Exhibit (e)

Combined Management Report

KfW Financial Report 2021 Combined Management Report | 2

Basic information on KfW Group

The KfW management report is combined with KfW’s group management report in accordance with Section 315 (5) in conjunction with Section 298 (2) of the German Commercial Code (Handelsgesetzbuch – “HGB”). The combined management report is included in the KfW Group financial report and is submitted to the operator of the electronic Federal Gazette (Bundesanzeiger) and disclosed in the Bundesanzeiger.

The KfW annual financial statements prepared in accordance with the German Commercial Code and the KfW Group financial report are also available online at www.kfw.de.

The presentation in the group management report was modified in connection with the transition to a combined management report in order to improve clarity and provide a better overview. Information on KfW as the parent company can be found under a separate section, “Notes to the KfW annual financial statements prepared in accordance with the German Commercial Code”.

The KfW consolidated financial statements were prepared in accordance with the provisions of Section 315e HGB in conjunction with the International Financial Reporting Standards (IFRS) as applicable within the European Union. With the exception of the HGB information in the section “Notes to the KfW annual financial statements prepared in accordance with the German Commercial Code”, all financial figures in this combined management report, including the comparative figures for the previous year, are reported in accordance with IFRS.

Overview

KfW Group consists of KfW and five consolidated subsidiaries. KfW is a promotional bank of the Federal Republic of Germany – which owns 80% of KfW while the German Federal States own 20%. The institutional framework for the promotional mandate including the Federal Republic of Germany’s liability for KfW’s obligations is defined in the Law Concerning KfW (KfW Law).

KfW promotes sustainable improvement of economic, environmental and social conditions around the world, with an emphasis on the German economy. The focus of KfW’s promotional activities is on the megatrends anchored in KfW’s strategic objectives. A variety of different financing products and services address in particular the areas of climate change and the environment, globalisation, social change, digitalisation and innovation, and financing of small and medium-sized German enterprises (SMEs). The domestic promotional lending business with enterprises and private individuals is characterised by the on-lending strategy, pursuant to which KfW extends loans to commercial banks, which, in turn, lend the funds to the ultimate borrowers. KfW thus does not have its own network of branch offices. It funds its business activities via the national and international money and capital markets. The group’s main operating subsidiaries are (i) KfW IPEX-Bank, which provides export and project finance, and (ii) DEG, which is active in promoting the private sector in developing countries and emerging economies. KfW Capital invests in German and European venture capital and venture debt funds, in order to strengthen venture and early growth financing in Germany.

In accordance with the business sector structure for KfW Group, the sectors and their main products and services can be presented as follows:

3 | KfW Financial Report 2021 Combined Management Report | Basic information on KfW Group

| | |

Mittelstandsbank & Private Kunden (SME Bank & Private Clients) | | – Start-up financing |

| | – Financing of general corporate investments and investments in innovation, energy and |

| | environmental protection |

| | – Education financing |

| | – Financing for housing construction, conversion and refurbishment |

Individualfinanzierung & Öffentliche Kunden (Customised Finance & Public Clients) | | – Financing of municipal and social infrastructure – Customised corporate financing with equity and debt capital – Customised financing of banks and promotional institutions of the federal states |

|

|

| | |

KfW Capital | | – Investments in German and European venture capital and venture debt funds |

Export and project finance | | – Financing of German and European export activities – Financing of projects and investments which are of special interest for Germany and Europe |

| | |

| Promotion of developing countries and emerging economies | | – Promotion of developing countries and emerging economies on behalf of the Federal |

| | Government with budget funds and complementary market funds raised by KfW |

| | – Financing provided by DEG – Deutsche Investitions- und |

| | Entwicklungsgesellschaft mbH (private sector promotion) |

| | |

| Financial markets | | – Securities and money market investments |

| | – Holding arrangements for the Federal Republic of Germany |

| | – Transactions mandated by the Federal Government, loan granted to Greece |

| | – Funding |

| Head office | | – Central interest rate and currency management |

| | – Strategic equity investments |

Composition of the KfW Group Total assets (IFRS, before consolidation)

| | | | | | | | | | | | | | | | | | |

| | | | | | | 31 Dec. 2021 | | | | | | | | | | 31 Dec. 2020 | | |

| | | | | | | EUR in millions | | | | | | | | | | EUR in millions | | |

| | | | | | | |

| KfW, Frankfurt am Main, Germany | | | | | | 546,648 | | | | | | | | | | 543,099 | | |

| Subsidiaries | | | | | | | | | | | | | | | | | | |

| KfW IPEX-Bank GmbH, Frankfurt am Main (KfW IPEX-Bank), Germany | | | | | | 28,860 | | | | | | | | | | 29,617 | | |

| DEG – Deutsche Investitions- und Entwicklungsgesellschaft mbH, Cologne (DEG), Germany | | | | | | 7,310 | | | | | | | | | | 6,286 | | |

| KfW Beteiligungsholding GmbH, Bonn, Germany | | | | | | 3,129 | | | | | | | | | | 3,209 | | |

| KfW Capital GmbH & Co. KG, Frankfurt am Main, Germany | | | | | | 754 | | | | | | | | | | 413 | | |

| Interkonnektor GmbH, Frankfurt am Main, Germany | | | | | | 357 | | | | | | | | | | 376 | | |

| Investments accounted for using the equity method | | | | | | | | | | | | | | | | | | |

| Microfinance Enhancement Facility S.A., Luxembourg (16.5%), Luxembourg | | | | | | 641 | | | | | | | | | | 575 | | |

| DC Nordseekabel GmbH & Co. KG, Bayreuth (50.0%), Germany | | | | | | 895 | | | | | | | | | | 996 | | |

| Green for Growth Fund, Southeast Europe S.A., Luxembourg (10.2%), Luxembourg | | | | | | 689 | | | | | | | | | | 639 | | |

coparion GmbH & Co. KG, Cologne (16.4%), Germany | | | | | | 294 | | | | | | | | | | 126 | | |

The development of the group’s operating income is determined by KfW.

KfW Financial Report 2021 Combined Management Report | Basic information on KfW Group | 4

Strategic objectives 2026

KfW Group has a set of strategic objectives in place that define KfW’s targeted medium-term positioning. This framework encompasses top-level objectives at the overall bank level and serves as a central, binding reference for the strategic orientation of all business sectors, with a five-year horizon. The strategic objectives for 2026 were adopted in 2021.

KfW’s primary objective is sustainable promotion. It aims to transform the economy and society to improve economic, environmental and social living conditions around the world. This primary objective is supported by the two promotional principles of subsidiarity and sustainability.

Subsidiarity means that KfW focuses on eliminating market weaknesses. Putting this principle into practice, KfW strives to consistently maintain high-quality promotional activities. KfW also aims to increase the volume of new commitments in line with the growth of Germany’s nominal gross domestic product. However, this principle may be overridden in exceptional situations such as the COVID-19 pandemic, to allow KfW as a promotional bank to take countercyclical action.

With regard to the principle of sustainability, KfW aims to achieve a ranking among the top five national and international promotional banks in the relevant sustainability ratings (Sustainalytics, imug, ISS ESG). In addition, the contributions of KfW’s financing activities to compatibility with the UN’s Sustainable Development Goals (“SDGs”) and the Paris climate agreement are monitored as a part of achieving the climate goals.

Within the framework of these promotional principles, KfW finances projects relating to the following megatrends of our time: climate change and the environment (environmental share of financing > 38%), globalisation, social change, and digitalisation and innovation. In domestic promotion, KfW aims to achieve an SME ratio of > 40% in financing small and medium-sized German enterprises.

The primary objective is complemented by secondary objectives in the areas of profitability and efficiency, risk and capital, regulation, digitalisation and process efficiency, and customer and employee centricity. Agility is considered a fundamental prerequisite for achieving these objectives.

Internal management system

KfW has an integrated strategy and planning process. Conceived as a group-wide strategy process, group business sector planning is KfW Group’s central planning and management tool. Group business sector planning consists of three consecutive sub-processes performed every year: defining objectives, implementation and quality assurance, and finalisation. The overall strategy and planning process includes the collaboration of staff responsible for planning in all areas.

Objectives: The group-wide strategic objectives set by the Executive Board form the basis. This system of objectives serves KfW Group as a roadmap, indicating the direction in which KfW would like to develop over the next five years. It defines KfW Group’s medium-term targeted positioning, and sets top-level objectives for the entire bank. The objectives are reviewed annually for relevance, completeness and aspiration level and adjusted where necessary – for example, due to changed parameters or newly determined focus areas. Efforts are made, however, to maintain a high degree of consistency to ensure that there are no fundamental changes made to the strategic road map in the course of the annual review. Within this strategic framework, major medium-term strategic initiatives are developed in a base case scenario by the business sectors and subsidiaries, taking into account their statutory requirements. Promised benefits (such as project efficiencies and cost reduction measures) are also considered in business sector planning. Assumptions regarding the future development of determinant factors are made based on a risks and opportunities assessment. This analysis takes into account both external factors (including market development, regulatory requirements, the competitive situation and customer behaviour) and internal factors and resources (including human and technical and organisational resources, promotional expense, primary cost planning and tied-up capital) as well as targeted earnings levels. It involves evaluation of the key business and revenue drivers for the business sectors and the group. The business sectors are also called upon to address the environmental, social and governance risks (“ESG” risks) resulting from their business model and new (strategic) initiatives. The central departments (e.g. information technology, human resources and central services) play important roles in achieving the strategic objectives.

5 | KfW Financial Report 2021 Combined Management Report | Basic information on KfW Group

By involving these departments, their own strategies are aligned with the strategic objectives. The first regular capital budget in the base case is prepared on a multi-year horizon on this basis. In this way, any capital bottlenecks resulting from strategic considerations or changed parameters can be identified and mitigated through appropriate measures. The Executive Board defines top-down objectives for each department and business sector (with regard to promotion, risk and finances) for the entire planning period based on the assessment and prioritisation of all strategic initiatives from a group perspective. Strategic group-level planning will be expanded to include business strategy scenario analysis. Scenario analysis is a “what if” analysis of a specific, plausible scenario, looking at the interaction of exogenous influencing factors and translating the results of the analysis into management-relevant parameters in new business, earnings and risk / capital. Such scenarios assist in the process of identifying potential risks and opportunities for promotional targets and KfW’s profitability and risk-bearing capacity, and enable these factors to be considered in the further planning process if necessary.

Implementation and quality assurance: The business sectors plan their new business, risks and earnings, and each department its budgets and full time equivalents (“FTEs”) based on the top-down objectives defined by the Executive Board, taking into account any changes in external or internal factors and in close collaboration with Accounting. These plans are checked for consistency with the objectives of the group and the business sectors/departments. The interest rate forecast plays a key role in shaping KfW’s earnings position. Thus, a high and a low interest rate scenario are also examined in addition to the anticipated base case. The plans are also assessed for future risk-bearing capacity in a second round of regular capital budgeting in a base and stress case over a multi-year horizon.

Finalisation: The Executive Board approves the resulting budget or has plans fine-tuned in a revision round if necessary. The key conclusions from the planning process are incorporated into the business and risk strategies. The management has overall responsibility for formulating and adopting both strategies. The business strategy comprises the group’s strategic objectives for its main business activities as well as important internal and external factors, which are included in the strategy process. It also contains the business sectors’ contribution to the strategic objectives and the measures for achieving each objective. Moreover, the business strategy combines the budget at the group and business sector levels. The Executive Board sets out KfW Group’s risk policies in its risk strategy, which is consistent with the business strategy. KfW Group has defined strategic risk objectives for factors including risk-bearing capacity and liquidity. The main risk management approaches and risk tolerance are also incorporated into the risk strategy as a basis for operational risk management. There is regular consultation with the Risk Controlling department to ensure consistency between the business and risk strategies. The group business sector planning process ends when the Executive Board has adopted a final budget for the entire planning period, including the future capital requirement and the business and risk strategies. The budget is then presented to the supervisory body (Board of Supervisory Directors) for approval, along with the business and risk strategy for discussion. After the Board of Supervisory Directors has decided on the business and risk strategy, it is appropriately communicated to the staff.

The adoption of the group business sector planning serves as a foundation for the group’s qualitative and quantitative objectives. The Executive Board reviews target achievement both on a regular and on an ad hoc basis during the current financial year. The assumptions concerning external and internal factors made when determining the business strategy are also subject to regular checks. The development of relevant control variables, their attainment, and the reasons for any shortfalls are analysed as part of strategic management. Strategic assumptions are reviewed, and a systematic variance analysis of early objectives and forecasts is performed at the beginning of every year. At mid-year, the integrated forecasting process serves as a comprehensive basis for interim management input on quantitative group variables of strategic importance in line with the strategic objectives (new business, risk, costs and earnings in respect of funding opportunities), while providing a well-founded guide to achieving planned objectives. Ad hoc issues of strategic relevance are also addressed in consultation with the group’s departments. Recommendations for action concerning potential strategy adjustments or optimising the use of resources are made as necessary to the Executive Board by means of the strategic performance report. Results of the analysis are included in further strategy discussions and the planning process. The achievement of objectives is regularly monitored by the Board of Supervisory Directors based on reports submitted under the KfW Bylaws. The commentary in these reports outlines analyses of causes and any potential plans for action. Detailed reports are prepared on a monthly or quarterly basis as part of operational controlling. These comprehensive detailed analyses at group, business sector and/or control portfolio level comprise earnings, cost and FTE developments and are reported to specific departments. Additionally, analyses of significant relevance to overall group performance are also presented directly to the Executive Board. The risk controlling function

KfW Financial Report 2021 Combined Management Report | Basic information on KfW Group | 6

has been implemented alongside strategic and operational controlling. Early warning systems have been established and mitigation measures defined for all material risk types in line with the risk management requirements set out in the risk strategy. All controlling and monitoring approaches are integrated into risk reporting. The Board of Supervisory Directors receives a risk report quarterly.

Alternative key financial figures used

The KfW Combined Management Report contains key financial figures that are not defined in the accounting regulations according to HGB, nor to IFRS. In its strategic objectives, KfW uses key indicators prescribed by accounting standards and supervisory regulations as well as key figures that are geared toward promotion as the core business activity. It also uses key figures in which the temporary effects on results determined and reported in the consolidated financial statements in accordance with IFRS and which KfW does not consider representative, are adjusted.

KfW has defined the following alternative key financial figures:

Promotional business volume

Promotional business volume refers to the commitments of each business sector during the reporting period. In addition to the lending commitments shown in the statement of financial position, promotional business volume comprises loans from Federal Government funds for promotion of developing countries and emerging economies – which are accounted for as trust activities – financial guarantees, equity financing and securities purchases (in the green bonds asset class). Promotional business volume also includes grants committed as part of development aid and in domestic promotional programmes. Allocation to the promotional business volume for the current financial year is generally based on the commitment date of each loan, financial guarantee and grant, and the transaction date of the equity finance and securities transactions. On the other hand, allocation of global loans to the promotional institutions of the federal states (Landesförderinstitute – “LFI”) and BAföG government loans is based on individual drawdown volume and date, instead of the total volume of the contract at the time of commitment. In the lending business, financing amounts denominated in foreign currency are converted into euros at the exchange rate on the commitment date, whereas in the securities and equity finance business, the conversion generally occurs at the rate on the transaction date.

See the “Development of KfW Group” economic report or segment reports for a breakdown of promotional business volume by individual segment.

Promotional expense

Promotional expense is understood to mean certain expenses from the two business sectors Mittelstandsbank & Private Kunden (SME Bank & Private Clients) and Individualfinanzierung & Öffentliche Kunden (Customised Finance & Public Clients) to achieve KfW’s promotional objectives.

Interest rate reductions accounted for at present value are the key component of KfW’s promotional expenses. KfW grants these reductions for certain domestic promotional loans for new business during the first fixed interest rate period in addition to passing on KfW’s favourable funding conditions (obtained on the strength of its triple-A rating). The difference between the fair value of these promotional loans and the transaction value during the first fixed interest rate period, due to the interest rate being below the market rate, is recognised in profit or loss as an interest expense and accounted for as an adjustment to the carrying amount under the item Financial assets at amortised cost. In addition, the accumulated interest rate reductions over the fixed interest rate period are recognised through profit or loss in Net interest income (see the relevant notes on KfW’s promotional lending business, financial assets at amortised cost, and provisions).

An additional promotional component (in commission expense) comprises the expense paid in the form of upfront fees to sales partners for processing microloans. Promotional expense also contains disposable and product-related marketing and sales expenses (administrative expense), expenses for innovative digital promotional approaches (commission and administrative expense), and promotional grants awarded as a supplement to the lending business (other operating expense).

7 | KfW Financial Report 2021 Combined Management Report | Basic information on KfW Group

Cost/income ratio (before promotional expense)

The cost/income ratio (before promotional expense) comprises administrative expense (excluding promotional expense) in relation to net interest and commission income before promotional expense.

The cost/income ratio (“CIR”) shows costs in relation to income and is thus a measure of efficiency. To enable comparison of the CIR with other (non-promotional) institutions, an adjustment for the components of KfW’s promotional business results is made to the numerator (administrative expense) and denominator (net interest and commission income).

Consolidated profit before IFRS effects

Consolidated profit before IFRS effects from hedging is another key financial figure based on Consolidated profit in accordance with IFRS. Derivative financial instruments are entered into for hedging purposes. Under IFRS, the requirements for the recognition and valuation of derivatives and hedges give rise to temporary net gains or losses that are offset over the term as a whole. In KfW’s opinion, such temporary effects on results are not representative as they are caused solely by economically effective hedging relationships.

Consequently, the following reconciliations are performed by eliminating temporary contributions to profit and loss as follows:

| – | Valuation results from micro and macro hedge accounting. |

| – | Net gains or losses from the use of the fair value option to avoid an accounting mismatch in the case of funding including related hedging derivatives. |

| – | Net gains or losses from the fair value accounting of hedges with high economic effectiveness but not qualifying for hedge accounting. |

| – | Net gains or losses from foreign currency translation of foreign currency positions, in accordance with recognition and valuation requirements for derivatives and hedging relationships. |

KfW Financial Report 2021 Combined Management Report | Basic information on KfW Group | 8

Economic report

General economic environment

Global real domestic product (“GDP”) increased by 5.9% year on year in 2021 according to estimates by the International Monetary Fund (“IMF”). Although this marked a rise compared to the 2019 level after the decline due to the economic effects of the coronavirus pandemic in 2020, GDP nonetheless registered below the IMF forecast for 2021 issued prior to the pandemic (see table on gross domestic product at constant prices). According to the IMF’s World Economic Outlook of October 2021, global real GDP grew at a positive rate in 2021 despite recurring waves of coronavirus infections in various countries and supply chain bottlenecks. However, according to the OECD Economic Outlook of December 2021, the gap between real GDP in 2021 and that of pre-pandemic 2019 varies from country to country.

Gross domestic product at constant prices

| | | | | | | | | | | | |

| | | | |

| | | | | | 2021 estimate | | | 2020 | | | 2019 | |

| Global economy* | | | | | | | | | | | | |

| Year-on-year change in % | | | | | 5.9 | | | –3.1 | | | 2.8 | |

| Index (2019 = 100) based on data from January 2022 | | | | | 103 | | | 97 | | | 100 | |

Index (2019 = 100) forecast based on data from January 2020 | | | | | 107 | | | 103 | | | 100 | |

| * | The IMF aggregates the annual growth rates of GDP at constant prices of each country on the basis of the shares of country-specific GDP at purchasing power parities in the corresponding global aggregate to the growth rate of global real GDP. |

The economies of the member states of the European Economic and Monetary Union (“EMU”) also returned to growth last year following the pandemic-induced recession. Economic output in the EMU countries measured in terms of price-adjusted GDP rose by 5.2% year on year in 2021, following a decline in 2020, which was the most significant contraction of price-adjusted GDP (–6.4%) recorded since the EMU was formed (see table on gross domestic product at constant prices, year-on-year change). The European Commission attributes the 2021 increase to the coronavirus vaccination campaigns and the gradual easing of pandemic-induced restrictions. However, disruptions in global supply chains, rising energy prices and a renewed surge in infections weighed on euro area economic activity towards the end of 2021. Price-adjusted GDP is no longer far below pre-pandemic levels in all member states, although economic recovery continues to vary between them.

Gross domestic product at constant prices, year-on-year change

| | | | | | | | | | | | | | | | | | |

| | | | 2021 | | | 2020 | | | 2011–2020

average | | | 1999–2019

minimum | |

| | | | in % | | | in % | | | in % | | | in % | |

Euro area | | | | | 5.2 | | | | –6.4 | | | | 0.5 | | | | –4.5 (2009) | |

Germany | | | | | 2.8 | | | | –4.6 | | | | 1.1 | | | | –5.7 (2009) | |

9 | KfW Financial Report 2021 Combined Management Report | Economic report

Against the backdrop of global supply chain bottlenecks for raw materials and intermediate products as well as the waves of COVID-19 infection, price-adjusted GDP in Germany grew by 2.8% in 2021 compared with the previous year, after shrinking by 4.6% in 2020 and having grown by 1.1% per year on average for the preceding ten years (from 2011 up to and including 2020) (see table on gross domestic product at constant prices, year-on-year change). Positive impetus for the rate of change in price-adjusted GDP was provided by price-adjusted government final consumption expenditure (+3.4%), price-adjusted gross fixed capital formation in construction (+0.5%), price-adjusted gross fixed capital formation in machinery and equipment (+3.2%) and price-adjusted gross capital formation in other products (+0.7%) in 2021. Price-adjusted final consumption expenditure stagnated (+0.0%), while the number of people in employment located in Germany remained virtually constant at 44.9 million (+0.0%) year on year in 2021. Price-adjusted domestic use rose by 1.9% overall in 2021. Net exports contributed 0.9 percentage points to the rate of change of price-adjusted GDP in 2021, with the increase in price-adjusted exports (+9.4%) exceeding that of price-adjusted imports (+8.6%). From a production perspective, price-adjusted gross value added was a positive driver for the rate of change of price-adjusted GDP in 2021 in most economic sectors, with the exception of agriculture, forestry and fishing (–2.1%), construction (–0.4%), and financial and insurance services (–0.4%).

Developments in the financial markets also continued to be dominated by the coronavirus pandemic in 2021. Unlike the previous year, however, markets focused on the economic recovery and related events, such as the global material and supply chain bottlenecks, and inflation. After sustained support from central banks, the changed macroeconomic environment in 2021 triggered discussions and initial decisions on the timing of the exit from the pandemic emergency purchase programmes. The US Federal Reserve, for example, announced at the December meeting of the Federal Open Market Committee (“FOMC”) that it would end net bond purchases by March 2022, and also signalled three rate hikes for 2022. The European Central Bank (“ECB”) had previously “significantly” increased its asset purchases under the pandemic emergency purchase programme (“PEPP���) in the second and third quarters of 2021, while leaving key interest rates unchanged (the deposit rate remained at –0.5% throughout 2021). The PEPP, with a total volume of EUR 1,850 billion, involves both government and corporate bonds, which can be purchased very flexibly in terms of maturity, asset class and country of origin. The ECB Governing Council resolved in December 2021 to end the PEPP asset purchases by the end of March 2022. Banks continued to be motivated to lend due to the favourable terms of the ECB’s targeted longer-term refinancing operations (“TLTRO III”) in 2021: For banks that maintain at least their eligible net lending for a certain period, the interest rate applied to all TLTRO III transactions will be 50 basis points (bp) lower than the average deposit facility rate over the same period and in no event more than –1%.

These developments have resulted in swap rates in the euro area and the USA, in particular, rising noticeably year-on-year in 2021. In contrast, euro area and US money market rates were considerably below the prior-year averages. For instance, the 3-month EURIBOR averaged –0.55% in 2021 (2020: –0.43%); the 5-year EUR swap rate averaged –0.26% (2020: –0.35%); and the yield of the 10-year German government bond was –0.31% (2020: –0.47%). In the US, the 3-month LIBOR was 0.16% on average for the year in 2021, compared with 0.65% in the previous year. The 5-year USD swap rate averaged 0.94% in 2021 (2020: 0.59%), and the yield on 10-year US Treasuries was 1.44% (2020: 0.89%). The yield curves for the EUR and the USD moved in a similar direction although at different paces as measured by the difference between the yields of 10- and 2-year government bonds. On average in 2021, the curve steepness for German government bonds was 39 bp (2020: 22 bp), whereas US government bonds climbed to 117 bp (2020: 50 bp).

KfW Financial Report 2021 Combined Management Report | Economic report | 10

Interrupted by sell-off periods at the start and in the autumn of 2021, some lasting a number of weeks, the previous year’s stock exchange rally continued. The US S&P 500 index reached multiple new highs in 2021, and recorded an annual average of 4,273 points, which was 33% above the prior-year average. Germany’s leading DAX 30 index stood at 15,884 points at the end of 2021. Its 2021 average of 15,209 points was around 23% above the prior-year average. The trade-weighted euro stagnated on average (against the currencies of the 18 most important trading partners outside the euro area) in 2021, and gained approximately 4% on the US dollar on an annual average for 2021 compared to the annual average for 2020.

Development of KfW Group

KfW had an exceptional promotional year in 2021. While promotional business volume declined by 21% compared to the previous year from EUR 135.3 billion to EUR 107.0 billion due to the decline in demand for coronavirus aid, KfW again exceeded the pre-pandemic promotion level (2019: EUR 77.3 billion) due to an increase in commitments in climate action and the environment.

A consolidated profit of EUR 2.2 billion for 2021, after the previous year having been adversely impacted by coronavirus pandemic effects (EUR 0.5 billion), was proof of an excellent recovery in the bank’s earnings position, and was well above expectations (EUR 0.8 billion). The operating result before valuation (before promotional expense), in contrast, declined from EUR 1.9 billion to EUR 1.7 billion. This development was also reflected in the cost-income ratio (before promotional expense), which rose to 45.9% (2020: 41.8%) due to higher administrative expense and the overall slight decline in income from interest and commissions. This extraordinarily positive valuation result increased consolidated profit by EUR 0.8 billion (2020: EUR –1.2 billion).

Consolidated total assets rose by EUR 4.6 billion to EUR 551.0 billion in financial year 2021. This development was largely attributable to the increase in Net loans and advances by EUR 14.9 billion to EUR 438.7 billion of which EUR 5.6 billion related to the KfW Special Programme 2020. The value adjustments from macro hedge accounting trended in the opposite direction, posting a market-induced decline of EUR 7.6 billion. The volume of own issues reported under Certificated liabilities amounted to EUR 447.6 billion (31 Dec. 2020: EUR 425.3 billion). The EUR 2.4 billion increase in equity to EUR 34.2 billion was due especially to consolidated comprehensive income.

Business performance in 2021 was largely characterised by the following developments:

A. High demand for KfW products in climate change and the environment

With a promotional business volume of EUR 107.0 billion (2020: EUR 135.3 billion), the group recorded an exceptional promotional year in 2021, marked by a decline in demand for coronavirus aid and an increase in commitments in the areas of climate action and the environment.

The increased promotional business volume in energy efficiency and renewable energy totalling EUR 47.1 billion (2020: EUR 34.3 billion), which in particular comprised commitments in financing for energy-efficient housing of EUR 19.3 billion (2020: EUR 26.8 billion) and the new business in Federal Funding for Efficient Buildings (Bundes-förderung für effiziente Gebäude – “BEG”) of EUR 15.2 billion (2020: EUR 0.0 billion), resulted in a promotional business volume in domestic business of EUR 82.9 billion (2020: EUR 106.4 billion). The decline in promotional business volume compared to 2020 was primarily due to the softened demand for coronavirus aid amounting to EUR 10.1 billion (2020: EUR 46.9 billion), of which EUR 9.1 billion (2020: EUR 44.5 billion) related to the KfW Special Programme launched by KfW as part of the government stabilisation measures for the coronavirus pandemic in 2020. The subsidiary KfW Capital made commitments totalling EUR 0.5 billion in 2021 (2020: EUR 0.9 billion).

International business commitments decreased by 18% to a promotional business volume of EUR 23.8 billion (2020: EUR 29.0 billion). In Export and project finance, the impact of the COVID-19 pandemic on global trade and large areas of the global economy as a whole continued to be reflected in new business, with commitments amounting to EUR 13.6 billion compared to EUR 16.6 billion in 2020. Commitments in Promotion of developing countries and emerging economies also decreased to a volume of EUR 10.1 billion (2020: EUR 12.4 billion), while DEG commitments of EUR 1.5 billion recorded a positive development in new business (2020: EUR 1.4 billion).

KfW raised EUR 82.6 billion in the capital markets to fund its business activities (2020: EUR 66.4 billion). Funding via the government-owned Economic Stabilisation Fund (Wirtschaftsstabilisierungsfonds – “WSF”) and the targeted longer-term funding of the Eurosystem via TLTRO III of EUR 3.0 billion and EUR 1.4 billion, respectively, was lower than in the previous year (EUR 39.0 billion and EUR 13.4 billion, respectively).

11 | KfW Financial Report 2021 Combined Management Report | Economic report

Promotional business volume of KfW Group

| | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | 2021 | | | | | | | | | | 2020 | | |

| | | | | | | EUR in billions | | | | | | | | | | EUR in billions | | |

| | | | | | | |

| Domestic business | | | | | | 82.9 | | | | | | | | | | 106.4 | | |

| Mittelstandsbank & Private Kunden (SME Bank & Private Clients) | | | | | | 73.0 | | | | | | | | | | 86.3 | | |

| Individualfinanzierung & Öffentliche Kunden (Customised Finance & Public Clients) | | | | | | 9.5 | | | | | | | | | | 19.2 | | |

| KfW Capital | | | | | | 0.5 | | | | | | | | | | 0.9 | | |

| Financial markets | | | | | | 0.5 | | | | | | | | | | 0.4 | | |

| International business | | | | | | 23.8 | | | | | | | | | | 29.0 | | |

| Export and project finance | | | | | | 13.6 | | | | | | | | | | 16.6 | | |

| Promotion of developing countries and emerging economies | | | | | | 10.1 | | | | | | | | | | 12.4 | | |

| | |

Volume of new commitments1) | | | | | | 107.0 | | | | | | | | | | 135.3 | | |

| 1) | Adjusted for export and project financing refinanced through KfW programme loans. |

B. Operating result exceeds expectations

At EUR 1,712 million (2020: EUR 1,855 million), the Operating result before valuation (before promotional expense) was 8% below prior-year level and exceeded the target by 5%. The outperformance was primarily due to the increase in net commission income (before promotional expense) from EUR 584 million to EUR 634 million, which was 11% above target. At EUR 1,452 million, Administrative expense (before promotional expense) was still below plan, despite exceeding the previous year’s figure by EUR 122 million. Reasons include an increase in personnel and a rise in costs of external service providers in domestic and international business and in the change environment. Net interest income (before promotional expense) of EUR 2,531 million reached the target level but declined by 3% compared with the previous year (EUR 2,601 million) due to the persistent low interest environment. Nevertheless, net interest income still constituted the main source of KfW’s income.

C. Positive risk provisions for lending business following the previous year’s negative impact

Risk provisions for lending business yielded positive earnings contributions of EUR 196 million in 2021. Risk provisions for lending business thus posted a considerably better result than in the previous year, which had been negatively impacted by the coronavirus pandemic (EUR –777 million), and than the projected standard risk costs (EUR –550 million). Reversal effects from risk provisions created in the previous year, in particular, contributed to this positive development. These were due to reduced provisions for latent risks in stages 1 and 2 based on the macroeconomic environment assessment, which was more favourable than that of the previous year. Reversals of risk provisions for stage 3 for individual impaired loans and income from recoveries of loans previously written off also contributed to the positive risk provisioning result.

Moreover, effects from further development of the loss given default (“LGD”) procedure, and rating upgrades, which largely result from the further developed rating procedure as well as from the improved macroeconomic environment, also had a positive impact. These effects are primarily reflected in the business sector Promotion of developing countries and emerging economies.

D. Record result in the equity finance business

The group generated an unusually high result of EUR 766 million (2020: EUR –281 million) from the valuation of the entire equity investment portfolio, which exceeded the target many times over. A positive development of EUR 211 million is due to reversals of impairment losses after the negative effects from the coronavirus pandemic in the previous year. Of this amount, EUR 197 million is attributable to DEG. The business sector Promotion of developing countries and emerging economies made the largest contribution in an amount of EUR 454 million to the overall result from the equity investment valuation, with EUR 424 million attributable to the DEG portfolio (of which EUR 140 million was attributable to foreign currency translation). In addition, the KfW Capital equity investment portfolio performed very well, with a value increase of EUR 211 million. Overall, EUR 68 million of the equity investment result was attributable to gains realised from the disposal of investments and EUR 698 million to the carrying amount result.

KfW Financial Report 2021 Combined Management Report | Economic report | 12

E. Increased promotional expense despite persistent low interest environment

KfW’s domestic promotional expense, which has a negative impact on the group’s earnings position, amounted to EUR 188 million in 2021, compared with EUR 88 million in 2020, but was still considerably below target (EUR 364 million) due to the low-interest environment. This development resulted largely from the rise in interest rate reductions to EUR 144 million (2020: EUR 54 million), following the introduction of negative funding rates for financing partners in the on-lending promotional business as of 1 July 2021. The reasons were extensive IT system modifications at both KfW and the on-lending institutions. This implementation enables KfW to regain scope for interest rate reductions, which was heavily limited in the persistent low interest environment.

The following key figures provide an overview of key financial figure development in financial year 2021:

Key financial figures of KfW Group

| | | | | | | | | | | | | | | | | | |

| | | | | | | 2021 | | | | | | | | | | 2020 | | |

| Key figures of the income statement | | | | | | EUR in millions | | | | | | | | | | EUR in millions | | |

| | | | | | | |

| Operating result before valuation (before promotional expense) | | | | | | 1,712 | | | | | | | | | | 1,855 | | |

| Operating result after valuation (before promotional expense) | | | | | | 2,575 | | | | | | | | | | 691 | | |

| Promotional expense | | | | | | 188 | | | | | | | | | | 88 | | |

| Consolidated profit | | | | | | 2,215 | | | | | | | | | | 525 | | |

| Cost-income ratio (before promotional expense)1) | | | | | | 45.9% | | | | | | | | | | 41.8% | | |

| | | | | | | |

| | | | | | | 2021 | | | | | | | | | | 2020 | | |

| Key economic figures | | | | | | EUR in millions | | | | | | | | | | EUR in millions | | |

| | | | | | | |

| Consolidated profit before IFRS effects | | | | | | 2,354 | | | | | | | | | | 633 | | |

| | | | | | | |

| | | | | | | 31 Dec. 2021 | | | | | | | | | | 31 Dec. 2020 | | |

| Key figures of the statement of financial position | | | | | | EUR in billions | | | | | | | | | | EUR in billions | | |

| | | | | | | |

| Total assets | | | | | | 551.0 | | | | | | | | | | 546.4 | | |

| Volume of lending | | | | | | 564.2 | | | | | | | | | | 543.1 | | |

| Volume of business | | | | | | 686.9 | | | | | | | | | | 674.12) | | |

| Equity | | | | | | 34.2 | | | | | | | | | | 31.8 | | |

Equity ratio | | | | | | 6.2% | | | | | | | | | | 5.8% | | |

| 1) | Administrative expense (before promotional expense) in relation to adjusted income. Adjusted income is calculated from net interest income and net commission income (in each case before promotional expense). |

| 2) | The comparative figure was adjusted by EUR 332 million for full recognition of all trust activities. |

Comparison with the previous year’s forecast

| | | | | | | | | | | | | | | | | | |

| | | | | | | 2020 forecast for 2021 | | | | | | | | | | 2021 actual | | |

| New business | | | | | | | | | | | | | | | | | | |

| Promotional business volume | | | | | | EUR 81.0 billion | | | | | | | | | | EUR 107.0 billion | | |

| Funding | | | | | | EUR 70–80 billion | | | | | | | | | | EUR 82.6 billion | | |

| Result | | | | | | | | | | | | | | | | | | |

| Consolidated profit | | | | | | EUR 0.8 billion | | | | | | | | | | EUR 2.2 billion | | |

| Net interest income (before promotional expense) | | | | | | EUR 2.5–2.6 billion | | | | | | | | | | EUR 2.5 billion | | |

| Low interest environment | | | | | | detrimental | | | | | | | | | | detrimental | | |

| Net commission income (before promotional expense) | | | | | | EUR 0.6 billion | | | | | | | | | | EUR 0.6 billion | | |

| Administrative expense (before promotional expense) | | | | | | EUR 1.5 billion | | | | | | | | | | EUR 1.5 billion | | |

| CIR (before promotional expense) | | | | | | 48% | | | | | | | | | | 46% | | |

| Risk provisions for lending business | | | | | | EUR –0.6 billion | | | | | | | | | | EUR +0.2 billion | | |

| Valuation result | | | | | | approx. EUR +0.1 billion | | | | | | | | | | EUR +0.6 billion | | |

Promotional expense | | | | | | EUR 0.4 billion | | | | | | | | | | EUR 0.2 billion | | |

13 | KfW Financial Report 2021 Combined Management Report | Economic report

The main differences between the forecasts from the Financial Report 2020 and the actual business development in 2021 are presented in the Economic report.

Development of earnings position

The earnings position in 2021 was characterised by a year-on-year decrease in the operating result combined with a positive valuation result. This resulted in a consolidated profit of EUR 2.2 billion, which was above both the prior-year figure (EUR 0.5 billion) and the target (EUR 0.8 billion).

Reconciliation of internal earnings position (before promotional expense)

with external earnings position (after promotional expense) for financial year 2021

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | Reconciliation | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | EUR in millions | | | | | | | | | EUR in millions | | | | | | | | | EUR in millions | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Net interest income (before promotional expense) | | | | | | | | | | | 2,531 | | | | | | | | | | | | –144 | | | | | | | | | | | | 2,386 | | | | | | | | | | | Net interest income | | | | |

| | | | | | | | | | | | | |

| Net commission income (before promotional expense) | | | | | | | | | | | 634 | | | | | | | | | | | | –12 | | | | | | | | | | | | 623 | | | | | | | | | | | Net commission income | | | | |

| | | | | | | | | | | | | |

| Administrative expense (before promotional expense) | | | | | | | | | | | 1,452 | | | | | | | | | | | | 14 | | | | | | | | | | | | 1,466 | | | | | | | | | | | Administrative expense | | | | |

| | | | | | | | | | | | | |

| Operating result before valuation (before promotional expense) | | | | | | | | | | | 1,712 | | | | | | | | | | | | –170 | | | | | | | | | | | | 1,542 | | | | | | | | | | | Operating result before valuation | | | | |

| | | | | | | | | | | | | |

| Risk provisions for lending business | | | | | | | | | | | 196 | | | | | | | | | | | | 0 | | | | | | | | | | | | 196 | | | | | | | | | | | Net gains/losses from risk provisions | | | | |

| | | | | | | | | | | | | |

| Net gains/losses from hedge accounting | | | | | | | | | | | –110 | | | | | | | | | | | | 0 | | | | | | | | | | | | –110 | | | | | | | | | | | Net gains/losses from hedge accounting | | | | |

| | | | | | | | | | | | | |

| Other financial instruments at fair value through profit or loss | | | | | | | | | | | 767 | | | | | | | | | | | | 0 | | | | | | | | | | | | 767 | | | | | | | | | | | Net gains/losses from other financial instruments at fair value through profit or loss | | | | |

| | | | | | | | | | | | | |

| Securities and investments | | | | | | | | | | | –4 | | | | | | | | | | | | 0 | | | | | | | | | | | | –4 | | | | | | | | | | | Net gains/losses from disposal of financial assets at amortised cost | | | | |

| | | | | | | | | | | | | |

| Net gains/losses from investments accounted for using the equity method | | | | | | | | | | | 14 | | | | | | | | | | | | 0 | | | | | | | | | | | | 14 | | | | | | | | | | | Net gains/losses from investments accounted for using the equity method | | | | |

| | | | | | | | | | | | | |

| Operating result after valuation (before promotional expense) | | | | | | | | | | | 2,575 | | | | | | | | | | | | –170 | | | | | | | | | | | | 2,405 | | | | | | | | | | | Operating result after valuation | | | | |

| | | | | | | | | | | | | |

| Net other operating income (before promotional expense) | | | | | | | | | | | –34 | | | | | | | | | | | | –18 | | | | | | | | | | | | –53 | | | | | | | | | | | Net other operating income or loss | | | | |

| | | | | | | | | | | | | |

| Profit/loss from operating activities (before promotional expense) | | | | | | | | | | | 2,541 | | | | | | | | | | | | –188 | | | | | | | | | | | | 2,353 | | | | | | | | | | | Profit/loss from operating activities | | | | |

| | | | | | | | | | | | | |

| Promotional expense | | | | | | | | | | | 188 | | | | | | | | | | | | –188 | | | | | | | | | | | | 0 | | | | | | | | | | | – | | | | |

| | | | | | | | | | | | | |

| Taxes on income | | | | | | | | | | | 137 | | | | | | | | | | | | 0 | | | | | | | | | | | | 137 | | | | | | | | | | | Taxes on income | | | | |

| | | | | | | | | | | | | |

| Consolidated profit | | | | | | | | | | | 2,215 | | | | | | | | | | | | 0 | | | | | | | | | | | | 2,215 | | | | | | | | | | | Consolidated profit | | | | |

| | | | | | | | | | | | | |

| Temporary net gains/losses from hedge accounting | | | | | | | | | | | –139 | | | | | | | | | | | | | | | | | | | | | | | | –139 | | | | | | | | | | | Temporary net gains/losses from hedge accounting | | | | |

| Consolidated profit before IFRS effects | | | | | | | | | | | 2,354 | | | | | | | | | | | | 0 | | | | | | | | | | | | 2,354 | | | | | | | | | | | Consolidated profit before IFRS effects | | | | |

KfW Financial Report 2021 Combined Management Report | Economic report | 14

Reconciliation of internal earnings position (before promotional expense)

with external earnings position (after promotional expense) for financial year 2020

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | Reconciliation | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | EUR in millions | | | | | | | | | EUR in millions | | | | | | | | | EUR in millions | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Net interest income (before promotional expense) | | | | | | | | | | | 2,601 | | | | | | | | | | | | –54 | | | | | | | | | | | | 2,547 | | | | | | | | | | | Net interest income | | | | |

| | | | | | | | | | | | | |

| Net commission income (before promotional expense) | | | | | | | | | | | 584 | | | | | | | | | | | | –11 | | | | | | | | | | | | 573 | | | | | | | | | | | Net commission income | | | | |

| | | | | | | | | | | | | |

| Administrative expense (before promotional expense) | | | | | | | | | | | 1,330 | | | | | | | | | | | | 12 | | | | | | | | | | | | 1,342 | | | | | | | | | | | Administrative expense | | | | |

| | | | | | | | | | | | | |

| Operating result before valuation (before promotional expense) | | | | | | | | | | | 1,855 | | | | | | | | | | | | –76 | | | | | | | | | | | | 1,778 | | | | | | | | | | | Operating result before valuation | | | | |

| | | | | | | | | | | | | |

| Risk provisions for lending business | | | | | | | | | | | –777 | | | | | | | | | | | | –5 | | | | | | | | | | | | –781 | | | | | | | | | | | Net gains/losses from risk provisions | | | | |

| | | | | | | | | | | | | |

| Net gains/losses from hedge accounting | | | | | | | | | | | 16 | | | | | | | | | | | | 0 | | | | | | | | | | | | 16 | | | | | | | | | | | Net gains/losses from hedge accounting | | | | |

| | | | | | | | | | | | | |

| Other financial instruments at fair value through profit or loss | | | | | | | | | | | –428 | | | | | | | | | | | | 0 | | | | | | | | | | | | –428 | | | | | | | | | | | Net gains/losses from other financial instruments at fair value through profit or loss | | | | |

| | | | | | | | | | | | | |

| Securities and investments | | | | | | | | | | | –6 | | | | | | | | | | | | 5 | | | | | | | | | | | | –1 | | | | | | | | | | | Net gains/losses from disposal of financial assets at amortised cost | | | | |

| | | | | | | | | | | | | |

| Net gains/losses from investments accounted for using the equity method | | | | | | | | | | | 31 | | | | | | | | | | | | 0 | | | | | | | | | | | | 31 | | | | | | | | | | | Net gains/losses from investments accounted for using the equity method | | | | |

| | | | | | | | | | | | | |

| Operating result after valuation (before promotional expense) | | | | | | | | | | | 691 | | | | | | | | | | | | –76 | | | | | | | | | | | | 614 | | | | | | | | | | | Operating result after valuation | | | | |

| | | | | | | | | | | | | |

| Net other operating income (before promotional expense) | | | | | | | | | | | –2 | | | | | | | | | | | | –12 | | | | | | | | | | | | –14 | | | | | | | | | | | Net other operating income or loss | | | | |

| | | | | | | | | | | | | |

| Profit/loss from operating activities (before promotional expense) | | | | | | | | | | | 688 | | | | | | | | | | | | –88 | | | | | | | | | | | | 600 | | | | | | | | | | | Profit/loss from operating activities | | | | |

| | | | | | | | | | | | | |

| Promotional expense | | | | | | | | | | | 88 | | | | | | | | | | | | –88 | | | | | | | | | | | | 0 | | | | | | | | | | | – | | | | |

| | | | | | | | | | | | | |

| Taxes on income | | | | | | | | | | | 76 | | | | | | | | | | | | 0 | | | | | | | | | | | | 76 | | | | | | | | | | | Taxes on income | | | | |

| | | | | | | | | | | | | |

| Consolidated profit | | | | | | | | | | | 525 | | | | | | | | | | | | 0 | | | | | | | | | | | | 525 | | | | | | | | | | | Consolidated profit | | | | |

| | | | | | | | | | | | | |

| Temporary net gains/losses from hedge accounting | | | | | | | | | | | –109 | | | | | | | | | | | | 0 | | | | | | | | | | | | –109 | | | | | | | | | | | Temporary net gains/losses from hedge accounting | | | | |

| Consolidated profit before IFRS effects | | | | | | | | | | | 633 | | | | | | | | | | | | 0 | | | | | | | | | | | | 633 | | | | | | | | | | | Consolidated profit before IFRS effects | | | | |

At EUR 1,712 million (2020: EUR 1,855 million), the Operating result before valuation (before promotional expense) was below the prior-year level but above the target (EUR 1,628 million).

At EUR 2,531 million, Net interest income (before promotional expense) decreased compared to the 2020 figure (EUR 2,601 million). While interest margin income developed positively, the structure contribution failed to reach the target due to market conditions, which were characterised by the low interest environment and a flat yield and cost curve.

Net commission income (before promotional expense) amounted to EUR 634 million, which exceeded the 2020 figure (EUR 584 million) and expectations (EUR 571 million). This development was mainly due to the increase in cost-based remuneration for the implementation of the promotional programmes for the Federal Government to EUR 362 million (2020: EUR 339 million), primarily in energy efficiency and renewable energy including charging infrastructure. Remuneration for administration of German Financial Cooperation (“FC”) also increased, to EUR 229 million (2020: EUR 217 million). The remuneration from the Federal Government was offset by related administrative expense.

Administrative expense (before promotional expense) increased from EUR 1,330 million to EUR 1,452 million, but was lower than expected (EUR 1,477 million). Personnel expense amounted to EUR 842 million, which is above the previous year’s figure of EUR 770 million. This increase was largely due to an FTE increase that turned out to be lower than expected. Non-personnel expense (before promotional expense) rose to EUR 610 million (2020: EUR 560 million). This development resulted from the increased use of external service providers compared to the previous year, including for KfW’s digitalisation and more stringent regulatory requirements applicable to IT.

15 | KfW Financial Report 2021 Combined Management Report | Economic report

The cost-income ratio before promotional expense increased to 45.9% (2020: 41.8%), mainly due to the increase in administrative expense and the overall decline in operating income. Adjusted for income and expenses from products for which cost-based remuneration has been agreed with the Federal Government, the cost-income ratio for 2021 amounted to 33.3% (2020: 30.0%).

KfW Group’s risk provisions for lending business generated net income of EUR 196 million in 2021 (2020: net expense of EUR 777 million), due among other things to the improved macroeconomic environment and recoveries on loans previously written off, after the previous year was impacted by the economic effects of the global coronavirus pandemic. The subsidiary DEG in the business sector Promotion of developing countries and emerging economies, and the business sector Export and project finance were the main contributors to the positive result.

Net additions to the provision for imminent credit risks (stage 3) including direct write-offs decreased by EUR 395 million year on year to EUR 8 million (2020: EUR 403 million). Net additions primarily related to DEG, in the amount of EUR 53 million (2020: EUR 95 million), and to the business sector Mittelstandsbank & Private Kunden (SME Bank & Private Clients) in the amount of EUR 47 million (2020: EUR 80 million), of which EUR 37 million was attributable to education financing (2020: EUR 67 million). The business sector Export and project finance, in contrast, recorded net reversals of EUR 74 million (2020: additions of EUR 212 million), affecting the aviation industry in particular.

Net reversals of risk provisions in stage 1 of EUR 224 million (2020: net additions of EUR 63 million) as well as the decline in net additions in stage 2 of EUR 350 million to EUR 82 million reflected effects from lower probabilities of default due to the improved macroeconomic environment, further developed rating procedures and related transfers back to stage 1 in some cases. These effects were observed across countries and sectors, with the most significant reversals undertaken in the banking environment and for SMEs and start-ups. Further development of LGD procedures also led to effects contributing to reduced risk provisioning. In contrast, effects contributing to increased risk provisioning came from renewed forbearance measures in the cruise ship industry, which led to further stage transfers and additions to risk provisions in stage 2. Overall, existing risks from the general development of countries and sectors were considered on an individual basis as of 31 December 2021. Persisting uncertainties as of the reporting date due to the development of the pandemic were also addressed in this process.

Environmental, Social and Governance (“ESG”) risks do not present any new risks for KfW to take into account, as Risk Management already addresses ESG risks in the context of borrower ratings, credit assessments and portfolio analyses as part of the group’s risk strategy. These risks are therefore already reflected in risk provisions for the lending business; they did not have a material impact on the determination of any individual risk provisions.

Furthermore, at EUR 83 million, income from recoveries of loans previously written off was above that of the previous year (EUR 60 million). Of this amount, EUR 40 million was attributable to the business sector SME Bank & Private Clients and EUR 26 million to the business sector Export and project finance.

Risk provisions decreased to EUR 2.0 billion in financial year 2021 (2020: EUR 2.3 billion), of which EUR 1.4 billion was related to provisions for imminent risks in stage 3 (2020: EUR 1.3 billion). Provisions for individual risks in stage 2 that cannot be allocated decreased from EUR 0.5 billion to EUR 0.4 billion, and in stage 1 from EUR 0.4 billion to EUR 0.3 billion.

The net gains/losses from hedge accounting and other financial instruments at fair value through profit or loss amounted to EUR 657 million (2020: EUR –412 million) and, in financial year 2021, were primarily driven by positive valuation effects from the equity investment portfolio, which were partly offset by purely IFRS-related effects from the measurement of derivatives used for hedging purposes.

The positive development of the equity investment portfolio measured at fair value through profit or loss was due to both the reversals of impairment losses taken on the valuation discounts as a result of the COVID-19 pandemic in the previous year, and further value increases. This development was also driven by exchange rate-induced increases in value, particularly due to the appreciation of the US dollar. Overall, the valuation resulted in income of EUR 752 million (2020: expense of EUR 312 million), largely due to the activities in the business sector Promotion of developing countries and emerging economies, with positive valuation effects of EUR 448 million (2020: EUR –380 million). Of DEG’s income of EUR 424 million, EUR 140 million was attributable to exchange rate-induced increases in value. In addition, the KfW Capital equity investment portfolio posted a value increase of EUR 194 million (2020: EUR 42 million).

KfW Financial Report 2021 Combined Management Report | Economic report | 16

The result from foreign currency translation amounted to EUR –11 million (2020: EUR –5 million).

Hedge accounting and borrowings recognised at fair value, including derivatives used for hedging purposes, resulted in net expenses of EUR 139 million (2020: EUR 109 million). The mark-to-market derivatives are part of economically hedged positions. However, if the other part of the hedging relationship cannot be carried at fair value or different valuation methods and parameters have to be applied, this inevitably results in temporary fluctuations in income that are fully offset over the term of the transactions.

The measurement of securities at fair value through profit or loss yielded a balanced result (2020: EUR –5 million).

In the case of securities not carried at fair value, developments in the financial markets resulted in a net positive difference of EUR 98 million between the carrying amount and the fair value (2020: EUR 48 million). This development is partly attributable to increases in the value of covered and government bonds.

There were net gains of EUR 10 million (2020: EUR 30 million) from securities and investments as well as from investments accounted for using the equity method. Investments accounted for using the equity method contributed EUR 14 million to the result. This was primarily due to value increases in the business sector KfW Capital.

Net other operating income (before promotional expense) was EUR –34 million, which was down on the previous year’s figure (2020: EUR –2 million). This item also includes expenses of EUR 13 million from the increase in KfW Stiftung’s foundation capital.

At EUR 188 million in 2021, KfW’s domestic promotional expense, which has a negative impact on KfW Group’s earnings position, was above the prior-year level (EUR 88 million) but below projections (EUR 364 million), due to the low-interest environment.

Interest rate reductions are the key component of KfW’s promotional expense. KfW grants these for certain domestic promotional loans during the first fixed-interest-rate period, which has a negative effect on its earnings position, in addition to passing on its funding conditions which are influenced by its triple-A rating. The volume of interest rate reductions was EUR 144 million in financial year 2021, which was above the prior-year figure (EUR 54 million) but below the projected figure (EUR 330 million). The increase in interest rate reductions was the result of passing on negative funding rates to KfW financing partners from the third quarter 2021 onwards, which led to an increase in demand for promotional loans at reduced rates.

In addition to its lending business, KfW provided promotional grants, in particular for the Climate action campaign and the ERP Digitalisation and Innovation programmes, totalling EUR 18 million in financial year 2021 (2020: EUR 12 million), which were recognised as promotional expense in Net other operating income.

Moreover, promotional expenses reported in net commission income and administrative expense were incurred in an amount of EUR 26 million (2020: EUR 23 million).This spending was aimed, among other things, at the sale of KfW’s promotional products.

Accounting for the net income tax result of EUR –137 million (EUR 2020: EUR –76 million), the consolidated profit of EUR 2,215 million was higher than in the previous year (EUR 525 million) and above expectations of EUR 793 million.

Consolidated profit before IFRS effects from hedging is another key financial figure based on Consolidated profit in accordance with IFRS to reflect the fact that KfW uses derivative financial instruments solely for hedging purposes. Under IFRS, the requirements for the recognition and valuation of derivatives and hedges give rise to temporary net gains or losses that are offset over the entire term. Against this backdrop, IFRS effects from hedging relationships amounting to EUR –139 million (2020: EUR –109 million) were eliminated.

The reconciled earnings position amounted to a profit of EUR 2,354 million (2020: EUR 633 million). The considerable increase in consolidated profit is primarily due to the positive effects from risk provisions and the valuation of the equity investment portfolio. Accordingly, the result exceeds the sustainable earnings potential of EUR 1.0 billion.

17 | KfW Financial Report 2021 Combined Management Report | Economic report

Development of net assets

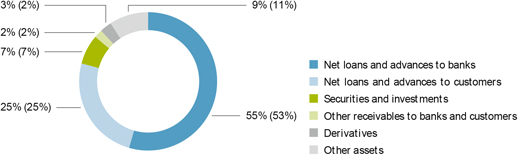

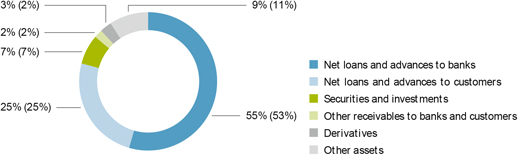

Lending to banks and customers accounted for 80% of the group’s assets as of 31 December 2021 (2020: 78%).

Assets as of 31 December 2021 (31 Dec. 2020)

The volume of lending increased compared to the previous year, amounting to EUR 564.2 billion.

Volume of lending

| | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | 31 Dec. 2021 | | | | | | 31 Dec. 2020 | | |

| | | | | | | EUR in millions | | | | | | EUR in millions | | |

| | | | | | | |

| Loans and advances | | | | | | 440,623 | | | | | | 425,880 | | |

| Risk provisions for lending business | | | | | | –1,943 | | | | | | –2,130 | | |

| Net loans and advances | | | | | | 438,680 | | | | | | 423,749 | | |

| Contingent liabilities from financial guarantees | | | | | | 3,168 | | | | | | 2,808 | | |

| Irrevocable loan commitments | | | | | | 111,376 | | | | | | 105,282 | | |

| Loans and advances held in trust | | | | | | 10,999 | | | | | | 11,239 | | |

Total | | | | | | 564,223 | | | | | | 543,078 | | |

Loans and advances increased by EUR 14.7 billion in 2021, of which around EUR 6 billion was attributable to the KfW Special Programme 2020, with the KfW Entrepreneur Loan and KfW Instant Loan programmes, in particular, contributing a total of EUR 7.6 billion, while the coronavirus special programme “Direct participation for syndicate financing”, in contrast, recorded a decline of EUR 2.5 billion. Overall, disbursements in new lending business more than compensated for unscheduled repayments (EUR 14.2 billion; 2020: EUR 11.5 billion) and scheduled repayments. At EUR 438.7 billion, Net loans and advances continued to account for 78% of lending volume.

Contingent liabilities from financial guarantees amounted to EUR 3.2 billion, an increase of EUR 0.4 billion on the prior-year figure (2020: EUR 2.8 billion). The increase in Irrevocable loan commitments of EUR 6.1 billion to EUR 111.4 billion was due to the irrevocable commitment to the Federal Government in connection with the Future Fund in the amount of EUR 8.5 billion and commitments of EUR 2.1 billion under the KfW Special Programme. The KfW Entrepreneur Loan and KfW Instant Loan programmes were the most significant drivers, with a total of EUR 5.0 billion, while the coronavirus special programme “Direct participation for syndicate financing” recorded a decline of EUR –3.2 billion. Overall, the coronavirus aid programmes recorded reduced demand in 2021. Within assets held in trust, the volume of Loans and advances held in trust, which primarily comprise loans to promote developing countries and emerging economies financed by budget funds provided by the Federal Republic of Germany, decreased by EUR 0.2 billion to EUR 11.0 billion.

At EUR 8.4 billion, Other loans and advances to banks and customers were EUR 2.4 billion below the previous year’s amount of EUR 10.7 billion. Of the decline, EUR 4.1 billion resulted from receivables from cash collateral in connection with collateral management in the derivatives business; short-term money market transactions, in contrast, rose by EUR 2.0 billion.

KfW Financial Report 2021 Combined Management Report | Economic report | 18

The total amount of securities and investments, at EUR 39.9 billion, was 3% above the previous year’s level.

Securities and investments

| | | | | | | | | | | | | | |

| | | | | | | 31 Dec. 2021 | | | | | | 31 Dec. 2020 | | |

| | | | | | | EUR in millions | | | | | | EUR in millions | | |

| | | | | | | |

| Bonds and other fixed-income securities | | | | | | 35,774 | | | | | | 35,779 | | |

| Shares and other non-fixed income securities | | | | | | 0 | | | | | | 0 | | |

| Equity investments | | | | | | 4,015 | | | | | | 3,016 | | |

| Shares in non-consolidated subsidiaries | | | | | | 68 | | | | | | 48 | | |

Total | | | | | | 39,856 | | | | | | 38,844 | | |

The securities portfolio remained virtually unchanged in financial year 2021. The portfolio of Equity investments and Shares in non-consolidated subsidiaries increased by EUR 1.0 billion to EUR 4.1 billion in 2021. This development was due, among other things, to value increases of EUR 0.7 billion, in particular in the business sectors Promotion of developing countries and emerging economies and KfW Capital.

Value adjustments from macro hedge accounting declined by EUR 7.6 billion, based on fair value, from EUR 12.2 billion to EUR 4.6 billion. Derivatives with positive fair values, which are primarily used to hedge refinancing transactions, rose from EUR 13.3 billion in the previous year to EUR 13.9 billion. This was due to value adjustments from micro hedging increasing from EUR 7.9 billion to EUR 8.4 billion.

KfW reduced its balances with central banks by EUR 1.7 billion to EUR 42.4 billion. The liquidity held continues to ensure the expected servicing of coronavirus aid measures and to enable reaction to market events at short notice. There were only minor changes in the other asset line items in the statement of financial position.

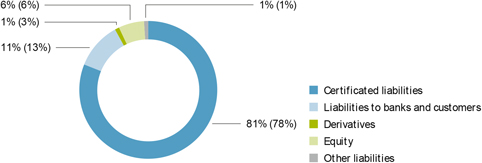

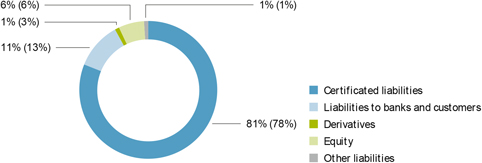

Development of financial position

KfW Group’s funding strategy in the national and international capital markets is based on the four product categories: “benchmark programmes in euros and US dollars”, “Green Bonds – Made by KfW”, “other public bonds” and “private placements”. Moreover, KfW accessed funding via the government-owned WSF as part of the KfW coronavirus special programme in the reporting year. KfW significantly reduced its funding via participation in the targeted longer-term funding of the Eurosystem via TLTRO III in 2021. Accordingly, the share of total assets accounted for by funding in the form of certificated liabilities rose to 81% overall (2020: 78%).

Financial position as of 31 December 2021 (31 Dec. 2020)

Borrowings increased by EUR 9.7 billion to EUR 506.1 billion.

19 | KfW Financial Report 2021 Combined Management Report | Economic report

Borrowings

| | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | 31 Dec. 2021 | | | | | | 31 Dec. 2020 | | |

| | | | | | | EUR in millions | | | | | | EUR in millions | | |

| | | | | | | |

| Short-term funds | | | | | | 51,588 | | | | | | 43,988 | | |

Bonds and notes | | | | | | 397,617 | | | | | | 383,975 | | |

Other funding | | | | | | 56,854 | | | | | | 68,394 | | |

Total | | | | | | 506,059 | | | | | | 496,357 | | |

Funds raised in the form of certificated liabilities rose by EUR 22.3 billion to EUR 447.6 billion. Of this increase, EUR 13.6 billion was a result of the greater volume of medium and long-term bonds and notes issued, which remain the group’s principal source of funding. At year-end 2021, such funds amounted to EUR 397.6 billion (31 Dec. 2020: EUR 384.0 billion) and accounted for 79% of borrowings. Short-term issues of commercial paper increased by EUR 8.7 billion to EUR 50.0 billion. Total short-term funds, including demand deposits and term deposits, amounted to EUR 51.6 billion, compared with EUR 44.0 billion the previous year. Some of the new funding sources tapped in connection with the KfW coronavirus special programme in 2020 were reduced. This largely resulted in the decline in Other funding of EUR 11.5 billion to EUR 56.9 billion (31 Dec. 2020: EUR 68.4 billion). In addition to the decrease of EUR 3.5 billion in promissory note loans (Schuldscheindarlehen) from banks and customers to EUR 40.8 billion (largely WSF funding), this also consisted of minor repurchase agreements, which declined, due to the repayment of EUR 13.4 billion (nominal) of loans under TLTRO III operation 4, by EUR 11.3 billion to EUR 2.1 billion (31 Dec. 2020: EUR 13.3 billion). In contrast, cash collateral received, which primarily serves to reduce counterparty risk from the derivatives business, increased by EUR 4.0 billion to EUR 9.0 billion (31 Dec. 2020: EUR 4.9 billion).

The carrying amounts of derivatives with negative fair values, which were primarily used to hedge loans, declined by EUR 7.3 billion from EUR 13.7 billion, primarily due to changes in market parameters, and amounted to EUR 6.4 billion at year-end 2021.

There were only minor changes in the other liability line items in the statement of financial position.

At EUR 34.2 billion, equity was EUR 2.4 billion above the level of 31 December 2020 (EUR 31.8 billion). The increase resulted in particular from consolidated profit (EUR 2.2 billion). The partial reversal of reserves in accordance with Section 340g of the German Commercial Code (Handelsgesetzbuch – “HGB”) of EUR 0.4 billion, resulted in a reclassification within Equity in accordance with IFRS, with no effect on profit or loss. The equity ratio increased year on year from 5.8% to 6.2% as of 31 December 2021, due to consolidated profit.

Equity

| | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | 31 Dec. 2021 | | | | | | 31 Dec. 2020 | | |

| | | | | | | EUR in millions | | | | | | EUR in millions | | |

| | | | | | | |

Paid-in subscribed capital | | | | | | 3,300 | | | | | | 3,300 | | |

Capital reserve | | | | | | 8,447 | | | | | | 8,447 | | |

Reserve from the ERP Special Fund | | | | | | 1,191 | | | | | | 1,191 | | |

Retained earnings | | | | | | 22,026 | | | | | | 19,411 | | |

Fund for general banking risks | | | | | | 200 | | | | | | 600 | | |

Revaluation reserves | | | | | | –957 | | | | | | –1,151 | | |

Total | | | | | | 34,207 | | | | | | 31,797 | | |

The consolidated profit was allocated to retained earnings.

KfW Financial Report 2021 Combined Management Report | Economic report | 20

Risk report

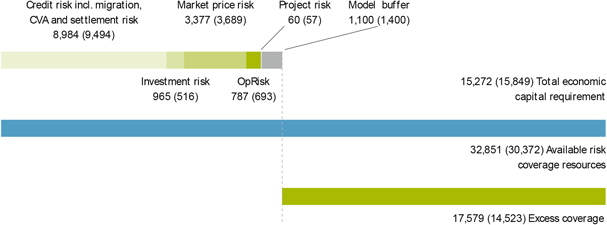

Overview of key indicators

Risks are reported on a group level in accordance with KfW Group’s internal risk management. The key risk indicators are presented below:

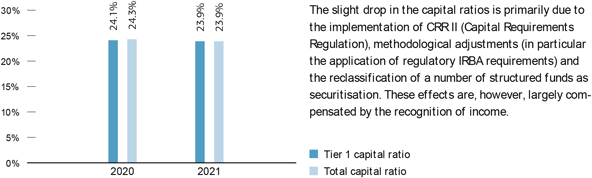

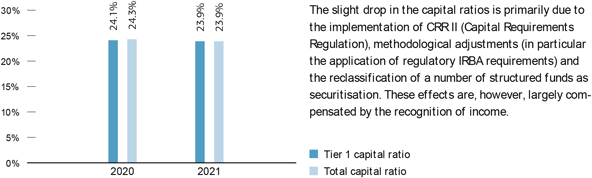

Regulatory capital ratios:

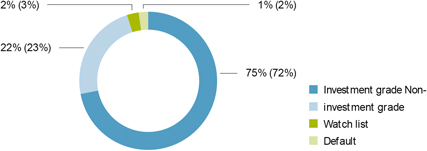

Credit risk:

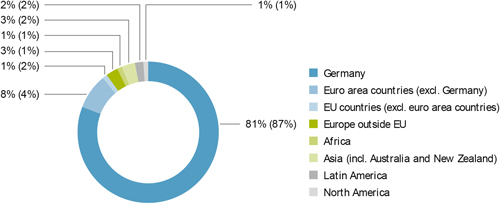

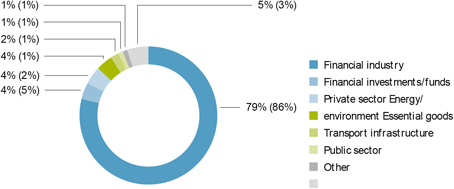

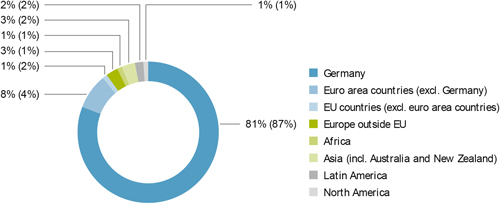

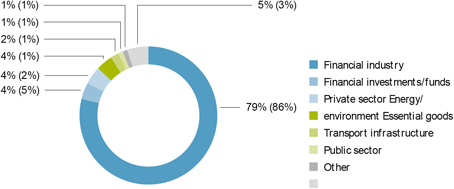

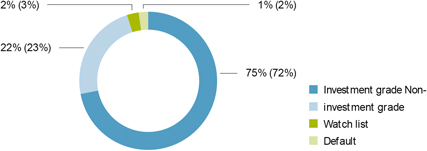

2021 (2020), Net exposure breakdown

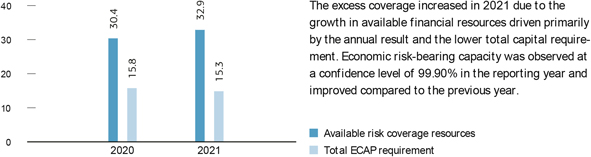

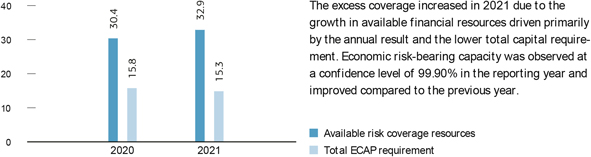

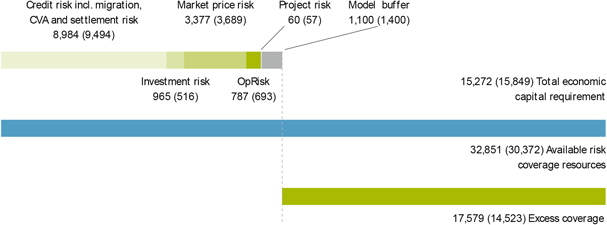

Economic risk-bearing capacity:

(EUR in billions)

21 | KfW Financial Report 2021 Combined Management Report | Risk report

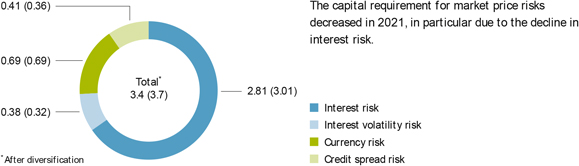

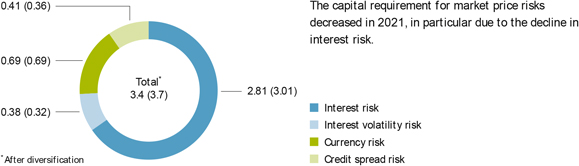

Market price risk:

2021 (2020), ECAP (EUR in billions)

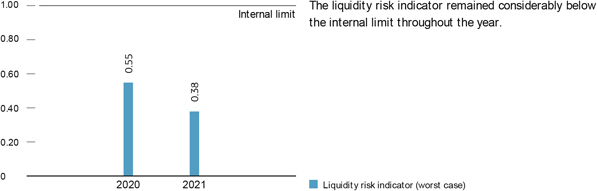

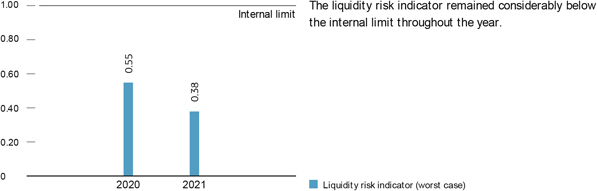

Liquidity risk:

Operational risk:

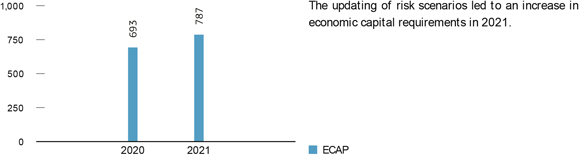

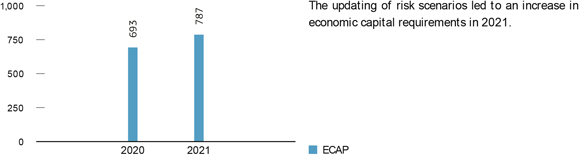

ECAP (EUR in millions)

KfW Financial Report 2021 Combined Management Report | Risk report | 22

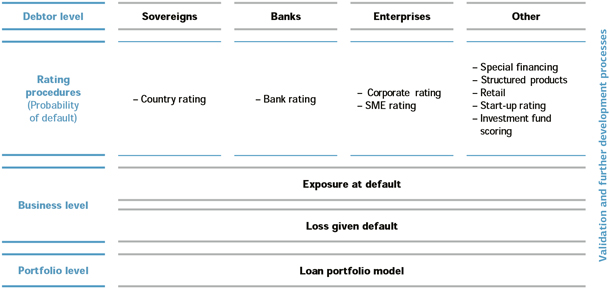

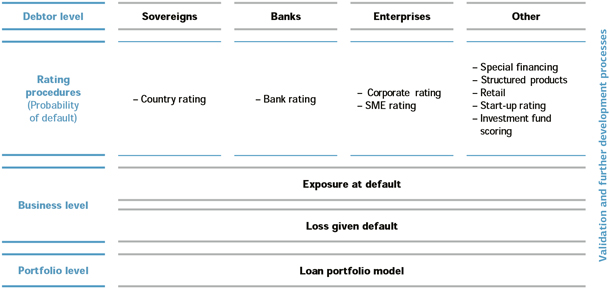

In financial year 2021, as in previous years, KfW Group refined the processes and instruments of its risk management and controlling, taking into account current banking supervisory requirements. A new system for calculating credit risk indicators was introduced for Pillar II, which had already been applied for Pillar I in the previous year. Furthermore, the credit risk methods for calculating the risk indicators for loss given default (LGD) and exposure at default (EAD) were further developed and adapted to reflect the new requirements set forth in EBA/GL/2017/06 (“IRBAnew”). The probability of default (PD) rating procedures were also revised, particularly for countries and corporates. Other focus areas included the expansion of the reporting systems in Risk Controlling and further development of the management of environmental, social and governance (ESG) risks as part of a group-wide project. KfW has been implementing its sustainable finance concept as part of this project (“tranSForm”) since the end of 2020, thereby evolving into a transformative promotional bank – in line with its mandate under the Climate Action Programme 2030 – in order to help the economy and society move towards a sustainable and net-zero greenhouse gas future.