| | |

| UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | |

| Investment Company Act file number: | (811-05346) |

| | |

| Exact name of registrant as specified in charter: | Putnam Variable Trust |

| | |

| Address of principal executive offices: | 100 Federal Street, Boston, Massachusetts 02110 |

| | |

| Name and address of agent for service: | Stephen Tate, Vice President

100 Federal Street

Boston, Massachusetts 02110 |

| | |

| Copy to: | Bryan Chegwidden, Esq.

Ropes & Gray LLP

1211 Avenue of the Americas

New York, New York 10036 |

| | |

| | James E. Thomas, Esq.

Ropes & Gray LLP

800 Boylston Street

Boston, Massachusetts 02199 |

| | |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| | |

| Date of fiscal year end: | December 31, 2024 |

| | |

| Date of reporting period: | January 1, 2024 – June 30, 2024 |

| | |

|

Item 1. Report to Stockholders: | |

| |

|

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: | |

| | |

Putnam VT High Yield Fund | |

Class IAtrue |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Putnam VT High Yield Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) 225-1581.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment† |

Class IA1 | $37 | 0.74% |

| 1 | Does not reflect expenses incurred from investing through variable annuity or variable life insurance products. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $143,433,171 |

Total Number of Portfolio Holdings* | 469 |

Portfolio Turnover Rate | 27% |

| * | Includes derivatives, if applicable. |

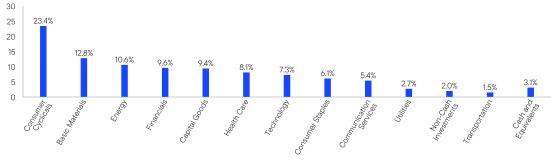

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition (% of Total Net Assets)

| Cash and Equivalents, if any, represent the market value weights of cash, derivatives, short-term securities, and other unclassified assets in the portfolio. Allocations may not total 100% because the chart includes the notional value of certain derivatives (the economic value for purposes of calculating periodic payment obligations), in addition to the market value of securities. Holdings and allocations may vary over time. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Putnam VT High Yield Fund | PAGE 1 | 38920-STSIA-0824 |

23.412.810.69.69.48.17.36.15.42.72.01.53.1

| | |

Putnam VT High Yield Fund | |

Class IBtrue |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Putnam VT High Yield Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) 225-1581.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment† |

Class IB1 | $50 | 0.99% |

| 1 | Does not reflect expenses incurred from investing through variable annuity or variable life insurance products. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $143,433,171 |

Total Number of Portfolio Holdings* | 469 |

Portfolio Turnover Rate | 27% |

| * | Includes derivatives, if applicable. |

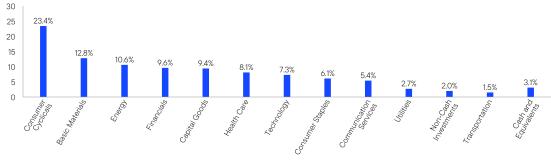

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition (% of Total Net Assets)

| Cash and Equivalents, if any, represent the market value weights of cash, derivatives, short-term securities, and other unclassified assets in the portfolio. Allocations may not total 100% because the chart includes the notional value of certain derivatives (the economic value for purposes of calculating periodic payment obligations), in addition to the market value of securities. Holdings and allocations may vary over time. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Putnam VT High Yield Fund | PAGE 1 | 38920-STSIB-0824 |

23.412.810.69.69.48.17.36.15.42.72.01.53.1

| |

| Item 3. Audit Committee Financial Expert: |

| |

| Item 4. Principal Accountant Fees and Services: |

| |

| Item 5. Audit Committee of Listed Registrants |

| |

| The registrant’s schedule of investments in unaffiliated issuers is included in the Financial Statements and Other Important Information in Item 7 below. |

| |

| Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies. |

Putnam

VT High Yield Fund

Financial Statements and Other Important Information

Semiannual | June 30, 2024

Table of Contents

| | Financial Statements and Other Important Information—Semiannual | franklintempleton.com |

| | | |

| The fund’s portfolio 6/30/24 (Unaudited) | | |

| |

| | | | |

| CORPORATE BONDS AND NOTES (84.0%)* | Principal amount | Value |

| Advertising and marketing services (1.5%) |

| Clear Channel Outdoor Holdings, Inc. 144A company guaranty sr. notes 7.875%, 4/1/30 | | $565,000 | $567,825 |

| Clear Channel Outdoor Holdings, Inc. 144A company guaranty sr. notes 5.125%, 8/15/27 | | 60,000 | 57,299 |

| Clear Channel Outdoor Holdings, Inc. 144A company guaranty sr. unsec. sub. notes 7.75%, 4/15/28 | | 580,000 | 507,502 |

| Neptune Bidco US, Inc. 144A sr. notes 9.29%, 4/15/29 | | 395,000 | 379,111 |

| Outfront Media Capital, LLC/Outfront Media Capital Corp. 144A company guaranty sr. notes 7.375%, 2/15/31 | | 380,000 | 395,469 |

| Outfront Media Capital, LLC/Outfront Media Capital Corp. 144A company guaranty sr. unsec. notes 5.00%, 8/15/27 | | 260,000 | 251,685 |

| | | | 2,158,891 |

| Broadcasting (1.5%) |

| Banijay Entertainment SASU 144A sr. notes 8.125%, 5/1/29 (France) | | 635,000 | 649,415 |

| Gray Television, Inc. 144A company guaranty sr. unsec. unsub. notes 5.375%, 11/15/31 | | 400,000 | 226,750 |

| Nexstar Media, Inc. 144A company guaranty sr. unsec. notes 4.75%, 11/1/28 | | 240,000 | 213,385 |

| Paramount Global sr. unsec. unsub. notes 4.20%, 6/1/29 | | 125,000 | 111,311 |

| Sirius XM Radio, Inc. 144A company guaranty sr. unsec. bonds 3.875%, 9/1/31 | | 350,000 | 285,717 |

| Sirius XM Radio, Inc. 144A company guaranty sr. unsec. notes 4.00%, 7/15/28 | | 380,000 | 343,274 |

| Univision Communications, Inc. 144A sr. notes 8.00%, 8/15/28 | | 355,000 | 346,206 |

| | | | 2,176,058 |

| Building materials (3.1%) |

| American Builders & Contractors Supply Co., Inc. 144A sr. notes 4.00%, 1/15/28 | | 295,000 | 275,411 |

| American Builders & Contractors Supply Co., Inc. 144A sr. unsec. notes 3.875%, 11/15/29 | | 295,000 | 263,873 |

| BCPE Ulysses Intermediate, Inc. 144A sr. unsec. notes 7.75%, 4/1/27 ‡‡ | | 220,000 | 214,444 |

| Camelot Return Merger Sub, Inc. 144A sr. notes 8.75%, 8/1/28 | | 525,000 | 514,708 |

| EMRLD Borrower LP/Emerald Co-Issuer, Inc. company guaranty sr. bonds Ser. REGS, 6.375%, 12/15/30 | EUR | 110,000 | 121,894 |

| EMRLD Borrower LP/Emerald Co-Issuer, Inc. 144A sr. notes 6.625%, 12/15/30 | | $515,000 | 518,219 |

| LBM Acquisition, LLC 144A company guaranty sr. unsec. notes 6.25%, 1/15/29 | | 370,000 | 327,035 |

| MIWD Holdco II, LLC/MIWD Finance Corp. 144A company guaranty sr. unsec. notes 5.50%, 2/1/30 | | 495,000 | 456,832 |

| Owens Corning 144A sr. unsec. notes 3.50%, 2/15/30 | | 325,000 | 296,120 |

| Standard Industries, Inc. sr. unsec. notes Ser. REGS, 2.25%, 11/21/26 | EUR | 100,000 | 100,734 |

| Standard Industries, Inc. 144A sr. unsec. bonds 3.375%, 1/15/31 | | $35,000 | 29,489 |

| Standard Industries, Inc. 144A sr. unsec. notes 4.375%, 7/15/30 | | 630,000 | 569,216 |

| White Cap Buyer, LLC 144A sr. unsec. notes 6.875%, 10/15/28 | | 665,000 | 641,653 |

| White Cap Parent, LLC 144A sr. unsec. notes 8.25%, 3/15/26 ‡‡ | | 150,000 | 150,003 |

| | | | 4,479,631 |

| Capital goods (8.1%) |

| Ardagh Metal Packaging Finance USA, LLC/Ardagh Metal Packaging Finance PLC sr. unsec. notes Ser. REGS, 3.00%, 9/1/29 | EUR | 100,000 | 85,997 |

| Ardagh Metal Packaging Finance USA, LLC/Ardagh Metal Packaging Finance PLC 144A sr. unsec. notes 4.00%, 9/1/29 | | $280,000 | 236,952 |

| Ardagh Packaging Finance PLC/Ardagh Holdings USA, Inc. 144A sr. unsec. notes 5.25%, 8/15/27 (Ireland) | | 295,000 | 182,995 |

| Benteler International AG 144A company guaranty sr. notes 10.50%, 5/15/28 (Austria) | | 540,000 | 577,800 |

| Boeing Co. (The) sr. unsec. bonds 5.705%, 5/1/40 | | 150,000 | 138,295 |

| Boeing Co. (The) sr. unsec. notes 3.20%, 3/1/29 | | 160,000 | 141,955 |

| Boeing Co. (The) 144A sr. unsec. notes 6.388%, 5/1/31 | | 315,000 | 320,688 |

| Bombardier, Inc. 144A sr. unsec. notes 7.875%, 4/15/27 (Canada) | | 99,000 | 99,252 |

| Bombardier, Inc. 144A sr. unsec. notes 7.50%, 2/1/29 (Canada) | | 175,000 | 181,341 |

| Bombardier, Inc. 144A sr. unsec. notes 7.00%, 6/1/32 (Canada) | | 105,000 | 106,459 |

| Bombardier, Inc. 144A sr. unsec. notes 7.25%, 7/1/31 | | 130,000 | 133,250 |

| Bombardier, Inc. 144A sr. unsec. unsub. notes 8.75%, 11/15/30 (Canada) | | 260,000 | 281,004 |

| Chart Industries, Inc. 144A company guaranty sr. notes 7.50%, 1/1/30 | | 335,000 | 346,178 |

| Chart Industries, Inc. 144A company guaranty sr. unsec. notes 9.50%, 1/1/31 | | 210,000 | 227,527 |

| Clarios Global LP 144A company guaranty sr. notes 6.75%, 5/15/25 | | 477,000 | 476,855 |

| Clarios Global LP 144A sr. notes 6.75%, 5/15/28 | | 215,000 | 217,591 |

| Clarios Global LP/Clarios US Finance Co. company guaranty sr. notes Ser. REGS, 4.375%, 5/15/26 | EUR | 115,000 | 122,450 |

| Clean Harbors, Inc. 144A company guaranty sr. unsec. unsub. notes 6.375%, 2/1/31 | | $275,000 | 275,716 |

| Crown Cork & Seal Co., Inc. company guaranty sr. unsec. bonds 7.375%, 12/15/26 | | 155,000 | 160,148 |

| Garrett Motion Holdings, Inc./Garrett LX I Sarl 144A company guaranty sr. unsec. notes 7.75%, 5/31/32 | | 200,000 | 202,684 |

| GFL Environmental, Inc. 144A company guaranty sr. unsec. notes 4.75%, 6/15/29 (Canada) | | 240,000 | 226,503 |

| GFL Environmental, Inc. 144A sr. notes 6.75%, 1/15/31 (Canada) | | 115,000 | 117,321 |

| Great Lakes Dredge & Dock Corp. 144A company guaranty sr. unsec. notes 5.25%, 6/1/29 | | 585,000 | 522,003 |

| | |

Putnam VT High Yield Fund 1 |

| | | | |

| CORPORATE BONDS AND NOTES (84.0%)* cont. | Principal amount | Value |

| Capital goods cont. |

| Madison IAQ, LLC 144A sr. notes 4.125%, 6/30/28 | | $235,000 | $219,168 |

| Madison IAQ, LLC 144A sr. unsec. notes 5.875%, 6/30/29 | | 540,000 | 502,415 |

| Owens-Brockway Glass Container, Inc. 144A company guaranty sr. unsec. notes 7.25%, 5/15/31 | | 420,000 | 419,271 |

| Panther BF Aggregator 2 LP/Panther Finance Co., Inc. 144A company guaranty sr. unsec. notes 8.50%, 5/15/27 | | 235,000 | 236,326 |

| Ritchie Bros Holdings, Inc. 144A company guaranty sr. notes 6.75%, 3/15/28 | | 115,000 | 117,156 |

| Ritchie Bros Holdings, Inc. 144A company guaranty sr. unsec. unsub. notes 7.75%, 3/15/31 | | 395,000 | 411,294 |

| Roller Bearing Co. of America, Inc. 144A sr. notes 4.375%, 10/15/29 | | 135,000 | 124,232 |

| Sensata Technologies BV 144A company guaranty sr. unsec. notes 4.00%, 4/15/29 | | 200,000 | 183,620 |

| Sensata Technologies BV 144A company guaranty sr. unsec. unsub. notes 5.875%, 9/1/30 | | 490,000 | 479,854 |

| Spirit AeroSystems, Inc. 144A company guaranty sr. notes 9.75%, 11/15/30 | | 505,000 | 557,074 |

| Spirit AeroSystems, Inc. 144A sr. unsub. notes 9.375%, 11/30/29 | | 115,000 | 123,813 |

| Terex Corp. 144A company guaranty sr. unsec. notes 5.00%, 5/15/29 | | 235,000 | 222,990 |

| TK Elevator Holdco GmbH sr. unsec. notes Ser. REGS, 6.625%, 7/15/28 (Germany) | EUR | 211,500 | 217,636 |

| TransDigm, Inc. company guaranty sr. unsec. sub. notes 4.875%, 5/1/29 | | $470,000 | 440,244 |

| TransDigm, Inc. 144A company guaranty sr. notes 7.125%, 12/1/31 | | 70,000 | 72,126 |

| TransDigm, Inc. 144A sr. notes 6.875%, 12/15/30 | | 290,000 | 296,047 |

| TransDigm, Inc. 144A sr. notes 6.75%, 8/15/28 | | 355,000 | 358,550 |

| TransDigm, Inc. 144A sr. notes 6.625%, 3/1/32 | | 305,000 | 308,068 |

| Vertical Midco GMBH company guaranty sr. notes Ser. REGS, 4.375%, 7/15/27 (Germany) | EUR | 210,000 | 216,477 |

| Vertiv Group Corp. 144A company guaranty sr. notes 4.125%, 11/15/28 | | $220,000 | 205,452 |

| WESCO Distribution, Inc. 144A company guaranty sr. unsec. notes 6.625%, 3/15/32 | | 90,000 | 90,947 |

| WESCO Distribution, Inc. 144A company guaranty sr. unsec. notes 6.375%, 3/15/29 | | 90,000 | 90,325 |

| Wrangler Holdco Corp. 144A company guaranty sr. unsec. sub. notes 6.625%, 4/1/32 | | 155,000 | 154,315 |

| ZF North America Capital, Inc. 144A company guaranty sr. unsec. unsub. notes 6.75%, 4/23/30 (Germany) | | 255,000 | 259,144 |

| | | | 11,687,508 |

| Chemicals (4.1%) |

| Avient Corp. 144A sr. unsec. unsub. notes 7.125%, 8/1/30 | | 415,000 | 422,924 |

| Axalta Coating Systems, LLC 144A company guaranty sr. unsec. notes 3.375%, 2/15/29 | | 650,000 | 581,544 |

| Herens Holdco SARL 144A company guaranty sr. notes 4.75%, 5/15/28 (Luxembourg) | | 380,000 | 329,627 |

| Ingevity Corp. 144A company guaranty sr. unsec. notes 3.875%, 11/1/28 | | 245,000 | 222,031 |

| LSF11 A5 HoldCo, LLC 144A sr. unsec. notes 6.625%, 10/15/29 | | 355,000 | 335,990 |

| Olympus Water US Holding Corp. sr. notes Ser. REGS, 3.875%, 10/1/28 | EUR | 155,000 | 154,871 |

| Olympus Water US Holding Corp. 144A sr. notes 9.75%, 11/15/28 | | $220,000 | 232,754 |

| Olympus Water US Holding Corp. 144A sr. notes 4.25%, 10/1/28 | | 520,000 | 473,029 |

| Olympus Water US Holding Corp. 144A sr. unsec. notes 6.25%, 10/1/29 | | 380,000 | 346,868 |

| PMHC II, Inc. 144A sr. unsec. notes 9.00%, 2/15/30 | | 420,000 | 384,405 |

| Rain Carbon, Inc. 144A sr. notes 12.25%, 9/1/29 | | 255,000 | 274,452 |

| SCIH Salt Holdings, Inc. 144A sr. notes 4.875%, 5/1/28 | | 525,000 | 487,852 |

| SCIH Salt Holdings, Inc. 144A sr. unsec. notes 6.625%, 5/1/29 | | 415,000 | 389,709 |

| SCIL IV, LLC/SCIL USA Holdings, LLC 144A sr. notes 5.375%, 11/1/26 | | 240,000 | 231,600 |

| Tronox, Inc. 144A company guaranty sr. unsec. notes 4.625%, 3/15/29 | | 350,000 | 315,941 |

| WR Grace Holdings, LLC 144A sr. notes 7.375%, 3/1/31 | | 355,000 | 358,994 |

| WR Grace Holdings, LLC 144A sr. unsec. notes 5.625%, 8/15/29 | | 310,000 | 285,726 |

| | | | 5,828,317 |

| Commercial and consumer services (2.2%) |

| ADT Security Corp. 144A sr. notes 4.125%, 8/1/29 | | 305,000 | 281,278 |

| Allied Universal Holdco, LLC/Allied Universal Finance Corp. 144A sr. notes 7.875%, 2/15/31 | | 480,000 | 481,249 |

| Allied Universal Holdco, LLC/Allied Universal Finance Corp. 144A sr. notes 6.625%, 7/15/26 | | 5,000 | 4,985 |

| Allied Universal Holdco, LLC/Allied Universal Finance Corp. 144A sr. unsec. notes 6.00%, 6/1/29 | | 340,000 | 297,631 |

| Block, Inc. sr. unsec. notes 3.50%, 6/1/31 | | 580,000 | 500,340 |

| Boost Newco Borrower, LLC 144A sr. notes 7.50%, 1/15/31 | | 365,000 | 380,568 |

| Garda World Security Corp. 144A sr. notes 7.75%, 2/15/28 (Canada) | | 80,000 | 81,200 |

| GW B-CR Security Corp. 144A sr. unsec. notes 9.50%, 11/1/27 (Canada) | | 213,000 | 213,986 |

| Prime Security Services Borrower, LLC/Prime Finance, Inc. 144A notes 6.25%, 1/15/28 | | 450,000 | 443,440 |

| Shift4 Payments, LLC/Shift4 Payments Finance Sub, Inc. 144A company guaranty sr. unsec. notes 4.625%, 11/1/26 | | 475,000 | 459,923 |

| | | | 3,144,600 |

| | |

2 Putnam VT High Yield Fund |

| | | | |

| CORPORATE BONDS AND NOTES (84.0%)* cont. | Principal amount | Value |

| Communication services (4.9%) |

| Altice Financing SA 144A company guaranty sr. notes 5.00%, 1/15/28 (Luxembourg) | | $205,000 | $155,888 |

| Altice France SA 144A company guaranty sr. notes 5.50%, 10/15/29 (France) | | 205,000 | 135,113 |

| Altice France SA 144A company guaranty sr. notes 5.50%, 1/15/28 (France) | | 400,000 | 273,955 |

| Altice France SA 144A company guaranty sr. notes 5.125%, 7/15/29 (France) | | 280,000 | 184,128 |

| CCO Holdings, LLC/CCO Holdings Capital Corp. 144A sr. unsec. bonds 5.375%, 6/1/29 | | 675,000 | 614,091 |

| CCO Holdings, LLC/CCO Holdings Capital Corp. 144A sr. unsec. bonds 4.75%, 3/1/30 | | 1,010,000 | 874,781 |

| CCO Holdings, LLC/CCO Holdings Capital Corp. 144A sr. unsec. unsub. notes 4.75%, 2/1/32 | | 550,000 | 450,434 |

| Connect Finco SARL/Connect US Finco, LLC 144A company guaranty sr. notes 6.75%, 10/1/26 (Luxembourg) | | 315,000 | 304,023 |

| CSC Holdings, LLC 144A company guaranty sr. unsec. notes 11.75%, 1/31/29 | | 635,000 | 541,562 |

| CSC Holdings, LLC 144A company guaranty sr. unsec. notes 5.375%, 2/1/28 | | 515,000 | 391,282 |

| DIRECTV Holdings, LLC/DIRECTV Financing Co., Inc. 144A sr. notes 5.875%, 8/15/27 | | 380,000 | 357,423 |

| DISH DBS Corp. 144A company guaranty sr. notes 5.25%, 12/1/26 | | 165,000 | 130,151 |

| Frontier Communications Holdings, LLC 144A company guaranty sr. notes 8.75%, 5/15/30 | | 295,000 | 303,981 |

| Frontier Communications Holdings, LLC 144A company guaranty sr. notes 5.875%, 10/15/27 | | 450,000 | 439,339 |

| Level 3 Financing, Inc. 144A company guaranty sr. notes 10.50%, 5/15/30 | | 395,000 | 391,214 |

| Level 3 Financing, Inc. 144A company guaranty sr. unsec. notes 4.25%, 7/1/28 | | 275,000 | 103,612 |

| Viasat, Inc. 144A sr. unsec. notes 7.50%, 5/30/31 | | 295,000 | 195,069 |

| Virgin Media Finance PLC 144A sr. unsec. bonds 5.00%, 7/15/30 (United Kingdom) | | 475,000 | 391,659 |

| Virgin Media Secured Finance PLC 144A company guaranty sr. sub. notes 4.50%, 8/15/30 (United Kingdom) | | 245,000 | 207,744 |

| VZ Secured Financing BV 144A sr. notes 5.00%, 1/15/32 (Netherlands) | | 240,000 | 204,600 |

| Ziggo Bond Co. BV 144A sr. unsec. notes 6.00%, 1/15/27 (Netherlands) | | 420,000 | 411,953 |

| | | | 7,062,002 |

| Construction (1.6%) |

| Beacon Roofing Supply, Inc. 144A sr. unsec. unsub. notes 4.125%, 5/15/29 | | 255,000 | 232,299 |

| Builders FirstSource, Inc. 144A company guaranty sr. unsec. bonds 6.375%, 6/15/32 | | 135,000 | 135,195 |

| Builders FirstSource, Inc. 144A company guaranty sr. unsec. bonds 4.25%, 2/1/32 | | 320,000 | 282,857 |

| Builders FirstSource, Inc. 144A sr. unsec. bonds 6.375%, 3/1/34 | | 195,000 | 193,052 |

| Cemex SAB de CV sr. unsec. sub. FRB Ser. REGS, 9.125%, perpetual maturity (Mexico) | | 400,000 | 427,000 |

| CP Atlas Buyer, Inc. 144A sr. unsec. notes 7.00%, 12/1/28 | | 230,000 | 196,612 |

| Miter Brands Acquisition Holdco, Inc./MIWD Borrower, LLC 144A company guaranty sr. notes 6.75%, 4/1/32 | | 230,000 | 231,150 |

| Smyrna Ready Mix Concrete, LLC 144A sr. notes 8.875%, 11/15/31 | | 350,000 | 370,125 |

| Smyrna Ready Mix Concrete, LLC 144A sr. notes 6.00%, 11/1/28 | | 225,000 | 219,817 |

| | | | 2,288,107 |

| Consumer staples (4.6%) |

| 1011778 BC ULC/New Red Finance, Inc. 144A company guaranty sr. sub. notes 6.125%, 6/15/29 (Canada) | | 145,000 | 145,526 |

| 1011778 BC ULC/New Red Finance, Inc. 144A bonds 4.00%, 10/15/30 (Canada) | | 400,000 | 352,120 |

| Albertsons Cos., Inc./Safeway, Inc./New Albertsons LP/Albertsons, LLC 144A company guaranty sr. unsec. notes 4.875%, 2/15/30 | | 500,000 | 472,500 |

| Aramark Services, Inc. 144A company guaranty sr. unsec. notes 5.00%, 2/1/28 | | 435,000 | 420,698 |

| Avis Budget Car Rental, LLC/Avis Budget Finance, Inc. 144A company guaranty sr. unsec. notes 8.00%, 2/15/31 | | 30,000 | 29,709 |

| Avis Budget Car Rental, LLC/Avis Budget Finance, Inc. 144A company guaranty sr. unsec. notes 5.75%, 7/15/27 | | 105,000 | 100,855 |

| Avis Budget Finance PLC 144A notes 7.00%, 2/28/29 | | 190,000 | 199,678 |

| Avis Budget Finance PLC 144A sr. unsec. notes 7.25%, 7/31/30 | EUR | 320,000 | 335,812 |

| CDW, LLC/CDW Finance Corp. company guaranty sr. unsec. notes 3.25%, 2/15/29 | | $330,000 | 298,112 |

| Chobani, LLC/Chobani Finance Corp., Inc. 144A sr. unsec. notes 7.625%, 7/1/29 | | 380,000 | 391,364 |

| Coty, Inc./HFC Prestige Products, Inc./HFC Prestige International US, LLC 144A company guaranty sr. notes 6.625%, 7/15/30 | | 245,000 | 248,626 |

| Coty, Inc./HFC Prestige Products, Inc./HFC Prestige International US, LLC 144A company guaranty sr. notes 4.75%, 1/15/29 | | 310,000 | 294,632 |

| EquipmentShare.com, Inc. 144A notes 9.00%, 5/15/28 | | 340,000 | 350,871 |

| EquipmentShare.com, Inc. 144A notes 8.625%, 5/15/32 | | 245,000 | 253,575 |

| Fertitta Entertainment, LLC/Fertitta Entertainment Finance Co., Inc. 144A company guaranty sr. unsec. notes 6.75%, 1/15/30 | | 515,000 | 452,251 |

| Gates Corp./The 144A sr. unsec. notes 6.875%, 7/1/29 | | 50,000 | 50,872 |

| Herc Holdings, Inc. 144A company guaranty sr. unsec. notes 6.625%, 6/15/29 | | 205,000 | 207,875 |

| Herc Holdings, Inc. 144A company guaranty sr. unsec. notes 5.50%, 7/15/27 | | 500,000 | 492,175 |

| IRB Holding Corp. 144A company guaranty sr. notes 7.00%, 6/15/25 | | 325,000 | 325,071 |

| Match Group Holdings II, LLC 144A sr. unsec. notes 4.125%, 8/1/30 | | 185,000 | 163,684 |

| Match Group Holdings II, LLC 144A sr. unsec. unsub. notes 4.625%, 6/1/28 | | 275,000 | 257,323 |

| | |

Putnam VT High Yield Fund 3 |

| | | | |

| CORPORATE BONDS AND NOTES (84.0%)* cont. | Principal amount | Value |

| Consumer staples cont. |

| TripAdvisor, Inc. 144A company guaranty sr. unsec. notes 7.00%, 7/15/25 | | $300,000 | $300,847 |

| US Foods, Inc. 144A company guaranty sr. unsec. notes 7.25%, 1/15/32 | | 120,000 | 124,535 |

| US Foods, Inc. 144A company guaranty sr. unsec. notes 4.75%, 2/15/29 | | 215,000 | 203,923 |

| VM Consolidated, Inc. 144A company guaranty sr. unsec. notes 5.50%, 4/15/29 | | 180,000 | 171,662 |

| | | | 6,644,296 |

| Energy (9.9%) |

| Antero Resources Corp. 144A company guaranty sr. unsec. notes 7.625%, 2/1/29 | | 96,000 | 98,720 |

| Chesapeake Energy Corp. 144A company guaranty sr. unsec. notes 6.75%, 4/15/29 | | 565,000 | 566,086 |

| Chord Energy Corp. 144A company guaranty sr. unsec. notes 6.375%, 6/1/26 | | 175,000 | 174,954 |

| Civitas Resources, Inc. 144A company guaranty sr. unsec. notes 8.625%, 11/1/30 | | 50,000 | 53,611 |

| Civitas Resources, Inc. 144A company guaranty sr. unsec. notes 8.375%, 7/1/28 | | 305,000 | 319,588 |

| Civitas Resources, Inc. 144A company guaranty sr. unsec. unsub. notes 8.75%, 7/1/31 | | 530,000 | 567,604 |

| Comstock Resources, Inc. 144A company guaranty sr. unsec. notes 5.875%, 1/15/30 | | 455,000 | 423,387 |

| Comstock Resources, Inc. 144A sr. unsec. notes 6.75%, 3/1/29 | | 75,000 | 72,684 |

| Encino Acquisition Partners Holdings, LLC 144A company guaranty sr. unsec. notes 8.50%, 5/1/28 | | 635,000 | 647,109 |

| Endeavor Energy Resources LP/EER Finance, Inc. 144A sr. unsec. bonds 5.75%, 1/30/28 | | 940,000 | 948,832 |

| Global Partners LP/GLP Finance Corp. 144A company guaranty sr. unsec. notes 8.25%, 1/15/32 | | 235,000 | 241,541 |

| Hess Midstream Operations LP 144A company guaranty sr. unsec. notes 5.50%, 10/15/30 | | 155,000 | 149,780 |

| Hess Midstream Operations LP 144A company guaranty sr. unsec. notes 5.125%, 6/15/28 | | 345,000 | 334,048 |

| Hess Midstream Operations LP 144A company guaranty sr. unsec. sub. notes 6.50%, 6/1/29 | | 180,000 | 182,477 |

| Kinetik Holdings LP 144A company guaranty sr. unsec. notes 5.875%, 6/15/30 | | 400,000 | 394,164 |

| Matador Resources Co. 144A sr. unsec. notes 6.50%, 4/15/32 | | 250,000 | 250,019 |

| Nabors Industries, Inc. 144A company guaranty sr. unsec. notes 7.375%, 5/15/27 | | 280,000 | 284,813 |

| Occidental Petroleum Corp. sr. unsec. sub. bonds 6.20%, 3/15/40 | | 890,000 | 891,735 |

| Ovintiv, Inc. company guaranty sr. unsec. unsub. bonds 7.375%, 11/1/31 | | 155,000 | 168,862 |

| Permian Resources Operating, LLC 144A company guaranty sr. unsec. notes 5.375%, 1/15/26 | | 320,000 | 316,454 |

| Precision Drilling Corp. 144A company guaranty sr. unsec. notes 7.125%, 1/15/26 (Canada) | | 199,000 | 198,999 |

| Precision Drilling Corp. 144A company guaranty sr. unsec. notes 6.875%, 1/15/29 (Canada) | | 230,000 | 227,527 |

| Rockcliff Energy II, LLC 144A sr. unsec. notes 5.50%, 10/15/29 | | 510,000 | 477,387 |

| Seadrill Finance, Ltd. 144A company guaranty notes 8.375%, 8/1/30 (Bermuda) | | 555,000 | 580,075 |

| Sitio Royalties Operating Partnership LP/Sitio Finance Corp. 144A sr. unsec. notes 7.875%, 11/1/28 | | 505,000 | 522,155 |

| SM Energy Co. sr. unsec. notes 6.625%, 1/15/27 | | 145,000 | 144,423 |

| SM Energy Co. sr. unsec. unsub. notes 6.75%, 9/15/26 | | 90,000 | 90,030 |

| SM Energy Co. sr. unsec. unsub. notes 6.50%, 7/15/28 | | 355,000 | 351,947 |

| Southwestern Energy Co. company guaranty sr. unsec. bonds 4.75%, 2/1/32 | | 85,000 | 78,194 |

| Southwestern Energy Co. company guaranty sr. unsec. notes 5.375%, 2/1/29 | | 740,000 | 719,286 |

| Transocean Aquila, Ltd. 144A company guaranty sr. notes 8.00%, 9/30/28 | | 95,000 | 96,479 |

| Transocean Poseidon, Ltd. 144A company guaranty sr. notes 6.875%, 2/1/27 | | 158,625 | 158,426 |

| Transocean Titan Financing, Ltd. 144A company guaranty sr. notes 8.375%, 2/1/28 (Cayman Islands) | | 350,000 | 361,230 |

| Transocean, Inc. 144A company guaranty sr. notes 8.75%, 2/15/30 | | 112,500 | 118,111 |

| USA Compression Partners LP/USA Compression Finance Corp. company guaranty sr. unsec. unsub. notes 6.875%, 9/1/27 | | 375,000 | 375,703 |

| USA Compression Partners LP/USA Compression Finance Corp. 144A company guaranty sr. unsec. notes 7.125%, 3/15/29 | | 145,000 | 145,906 |

| Venture Global Calcasieu Pass, LLC 144A company guaranty sr. notes 6.25%, 1/15/30 | | 65,000 | 65,968 |

| Venture Global Calcasieu Pass, LLC 144A company guaranty sr. notes 3.875%, 8/15/29 | | 130,000 | 118,396 |

| Venture Global LNG, Inc. 144A sr. notes 9.875%, 2/1/32 | | 315,000 | 342,854 |

| Venture Global LNG, Inc. 144A sr. notes 9.50%, 2/1/29 | | 340,000 | 372,333 |

| Venture Global LNG, Inc. 144A sr. notes 8.375%, 6/1/31 | | 480,000 | 497,871 |

| Venture Global LNG, Inc. 144A sr. notes 8.125%, 6/1/28 | | 170,000 | 175,137 |

| Viper Energy, Inc. 144A sr. unsec. sub. notes 7.375%, 11/1/31 | | 335,000 | 346,955 |

| Viper Energy, Inc. 144A sr. unsec. sub. notes 5.375%, 11/1/27 | | 50,000 | 49,059 |

| Vital Energy, Inc. 144A company guaranty sr. unsec. notes 7.875%, 4/15/32 | | 325,000 | 330,281 |

| Vital Energy, Inc. 144A company guaranty sr. unsec. notes 7.75%, 7/31/29 | | 90,000 | 90,563 |

| | | | 14,121,763 |

| Entertainment (2.5%) |

| Churchill Downs, Inc. 144A company guaranty sr. unsec. notes 6.75%, 5/1/31 | | 60,000 | 60,325 |

| Churchill Downs, Inc. 144A sr. unsec. notes 5.75%, 4/1/30 | | 315,000 | 305,944 |

| Cinemark USA, Inc. 144A company guaranty sr. unsec. notes 5.25%, 7/15/28 | | 330,000 | 315,453 |

| Live Nation Entertainment, Inc. 144A company guaranty sr. unsec. sub. notes 5.625%, 3/15/26 | | 230,000 | 226,784 |

| Live Nation Entertainment, Inc. 144A sr. notes 6.50%, 5/15/27 | | 160,000 | 160,916 |

| | |

4 Putnam VT High Yield Fund |

| | | | |

| CORPORATE BONDS AND NOTES (84.0%)* cont. | Principal amount | Value |

| Entertainment cont. |

| NCL Corp., Ltd. 144A company guaranty sr. notes 8.125%, 1/15/29 | | $150,000 | $157,125 |

| NCL Corp., Ltd. 144A sr. unsec. unsub. notes 7.75%, 2/15/29 | | 215,000 | 223,331 |

| Pinewood Finco PLC 144A notes 6.00%, 3/27/30 (United Kingdom) | GBP | 310,000 | 384,041 |

| Royal Caribbean Cruises, Ltd. 144A company guaranty sr. unsec. notes 7.25%, 1/15/30 | | $205,000 | 212,260 |

| Royal Caribbean Cruises, Ltd. 144A company guaranty sr. unsec. unsub. notes 9.25%, 1/15/29 | | 500,000 | 533,782 |

| Royal Caribbean Cruises, Ltd. 144A sr. unsec. notes 6.25%, 3/15/32 | | 75,000 | 75,630 |

| Royal Caribbean Cruises, Ltd. 144A sr. unsec. notes 5.50%, 8/31/26 | | 210,000 | 207,665 |

| Royal Caribbean Cruises, Ltd. 144A sr. unsec. notes 4.25%, 7/1/26 | | 75,000 | 72,585 |

| Six Flags Entertainment Corp. 144A company guaranty sr. unsec. notes 7.25%, 5/15/31 | | 425,000 | 432,698 |

| Six Flags Entertainment Corp./Six Flags Theme Parks, Inc. 144A company guaranty sr. notes 6.625%, 5/1/32 | | 165,000 | 167,681 |

| | | | 3,536,220 |

| Financials (8.9%) |

| Acrisure, LLC/Acrisure Finance, Inc. 144A sr. notes 7.50%, 11/6/30 | | 435,000 | 435,301 |

| Acrisure, LLC/Acrisure Finance, Inc. 144A sr. unsec. notes 8.50%, 6/15/29 | | 435,000 | 439,481 |

| Alliant Holdings Intermediate, LLC/Alliant Holdings Co-Issuer 144A sr. notes 7.00%, 1/15/31 | | 560,000 | 565,726 |

| Alliant Holdings Intermediate, LLC/Alliant Holdings Co-Issuer 144A sr. unsec. notes 10.50%, 11/1/29 | | 400,000 | 374,298 |

| Ally Financial, Inc. company guaranty sr. unsec. notes 8.00%, 11/1/31 | | 370,000 | 408,327 |

| Apollo Commercial Real Estate Finance, Inc. 144A company guaranty sr. notes 4.625%, 6/15/29 | | 795,000 | 666,466 |

| Aretec Group, Inc. 144A company guaranty sr. sub. notes 10.00%, 8/15/30 | | 265,000 | 288,211 |

| Aretec Group, Inc. 144A sr. unsec. notes 7.50%, 4/1/29 | | 335,000 | 322,922 |

| Bank of America Corp. jr. unsec. sub. FRN Ser. AA, 6.10%, perpetual maturity | | 140,000 | 139,592 |

| Cobra AcquisitionCo, LLC 144A company guaranty sr. unsec. notes 6.375%, 11/1/29 | | 315,000 | 248,058 |

| Credit Acceptance Corp. 144A company guaranty sr. unsec. notes 9.25%, 12/15/28 | | 440,000 | 465,040 |

| Dresdner Funding Trust I 144A jr. unsec. sub. notes 8.151%, 6/30/31 | | 150,000 | 162,537 |

| Encore Capital Group, Inc. 144A company guaranty sr. notes 9.25%, 4/1/29 | | 205,000 | 213,713 |

| Encore Capital Group, Inc. 144A company guaranty sr. notes 8.50%, 5/15/30 | | 285,000 | 289,938 |

| Freedom Mortgage Corp. 144A sr. unsec. notes 12.25%, 10/1/30 | | 95,000 | 102,006 |

| Freedom Mortgage Corp. 144A sr. unsec. notes 12.00%, 10/1/28 | | 515,000 | 552,981 |

| Freedom Mortgage Corp. 144A sr. unsec. sub. notes 6.625%, 1/15/27 | | 320,000 | 309,070 |

| GGAM Finance, Ltd. 144A company guaranty sr. unsec. notes 8.00%, 2/15/27 (Ireland) | | 130,000 | 134,280 |

| HUB International, Ltd. 144A sr. notes 7.25%, 6/15/30 | | 340,000 | 348,545 |

| Jefferson Capital Holdings, LLC 144A sr. unsec. notes 9.50%, 2/15/29 | | 830,000 | 855,585 |

| Jones Deslauriers Insurance Management, Inc. 144A sr. notes 8.50%, 3/15/30 (Canada) | | 170,000 | 177,288 |

| Jones Deslauriers Insurance Management, Inc. 144A sr. unsec. notes 10.50%, 12/15/30 (Canada) | | 290,000 | 311,417 |

| Ladder Capital Finance Holdings, LLLP/Ladder Capital Finance Corp. 144A company guaranty sr. unsec. notes 4.75%, 6/15/29 R | | 130,000 | 120,088 |

| Ladder Capital Finance Holdings, LLLP/Ladder Capital Finance Corp. 144A sr. unsec. notes 7.00%, 7/15/31 | | 255,000 | 257,231 |

| Ladder Capital Finance Holdings, LLLP/Ladder Capital Finance Corp. 144A sr. unsec. notes 4.25%, 2/1/27 R | | 285,000 | 269,928 |

| Macquarie Airfinance Holdings, Ltd. 144A sr. unsec. notes 6.50%, 3/26/31 (United Kingdom) | | 70,000 | 71,982 |

| Macquarie Airfinance Holdings, Ltd. 144A sr. unsec. notes 6.40%, 3/26/29 (United Kingdom) | | 45,000 | 45,761 |

| Nationstar Mortgage Holdings, Inc. 144A company guaranty sr. unsec. notes 7.125%, 2/1/32 | | 380,000 | 382,220 |

| Nationstar Mortgage Holdings, Inc. 144A company guaranty sr. unsec. notes 5.75%, 11/15/31 | | 475,000 | 446,460 |

| OneMain Finance Corp. company guaranty sr. unsec. notes 7.50%, 5/15/31 | | 355,000 | 359,216 |

| OneMain Finance Corp. company guaranty sr. unsec. sub. notes 6.625%, 1/15/28 | | 615,000 | 617,181 |

| OneMain Finance Corp. company guaranty sr. unsec. unsub. notes 5.375%, 11/15/29 | | 185,000 | 173,503 |

| PennyMac Financial Services, Inc. 144A company guaranty sr. unsec. notes 7.875%, 12/15/29 | | 320,000 | 329,979 |

| PHH Mortgage Corp. 144A company guaranty sr. notes 7.875%, 3/15/26 | | 345,000 | 336,406 |

| PRA Group, Inc. 144A company guaranty sr. unsec. notes 8.875%, 1/31/30 | | 715,000 | 713,499 |

| RHP Hotel Properties LP/RHP Finance Corp. 144A company guaranty sr. unsec. sub. notes 7.25%, 7/15/28 | | 110,000 | 113,748 |

| RHP Hotel Properties LP/RHP Finance Corp. 144A company guaranty sr. unsec. sub. notes 6.50%, 4/1/32 | | 235,000 | 235,000 |

| Societe Generale SA 144A jr. unsec. sub. FRN 4.75%, perpetual maturity (France) | | 255,000 | 227,438 |

| Societe Generale SA 144A jr. unsec. sub. notes 5.375%, perpetual maturity (France) | | 260,000 | 209,471 |

| | | | 12,719,893 |

| Forest products and packaging (2.5%) |

| Boise Cascade Co. 144A company guaranty sr. unsec. notes 4.875%, 7/1/30 | | 575,000 | 532,658 |

| Graphic Packaging International, LLC company guaranty sr. unsec. unsub. notes Ser. REGS, 2.625%, 2/1/29 | EUR | 215,000 | 212,838 |

| Graphic Packaging International, LLC 144A company guaranty sr. unsec. notes 3.75%, 2/1/30 | | $250,000 | 223,192 |

| Intelligent Packaging Holdco Issuer LP 144A sr. unsec. notes 9.00%, 1/15/26 (Canada) ‡‡ | | 370,000 | 352,425 |

| Intelligent Packaging, Ltd., Finco, Inc./Intelligent Packaging, Ltd. LLC. Co-Issuer, 144A sr. notes 6.00%, 9/15/28 (Canada) | | 320,000 | 309,398 |

| Kleopatra Holdings 2 SCA company guaranty sr. unsec. notes Ser. REGS, 6.50%, 9/1/26 (Luxembourg) | EUR | 240,000 | 154,263 |

| | |

Putnam VT High Yield Fund 5 |

| | | | |

| CORPORATE BONDS AND NOTES (84.0%)* cont. | Principal amount | Value |

| Forest products and packaging cont. |

| Louisiana-Pacific Corp. 144A sr. unsec. notes 3.625%, 3/15/29 | | $245,000 | $222,317 |

| Mauser Packaging Solutions Holding Co. 144A company guaranty notes 9.25%, 4/15/27 | | 465,000 | 465,299 |

| Mauser Packaging Solutions Holding Co. 144A sr. bonds 7.875%, 4/15/27 | | 350,000 | 356,997 |

| Mercer International, Inc. sr. unsec. notes 5.125%, 2/1/29 (Canada) | | 275,000 | 242,027 |

| Mercer International, Inc. 144A sr. unsec. notes 12.875%, 10/1/28 (Canada) | | 170,000 | 182,867 |

| Pactiv Evergreen Group Issuer, LLC/Pactiv Evergreen Group Issuer, Inc. 144A sr. notes 4.375%, 10/15/28 | | 325,000 | 303,266 |

| | | | 3,557,547 |

| Gaming and lottery (3.3%) |

| Boyd Gaming Corp. 144A sr. unsec. bonds 4.75%, 6/15/31 | | 545,000 | 493,936 |

| Caesars Entertainment, Inc. 144A company guaranty sr. notes 6.50%, 2/15/32 | | 65,000 | 65,319 |

| Caesars Entertainment, Inc. 144A sr. notes 7.00%, 2/15/30 | | 520,000 | 531,274 |

| Caesars Entertainment, Inc. 144A sr. unsec. notes 4.625%, 10/15/29 | | 635,000 | 582,149 |

| Light & Wonder International, Inc. 144A company guaranty sr. unsec. notes 7.50%, 9/1/31 | | 70,000 | 72,325 |

| Light & Wonder International, Inc. 144A company guaranty sr. unsec. notes 7.25%, 11/15/29 | | 540,000 | 551,505 |

| Penn Entertainment, Inc. 144A sr. unsec. notes 5.625%, 1/15/27 | | 290,000 | 279,978 |

| Penn Entertainment, Inc. 144A sr. unsec. notes 4.125%, 7/1/29 | | 100,000 | 85,767 |

| Scientific Games Holdings LP/Scientific Games US FinCo., Inc. 144A sr. unsec. notes 6.625%, 3/1/30 | | 360,000 | 350,934 |

| Station Casinos, LLC 144A company guaranty sr. unsec. sub. notes 6.625%, 3/15/32 | | 100,000 | 99,509 |

| Station Casinos, LLC 144A sr. unsec. bonds 4.625%, 12/1/31 | | 320,000 | 285,217 |

| Station Casinos, LLC 144A sr. unsec. notes 4.50%, 2/15/28 | | 305,000 | 286,985 |

| Wynn Resorts Finance, LLC/Wynn Resorts Capital Corp. 144A company guaranty sr. unsec. bonds 5.125%, 10/1/29 | | 435,000 | 413,713 |

| Wynn Resorts Finance, LLC/Wynn Resorts Capital Corp. 144A company guaranty sr. unsec. unsub. notes 7.125%, 2/15/31 | | 565,000 | 583,363 |

| | | | 4,681,974 |

| Health care (7.1%) |

| 1375209 BC, Ltd. 144A sr. notes 9.00%, 1/30/28 (Canada) | | 33,000 | 31,732 |

| Bausch & Lomb Escrow Corp. 144A sr. notes 8.375%, 10/1/28 (Canada) | | 235,000 | 240,581 |

| Bausch Health Cos., Inc. 144A company guaranty sr. notes 6.125%, 2/1/27 | | 225,000 | 187,313 |

| Bausch Health Cos., Inc. 144A sr. notes 4.875%, 6/1/28 | | 280,000 | 209,541 |

| Centene Corp. sr. unsec. bonds 3.00%, 10/15/30 | | 165,000 | 141,086 |

| Centene Corp. sr. unsec. notes 4.625%, 12/15/29 | | 285,000 | 269,560 |

| Charles River Laboratories International, Inc. 144A company guaranty sr. unsec. notes 4.00%, 3/15/31 | | 160,000 | 142,400 |

| Charles River Laboratories International, Inc. 144A company guaranty sr. unsec. notes 3.75%, 3/15/29 | | 220,000 | 200,750 |

| CHS/Community Health Systems, Inc. 144A company guaranty sr. notes 10.875%, 1/15/32 | | 315,000 | 327,848 |

| CHS/Community Health Systems, Inc. 144A company guaranty sr. notes 5.625%, 3/15/27 | | 380,000 | 353,859 |

| CHS/Community Health Systems, Inc. 144A company guaranty sr. unsec. sub. notes 6.875%, 4/1/28 | | 240,000 | 176,956 |

| CHS/Community Health Systems, Inc. 144A sr. notes 5.25%, 5/15/30 | | 690,000 | 568,900 |

| Concentra Escrow Issuer Corp. 144A sr. unsec. notes 6.875%, 7/15/32 | | 125,000 | 126,645 |

| Elanco Animal Health, Inc. sr. unsec. notes Ser. WI, 6.65%, 8/28/28 | | 345,000 | 349,716 |

| Endo Finance Holdings, Inc. 144A sr. notes 8.50%, 4/15/31 | | 185,000 | 191,013 |

| Grifols SA 144A company guaranty sr. unsec. notes 4.75%, 10/15/28 (Spain) | | 200,000 | 172,595 |

| Grifols SA company guaranty sr. unsec. notes 3.875%, 10/15/28 (Spain) | | 440,000 | 385,145 |

| Jazz Securities DAC 144A company guaranty sr. unsub. notes 4.375%, 1/15/29 (Ireland) | | 470,000 | 436,329 |

| Kedrion SpA 144A company guaranty sr. notes 6.50%, 9/1/29 (Italy) | | 850,000 | 777,219 |

| Medline Borrower LP 144A sr. notes 3.875%, 4/1/29 | | 395,000 | 363,759 |

| Medline Borrower LP 144A sr. unsec. notes 5.25%, 10/1/29 | | 230,000 | 219,495 |

| Minerva Merger Sub, Inc. 144A sr. unsec. notes 6.50%, 2/15/30 | | 440,000 | 405,108 |

| Service Corp. International sr. unsec. bonds 5.125%, 6/1/29 | | 460,000 | 446,968 |

| Service Corp. International sr. unsec. sub. notes 4.00%, 5/15/31 | | 50,000 | 44,529 |

| Tenet Healthcare Corp. company guaranty sr. notes 5.125%, 11/1/27 | | 370,000 | 362,094 |

| Tenet Healthcare Corp. company guaranty sr. notes 4.25%, 6/1/29 | | 230,000 | 214,191 |

| Tenet Healthcare Corp. company guaranty sr. unsec. notes 6.125%, 10/1/28 | | 45,000 | 44,775 |

| Tenet Healthcare Corp. company guaranty sr. unsub. notes 6.125%, 6/15/30 | | 935,000 | 928,686 |

| Teva Pharmaceutical Finance Netherlands II BV company guaranty sr. unsec. unsub. notes 4.375%, 5/9/30 (Israel) | EUR | 225,000 | 232,010 |

| Teva Pharmaceutical Finance Netherlands III BV company guaranty sr. unsec. notes 6.75%, 3/1/28 (Israel) | | $525,000 | 537,445 |

| Teva Pharmaceutical Finance Netherlands III BV company guaranty sr. unsec. unsub. notes 8.125%, 9/15/31 (Israel) | | 270,000 | 300,038 |

| | |

6 Putnam VT High Yield Fund |

| | | | |

| CORPORATE BONDS AND NOTES (84.0%)* cont. | Principal amount | Value |

| Health care cont. |

| Teva Pharmaceutical Finance Netherlands III BV company guaranty sr. unsec. unsub. notes 7.875%, 9/15/29 (Israel) | | $200,000 | $215,000 |

| Teva Pharmaceutical Finance Netherlands III BV company guaranty sr. unsec. unsub. notes 5.125%, 5/9/29 (Israel) | | 580,000 | 557,942 |

| | | | 10,161,228 |

| Homebuilding (0.8%) |

| Anywhere Real Estate Group, LLC/Anywhere Co-Issuer Corp. 144A company guaranty notes 7.00%, 4/15/30 | | 253,800 | 207,530 |

| LGI Homes, Inc. 144A company guaranty sr. unsec. notes 8.75%, 12/15/28 | | 460,000 | 479,138 |

| Taylor Morrison Communities, Inc. 144A company guaranty sr. unsec. notes 5.875%, 6/15/27 | | 140,000 | 139,385 |

| Taylor Morrison Communities, Inc. 144A sr. unsec. bonds 5.125%, 8/1/30 | | 250,000 | 239,398 |

| Taylor Morrison Communities, Inc. 144A sr. unsec. notes 5.75%, 1/15/28 | | 155,000 | 153,632 |

| | | | 1,219,083 |

| Lodging/Tourism (2.1%) |

| Carnival Corp. 144A company guaranty sr. notes 7.00%, 8/15/29 | | 105,000 | 108,842 |

| Carnival Corp. 144A company guaranty sr. unsec. unsub. notes 10.50%, 6/1/30 | | 465,000 | 505,134 |

| Carnival Corp. 144A company guaranty sr. unsec. unsub. notes 6.00%, 5/1/29 | | 150,000 | 148,173 |

| Carnival Corp. 144A sr. unsec. notes 5.75%, 3/1/27 | | 395,000 | 390,230 |

| Carnival Holdings Bermuda, Ltd. 144A company guaranty sr. unsec. unsub. notes 10.375%, 5/1/28 (Bermuda) | | 230,000 | 248,994 |

| Full House Resorts, Inc. 144A company guaranty sr. notes 8.25%, 2/15/28 | | 575,000 | 550,875 |

| SugarHouse HSP Gaming Prop. Mezz LP/SugarHouse HSP Gaming Finance Corp. 144A company guaranty sr. unsub. notes 5.875%, 5/15/25 | | 450,000 | 447,138 |

| Viking Cruises, Ltd. 144A sr. unsec. notes 9.125%, 7/15/31 | | 395,000 | 427,811 |

| Viking Cruises, Ltd. 144A sr. unsec. notes 7.00%, 2/15/29 | | 160,000 | 160,852 |

| | | | 2,988,049 |

| Metals (3.0%) |

| ArcelorMittal SA sr. unsec. unsub. notes 7.00%, 10/15/39 (France) | | 525,000 | 560,339 |

| ATI, Inc. sr. unsec. notes 7.25%, 8/15/30 | | 335,000 | 345,806 |

| ATI, Inc. sr. unsec. notes 5.125%, 10/1/31 | | 160,000 | 147,893 |

| ATI, Inc. sr. unsec. notes 4.875%, 10/1/29 | | 90,000 | 84,130 |

| ATI, Inc. sr. unsec. sub. notes 5.875%, 12/1/27 | | 435,000 | 429,210 |

| Big River Steel, LLC/BRS Finance Corp. 144A sr. notes 6.625%, 1/31/29 | | 256,000 | 256,570 |

| Commercial Metals Co. sr. unsec. notes 4.375%, 3/15/32 | | 165,000 | 148,761 |

| Commercial Metals Co. sr. unsec. notes 4.125%, 1/15/30 | | 130,000 | 118,836 |

| Constellium SE company guaranty sr. unsec. unsub. notes Ser. REGS, 3.125%, 7/15/29 (France) | EUR | 150,000 | 149,507 |

| Constellium SE 144A company guaranty sr. unsec. unsub. notes 5.875%, 2/15/26 (France) | | $250,000 | 248,693 |

| FMG Resources August 2006 Pty, Ltd. 144A sr. unsec. notes 6.125%, 4/15/32 (Australia) | | 540,000 | 533,892 |

| HudBay Minerals, Inc. 144A company guaranty sr. unsec. notes 6.125%, 4/1/29 (Canada) | | 375,000 | 373,165 |

| Novelis Corp. 144A company guaranty sr. unsec. bonds 3.875%, 8/15/31 | | 240,000 | 207,788 |

| Novelis Corp. 144A company guaranty sr. unsec. notes 4.75%, 1/30/30 | | 140,000 | 129,879 |

| Novelis Sheet Ingot GMBH company guaranty sr. unsec. notes Ser. REGS, 3.375%, 4/15/29 (Germany) | EUR | 100,000 | 100,589 |

| TMS International Holding Corp. 144A sr. unsec. notes 6.25%, 4/15/29 | | $370,000 | 337,779 |

| United States Steel Corp. sr. unsec. sub. FRB 6.65%, 6/1/37 | | 175,000 | 174,248 |

| | | | 4,347,085 |

| Publishing (1.0%) |

| McGraw-Hill Education, Inc. 144A sr. notes 5.75%, 8/1/28 | | 455,000 | 438,755 |

| McGraw-Hill Education, Inc. 144A sr. unsec. notes 8.00%, 8/1/29 | | 485,000 | 471,620 |

| News Corp. 144A sr. unsec. notes 3.875%, 5/15/29 | | 620,000 | 570,709 |

| | | | 1,481,084 |

| Retail (1.2%) |

| Bath & Body Works, Inc. company guaranty sr. unsec. sub. bonds 6.875%, 11/1/35 | | 430,000 | 433,666 |

| Crocs, Inc. 144A company guaranty sr. unsec. notes 4.25%, 3/15/29 | | 240,000 | 218,755 |

| FirstCash, Inc. 144A sr. unsec. notes 6.875%, 3/1/32 (Mexico) | | 710,000 | 710,000 |

| PetSmart, Inc./PetSmart Finance Corp. 144A company guaranty sr. unsec. notes 7.75%, 2/15/29 | | 370,000 | 360,331 |

| | | | 1,722,752 |

| Technology (5.6%) |

| Ahead DB Holdings, LLC 144A company guaranty sr. unsec. notes 6.625%, 5/1/28 | | 220,000 | 208,221 |

| Cloud Software Group, Inc. 144A notes 9.00%, 9/30/29 | | 495,000 | 480,150 |

| Cloud Software Group, Inc. 144A sr. notes. 6.50%, 3/31/29 | | 820,000 | 787,458 |

| CommScope Technologies, LLC 144A company guaranty sr. unsec. notes 6.00%, 6/15/25 | | 151,000 | 123,026 |

| CommScope, Inc. 144A company guaranty sr. notes 6.00%, 3/1/26 | | 140,000 | 122,857 |

| CrowdStrike Holdings, Inc. company guaranty sr. unsec. notes 3.00%, 2/15/29 | | 335,000 | 302,051 |

| | |

Putnam VT High Yield Fund 7 |

| | | | |

| CORPORATE BONDS AND NOTES (84.0%)* cont. | Principal amount | Value |

| Technology cont. |

| Fortress Intermediate 3, Inc. 144A sr. notes 7.50%, 6/1/31 | | $315,000 | $322,733 |

| Gartner, Inc. 144A company guaranty sr. unsec. bonds 3.75%, 10/1/30 | | 395,000 | 354,252 |

| Gen Digital, Inc. 144A company guaranty sr. unsec. unsub. notes 6.75%, 9/30/27 | | 150,000 | 151,500 |

| Imola Merger Corp. 144A sr. notes 4.75%, 5/15/29 | | 875,000 | 817,986 |

| McAfee Corp. 144A sr. unsec. notes 7.375%, 2/15/30 | | 675,000 | 623,601 |

| NCR Voyix Corp. 144A company guaranty sr. unsec. sub. notes 5.125%, 4/15/29 | | 525,000 | 494,422 |

| ON Semiconductor Corp. 144A company guaranty sr. unsec. notes 3.875%, 9/1/28 | | 80,000 | 73,833 |

| RingCentral, Inc. 144A sr. unsec. notes 8.50%, 8/15/30 | | 380,000 | 396,625 |

| Rocket Software, Inc. 144A sr. unsec. notes 6.50%, 2/15/29 | | 345,000 | 300,581 |

| Seagate HDD Cayman company guaranty sr. unsec. notes 9.625%, 12/1/32 (Cayman Islands) | | 80,000 | 91,251 |

| Seagate HDD Cayman company guaranty sr. unsec. notes 3.125%, 7/15/29 (Cayman Islands) | | 140,000 | 119,916 |

| TTM Technologies, Inc. 144A company guaranty sr. unsec. notes 4.00%, 3/1/29 | | 565,000 | 516,975 |

| Twilio, Inc. company guaranty sr. unsec. notes 3.875%, 3/15/31 | | 390,000 | 342,999 |

| Twilio, Inc. company guaranty sr. unsec. notes 3.625%, 3/15/29 | | 335,000 | 301,328 |

| UKG, Inc. 144A sr. notes 6.875%, 2/1/31 | | 465,000 | 470,826 |

| ZoomInfo Technologies, LLC/ZoomInfo Finance Corp. 144A company guaranty sr. unsec. notes 3.875%, 2/1/29 | | 770,000 | 699,172 |

| | | | 8,101,763 |

| Textiles (1.0%) |

| Hanesbrands, Inc. 144A company guaranty sr. unsec. unsub. notes 9.00%, perpetual maturity | | 455,000 | 476,613 |

| Kontoor Brands, Inc. 144A company guaranty sr. unsec. notes 4.125%, 11/15/29 | | 485,000 | 438,319 |

| Levi Strauss & Co. 144A sr. unsec. sub. bonds 3.50%, 3/1/31 | | 645,000 | 557,971 |

| | | | 1,472,903 |

| Tire and rubber (0.3%) |

| Goodyear Tire & Rubber Co. (The) company guaranty sr. unsec. notes 5.625%, 4/30/33 | | 480,000 | 433,882 |

| | | | 433,882 |

| Transportation (1.0%) |

| American Airlines, Inc./AAdvantage Loyalty IP, Ltd. 144A company guaranty sr. notes 5.75%, 4/20/29 | | 325,000 | 316,182 |

| American Airlines, Inc./AAdvantage Loyalty IP, Ltd. 144A company guaranty sr. notes 5.50%, 4/20/26 | | 216,667 | 214,741 |

| United Airlines, Inc. 144A company guaranty sr. notes 4.625%, 4/15/29 | | 130,000 | 121,070 |

| Watco Cos., LLC/Watco Finance Corp. 144A sr. unsec. notes 6.50%, 6/15/27 | | 720,000 | 717,064 |

| | | | 1,369,057 |

| Utilities and power (2.2%) |

| Calpine Corp. 144A sr. unsec. notes 5.00%, 2/1/31 | | 310,000 | 289,322 |

| Electricite De France SA 144A jr. unsec. sub. FRB 9.125%, perpetual maturity (France) | | 200,000 | 218,000 |

| Energy Transfer LP jr. unsec. sub. FRN 6.625%, perpetual maturity | | 630,000 | 611,371 |

| NRG Energy, Inc. 144A company guaranty sr. notes 7.00%, 3/15/33 | | 110,000 | 116,116 |

| NRG Energy, Inc. 144A jr. unsec. sub. FRB 10.25%, perpetual maturity | | 345,000 | 377,330 |

| Pacific Gas and Electric Co. company guaranty sr. unsec. unsub. notes 2.95%, 3/1/26 | | 160,000 | 153,142 |

| PG&E Corp. sr. sub. notes 5.25%, 7/1/30 | | 95,000 | 90,727 |

| Vistra Corp. 144A jr. unsec. sub. FRN 8.00%, perpetual maturity | | 150,000 | 151,275 |

| Vistra Corp. 144A jr. unsec. sub. FRN 7.00%, perpetual maturity | | 290,000 | 287,480 |

| Vistra Operations Co., LLC 144A company guaranty sr. notes 4.30%, 7/15/29 | | 135,000 | 127,558 |

| Vistra Operations Co., LLC 144A company guaranty sr. unsec. notes 6.875%, 4/15/32 | | 240,000 | 243,600 |

| Vistra Operations Co., LLC 144A sr. unsec. notes 7.75%, 10/15/31 | | 485,000 | 505,075 |

| | | | 3,170,996 |

| Total corporate bonds and notes (cost $122,216,493) | $120,554,689 |

| |

| | | | |

| SENIOR LOANS (7.8%)*c | Principal amount | Value |

| Basic materials (1.5%) |

| CP Atlas Buyer, Inc. bank term loan FRN Ser. B1, (CME Term SOFR 1 Month + 3.75%), 9.194%, 11/23/27 | | $329,918 | $321,370 |

| Herens US Holdco Corp. bank term loan FRN Ser. B, (CME Term SOFR 3 Month + 3.93%), 9.27%, 4/30/28 | | 154,226 | 149,283 |

| Hexion Holdings Corp. bank term loan FRN Class B, (CME Term SOFR 1 Month + 7.44%), 12.881%, 3/15/30 | | 405,000 | 368,955 |

| Klockner-Pentaplast of America, Inc. bank term loan FRN (CME Term SOFR 6 Month + 4.73%), 10.268%, 2/4/26 | | 486,653 | 453,804 |

| LSF11 A5 HoldCo, LLC bank term loan FRN Ser. B, (CME Term SOFR 1 Month + 3.50%), 8.941%, 9/30/28 | | 173,517 | 173,300 |

| Nouryon USA, LLC bank term loan FRN Class B, (CME Term SOFR 1 Month + 3.50%), 8.829%, 4/3/28 | | 133,988 | 134,322 |

| Nouryon USA, LLC bank term loan FRN Class B, (CME Term SOFR 1 Month + 3.50%), 8.826%, 4/3/28 | | 285,930 | 286,359 |

| Vibrantz Technologies, Inc. bank term loan FRN (CME Term SOFR 3 Month + 4.25%), 9.706%, 4/21/29 | | 149,241 | 145,509 |

| W.R. Grace Holdings, LLC bank term loan FRN Ser. B, (CME Term SOFR 3 Month + 3.25%), 8.594%, 9/22/28 | | 69,643 | 69,855 |

| | | | 2,102,757 |

| | |

8 Putnam VT High Yield Fund |

| | | | |

| SENIOR LOANS (7.8%)*c cont. | Principal amount | Value |

| Capital goods (0.8%) |

| DexKo Global, Inc. bank term loan FRN (CME Term SOFR 3 Month + 3.75%), 9.346%, 10/4/28 | | $371,203 | $368,845 |

| Filtration Group Corp. bank term loan FRN (ICE LIBOR USD 1 Month + 3.50%), 8.958%, 10/19/28 | | 212,263 | 213,159 |

| Filtration Group Corp. bank term loan FRN (CME Term SOFR 1 Month + 4.25%), 8.944%, 10/19/28 | | 64,185 | 64,410 |

| Madison IAQ, LLC bank term loan FRN (CME Term SOFR 1 Month + 2.75%), 8.094%, 6/15/28 | | 103,109 | 103,130 |

| TK Elevator US Newco, Inc. bank term loan FRN Ser. B, (CME Term SOFR 1 Month + 3.50%), 8.791%, 4/15/30 | | 434,206 | 436,151 |

| | | | 1,185,695 |

| Communication services (0.4%) |

| Connect Finco SARL bank term loan FRN Ser. B, (CME Term SOFR 1 Month + 4.50%), 9.844%, 9/13/29 | | 224,438 | 211,182 |

| CMG Media Corp. bank term loan (CME Term SOFR 3 Month + 3.500%), 8.7068%, 12/17/26 | | 554 | 439 |

| DIRECTV Financing, LLC bank term loan FRN Ser. B, (CME Term SOFR 1 Month + 5.25%), 10.708%, 8/2/29 | | 297,628 | 295,937 |

| | | | 507,558 |

| Consumer cyclicals (1.7%) |

| Clear Channel Outdoor Holdings, Inc. bank term loan FRN Ser. B, (CME Term SOFR 1 Month + 4.00%), 9.458%, 8/21/28 | | 93,433 | 93,433 |

| EMRLD Borrower LP bank term loan FRN Class B, (CME Term SOFR 1 Month + 2.50%), 7.842%, 6/18/31 | | 65,000 | 64,919 |

| Fertitta Entertainment, LLC/NV bank term loan FRN Ser. B, (CME Term SOFR 1 Month + 3.75%), 9.081%, 1/27/29 | | 223,855 | 223,996 |

| Garda World Security Corp. bank term loan FRN (CME Term SOFR 1 Month + 4.25%), 9.594%, 2/1/29 | | 291,262 | 292,718 |

| LBM Acquisition, LLC bank term loan FRN Ser. B, (CME Term SOFR 3 Month + 3.75%), 9.179%, 12/17/27 | | 174,551 | 174,163 |

| Mattress Firm, Inc. bank term loan FRN Ser. B, (CME Term SOFR 3 Month + 4.25%), 9.846%, 9/21/28 | | 236,218 | 235,418 |

| Michaels Cos., Inc. (The) bank term loan FRN (CME Term SOFR 3 Month + 4.25%), 9.846%, 4/15/28 | | 231,848 | 207,715 |

| Neptune Bidco US, Inc. bank term loan FRN Class C, (CME Term SOFR 1 Month + 5.00%), 10.406%, 4/11/29 | | 357,709 | 336,096 |

| PetSmart, LLC bank term loan FRN Ser. B, (CME Term SOFR 1 Month + 3.75%), 9.194%, 1/29/28 | | 293,373 | 292,149 |

| Robertshaw US Holding Corp. bank term loan FRN (CME Term SOFR 1 Month + 8.00%), 13.313%, 2/28/27 | | 200,000 | 2,000 |

| Scientific Games Holdings LP bank term loan FRN Class B, (CME Term SOFR 1 Month + 3.00%), 8.306%, 4/4/29 | | 184,532 | 184,070 |

| Station Casinos, LLC bank term loan FRN (CME Term SOFR 1 Month + 2.25%), 7.594%, 3/7/31 | | 149,625 | 149,451 |

| White Cap Buyer, LLC bank term loan FRN Class B, (CME Term SOFR 1 Month + 3.25%), 8.595%, 10/19/29 | | 323,551 | 323,975 |

| | | | 2,580,103 |

| Consumer staples (0.6%) |

| Ascend Learning, LLC bank term loan FRN (CME Term SOFR 1 Month + 5.75%), 11.194%, 11/18/29 | | 230,000 | 224,365 |

| IRB Holding Corp. bank term loan FRN (CME Term SOFR 1 Month + 2.75%), 8.179%, 12/15/27 | | 232,863 | 232,612 |

| PECF USS Intermediate Holding III Corp. bank term loan FRN Ser. B, (CME Term SOFR 1 Month + 4.25%), 9.841%, 12/17/28 | | 244,850 | 161,398 |

| VM Consolidated, Inc. bank term loan FRN (CME Term SOFR 1 Month + 3.00%), 8.094%, 3/27/28 | | 274,275 | 275,419 |

| | | | 893,794 |

| Energy (0.3%) |

| CQP Holdco LP (CME Term SOFR 1 Month + 2.25%), 7.593%, 12/31/30 | | 366,989 | 366,857 |

| | | | 366,857 |

| Financials (0.1%) |

| HUB International, Ltd. bank term loan FRN Ser. B, (CME Term SOFR 1 Month + 3.25%), 8.575%, 6/20/30 | | 200,284 | 200,634 |

| | | | 200,634 |

| Health care (0.7%) |

| Bausch + Lomb Corp. bank term loan FRN Ser. B, (CME Term SOFR 1 Month + 3.25%), 8.689%, 5/5/27 | | 348,540 | 344,532 |

| Endo Finance Holdings, Inc. bank term loan FRN (CME Term SOFR 1 Month + 4.50%), 9.826%, 4/23/31 | | 411,000 | 410,231 |

| Medline Borrower LP bank term loan FRN Ser. B, (CME Term SOFR 1 Month + 2.75%), 8.094%, 10/23/28 | | 199,384 | 199,651 |

| | | | 954,414 |

| Technology (1.2%) |

| Cloud Software Group, Inc. (CME Term SOFR 1 Month + 4.00%), 9.335%, 3/29/29 | | 371,242 | 370,686 |

| Fortress Intermediate 3, Inc. bank term loan FRN Class B, (CME Term SOFR 1 Month + 3.75%), 9.071%, 5/8/31 | | 110,000 | 110,000 |

| Genesys Cloud Services Holdings, LLC bank term loan FRN Ser. B4, (CME Term SOFR 1 Month + 3.50%), 8.844%, 12/1/27 | | 343,463 | 344,936 |

| Idera, Inc. bank term loan FRN (CME Term SOFR 1 Month + 3.50%), 8.843%, 3/2/28 | | 290,000 | 287,608 |

| Rocket Software, Inc. bank term loan FRN (CME Term SOFR 1 Month + 4.75%), 10.094%, 10/5/28 | | 284,284 | 285,071 |

| UKG, Inc. bank term loan FRN Ser. B, (CME Term SOFR 1 Month + 3.25%), 8.576%, 1/31/31 | | 312,192 | 313,207 |

| | | | 1,711,508 |

| Transportation (0.5%) |

| American Airlines, Inc. bank term loan FRN (CME Term SOFR 3 Month + 4.75%), 10.336%, 4/20/28 | | 244,444 | 252,210 |

| American Airlines, Inc. bank term loan FRN (CME Term SOFR 1 Month + 2.50%), 7.775%, 6/4/29 | | 185,000 | 184,538 |

| United Airlines, Inc. bank term loan FRN Ser. B, (CME Term SOFR 1 Month + 2.75%), 8.094%, 2/17/31 | | 304,238 | 304,508 |

| | | | 741,256 |

| Total senior loans (cost $11,509,895) | $11,244,576 |

| |

| | |

Putnam VT High Yield Fund 9 |

| | | | |

| CONVERTIBLE BONDS AND NOTES (2.2%)* | Principal amount | Value |

| Anywhere Real Estate Group, LLC/Anywhere Co-Issuer Corp. company guaranty cv. sr. unsec. notes 0.25%, 6/15/26 | | $274,000 | $219,885 |

| Chefs’ Warehouse, Inc. (The) cv. sr. unsec. unsub. notes 2.375%, 12/15/28 | | 200,000 | 221,872 |

| Dexcom, Inc. cv. sr. unsec. unsub. notes 0.375%, 5/15/28 | | 375,000 | 366,375 |

| Fiverr International, Ltd. cv. sr. unsec. notes zero %, 11/1/25 (Israel) | | 225,000 | 207,135 |

| Live Nation Entertainment, Inc. 144A cv. sr. unsec. notes 3.125%, 1/15/29 | | 195,000 | 215,313 |

| Nabors Industries, Inc. company guaranty cv. sr. unsec. unsub. notes 1.75%, 6/15/29 | | 155,000 | 112,220 |

| ON Semiconductor Corp. cv. sr. unsec. notes zero %, 5/1/27 | | 101,000 | 141,047 |

| PG&E Corp. 144A cv. sr. notes 4.25%, 12/1/27 | | 278,000 | 280,363 |

| Seagate HDD Cayman 144A company guaranty cv. sr. unsec. notes 3.50%, 6/1/28 (Cayman Islands) | | 260,000 | 354,770 |

| Shake Shack, Inc. cv. sr. unsec. notes zero %, 3/1/28 | | 280,000 | 242,200 |

| Uber Technologies, Inc. 144A cv. sr. unsec. notes 0.875%, 12/1/28 | | 310,000 | 368,590 |

| Welltower OP, LLC 144A company guaranty cv. sr. unsec. notes 2.75%, 5/15/28 R | | 303,000 | 359,209 |

| Total convertible bonds and notes (cost $3,110,816) | $3,088,979 |

| |

| | | |

| CONVERTIBLE PREFERRED STOCKS (0.7%)* | Shares | Value |

| Apollo Global Management, Inc. $3.38 cv. pfd. | 4,647 | $304,890 |

| Chart Industries, Inc. $3.375 cv. pfd. | 5,389 | 306,904 |

| NextEra Energy, Inc. $0.00 cv. pfd. † | 7,375 | 362,776 |

| Total convertible preferred stocks (cost $872,183) | $974,570 |

| |

| | | |

| COMMON STOCKS (0.6%)* | Shares | Value |

| GFL Environmental, Inc. (Canada) | 4,430 | $172,460 |

| Permian Resources Corp. | 14,815 | 239,262 |

| Viking Holdings, Ltd. (Bermuda) † | 11,800 | 400,492 |

| Total common stocks (cost $631,286) | $812,214 |

| |

| | | | |

| SHORT-TERM INVESTMENTS (3.7%)* | Shares | Value |

| Putnam Short Term Investment Fund Class P 5.48% L | | 5,254,680 | $5,254,680 |

| Total short-term investments (cost $5,254,680) | $5,254,680 |

| |

| | |

| TOTAL INVESTMENTS |

| Total investments (cost $143,595,353) | $141,929,708 |

| |

| | |

| Key to holding’s currency abbreviations |

| EUR | Euro |

| GBP | British Pound |

| |

| | |

| Key to holding’s abbreviations |

| bp | Basis Points |

| CME | Chicago Mercantile Exchange |

| DAC | Designated Activity Company |

| FRB | Floating Rate Bonds: The rate shown is the current interest rate at the close of the reporting period. Rates may be subject to a cap or floor. For certain securities, the rate may represent a fixed rate currently in place at the close of the reporting period. |

| FRN | Floating Rate Notes: The rate shown is the current interest rate or yield at the close of the reporting period. Rates may be subject to a cap or floor. For certain securities, the rate may represent a fixed rate currently in place at the close of the reporting period. |

| ICE | Intercontinental Exchange |

| LIBOR | London Interbank Offered Rate |

| REGS | Securities sold under Regulation S may not be offered, sold or delivered within the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act of 1933. |

| SOFR | Secured Overnight Financing Rate |

| |

| | |

10 Putnam VT High Yield Fund |

| | | | |

| Notes to the fund’s portfolio |

| | Unless noted otherwise, the notes to the fund’s portfolio are for the close of the fund’s reporting period, which ran from January 1, 2024 through June 30, 2024 (the reporting period). Within the following notes to the portfolio, references to “Putnam Management” represent Putnam Investment Management, LLC, the fund’s manager, an indirect wholly-owned subsidiary of Franklin Resources, Inc., and references to “ASC 820” represent Accounting Standards Codification 820 Fair Value Measurements and Disclosures. |

| * | Percentages indicated are based on net assets of $143,433,171. |

| † | This security is non-income-producing. |

| ‡‡ | Income may be received in cash or additional securities at the discretion of the issuer. The rate shown in parenthesis is the rate paid in kind, if applicable. |

| c | Senior loans are exempt from registration under the Securities Act of 1933, as amended, but contain certain restrictions on resale and cannot be sold publicly. These loans pay interest at rates which adjust periodically. The interest rates shown for senior loans are the current interest rates at the close of the reporting period. Senior loans are also subject to mandatory and/or optional prepayment which cannot be predicted. As a result, the remaining maturity may be substantially less than the stated maturity shown (Notes 1 and 7). |

| L | Affiliated company (Note 5). The rate quoted in the security description is the annualized 7-day yield of the fund at the close of the reporting period. |

| R | Real Estate Investment Trust. |

| | Debt obligations are considered secured unless otherwise indicated. |

| | 144A after the name of an issuer represents securities exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. |

| | The dates shown on debt obligations are the original maturity dates. |

| |

| | | | | | | |

| FORWARD CURRENCY CONTRACTS at 6/30/24 (aggregate face value $3,296,662) (Unaudited) |

| Counterparty | Currency | Contract

type* | Delivery

date | Value | Aggregate

face value | Unrealized

appreciation |

| Goldman Sachs International |

| | Euro | Sell | 9/18/24 | $94,165 | $95,826 | $1,661 |

| JPMorgan Chase Bank N.A. |

| | Euro | Sell | 9/18/24 | 138,990 | 141,432 | 2,442 |

| Morgan Stanley & Co. International PLC |

| | British Pound | Sell | 9/18/24 | 126,735 | 127,948 | 1,213 |

| | Euro | Sell | 9/18/24 | 1,062,690 | 1,078,678 | 15,988 |

| State Street Bank and Trust Co. |

| | British Pound | Sell | 9/18/24 | 265,613 | 268,227 | 2,614 |

| | Euro | Sell | 9/18/24 | 1,560,497 | 1,584,551 | 24,054 |

| Unrealized appreciation | 47,972 |

| Unrealized (depreciation) | — |

| Total | $47,972 |

| * The exchange currency for all contracts listed is the United States Dollar. |

| |

| | | | | | | | | |

| CENTRALLY CLEARED CREDIT DEFAULT CONTRACTS OUTSTANDING — PROTECTION SOLD at 6/30/24 (Unaudited) |

| Referenced debt* | Rating*** | Upfront

premium

received

(paid)** | | Notional

amount | Value | Termi-

nation

date | Payments

received

by fund | Unrealized

depreciation |

| CDX NA HY Series 42 Index | B+/P | $(188,647) | | $2,762,000 | $173,316 | 6/20/29 | 500 bp — Quarterly | $(11,111) |

| Total | $(188,647) | $(11,111) |

| * Payments related to the referenced debt are made upon a credit default event. |

| ** Upfront premium is based on the difference between the original spread on issue and the market spread on day of execution. |

| *** Ratings for an underlying index represent the average of the ratings of all the securities included in that index. The Moody’s, Standard & Poor’s or Fitch ratings are believed to be the most recent ratings available at June 30, 2024. Securities rated by Fitch are indicated by “/F.” Securities rated by Putnam are indicated by “/P.” The Putnam rating categories are comparable to the Standard & Poor’s classifications. |

| |

| | |

Putnam VT High Yield Fund 11 |

ASC 820 establishes a three-level hierarchy for disclosure of fair value measurements. The valuation hierarchy is based upon the transparency of inputs to the valuation of the fund’s investments. The three levels are defined as follows:

Level 1: Valuations based on quoted prices for identical securities in active markets.

Level 2: Valuations based on quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly.

Level 3: Valuations based on inputs that are unobservable and significant to the fair value measurement.

The following is a summary of the inputs used to value the fund’s net assets as of the close of the reporting period:

| | | | |

| | | Valuation inputs |

| Investments in securities: | Level 1 | Level 2 | Level 3 |

| Common stocks*: | | | |

| Capital goods | $172,460 | $— | $— |

| Consumer cyclicals | 400,492 | — | — |

| Energy | 239,262 | — | — |

| Total common stocks | 812,214 | — | — |

| Convertible bonds and notes | — | 3,088,979 | — |

| Convertible preferred stocks | — | 974,570 | — |

| Corporate bonds and notes | — | 120,554,689 | — |

| Senior loans | — | 11,244,576 | — |

| Short-term investments | — | 5,254,680 | — |

| Totals by level | $812,214 | $141,117,494 | $— |

| |

| | | | |

| | | Valuation inputs |

| Other financial instruments: | Level 1 | Level 2 | Level 3 |

| Forward currency contracts | $— | $47,972 | $— |

| Credit default contracts | — | 177,536 | — |

| Totals by level | $— | $225,508 | $— |

* Common stock classifications are presented at the sector level, which may differ from the fund’s portfolio presentation.

The accompanying notes are an integral part of these financial statements.

| | |

12 Putnam VT High Yield Fund |

Financial Statements

Statement of assets and liabilities

6/30/24 (Unaudited)

| Assets | |

| Investment in securities, at value (Notes 1 and 9): | |

| Unaffiliated issuers (identified cost $138,340,673) | $136,675,028 |

| Affiliated issuers (identified cost $5,254,680) (Note 5) | 5,254,680 |

| Cash | 75,906 |

| Dividends, interest and other receivables | 2,402,949 |

| Receivable for shares of the fund sold | 40,183 |

| Receivable for investments sold | 289,829 |

| Unrealized appreciation on forward currency contracts (Note 1) | 47,972 |

| Deposits with broker (Note 1) | 224,048 |

| Total assets | 145,010,595 |

| | |

| Liabilities | |

| Payable for investments purchased | 1,133,173 |

| Payable for shares of the fund repurchased | 88,317 |

| Payable for compensation of Manager (Note 2) | 131,678 |

| Payable for custodian fees (Note 2) | 8,223 |

| Payable for investor servicing fees (Note 2) | 25,228 |

| Payable for Trustee compensation and expenses (Note 2) | 110,205 |

| Payable for administrative services (Note 2) | 339 |

| Payable for distribution fees (Note 2) | 18,632 |

| Payable for variation margin on centrally cleared swap contracts (Note 1) | 1,689 |

| Payable to broker (Note 1) | 118 |

| Other accrued expenses | 59,822 |

| Total liabilities | 1,577,424 |

| Net assets | $143,433,171 |

| | |

| Represented by | |

| Paid-in capital (Unlimited shares authorized) (Notes 1 and 4) | $166,901,811 |

| Total distributable earnings (Note 1) | (23,468,640) |

| Total — Representing net assets applicable to capital shares outstanding | $143,433,171 |

| | |

| Computation of net asset value Class IA | |

| Net assets | $98,762,521 |

| Number of shares outstanding | 18,161,195 |

| Net asset value, offering price and redemption price per share (net assets divided by number of shares outstanding) | $5.44 |

| | |

| Computation of net asset value Class IB | |

| Net assets | $44,670,650 |

| Number of shares outstanding | 8,307,369 |

| Net asset value, offering price and redemption price per share (net assets divided by number of shares outstanding) | $5.38 |

The accompanying notes are an integral part of these financial statements.

Putnam VT High Yield Fund 13

Statement of operations

Six months ended 6/30/24 (Unaudited)

| Investment income | |

| Interest (including interest income of $226,019 from investments in affiliated issuers) (Note 5) | $5,124,738 |

| Dividends (net of foreign tax of $18) | 24,160 |

| Total investment income | 5,148,898 |

| | |

| Expenses | |

| Compensation of Manager (Note 2) | 399,326 |

| Investor servicing fees (Note 2) | 50,918 |

| Custodian fees (Note 2) | 14,326 |

| Trustee compensation and expenses (Note 2) | 3,995 |

| Distribution fees (Note 2) | 57,894 |

| Administrative services (Note 2) | 997 |

| Auditing and tax fees | 41,646 |

| Other | 22,254 |

| Total expenses | 591,356 |

| Expense reduction (Note 2) | (1,729) |

| Net expenses | 589,627 |

| Net investment income | 4,559,271 |

| | |

| Realized and unrealized gain (loss) | |

| Net realized gain (loss) on: | |

| Securities from unaffiliated issuers (Notes 1 and 3) | (1,929,472) |

| Foreign currency transactions (Note 1) | (101) |

| Forward currency contracts (Note 1) | 9,043 |

| Swap contracts (Note 1) | 257,646 |

| Total net realized loss | (1,662,884) |

| Change in net unrealized appreciation (depreciation) on: | |

| Securities from unaffiliated issuers | 1,285,882 |

| Assets and liabilities in foreign currencies | (1,483) |

| Forward currency contracts | 98,163 |

| Swap contracts | (172,289) |

| Total change in net unrealized appreciation | 1,210,273 |

| Net loss on investments | (452,611) |

| Net increase in net assets resulting from operations | $4,106,660 |

The accompanying notes are an integral part of these financial statements.

14 Putnam VT High Yield Fund

Statement of changes in net assets

| | Six months ended 6/30/24* | Year ended 12/31/23 |

| Increase (decrease) in net assets | | |

| Operations: | | |

| Net investment income | $4,559,271 | $8,510,893 |

| Net realized loss on investments and foreign currency transactions | (1,662,884) | (6,189,742) |

| Change in net unrealized appreciation of investments and assets and liabilities in foreign currencies | 1,210,273 | 13,795,727 |

| Net increase in net assets resulting from operations | 4,106,660 | 16,116,878 |

| Distributions to shareholders (Note 1): | | |

| From ordinary income | | |

| Net investment income | | |

| Class IA | (5,880,235) | (5,311,398) |

| Class IB | (2,839,660) | (2,098,210) |

| Increase from capital share transactions (Note 4) | 502,740 | 6,954,748 |

| Total increase (decrease) in net assets | (4,110,495) | 15,662,018 |

| Net assets: | | |

| Beginning of period | 147,543,666 | 131,881,648 |

| End of period | $143,433,171 | $147,543,666 |

| * Unaudited. | | |

The accompanying notes are an integral part of these financial statements.

Putnam VT High Yield Fund 15

Financial highlights

(For a common share outstanding throughout the period)

| INVESTMENT OPERATIONS: | LESS DISTRIBUTIONS: | RATIOS AND SUPPLEMENTAL DATA: |

| Period ended | Net asset value, beginning of period | Net investment income (loss)a | Net realized and unrealized gain (loss) on investments | Total from investment operations | From net investment income | From net realized gain on investments | Total distributions | Net asset value, end of period | Total return at net asset value (%)b,c | Net assets, end of period (in thousands) | Ratio of expenses to average net assets (%)b,d | Ratio of net investment income (loss) to average net assets (%) | Portfolio turnover (%) |

| Class IA |

| 6/30/24† | $5.61 | .17 | —g | .17 | (.34) | — | (.34) | $5.44 | 3.07* | $98,763 | .37* | 3.17* | 27* |

| 12/31/23 | 5.29 | .33 | .29 | .62 | (.30) | — | (.30) | 5.61 | 12.29 | 99,901 | .75 | 6.18 | 45 |

| 12/31/22 | 6.30 | .29 | (.98) | (.69) | (.31) | (.01) | (.32) | 5.29 | (11.37) | 94,436 | .75f | 5.24 | 28 |

| 12/31/21 | 6.30 | .28 | .03 | .31 | (.31) | — | (.31) | 6.30 | 5.20 | 119,199 | .70 | 4.56 | 44 |

| 12/31/20 | 6.39 | .30 | (.03)e | .27 | (.36) | — | (.36) | 6.30 | 5.50 | 125,959 | .72 | 4.98 | 48 |

| 12/31/19 | 5.94 | .33 | .51 | .84 | (.39) | — | (.39) | 6.39 | 14.55 | 131,799 | .73 | 5.29 | 37 |

| Class IB |

| 6/30/24† | $5.55 | .17 | (.01) | .16 | (.33) | — | (.33) | $5.38 | 2.89* | $44,671 | .49* | 3.05* | 27* |

| 12/31/23 | 5.23 | .31 | .30 | .61 | (.29) | — | (.29) | 5.55 | 12.13 | 47,643 | 1.00 | 5.93 | 45 |

| 12/31/22 | 6.23 | .27 | (.97) | (.70) | (.29) | (.01) | (.30) | 5.23 | (11.60) | 37,446 | 1.00f | 4.98 | 28 |

| 12/31/21 | 6.23 | .27 | .03 | .30 | (.30) | — | (.30) | 6.23 | 4.97 | 49,084 | .95 | 4.32 | 44 |

| 12/31/20 | 6.32 | .28 | (.03)e | .25 | (.34) | — | (.34) | 6.23 | 5.21 | 53,426 | .97 | 4.71 | 48 |

| 12/31/19 | 5.87 | .31 | .51 | .82 | (.37) | — | (.37) | 6.32 | 14.40 | 54,261 | .98 | 5.04 | 37 |

* Not annualized.

† Unaudited.

a Per share net investment income (loss) has been determined on the basis of the weighted average number of shares outstanding during the period.

b The charges and expenses at the insurance company separate account level are not reflected.

c Total return assumes dividend reinvestment.

d Includes amounts paid through expense offset and/or brokerage/service arrangements, if any (Note 2). Also excludes acquired fund fees and expenses, if any.

e The Net realized and unrealized gain (loss) on investments shown for the period noted may not correspond with the amounts shown on the Statement of changes in net assets as a result of timing of share activity.

f Includes one-time proxy cost of 0.01%.

g Amount represents less than $0.01 per share.

The accompanying notes are an integral part of these financial statements.

16 Putnam VT High Yield Fund

Notes to financial statements 6/30/24 (Unaudited)

Unless otherwise noted, the “reporting period” represents the period from January 1, 2024 through June 30, 2024. The following table defines commonly used references within the Notes to financial statements:

| References to | Represent |

| 1940 Act | Investment Company Act of 1940, as amended |

| Franklin Advisers | Franklin Advisers, Inc., a wholly-owned subsidiary of Franklin Templeton |

| Franklin Templeton | Franklin Resources, Inc. |

| Franklin Templeton Services | Franklin Templeton Services, LLC, a wholly-owned subsidiary of Franklin Templeton and an affiliate of Putnam Management |

| JPMorgan | JPMorgan Chase Bank, N.A. |

| OTC | Over-the-counter |

| PIL | Putnam Investments Limited, an affiliate of Putnam Management |

| Putnam Management | Putnam Investment Management, LLC, the fund’s manager, an indirect wholly-owned subsidiary of Franklin Templeton |

| SEC | Securities and Exchange Commission |

| State Street | State Street Bank and Trust Company |

Putnam VT High Yield Fund (the fund) is a diversified series of Putnam Variable Trust (the Trust), a Massachusetts business trust registered under the 1940 Act as an open-end management investment company. The goal of the fund is to seek high current income. Capital growth is a secondary goal when consistent with achieving high current income. The fund invests mainly in bonds that are obligations of U.S. companies, are below-investment-grade in quality (sometimes referred to as “junk bonds”), and have intermediate- to long-term maturities (three years or longer). Under normal circumstances, Putnam Management invests at least 80% of the fund’s net assets in securities rated below investment-grade. This policy may be changed only after 60 days’ notice to shareholders. The fund may also invest in other debt instruments, including loans. Putnam Management may consider, among other factors, credit, interest rate and prepayment risks, as well as general market conditions, when deciding whether to buy or sell investments. Putnam Management may also use derivatives, such as futures, options, certain foreign currency transactions and credit default swap contracts for both hedging and non-hedging purposes.

The fund offers class IA and class IB shares of beneficial interest. Class IA shares are offered at net asset value and are not subject to a distribution fee. Class IB shares are offered at net asset value and pay an ongoing distribution fee, which is identified in Note 2.

In the normal course of business, the fund enters into contracts that may include agreements to indemnify another party under given circumstances. The fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be, but have not yet been, made against the fund. However, the fund’s management team expects the risk of material loss to be remote.