Exhibit (e)

Group management report

Group management report

Basic information on KfW Group

Overview

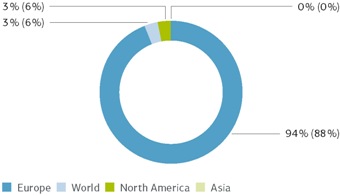

KfW Group consists of KfW and six consolidated subsidiaries. As the promotional bank of the Federal Republic of Germany – which owns 80% of KfW while the German Federal States own 20% – KfW is one of the world’s leading promotional banks. The institutional framework for the promotional mandate including the Federal Republic of Germany’s liability for KfW’s obligations is defined in the KfW Law.

KfW supports sustainable improvement of economic, social and environmental conditions around the world, with an emphasis on promotion of the German economy. In its promotional activities, KfW focuses on societal megatrends. A variety of different financing products and services address in particular the areas small and medium-sized enterprises (SMEs), start-ups, environmental protection, the housing sector, infrastructure, education, project and export finance, and development cooperation. The

domestic promotional lending business with enterprises and private individuals is characterised by the proven and successful strategy of on-lending, in which KfW extends loans to commercial banks, which, in turn, lend the funds to the ultimate borrowers at favourable rates. This strategy eliminates any need for KfW to have its own network of branch offices. Business activities are funded almost fully in the international capital markets; KfW is globally one of the most active and largest bond issuers. In addition to KfW, the group’s main operating subsidiaries are (i) KfW IPEX-Bank, which provides project and export financing, and (ii) DEG, which is active in promoting the private sector in developing and emerging market countries.

In accordance with the business sector structure for KfW Group, the sectors and their main products and services can be presented as follows:

| | | | |

| | | | – Financing of corporate and industrial pollution control investments |

| Mittelstandsbank (SME Bank) | | | | – Equity financing |

| | | | – Advisory services |

| | | | |

Kommunal– und Privatkundenbank/Kreditinstitute (Municipal and Private Client Bank/Credit Institutions) | | | | – Financing for housing construction and modernisation |

| | | | – Education finance |

| | | | – Infrastructure and social finance |

| | | | – Global funding of the promotional institutions of the German Federal States |

| | | | (Landesförderinstitute) |

| | | | – Individual financing banks |

| | | | – Transactions on behalf of the Federal Government |

| | | | |

| Export and project finance | | | | – Financing for German and European export activities |

| | | | – Financing for projects and investments in German and European interests |

| | | | |

| Promotion of developing and transition countries | | | | – Promotion of developing and transition countries on behalf of the Federal |

| | | | Government (budget funds) with complementary market funds raised by KfW |

| | | | – Financing provided by DEG – Deutsche Investitions- und |

| | | | Entwicklungsgesellschaft mbH (private enterprise financing) |

| | | | |

| Capital markets | | | | – Securities and money market investments |

| | | | – Holding arrangements of the Federal Republic of Germany |

| | | | – Transactions mandated by the Federal Government, loan granted to Greece |

| | | | – Funding |

| | | | |

| Head office | | | | – Central interest rate and currency management |

| | | | – Strategic equity investments |

3

KfW Financial Information 2015 Group management report

Composition of KfW Group – Total assets (before consolidation)

| | | | | | | | | | | | | | |

| | | | | | | 31 Dec. 2015 | | | | | | 31 Dec. 2014 | | |

| | | | | | | EUR in millions | | | | | | EUR in millions | | |

| | | | | | | |

| KfW, Frankfurt am Main | | | | | | 502,348 | | | | | | 488,760 | | |

| Subsidiaries | | | | | | | | | | | | | | |

| KfW IPEX-Bank GmbH, Frankfurt am Main (KfW IPEX-Bank) | | | | | | 29,547 | | | | | | 27,348 | | |

| DEG – Deutsche Investitions- und Entwicklungsgesellschaft mbH, Cologne, (DEG) | | | | | | 6,244 | | | | | | 5,647 | | |

| KfW IPEX-Beteiligungsholding GmbH, Frankfurt am Main | | | | | | 2,378 | | | | | | 2,376 | | |

| KfW Beteiligungsholding GmbH, Bonn | | | | | | 414 | | | | | | 398 | | |

| tbg Technologie-Beteiligungs-Gesellschaft mbH, Bonn, (tbg) | | | | | | 207 | | | | | | 208 | | |

| Interkonnektor GmbH, Frankfurt am Main | | | | | | 50 | | | | | | – | | |

| Investments accounted for using the equity method | | | | | | | | | | | | | | |

| Microfinance Enhancement Facility S. A., Luxembourg, (19.8%) | | | | | | 613 | | | | | | 444 | | |

| Green for Growth Fund, Southeast Europe S. A., Luxembourg (18.3%) | | | | | | 332 | | | | | | 253 | | |

| AF Eigenkapitalfonds für deutschen Mittelstand GmbH & Co. KG, Munich, (47.5%) | | | | | | 149 | | | | | | 73 | | |

DC Nordseekabel GmbH & Co. KG, Bayreuth, (50.0%) | | | | | | 127 | | | | | | – | | |

The development of the group’s operating result is largely dependent on KfW.

Strategic objectives

KfW Group has a set of strategic objectives in place that define KfW’s targeted medium-term positioning. This framework encompasses selected top-level objectives at the overall bank level and serves as a central, binding reference for the strategic orientation of all business sectors, with a five-year horizon.

The primary objective of KfW is promotion – the heart of KfW’s business activities – abiding by the principles of subsidiarity and sustainability. KfW addresses the primary objective of promotion largely by focusing its promotional activities on the socially and economically important megatrends of “climate change and the environment”, “globalisation and technical progress”, and “demographic change”.

In relation to the “climate change and the environment” megatrend, KfW finances measures to support renewable energy, improve energy efficiency, safeguard biodiversity and prevent and/or reduce environmental pollution. To address the special importance of this megatrend, KfW has set an environmental commitment ratio of around 35% of total new commitment volume. As part of the “globalisation and technical progress”

megatrend, KfW contributes to strengthening the international competitiveness of German companies by granting loans in the following areas, among others: research and innovation, projects to secure Germany’s supply of raw materials, and infrastructure and transport. With respect to the “demographic change” megatrend, KfW’s objective is to address the consequences that result from a declining and aging population, including the following focus areas: age-appropriate infrastructure, vocational and further training, family policy and childcare as well as corporate succession. KfW also focuses on “non-trend-based promotional issues” that play an important role for KfW but that are not related to any of the three megatrends, such as combating poverty in developing countries.

In addition to focusing on the issues described above, the primary objective in the bank’s strategic framework also extends to covering KfW’s most important customer groups and regions as well as to ensuring promotional quality. For KfW, this means a commitment to maintain the high level of quality of its promotional products that it has achieved in recent years and sufficient coverage of KfW’s key regions and customer groups. KfW

4

KfW Financial Information 2015 Group management report

aims to have around 45% of new domestic commitment volume utilised for the SMEs target group because of its special importance.

The stated priorities set for the primary objective are complemented by a set of secondary objectives or strict ancillary conditions that reflect profitability and efficiency, as well as

risk-bearing capacity aspects. KfW acts in accordance with the principle of subsidiarity, and plans real zero growth as measured by the group’s total commitment volume. Moreover, KfW’s success depends upon continuing to pursue the path of professionalism in the modernisation process upon which it has embarked.

Internal management system

KfW has a closely interlinked strategy and planning process. The results of the planning process are summarised in the business strategy adopted by the Executive Board as well as the risk strategy derived therefrom. The business strategy comprises the group’s strategic objectives for its main business activities as well as the contribution of the different business sectors to the strategic target system and measures for achieving each target. It also combines the operating budget at group and business sector levels. The Executive Board sets KfW Group’s risk policies in its risk strategy, which comprises the group’s strategic risk objectives and derived risk tolerance levels with a one-year horizon. KfW’s Executive Board draws up the operating budget as well as the business and risk strategies. The budget is then presented to the supervisory body (Board of Supervisory Directors) for approval, along with the business and risk strategies for discussion (at the last Board of Supervisory Directors meeting each year).

Conceived as a group-wide strategy process, group business sector planning is KfW Group’s central planning and management tool. Group business sector planning consists of two consecutive sub-processes that all KfW business sectors and subsidiaries perform every year: strategic planning and operational planning.

The group-wide strategic objectives set by the Executive Board form the basis for the strategic planning stage. Strategic medium-term courses of action are developed by the business sectors within this strategic activities framework. Assumptions are made with respect to the future development of determining factors on the basis of assessments of risks and opportunities. This analysis takes into account both external factors (including market development, regulatory requirements, the competitive situation and customer behaviour) and internal factors and resources (including human and physical resources, use of subsidy funds and primary cost planning) and targeted earnings levels. The central areas (e.g. information technology, human resources, and central services) also play important roles in achieving the strategic objectives. By involving the central areas in the planning phase, the consistency of their strategic considerations is aligned with the larger strategic objectives. Cost planning and Full-Time Equivalent (staff) planning are conducted in parallel to business sector strategic planning for all areas, applying a top-down approach. The underlying assumptions are reviewed annually via a rolling planning process. The Executive Board defines business sector objectives, including cost targets, for all sectors in the form of guidelines on the basis of a group-level assessment

of these strategic considerations for the entire planning period.

The business sectors plan their new business, risks and earnings, and all areas of the bank plan their budgets based on these guidelines, taking into account any changes in external or internal factors. These plans are checked for consistency with the group’s and the business sectors’ strategic planning and for any risk implications. The Executive Board either approves the resultant operating budget or instructs the business sectors to fine-tune their plans in an adjustment round. Any changes to the business strategy are subject to consultation with the Risk Management department in order to ensure consistency of business and risk strategy. The operational planning process ends when management has adopted the final budget for the next financial year.

Adoption of the group business sector plans establishes the group’s qualitative and quantitative objectives. The Executive Board reviews achievement of the objectives both on a regular and an ad hoc basis during the current financial year. The assumptions concerning external and internal factors made when determining the business strategy are also subject to regular checks. The development of relevant control variables, their attainment, and the cause of any failure in this respect are analysed on an ongoing basis as part of strategic controlling. Ad hoc issues of strategic relevance are also addressed in consultation with group areas. Recommendations for action concerning potential strategy adjustments or an optimised use of resources are made to the Executive Board by means of the strategic performance report. The results of the analysis are included in further strategy discussions and strategic planning processes. The achievement of objectives is regularly monitored by the Board of Supervisory Directors based on reports submitted to it according to the KfW Bylaws. The commentary in these reports outlines analyses of causes and any potential plans for action.

Comprehensive and detailed reports are prepared on a monthly/quarterly basis as part of operational controlling. These detailed analyses comprise earnings, cost and Full-Time Equivalent (staff) developments and are reported to specific departments. Additionally, complete analyses and extrapolations of significant relevance to the overall group performance are also presented directly to the Executive Board.

5

KfW Financial Information 2015 Group management report

Economic report

General economic environment

The global economy lost momentum in 2015, although the picture was mixed across the different economic areas. The economy in the industrialised nations generally stabilised, driven by the United States, the euro area and Japan. This was facilitated by the positive development of both, the labour market and private consumption, low energy prices and the continuing favourable interest rate environment in those economies. Development was less positive in other industrialised nations in 2015. Various geopolitical risks and the uncertainty regarding an increase in interest rates by the US Federal Reserve put pressure on these economies in 2015. The uncertainty put also pressure on the economies in developing and emerging market countries, which recorded slower growth for the fifth consecutive year. Many large emerging markets, in particular, faced strong headwinds; some even entered recession. In China, growth remained above average, but the economic slowdown continued, albeit without being headed for a hard landing. The weak growth of many emerging markets was due to the rapid decline in commodities prices, the restructuring of the Chinese economy and high capital outflows from China in a short space of time. Adjustments to these factors have led to growth slumps. Structural problems are becoming more acute again in this environment and need to be overcome somehow to unleash long-term growth potential.

Economic recovery gained some momentum in the member states of the European Economic and Monetary Union (EMU). Overall, the economic output in EMU member states increased by 1.5% year on year in 2015. Growth momentum therefore picked up slightly more than KfW had expected a year ago. Geopolitical conflicts were less problematic for the economy than had been anticipated, and financing conditions for business and private households improved considerably in the course of the year. Private consumption was the largest contributor to growth, buoyed by the drop in energy prices and gradual improvements in the labour markets. Exports were also instrumental to growth, due to favourable exchange rates, despite the weak global economic environment. However, foreign trade was neutral overall due to higher demand for imports.

Germany’s underlying economic performance in 2015 was almost as strong as that of the previous year. However, the extra working days – a positive calendar effect of around a quarter percentage point – resulted in real growth of 1.7%, slightly exceeding that of 2014 (+1.6%), according to the second monthly estimate (February 2016) of the Federal Statistical Office. Domestic demand remained strong. Consumption was by far the key driver, having profited from the continuous increase in employment and a notable increase in real wages. Private investments in housing construction continued its climb that began in

2010 (broken only by a slight decline in 2013), albeit at a slightly slower pace. Private investments in equipment were in positive territory, as in 2014, while investments in commercial buildings decreased noticeably overall in 2015. Corporate investments mainly exhibited strong growth at the beginning of 2015 but came to a temporary halt later in the year, likely because fears of recession in key emerging markets unsettled German exporters, causing them to delay their investment decisions. Net exports (exports minus imports) only had a mildly positive effect on economic growth, despite solid export growth, as the increase in imports was higher than that of exports due to high domestic demand. A year ago KfW’s projection for the trend in the expenditure components of gross domestic product (GDP) was reasonably accurate; however, economic growth was significantly above KfW’s cautious forecast of around 1% and also above the forecast consensus at the time of 1.3%. The main reason for this was the unexpectedly large boost to growth in the winter half-year 2014/15, which pushed the annual average for 2015 upwards.

The focus in the financial markets in 2015 was primarily on the diverging monetary policies of the world’s major central banks. Whereas the Bank of Japan maintained its expansionary stance and the European Central Bank (ECB) shifted into an even more accommodative gear, interest rates in the United States were raised slightly for the first time since 2006. Growing concerns among market participants were fuelled not only by shifting assessments of monetary policy, but also in the early summer by developments in Greece and later in the year by muted growth in emerging markets, particularly China, and the recent drop in crude oil prices. This led to temporary but considerable market turbulence in the late summer. The riskier asset classes suffered most from these market developments, whereas safe investments enjoyed consistently high demand. The year 2015 saw an unprecedented development with nominal yields sliding into negative terrain in tenors up to medium-term maturities on some bond markets, including in Germany.

Given the persisting moderate macroeconomic growth rate and unusually low rate of inflation, the ECB took further expansionary monetary policy measures in 2015. An extended bond-buying programme was decided at the ECB’s January meeting, with a total monthly volume of EUR 60 billion. The programme also included government and quasi-government bonds for the first time. In December 2015, it was announced that the programme would be extended until at least March 2017 and that the deposit rate would be further reduced to –0.30%. This environment caused money market rates to fall further in the euro area, all of them landing in negative territory by the end of the year.

6

KfW Financial Information 2015 Group management report

Yields in the longer maturity segments saw greater volatility during the year. In reaction to the ECB’s bond-buying programme decided on in January and begun in March 2015, the yields on ten-year German government bonds fell to a new all-time low of 0.05% in April 2015. After a temporary jump to over 1% in the second quarter, the yields dropped again significantly in the second half of the year. This was partly due to the additional expansionary measures the ECB had discussed. Yields on ten-year German government bonds in 2015 were down an average of approximately 70 basis points in comparison with the previous year. Money market rates in the United States rose significantly during the year, due not least to heightened expectations by year-end of a US rate hike, which were confirmed in December by the

US Federal Reserve’s first interest rate increase in nine years. Yields on ten-year US government bonds trended slightly upwards with heightened volatility during the year. However, their annual average for 2015 was around 40 basis points lower than a year before. In both the United States and the euro area, the yield curve in 2015 flattened on average compared to 2014.

The differing monetary policies of the US Federal Reserve and the ECB had a major impact on the EUR/USD exchange rate. The euro depreciated considerably against the US dollar to its low for the year of USD 1.05 per EUR 1.00 while the annual average exchange rate in 2015 was around 1.11. This was equivalent to depreciation of almost 17% compared to the 2014 average.

Development of KfW Group

All in all, 2015 was a very successful financial year for KfW. Overall, the plans and strategic objectives for the positioning targeted in the medium term were achieved, and in some cases far exceeded. With an increased promotional business volume of EUR 79.3 billion (2014: EUR 74.1 billion), it was also a very successful year in promotional terms. KfW made a key contribution to modernisation and social cohesion in Germany with its promotional products, which included national and international promotional activities for refugee aid. Promotional activities focused on the socially and economically significant megatrends of “climate change and the environment”, “globalisation and technical progress” and “demographic change”. The measures introduced for the comprehensive modernisation of KfW were continued successfully.

KfW’s earnings position developed far better than expected in 2015, exceeding the figure reported in 2014, primarily due to the positive valuation result. The valuation result benefited from various positive non-recurring effects, the cumulative impact of which cannot be expected to occur again. At EUR 2.1 billion (2014: EUR 2.0 billion), the Operating result before valuation (before promotional activity) was above both the prior-year figure and forecasts, primarily due to higher interest margins in Export and project finance and favourable funding opportunities for KfW. The cost-income ratio (before promotional activity) increased only slightly to 35.2% (2014: 34.4%) despite increasing administrative costs, which were attributable, in particular, to modernisation efforts and measures addressing regulatory requirements, such as KfW’s mandatory application, by analogy, of the German Banking Act (Gesetz über das Kreditwesen – “KWG”). The net valuation result was positive and thus better than expected. This was due in part to the rather moderate net charges from risk provisions for lending business helped by the good economic situation and in part to the net gains from hedge accounting and other financial instruments at fair value through profit or loss. At EUR 2.2 billion (2014: EUR 1.5 billion), the consolidated profit exceeded the projected level. Consolidated profit adjusted for IFRS effects from hedging was EUR 1.9 billion (2014: EUR 1.5 billion). With this result, KfW is improving its capital base in order to safeguard its promotional capacity in the long term and to ensure it can meet regulatory requirements, which have increased as a result of the mandatory application of the

KWG from 1 January 2016. In its current consolidated income projections for 2016, KfW expects Consolidated profit before IFRS effects from hedging of slightly under EUR 1 billion, which is at the lower end of the range of strategic projections.

Consolidated total assets rose by EUR 13.9 billion to EUR 503.0 billion in 2015. This increase was largely a result of the development of the US dollar exchange rate, which was reflected in the rise of liquidity held (+ EUR 7.9 billion) due to the increase in cash collateral received in the derivatives business and due to an increase of EUR 3.8 billion in net loan receivables to EUR 369.2 billion. Unscheduled repayments increased again slightly in comparison with the previous year. KfW’s promotional business is primarily funded in the international capital markets. The volume of own issues reported under Certificated liabilities amounted to EUR 415.2 billion (year-end 2014: EUR 404.0 billion). The EUR 3.6 billion increase in equity to EUR 25.2 billion was due in part to consolidated comprehensive income and also in part to a conversion of subordinated liabilities in the amount of EUR 1.25 billion to equity by inclusion in KfW’s capital reserves.

KfW Group’s business in 2015 was largely characterised by the following developments:

A. High demand for KfW products

With a promotional business volume of EUR 79.3 billion in 2015 (2014: EUR 74.1 billion), the group exceeded its projected new business volume of EUR 69.5 billion.

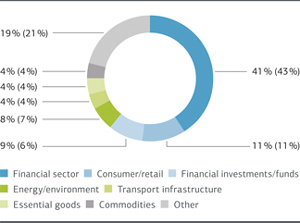

KfW’s domestic promotional business reached a commitment volume of EUR 50.5 billion, an increase compared to the previous year (EUR 47.6 billion). This increase was partly due to the rise in demand for commercial financing and partly due to the high demand for housing construction loans. KfW’s interest-free special loan facility for refugee accommodation of EUR 1.0 billion was an additional growth driver. The SME share of financing declined slightly to 41% from 44% in 2014, as a result of the high commitment volume in the Kommunal- und Privatkundenbank/Kreditinstitute business sector. Foreign business recorded strong growth and reached a total of EUR 27.9 billion (2014: EUR 25.5 billion). This was primarily due to increased demand in the Export and project finance business sector of

7

KfW Financial Information 2015 Group management report

EUR 20.2 billion (2014: EUR 16.6 billion), which was in excess of expectations, and which was the result of, among other things, large-volume individual transactions in the Maritime industries sector department. Promotion in the business sector Capital markets developed steadily with a commitment volume of EUR 1.1 billion, and investments totalling EUR 0.3 billion in KfW’s new green bond portfolio.

A percentage of 37% across all business sectors was attributable to the megatrend “climate change and the environment” (2014: 36%), and was slightly above the strategic projection. KfW raised EUR 62.6 billion in the international capital markets to fund its business activities (2014: EUR 57.4 billion).

Promotional business volume of KfW Group

| | | | | | | | | | | | | | |

| | | | | | | 2015 | | | | | | 2014 | | |

| | | | | | | EUR in billions | | | | | | EUR in billions | | |

| | | | | | | |

| Domestic business | | | | | | 50.5 | | | | | | 47.6 | | |

| Mittelstandsbank (SME Bank) | | | | | | 20.4 | | | | | | 19.9 | | |

| Kommunal– und Privatkundenbank/Kreditinstitute (Municipal and Private Client Bank/Credit Institutions) | | | | | | 30.1 | | | | | | 27.7 | | |

| Capital markets | | | | | | 1.1 | | | | | | 1.2 | | |

| International business | | | | | | 27.9 | | | | | | 25.5 | | |

| Export and project finance | | | | | | 20.2 | | | | | | 16.6 | | |

Promotion of developing and transition countries | | | | | | 7.7 | | | | | | 8.8 | | |

Volume of new commitments1) | | | | | | 79.3 | | | | | | 74.1 | | |

1) Adjusted for export and project financing refinanced through KfW programme loans.

B. Strong operating result

At EUR 2,066 million (2014: EUR 2,023 million), the Operating result before valuation (before promotional activity) was slightly above both the prior-year figure and expectations. This was primarily the result of the positive development – despite the low interest environment – in Net interest income (before promotional activity), which benefitted from the increasing margin income in foreign lending business, the US dollar exchange rate development and KfW’s continued favourable funding opportunities.

The slight decline in Net commission income (before promotional activity) to EUR 286 million (2014: EUR 313 million) was largely due to the absence of the non-recurring effects that occurred in 2014 in connection with the renegotiation of collateral agreements.

Administrative expense (before promotional activity) increased to EUR 1,125 million (2014: EUR 1,059 million); however, this increase was below expectations. The decisive factors here were extensive investments in modernising KfW and, in particular, measures connected to KfW’s application of the KWG.

C. Positive valuation result due to positive non-recurring effects

Charges arising from risk provisions for lending business totalled a very moderate EUR 48 million in 2015. This was below the projected standard risk costs and also beneath the level of the previous year (EUR 143 million). In addition to the favourable economic environment, this positive development was also due to factors such as high income from recoveries of loans written off (EUR 281 million), which resulted primarily from exposures in the Export and project finance business sector.

Moreover due to purely IFRS-induced effects from the valuation of derivatives used for hedging purposes the earnings position was overstated by EUR 271 million (2014: EUR 47 million). KfW also generated one-time earnings in an amount of EUR 119 million from the disposal of individual combinations of hedged items and hedging instruments.

A contribution to earnings of EUR 147 million (2014:

EUR 122 million) from the equity investment portfolio largely resulted from the Promotion of developing and transition countries business sector. Performance in the DEG portfolio was enhanced by exchange rate effects including those related to the US dollar.

The securities portfolio generated a lower contribution to earnings in 2015 of EUR 18 million (2014: EUR 57 million), which reflects the subdued development overall in the financial markets.

Other operating income from the waiver of the repayment of part of the ERP subordinated loan amounted to EUR 100 million.

D. Promotional activity lower than expected

KfW’s domestic promotional activity, which has a negative impact on KfW Group’s earnings position, decreased to EUR 345 million in 2015 (2014: EUR 364 million), which was below expectations. This was a result of declining interest rate reductions of EUR 304 million (2014: EUR 345 million), particularly due to the lower demand for subsidised promotional loans and the decreased scope for reductions in the low interest rate environment.

The following key figures provide an overview of developments in 2015 and are explained in more detail below:

8

KfW Financial Information 2015 Group management report

Key financial figures of KfW Group

| | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | 2015 | | | | | | 2014 | | |

| Key figures of the income statement | | | | | | EUR in millions | | | | | | EUR in millions | | |

| | | | | | | |

| Operating result before valuation (before promotional activity) | | | | | | 2,066 | | | | | | 2,023 | | |

| Operating result after valuation (before promotional activity) | | | | | | 2,539 | | | | | | 1,953 | | |

| Promotional activity (expense) | | | | | | 345 | | | | | | 364 | | |

| Consolidated profit | | | | | | 2,171 | | | | | | 1,514 | | |

| Cost-income ratio (before promotional activity)1) | | | | | | 35.2% | | | | | | 34.4% | | |

| | | | | | | |

| | | | | | | 2015 | | | | | | 2014 | | |

| Key economic figures | | | | | | EUR in millions | | | | | | EUR in millions | | |

| | | | | | | |

| Consolidated profit before IFRS effects from hedging | | | | | | 1,900 | | | | | | 1,467 | | |

| | | | | | | |

| | | | | | | 31 Dec. 2015 | | | | | | 31 Dec. 2014 | | |

| Key figures of the statement of financial position | | | | | | EUR in billions | | | | | | EUR in billions | | |

| | | | | | | |

| Total assets | | | | | | 503.0 | | | | | | 489.1 | | |

| Volume of lending | | | | | | 447.0 | | | | | | 440.3 | | |

| Volume of business | | | | | | 587.2 | | | | | | 572.5 | | |

| Equity | | | | | | 25.2 | | | | | | 21.6 | | |

Equity ratio | | | | | | 5.0% | | | | | | 4.4% | | |

| 1) | Administrative expense (before promotional activity) in relation to adjusted income. Adjusted income is calculated from Net interest income and Net commission income (in each case before promotional activity). |

Development of earnings position

The earnings position in 2015 was characterised by an increase in the operating result combined with an improvement in the valuation result due to various non-recurring effects. This

resulted in a high consolidated profit of EUR 2.2 billion, exceeding both the previous year’s result and forecasts.

Earnings position

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | 2015 | | | | | | 2014 | | | | | | Change | | |

| | | | | | | EUR in millions | | | | | | EUR in millions | | | | | | EUR in millions | | |

| | | | | | | | | | |

| Net interest income (before promotional activity) | | | | | | 2,904 | | | | | | 2,768 | | | | | | 136 | | |

Net commission income (before promotional activity) | | | | | | 286 | | | | | | 313 | | | | | | –27 | | |

| Administrative expense (before promotional activity) | | | | | | 1,125 | | | | | | 1,059 | | | | | | 66 | | |

Operating result before valuation (before promotional activity) | | | | | | 2,066 | | | | | | 2,023 | | | | | | 43 | | |

Risk provisions for lending business | | | | | | –48 | | | | | | –143 | | | | | | 95 | | |

Net gains/losses from hedge accounting and other financial instruments at fair value through profit or loss | | | | | | 478 | | | | | | 69 | | | | | | 409 | | |

Net gains/losses from securities and investments and from investments accounted for using the equity method | | | | | | 43 | | | | | | 4 | | | | | | 38 | | |

Operating result after valuation (before promotional activity) | | | | | | 2,539 | | | | | | 1,953 | | | | | | 586 | | |

Net other operating income | | | | | | 107 | | | | | | 20 | | | | | | 87 | | |

Profit/loss from operating activities (before promotional activity) | | | | | | 2,647 | | | | | | 1,973 | | | | | | 673 | | |

Promotional activity (expense) | | | | | | 345 | | | | | | 364 | | | | | | –19 | | |

Taxes on income | | | | | | 130 | | | | | | 95 | | | | | | 35 | | |

Consolidated profit | | | | | | 2,171 | | | | | | 1,514 | | | | | | 657 | | |

Consolidated profit before IFRS effects from hedging | | | | | | 1,900 | | | | | | 1,467 | | | | | | 433 | | |

9

KfW Financial Information 2015 Group management report

At EUR 2,066 million (2014: EUR 2,023 million), the Operating result before valuation (before promotional activity) was slightly above both the prior-year figure and expectations.

Despite the low interest rate environment and the resulting reduced potential for profit from maturity transformation, Net interest income (before promotional activity) increased to EUR 2,904 million in comparison with the previous year (2014: EUR 2,768 million), primarily due to the improved interest margin in the lending business, and remains the most important source of income.

The interest rate margin benefitted primarily from the positive development in commitments in the business sector Export and project finance and also from developments in the US dollar exchange rate in the financial year. In addition, KfW’s good funding opportunities in the capital and money markets, also due to its top-notch credit rating, boosted Net interest income. Income from early repayment penalties as a result of unscheduled repayments in 2015, which will lead to corresponding reduced income in the future, was up compared to the previous year.

Net commission income (before promotional activity) was EUR 286 million, which is slightly lower than the 2014 figure of EUR 313 million. Non-recurring compensation paid by derivatives partners following the renegotiation of collateral agreements totalled EUR 57 million in the previous financial year and was responsible for this decline. At EUR 87 million, higher loan processing fees developed in the opposite direction (2014: EUR 82 million). Income generated from managing financial cooperation loans on behalf of the German Federal Government in the business sector Promotion of developing and transition countries also increased to EUR 181 million (2014: EUR 156 million), due to additional income from a new remuneration agreement. This item was offset by a corresponding increase in KfW’s Administrative expense, in part due to branch offices in partner countries.

The increase in Administrative expense (before promotional activity) to EUR 1,125 million (2014: EUR 1,059 million) is lower than originally expected, largely as a result of the successful implementation of individual efficiency projects as part of cost management. The main drivers of expenses remain the measures connected with mandatory application of the KWG and the extensive investments in modernising KfW.

Personnel expenses increased by EUR 45 million to EUR 630 million (2014: EUR 585 million). In addition to the higher number of employees, this was due in particular to negotiated pay increases. Non-personnel expenses (before promotional activity) amounted to EUR 494 million (2014: EUR 474 million). The increase of EUR 20 million was due to a number of factors including higher office operating costs and the use of consultancy and support services. These services related in particular to the necessary fulfilment of regulatory requirements and the comprehensive modernisation of KfW’s information technology (IT) architecture, which will continue to be intensively pursued in the next few years. This extensive project portfolio is also expected to lead to a rise in Administrative expense in the future.

The cost-income ratio before promotional activity increased slightly to 35.2% (2014: 34.4%). This was primarily due to expected increased expenditures associated with KfW’s mandatory application of the KWG and the further modernisation of KfW.

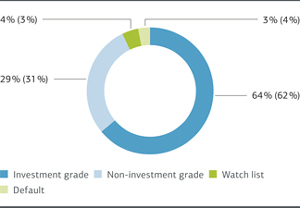

KfW Group’s Risk provisions for lending business resulted in moderate charges of EUR 48 million (2014: EUR 143 million) in a good economic environment, which was significantly below the projected standard risk costs. The expenses resulting from Risk provisions for lending business largely related to the business sector Kommunal- und Privatkundenbank/Kreditinstitute (Municipal and Private Client Bank/Credit Institutions) and the business sector Promotion of developing and transition countries.

At EUR 343 million, net additions to the provision for imminent credit risks including direct write-offs were higher than in 2014 (EUR 221 million). This increase was particularly concentrated on the business sector Export and project finance with additions of EUR 158 million (2014: EUR 34 million), of which EUR 65 million (2014: EUR 4 million) was attributable to the maritime industries sector. There were also net additions in the business sector Promotion of developing and transition countries (EUR 77 million) and domestic promotional business (EUR 108 million). In contrast, the group generated high income of EUR 281 million (2014: EUR 77 million) from recoveries of amounts previously written off. Thereof EUR 168 million was attributable to the business sector Export and project finance (2014: EUR 37 million), primarily in connection with the successful restructuring of older receivables. Risk provisions decreased during financial year 2015 from EUR 1.4 billion to EUR 1.2 billion, due to a high level of utilisation (EUR 0.5 billion), which was largely connected with the sale of exposures. Roughly half of this decrease related to the business sector Export and project finance.

In 2015, there was almost no change in the risk provisions for loan portfolio risks that were not yet allocable. As of year-end 2015, risk provisions remained at EUR 0.6 billion.

Risk provisions for lending business cover all imminent and latent risks, reflecting the consistent implementation of KfW Group’s conservative risk policy.

Net gains/losses from hedge accounting and other financial instruments at fair value through profit or loss stood at EUR 478 million (2014: EUR 69 million) and in 2015 were primarily driven by positive effects from the equity investment portfolio, one-time earnings from the disposal of individual combinations of hedged items and hedging instruments and high positive purely IFRS-related effects from the valuation of derivatives used for hedging purposes.

The equity investment portfolio measured at fair value through profit or loss was primarily influenced by the positive performance of investments and exchange rate-induced increase in value, largely due to the appreciation of the US dollar. This portfolio generated income of EUR 145 million (2014: EUR 175 million). This contribution is primarily attributable to the business activities of DEG in promoting developing and transition countries.

10

KfW Financial Information 2015 Group management report

The result from foreign currency translation had a negative effect with a charge of EUR 54 million (2014: EUR 57 million) resulting from exchange rate changes, particularly in the US dollar, combined with the corresponding foreign currency items in the consolidated statement of financial position. These were largely due to differences from the group companies’ financial statements prepared in accordance with German commercial law as regards recognition and measurement of financial instruments not used for hedging.

Hedge accounting and borrowings recognised at fair value, including derivatives used for hedging purposes, resulted in net earnings of EUR 271 million (2014: EUR 47 million). The mark-to-market derivatives are part of economically hedged positions. However, situations where the other part of the hedging relationship cannot be carried at fair value or has to be measured with a different method inevitably result in temporary fluctuations in income that fully reverse over the term of the transaction. KfW also generated one-time earnings in the amount of EUR 119 million from the disposal of individual combinations of hedged items and hedging instruments.

Net gains from securities and investments accounted for using the equity method of EUR 43 million (2014: EUR 4 million) largely resulted from positive developments in the securities and equity investment portfolio.

Securities not carried at fair value through profit or loss contributed positive earnings of EUR 22 million (2014: EUR 53 million). Among other things, individual structured securities performed well.

The general development of financial markets led to a decrease in the value of securities not recognised through profit or loss of EUR 37 million (2014: increase of EUR 55 million), which were reported in equity under Revaluation reserves. This affected well-collateralised European covered bonds in particular. The Revaluation reserves remained slightly positive overall.

Moreover, the net positive difference between the carrying amount and the fair value for those securities and investments not carried at fair value declined by EUR 26 million to EUR 20 million as of 31 December 2015 (2014: increase of EUR 53 million). This development was primarily due to price losses for well-collateralised covered bonds and securities in the asset-backed securities (ABS) portfolio. Overall, the total volume increased and amounted to EUR 10.5 billion as of 31 December 2015 (year-end 2014: EUR 9.2 billion).

The group generated a result of EUR 18 million (2014: EUR 7 million) from investments accounted for using the equity method, which was primarily attributable to the entity AF Eigenkapitalfonds für deutschen Mittelstand GmbH & Co KG.

Net other operating income of EUR 107 million (2014: EUR 20 million) primarily comprises income from the waiver of the repayment of part of the ERP subordinated loan in the amount of EUR 100 million. This was offset by an expense of

EUR 23 million from a donation to the KfW Stiftung. The foundation KfW Stiftung largely performs operating but also promotional activities and addresses the major social challenges of our time: globalisation, environmental and climate protection and demographic change.

KfW’s domestic promotional activity, which has a negative impact on KfW Group’s earnings position, amounted to EUR 345 million in 2015 (2014: EUR 364 million), below the prior-year level and expectations.

The key component of KfW’s promotional activity is interest rate reductions. KfW grants these reductions for certain domestic promotional loans during the first fixed interest rate period in addition to passing on KfW’s favourable refinancing conditions. The volume of interest rate reductions provided fell to EUR 304 million in 2015 (2014: EUR 345 million). This was primarily due to a demand-induced decline in the volume of interest rate-reduced promotional loans. The generally low interest rates also reduced the potential to stimulate the promotional business with additional reductions.

Moreover, promotional activity, as reported in Net commission income and Administrative expense, was provided in an amount of EUR 41 million (2014: EUR 19 million). This activity was targeted among other things at improving sales opportunities for KfW’s promotional products. Promotional activity was expanded in the form of consultancy grants.

After income taxes, a Consolidated profit of EUR 2,171 million was recorded, which significantly exceeded that of the previous year (EUR 1,514 million) as well as expectations. Given the stable operating result for 2015, this development was largely due to various positive non-recurring effects in the valuation result, the cumulative impact of which cannot be expected to reoccur.

Consolidated profit before IFRS effects from hedging is another key financial figure based on Consolidated profit in accordance with IFRS. Derivative financial instruments are entered into for hedging purposes. Under IFRS, the requirements for the recognition and valuation of derivatives and hedges nevertheless give rise to temporary net gains or losses. In KfW’s opinion, such net gains or losses do not sufficiently reflect economically effective hedges.

As a result, the following reconciliations were performed by eliminating temporary contributions to income in the amount of EUR –271 million (2014: EUR –47 million) as follows:

| – | Valuation results from micro and macro hedge accounting. All hedging relationships are economically effective and do not give rise to any net gain or loss over the entire life of the hedge. |

| – | Net gains or losses from the use of the fair value option to avoid an accounting mismatch in the case of funding include related hedging derivatives. Accumulated over the entire life of the hedge, the economically effective hedges do not give rise to any net gain or loss. |

11

KfW Financial Information 2015 Group management report

| – | Net gains or losses from the fair value accounting of hedges with high economic effectiveness but not qualifying for hedge accounting. These hedges do not give rise to any net gain or loss over the entire period to maturity. |

| – | Net gains or losses from foreign currency translation of foreign currency positions, in accordance with recognition and valuation requirements for derivatives and hedging relationships. |

In 2015, the reconciled earnings position amounted to a profit of EUR 1,900 million (2014: EUR 1,467 million). KfW Group achieved a good result in financial year 2015 that exceeded its sustainable earnings potential.

Development of net assets

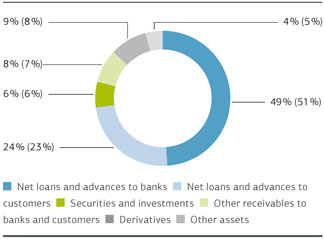

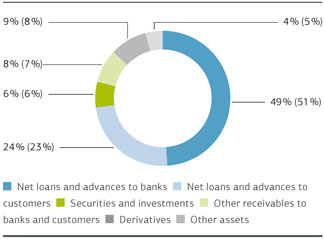

Lending to banks and customers has remained KfW Group’s core business. As of 31 December 2015, a total of 73% of KfW Group’s assets was attributable to its lending business.

Assets

31 Dec. 2015 (31 Dec. 2014)

The lending volume was EUR 6.6 billion above the prior-year level and amounted to EUR 447.0 billion.

Volume of lending

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | 31 Dec. 2015 | | | | | | 31 Dec. 2014 | | | | | | Change | | |

| | | | | | | EUR in millions | | | | | | EUR in millions | | | | | | EUR in millions | | |

| | | | | | | | | | |

| Loans and advances | | | | | | 370,920 | | | | | | 367,189 | | | | | | 3,731 | | |

| Risk provisions for lending business | | | | | | –1,743 | | | | | | –1,857 | | | | | | 114 | | |

| Net loans and advances | | | | | | 369,177 | | | | | | 365,332 | | | | | | 3,845 | | |

| Contingent liabilities from financial guarantees | | | | | | 3,260 | | | | | | 3,501 | | | | | | –241 | | |

| Irrevocable loan commitments | | | | | | 61,091 | | | | | | 57,049 | | | | | | 4,042 | | |

| Loans and advances held in trust | | | | | | 13,434 | | | | | | 14,448 | | | | | | –1,014 | | |

Total | | | | | | 446,962 | | | | | | 440,329 | | | | | | 6,633 | | |

12

KfW Financial Information 2015 Group management report

Loans and advances increased by EUR 3.7 billion from EUR 367.2 billion in 2014 to EUR 370.9 billion in 2015, mainly due to exchange rate effects from the appreciation of the US dollar. Disbursements in new lending business continued to be offset by high unscheduled repayments of EUR 18.0 billion, primarily in the domestic promotional lending business. At EUR 369.2 billion, Net loans and advances again represented 83% of lending volume.

Contingent liabilities from financial guarantees of EUR 3.3 billion remained at the prior-year level. Irrevocable loan commitments rose by EUR 4.0 billion to EUR 61.1 billion in 2015, largely due to

new commitments in international financing. Within assets held in trust, the volume of Loans and advances held in trust, which primarily comprised loans to promote developing countries financed by budget funds provided by the Federal Republic of Germany, decreased by EUR 1.0 billion to EUR 13.4 billion.

At EUR 40.8 billion, Other loans and advances to banks and customers were above the previous year’s amount of EUR 32.6 billion. This item in particular includes short-term secured and unsecured investments held for general liquidity management purposes and in connection with collateral management in the derivatives business.

At EUR 31.6 billion, the total amount of Securities and investments was at the previous year’s level.

Securities and investments

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | 31 Dec. 2015 | | | | | | 31 Dec. 2014 | | | | | | Change | | |

| | | | | | | EUR in millions | | | | | | EUR in millions | | | | | | EUR in millions | | |

| | | | | | | | | | |

| Bonds and other fixed-income securities | | | | | | 29,238 | | | | | | 28,600 | | | | | | 639 | | |

| Equity investments | | | | | | 2,388 | | | | | | 2,114 | | | | | | 274 | | |

| Shares in non-consolidated subsidiaries | | | | | | 8 | | | | | | 8 | | | | | | 0 | | |

Total | | | | | | 31,634 | | | | | | 30,722 | | | | | | 913 | | |

The securities portfolio, which increased in comparison with the previous year, constituted a significant item in Securities and investments. This increase in the portfolio was almost completely due to the increase of EUR 0.6 billion to EUR 28.1 billion in bonds and other fixed-income securities, while the volume of money market securities remained unchanged at EUR 1.1 billion.

The fair values of derivatives with positive fair values, which were primarily used to hedge refinancing transactions, increased by EUR 5.2 billion, from EUR 38.5 billion to EUR 43.7 billion, due to changes in market parameters including exchange rates.

Netting agreements reached with counterparties, which also included derivatives with negative fair values, and collateral agreements (largely cash collateral received) reduced counterparty risk substantially. Value adjustments from macro hedging related to the underlying asset portfolios decreased significantly by EUR 4.0 billion, from EUR 18.5 billion to EUR 14.4 billion, due to developments in market parameters.

There were only minor changes in the other asset line items in the statement of financial position.

13

KfW Financial Information 2015 Group management report

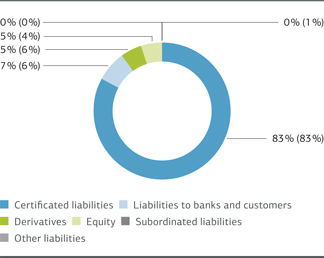

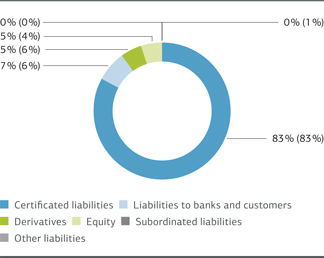

Development of financial position

KfW Group’s funding strategy in the international capital markets is based on three pillars: “benchmark bonds in euros and US dollars”, “other public bonds” and “private placements”. Funds raised in the form of Certificated Liabilities continued to play a significant role, at 83% of total assets, unchanged from the previous year.

Financial position

31 Dec. 2015 (31 Dec. 2014)

In 2015, borrowings increased by EUR 14.9 billion to EUR 449.1 billion.

Borrowings

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | 31 Dec. 2015 | | | | | | 31 Dec. 2014 | | | | | | Change | | |

| | | | | | | EUR in millions | | | | | | EUR in millions | | | | | | EUR in millions | | |

| | | | | | | | | | |

| Short-term funds | | | | | | 40,363 | | | | | | 34,213 | | | | | | 6,150 | | |

Bonds and notes | | | | | | 375,316 | | | | | | 370,034 | | | | | | 5,282 | | |

Other funding | | | | | | 33,118 | | | | | | 27,685 | | | | | | 5,433 | | |

Subordinated liabilities | | | | | | 300 | | | | | | 2,247 | | | | | | –1,947 | | |

Total | | | | | | 449,098 | | | | | | 434,179 | | | | | | 14,919 | | |

KfW Group’s principal sources of funding were medium and long-term bonds and notes issued by KfW. Funds from these sources amounted to EUR 375.3 billion and accounted for 84% of borrowings as of 31 December 2015. The increase of EUR 5.3 billion was primarily a result of changes in exchange rates. This was offset by interest-rate related valuation effects from micro hedge accounting. Short-term issues of commercial paper increased by EUR 5.9 billion to EUR 39.9 billion. Total short-term funds, including demand deposits and term deposits, amounted to EUR 40.4 billion. Other funding for KfW, in addition to promissory note loans from banks and customers (Schuldscheindarlehen), which decreased by EUR 0.6 billion year on year to EUR 8.0 billion, consisted mainly of liabilities to the Federal Republic of Germany and cash collateral received of EUR 21.8 billion (year-end 2014: EUR 15.0 billion), which serves primarily to reduce counterparty risk from the derivatives business.

Subordinated liabilities continue to include a subordinated loan granted by the ERP Special Fund as part of the restructuring of the ERP economic promotion programme in 2007. In financial year 2015, the ERP Special Fund and KfW agreed to convert EUR 1.25 billion to equity by inclusion in KfW’s capital reserve, to repay EUR 0.6 billion and to waive a repayment in the amount of EUR 0.1 billion, in view of the reduced acceptance of this loan as Tier 2 capital.

The carrying amounts of derivatives with negative fair values, which were primarily used to hedge loans, decreased by EUR 4.0 billion from EUR 28.5 billion due to changes in market parameters, and amounted to EUR 24.5 billion at year-end 2015.

There were only minor changes in the other liability line items in the statement of financial position.

14

KfW Financial Information 2015 Group management report

At EUR 25.2 billion, Equity was significantly above the level of EUR 21.6 billion as of 31 December 2014. This increase was largely due to consolidated profit of EUR 2.2 billion and the

conversion of the ERP subordinated loan of EUR 1.25 billion. This led to an improvement in the equity ratio from 4.4% at the end of 2014 to 5.0% as of 31 December 2015.

Equity

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | 31 Dec. 2015 | | | | | | 31 Dec. 2014 | | | | | | Change | | |

| | | | | | | EUR in millions | | | | | | EUR in millions | | | | | | EUR in millions | | |

| | | | | | | | | | |

| Paid-in subscribed capital | | | | | | 3,300 | | | | | | 3,300 | | | | | | 0 | | |

Capital reserve | | | | | | 8,447 | | | | | | 7,197 | | | | | | 1,250 | | |

of which promotional reserves from the ERP Special Fund | | | | | | 7,150 | | | | | | 5,900 | | | | | | 1,250 | | |

Reserve from the ERP Special Fund | | | | | | 1,191 | | | | | | 1,191 | | | | | | 0 | | |

Retained earnings | | | | | | 12,091 | | | | | | 10,019 | | | | | | 2,072 | | |

Fund for general banking risks | | | | | | 600 | | | | | | 500 | | | | | | 100 | | |

Revaluation reserves | | | | | | –429 | | | | | | –608 | | | | | | 180 | | |

Total | | | | | | 25,200 | | | | | | 21,598 | | | | | | 3,602 | | |

Consolidated profit was used to increase retained earnings and strengthen the fund for general banking risks.

Subsequent events (as of 15 March 2016)

No significant events have occurred since the end of the financial year.

15

KfW Financial Information 2015 Group management report

Risk report

Current developments

After moderate and disappointing growth in 2015, the global economy is not expected to gain momentum in 2016 either and is forecasted to remain around the same level as the previous year. Downside risks to the economy in emerging market countries prevail, while most industrialised countries appear poised for a moderate recovery. Economic growth in the United States is expected to remain stable in 2016. Robust private consumption buoyed by positive labour market trends and rising real income remain the key driving forces in this respect. Further appreciation of the US dollar as well as quicker moves to tighten monetary policy, however, pose risks to US industry. Although Japan’s short-term prospects have improved slightly, economic momentum will remain at a low level and is unlikely to be sustainable. The modest economic recovery in the euro area is likely to continue under accommodative monetary policy in tandem with neutral fiscal policy. This recovery could secure the initial success attained in reducing unemployment as well as private and public debt. Political developments are expected to play an important role in the European Union (“EU”) again in 2016; the United Kingdom’s potential exit from the EU, migration and security policy challenges as well as numerous government and policy changes are likely to have an impact on economic growth. Emerging market countries overall experienced a considerable slowdown in growth in 2015. Commodity-exporting countries in particular suffered significant declines in growth as well as currency depreciation. A general reversal of this trend, triggered for example by rising oil prices, is not expected for 2016. Among the BRICS countries (Brazil, Russia, India, China and South Africa), only India may expect above-average growth in 2016, while Brazil and Russia are in a recession and South Africa is experiencing a period of extremely weak growth. China’s economic transition will continue for the foreseeable future and deliver slightly lower growth rates. Misallocation of credit in China constitutes a considerable downside risk to this global outlook. If critical developments slow Chinese economic growth more than expected, it would have serious adverse consequences for the world economy. Geopolitical tensions, particularly in the Middle East, are creating further considerable uncertainty. Quicker tightening of US monetary policy could also cause high volatility in the financial markets.

In 2015, the performance of banks in the euro area remained mixed. While the banking sectors in Ireland and Spain have continued to recover, driven by improved economic parameters and stabilising real estate sectors, the quality of assets in Italy has deteriorated (with a rising share of non-performing loans in loan portfolios). In the European peripheral countries, the Greek financial sector again caused the greatest turmoil in 2015. As a result of the drawn-out agreement process between the new Greek government and its international creditors, Greek banks

were forced, following drastic deposit outflows, to close for several weeks in the summer, and capital controls were imposed. The Swiss National Bank’s removal of the Swiss franc’s cap against the euro at the beginning of 2015 brought about serious upheaval. The massive appreciation of the franc caused the value of CHF-denominated loans outside Switzerland to soar, raising borrower costs and creating higher credit risks for banks in some eastern European countries, in particular. One such consequence is Poland’s plan to force the conversion of foreign currency loans at the expense of the banks. This could result in a considerable burden on the Polish banking sector in 2016, which could be exacerbated by further government measures announced. The above-mentioned deterioration in economic parameters in critical emerging market countries resulted in lower credit ratings for important banks in these countries, such as Brazil. Russia’s economy and banking market are suffering a lot from the recession and the Western sanctions, which is reflected in increased loan defaults and risk costs, decreased profits and lending, and increased central bank funding.

Implementation of the bail-in rules as of 1 January 2016 represents one of the key reforms for European banks. These rules permanently change the risk profile for bank bonds and will likely result in slight increases in funding costs. Rating agencies stopped including the probability of government bail-ins when rating the creditworthiness of various European banks in 2015. Given that the ECB will continue to pursue its expansionary monetary policy in 2016 and accordingly maintain the low interest rate environment with narrow margins, cost-cutting programmes at banks will continue to play an important role. The focus is particularly on banks with less efficient cost-income ratios in Germany, France and Italy, which can also be seen in the results from the latest EU-wide transparency exercise published by the European Banking Authority (“EBA”) at the end of 2015. Banks active in ailing banking markets will continue to focus on reducing bad debt as a means of decreasing the share of non-performing loans in loan portfolios, particularly in Cyprus, Ireland, Italy, Greece and Portugal. Despite considerable improvement in European banks’ capital adequacy, the new EBA/ECB stress test is expected to be a greater measure of each bank’s resilience. The results will be published in the third quarter. It is expected that the supervisory authorities will use the results as a basis for determining individual capital requirements. Thus regulatory pressure on banks’ capitalisation will remain high. However, even if there continues to be a need for capital, the focus of European banks in 2016 will likely be directed more towards generating Tier 2 capital and other loss-bearing liabilities in order to meet future requirements for the leverage ratio, Total Loss-Absorbing Capacity (TLAC) and the minimum requirement for eligible liabilities

16

KfW Financial Information 2015 Group management report

(MREL). The effects on the banking markets of political changes in the peripheral countries as well as the tensions between Russia and Ukraine and between Russia and Turkey are more difficult to calculate. The spotlight will remain on Austrian and French banks due to their greater exposure in these regions. In China, where debts have risen considerably in recent years, particularly in state-owned enterprises in the construction, real estate, mining and utilities sectors, risk costs for banks’ loan portfolios will likely continue to increase.

The German and European economies were characterised by sideways movement in 2015. The business sector continues to stagnate; the positive impetus primarily stems from private households. A modest improvement is expected for 2016. Companies continue to benefit from favourable terms due to good credit availability and lending structures that are gradually being eased. The effects of the scandal involving the manipulation of exhaust emissions on Volkswagen but also on the European automotive industry as a whole cannot be estimated yet.

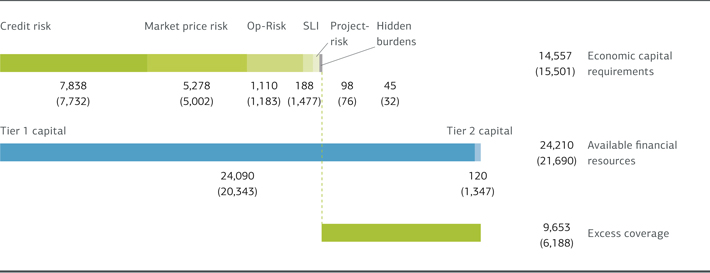

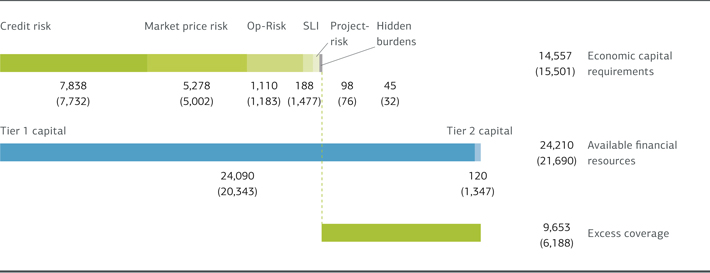

KfW Group has been affected by the aforementioned developments due to its international promotional mandate. The KfW portfolio recorded stable performance overall. All recognisable risks are measured using conservative standards and are taken

into account in KfW Group’s new business management through the systematic implementation of risk guidelines. The regularly performed calculations of risk-bearing capacity show that KfW Group can bear the risks assumed in the context of its mandate – even based on conservative stress scenarios. In 2015, as in previous years, KfW Group systematically refined the processes and instruments in its Risk Management and Controlling department, taking account of current banking regulations.

As a result of an amendment to the KfW Law in 2013 and the issuance of the “Regulation concerning key banking supervision standards under the German Banking Act to be declared applicable by analogy to KfW and supervision of compliance to these standards to be assigned to the German Federal Financial Supervisory Authority” (the “KfW Regulation”), the German legislature enacted an expanded application of the KWG to KfW. Going forward, KfW will be obliged to apply by analogy key bank regulatory standards, which also extend to the group management function. The German Federal Financial Supervisory Authority and the German Central Bank (Bundesbank) will be responsible for supervising compliance with the relevant applicable bank regulatory standards. The KfW Regulation provides for their entry into force in stages. The corporate governance rules have been binding since mid-2014, the other provisions since 1 January 2016.

Basic principles and objectives of risk management

KfW Group has a statutory promotional mandate, which provides the basis for its special position and institutional structure. Sustainable promotion is KfW Group’s overarching purpose. In order to utilise available resources to best carry out KfW Group’s promotional mandate, it is vital to measure and control incurred risks. As part of its risk management, KfW Group takes risks only to the extent that they appear manageable in the context of its current and anticipated earnings position and the development of the risks. KfW Group’s risk/return management takes into account the special characteristics of a promotional bank, with

adherence to supervisory requirements constituting a fundamental prerequisite to the group’s business activities.

In order to solidify risk management and controlling competence within its organisation, KfW Group offers its employees training that includes a modular programme on risk topics. The training programme enables management and non-management staff throughout KfW Group to acquire basic knowledge or to deepen their specialised knowledge.

Organisation of risk management and monitoring

Risk management bodies and responsibilities

As part of its overall responsibility, KfW’s Executive Board determines the group’s risk policies. The Board of Supervisory Directors is informed at least quarterly of KfW Group’s risk situation. The Presidial and Nomination Committee is responsible for dealing with legal and administrative matters as well as fundamental business and corporate policy issues. Moreover, in certain urgent cases, the committee has the authority to adopt resolutions in place of the Board of Supervisory Directors. The Chairman of the Board of Supervisory Directors decides whether an issue is urgent. The Risk and Credit Committee is primarily responsible for advising the Board of Supervisory Directors on the group’s current and future overall risk tolerance and strategy, and supports it in monitoring implementation of the latter. It decides on loan approvals (including loans to members of management), operational level equity investments, funding and swap transactions, to the extent committee authorisation is required by the KfW Bylaws. The Audit Committee monitors, above all, the accounting

process and the effectiveness of the risk management system and offers recommendations to the Board of Supervisory Directors concerning its approval of the consolidated financial statements. The Remuneration Committee monitors whether the structure of the remuneration system for the Executive Board and employees is appropriate. In accordance with applicable bank regulatory provisions, the Remuneration Committee is also responsible for monitoring whether the structure of the remuneration system for the heads of the Risk Controlling and Compliance functions and for any employees who have a significant impact on the group’s overall risk profile is appropriate.

Risk management within KfW Group is exercised by closely interlinked decision-making bodies. At the top of the system is the Executive Board, which takes the key decisions on risk policy. There are three risk committees below the level of the Executive Board (Credit Risk Committee, Market Price Risk Committee and Operational Risk Committee) which prepare decisions for the

17

KfW Financial Information 2015 Group management report

Executive Board and also take their own decisions within their remits. The committees also perform KfW Group management functions, so representatives from subsidiaries KfW IPEX-Bank and DEG are included. Further working groups do the preliminary

work for these committees. The middle and back office departments (Marktfolge) and Risk Controlling generally have a veto right in the committees; if a committee fails to reach a unanimous decision, the issue may be escalated to the Executive Board level.

Credit Risk Committee

The Credit Risk Committee is chaired by the Chief Risk Officer and meets once a week. The committee’s other voting members are the Director of Risk Management and Controlling, attending members of the Executive Board and KfW IPEX-Bank’s Chief Risk Officer (CRO). The Credit Risk Committee is supported by various working groups. The Country Rating Working Group serves as the central unit for assessing country risk. The Collateral Working Group ensures a uniform approach to all essential aspects of collateral acceptance and valuation, and collateral management processes. The Rating Systems Working Group is responsible for all essential aspects of credit risk measurement instruments. The Corporate Sector Risk Working Group analyses sector and product-related credit risks in the corporate segment. The weekly Credit Risk Committee meetings involve decisions on loans and credit lines, in particular. KfW IPEX-Bank’s and DEG’s commitments are also presented to the Credit Risk Committee. Additional extended meetings, held on a quarterly basis, are also attended by representatives of the business sectors and of DEG. Internal Auditing and Compliance have guest status. Reports about the development of regulatory requirements, e.g., the German Minimum Requirements for Risk Management (Mindestanforder-ungen an das Risikomanagement – “MaRisk”) and KWG, their impact and the progress of implementation projects in KfW Group, are made at this quarterly meeting. The committee also approves major changes to existing risk principles and credit risk methods as well as new principles and methods and procedural rules for the working groups performing the groundwork. The committee also monitors KfW Group’s loan portfolio, including country and sector risks.

Market Price Risk Committee

The Market Price Risk Committee is chaired by the Chief Risk Officer and meets once a month. The committee’s other members include the Executive Board member responsible for capital markets business, and, among others, the directors of Financial Markets, Risk Management and Controlling, and Accounting. Internal Auditing and Compliance have guest status. The Chief Risk Officers of KfW IPEX-Bank and DEG, or their representatives, attend the meetings on a quarterly basis and as necessary. The Market Price Risk Committee discusses KfW Group’s market

price risk position and assesses the market price risk strategy on a monthly basis. The committee also monitors KfW Group’s liquidity risk position and decides on all fundamental and methodological questions relating to the management of market price and liquidity risks as well as transfer pricing and the valuation model for commercial transactions. The committee prepares the final decision of the Executive Board regarding the interest rate risk strategy. The Market Price Risk Committee is supported by the Surveillance Committee, which discusses the valuation of securities and market developments as well as impairments of securities, and the Hedge Committee, which deals primarily with the earnings effects of IFRS hedge accounting and the further development thereof.

Operational Risk Committee

The Operational Risk Committee meets once a quarter and supports the Executive Board in the areas of operational risk and business continuity management. It comprises senior vice presidents (or represented by first vice presidents). It is chaired by the Director of Risk Management and Controlling. KfW IPEX-Bank and DEG are represented on the committee. Internal Auditing has guest status. The committee’s tasks are to adopt resolutions and to approve risk principles, methods and instruments. In addition, the committee is responsible for managing operational risk (“OpRisk”) and taking decisions regarding cross-functional group-wide measures. The committee also discusses any major or potential operational risk loss events and evaluates any group-wide action required. In the area of business continuity management, the committee establishes crisis-prevention and emergency-planning measures using the results of the annual business impact analysis. Monitoring is based on reports about planned or implemented emergency and crisis team tests and significant disruptions to business. All resolutions and recommendations by the Operational Risk Committee are presented to the Executive Board.

Additionally, the subsidiaries and organisational entities of KfW Group exercise their own control functions within the group-wide risk management system. In these entities, group-wide projects and working groups ensure a coordinated approach, for example, in the rollout of rating instruments to subsidiaries

18

KfW Financial Information 2015 Group management report

or in the management and valuation of collateral. The responsibility for developing and structuring risk management and risk

control activities is located outside the market areas and lies in particular with the Risk Management and Controlling area.

Risk management approach of KfW Group

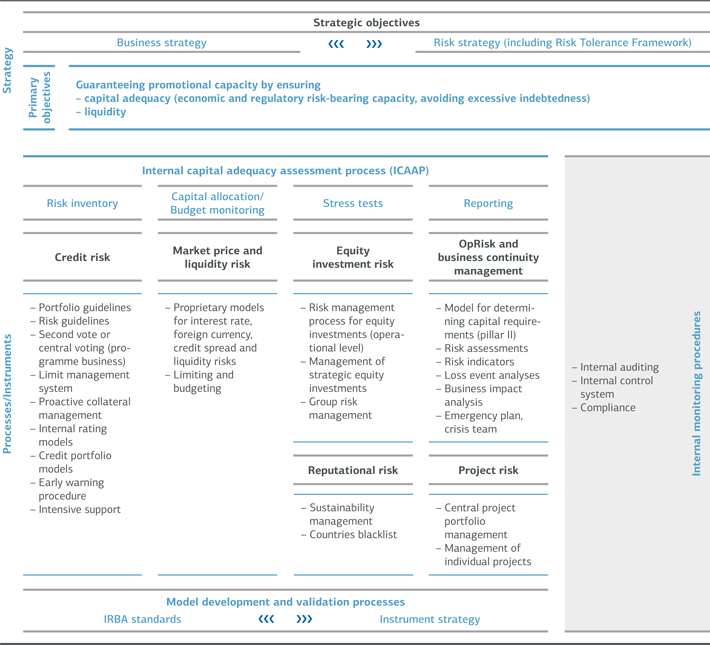

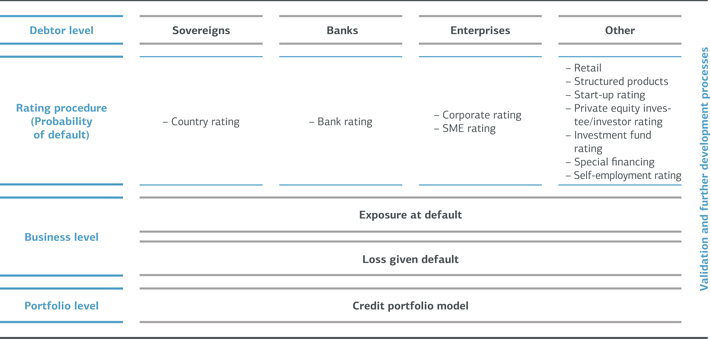

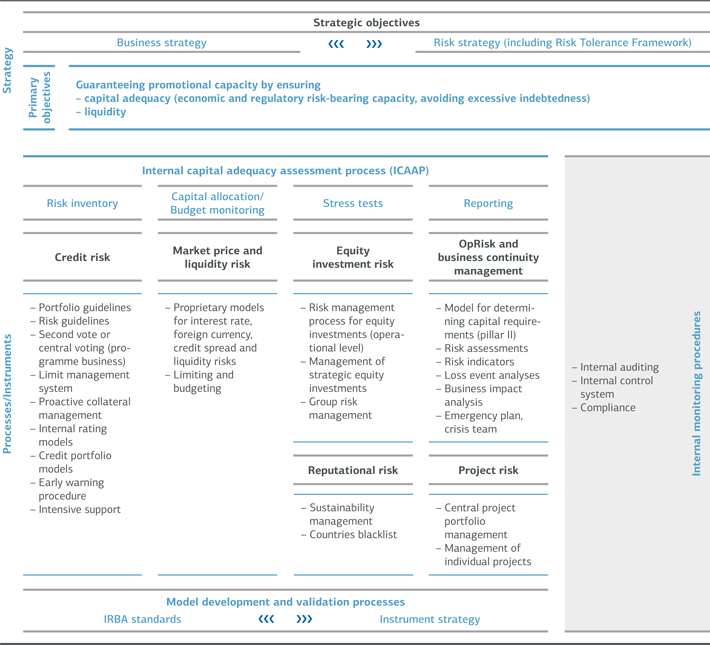

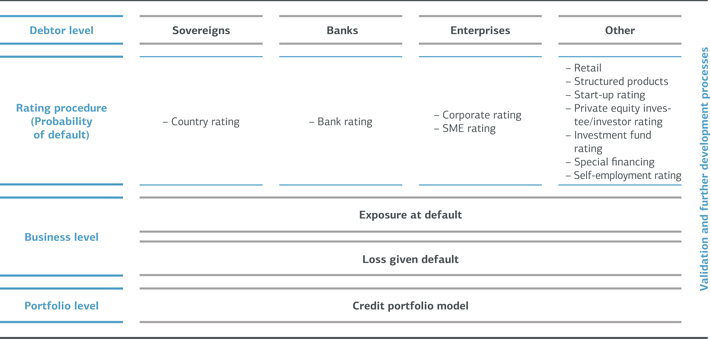

OVERVIEW

To ensure capital adequacy and liquidity in line with KfW Group’s defined risk tolerance, Risk Management and Controlling formulates and regularly reviews the risk strategy of KfW Group taking into account its significant subsidiaries.

The orientation of KfW’s risk strategy is in line with its business strategy and takes into account the regulatory requirements relating to KfW’s business model. The risk strategy translates the group’s long-term and strategic (risk) objectives into operational risk management requirements. This involves defining risk management objectives for core business activities and measures for achieving targets, as well as setting risk tolerance limits for managing KfW Group’s material risks. To implement the risk

strategy, a variety of instruments to control KfW Group’s major risks are used, including risk management instruments for individual counterparties and portfolios. In order to determine its material risks, KfW Group undertakes a risk inventory at least once a year. The risk inventory identifies and defines types of risks relevant to KfW Group in a structured process and then subjects these risks to an evaluation of materiality. The materiality of a risk type depends primarily on the potential danger for KfW Group’s net assets, earnings and liquidity. The key outcome of the risk inventory is an overall risk profile, which provides an overview of KfW Group’s material and immaterial risk types. The 2015 inventory identified the material risks facing KfW Group to be credit, market price, liquidity, operational,

19

KfW Financial Information 2015 Group management report

equity investment, project and reputational risks. Risk concentrations within a risk type or across various risk types are taken into account in the risk inventory.

Risk reporting is in line with regulatory requirements (MaRisk). The Executive Board is informed about KfW Group’s risk situation on a monthly basis. A risk report is issued quarterly to KfW Group’s supervisory bodies. The respective bodies are informed on an ad hoc basis as required. The risk indicators and information systems used by the Risk Management and Controlling department are reviewed on an ongoing basis.

The methods and instruments for KfW Group-wide risk analysis and control are regularly validated and enhanced through further development. The focus is on models to measure, control and price

both credit and market price risks. Validation and further development activities also take account of regulatory requirements.

The risk management approach is set out in KfW Group’s risk manual. The risk manual stipulates the framework for the application of uniform procedures and rules and regulations to identify, measure, control and monitor risk. The rules and regulations laid out in the risk manual are binding for the entire KfW Group, accessible to all employees and continually updated. KfW Group-wide regulations are supplemented by rules specific to each business sector. See the following sections for details on other elements of KfW Group’s risk management approach.

INTERNAL CAPITAL ADEQUACY ASSESSMENT PROCESS