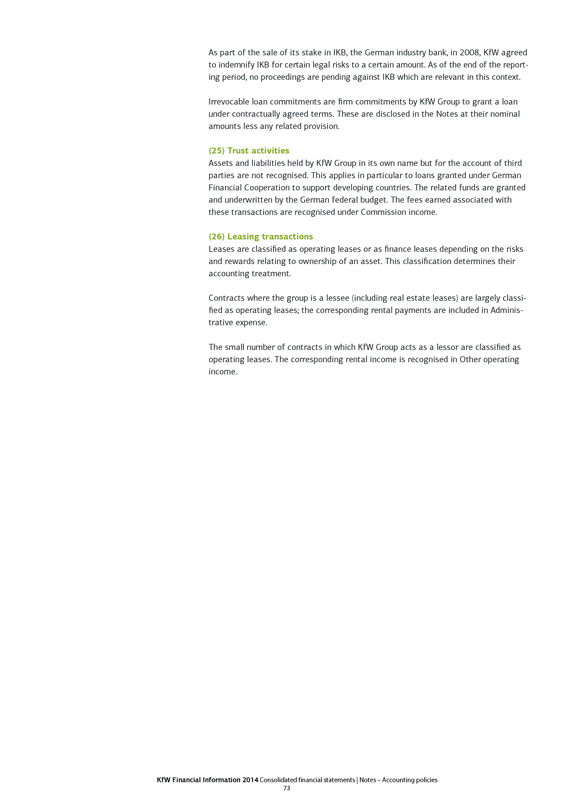

Financial position

31 Dec. 2014 (31 Dec. 2013)

0% (0%) 1% (2%)

4% (4%)

6% (6%)

6% (5%)

83% (83%)

Certificated liabilities Liabilities to banks and customers

Derivatives Equity Subordinated liabilities

Other liabilities

In 2014, borrowings increased by EUR 22.6 billion to EUR 434.2 billion.

Borrowings

31 Dec. 2014 31 Dec. 2013 Change

EUR in millions EUR in millions EUR in millions

Short-term funds 34,213 26,353 7,860

Bonds and notes 370,034 360,245 9,789

Other borrowings 27,685 22,737 4,948

Subordinated liabilities 2,247 2,247 0

Total 434,179 411,581 22,598

KfW Group’s principal sources of funding were medium and long-term bonds and notes issued by KfW. Funds from these sources amounted to EUR 370.0 billion and accounted for 85% of borrowings as of 31 December 2014. The increase of EUR 9.8 billion comprises interest-rate related valuation effects from micro hedge accounting as well as changes in exchange rates. Short-term issues of commercial paper increased by EUR 8.7 billion to EUR 34.0 billion. Total short-term funds, including demand deposits and term deposits, amounted to EUR 34.2 billion. Other borrowings by KfW, in addition to promissory notes to banks and customers (Schuldscheindarlehen), which decreased by EUR 0.3 billion to EUR 8.6 billion year-on-year, consisted mainly of liabilities to the Federal Republic of Germany and cash collateral received to reduce counterparty risk from the derivatives business of EUR 15.0 billion (year-end 2013: EUR 9.0 billion).

Subordinated liabilities continue to include a subordinated loan totalling EUR 2.25 billion granted by the ERP Special Fund as part of the restructuring of the ERP economic promotion programme in 2007.

The carrying amounts of derivatives with negative fair values, which were primarily used to hedge loans, increased by EUR 0.3 billion from EUR 28.2 billion due to changes in market parameters, and amounted to EUR 28.5 billion at year-end 2014.

There were only minor changes in the other liability line items in the statement of financial position.

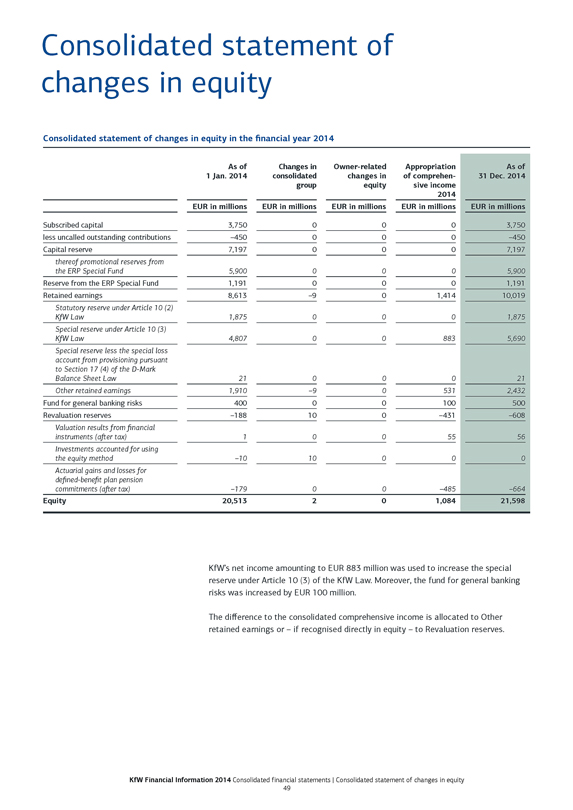

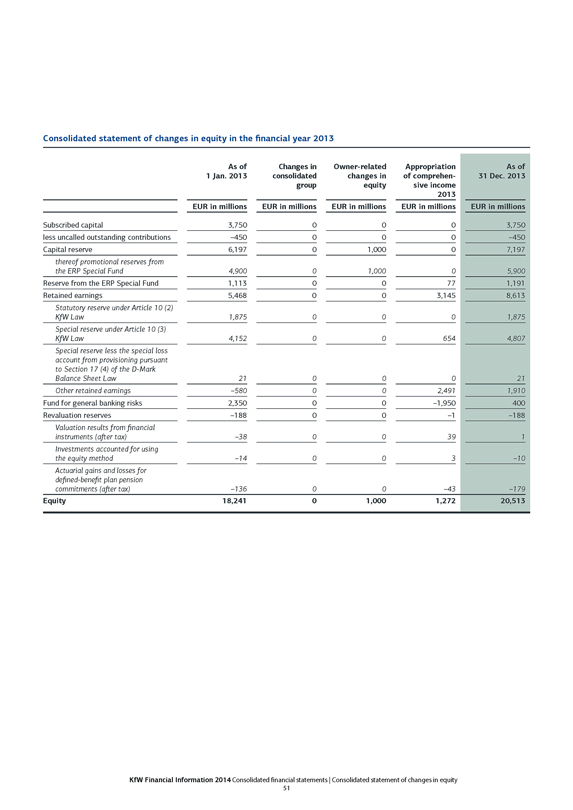

At EUR 21.6 billion, Equity was above the level of 31 December 2013 of EUR 20.5 billion. As of 31 December 2014, the equity ratio was 4.4%.

KfW Financial Information 2014 Group management report | Economic report 14

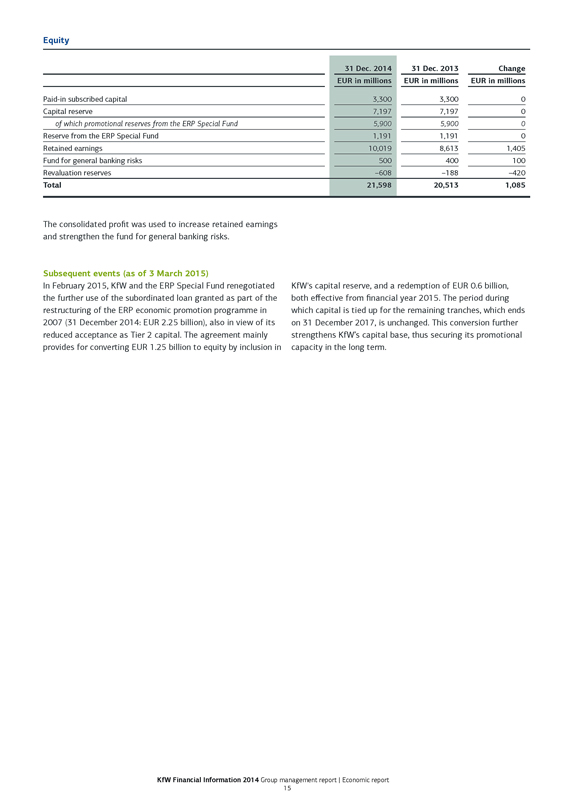

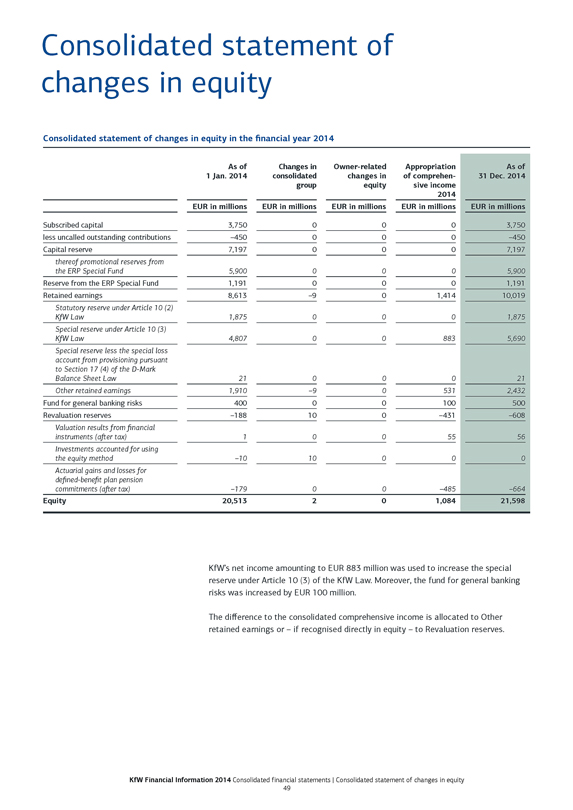

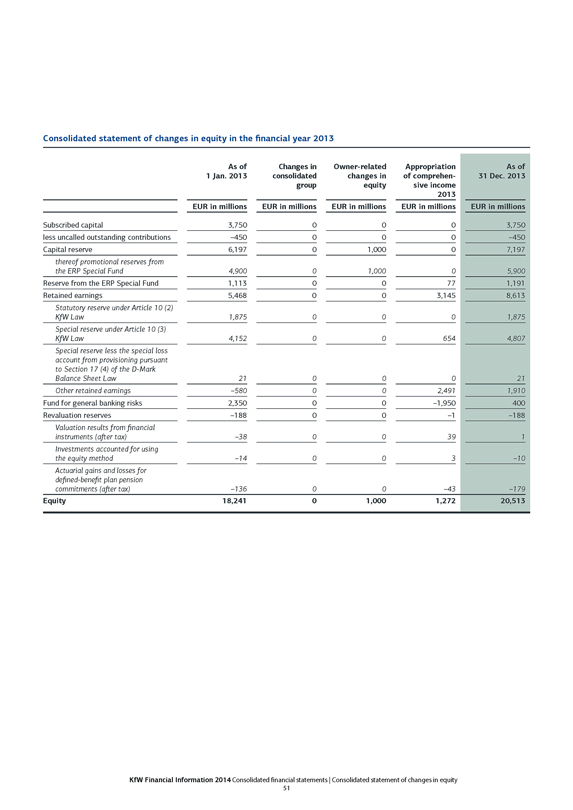

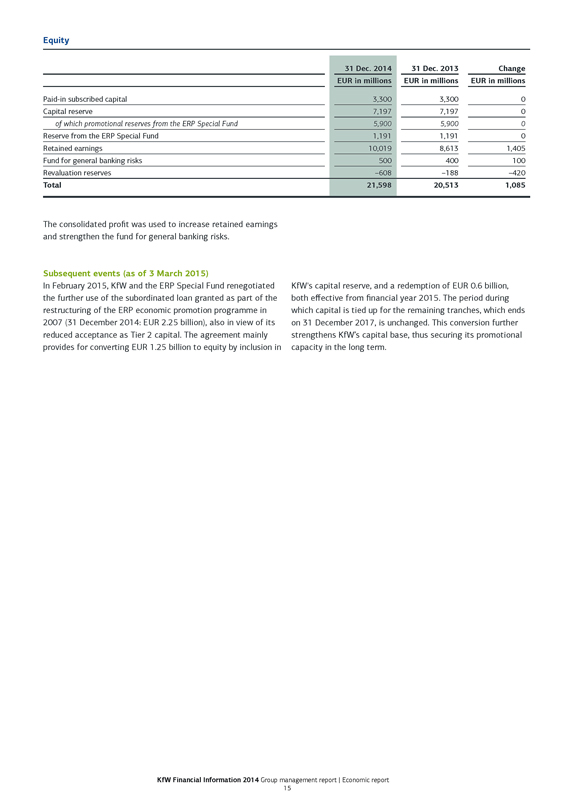

Equity

31 Dec. 2014 31 Dec. 2013 Change

EUR in millions EUR in millions EUR in millions

Paid-in subscribed capital 3,300 3,300 0

Capital reserve 7,197 7,197 0

of which promotional reserves from the ERP Special Fund 5,900 5,900 0

Reserve from the ERP Special Fund 1,191 1,191 0

Retained earnings 10,019 8,613 1,405

Fund for general banking risks 500 400 100

Revaluation reserves –608 –188 –420

Total 21,598 20,513 1,085

The consolidated profit was used to increase retained earnings and strengthen the fund for general banking risks.

Subsequent events (as of 3 March 2015)

In February 2015, KfW and the ERP Special Fund renegotiated the further use of the subordinated loan granted as part of the restructuring of the ERP economic promotion programme in 2007 (31 December 2014: EUR 2.25 billion), also in view of its reduced acceptance as Tier 2 capital. The agreement mainly provides for converting EUR 1.25 billion to equity by inclusion in

KfW’s capital reserve, and a redemption of EUR 0.6 billion, both effective from financial year 2015. The period during which capital is tied up for the remaining tranches, which ends on 31 December 2017, is unchanged. This conversion further strengthens KfW’s capital base, thus securing its promotional capacity in the long term.

KfW Financial Information 2014 Group management report | Economic report 15

Risk report

Current developments

Global economic development was largely disappointing in 2014 and it seems unlikely that momentum will accelerate in 2015 either, probably remaining at the same level as the previous year. We expect to see industrialised countries and emerging markets diverge in performance. The US economy will likely continue its positive growth trend in the coming quarters, mainly driven by an improved labour market and more robust private consumption. Monetary policy is expected to continue to support demand at the beginning of the year, with the expected rise in US interest rates during the course of 2015 carrying a certain risk for the financial markets. In Japan, economic performance is expected to be relatively subdued, given that neither monentary nor fiscal policy have much scope left for creating effective long-term impetus. The euro area faces a similar dilemma; despite a somewhat “more neutral” budgetary policy than in recent years and the ECB’s foreseeable quantitative easing, euro-area economic growth is likely to mark time in 2015. In light of forthcoming elections in Europe, new debates on the need to balance government budgets are expected to emerge. These could generate nervous sentiment on the capital markets at any time – as occurred at the beginning of the year in Greece. In some emerging market countries economic momentum is likely to decrease compared to the previous year. Although growth rates in China and India are expected to remain relatively high, macroeconomic performance in other countries is expected to be very subdued (Brazil, South Africa) or even negative (Russia). Overall, this economic outlook is overshadowed by a large number of downside risks. The geopolitical tensions between Russia and Ukraine as well as in the Middle East are creating considerable uncertainty. Despite the fact that the current low price of oil is generating opportunities for many economies, the risks faced by some crude oil-exporting countries have increased considerably. Moreover, certain misallocations on the financial markets due to current monetary policy could result in new crises at any time.

Despite stabilisation of economic parameters in some peripheral countries (Ireland, Spain), European banks’ asset quality continued to reflect diverging economic performance in Europe. Peripheral country banks, in particular, continue to hold large portfolios of non-performing loans. The sale of non-strategic assets resulting in further balance sheet reductions as well as cautious lending on the part of European banks was noticeable in the months prior to the ECB/EBA’s balance sheet and stress tests. In addition, a number of participating banks strengthened their equity through capital increases, thus improving the banks’ overall capital adequacy in 2014. The results of the balance sheet assessment, with a negative focus particularly on Italian banks, were comprehensible, and hardly came as any surprise. Refinancing of European institutions was rendered more stable through

increased deposit financing in combination with asset reduction. Furthermore, peripheral banks continued to return to the capital markets. Due to considerably declining risk costs and a stabilising economic environment, US banks made a positive impression compared to the relatively weak earnings posted by European banks. However, high burdens resulted from fines levied on certain financial institutions, setting a new overall record for the US banking sector.

The European banking sector will remain structurally vulnerable in 2015 due to the further deterioration of the economic outlook. In addition, the low-interest environment as well as regulatory requirements and the costs of legal disputes will negatively affect the profitability of European banks. For this reason, restructuring in the European banking sector, combined with a further reduction in non-strategic assets (in Italy, among other countries) is likely to continue. The political uncertainty in Greece could also shift the European sovereign debt crisis back into focus, with a largely negative impact on the still fragile banks of the peripheral countries. In addition, the persisting geopolitical tensions between Russia and Ukraine are likely to have a negative effect on the banks active in those countries – primarily Austrian and French – at an increasing rate. The gradual interest rate increases expected from the US Federal Reserve represent a rise in potential risks to banking markets of emerging countries with export deficits (such as Brazil, Turkey and South Africa) due to continued capital outflows and a further depreciation of own currencies.

The German and European economies were marked by stagnation last year, which we expect to continue this year. On the whole, the performance of businesses remained stable in this environment, even if investment was cautious due to the disappointing developments in Europe and various geopolitical uncertainties. It should be noted that companies are benefitting from favourable terms due to good credit availability and lending structures that are gradually being eased. The automobile industry which is important for Germany continues to grow due to brisk demand in developing countries and the USA; Europe too seems to have bottomed out after a number of difficult years, despite increasing sector risks. The merchant shipping situation remains difficult, with the exception of the gas tanker segment.

KfW Group has been affected by the aforementioned developments due to its international promotional mandate. Overall, however, KfW’s portfolio recorded a stable performance. Meanwhile, the merchant shipping crisis appears to be largely digested for the portfolio. All recognisable risks are measured using conservative standards and are taken into account in

KfW Financial Information 2014 Group management report | Risk report 16

KfW Group’s new business management through systematic implementation of risk guidelines. The regularly performed calculations of risk-bearing capacity show that KfW Group can bear the risks assumed in the context of its mandate – even based on conservative stress scenarios. In 2014, as in previous years, KfW Group systematically refined the processes and instruments in its Risk Management and Controlling department, taking account of current banking regulations.

As a result of an amendment to the KfW Law in 2013 and the publication of the “Regulation concerning key banking supervision standards under the German Banking Act to be declared applicable by analogy to KfW and supervision of compliance to these standards to be assigned to the German Federal Financial Supervisory Authority” (the “KfW Regulation”), the expanded application of the German Banking Act was introduced. In the future, KfW Group will be obliged to apply key bank regulatory standards by analogy. The German Federal Financial Supervisory Authority

and the German Central Bank (Bundesbank) will be responsible for supervising compliance with these bank regulatory standards. The relevant rules and regulations will enter into force in stages. The key provisions relating to risk will apply to KfW Group with effect from 1 January 2016. The Compliance department centrally coordinates fulfilment of the requirements of the German

Banking Act (Kreditwesengesetz – “KWG”).

As part of implementing the European regulatory mechanism, KfW IPEX-Bank was included in the ECB’s comprehensive assessment in 2014. The results of KfW IPEX-Bank’s asset quality review were announced in writing on 11 February 2015. No balance sheet adjustments have been required. The asset quality review and the stress test demonstrated that, in view of its business model, KfW IPEX-Bank is currently adequately capitalised overall. ECB has decided not to include KfW IPEX-Bank in the institutions under the ECB’s supervision.

Basic principles and objectives of risk management

KfW Group has a statutory promotional mandate, which provides the basis for its special position and institutional structure. Sustainable promotion is KfW Group’s overarching purpose. In order to utilise available resources to best carry out KfW Group’s promotional mandate, it is vital to measure and control incurred risks. As part of its risk management, KfW Group takes risks only to the extent that they appear manageable in the context of its current and anticipated earnings position and the development of the risks. KfW Group’s risk/return management takes into account the special characteristics of a promotional bank, with

adherence to supervisory requirements constituting a fundamental prerequisite to the group’s business activities.

In order to solidify risk management and controlling competence within its organisation, KfW Group offers its employees training that includes a modular programme on risk topics. The training programme enables management and non-management staff throughout KfW Group to acquire basic knowledge or to deepen their specialised knowledge.

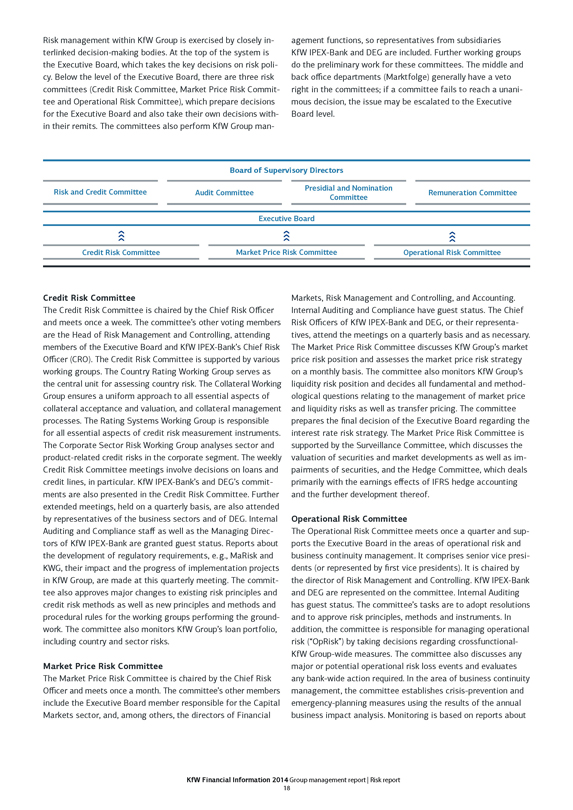

Organisation of risk management and monitoring Risk management bodies and responsibilities

As part of its overall responsibility, KfW’s Executive Board determines the bank’s risk policies. The Board of Supervisory Directors is informed at least quarterly of KfW Group’s risk situation. The Presidial and Nomination Committee is responsible for dealing with legal and administrative matters as well as fundamental business and corporate policy issues. Moreover, in certain urgent cases, the committee has the authority to adopt resolutions in place of the Board of Supervisory Directors. The Chairman of the Board of Supervisory Directors decides whether an issue is urgent. The Risk and Credit Committee is primarily responsible for advising the Board of Supervisory Directors on the group’s current and future overall risk tolerance and strategy, and supports it in monitoring implementation of the latter. It

decides on loan approval, operational level equity investments, funding and swap transactions, if these require committee authorisation in accordance with the KfW Bylaws. The Audit Committee monitors, above all, the accounting process and the effectiveness of the risk management system and offers recommendations to the Board of Supervisory Directors concerning its approval of the (consolidated) financial statements. The Remuneration Committee monitors whether the structure of the remuneration system for the Executive Board and employees is appropriate – particularly for the remuneration paid to the heads of the Risk Controlling and Compliance functions and any employees who have a significant impact on the group’s overall risk profile.

KfW Financial Information 2014 Group management report | Risk report 17

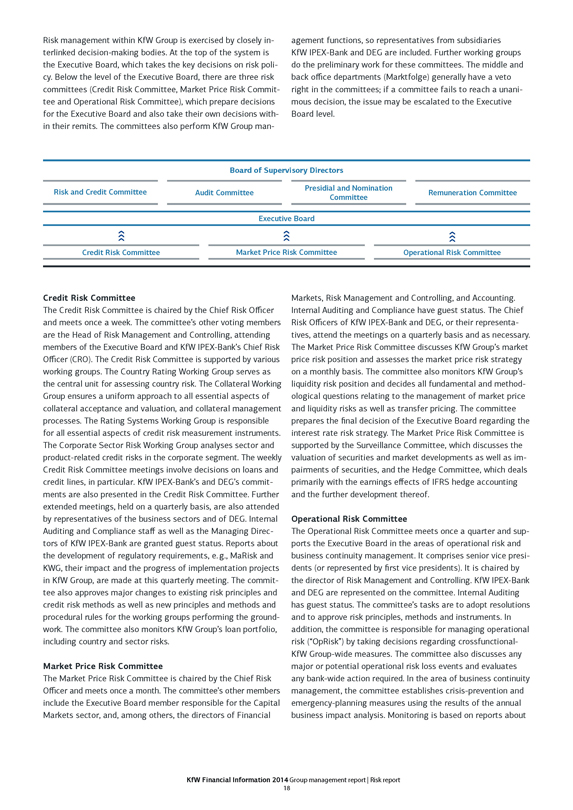

Risk management within KfW Group is exercised by closely interlinked decision-making bodies. At the top of the system is the Executive Board, which takes the key decisions on risk policy. Below the level of the Executive Board, there are three risk committees (Credit Risk Committee, Market Price Risk Committee and Operational Risk Committee), which prepare decisions for the Executive Board and also take their own decisions within their remits. The committees also perform KfW Group management functions, so representatives from subsidiaries KfW IPEX-Bank and DEG are included. Further working groups do the preliminary work for these committees. The middle and back office departments (Marktfolge) generally have a veto right in the committees; if a committee fails to reach a unanimous decision, the issue may be escalated to the Executive Board level.

Board of Supervisory Directors

Presidial and Nomination Committee

Risk and Credit Committee Audit Committee Remuneration Committee

Executive Board

Credit Risk Committee Market Price Risk Committee Operational Risk Committee

Credit Risk Committee

The Credit Risk Committee is chaired by the Chief Risk Officer and meets once a week. The committee’s other voting members are the Head of Risk Management and Controlling, attending members of the Executive Board and KfW IPEX-Bank’s Chief Risk Officer (CRO). The Credit Risk Committee is supported by various working groups. The Country Rating Working Group serves as the central unit for assessing country risk. The Collateral Working Group ensures a uniform approach to all essential aspects of collateral acceptance and valuation, and collateral management processes. The Rating Systems Working Group is responsible for all essential aspects of credit risk measurement instruments. The Corporate Sector Risk Working Group analyses sector and product-related credit risks in the corporate segment. The weekly Credit Risk Committee meetings involve decisions on loans and credit lines, in particular. KfW IPEX-Bank’s and DEG’s commitments are also presented in the Credit Risk Committee. Further extended meetings, held on a quarterly basis, are also attended by representatives of the business sectors and of DEG. Internal Auditing and Compliance staff as well as the Managing Directors of KfW IPEX-Bank are granted guest status. Reports about the development of regulatory requirements, e.g., MaRisk and KWG, their impact and the progress of implementation projects in KfW Group, are made at this quarterly meeting. The committee also approves major changes to existing risk principles and credit risk methods as well as new principles and methods and procedural rules for the working groups performing the groundwork. The committee also monitors KfW Group’s loan portfolio, including country and sector risks.

Market Price Risk Committee

The Market Price Risk Committee is chaired by the Chief Risk Officer and meets once a month. The committee’s other members include the Executive Board member responsible for the Capital Markets sector, and, among others, the directors of Financial

Markets, Risk Management and Controlling, and Accounting. Internal Auditing and Compliance have guest status. The Chief Risk Officers of KfW IPEX-Bank and DEG, or their representatives, attend the meetings on a quarterly basis and as necessary. The Market Price Risk Committee discusses KfW Group’s market price risk position and assesses the market price risk strategy on a monthly basis. The committee also monitors KfW Group’s liquidity risk position and decides all fundamental and methodological questions relating to the management of market price and liquidity risks as well as transfer pricing. The committee prepares the final decision of the Executive Board regarding the interest rate risk strategy. The Market Price Risk Committee is supported by the Surveillance Committee, which discusses the valuation of securities and market developments as well as impairments of securities, and the Hedge Committee, which deals primarily with the earnings effects of IFRS hedge accounting and the further development thereof.

Operational Risk Committee

The Operational Risk Committee meets once a quarter and supports the Executive Board in the areas of operational risk and business continuity management. It comprises senior vice presidents (or represented by first vice presidents). It is chaired by the director of Risk Management and Controlling. KfW IPEX-Bank and DEG are represented on the committee. Internal Auditing has guest status. The committee’s tasks are to adopt resolutions and to approve risk principles, methods and instruments. In addition, the committee is responsible for managing operational risk (“OpRisk”) by taking decisions regarding crossfunctional-KfW Group-wide measures. The committee also discusses any major or potential operational risk loss events and evaluates any bank-wide action required. In the area of business continuity management, the committee establishes crisis-prevention and emergency-planning measures using the results of the annual business impact analysis. Monitoring is based on reports about

KfW Financial Information 2014 Group management report | Risk report 18

planned or implemented emergency and crisis team tests and significant disruptions to business. All resolutions and recommendations by the Operational Risk Committee are presented to the Executive Board.

Additionally, the subsidiaries and organisational entities of KfW Group exercise their own control functions within the Group-wide risk management system. In these entities, Group-wide projects and working groups ensure a coordinated approach, for example, in the rollout of rating instruments to subsidiaries or in the management and valuation of collateral.

The responsibility for developing and structuring risk management and risk control activities is located outside the market areas and lies in particular with the Risk Management and Controlling area.

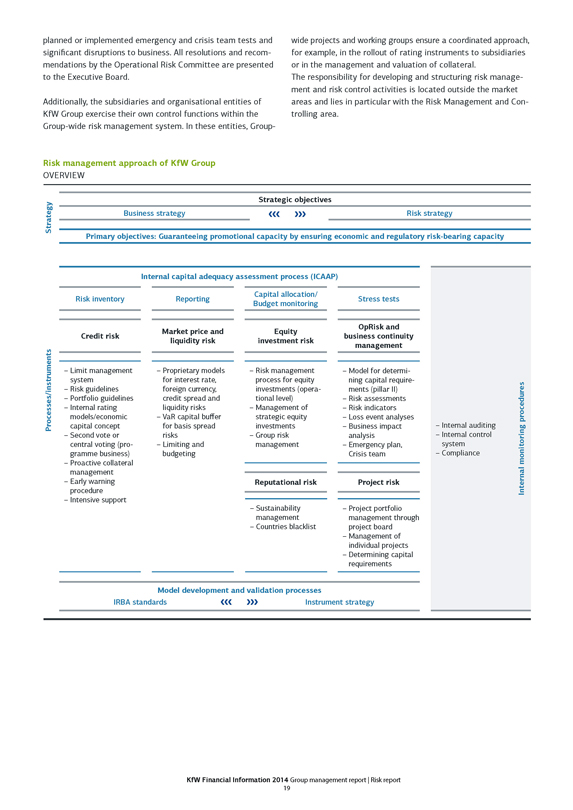

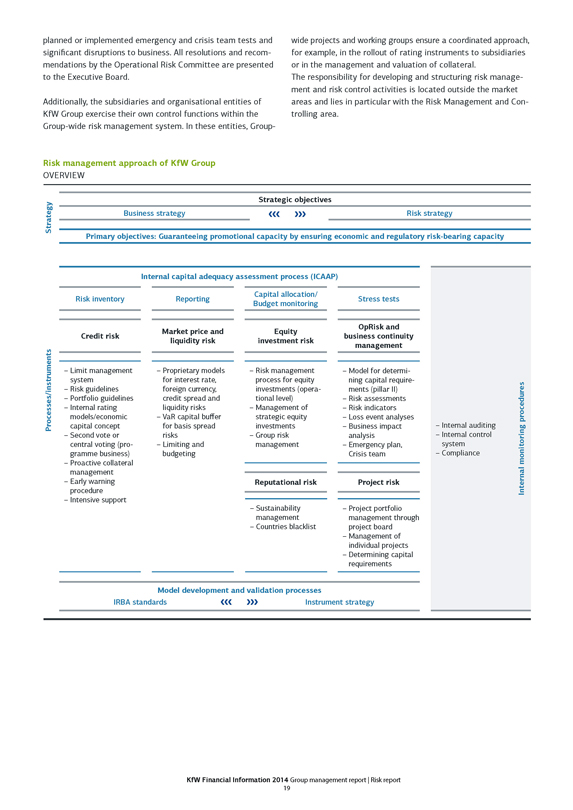

Risk management approach of KfW Group

OVERVIEW

Strategic objectives

Strategy Business strategy Risk strategy

Primary objectives: Guaranteeing promotional capacity by ensuring economic and regulatory risk-bearing capacity

Risk inventory Processes/instruments Model development and validation processes

Credit risk

– Limit management system

– Risk guidelines

– Portfolio guidelines

– Internal rating models/economic capital concept

– Second vote or central voting (programme business)

– Proactive collateral management

– Early warning procedure

– Intensive support

IRBA standards

Internal capital adequacy assessment process (ICAAP)

Reporting

Market price and liquidity risk

– Proprietary models for interest rate, foreign currency, credit spread and liquidity risks

– VaR capital buffer for basis spread risks

– Limiting and budgeting

Capital allocation/Budget monitoring

Equity investment risk

– Risk management process for equity investments (operational level)

– Management of strategic equity investments

– Group risk management

Reputational risk

– Sustainability management

– Countries blacklist

Instrument strategy

Stress tests

OpRisk and business continuity management

– Model for determining capital requirements (pillar II)

– Risk assessments

– Risk indicators

– Loss event analyses

– Business impact analysis

– Emergency plan, Crisis team

Project risk

– Project portfolio management through project board

– Management of individual projects

– Determining capital requirements

– Internal auditing

– Internal control system

– Compliance

Internal monitoring procedures

KfW Financial Information 2014 Group management report | Risk report 19

To ensure risk-bearing capacity in line with KfW Group’s defined risk tolerance, Risk Management formulates and regularly reviews KfW Group’s risk strategy, including the risk management of significant subsidiaries. The risk strategy builds on KfW Group’s basic business policy and establishes general risk principles and specific risk policy measures in line with its strategic objectives and business strategy. To implement the risk strategy, a variety of instruments to control KfW Group’s major risks are used, including risk management instruments for individual counterparties and portfolios.

In order to determine its material risks, KfW Group undertakes a risk inventory at least once a year. The risk inventory identifies and defines types of risks relevant to KfW Group in a structured process and then subjects these risks to an evaluation of materiality. The materiality of a risk type depends primarily on the potential danger for KfW Group’s net assets, earnings and liquidity. The key outcome of the risk inventory is an overall risk pro-file, which provides an overview of KfW Group’s material and immaterial risk types. The 2014 inventory identified the material risks facing KfW Group to be credit, market price, liquidity, operational, equity investment, project and reputational risks. Risk concentrations within a risk type or across various risk types are taken into account in the risk inventory.

INTERNAL CAPITAL ADEQUACY ASSESSMENT PROCESS KfW Group’s internal capital adequacy assessment process is characterised by the fact that economic and regulatory requirements regarding risk-bearing capacity are equally important overarching objectives for KfW Group. Accordingly, all risk monitoring and management measures must ensure compliance with both an economic solvency target and minimum requirements for Tier 1 and total capital ratios. This approach combines economically practicable capital management with the obligation to fulfil regulatory minimum capital requirements. As the basis for the close integration of these two perspectives, KfW Group takes a uniform definition of the resources available for risk coverage: regulatory capital in line with Sections 10 and 10a KWG in conjunction with Regulation (EU) No 575/2013 (CRR) is used as available financial resources for both views.

A further core feature of the capital adequacy assessment process is the proactive focus resulting from an additional forward-looking component. This focus evaluates the absorption potential of KfW Group’s reserves – and thus also its ability to act – in the event of certain economic and stress scenarios. A traffic light system, established in this context with thresholds for economic and regulatory risk-bearing capacity, signals the required action in the event of critical developments as part of operational and strategic management.

Risk reporting is in line with regulatory requirements (MaRisk). The Executive Board is informed about KfW Group’s risk situation on a monthly basis. A risk report is issued quarterly to KfW Group’s supervisory bodies. The respective bodies are informed on an ad hoc basis as required. The risk indicators and information systems used by the Risk Management and Controlling department are reviewed on an ongoing basis.

The methods and instruments for KfW Group-wide risk analysis and control are regularly validated and enhanced through further development. The focus is on models to measure, control and price both credit and market price risks. Validation and further development activities also take into account the requirements arising from extended KWG application.

The risk management approach is set out in KfW Group’s risk manual. The risk manual ensures that uniform procedures are applied throughout KfW Group to identify, measure, control and monitor risk. In addition, KfW Group-wide regulations are supplemented by rules specific to each business sector. The rules and regulations laid out in the risk manual are binding for the entire KfW Group, accessible to all employees and continually updated. See the following sections for details on other elements of KfW Group’s risk management approach.

KfW Group’s risk-bearing capacity concept serves first and foremost to protect debt capital providers from losses and therefore adopts a liquidation approach in its basic form. However, the addition of a forward-looking component, which also guarantees compliance with regulatory minimum capital requirements, expands the concept to include a going-concern view. KfW Group’s risk-bearing concept thus includes elements of both basic types of risk-bearing capacity approaches.

The targets for risk-bearing capacity are transferred via capital allocation in the form of economic capital budgets to individual business sectors/areas. The allocated available financial resources are available to the business sectors/areas for backing old and new business for the various types of risk. Capital allocation is conducted as part of KfW Group’s annual business sector planning. In addition to the requirements induced by business sector planning, this process also takes into account the risk objectives and the risk appetite of KfW Group (e.g. traffic light limits). At the same time, the Executive Board establishes a centrally held capital buffer for stress cases, which serves anti-cyclical risk management. Compliance is checked quarterly and action is taken as necessary. In addition, the corresponding target figures for regulatory capital requirements are determined at KfW Group level for the business sectors/areas and their utilisation is also monitored quarterly.

KfW Financial Information 2014 Group management report | Risk report 20

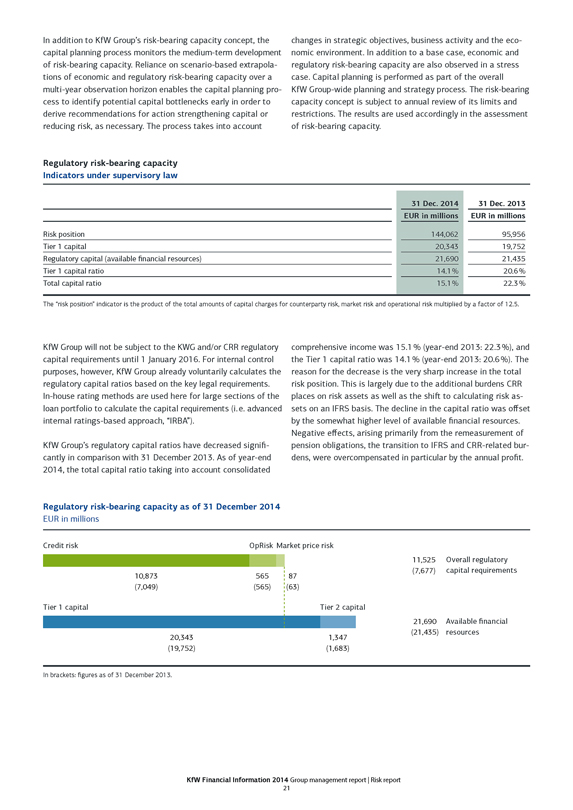

In addition to KfW Group’s risk-bearing capacity concept, the capital planning process monitors the medium-term development of risk-bearing capacity. Reliance on scenario-based extrapolations of economic and regulatory risk-bearing capacity over a multi-year observation horizon enables the capital planning process to identify potential capital bottlenecks early in order to derive recommendations for action strengthening capital or reducing risk, as necessary. The process takes into account changes in strategic objectives, business activity and the economic environment. In addition to a base case, economic and regulatory risk-bearing capacity are also observed in a stress case. Capital planning is performed as part of the overall KfW Group-wide planning and strategy process. The risk-bearing capacity concept is subject to annual review of its limits and restrictions. The results are used accordingly in the assessment of risk-bearing capacity.

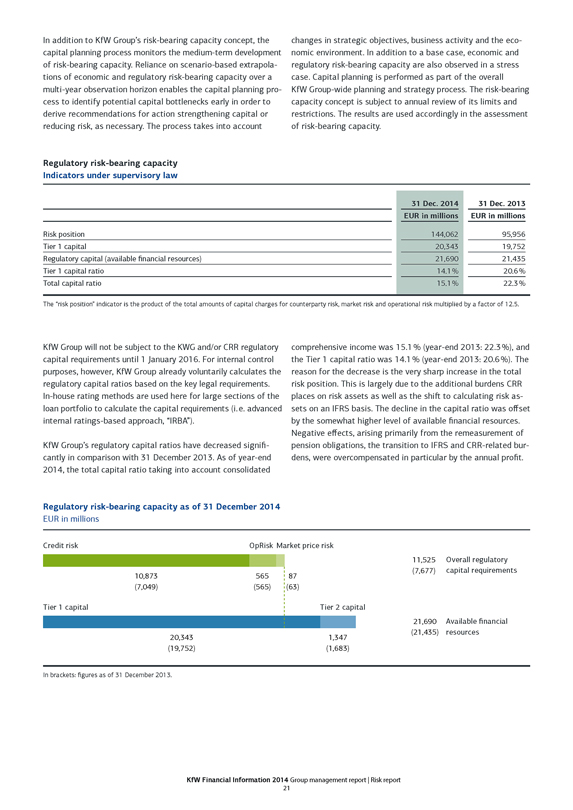

Regulatory risk-bearing capacity Indicators under supervisory law

31 Dec. 2014 31 Dec. 2013

EUR in millions EUR in millions

Risk position 144,062 95,956

Tier 1 capital 20,343 19,752

Regulatory capital (available financial resources) 21,690 21,435

Tier 1 capital ratio 14.1% 20.6%

Total capital ratio 15.1% 22.3%

The “risk position” indicator is the product of the total amounts of capital charges for counterparty risk, market risk and operational risk multiplied by a factor of 12.5.

KfW Group will not be subject to the KWG and/or CRR regulatory capital requirements until 1 January 2016. For internal control purposes, however, KfW Group already voluntarily calculates the regulatory capital ratios based on the key legal requirements. In-house rating methods are used here for large sections of the loan portfolio to calculate the capital requirements (i.e. advanced internal ratings-based approach, “IRBA”).

KfW Group’s regulatory capital ratios have decreased significantly in comparison with 31 December 2013. As of year-end 2014, the total capital ratio taking into account consolidated comprehensive income was 15.1% (year-end 2013: 22.3%), and the Tier 1 capital ratio was 14.1% (year-end 2013: 20.6%). The reason for the decrease is the very sharp increase in the total risk position. This is largely due to the additional burdens CRR places on risk assets as well as the shift to calculating risk assets on an IFRS basis. The decline in the capital ratio was offset by the somewhat higher level of available financial resources. Negative effects, arising primarily from the remeasurement of pension obligations, the transition to IFRS and CRR-related burdens, were overcompensated in particular by the annual profit.

Regulatory risk-bearing capacity as of 31 December 2014

EUR in millions

Credit risk OpRisk Market price risk

11,525 Overall regulatory

(7,677) capital requirements

10,873 565 87

(7,049) (565) (63)

Tier 1 capital Tier 2 capital

21,690 Available financial

20,343 1,347 (21,435) resources

(19,752) (1,683)

In brackets: figures as of 31 December 2013.

KfW Financial Information 2014 Group management report | Risk report 21

Economic risk-bearing capacity

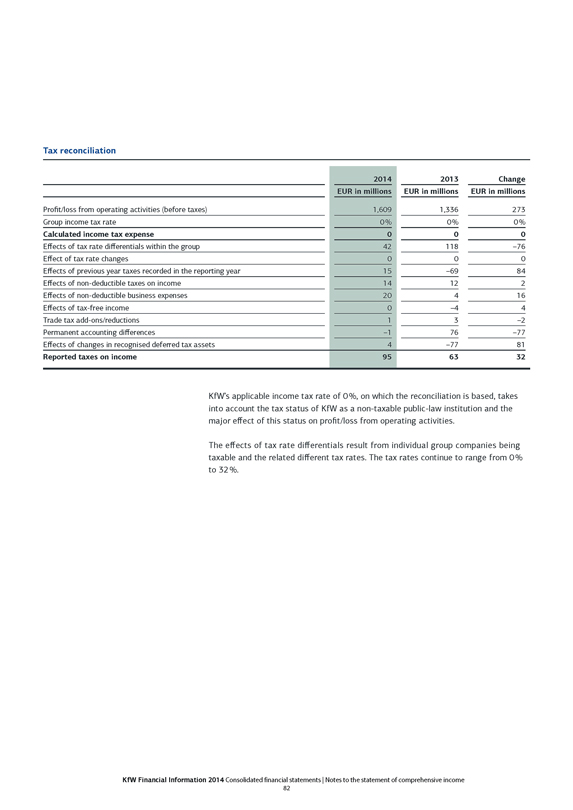

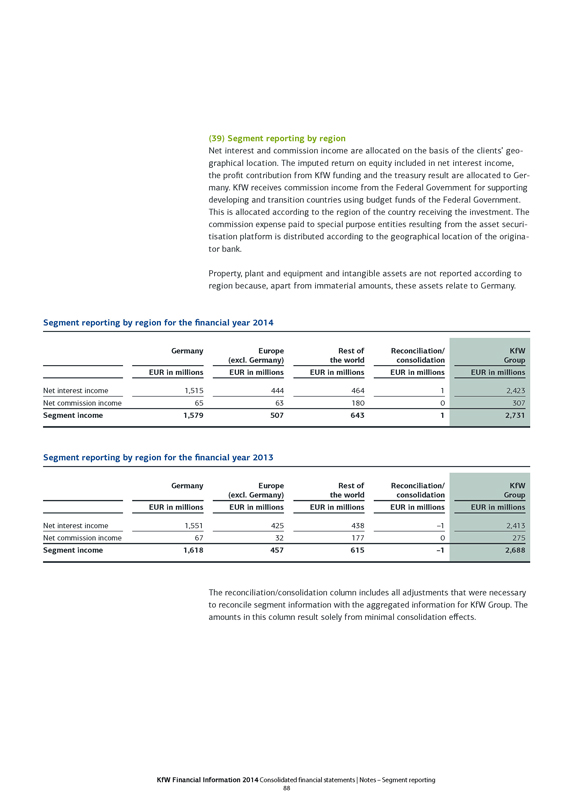

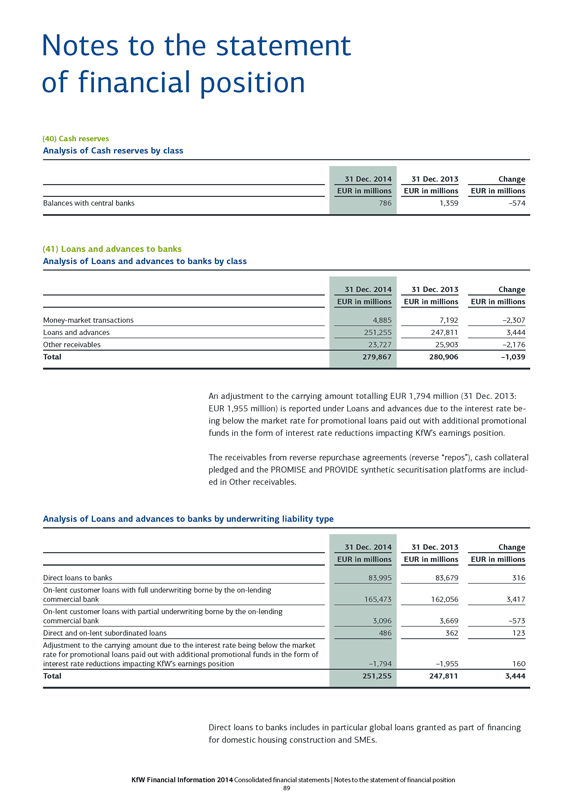

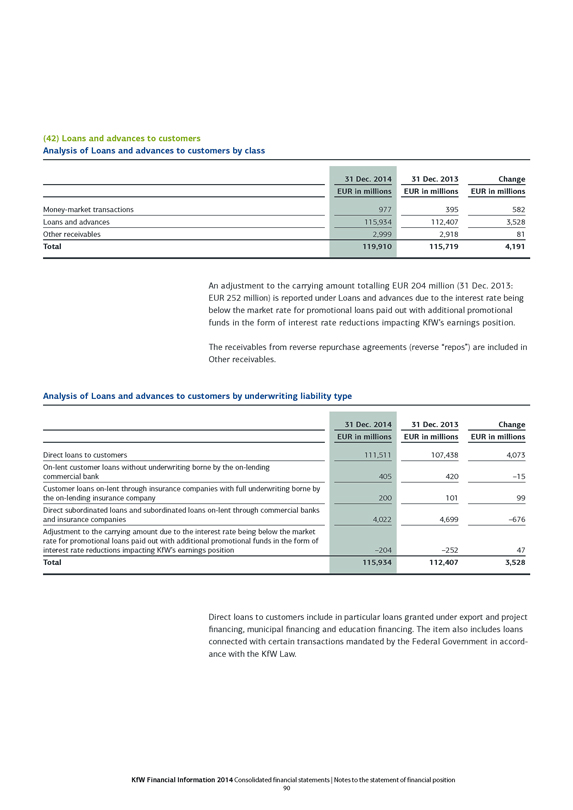

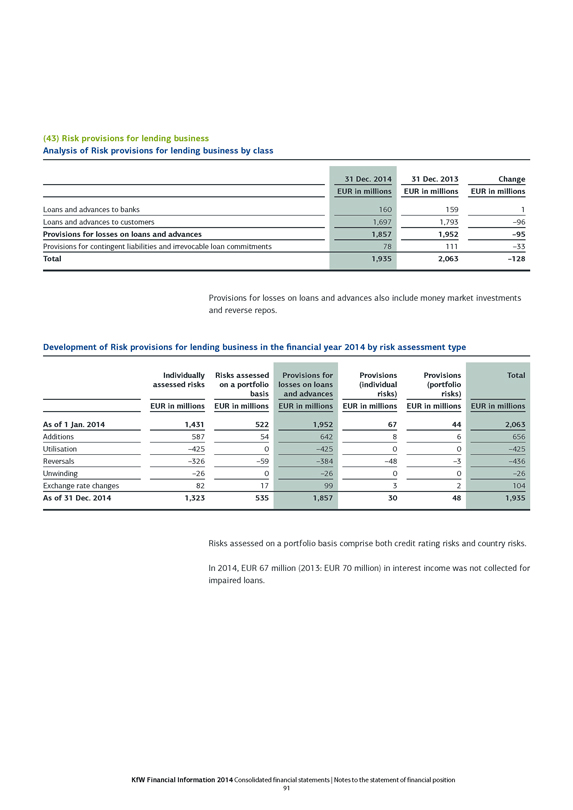

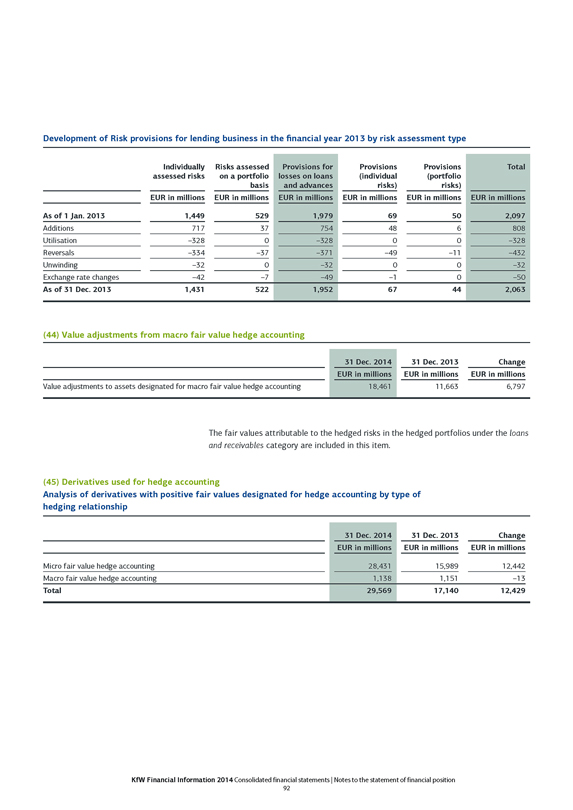

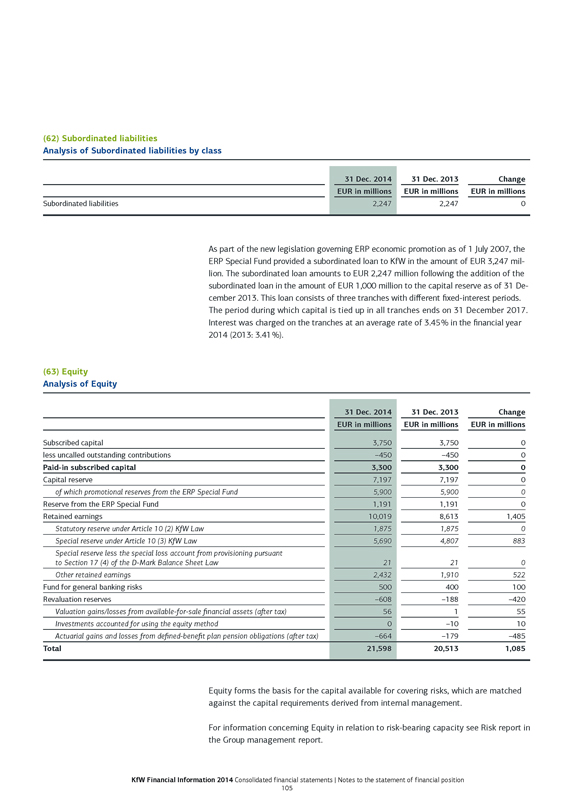

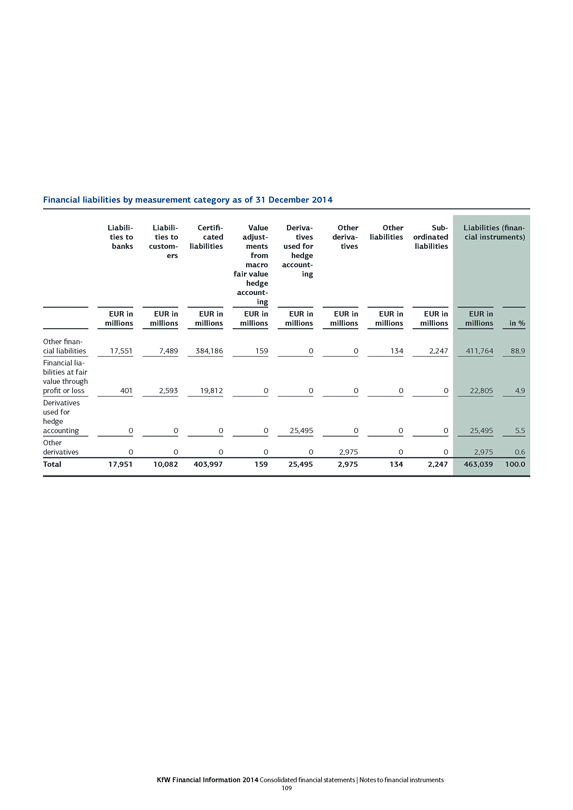

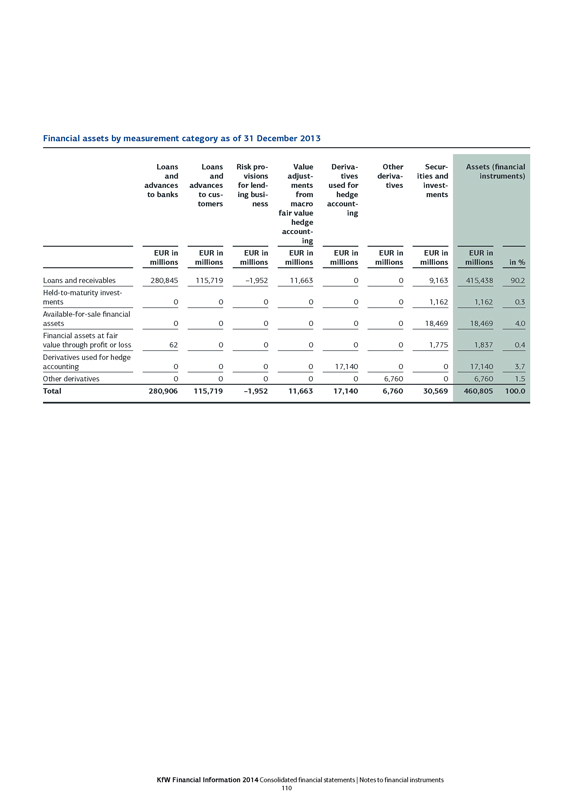

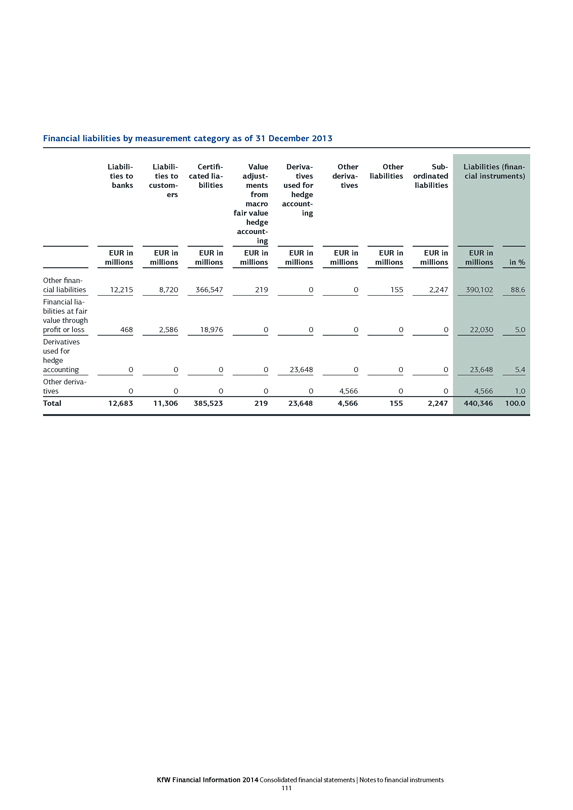

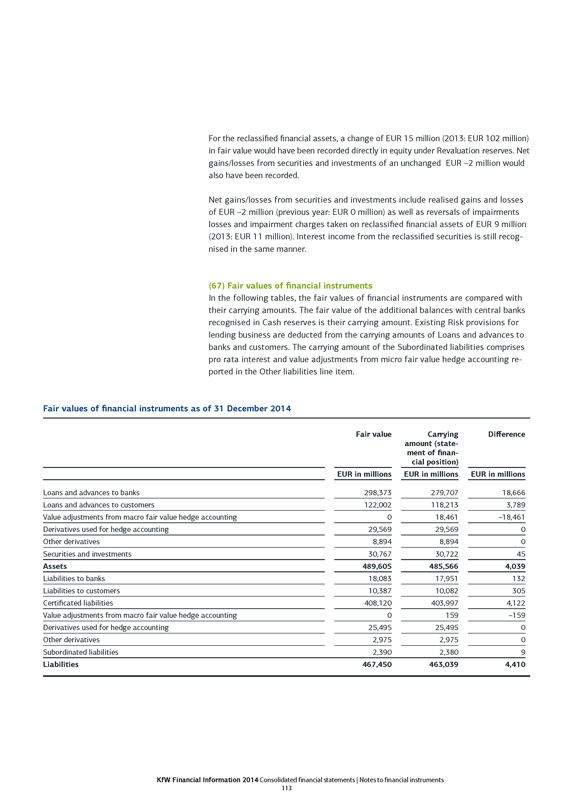

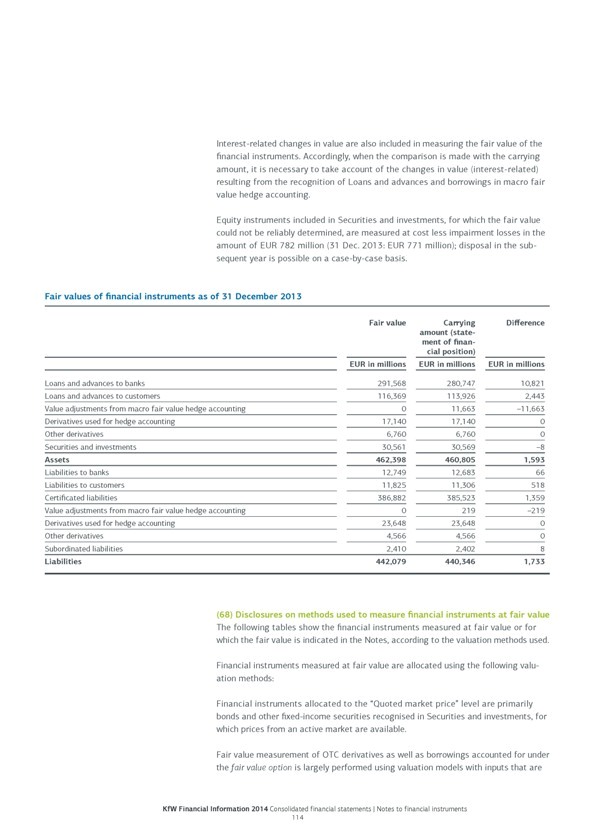

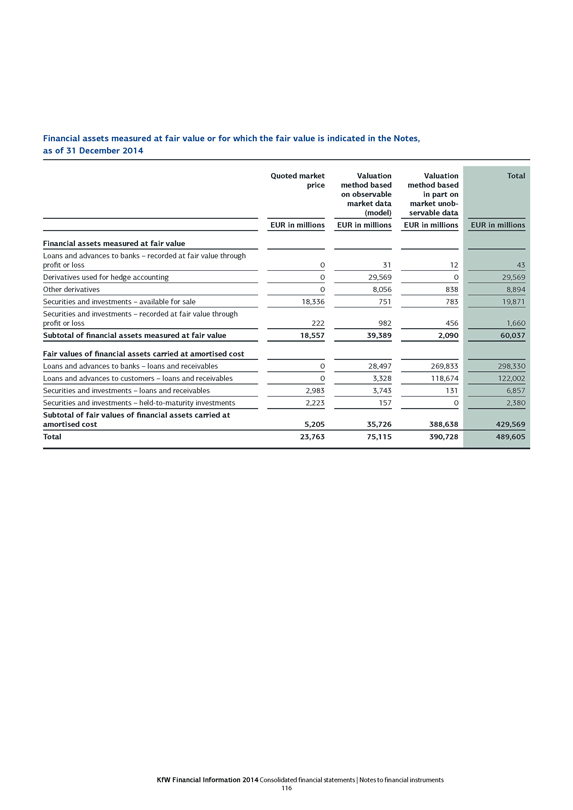

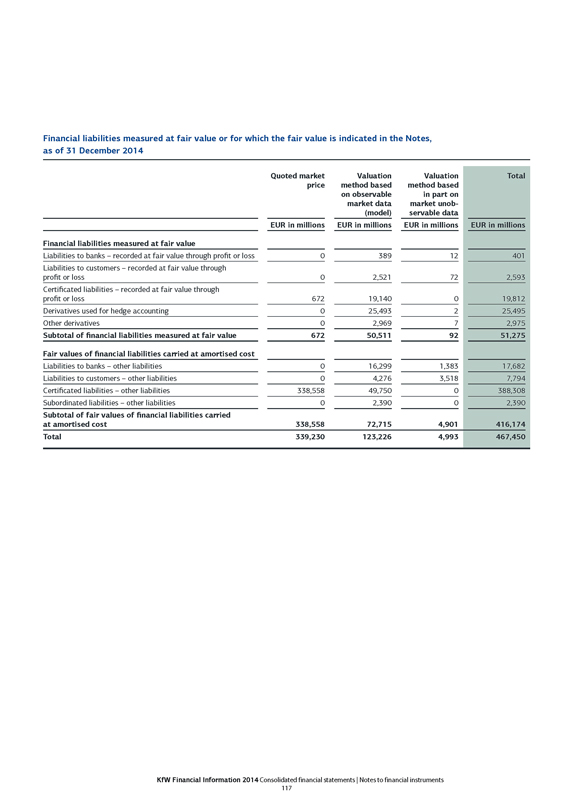

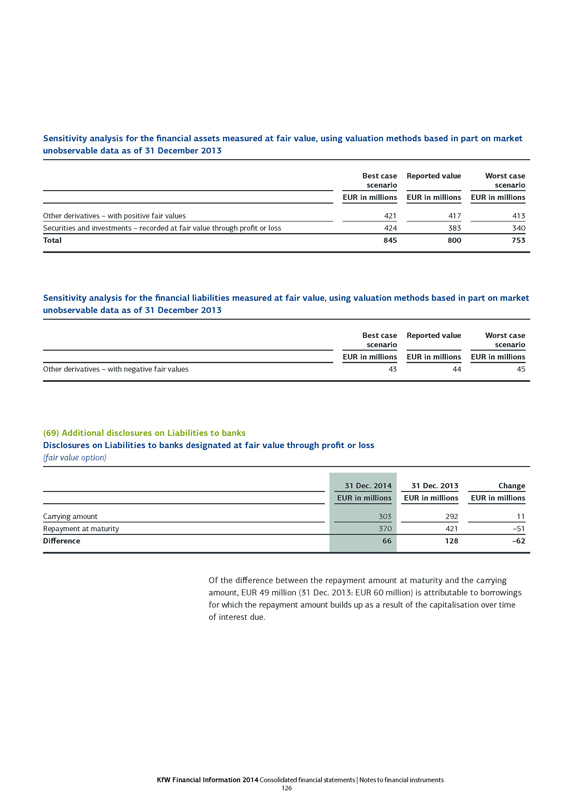

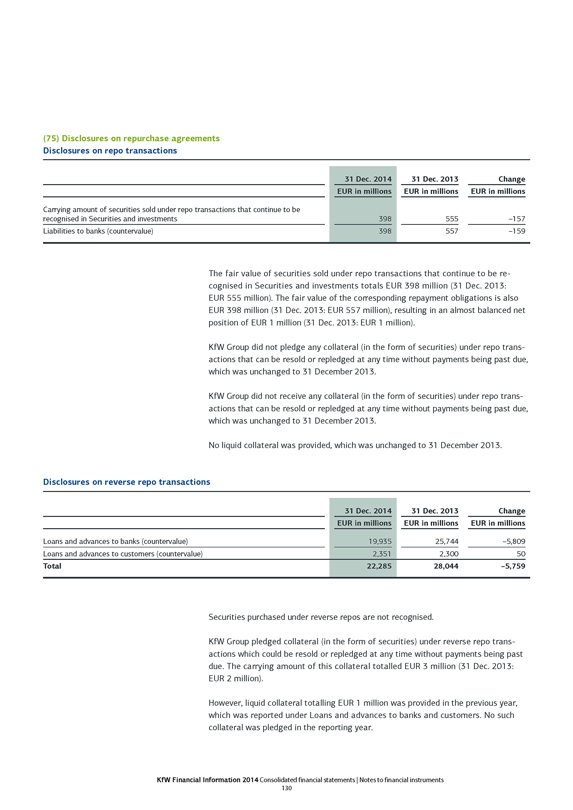

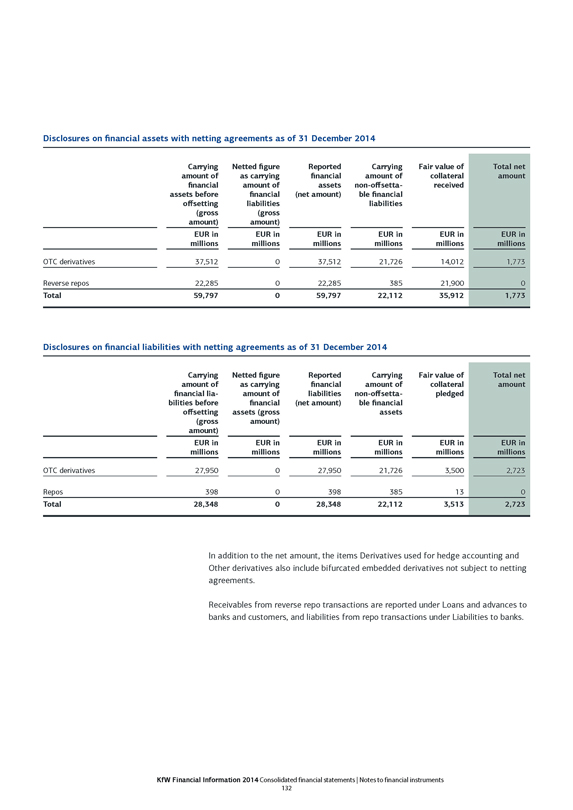

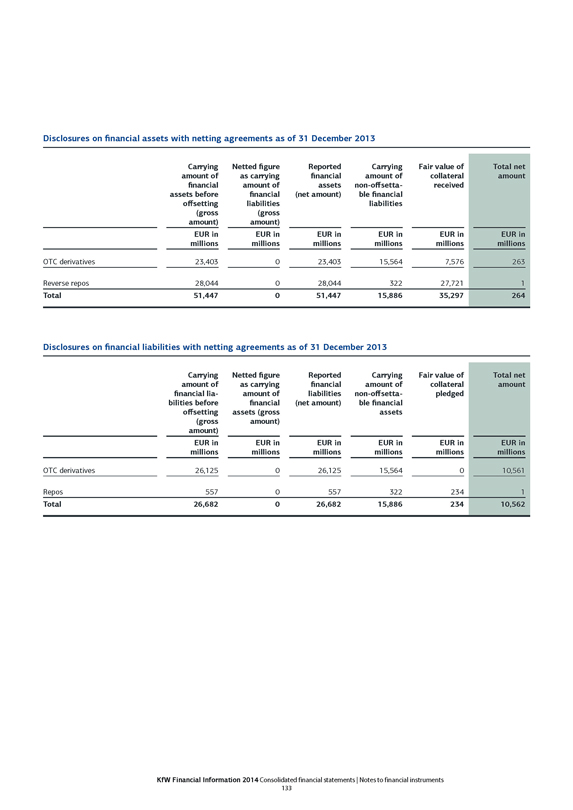

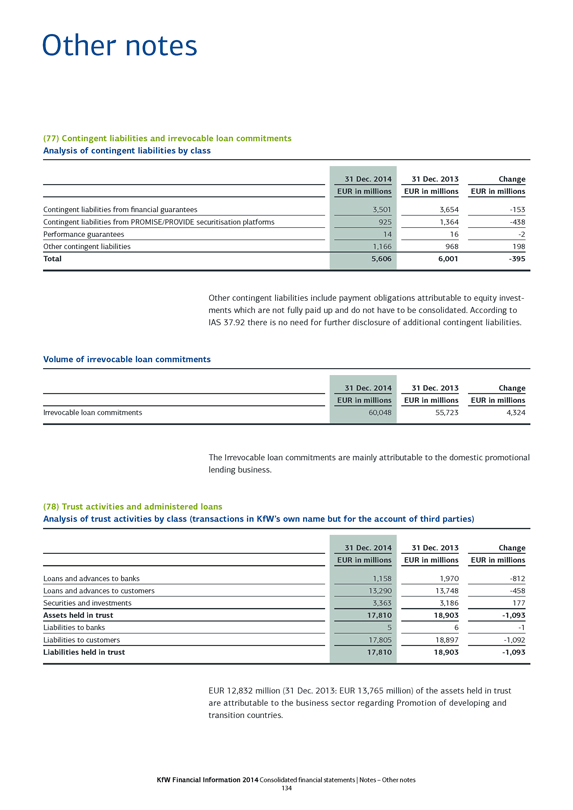

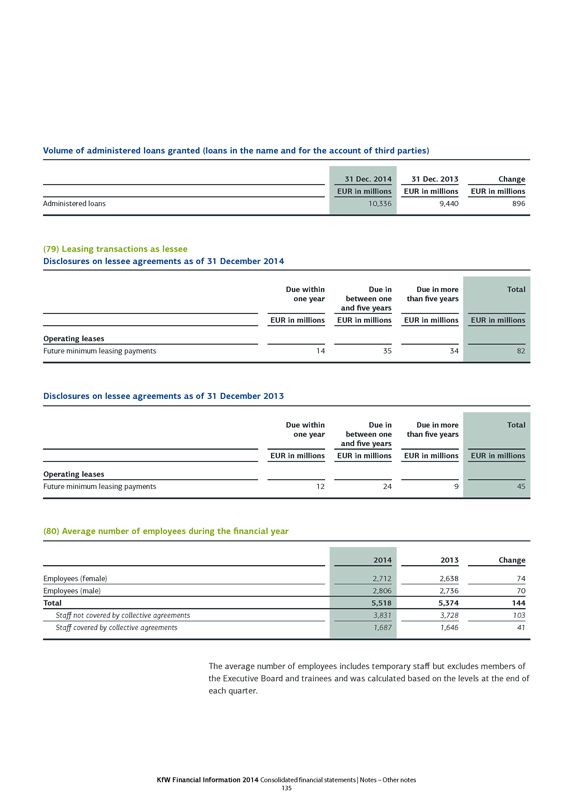

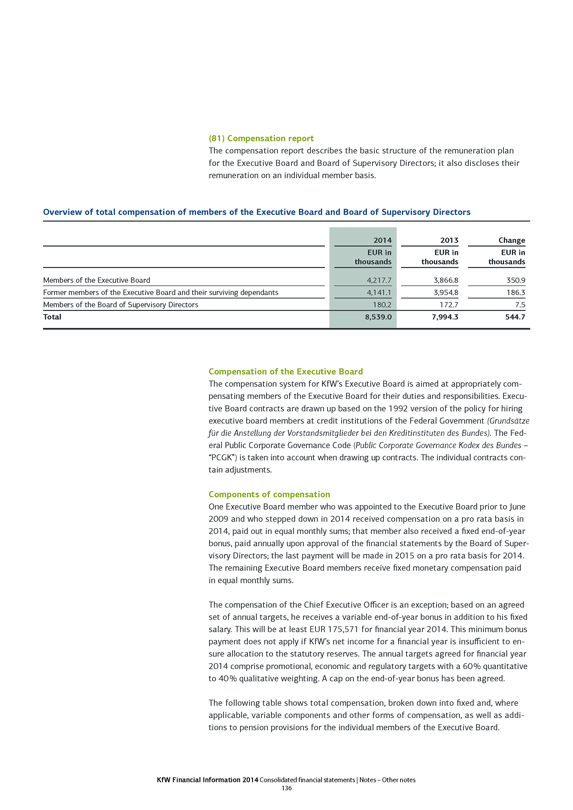

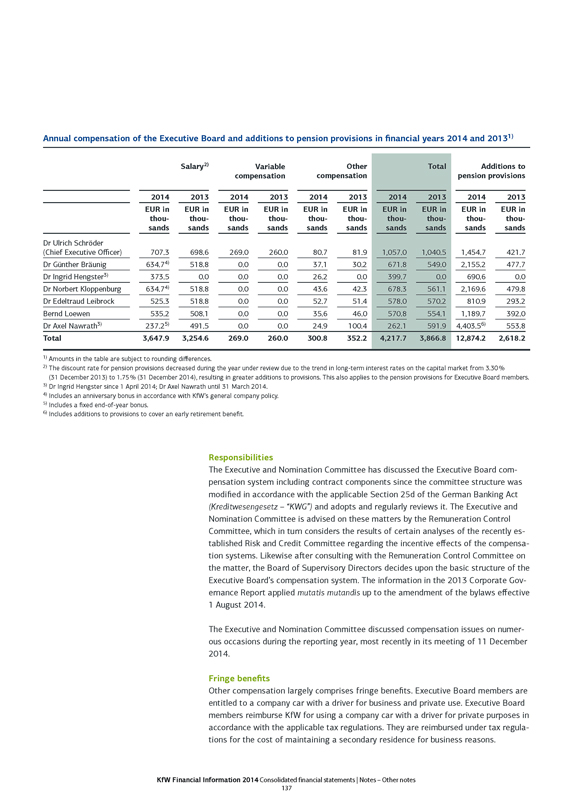

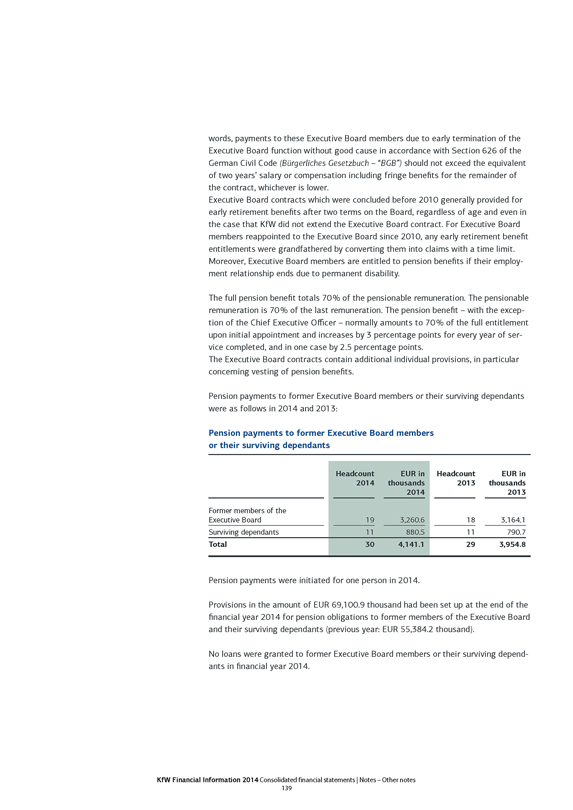

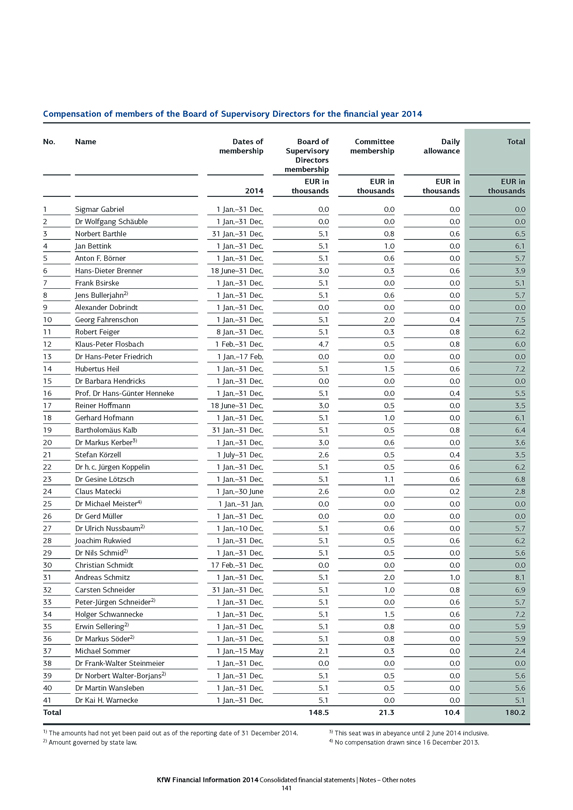

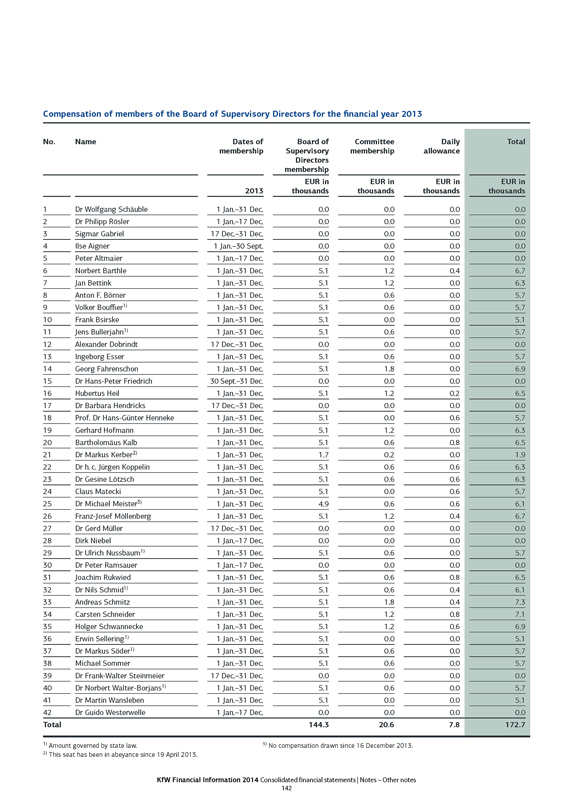

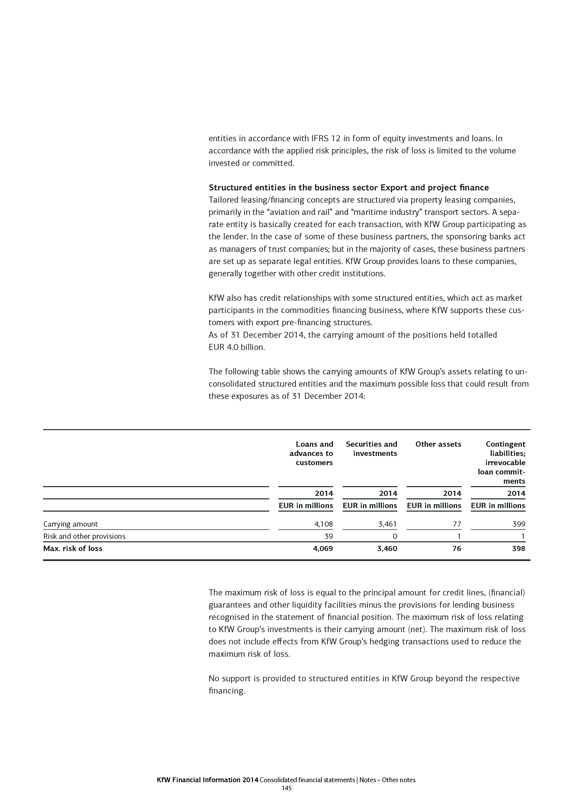

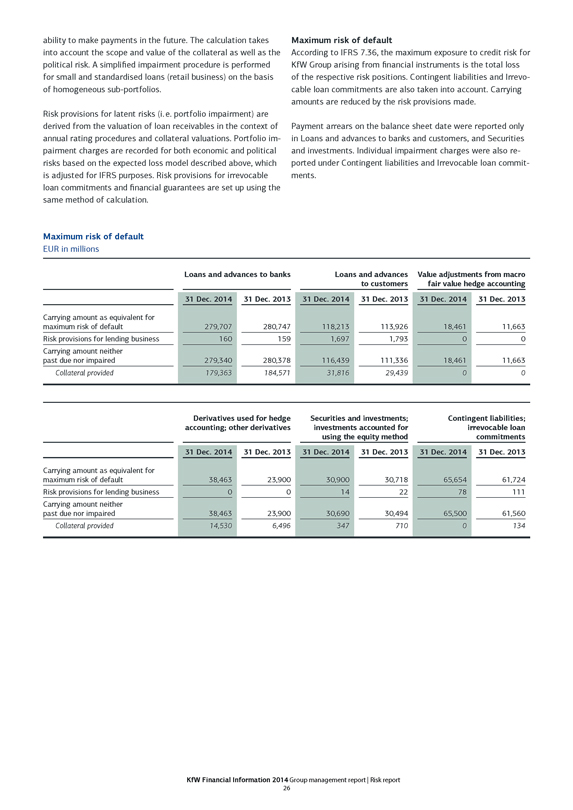

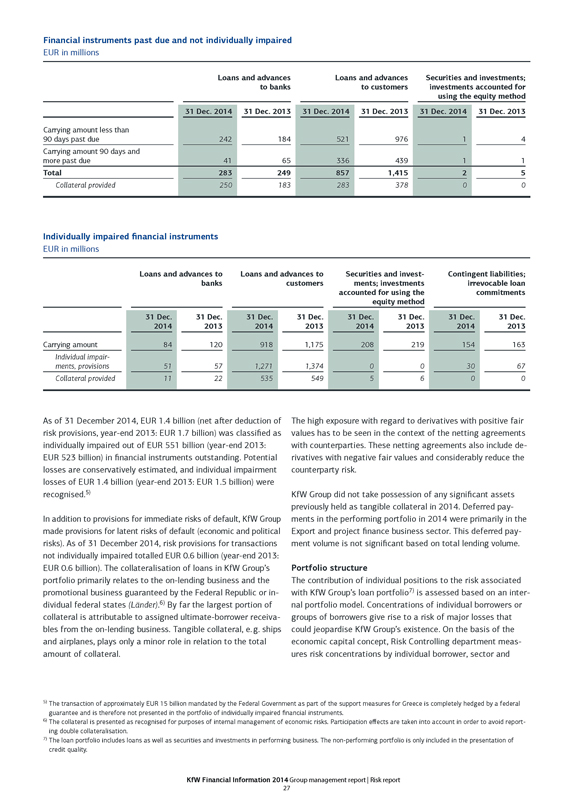

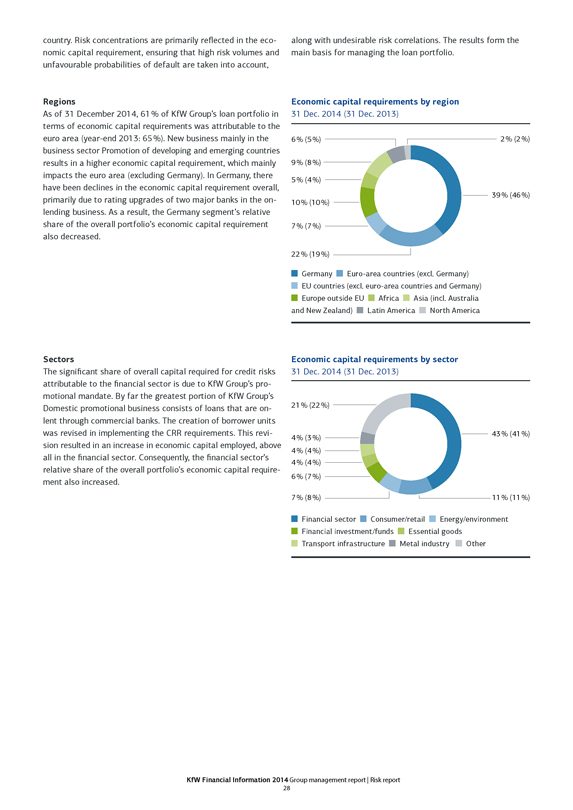

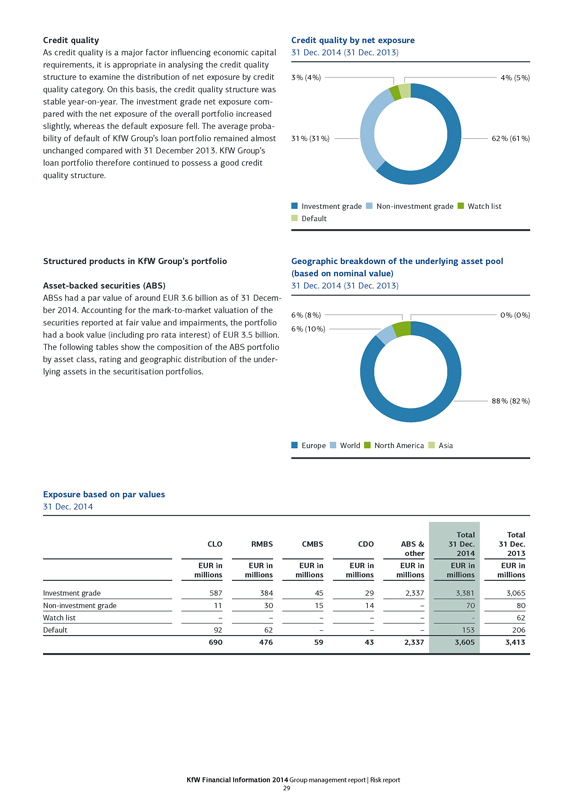

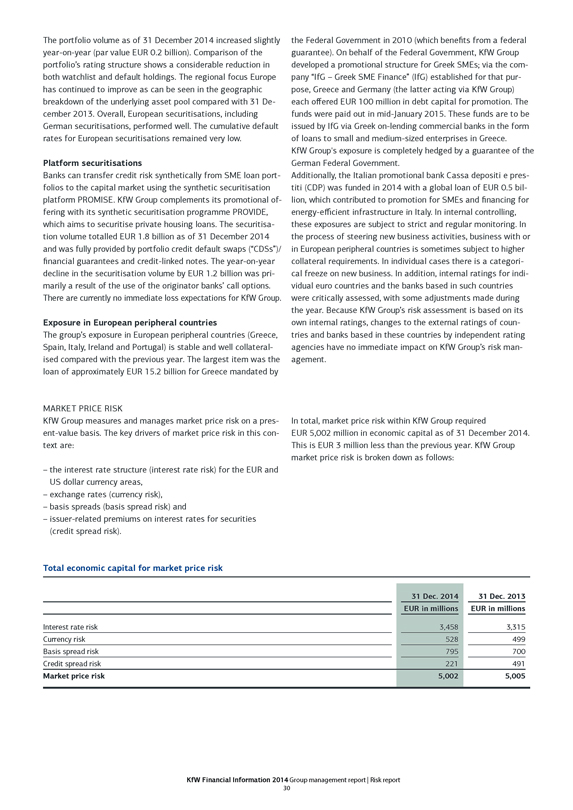

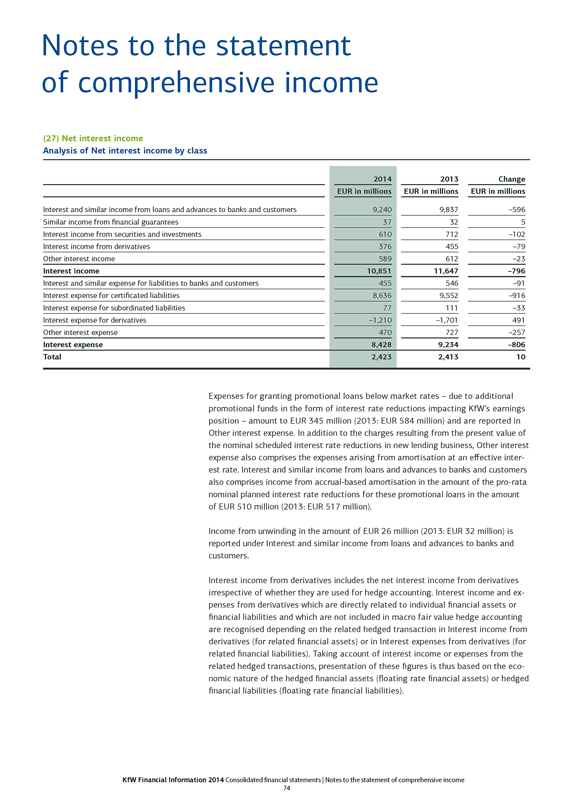

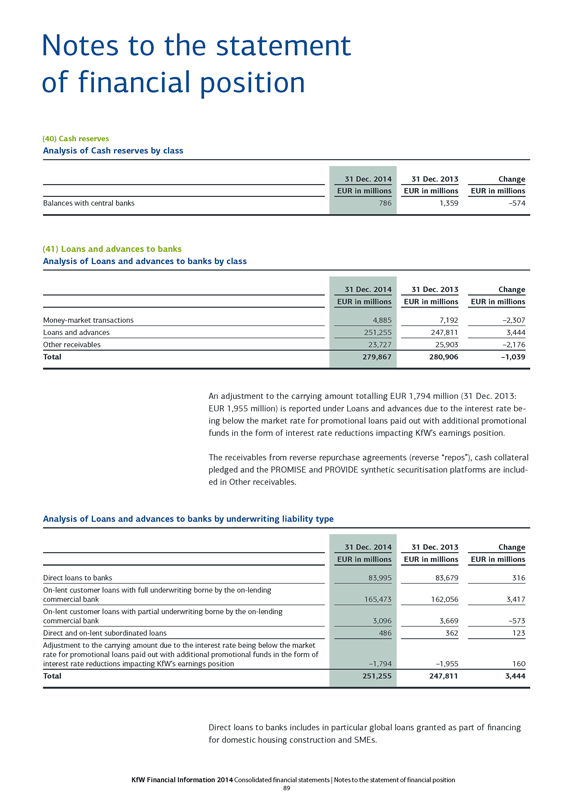

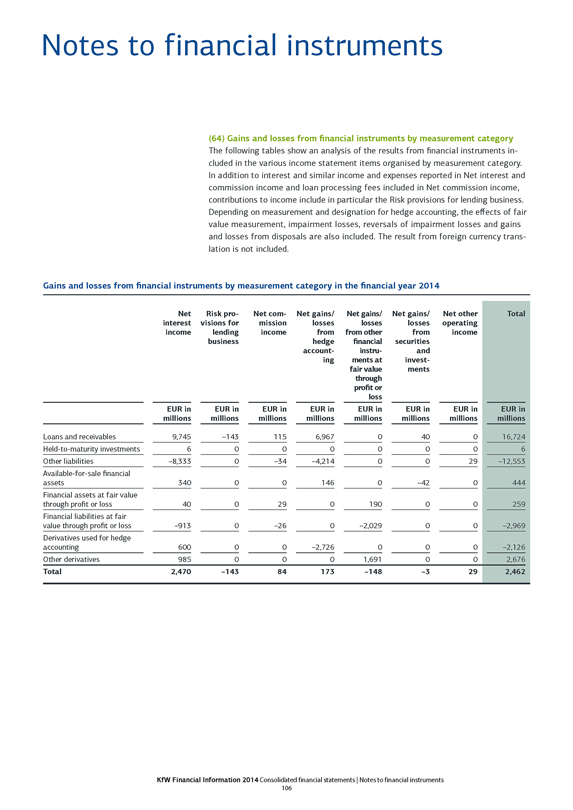

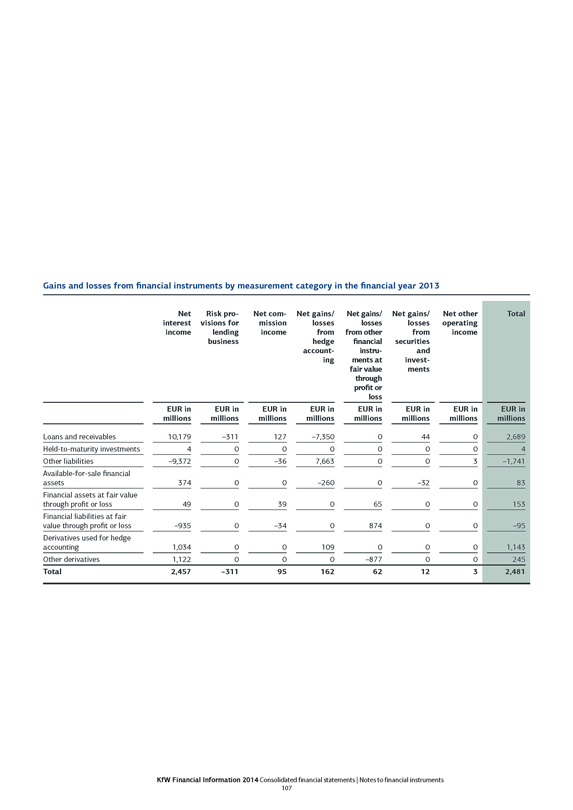

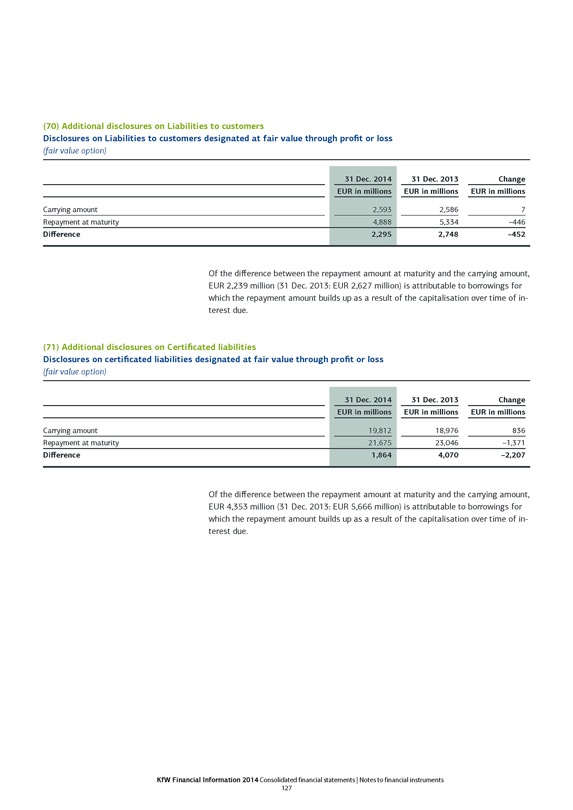

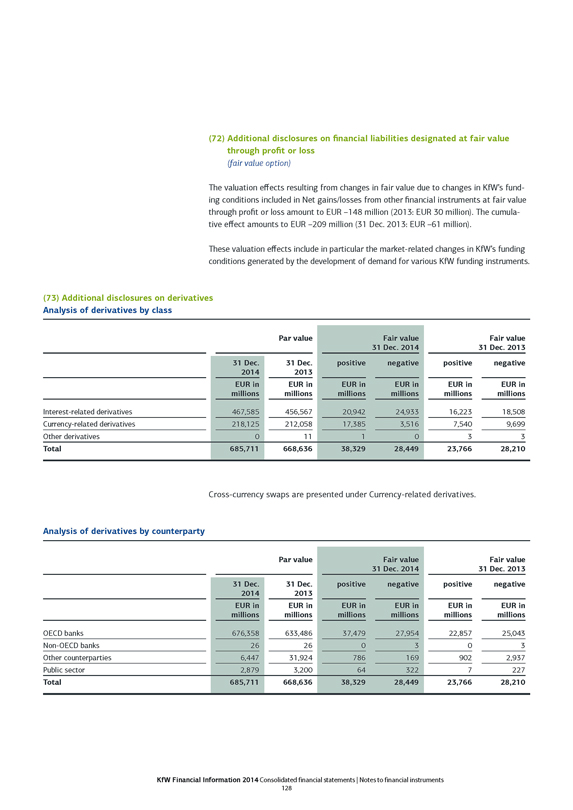

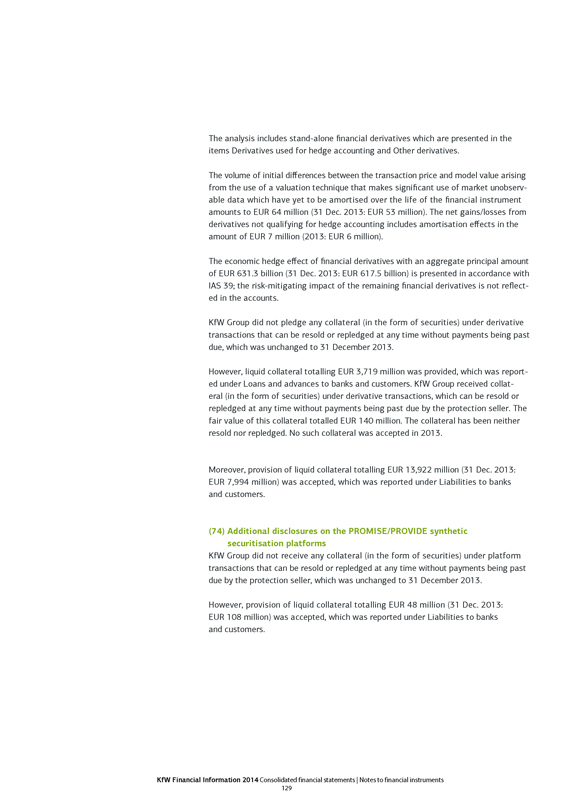

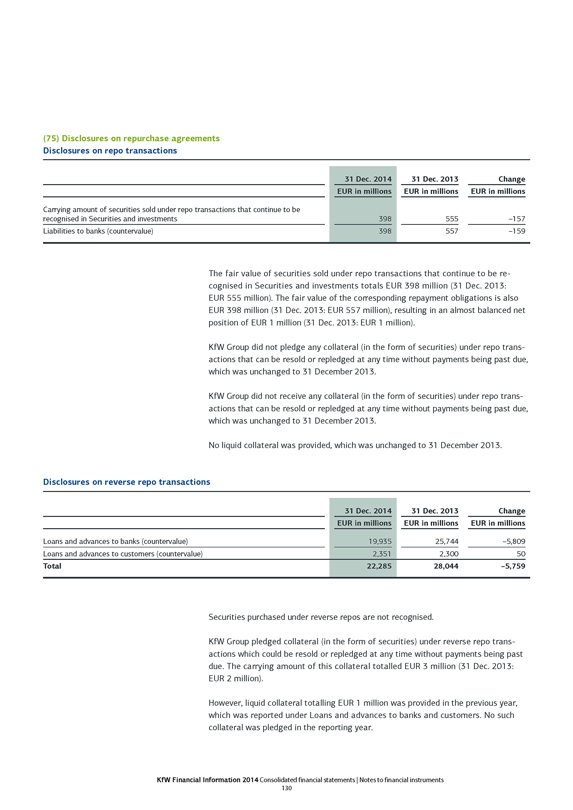

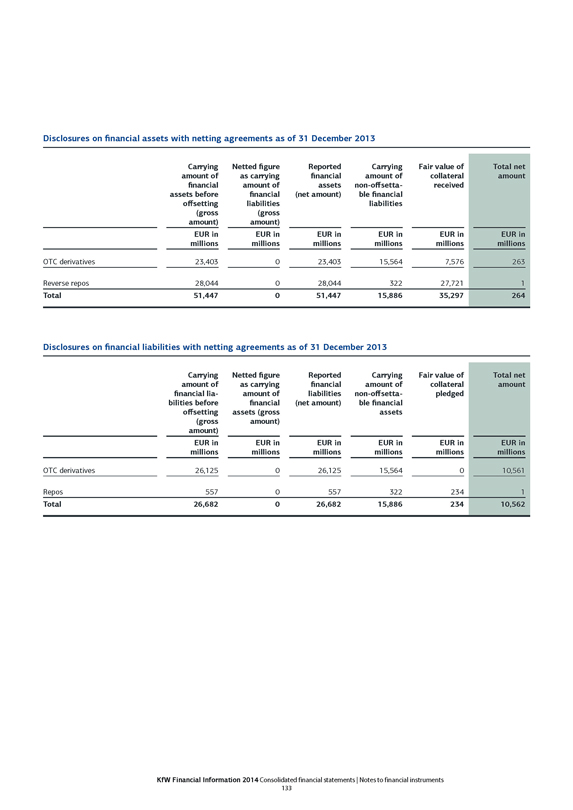

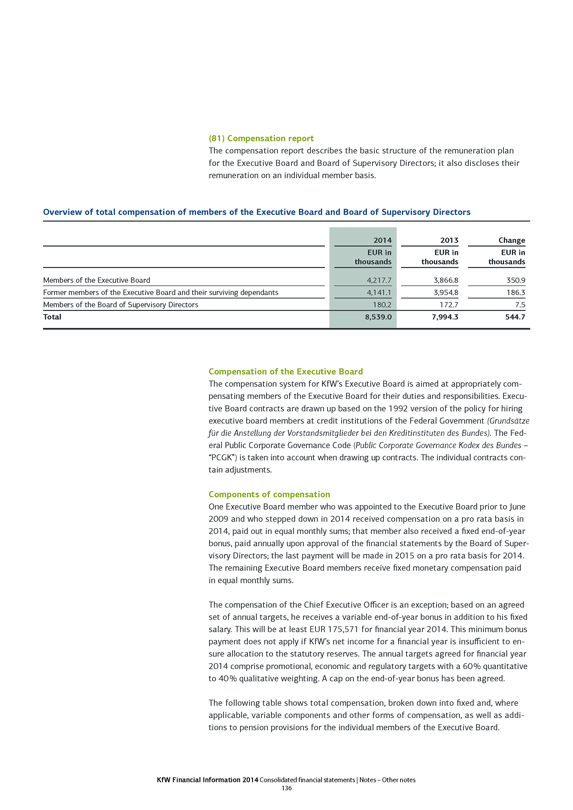

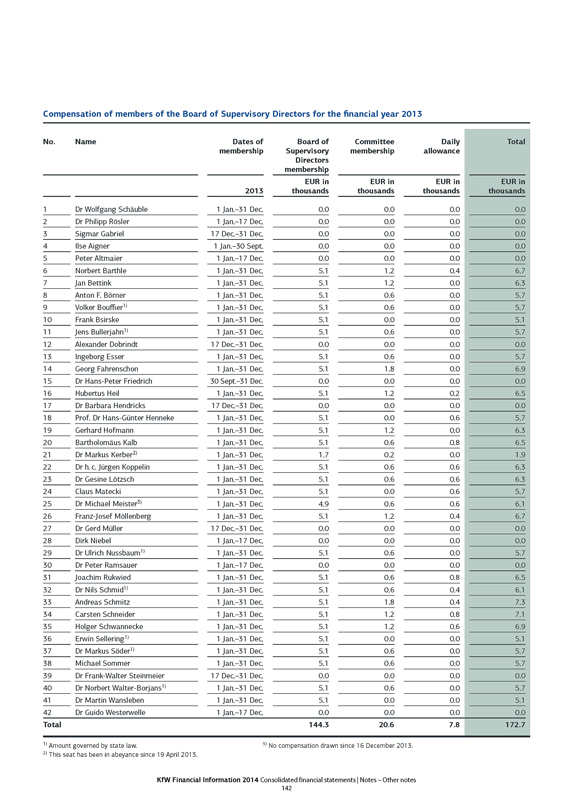

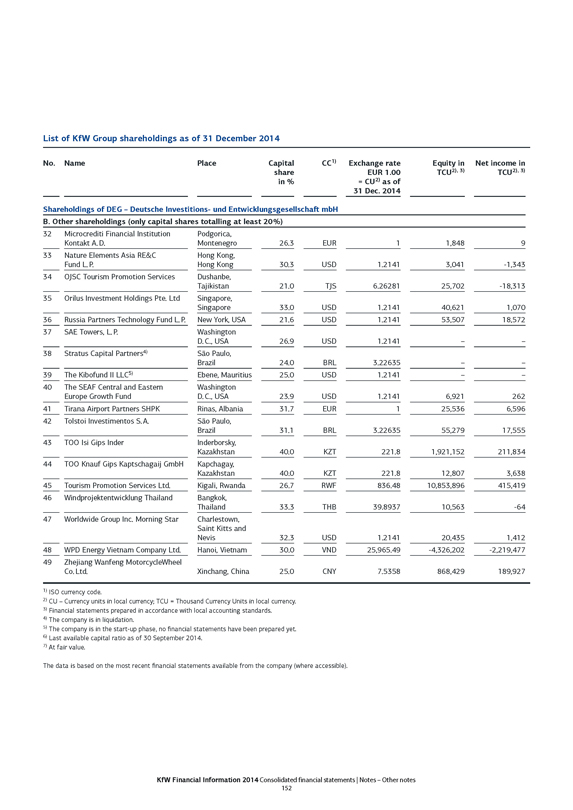

To assess its economic risk-bearing capacity, KfW Group compares its economic capital requirement for potential losses from material quantifiable risks against its available financial resources. KfW Group bases its calculation of the economic capital requirement on a solvency target of 99.99% and a time horizon of one year. The aggregation of the economic capital requirement across various types of risks is made through addition without taking account of diversification effects.