UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Materials Under Rule 14a-12 |

ImmunoCellular Therapeutics, Ltd.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

IMMUNOCELLULAR THERAPEUTICS, LTD.

23622 Calabasas Road, Suite 300

Calabasas, California 91302

May 2, 2014

Dear Stockholder:

You are cordially invited to attend the 2014 Annual Meeting of Stockholders of ImmunoCellular Therapeutics, Ltd. The meeting will be held at the Sheraton Gateway Hotel, 6101 West Century Boulevard, Los Angeles, California 90045, beginning at 8:00 A.M., local time, on Friday, June 13, 2014.

The Notice of Meeting and the Proxy Statement on the following pages cover the formal business of the meeting, which includes three items to be voted on by the stockholders.

Whether or not you plan to attend the meeting, please vote at your earliest convenience by following the instructions in the notice of internet availability of proxy materials or the proxy card you received in the mail.

I hope you will join us.

|

Sincerely, |

|

/s/ John S. Yu |

John S. Yu, M.D. |

Chairman of the Board |

IMMUNOCELLULAR THERAPEUTICS, LTD.

23622 Calabasas Road, Suite 300

Calabasas, California 91302

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

to be held on June 13, 2014

Notice is hereby given to the holders of common stock, $0.0001 par value per share, of ImmunoCellular Therapeutics, Ltd. (“ImmunoCellular,” the “Company,” “we” or “our”) that the Annual Meeting of Stockholders will be held on Friday, June 13, 2014 at the Sheraton Gateway Hotel, 6101 West Century Boulevard, Los Angeles, California 90045, beginning at 8:00 A.M., local time, for the following purposes:

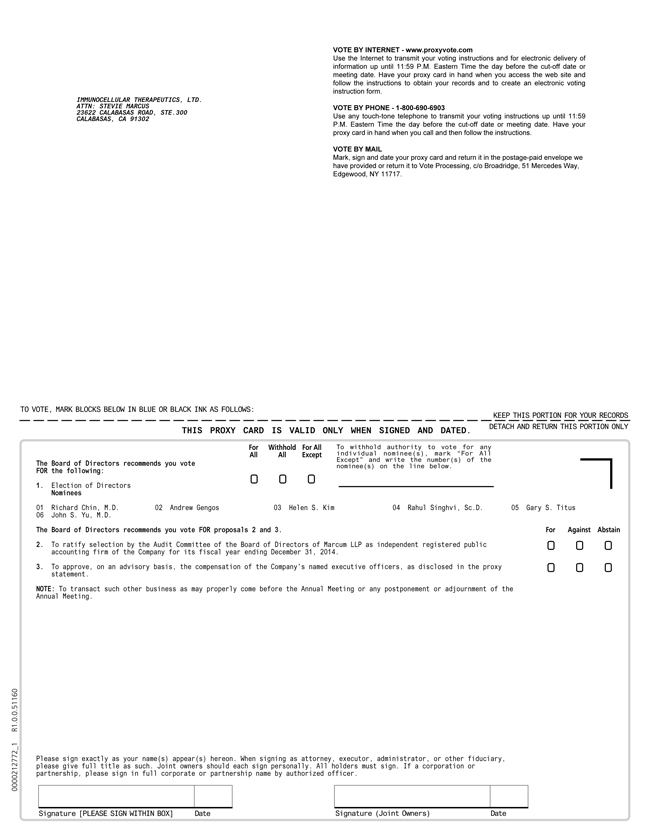

| | (1) | To elect the Board of Directors’ six nominees to serve on the Board of Directors until the 2015 Annual Meeting of Stockholders; |

| | (2) | To ratify the appointment of Marcum LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2014; |

| | (3) | To approve, on an advisory basis, the compensation of our named executive officers as disclosed in this Proxy Statement (a “Say-on-Pay” vote); and |

| | (4) | To transact such other business as may properly come before the Annual Meeting or any postponement or adjournment of the Annual Meeting. |

Only those stockholders of record at the close of business on April 15, 2014 are entitled to notice of and to vote at the Annual Meeting or any postponement or adjournment of the Annual Meeting. A complete list of stockholders entitled to vote at the Annual Meeting will be available at the Annual Meeting.

| | | | |

| | | | By Order of the Board of Directors |

| | |

May 2, 2014 | | | | /s/ John S. Yu |

| | | | John S. Yu, M.D. |

| | | | Corporate Secretary |

WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING, PLEASE FOLLOW THE INSTRUCTIONS IN THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS OR THE PROXY CARD YOU RECEIVED IN THE MAIL TO VOTE YOUR SHARES. IF YOU VOTE BY TELEPHONE OR VIA THE INTERNET, YOU NEED NOT RETURN A PROXY CARD. IF YOU ATTEND THE ANNUAL MEETING YOU MAY, IF YOU WISH, REVOKE YOUR PROXY AND VOTE IN PERSON. IF YOU HOLD YOUR SHARES THROUGH A BROKER OR OTHER CUSTODIAN, PLEASE CHECK THE VOTING INSTRUCTIONS PROVIDED TO YOU BY THAT BROKER OR CUSTODIAN.

Important Notice Regarding the Internet Availability of Proxy Materials for the Stockholders Meeting to be Held on

June 13, 2014

This Proxy Statement, the accompanying proxy and our 2013 Annual Report on Form 10-K are available at www.proxyvote.com.

TABLE OF CONTENTS

i

IMMUNOCELLULAR THERAPEUTICS, LTD.

23622 Calabasas Road, Suite 300

Calabasas, California 91302

Annual Meeting of Stockholders to be Held on June 13, 2014

PROXY STATEMENT

This Proxy Statement is furnished to holders of the common stock, $0.0001 par value per share, of ImmunoCellular Therapeutics, Ltd., a Delaware corporation, in connection with the solicitation of proxies by our Board of Directors for use at our 2014 Annual Meeting of Stockholders to be held at the Sheraton Gateway Hotel, 6101 West Century Boulevard, Los Angeles, California 90045, beginning at 8:00 A.M., local time, on Friday, June 13, 2014, and at any postponement or adjournment of the Annual Meeting.

Pursuant to the rules adopted by the Securities and Exchange Commission, or SEC, we have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending a Notice Regarding the Availability of Proxy Materials, or Notice, to certain of our stockholders of record, and we are sending a paper copy of the proxy materials and proxy card to other stockholders of record who we believe would prefer receiving such materials in paper form. Brokers and other nominees who hold shares on behalf of beneficial owners will be sending their own similar Notice. Stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to request a printed copy by mail or electronically may be found on the Notice and on the website referred to in the Notice, including an option to request paper copies on an ongoing basis. We intend to make this Proxy Statement available on the Internet and to mail the Notice, or to mail the Proxy Statement and Proxy Card, as applicable, on or about May 2, 2014 to all stockholders of record as of the close of business on April 15, 2014.

What is the purpose of the Annual Meeting?

At the Annual Meeting, stockholders will act upon the matters outlined in the attached Notice of Meeting and described in detail in this Proxy Statement, which are (1) to elect the Board of Directors’ six nominees to serve on our Board of Directors until the 2015 Annual Meeting of Stockholders; (2) to ratify the appointment of Marcum LLP as our independent registered public accounting firm; and (3) a Say-On-Pay vote to approve, on an advisory basis, the compensation of our named executive officers as disclosed in this Proxy Statement. In addition, management will report on our performance and respond to questions from stockholders.

Who is entitled to vote at the Annual Meeting?

Only stockholders of record at the close of business on April 15, 2014 are entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement of the Annual Meeting.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Some of our stockholders hold their shares through a broker, bank or other nominee rather than directly in their own name as the stockholder of record. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

| | • | | Stockholder of Record — If on April 15, 2014 your shares are registered directly in your name with our Transfer Agent, Computershare Trust Company, N.A., you are considered, with respect to those shares, the stockholder of record. As the stockholder of record, you have the right to vote your proxy directly with us by sending your proxy to Broadridge or to vote in person at the Annual Meeting. If you submit your proxy telephonically or over the internet, you must vote no later than 11:59 p.m. Eastern Time on June 12, 2014. |

| | • | | Beneficial Owner — If on April 15, 2014 your shares are held in the name of a stock brokerage account or a bank or other nominee, you are considered the beneficial owner of shares held in street name and your broker or nominee is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker or nominee on how to vote and are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you receive a proxy from your broker or nominee. Your broker or nominee has provided voting instructions for you to use. If you wish to attend the Annual Meeting and vote in person, please contact your broker or nominee so that you can receive a legal proxy to present at the Annual Meeting. |

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you owned as of the record date.

1

How many votes are needed to approve each proposal?

| | • | | For the election of directors, the six nominees receiving the highest number of “FOR” votes (from the holders of shares present in person or represented by proxy and entitled to vote) will be elected as directors. Only “FOR” or “WITHHOLD” votes will affect the outcome. |

| | • | | To be approved, Proposal 2, the ratification of the appointment of Marcum LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2014, must receive “FOR” votes from the holders of a majority of the votes cast in person or by proxy at the Annual Meeting. |

| | • | | Proposal 3, advisory approval of the compensation of our named executive officers as disclosed in this proxy statement, will be considered approved if it receives “FOR” votes from the holders of a majority of the votes cast in person or by proxy at the Annual Meeting. |

What constitutes a quorum?

Our Bylaws provide that the presence, in person or by proxy, at our Annual Meeting of the holders of a majority of the outstanding shares of our common stock entitled to vote will constitute a quorum.

For the purpose of determining the presence of a quorum, proxies marked “withhold authority” or “abstain” will be counted as present. Shares represented by proxies that include broker non-votes also will be counted as shares present for purposes of establishing a quorum. On the record date of April 15, 2014, there were 57,565,704 shares of our common stock issued and outstanding, and those shares are the only shares that are entitled to vote at the Annual Meeting.

What are the Board’s recommendations?

Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of our Board of Directors. The recommendations of our Board of Directors are set forth together with the description of each proposal in this Proxy Statement. In summary, our Board of Directors recommends a vote:

| | • | | “FOR” election of the directors named in this Proxy Statement (see Proposal 1); |

| | • | | “FOR” ratification of the appointment of Marcum LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014 (see Proposal 2). |

| | • | | “FOR” a Say-On-Pay advisory vote on the compensation of our named executive officers (see Proposal 3). |

How can I attend the Annual Meeting?

You may attend the Annual Meeting if you are listed as a stockholder of record as of April 15, 2014 and bring proof of your identity. If you hold your shares through a broker or other nominee, you will need to provide proof of your share ownership by bringing either a copy of a brokerage statement showing your share ownership as of April 15, 2014, or a legal proxy if you wish to vote your shares in person at the Annual Meeting. In addition to the items mentioned above, you should bring proof of your identity.

How can I vote my shares in person at the Annual Meeting?

| | • | | Shares held directly in your name as the stockholder of record may be voted in person at the Annual Meeting. If you choose to do so, please bring proof of your identity to the Annual Meeting. Shares beneficially owned may be voted by you if you receive and present at the Annual Meeting a proxy from your broker or nominee, together with proof of your identity. Even if you plan to attend the Annual Meeting, we urge you to vote by telephone, by Internet or by returning your marked proxy to Broadridge so that your vote will be counted if you later decide not to attend the Annual Meeting or are unable to attend. |

| | • | | You may vote over the Internet. Simply follow the instructions on the notice of internet availability or proxy card. If you vote over the Internet, you should not vote by telephone or vote by returning a proxy card. |

| | • | | You may vote by telephone. Simply follow the instructions on the notice of internet availability or proxy card. If you vote over the telephone, you should not vote by Internet or vote by returning a proxy card. |

| | • | | You may vote by mail. If you received a proxy card through the mail, simply complete and sign your proxy card and mail it in the enclosed envelope. If you mark your voting instructions on the proxy card, your shares will be voted as you instruct. If you vote by mail, you should not vote by telephone or over the Internet. |

2

How will my proxy card be voted?

If the proxy card is executed, returned in time and not revoked, the shares represented by the proxy card, telephone vote or Internet vote will be voted at the Annual Meeting and at any postponement or adjournment of the Annual Meeting in accordance with the directions indicated on the proxy card. IF NO DIRECTIONS ARE INDICATED, PROXIES MAILED, VOTED VIA TELEPHONE OR VOTED VIA INTERNET WILL BE VOTED IN ACCORDANCE WITH THE RECOMMENDATIONS OF OUR BOARD OF DIRECTORS ON ALL OF THE PROPOSALS DESCRIBED IN THIS PROXY STATEMENT, AND AS TO ANY OTHER MATTERS PROPERLY BROUGHT BEFORE THE ANNUAL MEETING OR ANY POSTPONEMENT OR ADJOURNMENT OF THE ANNUAL MEETING, IN THE SOLE DISCRETION OF THE PERSONS NAMED AS PROXY HOLDERS ON THE PROXY CARD.

How may I revoke the voting instructions previously given?

A stockholder who returns a proxy card may revoke it at any time prior to its exercise at the Annual Meeting by (1) giving written notice of revocation to our Corporate Secretary, (2) properly submitting to us a duly executed proxy bearing a later date, or (3) appearing at the Annual Meeting and voting in person. All written notices of revocation of proxies should be addressed as follows: ImmunoCellular Therapeutics, Ltd., 23622 Calabasas Road, Suite 300, Calabasas, California 91302, Attention: Corporate Secretary. To revoke a proxy previously submitted by telephone or through the Internet, you may simply vote again at a later date using the same procedures, in which case your later submitted vote will be recorded and your earlier vote revoked. For shares held beneficially by you, you may change your vote by submitting new voting instructions to your broker or nominee.

How may I request multiple sets of proxy materials if two or more stockholders reside in my household?

To minimize our expenses, one Proxy Statement and one 2013 Annual Report on Form 10-K Report may be delivered to two or more stockholders who share an address unless we have received contrary instructions from one or more of the stockholders. We will deliver promptly upon written or oral request a separate copy of these documents to a stockholder at a shared address to which a single copy of the documents was delivered. Requests for additional copies of these documents, and requests that in the future separate documents be sent to stockholders who share an address, should be directed by writing to ImmunoCellular Therapeutics, Ltd., 23622 Calabasas Road, Suite 300, Calabasas, California 91302, Attention: Corporate Secretary, or by calling our Corporate Secretary at(818) 264-2300.

How may I request a single set of proxy materials for my household?

If you share an address with another stockholder and have received multiple copies of our proxy materials, you may write or call us at the address set forth in the preceding paragraph to request delivery of a single copy of these materials.

3

PROPOSAL 1

ELECTION OF DIRECTORS

Pursuant to our Bylaws, our Board of Directors has fixed the number of our directors at six. Each director is elected for a term of one year and until his or her successor is elected.

Director Nominees

The following is information concerning our nominees for election as directors. Each nominee currently serves as a director of ImmunoCellular, and each nominee was re-elected as a director at our 2013 annual meeting of stockholders. Under his current right to designate two other members of our Board of Directors, Dr. Yu designated Ms. Helen Kim to serve as one of our directors in August 2011. Our Board of Directors appointed both Andrew Gengos and Gary S. Titus to serve as directors in December 2012. Mr. Gengos was selected as a nominee to the Board due to his position as the Company’s Chief Executive Officer. Mr. Titus was identified as a potential nominee by the Board and, following a review process by the Nominating and Corporate Governance Committee, was recommended to the Board for appointment by the Nominating and Corporate Governance Committee. Our Board of Directors has determined that all of our directors except Andrew Gengos and Dr. John Yu are independent directors as defined in the NYSE MKT rules governing members of boards of directors.

We believe that each nominee will be able to serve as a director. In the event that a nominee is unable to serve, the proxy holders will vote the proxies for such other nominee as they may determine.

| | | | |

Name | | Age | | Position(s) |

John S. Yu, M.D. | | 50 | | Chairman of the Board and Chief Scientific Officer |

Andrew Gengos | | 49 | | President, Chief Executive Officer and Director |

Richard Chin, M.D.(1)(3)(5) | | 47 | | Director |

Richard A. Cowell(1)(2)(3)(5)(6) | | 67 | | Director |

Helen S. Kim(1)(2)(4) (5)(7) | | 51 | | Director |

Rahul Singhvi, Sc.D.(1)(2)(3)(4) (5) | | 49 | | Lead Director |

Gary S. Titus(2)(3)(4) (5) | | 54 | | Director |

| (1) | Member of our Compensation Committee |

| (2) | Member of our Nominating and Corporate Governance Committee |

| (3) | Member of our Audit Committee |

| (4) | Member of our Finance Committee |

| (5) | Denotes independent Director |

| (6) | Mr. Cowell resigned from the Board of Directors effective September 30, 2013. |

| (7) | Ms. Kim was appointed to serve on the Compensation Committee effective December 6, 2013. |

John S. Yu, M.D.

Dr. Yu has served as our Chief Scientific Officer and a director since November 2006 and Chairman of the Board since January 2007. Dr. Yu also served as Interim Chief Executive Officer from August 2012 until November 2012. He is a member of the full-time faculty in the Department of Neurosurgery at Cedars-Sinai Medical Center where he has worked since 1997. An internationally renowned neurosurgeon, Dr. Yu’s clinical focus is on the treatment of malignant and benign brain and spinal tumors. He is also conducting extensive research in immune and gene therapy for brain tumors. He has also done extensive research in the use of neural stem cells as delivery vehicles for brain cancers and neurodegenerative diseases. He was inducted into Castle and Connelly’s America’s Top Doctors in 2005. Dr. Yu has published articles in a number of prestigious journals, including The Lancet, Cancer Research, Cancer Gene Therapy, Human Gene Therapy, Journal of Neuroimmunology, Journal of Neurological Science and Journal of Neurosurgery. Dr. Yu earned his bachelor’s degree in French literature and biological sciences from Stanford University and spent a year at the Sorbonne in Paris studying French literature. He also pursued a fellowship in immunology at the Institut Pasteur in Paris. He earned his medical degree from Harvard Medical School and master’s degree from the Harvard University’s Department of Genetics. He completed his neurosurgical residency at Massachusetts General Hospital in Boston. In addition, he was a Neuroscience Fellow at the National Institutes of Mental Health in the Neuroimmunology Unit at Massachusetts General Hospital from 1988 to 1989 and was a Culpepper Scholar at the Molecular Neurogenetics Unit at that hospital from 1993 to 1995. His other honors include the Preuss Award, Joint Section on Tumors, American Association of Neurological Surgeons and Congress of Neurologic Surgeons in 1995. He received the Academy Award from the American Academy of Neurological Surgery at its 1996 annual meeting. Other honors include the Young Investigator Award from the Congress of Neurological Surgeons in 2000, the National Brain Tumor Foundation Grant in 2001, and the Mahaley Clinical Research award from the American Association of Neurological Surgeons in 2005.

4

Dr. Yu, as a recognized leader in the field of neurosurgery, has extensive knowledge of current therapies and therapies under development for the treatment of brain tumors and has participated in numerous clinical trials for potential therapies in this field. As our Chief Scientific Officer and the co-inventor of our brain tumor vaccine technologies, Dr. Yu brings to the Board significant scientific expertise directly relevant to our product research and development activities.

Andrew Gengos

Mr. Gengos has served as our President, Chief Executive Officer and as a director since December 2012. Mr. Gengos was most recently the President and Chief Executive Officer of Neuraltus Pharmaceuticals, where he led implementation of the company’s clinical, regulatory, fundraising and business development strategies while operating the company on a virtual business model. Previously, he served for more than seven years with Amgen where, as Vice President, Strategy and Corporate Development, he managed Amgen’s worldwide in-and-outbound business development activities, including a broad slate of acquisitions, licensing, spin-outs, divestitures, corporate venture capital investments, which included board of director positions, and alliance management. In addition, he led the execution of strategic projects and supported the long-range planning process for the company. Before joining Amgen, Mr. Gengos was Vice President, Chief Financial Officer, and Chief Business Officer of Dynavax Technologies, where he led the company’s business functions, including finance and accounting, fundraising, budgeting and planning, and business development. Earlier in his career, Mr. Gengos served as Vice President of Strategy at the Chiron Corporation and as Senior Engagement Manager at McKinsey & Company. Mr. Gengos holds an MBA degree from the Anderson School of Management at the University of California, Los Angeles and a BS degree in chemical engineering from the Massachusetts Institute of Technology.

With more than 20 years in the life science industry, Mr. Gengos’ experience includes executive leadership positions in both large and emerging companies, with broad expertise in corporate strategy, business development and transactions, including mergers and acquisitions, financing, operations, commercial planning and healthcare policy.

Richard Chin, M.D.

Dr. Chin was appointed as a director in March 2012. Dr. Chin is a physician with extensive expertise in drug and biologics development. He has overseen multiple investigational new drug applications and new drug applications/biologic license applications, and has authored several textbooks on clinical trial medicine. Currently, Dr. Chin is the CEO of Kindred Bio. From 2008 until 2011, Dr. Chin served as a director and CEO of OneWorld Health, a nonprofit pharmaceutical company largely funded by the Bill and Melinda Gates Foundation. OneWorld Health is engaged in developing drugs for neglected diseases in impoverished countries. From 2006 to 2008, he was the CEO and President of OXiGENE. From 2004 to 2006, Dr. Chin was at Elan Corporation, where he served, among other roles, as Senior Vice President of Global Development. Dr. Chin also held various clinical and scientific roles for Genentech between 1999 and 2004, including Head of Clinical Research for the Biotherapeutics Unit, overseeing approximately half of the clinical programs at Genentech. Dr. Chin began his career at Procter and Gamble Pharmaceuticals, where he served as Associate Medical Director. He received a B.A. in Biology, magna cum laude, from Harvard University and the equivalent of a J.D. with honors from Oxford University in England under a Rhodes Scholarship. Dr. Chin holds a Medical Degree from Harvard Medical School and is licensed to practice medicine in California. He currently serves on the Adjunct Faculty of UCSF Medical School, and serves on the Board of Directors of several biotechnology companies, including Galena Biopharma.

Dr. Chin is highly qualified to serve as a member of the Board because of Dr. Chin’s expertise with drug development, his experience as both an executive and director of drug development companies, and his scientific and academic qualifications.

Helen S. Kim

Ms. Kim has served as a director since August 2011. She has been Chief Business Officer of NGM Pharmaceuticals, Inc., a privately held drug discovery company, since 2009, where she is responsible for all business functions and is active in raising capital. Ms. Kim served as President & Chief Executive Officer of KOSAN Biosciences from 2007 to 2008 where she restructured and repositioned the company prior to the successful sale of the company to Bristol-Myers Squibb. Ms. Kim served as Chief Program Officer for the Gordon and Betty Moore Foundation from 2003 to 2007. Ms. Kim previously held senior positions with Affymax, Inc., Onyx Pharmaceuticals, Inc., Protein Design Labs, Inc., and Chiron Corporation. She currently serves on the board of directors of Sunesis Pharmaceuticals. Ms. Kim received a M.B.A. in Marketing/Finance from the University of Chicago and a B.S. in Chemical and Biomedical Engineering from Northwestern University.

Having spent over twenty years in the biotech industry in various marketing, development and strategy positions, Ms. Kim brings to the Board significant experience and contacts in the pharmaceutical and life sciences industry. She has extensive knowledge in pharmaceutical product development and strategic planning that is directly relevant to the company’s activities.

5

Rahul Singhvi, Sc.D.

Dr. Singhvi has served as a director since June 2010 and as our Lead Director since December 2010. He is the Chief Operating Officer of Takeda Vaccines, Inc. and is responsible for Takeda’s global vaccine operations. Before joining Takeda, Dr. Singhvi was with Novavax, Inc., a biopharmaceutical company focused on developing novel, highly potent recombinant vaccines beginning in 2004 and served as President, Chief Executive Officer and a director of Novavax from August 2005 to April 2011. Dr. Singhvi was the Senior Vice President and Chief Operating Officer of Novavax from April 2005 to August 2005 and Vice President – Pharmaceutical Development and Manufacturing Operations from April 2004 to April 2005. For ten years prior to joining Novavax, Dr. Singhvi served in various positions with Merck & Co., Inc., culminating as Director of the Merck Manufacturing Division, where he helped develop several vaccines, including Zostavax®, the only vaccine on the market to prevent shingles. Dr. Singhvi received his M.S. and Sc.D. degree in Chemical Engineering from the Massachusetts Institute of Technology. He also holds an M.B.A. from the Wharton School.

Dr. Singhvi brings to the Board experience and knowledge in the operation and leadership of early stage public healthcare companies. He also has extensive expertise and experience in the development and manufacturing of vaccines, which may assist the Board in its oversight of our cancer vaccine programs.

Gary S. Titus

Mr. Titus was appointed as a director in December 2012. He has more than 20 years of business experience in the healthcare and biopharmaceutical industries, primarily in senior management roles. He is currently serving as Chief Financial Officer of BioCardia, Inc., a biotechnology company focused on biointerventional solutions for heart failure, chronic myocardial ischemia and acute myocardial infarction. Prior to BioCardia, Mr. Titus served as Senior Vice President and Chief Financial Officer at SciClone Pharmaceuticals, a commercial stage pharmaceutical company focused on Asia. Prior to that, Mr. Titus served as Senior Vice President of Finance and Chief Financial Officer at Kosan Biosciences, which was acquired by Bristol-Myers Squibb, in which transaction he played a significant role. Prior to that, Mr. Titus was Chief Financial Officer and Vice President at Nuvelo, Inc. Earlier in his career, Mr. Titus held a variety of positions with increasing management responsibilities at other companies, including Metabolex, Inc., Intrabiotics Pharmaceuticals, Inc., and Johnson & Johnson’s healthcare division LifeScan, Inc. Mr. Titus earned a Bachelor of Science degree in Accounting from University of South Florida and a Bachelor of Science degree in Finance from University of Florida and is a Certified Public Accountant. He also completed the Global BioExecutive Program at UC Berkeley’s Haas School of Business and is a member of several professional organizations.

Mr. Titus has extensive experience in working with public corporations in a variety of areas, including accounting, financial planning and analysis, SEC reporting, investor relations, business development, and corporate strategy.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE NOMINEES FOR ELECTION AS DIRECTORS.

Board of Directors

Our property, affairs and business are conducted under the supervision and management of our Board of Directors as called for under the laws of Delaware and our Bylaws. Our Board of Directors has established a standing Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee, each member of which is “independent” under the independence standards of both the NYSE MKT and the Securities and Exchange Commission (the “SEC”).

The Board of Directors held five meetings during the 2013 fiscal year. Each director attended at least 75% of the aggregate of the total meetings of the Board and the total number of meetings of all Board committees on which he or she served that were held during the portion of the 2013 fiscal year in which he or she served as a director or served on such committees, as applicable.

Committees of the Board of Directors

Our Board of Directors has established an Audit Committee, which currently consists of Mr. Titus, as Chair and Drs. Chin and Singhvi. Mr. Cowell served on the Audit Committee until his resignation from the Board effective September 30, 2013. The Audit Committee held four meetings during the 2013 fiscal year.

The Audit Committee assists the Board of Directors in fulfilling its oversight responsibilities relating to:

| | • | | the quality and integrity of our financial statements and reports; |

| | • | | the independent registered public accounting firm’s qualifications and independence; and |

| | • | | the performance of our internal audit function and independent registered public accounting firm. |

6

The Audit Committee appoints the independent registered public accounting firm, reviews with that accounting firm the plans and results of the audit engagement, approves permitted non-audit services provided by our independent registered public accounting firm and reviews that firm’s independence. Mr. Titus has been designated as an “audit committee financial expert” as defined under Item 407(d)(5) of Regulation S-K of the Securities Exchange Act of 1934 (the “Exchange Act”).

Our Board of Directors has established a Compensation Committee, which currently consists of Ms. Kim, as Chair and Drs. Chin and Singhvi. Mr. Cowell served on the Compensation Committee until his resignation from the Board effective September 30, 2013. Ms. Kim was appointed to serve on the Compensation Committee on December 6, 2013. The Compensation Committee reviews, and makes recommendations to the full Board of Directors relating to, the compensation of our officers and directors, including our officers’ annual salaries and bonuses and the terms and conditions of option grants to our officers and directors under our 2006 Equity Incentive Plan. The Compensation Committee held eight meetings during the 2013 fiscal year.

Our Board of Directors has established a Finance Committee currently consisting of Mr. Titus, as Chair, Ms. Kim and Dr. Singhvi. The Finance Committee has oversight responsibility for all material financial matters affecting the Company, including capital management, funding strategy and investing activities related to our financial position and financing activities. The Finance Committee held seven meetings during the 2013 fiscal year.

Our Board of Directors has established a Nominating and Corporate Governance Committee, which currently consists of Ms. Kim, as Chair, Dr. Singhvi and Mr. Titus. Mr. Cowell served on the Nominating and Corporate Governance Committee until his resignation from the Board effective September 30, 2013. The Nominating and Corporate Governance Committee develops and recommends corporate governance guidelines to the Board, selects or recommends for selection nominees to serve on the Board, and oversees the evaluation of the Board and its committees. The Nominating and Corporate Governance Committee held three meetings during the 2013 fiscal year.

The Charters of the Audit, Compensation and Nominating and Corporate Governance Committees are available on our website atwww.imuc.com.

Stockholder Recommendations of Director Candidates; Qualifications of Director Nominees

The Nominating and Corporate Governance Committee will consider Board nominees recommended by stockholders. In order for a stockholder to nominate a candidate for director, timely notice of the nomination must be given in writing to us at our principal executive office at 23622 Calabasas Road, Suite 300, Calabasas, California 91302, Attention: Corporate Secretary. To be timely, the notice must be received by us no later than 120 days prior to the date on which the proxy statement for the preceding year’s Annual Meeting of Stockholders was mailed to stockholders. Notice of a nomination must include the proposer’s name, address and number of shares he or she owns; the name, age, business address, residence address and principal occupation of the nominee; and the number of shares beneficially owned by the nominee. It must also include any other information that would be required to be disclosed in the solicitation of proxies for election of directors under the federal securities laws. A stockholder must submit the nominee’s consent to be elected and to serve. The Nominating and Corporate Governance Committee may require any nominee to furnish any other information that may be needed to determine the eligibility and qualifications of the nominee. Any recommendations in proper form received from stockholders will be evaluated in the same manner that potential nominees recommended by our Board members or management are evaluated.

The Nominating and Corporate Governance Committee has not established any specific minimum qualifications for director candidates or any specific qualities or skills that a candidate must possess in order to be considered qualified to be nominated as a director. Qualifications for consideration as a director nominee may vary according to the particular areas of expertise being sought as a complement to the existing Board composition. In making its nominations, our Nominating and Corporate Governance Committee generally will consider, among other things, an individual’s business experience, industry experience, financial background, breadth of knowledge about issues affecting our company, time available for meetings and consultation regarding company matters and other particular skills and experience possessed by the individual. Although the Nominating and Corporate Governance Committee believes that director nominees should add to the range of backgrounds and experiences of the Company’s directors, neither the Committee nor the Board of Directors has a policy regarding the consideration of diversity in identifying and evaluating director nominees.

Board Leadership Structure and Role in Risk Oversight

John S. Yu, M.D. serves as the Chairman of the Board of Directors and Andrew Gengos serves as the Company’s President and Chief Executive Officer. The Board of Directors believes that separating the positions of Chairman of the Board and Chief Executive Officer reinforces the independence of the Board in its oversight of both management and risks facing the Company. In addition, Dr. Rahul Singhvi, who is an independent director, serves as the Company’s Lead Director, providing the Board with further assistance in performing the foregoing obligations.

The full Board of Directors has responsibility for general oversight of risks facing the Company, with reviews of certain areas of risk being conducted by the relevant Board committees, which then provide reports to the full Board. The Board receives reports from management on areas of risk facing the Company and periodically conducts discussions with management regarding the identification, assessment and management of these risks.

7

Stockholder Communication with Board Members

Stockholders who wish to communicate with our Board members may contact us at our principal executive office at 23622 Calabasas Road, Suite 300, Calabasas, California 91302, Attention: Corporate Secretary. Written communications specifically marked as a communication for our Board of Directors, or a particular director, except those that are clearly marketing or soliciting materials, will be forwarded unopened to the Chairman of our Board, or to the particular director to whom they are addressed, or presented to the full Board or the particular director at the next regularly scheduled Board meeting.

Board Members’ Attendance at Annual Meetings

We do not have a specific policy regarding our directors attending our annual stockholders meetings; however, directors are encouraged to attend these meetings. All of our then directors attended our 2013 annual stockholders meeting.

Compensation of Directors

On August 2, 2012, the Board of Directors adopted certain revisions to the compensation program for non-employee directors. The annual cash retainer was increased to $30,000 for serving as a director, the fee for telephonic board meetings lasting more than one hour was increased to $1,500, the fee for committee meetings will be paid to the chair and other members of the committee and invited board members and the fee for committee meetings lasting more than one hour was increased to $1,000. The annual retainers paid to the Chairman of the Board and the Lead Director were increased to $5,500 and the annual retainers paid to the Audit Committee Chairman and the Chairs of the other board committees were increased to $11,000 and $5,500, respectively. The members of the Executive Committee will receive an annual retainer of $5,250 and $750 for committee meetings lasting up to one hour and $1,500 for meetings lasting more than one hour. In addition, seven-year non-qualified stock options to purchase shares of our common stock are to be granted annually on the date of the annual stockholders’ meeting to each non-employee director at an exercise price equal to the last reported trading price of our common stock on that date, with such option to vest quarterly over the four-year period following the date of grant in the following amounts: Chairman of the Board – 50,000 shares, Lead Director – 50,000 shares, board members (other than Chair and Lead) 30,000 shares, Audit Committee Chair – 20,000 shares, Compensation Committee, Finance and Nominating and Corporate Governance Committee Chairs each to receive 10,000 shares, and members of Committees (other than Chairs) to receive 5,000 shares, with all vested options to be exercisable for 24 months after termination for any reason except termination for cause by us.

During the fiscal year ended December 31, 2013, we paid our non-employee directors cash compensation for serving on the Board of Directors and committees of the Board and granted a non-qualified option to purchase shares of common stock to each of our directors for their service as a director for the one-year period commencing September 20, 2013. Each of the options granted to the directors has a term of seven years, has an exercise price of $2.70 per share, vests in equal quarterly installments for four years following the date of grant, and may be exercised within their term during the period the grantee provides services to us and for 24 months after the grantee ceases providing services for any reason other than termination by us for cause. The amounts of the annual grants were: Dr. Richard Chin, 45,000 shares; Helen Kim, 50,000 shares; Dr. Rahul Singhvi, 70,000 shares; Gary Titus, 65,000 shares; and Dr. John Yu, 50,000 shares.

In addition, Mr. Titus received prorated grants totaling 33,287 shares on March 7, 2013 at an exercise price of $2.72 per share, including 21,945 shares for serving on the Board of Directors commencing December 31, 2012 and vesting in equal quarterly installments for four years and 11,342 shares for serving on committees of the Board beginning March 1, 2013 and vesting in equal monthly installments ending September 1, 2016. Both of these grants have a term of seven years and may be exercised within their term during the period Mr. Titus provides services to us and for 24 months after he ceases providing services for any reason other than termination by us for cause.

8

The following table sets forth information concerning the compensation paid to each of our non-employee directors during 2013 for their services rendered as directors. The compensation of Mr. Gengos, who serves as a director and as our President and Chief Executive Officer, is described in the Summary Compensation Table of Executive Officers.

Director Compensation for Fiscal Year 2013

| | | | | | | | | | | | | | | | | | | | |

Name | | Fees

Earned

or Paid

in Cash | | | Stock

Awards | | Option

Awards (1)(7) | | | Non-Equity

Incentive

Plan

Compensation | | Nonqualified

Deferred

Compensation

Earnings | | All

Other

Compensation | | Total | |

Richard Chin, M.D. | | $ | 54,328 | | | | | $ | 82,781 | (2) | | | | | | | | $ | 137,109 | |

Richard A. Cowell(8) | | $ | 46,750 | | | | | $ | — | | | | | | | | | $ | 46,750 | |

Helen S. Kim | | $ | 56,500 | | | | | $ | 91,979 | (3) | | | | | | | | $ | 148,479 | |

Rahul Singhvi, Sc.D. | | $ | 70,073 | | | | | $ | 128,770 | (4) | | | | | | | | $ | 198,843 | |

Gary S. Titus | | $ | 60,193 | | | | | $ | 180,159 | (5) | | | | | | | | $ | 240,352 | |

John S. Yu, M.D. | | $ | 54,500 | | | | | $ | 91,979 | (6) | | | | | | | | $ | 146,479 | |

| (1) | This column represents the aggregate grant date fair value of options awarded computed in accordance with FASB ASC topic 718, excluding the effect of estimated forfeitures related to service-based vesting conditions. For additional information on the valuation assumptions with respect to the option grants, refer to Note 2 of our financial statements. These amounts do not correspond to the actual value that will be recognized by the named directors from these awards. |

| (2) | On September 20, 2013, we granted to Dr. Chin a seven-year non-qualified option to purchase 45,000 shares of our common stock at an exercise price of $2.70 per share that vest quarterly over a period of four years. |

| (3) | On September 20, 2013, we granted to Ms. Kim a seven-year non-qualified option to purchase 50,000 shares of our common stock at an exercise price of $2.70 per share that vest quarterly over a period of four years. |

| (4) | On September 20, 2013, we granted to Dr. Singhvi a seven-year non-qualified option to purchase 70,000 shares of our common stock at an exercise price of $2.70 per share that vest quarterly over a period of four years. |

| (5) | On March 7, 2013, we granted to Mr. Titus a seven-year non-qualified option to purchase 21,945 shares of our common stock at an exercise price of $2.72 per share, vesting quarterly over a period of four years, for serving on the Board of Directors commencing December 31, 2012. Also on March 7, 2013, we granted to Mr. Titus a seven-year non-qualified option to purchase 11,342 shares of our common stock at an exercise price of $2.72 per share, vesting in equal monthly installments ending September 1, 2016, for serving on committees of the Board. Additionally, on September 20, 2013, we granted to Mr. Titus a seven-year non-qualified option to purchase 65,000 shares of our common stock at an exercise price of $2.70 per share that vest quarterly over a period of four years. |

| (6) | On September 20, 2013, we granted to Dr. Yu a seven-year non-qualified option to purchase 50,000 shares of our common stock at an exercise price of $2.70 per share that vest quarterly over a period of four years. |

| (7) | As of December 31, 2013, our non-employee directors held vested and unvested options, which they received as compensation for their services as directors to purchase the following number of shares of our common stock: Dr. Chin – 127,500 shares, Mr. Cowell – 205,000 shares, Ms. Kim – 140,000 shares, Dr. Singhvi – 292,500 shares, Mr. Titus – 98,287 shares and Dr. Yu –331,068 shares. |

| (8) | Mr. Cowell resigned from the Board of Directors effective September 30, 2013. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors, executive officers, and holders of more than 10% of our common stock to file initial reports of ownership and changes in ownership with the SEC. Based on a review of such forms furnished to us and written representations from our executive officers and directors, we believe that during 2013 our directors, executive officers and 10% stockholders complied with all Section 16(a) filing requirements.

9

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information regarding beneficial ownership of our common stock as of April 15, 2014 (a) by each person known by us to own beneficially 5% or more of any class of our common stock, (b) by each of our executive officers named in the Summary Compensation Table and our directors and (c) by all executive officers and directors of this company as a group. As of April 15, 2014, there were 57,565,704 shares of our common stock issued and outstanding. Unless otherwise noted, we believe that all persons named in the table have sole voting and investment power with respect to all the shares beneficially owned by them.

| | | | | | | | |

Name and Address of Beneficial Owner(1) | | Shares

Beneficially

Owned(2) | | | Percent of

Total | |

John S. Yu, M.D. | | | 6,354,960 | (3) | | | 9.96 | % |

Andrew Gengos | | | 302,000 | (4) | | | * | |

Anthony Gringeri, Ph.D. | | | 25,000 | | | | * | |

David Fractor | | | 104,708 | (5) | | | * | |

Richard Chin, M.D. | | | 56,875 | (9) | | | * | |

Helen S. Kim | | | 69,792 | (6) | | | * | |

Rahul Singhvi, Sc.D. | | | 189,375 | (7) | | | * | |

Gary S. Titus | | | 37,033 | (8) | | | * | |

All executive officers and directors as a group (8 persons)(10) | | | 7,149,743 | | | | 11.07 | % |

| (1) | Unless otherwise indicated, the address of each of the persons shown is c/o ImmunoCellular Therapeutics, Ltd., 23622 Calabasas Road, Suite 300, Calabasas, California 91302. |

| (2) | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Shares of common stock subject to options, warrants and convertible securities currently exercisable or convertible, or exercisable or convertible within 60 days of April 15, 2014, are deemed outstanding, including for purposes of computing the percentage ownership of the person holding such option, warrant or convertible security, but not for purposes of computing the percentage of any other holder. |

| (3) | Includes 6,354,960 shares of our common stock underlying stock options that are exercisable within 60 days of April 15, 2014. |

| (4) | Includes 275,000 shares of our common stock underlying stock options that are exercisable within 60 days of April 15, 2014. |

| (5) | Includes 79,708 shares of our common stock underlying stock options that are exercisable within 60 days of April 15, 2014. |

| (6) | Includes 68,125 shares of our common stock underlying stock options that are exercisable within 60 days of April 15, 2014. |

| (7) | Includes 184,375 shares of our common stock underlying stock options that are exercisable within 60 days of April 15, 2014. |

| (8) | Includes 19,033 shares of our common stock underlying stock options that are exercisable within 60 days of April 15, 2014. |

| (9) | All of the shares shown are subject to options. |

| (10) | Includes 7,038,076 shares of our common stock underlying stock options that are exercisable within 60 days of April 15, 2014. |

10

Executive Officers

Our executive officers are Andrew Gengos, age 49, who serves as our President and Chief Executive Officer; Anthony Gringeri, Ph.D., age 60, who serves as our Senior Vice President – Strategic Resources; and David Fractor, age 54, who serves as our Vice President of Finance and Principal Accounting Officer. Information about Mr. Gengos is presented above under “Director Nominees.”

Dr. Gringerihas served as our Senior Vice President – Strategic Resources since August 2013. From 2011 to 2012, Dr. Gringeri served as Vice President and Chief Development Officer of ViaCyte, where he was responsible for all preclinical, clinical and regulatory activities. From 2006 to 2009, Dr. Gringeri served as Chief Operating Officer for Amsterdam Molecular Therapeutics, responsible for corporate strategy and operations, business development, building the company’s commercial capability, and playing a key role in its initial public offering. Prior to that, he worked with Amgen for 15 years in a series of executive leadership roles. He served as Vice President, Product Development, Executive Director, Scientific Operations, Vice President, Scientific Outreach and Licensing Operations, and Vice President, Project Management and Strategic Planning. Dr. Gringeri was the Product Development Team Leader responsible for the successful development and commercialization of ARANESP® (darbepoetin alfa), to treat anemia in patients with kidney failure as well as cancer patients. Dr. Gringeri holds a Ph.D. in pharmacology from the University of Rochester, and has authored multiple scientific publications.

Mr. Fractorhas served as our Treasurer and Chief Financial Officer on a part-time basis since April 2011 and as our Vice President of Finance and Principal Accounting Officer on a part-time basis since March 2013. Since 2003, Mr. Fractor has been a consultant providing financial consulting and strategic planning services, including Sarbanes-Oxley compliance consulting services, to a variety of companies in a variety of industries. From 1999 through 2003, Mr. Fractor was the Chief Financial Officer of HemaCare Corporation, a publicly traded corporation which collects, manufactures, tests and distributes blood products to hospitals and provides blood services to patients in hospital settings on an outsourcing basis. Mr. Fractor received his B.S. in Accounting from the University of Southern California in 1982 and is a certified public accountant and a member of AICPA and the California Society of CPA’s.

Executive Compensation

Compensation Discussion and Analysis

We have adopted a performance-based compensation strategy that is intended to focus our executive officers on the achievement of near-term corporate goals as well as long-term strategic objectives. The goals of our compensation practices include establishing compensation practices and policies designed to facilitate the hiring and retention of long-term employees in order to maintain continuity of focus on the long-term goals of the Company, as well as to foster executive collegiality and teamwork. The Compensation Committee of our Board is responsible for evaluating and administering our compensation programs and practices to ensure that they properly incentivize our work force and appropriately drive corporate performance while remaining competitive with comparable life sciences companies competing in the California labor market. Our Compensation Committee reviews and approves all of our compensation policies, including executive officer salaries and bonuses, and recommends, for approval by our Board, equity incentive compensation. For the year ended December 31, 2013, we have determined that our named executive officers were Andrew Gengos, our President and Chief Executive Officer, John Yu, MD, our Chief Scientific Officer, Anthony Gringeri, our Senior Vice President – Strategic Resources, David Fractor, our Vice President, Finance and Principal Accounting Officer, and James Bender, our former Vice President – Product Development and Manufacturing.

Objectives of our Executive Compensation Programs

Our compensation programs for our named executive officers are designed to achieve the following objectives:

| | • | | attract, engage and retain exceptionally talented and highly experienced executive officers in the competitive and dynamic life sciences industry; |

| | • | | motivate and reward executive officers whose knowledge, skills and performance contribute to our success; |

| | • | | encourage and inspire our executive officers to achieve key corporate strategic objectives by linking incentive award opportunities to the achievement of individual and company-wide short-term and long-term goals; and |

| | • | | align the interests of our executives and stockholders by motivating executive officers to increase stockholder value and rewarding executive officers when stockholder value increases. |

We do not believe that our compensation policies and practices, for either our executive or our non-executive employees, are reasonably likely to give rise to risks that would have a material adverse effect on the Company.

11

Our Executive Compensation Programs

The components of our executive compensation program consist primarily of base salary, annual cash incentive bonuses, equity awards, broad-based benefits programs and severance compensation. We use an array of short-term compensation components (such as base salaries and cash incentive bonuses) and long-term compensation components (such as equity incentive compensation) to provide an overall compensation structure that is designed to both attract and retain key executives as well as provide incentives for the achievement of short- and long-term corporate goals and objectives. Our Compensation Committee uses its judgment and experience along with the recommendations of our Chief Executive Officer (other than in connection with his own compensation) to determine the appropriate mix of long-term and short-term compensation elements for each executive officer. Our Compensation Committee analyzes each of the primary elements of our compensation program to ensure that our executive officers’ overall compensation is competitive with executive officers with similar positions at comparable life sciences companies in the California labor market based on the recommendations of our Chief Executive Officer, analysis and input from our compensation consultant, Mary Ann Rafferty, an experienced sole practitioner who advises on life sciences compensation matters, and our Committee’s and other members of the Board’s experience and knowledge within the life sciences industry. Additionally, upon the recommendation of our Compensation Committee, our Board also approves specific performance goals and metrics applicable to performance-based compensation for our executive officers and approves stock option grants. Consistent with the objectives of our compensation program, the Compensation Committee applies the elements of our compensation program to position compensation to our named executive officers as a group competitively with respect to comparable life sciences companies while individualizing compensation elements for each executive officer in light of his respective performance, responsibilities, experience in the position and his or her potential contributions to our future growth. Accordingly, we have in the past and may in the future provide our Chief Executive Officer or other executive officers with compensation awards that may be significantly different from other executive officers.

Our Compensation Committee has adopted a pay-for-performance compensation philosophy and works within the general framework of this philosophy to determine each component of an executive officer’s compensation package based on numerous factors, including:

| | • | | performance, including achievement of goals and objectives, and other expectations for the position and the individual; |

| | • | | the individual’s particular background and relevant expertise, including training and prior relevant work experience; |

| | • | | the individual’s role with us and the compensation paid to similar officers at other life sciences companies with which our Compensation Committee members are familiar; |

| | • | | the demand and competition for the position in the marketplace; |

| | • | | comparison to other executive officers within our Company having similar levels of expertise and experience; and |

| | • | | the recommendations of our Chief Executive Officer (other than in connection with his own compensation). |

Each of the primary elements of our executive compensation program is discussed in more detail below. While we have identified particular compensation objectives that each element of executive compensation serves, our compensation programs are designed to be flexible and complementary and collectively serve all of our executive compensation objectives described above. Accordingly, whether or not specifically mentioned below, we believe that, as a part of our overall executive compensation policy, each individual element serves each of our objectives.

On an annual basis our Compensation Committee meets to review the performance of our Chief Executive Officer and our other executive officers. At these meetings, the Compensation Committee typically invites our Chief Executive Officer to participate in the discussion (excluding the Chief Executive Officer when the discussion pertains to the Chief Executive Officer) and the Compensation Committee seeks our Chief Executive Officer’s input on progress against specific company-wide and individual performance goals and the overall performance of each of our executive officers. In addition, periodically throughout the year, our Compensation Committee meets to review and decide compensation matters. At our Board meetings, the Compensation Committee reports its findings and decisions. From time to time, the Compensation Committee seeks additional input from the other non-employee directors who are not members of the Compensation Committee. Consistent with its charter, the Compensation Committee determines whether to approve compensation decisions within its authority or to recommend approval by the Board.

Our Compensation Committee engaged Mary Ann Rafferty as a consultant to assist us in obtaining and analyzing compensation data that would be relevant for our executive compensation program. The analysis included the review of executive base salary, bonus and equity compensation against peer companies chosen by the Compensation Committee Chair along with the Chief Executive Officer. Our peer group of companies included Celldex Therapeutics, Inc.; Northwest Biotherapeutics, Inc.; Agenus Inc.; Advaxis, Inc.; Anthera Pharmaceuticals Inc.; Cytokinetics, Incorporated and StemCells, Inc. Comparative data was utilized from Top 5 Data Services’ Executive Pay in the Biopharmaceutical Industry, a comprehensive industry recognized executive compensation report that included a meaningful representation of industry peers, including the Company. In addition, the Compensation Committee

12

relied on their own experience as investors and board members in similarly situated life science companies, sought the input of the Chief Executive Officer and our consultant, reviewed and compared the relative salaries of our executive officers and also considered the amount of equity each executive then held, including the vesting schedules for each executive officer’s equity incentive plan holdings.

In July 2013, the Compensation Committee analyzed whether the work of Ms. Rafferty as a compensation consultant has raised any conflict of interest, taking into consideration the following factors: (i) Ms. Rafferty does not provide any other services to our company; (ii) fees from our company paid to Ms. Rafferty represent less than one percent of Ms. Rafferty’s firm’s total revenue; (iii) Ms. Rafferty’s policies and procedures that are designed to prevent conflicts of interest; (iv) the absence of any material business or personal relationship of Ms. Rafferty or the individual compensation advisors employed by the firm with any executive officer of our company; (v) the absence of any material business or personal relationship of Ms. Rafferty with any member of the Compensation Committee; and (vi) Ms. Rafferty does not own any stock of our company. The Compensation Committee determined, based on its analysis of the above factors, that the work of Ms. Rafferty has not created any conflict of interest and the Compensation Committee is satisfied with the independence of Ms. Rafferty. Going forward, the Compensation Committee intends to assess the independence of any of our compensation advisers by reference to the foregoing factors, consistent with applicable NYSE MKT listing standards.

Based on the judgment and experience of its members and the input and analysis provided by our consultant and the Chief Executive Officer (except with regard to his own compensation), the Compensation Committee decided that the total 2013 compensation for our Chief Executive Officer and other executive officers should be targeted with a general target of the 50th percentile, other than cases where the existing compensation for that individual exceeded the 50th percentile at the time of review, of compensation for executives holding similar positions in our peer group of companies, with equity compensation targeted at market ownership in the Company of 0.75% to 1.0%. In determining an executive officer’s award, the Compensation Committee examined market benchmark equity compensation data provided by our consultant.

Annual Cash Compensation

Base Salary

Base salaries are set at levels that are intended to be competitive with those of executives holding similar positions at companies in our peer group, according to peer group salary data provided by our compensation consultant. The base salaries of all executive officers are reviewed annually and adjusted to reflect individual roles, performance and competitive compensation levels. We may also increase the base salary of an executive officer at other times if a change in the scope of the executive officer’s responsibilities justifies such consideration or, in limited circumstances, to maintain salary equity within our competitive environment. We also evaluate general economic conditions and our cash position in determining base salaries. We believe that a competitive base salary is a necessary element of any compensation program designed to attract and retain talented and experienced executives. We also believe that competitive base salaries can retain, motivate and reward executive officers for their overall performance. Mr. Fractor became a part time employee of the Company on January 1, 2013 and his annual base salary was $150,000. Our Compensation Committee decided to significantly adjust the salary of Dr. Yu to reflect an increase in his time commitment to the Company retroactive to March 1, 2013. Our Compensation Committee also set Dr. Gringeri’s base salary effective August 19, 2013.

Cash Incentive Bonuses

Our annual compensation program includes a cash incentive bonus plan with pre-defined target payouts as a percentage of salary based on achievement of company and individual goals. Additionally, our Compensation Committee uses its discretion to determine bonuses for our executive officers based on the overall attainment of individual and/or corporate goals. Our bonus plan is designed to drive stockholder value by fostering teamwork throughout our Company by tying incentive compensation to the company-wide performance measures that we believe are most important to the success of our Company as well as to individual performance. An executive officer’s bonus payment is based on the achievement of both corporate and/or individual goals, which may include, for example, research, development, operational and financial goals. The relative weighting of each goal in determining the total bonus is approved each year by the Compensation Committee and may also be approved by our Board. Underachievement or overachievement of the major corporate goals may result in lower or higher bonus payments. Our Board or our Compensation Committee approves corporate and individual executive goals at what they believe are aggressive levels so as to require substantial effort and commitment by our executive officers to attain the goals, with the belief that such efforts will significantly contribute to increased stockholder value. Our Compensation Committee uses its discretion to adjust the amount of the cash bonuses paid and the weightings of each of the goals, and may also, in its discretion, award bonuses to executive officers based upon such other terms and conditions as they may determine are appropriate. In 2013, the target amount for the performance-based cash bonus was $160,000 for Mr. Gengos, $40,705 for Dr. Yu, $34,875 for Dr. Gringeri, $31,467 for Mr. Fractor, and $38,728 for Dr. Bender. These target amounts were determined by our Compensation Committee, and recommended to and approved by our Board, based in part on our consultant’s analysis and benchmarking of our executives’ cash compensation against the total cash compensation for executives in similar positions at companies in our peer group. In addition, our Compensation Committee and our Board relied on their members’ experience in the life sciences industry in establishing this target amount. The Board approved a set of corporate goals and assigned

13

weightings ranging from 10% to 40% for the achievement of each objective. The primary factor in establishing the weightings was their level of importance to our business, with the expectation that a majority of the goals were achievable with appropriate and diligent effort by our executive team and that achievement of all of the goals would represent extraordinary performance on their part. Specifically, the Compensation Committee believes that it would be a stretch for the executives to achieve the 100% target level of the Company goals.

The 2013 corporate goals, their target weightings and the achievement level for each, were as follows:

| | • | | ensure the Company has access to adequate financing at a favorable cost (20% weighting); |

| | • | | position ourselves with major pharmaceutical industry companies as an attractive potential partner on ICT-107 (10% weighting); |

| | • | | create and implement a risk mitigation plan (45% weighting); and |

| | • | | continue to execute quickly and efficiently with high quality results (25% weighting); |

In November 2013, the Compensation Committee evaluated the achievement of the corporate performance goals for 2013. While each corporate goal was initially assigned a weighting for purposes of determining the amount of executive officer bonuses, the Compensation Committee, in its discretion, evaluated the achievement of the goals in the context of our overall business and determined that for goals that were either fully or partially achieved, we achieved a combined total of 76% of our stated corporate goals, based on the target weightings as set forth above. Based on the Compensation Committee’s recommendation that our overall achievement of our 2013 corporate goals was at 76% of target, the following cash incentive bonus amounts for 2013 were approved by our Board: $127,680 for Mr. Gengos, $30,936 for Dr. Yu, $26,237 for Dr. Gringeri and $23,750 for Mr. Fractor. Dr. Bender resigned effective January 3, 2014 and his cash incentive bonus for 2013 was forfeited. The cash incentive bonuses for the achievement of the corporate goals are paid annually to each executive officer.

Equity Incentive Compensation

We believe that our long-term performance is best facilitated through a culture of executive ownership that aligns the executive officers’ interests with the interests of our stockholders. To encourage this ownership culture, we typically make an initial grant of stock options to new employees and have made awards of additional stock options from time to time. Our Compensation Committee is authorized to determine and approve or recommend to the Board option grants to all our employees including our executive officers. These grants have an exercise price that is not less than the fair market value of our common stock on the grant date. The size of the stock option award is determined based on the executive officer’s position with us and takes into account the executive officer’s performance, as well as base salary and other compensation. The Compensation Committee also examines market benchmark data provided by our compensation consultant and considers the grant and compensation practices of our peer group companies and other life sciences companies with which our Compensation Committee members are familiar. The stock option awards are intended to provide the executive officer with an incentive to build value in the organization over an extended period of time.

Consistent with the above criteria, upon the recommendation of the Compensation Committee, our Board approved grants of equity incentive awards to our executive officers for 2013. These equity incentive awards were determined by the Compensation Committee. In determining the size of the award for each named executive officer, our Chief Executive Officer and Compensation Committee considered such named executive officer’s relative job scope and responsibilities, individual performance history, prior contributions to us and importance to achievement of our upcoming objectives, as well as the size of the officer’s prior equity grants (including how much of the equity was vested) and our Compensation Committee members’ experience with the practices of other life sciences companies and executive compensation data for our peer group companies. For more information regarding the grants for 2013, see the “Summary Compensation Table” and “Stock Option Grants.”

In March 2013, we granted a seven-year option to purchase 64,000 shares of our common stock at an exercise price of $2.72 to Mr. Fractor for his continued service as our principal finance executive, with such option to vest as to 15,000 shares one year after grant, and the remaining shares to vest thereafter in 36 equal monthly installments following the first anniversary of the grant date.

Also in March 2013, we granted a seven-year option to purchase 80,000 shares of our common stock at an exercise price of $2.72 per share to Dr. Bender for his continued service as our Vice President – Product Development and Manufacturing, with such option to vest in 48 equal monthly installments over four years following March 1, 2013.

In June 2013, we granted a five-year option to purchase 45,000 shares of our common stock at an exercise price of $2.19 per share to Dr. Yu for his continued service as our Chief Scientific Officer, with such option to vest in 48 equal monthly installments over four years following March 1, 2013.

14

In September 2013, in connection with his hiring, we granted a ten-year option to purchase 300,000 shares of our common stock at an exercise price of $2.70 to Dr. Gringeri for his service as our Senior Vice President—Strategic Resources, with such option to vest as to 75,000 shares one year after grant, and the remaining shares to vest thereafter in 36 equal monthly installments following the first anniversary of the grant date.

Severance Compensation

In connection with certain terminations of employment, certain of our named executive officers may be entitled to receive severance payments and benefits pursuant to their respective employment agreements that provide alternative severance payments and benefits in the event the officer is terminated without cause or resigns with good reason from 90 days prior to or 12 months following certain corporate transactions. We entered into these agreements to retain and motivate our officers and minimize management distraction created by uncertain job security surrounding potential beneficial transactions. The agreements also provide alternative severance payments and benefits in the event that the officer is terminated without cause or resigns for good reason in the absence of such corporate transactions, and we believe that these benefits provide some degree of certainty and reduce distractions created by concerns about job security generally. The Compensation Committee approved different durations of severance benefits for different levels of our senior management based on the Compensation Committee members’ experience with other life sciences companies. These severance benefits are described more fully in “Compensation Discussion and Analysis—Change of Control and Severance Agreements.” In setting the terms of and determining whether to approve such arrangements, our Compensation Committee recognized that executives often face challenges securing new employment following termination. The severance payments and benefits are typically composed of cash payments and continued health care coverage for a limited period of time.

Other Compensation

All of our executive officers are eligible to participate in benefit plans and arrangements offered to employees generally, including health, dental and 401(k) plans. Consistent with our compensation philosophy, we intend to continue to maintain our current benefits for our executive officers. Our Compensation Committee in its discretion may revise, amend or add to any executive officer’s benefits and perquisites as it deems advisable. We do not believe it is necessary for the attraction or retention of management talent to provide our executive officers with a substantial amount of compensation in the form of perquisites.

Tax and Accounting Considerations

Section 162(m) of the Internal Revenue Code generally disallows a tax deduction for compensation in excess of $1.0 million paid to our Chief Executive Officer and our three other most highly paid executive officers other than our Chief Financial Officer. Qualifying performance-based compensation is not subject to the deduction limitation if specified requirements are met. We generally intend to structure the performance-based portion of our executive compensation, when feasible, to comply with exemptions in Section 162(m) so that the compensation remains tax deductible to us. However, our Board may, in its judgment, authorize compensation payments that do not comply with the exemptions in Section 162(m) when it believes that such payments are appropriate to attract and retain executive talent.

Also, the Compensation Committee takes into account whether components of our compensation program may be subject to the penalty tax associated with Section 409A of the Code, and aims to structure the elements of compensation to be compliant with or exempt from Section 409A to avoid such potential adverse tax consequences.

We account for equity compensation paid to our employees under ASC Topic 718, which requires us to estimate and record an expense over the employee’s requisite service period for each award. Our cash compensation is recorded as an expense at the time the obligation is accrued.

15

Compensation Committee Report on Executive Compensation