| | |

| UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | |

| Investment Company Act file number: | (811–05346) |

| | |

| Exact name of registrant as specified in charter: | Putnam Variable Trust |

| | |

| Address of principal executive offices: | 100 Federal Street, Boston, Massachusetts 02110 |

| | |

| Name and address of agent for service: | Robert T. Burns, Vice President

100 Federal Street

Boston, Massachusetts 02110 |

| | |

| Copy to: | Bryan Chegwidden, Esq.

Ropes & Gray LLP

1211 Avenue of the Americas

New York, New York 10036 |

| | |

| Registrant's telephone number, including area code: | (617) 292–1000 |

| | |

| Date of fiscal year end: | December 31, 2019 |

| | |

| Date of reporting period: | January 1, 2019 — June 30, 2019 |

| | |

|

Item 1. Report to Stockholders: | |

| | |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: | |

IMPORTANT NOTICE: Delivery of paper fund reports

In accordance with regulations adopted by the Securities and Exchange Commission, beginning on or after January 1, 2021, at the election of your insurance provider, you may not receive paper reports like this one in the mail from the insurance provider that offers your variable annuity contract or variable life insurance policy unless you specifically request it. Instead, they will be available on a website, and your insurance provider will notify you by mail whenever a new one is available, and provide you with a website link to access the report.

If you wish to continue to receive paper reports free of charge after January 1, 2021, please contact your insurance provider.

If you already receive these reports electronically, no action is required.

Message from the Trustees

August 9, 2019

Dear Shareholder:

If there is any lesson to be learned from constantly changing financial markets, it is the importance of positioning your investment portfolio for your long-term goals. We believe that one strategy is to diversify across different asset classes and investment approaches.

We also believe your mutual fund investment offers a number of advantages, including constant monitoring by experienced investment professionals who maintain a long-term perspective. Putnam’s portfolio managers and analysts take a research-intensive approach that includes risk management strategies designed to serve you through changing conditions.

Another key strategy, in our view, is seeking the counsel of a financial advisor. For over 80 years, Putnam has recognized the importance of professional investment advice. Your financial advisor can help in many ways, including defining and planning for goals such as retirement, evaluating the level of risk appropriate for you, and reviewing your investments on a regular basis and making adjustments as necessary.

As always, your fund’s Board of Trustees remains committed to protecting the interests of Putnam shareholders like you, and we thank you for investing with Putnam.

The views expressed in this report are exclusively those of Putnam Management and are subject to change. They are not meant as investment advice. Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future.

Consider these risks before investing:Emerging-market securities carry illiquidity and volatility risks. Lower-rated bonds may offer higher yields in return for more risk. Funds that invest in government securities are not guaranteed. Mortgage-backed investments, unlike traditional debt investments, are subject to prepayment risk, which means that they may increase in value less than other bonds when interest rates decline and decline in value more than other bonds when interest rates rise. Bond investments are subject to interest-rate risk (the risk of bond prices falling if interest rates rise) and credit risk (the risk of an issuer defaulting on interest or principal payments). Interest-rate risk is generally greater for longer-term bonds, and credit risk is generally greater for below-investment-grade bonds. Risks associated with derivatives include increased investment exposure (which may be considered leverage) and, in the case of over-the-counter instruments, the potential inability to terminate or sell derivatives positions and the potential failure of the other party to the instrument to meet its obligations. Unlike bonds, funds that invest in bonds have fees and expenses. The value of investments in the fund’s portfolio may fall or fail to rise over extended periods of time for a variety of reasons, including general economic, political, or financial market conditions; investor sentiment and market perceptions; government actions; geopolitical events or changes; and factors related to a specific issuer, geography, industry, or sector. International investing involves currency, economic, and political risks. These and other factors may lead to increased volatility and reduced liquidity in the fund’s portfolio holdings. You can lose money by investing in the fund.

Performance summary(as of 6/30/19)

Investment objective

As high a level of current income as Putnam Investment Management, LLC, (Putnam Management) believes is consistent with preservation of capital

Net asset valueJune 30, 2019

| |

| Class IA: $6.00 | Class IB: $6.02 |

Total return at net asset value

| | | |

| | | | | ICE BofAML |

| | | | | U.S. Treasury |

| (as of 6/30/19) | Class IA shares* | Class IB shares† | | Bill Index |

| 6 months | 6.92% | 6.79% | 1.30% |

| 1 year | 3.37 | 3.08 | 2.39 |

| 5 years | 14.37 | 13.07 | 4.53 |

| Annualized | 2.72 | 2.49 | 0.89 |

| 10 years | 95.97 | 91.90 | 5.31 |

| Annualized | 6.96 | 6.74 | 0.52 |

| Life | 283.16 | 266.26 | 93.41 |

| Annualized | 5.35 | 5.16 | 2.59 |

For a portion of the periods, the fund had expense limitations, without which returns would have been lower.

* Class inception date: September 15, 1993.

† Class inception date: April 6, 1998.

The ICE BofAML (Intercontinental Exchange Bank of America Merrill Lynch) U.S. Treasury Bill Index is an unmanaged index that tracks the performance of U.S.-dollar-denominated U.S. Treasury bills publicly issued in the U.S. domestic market. Qualifying securities must have a remaining term of at least one month to final maturity and a minimum amount outstanding of $1 billion.

ICE Data Indices, LLC (“ICE BofAML”), used with permission. ICE BofAML permits use of the ICE BofAML indices and related data on an “as is” basis; makes no warranties regarding same; does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofAML indices or any data included in, related to, or derived therefrom; assumes no liability in connection with the use of the foregoing; and does not sponsor, endorse, or recommend Putnam Investments, or any of its products or services.

Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. All total return figures are at net asset value and exclude contract charges and expenses, which are added to the variable annuity contracts to determine total return at unit value. Had these charges and expenses been reflected, performance would have been lower. Performance of class IB shares before their inception is derived from the historical performance of class IA shares, adjusted to reflect the higher operating expenses applicable to such shares. For more recent performance, contact your variable annuity provider who can provide you with performance that reflects the charges and expenses at your contract level.

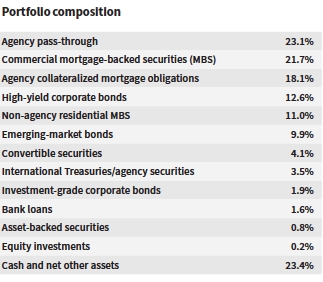

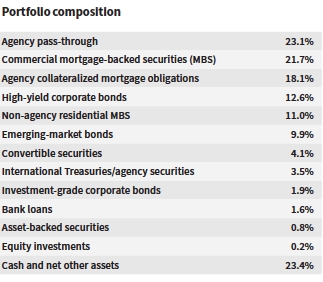

Allocations are shown as a percentage of the fund’s net assets. Cash and net other assets, if any, represent the market value weights of cash, derivatives, short-term securities, and other unclassified assets in the portfolio. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities, any interest accruals, the use of different classifications of securities for presentation purposes, and rounding. Allocations may not total 100% because the table includes the notional value of certain derivatives (the economic value for purposes of calculating periodic payment obligations), in addition to the market value of securities. Holdings and allocations may vary over time.

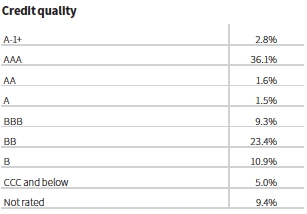

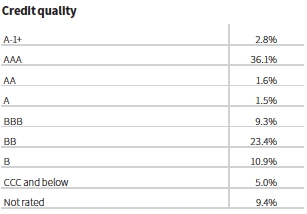

Credit qualities are shown as a percentage of net assets. A bond rated BBB or higher (A-3 or higher, for short-term debt) is considered investment grade. This chart reflects the highest security rating provided by one or more of Standard & Poor’s, Moody’s, and Fitch. To-be-announced (TBA) mortgage commitments, if any, are included based on their issuer ratings. Ratings may vary over time.

Cash, derivative instruments, and net other assets are shown in the not-rated category. Payables and receivables for TBA mortgage commitments are included in the not-rated category and may result in negative weights. The fund itself has not been rated by an independent rating agency.

| |

| Putnam VT Diversified Income Fund1 |

Understanding your fund’s expenses

As an investor in a variable annuity product that invests in a registered investment company, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, which are not shown in this section and would result in higher total expenses. Charges and expenses at the insurance company separate account level are not reflected. For more information, see your fund’s prospectus or talk to your financial representative.

Review your fund’s expenses

The two left-hand columns of the Expenses per $1,000 table show the expenses you would have paid on a $1,000 investment in your fund from 1/1/19 to 6/30/19. They also show how much a $1,000 investment would be worth at the close of the period,assuming actual returns and expenses. To estimate the ongoing expenses you paid over the period, divide your account value by $1,000, then multiply the result by the number in the first line for the class of shares you own.

Compare your fund’s expenses with those of other funds

The two right-hand columns of the Expenses per $1,000 table show your fund’s expenses based on a $1,000 investment,assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All shareholder reports of mutual funds and funds serving as variable annuity vehicles will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

Expense ratios

| | |

| | Class IA | Class IB |

| Total annual operating expenses for the fiscal | | |

| year ended 12/31/18 | 0.81% | 1.06% |

| Annualized expense ratio for the six-month | | |

| period ended 6/30/19 | 0.79% | 1.04% |

Fiscal-year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report.

Expenses are shown as a percentage of average net assets.

Expenses per $1,000

| | | | |

| | | | Expenses and value for a |

| | Expenses and value for a | $1,000 investment, assuming |

| | $1,000 investment, assuming | a hypothetical 5% annualized |

| | actual returns for the | return for the 6 months |

| | 6 months ended 6/30/19 | ended 6/30/19 | |

| | Class IA | Class IB | Class IA | Class IB |

| Expenses paid | | | | |

| per $1,000*† | $4.05 | $5.33 | $3.96 | $5.21 |

| Ending value | | | | |

| (after | | | | |

| expenses) | $1,069.20 | $1,067.90 | $1,020.88 | $1,019.64 |

*Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 6/30/19. The expense ratio may differ for each share class.

†Expenses based on actual returns are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year. Expenses based on a hypothetical 5% return are calculated by multiplying the expense ratio by the average account value for the six-month period; then multiplying the result by the number of days in the six-month period; and then dividing that result by the number of days in the year.

| |

| 2Putnam VT Diversified Income Fund |

ABOUT DERIVATIVES

Derivatives are an increasingly common type of investment instrument, the performance of which isderivedfrom an underlying security, index, currency, or other area of the capital markets. Derivatives employed by the fund’s managers generally serve one of two main purposes: to implement a strategy that may be difficult or more expensive to invest in through traditional securities, or to hedge unwanted risk associated with a particular position.

For example, the fund’s managers might use currency forward contracts to capitalize on an anticipated change in exchange rates between two currencies. This approach would require a significantly smaller outlay of capital than purchasing traditional bonds denominated in the underlying currencies. In another example, the managers may identify a bond that they believe is undervalued relative to its risk of default, but may seek to reduce the interest-rate risk of that bond by using interest-rate swaps, a derivative through which two parties “swap” payments based on the movement of certain rates. In other examples, the managers may use options and futures contracts to hedge against a variety of risks by establishing a combination of long and short exposures to specific equity markets or sectors.

Like any other investment, derivatives may not appreciate in value and may lose money. Derivatives may amplify traditional investment risks through the creation of leverage and may be less liquid than traditional securities. And because derivatives typically represent contractual agreements between two financial institutions, derivatives entail “counterparty risk,” which is the risk that the other party is unable or unwilling to pay. Putnam monitors the counterparty risks we assume. For example, Putnam often enters into collateral agreements that require the counterparties to post collateral on a regular basis to cover their obligations to the fund. Counterparty risk for exchange-traded futures and centrally cleared swaps is mitigated by the daily exchange of margin and other safeguards against default through their respective clearinghouses.

| |

| Putnam VT Diversified Income Fund3 |

The fund’s portfolio6/30/19 (Unaudited)

| | | |

| U.S. GOVERNMENT AND AGENCY | | | |

| MORTGAGE OBLIGATIONS (69.4%)* | Principal amount | Value |

| | |

| U.S. Government Guaranteed Mortgage Obligations (5.1%) | |

| Government National Mortgage Association | | | |

| Pass-Through Certificates | | | |

| 5.50%, 5/20/49 | | $38,950 | $42,439 |

| 5.00%, with due dates from 5/20/49 to 6/20/49## | 550,818 | 587,040 |

| 4.50%, TBA, 7/1/49 | | 6,000,000 | 6,254,531 |

| 4.50%, with due dates from 5/20/49 to 6/20/49## | 594,508 | 630,411 |

| 4.00%, TBA, 7/1/49 | | 3,000,000 | 3,110,156 |

| | | | 10,624,577 |

| U.S. Government Agency Mortgage Obligations (64.3%) | |

| Federal National Mortgage Association | | | |

| Pass-Through Certificates | | | |

| 5.00%, 5/1/19 | | 74,904 | 80,755 |

| 4.50%, 5/1/49 | | 59,925 | 63,711 |

| 3.33%, 7/1/20i | | 247,709 | 249,275 |

| Uniform Mortgage-Backed Securities | | | |

| 5.50%, TBA, 8/1/49 | | 3,000,000 | 3,200,391 |

| 5.50%, TBA, 7/1/49 | | 3,000,000 | 3,198,750 |

| 4.50%, TBA, 7/1/49 | | 3,000,000 | 3,134,766 |

| 4.00%, TBA, 8/1/49 | 11,000,000 | 11,368,672 |

| 4.00%, TBA, 7/1/49 | 18,000,000 | 18,603,281 |

| 3.50%, TBA, 8/1/49 | 27,000,000 | 27,598,007 |

| 3.50%, TBA, 7/1/49 | 27,000,000 | 27,605,391 |

| 3.00%, TBA, 7/1/49 | 22,000,000 | 22,187,343 |

| 2.50%, TBA, 8/1/49 | | 8,000,000 | 7,933,750 |

| 2.50%, TBA, 7/1/49 | | 8,000,000 | 7,945,000 |

| | | | 133,169,092 |

| Total U.S. government and agency mortgage | | |

| obligations (cost $143,413,141) | | | $143,793,669 |

| | |

| U.S. TREASURY OBLIGATIONS (0.3%)* | Principal amount | Value |

| | | |

| U.S. Treasury Notes | | |

| 1.75%, 1/31/23i | $365,000 | $367,913 |

| 1.125%, 2/28/21i | 155,000 | 153,836 |

| Total U.S. treasury obligations (cost $521,749) | $521,749 |

| | |

| MORTGAGE-BACKED SECURITIES (37.2%)* | Principal amount | Value |

| | |

| Agency collateralized mortgage obligations (17.3%) | |

| Federal Home Loan Mortgage Corporation | | |

| IFB Ser. 3408, Class EK, ((-4.024 x 1 Month US | |

| LIBOR) + 25.79%), 16.159%, 4/15/37 | $25,488 | $40,573 |

| IFB Ser. 3072, Class SM, ((-3.667 x 1 Month US | |

| LIBOR) + 23.80%), 15.018%, 11/15/35 | 74,215 | 114,589 |

| IFB Ser. 3249, Class PS, ((-3.3 x 1 Month US | |

| LIBOR) + 22.28%), 14.374%, 12/15/36 | 49,286 | 69,396 |

| IFB Ser. 3065, Class DC, ((-3 x 1 Month US LIBOR) | |

| + 19.86%), 12.677%, 3/15/35 | 157,253 | 206,189 |

| Structured Agency Credit Risk Debt FRN | | |

| Ser. 16-HQA2, Class M3, (1 Month US LIBOR | |

| + 5.15%), 7.554%, 11/25/28 | 590,000 | 660,403 |

| Ser. 4077, Class IK, IO, 5.00%, 7/15/42 | 1,150,508 | 179,544 |

| Ser. 4122, Class TI, IO, 4.50%, 10/15/42 | 1,054,132 | 180,266 |

| Ser. 4000, Class PI, IO, 4.50%, 1/15/42 | 502,695 | 78,281 |

| Ser. 4024, Class PI, IO, 4.50%, 12/15/41 | 1,097,990 | 158,093 |

| Ser. 4546, Class TI, IO, 4.00%, 12/15/45 | 792,861 | 111,992 |

| Ser. 4530, Class TI, IO, 4.00%, 11/15/45 | 1,162,383 | 177,942 |

| Ser. 4425, IO, 4.00%, 1/15/45 | 3,000,274 | 459,282 |

| Ser. 4452, Class QI, IO, 4.00%, 11/15/44 | 1,750,991 | 359,247 |

| Ser. 4403, Class CI, IO, 4.00%, 10/15/44 | 856,473 | 134,895 |

| Ser. 4000, Class LI, IO, 4.00%, 2/15/42 | 1,282,866 | 146,478 |

| | | |

| MORTGAGE-BACKED | | | |

| SECURITIES (37.2%)*cont. | Principal amount | Value |

| | |

| Agency collateralized mortgage obligationscont. | |

| Federal Home Loan Mortgage Corporation | | |

| IFB Ser. 4678, Class MS, IO, ((-1 x 1 Month US | | |

| LIBOR) + 6.10%), 3.706%, 4/15/47 | | $1,039,108 | $215,408 |

| Ser. 4604, Class QI, IO, 3.50%, 7/15/46 | 3,083,030 | 421,358 |

| Ser. 4580, Class ID, IO, 3.50%, 8/15/45 | 2,535,480 | 285,452 |

| Ser. 4105, Class HI, IO, 3.50%, 7/15/41 | 837,459 | 69,204 |

| Ser. 304, Class C37, IO, 3.50%, 12/15/27 | 843,358 | 66,065 |

| Ser. 4210, Class PI, IO, 3.00%, 12/15/41 | 1,120,856 | 50,349 |

| FRB Ser. 57, Class 1AX, IO, 0.374%, 7/25/43W | 896,022 | 8,960 |

| Ser. 3300, PO, zero %, 2/15/37 | | 16,267 | 14,246 |

| Ser. 3326, Class WF, zero %, 10/15/35W | 756 | 609 |

| Federal National Mortgage Association | | | |

| IFB Ser. 06-62, Class PS, ((-6 x 1 Month US | | |

| LIBOR) + 39.90%), 25.474%, 7/25/36 | | 30,839 | 53,695 |

| IFB Ser. 06-8, Class HP, ((-3.667 x 1 Month US | | |

| LIBOR) + 24.57%), 15.751%, 3/25/36 | | 104,153 | 167,669 |

| IFB Ser. 07-53, Class SP, ((-3.667 x 1 Month US | | |

| LIBOR) + 24.20%), 15.384%, 6/25/37 | | 69,920 | 106,561 |

| IFB Ser. 05-122, Class SE, ((-3.5 x 1 Month US | | |

| LIBOR) + 23.10%), 14.685%, 11/25/35 | 73,641 | 98,621 |

| IFB Ser. 08-24, Class SP, ((-3.667 x 1 Month US | | |

| LIBOR) + 23.28%), 14.467%, 2/25/38 | | 61,939 | 80,833 |

| IFB Ser. 05-83, Class QP, ((-2.6 x 1 Month US | | |

| LIBOR) + 17.39%), 11.143%, 11/25/34 | | 60,550 | 70,916 |

| Connecticut Avenue Securities FRB Ser. 15-C03, | | |

| Class 2M2, (1 Month US LIBOR + 5.00%), 7.404%, | | |

| 7/25/25 | | 151,074 | 161,458 |

| Connecticut Avenue Securities FRB Ser. 15-C02, | | |

| Class 2M2, (1 Month US LIBOR + 4.00%), 6.404%, | | |

| 5/25/25 | | 65,686 | 68,895 |

| Ser. 16-3, Class NI, IO, 6.00%, 2/25/46 | 1,375,585 | 299,944 |

| Ser. 15-30, IO, 5.50%, 5/25/45 | | 2,397,143 | 500,475 |

| Ser. 374, Class 6, IO, 5.50%, 8/25/36 | | 113,449 | 21,425 |

| Ser. 378, Class 19, IO, 5.00%, 6/25/35 | | 347,884 | 63,156 |

| Ser. 12-127, Class BI, IO, 4.50%, 11/25/42 | 325,159 | 69,011 |

| Ser. 12-30, Class HI, IO, 4.50%, 12/25/40 | 2,050,804 | 165,399 |

| Ser. 366, Class 22, IO, 4.50%, 10/25/35 | 8,082 | 158 |

| IFB Ser. 13-90, Class SD, IO, ((-1 x 1 Month US | | |

| LIBOR) + 6.60%), 4.196%, 9/25/43 | | 2,082,684 | 436,105 |

| Ser. 17-7, Class JI, IO, 4.00%, 2/25/47 | | 1,072,266 | 160,840 |

| Ser. 15-88, Class QI, IO, 4.00%, 10/25/44 | 1,228,339 | 136,222 |

| Ser. 15-83, IO, 4.00%, 10/25/43 | | 3,588,883 | 524,874 |

| Ser. 13-41, Class IP, IO, 4.00%, 5/25/43 | 1,052,592 | 140,132 |

| Ser. 13-44, Class PI, IO, 4.00%, 1/25/43 | 840,956 | 102,084 |

| IFB Ser. 10-35, Class SG, IO, ((-1 x 1 Month US | | |

| LIBOR) + 6.40%), 3.996%, 4/25/40 | | 687,534 | 128,913 |

| IFB Ser. 15-42, Class LS, IO, ((-1 x 1 Month US | | |

| LIBOR) + 6.20%), 3.796%, 6/25/45 | | 3,522,584 | 600,393 |

| IFB Ser. 18-86, Class DS, IO, ((-1 x 1 Month US | | |

| LIBOR) + 6.10%), 3.696%, 12/25/48 | | 3,130,423 | 451,955 |

| IFB Ser. 16-96, Class ST, IO, ((-1 x 1 Month US | | |

| LIBOR) + 6.10%), 3.696%, 12/25/46 | | 2,392,507 | 400,745 |

| IFB Ser. 10-140, Class GS, IO, ((-1 x 1 Month US | | |

| LIBOR) + 6.00%), 3.596%, 7/25/39 | | 1,916,236 | 124,985 |

| Ser. 13-107, Class SB, IO, ((-1 x 1 Month US | | |

| LIBOR) + 5.95%), 3.546%, 2/25/43 | | 1,446,607 | 294,746 |

| Ser. 16-102, Class JI, IO, 3.50%, 2/25/46 | 2,025,838 | 215,205 |

| Ser. 11-98, Class AI, IO, 3.50%, 11/25/37 | 2,677,813 | 54,520 |

| Ser. 13-35, Class IP, IO, 3.00%, 6/25/42 | 1,254,321 | 68,363 |

| Ser. 13-53, Class JI, IO, 3.00%, 12/25/41 | 1,541,580 | 112,856 |

| Ser. 13-23, Class PI, IO, 3.00%, 10/25/41 | 1,166,426 | 43,240 |

| Ser. 99-51, Class N, PO, zero %, 9/17/29 | 5,297 | 4,834 |

| |

| 4Putnam VT Diversified Income Fund |

| | |

| MORTGAGE-BACKED | | |

| SECURITIES (37.2%)*cont. | Principal amount | Value |

| | |

| Agency collateralized mortgage obligationscont. | |

| Federal National Mortgage Association IFB | | |

| Ser. 18-20, Class SB, IO, ((-1 x 1 Month US | | |

| LIBOR) + 0.00%), 3.846%, 3/25/48 | $3,761,869 | $672,998 |

| Federal National Mortgage Association Grantor | |

| Trust Ser. 00-T6, IO, 0.717%, 11/25/40W | 731,527 | 15,545 |

| Government National Mortgage Association | | |

| Ser. 17-38, Class DI, IO, 5.00%, 3/16/47 | 811,258 | 166,470 |

| Ser. 16-42, IO, 5.00%, 2/20/46 | 1,378,152 | 271,638 |

| Ser. 18-127, Class ID, IO, 5.00%, 7/20/45 | 1,459,121 | 183,922 |

| Ser. 18-127, Class IC, IO, 5.00%, 10/20/44 | 2,458,757 | 505,078 |

| Ser. 14-76, IO, 5.00%, 5/20/44 | 736,837 | 148,845 |

| Ser. 13-3, Class IT, IO, 5.00%, 1/20/43 | 789,058 | 167,512 |

| Ser. 12-146, IO, 5.00%, 12/20/42 | 1,197,289 | 252,173 |

| Ser. 10-35, Class UI, IO, 5.00%, 3/20/40 | 413,177 | 85,680 |

| Ser. 10-20, Class UI, IO, 5.00%, 2/20/40 | 607,790 | 127,443 |

| Ser. 10-9, Class UI, IO, 5.00%, 1/20/40 | 2,679,034 | 568,510 |

| Ser. 09-121, Class UI, IO, 5.00%, 12/20/39 | 1,527,756 | 316,413 |

| Ser. 17-26, Class MI, IO, 5.00%, 11/20/39 | 2,344,751 | 476,809 |

| Ser. 15-79, Class GI, IO, 5.00%, 10/20/39 | 511,690 | 98,654 |

| Ser. 18-94, Class AI, IO, 4.50%, 7/20/48 | 4,681,382 | 777,633 |

| Ser. 16-37, Class IW, IO, 4.50%, 2/20/46 | 930,662 | 162,866 |

| Ser. 16-104, Class GI, IO, 4.50%, 1/20/46 | 1,701,194 | 223,809 |

| Ser. 18-127, Class IB, IO, 4.50%, 6/20/45 | 1,132,135 | 118,784 |

| Ser. 13-182, Class IQ, IO, 4.50%, 12/16/43 | 1,203,895 | 239,274 |

| Ser. 13-34, Class IH, IO, 4.50%, 3/20/43 | 1,801,675 | 341,896 |

| Ser. 13-183, Class JI, IO, 4.50%, 2/16/43 | 688,639 | 78,959 |

| Ser. 14-108, Class IP, IO, 4.50%, 12/20/42 | 244,221 | 30,403 |

| Ser. 17-42, Class IC, IO, 4.50%, 8/20/41 | 1,019,334 | 189,745 |

| Ser. 10-35, Class AI, IO, 4.50%, 3/20/40 | 1,225,573 | 213,785 |

| Ser. 10-35, Class QI, IO, 4.50%, 3/20/40 | 1,239,505 | 229,657 |

| Ser. 13-151, Class IB, IO, 4.50%, 2/20/40 | 1,273,492 | 240,198 |

| Ser. 10-9, Class QI, IO, 4.50%, 1/20/40 | 629,276 | 119,714 |

| Ser. 09-121, Class BI, IO, 4.50%, 12/16/39 | 624,888 | 139,194 |

| Ser. 15-186, Class AI, IO, 4.00%, 12/20/45 | 3,564,839 | 578,395 |

| Ser. 16-27, Class IB, IO, 4.00%, 11/20/45 | 1,082,785 | 176,216 |

| Ser. 15-79, Class CI, IO, 4.00%, 5/20/45 | 2,217,081 | 374,762 |

| Ser. 15-64, Class YI, IO, 4.00%, 11/20/44 | 1,320,604 | 188,741 |

| Ser. 17-63, Class PI, IO, 4.00%, 12/20/43 | 1,399,367 | 158,951 |

| Ser. 13-165, Class IL, IO, 4.00%, 3/20/43 | 818,365 | 136,236 |

| Ser. 12-47, Class CI, IO, 4.00%, 3/20/42 | 1,299,560 | 227,278 |

| Ser. 12-8, Class PI, IO, 4.00%, 5/20/41 | 2,972,420 | 380,308 |

| IFB Ser. 13-129, Class SN, IO, ((-1 x 1 Month US | |

| LIBOR) + 6.15%), 3.767%, 9/20/43 | 681,869 | 119,750 |

| IFB Ser. 13-99, Class VS, IO, ((-1 x 1 Month US | |

| LIBOR) + 6.10%), 3.706%, 7/16/43 | 413,597 | 68,765 |

| IFB Ser. 19-78, Class SJ, IO, ((-1 x 1 Month US | |

| LIBOR) + 0.00%), 3.639%, 6/20/49 | 333,000 | 46,204 |

| Ser. 16-48, Class MI, IO, 3.50%, 4/16/46 | 1,483,767 | 152,726 |

| Ser. 18-127, Class IE, IO, 3.50%, 1/20/46 | 2,860,221 | 326,494 |

| Ser. 16-75, Class EI, IO, 3.50%, 8/20/45 | 2,406,808 | 302,985 |

| Ser. 13-102, Class IP, IO, 3.50%, 6/20/43 | 926,547 | 76,964 |

| Ser. 13-76, IO, 3.50%, 5/20/43 | 2,308,370 | 340,969 |

| Ser. 13-28, IO, 3.50%, 2/20/43 | 761,034 | 103,181 |

| Ser. 13-54, Class JI, IO, 3.50%, 2/20/43 | 1,100,462 | 148,562 |

| Ser. 13-37, Class JI, IO, 3.50%, 1/20/43 | 1,756,257 | 231,633 |

| Ser. 13-27, Class PI, IO, 3.50%, 12/20/42 | 1,144,381 | 146,950 |

| Ser. 12-136, Class BI, IO, 3.50%, 11/20/42 | 1,317,018 | 224,492 |

| Ser. 12-140, Class IC, IO, 3.50%, 11/20/42 | 1,478,698 | 257,625 |

| Ser. 12-128, Class IA, IO, 3.50%, 10/20/42 | 2,022,468 | 343,467 |

| Ser. 15-69, Class IK, IO, 3.50%, 3/20/38 | 1,645,665 | 125,755 |

| Ser. 14-44, Class IA, IO, 3.50%, 5/20/28 | 2,595,792 | 216,074 |

| | | |

| MORTGAGE-BACKED | | | |

| SECURITIES (37.2%)*cont. | Principal amount | Value |

| | |

| Agency collateralized mortgage obligationscont. | |

| Government National Mortgage Association | | |

| IFB Ser. 14-119, Class SA, IO, ((-1 x 1 Month US | | |

| LIBOR) + 5.60%), 3.217%, 8/20/44 | | $1,856,603 | $276,170 |

| Ser. 18-H05, Class AI, IO, 2.415%, 2/20/68W | 2,765,848 | 372,525 |

| Ser. 17-H11, Class TI, IO, 2.392%, 4/20/67W | 2,244,091 | 274,486 |

| Ser. 18-H03, Class XI, IO, 2.383%, 2/20/68W | 3,127,067 | 413,711 |

| Ser. 17-H16, Class JI, IO, 2.367%, 8/20/67W | 3,809,357 | 542,833 |

| Ser. 17-H12, Class QI, IO, 2.363%, 5/20/67W | 3,114,350 | 357,459 |

| Ser. 18-H05, Class BI, IO, 2.362%, 2/20/68W | 3,544,366 | 472,951 |

| Ser. 17-H06, Class BI, IO, 2.361%, 2/20/67W | 3,004,052 | 345,466 |

| Ser. 17-H02, Class BI, IO, 2.348%, 1/20/67W | 2,631,489 | 324,210 |

| Ser. 16-H22, Class AI, IO, 2.313%, 10/20/66W | 3,421,673 | 375,960 |

| Ser. 16-H23, Class NI, IO, 2.254%, 10/20/66W | 9,809,110 | 1,105,487 |

| Ser. 16-H16, Class EI, IO, 2.231%, 6/20/66W | 2,562,705 | 280,360 |

| Ser. 17-H08, Class NI, IO, 2.23%, 3/20/67W | 3,954,499 | 438,158 |

| Ser. 16-H24, Class JI, IO, 2.19%, 11/20/66W | 3,131,322 | 387,501 |

| Ser. 16-H03, Class AI, IO, 2.115%, 1/20/66W | 2,644,371 | 247,910 |

| Ser. 16-H14, Class AI, IO, 2.071%, 6/20/66W | 2,480,668 | 257,724 |

| Ser. 15-H10, Class BI, IO, 2.052%, 4/20/65W | 2,256,122 | 208,739 |

| Ser. 16-H09, Class BI, IO, 2.019%, 4/20/66W | 4,432,422 | 452,005 |

| Ser. 16-H03, Class DI, IO, 2.004%, 12/20/65W | 3,120,079 | 269,107 |

| Ser. 16-H17, Class KI, IO, 1.999%, 7/20/66W | 1,736,132 | 190,974 |

| Ser. 17-H11, Class DI, IO, 1.927%, 5/20/67W | 2,723,404 | 306,383 |

| Ser. 15-H24, Class AI, IO, 1.889%, 9/20/65W | 3,155,880 | 294,649 |

| Ser. 16-H02, Class HI, IO, 1.888%, 1/20/66W | 3,763,292 | 308,590 |

| Ser. 17-H16, Class IB, IO, 1.867%, 8/20/67W | 3,293,454 | 326,915 |

| Ser. 17-H09, IO, 1.862%, 4/20/67W | | 3,605,173 | 348,281 |

| Ser. 17-H10, Class MI, IO, 1.862%, 4/20/67W | 5,119,943 | 482,299 |

| Ser. 15-H25, Class EI, IO, 1.859%, 10/20/65W | 2,768,421 | 243,067 |

| FRB Ser. 15-H08, Class CI, IO, 1.793%, 3/20/65W | 1,699,962 | 141,423 |

| Ser. 16-H10, Class AI, IO, 1.773%, 4/20/66W | 5,091,912 | 355,278 |

| Ser. 15-H23, Class BI, IO, 1.738%, 9/20/65W | 3,620,676 | 297,982 |

| Ser. 17-H16, Class IG, IO, 1.712%, 7/20/67W | 3,417,956 | 333,251 |

| Ser. 16-H06, Class DI, IO, 1.712%, 7/20/65 | 4,946,892 | 386,110 |

| Ser. 16-H24, Class CI, IO, 1.695%, 10/20/66W | 2,453,516 | 199,356 |

| Ser. 16-H14, IO, 1.684%, 6/20/66W | | 2,038,690 | 142,994 |

| Ser. 13-H08, Class CI, IO, 1.66%, 2/20/63W | 4,116,340 | 220,636 |

| Ser. 16-H06, Class CI, IO, 1.631%, 2/20/66W | 5,394,124 | 356,163 |

| Ser. 15-H25, Class AI, IO, 1.614%, 9/20/65W | 5,067,600 | 394,259 |

| Ser. 14-H21, Class BI, IO, 1.545%, 10/20/64W | 3,159,628 | 220,542 |

| Ser. 15-H26, Class CI, IO, 0.456%, 8/20/65W | 6,917,900 | 80,248 |

| Ser. 06-36, Class OD, PO, zero %, 7/16/36 | 1,533 | 1,314 |

| | | | 35,788,615 |

| Commercial mortgage-backed securities (8.9%) | |

| Banc of America Commercial Mortgage Trust 144A | | |

| FRB Ser. 07-5, Class XW, IO, zero %, 2/10/51W | 5,067,423 | 51 |

| Bear Stearns Commercial Mortgage Securities Trust | |

| FRB Ser. 07-T26, Class AJ, 5.566%, 1/12/45W | 879,000 | 782,310 |

| Ser. 05-PWR7, Class B, 5.214%, 2/11/41W | 612,432 | 615,494 |

| Bear Stearns Commercial Mortgage Securities Trust | |

| 144A | | | |

| FRB Ser. 06-PW11, Class B, 5.809%, 3/11/39W | 383,274 | 272,067 |

| FRB Ser. 07-T28, Class D, 5.718%, 9/11/42W | 275,000 | 155,369 |

| CD Mortgage Trust 144A FRB Ser. 07-CD5, Class XS, | | |

| IO, zero %, 11/15/44W | | 1,561,807 | 16 |

| CFCRE Commercial Mortgage Trust 144A | | |

| FRB Ser. 11-C2, Class E, 5.939%, 12/15/47W | 326,000 | 327,251 |

| FRB Ser. 11-C2, Class F, 5.25%, 12/15/47W | 822,000 | 782,993 |

| |

| Putnam VT Diversified Income Fund5 |

| | | |

| MORTGAGE-BACKED | | | |

| SECURITIES (37.2%)*cont. | Principal amount | Value |

| | | |

| Commercial mortgage-backed securitiescont. | | |

| COMM Mortgage Trust 144A | | | |

| FRB Ser. 12-CR3, Class E, 4.911%, 10/15/45W | $233,000 | $210,488 |

| Ser. 12-CR3, Class F, 4.75%, 10/15/45W | 700,000 | 549,014 |

| FRB Ser. 13-CR9, Class D, 4.397%, 7/10/45W | 452,000 | 413,928 |

| Credit Suisse Commercial Mortgage Trust FRB | | |

| Ser. 06-C5, Class AX, IO, 1.089%, 12/15/39W | 1,130,102 | 5,400 |

| Credit Suisse Commercial Mortgage Trust 144A FRB | | |

| Ser. 07-C4, Class C, 5.91%, 9/15/39W | | 9,206 | 9,206 |

| Crest, Ltd. 144A Ser. 03-2A, Class E2, 8.00%, | | |

| 12/28/38 (Cayman Islands) | | 111,645 | 113,361 |

| CSAIL Commercial Mortgage Trust 144A FRB | | |

| Ser. 15-C1, Class D, 3.936%, 4/15/50W | | 407,000 | 385,278 |

| GS Mortgage Securities Corp. II 144A FRB | | |

| Ser. 05-GG4, Class XC, IO, 1.59%, 7/10/39W | 579,530 | 58 |

| GS Mortgage Securities Trust 144A FRB | | | |

| Ser. 14-GC24, Class D, 4.671%, 9/10/47W | | 675,000 | 609,042 |

| JPMBB Commercial Mortgage Securities Trust 144A | | |

| FRB Ser. 14-C18, Class D, 4.978%, 2/15/47W | 987,000 | 920,060 |

| FRB Ser. C14, Class D, 4.713%, 8/15/46W | 372,000 | 353,244 |

| FRB Ser. 14-C18, Class E, 4.478%, 2/15/47W | 381,000 | 316,018 |

| Ser. 14-C25, Class E, 3.332%, 11/15/47W | 656,000 | 457,899 |

| JPMorgan Chase Commercial Mortgage Securities | | |

| Trust FRB Ser. 13-LC11, Class D, 4.307%, 4/15/46 W | 314,000 | 279,201 |

| JPMorgan Chase Commercial Mortgage Securities | | |

| Trust 144A | | | |

| FRB Ser. 07-CB20, Class E, 6.389%, 2/12/51W | 403,000 | 394,940 |

| FRB Ser. 11-C3, Class F, 5.852%, 2/15/46W | 401,000 | 402,135 |

| FRB Ser. 13-LC11, Class E, 3.25%, 4/15/46W | 715,000 | 602,550 |

| FRB Ser. 07-CB20, Class X1, IO, zero %, 2/12/51 W | 2,121,743 | 21 |

| LSTAR Commercial Mortgage Trust 144A FRB | | |

| Ser. 15-3, Class C, 3.273%, 4/20/48W | | 413,000 | 389,901 |

| Mezz Cap Commercial Mortgage Trust 144A FRB | | |

| Ser. 07-C5, Class X, IO, 6.219%, 12/15/49W | 206,050 | 264 |

| Morgan Stanley Bank of America Merrill Lynch | | |

| Trust 144A | | | |

| FRB Ser. 13-C11, Class D, 4.499%, 8/15/46W | 750,000 | 393,750 |

| FRB Ser. 13-C10, Class D, 4.218%, 7/15/46W | 478,000 | 471,248 |

| Ser. 14-C17, Class E, 3.50%, 8/15/47 | | 369,000 | 286,167 |

| Morgan Stanley Capital I Trust | | | |

| Ser. 07-HQ11, Class C, 5.558%, 2/12/44W | 294,488 | 80,884 |

| Ser. 07-HQ11, Class B, 5.538%, 2/12/44W | 28,268 | 28,243 |

| Ser. 06-HQ10, Class B, 5.448%, 11/12/41W | 286,311 | 260,901 |

| Morgan Stanley Capital I Trust 144A FRB | | | |

| Ser. 08-T29, Class F, 6.288%, 1/11/43W | | 176,893 | 180,237 |

| STRIPS CDO 144A Ser. 03-1A, Class N, IO, 5.00%, | | |

| 3/24/20 (Cayman Islands) (In default) †W | 158,000 | 16 |

| TIAA Real Estate CDO, Ltd. 144A Ser. 03-1A, | | |

| Class E, 8.00%, 12/28/38 | | 472,775 | 39,428 |

| UBS-Barclays Commercial Mortgage Trust 144A | | |

| Ser. 12-C2, Class F, 5.00%, 5/10/63W | | 490,000 | 357,838 |

| Wachovia Bank Commercial Mortgage Trust FRB | | |

| Ser. 07-C34, IO, 0.123%, 5/15/46W | | 1,838,925 | 18 |

| Wells Fargo Commercial Mortgage Trust 144A | | |

| FRB Ser. 13-LC12, Class D, 4.421%, 7/15/46W | 649,000 | 601,093 |

| Ser. 14-LC16, Class D, 3.938%, 8/15/50 | 828,000 | 682,219 |

| WF-RBS Commercial Mortgage Trust 144A | | |

| Ser. 11-C4, Class F, 5.00%, 6/15/44W | | 1,331,000 | 1,045,246 |

| FRB Ser. 12-C7, Class E, 4.97%, 6/15/45W | 875,000 | 757,234 |

| FRB Ser. 13-C15, Class D, 4.622%, 8/15/46W | 1,231,000 | 1,000,457 |

| | | |

| MORTGAGE-BACKED | | | |

| SECURITIES (37.2%)*cont. | Principal amount | Value |

| |

| Commercial mortgage-backed securitiescont. | | |

| WF-RBS Commercial Mortgage Trust 144A | | |

| FRB Ser. 12-C10, Class D, 4.586%, 12/15/45W | $1,152,000 | $976,451 |

| Ser. 12-C7, Class F, 4.50%, 6/15/45W | | 2,626,000 | 1,883,785 |

| | | | 18,392,774 |

| Residential mortgage-backed securities (non-agency) (11.0%) |

| BCAP, LLC Trust 144A FRB Ser. 11-RR3, Class 3A6, | | |

| 4.301%, 11/27/36W | | 540,916 | 454,369 |

| Bear Stearns Alt-A Trust FRB Ser. 05-8, | | | |

| Class 21A1, 4.466%, 10/25/35W | | 363,140 | 337,705 |

| Bellemeade Re, Ltd. 144A FRB Ser. 17-1, Class B1, | | |

| (1 Month US LIBOR + 4.75%), 7.154%, 10/25/27 | | |

| (Bermuda) | | 220,000 | 233,063 |

| Chevy Chase Funding LLC Mortgage-Backed | | |

| Certificates 144A FRB Ser. 06-4A, Class A2, | | |

| (1 Month US LIBOR + 0.18%), 2.584%, 11/25/47 | 235,255 | 199,710 |

| Citigroup Mortgage Loan Trust, Inc. FRB | | | |

| Ser. 07-AMC3, Class A2D, (1 Month US LIBOR | | |

| + 0.35%), 2.754%, 3/25/37 | | 825,989 | 720,653 |

| Countrywide Alternative Loan Trust | | | |

| FRB Ser. 05-38, Class A1, (1 Month US LIBOR | | |

| + 1.50%), 4.004%, 9/25/35 | | 190,728 | 189,213 |

| FRB Ser. 06-OA7, Class 1A2, (1 Month US LIBOR | | |

| + 0.94%), 3.444%, 6/25/46 | | 374,574 | 342,804 |

| FRB Ser. 06-OA7, Class 1A1, 3.081%, 6/25/46W | 861,357 | 757,994 |

| FRB Ser. 06-24CB, Class A13, (1 Month US LIBOR | | |

| + 0.35%), 2.754%, 8/1/36 | | 305,623 | 198,032 |

| FRB Ser. 05-38, Class A3, (1 Month US LIBOR | | |

| + 0.35%), 2.754%, 9/25/35 | | 382,644 | 363,010 |

| FRB Ser. 05-59, Class 1A1, (1 Month US LIBOR | | |

| + 0.33%), 2.713%, 11/20/35 | | 395,544 | 377,235 |

| FRB Ser. 07-OH1, Class A1D, (1 Month US LIBOR | | |

| + 0.21%), 2.614%, 4/25/47 | | 163,704 | 144,366 |

| FRB Ser. 06-OA10, Class 2A1, (1 Month US LIBOR | |

| + 0.19%), 2.594%, 8/25/46 | | 253,483 | 230,670 |

| FRB Ser. 06-OA10, Class 3A1, (1 Month US LIBOR | |

| + 0.19%), 2.594%, 8/25/46 | | 329,710 | 304,982 |

| FRB Ser. 06-OA10, Class 4A1, (1 Month US LIBOR | |

| + 0.19%), 2.594%, 8/25/46 | | 1,595,564 | 1,408,039 |

| Deutsche Alt-A Securities Mortgage Loan Trust FRB | | |

| Ser. 06-AR4, Class A2, (1 Month US LIBOR | | |

| + 0.19%), 2.594%, 12/25/36 | | 426,025 | 255,302 |

| Federal Home Loan Mortgage Corporation | | |

| Structured Agency Credit Risk Debt FRN | | |

| Ser. 16-DNA1, Class B, (1 Month US LIBOR | | |

| + 10.00%), 12.404%, 7/25/28 | | 781,108 | 1,042,471 |

| Structured Agency Credit Risk Debt FRN | | |

| Ser. 15-DNA3, Class B, (1 Month US LIBOR | | |

| + 9.35%), 11.754%, 4/25/28 | | 522,507 | 683,765 |

| Structured Agency Credit Risk Debt FRN | | |

| Ser. 15-DNA2, Class B, (1 Month US LIBOR | | |

| + 7.55%), 9.954%, 12/25/27 | | 419,584 | 511,408 |

| Federal Home Loan Mortgage Corporation 144A | | |

| Structured Agency Credit Risk Trust FRN | | |

| Ser. 19-DNA1, Class M2, (1 Month US LIBOR | | |

| + 2.65%), 5.054%, 1/25/49 | | 99,000 | 100,843 |

| Structured Agency Credit Risk Debt FRN | | |

| Ser. 19-DNA2, Class M2, (1 Month US LIBOR | | |

| + 2.45%), 4.854%, 3/25/49 | | 205,000 | 207,804 |

| Seasoned Credit Risk Transfer Trust Ser. 19-2, | | |

| Class M, 4.75%, 8/25/58W | | 253,000 | 246,567 |

| |

| 6Putnam VT Diversified Income Fund |

| | | |

| MORTGAGE-BACKED | | | |

| SECURITIES (37.2%)*cont. | Principal amount | Value |

| |

| Residential mortgage-backed securities (non-agency)cont. | |

| Federal National Mortgage Association | | | |

| Connecticut Avenue Securities FRB Ser. 16-C02, | | |

| Class 1B, (1 Month US LIBOR + 12.25%), 14.654%, | | |

| 9/25/28 | | $876,741 | $1,275,992 |

| Connecticut Avenue Securities FRB Ser. 16-C03, | | |

| Class 1B, (1 Month US LIBOR + 11.75%), 14.154%, | | |

| 10/25/28 | | 497,649 | 711,074 |

| Connecticut Avenue Securities FRB Ser. 16-C01, | | |

| Class 1B, (1 Month US LIBOR + 11.75%), 14.154%, | | |

| 8/25/28 | | 273,420 | 393,063 |

| Connecticut Avenue Securities FRB Ser. 16-C05, | | |

| Class 2B, (1 Month US LIBOR + 10.75%), 13.154%, | | |

| 1/25/29 | | 89,772 | 118,730 |

| Connecticut Avenue Securities FRB Ser. 16-C03, | | |

| Class 2M2, (1 Month US LIBOR + 5.90%), 8.304%, | | |

| 10/25/28 | | 1,403,520 | 1,541,566 |

| Connecticut Avenue Securities FRB Ser. 15-C04, | | |

| Class 1M2, (1 Month US LIBOR + 5.70%), 8.104%, | | |

| 4/25/28 | | 1,040,418 | 1,151,172 |

| Connecticut Avenue Securities FRB Ser. 15-C04, | | |

| Class 2M2, (1 Month US LIBOR + 5.55%), 7.954%, | | |

| 4/25/28 | | 141,129 | 153,266 |

| Connecticut Avenue Securities FRB Ser. 17-C02, | | |

| Class 2B1, (1 Month US LIBOR + 5.50%), 7.904%, | | |

| 9/25/29 | | 405,000 | 455,752 |

| Connecticut Avenue Securities FRB Ser. 15-C03, | | |

| Class 1M2, (1 Month US LIBOR + 5.00%), 7.404%, | | |

| 7/25/25 | | 1,304,451 | 1,416,887 |

| Connecticut Avenue Securities FRB Ser. 17-C03, | | |

| Class 1B1, (1 Month US LIBOR + 4.85%), 7.254%, | | |

| 10/25/29 | | 445,000 | 501,086 |

| Connecticut Avenue Securities FRB Ser. 18-C05, | | |

| Class 1B1, (1 Month US LIBOR + 4.25%), 6.654%, | | |

| 1/25/31 | | 620,000 | 653,135 |

| Connecticut Avenue Securities FRB Ser. 16-C06, | | |

| Class 1M2, (1 Month US LIBOR + 4.25%), 6.654%, | | |

| 4/25/29 | | 63,000 | 68,175 |

| Connecticut Avenue Securities FRB Ser. 15-C02, | | |

| Class 1M2, (1 Month US LIBOR + 4.00%), 6.404%, | | |

| 5/25/25 | | 29,544 | 31,411 |

| Connecticut Avenue Securities FRB Ser. 17-C05, | | |

| Class 1B1, (1 Month US LIBOR + 3.60%), 6.004%, | | |

| 1/25/30 | | 160,000 | 166,446 |

| Connecticut Avenue Securities FRB Ser. 18-C01, | | |

| Class 1B1, (1 Month US LIBOR + 3.55%), 5.954%, | | |

| 7/25/30 | | 236,000 | 241,673 |

| Federal National Mortgage Association 144A | | |

| Connecticut Avenue Securities Trust FRB | | |

| Ser. 19-R04, Class 2B1, (1 Month US LIBOR | | |

| + 0.00%), 7.654%, 6/25/39 | | 200,000 | 204,086 |

| Connecticut Avenue Securities Trust FRB | | |

| Ser. 19-R03, Class 1B1, (1 Month US LIBOR | | |

| + 4.10%), 6.504%, 9/25/31 | | 200,000 | 207,501 |

| GSAA Home Equity Trust FRB Ser. 06-8, Class 2A2, | | |

| (1 Month US LIBOR + 0.18%), 2.584%, 5/25/36 | 634,855 | 274,734 |

| GSR Mortgage Loan Trust FRB Ser. 07-OA1, | | |

| Class 2A3A, (1 Month US LIBOR + 0.31%), 2.714%, | | |

| 5/25/37 | | 230,510 | 169,262 |

| HarborView Mortgage Loan Trust FRB Ser. 05-2, | | |

| Class 1A, (1 Month US LIBOR + 0.52%), 2.91%, | | |

| 5/19/35 | | 237,367 | 150,555 |

| JPMorgan Alternative Loan Trust FRB Ser. 07-A2, | | |

| Class 12A1, IO, (1 Month US LIBOR + 0.20%), | | |

| 2.604%, 6/25/37 | | 293,281 | 175,026 |

| | | |

| MORTGAGE-BACKED | | | |

| SECURITIES (37.2%)*cont. | Principal amount | Value |

| | |

| Residential mortgage-backed securities (non-agency)cont. | |

| Legacy Mortgage Asset Trust 144A FRB Ser. 19-GS2, | | |

| Class A2, 4.25%, 1/25/59 | | $260,000 | $253,292 |

| Morgan Stanley Re-REMIC Trust 144A FRB | | |

| Ser. 10-R4, Class 4B, (1 Month US LIBOR | | | |

| + 0.23%), 3.246%, 2/26/37 | | 308,036 | 275,014 |

| MortgageIT Trust FRB Ser. 05-3, Class M2, | | |

| (1 Month US LIBOR + 0.80%), 3.199%, 8/25/35 | 120,249 | 116,385 |

| Oaktown Re, Ltd. 144A FRB Ser. 17-1A, Class B1, | | |

| (1 Month US LIBOR + 6.00%), 8.154%, 4/25/27 | | |

| (Bermuda) | | 280,000 | 299,600 |

| Residential Accredit Loans, Inc. FRB | | | |

| Ser. 06-QO10, Class A1, (1 Month US LIBOR | | |

| + 0.16%), 2.564%, 1/25/37 | | 438,905 | 419,770 |

| Structured Asset Mortgage Investments II Trust | | |

| FRB Ser. 07-AR1, Class 2A1, (1 Month US LIBOR | | |

| + 0.18%), 2.584%, 1/25/37 | | 420,401 | 394,041 |

| WaMu Mortgage Pass-Through Certificates Trust | | |

| FRB Ser. 05-AR10, Class 1A3, 4.10%, 9/25/35W | 323,284 | 327,964 |

| FRB Ser. 05-AR19, Class A1C4, (1 Month US LIBOR | | |

| + 0.40%), 2.804%, 12/25/45 | | 316,368 | 309,245 |

| FRB Ser. 05-AR17, Class A1B3, (1 Month US LIBOR | | |

| + 0.35%), 2.754%, 12/25/45 | | 676,569 | 659,812 |

| Wells Fargo Mortgage Backed Securities Trust | | |

| FRB Ser. 06-AR5, Class 1A1, 5.208%, 4/25/36W | 176,884 | 180,422 |

| FRB Ser. 06-AR2, Class 1A1, 4.949%, 3/25/36W | 177,445 | 178,320 |

| | | | 22,784,462 |

| | |

| Total mortgage-backed securities (cost $76,838,003) | $76,965,851 |

| | |

| CORPORATE BONDS AND NOTES (20.3%)* | Principal amount | Value |

| | | |

| Basic materials (1.9%) | | |

| Allegheny Technologies, Inc. sr. unsec. | | |

| unsub. notes 7.875%, 8/15/23 | $102,000 | $109,298 |

| Allegheny Technologies, Inc. sr. unsec. | | |

| unsub. notes 5.95%, 1/15/21 | 39,000 | 40,073 |

| Beacon Roofing Supply, Inc. company | | |

| guaranty sr. unsec. unsub. notes 6.375%, 10/1/23 | 87,000 | 90,371 |

| Beacon Roofing Supply, Inc. 144A company | | |

| guaranty sr. unsec. notes 4.875%, 11/1/25 | 77,000 | 76,230 |

| Berry Global Escrow Corp. 144A notes 5.625%, | | |

| 7/15/27 | 45,000 | 46,800 |

| Berry Global Escrow Corp. 144A sr. notes 4.875%, | | |

| 7/15/26 | 45,000 | 45,956 |

| Big River Steel, LLC/BRS Finance Corp. 144A | | |

| company guaranty sr. notes 7.25%, 9/1/25 | 160,000 | 168,088 |

| BMC East, LLC 144A company | | |

| guaranty sr. notes 5.50%, 10/1/24 | 143,000 | 144,966 |

| Boise Cascade Co. 144A company | | |

| guaranty sr. unsec. notes 5.625%, 9/1/24 | 193,000 | 196,860 |

| Builders FirstSource, Inc. 144A company | | |

| guaranty sr. unsub. notes 5.625%, 9/1/24 | 48,000 | 49,472 |

| Builders FirstSource, Inc. 144A sr. notes 6.75%, | | |

| 6/1/27 | 25,000 | 26,375 |

| BWAY Holding Co. 144A sr. notes 5.50%, 4/15/24 | 100,000 | 100,050 |

| Chemours Co. (The) company guaranty sr. unsec. | | |

| notes 5.375%, 5/15/27 | 42,000 | 40,005 |

| Chemours Co. (The) company guaranty sr. unsec. | | |

| unsub. notes 7.00%, 5/15/25 | 49,000 | 51,205 |

| Cleveland-Cliffs, Inc. company | | |

| guaranty sr. unsec. notes 5.75%, 3/1/25 | 10,000 | 9,950 |

| Compass Minerals International, Inc. 144A company | | |

| guaranty sr. unsec. notes 4.875%, 7/15/24 | 202,000 | 192,910 |

| |

| Putnam VT Diversified Income Fund7 |

| | | |

| CORPORATE BONDS | | | |

| AND NOTES (20.3%)*cont. | Principal amount | Value |

| |

| Basic materialscont. | | | |

| Freeport-McMoRan, Inc. company guaranty | | |

| sr. unsec. notes 6.875%, 2/15/23 (Indonesia) | $128,000 | $134,720 |

| Freeport-McMoRan, Inc. company guaranty | | |

| sr. unsec. unsub. notes 5.45%, 3/15/43 (Indonesia) | 55,000 | 50,325 |

| GCP Applied Technologies, Inc. 144A sr. unsec. | | |

| notes 5.50%, 4/15/26 | | 252,000 | 255,780 |

| Greif, Inc. 144A company guaranty sr. unsec. | | |

| notes 6.50%, 3/1/27 | | 116,000 | 119,770 |

| Ingevity Corp. 144A sr. unsec. notes 4.50%, 2/1/26 | 132,000 | 128,040 |

| Joseph T Ryerson & Son, Inc. 144A | | | |

| sr. notes 11.00%, 5/15/22 | | 49,000 | 51,818 |

| Louisiana-Pacific Corp. company | | | |

| guaranty sr. unsec. unsub. notes 4.875%, 9/15/24 | 100,000 | 101,625 |

| Mercer International, Inc. company guaranty | | |

| sr. unsec. notes 7.75%, 12/1/22 (Canada) | 38,000 | 39,425 |

| Mercer International, Inc. sr. unsec. | | | |

| notes 6.50%, 2/1/24 (Canada) | | 74,000 | 76,590 |

| Mercer International, Inc. sr. unsec. | | | |

| notes 5.50%, 1/15/26 (Canada) | | 55,000 | 54,725 |

| Mercer International, Inc. 144A sr. unsec. | | |

| notes 7.375%, 1/15/25 (Canada) | | 20,000 | 21,250 |

| NCI Building Systems, Inc. 144A company | | |

| guaranty sr. unsec. sub. notes 8.00%, 4/15/26 | 107,000 | 104,058 |

| Novelis Corp. 144A company guaranty sr. unsec. | | |

| notes 6.25%, 8/15/24 | | 345,000 | 360,525 |

| PQ Corp. 144A company guaranty sr. unsec. | | |

| notes 5.75%, 12/15/25 | | 129,000 | 130,774 |

| Smurfit Kappa Treasury Funding DAC company | | |

| guaranty sr. unsec. unsub. notes 7.50%, 11/20/25 | | |

| (Ireland) | | 139,000 | 161,588 |

| Starfruit Finco BV/Starfruit US Holdco, LLC 144A | | |

| sr. unsec. notes 8.00%, 10/1/26 (Netherlands) | 150,000 | 154,125 |

| Steel Dynamics, Inc. company guaranty sr. unsec. | | |

| notes 5.00%, 12/15/26 | | 45,000 | 46,913 |

| Steel Dynamics, Inc. company guaranty sr. unsec. | | |

| notes 4.125%, 9/15/25 | | 17,000 | 16,915 |

| TopBuild Corp. 144A company guaranty sr. unsec. | | |

| notes 5.625%, 5/1/26 | | 125,000 | 127,813 |

| Tronox Finance PLC 144A company | | | |

| guaranty sr. unsec. notes 5.75%, 10/1/25 | | |

| (United Kingdom) | | 45,000 | 43,650 |

| U.S. Concrete, Inc. company guaranty sr. unsec. | | |

| unsub. notes 6.375%, 6/1/24 | | 115,000 | 119,600 |

| WR Grace & Co.- Conn. 144A company | | | |

| guaranty sr. unsec. notes 5.625%, 10/1/24 | 83,000 | 89,433 |

| Zekelman Industries, Inc. 144A company | | |

| guaranty sr. notes 9.875%, 6/15/23 | | 165,000 | 174,178 |

| | | | 3,952,249 |

| Capital goods (1.4%) | | | |

| Allison Transmission, Inc. 144A company | | |

| guaranty sr. unsec. notes 4.75%, 10/1/27 | 155,000 | 153,838 |

| Amsted Industries, Inc. 144A company | | | |

| guaranty sr. unsec. sub. notes 5.625%, 7/1/27 | 70,000 | 72,975 |

| ATS Automation Tooling Systems, Inc. 144A | | |

| sr. unsec. notes 6.50%, 6/15/23 (Canada) | 82,000 | 84,733 |

| Berry Global, Inc. company guaranty notes 5.50%, | | |

| 5/15/22 | | 105,000 | 106,181 |

| Berry Global, Inc. company | | | |

| guaranty unsub. notes 5.125%, 7/15/23 | | 100,000 | 102,230 |

| Berry Global, Inc. 144A notes 4.50%, 2/15/26 | 32,000 | 31,520 |

| | | |

| CORPORATE BONDS | | | |

| AND NOTES (20.3%)*cont. | Principal amount | Value |

| |

| Capital goodscont. | | | |

| Bombardier, Inc. 144A sr. unsec. notes 8.75%, | | |

| 12/1/21 (Canada) | | $39,000 | $42,413 |

| Briggs & Stratton Corp. company | | | |

| guaranty sr. unsec. notes 6.875%, 12/15/20 | 164,000 | 170,560 |

| Clean Harbors, Inc. 144A sr. unsec. bonds 5.125%, | | |

| 7/15/29 | | 35,000 | 35,700 |

| Clean Harbors, Inc. 144A sr. unsec. notes 4.875%, | | |

| 7/15/27 | | 65,000 | 66,063 |

| Crown Americas, LLC/Crown Americas Capital Corp. | | |

| VI company guaranty sr. unsec. notes 4.75%, | | |

| 2/1/26 | | 60,000 | 61,650 |

| Crown Cork & Seal Co., Inc. company | | | |

| guaranty sr. unsec. bonds 7.375%, 12/15/26 | 111,000 | 127,650 |

| Great Lakes Dredge & Dock Corp. company | | |

| guaranty sr. unsec. notes 8.00%, 5/15/22 | 144,000 | 152,460 |

| Hulk Finance Corp. 144A sr. unsec. notes 7.00%, | | |

| 6/1/26 (Canada) | | 83,000 | 84,971 |

| Nordex SE sr. unsec. notes Ser. REGS, 6.50%, | | |

| 2/1/23 (Germany) | EUR | 100,000 | 114,144 |

| Novafives SAS sr. notes Ser. REGS, 5.00%, 6/15/25 | | |

| (France) | EUR | 100,000 | 108,228 |

| Oshkosh Corp. company guaranty sr. unsec. | | |

| sub. notes 5.375%, 3/1/25 | | $85,000 | 88,188 |

| Panther BF Aggregator 2 LP/Panther | | | |

| Finance Co., Inc. 144A company | | | |

| guaranty sr. notes 6.25%, 5/15/26 | | 102,000 | 105,953 |

| Panther BF Aggregator 2 LP/Panther | | | |

| Finance Co., Inc. 144A company | | | |

| guaranty sr. unsec. notes 8.50%, 5/15/27 | 90,000 | 92,700 |

| RBS Global, Inc./Rexnord, LLC 144A sr. unsec. | | |

| notes 4.875%, 12/15/25 | | 170,000 | 172,125 |

| Resideo Funding, Inc. 144A company | | |

| guaranty sr. unsec. notes 6.125%, 11/1/26 | 65,000 | 67,600 |

| Staples, Inc. 144A sr. notes 7.50%, 4/15/26 | 210,000 | 208,763 |

| Stevens Holding Co, Inc. 144A company | | |

| guaranty sr. unsec. notes 6.125%, 10/1/26 | 142,000 | 149,633 |

| Tennant Co. company guaranty sr. unsec. | | |

| unsub. notes 5.625%, 5/1/25 | | 80,000 | 82,600 |

| TransDigm, Inc. company guaranty sr. unsec. | | |

| sub. notes 6.375%, 6/15/26 | | 72,000 | 72,540 |

| TransDigm, Inc. 144A company | | | |

| guaranty sr. notes 6.25%, 3/15/26 | | 359,000 | 377,848 |

| | | | 2,933,266 |

| Communication services (2.5%) | | | |

| Altice Financing SA 144A company | | | |

| guaranty sr. notes 6.625%, 2/15/23 (Luxembourg) | 200,000 | 205,000 |

| Altice France SA 144A sr. bonds 6.25%, 5/15/24 | | |

| (France) | | 200,000 | 205,750 |

| Altice Luxembourg SA company guaranty | | |

| sr. unsec. sub. notes Ser. REGS, 6.25%, | | |

| 2/15/25 (Luxembourg) | EUR | 100,000 | 112,906 |

| Altice Luxembourg SA 144A company | | |

| guaranty sr. unsec. notes 7.75%, 5/15/22 | | |

| (Luxembourg) | | $200,000 | 203,250 |

| Cablevision Systems Corp. sr. unsec. | | | |

| unsub. notes 8.00%, 4/15/20 | | 66,000 | 68,167 |

| CCO Holdings, LLC/CCO Holdings Capital Corp. 144A | | |

| company guaranty sr. unsec. bonds 5.50%, 5/1/26 | 253,000 | 264,777 |

| CCO Holdings, LLC/CCO Holdings Capital Corp. 144A | | |

| company guaranty sr. unsec. notes 5.875%, 4/1/24 | 220,000 | 229,900 |

| CCO Holdings, LLC/CCO Holdings Capital Corp. 144A | | |

| sr. unsec. bonds 5.375%, 6/1/29 ## | | 280,000 | 289,100 |

| |

| 8Putnam VT Diversified Income Fund |

| | | |

| CORPORATE BONDS | | | |

| AND NOTES (20.3%)*cont. | Principal amount | Value |

| |

| Communication servicescont. | | | |

| CCO Holdings, LLC/CCO Holdings Capital Corp. 144A | | |

| sr. unsec. notes 5.75%, 2/15/26 | | $69,000 | $72,364 |

| CCO Holdings, LLC/CCO Holdings Capital Corp. 144A | | |

| sr. unsec. unsub. notes 5.125%, 5/1/23 | 64,000 | 65,340 |

| CommScope Technologies, LLC 144A company | | |

| guaranty sr. unsec. notes 6.00%, 6/15/25 | 236,000 | 221,182 |

| CommScope Technologies, LLC 144A company | | |

| guaranty sr. unsec. unsub. notes 5.00%, 3/15/27 | 12,000 | 10,440 |

| CSC Holdings, LLC sr. unsec. unsub. bonds 5.25%, | | |

| 6/1/24 | | 98,000 | 101,798 |

| CSC Holdings, LLC sr. unsec. unsub. notes 6.75%, | | |

| 11/15/21 | | 146,000 | 155,855 |

| CSC Holdings, LLC 144A sr. unsec. | | | |

| unsub. notes 7.50%, 4/1/28 | | 200,000 | 219,560 |

| CSC Holdings, LLC 144A sr. unsec. | | | |

| unsub. notes 5.125%, 12/15/21 | | 256,000 | 256,000 |

| Digicel Group Two Ltd. 144A company guaranty | | |

| sr. unsec. notes 6.75%, 3/1/23 (Jamaica) | 200,000 | 113,500 |

| DISH DBS Corp. company guaranty sr. unsec. | | |

| unsub. notes 5.875%, 11/15/24 | | 117,000 | 110,711 |

| Equinix, Inc. sr. unsec. notes 5.375%, 5/15/27R | 111,000 | 118,989 |

| Equinix, Inc. sr. unsec. unsub. notes 5.875%, | | |

| 1/15/26R | | 30,000 | 31,763 |

| Frontier Communications Corp. 144A company | | |

| guaranty notes 8.50%, 4/1/26 | | 66,000 | 64,020 |

| Intelsat Connect Finance SA 144A company | | |

| guaranty sr. unsec. notes 9.50%, 2/15/23 | | |

| (Luxembourg) | | 81,000 | 71,685 |

| Intelsat Jackson Holdings SA 144A company | | |

| guaranty sr. notes 8.00%, 2/15/24 (Bermuda) | 8,000 | 8,340 |

| Level 3 Financing, Inc. company | | | |

| guaranty sr. unsec. unsub. notes 5.625%, 2/1/23 | 79,000 | 79,984 |

| Level 3 Financing, Inc. company | | | |

| guaranty sr. unsec. unsub. notes 5.25%, 3/15/26 | 194,000 | 200,790 |

| Quebecor Media, Inc. sr. unsec. | | | |

| unsub. notes 5.75%, 1/15/23 (Canada) | 36,000 | 38,520 |

| Sprint Capital Corp. company guaranty sr. unsec. | | |

| unsub. notes 6.875%, 11/15/28 | | 101,000 | 103,808 |

| Sprint Corp. company guaranty sr. unsec. | | |

| sub. notes 7.875%, 9/15/23 | | 328,000 | 356,290 |

| Sprint Corp. company guaranty sr. unsec. | | |

| sub. notes 7.25%, 9/15/21 | | 175,000 | 185,938 |

| T-Mobile USA, Inc. company guaranty sr. unsec. | | |

| notes 6.375%, 3/1/25 | | 135,000 | 140,198 |

| T-Mobile USA, Inc. company guaranty sr. unsec. | | |

| notes 5.375%, 4/15/27 | | 27,000 | 28,890 |

| T-Mobile USA, Inc. company guaranty sr. unsec. | | |

| unsub. bonds 4.75%, 2/1/28 | | 105,000 | 108,029 |

| T-Mobile USA, Inc. company guaranty sr. unsec. | | |

| unsub. notes 4.50%, 2/1/26 | | 45,000 | 46,069 |

| Unitymedia Hessen GmbH & Co. KG/ | | | |

| Unitymedia NRW GmbH company | | | |

| guaranty sr. bonds Ser. REGS, | | | |

| 6.25%, 1/15/29 (Germany) | EUR | 231,300 | 292,169 |

| Videotron, Ltd. company guaranty sr. unsec. | | |

| unsub. notes 5.00%, 7/15/22 (Canada) | $172,000 | 180,170 |

| Videotron, Ltd./Videotron Ltee. 144A sr. unsec. | | |

| notes 5.125%, 4/15/27 (Canada) | | 60,000 | 62,625 |

| Virgin Media Secured Finance PLC company | | |

| guaranty sr. notes Ser. REGS, 5.125%, | | |

| 1/15/25 (United Kingdom) | GBP | 100,000 | 131,478 |

| | | |

| CORPORATE BONDS | | | |

| AND NOTES (20.3%)*cont. | Principal amount | Value |

| |

| Communication servicescont. | | | |

| Virgin Media Secured Finance PLC 144A | | | |

| company guaranty sr. bonds 5.00%, | | | |

| 4/15/27 (United Kingdom) | GBP | 100,000 | $130,708 |

| | | | 5,286,063 |

| Consumer cyclicals (3.3%) | | | |

| American Builders & Contractors Supply Co., Inc. | | |

| 144A company guaranty sr. unsec. notes 5.875%, | | |

| 5/15/26 | | $30,000 | 31,275 |

| American Builders & Contractors Supply Co., Inc. | | |

| 144A sr. unsec. notes 5.75%, 12/15/23 | | 86,000 | 89,010 |

| Boyd Gaming Corp. company guaranty sr. unsec. | | |

| notes 6.00%, 8/15/26 | | 125,000 | 131,406 |

| Cinemark USA, Inc. company guaranty sr. unsec. | | |

| notes 5.125%, 12/15/22 | | 52,000 | 52,780 |

| Cinemark USA, Inc. company guaranty sr. unsec. | | |

| sub. notes 4.875%, 6/1/23 | | 65,000 | 65,813 |

| Clear Channel Worldwide Holdings, Inc. company | | |

| guaranty sr. unsec. unsub. notes 6.50%, 11/15/22 | 105,000 | 106,969 |

| CRC Escrow Issuer, LLC/CRC Finco, Inc. 144A | | |

| company guaranty sr. unsec. notes 5.25%, | | |

| 10/15/25 | | 160,000 | 160,500 |

| Eldorado Resorts, Inc. company | | | |

| guaranty sr. unsec. notes 6.00%, 9/15/26 | | 20,000 | 21,850 |

| Eldorado Resorts, Inc. company | | | |

| guaranty sr. unsec. unsub. notes 7.00%, 8/1/23 | 65,000 | 67,925 |

| Entercom Media Corp. 144A company | | | |

| guaranty notes 6.50%, 5/1/27 | | 91,000 | 94,640 |

| Entercom Media Corp. 144A company | | | |

| guaranty sr. unsec. notes 7.25%, 11/1/24 | | 84,000 | 88,515 |

| Gartner, Inc. 144A company guaranty sr. unsec. | | |

| notes 5.125%, 4/1/25 | | 70,000 | 71,960 |

| Gray Television, Inc. 144A sr. unsec. | | | |

| notes 7.00%, 5/15/27 | | 189,000 | 205,065 |

| Hanesbrands, Inc. 144A company | | | |

| guaranty sr. unsec. unsub. notes 4.625%, 5/15/24 | 90,000 | 93,438 |

| Hilton Worldwide Finance, LLC/Hilton Worldwide | | |

| Finance Corp. company guaranty sr. unsec. | | |

| notes 4.875%, 4/1/27 | | 135,000 | 139,516 |

| Howard Hughes Corp. (The) 144A sr. unsec. | | |

| notes 5.375%, 3/15/25 | | 142,000 | 146,714 |

| iHeartCommunications, Inc. company | | | |

| guaranty sr. notes 6.375%, 5/1/26 | | 79,202 | 84,053 |

| iHeartCommunications, Inc. company | | | |

| guaranty sr. unsec. notes 8.375%, 5/1/27 | | 152,931 | 160,199 |

| IHS Markit, Ltd. sr. unsec. sub. bonds 4.75%, | | |

| 8/1/28 (United Kingdom) | | 50,000 | 54,563 |

| IHS Markit, Ltd. 144A company | | | |

| guaranty notes 4.75%, 2/15/25 (United Kingdom) | 80,000 | 85,800 |

| IHS Markit, Ltd. 144A company guaranty sr. unsec. | | |

| notes 4.00%, 3/1/26 (United Kingdom) | | 25,000 | 25,813 |

| Iron Mountain, Inc. 144A company | | | |

| guaranty sr. unsec. bonds 5.25%, 3/15/28R | 50,000 | 50,063 |

| Iron Mountain, Inc. 144A company | | | |

| guaranty sr. unsec. notes 4.875%, 9/15/27R | 170,000 | 168,513 |

| Jack Ohio Finance, LLC/Jack Ohio Finance 1 Corp. | | |

| 144A company guaranty sr. notes 6.75%, 11/15/21 | 174,000 | 178,733 |

| JC Penney Corp., Inc. company guaranty sr. unsec. | | |

| unsub. bonds 7.40%, 4/1/37 | | 84,000 | 22,680 |

| Jeld-Wen, Inc. 144A company guaranty sr. unsec. | | |

| notes 4.875%, 12/15/27 | | 60,000 | 58,050 |

| Jeld-Wen, Inc. 144A company guaranty sr. unsec. | | |

| notes 4.625%, 12/15/25 | | 38,000 | 37,288 |

| |

| Putnam VT Diversified Income Fund9 |

| | | |

| CORPORATE BONDS | | | |

| AND NOTES (20.3%)*cont. | Principal amount | Value |

| |

| Consumer cyclicalscont. | | | |

| Lennar Corp. company guaranty sr. unsec. | | |

| sub. notes 5.875%, 11/15/24 | | $69,000 | $75,641 |

| Lions Gate Capital Holdings, LLC 144A company | | |

| guaranty sr. unsec. notes 5.875%, 11/1/24 | 129,000 | 132,225 |

| Lions Gate Capital Holdings, LLC 144A sr. unsec. | | |

| notes 6.375%, 2/1/24 | | 90,000 | 94,613 |

| Live Nation Entertainment, Inc. 144A company | | |

| guaranty sr. unsec. notes 4.875%, 11/1/24 | 67,000 | 68,926 |

| Live Nation Entertainment, Inc. 144A company | | |

| guaranty sr. unsec. sub. notes 5.625%, 3/15/26 | 65,000 | 68,169 |

| Mattamy Group Corp. 144A sr. unsec. notes 6.875%, | | |

| 12/15/23 (Canada) | | 71,000 | 73,929 |

| Mattamy Group Corp. 144A sr. unsec. notes 6.50%, | | |

| 10/1/25 (Canada) | | 39,000 | 40,950 |

| Meredith Corp. company guaranty sr. unsec. | | |

| notes 6.875%, 2/1/26 | | 95,000 | 100,807 |

| MGM Resorts International company | | | |

| guaranty sr. unsec. unsub. notes 6.625%, | | |

| 12/15/21 | | 175,000 | 189,000 |

| Navistar International Corp. 144A sr. unsec. | | |

| notes 6.625%, 11/1/25 | | 193,000 | 202,168 |

| Nexstar Broadcasting, Inc. 144A company | | |

| guaranty sr. unsec. notes 5.625%, 8/1/24 | 101,000 | 104,632 |

| Nexstar Escrow, Inc. 144A sr. unsec. | | | |

| notes 5.625%, 7/15/27 | | 35,000 | 35,831 |

| Nielsen Co. Luxembourg SARL (The) 144A company | | |

| guaranty sr. unsec. notes 5.00%, 2/1/25 | | | |

| (Luxembourg) | | 61,000 | 59,933 |

| Nielsen Finance, LLC/Nielsen Finance Co. 144A | | |

| company guaranty sr. unsec. sub. notes 5.00%, | | |

| 4/15/22 | | 124,000 | 123,690 |

| Outfront Media Capital, LLC/Outfront Media | | |

| Capital Corp. company guaranty sr. unsec. | | |

| sub. notes 5.875%, 3/15/25 | | 125,000 | 129,219 |

| Outfront Media Capital, LLC/Outfront Media | | |

| Capital Corp. company guaranty sr. unsec. | | |

| sub. notes 5.625%, 2/15/24 | | 66,000 | 67,901 |

| Penske Automotive Group, Inc. company | | |

| guaranty sr. unsec. sub. notes 5.75%, 10/1/22 | 200,000 | 202,750 |

| Penske Automotive Group, Inc. company | | |

| guaranty sr. unsec. sub. notes 5.50%, 5/15/26 | 48,000 | 50,040 |

| Penske Automotive Group, Inc. company | | |

| guaranty sr. unsec. sub. notes 5.375%, 12/1/24 | 109,000 | 111,998 |

| PulteGroup, Inc. company guaranty sr. unsec. | | |

| unsub. notes 7.875%, 6/15/32 | | 9,000 | 10,710 |

| PulteGroup, Inc. company guaranty sr. unsec. | | |

| unsub. notes 5.50%, 3/1/26 | | 155,000 | 167,400 |

| Refinitiv US Holdings, Inc. 144A company | | |

| guaranty sr. notes 6.25%, 5/15/26 | | 17,000 | 17,485 |

| Rivers Pittsburgh Borrower LP/Rivers Pittsburgh | | |

| Finance Corp. 144A sr. notes 6.125%, 8/15/21 | 165,000 | 167,888 |

| Sabre GLBL, Inc. 144A company | | | |

| guaranty sr. notes 5.375%, 4/15/23 | | 131,000 | 133,948 |

| Scientific Games International, Inc. company | | |

| guaranty sr. unsec. notes 10.00%, 12/1/22 | 205,000 | 214,994 |

| Scientific Games International, Inc. 144A company | | |

| guaranty sr. notes 5.00%, 10/15/25 | | 55,000 | 55,550 |

| Sinclair Television Group, Inc. 144A company | | |

| guaranty sr. unsec. sub. notes 5.625%, 8/1/24 | 60,000 | 61,350 |

| Sirius XM Radio, Inc. 144A company | | | |

| guaranty sr. unsec. sub. notes 6.00%, 7/15/24 | 105,000 | 108,255 |

| | | |

| CORPORATE BONDS | | | |

| AND NOTES (20.3%)*cont. | Principal amount | Value |

| |

| Consumer cyclicalscont. | | | |

| Sirius XM Radio, Inc. 144A sr. unsec. | | | |

| bonds 5.00%, 8/1/27 | | $157,000 | $159,551 |

| Six Flags Entertainment Corp. 144A company | | |

| guaranty sr. unsec. bonds 5.50%, 4/15/27 | 155,000 | 161,200 |

| Six Flags Entertainment Corp. 144A company | | |

| guaranty sr. unsec. unsub. notes 4.875%, 7/31/24 | 195,000 | 198,047 |

| Spectrum Brands, Inc. company guaranty sr. unsec. | | |

| sub. notes 6.625%, 11/15/22 | | 7,000 | 7,158 |

| Standard Industries, Inc. 144A sr. unsec. | | |

| notes 6.00%, 10/15/25 | | 30,000 | 31,838 |

| Standard Industries, Inc. 144A sr. unsec. | | |

| notes 5.375%, 11/15/24 | | 151,000 | 156,285 |

| Standard Industries, Inc. 144A sr. unsec. | | |

| notes 4.75%, 1/15/28 | | 10,000 | 9,925 |

| Tendam Brands SAU sr. notes Ser. REGS, | | |

| 5.00%, 9/15/24 (Spain) | EUR | 100,000 | 116,836 |

| Tribune Media Co. company guaranty sr. unsec. | | |

| notes 5.875%, 7/15/22 | | $107,000 | 108,862 |

| Weekley Homes, LLC/Weekley Finance Corp. | | |

| sr. unsec. notes 6.00%, 2/1/23 | | 70,000 | 69,125 |

| Wolverine World Wide, Inc. 144A company | | |

| guaranty sr. unsec. bonds 5.00%, 9/1/26 | 87,000 | 85,913 |

| Wyndham Hotels & Resorts, Inc. 144A company | | |

| guaranty sr. unsec. notes 5.375%, 4/15/26 | 90,000 | 94,275 |

| Wynn Las Vegas, LLC/Wynn Las Vegas Capital Corp. | | |

| 144A company guaranty sr. unsec. | | | |

| sub. notes 5.25%, 5/15/27 | | 220,000 | 220,825 |

| | | | 6,782,973 |

| Consumer staples (0.8%) | | | |

| 1011778 BC ULC/New Red Finance, Inc. 144A company | |

| guaranty notes 5.00%, 10/15/25 (Canada) | 135,000 | 136,013 |

| 1011778 BC ULC/New Red Finance, Inc. 144A company | |

| guaranty sr. sub. notes 4.25%, 5/15/24 (Canada) | 100,000 | 101,125 |

| Energizer Holdings, Inc. 144A company | | |

| guaranty sr. unsec. notes 7.75%, 1/15/27 | 10,000 | 10,823 |

| Energizer Holdings, Inc. 144A company | | |

| guaranty sr. unsec. sub. notes 6.375%, 7/15/26 | 35,000 | 35,963 |

| Go Daddy Operating Co, LLC/GD Finance Co., Inc. | | |

| 144A company guaranty sr. unsec. notes 5.25%, | | |

| 12/1/27 | | 45,000 | 46,575 |

| Golden Nugget, Inc. 144A company | | | |

| guaranty sr. unsec. sub. notes 8.75%, 10/1/25 | 81,000 | 85,050 |

| Golden Nugget, Inc. 144A sr. unsec. notes 6.75%, | | |

| 10/15/24 | | 180,000 | 185,400 |

| IAA, Inc. 144A sr. unsec. notes 5.50%, 6/15/27 | 20,000 | 20,800 |

| Itron, Inc. 144A company guaranty sr. unsec. | | |

| notes 5.00%, 1/15/26 | | 70,000 | 71,575 |

| KFC Holding Co./Pizza Hut Holdings, LLC/Taco Bell | | |

| of America, LLC 144A company guaranty sr. unsec. | | |

| notes 5.25%, 6/1/26 | | 115,000 | 120,605 |

| KFC Holding Co./Pizza Hut Holdings, LLC/Taco Bell | | |

| of America, LLC 144A company guaranty sr. unsec. | | |

| notes 5.00%, 6/1/24 | | 115,000 | 118,881 |

| KFC Holding Co./Pizza Hut Holdings, LLC/Taco Bell | | |

| of America, LLC 144A company guaranty sr. unsec. | | |

| notes 4.75%, 6/1/27 | | 65,000 | 66,625 |

| Lamb Weston Holdings, Inc. 144A company | | |

| guaranty sr. unsec. unsub. notes 4.875%, 11/1/26 | 130,000 | 135,200 |

| Lamb Weston Holdings, Inc. 144A company | | |

| guaranty sr. unsec. unsub. notes 4.625%, 11/1/24 | 32,000 | 33,160 |

| |

| 10Putnam VT Diversified Income Fund |

| | | |

| CORPORATE BONDS | | | |

| AND NOTES (20.3%)*cont. | Principal amount | Value |

| |

| Consumer staplescont. | | | |

| Match Group, Inc. 144A sr. unsec. bonds 5.00%, | | |

| 12/15/27 | | $142,000 | $148,731 |

| Netflix, Inc. sr. unsec. notes 4.875%, 4/15/28 | 90,000 | 92,813 |

| Netflix, Inc. sr. unsec. unsub. notes 5.875%, | | |

| 11/15/28 | | 150,000 | 166,068 |

| Netflix, Inc. 144A sr. unsec. bonds 6.375%, | | |

| 5/15/29 | | 50,000 | 56,828 |

| Newell Brands, Inc. sr. unsec. | | | |

| unsub. notes 4.20%, 4/1/26 | | 85,000 | 84,476 |

| | | | 1,716,711 |

| Energy (4.1%) | | | |

| Aker BP ASA 144A sr. unsec. notes 6.00%, 7/1/22 | | |

| (Norway) | | 150,000 | 154,313 |

| Aker BP ASA 144A sr. unsec. notes 5.875%, 3/31/25 | | |

| (Norway) | | 184,000 | 194,350 |

| Antero Midstream Partners LP/Antero Midstream | | |

| Finance Corp. 144A sr. unsec. notes 5.75%, | | |

| 1/15/28 | | 70,000 | 69,300 |

| Antero Resources Corp. company | | | |

| guaranty sr. unsec. notes 5.625%, 6/1/23 | 40,000 | 38,608 |

| Antero Resources Corp. company | | | |

| guaranty sr. unsec. notes 5.00%, 3/1/25 | | 130,000 | 119,925 |

| Apergy Corp. company guaranty sr. unsec. | | |

| notes 6.375%, 5/1/26 | | 103,000 | 103,773 |

| Ascent Resources Utica Holdings, LLC/ARU | | |

| Finance Corp. 144A sr. unsec. notes 10.00%, | | |

| 4/1/22 | | 79,000 | 83,633 |

| Ascent Resources Utica Holdings, LLC/ARU | | |

| Finance Corp. 144A sr. unsec. notes 7.00%, | | |

| 11/1/26 | | 35,000 | 31,938 |

| California Resources Corp. 144A company | | |

| guaranty notes 8.00%, 12/15/22 | | 161,000 | 121,354 |

| Cenovus Energy, Inc. sr. unsec. bonds 6.75%, | | |

| 11/15/39 (Canada) | | 75,000 | 88,313 |

| Cheniere Corpus Christi Holdings, LLC company | | |

| guaranty sr. notes 5.875%, 3/31/25 | | 219,000 | 243,911 |

| Cheniere Corpus Christi Holdings, LLC company | | |

| guaranty sr. notes 5.125%, 6/30/27 | | 301,000 | 326,961 |

| Chesapeake Energy Corp. company | | | |

| guaranty sr. unsec. notes 8.00%, 6/15/27 | 43,000 | 37,894 |

| Chesapeake Energy Corp. company | | | |

| guaranty sr. unsec. notes 8.00%, 1/15/25 | 85,000 | 78,838 |

| Chesapeake Energy Corp. company | | | |

| guaranty sr. unsec. notes 5.75%, 3/15/23 | 8,000 | 7,500 |

| Covey Park Energy, LLC/Covey Park Finance Corp. | | |

| 144A company guaranty sr. unsec. notes 7.50%, | | |

| 5/15/25 | | 148,000 | 106,560 |

| Denbury Resources, Inc. 144A company | | | |

| guaranty notes 9.00%, 5/15/21 | | 90,000 | 88,650 |

| Denbury Resources, Inc. 144A company | | | |

| guaranty sub. notes 7.75%, 2/15/24 | | 35,000 | 29,050 |

| Diamondback Energy, Inc. company | | | |

| guaranty sr. unsec. unsub. notes 5.375%, 5/31/25 | 140,000 | 147,175 |

| Endeavor Energy Resources LP/EER Finance, Inc. | | |

| 144A sr. unsec. bonds 5.75%, 1/30/28 | | 120,000 | 126,750 |

| Energy Transfer Partners LP company | | | |

| guaranty sr. unsec. notes 5.875%, 1/15/24 | 91,000 | 101,298 |

| Energy Transfer Partners LP company | | | |

| guaranty sr. unsec. notes 5.50%, 6/1/27 | | 50,000 | 55,891 |

| Energy Transfer Partners LP jr. unsec. sub. FRB | | |

| Ser. B, 6.625%, perpetual maturity | | 210,000 | 196,350 |

| | | |

| CORPORATE BONDS | | | |

| AND NOTES (20.3%)*cont. | Principal amount | Value |

| |

| Energycont. | | | |

| Ensco Rowan PLC sr. unsec. notes 7.75%, 2/1/26 | | |

| (United Kingdom) | | $81,000 | $60,345 |

| Hess Infrastructure Partners LP/Hess | | | |

| Infrastructure Partners Finance Corp. 144A | | |

| sr. unsec. notes 5.625%, 2/15/26 | | 129,000 | 132,709 |

| Holly Energy Partners LP/Holly Energy | | | |

| Finance Corp. 144A company guaranty sr. unsec. | | |

| notes 6.00%, 8/1/24 | | 181,000 | 188,466 |

| Indigo Natural Resources, LLC 144A sr. unsec. | | |

| notes 6.875%, 2/15/26 | | 123,000 | 110,393 |

| MEG Energy Corp. 144A company guaranty sr. unsec. | |

| notes 7.00%, 3/31/24 (Canada) | | 7,000 | 6,650 |

| MEG Energy Corp. 144A company guaranty sr. unsec. | |

| notes 6.375%, 1/30/23 (Canada) | | 37,000 | 35,243 |

| MEG Energy Corp. 144A notes 6.50%, 1/15/25 | | |

| (Canada) | | 90,000 | 90,450 |

| Nabors Industries, Inc. company | | | |

| guaranty sr. unsec. notes 5.75%, 2/1/25 | | 115,000 | 101,919 |

| Nabors Industries, Inc. company | | | |

| guaranty sr. unsec. notes 5.50%, 1/15/23 | 15,000 | 14,025 |

| Nine Energy Service, Inc. 144A sr. unsec. | | | |

| notes 8.75%, 11/1/23 | | 45,000 | 43,875 |

| Noble Holding International, Ltd. company | | |

| guaranty sr. unsec. unsub. notes 7.75%, 1/15/24 | 46,000 | 35,075 |

| Oasis Petroleum, Inc. company guaranty sr. unsec. | | |

| sub. notes 6.875%, 1/15/23 | | 61,000 | 60,695 |

| Oasis Petroleum, Inc. company guaranty sr. unsec. | | |

| unsub. notes 6.875%, 3/15/22 | | 66,000 | 65,835 |

| Oasis Petroleum, Inc. 144A sr. unsec. | | | |

| notes 6.25%, 5/1/26 | | 95,000 | 91,913 |

| Pertamina Persero PT 144A sr. unsec. | | | |

| unsub. notes 4.875%, 5/3/22 (Indonesia) | 200,000 | 210,600 |

| Pertamina Persero PT 144A sr. unsec. | | | |

| unsub. notes 4.30%, 5/20/23 (Indonesia) | 285,000 | 297,240 |

| Petrobras Global Finance BV company guaranty | | |

| sr. unsec. unsub. bonds 7.375%, 1/17/27 (Brazil) | 541,000 | 618,904 |

| Petrobras Global Finance BV company guaranty | | |

| sr. unsec. unsub. notes 6.25%, 3/17/24 (Brazil) | 432,000 | 474,660 |

| Petrobras Global Finance BV company guaranty | | |

| sr. unsec. unsub. notes 6.125%, 1/17/22 (Brazil) | 1,001,000 | 1,072,286 |

| Petrobras Global Finance BV company guaranty | | |

| sr. unsec. unsub. notes 5.999%, 1/27/28 (Brazil) | 475,000 | 504,094 |

| Petrobras Global Finance BV company guaranty | | |

| sr. unsec. unsub. notes 5.299%, 1/27/25 (Brazil) | 35,000 | 37,144 |

| Petroleos de Venezuela SA company | | | |

| guaranty sr. unsec. bonds Ser. REGS, 6.00%, | | |

| 11/15/26 (Venezuela) (In default) † | | 378,000 | 56,700 |

| Petroleos de Venezuela SA company | | | |

| guaranty sr. unsec. unsub. notes 5.375%, 4/12/27 | | |

| (Venezuela) (In default) † | | 297,000 | 53,460 |

| Petroleos de Venezuela SA 144A company | | |

| guaranty sr. unsec. notes 6.00%, 11/15/26 | | |

| (Venezuela) (In default) † | | 760,000 | 114,000 |

| Petroleos Mexicanos company guaranty sr. unsec. | | |

| unsub. notes 6.375%, 1/23/45 (Mexico) | | 343,000 | 295,011 |

| Precision Drilling Corp. 144A company | | | |

| guaranty sr. unsec. notes 7.125%, 1/15/26 | | |

| (Canada) | | 111,000 | 107,393 |

| Regency Energy Partners LP/Regency Energy | | |

| Finance Corp. company guaranty sr. unsec. | | |

| unsub. notes 4.50%, 11/1/23 | | 69,000 | 72,890 |

| |

| Putnam VT Diversified Income Fund11 |

| | | |

| CORPORATE BONDS | | | |

| AND NOTES (20.3%)*cont. | Principal amount | Value |

| |

| Energycont. | | | |

| Rose Rock Midstream LP/Rose Rock Finance Corp. | | |

| company guaranty sr. unsec. sub. notes 5.625%, | | |

| 11/15/23 | | $16,000 | $15,280 |

| Rose Rock Midstream LP/Rose Rock Finance Corp. | | |

| company guaranty sr. unsec. sub. notes 5.625%, | | |

| 7/15/22 | | 83,000 | 81,818 |

| SESI, LLC company guaranty sr. unsec. | | | |

| notes 7.75%, 9/15/24 | | 34,000 | 21,845 |

| SESI, LLC company guaranty sr. unsec. | | | |

| unsub. notes 7.125%, 12/15/21 | | 69,000 | 48,128 |

| Seventy Seven Energy, Inc. escrow sr. unsec. | | |

| notes 6.50%, 7/15/22F | | 20,000 | 2 |

| SM Energy Co. sr. unsec. unsub. notes 6.125%, | | |

| 11/15/22 | | 74,000 | 73,445 |

| Tallgrass Energy Partners LP/Tallgrass Energy | | |

| Finance Corp. 144A company guaranty sr. unsec. | | |

| notes 5.50%, 1/15/28 | | 85,000 | 85,956 |

| Targa Resources Partners LP/Targa Resources | | |

| Partners Finance Corp. company | | | |

| guaranty sr. unsec. unsub. notes 5.00%, 1/15/28 | 87,000 | 87,218 |

| Targa Resources Partners LP/Targa Resources | | |

| Partners Finance Corp. 144A company | | | |

| guaranty sr. unsec. notes 6.875%, 1/15/29 | 30,000 | 33,261 |

| Targa Resources Partners LP/Targa Resources | | |

| Partners Finance Corp. 144A company | | | |

| guaranty sr. unsec. notes 6.50%, 7/15/27 | 45,000 | 49,106 |

| Transocean Pontus, Ltd. 144A company | | | |

| guaranty sr. notes 6.125%, 8/1/25 | | | |

| (Cayman Islands) | | 75,600 | 77,868 |

| Transocean Poseidon, Ltd. 144A company | | |

| guaranty sr. notes 6.875%, 2/1/27 | | 49,000 | 51,787 |

| Transocean Sentry Ltd. 144A company | | | |

| guaranty sr. notes 5.375%, 5/15/23 | | | |

| (Cayman Islands) | | 80,000 | 80,100 |